Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - China Information Technology, Inc. | cistf8k120809.htm |

Exhibit 99.1

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and they are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 7, 2009

Filed pursuant to Rule 424(b)(5)

Registration Statement No. 333-159375

P R E L I M I N A R Y P R O S P E C T U S S U P P L E M E N

T

(To Prospectus Dated November 18, 2009)

6,454,000 Shares

China Information Security Technology, Inc.

Common Stock

$ per share

___________________

We are selling 4,854,000 shares of our common stock and the selling stockholder named in this prospectus supplement is selling 1,600,000 shares. We will not receive any proceeds from the sale of the shares by the selling stockholder.

We have granted the underwriters an option to purchase up to 968,100 additional shares to cover over-allotments.

Our common stock is listed on the Nasdaq Global Select Market under the symbol "CPBY." The last reported sale price of our common stock on the Nasdaq Global Select Market on December 4, 2009 was $6.18 per share.

___________________

Investing in our common stock involves significant risks. See "Risk Factors" beginning on page S-10 and "Item 1A. Risk Factors" in our Annual Report on Form 10-K/A, filed August 12, 2009, and our Quarterly Reports on Form 10-Q, filed May 11, 2009, August 6, 2009 and November 9, 2009 which are incorporated by reference herein, for a discussion of factors you should consider carefully before investing in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

___________________

| Per Share | Total | |||||

| Public Offering Price | $ | $ | ||||

| Underwriting Commissions and Discounts | $ | $ | ||||

| Proceeds to Us (before expenses) | $ | $ | ||||

| Proceeds to the Selling Stockholder (before expenses) | $ | $ |

The underwriters expect to deliver the shares of our common stock on or about , 2009 through the book-entry facilities of The Depository Trust Company.

___________________

Book Running Managers

Macquarie Capital Roth Capital Partners

Co-Manager

Rodman & Renshaw, LLC

, 2009

You should rely only on the information we have provided or incorporated by reference in this prospectus supplement, the accompanying prospectus or any related free writing prospectus. No person has been authorized to give any information or to make any representation not contained in this prospectus supplement, the accompanying prospectus or any free writing prospectus in connection with the offering of our securities and, if given or made, no one may rely on such unauthorized information or representations. This prospectus supplement, the accompanying prospectus and any free writing prospectus do not constitute an offer to sell or the solicitation of an offer to buy these securities in any jurisdiction in which such offer or solicitation may not be legally made. Neither the delivery of this prospectus supplement, the accompanying prospectus or any free writing prospectus nor any sale made hereunder or thereunder shall, under any circumstances, create any implication that the information contained herein is correct as of any date subsequent to the date hereof. You should assume that the information in this prospectus supplement, the accompanying prospectus or any free writing prospectus and the documents incorporated herein and therein is accurate only as of the respective dates of these documents or on the date or dates specified in these documents, regardless of the time of delivery or any sale of our securities.

TABLE OF CONTENTS

Prospectus Supplement

| Page | |

| About this Prospectus Supplement | S-ii |

| Enforceability of Civil Liabilities | S-ii |

| Summary | S-1 |

| Risk Factors | S-10 |

| Forward-Looking Statements | S-15 |

| Use of Proceeds | S-16 |

| Price Range of Common Stock | S-17 |

| Dividend Policy | S-17 |

| Capitalization | S-18 |

| Selling Stockholder | S-19 |

| Material United States Federal Income Tax Considerations | S-20 |

| Underwriting | S-26 |

| Legal Matters | S-31 |

| Experts | S-31 |

| Available Information | S-31 |

| Incorporation by Reference | S-32 |

Prospectus

| Page | |

| Prospectus Summary | 2 |

| Risk Factors | 5 |

| Forward-Looking Statements | 5 |

| Use of Proceeds | 5 |

| Ratio of Earnings to Fixed Charges | 6 |

| Selling Stockholder | 6 |

| Description of Capital Stock | 7 |

| Description of Warrants | 9 |

| Description of Debt Securities | 10 |

| Description of Units | 17 |

| Plan of Distribution | 17 |

| Legal Matters | 19 |

| Experts | 19 |

| Incorporation By Reference | 19 |

| Available Information | 20 |

| Indemnification | 20 |

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement describes the specific terms of the common stock we and the selling stockholder are offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into the accompanying prospectus. The prospectus, which accompanies this prospectus supplement, including the documents incorporated by reference therein, provides more general information. Generally, when we refer to this prospectus, we are referring to both the prospectus supplement and the accompanying prospectus combined. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or any document incorporated by reference therein, on the other hand, you should rely on the information in this prospectus supplement.

ENFORCEABILITY OF CIVIL LIABILITIES

We are a corporation organized under the laws of Nevada. Substantially all of our current operations are conducted in China, and substantially all of our assets are located in China. A majority of our directors and officers are nationals or residents of jurisdictions other than the United States and a substantial portion of their assets are located outside the United States. As a result, it may be difficult for a shareholder to effect service of process within the United States upon us or such persons, or to enforce against us or them judgments obtained in United States courts, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States.

We have been advised by our PRC counsel that the recognition and enforcement of foreign judgments are provided for under the PRC Civil Procedures Law. PRC courts may recognize and enforce foreign judgments in accordance with the requirements of the PRC Civil Procedures Law based either on treaties between the PRC and the country where the judgment is made or on reciprocity between jurisdictions, provided that the foreign judgments do not violate the basic principles of laws of the PRC or its sovereignty, security or social and public interests. As there is currently no treaty or other form of reciprocity between the PRC and the United States governing the recognition of judgments, there is uncertainty on whether and/or upon what basis a PRC court would enforce judgments rendered by courts in the United States.

S-ii

SUMMARY

This summary highlights some information from this prospectus, and it may not contain all of the information that is important to you. You should read the following summary together with the more detailed information regarding our company and the common stock being sold in this offering, including "Risk Factors" and our consolidated financial statements and related notes, included elsewhere in, or incorporated by reference into, this prospectus.

Overview of China Information Security Technology

We are a leading provider of integrated solutions for the information security sector, the Geographic Information Systems, or GIS sector, and the digital hospital information sector. We also provide an e-Government application platform and solutions technology. We are a Certificate Authority (CA) application provider for the Shenzhen municipality in PRC. The CA certification allows us to issue digital certificates that contain a public key that can be used by the public to encrypt messages and protect the identity of the user. The CA also certifies that the public key contained in the certificate belongs to the person, organization, server or other entity noted in the certificate. CAs are currently used in China's e-Government industry and can be integrated with our e-Government platforms and solutions to enhance customers' applications.

We are headquartered in Shenzhen, China and our common stock is listed on the Nasdaq Global Select Market. As of October 2009, we had more than 800 employees and 11 sales offices nationwide. We were founded in 1993.

Our customers are mostly public sector entities that use our products and services to improve the service quality and management level and efficiency of public security, traffic control, fire control, medical rescue, border control, and surveying and mapping. Our typical customers include some of the most important governmental departments in China, including the Ministry of Public Security, the public security, fire fighting, traffic and police departments of several provinces, the Shenzhen General Station of Exit and Entry Frontier Inspection, and several provincial personnel, urban planning, civil administration, land resource, and mapping and surveying bureaus. Over the past several years, we have diversified our customer base beyond our local reach. In the future, we expect to continually expand our market and product offerings in the public and other sectors, through active industry consolidation and enhancement of our technical capabilities.

We generate revenues through the sale of our integrated hardware and software products and through the provision of related support services. A significant portion of our operations are conducted through iASPEC, our variable interest entity. iASPEC is a PRC domestic company owned by our Chairman and Chief Executive Officer, who is a PRC citizen and resident. iASPEC is able to obtain governmental licenses that are restricted to PRC entities that have no foreign ownership. These licenses allow iASPEC to perform Police-use Geographic Information Systems, or PGIS, services for PRC governmental customers. 100% of the net profit of iASPEC and is obligated to pay iASPEC an annual fee of $180,000 and to reimburse iASPEC for all net losses incurred by iASPEC. In fiscal years 2008 and 2007, 48% and 68% of our revenues, respectively, were generated. Under the Management Services Agreement, or MSA, among our subsidiary, IST, iASPEC, Jiang Huai Lin, our President and Chief Executive Officer and the majority shareholder of iASPEC at the time, and Jin Zhu Cai, then owner of a 24% minority interest in iASPEC, IST receives 100% of the net profit of iASPEC and is to pay iASPEC an annual fee of $180,000 and to reimburse iASPEC for all net losses incurred by iASPEC. Mr. Lin subsequently acquired Mr. Cai's minority interest in iASPEC in July 2008 for a total consideration of RMB60 million (approximately $8.72 million). In fiscal years 2008 and 2007, 48% and 68% of our revenues, respectively, were generated under this exclusive commercial arrangement with iASPEC. During the three and nine month periods ended September 30, 2009, $15.43 million and $38.51 million, respectively, or 53.80% and 55.45%, respectively, of our revenues was derived under the MSA.

S-1

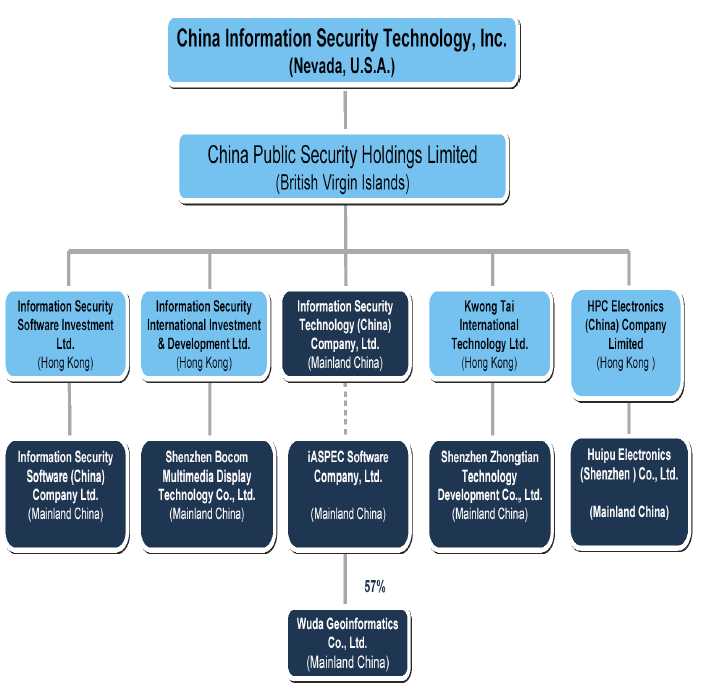

Corporate Structure

The following chart reflects our current corporate organizational structure:

S-2

Our Competitive Strengths

Our services are designed to provide our customers with integrated and innovative public safety and security solutions. We believe the following are our key competitive strengths.

-

Broad and Growing Portfolio of Software and Services – We offer our customers location-based public security solutions through our growing portfolio of software and services offerings. We are therefore able to provide multiple integrated solutions for our clients. Government agencies use our core products to incorporate location-based data into their decision-making processes to drive more effective results. Through our platforms, our customers can develop customized location-based applications, which can be extended across their agencies to support a variety of needs and generate more valuable intelligence. As a complement to these offerings, we offer related services, such as application development, software upgrades, follow-on phases, and systems integration, which help our customers quickly implement and customize our solutions.

-

Successful Implementation of High Profile Contracts – Our management team has a proven track record of successful implementation of high profile government contracts in China. This track record has enabled us to expand our customer base, which has grown beyond its historical geographic area in the Guangdong province and now includes customers in over 16 provinces throughout China. During 2007, we completed several large-scale system integration contracts relating to our First Responder Coordination System, our Intelligent Recognition System and our Residence Card Management System. We have successfully implemented our Consolidated Command System, or Three-in-One System, which combines the functions of the police emergency system, the fire emergency system, and the traffic control emergency system, in Shenzhen City, Guangdong and in Dongbang City, Hainan. We successfully implemented our Intelligent Recognition System at the Shenzhen Bay Port and the Futian Bay Port, the former of which received official recognition in July 2007 when China's President Hu Jintao inspected the system and became the first passenger to use the crossing. During the third quarter of 2009, the Company signed new contracts totaling $30.1 million from customers in 14 provinces and provincial cities in China. Some important contracts secured in the third quarter included: Shenzhen's Border Control Bureau Police-use GIS Command System, valued at $3.4 million; Nanning City's Traffic Police Command Center Video Surveillance System, valued at $3.2 million; the Shenzhen Entry-Exit Inspection and Quarantine Bureau First Responder Coordination Platform, valued at $1.0 million; and the Shenzhen Traffic Police Bureau Traffic Surveillance System, valued at $0.88 million. Of these contracts, 55% were won in the Digital Information Security Technology, or DIST, sector, 30% in our GIS sector, and 15% in the Digital Hospital Information Systems, or DHIS, sector. At the end of third quarter 2009, the total value of the Company's backlog increased by $1.4 million sequentially to $36.1 million, from $34.7 million in the previous quarter. We expect that the majority of these contracts will be recognized as revenue in 2009.

-

High Barriers to Entry – We believe our qualifications, our successful contract implementation record, and the high cost of switching to other providers provide us with a "first mover" advantage in the PRC market and poses high barriers to entry for our potential competitors. Our VIE entity, iASPEC, holds the Computer System Integration Level 1 license from the PRC Ministry of Information, the Information System Security Service qualification from Guangdong Province and a State Secret-related Computer Information Integration Certificate, and iASPEC's 57% subsidiary, Geo, holds a Level A Certificate of Surveying & Mapping. As discussed above, we are gaining wider market recognition from our successful contract execution record. In addition, after investing in our systems, our existing customers have a strong incentive to purchase follow-on phases from us in order to expedite implementation and save costs.

-

Scalability of Platform – We have digitized detailed proprietary information systems data related to Shenzhen City and Guangdong Province that can be leveraged for future civil-use applications in logistics, insurance, and location based services across industries. We believe that we are uniquely positioned to take advantage of future broad scale implementations in our core market sectors.

S-3

Our Growth Strategy

Our objective is to be the leading provider of integrated solutions for public security information technology, GIS, and related software service operations in China. Our intelligence solutions can help organizations make more insightful decisions and improve the efficiency of their internal processes. Our strategy for achieving this objective includes the following key elements:

-

Expand geographic footprint to cover all major markets in China - We intend to leverage our strengths to expand into new geographic markets. For the third quarter of 2009 approximately 60% of our total revenue was generated through our operations in the Guangdong Province. We also have established offices in Guangzhou and Beijing, and work through representatives in Changsha, Hunan Province, and in Nanning, Guangxi Province. Our long-term plan is to manage our national operations through offices in six geographic hubs located in Guangzhou, Beijing, Shanghai, Wuhan, Chongqing and Xi'an. We believe that expanding our presence in new geographic areas will allow us to increase our cross-selling opportunities for our product and service offerings.

-

Strengthen R&D capability to enhance and expand core products and further penetrate customer base – To provide our clients with innovative solutions, we expect to offer additional value-added services and add-ins to our current platform through continuous research and development, to enhance our product and service offerings and to maintain our leadership position in our core areas of focus.

-

Continue to maintain our leading position in the rapidly growing public security technology market – We plan to leverage our strong brand recognition to obtain new customers and new projects from existing customers of our: (1) First Responder Coordination Platform, (2) Intelligent Recognition System and (3) Residence Card Information Management System product lines.

-

Pursue strategic acquisitions to complement strong internal growth – We adhere to a focused and disciplined approach to identify, execute and integrate acquisitions. We intend to target acquisitions that enable geographic expansion, enhance our technological capabilities and competitive advantages, provide licensing and recurring revenue opportunities and propel our expansion into markets populated by high growth enterprises.

-

Enhance our capabilities – We strive to improve our existing capabilities and develop new ones. We plan to leverage our PGIS strength and our recent acquisition of Geo to target planned expansion into civil-use GIS, enterprise class information security markets and other government sectors. Geo was founded in 1999 by Wuhan University, a leading university in Asia for GIS-related studies. Geo develops and sells GIS software, contracts surveying and mapping projects, produces space measurement data and provides technical consulting and supervision services for GIS projects. We also plan to capitalize on our recent acquisition of Zhongtian and its patented Medical Case Statistics Software to serve the growing demand for digital hospital and electronic medical record, or EMR, systems in China. Zhongtian is focused on the development and sale of Hospital Information Management Software in order to help build modern, scientific and digitized hospitals. Its products are widely used to efficiently manage hospital fiscal information, clinical information, medical technologies, equipment and inventory, as well as other comprehensive hospital information. We also plan to continue providing our superior E-Government Platform and to maintain strong relationships with our current clients.

We expect to execute these key elements of our growth strategy through a combination of investments in internal initiatives and through acquisitions. Internal initiatives will focus on expanding capacity and enhancing our technology and services capabilities. We also intend to focus on acquisition targets in regions into which we plan to expand and that produce complementary products and services.

Industry Overview

General

Over the past two decades, the PRC government has encouraged the development and use of new technologies for information and communication (or ICTs) and their application in all spheres of government, industry, education and culture. The term "Informatization" or "xinxihua" has been coined in China to describe the overall process of ICT application in China and has in recent years become a linchpin of central and many local economic development strategies.

S-4

As a part of the Informatization process, the PRC government has launched a series of online programs to accelerate its pace of implementing and using information technology to improve China's current government information management systems, and help promote China's economic development. The Informatization process has led to a growth in the use of information technology, such as e-Government platforms and GIS, for public security. An example of this has been the Government Online Project or GOP. The Government Online Project is a three-stage initiative: Stage One focused upon connecting 800-1,000 government offices and agencies to the Internet; Stage Two focused on having government offices and agencies move their information systems into compatible electronic form; and Stage Three focused on making government offices and agencies paperless. The purpose of the GOP is to create a centrally accessible administrative system that collects and transports data to and from users; users being the public and the enterprise system, as well as government departments.

On January 22, 1999, the GOP was formally launched by China Telecom and the State Economic and Trade Commission's Economic Information Center along with the Information Offices of more than 40 central government departments. The project interconnects government offices of every province, autonomous region and municipality. The network will promote the establishment of formal government websites to provide information and services and then (in theory) also facilitate collaboration between the government and the nation's growing number of IT enterprises. By developing the basic infrastructure and encouraging government agencies at all levels to incorporate Internet technologies, the government hopes to set the tone for online development and, ultimately, e-commerce. Our First Responder Coordination Platform, Intelligent Recognition System and Residence Card Information Management System are a part of the information technology implementation program of the public security sector in China.

Global GIS Industry

The GIS field is a rapidly growing field that identifies data according to location. GIS incorporates geographical features with data in order to assess real world problems. In the strictest sense, a GIS is a computer system capable of capturing, storing, analyzing, and displaying geographically referenced information. The term GIS also includes the procedures, operating personnel, and spatial data that go into the system.

The power of a GIS comes from the ability to relate different information in a spatial context and reach a conclusion about this relationship. Most of the information we have about our world contains a location reference, placing that information at some point on the globe. However, GIS can be used to emphasize objects on a map, their absolute location on the Earth's surface and their spatial relationships, in a series of attribute tables—the "information" part of a GIS. For example, while a computer-aided mapping system may represent a road simply as a line, a GIS may also recognize that road as the boundary between wetland and urban development between two census statistical areas. A GIS, therefore, can reveal important new information (such as whether features intersect or whether they are adjacent) that leads to better decision making or solutions.

Data Capture and Integration – In order to utilize a GIS, data must be directly entered into (or captured by) a GIS in digital form, that is, in a form the computer can recognize. A GIS can also convert existing digital information, which may not yet be in map form, into forms it can recognize and use. Map data may also be created by (1) digitizing maps by hand-tracing with a computer mouse on the screen or on a digitizing tablet to collect the coordinates of features, (2) using electronic scanners to convert maps to digits, or (3) uploading coordinates from Global Positioning System or GPS receivers into a GIS. Once a time-consuming process, the data capture process is now made easier by the development in the GIS industry of software tools to automatically extract features from satellite images or aerial photographs and create databases in map form for use in a GIS. Information Retrieval and Data Output – With a GIS you can "point" at a location, object, or area on the screen and retrieve recorded information about it from off-screen files. For example, using scanned aerial photographs as a visual guide, you can ask a GIS about the location of a fire, analyze the area around the fire and determine conditions of adjacency (what is next to it), containment (what is enclosed by it) and proximity (how close is something to it).

Another critical component of a GIS is its ability to produce graphics on the screen or on paper to convey the results of analyses to the people who make decisions about resources. Wall maps, Internet-ready maps, interactive maps and other graphics can be generated, allowing decision makers to visualize and thereby understand the results of analyses or simulations of potential events.

S-5

Components of GIS

Hardware – Hardware comprises the equipment needed to support the many activities ranging from data collection to data analysis. A central piece of the equipment is a workstation, which runs the GIS software and is the attachment point for the equipment. Data collection efforts can also require the use of a digitizer for conversion of hard copy data to digital data and a GPS data logger to collect the field. The use of handheld field technology is also becoming an important tool in GIS. With the advent of web-enabled GIS, web servers have become an important piece of equipment for GIS.

Software – Different software packages are important for GIS. Central to this is the GIS application package. Such software is essential for creating, editing and adding spatial and attributed data, therefore these packages contain a myriad of functions inherent to them. Extensions or add-ons are software that extends capabilities of the GIS software package. Component GIS software is the opposite of application software. Component GIS seeks to build software applications that meet a specific purpose and thus are limited in their spatial analysis capabilities. Utilities are stand-alone programs that perform a specific function. For example, a file format utility that converts from one type of GIS file to another. There is also web-GIS software that helps serve data through Internet browsers.

Data – Data is the core of any GIS. There are two primary types of data that are used in GIS, data in geodatabases and attribute data. A geodatabase is a database that is in some way referenced to locations on earth. Geodatabases are grouped into two different types: vector and raster. A vector image is stored as geometric objects, such as lines and arcs, which are drawn between specific coordinates. If you magnify a vector image you see the lines more accurately, and the line edges stay smooth. A raster image is made up from pixels, like the picture obtained from a scanner, or the screen image on a computer monitor, and has a finite amount of detail which is dependent upon the image size and resolution. However, the closer you look at a raster image the coarser it appears and you don't see any extra detail. Vector drawings are utilized in GIS and other applications where accuracy is important. Usually coupled with this data is data known as attribute data. Attribute data are data that relate to a specific, precisely defined location. The data are often statistical but may be text, images or multi-media. These are linked in the GIS to spatial data that define the location.

People – Well-trained people knowledgeable in spatial analysis and skilled in using GIS software are essential to the GIS process.

Public Sector Use of GIS

GIS can be used by the public sector in the following ways:

Pubic Safety and Emergency Response Planning – GIS technology gives public safety personnel the ability to manage and analyze large amounts of location-based information. Data (including files from legacy systems) can be stored in a geodatabase and used to visualize spatial relationships and reveal trends critical to public safety response and planning. Computer-generated maps can be shared across a network or the Internet with multiple agencies to coordinate efforts and maximize resources.

Law Enforcement – GIS software uses geography and computer-generated maps as an interface for integrating and accessing massive amounts of location-based information. GIS allows law enforcement and criminal justice personnel to effectively plan for emergency response, determine mitigation priorities, analyze historical events, and predict future events. GIS can also be used to get critical information to emergency responders upon dispatch or while en route to an incident to assist in tactical planning and response. While law enforcement agencies collect vast amounts of data, only a very small part of this information can be absorbed from spreadsheets and database files. GIS provides a visual, spatial means of displaying data, allowing law enforcement agencies to integrate and leverage their data for more informed decision making.

Public Works and Development – Use of GIS software in public works improves efficiency and productivity to better serve citizens. For example, GIS applications are in demand in connection with the construction of the Pan Asia Railway and development of the Meigong River and Tumen River in the Northwest of China. Such public works systems could use GIS to connect all divisions in a public works department from engineering to accounting, which streamlines work flows, asset management, operations, and planning. Using a GIS throughout the department allows all sections to share and easily access geographic data. GIS promotes data integrity and facilitates better communication and decision making throughout the organization.

S-6

Economic Development – GIS may be used to foster economic development. Agencies could work to advance the quality of life and strengthen the economic base of their region by retaining and growing existing businesses and attracting new investment.

Urban Planning and Site Selection – Information regarding a proposed site for parcel zoning, transportation planning, waste disposal or other use may be combined and manipulated in a GIS to address planning and natural resource issues (such as the location of a water well near a proposed waste disposal site) to guarantee the quality of life for everyone in livable communities. Planning agencies have realized the power of enterprise GIS to identify problems, respond to them efficiently, and share the results with the public.

Our Selling Stockholder

The selling stockholder in this offering, Mr. Jiang Huai Lin, is our President, Chief Executive Officer and Chairman and the sole shareholder of our VIE entity, iASPEC. Between October 6, 2006 and January 31, 2007, our shareholders approved a series of transactions whereby we purchased all of the issued and outstanding stock of CPSH from Jiang Huai Lin for 25,500,000 shares of our common stock. As a result of these transactions CPSH became our wholly-owned subsidiary, and Mr. Lin became the beneficial owner of 25,500,000 shares of our common stock. As of December 4, 2009, Mr. Lin beneficially owned 21,750,080 shares of our common stock, including 2,600,000 shares held indirectly through Total Devices Management, Ltd., an entity that is wholly-owned by Mr. Lin, which represents 43.6% of the outstanding shares of our common stock. Assuming the sale by Mr. Lin of 1,600,000 shares of our common stock in this offering, Mr. Lin would continue to beneficially own 20,150,080 shares of our common stock, which represents 36.8% of the shares of our common stock to be outstanding after this offering. Beneficial ownership percentages are calculated based on Rule 13d-3 of the Exchange Act using 49,899,141 shares of common stock outstanding as of December 4, 2009.

Principal Executive Offices

Our corporate headquarters are located at 21st Floor, Everbright Bank Building, Zhuzilin, Futian District, Shenzhen, Guangdong, 518040, People's Republic of China. Our telephone number is (+86) 755-8370-8333. We maintain a website at www.chinacpby.com that contains information about us and our subsidiaries, but that information is not a part of this prospectus or incorporated by reference herein.

Conventions

In this prospectus supplement, unless otherwise indicated, references to

-

"Bocom" are to Shenzhen Bocom Multimedia Display Technology Co., Ltd, a PRC company,

-

"China" and "PRC," are to the People's Republic of China,

-

"CIST", "we," "us," or "our" and the "Company" are to the combined business of China Information Security Technology, Inc. and its wholly-owned subsidiary, CPSH; along with CPSH's wholly-owned subsidiaries, IST and ISSI; and ISSI's wholly-owned subsidiary, ISS; ISIID, and its operating PRC subsidiary, Bocom; iASPEC, to whose operations we succeeded on October 9, 2006 and who became our variable interest entity effective July 1, 2007, and its 57% majority owned subsidiary, Geo; and Kwong Tai, and its wholly-owned PRC subsidiary, Zhongtian.

-

"CPSH" are to China Public Security Holdings Limited, a British Virgin Islands company,

-

"Geo," are to Wuda Geoinformatics Co., Ltd., a PRC company,

-

"Hong Kong," are to the Hong Kong Special Administrative Region of China,

-

"iASPEC" are to iASPEC Software Co., Ltd., a PRC company,

-

"ISIID," are to Information Security International Investment and Development Limited, a Hong Kong company,

-

"ISS," are to Information Security Software (China) Co., Ltd., a PRC company,

-

"ISSI" are to Information Security Software Investment Limited, a Hong Kong company, "IST" are to Information Security Technology (China) Co., Ltd., a PRC company,

-

"Kwong Tai, " are to Kwong Tai International Technology Limited, a Hong Kong company, and

-

"Zhongtian," are to Shenzhen Zhongtian Technology Development Company Ltd. a PRC company.

S-7

| The Offering |

|

|

| |

| Common stock offered by the Company |

4,854,000 shares. |

|

| |

| Common stock offered by the selling stockholder |

1,600,000 shares. |

|

| |

| Common stock to be outstanding after this offering |

54,753,141 shares (or 55,721,241 shares if the underwriters exercise their over-allotment option in full). |

|

| |

| Over-allotment option |

We have granted the underwriters an option for a period of 30 days from the date of this prospectus supplement to purchase up to 968,100 additional shares of our common stock to cover any over-allotments. |

|

| |

| Public offering price per share |

$ |

|

| |

| Use of proceeds |

We will receive approximately $28.1 million in net proceeds from this offering (based on the assumed offering price of $6.18 per share, the closing price of our common stock as reported on the Nasdaq Global Select Market on December 4, 2009) after deducting underwriting discounts and estimated offering expenses. We intend to use the net proceeds for general corporate purposes, which may include, among other things: acquisitions; working capital; capital expenditures; research and development expenditures; investments; and repayment of debt. See "Use of Proceeds." |

|

| |

|

We will not receive any of the proceeds from the shares of common stock sold by the selling stockholder. | |

|

| |

| Risk factors |

Before investing in our common stock, you should consider carefully all of the information set forth in this prospectus supplement, the accompanying prospectus, any free writing prospectus with respect to this offering filed by us with the Securities and Exchange Commission and the documents incorporated by reference herein and, in particular, you should evaluate the specific factors set forth in the section entitled "Risk Factors" in this prospectus supplement and the section entitled "Item 1A. Risk Factors" in our Annual Report on Form 10-K/A, filed August 12, 2009, and our Quarterly Reports on Form 10-Q, filed May 11, 2009, August 6, 2009 and November 9, 2009 which are incorporated by reference herein. |

|

| |

| Nasdaq Global Select Market symbol |

CPBY |

The number of shares to be outstanding after this offering is based on 49,899,141 shares outstanding as of December 4, 2009. No shares of our common stock were issuable upon the exercise of stock options outstanding as of December 4, 2009.

Except as otherwise indicated, all information in this prospectus supplement assumes no exercise of the underwriters' option to purchase up to 968,100 additional shares of common stock from us.

S-8

Summary Consolidated Financial Information

The following tables set forth our summary consolidated financial data as of and for the years ended December 31, 2008 and 2007, as well as summary consolidated financial data as of and for the nine months ended September 30, 2009 and 2008. The summary consolidated financial data set forth below has been derived from our audited consolidated financial statements and related notes thereto where applicable for the respective fiscal years. The summary consolidated financial data as of and for the nine months ended September 30, 2009 and 2008, were derived from our unaudited condensed consolidated financial statements and related notes thereto. The summary consolidated financial data should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" as well as our consolidated financial statements and notes thereto contained in our Annual Report on Form 10-K/A for the year ended December 31, 2008 and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2009 which are incorporated by reference herein. These historical results are not necessarily indicative of the results to be expected in the future. The results of ISS, Bocom, Geo, and Zhongtian are included from their dates of acquisition of November 7, 2007, February 1, 2008, April 1, 2008, and November 1, 2008, respectively.

| For the Nine Months Ended | For the Years Ended | |||||||||||

| September 30, | December 31, | |||||||||||

| 2009 | 2008 | 2008 | 2007 | |||||||||

| (unaudited) | ||||||||||||

| Statements of Income Data (in thousands): | ||||||||||||

| Total Revenue | $ | 69,449 | $ | 57,730 | $ | 85,301 | $ | 30,343 | ||||

| Total Cost | 34,579 | 29,539 | 46,222 | 12,373 | ||||||||

| Administrative expenses | (6,984 | ) | (6,226 | ) | (10,159 | ) | (3,289 | ) | ||||

| Research and development expenses | (1,912 | ) | (1,978 | ) | (2,596 | ) | (798 | ) | ||||

| Management fee | - | - | - | (92 | ) | |||||||

| Selling expenses | (1,954 | ) | (1,573 | ) | (2,441 | ) | (480 | ) | ||||

| Subsidy income | 674 | 264 | - | - | ||||||||

| Other income, net | 167 | 112 | 939 | 79 | ||||||||

| Interest income | 238 | 182 | 215 | 139 | ||||||||

| Interest expense | (226 | ) | (83 | ) | (179 | ) | - | |||||

| Income tax expense | (3,478 | ) | (907 | ) | (1,548 | ) | (107 | ) | ||||

| Less: Net income attributable to the non-controlling interest | (115 | ) | (177 | ) | (241 | ) | (90 | ) | ||||

| Income from continuing operations | 21,397 | 17,983 | 23,069 | 13,331 | ||||||||

| Income from discontinued operations (net of tax of $0 | - | 858 | 718 | - | ||||||||

| Net income | $ | 21,397 | $ | 18,841 | $ | 23,787 | $ | 13,331 | ||||

| Foreign currency translation gain | 643 | 4,251 | 4,580 | 1,468 | ||||||||

| Comprehensive income | $ | 22,040 | $ | 23,092 | $ | 28,367 | $ | 14,799 | ||||

| Statements of Cash Flow Data (in thousands): | ||||||||||||

| Net cash provided by operating activities | $ | 8,326 | $ | 3,978 | $ | 4,548 | $ | 1,607 | ||||

| Net cash used in investing activities | (8,579 | ) | (7,544 | ) | (21,045 | ) | (31,965 | ) | ||||

| Net cash provided by financing activities | 5,112 | 4,789 | 5,228 | 49,535 | ||||||||

| Effect of exchange rate changes on cash and cash equivalent | 40 | 596 | 1,079 | 405 | ||||||||

| As of | |||||||||

| September 30, | As of December 31, | ||||||||

| 2009 | 2008 | 2007 | |||||||

| Balance Sheet Data (in thousands): | |||||||||

| Cash and cash equivalents | $ | 14,464 | $ | 9,565 | $ | 19,755 | |||

| Property and equipment, net | 23,575 | 23,556 | 13,827 | ||||||

| Total assets | 183,045 | 148,468 | 88,854 | ||||||

| Total current liabilities | 37,827 | 25,463 | 4,787 | ||||||

| Total stockholders' equity | 129,787 | 109,098 | 74,006 | ||||||

S-9

RISK FACTORS

Before you invest in our common stock, you should carefully consider the risk factors specified below, those risk factors set forth in the accompanying prospectus, our annual report on Form 10-K/A for the year ended December 31, 2008 and our quarterly reports on Form 10-Q for the quarters ended March 31, 2009, June 30, 2009 and September 30, 2009, together with all of the other information and documents included or incorporated by reference in this prospectus supplement, the accompanying prospectus, and any free writing prospectus and the documents incorporated by reference herein or therein, in evaluating an investment in our common stock. If any of the risks discussed below, in the accompanying prospectus, any free writing prospectus, our annual report on Form 10-K/A for the year ended December 31, 2008 and our quarterly reports on Form 10-Q for the quarters ended March 31, 2009, June 30, 2009 and September 30, 2009, or in any document incorporated by reference into this prospectus supplement, the accompanying prospectus, or any free writing prospectus were actually to occur, our business, financial condition, results of operations, or cash flow could be materially adversely affected. In that case, the trading price of our common stock could decline and you could lose all or part of your investment.

Risks Related to Our Business

We are not likely to sustain our recent growth rate.

Our revenues have grown significantly in the last few years, primarily resulting from our strategic acquisitions, including our acquisition of Fortune Fame and its operating subsidiary Information Security Development Technology (Shenzhen) Company Ltd., Bocom Multimedia Display Company Limited and the acquisition of Wuhan Wuda Geoinformatics Co., Ltd. by our variable interest entity, iASPEC Software Co., Ltd. Specifically, our revenue has grown 157%, between the fiscal year 2007 and the fiscal year 2006 (including revenue earned by our predecessor in fiscal year 2006) and 181%, between the fiscal year 2008 and the fiscal year 2007. Additionally, our net income has grown 135%, between the fiscal year 2007 and the fiscal year 2006 (including revenue earned by our predecessor in fiscal year 2006) and 78%, between the fiscal year 2008 and the fiscal year 2007. We are not likely to sustain similar growth in revenues or net income in future periods due to a number factors, including, among others, the greater difficulty of growing at sustained rates from a larger revenue base and our ability to identify and consummate strategic acquisitions. Accordingly, you should not rely on the results of any prior period as an indication of our future financial and operating performance.

Our quarterly operating results are difficult to predict and could fall below investor expectations or estimates by securities research analysts, which may cause the trading price of our common stock to decline.

Our revenues and operating results can vary significantly from quarter to quarter due to a number of factors, many of which are outside of our control, such as variations in the volume of business from customers resulting from changes in our customers' operations, the business decisions of our customers regarding the use of our products and services, delays or difficulties in expanding our operational facilities and infrastructure, changes to our pricing structure or that of our competitors, inaccurate estimates of resources and time required to complete ongoing projects and currency fluctuations. As many of our employees take long vacations during the Chinese New Year in the first quarter, our revenues in that quarter are relatively low compared to the other quarters. Moreover, our results may vary depending on our customers' business needs and spending patterns. Due to the annual budget cycles of most of our customers, we may not be able to estimate accurately the demand for our products and services beyond the immediate calendar year, which could adversely affect our business planning and may have a material adverse effect on our business, results of operations and financial condition. In addition, the volume of work performed for specific customers is likely to vary from year to year. Thus, a major customer in one year may not provide the same amount or percentage of our revenues in any subsequent year.

These fluctuations are likely to continue in the future and operating results for any period may not be indicative of our performance in any future period. If our operating results for any quarterly period fall below investor expectations or estimates by securities research analysts, the trading price of our common stock may decline.

We generally do not have exclusive or long-term agreements with our customers and we may lose their engagement if they are not satisfied with our products and services or for other reasons.

We generally do not have exclusive or long-term agreements with our customers. As a result, we must rely on the quality of our products and services, industry reputation and favorable pricing to attract and retain customers. There is no assurance, however, that we will be able to maintain our relationships with current and/or future customers. Our customers may elect to terminate their relationships with us if they are not satisfied with our services. If a substantial number of our customers choose not to continue to purchase products and services time from us, it would have a material adverse effect on our business and results of operations.

S-10

We face risks once a business is acquired and the acquired companies may not perform to our expectations, either of which may adversely affect our results of operations.

We face risks when we acquire other businesses. These risks include:

-

difficulties in the integration of acquired operations and retention of personnel,

-

entry into unfamiliar markets,

-

unforeseen or hidden liabilities,

-

tax, regulatory and accounting issues, and

-

inability to generate sufficient revenues to offset acquisition costs.

Acquired companies may not perform to our expectations for various reasons, including the loss of key personnel or, as a result, key customers, and our strategic focus may change. As a result, we may not realize the benefits we anticipated. If we fail to integrate acquired businesses or realize the expected benefits, we may lose the return on the investment in these acquisitions, incur transaction costs and our results of operations could be materially and adversely affected as a result.

Risks Related to Doing Business in China

If we fail to obtain or maintain all licenses and approvals required to operate our businesses in the PRC, our business and operations may be adversely affected.

Fulfillment of certain Police-Use Geographical Information Services, or PGIS, contracts with PRC Government customers is restricted to entities possessing the necessary government licenses and approvals which our subsidiary Information Security Technology (China) Co., Ltd. or IST, does not have. We currently perform PGIS contracts through our VIE, iASPEC, which possesses the requisite licenses and approvals, pursuant to our Management Services Agreement with iASPEC, whereby iASPEC exclusively engages IST as its subcontractor to provide iASPEC with outsourcing services (to the extent that those services do not violate any special governmental permits held by iASPEC and do not involve the improper transfer of any sensitive confidential governmental or other data). If the PRC government determines that we are operating without the requisite licenses we may become subject to administrative penalties or an order to discontinue our business operations, both of which could have a material adverse effect on our business and results of operations. For a discussion of the risks attendant to our commercial relationship with iASPEC, please refer to our Annual Report on Form 10-K for the fiscal year ended December 31, 2008, Item 1A. "Risk Factors—Risks Relating to Our Commercial Relationship with iASPEC".

The digital security, geographic, and hospital information systems markets in China are highly competitive, and we may fail to compete successfully, thereby resulting in loss of customers and decline in our revenues.

The digital security, geographic, and hospital information systems markets in China are intensely competitive and are characterized by frequent technological changes, evolving industry standards and changing customer demands. We have competition from multiple domestic competitors in each segment. Increased competition may result in price reductions, reduced margins and inability to gain or hold market share.

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident stockholders to personal liability, limit our ability to acquire PRC companies or to inject capital into our PRC subsidiaries, limit our PRC subsidiaries' ability to distribute profits to us or otherwise materially adversely affect us.

In October 2005, the PRC State Administration of Foreign Exchange, or SAFE, issued the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, generally referred to as Circular 75, which required PRC residents to register with the competent local SAFE branch before establishing or acquiring control over an offshore special purpose company, or SPV, for the purpose of engaging in an equity financing outside of China on the strength of domestic PRC assets originally held by those residents. Internal implementing guidelines issued by SAFE, which became public in June 2007 (known as Notice 106), expanded the reach of Circular 75 by (1) purporting to cover the establishment or acquisition of control by PRC residents of offshore entities which merely acquire "control" over domestic companies or assets, even in the absence of legal ownership; (2) adding requirements relating to the source of the PRC resident's funds used to establish or acquire the offshore entity; (3) covering the use of existing offshore entities for offshore financings; (4) purporting to cover situations in which an offshore SPV establishes a new subsidiary in China or acquires an unrelated company or unrelated assets in China; and (5) making the domestic affiliate of the SPV responsible for the accuracy of certain documents which must be filed in connection with any such registration, notably, the business plan which describes the overseas financing and the use of proceeds. Amendments to registrations made under Circular 75 are required in connection with any increase or decrease of capital, transfer of shares, mergers and acquisitions, equity investment or creation of any security interest in any assets located in China to guarantee offshore obligations, and Notice 106 makes the offshore SPV jointly responsible for these filings. In the case of an SPV which was established, and which acquired a related domestic company or assets, before the implementation date of Circular 75, a retroactive SAFE registration was required to have been completed before March 31, 2006; this date was subsequently extended indefinitely by Notice 106, which also required that the registrant establish that all foreign exchange transactions undertaken by the SPV and its affiliates were in compliance with applicable laws and regulations. Failure to comply with the requirements of Circular 75, as applied by SAFE in accordance with Notice 106, may result in fines and other penalties under PRC laws for evasion of applicable foreign exchange restrictions. Any such failure could also result in the SPV's affiliates being impeded or prevented from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the SPV, or from engaging in other transfers of funds into or out of China.

S-11

We have asked our stockholders, who are PRC residents as defined in Circular 75, to register with the relevant branch of SAFE, as currently required, in connection with their equity interests in us and our acquisitions of equity interests in our PRC subsidiaries. However, we cannot provide any assurances that they can obtain the above SAFE registrations required by Circular 75 and Notice 106. Moreover, because of uncertainty over how Circular 75 will be interpreted and implemented, and how or whether SAFE will apply it to us, we cannot predict how it will affect our business operations or future strategies. For example, our present and prospective PRC subsidiaries' ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with Circular 75 and Notice 106 by our PRC resident beneficial holders.

In addition, such PRC residents may not always be able to complete the necessary registration procedures required by Circular 75 and Notice 106. We also have little control over either our present or prospective direct or indirect stockholders or the outcome of such registration procedures. A failure by our PRC resident beneficial holders or future PRC resident stockholders to comply with Circular 75 and Notice 106, if SAFE requires it, could subject these PRC resident beneficial holders to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit our subsidiaries' ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects.

The increase in the PRC enterprise income tax could result in a decrease of our net income and materially and adversely affect our financial condition and results of operations.

Our PRC subsidiaries are incorporated in the PRC and are governed by applicable PRC income tax laws and regulations. Prior to January 1, 2008, entities established in the PRC were generally subject to a 30% state and 3% local enterprise income tax rate. There were various preferential tax treatments promulgated by national tax authorities that were available to foreign-invested enterprises or enterprises located in certain areas of China. The PRC Enterprise Income Tax Law, or the EIT Law, was enacted on March 16, 2007 and became effective on January 1, 2008. The implementation regulations under the EIT Law issued by the PRC State Council became effective January 1, 2008. Under the EIT Law and the implementation regulations, the PRC has adopted a uniform tax rate of 25% for all enterprises (including foreign-invested enterprises) and revoked the previous tax exemption, reduction and preferential treatments applicable to foreign-invested enterprises. However, there is a transition period for enterprises, whether foreign-invested or domestic, that received preferential tax treatments granted in accordance with the then prevailing tax laws and regulations prior to January 1, 2008. Enterprises that were subject to an enterprise income tax rate lower than 25% prior to January 1, 2008 may continue to enjoy the lower rate and gradually transition to the new tax rate within five years after the effective date of the EIT Law. As a wholly-owned FIE, our PRC subsidiary, IST, was approved by PRC tax authorities on August 10, 2007, to enjoy a two-year tax exemption, followed by a 50% exemption for three years, retroactive to as of January 1, 2007. Since the EIT Law permits companies, such as IST, that were previously exempt from taxes or that had concessional rates to retain their preferences until the original expiration date the EIT Law does not impact IST's income tax qualification to enjoy a tax exemption in fiscal year 2008 and IST will continue to qualify for a 50% tax exemption for the two years thereafter. EIT exemptions claimed by IST may become payable if IST were to dissolve within the next 10 years. The tax rate for IST in 2009 is 10%. ISS is a foreign invested enterprise incorporated in Shenzhen entitled a preferential enterprise income tax rate of 15% prior to the new EIT law, which was transited to 18% in 2008 and 20% in 2009. We cannot assure you that the preferential income tax rates that we enjoy will not be phased out at a faster rate or will not be discontinued altogether, either of which could result in a decrease of our net income and materially and adversely affect our financial condition and results of operations.

Under the New Enterprise Income Tax, or EIT, Law, we may be classified as a "resident enterprise" of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.

China passed the New EIT Law and its implementing rules, both of which became effective on January 1, 2008. Under the New EIT Law, an enterprise established outside of China with "de facto management bodies" within China is considered a "resident enterprise," meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the New EIT Law define de facto management as "substantial and overall management and control over the production and operations, personnel, accounting, and properties" of the enterprise. In addition, a recent circular issued by the State Administration of Taxation on April 22, 2009 regarding the standards used to classify certain Chinese-invested enterprises controlled by Chinese enterprises or Chinese group enterprises and established outside of China as "resident enterprises" clarified that dividends and other income paid by such "resident enterprises" will be considered to be PRC source income, subject to PRC withholding tax, currently at a rate of 10%, when recognized by non-PRC enterprise shareholders. This recent circular also subjects such "resident enterprises" to various reporting requirements with the PRC tax authorities.

S-12

In addition, the recent circular mentioned above sets out criteria for determining whether "de facto management bodies" are located in China for overseas incorporated, domestically controlled enterprises. However, as this circular only applies to enterprises established outside of China that are controlled by PRC enterprises or groups of PRC enterprises, it remains unclear how the tax authorities will determine the location of "de facto management bodies" for overseas incorporated enterprises that are controlled by individual PRC residents like us and some of our subsidiaries.

Therefore, although substantially all of our management is currently located in the PRC, it remains unclear whether the PRC tax authorities would require or permit our overseas registered entities to be treated as PRC resident enterprises. We do not currently consider our company to be a PRC resident enterprise. However, if the PRC tax authorities determine that China Information Security Technology, Inc. is a "resident enterprise" for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that income such as interest on offering proceeds and non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the New EIT Law and its implementing rules dividends paid to us from our PRC subsidiaries would qualify as "tax-exempt income," we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that future guidance issued with respect to the new "resident enterprise" classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our shares.

In addition, under the EIT law, the Notice of the State Administration of Taxation on Negotiated Reduction of Dividends and Interest Rates, or Notice 112, which was issued on January 29, 2008, the Arrangement between the PRC and the Hong Kong Special Administrative Region on the Avoidance of Double Taxation and Prevention of Fiscal Evasion, or the Double Taxation Arrangement (Hong Kong), which became effective on December 8, 2006, and the Notice of the State Administration of Taxation Regarding Interpretation and Recognition of Beneficial Owners under Tax Treaties, or Notice 601, which became effective on October 27, 2009, dividends from Shenzhen Bocom, Information Security Software, Information Security Technology, Shenzhen Zhongtian Technology Development Co., Ltd. and Huipu Electronics (Shenzhen) Co., Ltd. paid to us through our Hong Kong subsidiaries may be subject to a withholding tax at a rate of 10%, or at a rate of 5% if our Hong Kong subsidiaries are considered as "beneficial owners" that are generally engaged in substantial business activities and entitled to treaty benefits under the Double Taxation Arrangement (Hong Kong). Furthermore, the ultimate tax rate will be determined by treaty between the PRC and the tax residence of the holder of the PRC subsidiary. We are actively monitoring the proposed withholding tax and are evaluating appropriate organizational changes to minimize the corresponding tax impact.

Dividends declared and paid from pre-January 1, 2008 distributable profits are grandfathered under the New EIT Law and are not subject to withholding tax.

We have limited insurance coverage for our operations in China.

The insurance industry in China is still at an early stage of development. Insurance companies in China offer limited insurance products. We have determined that the risks of disruption or liability from our business, the loss or damage to our property, including our facilities, equipment and office furniture, the cost of insuring for these risks, and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. As a result, we do not have any business liability, disruption, litigation or property insurance coverage for our operations in China except for insurance on some company owned vehicles. Any uninsured occurrence of loss or damage to property, or litigation or business disruption may result in the incurrence of substantial costs and the diversion of resources, which could have an adverse effect on our operating results.

S-13

Risks Related to this Offering

Management will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

We have not designated the amount of net proceeds from this offering to be used for any particular purpose. Accordingly, our management will have broad discretion as to the application of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of this offering. Our shareholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not increase our profitability or market value.

You will experience immediate dilution in the book value per share of the common stock you purchase.

If you purchase shares of our common stock, your ownership will be diluted to the extent of the difference between the public offering price per share of our common stock and the net tangible book value of our common stock. Net tangible book value represents our total consolidated assets, minus the amount of our total consolidated intangible assets, total consolidated liabilities and minority interests. Based on an assumed offering price of $6.18 per share, the closing price of our common stock as reported on the Nasdaq Global Select Market on December 4, 2009, and the net tangible book value of the common stock of $2.72 per share as of September 30, 2009, if you purchase shares of common stock in this offering, you will suffer dilution of $ per share in the net tangible book value of the common stock.

A large number of shares may be sold in the market following this offering, which may depress the market price of our common stock.

All of the shares of our common stock sold in the offering will be freely tradable without restriction or further registration under the Securities Act. As a result, a substantial number of shares of our common stock may be sold in the public market following this offering, which may cause the market price of our common stock to decline. If there are more shares of common stock offered for sale than buyers are willing to purchase, then the market price of our common stock may decline to a market price at which buyers are willing to purchase the offered shares of common stock and sellers remain willing to sell the shares.

S-14

FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus, any applicable free writing prospectus, the documents incorporated by reference herein or therein, and other written reports and oral statements made by us from time to time, may contain and incorporate "forward-looking statements" within the meaning of Section 27A of the United States Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the United States Securities Exchange Act of 1934, as amended, or the Exchange Act. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases like "anticipate," "estimate," "plans," "projects," "continuing," "ongoing," "target," "expects," "management believes," "we believe," "we intend," "we may," "we will," "we should," "we seek," "we plan," the negative of those terms, and similar words or phrases. We base these forward-looking statements on our expectations, assumptions, estimates and projections about our business and the industry in which we operate as of the respective date or dates of or specified in the documents, written reports, and oral statements that contain such statements. These forward-looking statements are subject to a number of risks and uncertainties that cannot be predicted, quantified or controlled and that could cause actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. Statements in this prospectus supplement, the accompanying prospectus, any applicable free writing prospectus, and in documents incorporated herein and therein, including those set forth herein under the heading "Risk Factors," describe factors, among others, that could contribute to or cause these differences.

Because the factors discussed in this prospectus supplement, the accompanying prospectus, any applicable free writing prospectus, and documents incorporated by reference herein or therein could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any such forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

S-15

USE OF PROCEEDS

We will receive approximately $28.1 million in net proceeds from this offering (based on an assumed offering price of $6.18 per share, the closing price of our common stock as reported on the Nasdaq Global Select Market on December 4, 2009) after deducting underwriting discounts and estimated offering expenses. If the underwriters exercise their over-allotment option in full, we estimate that we will receive approximately $33.8 million in net proceeds, after deducting underwriting discounts and estimated offering expenses.

We expect to use the net proceeds for general corporate purposes, which may include, among other things: acquisitions, working capital, capital expenditures, research and development expenditures, investments and repayment of debt.

The precise amount and timing of the application of such proceeds will depend upon our funding requirements and the availability and cost of other capital. Pending any specific application, we may initially invest funds in short-term marketable securities or apply them to the reduction of short-term indebtedness. We will not receive any proceeds from the sale of our common stock by the selling stockholder in this offering.

S-16

PRICE RANGE OF COMMON STOCK

Our common stock is traded on the Nasdaq Global Select Market under the symbol "CPBY."

The following table sets forth, for the periods indicated, the high and low reported sales prices of our common stock. These prices reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not represent actual transactions.

| Sales Prices(1) | ||||||

| High | Low | |||||

| Year ended December 31, 2009 | ||||||

| Fourth Quarter (through December 4, 2009) | $ | 7.85 | $ | 5.21 | ||

| Third Quarter | 5.54 | 2.60 | ||||

| Second Quarter | 3.99 | 2.55 | ||||

| First Quarter | 3.93 | 1.83 | ||||

| Year ended December 31, 2008 | ||||||

| Fourth Quarter | $ | 4.75 | $ | 3.00 | ||

| Third Quarter | 5.66 | 4.00 | ||||

| Second Quarter | 7.45 | 5.56 | ||||

| First Quarter | 8.30 | 4.20 | ||||

| Year ended December 31, 2007 | ||||||

| Fourth Quarter | $ | 10.68 | $ | 7.90 | ||

| Third Quarter | 9.00 | 4.40 | ||||

| Second Quarter | 7.99 | 4.20 | ||||

| First Quarter | 9.50 | 4.25 | ||||

| (1) |

The last reported sales price of our common stock on the Nasdaq Global Select Market on December 4, 2009 was $6.18. As of December 4, 2009, there were approximately 53 stockholders of record of our common stock. Certain of our shares are held in "nominee" or "street" name; accordingly, we believe the number of beneficial owners is greater than the foregoing number. |

DIVIDEND POLICY

We have never declared or paid cash dividends. Any future decisions regarding dividends will be made by our Board of Directors. We currently intend to retain and use any future earnings for the development and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future.

Our Board of Directors has complete discretion on whether to pay dividends, subject to the approval of our shareholders. Even if our Board of Directors decides to pay dividends, the form, frequency and amount will depend upon our future operations and earnings, capital requirements and surplus, general financial condition, contractual restrictions and other factors that the Board of Directors may deem relevant.

S-17

CAPITALIZATION

The following table sets forth our cash and cash equivalents and capitalization as of September 30, 2009, both on an actual basis and as adjusted to give effect to the sale of 4,854,000 shares of common stock by us in this offering at an assumed public offering price of $6.18 per share (the closing sales price of our common stock as reported on the Nasdaq Global Select Market on December 4, 2009), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

This table should be read in conjunction with "Use of Proceeds" and our unaudited consolidated financial statements, including the related notes, included or incorporated by reference in this prospectus supplement.

| As of September 30, 2009 | ||||||

| Actual | As Adjusted | |||||

| (dollars in thousands, except | ||||||

| per share data) | ||||||

| Cash and cash equivalents | $ | 14,464 | $ | 42,604 | ||

| Current Liabilities | ||||||

| Short-term bank loans | 11,461 | 11,461 | ||||

| Accounts payable | 16,535 | 16,535 | ||||

| Advances from customers | 2,930 | 2,930 | ||||

| Amount due to related parties | 576 | 576 | ||||

| Accrued payroll and benefits | 1,432 | 1,432 | ||||

| Other payables and accrued expenses | 1,952 | 1,952 | ||||

| Income tax payable | 2,941 | 2,941 | ||||

| Total Current Liabilities | 37,827 | 37,827 | ||||

| Stockholder's Equity | ||||||

|

Common stock, par value $0.01; authorized capital 200,000,000 shares; shares outstanding as of September 30, 2009: 48,803,211 shares, actual, 53,657,211, as adjusted for this offering |

223 | 271 | ||||

| Treasury stock, at cost (6,000 shares) | (11 | ) | (11 | ) | ||

| Additional paid-in capital | 64,298 | 92,390 | ||||

| Reserve | 4,965 | 4,965 | ||||

| Retained earnings | 55,029 | 55,029 | ||||

| Accumulated other comprehensive income | 5,285 | 5,285 | ||||

| Total Stockholders' Equity | 129,789 | 157,929 | ||||

| Non-controlling interest | 15,430 | 15,430 | ||||

| Total Equity | $ | 145,219 | $ | 173,359 | ||

| Total Capitalization | $ | 183,046 | $ | 211,186 | ||

S-18

SELLING STOCKHOLDER

The following table sets forth certain information regarding the beneficial ownership of our outstanding shares of common stock as of December 4, 2009 by the selling stockholder, as adjusted to reflect the sale of shares in this offering. Information with respect to beneficial ownership is based upon information obtained from the selling stockholder.

The selling stockholder in this offering, Mr. Jiang Huai Lin, is our President, Chief Executive Officer and Chairman and sole shareholder of our VIE entity, iASPEC. Between October 6, 2006 and January 31, 2007, our shareholders approved a series of transactions whereby we purchased all of the issued and outstanding stock of CPSH from Jiang Huai Lin for 25,500,000 shares of our common stock. As a result of these transactions CPSH became our wholly-owned subsidiary, and Mr. Lin became the beneficial owner of 25,500,000 shares of our common stock. As of December 4, 2009, Mr. Lin beneficially owned 21,750,080 shares of our common stock, including 2,600,000 shares held indirectly through Total Devices Management, Ltd., an entity that is wholly-owned by Mr. Lin, which represents 43.6% of the outstanding shares of our common stock. Assuming the sale by Mr. Lin of the 1,600,000 shares of our common stock in this offering, Mr. Lin would continue to beneficially own 20,150,080 shares of our common stock, which represents 36.8% of the shares of our common stock to be outstanding after this offering. Beneficial ownership percentages are calculated based on Rule 13d-3 of the Exchange Act using 49,899,141 shares of common stock outstanding as of December 4, 2009.

The selling stockholder has informed us that he is not a registered broker-dealer or an affiliate of a registered broker-dealer.