Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NOBEL LEARNING COMMUNITIES INC | d8k.htm |

Exhibit 99.1

NOBEL LEARNING COMMUNITIES Inc

Nobel Learning Communities, Inc.

Wedbush Securities

Management Access Conference

December 9, 2009

Nobel Learning Communities – Safe Harbor

NOBEL LEARNING COMMUNITIES Inc

Except for historical information contained in this press release, the information in this press release consists of forwardlooking

statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These

statements involve risks and uncertainties that could cause actual results to differ materially from those in the forwardlooking

statements. Potential risks and uncertainties include among others, the implementation and results of the

Company’s ongoing strategic initiatives; the Company’s ability to compete with new or existing competitors; dependence

on senior management and other key personnel; changes in general economic conditions; and risks and uncertainties

arising in connection Corporation’s proposal Company with Knowledge Learning Corporation s unsolicited to acquire the Company. Other risks

and uncertainties are discussed in the Company’s filings with the SEC. These statements are based only on management’s

knowledge and expectations on the date of this press release. The Company will not necessarily update these statements

or other information in this press release based on future events or circumstances.

In this release, financial measures are presented both in accordance with United States generally accepted accounting

principles (“GAAP”) and also on a non-GAAP basis. Adjusted earnings and EBITDA in this presentation are non-GAAP

financial measures. EBITDA is commonly presented as a reconciliation starting with net income due to the number of

non-operating related items included in net income, we present EBITDA as derived from operating income as we believe

this provides the user the most useful and comparable information on an operating basis. The Company believes that the

use of certain non-GAAP financial measures enables the Company and its investors and potential investors to evaluate and

compare the Company’s results from operations generated from its business in a more meaningful and consistent manner

and provides an analysis of operating results using the same measures used by the Company’s chief operating decision

makers to measure the performance of the Company. Please see the financial summary in this presentation for

information reconciling non GAAP financial measures

2

non-measures to comparable GAAP financial measures.

NOBEL LEARNING COMMUNITIES Inc

NLCI Business Summary

• Leading education provider as an operator of 180+ private schools.

Revenue for fiscal year ended June 2009 increased y 8% to $220 mm

• Recently acquired a K-12 College Prep Online Distance Learning School

• Portfolio of schools consists of the following:

• Preschools

• Elementary and Middle schools

• Online K-12 Distance Learning School

• Dual income families; high average household income.

• Primarily private pay customer.

3

NOBEL LEARNING COMMUNITIES Inc

Platform spans PreK-12 with proprietary

curriculum and accredited programs

Program

Premier Portfolio

of Local Brands

Accreditations

National Curricula

21st Skills

4

21 Century

NOBEL LEARNING COMMUNITIES Inc

NLCI has multiple growth channels

Organic Growth: Generate enrollment growth g plus annual

tuition increases in existing schools; open new ones

Continue acquisition of K+ and Preschools

Expand online and distance learning presence into new

domestic and international market segments

5

NOBEL LEARNING COMMUNITIES Inc

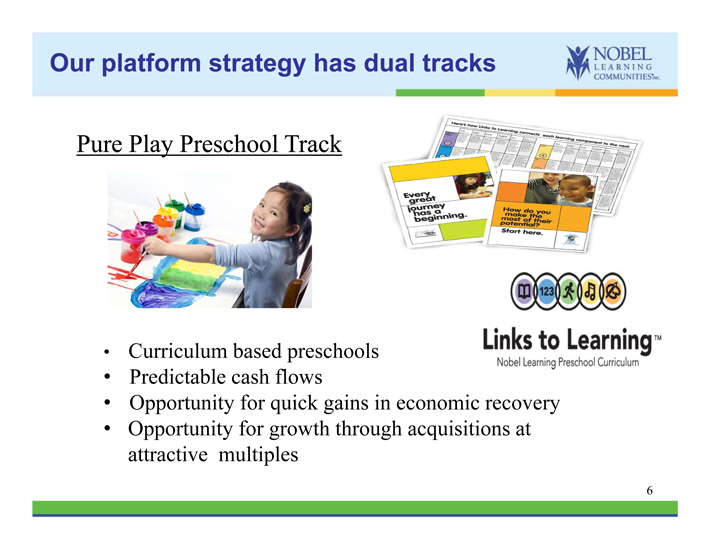

Our platform strategy has dual tracks

Pure Play Preschool Track

• Curriculum based preschools

• Predictable cash flows

• Opportunity for quick gains in economic recovery

• Opportunity for growth through acquisitions at

i lil

6

attractive multiples

NOBEL LEARNING COMMUNITIES Inc

Our platform strategy has dual tracks

Integrated K-12 Track

• K-8 schools and K-12 distance learning

• Multiple delivery modalities; move to onsite/online model

• Strong growth opportunity

• Balance “onsite” capital requirements with online scalability

7

p q y

NOBEL LEARNING COMMUNITIES Inc

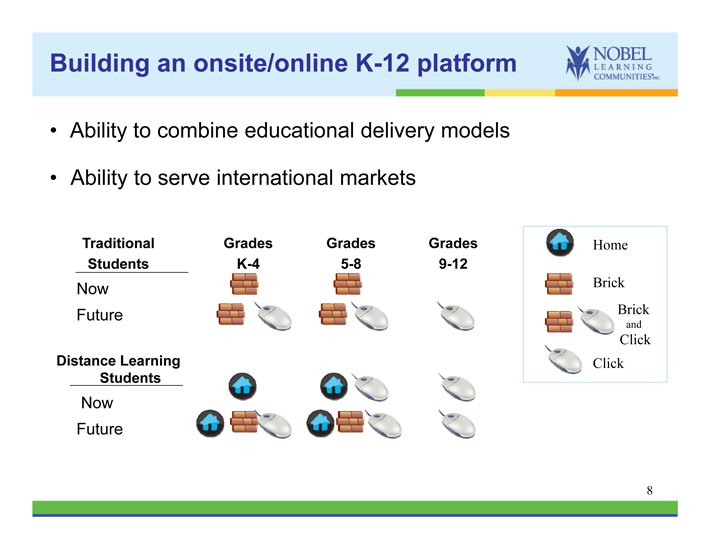

Building an onsite/online K-12 platform

• Ability to combine educational delivery models

Abilit t i t ti l k t

T diti l G d G d G d

• Ability to serve international markets

Traditional

Students

Grades

K-4

Grades

5-8

Grades

9-12

Now

F

Home

Brick

Future Brick

Distance Learning

Students

and

Click

Click

Now

Future

8

NOBEL LEARNING COMMUNITIES Inc

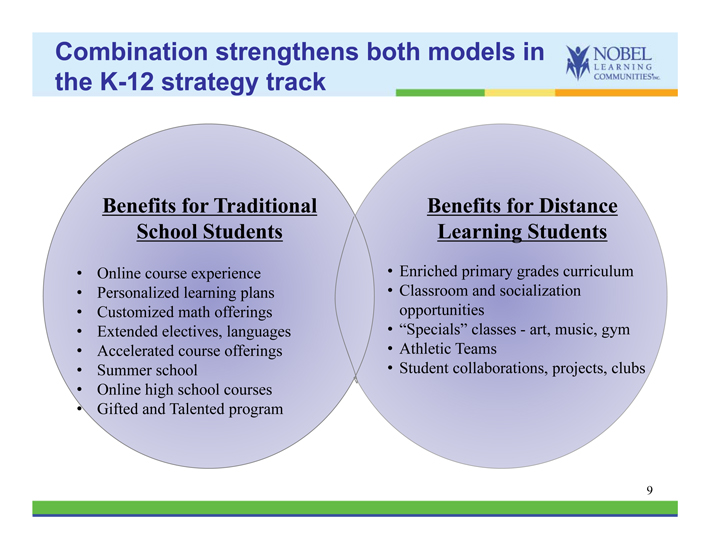

Combination strengthens both models in

the K-12 strategy track

Benefits for Traditional

School Students

Benefits for Distance

Learning Students

• Online course experience

• Personalized learning plans

• Enriched primary grades curriculum

• Classroom and socialization

• Customized math offerings opportunities

• Extended electives, languages

• Accelerated course offerings

• Summer school

• “Specials” classes—art, music, gym

• Athletic Teams

• Student collaborations, projects, clubs

• Online high school courses

• Gifted and Talented program

9

NOBEL LEARNING COMMUNITIES Inc

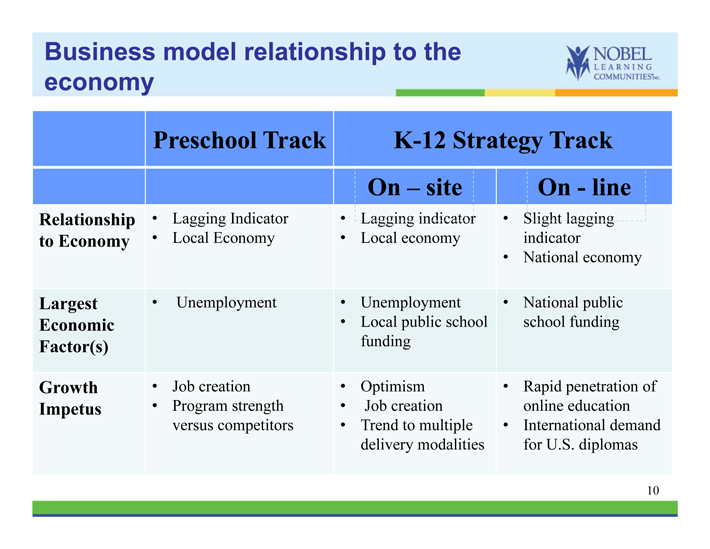

Business model relationship to the

economy

Preschool Track K-12 Strategy Track

On – site On—line

Relationship

to • Lagging Indicator

• Local Economy

• Lagging indicator

• Local economy

• Slight lagging

Economy

indicator

• National economy

Largest • Unemployment • Unemployment • National public

Economic

Factor(s)

p y p y

• Local public school

funding

p

school funding

Growth

Impetus

• Job creation

• Program strength

versus competitors

• Optimism

• Job creation

• Trend to multiple

modalities

• Rapid penetration of

online education

• International demand

U S 10

delivery for U.S. diplomas

NOBEL LEARNING COMMUNITIES Inc

Learning Nobel Communities, Inc.

Financial Update

11

NOBEL LEARNING COMMUNITIES Inc

Key business model characteristics

Sources of Strength

• Revenue growth – tuition, enrollment, new facilities, acquisitions

• Strong – high student recurring revenues retention rate

Margin and Earnings Leverage

• Comparable school revenue growth = Margin expansion

• Distance learning online school delivers leverage with scalable platform

• $175,000 pretax income = $0.01 EPS

Attractive Cash Flow

• Generate cash before services delivered

• Modest capital requirements – real estate leased, not owned

• Dry powder—$75,000,000 revolving credit facility

– Substantial 40 000 000

12

availability at $40,000,000

NOBEL LEARNING COMMUNITIES Inc

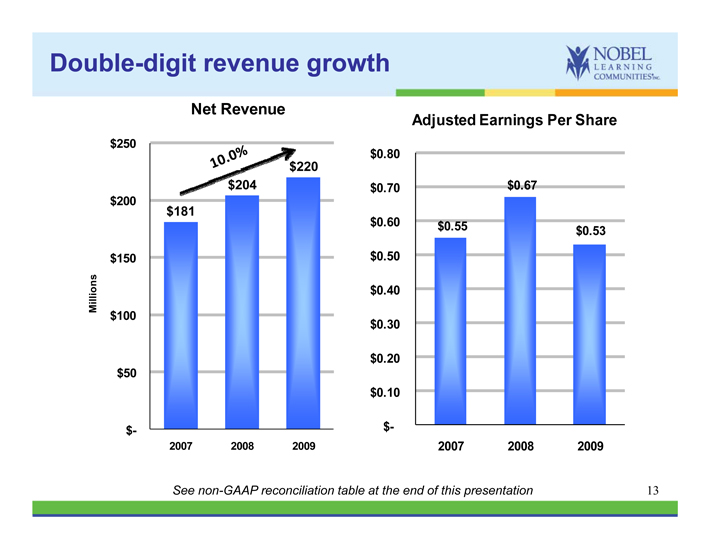

Double-digit revenue growth

$220

$250

Net Revenue

$0.80

Adjusted Earnings Per Share

$181

$204

$200

$0.55

$0.67

$$0.60 0.53

$0.70

$150

Millions

$0.40

$0.50

$

50

$100

M

$0.20

$0.30

$-

2007 2008 2009

$-

$0.10

2007 2008 2009

13

See non-GAAP reconciliation table at the end of this presentation

NOBEL LEARNING COMMUNITIES Inc

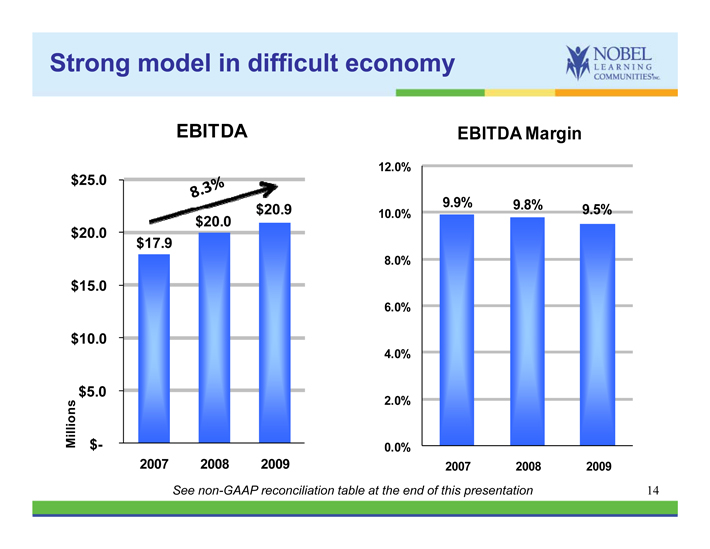

Strong model in difficult economy

EBITDA

12.0%

EBITDA Margin

$17 9

$20.0

$20.9

$20.0

$25.0

9.9% 9.8% 10.0% 9.5%

17.9

$15.0

6 0%

8.0%

$10.0

4.0%

6.0%

$-

$5.0

Millions

0 0%

2.0%

14

$

2007 2008 2009

M

See non-GAAP reconciliation table at the end of this presentation

0.0%

2007 2008 2009

NOBEL LEARNING COMMUNITIES Inc

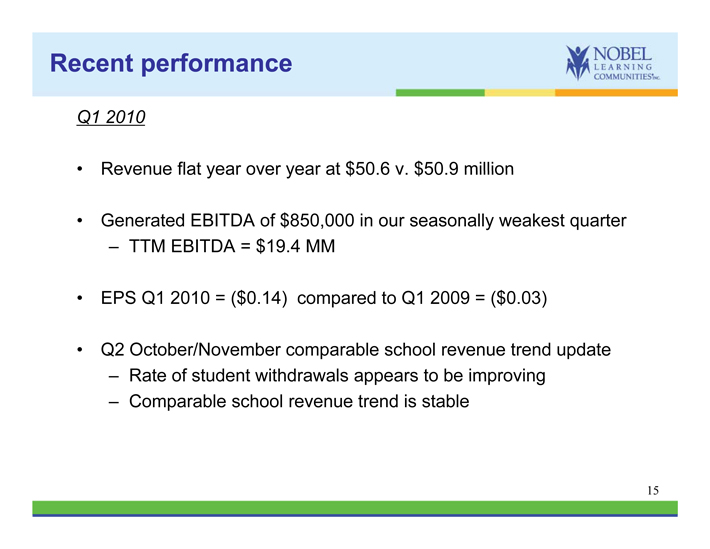

Recent performance

Q1 2010

• Revenue 50 6 v 50 flat year over year at $50.6 v. $50.9 million

• Generated EBITDA of $850,000 in our seasonally weakest quarter

– TTM EBITDA = $19.4 MM

• EPS Q1 2010 = ($0.14) compared to Q1 2009 = ($0.03)

• Q2 October/November comparable school revenue trend update

– Rate of student withdrawals appears to be improving

– Comparable school revenue trend is stable

15

NOBEL LEARNING COMMUNITIES Inc

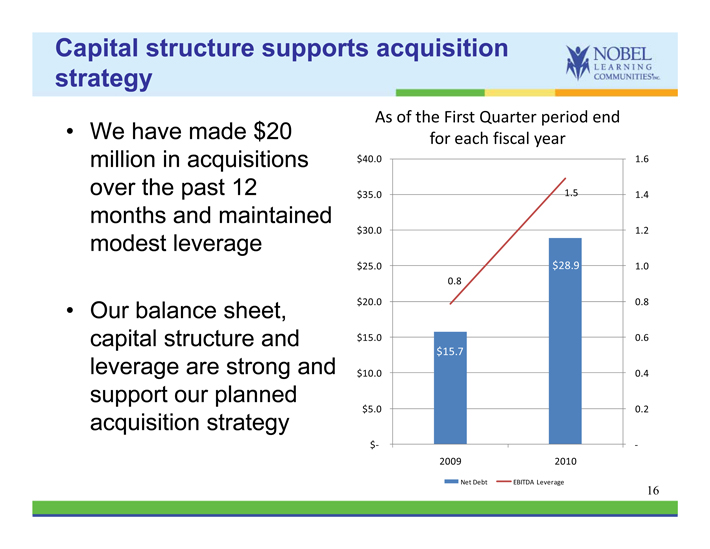

Capital structure supports acquisition

strategy

$40.0 1.6

As of the First Quarter period end

• We have made $20 for each fiscal year

million in acquisitions

1.5

1.2

1.4

$30.0

$35.0

q

over the past 12

months and maintained

$28.9

0.8

0.8

1.0

$20.0

$25.0

modest leverage

• sheet

$15.7

0.4

0.6

$10.0

$15.0

Our balance sheet,

capital structure and

leverage are strong and

?

0.2

$?

$5.0

g g

support our planned

acquisition strategy

16

$

2009 2010

Net Debt EBITDA Leverage

NOBEL LEARNING COMMUNITIES Inc

Nobel Learning Communities, Inc.

Appendix

18

NOBEL LEARNING COMMUNITIES Inc

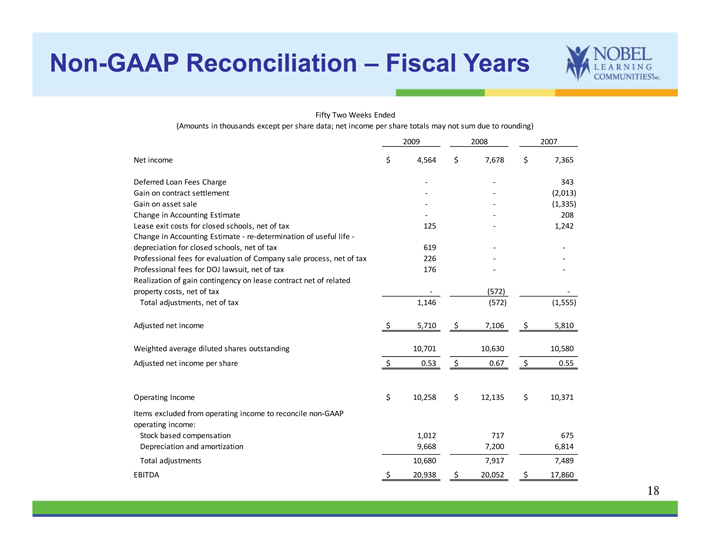

Non-GAAP Reconciliation – Fiscal Years

2009 2008 2007

Net income $ 4,564 $ 7,678 $ 7,365

(Amounts in thousands except per share data; net income per share totals may not sum due to rounding)

Fifty Two Weeks Ended

Deferred Loan Fees Charge - - 343

Gain on contract settlement - - (2,013)

Gain on asset sale - - (1,335)

Change in Accounting Estimate - - 208

Lease exit costs for closed schools, net of tax 125 - 1,242

Change in Accounting Estimate - re-determination of useful life -

depreciation for closed schools, net of tax 619 - -

Professional fees for evaluation of Company sale process, net of tax 226 - -

Professional fees for DOJ lawsuit, net of tax 176 - -

Realization of gain contingency on lease contract net of related

property costs, net of tax - (572) -

Total adjustments, net of tax 1,146 (572) (1,555)

Adjusted net income $ 5,710 $ 7,106 $ 5,810

Weighted average diluted shares outstanding 10,701 10,630 10,580

Adjusted net income per share $ 0.53 $ 0.67 $ 0.55

Operating Income $ 10,258 $ 12,135 $ 10,371

Items excluded from operating income to reconcile non-GAAP

operating income:

Stock based compensation 1,012 717 675

Depreciation 9 668 7 200 6 814

19

and amortization 9,668 7,200 6,814

Total adjustments 10,680 7,917 7,489

EBITDA $ 20,938 $ 20,052 $ 17,860