Attached files

| file | filename |

|---|---|

| 8-K - Secure America Acquisition CORP | v169259_8k.htm |

Investor Presentation

December 2009

1

Safe Harbor Statement

This presentation contains forward looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that

involve risks and uncertainties. Such statements may

include, without limitation, statements with respect to the plans, objectives,

expectations and intentions of Ultimate Escapes’ management. Words such as "may," "could," "would," "should," "believes," "expects,"

"anticipates," "estimates,"

"intends," "plans" and similar expressions are intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words.

These statements are based upon the current beliefs and expectations of the management of Ultimate Escapes and are subject to

significant risks and uncertainties, including those detailed

in Ultimate Escapes’ filings with the SEC. Actual results, including, without

limitation, operating or financial results, may differ from those set forth in the forward-looking statements.

These forward-looking statements involve certain risks and uncertainties that are subject to change based on various factors (many of

which are beyond the control of Ultimate Escapes). The

following factors, among others, could cause actual results to differ from those set

forth in the forward-looking statements: weather and natural disasters; changing interpretations of generally accepted accounting

principles; outcomes of government

reviews; inquiries and investigations and related litigation; continued compliance with government

regulations; legislation or regulatory environments, requirements or changes adversely affecting the businesses in which Ultimate

Escapes is engaged;

fluctuations in consumer demand; management of rapid growth; intensity of competition from other companies in

the same or similar industry; general economic conditions; geopolitical events and regulatory changes, as well as other relevant risks

detailed

in Ultimate Escapes’ filings with the Securities and Exchange Commission, including those set forth in the “Risk Factors” section

of the Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on October

16, 2009 by Secure

America Acquisition Corporation, the predecessor of Ultimate Escapes. The information set forth herein should be read in light of such

risks.

Ultimate Escapes assumes no obligation to publicly update or revise any forward-looking statements or information or data contained in

this presentation, whether to reflect any change in our

expectations with respect to such statement or any change in events, conditions or

circumstances on which any statement is based, or otherwise.

The financial information and data contained in this presentation is unaudited and does not conform to the SEC's Regulation S-X.

Accordingly, such information and data may not be included,

or may be presented differently, in the Company's SEC filings. This

presentation contains disclosures of EBITDA for certain periods, which may be deemed to be a non-GAAP financial measure within the

meaning of Regulation G promulgated by the Securities

and Exchange Commission. Management believes that EBITDA, or earnings

before interest, taxes, depreciation and amortization, is an appropriate measure of evaluating operating performance and liquidity,

because it reflects the resources available for

strategic opportunities including, among others, investments in the business and strategic

acquisitions. The disclosure of EBITDA may not be comparable to similarly titled measures reported by other companies. EBITDA should

be considered in addition

to, and not a substitute, or superior to, operating income, cash flows, revenue, or other measures of financial

performance prepared in accordance with generally accepted accounting principles.

2

Investment Highlights

Elite Club – Casa Eternidad

Los Cabos, Mexico

5,105 Square feet

4 Bedrooms, 5 Bathrooms

Outdoor Heated Pool/Spa

Oceanfront

3

Ultimate Escapes is a market leader in the luxury destination club market and

is the #1 destination club as measured by number of global destinations and #2

as measured by number of members

Excellent long-term revenue visibility, driven by recurring revenue

Rapid growth-to-date expected to continue, both organically and via accretive

transactions

Seasoned, experienced management team has worked together for 15-20

years in various successful ventures, including public company/IPO experience

Enterprise value of $141 million is below appraised real estate portfolio value of

$165 million, based on recent appraisals by primary lender (CapitalSource).

Investors effectively getting

operating business (members, revenues, EBITDA)

for free.

Attractive economics - pro forma 2009 & 2010 EBITDA multiples are 37.0% &

68.0% discount to respective public

company comparables1

Investment Highlights

(1)

Discount based on the industry median multiples defined on slide 29

4

Capital Structure

Ultimate Escapes enterprise value of $141 million, based on UEI closing stock price

of $3.73 on 12/15/09 – valuation

includes:

$120 million in long-term debt outstanding, plus

$33 million in common stock, less $12 million estimated cash balance at

year end

Under the terms of the recent business combination, the total consideration paid by

Secure America Acquisition Corporation (SAAC) to Ultimate Escapes Holdings, LLC

stockholders consisted

of:

The delivery of 7,556,675 units exchangeable for UEI common stock valued at

$7.94 per share

Up to 3.0 million additional shares of SAAC’s common stock if Adjusted EBITDA

in 2010 or 2011 is between $23 million and $27 million

Up to 4.0 million additional shares of SAAC’s common stock if Adjusted EBITDA

in 2011 or 2012 is between $32 million and $45 million

5

Overview of Ultimate Escapes

Ultimate Escapes was founded in 2004 and is the industry’s fastest growing and

most diverse family of luxury destination clubs in the world

Ultimate Escapes has experienced rapid membership growth through a

combination of organic membership sales and accretive transactions

Ultimate Escapes has:

Over 1,200 affluent club members

Over 130 club properties in 45 global destinations

$167 million recently appraised real estate portfolio

Access to over 140 four and five-star affiliated luxury hotels and resorts

Within the Destination Club industry, Ultimate Escapes is:

#1 club as measured by total number of global destinations

#1 club with properties in the $1 million range

#1 club with properties in the $2 million range

#2 club with properties in the $3 million range

#2 club in total number of members

6

Financial Highlights

Signature Club – Pura Vida

Costa Rica

4,800 square feet

4 Bedrooms, 5 Bathrooms

Outdoor Heated Pool/Spa

Golf and Ocean Views

Reserva Conchal Resort

7

Pro Forma Financial Highlights

Total Year-End Members

Revenue (a)

EBITDA (a)

Net Income (a)

($ in millions)

($ in millions)

Notes:

(a)

Based on adjusted GAAP revenue recognition: The non-refundable 25% portion of new membership fees is recognized over first 18 months of membership, with the remaining portion of

new membership

fees amortized over 10 years

($ in millions)

8

Long-Term Revenue Visibility

Large member base and high 97-99%

renewal rate lead to long-term revenue

visibility, including substantial recurring

revenue

Revenue recognition comprised of recurring

annual dues, nightly fees and services fees

and semi-recurring new member initiation

fees and new member dues

Qualified affluent prospects are on the

sidelines due to the economy. As economy

improves, new leads are increasing, sales

opportunity pipeline is growing and close

rates

are improving

Current real estate infrastructure allows for

forecasted member growth through 2011

before purchases of new homes are required

(a) Includes Discovery Membership revenues

44.5%

9

Future Growth Strategy

Additional accretive transactions

Historically it has been cheaper to buy existing club assets at a “discount”

rather than build organically; this trend expected to continue

Global expansion

Europe

Asia

Introduce new club offerings and plans

Equity club offering

Points-based membership plans

Partnerships/joint ventures with luxury brands & hospitality REITS

“Private label” offerings with resort and hospitality brands

10

Ultimate Escapes Outperforms Luxury Shared-Use Market

Recession impacted luxury shared-use market, with industry sales down 34%

Ultimate Escapes outperformed the luxury shared-use industry, with record

member growth, revenue growth and EBITDA

growth forecasted in 2009:

47% membership growth (2008-2009)

37% revenue growth (2008-2009)

Expected Positive EBITDA and Net Income

LUXURY FRACTIONAL PRC AND DESTINATION CLUB SALES (IN MILLIONS)

2006

2007

2008

'07 - '08

% Change

Traditional Fractional Interest

$476.0

$485.1

$263.0

-46%

Private Residential Clubs

$1,070.1

$1,202.3

$912.0

-24%

Destination Clubs

$575.5

$610.0

$349.0

-43%

Total Luxury Fractional & Destination Club Sales

$2,121.9

$2,297.4

$1,525.0

-34%

Source: Ragatz Associates

11

Industry Resilient & Growth Opportunities

Large destination clubs have been reasonably resilient through the global

market downturn, due to strong member appeal, critical operational scale and

affluent membership demographics

High-net-worth member base has continued to pay annual dues and maintain

frequent travel plans despite a broader slow-down in business

and leisure travel

(1st Quarter 2009 busiest quarter ever for volume of member travel)

Ultimate Escapes’ property values have held better than overall market - as

evidenced by recent appraisals

completed by the Company’s lender (CapitalSource)

Tremendous property acquisition opportunities in soft luxury real estate

markets during 2009 and 2010

The Ultimate

Reciprocity Program also

capitalizes on excess current capacity

without making new property acquisitions

12

Management Team

Premiere Club – Belizean Dreams

Belize

2,300 square feet

3 Bedrooms, 3 Bathrooms

Outdoor Heated Pool/Spa

Beachfront

13

Experienced Management Team

Jim Tousignant

President and CEO

20 years entrepreneurial experience building fast growth companies

Ultimate Resort - Founder, President & CEO

Multex.com - President and Co-Founder

Thomson Financial - Managing Director, Global Sales

Morgan Stanley - Managing Director, Business Development

Richard Keith

Chairman

15 years experience in launching successful start-up companies

Private Escapes - Founder, President

Center Partners, Inc. - Co-Founder

Private Retreats Destination Club - Chief Operating Officer

AppleOne Employment Services - Founder

Phil Callaghan

Chief Financial Officer

25 years experience in senior

management and finance

Multex.com - Chief Financial

Officer

Thomson Financial - Senior Vice

President, Finance

MTV Europe - Financial Director

Gregg Amonette

Senior VP, Bus Dev

20 years experience

Reuters - Senior Vice President,

Business Development

Multex.com - Executive Vice

President Global Product Groups

ADP Brokerage - Vice President

Retail Sales

Ed Powers

Senior VP, Operations

19 years experience

Private Escapes - Co-founder,

Executive Vice President,

Operations

Center Partners, Inc., - Vice

President Corporate Planning and

Development

Sorcia Inc., - Vice President of

Operations

Tom D'Ambrosio

CTO/Senior VP, Tech

20 years experience

Reuters - Chief Information

Officer, Reuters Research

Multex.com - Chief Information

Officer

ADP Brokerage - Director

Advanced Systems Development

Steve Healy

Senior VP, Sales

10 years experience

Stirling Sotheby’s

International Realty - Sales

Executive

14

Industry Overview

Elite Club – Happy Valley

Scottsdale, Arizona

5,500 square feet

4 Bedrooms, 4 Bathrooms

Outdoor Heated Pool/Spa

Golf Front – Guest Casita

15

Evolution of Luxury Shared-Use Industry

Luxury target market in United States of 6.7 million “millionaires” with assets of at

least $1 million and 840,000 “pentamillionaires” with assets of at least $5 million,

excluding housing1

(1) 2008 estimate from Spectrem Group, a consulting and market research firm specializing in affluent and retirement markets

Location

Major U.S. Vacation

Destinations

Primarily

Ski-Oriented

North American Vacation

Destinations and Urban

Locations

North American Vacation

Destinations and Urban

Locations

Worldwide Destinations

Target Market

Middle-to-Lower Income

Middle-to-Upper Income

Upper Income

Luxury

Super Luxury

Time/Unit

One Week

Three to Thirteen Weeks

Three to Thirteen Weeks

Three to Thirteen Weeks

Two to Six Weeks

Avg Price

Cost/Unit

Cost/SF

$10,000-$40,000

$115,650

$10,500/week

<$500/sf

$187,500

$29,425/week

$500-$999/sf

$290,000

$59,335/week

>$1,000/sf

$100,000-$500,000

Ownership Structure

Right-to-Use

Non-Equity

Equity Ownership

Equity Ownership

Equity Ownership

Right-to-Use

Non-Equity

Key Players

Marriott, Disney, Hilton,

Wyndham

Marriott, Hyatt, Grand

Summit

Marriott, Hyatt

Ritz-Carlton, Four Seasons,

Auberge

Exclusive Resorts,

Ultimate Escapes

Traditional

Timeshare

Traditional

Fractional

Interests (TFI)

High

-

End

Fractional

Interests (HFI)

Private

Residence

Clubs (PRC)

Destination

Clubs (DC)

16

Industry Overview

Destination club industry started in 1999; Rapid growth of new clubs from 2003-2007 with

over 30 clubs started; Rapid

consolidation in 2007-2008, resulting in 2 dominant large “global”

destination clubs

The Destination Club industry today is dominated by two major players and a number of

smaller competitors

Ultimate Escapes and Exclusive Resorts together maintain an 82% global market share

Large Market Opportunity - Luxury target market in United States of 6.7 million “millionaires”

with assets

of at least $1 million and 840,000 “pentamillionaires” with assets of at least

$5 million, excluding housing

1

(1)

2008 estimate from Spectrem Group, a consulting and market research firm specializing

in affluent and retirement markets

3,100 (59%)

1,212 (23%)

400 (7%)

150 (3%)

120 (2%)

300 (6%)

0

500

1,000

1,500

2,000

2,500

3,000

3,500

Exclusive Resorts

Ultimate Escapes

Quintess

A&K Residence Club

M Residences

Other Clubs

17

Ultimate Escapes Overview

Elite Club – Villa Paraiso

Los Cabos, Mexico

5,567 square feet

4 Bedrooms, 4 Bathrooms

Outdoor Heated Pool/Spa

Oceanfront

18

Company was founded by Jim Tousignant in 2004. Seasoned

management team has worked together for 15-20 years in various

successful ventures

Strong history of consistent annual member growth and revenue growth

through organic sales and accretive transactions, including:

May 2007 – Purchased $125 million of real estate assets from Tanner &

Haley bankruptcy for $105 million cash

Signed new membership agreements with 645 members

February 2008 – Purchased $17 million of real estate assets Ventures

Equity Vacation Club for $12 million cash

Signed new membership agreements with 19 members

September 2009 – Acquired $50 million of real estate assets from Private

Escapes for 8% ownership of Ultimate Escapes

Signed new membership agreements with 387 members

Company History

19

Members are primarily concentrated within 100-mile radius of top 30

metropolitan areas of the United States

Member demographics (based on member survey):

Highly educated (95%+ undergraduate/masters/doctorate degrees)

Majority own businesses, are senior executives or professionals

(doctors, lawyers, etc.)

High net worth: $5+ million

High annual income: $500,000+

Primary home value: $2-3 million; 50% own 2nd home

Members are active travelers (4-6 weeks per year)

Members are active in other private clubs/associations

Membership Demographics

20

Membership Offerings

Ultimate Escapes operates a family of 3 distinct luxury destination clubs targeting

$1 million, $2 million and $3 million average home value categories

The

Ultimate CollectionSM

offers club members access to more than 140 of the

world’s most desirable 4 and 5-star independent luxury hotels in major cities and

resorts in Europe, Middle East,

Asia, Africa, South America and North America

The Ultimate Reciprocity ProgramSM provides members with

flexible reciprocity

access to participating luxury fractional and private residence club (PRC) resort

properties

Ultimate Escapes®

Elite ClubSM

$3 million home value

Signature ClubSM

$2 million home value

Premiere ClubSM

$1 million home value

21

Premiere ClubSM

($1 mm home values)

Signature ClubSM

($2 mm home values)

Elite ClubSM

($3 mm home values)

Membership

Fee

$70,000 - $150,000

$145,000 - $300,000

$200,000 - $450,000

Included Days

14 - 60

14 - 60

14 - 60

Advanced

Reservations

1 - 5

1 - 5

1 - 5

Holiday

Reservations

1* - 2

1* - 2

1* - 2

Space

Available

Inside 90 - 180 Days

Inside 90 - 180 Days

Inside 90 - 180 Days

Annual Dues

$8,000 - $17,000

$11,500 - $35,500

$16,000 - $49,000

(*) Bronze Members receive Advanced Holiday Reservation every other year

Membership Plan Pricing

22

Provide range of member services and

concierge services for each club

reservation, offering both bundled

“base services” and a la carte

“premium services”

for extra fee:

Pre-arrival member travel planning

Pre-stocking of kitchen and wine cellar

Private chef services

Destination activities, tours and excursions

Theatre tickets, golf tee times or spa

In-residence maid, chef, nanny

Other member services as needed

Escape Planners and Local Hosts

23

#1 Club in Global Destinations

Beaches and Shores

Golf and Leisure

Mountains and Trails

Metropolitan

Abaco, Bahamas

Nevis, West Indies

Bend, OR

Beaver Creek, CO

Chicago, IL

Big Island, HI

Punta Cana, DR

Boca Raton, FL

Breckenridge, CO

London, England

BVI Yacht

Punta Mita, MX

Kiawah Island, SC

Copper Mountain, CO

New York, NY

Candlewood Lake, CT

St. Thomas, USVI

La Costa, CA

Deer Valley, UT

Paris, France

Costa Rica

Turks & Caicos

La Quinta, CA

Jackson Hole, WY

Delray Beach, FL

Watercolor, FL

Lake George, NY

Lake Tahoe, NV

Belize

Lake Las Vegas, NV

Steamboat Springs, CO

Indian Rocks, FL

Naples, FL

Stowe, VT

Key West, FL

Orlando, FL

Sun Valley, ID

Los Cabos, Mexico

Outer Banks, NC

Telluride, CO

Maui, HI

Reynolds Plantation, GA

Miami Beach, FL

Scottsdale, AZ

Tuscany, Italy

130+ homes available in 45 worldwide destinations

24

Smart Home Technology Platform

Designed to improve member experience, control operating costs and

differentiate Ultimate Escapes from competition

SMART CARD controls music and multimedia services, digital family photo library,

lighting, temperature, and home security, providing members with personalized, safe

and friendly vacation

experiences

25

Annual Member Renewal Rates

26

Valuation

Signature Club – Riga Salcio

Tuscany, Italy

3,000 square feet

3 Bedrooms, 3 Bathrooms

Outdoor Heated Pool

17 acres – private vineyard

27

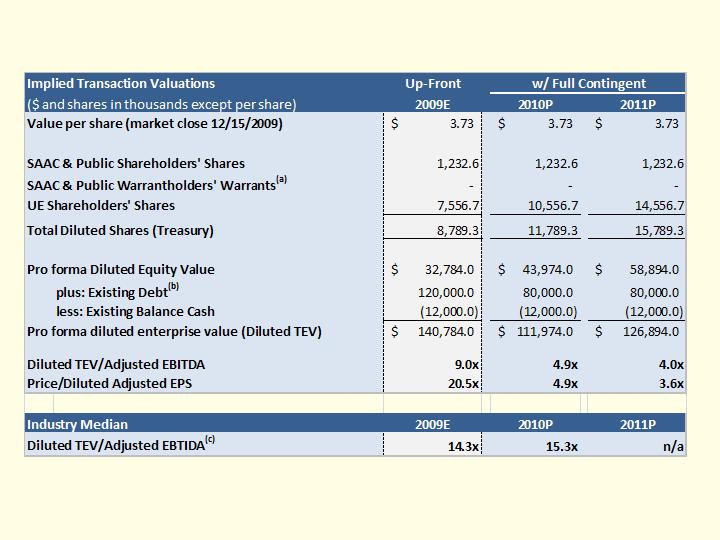

Transaction Valuation

Notes:

(a) Treasury Method diluted shares outstanding assumes all warrants with exercise price of $8.80

(b) Assumes $40.0 million reduction in debt from the sale of excess real estate in 2010

(c) Industry universe includes HST, AHT, BEE, SHO, LHO, DRH, MAR, HOT and WYN

28

Comparable Analysis

Sources: Bloomberg and ThomsonONE

29

Summary

Signature Club – Villa Paradiso

Nevis, West Indies

3,200 square feet

3 Bedrooms, 4 Bathrooms

Outdoor Pool

Beach Views

30

Ultimate Escapes is a market leader in the luxury destination club market and

is the #1 destination club as measured by number of global destinations and #2

as measured by number of members

Excellent long-term revenue visibility, driven by recurring revenue

Rapid growth-to-date expected to continue, both organically and via accretive

transactions

Seasoned, experienced management team has worked together for 15-20

years in various successful ventures, including public company/IPO experience

Enterprise value of $141 million is below appraised real estate portfolio value of

$165 million, based on recent appraisals by primary lender (CapitalSource).

Investors effectively getting

operating business (members, revenues, EBITDA)

for free.

Attractive economics - pro forma 2009 & 2010 EBITDA multiples are 37.0% &

68.0% discount to respective public

company comparables1

Summary

(1)

Discount based on the industry median multiples defined on slide 29

31

Appendix

Elite Club – Country Club Drive

Telluride, Colorado

3,337 square feet

4 Bedrooms, 5 Bathrooms

Outdoor Heated Spa

32

Senior Management Track Record

Jim Tousignant, President and CEO - history of successful

entrepreneurial ventures with high growth companies:

Founded Ultimate Resort in 2004; grew business to become 2nd

largest

destination club with over 800 members; purchased certain assets from Tanner

& Haley bankruptcy in 2007; purchased certain assets from Equity Ventures

Vacation Club in 2008

Co-founded Multex.com in 1993; raised over $50 million in venture capital and

led Multex to successful $42 million IPO in 1999; acquired four companies and

grew annual revenues to $100 million;

Multex was sold to Reuters in 2003

Rich Keith, Chairman - history of successful entrepreneurial ventures with

high growth companies:

Founded Private Escapes in 2003 and grew to become the 3rd largest

destination club with over 400 members

Co-Founded Center Partners in 1996; sold to WPP Group in 1999

33

Beaches & Shores (Cabo, Mexico)

Golf & Leisure (Scottsdale, Arizona)

Metropolitan (New York, NY)

Mountains & Trails (Telluride, CO)

Property Themes

34

Timeshare Market – 20+ Years of Strong Growth

(Set

Stage for Recent Expansion into Luxury Markets)

Timeshare Industry Metrics (Source: ARDA)

$9.7 billion sales in 2008 (down 8% from 2007; impacted by soft market for securitized

receivables)

1,629 timeshare resorts in 2008

7 million timeshare intervals owned; 99% participate in exchanges (RCI or Interval)

4.7 million timeshare owner households

Occupancy of 82% in 2008

Consistent growth during wars, recessions, oil embargo, 9/11

35

$1.5 Billion Luxury Shared-Use Market

(Luxury Shared-Use

Market: Similar Growth Dynamics As Timeshare)

36

Competition - “Smart Money” Entering Market

Steve Case (AOL) and Perry Capital invested $90+ million in

Exclusive Resorts

Fortress Investment Group acquired Crecendo and

BellHavens in late 2008 and launched A&K Residence Club

Marriott launched Ritz Carlton Destination Club in early 2009

Other major resort and hospitality brands interested in

entering destination club market

37

Integrates smart-card technology, computers, home music and entertainment, lighting,

HVAC, security and energy systems with Ultimate Escapes’ proprietary web-based

technology platform

Smart Home Technology

Elite Club – Terrace Green

La Quinta, CA (PGA West)

4,400 square feet

5 Bedrooms, 5 Bathrooms

Outdoor Heated Pool/Spa

PGA West – Golf front

38

Improves operating efficiency and scalability

Significant cost savings due to reduced energy, water and labor

Modular and easily expandable

Proactive remote monitoring and intervention

Smart Homes Reduce Energy Costs

Smart Home Technology Rollout

Phase I Systems

Pool Monitoring

Lights

HVAC

Irrigation

Water flow

Electrical Meter

Phase II Systems

Irrigation

LED Lighting

Solar Power Panels

Two Way Power Meters

Wind Power

Geothermal Heating

39