Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Changda International Holdings, Inc. | ex991.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K/ A

(Amendment

No. 1)

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported):

February

13, 2009

CHANGDA

INTERNATIONAL HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

333-147169

|

98-0521484

|

|

(State

or other jurisdiction

|

(Commission

File Number)

|

(IRS

Employer

|

|

of

incorporation)

|

Identification

No.)

|

|

2870-Agricultural

|

||

|

Chemicals

|

0001417624

|

|

|

(Standard

Industrial

|

(Central

Index Key)

|

|

|

Classification)

|

10

th

Floor Chenhong Building

No.

301 East Dong Feng Street

Weifang,

Peoples Republic of China

(Address

of principal executive offices, including zip code)

86

1586 311 1662

(Registrant's

telephone number, including area code)

Copy

of Communication to:

Richard

A. Friedman, Esq.

Sichenzia

Ross Friedman Ference LLP

61

Broadway, 32nd

Floor

New

York, New York 10006

Promodoeswork.com,

Inc.

6972

Coach Lamp Drive, Chilliwack, BC, Canada V2R 2Y7

(Former

name or former address, if changed since last report.)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Table

of Contents

|

Item

1.01

|

Entry

into a Material Definitive Agreement

|

4

|

|

|

Item

2.01

|

Completion

of Acquisition or Disposition of Assets

|

4

|

|

|

Item

3.02

|

Unregistered

Sale of Equity Securities

|

43

|

|

|

Item

5.03

|

Amendments

to Articles of Incorporation or Bylaws, Change in Fiscal

Year

|

43

|

|

|

Item

5.06

|

Change

in Shell Company Status

|

43

|

|

|

Other

Events

|

43

|

||

|

Item

9.01

|

Financial

Statements and Exhibits

|

44

|

2

EXPLANATORY

NOTE: Changda International Holdings, Inc. is filing this Current Report on Form

8-K/A to amend the Current Report on Form 8-K initially filed with the

Securities Exchange Commission on February 20, 2009 to (i) update the management

discussion and analysis with updated financial information for the fiscal years

ended December 31, 2008 and 2007 and (ii) include the audited financial

statements of Changda International Ltd. for the two fiscal years ended December

31, 2008 and 2007.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Our

disclosure and analysis in this Current Report on Form 8-K/A contains some

forward-looking statements. Certain matters discussed concerning our operations,

cash flows, financial position, economic performance and financial condition,

including, in particular, future sales, product demand, the market for our

products in the People’s Republic of China and elsewhere, competition, exchange

rate fluctuations and the effect of economic conditions include forward-looking

statements.

Statements

that are predictive in nature, that depend upon or refer to future events or

conditions or that include words such as “expects”, “anticipates”, “intends”,

“plans”, “believes”, “estimates” and similar expressions are forward-looking

statements. Although we believe that these statements are based upon reasonable

assumptions, including projections or orders, sales, operating margins,

earnings, cash flow, research and development costs, working capital, capital

expenditures and other projections, they are subject to several risks and

uncertainties, and therefore, we can give no assurance that these statements

will be achieved.

Investors

are cautioned that our forward-looking statements are not guarantees of future

performance and the actual results or developments may differ materially from

the expectations expressed in the forward-looking statements.

As for

the forward-looking statements that relate to future financial results and other

projections, actual results will be different due to the inherent uncertainty of

estimates, forecasts and projections may be better or worse than projected.

Given these uncertainties, you should not place any reliance on these

forward-looking statements. These forward-looking statements also represent our

estimates and assumptions only as of the date that they were made. We expressly

disclaim a duty to provide updates to these forward-looking statements, and the

estimates and assumptions associated with them, after the date of this filing to

reflect events or changes in circumstances or changes in expectations or the

occurrence of anticipated events.

We

undertake no obligation to publicly update any forward-looking statement,

whether as a result of new information, future events or otherwise. You are

advised, however, to consult any additional disclosures we make in our reports

on Form 10-K, Form 10-Q, Form 8-K, or their successors. We also note that we

have provided a cautionary discussion of risks and uncertainties under the

caption “Risk Factors” in this Current Report. These are factors that we think

could cause our actual results to differ materially from expected results. Other

factors besides those listed here could also adversely affect us.

Information

regarding market and industry statistics contained in this Current Report is

included based on information available to us which we believe is accurate. We

have not reviewed or included data from all sources, and cannot assure

stockholders of the accuracy or completeness of the data included in this

Current Report. Forecasts and other forward-looking information obtained from

these sources are subject to the same qualifications and the additional

uncertainties accompanying any estimates of future market size, revenue and

market acceptance of products and services.

Unless

otherwise noted, all currency figures in this filing are in U.S.

dollars.

3

This

Current Report on Form 8-K/A is being filed by Changda International Holdings,

Inc. (either the “Company”, “we”, “our” or “Registrant”) in connection with a

share exchange transaction in which the Company has acquired all of the issued

and outstanding capital stock of Changda International Ltd., a company organized

under the laws of Marshall Islands. On February 13, 2009 the Company entered

into a share exchange agreement under which the Company issued 47,729,964 shares

of its common stock, par value $0.001, to the shareholders of Changda

International Ltd. in exchange for 100% of the issued and outstanding shares of

common stock of Changda International Ltd.

On

February 19, 2009 a change in Registrant’s name from Promodoeswork.com, Inc. to

Changda International Holdings, Inc. became effective. Any references to

Promodoeswork.com, Inc, or PDWK in this Current Report on Form 8-K/A, including

any financial statements or other exhibits to this report, refer to

Registrant.

Item

1.01 Entry Into a Material Definitive Agreement

On

February 13, 2009, the Company entered into a share exchange agreement (the

“Share Exchange Agreement”) which is attached to this current report on Form

8-K/A as Exhibit 10.1, under which the Company issued Forty Seven Million Seven

Hundred Twenty Nine Thousand Nine Hundred Sixty Four (47,729,964) shares of its

common stock, par value $ 0.001 per share, to the shareholders

of Changda International, Ltd., a company organized under the laws of

Marshall Islands, (“Changda”), in exchange for 100% of the issued and

outstanding capital stock of Changda. As a result of the Share

Exchange Agreement, Changda became a wholly owned subsidiary of

Registrant. As of the date of the Share Exchange Agreement, Changda

held, directly or indirectly, the entire equity interest in the following

operating companies: Weifang Changda Chemical Co., Ltd., (“Changda

Chemical”), Shandong Fengtai Fertiliser Co., Ltd., (“Changda Fengtai”), Weifang

Changda Fertiliser Co., Ltd., (“Changda Fertilizer”) and Heze Changda Fertiliser

Co., Ltd. (“Changda Heze”) (Changda, Changda Chemical, Changda Fengtai, Changda

Fertiliser, and Changda Heze, collectively “The Group”).

Item

2.01 Completion of Acquisition or Disposition of Assets

Organizational

History of Changda International Holdings, Inc.

We were

incorporated on January 25, 2007, in the state of Nevada under the name

Promodoeswork.com, Inc. We subsequently changed our name to Changda

International Holdings, Inc. We have never declared bankruptcy, we

have never been in receivership, and we have never been involved in any legal

action or proceedings.

On

January 15, 2009, Darryl Mills (the "Affiliate Seller"), a major shareholder and

affiliate of the Registrant consummated one Affiliate Stock Purchase

Agreement (the "Affiliate Agreement") with Allhomely International, Limited (the

"Buyer"). Pursuant to the Affiliate Agreement the Buyer acquired from the

Affiliate Seller a total 2,000,000 restricted shares of common stock of the

Registrant for a total price of One Hundred Thousand Dollars

($100,000.00). Also on January 15, 2009, John Spencer, Derrick

Waldman, and Louis Waldman (collectively the “Restricted Sellers”), shareholders

and affiliates of the Registrant, consummated one Restricted

Stock Purchase Agreement (the " Share Agreement") with the

Buyer. Pursuant to the Share Agreement the Buyer acquired

from the Restricted Sellers a total 2,200,000 restricted shares of

common stock of the Registrant for a total price of Eighty Seven Thousand Five

Hundred Dollars ($87,500.00).

4

As the

result, under the terms and conditions of the Affiliate Agreement and the Share

Agreement, the Buyer acquired from Affiliate Seller and Restricted Sellers a

total 4,200,000 shares of common stock of the Registrant (the "Transaction"),

resulting in a change in control of registrant.

Immediately

prior to the closing of the Transaction, Louis Waldman served as the

Registrant’s President, and Derrick Waldman served as the Registrant’s Secretary

and Treasurer. Immediately following the closing of the

Transaction Mr. Jan Panneman was nominated and elected by the Board of Directors

as Registrant’s sole officer, to act as President and Chief Executive Officer

and to serve until his successors shall be elected and qualified until the

earlier of death, resignation or removal in the manner provided for

in the Company’s by-laws;

Also

following the closing of the Transaction Mr. Jan Panneman was appointed as the

Company’s sole Director to serve until his successors shall be elected and

qualified on the earlier of death, resignation or removal in the manner provided

for in the Company’s by-laws. Following the election and appointment of Mr. Jan

Panneman as officer and Director of the Company, Louis Waldman, Derrick Waldman,

and John Spencer tendered their resignations as officers and directors of the

Company.

On

February 13, 2009, the Company entered into the “Share Exchange Agreement under

which the Company issued Forty Seven Million Seven Hundred Twenty Nine Thousand

Nine Hundred Sixty Four (47,729,964) shares of its common stock, par value $

0.001 per share, to the shareholders of Changda in

exchange for 100% of the issued and outstanding capital stock of

Changda. As a result of the Share Exchange Agreement Changda became a

wholly owned subsidiary of Registrant. As of the date of the Share

Exchange Agreement, Changda held, directly or indirectly, the entire equity

interest in Changda Chemical, Changda Fengtai, Changda

Fertiliser and Changda Heze.

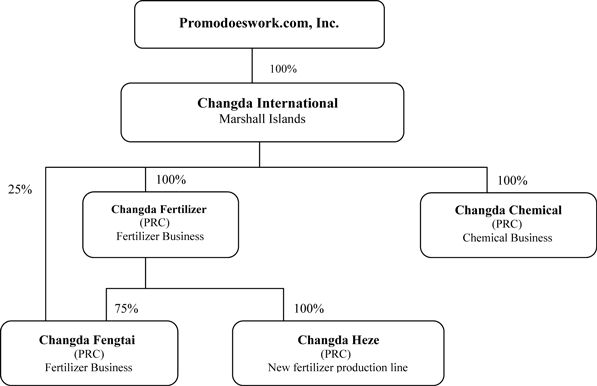

Company’s

Post-acquisition Organizational Structure

Following

our acquisition of Changda International Ltd. as described under Item 1.01, as

set forth in the following diagram, Changda International Ltd. became our direct

wholly owned subsidiary and Changda International, directly or indirectly, holds

the entire equity interest in Changda Fertilizer, Changda Chemical, Changda

Fengtai and Changda Heze.

5

Our

Corporate Structure

Our

current corporate structure is set forth below:

Organizational

History of Changda International Limited

On

December 1, 2000, the Co-founders set up Changda Chemical, which is engaged in

the production and sale of a snow melting agent. In view of the continuing

expansion in the agricultural sector and supportive government policies, the

Co-founders established Changda Fertilizer on April 24, 2003, which is engaged

in the production and sale of various fertilizers, including chemical, organic

and compound fertilizers. In March 2007, Changda Chemical began to set up

production lines for thiophene and fire retardant agents, which were completed

and put into production in September 2007 and July 2008 respectively. Changda

Heze was established on September 3, 2007 to take advantage of the continued

growth in demand for microbial organic-inorganic compound fertilizers and

slow-release fertilizers. All current production lines of the Group are located

in Shandong Province, People’s Republic of China (“PRC”). Changda Fengtai was

established on May 17, 2004, jointly owned by Changda Fertilizer (75 percent)

and Seiwa Fertilizer Co. Ltd (“Seiwa”), a Japanese company (25 percent), to

develop export sales to Japan. On June 13, 2008, the Company and Seiwa entered

into an agreement whereby the Company acquired the remaining twenty-five percent

interest in Changda Fengtai from Seiwa for a cash consideration of US$130,500.

The equity transfer is closed.

6

Changda

was incorporated on April 2, 2007 in the Republic of Marshall Islands as the

holding company of the Group. Changda holds, directly or indirectly,

the entire equity interest in Changda Fertilizer, Changda Chemical, Changda

Fengtai and Changda Heze.

Overview

of the Business

The Group

is principally engaged in the research and development, manufacture and sale of

fertilizer and chemical products in the PRC. During the years ended December 31,

2005, 2006 and 2007 (“Track Record Period”), the Group’s sales revenue from

fertilizers accounted for approximately 77.4 percent, 81.2 percent, 90.0 percent

and 94.2 percent of the total aggregate revenue in 2005, 2006, 2007 and the six

months ended on June 30, 2008 respectively. Fertilizers manufactured by the

Group can be broadly classified into chemical compound fertilizers and microbial

organic and inorganic compound fertilizers. The chemical products manufactured

by the Group consist of snow melting agents and various other industrial

chemicals.

Primary

Products

The Group

produces chemical and microbial organic-inorganic compound fertilizers. The

Group’s chemical fertilizer products are classified into three types, namely

complex fertilizers, compound fertilizers and slow- release compound fertilizers

with more than 10 product lines sold under the “CHANGDA” and “FENGTAI WOSIDA”

brands.

Compound

fertilizer products are produced by initiating chemical reactions between the

three key nitrogen, phosphorous and potassium nutrients during the production

process; each granule contains a combination of these nutrients so as to provide

balanced distribution capabilities.

The

Group’s principal compound fertilizers are sulphur-based compound fertilizer,

ammoniated sulphur-based compound fertilizer and chloric-based compound

fertilizer.

Slow-release

compound fertilizer products allow the fertilizer nutrients to be released

progressively, enabling plants to absorb most of the nutrients and enhance yield

rate. Slow-release compound fertilizers are also more convenient, as they

require less frequent applications. The Group has modified and developed

controlled-release (which is a subset of slow-release) fertilizers.

The

Group’s microbial organic-inorganic compound fertilizer is a new type of

fertilizer. In general, it helps plants to secure nitrogen from the air and to

dissolve useful minerals such as phosphorus and potassium from soil thus

facilitating absorption of these useful minerals by plants and enhancing their

stress resistance. The organic and inorganic elements enhance soil fertility and

crop yield respectively.

In recent

years, with the increase in health awareness among consumers in the PRC, the

production and sale in the PRC of green food and organic food products, or food

products using organic fertilizers, has increased significantly.

7

Customers,

sales and distribution

The Group

distributes some of its fertilizer products to farmers through China Post

Logistics (Shandong) Limited; a subsidiary of the China Postal Service (“China

Post”), which provides postal services in the PRC. Other distribution channels

used by the Group include five exclusive distributions centers. The Group also

distributes fertilizer products overseas to Seiwa in Japan. The Directors

believe these distribution channels minimize the promotion costs of the Group by

taking advantage of China Post and Seiwa’s sales channels and goodwill to

penetrate target markets, and also minimize transportation costs as products are

distributed primarily to China Post and Seiwa rather than directly to

end-users.

In 2007,

approximately 97 percent of the Group’s fertilizer products were sold within

Shandong Province in the PRC, while approximately 3 percent of the Group’s

fertilizer sales were made to Japan. Domestic sales are settled in RMB while

export sales are settled in USD. Terms of sale are usually cash on delivery or

cash in advance of delivery and a credit period is not normally granted to

customers. Fertilizer sales are subject to seasonality, being comparatively

higher during planting months such as March to April and September to October

each year.

Materials,

production process and facilities

The key

raw materials used by the Group in the production of its fertilizers are urea,

potassium sulphate, potassium chloride, ammonium sulphate, ammonium phosphate

and potash. The Group’s chemical fertilizer products are manufactured through

chemical reactions occurring between different inorganic fertilizer materials so

as to provide a balanced proportion of all nutrients. The Group’s microbial

organic-inorganic compound fertilizer products are manufactured from bacteria

combined with inorganic and organic elements. Most of the raw materials are

sourced domestically in the PRC and are paid for in RMB. The Group’s payout

terms with its suppliers vary from a credit period of up to 60 days to cash

payments in advance.

The

fertilizer production facilities of the Group are located in Weifang and Heze,

Shandong Province in the PRC, consisting of land parcels with a total site area

of approximately 151,164 square meters. There are two production lines for the

manufacture of chemical fertilizers, and two production lines for the

manufacture of the microbial organic-inorganic compound fertilizers and

slow-release compound fertilizers, with an aggregate annual capacity of 350,000

tonnes in 2007.

Chemical

Business

Products

The

Group’s principal chemical products are snow melting agents and various other

industrial chemicals.

Snow

melting agents are de-icing salt, consisting of a combination of sodium

chloride, calcium chloride, magnesium chloride and additives in varying levels

for different customer segments and uses. The products are a white, odorless and

soluble solid compound and are used primarily to de-ice airports, roads and golf

courses in the winter seasons, spread by winter service vehicles.

The

Group’s industrial chemical products range includes thiophene, calcium chloride

and magnesium chloride. Thiophene is a colourless and transparent liquid which

is primarily used in the pharmaceutical raw materials industry as a medicine

chemical auxiliary, and for the synthesisation of anti-bacterial fungus. Calcium

chloride and magnesium chloride are used for dust control on roads and also as

essential product inputs for a wide range of industrial usage such as in cement

production.

8

Customers,

sales and distribution

The Group

mainly sells and distributes its snow melting agents and thiophene to industrial

end-users through its sales team. Most of the Group’s snow melting agent

products are sold to Japanese customers and in total made up 13 percent, 11

percent, and 5 percent of the Group’s sales in 2005, 2006, and 2007

respectively. Changda Chemical supplied 10 percent of snow melting agent

demanded in Japan in 2007.

Thiophene

was commercialized in the first half of 2008 and sales were not material during

the Track Record Period. Domestic sales are settled in RMB while sales to Japan

are settled in USD. Payment terms are usually by cash payment for sales to

Japan. Payment terms for domestic sales are usually cash in advance of delivery,

although a credit period of up to 60 days may be granted to repeat customers.

Snow melting agent sales are subject to seasonality, being comparatively higher

during October to February each year.

Materials,

production process and facilities

The

principal raw materials in the chemical products include sodium chloride,

calcium chloride, magnesium chloride and additives. For each of the three years

ended 31 December, 2005, 2006 and 2007, consumption of sodium chloride, calcium

chloride and magnesium chloride accounted for approximately 21 percent, 16

percent and 13 percent of the Group’s total cost of sales respectively and

approximately 17 percent, 13 percent and 11 percent of its turnover

respectively. De-icing agents are manufactured by granulisation and drying of

various chlorides and additives. Thiophenes are manufactured from the

catalisation and distillation of butadiene and sulphur.

At

present, the Group purchases most of its principal raw materials locally. All of

the Group’s suppliers are paid in RMB. Most of the Group’s suppliers do not

allow a credit period.

The

chemical production facilities of the Group are located in Shandong Province in

the PRC and occupy a total site area of 69,278 square meters. Three production

lines are utilized for the manufacture of snow melting agent products, while one

production line is operated to produce thiophene and one production line is

operated to produce fire retardant agent. Total annual production capacity in

2007 was 300,000 tonnes (tonnes is a metric measure of weight equivalent to

1,000 kilograms).

The

PRC Fertilizer Industry

The PRC’s

chemical fertilizer industry plays an important role in the world fertilizer

industry. The PRC is one of the largest fertilizer producers and it accounts for

34.3 percent of global consumption (168.7 million tonnes – by effective

component) in 2007.

In order

to encourage investment in the fertilizer industry, the PRC Government has

promulgated a number of preferential policies, including zero rate VAT for

fertilizer products, preferential electricity prices and cheaper railway

transportation.

The PRC’s continuous economic growth,

agricultural development, growing demand for fertilizers and preferential

fertilizer industry policies combine to promote the development of the

fertilizer industry. According to the National Bureau of Statistics, the PRC’s

output of chemical fertilizers grew from 37.9 million tonnes (by effective

component) in 2002 to 57.9 million tonnes (by effective component) in

2007, with an average annual

growth rate of 8.8 percent.

9

The

PRC Chemical Industry

The

chemical industry is the third largest in the PRC and accounted for 10 percent

of the country’s Gross Domestic Product (“GDP”) in 2006 according to the PRC

National Bureau of Statistics. Chinese consumption constituted 35 percent to 40

percent of global demand growth for chemicals. The growth in domestic demand for

chemicals alone in 2005 and 2006 was 7 percent to 8 percent, according to the

PRC National Bureau of Statistics. Despite this growth however, the PRC has a

net chemical trade deficit and remains heavily dependent on imported raw

materials, which have over recent years been affected by upward price trends in

the world market caused by heavy global demand for raw materials, petroleum and

other inputs.

Information

on the Industry

Classification

and Function of Fertilizers

Fertilizers

are used to provide, maintain and improve plant nutrition and enhance the

performance of the soil in which plants grow, with the aim of increasing

agricultural output, improving the quality of agricultural products and

increasing plants’ resistance to disease. As set out below, fertilizers come in

both organic and inorganic forms.

Chemical

Fertilizers (Inorganic Fertilizers)

Chemical

fertilizers are manufactured using inorganic material of wholly or partially

synthetic origin, and are added to the soil to sustain plant growth. Chemical

fertilizers generally contain one or more of the following nutrients, which are

essential to plant growth:

• Nitrogen

Nitrogen

plays an important role during plant growth. It is a component of amino acids in

plants, which are the building blocks of protein. Nitrogen also helps the crop

yield. It not only increases the output of agricultural products, but also

improves their quality.

• Potassium

Potassium

is essential in its ionic form for metabolism. Potassium encourages crops to use

nitrogen more efficiently, increases production, improves crop quality and

increases crop resistance.

• Phosphorous

Phosphorus

is the component of cell protoplasm in the plant. It plays an important role in

cell growth and proliferation. It also assists in photosynthesis, and

accelerates root growth of seedlings and the growth of plump-eared

grain.

In

accordance with their mineral nutrient content, chemical fertilizers can be

divided into four types, namely nitrogen, phosphate, potash and compound

fertilizers.

Organic

Fertilizers

Organic fertilizer is made up of

materials of natural origin (primarily derived from plants and/or

animals). It releases

nutrients into the soil as its constituent parts are broken down by

micro-organisms.

Organic

fertilizers promote the growth and reproduction of micro-organisms in the soil,

improve the physical, chemical and biological characteristics of the soil, and

increase the soil’s capacity to hold water and nutrients, thus creating a

favorable environment for plant growth.

10

GLOBAL

DEMAND AND SUPPLY OF FERTILIZER

The

steady growth of the global population and of the world economy has contributed

to increased demand for agricultural products. Other factors, including the

development of bio-energy (partly in response to rising oil prices) and the

implementation of favorable agricultural policies in certain countries, have

also promoted agricultural growth, which in turn has led to growth in demand for

fertilizers.

2007 was

a record year for the global production of fertilizer, as buoyant demand

stretched the industry’s capability to meet global requirements. External

factors such as those noted above are likely to further increase agricultural

production, thus stimulating demand for fertilizers, particularly in Asia and

the Americas. After a modest 1.5 percent growth in 2006, aggregate world

fertilizer consumption increased sharply, by over 5 percent in 2007. East Asia

and North America accounted for the majority of the increase in

demand.

Global

Fertilizer Consumption (million tonnes)

|

Nitrogen

|

Phosphorus

|

Potassium

|

Total

|

|||||||||||||

|

2007

(estimated)

|

99.4

|

40.2

|

29.1

|

168.7

|

||||||||||||

|

2008

(forecast)

|

102.9

|

40.8

|

29.8

|

173.5

|

||||||||||||

|

2012

(forecast)

|

114.9

|

45.4

|

32.8

|

193.1

|

||||||||||||

|

2008-2012

CAGR* 2008 **

|

2.8

|

%

|

2.7

|

%

|

2.4

|

%

|

2.7

|

%

|

||||||||

*Compound

Annual Growth Rate

**Based

on estimates of future demand in 2008 and 2012.

Source:

IFA, June 2008

An

International Fertilizer Association (“IFA”) report indicates that, in response

to relatively high agricultural commodity prices in 2007, as well as to policies

promoting fertilizer use in many Asian countries and favorable weather

conditions in the northern hemisphere, global fertilizer demand in 2007 is

estimated at 168.7 million metric (Mt) tonnes of nutrients. At the regional

level, the bulk of the increase in demand is forecast to come from Asia and, to

a lesser extent, from Latin America. South Asia and East Asia together are

forecast to account for two-thirds of total global growth. If Latin America is

added, the three regions together are forecast to account for 81 percent of the

increase in global demand in the next five years. The IFA report’s projections

for 2008 point to a further increase of 2.87 percent in world fertilizer demand,

reaching 173.5 million metric tonnes.

GROWING

AGRICULTURAL INDUSTRY IN THE PRC

The PRC

is one of the fastest growing economies in the world and primary industry

(farming, forestry, animal husbandry, sideline production and fishery) accounts

for over 10 percent of the PRC’s total gross domestic product.

The PRC

has a huge population of 1.3 billion. In contrast, the country’s farmland is

relatively limited, with approximately 130 million hectares of arable land. Per

capita arable land is less than 0.1 hectares.

11

Accordingly,

the PRC Government attaches great importance to the PRC’s issues concerning

“countryside, farmers and agriculture”. It has promulgated a series of

agricultural measures in favor of farmers since 2004, such as agricultural tax

relief, adopting agricultural subsidies and controlling arable area, so as to

promote the continued growth of agricultural production and farmers’ income. In

2007, the average per capita net income of Chinese farmers reached RMB 4,140,

representing an increase of 9.5 percent Over 2006. The PRC’s total grain output

reached 0.5015 trillion kilograms in 2007.

OVERVIEW

OF THE PRC FERTILIZER INDUSTRY

The PRC’s

chemical fertilizer industry plays an important role in the world fertilizer

industry. The PRC is one of the largest fertilizer producers and it accounts for

34 percent of global consumption (168.7 million tonnes – by effective component)

in 2007.

In order

to encourage investment in the fertilizer industry, the PRC Government has

promulgated a number of preferential policies, including zero rate VAT for

fertilizer products, preferential electricity prices and cheaper railway

transportation.

The PRC’s continuous economic growth,

agricultural development, growing demand for fertilizers and preferential

fertilizer industry policies combine to promote the development of the

fertilizer industry. According to the National Bureau of Statistics, the PRC’s

output of chemical fertilizers grew from 37.9 million tonnes (by effective

component) in 2002 to 57.9 million tonnes (by effective component) in

2007, with an average annual

growth rate of 8.8 percent.

Development

trend of Chinese fertilizers

|

1.

|

Continuous

development of chemical fertilizers

|

The

pressure to use a decreasing area of land to feed a growing population has

resulted in a consistent upward trend in the output of chemical fertilizers in

the PRC. The use of compound fertilizers in particular has grown continuously in

recent years.

|

2.

|

Development

opportunity for slow/controlled release

fertilizers

|

The PRC

Government’s 11th Five-Year Technology Development Planning and the National

Mid/Long- Term Science and Technology Development Planning Framework of 2006

indicated the direction for the development of technology of Chinese

fertilizers, focusing on research and development of environmentally-friendly

fertilizers’ key technologies and developing compound slow release and

controlled-release fertilizers. The development and increased usage of slow

release and controlled release fertilizers should serve to reduce agricultural

pollution, and also to save non-renewable resources.

COMPOUND

FERTILIZERS IN THE PRC

Compound

fertilizers have become increasingly popular over the past decade and the

consumption of them has been growing at the fastest rate among the categories

listed. The consumption of compound fertilizers in the PRC has grown from

approximately 6,708,000 tonnes in 1995 to approximately 13,032,000 tonnes in

2005, representing a CAGR of approximately 7.66 percent The Directors believe

that the increasing popularity of compound fertilizers in the PRC derives from

their greater nutrient content compared with that of single-fertilizer mixtures,

and the fact that they can be adapted to give crops a variety of different

nutrients to cater for different conditions and times of

application.

12

EMERGENCE

OF ORGANIC FERTILIZERS

Chemical

fertilizers provide plants with immediately available nutrients to sustain plant

growth and have been widely used in traditional PRC agricultural production for

decades. Prolonged usage of chemical fertilizers will reduce the soil’s

beneficial organism population and harden the soil. More and more countries are

therefore shifting gradually towards the use of organic

fertilizers.

Organic

fertilizer has been listed as one of the key development products in the 11th

Five-Year Plan for Ecology Protection, promulgated in October 2006. The PRC

Government also indicated that it would increase spending on research and

development on organic fertilizer products and technologies in the next five to

ten years. These new policies will help the farmers to realize the advantages of

using organic fertilizers, especially for farmland with poor soil structure and

fertility after prolonged inappropriate use of chemical fertilizers.

Accordingly, the Directors believe that demand for organic fertilizers will

remain strong in the coming years.

PRC

GOVERNMENT SUPPORT FOR THE FERTILIZER INDUSTRY

According

to the PRC National Bureau of Statistics, the PRC is currently the largest

fertilizer market in the world whereby fertilizer production and consumption

account for 34.3 percent of the global market and the annual average growth rate

in fertilizer application for 2002-2007 was 8.8 percent with demand growth

higher than the world average level. The Directors expect that the steady growth

of the PRC’s population and rising income will lead to demand for a diet with

higher protein such as meat, which requires grain as feedstock. The PRC’s

urbanization and industrialization will result in a continued decline in

available arable farm land, thus making it essential for the PRC to raise its

agricultural products yield to ensure adequate food supply. At the same time,

the Directors believe that economic reform in the PRC will lead to a growth in

consumer demand for cash crops such as vegetables and fruits, which generally

require the application of higher volumes of fertilizers than traditional farm

crops. The PRC Government has mandated that farmers increase crop yields in

order to decrease the nation’s dependence on food imports; the growing consensus

on the need to use environmentally friendly fertilizers has also been a factor

in the growth of the business of the Group. The Directors believe that as a

result of these factors, the demand for and the usage of fertilizers in the PRC

will increase and that, as one of the fast-growing and competitive fertilizer

producers in the PRC, the Group will benefit from the growth of the Chinese

fertilizer market.

As

fertilizer usage is key to increasing grain production yields, the PRC

Government has been encouraging fertilizer application and hence production.

Fertilizer production enterprises are given a number of benefits by the PRC

Government in terms of electricity supply and transportation. Since 2004, the

PRC Government has introduced several preferential VAT policies directly for the

benefit of fertilizer production enterprises; for instance, 50 percent of the

VAT collected from urea producers is refundable to these producers. To further

support the industry, from 1 July 2005, urea producers were temporarily exempted

from paying VAT, pursuant to a joint announcement made in May 2005 by the

Ministry of Finance and State Administration of Taxation. The purpose of these

preferential tax policies, and other supportive policies from the Government, is

to promote domestic fertilizer supply and stable fertilizer prices.

In

addition, the 11th Five-Year Plan for National Agricultural & Rural Economic

Development, promulgated in August 2006, establishes a goal of an annual 0.65

percent increase in comprehensive grain productive capacity over five years,

assuming an annual 0.18 percent decrease in planted grain acreage. The allowance

for the agricultural industry reached RMB 63.8 billion in 2008, representing an

increase of 131 percent over 2007. The PRC Government has recently declared that

it will strive to double the income of Chinese farmers by 2020 from the 2008

level and elevate the nation’s agricultural productivity to a higher level. The

11th Five-Year Plan for Fertilizer Industry, issued by the PRC’s National

Development and Reform Commission in October 2006, urges that the nation’s

fertilizer production should reach 60 million tonnes by 2010, which represents

an approximately 25 percent growth above the production in 2004. The Directors

believe that these policies will lead to a sustained demand for each type of

fertilizer.

13

OVERVIEW

OF THE PRC CHEMICAL INDUSTRY

The

chemical industry is the third largest in the PRC and accounted for 10 percent

of the country’s GDP in 2006 according to the PRC National Bureau of Statistics.

Chinese consumption constituted 35 percent to 40 percent of global demand growth

for chemicals. The growth in domestic demand for chemicals alone in 2005 and

2006 was 7 percent to 8 percent, according to the PRC National Bureau of

Statistics.

Despite

this growth however, the PRC has a net chemical trade deficit and remains

heavily dependent on imported raw materials, which have over recent years been

affected by upward price trends in the world market caused by heavy global

demand for raw materials, petroleum and other input.

Operations

and Employees

The

Group’s major production facilities and sales offices are located in Weifang,

Shandong Province in the PRC. At the date of this document, the Group has

approximately 220 employees, including the Executive Directors. Most of the

employees work in Shandong Province.

The

breakdown of the employees by function is as follows:

|

Changda Fertilizer

|

Changda Chemical

|

Changda

International Total

|

||||||||||

|

Directors

|

6

|

1

|

7

|

|||||||||

|

Management

and administration

|

9

|

4

|

13

|

|||||||||

|

Finance

and Accounting

|

13

|

5

|

18

|

|||||||||

|

Sales

and marketing

|

17

|

9

|

26

|

|||||||||

|

Product

Development

|

7

|

7

|

14

|

|||||||||

|

Production

|

49

|

81

|

130

|

|||||||||

|

Quality

Control

|

7

|

5

|

12

|

|||||||||

|

Total

|

108

|

112

|

220

|

|||||||||

Directors

Charles Frans Victor Brock

, Chairman and Director (age

42)

Mr. Brock

has over 20 years of experience in investment management and corporate finance,

specializing in the Asian region. Mr. Brock most recently served as a director

in the corporate finance department of Insinger de Beaufort, helping to develop

the Chinese/Asian side of business. Before joining Insinger, he was Head of

Pacific Equities at F&C Management Limited and Director of F&C Emerging

Markets Ltd. Mr. Brock is a member of the CFA Institute and the UK

Society of Investment Professionals. He graduated from York University with a

BA(Hons) in Economics and Politics and obtained an M.Sc. in Development Studies

from The School of Oriental and African Studies.

14

Leodegario Quinto Camacho

, Chief Financial Officer and

Director (age 56)

Mr.

Camacho has over 34 years of experience as a financial controller in both public

and private companies in the United States and the Philippines. As a

professional Certified Public Accountant for 33 years, he is a member of the

American Institute of Certified Public Accountants, New Jersey Society of

Certified Public Accountants and Association of Filipino-American Accountants.

Mr. Camacho is currently serving in a CPA firm Camacho & Camacho LLP in New

Jersey.

Qing Ran Zhu , Chief Executive Officer and

Director (age 47)

Mr. Zhu

has over 20 years of experience working in the sales and marketing of feed

products in the PRC agricultural industry. Before co-founding Changda Fertilizer

and Changda Chemical, Mr. Zhu was the Vice General Manager of Weifang Legang

Food Company and obtained extensive knowledge about food production, and

consequently food and health regulations in the domestic market. Mr. Zhu

graduated from Weifang Vocational College with a Bachelor’s degree in Economics

Administration.

Hua Ran Zhu , Director and Co-founder (age

54)

Mr. Zhu

has over 20 years of experience working in the chemical industry. Before

co-founding Changda Fertilizer and Changda Chemical, Mr. Zhu was in charge of

the production workshop and machinery safety department in Shandong Haihua

Group, thereby building years of expertise and experience in the production and

safety of chemical products. Mr. Zhu graduated from the University of Shandong

Government Official Distance-Learning.

Carsten Aschoff , Director (age

38)

Mr.

Aschoff has over 10 years’ management experience with various technology

companies in both Germany and the PRC. Mr. Aschoff is currently the director of

Siger Trading Ltd and Siger Technologies GmbH in Germany since March 2006 and

August 2006 respectively. From July 2005 to March 2006, Mr.Aschoff was involved

in freelance consulting work in the PRC. Between 2002 and June 2005, Mr. Aschoff

was the general manager for Shandong Linuo Paradigma Co. Ltd. in Jinan, China.

He was responsible for business development, production and distribution of

solar thermal systems. From 1998 to 2003, Mr. Aschoff was the lecturer at the

University of Applied Science HFT in Stuttgart, Faculty of Architecture –

“technical development” and “sustainable building”. Between 1996 and 2001, Mr.

Aschoff was working in the product management in Paradigma Energie-und

Umwelttechnik GmbH & Co. KG, Karlsbad, Germany.

Jan Pannemann , Director (age

34)

Mr.

Pannemann has six years of experience as a project manager and independent

business advisor in the City of London. Mr. Pannemann is also a co-founder of

Qingdao China Partners Investment Advisory, a PRC centric strategic management

advisory company, which was successfully merged in 2007 with now PLUS Markets

quoted Geo Genesis Group Ltd. Mr. Pannemann currently lives and works in the

PRC.

15

Senior

Management

Intellectual

Property

All of

the Group’s fertilizer products are sold under the “CHANGDA” trade mark, which

was granted by the PRC authorities on October 14, 2008, other than those sold

through China Post, which are sold under the “FENGTAI WOSIDA” trade mark, which

was granted by the PRC authorities on October 7, 2008. The “CHANGDA” trade mark

covers a wide range of fertilizer products, including agricultural fertilizers,

animal fertilizers, compound fertilizers and plant fertilizers.

All the

Group’s chemical products are also sold under the “CHANGDA” trade mark. The

trademark “CHANGDA” for the chemical products was applied for in June 2006 and

June 2007.

A total

of eight patent applications have been filed in the PRC in relation to the

various production methods and technology currently employed by the Group for

its fertilizer business. In addition, the Group has, together with Mr. Qing Ran

Zhu filed two patent applications in the PRC in relation to its snow melting

agent product and thiophene production methods and technology for its chemical

business segment. A summary of the Group’s patents is set out

below:

|

Company

Business

|

Patent

Description

|

Patent

registration

No.

|

Status

|

Date

of patent

filed/issued

|

||||

|

Fertilizer

|

High

silicon compound fertilizer product and its Production

Process

|

200710110812.1

|

Filed

|

June

11, 2007

|

||||

|

Sprout

and Article Formation Production Process for Compound

Fertilizer

|

200610043439.8

|

Granted

|

December

12, 2007

|

|||||

|

An

Organic-Compound Fertilizer and its Production Process

|

200810007504.0

|

Filed

|

February

26, 2008

|

|||||

|

Intelligent

Sulfur Film Coating for Large Granular Urea or Granular Compound

Fertilizers

|

200710195664.8

|

Filed

|

December

5, 2007

|

|||||

|

A

Soil Conditioner Containing Nitrogen and Phosphor

|

200810007850.9

|

Filed

|

February

26, 2008

|

|||||

|

A

Social Conditioner and its Production Process

|

200810007503.6

|

Filed

|

February

26, 2008

|

|||||

|

Resin

capsule fertilizer and technology 1

|

200810126410.5

|

Filed

|

June

26, 2008

|

|||||

|

Resin

capsule fertilizer coating

|

200810126411.X

|

Filed

|

June

26, 2008

|

|||||

|

Chemical

|

Treatment

method of a Sulphur contained Tar Waste produced in Manufacture Process

for Thiophene 1

|

200710195665.2

|

Filed

|

December

5, 2007

|

||||

|

Anti

Freeze Combination and its Production Process

|

200610043440.0

|

Granted

|

December

25, 2007

|

16

1

Patent applications were filed in the name of Mr. Qing Ran Zhu, who has signed

an instrument stating that he will assign the patents to Changda Chemical and

Changda fertilizer (wherever applicable) free of consideration after the patents

are granted.

Currently,

two patent applications have been granted to the Company’s PRC subsidiaries and

eight applications are still pending. Upon completion of the registration as the

owner of the filed patents, the Group will be able to enjoy all rights and

benefits in those patents.

Insurance

The Group

has taken out a basic asset insurance policy with China Continent Property &

Casualty Insurance Company Ltd. However, the Group does not have business

disruption insurance, as the Group has determined that the risks of disruption

and the cost of insurance are such that it does not required it at this time.

Any business disruption, litigation or natural disaster may result in

substantial costs and diversion of resources. Should any of these events occur

they may have a material adverse risk on the business and financial results of

the Group.

Research

and Development

The Group

devotes considerable effort and resources in improving the quality of its

existing products and accelerating the development of new products. The Group

has a research and development team comprising 14 staff. Most members of the

research and development team have either bachelors or master’s degrees in

related fields. They have considerable experience in soil studies, plant

nutrition and fertilizers and chemistry. The main functions of the research and

development team are to:

|

i.

|

conduct

research and technical feasibility studies on the formulae, manufacturing

processes, quality and stability of the Group’s

products;

|

|

|

ii.

|

keep

the Group abreast of the latest developments in both the global and

domestic chemical fertilizer markets; and

|

|

|

iii.

|

formulate

and evaluate the strategic policies for the Group’s products to enhance

their marketability.

|

In

addition to research and development into new products and production processes,

the Group’s research and development centre also provides after-sales support

and training to its distributors and customers. Such services not only help to

build and strengthen customer relationships, but also allow the Group to receive

feedback on its products for continuous development and

improvement.

Our

Competitors

Given the

relatively high cost of transporting fertilizers and the poor transport links

across parts of rural China, the major competitors to the Group’s fertilizer

business are companies located in Shandong Province or nearby, many of which are

small family-run operations. The Group also faces some competition from larger

quasi-national companies, in particular:

17

●

Shandong Hualu-Hengsheng Chemical Co., which operates various fertilizer

production lines, including those for urea and ammonia, in Dezhou, Shandong

Province;

● China

Blue Chemical Ltd, which supplies an extensive range of fertilizers. It operates

in the main agricultural regions of China, including Shandong

Province;

● Hubei

Yihua Chemical Industry Co., which supplies the domestic market with a range of

chemical fertilizers. It is based in Hubei Province in Eastern

China;

● Qinghai

Salt Lake Potash, a leading fertilizer company which specializes in the

production of potassium chloride, a product that it sells throughout

China;

●

Sinofert Holdings Ltd. (“Sinofert”) is an investment company with shareholdings

in various undertakings which operate in the Chinese fertilizer market.

Sinofert’s two main business streams – sources and distribution – operate

nationwide. Sinofert produces all three nutrient-based fertilizers – nitrogen,

phosphate and potash – as well as a range of compound products: potash is its

leading profit generator.

In terms

of its specialty chemicals business, competition for the Group is less

clear-cut. In particular, contracts for its snow melting products normally

follow the submission of tenders, both in mainland China and in overseas

markets; in the latter case, the Group will normally be competing against local

suppliers.

Competitive

Strengths

The

Directors believe that, compared with other PRC fertilizer manufacturers, the

following principal competitive strengths contribute to the Group’s historical

success and future prospects:

Experienced

management team

The

management team has average industry experience of over 10 years in production,

financial and business management. The Directors believe the management team

possesses the leadership, vision and in depth industry knowledge to anticipate

and take advantage of market opportunities, to formulate sound business

strategies, and to execute the strategies in an effective manner to maximize the

benefit to Shareholders. Senior management has been able to achieve

cost-efficient, organic and acquisitive growth of the Group’s business as well

as effective integration of management and operations. A corporate management

system, business philosophy and corporate culture have contributed to the

success of the Group’s historical growth.

Strong

distribution channel anchored by an exclusive distribution agreement with China

Post

The

Group’s sales are primarily in Shandong Province, one of the major agricultural

provinces in the PRC, and overseas to Japan. The Group supplied 10 percent of

snow melting agents demanded in Japan in 2007. The Group has established a broad

distribution network, including five exclusive distribution centers in Shandong

Province, and an exclusive distribution agreement with China Post, which has a

broad network of 80,000 distribution centers in 18 cities in Shandong Province.

The Group has a large corporate and government client base. The Group is able to

obtain information on the identity of end-users, so as to establish on-going and

direct business relationships with them, providing technical training and

after-sales services. Training seminars are also conducted on a regular basis

for end-users, to familiarize them with the Group’s products and promote brand

presence and enhance market value.

18

The Group

reviews the strengths of potential distributors, including their financial

soundness, market coverage and reputation, to evaluate potential candidates

before appointing them as distributors.

A

developer of next generation microbial organic-inorganic compound fertilizers

and slow-release compound fertilizers

Prolonged

application of synthetic chemical additives to soil leads to deterioration of

soil condition and water pollution. Unlike inorganic fertilizers, the Group’s

microbial organic-inorganic compound fertilizer products may facilitate the

preservation of soil fertility and the prevention of some plant diseases. In

1998, the State Council of the PRC launched the “Rich Soil Project” in the PRC,

with the objective of improving the deteriorating arable soil condition by

promoting the usage of organic fertilizers. The Group’s microbial

organic-inorganic compound fertilizer products are consistent with this

government policy, and the Directors believe they will contribute to the

protection of the environment.

Excellent

growth in turnover and asset scale compared to peers in the PRC

Between

2005 and 2007 the Group achieved a CAGR of 59 percent in turnover and 74 percent

in net income. This is significantly greater than the growth rates exhibited by

the Group’s listed peers. The Directors believe that the use of the proceeds of

the offering to fund the new plant in Heze, the expansion of new chemical lines

and the advancement of research and development shall help the Group to continue

on this strong growth trajectory.

Full

scale research and development support with patent coverage over both the

fertilizer and chemical key products

The

Group’s product range of fertilizers and chemical products are covered by two

granted patents and eight patents which are pending. The Group has a strong

focus on research and development to ensure that the quality of its products is

continuously improved and to accelerate the development of new

products. The Directors are confident that the Group’s capabilities

in developing new products and production processes will allow the Group’s

products to remain at the forefront of those available in the Group’s target

markets.

Strong

brand with national awards and accreditations

The

Group’s brands are well known in the Shandong province of the PRC, which is the

Group’s key target market. The products offered by the Group are associated with

high quality fertilizer products.

Fertilizer

sector receives significant support from the PRC government

The PRC

Government has expressed strong support for the agricultural industry, declaring

that farmers’ incomes should double from the 2008 level by 2020 and that

agricultural productivity should increase. The PRC Government has also expressed

support for the fertilizer industry in particular, stating that annual

fertilizer production should reach 60m tonnes by 2010, representing a 25 percent

increase over the 2004 level. The Directors believe that these policies will

lead to a sustained demand for each type of fertilizer.

The

Company’s internal processes and environmental procedures are ISO9001/ISO 14000

certified

19

The

internal processes and environmental procedures adopted by the Group ensure that

quality control, efficiency and environmental awareness are of the highest

level. This has been recognized by the attaining of the internationally

recognized ISO 9001 and ISO 14000 certifications.

Quality

Control Standards and Procedures

Stringent

quality control measures are implemented throughout the fertilizer and chemical

products’ production process in accordance with national standards. Each of the

plants has a quality control team in place to ensure product quality meets the

standards set by the PRC Government.

The

quality management and control system of the production facilities encompasses

the following features:

• Process

control – well-trained management and operating personnel to optimize

operations, stabilize production and ensure product quality.

•

Packaging and storage – systematic package and storage procedures are in place

to ensure proper packaging and to avoid any damage to the products during

storage in the Group’s warehouses.

• Testing

and Inspection – testing appliances are installed. Quality inspection teams

undertake random tests of both intermediate and finished products on a sample

basis to ensure the products comply with the required standards. Testing

processes include checking physical appearance and composition of

nutrients.

•

Machinery and equipment management – engineers and other personnel conduct

regular checks and repairs to maintain production.

Legal

Proceedings

Currently

we are not involved in any pending litigation or legal proceeding.

RISK

FACTORS

In

addition to the other information set out in this document, the following

special factors should be considered carefully in evaluating whether to make an

investment in the Company. This is a high risk investment and investors may lose

a substantial proportion or even all of the money they invest in the Company. If

you are in any doubt about the contents of this document or the action you

should take, you should consult your stockbroker, solicitor, accountant or other

independent professional advisor authorized under the FSMA who specializes in

advising on the acquisition of shares and other securities.

The

Directors believe the risks set out below to be the most significant for

potential investors. The risks listed, however, do not necessarily comprise all

those associated with an investment in the Company and are not intended to be

presented in any order of priority.

Any

persons considering whether to acquire Shares should seek professional tax

advice as to the consequences of their owning Shares in the Company as well as

receiving returns from it. Tax commentary in this document is provided for

information only and no representation or warranty, express or implied, is given

to any recipient of this document as to the tax consequences of acquiring,

owning or disposing of Shares and neither the Company nor the Directors will be

responsible for any tax consequences of any investment in the

Company.

20

RISKS

RELATING TO THE GROUP’S BUSINESS OPERATIONS

The

Company is a newly formed company with no operating history and therefore

investors are not able to assess the Company’s prospects on the basis of past

results

Although

the Group has a history going back to 2005, the Company was incorporated on

April 2, 2007 and has no significant trading, operating or financial history. It

may be difficult, therefore, to evaluate the Company’s current or future

prospects. In addition, new products such as microbial fertilizer and thiophene

which were launched in 2007 cannot be construed as an indication of the future

performance of the Group. The Group will also launch new types of fertilizer

after completion of the new production plant in Heze, Shandong Province. Certain

business segments of the Group are in an initial stage of operation, and may

therefore incur additional business risk.

Reliance

on China Post Logistics (Shandong) Limited (“China Post”)

For each

of the three years ended December 31, 2005, 2006, and 2007, sales via China Post

and its branch offices accounted for approximately 56 percent, 51 percent and 61

percent respectively of the Group’s total turnover. If there is any disruption

in the Group’s business relationship with China Post and the Group fails to

secure new distributors with a similar sales network in the PRC, the operation

and profitability of the Group may be adversely affected.

Dependence

upon key personnel

The

Group’s performance is to a significant extent dependent upon the continuing

services and performance of key management personnel and in particular the

Co-founders, two of whom are also Executive Directors. The Group’s future

success will depend, in part, on its ability to attract and retain highly

qualified management and technical personnel. There can be no assurance that the

Group will be successful in hiring or retaining qualified personnel. The loss of

key personnel, or the inability to hire or retain qualified personnel, could

have an adverse effect on the business and operations of the Group.

30

days’ notice of termination by key management

Under the

laws of the PRC, no employee can be required to give longer than 30 days’ notice

of the termination of their employment. Although the key management personnel in

the PRC have been hired on employment contracts with an initial fixed term of 3

to 5 years, there is a risk that any of the key management personnel could cease

employment with the Group on 30 days’ notice at any time.

Risk

of infringement of the Group’s intellectual property rights in the

PRC

All the

Group’s fertilizer and chemical products are sold under the “CHANGDA” and

“FENGTAI WOSIDA” trademarks which are registered as trademarks in the PRC. In

addition, two patent applications have been granted and eight patent

applications are still pending. There can be no assurance that the existing

legal protection in the PRC will effectively prevent unauthorized use of the

Group’s “CHANGDA” and “FENGTAI WOSIDA” trademarks or the misappropriation by

third parties of the technology associated with the Group’s applied/registered

patents.

21

Policing

unauthorized use of the trademarks and the proprietary technology of the Group

may be difficult, costly and ineffective, and there can be no assurance that any

steps taken by the Group will effectively prevent any such misappropriation or

infringement from occurring. Unauthorized use of the Group’s trademarks and

patented technology could adversely affect the performance of the Group and its

business reputation. Failure to renew the Group’s trademarks could also

adversely affect the performance of the Group and its business

reputation.

In

relation to the eight patent applications which are still pending, should the

Group fail in its application for securing such patents, it may not be able to

prevent the unauthorized use of the Group’s technologies and methods as set out

in the applications. In this event, unauthorized use of the Group’s production

methods and technologies could adversely affect the performance of the

Group.

Risk

that the Group may be subject to claims of infringement of third-party

intellectual property rights

From time

to time, third parties may assert against the Group alleged patent, copyright,

trademark, knowhow, or other intellectual property rights to technologies that

are important to the Group’s business. In particular, the Group may be subject

to intellectual property infringement claims relating to micro-organic compound

fertilizers from a Mr. Jiu Shun Chen. Mr. Chen and one of the Co-founders, Mr.

Qing Ran Zhu, who were co-applicants in relation to three patent applications

relating to micro-organic compound fertilizers, but those patent applications,

were rejected by the China Patent Office. Changda Fertilizer used the underlying

technology as set out in the patent applications in manufacturing its products

in 2006 and 2007, and the sales of those products made up a significant portion

of Changda Fertilizer’s revenues in 2006 and 2007; however, the products related

to the patents in question are no longer in production by the Group and are not

anticipated to be produced by the Group in the future.

Any

claims that the Group’s products or processes, whether in relation to the

specific circumstances set out above or otherwise, infringe the intellectual

property rights of others, regardless of the merit or resolution of such claims,

could cause the Group to incur significant costs in responding to, defending,

and resolving such claims, and may divert the efforts and attention of the

Group’s management and technical personnel away from the business. As a result

of such intellectual property infringement claims, the Group could be required

or otherwise decide it is appropriate to: pay third-party infringement claims;

discontinue manufacturing, using, or selling particular products subject to

infringement claims; discontinue using the technology or processes subject to

infringement claims; develop other technology not subject to infringement

claims, which could be time-consuming and costly or may not be possible; and/or

license technology from the third-party claiming infringement, which license may

not be available on commercially reasonable terms.

The

occurrence of any of the foregoing could result in unexpected expenses or

require the Group to recognize an impairment of the Group’s assets, which would

reduce the value of the assets and increase expenses. In addition, if the Group

alters or discontinues the production of affected items, its revenue could be

negatively impacted.

22

Risks

in failing to obtain statutory permits/certificates/approvals or to renew

existing statutory permits/ certificates/ approvals

|

(a)

|

Fertilizer

related permits and certificates

|

Industrial

production permits and fertilizer registration certificates are statutory

requirements for the production and/or distribution of certain fertilizers in

the PRC. As at the date of this document, these permits and certificates in

relation to all of the Group’s fertilizer products have been obtained. Failure

to renew these industrial production permits and/or fertilizer registration

certifications by the Group upon their respective expiry could adversely affect

the operation of the Group.

|

(b)

|

Real

estate approvals

|

The Group

has not obtained formal title certificates to some of the properties it occupies

and one landlord lacks the legal right to lease the properties to the Group,

which may materially and adversely affect the Group’s right to use such

properties.

Changda

Heze is constructing fertilizer manufacturing facilities on a parcel of land

with an area of approximately 53,333 square meters in the Mudan Industrial Park,

Heze City, Shandong Province. Although the Group has entered into a letter of

intent with the local government in Heze regarding the purchase of the land from

the State, the Group is still in the process of obtaining the relevant land use

right certificates and building ownership certificates for the land and the

constructions being built thereon. Upon obtaining the relevant certificates for

these properties, the Group will have the legal right to occupy, let, transfer

and mortgage such properties. However, the Group may not be able to obtain all

of the title certificates it currently lacks, in which case its rights as owner

or occupier of the land and the constructions may be adversely affected as a

result of the absence of the formal title certificates as described above and it

may be subject to lawsuits or other actions taken against the Group. Moreover,

Changda Heze may also be subject to fines of 5 to 10 percent of the cost of

constructions built by Changda Heze on the land without first obtaining

construction approvals (construction costs were approximately RMB 18 million,

approximately U.S. $2.6 million).

Changda

Chemical leases a parcel of land with an area of approximately 22,500 square

meters from Xinxing Village Villagers’ Committee (the “Committee”). Changda

Chemical has built manufacturing facilities on the land. The Committee does not

have the right to lease the land to Changda Chemical because the land is

collectively-owned land for agricultural purposes and therefore is not permitted

to be leased for industrial purposes. Although the Company has received written

certifications from the local authority that Changda Chemical has attended to

all relevant procedures using the land and that the land is, according to the

municipal planning authority, intended for industrial purposes, the lease may be

deemed invalid under PRC law. If the lease is terminated or invalidated, the

Group may be forced to seek alternative premises, without entitlement to any

compensation and incur additional costs relating to such relocations. Moreover,

Changda Chemical may also be subject to fines of 5 to 10 percent of the cost of

the constructions built by Changda Chemical on the land without first obtaining

construction approvals (construction costs were approximately RMB 4.3m,

approximately U.S.$629,000).

|

(c)

|

Safety

and environmental approvals

|

The Group

has obtained production safety approvals with respect to its manufacturing lines

which are currently in use for its fertilizer and chemical business. Failure to

renew these approvals upon their respective expiry could adversely affect the

operations of the Group.

23

Differences

between PRC and US GAAP

The

profits of the Group are derived from its subsidiaries established in the PRC.

The profits available for distribution for companies established in the PRC are

determined in accordance with PRC accounting standards, which may differ from

the amount arrived at under the U.S. Generally Accepted Accounting Principles

(“US GAAP”). In the event that the amount of the profits determined

under the PRC accounting standard in a given year is less than that determined

under the US GAAP, the Company may not have funds to allow distribution of

profits to its Shareholders.

Untested

market for thiophene and fire retardant chemical

It is

possible that if and when the Group’s thiophene and fire retardant chemical

products are launched into the market, the originally predicted market may have

changed either due to an increase in the supply of such products or changes in

the demand for such products. Therefore, there is no assurance that the Group

will be able to sell any of its new products as planned, and failure to do so

may have an adverse impact on the Group’s business, operations and financial

condition.

Sustainability

of growth

The Group

achieved a turnover and net profit growth of about 57 percent and 52 percent

respectively for the financial year ended December 31, 2007. There is no

assurance that such growth rate can be sustained or that the Group can retain

and attract qualified management, employees and customers. In the event that the

Group is unable to maintain such attributes, the Group may have negative growth