Attached files

| file | filename |

|---|---|

| 10-K - FORM 10-K - MACC PEI LIQUIDATING TRUST | form10k_122809.htm |

| EX-10.4 - EXHIBIT 10.4 - MACC PEI LIQUIDATING TRUST | form10kexh14_122809.htm |

| EX-32.1 - EXHIBIT 32.1 - MACC PEI LIQUIDATING TRUST | form10kexh321_122809.htm |

| EX-31.1 - EXHIBIT 31.1 - MACC PEI LIQUIDATING TRUST | form10kexh311_122809.htm |

| EX-31.2 - EXHIBIT 31.2 - MACC PEI LIQUIDATING TRUST | form10kexh312_122809.htm |

| EX-32.2 - EXHIBIT 32.2 - MACC PEI LIQUIDATING TRUST | form10kexh322_122809.htm |

Exhibit

13

2009

Annual Report

|

|

|

|

Annual

Report

September

30, 2009

|

TO OUR SHAREHOLDERS

Fiscal

year 2009 was a difficult year for MACC. The general economic

conditions and disruptions in the capital markets in particular decreased

liquidity, pressured global asset prices, made credit difficult to obtain, and

suppressed economic activity. The adverse environment we believe

affected MACC’s ability to liquidate portfolio assets at reasonable

valuations. Further, many of the companies in which MACC has

investments were also susceptible to the adverse environment causing their

performance to suffer. In this difficult environment, the company has

wrestled with the question of how to best maximize shareholder value and have

been actively reviewing the current course of the company and the various

options before it.

Part of

the stated plan going into fiscal year 2009 was to make no new investments in

the legacy investment strategy, continue to harvest legacy portfolio

investments, reduce expenses, and repay outstanding debt. During the

year, three legacy portfolio assets were sold and MACC collected on various

installment sales for a realized net gain of $146,807. The company

reduced operating expenses by 17%, and reduced outstanding debt from $4,750,405

to $4,618,659 as of September 30, 2008 and September 30, 2009,

respectively. This relatively good news however was tempered by

overall net realized and unrealized losses on portfolio assets of

$2,048,783. The write-downs were the result of negative economic and

credit conditions affecting the performance of MACC’s underlying portfolio

companies as well as the compression of multiples and lack of credit

availability.

In 2008,

MACC made the strategic decision to change investment advisers and pursue a new

investment strategy. Effective April 29, 2008 Eudaimonia Asset

Management, LLC (“EAM”) was appointed to serve as the investment adviser to

MACC. Concurrent with the hiring of EAM, InvestAmerica Investments

Advisors, Inc. was kept on as a sub-adviser to continue the process of

harvesting the legacy portfolio while maximizing its value.

EAM was

appointed the investment adviser based on the experience of their investment

professionals in the small and micro cap investment universe and because we

believe their strategy will offer a strong opportunity for capital appreciation

while increasing the liquidity profile of MACC’s portfolio. EAM’s

investment strategy for MACC was to seek capital appreciation by making direct

equity investments in public companies that are benefiting from positive

fundamental change. These investments were to be made in the form of

private placements and registered-direct equity offerings. Further,

the strategy would take advantage of recent regulatory changes that

significantly expand the types of assets eligible for BDC investment to include

domestic operating companies which are listed on a national securities exchange

having a market capitalization of less than $250 million.

With the

difficulties of raising new money in the fiscal year 2009, the new strategy

under EAM was put on hold. There simply was no money available to

execute. As we look forward into 2010, we believe the EAM strategy

provides us the best opportunity to maximize shareholder value. Disruptions in

credit and equity markets worldwide have created attractive valuations for

long-term investors, as well as increased the need for equity capital for small

and micro cap companies to grow, as normal avenues of capital formation have

become less available or non-existent. We are unaware of any other

BDC employing a similar strategy and believe the new investment strategy

provides an investment opportunity previously unavailable to most

investors. We also expect that the increased liquidity profile and

transparency of the new strategy portfolio assets will lead to a closer

relationship between MACC’s stock price and its underlying net asset

value. Currently, MACC is continuing to trade at a significant

discount to its book value.

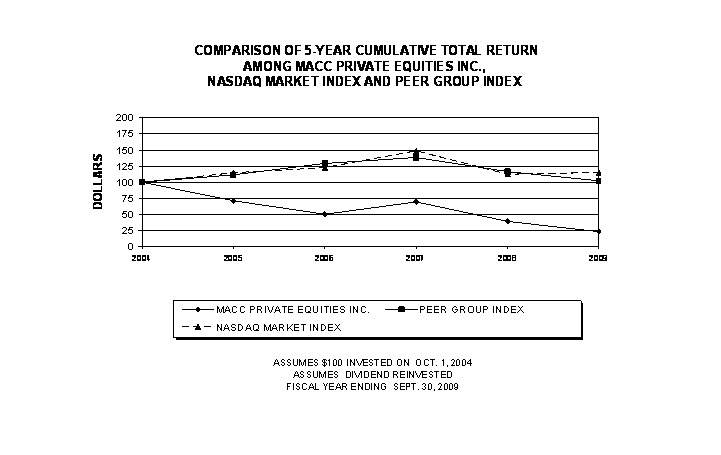

[Missing Graphic Reference]

For

fiscal 2010, our plan is to continue to harvest legacy portfolio assets and to

continue the repayment of our outstanding debt. We also feel that it

will be important for MACC to raise new equity capital in the coming year in

order to execute on the new portfolio strategy. The process was begun

by commencing the registration of a rights offering which was approved by

shareholder vote on April 28, 2008. Looking into 2010 we expect to

commence the rights offering to raise funds to begin the new

strategy. Further, we believe that future capital raises will be

necessary and we are exploring those options. We expect that the

attractiveness of the new investment strategy, combined with the value

proposition of MACC’s current portfolio, will make additional capital raises

possible in the coming year. In light of challenging market

conditions, however, the Board will continue to review alternatives, including

seeking shareholder approval to liquidate, should additional capital raising

prospects prove unlikely or inadequate to effectively execute on the new

strategy.

|

|

|||

|

Michael W.

Dunn,

Chairman

of the Board

|

Travis

Prentice

President

and CEO

|

1

|

Contents

|

|

|

1

|

LETTER

TO SHAREHOLDERS; CORPORATE PROFILE

|

|

4

|

FINANCIAL

HIGHLIGHTS

|

|

6

|

SELECTED

FINANCIAL DATA

|

|

6

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

|

17

|

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

|

37

|

SHAREHOLDER

INFORMATION

|

|

39

|

CORPORATE

INFORMATION

|

2

CORPORATE PROFILE

MACC PRIVATE EQUITIES INC.

MACC

Private Equities Inc. (Nasdaq Capital Market: MACC), a Delaware corporation, has

elected to be treated as a business development company (“BDC”) under the

Investment Company Act of 1940 (“1940

Act”). MACC’s primary goal has been to create long-term

appreciation of shareholder value based upon the successful management of later

stage venture capital activities.

MACC

generally has invested from $1,000,000 up to $3,800,000 in growth and later

stage manufacturing and service businesses with annual sales typically from

$10,000,000 to $100,000,000. These growth and buyout investments have

been made in the form of subordinated debt or preferred stock with warrants or

common stock. Since 1980, MACC has provided equity financing of over

$90,000,000 to more than 120 companies and has played a significant role in the

syndication of equity funding for later stage, middle market growth and buyout

financings. MACC, however, has not made any such investments for over

5 years and has been actively seeking to liquidate its legacy

portfolio.

Consistent

with shareholder approval of its new investment adviser, in April 2008, MACC

determined to change its investment focus to capital

appreciation. MACC intends to implement this strategy once new

capital is raised. Presently, it is reviewing the prudence of

conducting the rights offering approved by shareholders in April 2008 as well as

conducting future offerings of its common stock if the Board of Directors

determines market conditions favor such an offering.

EUDAIMONIA ASSET MANAGEMENT, LLC

Eudaimonia

Asset Management, LLC, a California limited liability company (“EAM” or the “Investment Adviser”),

with its executive offices at 580 Second Street, Suite 102, Encinitas,

California 92024, is the investment adviser to MACC under an Investment Advisory

Agreement dated April 29, 2008 (the “Advisory

Agreement”). EAM is registered as an investment adviser

with the Department of Corporations of the State of California. EAM

currently manages approximately $57 million of other assets under strategies

similar to that to be employed for all new investments made by MACC after the

effectiveness of the Advisory Agreement (the “New

Portfolio”). EAM’s sole focus is managing small- and micro-cap

growth investments using a behaviorally-based investment philosophy and

disciplined process. EAM’s three investment principals have

combined over 30 years of investment management experience.

INVESTAMERICA INVESTMENT ADVISORS, INC.

InvestAmerica

Investment Advisors, Inc. an Iowa Corporation (“InvestAmerica” or the

“Subadviser”),

has been retained by MACC and EAM to serve as a subadviser to MACC under a

Subadvisory Agreement dated April 29, 2008 among MACC, EAM and InvestAmerica

(the “Subadvisory

Agreement”) to manage MACC’s portfolio of investments in existence prior

to the effective date of the Advisory Agreement (the “Existing

Portfolio”). The Subadviser is affiliated with a group of

venture capital management companies (the “Investamerica

Group”), the first of which was organized in 1985. The

InvestAmerica Group manages more than $60 million in assets, including committed

capital, and the three InvestAmerica Group principals combined have over 80

years of venture capital fund experience. Prior to the effectiveness

of the Advisory and Subadvisory Agreements, InvestAmerica served as the

investment adviser for both MACC and MorAm.

3

|

FINANCIAL HIGHLIGHTS

|

[Dollars

in Thousands Except Per Share Data]

|

|||||

|

BALANCES

AT YEAR END SEPTEMBER 30

|

2009

|

2008

|

||||

|

Total

Assets

|

$

|

12,517

|

15,314

|

|||

|

Total

Long Term Debt

|

4,619

|

4,750

|

||||

|

Total

Net Assets

|

7,809

|

10,435

|

||||

|

OPERATIONS FOR THE YEAR

|

||||||

|

Total

Investment Income

|

$

|

587

|

956

|

|||

|

Investment

Expense, Net

|

(577)

|

(448)

|

||||

|

Net

Realized (Loss) Gain on Investments

|

(2,444)

|

687

|

||||

|

Net

Change in Unrealized Depreciation/

Appreciation on

Investments

|

395

|

(1,295)

|

||||

|

Realized

loss on other assets

|

---

|

(30)

|

||||

|

Net

Change in Net Assets from Operations

|

(2,626)

|

(1,086)

|

||||

|

PER SHARE DATA

|

||||||

|

Net

Assets Per Share

|

$

|

3.17

|

4.23

|

|||

FINANCIAL HISTORY

|

2009

|

2008

|

2007

|

2006

|

2005

|

|||||||

|

Total

Assets

|

$ 12,516,519

|

15,313,877

|

18,008,787

|

22,830,055

|

31,336,214

|

||||||

|

Total

Assets decreased

by

$2,797,358, or 18%,

in

fiscal 2009.

|

|||||||||||

|

Total

Long Term Debt

|

$ 4,618,659

|

4,750,405

|

6,108,373

|

10,790,000

|

16,790,000

|

||||||

|

Total

Long Term Debt

decreased

by $131,746, or

3%,

in fiscal 2009.

|

|||||||||||

|

Net

Asset Value Per Share

|

$ 3.17

|

4.23

|

4.67

|

4.71

|

5.54

|

||||||

|

Year

end Net Asset Value

Per

Share decreased by

$1.06,

or 25%, as of the

end

of fiscal 2009.

|

|||||||||||

|

Market

Bid Price Per Share

|

$ 0.80

|

1.36

|

2.45

|

1.78

|

2.57

|

||||||

|

Year

end Market Bid Price

Per

Share decreased by

$0.56,

or 41%, as of the

end

of fiscal 2009.

|

|||||||||||

|

Stock

Price as a Percentage of Net Asset Value Per Share

|

25.2%

|

32.2%

|

52.5%

|

37.8%

|

46.4%

|

||||||

|

Stock

Price as a Percentage of

Net

Asset Value Per Share

decreased

by 22% as of the

end

of fiscal 2009.

|

|||||||||||

|

Annual

Capital Invested

|

$ 139,586

|

52,000

|

65,000

|

333,325

|

781,611

|

||||||

|

Annual

capital invested

increased

by $87,586

or

168%, in fiscal 2009.

MACC

currently is doing

only

follow-on investing.

|

|||||||||||

|

Investment

Income

(Expense),

Net

|

($576,810)

|

(447,791)

|

(786,487)

|

(1,171,152)

|

(1,855,902)

|

||||||

|

Investment

Expense,

Net

increased by $129,019, or 29%, in fiscal 2009

|

4

FINANCIAL

REPORT

|

CONTENTS

|

||

|

6

|

SELECTED FINANCIAL DATA

|

|

|

6

|

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

|

17

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

|

|

37

|

SHAREHOLDER INFORMATION

|

|

|

39

|

Corporate

Information

|

5

SELECTED FINANCIAL DATA

FOR THE FISCAL YEARS ENDING SEPTEMBER 30

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||

|

Investment

expense, net

|

$

|

(576,810)

|

(447,791)

|

(786,487)

|

(1,171,152)

|

(1,855,902)

|

||||

|

Net

realized (loss)gain on investments

|

(2,444,130)

|

687,269

|

1,351,456

|

3,645

|

3,672,664

|

|||||

|

Net

change in unrealized depreciation/ appreciation

on

investments

|

395,347

|

(1,294,629)

|

(662,393)

|

(879,234)

|

771,576

|

|||||

|

Realized

loss on other assets

|

---

|

(30,678)

|

---

|

---

|

---

|

|||||

|

Net

change in net assets from operations

|

$

|

(2,625,593))

|

(1,085,829)

|

(97,424)

|

(2,046,741)

|

2,588,338

|

||||

|

Net

change in net assets from operations per common share

|

(1.061)

|

(0.441)

|

(0.041)

|

(0.831)

|

1.051

|

|||||

|

Total

assets

|

$

|

12,516,519

|

15,313,877

|

18,008,787

|

22,830,055

|

31,336,214

|

||||

|

Total

long term debt

|

$

|

4,618,659

|

4,750,405

|

6,108,373

|

10,790,000

|

16,790,000

|

1

Computed using 2,464,621 shares outstanding at September 30, 2009,

September 30, 2008, September 30, 2007, September 30, 2006 and September 30,

2005.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This

Annual Report contains certain forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995 (the “1995

Act”). Such statements are made in good faith by MACC pursuant

to the safe-harbor provisions of the 1995 Act, and are identified as including

terms such as “may,” “will,” “should,” “expects,” “anticipates,” “estimates,”

“plans,” or similar language. The

forward-looking statements contained in this Annual Report are excluded from the

safe harbor protection provided by Section 27A of the Securities Act of 1933, as

amended (the “1933

Act”) and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange

Act”). MACC has identified herein important factors that

could cause actual results to differ materially from those contained in any

forward-looking statement made by or on behalf of MACC, including, without

limitation, the high risk nature of MACC’s portfolio investments, the effects of

general economic conditions on MACC’s portfolio companies and MACC’s ability to

obtain future funding, changes in prevailing market interest rates, and

contractions in the markets for corporate acquisitions and initial public

offerings. MACC further cautions that such factors are not exhaustive

or exclusive. MACC does not undertake to update any forward-looking

statement which may be made from time to time by or on behalf of

MACC.

Overview

and Looking Ahead

Fiscal

year 2009 was a difficult year for the capital markets and for

MACC. MACC’s stated plan for fiscal year 2009 was to make no

new investments in its legacy investment strategy, continue to harvest the value

of the investments within the Existing Portfolio, repay its outstanding debt,

execute a rights offering and begin making investments in the new portfolio

strategy under EAM. Severe disruptions in the capital markets,

however, during the 2008 and the first half of the year made the execution of

MACC’s stated plan difficult. Falling global assets prices and

deteriorating economic and credit conditions made the prospect of raising new

capital to begin executing the new portfolio strategy

distant. Although three portfolio investments were sold during the

year, net proceeds were not adequate to provide sufficient capital to begin

EAM’s investment strategy. In addition portfolio assets were written

down to reflect the impact the economic conditions were having on portfolio

companies.

MACC also

experienced pressure on its operating cashflow in 2009 as income from existing

portfolio assets were insufficient to cover operating

expenses. Proceeds from portfolio sales were applied to outstanding

debt and toward operating cashflow needs. In April and May of 2009,

MACC’s investment advisor, EAM, voluntarily reduced its management fee from 2%

to 1% in recognition of the fact that the new portfolio strategy had been put on

hold and to help alleviate MACC’s cashflow difficulties.

6

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS CONTINUED…

Operating

expenses have been funded primarily from the sale of portfolio companies,

dividends, interest and other distributions from MACC’s portfolio companies and

from MACC’s bank financing. MACC continues to have an ongoing need to

raise cash from portfolio sales to fund operations and pay down outstanding

debt. MACC’s note payable with Cedar Rapids Bank & Trust Company

in the amount of $4,618,659 is due and payable March, 2010. MACC will

need to either extend the due date on the current note payable or consider

additional sources of financing and additional sales of investments in order to

meet current payment and operating requirements. No assurance can be

given that MACC will be successful in its efforts to extend its current

financing arrangement or raise additional funding in the near term and

accordingly these facts raise substantial doubt about MACC’s ability to continue

as a going concern.

MACC

continues to seek additional cash through future sales of portfolio equity and

debt securities and from other financing arrangements. Absent

financing amendments to the current note payable or additional sources of

financing, current working capital and cash will not be adequate for operations

at their current levels. If such efforts are not successful, MACC may

need to liquidate its current investment portfolio, to the extent possible,

which could result in significant realized losses due to the current economic

conditions.

MACC made

the strategic decision in 2008 upon the recommendation of the Board of Directors

and subsequent shareholder approval to contract with EAM to become the new

investment adviser of MACC. EAM’s investment strategy seeks to make

direct equity investments in very small and micro-cap public companies eligible

for investment by a BDC. EAM was appointed as the investment advisor

in part because its strategy is believed to offer a strong opportunity for

capital appreciation and because of the increased liquidity profile of its

investments.

EAM and

MACC believe that recent regulatory changes that have expanded the types of

investments available to BDCs may provide significant opportunities for MACC and

its shareholders under its new investment strategy. In 2006, the

Securities Exchange Commission (the “SEC”) adopted rule

2a-46 under the 1940 Act to revise the categories of companies that are eligible

for BDC investment. Rule 2a-46 defined the term “eligible portfolio

company” to include all private domestic operating companies and those public

domestic operating companies whose securities are not listed on a national

securities exchange (“Exchange”). In

2008, the SEC amended Rule 2a-46 by further expanding the exchange-based

definition of “eligible portfolio company” to include a market capitalization

based definition. Eligible portfolio companies now include domestic

operating companies that have a class of securities listed on an Exchange and

with a market capitalization of less than $250 million. EAM and MACC

believe that this action by the SEC not only unlocks capital to an under-served

segment of the U.S. economy, but provides significant opportunities for

long-term investors within the BDC structure.

EAM and

MACC further believe that the timing of its shift in investment strategy may be

particularly fortuitous for its investors and for very small- and micro-cap

companies generally. EAM believes that current disruptions in credit

and equity markets worldwide have created attractive valuations for long-term

investors, as well as increased the need for equity capital for small- and

micro-cap companies to grow as normal avenues of capital formation have become

less available or non-existent.

EAM and

MACC also believe that the new investment strategy provides an investment

opportunity previously unavailable to most investors. We are unaware

of any BDC employing a similar strategy. Because of its unique

nature, MACC believes that its new investment strategy will offer a better

opportunity to increase its capital base by more closely aligning MACC’s stock

price with its net asset value. EAM and MACC also believe that by

increasing its capital base, MACC may become a more attractive investment

vehicle, as its larger capital base should increase the liquidity profile of its

shares. Furthermore, the structure of a BDC within this investment

framework offers greater transparency than other investment vehicles available

to investors.

During

the year the Board continued to discuss various options to maximize shareholder

value. Looking forward to 2010 MACC will look to execute on its

stated goals of 2009. Although economic, market and credit

conditions continue to be difficult, they have improved somewhat, and MACC

believes that its best opportunity to maximize shareholder value is to move

forward with harvesting legacy investments when and at appropriate prices, pay

down outstanding debt, execute the rights offering and seek shareholder approval

for future capital raises, and finally to begin executing on the new portfolio

strategy under EAM.

It will

be important for MACC to raise new equity capital in the coming year for a

number of reasons. First, MACC’s current annual carrying costs as a

public company are burdensome relative to its available capital and operating

income from Existing Portfolio assets is inadequate to fund the company’s

operating expenses. Secondly, proceeds from the sale of Existing

Portfolio assets will not be significant enough to adequately initiate the new

strategy in a reasonable time period. Currently, in accordance with

the debt agreements 80% of the proceeds from the sale of Existing Portfolio

assets are required to be applied against the outstanding note

7

payable

of $4,618,659. Further, given the nature of the current market

environment and the Existing Portfolio assets, liquidating these assets to

derive maximum value may not be possible in the near-term. Lastly,

the new portfolio strategy will be most effective when MACC has adequate assets

available to build a well-diversified portfolio of small- and micro-cap

companies. EAM and MACC feel that the attractiveness of its new

investment strategy combined with the value proposition of its current portfolio

could make it possible in the coming year to make investments in the

New Portfolio.

MACC and

EAM have initiated the process of raising additional capital by filing a

registration statement to effect a rights offering, which was approved by

shareholder vote on April 28, 2008. EAM and MACC further believe that

future capital raises will be necessary. EAM and MACC feel that the

attractiveness of its new investment strategy combined with the value of its

current portfolio could make this possible in the coming year. As

discussed below, as capital constraints improve, we intend to continue our

strategy of making conservative investments in businesses that we believe will

weather the economy and that are likely to produce attractive long-term returns

for our stockholders.

The

impact of the recession on our portfolio investments may also continue to

decrease the value of collateral securing our note payable, which could impact

our ability to borrow under our existing credit facility and to obtain future

funding. Additionally, our credit facility contains covenants

regarding the maintenance of certain minimum net worth requirements, which are

affected by the

decrease

in the value of our portfolio. Failure to meet these requirements

would result in a default which, if we are unable to obtain a waiver from our

lenders, would result in the acceleration of our repayment obligations under our

credit facility. As of September 30, 2009, we are in compliance with

all of the facility covenants.

In

addition, our note payable in the amount of $4,618,659 as of September 30, 2009

is due and payable in March, 2010. MACC will need to either extend

the due date on the current note payable or consider additional sources of

financing and additional sales of investments in order to meet current payment

and operating requirements. Accordingly, the combination of these

facts raises substantial doubt as to MACC’s ability to continue as a going

concern. No assurance can be given that MACC will be successful in

its efforts to extend its current financing arrangement or raise additional

funding in the near term and accordingly these facts also raise substantial

doubt about MACC’s ability to continue as a going concern. The

financial statements included elsewhere in this report have been prepared

assuming that MACC will successfully refinance its credit terms and continue as

a going concern.

RESULTS

OF OPERATIONS

MACC’s

primary activities in 2009 were consistent with the legacy portfolio

strategy. MACC made no new investments and focused on selling

Existing Portfolio assets while closely monitoring and reducing where possible

current expenses. Total investment income includes income from

interest and dividends. Investment expense, net represents total

investment income minus net operating expenses and income tax

expense. The main objective of portfolio company investments is to

achieve capital appreciation and realized gains in the

portfolio. These gains and losses are not included in investment

expense, net and are reported as separate line items.

Fiscal 2009,

Fiscal 2008 and Fiscal 2007

|

For

the year ended

September 30,

|

||||||||||||

|

2009

|

2008

|

2007

|

||||||||||

|

Total

investment income

|

$ | 586,989 | 955,563 | 996,627 | ||||||||

|

Total

operating expenses

|

(1,163,799 | ) | (1,403,354 | ) | (1,853,607 | ) | ||||||

|

Income

tax benefit

|

--- | --- | 70,493 | |||||||||

|

Investment

expense, net

|

(576,810 | ) | (447,791 | ) | (786,487 | ) | ||||||

|

Net

realized (loss) gain on investments

|

(2,444,130 | ) | 687,269 | 1,351,456 | ||||||||

|

Net

change in unrealized depreciation/

appreciation

on investments

|

395,347 | (1,294,629 | ) | (662,393 | ) | |||||||

|

Realized

loss on other assets

|

--- | (30,678 | ) | --- | ||||||||

|

Net

(loss) gain on investments and other assets

|

(2,048,783 | ) | (638,038 | ) | 689,063 | |||||||

|

Net

change in net assets from operations

|

$ | (2,625,593 | ) | (1,085,829 | ) | (97,424 | ) | |||||

|

Net

asset value:

|

||||||||||||

|

Beginning

of period

|

$ | 4.23 | 4.67 | 4.71 | ||||||||

|

End

of period

|

$ | 3.17 | 4.23 | 4.67 | ||||||||

8

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS CONTINUED…

Total

Investment Income

During

the fiscal year ended September 30, 2009, total investment income was $586,989,

a decrease of 39% from fiscal year 2008 total investment income of

$955,563. The decrease during the current year was the net result of

a decrease in interest income of $209,156, or 35%, and a decrease in dividend

income of $167,065, or 47%. MACC attributes the decrease in interest

income primarily to the repayments of principal on debt portfolio securities and

on two debt portfolio securities which have been placed on non-accrual of

interest status during fiscal year 2009. Dividend income for fiscal

year 2009 represents dividends received on three existing portfolio companies,

two of which were distributions from limited liability companies, as compared to

dividends received on four portfolio companies, two of which were distributions

from limited liability companies, during fiscal year 2008. The timing

and amount of dividend income is difficult to predict.

During

the fiscal year ended September 30, 2008, total investment income was $955,563,

a decrease of 4% from fiscal year 2007 total investment income of

$996,627. The decrease during the fiscal year ended September 30,

2008 was the net result of a decrease in interest income of $267,021, or 31%,

and an increase in dividend income of $225,951, or 175%. MACC

attributes the decrease in interest income primarily to the repayments of

principal on debt portfolio securities. Dividend income for fiscal

year 2008 represented dividends received on three existing portfolio companies

and one previously held portfolio company, two of which were distributions from

limited liability companies, as compared to dividends received on three

portfolio companies, two of which were distributions from limited liability

companies, during fiscal year 2007. Dividend income increased in

fiscal year 2008 because the distributions from limited liability companies

during fiscal 2008 were larger than the distributions in fiscal year 2007 and

the receipt of dividends in two other portfolio companies were larger than in

fiscal year 2007.

Net

Operating Expenses

Net

operating expenses of MACC decreased by 17% in fiscal year 2009 to $1,163,799

from $1,403,354 in fiscal year 2008. The relative decrease in net

operating expenses is the net result of decreases of $104,381, or 26%, in

interest expense, $58,653, or 21%, in management fees, $69,401, or 18%, in

professional fees, and $7,120, or 2%, in other operating

expenses. Interest expense decreased due to a combination of

the decrease in the interest rate and the principal balance of the Note Payable

with Cedar Rapids Bank & Trust Company in fiscal year 2009 as compared to

fiscal year 2008. Management fees decreased due to the investment

adviser, Eudaimonia Asset Management, LLC (“EAM”), having voluntarily waived its

management fee of 1% of net assets, effective in May, for an indefinite

period. The remaining 1% of the management fee continues to be paid

to our subadviser, InvestAmerica Investment Advisors, Inc.

(“InvestAmerica”). Professional fees decreased primarily due to the

absence of legal costs in 2009 compared to 2008 where the costs were

related to changes in the investment advisory structure, the merger and

exploration of capital raising options.

Net

operating expenses of MACC decreased by 24% in fiscal year 2008 to $1,403,354

from $1,853,607 in fiscal year 2007. The relative decrease in net

operating expenses was the net result of decreases of $390,866, or 49%, in

interest expense, $49,168, or 15%, in management fees, $143,732, or 100%, in

incentive fees, and increases of $9,923, or 3%, in other expenses and $123,590,

or 45%, in professional fees. Interest expense decreased due to

a decrease in long term debt and a lower rate of interest on the debt in fiscal

year 2008 as compared to fiscal year 2007. Management fees decreased

due to a decrease in capital under management, which was partially offset by the

increase in the management fee percentage from 1.5% to 2.0% under the Advisory

Agreement. Professional fees increased in 2008 compared to 2007

primarily due to the legal expenses incurred from the change in MACC’s

investment advisor, the merger, and the exploration of capital raising

options.

Investment

Expense, Net

MACC had

investment expense, net in fiscal year 2009 of $576,810, an increase of 29% from

investment expense, net of $447,791 in fiscal year 2008. The increase

in investment expense, net is the result of the decrease in investment income

and net operating expenses described above and the decrease of interest expense

to $303,794 in fiscal year 2009 from $408,175 in fiscal year 2008.

MACC had

investment expense, net in fiscal year 2008 of $447,791, a decrease of 43% from

investment expense, net of $786,487 in fiscal year 2007. The decrease

in investment expense, net was primarily the result of the decrease in operating

expenses in 2007 as a result of decreased interest expense, management fees, and

incentive fees. The net decrease in operating expenses is more fully

described above.

9

MANAGEMENT’S

DISCUSSION

AND ANALYSIS

OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS CONTINUED…

Net

Realized Gain (Loss) on Investments

MACC

recorded a net realized loss on investments in fiscal 2009 of $2,444,130 as

compared to a net realized gain of $687,269 in fiscal year 2008. The

fiscal year 2009 net realized loss is the net result of $245,179 of realized

gains from the sale of two portfolio companies, a realized gain of $1,620

from final distributions on two portfolio companies sold in a previous fiscal

year, a realized loss of $99,992 from the sale of one portfolio company, a

realized loss of $1,923,610 on the write-off of two portfolio investments which

had been previously written down to $1 through unrealized losses, and a realized

loss of $667,327 on the partial write-off of one portfolio

company. Management does not attempt to maintain a comparable level

of realized gains quarter to quarter but instead attempts to maximize total

investment portfolio appreciation through realizing gains in the disposition of

securities. Under the Advisory Agreement, the Investment Adviser is

entitled to be paid an incentive fee, which is calculated as a percentage of the

excess of MACC’s realized gains in a particular period, over the sum of net

realized losses, unrealized depreciation, and operating losses during the same

period. As a result, the timing of realized gains, realized losses

and unrealized depreciation can have an effect on the amount of the incentive

fee payable to the Investment Adviser under the Advisory Agreement.

MACC

recorded a net realized gain on investments in fiscal 2008 of $687,269, as

compared to a net realized gain of $1,351,456 in fiscal year

2007. The fiscal year 2008 net realized gain was a net result of

$571,028 of a realized gain from the sale of one portfolio company,

$104,120 from the sale of warrants in one portfolio company, $6,628 from final

distributions on one portfolio company sold in fiscal year 2007, and the receipt

of $5,493 of escrowed funds from two previously sold portfolio

companies. Under the Advisory Agreement, the Investment Adviser is

entitled to be paid an incentive fee, which is calculated as a percentage of the

excess of MACC’s realized gains in a particular period, over the sum of net

realized losses, unrealized depreciation, and operating losses during the same

period. As a result, the timing of realized gains, realized losses

and unrealized depreciation can have an effect on the amount of the incentive

fee payable to the Investment Adviser under the Advisory Agreement.

Changes

in Unrealized Depreciation/Appreciation of Investments

MACC had

unrealized depreciation of $2,543,635 at September 30, 2009, a change of

$395,347 from the $2,938,982 of unrealized depreciation at September 30,

2008. This, along with the net realized loss of $2,444,130, resulted

in a net loss on investments for fiscal year 2009 of $2,048,783, as compared to

a net loss on investments of $607,360 for fiscal year 2008. The

fiscal year 2009 change in unrealized depreciation/appreciation is the net

effect of increases in fair value of three portfolio companies totaling

$796,398, decreases in fair value of nine portfolio companies totaling

$2,517,636, the reversal of appreciation of $200,000 in one portfolio investment

from its sale resulting in a realized gain, the reversal of appreciation of

$24,951 in one portfolio investment from its sale resulting in a realized loss,

the reversal of $1,923,608 of depreciation from the write off of two portfolio

investments resulting in a realized loss, and the reversal of $417,928

depreciation resulting from the partial write off of one portfolio investment

resulting in a realized loss.

MACC had

unrealized depreciation of $2,938,982 at September 30, 2008, a change of

$1,294,629 from the $1,644,353 of unrealized depreciation at September 30,

2007. This, along with the net realized gain of $687,269, resulted in

a net loss on investments for fiscal year 2008 of $607,360, as compared to a net

gain on investments of $689,063 for fiscal year 2007. The fiscal year

2008 change in unrealized depreciation/appreciation is the net effect of

increases in fair value of four portfolio companies totaling $1,018,289 and

decreases in fair value of nine portfolio companies totaling

$2,312,918.

Net

change in unrealized depreciation/appreciation on investments represents the

change for the period in the unrealized appreciation, net of unrealized

depreciation on MACC’s total investment portfolio. When MACC

increases the fair value of a portfolio investment above its cost, the

unrealized appreciation for the portfolio as a whole increases, and when MACC

decreases the fair value of a portfolio investment below its cost, unrealized

depreciation for the portfolio as a whole increases. See accounting

policy for determining fair value on investments below under “Determination of

Net Asset Value.” When MACC sells an appreciated portfolio investment

for a gain, unrealized appreciation for the portfolio as a whole decreases as

the gain is realized. Similarly, when MACC sells or writes off a

depreciated portfolio investment for a loss, unrealized depreciation for the

portfolio as a whole decreases as the loss is realized.

Net

Change in Net Assets from Operations

As a

result of the items described above, MACC experienced a decrease of $2,625,593

in net assets during fiscal year 2009, and the resulting net asset value per

share was $3.17 at September 30, 2009, as compared to $4.23 at September 30,

2008 and $4.67 at September 30, 2007. Management attributes these

results to the write-down of portfolio assets and the operating loss incurred

in

10

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS CONTINUED…

fiscal

2009. Although MACC realized gains on two portfolio companies and had

three portfolio investments increase in value during fiscal year 2009, nine

portfolio companies required a write-down in valuation.

The

current economic challenges and restrictive credit environment may pose

significant challenges to the Existing Portfolio operating performance and the

ability to exit Existing Portfolio positions. Many factors such

as the availability of credit, continued economic struggles, volatile commodity

markets, all could have major impacts on the Existing Portfolio

performance.

FINANCIAL

CONDITION, LIQUIDITY AND CAPITAL RESOURCES

MACC

relies upon several sources to fund its operating and investment activities,

including MACC’s cash and money market accounts, and proceeds from the sale of

portfolio assets, as further described below.

As of

September 30, 2009, MACC’s cash and money market accounts totaled

$173,521. MACC has a term loan in the amount of $4,618,659 with Cedar

Rapids Bank & Trust Company. The term loan is due and

payable March 31, 2010.

Currently MACC does not have sufficient cash flows from operations to pay

current operating expenses and to repay the term loan when it is

due. MACC therefore continue to have an ongoing need to raise cash

from portfolio sales and will need to either extend the due date on the current

term loan or seek additional sources of financing in order to meet current

payment and operating requirements. To date an extension on the term

loan and additional financing has not been secured, accordingly these facts

raise substantial doubt about MACC’s ability to continue as a going

concern.

MACC continues to seek additional cash through future sales of portfolio

equity and debt securities and from other financing

arrangements. Absent financing amendments to the current note payable

or additional sources of financing, current working capital and cash will not be

adequate for operations at their current levels. If such efforts are

not successful, MACC may need to liquidate its current investment portfolio, to

the extent possible, which could result in significant realized losses due to

the current economic conditions.

The

following table shows MACC’s significant contractual obligations as of September

30, 2009:

|

Payments due by

period

|

||||||||||||||||||||

|

Contractual

Obligations

|

||||||||||||||||||||

|

Total

|

Less

than

1

Year

|

1-3

Years

|

3-5

Years

|

More

than 5 Years

|

||||||||||||||||

|

Note

Payable

|

$ | 4,618,659 | 4,618,659 | --- | --- | --- | ||||||||||||||

|

Incentive

Fees Payable

|

$ | 16,361 | 16,361 | --- | --- | --- | ||||||||||||||

Although

we believe we will be able to refinance the term loan, failure to do so or find

alternative financing could pose significant financial risks to MACC given the

relative illiquid nature of the Existing Portfolio. In addition, we

anticipate that our current cash and money market accounts will not be adequate

enough to fund our cash flow short-fall from operation during fiscal year

2010. We will need to liquidate portfolio assets to fund the

operating cash short-fall. Although management believes we will be

able to liquidate portfolio assets sufficient to provide funds for MACC to meet

its fiscal year 2010 anticipated cash requirements, there can be no assurances

that MACC’s cash flows from portfolio sales, operations or cash requirements

will be as projected.

PORTFOLIO

ACTIVITY

MACC’s

primary business had been investing in and lending to businesses through

investments in subordinated debt (generally with detachable equity warrants),

preferred stock and common stock. As noted above, MACC did not make

any new investments in fiscal year 2009. The total portfolio value of

the Existing Portfolio was $11,775,272 and $14,501,851 at September 30, 2009 and

September 30, 2008, respectively. During fiscal year 2009, MACC

invested $139,586 in two follow-on investments in an Existing Portfolio

companies. The $139,586 of investments were co-investments with

another fund managed by InvestAmerica. When it makes any

co-investment with these related funds, MACC follows certain procedures

consistent with orders of the SEC for related party co-investments to mitigate

conflict of interest issues.

11

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS CONTINUED…

VALUATION

CHANGES

The

following table presents those portfolio investments held at September 30, 2009

with respect to which the valuation changed from September 30,

2008:

|

F

A I R V A L U E

|

|||||

|

PORTFOLIO COMPANY

|

SEPTEMBER 30,

2009

|

SEPTEMBER 30, 2008(1)

|

|||

|

Aviation

Manufacturing Group, LLC

|

1,618,039

|

1,642,559

|

|||

|

Detroit

Tool Metal Products Co.

|

1,371,507

|

1,693,480

|

|||

|

Feed

Management Systems, Inc.

|

2,041,136

|

2,001,495

|

|||

|

Handy

Industries, LLC

|

67,042

|

269,093

|

|||

|

Linton

Truss Corporation

|

75,036

|

190,036

|

|||

|

M.A.

Gedney Company

|

1

|

146,000

|

|||

|

Magnum

Systems, Inc.

|

1,257,278

|

1,507,278

|

|||

|

Morgan

Ohare, Inc.

|

1,091,667

|

1,308,334

|

|||

|

Portrait

Displays, Inc.

|

685,068

|

361,017

|

|||

|

Pratt-Read

Corporation

|

1

|

905,577

|

|||

|

Spectrum

Products, LLC

|

1,510,355

|

1,077,649

|

|||

|

Superior

Holding, Inc.

|

1,137,608

|

1,473,458

|

|||

|

|

(1)

|

September

30, 2008 valuations have been adjusted for additional amounts invested or

partial disposition of the portfolio investment for purposes of

comparison.

|

CRITICAL

ACCOUNTING POLICY

Investments

in securities that are traded in the over-the-counter market or on a stock

exchange are valued by taking the average of the close (or bid price in the case

of over-the-counter equity securities) for the valuation date and the preceding

two days. The Board of Directors generally use market quotations to

assess the value of our investments for which market quotations are readily

available. We obtain these market values from an independent pricing

service or at the bid prices, if available, obtained from at least two

broker/dealers or by a principal market maker or a primary market

dealer. Restricted and other securities for which quotations are not

readily available are valued at fair value as determined by the Board of

Directors. Such determination of fair values involved subjective

judgments and estimates. Among the factors considered in determining

the fair value of investments are the cost of the investment; developments,

including recent financing transactions, since the acquisition of the

investment; the financial condition and operating results of the portfolio

company; discounted cash flow models, comparisons of multiples of peer companies

that are public, the long-term potential of the business of the portfolio

company; market interest rates for similar debt securities; overall market

conditions and other factors generally pertinent to the valuation of

investments. When an external event such as a purchase transaction,

public offering or subsequent equity sale occurs in connection with one of our

portfolio companies, our board of directors uses the pricing indicated by the

external event to corroborate and/or assist us in our valuation of our

investment in such portfolio company. However, because of the

inherent uncertainty of valuation, those estimated values may differ

significantly from the values that would have been used had a ready market for

the securities existed, and the differences could be material.

In the

valuation process, MACC uses financial information received monthly, quarterly,

and annually from its portfolio companies which includes both audited and

unaudited financial statements. This information is used to determine

financial condition, performance, and valuation of the portfolio

investments.

Realization

of the carrying value of investments is subject to future

developments. Investment transactions are recorded on the trade date

and identified cost is used to determine realized gains and

losses. Under the provisions of authoritative guidance, the fair

value of loans and investments in portfolio securities on February 15, 1995,

MACC’s fresh-start date, is considered the cost basis for financial statement

purposes.

The

preparation of financial statements in conformity with GAAP requires management

to estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at the date of

the financial statements, and the reported amounts of revenues and expenses

during the reporting period. Actual results could differ from those

estimates.

12

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS CONTINUED…

DETERMINATION

OF NET ASSET VALUE

The net

asset value per share of MACC’s outstanding common stock is determined

quarterly, as soon as practicable after and as of the end of each calendar

quarter, by dividing the value of total assets minus total liabilities by the

total number of shares outstanding at the date as of which the determination is

made.

In

calculating the value of total assets, securities that are traded in the

over-the-counter market or on a stock exchange are valued in accordance with the

current guidelines of the SEC. Under SEC Regulations, publicly-traded

equity securities are valued by taking the close (or bid price in the case of

over-the-counter equity securities) for the valuation date. MACC did

not have any publicly-traded equity securities as of September 30,

2009.

All other

investments are valued at fair value as determined in good faith by the Board of

Directors. The Board of Directors has determined that all other

investments will be valued initially at cost, but such valuation will be subject

to quarterly adjustments and on such other interim periods as are justified by

material portfolio company events if the Board of Directors determines in good

faith that cost no longer represents fair value

We

currently have a portfolio of debt and equity securities for which no regular

trading market exists. The fair value of these investments may not be

readily determinable. We value these investments quarterly at fair

value as determined in good faith under the direction of our board of directors

pursuant to a valuation policy and consistently applied valuation process

utilizing the input of our investment advisers and audit

committee. The types of factors that may be considered in fair value

pricing of these investments include the nature and realizable value of any

collateral, the portfolio company’s ability to make payments and its earnings,

the markets in which the portfolio company does business, comparison to more

liquid securities, indices and other market related inputs, discounted cash flow

and other relevant factors. Because such valuations and particularly

valuations of private securities and private companies, are inherently

uncertain, may fluctuate over short periods of time and may be based on

estimates, our determinations of fair value may differ materially from the

values that would have been used if a readily available market for these

investments existed and may differ materially from the amounts we realize on any

disposition of such investments. Our net asset value could be adversely affected

if our determinations regarding the fair value of these investments were

materially higher than the values that we ultimately realize upon the disposal

of such investments. In addition, decreases in the market values or

fair values of our investments are recorded as unrealized

depreciation. Continued declines in prices and liquidity in the debt

markets could result in substantial unrealized/realized losses, which could have

a material adverse impact on our business, financial condition and results of

operations.

We are

required to record our assets at fair value, as determined in good faith by our

board of directors in accordance with our valuation policy. As a

result, volatility in the capital markets may adversely affect our valuations

and our net asset value, even if we intend to hold respective investments to

maturity. Volatility or dislocation in the capital markets may

depress our stock price below our net asset value per share and create a

challenging environment in which to raise debt and equity capital. As

a business development company, we are generally not able to issue additional

shares of our common stock at a price less than net asset value without first

obtaining approval for such issuance from our stockholders and our independent

directors. Additionally, our ability to incur indebtedness is limited

by applicable regulations such that our assets coverage under the 1940 Act must

equal to at least 200% of total indebtedness immediately after each time we

incur indebtedness. Shrinking portfolio values negatively impact our

ability to borrow our ability to borrow additional funds under our credit

facility because our net asset value is reduced for purposes of the 200% asset

leverage test. If the fair value of our assets declines

substantially, we may fail to maintain the asset coverage ratios stipulate by

the 1940 Act, which could, in turn, cause us to lose our status as a business

development company and materially impair our business operations. A

protracted disruption in the credit markets could also materially decrease

demand for our investments.

The

significant disruption in the capital markets has had and may continue to have a

negative effect on the valuations of our investments and on the potential for

liquidity events involving our investments. The debt capital that

will be available to use, if at all, may be at a higher cost and on less

favorable terms and conditions in the future. A prolonged inability

to raise capital will further delay any opportunity to execute the New Portfolio

strategy, and/or could have a material adverse impact on our business, financial

conditions or results of operations.

The

current economic conditions generally and the disruptions in the capital markets

in particular have decreased liquidity, where available. The longer these

conditions persist, the greater the probability that these factors

could reduce our ability to effectively liquidate portfolio

positions, increase our cost and significantly limit our access to debt and

equity capital, and thus have an adverse

13

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS CONTINUED…

effect on

our operations and financial results. Many of our portfolio companies may also

be susceptible to the economic downturn, which could affect the ability of one

or more of our portfolio companies to repay our loans or engage in a liquidity

event, such as a sale or recapitalization.

A

continued economic downturn could also disproportionately impact some of the

industries in which we invest, causing us to be more vulnerable to further

losses in our portfolio. Therefore, the number of our non-performing assets

could increase and the fair market value of our portfolio decrease during these

periods. The economic downturn has affected the availability of credit

generally and may prevent us from replacing or renewing our credit facility on

reasonable terms, if at all. If market instability persists or

intensifies, we may continue to experience difficulty in raising

capital.

Recent

market conditions have also affected the trading price of our common stock and

thus our ability to finance new investments through the issuance of

equity. The economic downturn may also continue to decrease the value

of collateral securing the Note Payable, as well as the value of our equity

investments.

For the

year ended September 30, 2009, we recorded net unrealized appreciation on our

portfolio of investments of $395,347, of which the increase was primarily due to

the reversal of unrealized depreciation from the write off of two portfolio

investments resulting in a realized loss. Overall, the investments

held in the portfolio as of the reporting date generally reflect a decrease in

fair value and we may continue to see further decreases in the value of our

portfolio in the event that the economic downturn continues and the general

illiquidity of capital markets continues.

We are

also subject to financial market risks from changes in market interest

rates. The Note Payable is subject to a variable interest rate that

is based on an independent index. Therefore, general interest rate

fluctuations may have a materially adverse effect on our investment

expense.

QUANTITATIVE

AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK

MACC is

subject to market risk from changes in market prices of publicly-traded equity

securities held from time to time in the MACC investment

portfolio. At September 30, 2009, MACC had no publicly-traded equity

securities in the MACC investment portfolio.

MACC is

also subject to financial market risks from changes in market interest

rates. MACC currently has an outstanding note payable with a variable

interest rate that is based on an independent index. Therefore,

general interest rate fluctuations may have a materially adverse effect on our

investment expense.

We are

also subject to financial market risk from the short term nature of our credit

facilities in combination with current market conditions and the relatively

illiquid nature of our Existing Portfolio. Our Note Payable is due

March 31, 2010. Given the currently challenging market environment as

discussed elsewhere, we may have difficultly refinancing our Note Payable, or

finding alternative sources of financing. Failure to refinance the

Note Payable could result in significant financial difficulties for us including

the seizure and sale of Existing Portfolio assets at prices which would likely

be at prices significantly less than fair value. Further, the cost of

financing could be significantly more costly than our current financing which

could have a material impact on our financial condition

PORTFOLIO

RISKS

Pursuant

to Section 64(b)(1) of the 1940 Act, a BDC is required to describe the risk

factors involved in an investment in the securities of such company due to the

nature of MACC’s investment portfolio. Accordingly, MACC states

that:

Existing

Portfolio:

The

Existing Portfolio securities of MACC consist primarily of securities issued by

small, privately held companies. Generally, little or no public

information is available concerning the companies in which MACC is currently

invested in, and MACC must rely on the diligence of the Investment Adviser to

obtain the information necessary for MACC’s investment decisions. In

order to maintain their status as a BDC, MACC must invest at least 70% of its

total assets in the types of portfolio investments described by Section 55(a) of

the 1940 Act, as amended. These investments generally are securities

purchased in private placement transactions from small privately held

companies. Typically, the success or failure of such companies

depends on the management talents and efforts of one

14

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS CONTINUED…

person or

a small group of persons, so that the death, disability or resignation of such

person or persons could have a materially adverse impact on such

companies. Moreover, smaller companies frequently have smaller

product lines and smaller market shares

than

larger companies and may be more vulnerable to economic

downturns. Because these companies will generally have highly

leveraged capital structures, reduced cash flows resulting from an economic

downturn may adversely affect the return on, or the recovery of, MACC’s

investments. Investment in these companies therefore involves a high

degree of business and financial risk, which can result in substantial losses

and should be considered speculative.

MACC’s

Existing Portfolio investments primarily consist of securities acquired from the

issuers in private transactions, which are usually subject to restrictions on

resale and are generally illiquid. No established trading market

generally exists with regard to such securities, and most of such securities are

not available for sale to the public without registration under the Securities

Act of 1933, as amended, which involves significant delay and

expense.

The

Existing Portfolio investments of MACC are generally long-term in

nature. Some existing investments do not bear a current yield and a

return on such investments will be earned only after the investment matures or

is sold. Although most investments are structured so as to return a

current yield throughout most of their term, these investments will typically

produce gains only when sold in five to seven years. There can be no

assurance, however, that any of MACC’s investments will produce current yields

or gains.

New

Portfolio:

MACC’s

New Portfolio will primarily consist of equity investments in smaller company

growth stocks. Investments in growth stocks involves certain risks,

in part, because the value of the securities is based upon future expectations

that may or may not be met. We will therefore be particularly

sensitive to the risks associated with small companies. The general risks

associated with equity securities are particularly pronounced for securities

issued by companies with small market capitalizations. Micro-cap and other small

capitalization companies may offer greater opportunities for capital

appreciation than larger companies, but may also involve certain special risks.

They are more likely than larger companies to have limited product lines,

markets or financial resources, or to depend on a small, inexperienced

management group. Securities of smaller companies may trade less frequently and

in lesser volume than more widely held securities and their values may fluctuate

more sharply than other securities. They may also trade in the over-the-counter

market or on a regional exchange, or may otherwise have limited liquidity. These

securities may therefore be more vulnerable to adverse developments than

securities of larger companies, and we may have difficulty establishing or

closing out our securities positions in smaller companies at prevailing market

prices. Also, there may be less publicly-available information about smaller

companies or less market interest in their securities as compared to larger

companies, and it may take longer for the prices of the securities to reflect

the full value of the issuers’ earnings potential or assets.

The

majority of our New Portfolio investments will primarily consist of, securities

acquired from the issuers in private transactions, which are usually subject to

restrictions on resale and are generally illiquid. Often, no

established trading market exists with regard to such securities, and most of

such securities are not available for sale to the public without registration

under the Securities Act 1933, which involves significant delay and expense. In

addition, unregistered shares sold in a private transaction will typically sell

at a discount to the price of publicly available registered

shares. As of September 30, 2009, we do not have any securities in

the New Portfolio.

OPERATIONS

RISKS

MACC

generally relies on portfolio investment divestitures and liquidity events, as

well as increases in fair value of portfolio investments, to provide for

increases in net asset value in any period. MACC typically relies on

the sale of portfolio companies in negotiated transactions and on the initial

public offering of portfolio company securities to provide for portfolio

investment divestitures and liquidity events. Accordingly, a general

contraction in the markets for corporate acquisitions and/or initial public

offerings could adversely affect MACC’s ability to realize capital gains, if

any, from the sale of its Existing Portfolio company securities. The

SEC guidelines under which MACC operates permit the MACC Board of Directors to

determine increases in fair value of unliquidated Existing Portfolio investments

based upon a number of factors, including subsequent financings provided to

Existing Portfolio companies. Accordingly, decreases in the supply of

additional capital to MACC’s Existing Portfolio companies could adversely affect

MACC’s ability to achieve increases, if any, in fair value of its Existing

Portfolio investments.

15

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS CONTINUED…

INTEREST

RATE RISKS

MACC

faces risks in relation to changes in prevailing market interest

rates. First, at September 30, 2009, MACC had outstanding $4,618,659

in principal amount of a note payable, which matures in March of

2010. This note has a variable rate of interest, and accordingly,

changes in market interest rates will have an effect on the amount of interest

paid by MACC with respect to the note. At September 30, 2009, the

interest rate on the note was 6.0%.

Second,

MACC’s Existing Portfolio companies have or may issue debt senior to MACC’s

investment. The payment of principal and interest due on MACC’s

investment, therefore, will generally be subordinate to payments due on any such

senior debt. Moreover, senior debt typically bears interest at a

floating rate, whereas MACC’s investments generally do not. Any

increase in market interest rates may put significant economic pressure on those

Existing Portfolio companies that have issued senior debt which bears interest

at a floating rate. Accordingly, MACC’s ability to achieve net

operating income and generally to realize gains from its Existing Portfolio

investments may be adversely affected by an increase in market interest

rates.

16

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board

of Directors and Shareholders

MACC

Private Equities Inc.:

We have

audited the accompanying balance sheets of MACC Private Equities Inc.

(the Company), including the schedule of investments, as of

September 30, 2009 and 2008, and the related statements of operations,

changes in net assets, and cash flows for each of the years in the three-year

period ended September 30, 2009, and the financial highlights for each of

the years in the five-year period ended September 30, 2009. These financial

statements and financial highlights are the responsibility of the Company’s

management. Our responsibility is to express an opinion on these financial

statements and financial highlights based on our audits.

We

conducted our audits in accordance with the standards of the Public Company

Accounting Oversight Board (United States). Those standards require that we

plan and perform the audit to obtain reasonable assurance about whether the

financial statements and financial highlights are free of material misstatement.

An audit includes examining, on a test basis, evidence supporting the amounts

and disclosures in the financial statements. Our procedures included

confirmation or examination of securities owned as of September 30, 2009.

An audit also includes assessing the accounting principles used and significant

estimates made by management, as well as evaluating the overall financial

statement presentation. We believe that our audits provide a reasonable basis

for our opinion.

In our

opinion, the financial statements and financial highlights referred to above

present fairly, in all material respects, the financial position of MACC Private

Equities Inc. as of September 30, 2009 and 2008, the results of its

operations, the changes in its net assets, and its cash flows for each of the

years in the three-year period ended September 30, 2009, and the financial

highlights for each of the years in the five-year period ended

September 30, 2009, in conformity with U.S. generally accepted

accounting principles.

The

accompanying financial statements have been prepared assuming that the Company

will continue as a going concern. As discussed in note 1 to the financial

statements, the Company does not have sufficient cash on hand to meet current

obligations, which raise substantial doubt about its ability to continue as a

going concern. Management’s plans in regard to these matters are also described

in note 1. The financial statements do not include any adjustments that

might result from the outcome of this uncertainty.

/s/ KPMG

San

Diego, California

December 28,

2009

17

MACC PRIVATE EQUITIES INC.

BALANCE SHEETS

SEPTEMBER

30, 2009 AND 2008

|

Assets

|

2009

|

2008

|

||||||

|

Loans

and investments in portfolio securities, at market or fair value (note

2):

|

||||||||

|

Unaffiliated

companies (cost of $779,807 for 2009; $2,274,595 for 2008)

|

$ | 1,199,388 | 1,530,127 | |||||

|

Affiliated

companies (cost of $10,664,161 for 2009; $12,234,007 for

2008)

|

7,973,862 | 10,528,449 | ||||||

|

Controlled

companies (cost of $2,874,939 for 2009; $2,932,231 for

2008)

|

2,602,022 | 2,443,275 | ||||||

|

Cash

and money market accounts

|

173,521 | 145,790 | ||||||

|

Interest

receivable

|

303,656 | 313,561 | ||||||

|

Other

assets (note 1)

|

264,070 | 352,675 | ||||||

|

Total

assets

|

$ | 12,516,519 | 15,313,877 | |||||

|

Liabilities

and net assets

|

||||||||

|

Liabilities:

|

||||||||

|

Note

payable (note 3)

|

$ | 4,618,659 | 4,750,405 | |||||

|

Incentive

fees payable (note 5)

|

16,361 | 16,361 | ||||||

|

Accounts

payable and other liabilities

|

72,111 | 112,130 | ||||||

|

Total

liabilities

|

4,707,131 | 4,878,896 | ||||||

|

Net

assets:

|

||||||||

|

Common

stock, $.01 par value per share; authorized 10,000,000

shares;

issued

and outstanding 2,464,621 shares for each 2009 and 2008

|

24,646 | 24,646 | ||||||

|

Additional

paid-in-capital

|

10,328,377 | 13,349,317 | ||||||

|

Unrealized

depreciation on investments (note 2)

|

(2,543,635 | ) | (2,938,982 | ) | ||||

|

Total

net assets

|

7,809,388 | 10,434,981 | ||||||

|

Commitments

and contingency (note 6)

|

||||||||

|

Total

liabilities and net assets

|

$ | 12,516,519 | 15,313,877 | |||||

|

Net

assets per share

|

$ | 3.17 | 4.23 | |||||

SEE