Attached files

Registration

Statement No. ______

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHANGDA

INTERNATIONAL HOLDINGS, INC.

(Exact

Name of Registrant in Its Charter)

|

Nevada

|

|

2870

|

|

98-0521484

|

|

(State

or Other Jurisdiction of

Incorporation

or Organization)

|

|

(Primary

Standard Industrial

Classification

Code Number)

|

|

(I.R.S.

Employer

Identification

Number)

|

10th

Floor Chenhong Building

No.

301East Dong Feng Street

Weifang,

Peoples Republic of China

Telephone: +86-536 8513228

(Address,

Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s

Principal Executive Offices)

Laughlin

Associates, Inc.

2533 N.

Carson Street

Carson

City, Nevada 89706

(Name,

Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent

for Service)

Copies

to:

|

Richard

A. Friedman, Esq.

|

|

|

Sichenzia

Ross Friedman Ference LLP

|

|

|

61

Broadway

|

|

|

New

York, New York 10006

|

|

|

Tel:

(212) 930-9700

|

|

|

Fax:

(212) 930-9725

|

Approximate date of commencement of

proposed sale to the public: from time to time after the effective date

of this registration statement.

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis

pursuant to Rule 415 under the Securities Act of 1933, check the following box.

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the

Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement

for the same offering.

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the

following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering.

If this Form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the

following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering.

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a smaller reporting company. See definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule

12b-2 of the Exchange Act. (Check one):

|

Large accelerated

filer

|

Accelerated filer

|

Non-accelerated filer

|

Smaller reporting company

|

|||

|

(Do

not check if a smaller

reporting

company)

|

1

CALCULATION

OF REGISTRATION FEE

|

|

|

||||

|

Title

of Each Class of

|

|

|

|||

|

Securities

to be Registered

|

|

|

|||

|

Proposed

Maximum

|

Amount

of

|

||||||||

|

Aggregate

|

Registration

|

||||||||

|

Offering

Price(1)

|

Fee

|

||||||||

|

Units,

each consisting of one share of Common Stock, $.001 par value, and

one Class A Warrant

|

$ | 20,700,000 | $ | 1,475.91 | |||||

|

Shares

of Common Stock included as part of the Units

|

— | — | (2) | ||||||

|

Class A

Warrants included as part of the Units

|

— | — | (2) | ||||||

|

Shares

of Common Stock underlying the Class A Warrants included in the

Units(3)

|

$ | 10,350,000 | $ | 737.96 | |||||

|

Total

|

$ | 2,213.87 | |||||||

|

(1)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to

Rule 457(o) of the Securities Act of 1933, as amended.

|

|

|

(2)

|

No

fee pursuant to Rule 457(g) of the Securities Act of 1933, as

amended

|

|

|

(3)

|

Pursuant

to Rule 416, there are also being registered such additional

securities as may be issued to prevent dilution resulting from stock

splits, stock dividends or similar transactions as a result of the

anti-dilution provisions contained in the Class A

Warrants.

|

|

THE

REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS

MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A

FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT

SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE

SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON

SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SECTION

8(a), MAY DETERMINE.

2

|

This information in this prospectus is not complete and

may be changed. We may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective.

This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any state where the offer

or sale is not permitted.

|

SUBJECT TO COMPLETION, DATED DECEMBER 31,

2009

PRELIMINARY

PROSPECTUS

$

CHANGDA

INTERNATIONAL HOLDINGS, INC.

[_____] Units

We are

selling [_____] units, each unit consisting of one share of our common stock and

one Class A warrant. Each Class A warrant entitles the holder to

purchase one-half a share of our common stock at a price of $[_____], and will

expire on [_____], 2015. The Class A warrants will be exercisable [_____]

days after issuance.

There is

presently no public market for our units or Class A warrants, and no market

for the units will exist. Our common stock is currently quoted on the

Over-the-Counter Bulletin Board under the symbol "CIHD.OB." On December 30,

2009, the last reported market price of our common stock on the Over-the-Counter

Bulletin Board was $3.41. We have applied to list our common shares

on the NYSE Amex. We cannot assure you, however, that our securities

will be listed on the NYSE Amex on or before the date of this

prospectus.

These

are speculative securities. Investing in our securities involves significant

risks. You should purchase these securities only if you can afford a complete

loss of your investment. See “Risk Factors” beginning on

page 7.

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or passed upon the adequacy or

accuracy of this prospectus. Any representation to the contrary is a criminal

offense.

|

Underwriting

|

Proceeds

to

|

|||||||||||

|

Price

to

|

Discounts

and

|

Converted

|

||||||||||

|

Public

|

Commissions(1)

|

Organics

|

||||||||||

|

Per

Unit

|

$

|

|

$

|

|

$

|

|

||||||

|

Total

|

$

|

$

|

$

|

|||||||||

|

(1)

|

This

amount does not include a non-accountable expense allowance in the amount

of __% of the gross proceeds, or $

($ per unit) payable to

_______________.

|

Delivery

of the units will be made on or

about , 2010. We have

granted the underwriters a __-day option to purchase up to [_____] additional

units solely to cover over-allotments, if any.

In

connection with this offering, we may also agree to sell to [_____] an option to

purchase up to [_____] % of the units sold for $100. If the underwriter

exercises this option, each unit may be purchased for

$ per unit ( % of the

price of the units sold in the offering).

The date

of this prospectus

is ,

2010

3

TABLE

OF CONTENTS

|

Prospectus

Summary

|

5 |

|

Risk

Factors

|

9 |

|

Special

Note Regarding Forward Looking Statement

|

21 |

|

Use

of Proceeds

|

21 |

|

Determination

of Offering Price

|

21 |

|

Capitalization

|

23 |

|

Dilution

|

23 |

|

Underwriting

and Plan of Distribution

|

51 |

|

Business

|

33 |

|

Description

of Property

|

44 |

|

Legal

Proceedings

|

44 |

|

Market

for Common Equity and Related Stockholder Matters

|

22 |

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

25 |

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

32 |

|

Quantitative

and Qualitative Disclosures About Market Risk

|

48 |

|

Management

|

45 |

|

Executive

Compensation

|

47 |

|

Security

Ownership of Certain Beneficial Owners and Management

|

48 |

|

Transactions

with Related Persons, Promoters and Certain Control

Persons

|

50 |

|

Legal

Matters

|

54 |

|

Experts

|

54 |

|

Disclosure

of Commission Position of Indemnification for Securities Act

Liabilities

|

54 |

|

Index

to Financial Statements

|

F-1 |

You

should rely only on the information contained or incorporated by reference to

this prospectus in deciding whether to purchase our common stock. We have not

authorized anyone to provide you with information different from that contained

or incorporated by reference to this prospectus. Under no circumstances should

the delivery to you of this prospectus or any sale made pursuant to this

prospectus create any implication that the information contained in this

prospectus is correct as of any time after the date of this prospectus. To the

extent that any facts or events arising after the date of this prospectus,

individually or in the aggregate, represent a fundamental change in the

information presented in this prospectus, this prospectus will be updated to the

extent required by law.

We

obtained statistical data, market data and other industry data and forecasts

used throughout this prospectus from market research, publicly available

information and industry publications. Industry publications generally state

that they obtain their information from sources that they believe to be

reliable, but they do not guarantee the accuracy and completeness of the

information. Nevertheless, we are responsible for the accuracy and completeness

of the historical information presented in this prospectus, as of the date of

the prospectus.

4

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus. It does

not contain all of the information that you should consider before investing in

our securities. You should read the entire prospectus carefully, including the

section entitled “Risk Factors” and our consolidated financial statements and

the related notes. In this prospectus, we refer to Changda International

Holdings, Inc. as “we” “our” or “Changda” which includes our wholly owned

subsidiary, Changda International Ltd., which conducts its operations through

its wholly owned subsidiaries, Weifang Changda Fertilizer Co., Ltd and Weifang

Changda Chemical Col, Ltd., in the People’s Republic of China.

Corporate

History

We

produce chemical and microbial organic-inorganic compound fertilizers. Our

chemical fertilizer products are classified into three types, namely complex

fertilizers, compound fertilizers and slow- release compound fertilizers with

more than 10 product lines sold under the “CHANGDA” and “FENGTAI WOSIDA”

brands.

Compound

fertilizer products are produced by initiating chemical reactions between the

three key nitrogen, phosphorous and potassium nutrients during the production

process; each granule contains a combination of these nutrients so as to provide

balanced distribution capabilities.

Our

principal compound fertilizers are sulfur-based compound fertilizer, ammoniated

sulfur-based compound fertilizer and chloric-based compound

fertilizer.

Slow-release

compound fertilizer products allow the fertilizer nutrients to be released

progressively, enabling plants to absorb most of the nutrients and enhance yield

rate. Slow-release compound fertilizers are also more convenient, as they

require less frequent applications. We have modified and developed

controlled-release (which is a subset of slow-release) fertilizers.

Our

microbial organic-inorganic compound fertilizer is a new type of fertilizer. In

general, it helps plants to secure nitrogen from the air and to dissolve useful

minerals such as phosphorus and potassium from soil thus facilitating absorption

of these useful minerals by plants and enhancing their stress resistance. The

organic and inorganic elements enhance soil fertility and crop yield

respectively.

In recent

years, with the increase in health awareness among consumers in the PRC, the

production and sale in the PRC of green food and organic food products, or food

products using organic fertilizers, has increased significantly.

We were

incorporated on January 25, 2007, in the state of Nevada under the name

Promodoeswork.com, Inc. We subsequently changed our name to Changda

International Holdings, Inc. We have never declared bankruptcy, we

have never been in receivership, and we have never been involved in any legal

action or proceedings.

On

January 15, 2009, Darryl Mills, our major shareholder and affiliate consummated

an Affiliate Stock Purchase Agreement with Allhomely International, Limited.

Pursuant to such agreement, Allhomely International Limited acquired a total

2,000,000 restricted shares (pre-reverse split) of our common

stock. Also on January 15, 2009, John Spencer, Derrick Waldman,

and Louis Waldman, shareholders and affiliates of the Company, consummated a

Restricted Stock Purchase Agreement with Allhomely International

Limited. Pursuant to such agreement, Allhomely

International Limited acquired a total 2,200,000 restricted shares (pre-reverse

split) of our common stock.

As

the result, ,Allhomely International Limited acquired a total 4,200,000 shares

(pre-reverse split) of our common stock, resulting in a change of

control.

Immediately

prior to the closing of this transaction, Louis Waldman served as our President,

and Derrick Waldman served as the our Secretary and

Treasurer. Immediately following the closing of the transaction

Mr. Jan Pannemann was nominated and elected by the Board of Directors as our

sole officer, to act as President and Chief Executive Officer and to serve until

his successors shall be elected and qualified until the earlier

of death, resignation or removal in the manner provided for in our

by-laws.

Also

following the closing of the transaction Mr. Jan Pannemann was appointed as our

sole Director to serve until his successors shall be elected and qualified on

the earlier of death, resignation or removal in the manner provided for in the

Company’s by-laws. Following the election and appointment of Mr. Jan Pannemann

as officer and Director, Louis Waldman, Derrick Waldman, and John Spencer

tendered their resignations as our officers and directors.

5

On

February 13, 2009, we entered into a Share Exchange Agreement under which we

issued Forty Seven Million Seven Hundred Twenty Nine Thousand Nine Hundred Sixty

Four (47,729,964) shares of our common stock (pre-reverse split), to

the shareholders of Changda International Limited in

exchange for 100% of the issued and outstanding capital stock of Changda

International Limited. As a result of the Share Exchange Agreement

Changda International Limited became our wholly-owned subsidiary. As

of the date of the Share Exchange Agreement, Changda International Limited held,

directly or indirectly, the entire equity interest in Changda

Chemical, Shandong Fengtai, Changda Fertilizer and

Changda Heze.

Following

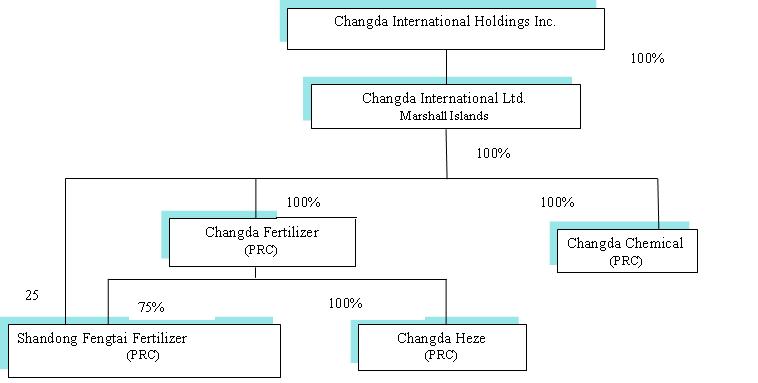

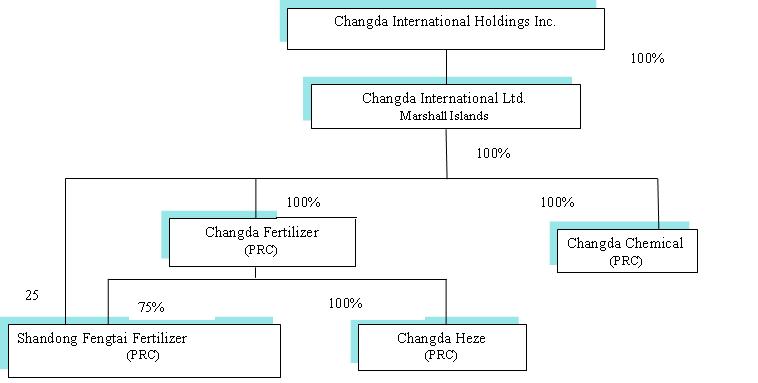

our acquisition of Changda International Ltd., as set forth in the following

diagram, Changda International Ltd. became our direct wholly-owned subsidiary

and Changda International, directly or indirectly, holds the entire equity

interest in Changda Fertilizer, Changda Chemical, Shandong Fengtai and Changda

Heze.

Corporate

Overview

Our

current corporate structure is set forth below:

Organizational

History of Changda International Limited

On

December 1, 2000, Changda Chemical was formed, which is engaged in the

production and sale of a snow melting agent. In view of the continuing expansion

in the agricultural sector and supportive government policies, Changda

Fertilizer was formed on April 24, 2003, which is engaged in the production and

sale of various fertilizers, including chemical, organic and compound

fertilizers. In March 2007, Changda Chemical began to set up production lines

for thiophene and fire retardant agents, which were completed and put into

production in September 2007 and July 2008 respectively. Changda Heze was

established on September 3, 2007 to take advantage of the continued growth in

demand for microbial organic-inorganic compound fertilizers and slow-release

fertilizers. All of our current production lines of are located in Shandong

Province, Peoples Republic of China, or PRC. Shandong Fengtai was established on

May 17, 2004, jointly owned by Changda Fertilizer (75 percent) and Seiwa

Fertilizer Co. Ltd , or Seiwa, a Japanese company (25 percent), to develop

export sales to Japan. On June 13, 2008, we entered into an agreement with Seiwa

whereby we acquired the remaining twenty-five percent interest in Shangdong

Fengtai from Seiwa for a cash consideration of US$130,500.

Changda

International Limited was incorporated on April 2, 2007 in the Republic of

Marshall Islands as the holding company of our operating

subsidiaries. Changda International Limited holds, directly or

indirectly, the entire equity interest in Changda Fertilizer, Changda Chemical,

Shandong Fengtai and Changda Heze.

Our

principal business office is located at 10th

Floor, Chenhong Building, No. 301East Dong Feng Street, Weifang, Peoples

Republic of China and our telephone number is +86 536 851 3228. Our website

address is http://changdastock.com .

Information contained on our website or any other website does not constitute

part of this prospectus.

6

THE

OFFERING

|

Securities

Offered

|

[______] units, at

$ per unit (plus [______] additional units

if the representative of the underwriters exercise the over-allotment

option), each unit consisting of

· One

share of common stock; and

· One

Class A warrant

|

|

|

Each

Class A warrant is exercisable for one-half a share of common

stock. The Class A warrants will be exercisable

__ days after issuance. The Class A warrants will expire at

5:00 p.m., New York City time, on ________, 2015.

|

||

|

Number

of shares outstanding on the date of effectiveness of this registration

statement

|

______

shares (1)

|

|

|

Number

of shares outstanding on the date after the unitsoffered and registered

are sold

|

______

shares (1)

|

|

|

Use

of Proceeds

|

We

intend to use the net proceeds of this offering for working capital,

general corporate purposes and investments in production facilities and

equipment.

|

|

|

OTC

Bulletin Board symbol for Our Common Stock

|

CIHD.OB

|

|

|

Risk

Factors

|

The

securities offered by this prospectus are speculative and involve a high

degree of risk and investors purchasing securities should not purchase the

securities unless they can afford the loss of their entire investment. See

“Risk Factors” beginning on page ___.

|

|

|

(1)

|

The

number of shares of our common stock to be outstanding after this offering

is based on the number of shares outstanding as of _____,

2009.

|

7

SUMMARY

FINANCIAL INFORMATION

The

following tables set forth our summary statement of operations data for the

fiscal years ended December 31, 2008 and 2007, for the nine months ended

September 30, 2009 and 2008, and our summary balance sheet as of

September 30, 2009. Our statement of operations data for the fiscal years

ended December 31, 2008 and 2007 were derived from our audited consolidated

financial statements of Changda International Limited, our wholly-owned

subsidiary, included elsewhere in this prospectus. Our statement of operations

data for the nine months ended September 30, 2009 and 2008 and our balance

sheet data as of September 30, 2009 were derived from our unaudited interim

condensed consolidated financial statements included elsewhere in this

prospectus. In the opinion of management the unaudited interim condensed

consolidated financial statements have been prepared on the same basis as the

audited consolidated financial statements and include all adjustments,

consisting of only normal recurring adjustments, necessary for a fair

presentation of our operating results and financial position for those periods

and as of such dates. The results for any interim period are not necessarily

indicative of the results that may be expected for a full year.

The

results indicated below and elsewhere in this prospectus are not necessarily

indicative of our future performance. You should read this information together

with “Capitalization,” “Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” our consolidated financial statements and

related notes and our unaudited condensed consolidated financial statements and

related notes included elsewhere in this prospectus.

|

Changda

International Holdings Inc.

Nine

Months Ended

September

30,

|

Changda

International Limited

Fiscal

Year Ended

December

31,

|

|||||||||||||||

|

2009

|

2008

|

2008

|

2007

|

|||||||||||||

|

Statements

of Operations Data

|

(Unaudited)

US$’000

|

US$’000

|

||||||||||||||

|

Revenue

|

$ | 51,978 | $ | 53,732 | $ | 80,958 | $ | 38,245 | ||||||||

|

Cost

of Sales

|

43,581 | 45,632 | 67,907 | 31,417 | ||||||||||||

|

Gross

Profit

|

8,397 | 8,100 | 13,051 | 6,828 | ||||||||||||

|

Operating

Expenses

|

3,811 | 3,225 | 6,122 | 3,034 | ||||||||||||

|

Operating

Income

|

4,586 | 4,875 | 6,929 | 3,794 | ||||||||||||

|

Income

before Income Taxes

|

4,415 | 4,601 | 6,576 | 3,753 | ||||||||||||

|

Income

Taxes

|

940 | 669 | 931 | - | ||||||||||||

|

Net

Income (Loss)

|

$ | 3,475 | $ | 3,932 | $ | 5,645 | $ | 3,753 | ||||||||

|

Other

Comprehensive Income

|

50 | 784 | 1,025 | 285 | ||||||||||||

|

Total

Comprehensive Income

|

3,525 | 4,716 | 6,670 | 4,038 | ||||||||||||

|

Earnings

Per Common Share Data

|

||||||||||||||||

|

Basic

and Diluted

|

$ | 0.0619 | $ | 0.0734 | ||||||||||||

|

Weighted

Average Number of Common

Shares

Outstanding

|

56,096,059 | 53,599,965 | ||||||||||||||

|

Changda

International Holdings, Inc.

September

30, 2009

(Unaudited)

US$’000

|

Changda

International Limited

December

31, 2008

US$’000

|

|||||||

| Balance Sheet Information: | ||||||||

|

Working

capital

|

$ | 8,553 | $ | 6,890 | ||||

|

Total

assets

|

39,532 | 35,114 | ||||||

|

Total

liabilities

|

14,585 | 13,912 | ||||||

|

Retained

earnings

|

15,602 | 12,573 | ||||||

|

Stockholders’

equity

|

24,947 | 21,202 | ||||||

8

RISK

FACTORS

You

should carefully consider the risks described below together with all of the

other information included in this prospectus before making an investment

decision with regard to our securities. The statements contained in or

incorporated into this offering that are not historic facts are forward-looking

statements that are subject to risks and uncertainties that could cause actual

results to differ materially from those set forth in or implied by

forward-looking statements. If any of the following risks actually occurs, our

business, financial condition or results of operations could be harmed. In that

case, the trading price of our common stock could decline, and you may lose all

or part of your investment.

Risks

Associated with Our Business

RISKS

RELATING TO OUR BUSINESS OPERATIONS

We

are a newly formed company with no operating history and therefore investors are

not able to assess our prospects on the basis of past

results

Although

as a group, we have a history going back to 2000, Changda International

Holdings, Inc. was incorporated on January 25, 2007 and has no significant

trading, operating or financial history. It may be difficult, therefore, to

evaluate our current or future prospects. In addition, new products such as

microbial fertilizer and thiophene which were launched in 2007 cannot be

construed as an indication of the future performance. We will also launch new

types of fertilizer after completion of the new production plant in Heze,

Shandong Province. Certain business segments are in an initial stage of

operation, and may therefore incur additional business risk.

We rely on China Post Logistics to

secure new distributors.

,

For each

of the three years ended December 31, 2006, 2007 and 2008 , sales via China Post

and its branch offices accounted for approximately 51 percent, 61 percent 70

percent, respectively, of our total turnover. For the nine months ended

September 30, 2009, sales via China Post and its branch offices accounted for

approximately 69% of our total turnover. If there is any disruption

in our business relationship with China Post and we fail to secure new

distributors with a similar sales network in the PRC, our operation and

profitability may be adversely affected.

We

are dependent upon key personnel and the loss of key personnel, or the inability

to hire or retain qualified personnel, could have an adverse effect on our

business and operations

Our

performance is to a significant extent dependent upon the continuing services

and performance of key management personnel and in particular the co-founders,

two of whom are also Executive Directors. Our future success will depend, in

part, on our ability to attract and retain highly qualified management and

technical personnel. There can be no assurance that we will be successful in

hiring or retaining qualified personnel. The loss of key personnel, or the

inability to hire or retain qualified personnel, could have an adverse effect on

our business and operations.

We

are subject to PRC laws allowing a required maximum of 30 days’ notice of

termination by key management

Under the

laws of the PRC, no employee can be required to give longer than 30 days’ notice

of the termination of their employment. Although the key management personnel in

the PRC have been hired on employment contracts with an initial fixed term of 3

to 5 years, there is a risk that any of the key management personnel could cease

employment on 30 days’ notice at any time.

There

is a risk of infringement of our intellectual property rights in the

PRC

All our

fertilizer and chemical products are sold under the “CHANGDA” and “FENGTAI

WOSIDA” trademarks which are registered as trademarks in the PRC. In addition,

two patent applications have been granted and eight patent applications are

still pending. There can be no assurance that the existing legal protection in

the PRC will effectively prevent unauthorized use of our “CHANGDA” and “FENGTAI

WOSIDA” trademarks or the misappropriation by third parties of the technology

associated with our applied/registered patents.

Policing

unauthorized use of our trademarks and the proprietary technology may be

difficult, costly and ineffective, and there can be no assurance that any steps

taken by us will effectively prevent any such misappropriation or infringement

from occurring. Unauthorized use of our trademarks and patented technology could

adversely affect our performance and business reputation. Failure to renew our

trademarks could also adversely affect our performance and business

reputation.

In

relation to the eight patent applications which are still pending, should we

fail in our application for securing such patents, we may not be able to prevent

the unauthorized use of our technology and methods as set out in the

applications. In this event, unauthorized use of our production methods and

technologies could adversely affect our performance.

9

We

may be subject to claims of infringement of third-party intellectual property

rights

From time

to time, third parties may assert against us alleged patent, copyright,

trademark, knowhow, or other intellectual property rights to technologies that

are important to our business. In particular, we may be subject to intellectual

property infringement claims relating to micro-organic compound fertilizers from

a Mr. Jiu Shun Chen. Mr. Chen and one of the Co-founders, Mr. Qing Ran Zhu, who

were co-applicants in relation to three patent applications relating to

micro-organic compound fertilizers, but those patent applications, were rejected

by the China Patent Office. Changda Fertilizer used the underlying technology as

set out in the patent applications in manufacturing its products in 2006 and

2007, and the sales of those products made up a significant portion of Changda

Fertilizer’s revenues in 2006 and 2007; however, the products related to the

patents in question are no longer in production by us and are not anticipated to

be produced by us in the future.

Any

claims that our products or processes, whether in relation to the specific

circumstances set out above or otherwise, infringe the intellectual property

rights of others, regardless of the merit or resolution of such claims, could

cause us to incur significant costs in responding to, defending, and resolving

such claims, and may divert the efforts and attention of our management and

technical personnel away from the business. As a result of such intellectual

property infringement claims, we could be required or otherwise decide it is

appropriate to pay third-party infringement claims; discontinue manufacturing,

using, or selling particular products subject to infringement claims;

discontinue using the technology or processes subject to infringement claims;

develop other technology not subject to infringement claims, which could be

time-consuming and costly or may not be possible; and/or license technology from

the third-party claiming infringement, which license may not be available on

commercially reasonable terms.

The

occurrence of any of the foregoing could result in unexpected expenses or

require us to recognize an impairment of our assets, which would reduce the

value of the assets and increase expenses. In addition, if we alter or

discontinue the production of affected items, our revenue could be negatively

impacted.

We

may fail to obtain statutory permits/certificates/approvals or to renew existing

statutory permits/ certificates/ approvals

|

(a)

|

Fertilizer

related permits and certificates

|

Industrial

production permits and fertilizer registration certificates are statutory

requirements for the production and/or distribution of certain fertilizers in

the PRC. As at the date of this document, these permits and certificates in

relation to all of our fertilizer products have been obtained. Failure to renew

these industrial production permits and/or fertilizer registration

certifications upon their respective expiry dates could adversely affect our

operations.

|

(b)

|

Real

estate approvals

|

We have

not obtained formal title certificates to some of the properties we occupy and

one landlord lacks the legal right to lease properties to us, which may

materially and adversely affect our right to use such properties.

Changda

Heze is constructing fertilizer manufacturing facilities on a parcel of land

with an area of approximately 53,333 square meters in the Mudan Industrial Park,

Heze City, Shandong Province. Although we had entered into a letter

of intent with the local government in Heze regarding the purchase of the land

from the State, we are still in the process of obtaining the relevant land use

right certificates and building ownership certificates for the land and the

constructions being built thereon. Upon obtaining the relevant certificates for

these properties, we will have the legal right to occupy, let, transfer and

mortgage such properties. However, we may not be able to obtain all of the title

certificates we currently lack, in which case our rights as owner or occupier of

the land and the constructions may be adversely affected as a result of the

absence of the formal title certificates as described above and we may be

subject to lawsuits or other actions. Moreover, Changda Heze may also be subject

to fines of 5 to 10 percent of the cost of constructions built by Changda Heze

on the land without first obtaining construction approvals (construction costs

were approximately RMB 20.1 million through September 30,

2009).

Changda

Chemical leases a parcel of land with an area of approximately 22,500 square

meters from Xinxing Village Villagers’ Committee (the “Committee”). Changda

Chemical has built manufacturing facilities on the land. The Committee does not

have the right to lease the land to Changda Chemical because the land is

collectively-owned land for agricultural purposes and therefore is not permitted

to be leased for industrial purposes. Although we have received written

certifications from the local authority that Changda Chemical has attended to

all relevant procedures using the land and that the land is, according to the

municipal planning authority, intended for industrial purposes, the lease may be

deemed invalid under PRC law. If the lease is terminated or invalidated, we may

be forced to seek alternative premises, without entitlement to any compensation

and incur additional costs relating to such relocations. Moreover, Changda

Chemical may also be subject to fines of 5 to 10 percent of the cost of the

constructions built by Changda Chemical on the land without first obtaining

construction approvals (construction costs were approximately RMB 4.3m,

approximately U.S.$629,000).

10

|

(c)

|

Safety

and environmental approvals

|

We have

obtained production safety approvals with respect to our manufacturing lines

which are currently in use for our fertilizer and chemical business. Failure to

renew these approvals upon their respective expiry dates could adversely affect

our operations.

There

are differences between PRC and U.S. Generally Accepted Accounting

Principles

Our

profits are derived from our subsidiaries established in the PRC. The profits

available for distribution for companies established in the PRC are determined

in accordance with PRC accounting standards, which may differ from the amount

arrived at under the United States Generally Accepted Accounting

Principles. In the event that the amount of the profits determined

under the PRC accounting standard in a given year is less than that determined

under the US GAAP, we may not have funds to allow distribution of profits to our

shareholders.

There

is an untested market for thiophene and fire retardant chemical

It is

possible that if and when our thiophene and fire retardant chemical products are

launched into the market, the originally predicted market may have changed

either due to an increase in the supply of such products or changes in the

demand for such products. Therefore, there is no assurance that we will be able

to sell any of our new products as planned, and failure to do so may have an

adverse impact on our business, operations and financial condition.

There

is no assurance that we will sustain the growth in our business

Our

compound annual growth rate of sales revenue from 2006 to 2008 was approximately

47.73%, and our compound annual growth rate of net income was approximately

55.02% during this same period. Under the influence of raw materials price and

economic circumstance, the sales revenue of the first three quarters of 2009 was

$51,978,000 and the net income of the first three quarters of 2009 was

$3,475,000, as compared to $53,732,000 of sale revenue and $3,932,000 of net

income for the first three quarters of 2008.

There is

no assurance that such growth rate can be sustained or that we can retain and

attract qualified management, employees and customers. In the event that we are

unable to maintain such attributes, we may have negative growth or stagnant

growth, which in turn may impair our business operations and

profitability.

There

is no assurance that we will sustain increasing profit margin

Raw

materials for fertilizer products have risen significantly in the last several

years. We expect continued volatility and uncertainty in prices for raw

materials. In addition, our operations, like those of other PRC fertilizer

companies, are also subject to extensive regulation by the PRC Government

authorities such as the Ministry of Agriculture, the State Development Planning

Commission, the Ministry of Commerce, the State Bureau of Taxation and the local

pricing bureaus, which exercise extensive control over various aspects of our

operations: pricing mechanisms for our raw materials and main products;

industry-specific taxes and fees; and import and export quotas and procedures.

As a result, we may face significant constraints on our ability to implement our

business strategies or to maximize our profitability. Any price increase in raw

materials and any change to the regulation by the PRC Government authorities may

adversely affect our fertilizer business and our profitability and financial

results.

There

is no assurance that we will be able to maintain a prolonged relationship with

existing and ex-employees

We have a

total of approximately182 employees and skilled labor working in our offices and

production facilities in the PRC. Our directors are of the view that we have not

experienced any labor disputes which could lead to material undesirable

disruptions to our operations and business. However, there can be no assurance

that we will be able to maintain a prolonged good relationship with our existing

or ex-employees and that no labor disruptions will occur in the future. Should

any industrial action or labor unrest occur, our business operations could be

adversely affected.

We

face competition from other fertilizer and chemical producers and sellers.

Therefore, business and prospects may be adversely affected if we are not able

to compete effectively.

We

operate in markets where we compete with domestic chemical and organic

fertilizer and chemical producers and sellers of similar or larger size and

scale in the PRC. In addition, a number of foreign companies have established

fertilizer and chemical manufacturing enterprises in the PRC, and other foreign

manufacturers may do so in the future. We also operate in a very competitive

international fertilizer market. Such domestic and foreign competitors may have

greater access to financial resources, higher levels of vertical integration,

better operating efficiency and longer operating histories. If we are

unable to improve product quality, performance and price competitiveness or if

we are unable to anticipate and respond to changing market demand, maintain

operating efficiency and economies of scale, and control costs in connection

with the planned expansion, raw materials and energy, our business and prospects

may be adversely affected and we may not be able to compete

effectively.

11

Our

business and operations require capital investment. Failure to raise sufficient

capital in a timely manner may adversely affect business and results of

operations

In

accordance with our development plan, we intend to expand our operations in

Heze, Shandong Province of the PRC. Management may from time to time have other

business expansion plans that require further capital. If we are unable to

obtain such additional funding, we may not be able to pay for the necessary

capital expenditures needed for expansion, or to implement proposed business

strategies or at all. Any of the above could impede the implementation of our

business strategies or prevent us from entering into transactions that would

otherwise benefit business on commercially reasonable terms or at all and

adversely affect its financial condition and results of operations.

Product

liability is not covered under our insurance policies

Any

defects in our fertilizer and chemical products could result in economic loss,

adverse customer reaction, negative publicity, and additional expenditure to

rectify the problems and/or legal proceedings instituted against us. We have not

maintained any insurance policy against losses that may arise from such claims.

Any litigation relating to such liability may be expensive and time consuming,

and successful claims against us could result in substantial monetary liability

or damage to our business reputation and disruption to our business

operations.

Our

business is subject to operation risks beyond our control and could have a

detrimental effect on our profitability

Our

financial performance is at all times subject to operational risks which may

include factors that are beyond our control. The production process could face

unforeseen operating problems and therefore production could be delayed and

financial performance would be adversely affected. Unanticipated additional

maintenance of the plant would also impact upon production capacity and revenue

projections. This potential downtime would impact upon our results.

Operations

are subject to hazards and natural disasters that may not be fully covered by

our insurance policies

We make

substantial investments in complex manufacturing and production facilities and

transportation equipment. Many of the production processes, raw materials and

certain finished products are potentially destructive and dangerous in

uncontrolled or catastrophic circumstances, including operating hazards, fires

and explosions, and natural disasters such as typhoons, floods, earthquakes and

major equipment failures for which insurance may not be obtainable at a

reasonable cost or at all. Should an accident or natural disaster occur, it may

cause significant property damage, disruption to operations and personal

injuries and our insurance coverage may be inadequate to cover such loss. Should

an uninsured loss or a loss in excess of insured limits occur, we could suffer

from damage to our reputation or lose all or a portion of production capacity as

well as future revenues anticipated to derive from the relevant facilities. Any

material loss not covered by our insurance policies could materially and

adversely affect our business, financial condition and operations.

Possible

shortage in supply or price fluctuations of raw materials may have a detrimental

effect on our profitability

We have

not experienced any significant shortage of raw materials during the past few

years. The purchase prices of major raw materials such as urea increased in

2008. We have managed to pass on the additional cost to our customers by raising

the selling price of our major products; however, we have not entered into any

long-term supply contracts with suppliers of major raw materials and cannot

guarantee that we will be able to pass any future increases in raw material

purchase prices on to consumers. In the event that there is a significant

shortage or change in the purchase price of raw materials in the future and we

are unable to transfer resulting cost increases to our customers, our business

operations and profitability may be adversely affected.

Reliance

on the PRC market

For the

fiscal years ended December 31, 2006, 2007 and 2008, 84 percent, 92 percent and

94 percent of our sales were derived from the PRC market,

respectively. For the nine months ended September 30, 2009, 99

percent of our sales were derived from the PRC market. We expect that domestic

sales will continue to account for a significant portion of our total turnover.

If there is any material adverse change in political, economic or legal

conditions in the PRC market, our sales and profitability may be adversely

affected.

We

may fail to achieve our outline business objectives

The

future plans as set out in this document have been formulated on the basis of a

number of assumptions in relation to future events, which by their nature are

subject to changes and uncertainties and may not materialize. Although we will

endeavor to execute such plans there is no assurance that our plans will

materialize or be executed in accordance with the stated timeframe or that our

objectives will be fully accomplished.

Moreover,

we expect our business plans to be financed by the net proceeds from the

Offering and cash generated from operations. In the event that these funds are

insufficient to finance our business plans and we are unable to raise funds

through other financing activities, our business plans may not materialize as

described in this document.

12

Loss

of or refusal of extension for preferential tax treatments

Changda

Chemical enjoys a tax concession with fifteen percent exemption from enterprise

income tax from 2009 to 2011. Shandong Fengtai Fertilizer enjoys a tax

concession with full exemption from enterprise income tax from 2008 to 2009, and

will have a fifty percent exemption from enterprise income tax from 2010 to

2012. All productions of fertilizer enjoy tax concession from value added tax.

Accordingly, any loss or refusal of an extension for these preferential tax

treatments could increase our tax expenditure in the future and could have an

adverse effect on our business, operations or financial conditions.

Failure

to make payments for the compulsory social insurance schemes may result in late

charges or third party claims

Changda

Fertilizer and Changda Chemical failed to make due payments for the compulsory

social insurance schemes for their employees in accordance with the relevant PRC

laws and the companies are subject to a late charge on the outstanding social

insurance premiums. The employees also have the right to claim damages in

connection with the non-payment of the social insurance. No claim, late charge

nor penalty has been imposed on us as at December 2008. Although we have made

provision for the outstanding premium, the late charges and the penalties, and

the Co-founders have executed a deed of indemnity in favor of the Company

against any costs and liabilities which may be suffered or incurred by us, our

operations and financial results may be adversely affected if any such claim is

made against us and the Co-founders are unable to comply with their indemnities

obligations.

RISKS

RELATING TO THE FERTILIZER AND CHEMICAL INDUSTRIES IN THE PRC

The

cyclical nature of our business will expose us to potentially significant

fluctuations in our financial condition

Our sales

volumes and revenues are derived from two main product lines, fertilizer and

chemical products. In the normal course of business, we are exposed to

fluctuations in supply and demand and the prices of our products depend on a

number of factors, including general economic conditions, cyclical trends in

end-user markets, and supply and demand imbalances. In addition, prices of our

fertilizer products also depend on weather conditions, which have a greater

relevance because of the seasonal nature of fertilizer application. The domestic

price of fertilizers is also affected by demand for agricultural products and

affordability of fertilizers by farmers, PRC Government policies and other

factors beyond our control. Changes in supply result from capacity additions or

reductions and from changes in inventory levels. We cannot guarantee that its

prices will remain at recent or current levels or that they will increase in the

future.

We

face significant challenges and changes in government policies, including

changes to VAT policies, adjustments of export custom duties and accession to

the WTO, which could affect the operational environment of our industry and thus

our financial performance.

To ensure

a sufficient supply of fertilizers to meet the domestic demand in the PRC, the

PRC Government has historically adjusted its policies towards the export of

fertilizers, in particular through the cancellation of VAT refunds and

imposition of export tariffs. The PRC Government’s policies regarding export

tariffs have historically encouraged or discouraged exports, and the PRC

Government changed its tax regime for exports several times during the Track

Record Period and thereafter. In addition, the PRC Government may from time to

time change its VAT refund policies based on the level of supply or demand.

While we previously enjoyed VAT refunds for exports of our fertilizer products,

we are currently subjected to a seasonal export tariff ranging from 20 percent

to 185 percent. Because of such changes in taxes and export tariffs payable on

exports of fertilizer products, our sales are primarily domestically focused. We

may in the future be subject to further changes in tax liabilities, which may

further affect the mix of domestic and export sales and have an adverse impact

on our business, results of operations and net profits.

As part

of its WTO concession commitment, the PRC is obliged to open its domestic

fertilizer market to foreign participation within five years of its accession to

the WTO by allowing foreign participation in the trading and distribution of

fertilizers in the PRC. Whereas domestic fertilizer prices are insulated from

fluctuations of international market prices prior to the PRC’s World Trade

Organization accession, we anticipate that international market prices will have

an increasingly direct impact on our fertilizer prices as the PRC gradually

relaxes its fertilizer trade restrictions.

Results

of operations are subject to seasonality and could be negatively impacted by

adverse weather conditions and seasonality

Sales of

fertilizer and snow melting agent products to end-users are seasonal in nature.

In general, we generate a greater amount of net sales and revenue during

planting months such as March to April and September to October each year for

its fertilizer business. For the snow melting agent business, net sales are

higher during the winter season only. Accordingly, revenue and results of

operations may be affected by seasonal variations in demand for our

products.

13

Imposition

of tariffs on export sale of fertilizer products could affect our overall

operations and profitability

In order

to ensure fertilizer supply in domestic market and the stable price of

fertilizer, PRC Government will make coordination of export tariff at all times.

If the export tariff imposed on fertilizer highly increase, the export will be

affected and our export sales and income will be reduced

accordingly.

RISKS

RELATING TO DOING BUSINESS IN CHINA

Adverse

changes in economic and political policies of the Chinese government could have

a material adverse effect on the overall economic growth of China, which could

adversely affect our business.

Substantially

all of our business operations are conducted in China. Accordingly, our results

of operations, financial condition and prospects are subject to a significant

degree to economic, political and legal developments in China. China’s economy

differs from the economies of most developed countries in many respects,

including with respect to the amount of government involvement, level of

development, growth rate, control of foreign exchange and allocation of

resources. While the Chinese economy has experienced significant growth in the

past 20 years, growth has been uneven across different regions and among various

economic sectors of China. The Chinese government has implemented various

measures to encourage economic development and guide the allocation of

resources. Some of these measures benefit the overall Chinese economy, but may

also have a negative effect on us. For example, our financial condition and

results of operations may be adversely affected by government control over

capital investments or changes in tax regulations that are applicable to us.

Since early 2004, the Chinese government has implemented certain measures to

control the pace of economic growth. Such measures may cause a decrease in the

level of economic activity in China, which in turn could adversely affect our

results of operations and financial condition.

Any

deterioration of political relations between the United States and the PRC could

impair our operations.

The

relationship between the United States and the PRC is subject to sudden

fluctuation and periodic tension. Changes in political conditions in the PRC and

changes in the state of Sino-U.S. relations are difficult to predict and could

adversely affect our operations or cause potential acquisition candidates or

their goods and services to become less attractive. Such a change could lead to

a decline in our profitability. Any weakening of relations between

the United States and the PRC could have a material adverse effect on our

operations.

Changes

in foreign exchange regulations and future movements in the exchange rate of RMB

may adversely affect our financial condition and results of operations and our

ability to pay dividends

The

exchange rate of the RMB depends to a large extent on economic and political

developments in the PRC and around the world. Currently, the RMB is freely

exchangeable in current account transactions, but government-controlled in

capital accounts. Our principal accounting records and domestic sales are in

RMB, but our revenue derived from export sales is denominated in foreign

currencies. As a result, our operations are exposed to fluctuations in the

exchange rate of the RMB against these foreign currencies. Any appreciation of

the RMB would increase our cost of production and may have an adverse impact on

our export sales. We will be able to pay dividends in foreign currencies without

prior approval from the PRC’s State Administration of Foreign Exchange by

complying with certain procedural requirements. However, there is no assurance

that these foreign exchange policies regarding payment of dividends in foreign

currencies will continue in the future. Fluctuations in the exchange rate of the

RMB may cause uncertainty to our financial condition and adversely affect our

operating results.

The

Chinese economy may experience inflationary pressure, which may lead to an

increase in interest rates and a slowdown in economic growth.

In

response to concerns regarding the PRC’s high rate of growth, the PRC Government

has taken measures to slow down economic growth to a more manageable level.

Among the measures that the PRC Government has taken are restrictions on bank

loans in certain sectors. These measures have contributed to a slowdown in

economic growth in the PRC and a reduction in demand for consumer goods.

Consequently, these measures and any additional measures, including a possible

increase in interest rates, could contribute to a further slowdown in the

Chinese economy, which in turn could adversely affect the future demand of the

our products and our operating results.

14

Restrictions

on receipt of dividends from, and transfer of funds to, our Chinese operating

subsidiaries may be imposed

Changda

International Ltd is incorporated in the Republic of the Marshall Islands and is

the holding company of our operating subsidiaries. At present, Changda

Fertilizer, Changda Chemical, Changda Heze and Shangdong Fengtai are the only

subsidiaries. The ability of Changda Fertilizer, Changda Chemical, Changda Heze

and Shangdong Fengtai and any future subsidiaries which are Wholly Foreign Owned

Enterprises, or WFOEs, to declare dividends and other payments to Changda

International Ltd may be restricted by factors that include changes in

applicable foreign exchange and other laws and regulations in the PRC and in the

Marshall Islands.

In

particular, under PRC law, profit available for distribution from the PRC

operating subsidiaries is determined in accordance with generally accepted

accounting principles in the PRC. This calculation may differ from the one

performed in accordance with IFRS. As a result of the potential difference in

profit calculation, there is a risk that the PRC subsidiaries may not have

sufficient profit to distribute so as to allow distributions to the shareholders

in the future. In addition, distributions by our subsidiaries other than as

dividends may be subject to governmental approval and taxation.

Any

transfer of funds to our PRC subsidiaries, either as a shareholder loan or as an

increase in registered capital, is subject to registration or approval of

certain PRC governmental authorities, including the relevant administration of

foreign exchange and/or the relevant examining and approval authority. Further,

it is not permitted under PRC law for our PRC subsidiaries to lend money to each

other/another member. Therefore, it is difficult to change our capital

expenditure plans once the relevant funds have been remitted to our PRC

subsidiaries. These limitations on the free flow of funds between our companies

and our PRC subsidiaries could restrict our ability to act in response to

changing market conditions and to reallocate funds from one PRC subsidiary to

another in a timely manner.

Uncertainties

with respect to the Chinese legal system could adversely affect us.

Our

operations in China are governed by Chinese laws and regulations. We are

generally subject to laws and regulations applicable to foreign investments in

China and, in particular, laws applicable to wholly foreign-owned enterprises.

The Chinese legal system is based on written statutes. Prior court decisions may

be cited for reference but have limited precedential value.

Since

1979, Chinese legislation and regulations have significantly enhanced the

protections afforded to various forms of foreign investments in China. However,

China has not developed a fully integrated legal system and recently enacted

laws and regulations may not sufficiently cover all aspects of economic

activities in China. In particular, because these laws and regulations are

relatively new, and because of the limited volume of published decisions and

their nonbinding nature, the interpretation and enforcement of these laws and

regulations involve uncertainties. In addition, the Chinese legal system is

based in part on government policies and internal rules (some of which are not

published on a timely basis or at all) that may have a retroactive effect. As a

result, we may not be aware of our violation of these policies and rules until

some time after the violation. In addition, any litigation in China may be

protracted and result in substantial costs and diversion of resources and

management attention.

You

may experience difficulties in effecting service of legal process, enforcing

foreign judgments or bringing original actions in China based on United States

or other foreign laws against us or our management.

We are a

holding company and do not have any assets or conduct any business operations

other than the contractual arrangements. In addition, all of our assets are

located in, and other than our chief financial officer, all of our other senior

executive officers reside within, China. As a result, it may not be possible to

effect service of process within the United States or elsewhere outside China

upon our senior executive officers and directors not residing in the United

States, including with respect to matters arising under U.S. federal securities

laws or applicable state securities laws. Moreover, our Chinese counsel has

advised us that China does not have treaties with the United States or many

other countries providing for the reciprocal recognition and enforcement of

judgment of courts. As a result, our public shareholders may have substantial

difficulty in protecting their interests through actions against our management

or directors than would shareholders of a corporation with assets and management

members located in the United States

.

Governmental

control of currency conversion may affect the value of your

investment.

The

Chinese government imposes controls on the convertibility of RMB into foreign

currencies and, in certain cases, the remittance of currency out of China. We

receive substantially all of our revenues in RMB. Shortages in the availability

of foreign currency may restrict the ability of our Chinese subsidiaries and our

affiliated entity to remit sufficient foreign currency to pay dividends or other

payments to us, or otherwise satisfy their foreign currency denominated

obligations. Under existing Chinese foreign exchange regulations, payments of

current account items, including profit distributions, interest payments and

expenditures from trade-related transactions, can be made in foreign currencies

without prior approval from China State Administration of Foreign Exchange by

complying with certain procedural requirements. However, approval from

appropriate government authorities is required where RMB is to be converted into

foreign currency and remitted out of China to pay capital expenses such as the

repayment of bank loans denominated in foreign currencies. The Chinese

government may also at its discretion restrict access in the future to foreign

currencies for current account transactions. If the foreign exchange control

system prevents us from obtaining sufficient foreign currency to satisfy our

currency demands, we may not be able to pay dividends in foreign currencies to

our stockholders.

15

Failure

to comply with the United States Foreign Corrupt Practices Act could subject us

to penalties and other adverse consequences.

We are

subject to the United States Foreign Corrupt Practices Act, which generally

prohibits United States companies from engaging in bribery or other prohibited

payments to foreign officials for the purpose of obtaining or retaining

business. Foreign companies, including some that may compete with us, are not

subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft

and other fraudulent practices occur from time-to-time in the PRC. We can make

no assurance, however, that our employees or other agents will not engage

in such conduct for which we might be held responsible. If our employees or

other agents are found to have engaged in such practices, we could suffer severe

penalties and other consequences that may have a material adverse effect on our

business, financial condition and results of operations.

Exchange

controls that exist in the PRC may limit our ability to utilize our cash flow

effectively.

We are

subject to the PRC’s rules and regulations affecting currency conversion. Any

restrictions on currency exchanges may limit our ability to use our cash flow

for the distribution of dividends to our stockholders or to fund operations we

may have outside of the PRC. Conversion of RMB, the currency of the PRC, for

capital account items, including direct investment and loans, is subject to

governmental approval in the PRC, and companies are required to open and

maintain separate foreign exchange accounts for capital account items. We cannot

be certain that the regulatory authorities of the PRC will not impose more

stringent restrictions on the convertibility of the RMB, especially with respect

to foreign exchange transactions. Because a significant component for many of

our customized pressure containers, the steel vessels, is manufactured outside

of the PRC, our inability to pay our foreign manufacturer may impair our ability

to manufacture our products.

Fluctuations

in the exchange rate could have a material adverse effect upon our

business.

We

conduct our business in RMB. To the extent our future revenue are denominated in

currencies other the United States dollars, we would be subject to increased

risks relating to foreign currency exchange rate fluctuations which could have a

material adverse affect on our financial condition and operating results since

our operating results are reported in United States dollars and significant

changes in the exchange rate could materially impact our reported

earnings.

Due

to the nature of our business, we are subject to certain environmental

regulation.

Our

operations are subject to environmental and safety regulation in the PRC. Such

regulation covers a wide variety of matters, including, without limitation,

prevention of waste, pollution and protection of the environment, labor

regulations and worker safety. We may also be subject, under such regulations,

to clean up costs and liability for toxic and hazardous substances which may

exist on or under any of our properties or which may be produced as a result of

our operations. In particular, the acceptable level of pollution and the

potential clean up costs and obligations and liability for toxic or hazardous

substances for which we may become liable as a result of our activities may be

impossible to assess against the current legal framework and current enforcement

practices of the PRC. In addition, environmental legislation and permit regime

are likely to evolve in a manner which will require stricter standards and

enforcement, increased fines and penalties for non-compliance, more stringent

environmental assessments of proposed projects and heightened degree of

responsibility for companies and their directors and employees.

The

downturn in the economy of the PRC may slow our growth and

profitability

The

development of the countryside and agricultural sector is linked China’s overall

economic growth. There can be no assurance that a downturn will not have a

negative effect on our business, especially if it results in either a decreased

use of our products or in pressure on us to lower our prices. Our

fertilizer business is dependent on the ability of the Chinese farmers to afford

our products, thus any significant disruptions in the food/ agricultural

products market might adversely affect our business. Our chemical business is

dependent the further development of Chinese consumer safety standards,

increased demand for standardized drugs and further creation as well as

extension of useable during winter time of infrastructures. Any trends that

might lead to lowering of consumer safety standards, decrease spending on

pharmacy, lower demand on infrastructure use during winter time or climatic

effects leading to warmer winters, might affect our business in a negative

way.

We

may be subject in the future to new M&A Regulations.

We have

not obtained the approval of the China Securities Regulatory Commission, or

CSRC, in connection with Admission under the Provisional Regulations on the

Merger and Acquisitions of Domestic Enterprises by Foreign Investors, or New

M&A Regulations. In the event that such an approval is subsequently deemed

to be required, our business, financial results and prospects may be adversely

affected. The New M&A Regulations also establish more complex procedures for

acquisitions conducted by foreign investors which could make it more difficult

to pursue growth through acquisitions.

On August

6, 2006, six PRC regulatory authorities, including the CSRC, promulgated the New

M&A Regulations which came into effective on September 8, 2006. The New

M&A Regulations purport, among other things, to require an offshore special

purpose vehicle or SPV, formed for overseas listing purposes through

acquisitions of PRC domestic companies and controlled directly or indirectly by

PRC domestic companies or individuals, to obtain the approval of various

authorities, including the CSRC, prior to the listing and trading of such SPV’s

securities on an overseas stock exchange. On September 21, 2006, the CSRC

published procedures specifying documents and materials required to be submitted

to it by the SPVs seeking CSRC approval for their overseas listings. However,

the application of this PRC regulation remains unclear and there is currently no

consensus among PRC law firms regarding the scope and applicability of the CSRC

approval requirement.

16

In

accordance with the New M&A Regulations, a SPV is an offshore company

directly or indirectly controlled by a PRC domestic company or a PRC individual

for the purpose of realizing an offshore listing of the interests owned by

it/him in a PRC domestic company.

Our PRC

legal counsel has advised that we are not considered to be a SPV for the

purposes of the New M&A Regulations as we are not directly or indirectly

controlled by PRC domestic companies or PRC individuals. Accordingly, the New

M&A Regulations are not applicable to us and it is not necessary to obtain

the CSRC approval for the Admission.

However,

if the CSRC or other PRC regulatory authorities subsequently determines that we

are required to obtain the CSRC’s written approval for the Admission, we may

face regulatory actions or other sanctions from the CSRC or other PRC regulatory

authorities. In such an event, these regulatory authorities may impose fines and

penalties on our operations in the PRC, limit our operating privileges in the

PRC, or take other actions that could have a material adverse effect on our

business, financial conditions, results of operations, reputations and

prospects, as well as on the trading price of the Shares.

The New

M&A Regulations also established additional procedures and requirements that

could make merger and acquisition activities by foreign investors more

time-consuming and complex, including requirements in some instances that the

Ministry of Commerce, or MOC, be notified in advance of any change-of-control

transactions in which a foreign investor takes control of a PRC domestic

company. In the future, we may grow our business in part by acquiring other

businesses, although currently we do not have any plans to do so. Complying with

the requirements of the New M&A Regulations could be time-consuming, and any

required approval processes, including obtaining approval from the MOC, may

delay or inhibit our ability to complete such transactions, which could affect

our ability to expand our business or maintain our market share.

PRC

regulations relating to the establishment of offshore special purpose companies

by PRC residents.

The State

Administration of Foreign Exchange in the PRC or SAFE, issued a public notice in

October 2005 requiring PRC residents and non-PRC residents who habitually reside

in the PRC for economic reasons, or PRC Residents, to register with the local

SAFE branch before establishing or controlling any company outside of China for

the purpose of capital financing with assets or equities of PRC companies

(referred to in the SAFE notice as an “offshore special purpose company”). PRC

Residents that are shareholders of offshore special purpose companies

established before November 1, 2005 were required to register with the local