Attached files

| file | filename |

|---|---|

| 8-K - TERRESTAR CORP | c129948k.htm |

December 2009

1

Safe

Harbor

“Safe

Harbor” Statement under the Private Securities Litigation Reform Act of

1995:

This

presentation includes “forward looking statements.” All statements other than

statements of

historical facts included in this presentation regarding the prospects of our industry and our

prospects, plans, financial position and business strategy, may constitute forward looking

statements. These statements are based on the beliefs and assumptions of our management and

on the information currently available to our management at the time of such statements. Forward

looking statements generally can be identified by the words “believes,” “expects,” “anticipates,”

“intends,” “plans,” “estimates” or similar expressions that indicate future events and trends. Although

we believe that the expectations reflected in these forward-looking statements are reasonable,

these expectations may not prove to be correct. Important factors that could cause actual results to

differ materially from our expectations are disclosed in our filings with the United States Securities

and Exchange Commission (“SEC”). All subsequent written and oral forward-looking statements

attributable to us or persons acting on our behalf are expressly qualified in their entirety by the

cautionary statements included our SEC filings. Factors, risks and uncertainties that could cause

actual outcomes and results to be materially different from those projected include, but are not

limited to, our ability to obtain financing, obtain and maintain regulatory approvals, generate

sufficient cash flows, develop our universal chipset architecture, achieve market acceptance for our

services, develop our network and generate technological innovations.

historical facts included in this presentation regarding the prospects of our industry and our

prospects, plans, financial position and business strategy, may constitute forward looking

statements. These statements are based on the beliefs and assumptions of our management and

on the information currently available to our management at the time of such statements. Forward

looking statements generally can be identified by the words “believes,” “expects,” “anticipates,”

“intends,” “plans,” “estimates” or similar expressions that indicate future events and trends. Although

we believe that the expectations reflected in these forward-looking statements are reasonable,

these expectations may not prove to be correct. Important factors that could cause actual results to

differ materially from our expectations are disclosed in our filings with the United States Securities

and Exchange Commission (“SEC”). All subsequent written and oral forward-looking statements

attributable to us or persons acting on our behalf are expressly qualified in their entirety by the

cautionary statements included our SEC filings. Factors, risks and uncertainties that could cause

actual outcomes and results to be materially different from those projected include, but are not

limited to, our ability to obtain financing, obtain and maintain regulatory approvals, generate

sufficient cash flows, develop our universal chipset architecture, achieve market acceptance for our

services, develop our network and generate technological innovations.

The

forward-looking statements in this presentation are made only as of the date of

this

presentation.

presentation.

We

undertake no obligation to update or revise the forward-looking statements,

whether as a result

of new information, future events or otherwise.

of new information, future events or otherwise.

2

TerreStar

Delivers in 2009

• Introduced the

world's first quad-band GSM and tri-band WCDMA/HSPA

smartphone with integrated all-IP satellite-terrestrial voice and data capabilities

- TerreStar Genus™.

smartphone with integrated all-IP satellite-terrestrial voice and data capabilities

- TerreStar Genus™.

• Signed agreements

with Qualcomm and Infineon to add S Band satellite

capability to next generation mobile chipsets enabling integrated satellite

functionality in mass-market devices costing about the same as cellular-only

devices.

capability to next generation mobile chipsets enabling integrated satellite

functionality in mass-market devices costing about the same as cellular-only

devices.

• Launched the

world’s largest, most powerful commercial communications

satellite - TerreStar-1 and successfully deployed its 18 meter reflector, the

largest commercial satellite antenna ever unfurled.

satellite - TerreStar-1 and successfully deployed its 18 meter reflector, the

largest commercial satellite antenna ever unfurled.

• Brought on-line

redundant gateway earth stations in the United States and

Canada.

Canada.

• Completed the

first end-to-end phone call over TerreStar-1 between two

TerreStar GENUS™ smartphones and satisfied last regulatory milestones.

TerreStar GENUS™ smartphones and satisfied last regulatory milestones.

• Announced the

successful completion of in-orbit testing of TerreStar-1.

• Activated an

all-IP, 4G core network.

• Executed a

distribution agreement with AT&T whereby AT&T will offer the

TerreStar GENUS solution to its government and commercial customers.

TerreStar GENUS solution to its government and commercial customers.

• Signed multi-year,

multi-million dollar revenue lease of 1.4GHz spectrum asset.

• Received FCC and

industry certification for the TerreStar GENUS™

smartphone.

3

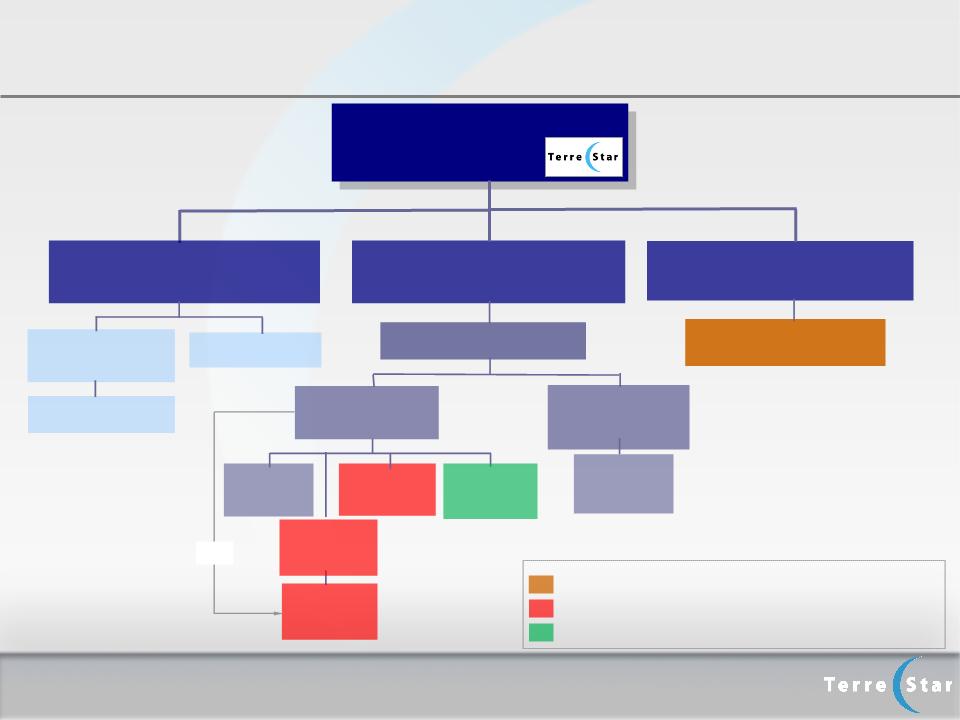

Holdings

structured to comply with Canadian foreign ownership rules

Legal

entity holding of 8 MHz of 1.4GHz spectrum

Legal

entity holding of 20 MHz of 2.0 GHz spectrum

TerreStar

Corporation

(NASDAQ:

TSTR)

MVH

HOLDINGS INC.

(100%

owned)

MOTIENT

HOLDINGS INC.

(100%

owned)

TerreStar

National

Services,

Inc.

(Government

Sub)

(100%

owned)

MOTIENT

VENTURES HOLDING INC.

(100%

owned)

TERRESTAR

NETWORKS

INC.

(88.4%

owned)

MOTIENT

COMMUNICATIONS

INC.

(100%

owned)

MOTIENT LICENSE

INC.

(100%

owned)

MOTIENT SERVICES

INC.

(100%

owned)

TerreStar

License

Inc.

(License

Sub)

(100%

owned)

TERRESTAR

GLOBAL

LTD

(a Bermuda

Company)

(86.5%

owned)

TerreStar

Europe

Limited

(a

UK Company)

(100%

owned)

TerreStar

Networks

Holdings

(Canada)

Inc.

(33-1/3%

owned)

TerreStar

Networks

(Canada)

Inc.

(80%

owned)

20%

4506901

Canada Inc

(100%

owned)

TERRESTAR

HOLDINGS INC.

(100%

owned)

TERRESTAR

1.4 HOLDINGS LLC

(100%

owned)

TerreStar

Corporate Structure

4

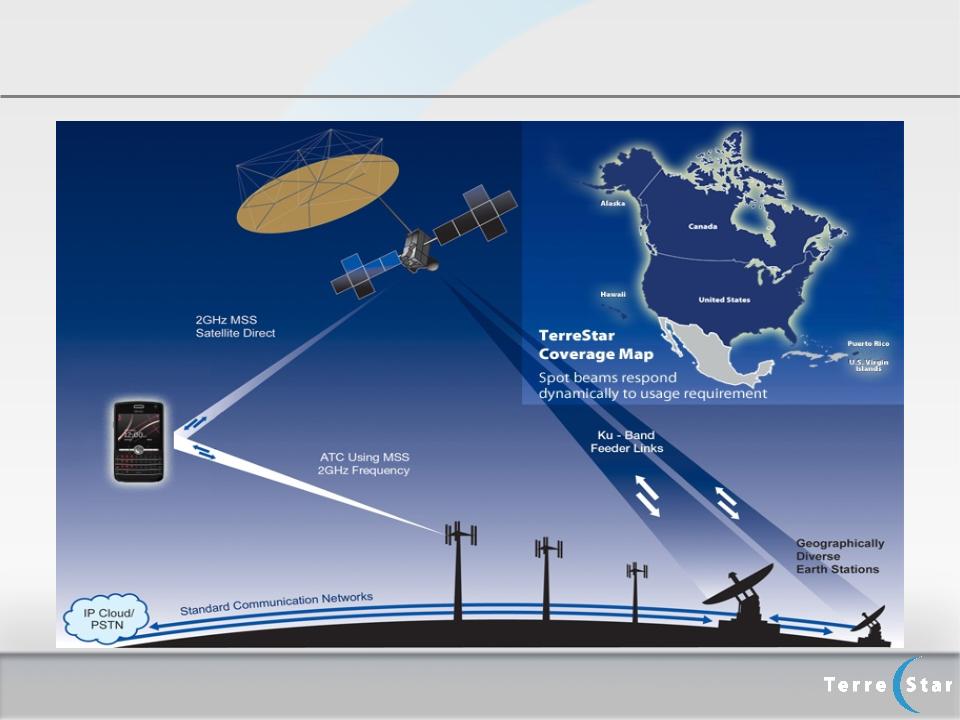

Integrated

Network Architecture

5

Significant

Development Progress

TerreStar

Networks Strategy

• Spectrum

Perfected, License Secured

– Successful Satellite

Launch

– Call Completed Over

Satellite with Integrated Satellite-Terrestrial Devices

– All FCC and IC

Milestones Achieved

• Minimize

Risk

– Experienced

Management

– Market-Defining

Technology

– Tier 1 Partners and

Suppliers

• Prudent

Capital Plan

– Targeted and

Prioritized Technology Spend

– Aggressive Operating

Expense Reduction

– Restructured

Agreements with Partners and Suppliers

6

Significant

Assets and Capabilities

|

Assets

|

Capabilities

|

|

• Most powerful

two-way commercial communications

satellite ever launched • TerreStar-2

underway

• 2 Satellite

Gateways licensed, ground segments

completed -- in testing • ATC global IP

license portfolio

|

• Beam coverage:

United States, Canada, Puerto

Rico, Hawaii, Alaska and US Virgin Islands • Capable of

generating approximately 500

simultaneous spot beams |

|

Significant

2 GHz Ecosystem

|

7

Industry-Leading

Partners and Suppliers

Critical

Partner Ecosystem is in Place and Executing to Plan

8

Key

Dates

Complete

Satellite simulated

calls with ground network

calls with ground network

Final

Satellite review for

shipment to launch base

shipment to launch base

Commence

Core Network/IT

Development Program

Development Program

TerreStar-1

Launch

TerreStar

Network

Operational

Operational

EB

Commercial Terminals

ready

ready

Final

hardware and software

certification to perfect

spectrum

certification to perfect

spectrum

FCC

& PTCRB

(industry)

certification

Scale

Commercial Service

Launch with AT&T

Launch with AT&T

2009

2010

Satellite

Demonstration

at

IACP conference

Limited

Service Launch

9

TerreStar

GENUSTM

Smartphone

|

|

|

|

|

|

|

|

|

|

• Components usable by

any ODM

• Windows Mobile

Professional 6.5

• Touch

Screen

• QWERTY

Keyboard

• Dual-band WCDMA (850

and 1900)

• Quad-band GSM/EGPRS

(850,900,1800,1900)

• Wi-Fi

• Bluetooth

• 2.x GHz

GMR-3G

• No external

antenna

• Conventional Size

& Weight

– 4.2” x 2.5” x

0.8”

– 5.2 ounces (with

battery)

FCC

& PTCRB (industry)

certification -- December 2009

certification -- December 2009

10

Next

Generation Chipsets

|

Infineon

|

Qualcomm

|

|

• Software

Defined Radio

– Programmable

protocols

– Support for

all major frequency

bands • High volume /

Low cost chips

• Lower power

consumption

|

• Qualcomm

Chipset

– sHRPD

Satellite Protocol in

future chips • Significant

downstream

channels • High volume /

Low cost chips

• Universal -

3GPP, 3GPP2, CDMA

|

|

Hughes Network

Systems

|

Alcatel-Lucent

|

|

• Native support

for GMR3-G Satellite

Protocol |

• Leverage

Commercial Base Stations

– Higher

Volumes

|

GSM/HSPA/LTE/GMR-3G

CDMA/HRPD(EVDO)HSPA+/LTE/sHRP

D

D

Chipset

Satellite

Base

Stations

Stations

11

Competitive

Overview

|

|

• Next generation

system

with configurable spot beams |

• Voice, data up

to 400 kbps

• Broadcast

mobile video

capable |

• PDA size

GSM/satellite

handsets, priced slightly higher than standard cellular PDAs |

• NA

|

|

|

• Next generation

system

with configurable spot beams |

• Mobile video to

vehicle

platform (MIM - Mobile Interactive Media) for video and two-way messaging |

• NA

|

• NA

|

|

|

• Legacy

system

• GEO two

satellites

covering N, central and part of S. America |

• NA

|

• Large expensive

terminals

$4000+ |

• Planned next

generation

system similar to TerreStar’s |

|

|

• Legacy

system

|

• 2.4k voice,

2.4k data

|

• Large expensive

handsets

($1500 handset) |

• $1-2/min

|

|

|

• Legacy

system

|

• Voice, data up

to 9.6 kbps

|

• Large expensive

handsets

|

• Failing

satellite system

|

|

|

• Legacy

system

|

• Voice, data up

to 492 kbps

|

• Large,

expensive terminals

& devices |

• NA

|

12

Roam-In

Business Model

• Definition: Roam-In

Service

– Effectively allows

customers of GSM carriers to “roam-in” to satellite coverage

– Requires GSM

customers to purchase a satellite enabled handset

• Roam-In

Business Model

– GSM carriers will

pay a monthly recurring charge per subscriber plus usage charges

– Introduced as an

additional service feature from GSM operators, and would appear on

the customers’ bill from the carrier

the customers’ bill from the carrier

– Satellite usage

charges will appear as roaming charges on the customers’

bill

13

The

Roam-In Value Proposition

|

Channel

Partners

|

GSM

Customers

|

|

• Fills network

gaps for carriers

• Enhances

customer retention

• Utilizes

existing form factor devices

• Creates new

market opportunities

• Creates a key

competitive differentiator

|

• Provides

complete coverage nationwide

• Single device

for everyday and disaster

communications • More robust

voice and date applications (than

existing MSS) |

Roam-In

Value Proposition For:

• Risk averse business

and

consumers willing to pay a premium

for safety and peace of mind

consumers willing to pay a premium

for safety and peace of mind

• For use primarily in

emergency

situations

situations

13

• Adventurous

travelers to parks and

nature areas, leisure boaters,

ATV/4x4/snowmobilers, mountain

bikers…

nature areas, leisure boaters,

ATV/4x4/snowmobilers, mountain

bikers…

• For use in

emergencies and

occasional communications

occasional communications

• Need for

communication and vertical

applications for business continuity

and in remote areas

applications for business continuity

and in remote areas

• All enterprise

markets, including

finance & insurance, transportation &

logistics, extractive industries, oil &

gas, agriculture, forestry, etc.

finance & insurance, transportation &

logistics, extractive industries, oil &

gas, agriculture, forestry, etc.

• Consumers and small

business users

living/working in areas where

terrestrial coverage is poor

living/working in areas where

terrestrial coverage is poor

• For use for basic

communication

Safety

Conscious

Outdoor

Adventurers

Industry/Enterprise

Rural

Population

• First Responders,

Public Safety

Personnel & Essential Mission Critical

Personnel

Personnel & Essential Mission Critical

Personnel

• Continuous coverage

when terrestrial

networks are unavailable

networks are unavailable

Government

& Public Safety

A

number of wireless market segments would benefit from the addition of

TerreStar

service capabilities

service capabilities

Addressable

Wireless Market Segments

14

15

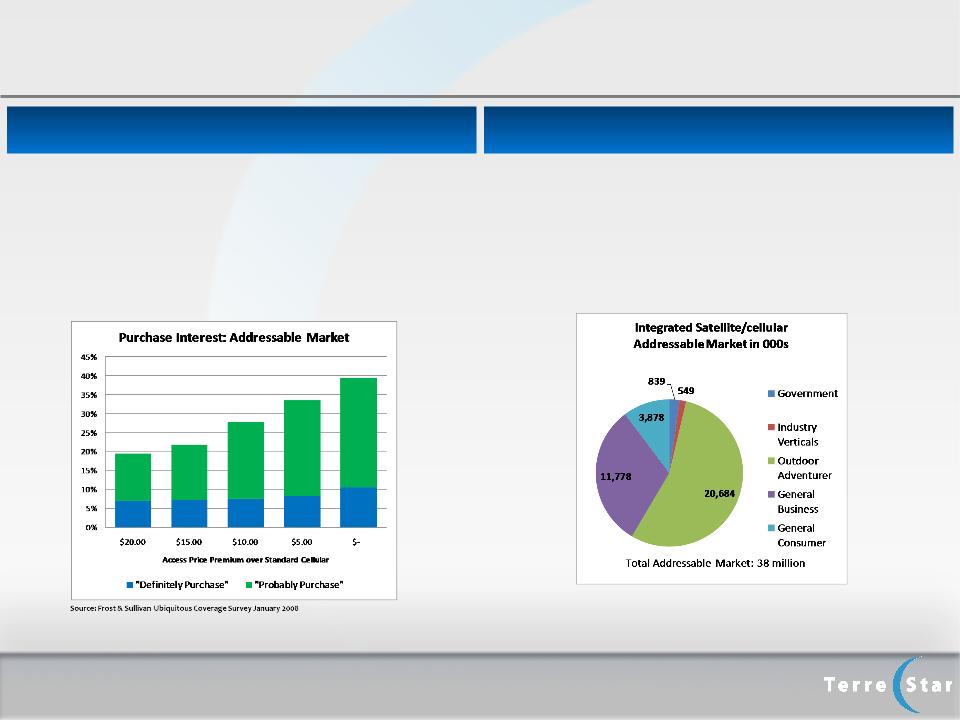

• At a $20 monthly

premium, almost 20% of cellular

subscribers indicated an interest in purchasing integrated

cellular/satellite services

subscribers indicated an interest in purchasing integrated

cellular/satellite services

• This equates to a

potential total addressable market size of

over 50M (270M US cellular market x 19.5% = 53M)

over 50M (270M US cellular market x 19.5% = 53M)

• 10% of business

cellular subscribers indicated they would

definitely purchase at a $20 premium

definitely purchase at a $20 premium

• Bottom-up approach

to defining addressable market results

in 38M market size

in 38M market size

• Achieving 38M market

size depends on bringing equipment

costs down to no more than $50 premium over standard

cellular devices

costs down to no more than $50 premium over standard

cellular devices

• Earliest adopters

will be government/public safety, industry

verticals, and outdoor adventurers

verticals, and outdoor adventurers

Source:

Sources: US

Bureau of labor statistics , National Fire Protection Association,

Department of Justice website, Office of Management and Budget, FEMA website,

National Survey on Recreation and the Environment, USDA Forest Service, National

Marine Manufacturers Association, US Census Bureau, TerreStar market feedback

and analysis

Department of Justice website, Office of Management and Budget, FEMA website,

National Survey on Recreation and the Environment, USDA Forest Service, National

Marine Manufacturers Association, US Census Bureau, TerreStar market feedback

and analysis

US

Market of ~50M for integrated terrestrial/satellite

service

service

Breakdown

of US Integrated Satellite/Cellular Market

Breakdown

of US Market Segments

16

Significant

Progress on Roam-In

TerreStar

has made significant progress towards launching the Roam-In

business

Execution

of Roam-In Plan

|

Roam-In

Revenues Expected To Begin in 2010

|

|

Perfected

Spectrum

&

Secured License

|

Technological

Ecosystem

|

Roaming-Agreements

|

Third

Party Distribution

Agreements |

|

• Successfully

launched satellite into

orbit on July, 1 2009 • First

successful call over satellite

using TerreStar smart phones completed on July 19, 2009 • All FCC and IC

milestones achieved

|

• Integrated

satellite / ground-based

design • Handsets

achieved FCC and

industry certification in December 2009 • Third-party

handset certification

process underway • R&D

agreements in place with

Infineon and Qualcomm for chip development • Nokia base

stations available, with

next gen LTE versions expected to be available in 2011 |

• AT&T

roaming agreement

executed • In discussions

with other

carriers |

• AT&T

distribution agreement

executed • Significant

progress in

negotiating distribution agreements with third-parties • Creates a

distribution channel

for TerreStar handsets and satellite services • Currently

integrating logistics,

provisioning, billing and customer care operations with initial MNO. |

17

1.4

GHz Spectrum

• 8

year lease term with ROFR purchase option at $250M or value of

competing offer

competing offer

– Lease payments $1M

per month for first eight months; $2M per month

thereafter

thereafter

– Lease commenced

October 2009

18

ATC

Opportunities

• Several

Integrated Satellite / ATC opportunity classes identified

– 4G upgrade for

existing carriers

– 4G capacity

expansion for existing carriers

– Market / geographic

expansion

– Industry vertical

applications (Smart Grid, transportation, government…)

• Project

activity underway in all classes

• Commercial

availability of 2.0 GHz LTE equipment expected in 2011

• MNOs experiencing

rapidly increasing demand for data services on

3G networks and face increasing spectrum limitations

3G networks and face increasing spectrum limitations

• 4G

demands even more spectrum for implementation

• FCC

ATC authorization application pending

• TS-2

(ground spare) 85% complete and on schedule to permit

commencement of commercial ATC operations in late 2010

commencement of commercial ATC operations in late 2010

19

Financials

Consolidated

Condensed Balance Sheet 9/30/09

| Unaudited ($ in millions) | |||||||

|

Cash

and Cash Equivalents

|

$ | 72.3 |

Accounts

Payable and Accrued Expense

|

$ |

22.0

|

|

|

|

Other

Current Assets

|

$ | 8.6 |

Dividend

Payable on Series A & B and

Other Current Liabilities

|

31.6

|

|

||

|

Total

Current Assets

|

$ | 81.0 |

Total Current

Liabilities

|

$ |

53.5

|

|

|

|

Fixed

Assets, Net

|

$ | 900.6 |

Notes

and Accrued Interest, Net of Discount

|

$ |

904.6

|

|

|

|

Intangible

Assets, Net

|

$ | 345.8 |

Other

Long Term Liabilities

|

24.8

|

|

||

|

Other

Long Term Assets

|

$ | 13.3 |

Total Long Term

Liabilities

|

$ |

929.4

|

|

|

|

Total

Long Term Assets

|

$ | 1,259.8 | |||||

|

Series

A Convertible Preferred Stock

|

$ |

90.0

|

|

||||

|

Series

B Convertible Preferred Stock

|

$ |

318.5

|

|

||||

|

All

Other Equity and APIC

|

$ |

1,203.0

|

|||||

|

Accumulated

Deficit

|

$ | (1,253.7 | ) | ||||

|

Total

Shareholder's Equity

|

$ |

357.8

|

|||||

| Total Assets | $ | 1,340.8 | Total Liabilities and Shareholder's Equity | $ | 1,340.8 | ||

20

21

TerreStar

Capitalization and Market Value

as of September 30, 2009

as of September 30, 2009

|

Book Value

|

||||

|

Current Share Price as of

9/30/2009

|

$ | 2.29 | ||

|

Common Shares

Outstanding

|

139.7 | |||

|

Options,

Warrants and Convertible Instruments

|

30.0 | |||

|

Fully Diluted

Shares Outstanding

|

169.7 | |||

|

Equity

Value

|

$ | 388.6 | ||

|

Plus:

|

||||

|

TerreStar

Networks 16.5% Senior PIK Notes due February 15,

2014

|

$ | 810.4 | ||

|

TerreStar

Networks 6.5% Exchangeable PIK Notes due June 15, 2014

|

$ | 167.0 | ||

|

TerreStar-2

14.0% Purchase Money Credit Agreement due February 5, 2013

|

$ | 65.3 | ||

|

Total

Debt

|

$ | 1,042.7 | ||

|

Plus:

|

||||

|

Series A

Cumulative Convertible Preferred Stock

|

$ | 90.0 | ||

|

Series B

Cumulative Convertible Preferred Stock

|

$ | 318.5 | ||

|

Series C

Preferred Stock

|

$ | 0.0 | ||

|

Series D

Preferred Stock

|

$ | 0.0 | ||

|

Series E

Junior Participating Preferred Stock

|

$ | 0.0 | ||

|

Total

Preferred

|

$ | 408.5 | ||

|

Less:

|

||||

| Cash and Cash Equivalents | $ | (72.3 | ) | |

|

Total

Enterprise Value

|

$ | 1,767.5 | ||

Senior

Secured PIK Notes:

Original

Issue Amount $550

million

Maturity: 2/14/2014

PIK

Interest: 16.5%

on 2/15 & 8/15

Senior

Exchangeable PIK Notes:

Original

Issue Amount: $150

million

Maturity: 6/15/2014

Interest: PIK

thru 3/2011 at 6.5%

Conversion: TSTR

shares at $5.57/share

TerreStar-2

Credit Agreement:

Commitment: $100

million

Outstanding: $65.3

million

Maturity: 2/5/2013

Interest: PIK

thru 2/2012 at 14%

Series

A&B Preferred Stock:

Series A

Amount: $90.0

million

Series B

Amount: $318.5

million

Series

A&B Maturity: 4/15/2010

Conversion: TSTR

shares at $33.33/share

Dividends: 5.5%

cash or 6.5% common

Paid on

4/15 & 10/15

Series

E Junior Preferred Stock:

1.9

million shares authorized and 1.2 million issued on

6/10/2008, convertible into TSTR shares at a rate of 25:1

6/10/2008, convertible into TSTR shares at a rate of 25:1