Attached files

| file | filename |

|---|---|

| EX-21.1 - EXHIBIT 21.1 - RESOURCE AMERICA, INC. | exh21_1.htm |

| EX-23.1 - EXHIBIT 23.1 - RESOURCE AMERICA, INC. | exh23_1.htm |

| EX-12.1 - EXHIBIT 12.1 - RESOURCE AMERICA, INC. | exh12_1.htm |

| EX-32.1 - EXHIBIT 31.1 - RESOURCE AMERICA, INC. | exh31_1.htm |

| EX-32.1 - EXHIBIT 32.1 - RESOURCE AMERICA, INC. | exh32_1.htm |

| EX-32.2 - EXHIBIT 32.2 - RESOURCE AMERICA, INC. | exh32_2.htm |

| EX-31.2 - EXHIBIT 31.2 - RESOURCE AMERICA, INC. | exh31_2.htm |

| EX-10.9(F) - SEVENTH AMENDMENT BETWEEN LEAF AND NATCITY - RESOURCE AMERICA, INC. | exh10_9f.htm |

| EX-10.9(G) - EIGHTH AMENDMENT BETWEEN LEAF AND NATCITY - RESOURCE AMERICA, INC. | exh10_9g.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

(Mark One)

R ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the fiscal year ended September 30, 2009

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the transition period from _________ to __________

Commission file number: 0-4408

RESOURCE AMERICA, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

72-0654145 | |

|

(State or other jurisdiction of |

(I.R.S. Employer | |

|

incorporation or organization) |

Identification No.) |

|

One Crescent Drive, Suite 203, Navy Yard Corporate Center, Philadelphia, PA 19112 | ||

|

(Address of principal executive offices) (Zip code) | ||

|

(215) 546-5005 | ||

|

(Registrant's telephone number, including area code) | ||

|

Securities registered pursuant to Section 12(g) of the Act: |

|

Common stock, par value $.01 per share |

NASDAQ |

|||

|

Title of class |

Name of exchange on which registered |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No R

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(a) of the Act. Yes o No R

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90

days. Yes R No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such

files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. R

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

o |

Accelerated filer |

þ | ||

|

Non-accelerated filer |

o |

(Do not check if a smaller reporting company) |

Smaller reporting company |

o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No R

The aggregate market value of the voting common equity held by non-affiliates of the registrant, based on the closing price of such stock on the last business day of the registrant’s most recently completed second fiscal quarter (March 31, 2009) was approximately $39,339,000.

The number of outstanding shares of the registrant’s common stock on December 1, 2009 was 18,490,971 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement to be filed with the Commission in connection with the 2010 Annual Meeting of Stockholders are incorporated by reference in Part III of this Form 10-K.

RESOURCE AMERICA, INC. AND SUBSIDIARIES

INDEX TO ANNUAL REPORT

ON FORM 10-K

|

Page | |||

|

PART I |

|||

|

Business |

3 | ||

|

Risk Factors |

10 | ||

|

Unresolved Staff Comments |

14 | ||

|

Properties |

14 | ||

|

Legal Proceedings |

15 | ||

|

Submission of Matters to a Vote of Security Holders |

15 | ||

|

PART II |

|||

|

Market for Registrant's Common Equity, Related Stockholder Matters and

Issuer Purchases of Equity Securities |

16 | ||

|

Selected Financial Data |

18 | ||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

19 | ||

|

Quantitative and Qualitative Disclosures About Market Risk |

44 | ||

|

Financial Statements and Supplementary Data |

45 | ||

|

Changes in and Disagreements with Accountants on Accounting and

Financial Disclosure |

94 | ||

|

Controls and Procedures |

94 | ||

|

Other Information |

96 | ||

|

PART III |

|||

|

Directors and Executive Officers and Corporate Governance |

96 | ||

|

Executive Compensation |

96 | ||

|

Security Ownership of Certain Beneficial Owners and Management and

Related Stockholder Matters |

96 | ||

|

Certain Relationships and Related Transactions, and Director Independence |

96 | ||

|

Principal Accounting Fees and Services |

96 | ||

|

PART IV |

|||

|

Exhibits and Financial Statement Schedules |

97 | ||

|

99 | |||

PART I

|

BUSINESS. |

This report contains certain forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases,

you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expects,” “intend,” “may,” “plan,” “potential,” “project,” “should,” “will” and “would” or the negative of these terms or other comparable terminology. Such statements are subject to the risks and uncertainties more particularly described

in Item 1A, under the caption “Risk Factors.” These risks and uncertainties could cause actual results and financial position to differ materially from those anticipated in such statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly revise or update these forward-looking statements to reflect events or circumstances after the date of this report, except as

may be required under applicable law. We make references to the fiscal years ended September 30, 2009, 2008 and 2007 as fiscal 2009, fiscal 2008 and fiscal 2007, respectively.

General

We are a specialized asset management company that uses industry specific expertise to evaluate, originate, service and manage investment opportunities in the commercial finance, real estate and financial fund management sectors. As a specialized asset manager, we seek to develop investment funds for outside investors for which

we provide asset management services, typically under long-term management arrangements either through a contract with, or as the manager or general partner of, our sponsored investment funds. We typically maintain an investment in the funds we sponsor. Assets under management were $13.7 billion at September 30, 2009.

We limit our fund development and management services to asset classes in which we have specific expertise. We believe this strategy enhances the return on investment we can achieve for our funds. In our commercial finance operations, we focus on originating small and middle-ticket equipment leases and commercial

loans secured by business-essential equipment, including technology, commercial and industrial equipment and medical equipment. In our real estate operations, we concentrate on the ownership, operation and management of multifamily and commercial real estate and real estate mortgage loans including whole mortgage loans, first priority interests in commercial mortgage loans, known as A notes, subordinated interests in first mortgage loans, known as B notes, mezzanine loans, investments in discounted

and distressed real estate loans and investments in “value-added” properties (properties which, although not distressed, need substantial improvements to reach their full investment potential). In our financial fund management operations, we concentrate on trust preferred securities of banks, bank holding companies, insurance companies and other financial companies, bank loans and asset-backed securities, or ABS.

We have developed and manage public and private investment entities, a real estate investment trust, or REIT, and, historically, collateralized debt obligation, or CDO, issuers. Our funds are marketed principally through an extensive broker-dealer/financial planner network that we have developed. During fiscal 2009,

we focused on developing investment opportunities in our commercial finance and real estate segments:

|

|

· |

In commercial finance, we completed the offering of two public limited partnerships, which obtained $135.0 million in investor funding through October 30, 2009. |

|

|

· |

In real estate, we completed the offering of one private limited partnership which obtained $32.5 million in investor funding, and commenced an offering of another $40.0 million fund that will invest in discounted real estate and real estate debt ($37.3 million of investor funding has been raised through December 4, 2009). In addition, we filed a registration statement with the Securities and Exchange

Commission, or SEC, for Resource Real Estate Opportunity REIT, Inc., which will seek to obtain up to $750.0 million in investor funding. |

|

|

· |

In financial fund management, we focused on the management of 32 CDO issuers, six investment entities (one of which is currently in the offering stage), and Resource Capital Markets through our registered broker-dealer subsidiary, Chadwick Securities, Inc. |

Assets Under Management

As of September 30, 2009 and 2008, we managed $13.7 billion and $18.0 billion of assets, respectively, for the accounts of institutional and individual investors, Resource Capital Corp., or RCC (our sponsored REIT), and for our own account in the following asset classes (in millions):

|

September 30, 2009 |

September 30,

2008 |

|||||||||||||||||||

|

Institutional and Individual Investors |

RCC |

Company |

Total |

Total |

||||||||||||||||

|

Trust preferred securities (1) |

$ | 4,458 | $ | − | $ | − | $ | 4,458 | $ | 4,787 | ||||||||||

|

Bank loans (1) |

3,006 | 914 | − | 3,920 | 4,251 | |||||||||||||||

|

Asset-backed securities (1) |

2,186 | − | − | 2,186 | 5,638 | |||||||||||||||

|

Real properties (2) |

643 | − | − | 643 | 614 | |||||||||||||||

|

Mortgage and other real estate-related loans (2) |

10 | 860 | 177 | 1,047 | 1,089 | |||||||||||||||

|

Commercial finance assets (3) |

1,212 | 2 | 147 | 1,361 | 1,535 | |||||||||||||||

|

Private equity and other assets (1) |

66 | − | − | 66 | 59 | |||||||||||||||

| $ | 11,581 | $ | 1,776 | $ | 324 | $ | 13,681 | $ | 17,973 | |||||||||||

|

(1) |

We value these assets at their amortized cost. |

|

(2) |

We value our managed real estate assets as the sum of: (i) the amortized cost of our commercial real estate loans; and (ii) the book value of each of the following: (a) real estate and other assets held by our real estate investment entities, (b) our outstanding legacy loan portfolio, and (c) our interests in real estate. |

|

(3) |

We value our commercial finance assets as the sum of the book value of the equipment and notes and future payment card receivables financed by us. |

Our assets under management are primarily managed through the investment entities we sponsor. The following table sets forth the number of entities we manage by operating segment:

|

CDOs |

Limited

Partnerships |

TIC Programs |

Other Investment Funds |

|||||||||||||

|

As of September 30, 2009 (1) |

||||||||||||||||

|

Financial fund management |

32 | 13 | − | − | ||||||||||||

|

Real estate |

2 | 8 | 7 | 5 | ||||||||||||

|

Commercial finance |

− | 4 | − | 1 | ||||||||||||

| 34 | 25 | 7 | 6 | |||||||||||||

|

As of September 30, 2008 (1) |

||||||||||||||||

|

Financial fund management |

35 | 13 | − | − | ||||||||||||

|

Real estate |

2 | 7 | 7 | 5 | ||||||||||||

|

Commercial finance |

− | 4 | − | 1 | ||||||||||||

| 37 | 24 | 7 | 6 | |||||||||||||

|

(1) |

All of our operating segments manage assets on behalf of RCC. |

We managed three less CDO investment funds at September 30, 2009 as compared to September 30, 2008, reflecting the sale of Apidos CDO VI and the liquidation of two Ischus CDO issuers that invested primarily in real estate ABS. These three funds accounted for a $1.8 billion reduction in our assets under management.

Commercial Finance

General. Through LEAF Financial Corporation, or LEAF, we focus our commercial finance operations on equipment leases and equipment-secured notes to small and mid-sized companies. Our financing is generally for “business-essential” equipment including

technology, commercial, industrial and medical equipment, with a primary financed transaction size of under $500,000 and an average size of $20,000 to $75,000.

During fiscal 2009, we originated $401.0 million in commercial finance assets. As of September 30, 2009, we managed a $1.4 billion commercial finance portfolio, of which $1.2 billion were on behalf of five investment entities we sponsored.

Since we originate equipment leases and loans to sell to our investment entities, our originations primarily depend on the purchasing capacity of those entities. The purchasing capacity of our investment entities depends upon their ability to raise equity capital, to obtain debt and the payments received on existing leases and

loans. We anticipate that current credit market conditions may limit our ability to obtain new debt facilities for our investment entities at least during fiscal 2010 and, if so, our originations may decline from the level of originations in previous years.

We receive acquisition fees, management fees and reimbursements of our operating and administrative expenses incurred from the investment entities we manage. Acquisition fees range from 1% to 2% of the value of the equipment leases and loans sold. Management fees range from 1% to 4% of gross rental or loan payments.

Real Estate

General. Through our real estate segment, we focus on four different areas:

|

|

· |

the acquisition, ownership and management of portfolios of discounted real estate and real estate related debt, which have been acquired to date through joint ventures with institutional investors and a sponsored real estate investment entity; |

|

|

· |

the sponsorship and management of real estate investment entities that principally invest in multifamily housing; |

|

|

· |

the management, principally for RCC, of general investments in commercial real estate debt, including first mortgage debt, whole loans, mortgage participations, notes, mezzanine debt and related commercial real estate securities; and |

|

|

· |

to a lesser extent, the management and resolution of a portfolio of real estate loans and property interests that we acquired at various times between 1991 and 1999, which we refer to as our legacy portfolio. |

Discounted Real Estate Operations. On September 26, 2007, we entered into a joint venture with an institutional partner that acquired a pool of eleven mortgage loans from HUD. This portfolio was acquired at an overall discount of 51% to the approximately $75.0

million face value of the mortgage loans. Through September 30, 2009, we have sold three of the mortgages, foreclosed on the properties underlying eight of the mortgage loans, and have sold three of the foreclosed properties.

In May 2008, we entered into a second joint venture, structured as a credit facility, with the same institutional investor, that makes available up to $500.0 million to finance the acquisition of distressed properties and mortgage loans and that has the objective of repositioning both the directly owned properties and the properties

underlying the mortgage loans to enhance their value. Through September 30, 2009, the joint venture had acquired four distressed loans and two properties for an aggregate of $47.9 million and, in the first quarter of fiscal 2010, acquired an additional distressed loan for $7.2 million. On December 1, 2009, we sold our joint venture interest to RCC at its book value. We retained management of the joint venture assets and will continue to receive fees in connection with the acquisition,

investment management and disposition of new assets acquired by the joint venture.

In July 2009, we filed a registration statement with the Securities and Exchange Commission, or SEC, for Resource Real Estate Opportunity REIT, Inc., that intends to purchase a diversified portfolio of U.S. commercial real estate and real estate related debt that has been significantly discounted due to the effects of economic events and

high levels of leverage, including properties that may benefit from extensive renovations intended to increase their long-term values.

Real Estate Investment Entities. Since 2003, we have sponsored 17 real estate investment entities, all of which have commenced operations having raised $300.4 million in investor funds. The entities using a portion of these funds have acquired interests in 50

multifamily apartment complexes comprising 12,794 units with a combined acquisition cost of $609.8 million, including interests owned by third parties and excluding properties sold.

We receive acquisition, debt placement and bridge equity fees from the partnerships in their acquisition stage. These fees, in the aggregate, have ranged from 1% to 2% of the acquisition costs of the properties or the debt financing, in the case of debt placement fees. In their operational stage, we receive property

management fees of 5% of gross revenues as well as 1% on third-party partnership capital that has been deployed.

Resource Capital Corp. As of September 30, 2009, our real estate operations managed approximately $860.2 million of commercial real estate loan assets on behalf of RCC, including $799.1 million held in CDOs we sponsored in which RCC holds the equity interests. We

discuss RCC in more detail in “− Resource Capital Corp.,” below.

In December 2009, RCC announced that it priced a public offering of 10 million shares of its common stock at a price of $4.50 per share for expected net proceeds, after underwriting discounts and expenses, of $42.2 million.

Resource Residential. In October 2007, we established our internal property management division, Resource Real Estate Management, Inc., or Resource Residential, which has assumed the property management for our investment entities and for the properties we have in our

legacy portfolio. Our property management division has provided us with a source of stable revenues for our real estate operations. Furthermore, we believe that having direct management control over the properties in our investment programs has not only enabled us to enhance their profitability, but also provides us with a competitive edge in marketing our funds by distinguishing us from other sponsors of real estate investment funds. As of September 30, 2009, our property management

division manages all of our fund multifamily properties located in 14 states, with the exception of one property, in addition to managing the distressed/value-added properties in our joint ventures. Resource Residential had 318 employees as of September 30, 2009.

Legacy Portfolio of Loan and Property Interests. Between fiscal 1991 and 1999, our real estate operations focused on the purchase of commercial real estate loans at a discount to their outstanding loan balances and the appraised value of their underlying properties. Since

1999, management has focused on resolving and disposing of these assets. At September 30, 2009, our legacy portfolio consisted of five loans with a book value of $2.9 million and six property interests with a book value of $24.5 million. During fiscal 2009, the number of loans in this portfolio decreased from eight to five through the payoff of two loans and the foreclosure of another loan.

Our real estate operation has consolidated certain variable interest entities, or VIEs, in our financial statements. Loans held by two such VIEs are included in our legacy portfolio. Although included in our consolidated balance sheet and consolidated statement of operations, the assets, liabilities, revenues, costs

and expenses of these VIEs are not ours, and their liabilities will be satisfied only from the operations of the respective VIE and not from our assets.

Financial Fund Management

General. We conduct our financial fund management operations primarily through seven separate operating entities:

|

|

· |

Apidos Capital Management, LLC, or Apidos, finances, structures and manages investments in bank loans, high yield bonds and equity investments; |

|

|

· |

Trapeza Capital Management, LLC, or TCM, a joint venture between us and an unrelated third-party, originates, structures, finances and manages investments in trust preferred securities and senior debt securities of banks, bank holding companies, insurance companies and other financial companies. TCM together with the Trapeza CDO issuers and Trapeza Partnerships are collectively referred to as Trapeza; |

|

|

· |

Resource Capital Markets, Inc., which, through our registered broker-dealer subsidiary, Chadwick Securities, Inc., acts as an agent in the primary and secondary markets for trust preferred securities of banks, bank holding companies, insurance companies, other financial companies, real estate companies, REITS, and other real estate related companies as well as securities of CDO issuers; |

|

|

· |

Resource Europe Management Ltd., or Resource Europe, structures and manages investments in international bank loans; |

|

|

· |

Resource Financial Institutions Group, Inc., or RFIG, serves as the general partner for six (one of which is currently in the offering stage) company-sponsored affiliated partnerships which invest in financial institutions; |

|

|

· |

Ischus Capital Management, LLC, or Ischus, finances, structures and manages investments in asset-backed securities or ABS, including residential mortgage-backed securities, or RMBS, and commercial mortgage-backed securities, or CMBS; and |

|

|

· |

Resource Capital Manager, Inc., or RCM, an indirect wholly-owned subsidiary, provides investment management and administrative services to RCC under a management agreement between RCM and RCC. |

We derive revenues from our existing financial fund management operations through management and administration fees. We are also entitled to receive distributions on amounts we have invested directly in CDOs or in limited partnerships we formed that purchased equity in the CDO issuers we sponsored. Our CDO management

fees generally consist of base and subordinated management fees. For the Trapeza CDO issuers we sponsored and manage, we share the base and subordinated management fees with our co-sponsors. For CDO issuers we sponsored and manage on behalf of RCC, we receive fees directly from RCC pursuant to our management agreement in lieu of asset management fees from the CDO issuers. We describe the management fees we receive from RCC in “− Resource Capital Corp” below. Base

management fees generally are a fixed percentage of the aggregate principal balance of the assets held by the CDO. Our base management fees range from 0.10% to 0.25% of a managed CDO’s assets. Subordinated management fees are also a percentage of the aggregate principal balance of the assets held by the CDO, and range from 0.08% to 0.45%, but typically are subordinated to debt service payments on the CDOs. The management fees are payable monthly, quarterly or semi-annually,

as long as we continue to manage portfolio assets on behalf of the CDO issuer. While we were receiving subordinated management fees from 8 CDOs at September 30, 2009 and have subsequently begun to receive such fees from two additional CDOs, we cannot assure you that we will continue to receive these subordinated management fees in the future.

CDOs. We expect that we will continue to focus on managing the assets of our existing CDOs in fiscal 2010 while we will also seek opportunities to manage additional assets where we can use our existing financial fund management platform and personnel with little or no

equity investment exposure. No such opportunities became available to us in fiscal 2009, and we may be unable to identify any such opportunities in fiscal 2010.

As of September 30, 2009, our financial fund management operations have sponsored and manage 32 CDO issuers (three of which we manage on behalf of RCC) holding approximately $10.6 billion in assets as set forth in the following table:

|

Sponsor/Manager |

Asset Class |

Number of

CDO Issuers |

Assets Under Management (1) |

|||||||

|

(in billions) |

||||||||||

|

Trapeza (2)(3) |

Trust preferred securities |

13 | $ | 4.5 | ||||||

|

Apidos |

Bank loans |

11 | 3.5 | |||||||

|

Ischus (2) |

RMBS/CMBS/ABS |

7 | 2.2 | |||||||

|

Resource Europe |

Bank loans |

1 | 0.4 | |||||||

| 32 | $ | 10.6 | ||||||||

|

(1) |

Calculated as set forth in “Assets Under Management,” above. |

|

(2) |

We also own a 50% interest in the general partners of the limited partnerships that own a portion of the equity interests in each of five Trapeza CDO issuers and one Ischus CDO issuer. |

|

(3) |

Through Trapeza, we own a 50% interest in an entity that manages 11 of the Trapeza CDO issuers and a 33.33% interest in another entity that manages two of the Trapeza CDO issuers. |

Resource Capital Corp. As of September 30, 2009, our financial fund management operations manage $913.6 million of bank loans on behalf of RCC, all of which are in Apidos CDOs we sponsored in which RCC holds the equity interests. We discuss RCC in more detail

in “ − Resource Capital Corp.,” below.

Company-Sponsored Partnerships. We sponsored, structured and currently manage six (one of which is currently in the offering stage) investment entities for individual and institutional investors, five of which invest in banks and other financial institutions and one of

which has been organized as a credit opportunities fund. At September 30, 2009, these partnerships held $65.6 million of assets.

Resource Capital Corp.

RCC, a publicly-traded (NYSE: RSO) REIT that we sponsored and manage, invests in a diversified portfolio of whole loans, B notes, CMBS and other real estate-related loans and commercial finance assets. At September 30, 2009, we owned 2.2 million shares of RCC common stock, or approximately 8.2% of RCC’s outstanding common

stock, and held options to acquire 2,166 shares (at an exercise price of $15.00 per share).

We manage RCC through RCM. At September 30, 2009, we managed a total of $1.8 billion of assets on behalf of RCC. Under our management agreement with RCC, RCM receives a base management fee, incentive compensation and a reimbursement for out-of-pocket expenses. The base management fee is 1/12th of

1.50% of RCC’s equity per month. The management agreement defines “equity” as, essentially, shareholder’s equity, subject to adjustment for non-cash equity compensation expense and non-recurring charges to which the parties agree. The incentive compensation is 25% of (i) the amount by which RCC’s adjusted operating earnings (as defined in the agreement) of RCC (before incentive compensation but after the base management fee) for such quarter per common share

(based on the weighted average number of common shares outstanding for such quarter) exceeds (ii) an amount equal to (a) the weighted average of the price per share of RCC’s common shares in the initial offering by RCC and the prices per share of the common shares in any subsequent offerings of RCC, in each case at the time of issuance thereof, multiplied by (b) the greater of (1) 2.00% and (2) 0.50% plus one-fourth of the ten year treasury rate (as defined in the agreement)

for such quarter, multiplied by the weighted average number of common shares outstanding during such quarter; provided, that the foregoing calculation of incentive compensation will be adjusted to exclude events pursuant to changes in accounting principles generally accepted in the United States, or U.S. GAAP, or the application of U.S. GAAP, as well as non-recurring or unusual transactions or events, after discussion between us, RCC and the approval of a majority of RCC’s directors in the case of non-recurring

or unusual transactions or events. RCM receives at least 25% of its incentive compensation in additional shares of RCC common stock and has the option to receive more of its incentive compensation in stock under the management agreement. We also receive an acquisition fee of 1% of the carrying value of the commercial finance assets we sell to RCC. In fiscal 2009, the management, incentive, servicing and acquisition fees we received from RCC were $8.2 million, or 8% of our consolidated

revenues. These fees have been reported as revenues through our operating segments.

Credit Facilities

We, or our subsidiaries, have access to three separate credit facilities, which we describe in this section.

Commercial Finance - Secured revolving credit facility.

PNC Bank, N.A. (previously National City Bank), or PNC Bank. LEAF has had a revolving warehouse credit facility with a group of banks led by PNC Bank since July 2006. On November 30, 2009, the facility was amended to extend the maturity of the facility to January

29, 2010 to provide additional time for the negotiation of a new longer-term facility. The amendment reduces the maximum credit facility to $125.0 million on December 30, 2009 and to $115.0 million on January 19, 2010, increase the interest rates on base rate borrowings to the base rate (as defined below) plus 4% and on LIBOR-based borrowings to LIBOR plus 5%, reduces the advance rate and alters certain covenants.

The $150.0 million credit facility was previously amended in July and September 2009. The $150.0 million credit facility was previously amended in July and September 2009. As of November 15, 2009, the facility was reduced to $135.0 million. The

July 2009 amendment increased the rate of interest on borrowings outstanding to either (i) the base rate plus 2.75% or (ii) LIBOR plus 3.75%. The base rate is the higher of (i) the prime rate, as defined or (ii) the Federal Funds Rate plus 0.5% and (iii) the LIBOR plus 1%. Prior to July 31, 2009, interest was charged at one of two rates: (i) LIBOR plus 1.5%, or (ii) the prime rate. The facility is non-recourse to us and the underlying equipment being leased or financed collateralizes

the borrowings. In September 2007, LEAF entered into a two-year $75.0 million interest rate swap agreement in order to mitigate the effect of fluctuations in LIBOR. The swap agreement terminated in September 2009. Weighted average borrowings for fiscal 2009 and 2008 were $133.7 million and $136.1 million, respectively, at an effective interest rate of 5.0% and 5.7%, respectively.

Corporate – Secured revolving credit facilities:

TD Bank, N.A. (previously Commerce Bank, N.A.), or TD Bank). We have had a revolving credit facility with TD Bank since May 2007. In November 2009, the facility was amended to (i) extend the maturity date of the loan for an additional year to October 15, 2011,

(ii) decrease the available borrowings to $20.0 million as of November 6, 2009, (iii) reduce the interest rate on the loan to (a) the prime rate of interest plus 3% with a floor of 7% or (b) LIBOR plus 4.5% with a floor of 7.5% and (iv) reduce the monthly reduction in maximum credit facility amount from $850,000 to $150,000 per month. The amendment requires us to further reduce the maximum revolving credit amount to $15.0 million as of June 30, 2010. In consideration for these modifications,

we paid a fee of $345,000 to the lender in lieu of our obligation to pay a $500,000 fee due from the May 2009 amendment.

The facility had previously been amended on May 15, 2009 to (i) extend the maturity to October 15, 2010, (ii) reduce the maximum revolving credit facility amount to $35.0 million (from $45.0 million), (iii) provide for a monthly reduction in the maximum credit facility by $850,000 commencing June 15, 2009, (iv) increase the interest rate

on borrowings to the greater of 10.0% or the prime rate of interest plus 5.0%, (v) eliminate the net worth covenant and (vi) increase the letter of credit fee to 5.25%. In consideration for these modifications, we paid a $1.0 million fee to the lender as of the amendment date and were committed, except under certain circumstances, to pay an additional $500,000 fee in December 2009.

The facility has an unused fee of 0.25% per annum, payable quarterly in arrears. Borrowings are secured by a first priority security interest in certain of our assets and certain subsidiary guarantors, including (i) the present and future fees and investment income earned in connection with the management of, and investments

in, sponsored CDO issuers, (ii) a pledge of 12,972 shares of TBBK common stock, and (iii) the pledge of 1,491,088 shares of RCC common stock. Availability under the facility is limited to the lesser of (a) 75% of the net present value of future management fees to be earned or (b) the maximum revolving credit facility amount. Weighted average borrowings for fiscal 2009 and 2008 were $39.6 million and $50.8 million, respectively, at an effective interest rate of 8.7% and 7.0%, respectively. As

of September 30, 2009, borrowings outstanding were $26.5 million and the line was fully utilized.

Through March 25, 2009, interest was charged at one of two rates at our election: (i) the prime rate plus 1%, or (ii) LIBOR plus 2.25%. From March 26, 2009 to May 15, 2009, the rates had been increased to: (i) the prime rate plus 2.25%, or (ii) LIBOR plus 3.5%.

Sovereign Bank. We have a revolving line of credit with Sovereign Bank with $577,000 of outstanding borrowings as of September 30, 2009. The facility has expired. We are currently negotiating a long term

renewal. The facility is secured by certain investment securities available-for-sale. There was no availability based on the value of the collateral at September 30, 2009. Interest is charged on outstanding borrowings at one of two rates elected at our option: (i) LIBOR plus 2.0%, or (ii) the prime rate. Weighted average borrowings for fiscal 2009 and 2008 were $3.1 million and $6.0 million, respectively, at an effective interest rate of 5.1% and 6.7%, respectively.

Asset Sourcing for Commercial Finance and Real Estate

Commercial finance. LEAF is responsible for sourcing commercial finance investments primarily through program relationships with manufacturers and dealers of essential use equipment and software as well as through acquisitions of existing portfolios originated by third

parties. LEAF’s strategy for originations involves integrating its finance products into the sales and marketing organizations of its program partners such as Dell, Mitel, 3M, Toshiba, OCE, Konica Minolta, Extreme Networks, Honeywell, Sage, Phillips, and Sullivan Schein. By developing and maintaining program relationships with manufacturers and dealers, LEAF is able to leverage and utilize the sales organizations of its partners to market its commercial finance products and services to the highly

dispersed population of small- to medium-sized businesses, which is LEAF’s targeted demographic. On acquisitions, LEAF seeks organizations with a portfolio of financing contracts that provide acceptable returns for its investment entities coupled with proven origination teams.

Real estate. Resource Real Estate is responsible for sourcing investments for our real estate operations and CMBS, which our financial fund management operations have secured. In addition, we maintain relationships with asset owners, institutions, existing partners

and borrowers, who often source investment opportunities directly to us. We maintain offices in Philadelphia, New York, Denver and Los Angeles that provide us with a national platform of acquisition and loan origination specialists that source deals from key intermediaries such as commercial real estate brokers, mortgage brokers and specialists in selling discounted and foreclosed assets. We systematically work to exchange market data and asset knowledge across the platform to provide instant

market feedback on potential investments that is based on empirical data as well as on our $1.7 billion portfolio of assets under management.

Employees

As of September 30, 2009, excluding our property management team, we employed 451 full-time workers, a decrease of 95, or 17%, from 546 employees at September 30, 2008. The following table summarizes our employees by operating segment:

|

Total |

Financial Fund Management |

Real Estate |

Commercial Finance |

Corporate/ Other |

||||||||||||||||

|

September 30, 2009 |

||||||||||||||||||||

|

Investment professionals |

121 | 32 | 26 | 61 | 2 | |||||||||||||||

|

Other |

330 | 16 | 17 | 259 | 38 | |||||||||||||||

| 451 | 48 | 43 | 320 | 40 | ||||||||||||||||

|

Property management |

318 | − | 318 | − | − | |||||||||||||||

|

Total |

769 | 48 | 361 | 320 | 40 | |||||||||||||||

|

September 30, 2008 |

||||||||||||||||||||

|

Investment professionals |

179 | 39 | 31 | 104 | 5 | |||||||||||||||

|

Other |

367 | 19 | 18 | 294 | 36 | |||||||||||||||

| 546 | 58 | 49 | 398 | 41 | ||||||||||||||||

|

Property management |

253 | − | 253 | − | − | |||||||||||||||

|

Total |

799 | 58 | 302 | 398 | 41 | |||||||||||||||

Operating Segments

We provide information on our operating segments in Note 23 to our consolidated financial statements included in Item 8 of this report.

Available Information

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The public may read and copy information we file with the SEC at the SEC’s public reference room at 450 Fifth Street, NW, Washington, D.C. 20549. The public may obtain information on the operations of the Public

Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The internet address of the SEC site is http://www.sec.gov. Our internet address is http://www.resourceamerica.com. We

make our SEC filings available free of charge on or through our internet website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. We are not incorporating by reference in this report any material from our website.

|

RISK FACTORS. |

You should carefully consider the following risks together with all of the other information contained in this report in evaluating our company. If any of these risks develop into actual events, our business, financial condition and results of operations could be materially adversely affected and the trading price of our common

stock could decline.

Risks Related to Our Business Generally

Our business depends upon our ability to sponsor, and raise debt and equity capital for, our investment funds.

Our business as a specialized asset manager depends upon our ability to sponsor investment funds, raise sufficient debt financing for these funds and to generate management fees by managing those funds and the assets they hold. If we are unable to raise capital or obtain financing through these funds, we will not be able to

increase our assets under management and, accordingly, our revenues from management fees will be significantly reduced. Our ability to raise capital and obtain financing through these funds depends upon numerous factors, many of which are beyond our control, including:

|

|

· |

existing capital markets conditions. As a result of the ongoing credit market turmoil, we may not be able to obtain debt financing on attractive terms. As a result, we may be required to use a greater proportion of our equity funds to complete asset acquisitions and originations, reducing the number of investments we would otherwise make. If the current capital markets environment

persists, we may modify our investment strategy in order to optimize our portfolio performance. Our options would include limiting or eliminating the use of debt and focusing on those investments that do not require the use of leverage to meet our portfolio goals. During fiscal 2009, the market constraints on our ability to obtain debt financing caused our commercial finance operations to reduce originations of leases and loans held for our investment entities, as well as for our account,

which reduced our operating revenues. For our financial fund management operations, the availability of financing has been largely halted; |

|

|

· |

market acceptance of the types of funds we sponsor and market perceptions about the types of assets which we seek to acquire for our funds which has been impaired by current market conditions; |

|

|

· |

the willingness or ability of retail investors, a principal source of investment funds for our commercial finance and real estate investment funds, to invest in long-term, relatively illiquid investments of the type sponsored by us; |

|

|

· |

the performance of our existing funds. During fiscal 2009, several of our funds reduced or ceased to make equity distributions as a result of reduced operations. In one of those funds, we have deferred our management fees until such time as we are able to resume those distributions in full; |

|

|

· |

the availability of qualified personnel to manage our funds; |

|

|

· |

the availability of suitable investments in the types of loans, real estate, commercial finance assets and other assets that we seek to acquire for our funds; and |

|

|

· |

interest rate changes and their effect on both the assets we seek to acquire for our funds, and the amount, cost and availability of acquisition financing. |

Declines in the market values of our investments may reduce periodic reported results, credit availability and our ability to make distributions.

We classify a substantial portion of our assets for accounting purposes as “available-for-sale.” As a result, changes in the market values of those assets are directly charged or credited to stockholders’ equity. A decline in these values will reduce

the book value of our assets. Moreover, if the decline in value of an available-for-sale asset is other-than-temporary, such decline will reduce earnings. As a result of market conditions, the market value of many of our assets has declined. We cannot assure you that there will not be further declines in the value of our assets, or that the declines will not be material.

A decline in the market value of our assets may also adversely affect us in instances where we have borrowed money based on the market value of those assets. If the market value of those assets declines, the lender may require us to post additional collateral to support the loan. If we were unable to post the additional

collateral, we could have to sell the assets under adverse market conditions. As a result, a reduction in credit availability may reduce our earnings.

Interest rate changes may reduce the value of our assets, our returns on these assets and our ability to generate and increase our management fee revenues.

Changes in interest rates will affect the market value of assets we hold for our own account and our returns from such assets. In general, as interest rates rise, the value of fixed-rate investments, such as equipment leases and loans, will decrease, while as interest rates fall, the return on variable rate assets will fall. In

addition, changes in interest rates may affect the value and return on assets we manage for our investment funds, thereby affecting both our management fees from those funds as well as our ability to sponsor additional investment funds, which, in turn, may affect our ability to generate and increase our management fee revenues.

Increases in interest rates will increase our operating costs.

As of September 30, 2009, we had two corporate credit facilities and one commercial finance credit facility. We may seek to obtain other credit facilities depending upon capital markets conditions. All of our current credit facilities are at variable interest rates, and any facilities that we may be required to consolidate

will also be at variable rates. As a result, increases in interest rates on our credit facilities, to the extent they are with recourse to us and are not matched by increased interest rates or other income from the assets whose acquisition was financed by these facilities, or are not subject to effective hedging arrangements, will increase our interest costs, which would reduce our net income or cause us to sustain losses. In addition, any financing we obtain may require us to maintain a

specified ratio of the amount of the loan to the value of the underlying assets. A decrease in the value of these assets may lead to margin calls or calls for the pledge to, or deposit with, the lender of additional assets. We may not have sufficient funds or unpledged assets to satisfy these calls. While losses sustained by CDOs or other VIEs we consolidate are typically without recourse to us, financing we obtain may impose financial covenants calculated pursuant to U.S. GAAP,

which would include the effects of the these consolidated VIEs. As a result, asset value declines or other adverse occurrences in the CDOs may cause us to breach these covenants, which could lead to margin calls or, possibly, constitute events of default under our corporate or other credit facilities.

Changes in interest rates may impair the operating results of our investment funds and thereby impair our operating results.

The investments made by many of our funds are interest rate sensitive. As a result, changes in interest rates could reduce the value of the assets held and the returns to investors, thereby impairing our ability to raise capital, reducing the management and other fees from those funds and reducing our returns on, and the value

of, amounts we have invested in those funds.

If we cannot generate sufficient cash to fund our participations in our investment funds, our ability to maintain and increase our revenues may be impaired.

We typically participate in our investment funds along with our investors, and believe that our participation enhances our ability to raise capital from investors. We typically fund our participations through cash derived from operations or from financing. If our cash from operations is insufficient to fund our participation

in future investment funds we sponsor, and we cannot arrange for financing, our continuing ability to raise funds from investors and, thus, our ability to maintain and increase the revenues we receive from fund management, will be impaired.

Termination of management arrangements with one or more of our investment funds could harm our business.

We provide management services to our investment funds through management agreements, through our position as the sole or managing general partner of partnership funds, through our position as the operating manager of other fund entities, or combinations thereof. Our arrangements are long-term, and frequently have no specified

termination dates. However, our management arrangements with, or our position as general partner or operating manager of, an investment fund typically may be terminated by action taken by the investors. Upon any such termination, our management fees, after payment of any termination payments required, would cease, thereby reducing our expected revenues. Moreover, under our credit facility with TD Bank, the borrowing base depends upon the value of the collateral pledged, which

includes management fees from our financial fund management segment. As a result, termination of one or more management arrangements would reduce our collateral which could reduce our borrowing base. If the borrowing base were reduced below amounts outstanding on the facility, we would be required to repay the excess. To the extent we do not have cash available to repay the excess, we may be required to sell assets to obtain the necessary cash; any such sale may not be on economically

attractive terms, particularly under current economic condition.

We may have difficulty managing our asset portfolios under current market conditions.

Current market conditions have increased the complexity of managing the assets held by us and our investment funds. As a result, we depend on the ability of our officers and key employees to continue to implement and improve our operational, financial and management controls, reporting systems and procedures to deal effectively

with the complexity of the conditions under which we operate. We may not be able to implement improvements to our management information and control systems in an efficient or timely manner and may discover deficiencies in existing systems and controls. Consequently, we may experience strains on our administrative and operations infrastructure, increasing our costs or reducing or eliminating our profitability.

Our allowance for credit losses may not be sufficient to cover future losses.

At September 30, 2009, our allowances for possible credit losses were $3.2 million in commercial finance (57% of the book value of our leases and loans held for investment in our commercial finance segment) and $1.6 million in real estate (36% of the book value of our investments in real estate loans). We cannot assure you that

these allowances will prove to be sufficient to cover future losses, or that future provisions for credit losses will not be materially greater than those we have recorded to date. Losses that exceed our allowance for credit losses, or cause an increase in our provision for credit losses, could materially reduce our earnings.

Many of the assets we hold in our portfolios are illiquid, and we may not be able to divest them in response to changing economic, financial and investment conditions.

Many of the assets in our portfolio, including those of VIEs included in our consolidated financial statements, do not have ready markets. Moreover, we believe that the market for many of the assets in our portfolio, particularly real estate and CDO interests, have been severely constricted as a result of current economic conditions. As

a result, many of our portfolio assets are relatively illiquid investments. We may be unable to vary our portfolio in response to changing economic, financial and investment conditions or to sell our investments on acceptable terms should we desire to do so.

We are subject to substantial competition in all aspects of our business.

Our ability to sponsor investment funds is highly dependent on our access to various distribution systems of national, regional and local securities firms, and our ability to locate and acquire appropriate assets for our investment funds. We are subject to substantial competition in each area. In the distribution

area, our investment funds compete with those sponsored by other asset managers, which are being distributed through the same networks, as well as investments sponsored by the securities firms themselves. While we have been successful in maintaining access to these distribution channels, we cannot assure you that we will continue to do so. The inability to have continued access to our distribution channels could reduce the number of funds we sponsor and assets we manage, thereby impeding

and possibly impairing our revenues and revenue growth.

In acquiring appropriate assets for our investment funds, we compete with numerous public and private investment entities, commercial banks, investment banks and other financial institutions, as well as industry participants in each of our separate asset management areas. Many of our competitors are substantially larger and

have considerably greater financial, technical and marketing resources than we do. Competition for desirable investments may result in higher costs and lower investment returns, and may delay our sponsorship of investment funds.

There are few economic barriers to entry in the asset management business.

Our investment funds compete against an ever-increasing number of investment and asset management products and services sponsored by investment banks, banks, insurance companies, financial services companies and others. There are few economic barriers to entry into the investment or asset management industries and, as a result,

we expect that competition for access to distribution channels and appropriate assets to acquire will increase.

The Company’s ability to realize its deferred tax asset may be reduced, which may adversely impact results of operations.

Realization of a deferred tax asset requires us to exercise significant judgment and is inherently uncertain because it requires the prediction of future occurances. Our deferred tax asset may be reduced in the future if estimates of future income or our tax planning strategies do not support

the amount of the deferred tax asset. If it is determined that a valuation allowance of its deferred tax asset is necessary, the Company may incur a charge to earnings.

Risks Relating to Particular Aspects of Our Commercial Finance, Financial Fund Management and Real Estate Operations

If LEAF cannot renew, extend or replace its existing credit facility, its ability to originate equipment leases and loans may be impaired and it may have to sell assets to obtain cash to repay the facility.

LEAF's existing secured revolving credit facility expires on January 29, 2010. If LEAF cannot renew or extend the facility, or obtain a replacement facility, LEAF's ability to originate new equipment leases and loans may be impaired. Even

if LEAF is able to renew, extend or replace the facility, the economic terms upon which it is able to do so may be less favorable to LEAF than the terms currently in effect which would reduce LEAF's net revenues and, as a consequence, adversely affect our earnings. Moreover, if LEAF is unable to renew, extend or replace the facility, it will be required to repay the outstanding balance of the facility on its January 29, 2010 maturity. We believe LEAF would repay the balance by accelerating

sales to the investment entities they sponsor. If these entities lack capacity to purchase the assets, LEAF would have to seek sales to third parties. There can be no assurance that LEAF would be able to make any such sales on acceptable terms, or at all, and, as a consequence, that LEAF would not experience material reductions in net income, or losses which would adversely affect our earnings.

The Company may incur impairments to goodwill.

At September 30, 2009, we had $8.0 million recorded as goodwill. We review our goodwill at least annually. Significant negative industry or economic trends, including the lack of recovery in the market price of the Company’s common stock, reduced estimates of future cash flows or disruptions to the commercial

finance business, could indicate that goodwill might be impaired. Our valuation methodology for assessing impairment requires management to make judgements and assumptions based on historical experience and to rely on projections of future operating performance. Our commercial finance business operates in competitive environments and projections of future operating results and cash flows may vary significantly from actual results. If our analysis results in an impairment to its

goodwill, we would be required to record a non-cash charge to earnings in its financial statements during the period in which such impairment is determined to exist. Any such change could have a material adverse effect on our results of operation and our stock price.

While we expect that we will transfer to third-party programs a substantial portion of the commercial finance assets that we originate or acquire, we may retain some assets for our own account. Many of the entities seeking equipment financing from us are small- to middle-size businesses which may have less resources than larger

businesses and which may be disproportionally affected by current economic conditions. As a result, we may be subject to higher risks of a default than if we provided equipment financing to larger businesses. While we will seek to repossess and re-lease or sell the equipment subject to a defaulted lease or other commercial finance instrument, we may not be able to do so on advantageous terms. If a borrower files for protection under the bankruptcy laws, we may experience difficulties

and delays in recovering the equipment. Moreover, the equipment may be returned in poor condition and we may be unable to enforce important lease or loan provisions against an insolvent borrower, including the contract provisions that require the borrower to return the equipment in good condition. In some cases, the deteriorating financial condition of a borrower may make trying to recover what it owes impractical. The costs of recovering equipment upon a default, enforcing obligations

under the lease or loan, and transporting, storing, repairing and finding a new borrower or purchaser for the equipment may be high. All the foregoing risks may be heightened by economic conditions currently existing in the United States. Higher than expected lease defaults will result in a loss of anticipated revenues and will reduce our ability to operate LEAF at a profit.

As a result of recent conditions in the global credit markets, our ability to sponsor investment entities and increase our assets under management may be limited.

Our financial fund management business has largely consisted of the sponsorship and management of CDO issuers. As a result of recent conditions in the global credit markets, sponsorship of new CDOs was impracticable in fiscal 2009 and likely will continue to be impracticable in fiscal 2010. Moreover, our ability to

sponsor investment funds in our commercial finance and real estate segments depends to a significant extent on our ability to obtain financing. Our ability to obtain new financing, and refinance existing financing, both for us and for our investment funds, was adversely impacted by credit market conditions in fiscal 2009. We cannot assure you that we will be able to obtain new financing or refinance existing financing in the future on acceptable financial terms, or at all. An

inability to obtain financing could limit or eliminate our ability to sponsor investment entities and increase our assets under management and, accordingly, impair our ability to generate asset management fees.

We typically have retained some portion or all of the equity in the CDOs we sponsored. CDO equity receives distributions from the CDO only if the CDO generates enough income to first pay the holders of the debt securities and the CDO’s expenses.

We typically have retained some portion or all of the equity interest in CDOs we sponsored either directly or through limited partnership investments. The equity is usually entitled to all of the income generated by the CDO after the CDO pays all of the interest due on the debt securities and its other expenses, and is entitled

to a return on capital only when the principal amount and accrued interest of all of the debt securities has been paid. However, there will be little or no income available to the CDO equity if covenants regarding the operations of a CDO (primarily relating to the value of collateral and interest coverage) are not met, or if there are excessive payment defaults, payment deferrals or rating agency downgrades by the issuers of the underlying collateral, and there may be little or no amounts available

to return our capital. In that event, the value of our direct or indirect investment in the CDO’s equity, which for all CDOs was approximately $8.2 million at September 30, 2009, could decrease substantially or be eliminated. In addition, the equity securities of CDOs are generally illiquid, and because they represent a leveraged investment in the CDO’s assets, the value of the equity securities will generally have greater fluctuations than the value of the underlying collateral.

In some of our investment funds, a portion of our management fees may depend upon the performance of the fund and, as a result, our management fee income may be volatile.

As of September 30, 2009, a portion of our management fees is subordinated to the investors’ receipt of specified returns in 11 of the CDOs we manage. In addition, with respect to RCC and six of our investment entities, we receive incentive or subordinated compensation in addition to our base management fee, depending

upon whether RCC or those partnerships achieve returns above specified levels. During fiscal 2009 and 2008, we earned incentive and subordinated management fees from RCC and from 21 and 22 CDOs, respectively, which constituted 17% and 20%, respectively, of our aggregate management fee income for both periods. As a result of current economic conditions, the amount of incentive or subordinated management fee income we receive maybe reduced, and any such reduction may be material.

Real estate loans in our portfolio are subject to a higher risk of loss than conventional mortgage loans.

Real estate loans in our portfolio differ significantly from conventional mortgage loans. In particular, these loans:

|

|

· |

are junior mortgage loans; |

|

|

· |

involve payment structures other than equal periodic payments that retire a loan over its term; |

|

|

· |

require the borrower to pay a large lump sum at loan maturity (which will depend upon the borrower’s ability to obtain financing or otherwise raise a substantial amount of cash at maturity); and |

|

|

· |

while producing income, do not generate sufficient revenues to pay the full amount of debt service on the loan as originally structured. |

As a result, real estate loans in our portfolio may have a higher risk of default and loss than conventional mortgage loans, and may require us to become involved in expensive and time-consuming workouts, or bankruptcy, reorganization or foreclosure proceedings.

In addition, the principal or sole source of recovery for our real estate loans is typically the underlying property and, accordingly, the value of our loans, and our ability to collect loan payments will depend upon local, regional and national economic conditions, and conditions affecting the property specifically, including the cost

of compliance with, and liability under environmental, health and safety laws, changes in interest rates and the availability of financing, casualty losses, the attractiveness of the property, the availability of tenants, the ability of tenants to pay rent, competition from similar properties in the area and neighborhood values. Operating and other expenses of real properties, particularly significant expenses such as real estate taxes, insurance and maintenance costs, generally do not decrease when

revenues decrease and, even if revenues increase, operating and other expenses may increase faster than revenues.

|

UNRESOLVED STAFF COMMENTS. |

None

|

PROPERTIES. |

Philadelphia, Pennsylvania:

We maintain our executive and corporate offices at One Crescent Drive in the Philadelphia Navy Yard under a lease for 13,484 square feet that expires in May 2019. Certain of our financial fund management and real estate operations are also located in these offices. We lease

21,554 square feet for additional executive office space and for certain of our real estate operations at 1845 Walnut Street, Philadelphia, Pennsylvania. We sublease a portion of this space to Atlas Energy, Inc. (formerly Atlas America, Inc., or Atlas Energy, our former energy subsidiary). This lease, which expires in May 2013, is in an office building in which we own a 5% equity interest. Our commercial finance operations

are located in another office building at One Commerce Square, 2005 Market Street, 15th Floor, Philadelphia, Pennsylvania under a lease for 59,448 square feet that expires in August 2013.

New York, New York:

We maintain additional executive offices in a 19,590 square foot location (of which a portion is sublet to Atlas Energy) at 712 5th Avenue, New York, New York under a lease agreement that expires in March 2010.

Other Locations:

Our commercial finance operations own a 29,500 square foot building at 1720A Crete Street, Moberly, Missouri. In addition, we maintain various office leases in the following cities: Omaha, Nebraska; Los Angeles and Santa Ana, California; Denver, Colorado and Columbia, South Carolina. We also lease office

space in London, England for our European operations.

|

LEGAL PROCEEDINGS. |

In August 2009, Riverside National Bank of Florida, or Riverside, initiated a lawsuit now captioned Riverside National Bank of Florida v. The McGraw-Hill Companies, Inc. et al., New York Supreme Court, New York County, No. 650665/2009, against several investment banks, rating

agencies, and collateral managers of CDOs, including Trapeza Capital Management, LLC, or TCM. We own a 50% interest in TCM, and an unaffiliated third-party owns the other 50% interest.

The complaint seeks monetary damages in an unspecified amount against TCM arising out of Riverside’s investment in certain CDOs between 2005 and 2007. Riverside’s claims against TCM stem from its role as collateral manager for various Trapeza CDOs, which were sold by various investment banks. The complaint

alleges that the offering materials for the CDOs were prepared in part by TCM and were false and misleading. The complaint further alleges that TCM breached fiduciary and contractual obligations by failing to properly monitor the collateral for the CDOs, failing to mitigate losses and failing to disclose known quality and performance problems with the underlying collateral. TCM believes that none of the claims have merit and intends to vigorously defend itself in this matter.

We are also a party to various routine legal proceedings arising out of the ordinary course of our business. Management believes that none of these actions, individually or in the aggregate, will have a material adverse effect on our financial condition or operations.

|

ITEM 4. |

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

No matter was submitted to a vote of security holders during the quarter ended September 30, 2009.

PART II

|

MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER | |

|

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Our common stock is quoted on the NASDAQ Global Select Market under the symbol "REXI." The following table sets forth the high and low sale prices as reported by NASDAQ on a quarterly basis for our last two fiscal years:

|

As Reported |

||||||||

|

High |

Low |

|||||||

|

Fiscal 2009 |

||||||||

|

Fourth Quarter |

$ | 6.23 | $ | 4.68 | ||||

|

Third Quarter |

$ | 6.60 | $ | 3.42 | ||||

|

Second Quarter |

$ | 4.19 | $ | 2.76 | ||||

|

First Quarter |

$ | 9.36 | $ | 3.25 | ||||

|

Fiscal 2008 |

||||||||

|

Fourth Quarter |

$ | 13.61 | $ | 8.35 | ||||

|

Third Quarter |

$ | 10.84 | $ | 8.01 | ||||

|

Second Quarter |

$ | 14.47 | $ | 9.44 | ||||

|

First Quarter |

$ | 18.71 | $ | 14.18 | ||||

As of December 1, 2009, there were 18,490,971 shares of common stock outstanding held by 402 holders of record.

We have paid regular quarterly cash dividends since the fourth quarter of fiscal 1995. Commencing with the dividend payable in the first quarter of fiscal 2006, we increased our quarterly dividend by 20% to $0.06 per common share and, beginning with the dividend payable in the first quarter

of fiscal 2007 and continuing to the second quarter of fiscal 2009, we further increased our quarterly dividend by 17% to $0.07 per common share. For the third and fourth quarters of fiscal 2009, we decreased our quarterly dividend by 57% to $0.03 per common share due to the volatility and reduction in liquidity in global credit markets.

Securities Authorized for Issuance under Equity Compensation Plans

|

(a) |

(b) |

(c) | |

|

Plan category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans excluding securities reflected in column (a) |

|

Equity compensation plans approved by security holders |

3,134,596 |

$9.04 |

576,863 |

Issuer Sales of Equity Securities

In connection with the sale of $15.6 million of our 12% senior notes on September 29, 2009, we issued five-year detachable warrants which provide purchasers with the right to acquire 3,052,940 shares of our common stock at an exercise price of $5.10 per share. At

completion of the sale of an additional $3.4 million of senior notes on October 6, 2009, we issued additional warrants to purchase 637,255 shares upon the same terms. No separate consideration was paid by the purchasers for the warrants. See Note 12 to our consolidated financial statements included in Item 8 of this report. We relied upon the exemption from registration provided by Section 4(2) and Regulation D under the Securities Exchange Act of 1933, as amended. The

proceeds of the offering were used to paydown our credit facility with TD Bank by $4.7 million and for general corporate purposes.

Issuer Purchases of Equity Securities

On July 26, 2007, the Board of Directors approved a share repurchase program under which we may buy up to $50.0 million of our outstanding common stock from time to time, replacing a similar plan that had been approved by the Board in September 2004. As of September 30, 2009, we

have repurchased an aggregate of 188,123 shares at a total cost of $2.8 million under this program, at an average cost of $14.99 per share. We did not repurchase any shares during fiscal 2009.

Performance Graph

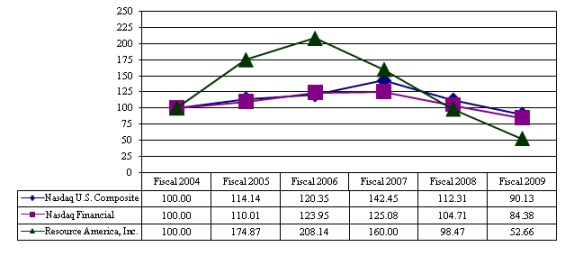

The following graph compares the cumulative total stockholder return on our common stock with the cumulative total return of two other stock market indices: the NASDAQ United States Composite and the NASDAQ Financial.

Comparison of Five Year Cumulative Total Return*

|

|

* |

Assumes $100 was invested on October 1, 2004 in our common stock or in the indicated index and that all cash dividends were reinvested as received. |

|

SELECTED FINANCIAL DATA. |

The following selected financial data should be read together with our consolidated financial statements, the notes to the consolidated financial statements and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Item 7 of this report. We derived the

selected consolidated financial data for each of the fiscal years ended September 30, 2009, 2008 and 2007, and as of September 30, 2009 and 2008 from our consolidated financial statements appearing elsewhere in this report, which have been audited by Grant Thornton LLP, an independent registered public accounting firm. We derived the selected financial data for the years ended September 30, 2006 and 2005 and as of September 30, 2007, 2006 and 2005 from our consolidated internal financial statements

for those periods. As a result of our spin-off of Atlas Energy in June 2005, financial data relating to our former energy operations were reclassified as discontinued operations for fiscal 2005. The following table sets forth selected operating and balance sheet data (in thousands, except per share data):

|

As of and for the Years Ended September 30, |

||||||||||||||||||||

|

2009 |

2008 |

2007 |

2006 |

2005 |

||||||||||||||||

|

(unaudited) |

||||||||||||||||||||

|

Statement of operations data: |

||||||||||||||||||||

|

Revenues: |

||||||||||||||||||||

|

Commercial finance |

$ | 49,395 | $ | 96,881 | $ | 40,692 | $ | 23,840 | $ | 13,381 | ||||||||||

|

Real estate |

25,417 | 31,519 | 22,987 | 23,076 | 17,791 | |||||||||||||||

|

Financial fund management |

33,344 | 27,536 | 63,089 | 28,457 | 19,550 | |||||||||||||||

|

Total revenues |

$ | 108,156 | $ | 155,936 | $ | 126,768 | $ | 75,373 | $ | 50,722 | ||||||||||

|

(Loss) income from continuing operations

before cumulative effect of a change in

accounting principle |

$ | (14,487 | ) | $ | (24,944 | ) | $ | 5,254 | $ | 15,668 | $ | 7,426 | ||||||||

|

(Loss) income from discontinued operations,

net of tax |

(444 | ) | (1,299 | ) | (1,558 | ) | 1,231 | 11,070 | ||||||||||||

|

Cumulative effect of a change in accounting

principle, net of tax |

− | − | − | 1,074 | − | |||||||||||||||

|

Net (loss) income |

$ | (14,931 | ) | $ | (26,243 | ) | $ | 3,696 | $ | 17,973 | $ | 18,496 | ||||||||

|

Basic (loss) earnings per common share: |

||||||||||||||||||||

|

Continuing operations |

$ | (0.81 | ) | $ | (1.42 | ) | $ | 0.30 | $ | 0.89 | $ | 0.42 | ||||||||

|

Discontinued operations |

(0.03 | ) | (0.08 | ) | (0.09 | ) | 0.07 | 0.63 | ||||||||||||

|

Cumulative effect of a change in accounting principle |

− | − | − | 0.06 | − | |||||||||||||||

|

Net (loss) income |

$ | (0.84 | ) | $ | (1.50 | ) | $ | 0.21 | $ | 1.02 | $ | 1.05 | ||||||||

|

Diluted (loss) earnings per common share: |

||||||||||||||||||||

|

Continuing operations |

$ | (0.81 | ) | $ | (1.42 | ) | $ | 0.27 | $ | 0.82 | $ | 0.38 | ||||||||

|

Discontinued operations |

(0.03 | ) | (0.08 | ) | (0.08 | ) | 0.07 | 0.58 | ||||||||||||

|

Cumulative effect of a change in accounting principle |

− | − | − | 0.05 | − | |||||||||||||||

|

Net (loss) income |

$ | (0.84 | ) | $ | (1.50 | ) | $ | 0.19 | $ | 0.94 | $ | 0.96 | ||||||||

|

Cash dividends per common share |

$ | 0.20 | $ | 0.28 | $ | 0.27 | $ | 0.24 | $ | 0.20 | ||||||||||

|

Balance sheet data: |

||||||||||||||||||||

|

Total assets |

$ | 375,840 | $ | 758,357 | $ | 966,452 | $ | 418,858 | $ | 463,037 | ||||||||||

|

Borrowings |

$ | 191,383 | $ | 554,059 | $ | 706,372 | $ | 172,238 | $ | 147,302 | ||||||||||

|

Stockholders’ equity |

$ | 139,818 | $ | 143,733 | $ | 185,347 | $ | 195,167 | $ | 191,138 | ||||||||||

|

ITEM 7. |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION |

|

AND RESULTS OF OPERATIONS. |

Overview

We are a specialized asset management company that uses industry specific expertise to evaluate, originate, service and manage investment opportunities in the commercial finance, real estate and financial fund management sectors. As a specialized asset manager, we seek to develop investment

funds for outside investors for which we provide asset management services, typically under long-term management arrangements either through a contract with, or as the manager or general partner of, our sponsored investment funds. We typically maintain an investment in the funds we sponsor. Assets under management have grown from $7.1 billion at September 30, 2005 to $13.7 billion at September 30, 2009.