Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - US AIRWAYS GROUP INC | c93527e8vk.htm |

EXHIBIT 99.1

| Next Generation Equity Research U.S. Airline Conference December 9, 2009 Scott Kirby President US Airways Group, Inc. |

| Forward-Looking Statements Certain of the statements contained herein should be considered "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward looking statements may be identified by words such as "may," "will," "expect," "intend," "anticipate," "believe," "estimate," "plan," "could," "should," and "continue" and similar terms used in connection with statements regarding the outlook, expected fuel costs, revenue and pricing environment, and expected financial performance of US Airways Group (the "Company"). Such statements regarding future financial and operating results, the Company's plans, objectives, expectations and intentions, and other statements that are not historical facts. These statements are based upon the current beliefs and expectations of the Company's management and are subject to significant risks and uncertainties that could cause the Company's actual results and financial position to differ materially from these statements. Such risks and uncertainties include, but are not limited to, the following: the impact of future significant operating losses; the impact of economic conditions and their impact on passenger demand and related revenues; a reduction in the availability of financing, changes in prevailing interest rates and increased costs of financing; the Company's high level of fixed obligations and the ability of the Company to obtain and maintain any necessary financing for operations and other purposes and operate pursuant to the terms of its financing facilities (particularly the financial covenants); the impact of fuel price volatility, significant disruptions in fuel supply and further significant increases to fuel prices; the ability of the Company to maintain adequate liquidity; labor costs, relations with unionized employees generally and the impact and outcome of the labor negotiations, including the ability of the Company to complete the integration of the labor groups of the Company and America West Holdings; reliance on vendors and service providers and the ability of the Company to obtain and maintain commercially reasonable terms with those vendors and service providers; reliance on automated systems and the impact of any failure or disruption of these systems; the impact of the integration of the Company's business units; the impact of changes in the Company's business model; competitive practices in the industry, including significant fare restructuring activities, capacity reductions or other restructuring or consolidation activities by major airlines; the impact of industry consolidation; the ability to attract and retain qualified personnel; the impact of global instability including the potential impact of current and future hostilities, terrorist attacks, infectious disease outbreaks or other global events; government legislation and regulation, including environmental regulation; the Company's ability to obtain and maintain adequate facilities and infrastructure to operate and grow the Company's route network; costs of ongoing data security compliance requirements and the impact of any data security breach; interruptions or disruptions in service at one or more of the Company's hub airports; the impact of any accident involving the Company's aircraft; delays in scheduled aircraft deliveries or other loss of anticipated fleet capacity; weather conditions and seasonality of airline travel; the cyclical nature of the airline industry; the impact of insurance costs and disruptions to insurance markets; the impact of foreign currency exchange rate fluctuations; the ability to use NOLs and certain other tax attributes; the ability to maintain contracts critical to the Company's operations; the ability of the Company to attract and retain customers; and other risks and uncertainties listed from time to time in the Company's reports to the SEC. There may be other factors not identified above of which the Company is not currently aware that may affect matters discussed in the forward-looking statements, and may also cause actual results to differ materially from those discussed. The Company assumes no obligation to publicly update any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting such estimates other than as required by law. Additional factors that may affect the future results of the Company are set forth in the section entitled "Risk Factors" in the Company's Report on Form 10-Q for the quarter ended September 30, 2009 and in the Company's other filings with the SEC, which are available at www.usairways.com. |

| Overview Aggressive actions to address the challenges presented in 2009 Leading operational performance Reduced capacity Created new revenue opportunities Cut costs Industry leading YOY RASM Enhanced liquidity Revenue environment improving rapidly into 2010 |

| Leading Operational Performance * YTD 2009 numbers are through Oct 31st / Source: U.S. Department of Transportation |

| Capacity Discipline JBLU LUV AAI LCC ALK DAL CAL AMR UAUA -0.015 -0.043 -0.052 -0.053 -0.071 -0.075 -0.076 -0.081 -0.086 Source: SEC filings and company reports |

| A la Carte Revenues Q208 Q308 Q408 Q109 Q209 Q309 10.3 61.2 92.6 92.9 102.1 109 |

| ALK JBLU AAI LUV AMR CAL DAL LCC UAUA 0.104 0.09 0.076 0.069 0.063 0.044 0.029 -0.006 -0.013 Relative YTD CASM Performance YOY Capacity (%) (7.9) (6.3) (6.8) (5.5) (10.7) |

| YTD Relative Total RASM ALK JBLU LUV AAI LCC AMR DAL CAL UAUA -0.031 -0.033 -0.037 -0.064 -0.116 -0.117 -0.144 -0.145 -0.151 |

| LCC UAUA AMR DAL CAL 8.8 6.2 5.9 5.5 4.4 Leading to Best YTD Margin Improvement * Excludes special charges and impact of realized and unrealized fuel hedge losses/gains |

| Outlook Going Forward |

| Recent Announcements DCA / LGA Slot Transaction Network Realignment - 99 percent of flying in hubs / focus cities Aircraft Deferral / Liquidity Enhancement |

| Aircraft Deferral / Liquidity Enhancements Defer 54 Airbus aircraft for 3 years Eliminates need to access capital markets for aircraft Lowered Barclays monthly unrestricted cash condition precedent |

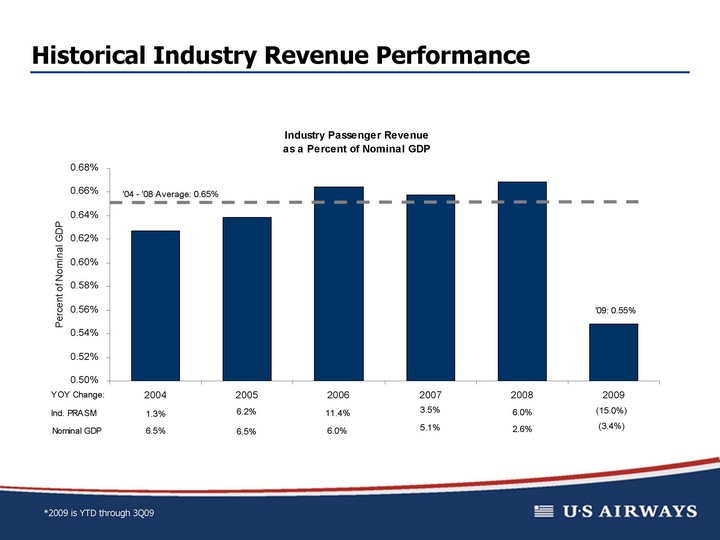

| Historical Industry Revenue Performance *2009 is YTD through 3Q09 |

| Historical Industry Revenue Performance |

| Revenue Trends are Encouraging |

| Yield Continues to Improve Yield bottomed in May/June |

| Yield Continues to Improve Pricing environment gradually improved over the summer |

| Yield Continues to Improve Less aggressive fare sales Cancelling junk fares "Surcharges" |

| Summary Aggressive actions to address the challenges presented in 2009 Leading operational performance Reduced capacity Created new revenue opportunities Cut costs Industry leading YOY RASM Enhanced liquidity Revenue environment improving rapidly into 2010 |

| APPENDIX |

| GAAP to non-GAAP Reconciliation |

| GAAP to non-GAAP Reconciliation |

| Questions? |