Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - BROADWIND, INC. | a2195798zex-23_2.htm |

| EX-23.3 - EX-23.3 - BROADWIND, INC. | a2195798zex-23_3.htm |

| EX-23.1 - EX-23.1 - BROADWIND, INC. | a2195798zex-23_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on December 10, 2009

Registration No. 333-162790

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BROADWIND ENERGY, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

3360 (Primary Standard Industrial Classification Code Number) |

88-0409160 (IRS Employer Identification No.) |

47 East Chicago Avenue, Suite 332

Naperville, IL 60540

(630) 637-0315

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

J.D. Rubin

Vice President, General Counsel and Secretary

Broadwind Energy, Inc.

47 East Chicago Avenue, Suite 332

Naperville, IL 60540

(630) 637-0315

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

Robert L. Verigan Matthew G. McQueen Sidley Austin LLP One South Dearborn Street Chicago, IL 60603 (312) 853-7000 |

Michael Kaplan Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 (212) 450-4000 |

|

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion) December 10, 2009

15,000,000 Shares

COMMON STOCK

We are offering 10,000,000 shares of our common stock, $0.001 par value per share, and the selling stockholders affiliated with Tontine Capital Partners, L.P. identified in this prospectus are offering an additional 5,000,000 shares of our common stock, $0.001 par value per share, in each case through the underwriters identified in this prospectus. We will not receive any of the proceeds from the sale of the common stock by the selling stockholders.

Our common stock is listed on the Nasdaq Global Select Market under the symbol "BWEN." On December 9, 2009, the last reported sale price of our common stock was $8.36 per share.

Investing in our common stock involves substantial risks. See "Risk Factors" beginning on page 10.

|

||||||||

| |

Price to Public |

Underwriting Discounts and Commissions |

Proceeds to Company (before expenses) |

Proceeds to Selling Stockholders (before expenses) |

||||

|---|---|---|---|---|---|---|---|---|

Per share |

$ | $ | $ | $ | ||||

Total |

$ | $ | $ | $ | ||||

|

||||||||

The underwriters have an option to purchase up to a maximum of 2,250,000 additional shares of our common stock from the selling stockholders (with 1,125,000 of such additional shares offered by the selling security holders affiliated with Tontine Capital Partners, L.P. and 1,125,000 of such additional shares offered by J. Cameron Drecoll, our Chief Executive Officer and one of our directors), at the public offering price, less underwriting discounts and commissions, to cover over-allotments, if any. The underwriters can exercise this right at any time and from time to time, in whole or in part, within 30 days after the date of this prospectus. If the underwriters exercise this option in full, the total underwriting discounts and commissions will be $ , the total proceeds, before expenses, to the selling stockholders will be $ .

The underwriters are offering the common stock as set forth under "Underwriting."

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2009.

| Macquarie Capital | J.P. Morgan | |

Raymond James |

Lazard Capital Markets |

, 2009

You should rely only on the information contained or incorporated by reference in this prospectus and any free writing prospectus prepared by or on behalf of us. We and the selling stockholders have not, and the underwriters have not, authorized any other person to provide you with information different from that contained in this prospectus. We and the selling stockholders are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where such offers and sales are permitted. The information contained or incorporated by reference in this prospectus is accurate only as of their respective dates of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the shares of common stock. Our business, financial operations and prospects may have changed since those dates.

Information contained on our website does not constitute a part of this prospectus.

We obtained the industry, market and competitive position data used throughout this prospectus from our own research, internal surveys and studies conducted by third parties, independent industry associations or general publications and other publicly available information. Independent industry publications and surveys generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. Forecasts and estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading "Risk Factors" elsewhere in this prospectus. References in this prospectus to the size or quantity of wind turbines or towers expressed in terms of Megawatts, or MW, or Kilowatts, or kW, refer to the nameplate capacity of the wind turbines as specified by the manufacturer.

i

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information you should consider in making your investment decision. You should read the following summary together with all of the more detailed information regarding us and our common stock being sold in the offering, including our consolidated financial statements and the related notes, the information set forth under the headings "Risk Factors" and "Management's Discussion and Analysis of Financial Conditions and Results of Operations" appearing elsewhere in this prospectus, as well as the documents incorporated by reference herein. Unless we state otherwise, "Broadwind Energy," "Broadwind," the "Company," "we," "us" and "our" refer to Broadwind Energy, Inc. and its wholly-owned subsidiaries. The "selling stockholders" refers, collectively, to the selling stockholders named in this prospectus under the heading "Principal and Selling Stockholders."

Business Overview

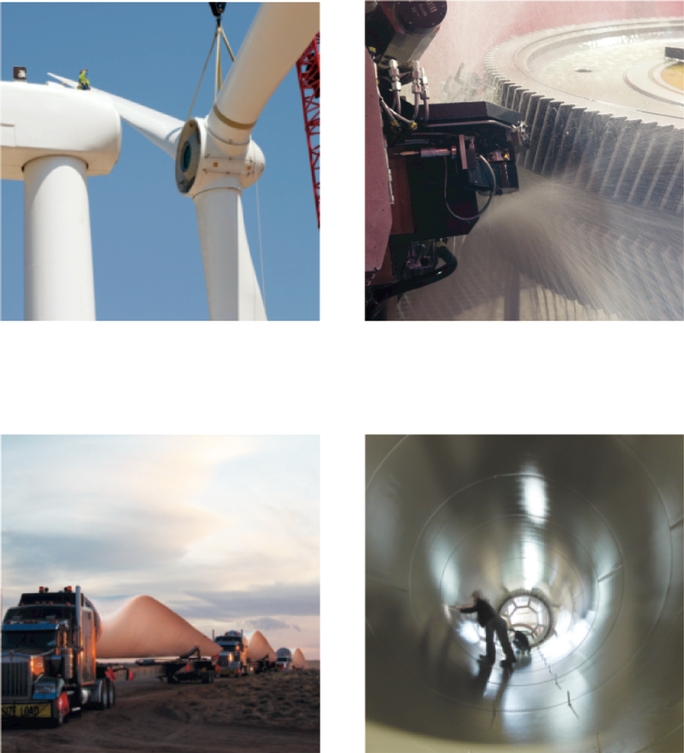

Broadwind Energy provides technologically advanced high-value products and services to the U.S. wind energy industry. We believe we are the only independent company that offers our breadth of products and services to the market. Our product and service portfolio provides our customers, including wind turbine manufacturers, wind farm developers and wind farm operators, with access to a broad array of wind component and service offerings, which we believe is becoming increasingly important in today's wind market. We are the number one U.S.-based manufacturer of gearing systems for the wind industry and the third largest U.S.-based manufacturer of wind towers, in each case based on total MW shipped in 2008. We also provide technical service and precision repair and engineering and specialized logistics to the wind industry in the United States, a highly-fragmented market in which we hold a significant position. We have long standing relationships with our primary customers, who include several leading participants in the U.S. wind sector.

We believe we are well positioned to capture market opportunities associated with the anticipated turn-around in the wind farm development business in the United States and abroad. In the United States, we believe this turn-around will be driven by: (i) macroeconomic factors, including a broad economic recovery, an increase in overall energy prices and federal and state-level wind development incentives, (ii) broad upgrades to existing transmission infrastructure and increasing proliferation of smart grid technology, and (iii) the maturation of technologies and services within the wind industry, including increased turbine efficiencies, a coordinated global supply chain and improved equipment maintenance and reliability. Given our installed capital base, we believe we will be able to substantially grow revenues prior to investing in additional capital equipment.

For the nine months ended September 30, 2009, our revenues were approximately $164.9 million, our earnings before interest, taxes, depreciation, amortization, stock-based compensation and goodwill impairment ("Adjusted EBITDA") was approximately $6.1 million and our net loss was approximately $17.5 million. Please refer to the section of the prospectus entitled "Summary Consolidated Financial Data" for a reconciliation of Adjusted EBITDA to net loss for the nine months ended September 30, 2009.

Our businesses are currently organized in two operating segments, Products and Services.

Products

We manufacture high precision gearing systems and structural towers for wind turbines. We also manufacture custom-engineered gearing systems, and fabrications and weldments for the mining, energy and other industrial sectors. For the nine months ended September 30, 2009, our Products segment generated approximately $130.9 million in revenues and had an operating loss of approximately $10.2 million. Our product offerings within our products segment are wind turbine gearing systems, wind turbine structural towers, and industrial products.

1

Our high precision gearing systems and structural towers for wind turbines are predominantly sold to wind turbine manufacturers who utilize our products in the assembly of wind turbines. Due to the highly specialized nature of our products, they are generally sold through our direct sales force following an evaluation, qualification and testing period, which may occur over a number of months. We compete based on product performance, quality, price, location and available capacity. We have periodically entered into multi-year framework agreements under which we expect to provide products to certain key customers over multi-year periods.

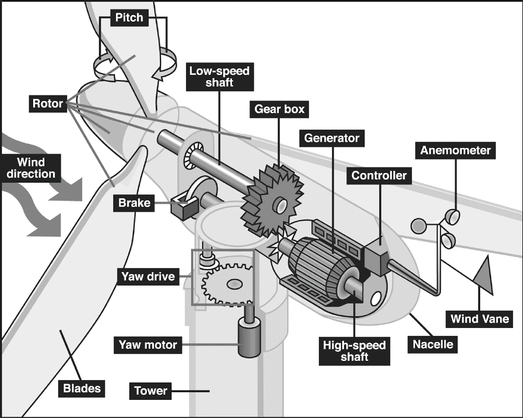

Wind Turbine Gearing Systems

We are the largest U.S.-based precision gearing system manufacturer for the wind industry in North America based on total Megawatts of the turbines for which gearing systems were shipped in 2008, with plants in Illinois and Pennsylvania. We produce to the highest industry quality standards, and we were the first U.S. gear manufacturer to achieve ISO 9001 certification. We use an integrated manufacturing process, which includes our machining process in Cicero, Illinois, our heat treatment process in Neville Island, Pennsylvania and our finishing process in our Cicero factory. These complex production processes allow us to manufacture custom products to meet the stringent tolerances and high quality standards of our wind turbine customers. Our precision gearing manufacturing facilities have a production capacity to support turbines producing more than 4,000 MW of power annually. Our principal customers include General Electric and Clipper Windpower, both of whom have been long-standing customers. We are currently in discussions with large global gear drive original equipment manufacturers with the aim of becoming a gearing system supplier to one or more of these companies.

Wind Turbine Structural Towers

We are the third largest wind tower manufacturer in North America based on MW sold in 2008 in the United States. We specialize in heavier "next generation" wind towers that are larger, more technically advanced towers, designed for 2 MW and larger wind turbines. Since starting commercial production in 2005, we have produced over 500 towers. Our production facilities are strategically located in close proximity to the primary U.S. wind resource regions, sited in Wisconsin, Texas and South Dakota. Upon completion of our Brandon, South Dakota facility, scheduled in the first quarter of 2010, our three tower production facilities will have a combined annual tower production capacity sufficient to support turbines generating more than 1,500 MW of power. Our principal wind tower customers include Gamesa, Vestas and Nordex.

Industrial Products

We manufacture products for industrial markets including mining and oilfield equipment and cranes. Our industrial products include gearing, gear drives and custom weldments. We target niche markets and applications that require the strict tolerances and high quality standards of our processes. These products are produced in Illinois and Wisconsin and serve to diversify our customer and product portfolio and balance our plant loadings.

Services

We offer a wide variety of services to our customers, including technical services, precision repair and engineering and logistics. For the nine months ended September 30, 2009, our services business generated approximately $34.5 million in revenues and had an operating loss of approximately $0.8 million. Our services are typically provided to wind farm developers and operators or manufacturers of wind turbines. Sales contacts are typically initiated through a small direct sales force, or through operating unit managers located in our geographically dispersed service locations. Sales are generally made under individual purchase orders, although we have blanket purchase orders or framework agreements in place with select key customers. Our technical service and precision repair and engineering services representatives compete with a number of independent service providers in a

2

highly-fragmented but growing industry. For our logistics business, we primarily compete based on the availability of our trailer asset base, our service, price and reliability. Our principal Services segment customers include Acciona, Fuhrlander, Gamesa, Horizon Wind Energy, NexGen Energy Partners, NextEra Energy Resources, Siemens Energy and Suzlon Wind Energy. Our service locations are in Illinois, California, South Dakota, Texas and Colorado. Our vision is to become the most comprehensive service provider to the United States and Canadian wind industry by expanding the number of our service centers. Our product offerings within our services segment are technical services, precision repair and engineering services, and logistics.

Technical Services

We are a leading independent service provider of construction support and operations and maintenance services for the wind industry based on number of trained service technicians employed as of December 31, 2008. Our specialty services include oil change-out, up-tower tooling for gearing systems, drive-train and blade repairs and component replacement. Our construction support capabilities include assembly of towers, nacelles, blades and other components. We also provide customer support, preventive maintenance and wind technician training. Our technicians utilize our regional service centers for storage and repair of parts as well as our training offerings.

Precision Repair & Engineering Services

Through our precision repair and engineering services, we repair and refurbish complex wind components, including control systems, gearboxes and blades. We also conduct warranty inspections, commission turbines and provide technical assistance. Additionally, we build replacement control panels for kW class wind turbines and repair both kW and MW blades.

A large portion of the approximately 31,100 MW installed base of wind turbines in the United States is now coming out of warranty creating a growing need for MW gearbox refurbishment. We plan to develop the first independent gearbox refurbishing center and gearbox test stand to perform full-load testing for MW class wind turbine units.

Logistics

We offer specialized transportation, permitting and logistics management to the wind industry for oversize and overweight machinery and equipment. We deliver complete turbines to the installation site, including blades, nacelles and tower sections for final erection. We focus on the project management of the delivery of complete wind turbine farms. We have a fleet of over 60 specialized heavy haul trailers supporting annual delivery of 500 MW of full turbine components.

Competitive Strengths

We believe our business model offers a number of competitive strengths that have contributed to our commercial success and will enable us to capitalize on significant opportunities for growth. These competitive strengths include the following:

- •

- Strong relationships with leading wind industry players. Our integrated business model has enabled us to hold leading positions in many of the markets we serve by successfully winning key contracts and establishing strong relationships with major wind sector manufacturers. We provide products and services to the eight largest wind turbine manufacturers currently selling in the United States: Acciona, Clipper Windpower, Gamesa, General Electric, Mitsubishi, Siemens Energy, Suzlon Wind Energy, and Vestas. We believe our relationships with leading players endorse our product quality and service capabilities and position us well to sell effectively to new customers. We intend to continue to develop long-term, multi-year contracts and strategic customer relationships across our product and service businesses.

3

- •

- Leading service

platform. We are the largest horizontally integrated independent service provider to the U.S. wind industry. We believe that we are

differentiated by the breadth of our offerings, which enables us to work with wind farm developers through a project lifecycle: construction support including logistics and transport, commissioning of

the wind farm, ongoing maintenance and operational support services, precision repair and upgrades to existing installations. Our in-house gearing system manufacturing expertise positions

us to enter the market for gearbox repair and refurbishment which, for MW-scale turbines, has historically been performed by non-domestic sources. We believe that our broad

service offerings and technical capabilities will allow us to grow our services business significantly as the installed wind turbine base grows and wind turbines come off warranty.

- •

- Manufacturing and service capacity to support anticipated

growth. Over the past two years, we have made substantial upfront investments in property and equipment to position ourselves to take

advantage of the expected rapid growth in the North American wind industry. We believe this capacity will allow us to quickly respond to increased demand from our customers and enable us to gain share

as market growth returns. In our products businesses, we have invested substantial capital in technology, engineering and manufacturing capabilities and capacity for both wind turbine towers and

gearing systems. We have also invested significantly in our service group and grown our capacity through the addition of personnel and new service offerings and by expanding our footprint of regional

service centers. In connection with the expected growth of the wind power market, we believe these investments will allow us to realize significant operating leverage as we increase our revenues with

minimal capital expenditure.

- •

- Ability to cross-sell our product and service

offerings. Our combined product and service suite provides us with opportunities to increase sales to existing customers and approach

potential customers with a coordinated offering. Leveraging our broad existing customer base, we have realized additional revenues by selling products and services that our customers previously

purchased from various other providers. As an example, we have provided logistics services to customers to whom we had previously only supplied towers or operations and maintenance services. We have

also recently been engaged by wind farm developers for comprehensive supply chain solutions including supply of towers, gearbox rebuilds, transport and logistics and construction and commissioning

support services. We believe that the breadth of our comprehensive solution is unique and is compelling for the growing segment of smaller wind developers.

- •

- Horizontally integrated supply chain offering with strategically

located operations. We believe that we have the leading North American platform designed to provide an integrated solution to the

fragmented supply chain our customers face. Today, the manufacture and production of wind turbines involves over 8,000 components and many of the key inputs are both geographically dispersed

and lack integration. This results in high transportation costs and quality control issues as many developers and manufacturers are forced to coordinate among multiple suppliers. While we do not

provide all key components, our wind turbine component production capabilities combined with the broad array of services we offer allows our customers to simplify coordination for these increasingly

complex wind development projects. We believe the breadth of our capabilities will prove attractive to new entrants and incumbents by improving speed to market, increasing product reliability and

reducing costs. Additionally, our production facilities and service offerings are strategically located near existing wind centers, which allows us to minimize our response time and reduce logistics

costs for our customers.

- •

- Industry leading technology and manufacturing expertise. We utilize industry-leading technology and design capabilities and have wind product manufacturing expertise. We specialize in manufacturing "next generation" wind towers, and we were the first U.S. gear manufacturer to achieve ISO 9001 certification. Our gearing systems production facilities utilize state-of-the-art Höfler production centers and are experienced in designing and manufacturing customized

4

- •

- Experienced management team with decades of wind industry experience. Our senior management team has significant industry experience and proven expertise in wind and other energy sectors and holds leadership positions in industry organizations such as the American Wind Energy Association ("AWEA"), the Canadian Wind Energy Association and the American Gear Manufacturers Association. Key areas of expertise include high technical specification industrial manufacturing, operational execution in the wind industry, strategic business development, financial planning and acquisition integration. Members of our senior management team have held positions at leading global and national wind and industrial sector companies including Vestas, General Electric, Trinity Industries, DMI Industries, British Petroleum, Regal Beloit, FMC Technologies and Federal Signal.

products to meet specific customer needs. We have diverse technical repair expertise and the necessary spare inventory to minimize costs and response time and deliver the greatest long-term value for the lifecycle of our customers' projects. We believe our ability to design and manufacture high quality customized products and provide superior service creates high barriers to entry and allows us to maintain an advantage over our competition.

Business and Operating Strategy

We intend to capitalize on the anticipated growth of the wind sector in the United States and Canada by providing our technologically advanced, highly reliable, value-added products and components and customized services across the wind supply chain to enhance our leadership position.

Our strategic objectives include the following:

- •

- Utilize our established platform to increase market share and satisfy

customer demand. During 2008, we took steps to enhance our manufacturing capabilities by increasing gearing production capacity and

constructing a new state-of-the-art tower manufacturing plant in Abilene, Texas. We are also constructing an additional tower manufacturing plant in Brandon, South

Dakota. We increased specialized heavy-haul capacity by over 20% and increased our service capacity through strategic hiring and the addition of a new facility capable of supporting

MW-class blade repair. We believe our presence in key wind resource states provides us with an advantage on cost, efficiency and speed to market by limiting exchange rate risk and

importation and customs duties (compared to international competitors) and substantially reducing transportation and working capital costs for our customers. As a result, we believe that we are well

positioned with our existing infrastructure to take advantage of projected improvements in market conditions.

- •

- Continue to develop and grow our service

businesses. We have established a network of service centers strategically located near key wind farm sites with precision repair and

engineering capabilities and skilled personnel. We believe that there is a significant opportunity to continue to develop this network to provide more comprehensive support to additional businesses in

the wind industry. Wind turbine components are initially serviced by wind turbine manufacturers under applicable warranties, which have generally been shortening over time. We believe that, as the

size of the installed base grows and ages, manufacturer warranties expire and as the complexity and size of wind turbines increase, wind farm operators will increasingly seek third party service

providers to maintain their assets. We intend to support our customers' service strategies, to further develop our own service channels and to capture a share of the expanding service and aftermarket

support business through relationships with wind turbine manufacturers, wind farm operators and independent service providers. Consistent with this strategy, we continually evaluate potential

acquisition opportunities, some of which may be material.

- •

- Leverage our success in North America to pursue international business opportunities. We have begun to expand our focus beyond the North American wind energy market to develop an international presence as a long-term strategic objective. We believe that there has been a rapid migration of turbine manufacturers to the United States, which has allowed us to develop

5

- •

- Continue to improve production technology and operational

efficiency. We believe that the proper coordination and integration of the supply chain are key factors that enable high operating

efficiencies, increased reliability and lower costs. Our manufacturing facilities include state-of-the-art equipment and lean processes to help enhance our

operational efficiency and flexibility. We will continue to pursue strategies to further optimize our production processes to generate increased output, leverage our scale and lower our costs while

maintaining product quality.

- •

- Broaden our product offerings. We believe that we offer one of the most complete sets of product offerings addressing the needs of customers across the North American wind supply chain. We are dedicated to the identification, development and commercialization of new products that take advantage of our scale in order to provide comprehensive solutions for our customers. Since a turbine often contains more than 8,000 components, we plan to take advantage of our extensive expertise and technological capabilities to develop the complex product offerings required to compete in the North American wind market.

relationships with leading global turbine assembly companies and increases our opportunity to leverage these relationships into global markets. We have recently restructured our management team to provide the framework for pursuing international business opportunities, which we believe will expand our revenue opportunities and enable us to better serve our customers, enhance our supply chain and develop additional synergies across our operating units.

As the North American wind industry matures and the complexity of wind turbines increases, complex product offerings, advanced supply chain management and specialized services will be critical for wind turbine manufacturers and wind farm developers and owners, and we intend to pursue our business strategies and maintain and enhance our established platform to more deeply penetrate our target markets and further diversify our customer base.

Our Corporate Information

Our principal executive office is located at 47 East Chicago Avenue, Suite 332, Naperville, IL 60540. Our phone number is (630) 637-0315 and our website address is www.broadwindenergy.com. Information contained on our website does not constitute part of this prospectus.

Risk Factors

An investment in our common stock involves substantial risk. You should carefully read and consider the information set forth under "Risk Factors," as well as all other information contained or incorporated by reference in this prospectus before investing in our common stock. For example:

- •

- our business, results of operations and financial condition may continue to be adversely affected by dislocation in the

global credit markets and economic uncertainty;

- •

- a significant change in tax and other economic incentives and political and governmental policies related to the U.S. wind

industry could negatively impact our results of operations and growth;

- •

- we are substantially dependent on a few significant customers;

- •

- we face competition from industry participants who may have greater resources than we do;

- •

- our customers may be significantly affected by disruptions and volatility in financial markets;

- •

- we may have difficulty raising additional financing when needed or on acceptable terms;

- •

- our operations may not generate cash flows in an amount sufficient to enable us to pay our indebtedness; and

- •

- we have generated net losses and negative cash flows since our inception and we may not achieve profitability.

6

Common stock offered by us |

10,000,000 shares | |

Common stock offered by the selling stockholders |

5,000,000 shares by Tontine (as defined below) |

|

Underwriters' option to purchase additional shares from the selling stockholders |

2,250,000 shares (half by Tontine and half by J. Cameron Drecoll) |

|

Common stock to be outstanding after this offering |

106,651,630 shares |

|

Use of proceeds |

We estimate that we will receive net proceeds from this offering of approximately $78.7 million, after underwriting discounts and commissions and estimated offering expenses. |

|

|

We intend to use approximately $16.6 million of the net proceeds to us from this offering to repay our outstanding indebtedness under our credit facilities with Bank of America and to use the remaining proceeds for general corporate purposes, including capital expenditures to grow our services businesses or for the repayment of other outstanding indebtedness. |

|

|

We will not receive any proceeds from the sale of any shares in this offering by the selling stockholders. |

|

|

See "Use of Proceeds" for more information. |

|

Nasdaq Global Select Market Symbol |

"BWEN" |

The selling stockholders are Tontine Capital Partners, L.P. ("TCP"), Tontine Capital Overseas Master Fund, L.P. ("TMF"), Tontine Partners, L.P. ("TP"), Tontine Overseas Fund, Ltd. ("TOF"), Tontine 25 Overseas Master Fund, L.P. ("T25" and collectively with TP, TOF, TCP, TMF and their affiliates, "Tontine") and, in the event the underwriters exercise their over-allotment option, J. Cameron Drecoll, our Chief Executive Officer and one of our directors.

The number of shares to be outstanding after this offering is based on 96,651,630 shares outstanding as of December 8, 2009, and does not include, as of December 8, 2009:

- •

- 1,403,603 shares of common stock issuable upon the exercise of stock options with a weighted average exercise price

of $11.09 per share;

- •

- 269,151 shares subject to outstanding restricted stock units; and

- •

- 3,631,879 shares that are reserved for issuance pursuant to our equity incentive plan.

Unless otherwise indicated, the information in this prospectus assumes:

- •

- a public offering price of $8.36 per share, which was the last reported sale price of our common stock on

December 9, 2009; and

- •

- no exercise by the underwriters of their option to purchase additional shares of common stock from the selling stockholders to cover over-allotments, if any.

7

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables set forth our summary consolidated financial data for the periods ended and as of the dates indicated below. We have derived the summary consolidated financial data as of and for the years ended December 31, 2008, 2007, and 2006 from our audited consolidated financial statements included elsewhere in this prospectus and as of and for the nine months ended September 30, 2009 and 2008 from our unaudited consolidated financial statements included elsewhere herein.

The information set forth below should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements included or incorporated by reference in this prospectus. Our historical results may not be indicative of the operating results to be expected in any future period.

(In thousands, except per share data)

| |

Nine Months Ended September 30, |

For the Year Ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2009 | 2008 | 2008 | 2007 | 2006 | ||||||||||||

Selected Statement of Operations Data |

|||||||||||||||||

Revenues |

$ | 164,882 | $ | 139,682 | $ | 217,321 | $ | 29,804 | $ | 4,023 | |||||||

Cost of sales |

150,464 | 112,599 | 183,951 | 25,865 | 4,822 | ||||||||||||

Gross profit (loss) |

14,418 | 27,083 | 33,370 | 3,939 | (799 | ) | |||||||||||

Selling, general and administrative expenses |

27,688 |

28,475 |

41,545 |

5,724 |

1,501 |

||||||||||||

Intangible amortization and goodwill impairment(1) |

8,718 | 8,249 | 13,568 | 1,750 | 21 | ||||||||||||

Total other income (expense), net |

4,079 |

(1,864 |

) |

(2,480 |

) |

(866 |

) |

(414 |

) |

||||||||

(Benefit) provision for income taxes |

(389 | ) | 1,410 | 1,062 | (1,039 | ) | — | ||||||||||

Net loss |

$ | (17,520 | ) | $ | (12,915 | ) | $ | (25,285 | ) | $ | (3,362 | ) | $ | (2,735 | ) | ||

Net loss per share—basic and diluted |

$ |

(0.18 |

) |

$ |

(0.15 |

) |

$ |

(0.28 |

) |

$ |

(0.07 |

) |

$ |

(0.08 |

) |

||

Nine Months Ended September 30, |

For the Year Ended December 31, |

||||||||||||||||

| |

2009 | 2008 | 2008 | 2007 | 2006 | ||||||||||||

Selected Other Data |

|||||||||||||||||

Adjusted EBITDA(2) |

$ | 6,095 | $ | 7,250 | $ | 4,327 | $ | 103 | $ | (1,643 | ) | ||||||

Adjusted EBITDA margin(2) |

3.7 | % | 5.2 | % | 2.0 | % | 0.3 | % | (40.8 | )% | |||||||

Net cash provided by (used in) operating activities |

$ | 2,853 | $ | (5,812 | ) | $ | (2,359 | ) | $ | 521 | $ | (711 | ) | ||||

Net cash used in investing activities |

(11,710 | ) | (84,646 | ) | (106,696 | ) | (82,828 | ) | (408 | ) | |||||||

Net cash provided by financing activities |

1,264 | 119,068 | 118,526 | 87,964 | 1,078 | ||||||||||||

8

| |

As of September 30, 2009(3) | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| |

Actual | As Adjusted | |||||||

Selected Balance Sheet Data |

|||||||||

Assets: |

|||||||||

Cash and cash equivalents |

$ | 7,660 | $ | 68,583 | |||||

Total current assets |

55,755 | 116,678 | |||||||

Total assets |

328,329 | 389,252 | |||||||

Liabilities: |

|||||||||

Total current liabilities |

55,414 | 49,272 | |||||||

Total long-term debt, net of current maturities |

18,126 | 7,693 | |||||||

Total liabilities |

81,103 | 15,256 | |||||||

Total stockholders' equity |

$ |

247,226 |

$ |

325,946 |

|||||

- (1)

- During

the year ended December 31, 2008, we recorded a goodwill impairment charge of $2,409 related to our Products Segment.

- (2)

- For any period, Adjusted EBITDA is calculated as presented below. Additionally, the calculation of Adjusted EBITDA excludes the effect of any goodwill impairment charges. We believe that Adjusted EBITDA is particularly meaningful due principally to the role acquisitions have played in our development. Historically, our growth through acquisitions has resulted in significant non-cash depreciation and amortization expense because a significant portion of the purchase price of our acquired businesses is generally allocated to depreciable fixed assets and long-lived assets, which primarily consist of goodwill and amortizable intangible assets. Please note that neither Adjusted EBITDA nor Adjusted EBITDA margin, which are non-GAAP measures, should be considered alternatives to, nor is there any implication that they are more meaningful than, any measure of performance or liquidity promulgated under accounting principles generally accepted in the United States.

| |

Nine Months Ended September 30, |

For the Year Ended December 31, | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2009 | 2008 | 2008 | 2007 | 2006 | |||||||||||||

Reconciliation of net loss to Adjusted EBITDA |

||||||||||||||||||

Net loss |

$ | (17,520 | ) | $ | (12,915 | ) | $ | (25,285 | ) | $ | (3,362 | ) | $ | (2,735 | ) | |||

(Benefit) provision for income taxes |

(389 | ) | 1,410 | 1,062 | (1,039 | ) | — | |||||||||||

Interest expense (income), net |

1,831 | 1,921 | 2,276 | 839 | 411 | |||||||||||||

Goodwill impairment |

— | — | 2,409 | — | — | |||||||||||||

Depreciation and amortization |

20,131 | 15,706 | 21,866 | 3,523 | 328 | |||||||||||||

Share-based compensation |

2,042 | 1,128 | 1,999 | 142 | 353 | |||||||||||||

Adjusted EBITDA |

$ | 6,095 | $ | 7,250 | $ | 4,327 | $ | 103 | $ | (1,643 | ) | |||||||

Adjusted EBITDA margin equals Adjusted EBITDA divided by total revenue.

- (3)

- The summary balance sheet data as of September 30, 2009 is presented (a) on an actual basis and (b) on an adjusted basis to reflect the sale by us of 10,000,000 shares of common stock in this offering at an assumed initial offering price of $8.36 per share, after deducting underwriting discounts and commissions and estimated expenses, and the use of a portion of the proceeds to us from this offering to repay a portion of our indebtedness as described in "Use of Proceeds."

9

Investing in our common stock involves a high degree of risk. You should carefully consider the following risks and all other information contained or incorporated by reference in this prospectus, including our consolidated financial statements and the related notes, before investing in our common stock. If any of the following risks materialize, our business, financial condition or results of operations could be materially harmed. In that case, the trading price of our common stock could decline, and you may lose some or all of your investment.

Risks Relating to Our Business and Our Industry

Our businesses, and therefore our results of operations and financial condition, may continue to be adversely affected by dislocation in the global credit markets and economic uncertainty.

The recent disruption in the global credit markets, the re-pricing of credit risk and the deterioration of the financial and real estate markets generally, particularly in the United States and Europe, have all contributed to a reduction in consumer spending and a contraction in global economic growth. Although initially impacting the housing, financial and insurance sectors, this deterioration further expanded into a significant recession affecting the general economy, including in the United States and throughout Europe, and other sectors, including the wind energy sector. The recession has had negative effects on demand for alternative sources of energy and consequently for our product and service offerings. Although there is a growing confidence that the global economies have resumed growth, there remains risk that the recovery will be short-lived, such recovery may not include the industries or markets in which we conduct our business, or the downturn may resume. In addition, because there is a long lead-time between orders for wind products and delivery, there is generally a lag before the impact of changed economic conditions affects our results, and an improvement in economic conditions in late 2009 would not be reflected in our results until at least the second quarter of 2010. Any such event could have a material adverse effect on our business in a number of ways, including lower sales and renewal cycles if there is a reduction in demand for wind energy and could have a material adverse effect on our liquidity, results of operations and financial condition.

In particular, risks we might face could include: potential declines in revenues in our business segments due to reduced orders or other factors caused by economic challenges faced by our customers and prospective customers, and an inability to finance future acquisitions or significant capital expenditures relating to new projects or lines of business on reasonable terms.

The U.S. wind industry is reliant on tax and other economic incentives and political and governmental policies. A significant change in these incentives and policies could negatively impact our results of operations and growth.

Our business segments are focused on supplying products and services to wind turbine manufacturers and owners and operators of wind energy generation facilities. Currently, the wind industry is dependent upon federal tax incentives and state renewable portfolio standards and would not be economically viable absent such incentives. The federal government provides economic incentives to the owners of wind energy facilities, including a federal production tax credit, an investment tax credit and a cash grant equal in value to the investment tax credit. The production tax credit was extended by the American Recovery and Reinvestment Act ("ARRA") in February 2009 and provides the owner of a qualifying wind energy facility placed in service before the end of 2012 with a ten-year tax credit against the owner's federal income tax obligations based on the amount of electricity generated by the qualifying wind energy facility and sold to unrelated third parties. Alternatively, wind project owners may (i) elect to receive an investment tax credit equal to 30% of the qualifying basis of facilities placed in service before the end of 2012 or (ii) for facilities placed in service in 2009 or 2010

10

(or, if construction begins before the end of 2010, placed in service before the end of 2012), apply to receive a cash grant from the Department of Treasury, equal in value to the investment tax credit.

The production tax credit, investment tax credit and cash grant program provide material incentives to develop wind energy generation facilities and thereby impact the demand for our manufactured products and services. The increased demand for our products and services resulting from the credits and incentives may continue until such credits or incentives lapse. The failure of Congress to extend or renew these incentives beyond their current expiration dates could significantly delay the development of wind energy generation facilities and the demand for wind turbines, towers and related components. In addition, we cannot assure you that any subsequent extension or renewal of the production tax credit, investment tax credit or cash grant program would be enacted prior to its expiration or, if allowed to expire, that any extension or renewal enacted thereafter would be enacted with retroactive effect. It is possible that these federal incentives will not be extended beyond their current expiration dates. Any delay or failure to extend or renew the federal production tax credit, investment tax credit or cash grant program in the future could have a material adverse impact on our business, results of operations, financial performance and future development efforts.

State renewable energy portfolio standards generally require state-regulated electric utilities to supply a certain proportion of electricity from renewable energy sources or devote a certain portion of their plant capacity to renewable energy generation. Typically, subject utilities comply with such standards by qualifying for renewable energy credits evidencing the share of electricity that was produced from renewable sources. Under many state standards, these renewable energy credits can be unbundled from their associated energy and traded in a market system allowing generators with insufficient credits to meet their applicable state mandate. These standards have spurred significant growth in the wind energy industry and a corresponding increase in the demand for our manufactured products. Currently, the majority of states and the District of Colombia have renewable energy portfolio standards in place and certain states have voluntary utility commitments to supply a specific percentage of their electricity from renewable sources. The enactment of renewable energy portfolio standards in additional states or any changes to existing renewable energy portfolio standards, or the enactment of a federal renewable energy portfolio standard or imposition of other greenhouse gas regulations may impact the demand for our products. We cannot assure you that government support for renewable energy will continue. The elimination of, or reduction in, state or federal government policies that support renewable energy could have a material adverse impact on our business, results of operations, financial performance and future development efforts.

We could incur substantial costs to comply with environmental, health, and safety laws and regulations and to address violations of or liabilities under these requirements.

Our operations and products are subject to a variety of environmental laws and regulations in the jurisdictions in which we operate and sell products governing, among other things, air emissions, wastewater discharges, the use, handling and disposal of hazardous materials, soil and groundwater contamination, employee health and safety, and product content, performance and packaging. We cannot guarantee that we will at all times be in compliance with such laws and regulations and if we fail to comply with these laws and regulations or our permitting and other requirements, we may be required to pay fines, limit production at our facilities or be subject to other sanctions. Also, certain environmental laws can impose the entire or a portion of the cost of investigating and cleaning up a contaminated site, regardless of fault, upon any one or more of a number of parties, including the current or previous owner or operator of the site. These environmental laws also impose liability on any person who arranges for the disposal or treatment of hazardous substances at a contaminated site. Third parties may also make claims against owners or operators of sites and users of disposal sites for personal injuries and property damage associated with releases of hazardous substances from those

11

sites. Many of our facilities have a history of industrial operations and contaminants have been detected at some of our facilities.

Changes in existing environmental laws and regulations, or their application, could cause us to incur additional or unexpected costs to achieve or maintain compliance. Our facilities emit greenhouse gases which may be subject to pending or future environmental laws or regulations which could cause us to incur additional or unexpected costs to achieve and maintain compliance. The assertion of claims relating to on- or off-site contamination, the discovery of previously unknown environmental liabilities, or the imposition of unanticipated investigation or cleanup obligations, could result in potentially significant expenditures to address contamination or resolve claims or liabilities. Such costs and expenditures could have a material adverse effect on our business, financial condition or results of operations.

Our financial and operating performance is subject to certain factors which are out of our control, including prevailing economic conditions and the state of the wind energy market in North America.

As a supplier of products and services to wind turbine manufacturers and owners and operators of wind energy generation facilities, our results of operations (like those of our customers) are subject to general economic conditions and specifically, to the state of the wind energy market. In addition to the state and federal government policies supporting renewable energy described above, the growth and development of the larger wind energy market in North America is subject to a number of factors, including, among other things:

- •

- available financing for the estimated pipeline of wind development projects;

- •

- the cost of electricity, which may be affected by a number of factors, including the cost and availability of fuel,

government regulation, power transmission, seasonality and fluctuations in demand;

- •

- the development of new power generating technology or advances of existing technology or discovery of power generating

natural resources;

- •

- the development of electrical transmission infrastructure;

- •

- state and federal laws and regulations;

- •

- administrative and legal challenges to proposed wind development projects; and

- •

- public perception and localized community responses to wind energy projects.

In addition, while some of the factors listed above may only affect individual wind project developments or portions of the market, in the aggregate they may have a significant effect on the successful development of the wind energy market, and thus, affect our operating and financial results.

We are substantially dependent on a few significant customers.

The wind turbine market in the United States is very concentrated, with eight manufacturers controlling in excess of 90% of the market. Like us, these customers have been adversely affected by the recent downturn in the economy and we have seen, and may continue to see, a decrease in order volume from such customers. During 2009, we have continued to be affected by the global economic downturn, particularly with respect to the economic impact that it continues to have on our customers. Historically, the majority of our revenues are highly concentrated with a limited number of customers. In 2008, three customers—Gamesa, General Electric and Clipper Windpower—each accounted for more than 10% of our consolidated revenues. During the first nine months of 2009, several of our customers within our Products segment expressed their intent to scale back, delay or restructure existing customer agreements, which has led to reduced revenues from these customers. As a result, our

12

operating profits and gross margins have been negatively affected by a decline in production levels during 2009, which have created production volume inefficiencies in our operations and cost structures.

Additionally, if our relationships with significant customers should change materially, it would be difficult for us to immediately and profitably replace lost sales in a market with such concentration, which would materially adversely affect our results. We could be adversely impacted by decreased customer demand for our products and services due to (1) the impact of current or future economic conditions on our customers, (2) our customers' loss of market share to competitors of theirs that do not use our products and (3) our loss of market share with our customers. We could lose market share with our customers to competitors or to our customers themselves, should they decide to become more vertically integrated and produce our products and services internally.

In addition, even if our customers continue to do business with us, we can be adversely affected by a number of other potential developments with our customers. For example:

- •

- our customers may not comply with their contractual payment or volume obligations or may become subject to insolvency or

liquidation proceedings. The inability or failure of our customers to meet their contractual obligations or the insolvency or liquidation of one or more of our significant customers could have a

material adverse effect on our business, financial position and results of operations;

- •

- our customers have, and in the future may seek to renegotiate the terms of current agreements or renewals; for example,

some customers have sought payments from us for claims despite contractual limits that preclude our obligation to make payments for such claims; and

- •

- although our subsidiary companies operate independently, a dispute between a significant customer and us or one of our

subsidiaries could have a negative effect on the business relationship we have with that customer across our entire organization. Among other things, such a dispute could lead to an overall decrease

in such customer's demand for our products and services or difficulty in collecting amounts due to one or more of our subsidiaries that are otherwise not related to such a dispute; and

- •

- a material change in payment terms for accounts receivable of a significant customer could have a material adverse effect on our short-term cash flows.

Our customers may be significantly affected by disruptions and volatility in the markets.

Current market disruptions and regular market volatility may have adverse impacts on our customers' abilities to pay when due the amounts payable to us and could cause related increases in our cost of capital associated with any increased working capital or borrowing needs we may have if this occurs. We may also have difficulty collecting amounts payable to us in full (or at all) if any of our customers fail or seek protection under applicable bankruptcy or insolvency laws. In addition, our customers have in the past and may attempt in the future to renegotiate the terms of contracts or reduce the size of orders with us as a result of disruptions and volatility in the markets. Our backlog is substantial, but we cannot predict with any degree of certainty the amount of our backlog that we will be successful in collecting from our customers.

Market disruptions and regular market volatility may also result in an increased likelihood of our customers bringing warranty or remediation claims in connection with our products or services that they would not ordinarily bring in a more stable economic environment. In the event of such a claim, we may incur costs if we decide to compensate the affected customer or to engage in litigation against the affected customer regarding the claim. We maintain product liability insurance, but there can be no guarantee that such insurance will be available or adequate to protect against such claims. A successful claim against us could result in a material adverse effect on our business.

13

We may have difficulty raising additional financing when needed or on acceptable terms and there can be no assurances that our operations will generate sufficient cash flows in an amount sufficient to enable us to pay our indebtedness.

We rely on access to both short- and long-term capital markets as a source of liquidity for capital requirements not satisfied by cash flows from operations. While we anticipate that our current cash resources and cash to be generated from this offering and our operations will be adequate to meet our liquidity needs for at least the next twelve months, following this offering, we will not have any significant committed sources of liquidity. If we are not able to access capital at competitive rates, the ability to implement our business plans may be adversely affected. In the absence of access to capital resources, we could face substantial liquidity problems and might be required to dispose of material assets or operations at times when the prices for such assets are depressed. We may not be able to consummate those dispositions. Furthermore, these proceeds may not be adequate to meet our debt service obligations then due.

Additionally, our ability to make scheduled payments on our existing or future debt obligations and fund operations will depend on our future financial and operating performance. While we believe that we will continue to have sufficient cash flows to operate our businesses, there can be no assurances that our operations will generate sufficient cash flows to enable us to pay our indebtedness or to fund our other liquidity needs. If we cannot make scheduled payments on our debt, we will be in default and, as a result, among other things, our debt holders could declare all outstanding principal and interest to be due and payable and we could be forced into bankruptcy or liquidation or required to substantially restructure or alter our business operations or debt obligations. Moreover, if we are unable to obtain additional capital or if our current sources of financing are reduced or unavailable, we will likely be required to delay, reduce the scope of or eliminate our plans for expansion and growth and this could affect our overall operations.

Our current credit agreements limit our ability to take various actions, and a default under our credit agreements could have a material adverse impact on our business.

While we currently anticipate using a portion of the net proceeds to us from this offering to repay our existing debt facilities with Bank of America, our current credit agreements limit our ability to take various actions, including paying dividends and disposing of assets. There can be no assurances that we will complete this offering or use proceeds to retire our existing debt facilities in full or, if these facilities with Bank of America are not retired, that we will remain in compliance with the covenants contained in the applicable loan agreements. In addition, we are in discussions with Bank of America regarding an amendment to the applicable loan agreements, but if we fail to negotiate an acceptable amendment and fail to remain in compliance with the covenants contained in the applicable loan agreements, we would be in default on such loan agreements.

The covenants, among other things, limit the manner in which we conduct our business and require us to satisfy specified financial and non-financial covenants. Accordingly, we may be restricted from taking actions that management believes would be desirable and in the best interests of us and our stockholders. Additionally, a breach of any covenants contained in our credit agreements could result in an event of default under the agreements. Upon the occurrence of an event of default under our credit agreements, the lenders may not be required to lend any additional amounts to us and could elect to declare all borrowings outstanding thereunder, together with accrued and unpaid interest and fees, to be due and payable, which could also trigger payment obligations under various guaranties securing certain of our borrowings, any of which could have a material adverse effect on our business or financial condition. For further information regarding our existing borrowings, please refer to "Management's Discussion and Analysis of Financial Condition and Results of Operations—Credit Facilities."

14

Growth and diversification through acquisitions and internal expansion may not be successful, and could result in poor financial performance.

To execute our business strategy, we may acquire new businesses. We may not be able to identify appropriate acquisition candidates or successfully negotiate, finance or integrate acquisitions. If we are unable to make acquisitions, we may be unable to realize the growth we anticipate. Future acquisitions could involve numerous risks including difficulties in integrating the operations, services, products, and personnel of the acquired business; and the potential loss of key employees, customers and suppliers of the acquired business. If we are unable to successfully manage these acquisition risks, future earnings may be adversely affected.

We may also plan to continue to grow our existing business through increased production levels at existing facilities and through expansion to new manufacturing facilities and locations, such as our recently completed tower manufacturing facility in Abilene, Texas and our partially constructed tower manufacturing facility in Brandon, South Dakota. Such expansion and any future expansion will require coordinated efforts across the Company and continued enhancements to our current operating infrastructure, including management and operations personnel, systems and equipment, and property. Difficulties or delays in acquiring and effectively integrating any new facilities may adversely affect future performance. For example, we recorded higher costs in 2008 to handle a higher volume of orders and in 2009 in connection with the startup of production at our Abilene facility. Moreover, if our expansion efforts do not adequately predict the demand of our customers and our potential customers, our future earnings may be adversely affected.

We face competition from industry participants who may have greater resources than we do.

Our businesses are subject to risks associated with competition from new or existing industry participants who may have more resources and better access to capital. Many of our competitors and potential competitors may have substantially greater financial, customer support, technical and marketing resources, larger customer bases, longer operating histories, greater name recognition and more established relationships in the industry than we do. Among other things, these industry participants compete with us based upon price, quality, location and available capacity. We cannot be sure that we will have the resources or expertise to compete successfully in the future. Some of our competitors may also be able to provide customers with additional benefits at lower overall costs to increase market share. We cannot be sure that we will be able to match cost reductions by our competitors or that we will be able to succeed in the face of current or future competition. In addition, we face competition from our customers as they seek to be more vertically integrated and offer full service packages. Some of our customers are also performing more services themselves.

We have generated net losses and negative cash flows since our inception.

We have experienced operating losses, as well as net losses, for each of the years during which we have operated. In addition in light of current economic conditions, we anticipate that losses and negative cash flow are possible for the foreseeable future. We have incurred significant costs in connection with the development of our businesses and there is no assurance that we will achieve sufficient revenues to offset anticipated operating costs. Although we anticipate deriving revenues from the sale of our products and services, no assurance can be given that these products can be sold on a net profit basis. If we achieve profitability, we cannot give any assurance that we would be able to sustain or increase profitability on a quarterly or annual basis in the future.

15

We may not be able to effectively utilize the additional production capacity at our new wind tower manufacturing facility currently under construction in Brandon, South Dakota.

We currently have a third wind tower manufacturing facility under construction on land that we own in Brandon, South Dakota. The terms of the construction financing require that construction of the facility be completed on or before January 5, 2010. If there is insufficient market demand for the products we intend to produce at this facility, it could be difficult or impossible for us to operate the facility in a profitable or cost-effective manner. If we elected not to commence operations of the facility we would continue to incur fixed costs associated with ownership of the facility, and there can be no assurance that we would be able to sell or otherwise dispose of the facility on terms deemed to be commercially reasonable by us if we sought to do so in the future.

Our future operating results and the market price of our common stock could be materially adversely affected if we are required to write down the carrying value of goodwill or intangible assets associated with any of our operating segments in the future.

We review our goodwill and intangible balances for impairment on at least an annual basis through the application of a fair-value-based test. Our estimate of fair-value for each of our operating segments is based primarily on projected future results and cash flows and other assumptions. In addition, we review long-lived assets whenever events or changes in circumstances indicate that its carrying amount may not be recoverable. In October of 2008, we performed our annual test for goodwill impairment and determined that the goodwill balance related to R.B.A. Inc. ("RBA"), a specialty industrial weldment business acquired by us in October 2007, was impaired. This determination indicated a decline in the projected fair value of RBA net assets based upon forecasted operating results. Our analysis indicated that the projected discounted cash flows associated with RBA's net assets did not exceed their carrying value. As a result, we recorded a goodwill impairment charge of approximately $2.4 million during the fourth quarter of 2008. In the future, if our projected discounted cash flows associated with our operating segments do not exceed the carrying value of their net assets, we may be required to record additional write downs of the carrying value of goodwill, intangible assets or other long-lived assets associated with any of our operating segments and our operating results and the market price of our common stock may be materially adversely affected.

As of September 30, 2009 our goodwill and intangible balances were $34.0 million and $96.9 million respectively. We perform an annual goodwill impairment test during the fourth quarter of each year, or more frequently when events or circumstances indicate that the carrying value of our assets may not be recovered. The 2008-2009 recession has impacted our financial results and has reduced near-term purchases from certain of our key customers. We may determine that our expectations of future financial results and cash flows from one or more of our businesses has decreased or a decrease in stock valuation may occur, which could result in a review of our goodwill and intangible assets associated with these businesses. Since a large portion of the value of our intangibles has been ascribed to projected revenues from certain key customers, a change in our expectation of future cash from one or more of these customers could indicate potential impairment to the carrying value of our assets.

Disruptions in the supply of parts and raw materials, or changes in supplier relations, may negatively impact our operating results.

We are dependent upon the supply of certain raw materials used in our production process and these raw materials are exposed to price fluctuations on the open market. Raw material costs for items such as steel, the primary raw material used by us, have fluctuated significantly and may continue to fluctuate. To reduce price risk caused by market fluctuations, we have incorporated price adjustment clauses in many sales contracts. However, limitations on availability of raw materials or increases or decreases in the cost of raw materials (including steel), energy, transportation and other necessary

16

services may impact our operating results if our manufacturing businesses are not able to fully pass on the costs associated with such increases or decreases to their respective customers. Alternatively, we will not realize material improvements from declines in steel prices as the terms of many of our contracts provide that we pass through these costs to our customers.

In addition, we may encounter supplier constraints, be unable to maintain favorable supplier arrangements and relations or be affected by disruptions in the supply chain caused by such events as natural disasters, power outages and the effect of labor strikes. In the event of significant increases or decreases in the price of raw materials, particularly steel, our margins and profitability could be negatively impacted.

If our projections regarding the future market demand for our products are inaccurate, our operating results and our overall business may be adversely affected.

We have made significant capital investments in anticipation of rapid growth in the wind energy market. The expansion of our internal manufacturing capabilities has required significant up-front fixed costs. If market demand for our products does not increase as quickly as we have anticipated and align with our expanded manufacturing capacity, we may be unable to offset these costs and to achieve economies of scale, and our operating results may be adversely affected as a result of high operating expenses, reduced margins and underutilization of capacity. Alternatively, if we experience rapid demand for our products in excess of our estimates, our installed capital equipment and existing workforce may be insufficient to support higher production volumes, which could harm our customer relationships and overall reputation. In addition, we may not be able to expand our workforce and operations in a timely manner, procure adequate resources, or locate suitable third-party suppliers, to respond effectively to changes in demand for our existing products or to the demand for new products requested by our customers, and our business could be adversely affected. Our ability to meet such excess customer demand could also depend on our ability to raise additional capital and effectively scale our manufacturing operations.

If our estimates for warranty expenses differ materially from actual claims made, or if we are unable to reasonably estimate future warranty expense for our products and services our business and financial results could be negatively affected.

Within our Products segment, we provide warranty terms generally ranging between two and seven years to our customers depending upon the specific product and terms of the customer purchase agreement. We reserve for warranty claims based on industry experience and estimates made by management based upon a percentage of our product sales revenues. From time to time, customers have submitted warranty claims against the Company. However, we have a limited history on which to base our warranty estimates for certain products which we manufacture. Our assumptions could be materially different from the actual performance of our products in the future and could exceed the levels against which we have reserved. In some instances our customers have interpreted the scope and coverage of certain of our warranty provisions differently from the Company's interpretation of such provisions. The expenses associated with remediation activities in the wind energy industry can be substantial and if the Company is required to pay such costs in connection with a customer's warranty claim it could be subject to additional unplanned cash expenditures. If our estimates prove materially incorrect, or if we are required to cover remediation expenses in addition to our regular warranty coverage, we could be required to accrue additional expenses and could face a material unplanned cash expenditure, which could harm our financial and operating results.

17

Material weaknesses or other deficiencies in our internal control over financial reporting, including potential failure to prevent or detect errors or fraud, could affect the accuracy of our reported financial results.