Attached files

| file | filename |

|---|---|

| EX-32.1 - SPAN AMERICA MEDICAL SYSTEMS INC | v169922_ex32-1.htm |

| EX-23.1 - SPAN AMERICA MEDICAL SYSTEMS INC | v169922_ex23-1.htm |

| EX-31.1 - SPAN AMERICA MEDICAL SYSTEMS INC | v169922_ex31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

10-K

|

x

|

Annual

report pursuant to section 13 or 15(d) of the Securities Exchange Act of

1934

|

For the fiscal year ended October 3, 2009

or

|

¨

|

Transition

report pursuant to section 13 or 15(d) of the Securities Exchange Act of

1934

|

For the transition period from _______

to _______.

Commission

file number 0-11392

SPAN-AMERICA

MEDICAL SYSTEMS, INC.

(Exact

name of registrant as specified in its charter)

|

South

Carolina

|

57-0525804

|

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification

No.)

|

|

70

Commerce Center, Greenville, South Carolina

|

29615

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

|

Registrant’s

telephone number, including area code

|

(864)

288-8877

|

Securities

registered pursuant to section 12(b) of the Act:

|

Title

of each class

|

Name

of each exchange on which registered

|

|

None

|

None

|

Securities

registered pursuant to section 12(g) of the Act:

Common

stock, no par value

(Title of

class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No

x

Indicate by check mark if the

registrant is not required to file reports pursuant to Section 13 or Section

15(d) of the Act. Yes ¨ No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes x No

¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Website, if any, every Interactive Data file required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes x No

¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and will not

be contained, to the best of the registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act. (Check one):

Large

Accelerated Filer ¨ Accelerated

Filer ¨

Non-Accelerated

Filer x Smaller

Reporting Company ¨

Indicate by check mark whether the

registrant is a shell company (as defined in Rule 12b-2 of the

Act). Yes ¨ No x

The

aggregate market value of the voting and non-voting common equity held by

non-affiliates computed by reference to the price at which the common equity was

last sold as of the last business day of the registrant’s most recently

completed second fiscal quarter was $19,749,935.

The

number of shares of the registrant’s common stock, no par value, outstanding as

of December 22, 2009 was 2,715,101.

Documents

Incorporated By Reference

Portions

of the Company’s Definitive Proxy Statement for the annual shareholders’ meeting

to be held February 12, 2010 are incorporated by reference into Part

III.

PART

I

Item

1. Business

Forward-Looking

Statements

This annual report on Form 10-K

includes forward-looking statements that describe anticipated results for

Span-America Medical Systems, Inc. (the “Company” or

“Span-America”). These statements are estimates or forecasts about

Span-America and its markets based on our beliefs, assumptions and

expectations. These forward-looking statements therefore involve

numerous risks and uncertainties. We wish to caution the reader that

these forward-looking statements, such as, but not limited to, our expectations

for future sales or future expenses, are only predictions. Actual

events or results may differ materially as a result of risks and uncertainties

in our business. Such risks include, but are not limited to, the

“Risk Factors” described in Item 1A below and other risks referenced from time

to time in our other Securities and Exchange Commission (“SEC”)

filings. We disclaim any obligation to update any forward-looking

statement, whether as a result of new information, future events or

otherwise.

Background

Span-America Medical Systems, Inc. was

incorporated under the laws of the state of South Carolina on September 21,

1970. We manufacture and distribute a variety of therapeutic support

surfaces and related products utilizing polyurethane and other foam products for

the medical, consumer and industrial markets.

We began operations in 1975 as a

manufacturer of polyurethane foam patient positioners and later expanded our

product lines to include foam mattress overlays for the wound care market

primarily in acute care hospitals. Wound care products aid in the

treatment or prevention of pressure ulcers and diabetic ulcers commonly known as

bedsores. In the late 1970s, we also began producing foam products

for industrial applications. In 1985, we introduced the patented

Geo-Mattâ therapeutic

mattress overlay in the health care market, which became one of our leading

products. During the same time period, we began selling convoluted

foam mattress overlay products to consumer bedding retailers throughout the

United States.

We entered the replacement mattress

segment of the medical market in 1992 by acquiring certain assets of Healthflex,

Inc., including its PressureGuard® II therapeutic support surface. We

have since significantly expanded the PressureGuard product line and have added

the Geo-Mattress® product line to provide a broad line of therapeutic support

surfaces that we sell directly and through distributors to hospitals, long-term

care facilities, and home health care dealers throughout the Unites States and

Canada.

In July 2002, we acquired certain

assets of Vadus, Inc., which included patents and equipment related to the

design and production of the Secure I.V.® line of short peripheral intravenous

catheters. The product line was in the development stage at the time

of the acquisition, and we completed the development of the product and

initially launched Secure I.V. in 2004. However, we were unable to

generate sufficient sales volume in the safety catheter segment to make it a

viable business. Consequently, in October 2007, we decided to exit

the safety catheter business and try to sell the related assets. As

of September 29, 2007, we recorded an impairment charge to eliminate the book

value of our safety catheter assets. We are currently engaged in

efforts to sell this part of our business. However, our efforts to

date have been unsuccessful.

1

Our primary long-term strategy is to

become a leading health care manufacturer and marketer specializing in wound

management products used in the prevention and treatment of pressure

ulcers. We are actively seeking to develop or acquire new products in

this market segment. We also seek to further develop consumer and

industrial applications of our medical products.

Our products are distributed in the

United States and, to a lesser degree, in several foreign

countries. Total export sales during fiscal 2009 were approximately

$2.4 million or 4.3% of total net sales. The majority of our export

sales occurred in Canada. See Note 18 – Operations and Industry

Segments in the Notes to Financial Statements included in Item 8 of this

report.

We maintain a website at http://www.spanamerica.com. Our

reports and other filings made with the SEC are available free of charge on our

website, which includes a link to the Company’s filings in the SEC’s EDGAR

filing database.

Industry

Segment Data

Please see Note 18 – Operations and

Industry Segments in the Notes to Financial Statements included in Item 8 of

this report for additional information on industry segment data and revenues

from foreign sales.

Medical

Span-America’s

principal medical products consist of polyurethane foam mattress overlays,

therapeutic support surfaces (which consist of non-powered and powered

therapeutic support surfaces), patient positioners, seating products and Selan®

skin care products. We sell these products primarily in North America

to customers in the major segments of the health care market, including acute

care hospitals, long-term care facilities and home health care

providers. Sales of medical products represented 68% of

total net sales in fiscal 2009, 72% of total net sales in fiscal 2008 and 71% of

total net sales in fiscal 2007.

Mattress

Overlays. Span-America produces a variety of foam mattress

overlays, including convoluted foam pads and its patented Geo-Matt®

overlay. Span-America's overlay products are mattress pads rather

than complete mattresses and are marketed as less expensive alternatives to more

complex therapeutic support surfaces. Our mattress overlays disperse

body heat, increase air circulation beneath the patient and reduce moisture

accumulation to aid in the prevention and treatment of pressure

ulcers. Their convoluted or geometrically contoured construction also

reduces shear forces and more evenly distributes the patient's body weight,

thereby reducing the localized pressure that can cause ulcers. The

Geo-Matt design includes numerous individual foam cells that are cut to exacting

tolerances on computer-controlled equipment to create a clinically effective

mattress surface. Mattress overlays comprised approximately 7% of total net

sales in fiscal 2009. These products are designed to provide patients

with greater comfort and to assist in treating patients who have developed or

are susceptible to developing pressure ulcers. The mattress overlays

are designed for single patient use.

2

Therapeutic Support

Surfaces. Span-America’s non-powered therapeutic support

surfaces fall into two main product categories: the Geo-Mattress® all-foam

products and the non-powered portion of the PressureGuard® product

line. Geo-Mattress® products are single-density or multi-layered foam

mattresses topped with the same patented Geo-Matt surface used in our

overlays. These mattresses are sold as alternatives to standard

innerspring and all-foam mattresses often found in acute and long-term care

settings.

In 1997,

we introduced the Geo-Mattress Max, Plus, and Pro models of foam therapeutic

support surfaces. In early 1999, we extended the product line with

the release of the Geo-Mattress with Wings®, which has been a significant

contributor to overall Geo-Mattress sales. The Wings support surfaces

feature raised perimeter bolsters designed to reduce the chances of patients

rolling out of bed or becoming entrapped. We added a second line

extension, the Geo-Mattress Atlas®, in December 2000 to address the needs of

heavier patients.

Span-America’s

more complex non-powered support surfaces consist of products from the

PressureGuard® series. We acquired the PressureGuard design through

the acquisition of Healthflex, Inc. in February 1992. The original

design combined a polyurethane foam shell and static air cylinders to form a

support surface that incorporated the comfort and pressure relieving features of

both mattress overlays and more sophisticated dynamic

mattresses. This original design, which we later used as the basis

for powered versions (see below), was further refined through a complete

technical upgrade of all PressureGuard components in November 1997.

In

addition to the non-powered, static PressureGuard Renew®, we offer the

PressureGuard CFT®. This model incorporates patented design

principles of constant force technology. The PressureGuard CFT is

unique in that it is a dynamic support surface that rivals more expensive

powered surfaces in effectiveness, yet it requires no power source.

Span-America’s

powered therapeutic support surfaces constitute the remaining models in the

PressureGuard Series. In November 1993, we received Food and Drug

Administration (“FDA”) 510(k) marketing approval for the PressureGuard IV

therapeutic support surface. Building on the comfort and support of

the original PressureGuard design, PressureGuard IV was designed as a

sophisticated, powered system for providing pressure reduction and patient

comfort, with the added ability to turn the patient. The system was

designed to automatically sense the patient’s weight and position, and to

continually adjust the pressures appropriately while slowly and quietly

repositioning the patient at angles up to 30 degrees in cycles of up to two

hours. The upgraded version, renamed the PressureGuard Turn Select®,

incorporates all of these capabilities, as well as several additional

features. Of particular note is a pendant-operated,

microprocessor-controlled motion system, which is built into the support surface

rather than being suspended from the bed frame as a separate

unit.

3

Another

powered system in the PressureGuard line is the PressureGuard APM®, a simpler

but effective alternating pressure mattress. The APM is targeted

primarily at the long-term care and home care markets. In 2000, we

added a more feature-rich version of this mattress called the PressureGuard

APM2. In

2003, we further upgraded the APM2 products

with new features such as the addition of the Deluxe control

unit. The APM2 gives

caregivers the flexibility to offer either alternating pressure or a basic

lateral rotation modality by activating a toggle switch on the control

panel. In fiscal 2009, the APM2 was our

highest selling medical product line.

In late 2001, Span-America introduced

the PressureGuard Easy Air®, our first offering in the category of low-air-loss

mattresses. The Easy Air incorporates several patented design

innovations, which we believe allow it to overcome common performance

compromises inherent in competitive low-air-loss

products. Additionally, the Easy Air was independently documented to

outperform all leading competitors at that time in controlling excess skin

moisture, a key performance advantage in the competitive support surfaces

marketplace (see Ostomy/Wound

Management, January 2003, Volume 49, Issue 1, pp. 32-42).

We sell

all of the powered products in the PressureGuard Series to long-term care

facilities, usually through our distributors, and to home health care equipment

dealers for daily rental in the home care market. We also sell the

PressureGuard products in the acute care market, but in much smaller quantities

than in the long-term care and home care markets.

In fiscal

2004, we began working with Hill-Rom Company, Inc. (now Hill-Rom Holdings, Inc.

(NYSE:HRC)) to develop a private-label version of our PressureGuard CFT

therapeutic support surface to be sold under the Hill-Rom name primarily to

acute care hospitals. Hill-Rom, formerly a division of Hillenbrand

Industries, is a major supplier of hospital beds and various other types of

patient care equipment. Since the initial work in 2004, we expanded

the private label CFT line to include several other therapeutic support surfaces

with additional features designed and manufactured to meet Hill-Rom’s

specifications. As a result of the private label sales to Hill-Rom,

the PressureGuard CFT support surfaces became our fastest growing product line

in fiscal years 2006 and 2007. Our original supply agreement with

Hill-Rom expired in May 2008, and Hill-Rom decided to add competing support

surfaces to broaden their product line. We signed a new, short-term

agreement in July 2008, primarily to provide a structure for an orderly wind

down of our supply relationship with Hill-Rom. The new agreement was

cancelled by Hill-Rom in April 2009 as their transition neared

completion. Our sales to Hill-Rom in fiscal 2009 were $2.0

million. We expect sales to Hill-Rom in fiscal 2010 to be

minimal. We continue to offer private label versions of selected

medical products to other customers, depending on market conditions and customer

interest.

Therapeutic

support surfaces and related products made up approximately 46% of total Company

net sales in fiscal 2009, 54% in fiscal 2008, and 54% in fiscal

2007.

4

Patient

Positioners. We sell our specialty line of patient positioners

primarily under the trademark Span-Aids®. Span-Aids accounted for

approximately 7% of our total net sales in fiscal 2009. This is our

original product line and consists of over 300 different foam items that aid in

relieving the basic patient positioning problems of elevation, immobilization,

muscle contracture, foot drop, and foot or leg rotation. Span-Aids

patient positioners hold a patient's body in prescribed positions, provide

greater patient comfort, and generally are used to aid long-term comatose

patients or those in a weakened or immobilized condition. The

positioners also help in the prevention of pressure ulcers by promoting more

effective dispersion of pressure, heat and moisture. Span-Aids are

intended for single-patient use throughout a patient's entire treatment

program. Among the Span-Aids products that we presently market are

abduction pillows, body aligners, head supports, limb elevators and various foot

and wrist positioners. We sell patient positioners primarily to

hospitals and long-term care facilities through several national medical

products distributors.

Seating Products. Another

product category in our medical segment consists of seat cushions and related

seating products for wheelchairs, Geri-chairs (typically used in long-term care

facilities) and other health care seating needs. Our offerings in

this category can be subdivided into three main groups:

|

|

·

|

wound

healing aids,

|

|

|

·

|

patient

positioning and general pressure management products,

and

|

|

|

·

|

pressure

management products without patient positioning

features.

|

Seating

products made specifically as an aid to wound healing include the Isch-Dish® and

Sacral Dish® pressure relief cushions. Seating products made for

patient positioning and general pressure management include the Isch-Dish Thin,

the Geo-Matt® Contour® cushion, the Equalizer®, and the EZ-Dish®. The

Equalizer contoured positioning cushion has a multi-component design that

includes a viscoelastic foam top, proprietary soft polymer inserts, and a

contoured base. Like the Isch-Dish, the Equalizer is covered for

reimbursement by the Medicare system. This makes it an attractive

option for durable medical equipment suppliers and rehab seating

specialists. The EZ-Dish pressure relief cushion, which uses some of

the features of the original Isch-Dish design, offers a simpler, more affordable

solution to the seating problems of nursing home patients. The

Geo-Wave® Cushion assists with positioning and pressure reduction for patients

using specialty recliners and Geri-chairs. The Short-Wave® seat and back

cushion reduces shear and assists with patient positioning in standard

wheelchairs.

Seating

products designed to address pressure management without additional positioning

benefits include the Gel-T® cushion and the Geo-Matt and Geo-Matt PRT®

wheelchair cushions. The Gel-T is a gel/foam combination cushion that

is especially popular with elderly patients. The Geo-Matt and

Geo-Matt PRT cushions incorporate our proprietary Geo-Matt anti-shearing

surface.

Seating products accounted for

approximately 4% of total net sales in fiscal 2009.

Skin Care

Products. We also market the Selan® line of skin care creams

and lotions under a license agreement with PJ Noyes Company. The

products, which are manufactured by PJ Noyes, are used for cleaning,

moisturizing and protecting patients’ skin and are sold primarily in long-term

care and acute care settings. The license agreement with PJ Noyes

will expire on December 14, 2010. We anticipate renewing the license

agreement under similar terms and conditions prior to the 2010 expiration

date. Sales of skin care products accounted for approximately 2% of

our total net sales in fiscal 2009.

5

Fall Protection

Products. In December 2008, we introduced the Risk Manager®

bedside safety mat, which is a new product category for

Span-America. The Risk Manager is manufactured using an elastomeric

gel compound and is designed to cushion the force of impact and reduce the

chance of injury to a patient who falls at the bedside. Sales of the

Risk Manager made up 1% of our total net sales in fiscal 2009.

Distributor and Private-Label

Manufacturing Relationships. We sell our medical products to many

customers of varying sizes. We also sell our branded medical products

to several medical products distributors which resell our products to acute care

hospitals and long-term care facilities throughout North

America. Sales to our four largest medical distributors made up

approximately 45% of net sales in the medical segment during fiscal

2009. We believe our relationships with these distributors are

good. However, the loss of any one of these customers could have a

material adverse effect on our business. See Item 1A. “Risk Factors”

below for more information on our relationships with large

customers.

Custom

Products

Span-America's custom products segment

includes two major product lines: consumer bedding products and various

engineered industrial products. Our consumer product line consists

primarily of convoluted and contour-cut mattress overlays and specially designed

pillows for the consumer bedding market. The consumer products are

marketed to retailers through Louisville Bedding Company, a leading manufacturer

and distributor of bedding products in North America. Louisville

Bedding is the exclusive distributor of our consumer foam products pursuant to a

distribution agreement between us, which expires in December

2012. The agreement automatically renews for successive three-year

terms unless either party provides notice of its intent not to renew at least 60

days prior to the expiration date.

Our industrial product line consists of

specially engineered foam products used in a variety of markets, including the

water sports equipment, automotive, photographic film, durable goods and

electronics industries. Our largest industrial customers manufacture

kayaks, cars and specialty packaging products. The majority of our

industrial products are made to order according to customer

specifications. We currently have one full-time sales representative

selling our industrial foam fabrication capabilities primarily in the

southeastern United States.

The custom products segment represented

approximately 32% of our total net sales in fiscal 2009, compared with 28% in

fiscal 2008 and 29% in fiscal 2007. In fiscal 2009, approximately 79%

of our total custom products sales were distributed through Louisville Bedding

Company. The loss of this relationship would have a material adverse

effect on our business. Sales of consumer bedding products within the

custom products segment represented 27% of total Company net sales in fiscal

2009, 22% in fiscal 2008 and 23% in fiscal 2007.

6

Safety

Catheters

In July

2002, we acquired assets related to the Secure I.V.® protected short peripheral

intravenous catheter from Vadus, Inc., a privately owned designer and

manufacturer of catheters. The acquired assets consisted primarily of

patents and equipment related to the design, production and sale of the Secure

I.V. catheter. The product line was in the development stage at the

time of the acquisition, and we completed the development of the product and

initially launched Secure I.V. in 2004. However, we were unable to

generate sufficient sales volume in the safety catheter segment to make it a

viable business. Consequently, in October 2007, we decided to exit

the safety catheter business and try to sell the related assets. As

of September 29, 2007, we recorded an impairment charge to eliminate the book

value of our safety catheter assets. The losses, net of income taxes,

for the discontinued safety catheter segment were $21,000 in 2009, $50,000 in

2008, and $2.6 million in 2007 (including an after-tax impairment charge of $1.9

million).

We have

attempted to sell the assets related to the safety catheter business, but our

efforts so far have not been successful. We have ceased the use of

the safety catheter assets and are committed to a plan of sale or

abandonment. However, we have no offers pending and can give no

assurance that the assets will eventually be sold. If the assets are

not eventually sold, they will be abandoned and disposed of.

Research

and Development

Span-America’s expenditures for

research and development for the last three fiscal years are set forth in the

following table:

|

Research

and Development Expense

|

||||||||||||

|

2009

|

2008

|

2007

|

||||||||||

|

Medical

|

$ | 822,000 | $ | 657,000 | $ | 724,000 | ||||||

|

Custom

products

|

44,000 | - | - | |||||||||

|

Total

R& D - Operating

|

866,000 | 657,000 | 724,000 | |||||||||

|

Discontinued

Operations - Safety catheters

|

- | - | 83,000 | |||||||||

|

Total

R&D expense

|

$ | 866,000 | $ | 657,000 | $ | 807,000 | ||||||

We expect

research and development costs in fiscal 2010 to be similar to those of fiscal

2009.

Competition

Medical. In the

medical market segment, we face significant competition for sales of our foam

mattress overlays. Competition within the overlay market is primarily

based on price and delivery for convoluted foam overlays. For

therapeutic overlays, including Geo-Matt, competition is based on price, product

performance, quality and delivery. However, the largest single source

of competition for our mattress overlay products is from full-function

therapeutic support surfaces designed and manufactured either by us or our

competitors. Sales of overlays have generally declined since the

1990s as customers began to replace single-patient-use overlays with full

function mattresses that incorporated the pressure relieving features of

overlays. Competition with respect to our Span-Aids patient

positioners is primarily based on price. However, a secondary source

of competition for patient positioners results from alternative methods, such as

the use of pillows and other devices to position patients.

7

We believe that Span-America is one of

the largest nationwide suppliers of therapeutic mattress overlays and patient

positioners to the U.S. health care market. Our primary competitors

in the overlay and positioner markets are Sunrise Medical, Inc. and Covidien

(formerly Tyco Healthcare).

Competition in the therapeutic support

surface market is based on product performance, price and

durability. Customers typically select a product based on these

criteria after conducting a formal clinical evaluation of sample mattresses for

periods of one to six months. A secondary source of competition

results from alternative products such as mattress overlays, which are

significantly less expensive than support surfaces.

The market for therapeutic support

surfaces developed principally during the 1990s. Competitors include

The Encompass Group, Gaymar Industries, Inc., Hill-Rom Holdings, Inc., Kinetic

Concepts, Inc., Invacare Corporation, Sunrise Medical, Inc., Anodyne Medical

Device, Inc., Direct Supply, Inc. and Medline Industries, Inc. These

competitors use combinations of their own sales representatives and

manufacturer’s representatives to sell nationwide directly to hospitals,

distributors, long-term care facilities and original equipment

manufacturers.

Many of our competitors in the health

care segment are larger and have greater resources than

Span-America. We believe our competitive advantages in the medical

segment include innovative and patented product designs, product quality,

manufacturing capabilities, distribution relationships and responsiveness to

customer requirements.

Custom

Products. In the custom products segment, we have encountered

significant competition for our mattress pad and pillow products. The

competition is principally based on price, which is largely determined by foam

density and thickness. However, competition also exists due to

variations in product design and packaging. There are presently a

number of companies with the manufacturing capability to produce similar bedding

products. Our primary competitors in this market are Sleep

Innovations, Inc., E.R. Carpenter Company and Zinus, Inc., most of which are

larger and have greater resources than we do. We also have a number

of competitors in the market for our industrial products,

including CelloFoam North America, Inc., UFP Technologies,

Inc. (NASDAQ-CM:UFPT) and Foam-Tech. These competitors are larger and

have greater resources than we do. The competition for industrial

foam products is largely based on price. In many instances, however,

design, product quality and delivery capabilities are also

important. We believe that our competitive advantages in the custom

products segment include our distribution relationship with Louisville Bedding

Company, innovative product designs, manufacturing and foam fabrication

capabilities, low cost manufacturing processes and responsiveness to customer

requirements.

8

Within the last few years, we have

encountered increasing competition in the consumer bedding market from visco

foam products manufactured both in the United States and China. Visco

foam, also known as visco-elastic foam or memory foam, has greater density and

different properties than traditional polyurethane foam products. It

responds to body temperature, conforms to the shape of the body, and generally

has slower recovery time compared with traditional polyurethane

foam. Visco foam is also significantly more expensive than

traditional foam and is more difficult to handle and

fabricate. Because visco foam is more difficult to cut and shape than

traditional foam, it is more difficult for us to differentiate our products from

those of our competitors. Consequently, the visco mattress pads

currently on the market tend to be somewhat undifferentiated without unique

surface designs. In addition, since visco foam is significantly more

expensive and more dense than traditional foam, it is more cost effective for

overseas competitors (from China for example) to ship the products into the U.S.

market. This is generally because retail prices of visco foam

products are significantly higher than comparable traditional foam products,

which generates much higher revenue per square foot of retail shelf space and

lowers shipping costs as a percent of sales value.

Major

Customers

We have an agreement with Louisville

Bedding Company to distribute our consumer foam products. Sales to

Louisville Bedding during fiscal 2009 made up approximately 26% of our total net

sales and approximately 79% of sales in the custom products

segment.

In the medical segment, sales to an

additional customer with whom we have a business relationship to re-sell certain

of our medical products exceeded 10% of our total net sales. Sales to

this distributor, McKesson Medical-Surgical, during fiscal 2009 made up

approximately 12% of total net sales and approximately 18% of net sales in the

medical products segment.

See “Industry Segment Data – Medical –

Distributor and Private-Label Manufacturing Relationships” above and Note 17 –

Major Customers and Note 18 – Operations and Industry Segments in the Notes to

Financial Statements below for more information on major

customers. The loss of any of these major customers would have a

material adverse effect on our business.

9

Seasonal

Trends

Some seasonality can be identified in

certain of our medical and consumer foam products. However, the

fluctuations have minimal effect on our operations because of offsetting trends

among these product lines. We have not experienced significant

seasonal fluctuations in our industrial product line.

Patents

and Trademarks

We hold 34 United States patents and 8

foreign patents relating to various components of our patient positioners,

mattress overlays, and therapeutic support surfaces for the medical

segment. We have also filed additional patent

applications. We believe that these patents are important to our

business. However, while we have a number of products covered by

patents, there are competitive alternatives available, which are not covered by

these patents. Therefore, we do not rely solely on our patents to

maintain our competitive position in our various markets.

Our principal patents include the

patents on Geo-Matt, Geo-Mattress, PressureGuard, and Span-Aids

products. The Geo-Matt and Geo-Mattress patents have remaining lives

ranging from 1 to 4 years with additional patents pending. The

PressureGuard patents have remaining lives ranging from 5 to 9 years with

additional patents pending. The Span-Aids patents have remaining

lives ranging from less than a year to 6 years.

As previously noted, in July 2002, we

acquired assets related to the Secure I.V.® catheter product line of Vadus,

Inc., a privately owned designer and manufacturer of peripheral intravenous

catheters. The Secure I.V. has FDA 510(k) approval and is protected

by 11 U. S. patents and 9 foreign patents, all of which are owned by

Span-America. The Secure I.V. patents have remaining terms ranging

from 3 to 12 years. The mark “Secure I.V.” is also Span-America’s

registered trademark. We have also filed additional patent

applications. If we are successful in our efforts to sell the Secure

I.V. business, we expect that the purchaser will acquire the related patents and

trademarks.

We hold 37 federally registered

trademarks and 18 foreign trademark registrations, including Span-America, Span-Aids, Geo-Matt,

Geo-Mattress, PressureGuard, and Isch Dish in the medical and

consumer segments. Other federal

registration applications are presently pending. We believe that

these trademarks are readily identifiable in their respective markets and add

value to our product lines.

Raw

Materials and Backlog

Polyurethane foam and nylon/vinyl

mattress covers and tubes account for approximately 80% of our raw

materials. In addition, we use corrugated shipping containers,

polyethylene plastic packaging material and hook-and-loop

fasteners. We believe that our basic raw materials are in adequate

supply and are available from many suppliers at competitive

prices.

10

See Item 1A. “Risk Factors” and Item 7.

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations” for more information on price increases for polyurethane

foam.

As of October 3, 2009, we had unshipped

orders of approximately $400,000 which represents a 67% decrease compared to our

backlog of $1.2 million at fiscal year-end 2008. We believe the

decline in our fiscal year-end level of unshipped orders from 2008 to 2009 was

an aberration caused by an unusual fluctuation in the timing of orders

received. We do not believe that the decline in unshipped orders is

indicative of expected sales trends in fiscal 2010. It is common for

our level of unshipped orders to fluctuate significantly on a daily

basis. Order volumes and shipments after October 3, 2009 have been

similar to historical levels and have generally met our

expectations. We expect to fill all orders in the current backlog in

the 2010 fiscal year.

Employees

We had 212 full-time employees as of

October 3, 2009. Of these employees, eight were officers, 14 were

management personnel, 22 were administrative and clerical personnel, 27 were

sales personnel, and 141 were manufacturing employees. We are not a

party to any collective bargaining agreement and have never experienced an

interruption or curtailment of operations due to labor

controversy. We believe that our relations with our employees are

good.

Supervision

and Regulation

The Federal Food, Drug and Cosmetic

Act, and regulations issued or proposed thereunder, provide for regulation by

the FDA of the marketing, manufacture, labeling, packaging and distribution of

medical devices, including our products. These regulations require,

among other things, that medical device manufacturers register with the FDA,

list devices manufactured by them, and file various reports. In

addition, our manufacturing facilities are subject to periodic inspections by

regulatory authorities and must comply with “good manufacturing practices” as

required by the FDA and state regulatory authorities. We believe that

we are in substantial compliance with applicable regulations and do not

anticipate having to make any material expenditures as a result of FDA or other

regulatory requirements.

We are certified as an ISO 9001 and ISO

13485 supplier for our PressureGuard mattress products from our Greenville,

South Carolina plant. These standards are prepared by the American

Society for Quality Control Standards Committee to correspond to the

International Standard ISO 9001:2000. ISO (the International

Organization for Standardization) is a worldwide federation of national

standards bodies dealing with quality-system requirements that can be used by a

supplier to demonstrate its capability and for the assessment of the capability

of a supplier by external parties. Compliance with ISO standard 13485

is required by Health Canada for all Class II medical devices sold

there. All of our powered therapeutic support surfaces for the health

care market are considered Class II medical devices. The

certification is subject to reassessment at six-month intervals. We

have maintained our certification based on the results of ISO audits conducted

during fiscal year 2009.

11

Environmental

Matters

Our manufacturing operations are

subject to various government regulations pertaining to the discharge of

materials into the environment. We believe that we are in substantial

compliance with applicable regulations. We do not anticipate that

continued compliance will have a material effect on our capital expenditures,

earnings or competitive position.

Item 1A. Risk

Factors

The loss of a key distributor or

customer in the Company’s medical or custom products segments could cause a

rapid and significant sales decline, which would likely result in a decline in

earnings. Many of our medical products are sold through large

national distributors in the United States and Canada. We do not

maintain long-term distribution agreements with most of these

distributors. Instead, we supply them based on purchase orders that

are issued by the customers on a daily or weekly basis. These

supplier-customer relationships can generally be ended by either party with

minimal notice. Consequently, if a large customer or distributor

decided to discontinue purchasing our products, our sales and earnings could

quickly decline. Our largest customer in the medical segment is

McKesson Medical-Surgical which accounted for 18% of sales in the medical

segment in fiscal 2009. In addition, all of our consumer foam

products are sold through our exclusive distributor, Louisville Bedding Company,

under a marketing and distribution agreement that expires in December

2012. The agreement automatically renews for successive three-year

terms unless either party provides notice of its intent not to renew at least 60

days prior to the expiration date.

For more information on major customers

and information on our business segments, see the discussions under Item 1.

“Business – Major Customers,” Note 17 – Major Customers and Note 18 – Operations

and Industry Segments in the Notes to Financial Statements, Item 1. “Business –

Industry Segment Data – Medical – Distributor and Private-Label Manufacturing

Relationships” and Item 1. “Business – Industry Segment Data – Custom

Products.”

The current weakness in the U.S.

economy and associated problems in the credit markets could cause our sales to

decline, which in turn could have a negative effect on our

earnings. Our fastest growing products during the last five

years have been our lines of therapeutic support surfaces, which consist of our

PressureGuard and Geo-Mattress products as well as our private-label support

surfaces. Sales of these support surfaces represented 46% of our

total net sales in fiscal 2009. These products are generally

considered by us and our customers to be capital purchase items instead of

consumable supplies. We believe that purchases of these capital goods

are more easily postponed during business downturns than purchases of

consumables. Consequently, sales of our support surfaces are likely

to be more sensitive to general economic weakness than other medical product

lines in our business. Also, tight conditions in credit markets could

make it more difficult for our customers to obtain financing for capital

expenditures, which could slow sales particularly within our support surface

product lines. Therapeutic support surface sales decreased 20% during fiscal

2009 compared with fiscal 2008. Sales of our therapeutic support

surfaces may continue to decline if the economy remains weak.

12

In addition, our industrial products

are sold primarily to the water sports, automotive and packaging industries, as

well as various other manufacturers. Our industrial business has

historically been more affected by general economic trends than other

Span-America product lines. Therefore an economic downturn is likely

to have a greater effect on sales of industrial products than on other product

lines in our business. Industrial sales decreased 26% during fiscal

2009 compared with fiscal 2008. Sales of industrial products could

continue to decline if the economy remains weak.

Since many of our operating costs are

fixed within a reasonable range of sales and production activity, sales declines

could result in proportionally greater declines in earnings

performance. We would attempt to reduce expenses in response to lower

sales levels, but we cannot give assurance that we would be able to fully offset

the effect of a rapid decline in sales volume.

Our medical business could lose sales

volume or could have a lower sales growth rate as a result of government

reimbursement changes in the medical market. A number of our

medical products are eligible for reimbursement by Medicare. We

receive no direct reimbursements from Medicare, but our customers often submit

reimbursement requests to Medicare. For example, we sell therapeutic

support surfaces to home health care dealers who in turn rent these products to

patients. Medicare reimburses the dealers for some or all of the

patient’s rental cost. If Medicare reimbursement rates are reduced,

the demand for our medical products that are covered by Medicare could also be

reduced, depending on the size of the rate reduction.

Our earnings could be negatively

affected by raw material cost increases that we are unable to recover through

sales price increases. The cost of polyurethane foam

represented approximately 41% of our total cost of goods sold in fiscal

2009. An increase in foam raw material costs that we are not able to

pass through to our customers by increasing prices could have a significant

negative effect on our profitability. Besides polyurethane foam, our

other major raw material categories include mattress covers made of various

water proof fabrics, vinyl bags, vinyl air cylinders, electronic components for

mattresses and corrugated boxes. Raw materials are our single largest

cost category, representing approximately 73% of our total cost of goods sold in

fiscal 2009. Cost increases in these raw materials could have a

significant adverse effect on earnings if we are unable to recover the higher

costs through sales price increases or operating expense

reductions.

Our sales volume could decline as a

result of competition from low-cost foreign imports. During

the last two years, we have experienced increased competition in our medical and

custom products segments from low-cost foreign imports. In the

medical segment, the number of low-cost, imported mattress products has

increased in the last two years, but it has not yet had a significant impact on

our medical business. We believe that we have potentially greater

exposure to low-cost imports in our consumer bedding product lines because those

products have more commodity-like characteristics than our medical

products. Also, our customers, which are generally national

retailers, are more likely to change suppliers to buy lower-cost

products. Therefore, we could lose significant sales volume in our

consumer bedding business and smaller parts of our medical sales volume if we

are unable to compete effectively with low-cost imports.

13

Certain of our medical products are

classified as medical devices and are regulated by the

FDA. These regulations require, among other things, that

medical device manufacturers register with the FDA, list devices manufactured by

them, and file various reports. In addition, our manufacturing

facilities are subject to periodic inspections by regulatory authorities and

must comply with “good manufacturing practices” as required by the FDA and state

regulatory authorities. Although we believe that we are in

substantial compliance with applicable regulations, the existence of the

regulations creates the risk of a product recall and related expenses as well as

the risk of additional expenses required to meet the regulatory

requirements.

Item

1B. Unresolved Staff Comments

None

Item

2. Properties

We own our principal office and

manufacturing facility, which is located in Greenville, South

Carolina. This facility contains approximately 188,000 square feet

used by the medical and custom products segments and is located on a 13-acre

site. We believe that our current manufacturing and storage space is

adequate to support our operations during the next several years, depending on

sales growth rates.

We also lease 15,000 square feet of

warehouse space in Salt Lake City, Utah for use as a distribution center for our

medical products. We lease this facility on a month-by-month basis at

a rate of $6,750 per month.

We consider the South Carolina and Utah

facilities to be suitable and adequate for their intended purposes.

Item 3. Legal

Proceedings

From time to time we are a party to

various legal actions arising in the normal course of business. We

believe that as a result of legal defenses and insurance arrangements with

parties believed to be financially capable, there are no proceedings threatened

or pending against us that, if determined adversely, would have a material

adverse effect on our financial position or results of operations.

Item

4. Submission of Matters to a Vote of Security

Holders

No

matters were submitted to a vote of security holders during the fourth quarter

of our 2009 fiscal year.

14

PART

II

Item 5. Market

for the Registrant's Common Equity, Related Stockholder Matters and Issuer

Repurchases of Equity Securities

The common stock of Span-America

Medical Systems, Inc. trades on The NASDAQ Global Market® under the symbol

SPAN. As of December 16, 2009, there were 2,715,118 common shares

outstanding, 180 shareholders of record and approximately 1,100 beneficial

shareholders. The closing price of Span-America's stock on December

16, 2009 was $15.90 per share.

The high and low sales prices for the

Company’s Common Stock in each of the last eight fiscal quarters is shown on the

following table.

|

Quarterly

Stock Price Data

|

||||||||||||||||||||

|

First

|

Second

|

Third

|

Fourth

|

Year

|

||||||||||||||||

|

For

Fiscal 2009

|

||||||||||||||||||||

|

High

|

$ | 12.94 | $ | 10.75 | $ | 11.94 | $ | 13.53 | $ | 13.53 | ||||||||||

|

Low

|

8.03 | 7.76 | 8.05 | 10.54 | 7.76 | |||||||||||||||

|

For

Fiscal 2008

|

||||||||||||||||||||

|

High

|

$ | 18.75 | $ | 13.39 | $ | 13.52 | $ | 13.50 | $ | 18.75 | ||||||||||

|

Low

|

9.88 | 10.17 | 10.17 | 10.60 | 9.88 | |||||||||||||||

The Company has paid a regular

quarterly cash dividend since January 1990. In April 2008, the Board

increased the quarterly dividend to $0.09 per share from $0.08 per

share. In November 2009, the Board increased the quarterly dividend

to $0.10 per share from $0.09 per share payable on December 4,

2009. We expect the Company to continue to pay quarterly dividends

for the foreseeable future, though the Board may discontinue paying dividends at

any time. Future dividend payments will depend upon the Company’s

earnings and liquidity position. See the discussion of our revolving

bank credit facility in Note 9 – Borrowings in the Notes to Financial Statements

for a description of restrictions on our ability to pay dividends and repurchase

our stock, which description is incorporated herein by reference.

The information regarding equity

compensation plans set forth under Item 12 below is incorporated herein by

reference.

15

ISSUER

PURCHASES OF EQUITY SECURITIES

|

Period

|

(a)

Total Number

of

Shares

Purchased

|

(b)

Average

Price

Paid per

Share

|

(c)

Total Number

of

Shares

Purchased

as Part

of

Publicly

Announced

Plans

or

Programs

|

(d)

Maximum

Number

of

Shares

that May

Yet

Be

Purchased

Under

the

Plans

|

||||||||||||

|

June

28, 2009-Aug.

1, 2009

|

1,000 | 11.28 | 1,000 | 126,991 | ||||||||||||

|

Aug.

2, 2009 – Aug. 29, 2009

|

3,662 | 11.52 | 3,662 | 123,329 | ||||||||||||

|

Aug.

30, 2009 – Oct. 3, 2009

|

5,350 | 12.45 | 5,350 | 117,979 | ||||||||||||

|

Total

|

10,012 | 12.00 | 10,012 | 117,979 | ||||||||||||

The

Company announced on November 28, 2007 that the Board of Directors authorized

the Company to repurchase up to 138,772 shares of its common

stock. On February 11, 2009, the Board expanded the

repurchase program by 100,000 shares, bringing the total number of authorized

shares to 238,772. The program may be suspended or discontinued at

any time.

16

PERFORMANCE

GRAPH

Notwithstanding

any statement in any of the Company’s previous or future filings under the

Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as

amended, incorporating future or past filings, including this Annual Report on

Form 10-K, in whole or in part, the following Performance Graph shall not be

incorporated by reference into any such filing unless the incorporation

specifically lists the following Performance Graph.

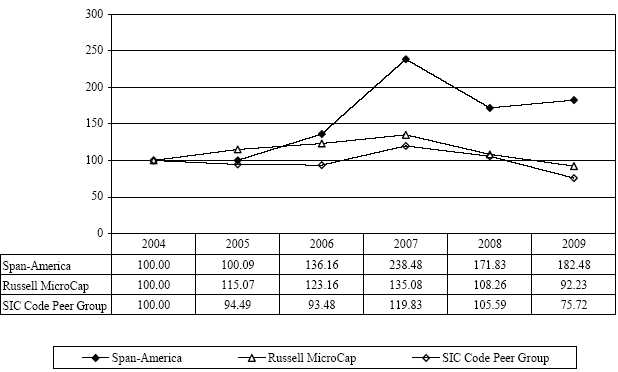

The following graph sets forth the

performance of the Company’s Common Stock for the five-year period from October

2, 2004 through October 3, 2009, compared to the Russell MicroCap Index and a

peer group index. The peer group index was prepared by an

unaffiliated third party and is comprised of all exchange-listed companies that

had the standard industry classification code 3842 (which relates to medical

products and supplies) as of October 3, 2009. The companies included

in the peer group index are shown below. All stock prices reflect the

reinvestment of cash dividends.

COMPARISON

OF CUMULATIVE TOTAL RETURN AMONG

SPAN-AMERICA

MEDICAL SYSTEMS, INC.,

THE

RUSSELL MICROCAP INDEX

AND

A PEER GROUP

Assumes

$100 invested on October 2, 2004.

Assumes

dividends reinvested. Fiscal year ended October 3,

2009.

17

COMPANIES

INCLUDED IN PEER GROUP INDEX

Standard

Industry Classification Code 3842

at

October 3, 2009

|

American

Surgical Holdings, Inc.

|

Antares

Pharma, Inc.

|

Applied

Nanoscience Inc.

|

||

|

ATS

Medical, Inc.

|

Biocoral,

Inc.

|

Cardo

Medical, Inc.

|

||

|

Chad

Therapeutics, Inc.

|

Cytori

Therapeutics, Inc.

|

Exactech,

Inc.

|

||

|

Hansen

Medical, Inc.

|

Heritage

Worldwide, Inc.

|

Hill-Rom

Holdings, Inc.

|

||

|

Ibrands

Corp.

|

Insulet

Corp.

|

Integra

Lifesciences Holdings

|

||

|

Invacare

Corp.

|

Lakeland

Industries, Inc.

|

MB

Software Corp.

|

||

|

Medical

Action Industries Inc.

|

Medical

Solutions Management

|

Mine

Safety Appliances Co.

|

||

|

Miracor

Diagnostics, Inc.

|

Nano

Mask Inc.

|

Orthologic

Corp.

|

||

|

Otix

Global, Inc.

|

PC

Group Incorporated

|

Point

Blank Solutions, Inc.

|

||

|

Pride

Business Development Holdings

|

Quantum

MRI, Inc.

|

RTI

Biologics, Inc.

|

||

|

Sector

10, Inc.

|

Sharps

Compliance Corp.

|

Stryker

Corp.

|

||

|

Symmetry

Medical, Inc.

|

Synovis

Life Technologies

|

Theragenics

Corp.

|

||

|

Wright

Medical Group, Inc.

|

Zimmer

Holdings, Inc.

|

18

Item 6. Selected

Financial Data

Selected Financial Data for the

Company’s last five fiscal years is shown in the table below.

Five-Year

Financial Summary

(Amounts

in thousands, except per share and employee data)

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||||

|

(1)

|

(1)

|

(1)

|

||||||||||||||||||

| For the year: | ||||||||||||||||||||

|

Net

sales

|

$ | 55,867 | $ | 59,265 | $ | 60,544 | $ | 51,436 | $ | 48,433 | ||||||||||

|

Gross

profit

|

20,208 | 20,395 | 20,951 | 16,438 | 15,304 | |||||||||||||||

|

Operating

income

|

6,868 | 7,518 | 8,128 | 5,093 | 4,633 | |||||||||||||||

|

Income

from continuing operations

|

4,705 | 4,919 | 5,505 | 3,779 | 3,408 | |||||||||||||||

|

Net

income

|

4,684 | 4,869 | 2,874 | 3,055 | 2,439 | |||||||||||||||

|

Cash

flow from operations

|

6,806 | 5,250 | 6,294 | 2,497 | 2,589 | |||||||||||||||

|

Capital

expenditures for continuing operations

|

355 | 692 | 1,009 | 1,071 | 2,375 | |||||||||||||||

|

Per

share:

|

||||||||||||||||||||

|

Income

from continuing operations:

|

||||||||||||||||||||

|

Basic

|

$ | 1.72 | $ | 1.77 | $ | 2.02 | $ | 1.43 | $ | 1.31 | ||||||||||

|

Diluted

|

1.68 | 1.71 | 1.92 | 1.36 | 1.24 | |||||||||||||||

|

Net

income:

|

||||||||||||||||||||

|

Basic

|

$ | 1.72 | $ | 1.76 | $ | 1.06 | $ | 1.15 | $ | 0.94 | ||||||||||

|

Diluted

|

1.67 | 1.70 | 1.00 | 1.10 | 0.89 | |||||||||||||||

|

Cash

dividends declared (2)

|

0.36 | 0.34 | 5.30 | 0.195 | 0.565 | |||||||||||||||

|

(1)

|

As

restated to show the safety catheter segment as a discontinued operation.

See Note 12 in Notes to Financial

Statements.

|

|

(2)

|

Cash

dividends declared include special dividends of $5.00 per share in 2007

and $0.40 per share in 2005.

|

19

Five-Year

Financial Summary

(Amounts

in thousands, except per share and employee data)

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||||

|

(1)

|

(1)

|

(1)

|

||||||||||||||||||

|

At

end of year:

|

||||||||||||||||||||

|

Working

capital

|

10,858 | 8,048 | 7,447 | 13,338 | 10,638 | |||||||||||||||

|

Property

and equipment - net

|

6,159 | 6,569 | 6,537 | 6,137 | 5,812 | |||||||||||||||

|

Total

assets

|

26,835 | 24,113 | 23,838 | 31,012 | 28,666 | |||||||||||||||

|

Long

term debt

|

700 | 3,700 | ||||||||||||||||||

|

Shareholders'

equity

|

20,573 | 17,332 | 13,788 | 24,517 | 21,561 | |||||||||||||||

|

Book

value per share

|

7.59 | 6.28 | 4.97 | 9.22 | 8.26 | |||||||||||||||

|

Number

of employees from continuing operations

|

212 | 253 | 317 | 287 | 291 | |||||||||||||||

|

Key

ratios:

|

||||||||||||||||||||

|

Return

on net sales (2)

|

8.4 | % | 8.2 | % | 4.7 | % | 5.9 | % | 5.0 | % | ||||||||||

|

Return

on average shareholders' equity (2)

|

24.7 | % | 31.3 | % | 15.0 | % | 13.3 | % | 11.6 | % | ||||||||||

|

Return

on average total assets (2)

|

18.4 | % | 20.3 | % | 10.5 | % | 10.2 | % | 8.7 | % | ||||||||||

|

Current

ratio

|

3.0 | 2.5 | 2.3 | 3.8 | 3.0 | |||||||||||||||

|

(1)

|

As restated to show the safety

catheter segment as a discontinued operation. See Note 12 in Notes to Financial

Statements.

|

|

(2)

|

These

"Return" ratios are calculated using net income as shown above, which

includes losses from discontinued

operations.

|

20

Item

7. Management's Discussion and Analysis of Financial Condition and

Results of Operations

OVERVIEW

Span-America’s operations are divided

into two primary business units or segments: medical and custom

products. Our revenues, profits and cash flows are derived from the

development, manufacture and sale of products for these two market

segments. In the medical segment, we manufacture and market a

comprehensive selection of pressure management products, including Geo-Matt®,

PressureGuard®, Geo-Mattress®, Span-Aids® and Isch-Dish® products. We

license and market, but do not manufacture, Selan® skin care

products. In the custom products segment, we manufacture consumer

mattress pads and pillows for the retail bedding market and various engineered

foam products for the industrial market. Our consumer mattress pads

and pillows are marketed by our exclusive distributor, Louisville Bedding

Company. We sell the industrial product line directly to our

customers instead of using distributors. Prior to fiscal year 2008,

we had a third business unit engaged in the development, manufacture and sale of

safety catheters. We decided to exit the safety catheter business in

October 2007. Revenues and expenses related to the safety catheter

business in fiscal years 2009 and 2008 are shown in our financial statements as

a discontinued operation. Results of operations for fiscal year 2007

were restated to show the safety catheter segment as a discontinued

operation.

RESULTS

OF OPERATIONS FISCAL 2009 VS. 2008

Summary

Total sales in fiscal 2009 declined 6%

to $55.9 million compared with $59.3 million in fiscal 2008 because of lower

sales volume in our medical segment, which was partially offset by increases in

sales volume in our custom products segment. Medical sales were down

11% to $37.8 million due mainly to a decline in sales of private label

therapeutic support surfaces. Custom products sales for fiscal 2009

increased 7% to $18.1 million due to higher sales of consumer bedding products

compared with fiscal year 2008.

Income from continuing operations

declined 4% in fiscal 2009 to $4.7 million, or $1.68 per diluted share, because

of lower sales levels. Net income, which includes results from the

discontinued safety catheter segment, also fell 4% in fiscal 2009 to $4.7

million, or $1.67 per diluted share.

Sales

Total sales in our core medical

business declined 11% to $37.8 million in fiscal 2009 compared with $42.5

million in fiscal 2008. The decline in medical sales was primarily

related to the expiration of a private label supply contract with Hill-Rom that

accounted for $7.0 million in fiscal 2008 sales compared with $2.0 million in

fiscal 2009 sales. Consequently, sales of therapeutic support

surfaces, including private label products, declined by 20% to $25.5 million

during fiscal 2009 compared with $31.8 million in fiscal

2008. Therapeutic support surfaces, or mattresses, are our largest

medical product line, making up 67% of our medical segment sales in fiscal 2009

and 75% in fiscal 2008. We sell these specialty mattresses to

hospitals, long-term care facilities and home care dealers throughout the United

States and Canada. Sales of therapeutic support surfaces have

declined compared to previous fiscal years due primarily to the expiration of

the private label contract mentioned above and secondarily due to reduced

capital spending by many of our customers. Excluding sales to

Hill-Rom in both years, sales of therapeutic support surfaces would have

declined by 5% in fiscal 2009 compared with fiscal 2008.

21

Sales of the new Risk Manager™ bedside

safety mat, introduced at the beginning of our second fiscal quarter in 2009,

were $801,000 in fiscal 2009. Sales of our Span-Aids patient

positioners and mattress overlays both increased by 7% during fiscal 2009

compared with fiscal 2008. Selan skin care sales fell 4%, and sales

of seating products increased 10% during fiscal 2009. The growth in

sales of positioners, overlays and seating products in fiscal 2009 was mainly

due to sales price increases during the year. Medical sales accounted

for 68% of total net sales in fiscal year 2009 compared with 72% in fiscal

2008. We expect medical sales for 2010 to be higher than those of

2009.

Our custom products segment consists of

consumer bedding products and specialty foam products for the industrial

market. Sales in the custom products segment increased 7% during

fiscal 2009 to $18.1 million from $16.8 million in fiscal 2008. The

primary reason for the increase occurred in the consumer part of the custom

products segment, where sales increased 17% to $15.3 million compared with $13.0

million in fiscal 2008. This increase was caused by higher volumes of

consumer mattress overlays sold to existing customers and the addition of

several new customers during the year. All of our consumer products

are sold through our marketing and distribution partner, Louisville Bedding

Company.

Early in 2009, Span-America was

selected as one of three companies to supply consumer mattress pads to Sam’s

Club. We began shipping the new products in April, and our sales to

Sam’s Club in fiscal 2009 were $2.0 million. We learned in August

that Sam’s Club had selected an offshore company as its sole supplier of

mattress pads and that Span-America would not be a continuing supplier to Sam’s

Club. Our ongoing business with Wal-Mart is unaffected by the Sam’s

Club decision. We plan to sell the remaining Sam’s Club-related

inventory, and we do not expect significant future write-offs or charges related

to the loss of the Sam’s Club business. We expect consumer sales in

fiscal 2010 to be lower than they were in fiscal 2009 primarily because of the

loss of the Sam’s Club business described above.

In the other part of the custom

products segment, industrial sales decreased 26% in fiscal 2009 to $2.8 million

compared with $3.8 million in fiscal 2008. This portion of our

business has been more impacted by the weak economy as our largest customers

serve the water sports, automotive and packaging markets that have been

adversely affected by the recession. We believe that industrial sales

in fiscal 2010 will be higher than those of fiscal 2009 because we expect

increased demand in our key industrial markets as the U. S. economy

improves. There can be no assurance, however, that economic

conditions will improve or that industrial sales will increase.

22

Gross

Profit

Our gross profit decreased by 1% during

fiscal 2009 to $20.2 million compared with $20.4 million in fiscal

2008. Gross margin increased to 36.2% for fiscal 2009 from 34.4% in

fiscal 2008. The decrease in gross profit was caused mostly by lower

sales volume in the medical segment. The increase in gross margin was

the result of lower raw material costs during fiscal 2009 and the ongoing

implementation of lean manufacturing techniques during the year. As a

result of the lean manufacturing initiatives, we have improved our overall

manufacturing efficiency, and specifically we have reduced scrap rates, improved

product yields and reduced labor costs. We expect our gross profit in

fiscal 2010 to be higher than in 2009, but we believe our 2010 gross margin will

be slightly lower than 2009 because of anticipated increases in raw material

costs. Our 2010 gross profit and margin performance will depend

heavily on sales volume, product mix and raw material costs.

Selling,

Research & Development and Administrative Expenses

Selling and marketing expenses

increased 1%, or $49,000, to $9.0 million and 16.2% of net sales in fiscal 2009

compared with 15.2% of net sales in fiscal 2008. The increase

occurred in the medical segment and was primarily the result of higher incentive

compensation, which was partially offset by declines in evaluation samples

expense and shipping costs. We believe that total selling and

marketing expenses for fiscal 2010 will increase over 2009 levels.

Total research and development expenses

increased 32% to $866,000 in fiscal 2009 compared with $657,000 in fiscal

2008. Almost all of our research and development expenses are

incurred in the medical segment and are related to the development of new

products, new features of existing products and design

improvements. The increase in expense during fiscal 2009 was caused

by a greater number of new product development projects and higher incentive

compensation for R&D employees. R&D expenses will likely

fluctuate from quarter to quarter and from year to year, depending on the nature

of the development projects being pursued. We expect total R&D

expenses in fiscal 2010 to be similar to those of fiscal 2009.

General and administrative expenses

increased 6% to $3.4 million in fiscal 2009 from $3.2 million in fiscal

2008. The expense increase during fiscal 2009 was caused by higher

incentive compensation expense and an increase in depreciation expenses

associated with our new enterprise resource planning system. These

expense increases were partially offset by decreases in property and casualty

insurance and bad debt expenses. Incentive compensation is determined by

comparing actual operating earnings to planned operating earnings for the

current fiscal year. Incentive compensation expense increased in 2009 because we

exceeded our operating earnings goal by a wider margin in 2009 than in

2008. We expect administrative expenses for fiscal 2010 to be slightly

lower than they were in fiscal 2009.

Operating

Income

In the

medical segment, operating income for fiscal 2009 declined by 27% to $5.6

million compared with $7.6 million in fiscal 2008. The decrease was

caused by lower medical sales volume and higher R&D expenses compared with

last fiscal year.

Operating

income in the custom products segment increased 166% to $2.1 million in fiscal

2009 compared with $801,000 in fiscal 2008. The increase in

profitability of the custom products segment was caused by higher sales volume

in our consumer product lines, improved manufacturing efficiencies as discussed

above and lower raw material costs. The profit improvement for our

consumer product lines was partially offset by a profit decline in our

industrial product lines caused by a sharp decrease in industrial sales

volume.

23

Operating income for the total Company

declined 9% in fiscal 2009 to $6.9 million compared with $7.5 million in fiscal

2008. As discussed above, the decline in medical operating income,

caused by lower medical sales volume, was greater than the improvement in

operating income for the custom products segment.

Non-Operating

Income

Investment and other income declined by

43% to $29,000 in fiscal 2009 compared with $51,000 in fiscal

2008. The decline was caused by lower interest rates on overnight

investments in fiscal 2009 compared with 2008. We expect investment

income for fiscal 2010 to be higher than for fiscal 2009.

Interest

Expense

Interest expense in fiscal 2009

decreased 96% to $4,000 compared with $108,000 in fiscal 2008. The

decrease was caused by a lower average balance of long-term debt in fiscal 2009

compared with 2008 as we paid off the remaining balance of $700,000 on our

revolving note in the first quarter of fiscal 2009. See “Liquidity

and Capital Resources” below for further discussion about our revolving credit

facility.

Net

Income and Dividends

Net income, which includes results from

the discontinued safety catheter segment, decreased 4% in fiscal 2009 to $4.7

million, or $1.67 per diluted share, compared with $4.9 million, or $1.70 per

diluted share, in fiscal 2008. The decrease in net income was

primarily the result of lower medical sales volume.

During fiscal 2009, we paid dividends

of $983,000, or 21% of net income for the year. This amount consisted

of four quarterly dividends of $0.09 per share. During fiscal 2008,

we paid dividends of $943,000, or 19% of net income for the

year. This amount consisted of two quarterly dividends of $0.08 per

share and two quarterly dividends of $0.09 per share.

RESULTS

OF OPERATIONS FISCAL 2008 VS. 2007

Summary

Total sales in fiscal 2008 declined 2%

to $59.3 million compared with $60.5 million in fiscal 2007 because of lower

sales volume in both our medical and custom products

segments. Medical sales were down 2% to $42.5 million due mainly to a

decline in sales of private label therapeutic support

surfaces. Custom products sales for fiscal 2008 decreased 3% to $16.8

million due to lower sales of consumer bedding products compared with fiscal

year 2007.

Income from continuing operations

declined 11% in fiscal 2008 to $4.9 million, or $1.71 per diluted share, because

of lower sales levels, higher raw material costs in the medical segment, a

slight increase in selling expenses and a decline in non-operating

income.

24

Net income, which includes results from

the discontinued safety catheter segment, was up 69% in fiscal 2008 to $4.9

million, or $1.70 per diluted share. The increase in fiscal 2008 net

income was caused by our exit from the safety catheter segment in early fiscal

2008 and the resulting decrease in losses from the discontinued

operation.

Sales

Total sales in our core medical

business declined 2% to $42.5 million in fiscal 2008 compared with $43.2 million

in fiscal 2007. The decline in medical sales was caused mostly by

lower volume of private-label therapeutic support surfaces manufactured for

Hill-Rom. Sales to Hill-Rom declined by $2.7 million in fiscal 2008.

Sales of therapeutic support surfaces, including private label and branded

products, declined by 2% during fiscal 2008. Therapeutic support