Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ZIONS BANCORPORATION, NATIONAL ASSOCIATION /UT/ | form_8k.htm |

Goldman

Sachs

Financial

Services Conference

8

December 2009 ■ New York

Forward-Looking

Statements

This

presentation contains statements that relate to the projected performance

of

Zions Bancorporation and elements of or affecting such performance, including

statements with respect to the beliefs, plans, objectives, goals, guidelines,

expectations, anticipations and estimates of management. These statements

constitute forward-looking information within the meaning of the Private Securities

Litigation Reform Act. Actual facts, determinations, results or achievements may

differ materially from the statements provided in this presentation since such

statements involve significant known and unknown risks and uncertainties. Factors

that might cause such differences include, but are not limited to: competitive

pressures among financial institutions; economic, market and business conditions,

either nationally or locally in areas in which Zions Bancorporation conducts its

operations, being less favorable than expected; changes in the interest rate

environment reducing expected interest margins; changes in debt, equity and

securities markets; adverse legislation or regulatory changes; and other factors

described in Zions Bancorporation’s most recent annual and quarterly reports. In

addition, the statements contained in this presentation are based on facts and

circumstances as understood by management of the company on the date of this

presentation, which may change in the future. Zions Bancorporation disclaims any

obligation to update any statements or to publicly announce the result of any

revisions to any of the forward-looking statements included herein to reflect future

events, developments, determinations or understandings.

Zions Bancorporation and elements of or affecting such performance, including

statements with respect to the beliefs, plans, objectives, goals, guidelines,

expectations, anticipations and estimates of management. These statements

constitute forward-looking information within the meaning of the Private Securities

Litigation Reform Act. Actual facts, determinations, results or achievements may

differ materially from the statements provided in this presentation since such

statements involve significant known and unknown risks and uncertainties. Factors

that might cause such differences include, but are not limited to: competitive

pressures among financial institutions; economic, market and business conditions,

either nationally or locally in areas in which Zions Bancorporation conducts its

operations, being less favorable than expected; changes in the interest rate

environment reducing expected interest margins; changes in debt, equity and

securities markets; adverse legislation or regulatory changes; and other factors

described in Zions Bancorporation’s most recent annual and quarterly reports. In

addition, the statements contained in this presentation are based on facts and

circumstances as understood by management of the company on the date of this

presentation, which may change in the future. Zions Bancorporation disclaims any

obligation to update any statements or to publicly announce the result of any

revisions to any of the forward-looking statements included herein to reflect future

events, developments, determinations or understandings.

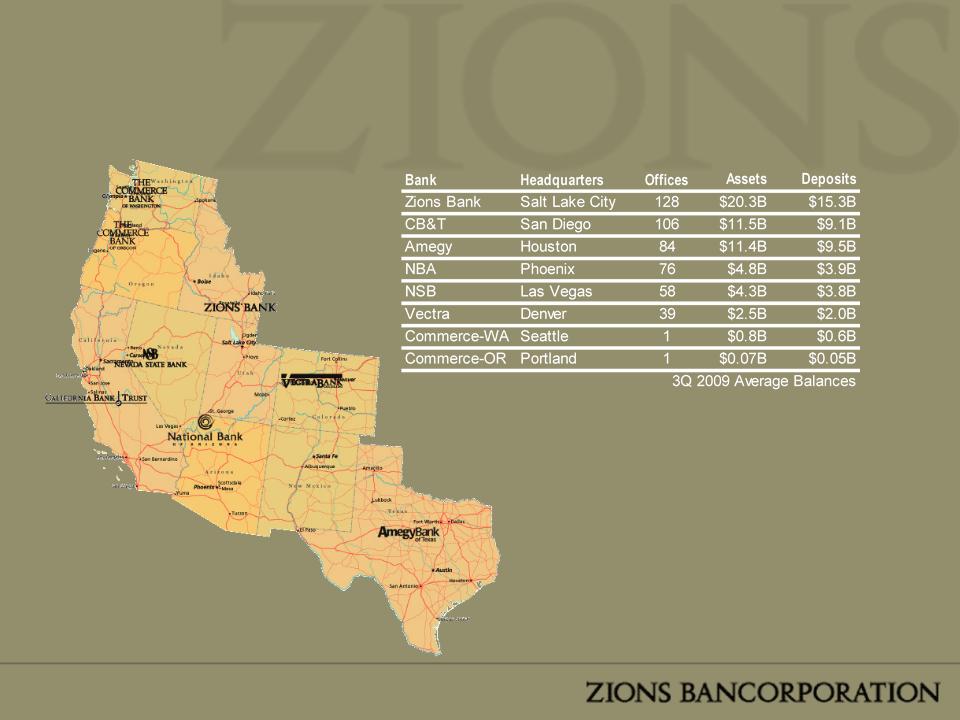

A

Collection of Great Banks

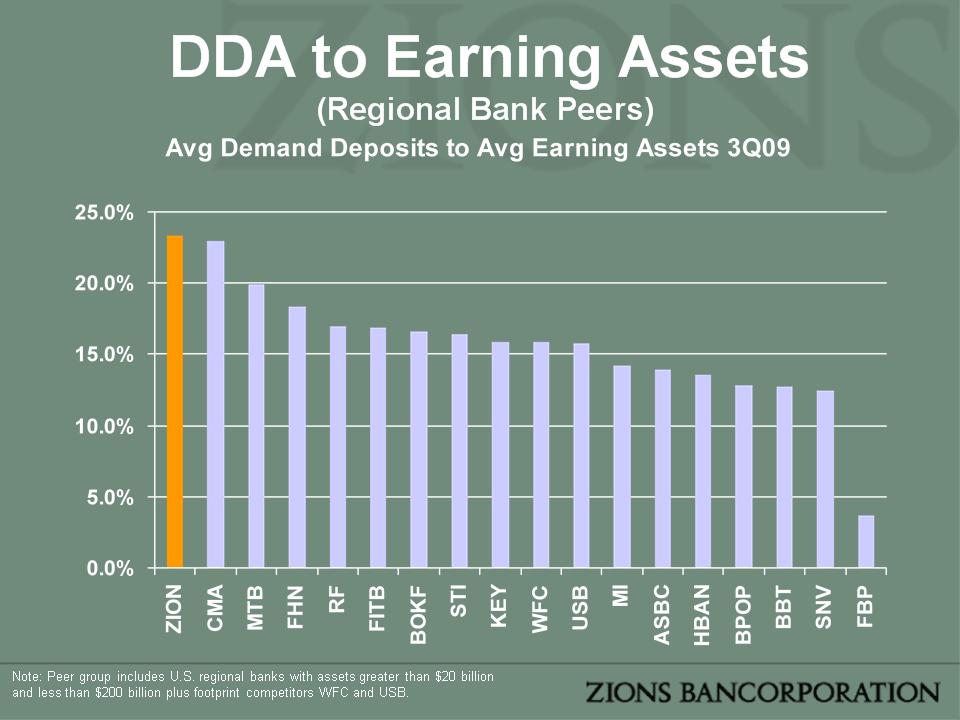

• Annual pretax,

pre-credit earnings of ~$1billion

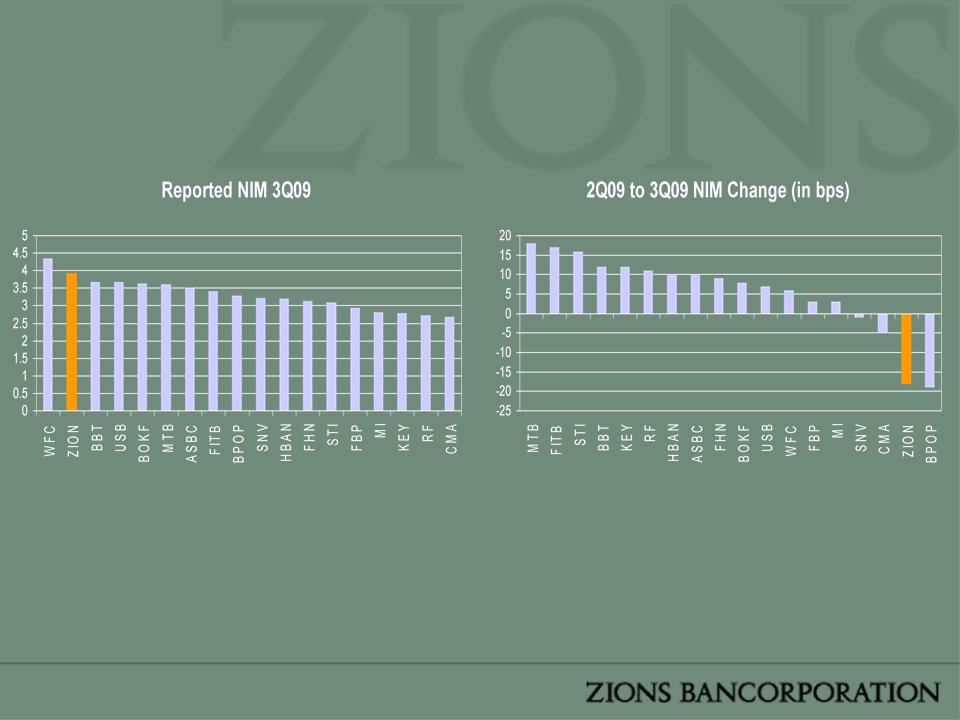

– NIM: 3.91%, ranked

#2 of regional banks/peers.

– Best among peers for

non-interest bearing deposits as a percent of

earning assets

earning assets

• Strong allowance for

credit loss: 3.9% of loans

• Low LTV ratios on

term commercial real estate loans

• Successful bidder on

four FDIC assisted transactions

• Markets with

nation’s strongest long term growth profile

• Competitive

operating cost structure - Zions continues

to cut costs; on target to reduce costs by $75 million by

end of FY09.

to cut costs; on target to reduce costs by $75 million by

end of FY09.

*Peer

group includes U.S. regional banks with assets greater than $20 billion

and

less than $200 billion plus footprint competitors WFC and USB.

less than $200 billion plus footprint competitors WFC and USB.

Zions’

Strengths

• Rising NPAs, to 5.4%

of loans from 4.7% in prior

quarter

quarter

– Total delinquent +

NPA was up 13% in 3Q09 compared to the prior

quarter

quarter

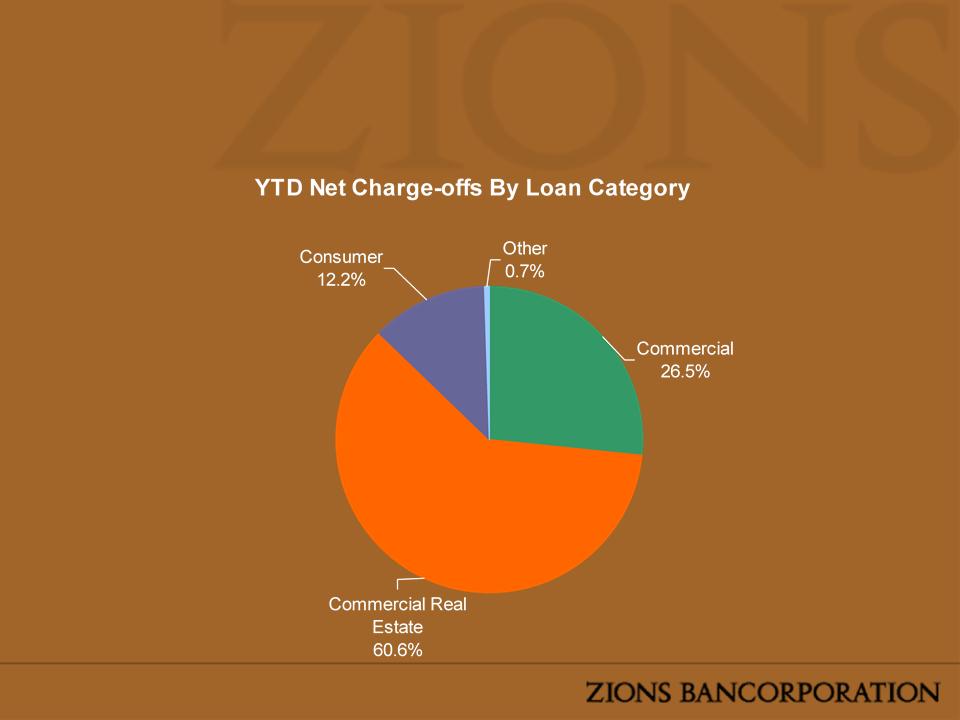

• YTD net charge-off

rate of 2.8%

• Continued securities

impairments (OTTI), primarily on

bank/insurance CDOs - $56.5 million in 3Q

bank/insurance CDOs - $56.5 million in 3Q

Zions’

Challenges

Footprint

Population Growth Estimates from SNL Financial (2009-2014)

Our

Growth Engine

Agenda

|

Key

Issues Going Forward

–Net Interest

Margin

–Credit

Quality

–Term

CRE

–Securities

Portfolio

–Capital &

Deferred Tax Asset

|

|

Outlook

Summary

|

Source:

SNL

Source:

SNL

Note:

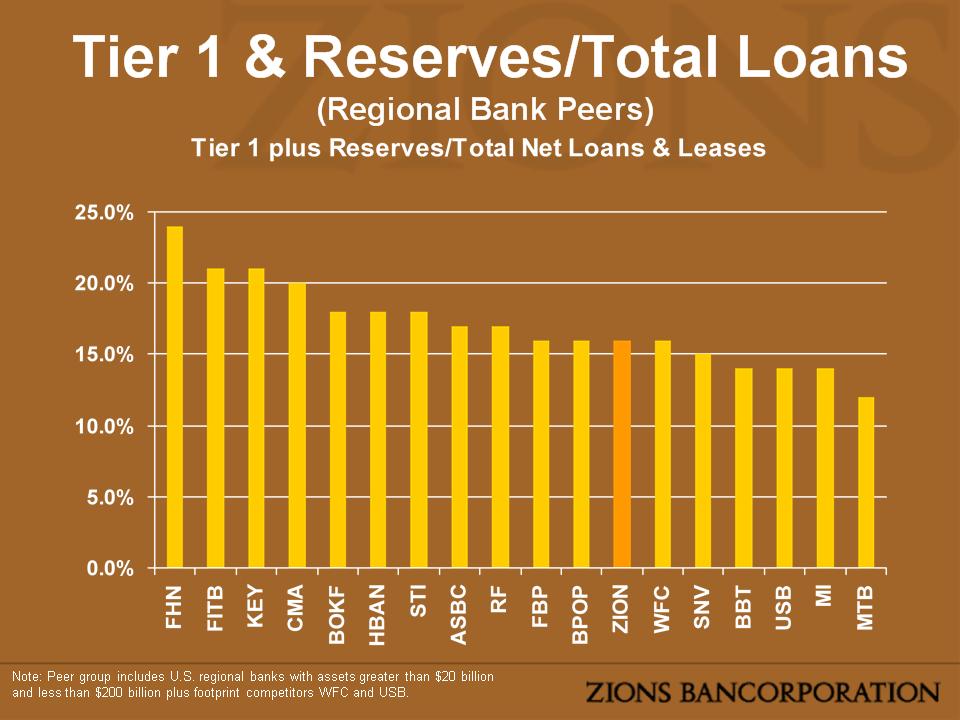

Peer group includes U.S. regional banks with assets greater than $20

billion

and less than $200 billion plus footprint competitors WFC and USB.

and less than $200 billion plus footprint competitors WFC and USB.

•Excluding

the effects of the 2Q09 sub debt modification, NIM increased 9 basis

points

•A

200 basis point rise in interest rates would increase the NIM by up to 13 basis

points

•See

Appendix for additional asset sensitivity information

Net

Interest Margin

(Regional Bank Peers)

(Regional Bank Peers)

Source:

SNL

Source:

SNL - Estimated where data was unavailable

Agenda

|

Key

Issues Going Forward

–Net Interest

Margin

–Credit

Quality

–Term

CRE

–Securities

Portfolio

–Capital &

Deferred Tax Asset

|

|

Outlook

Summary

|

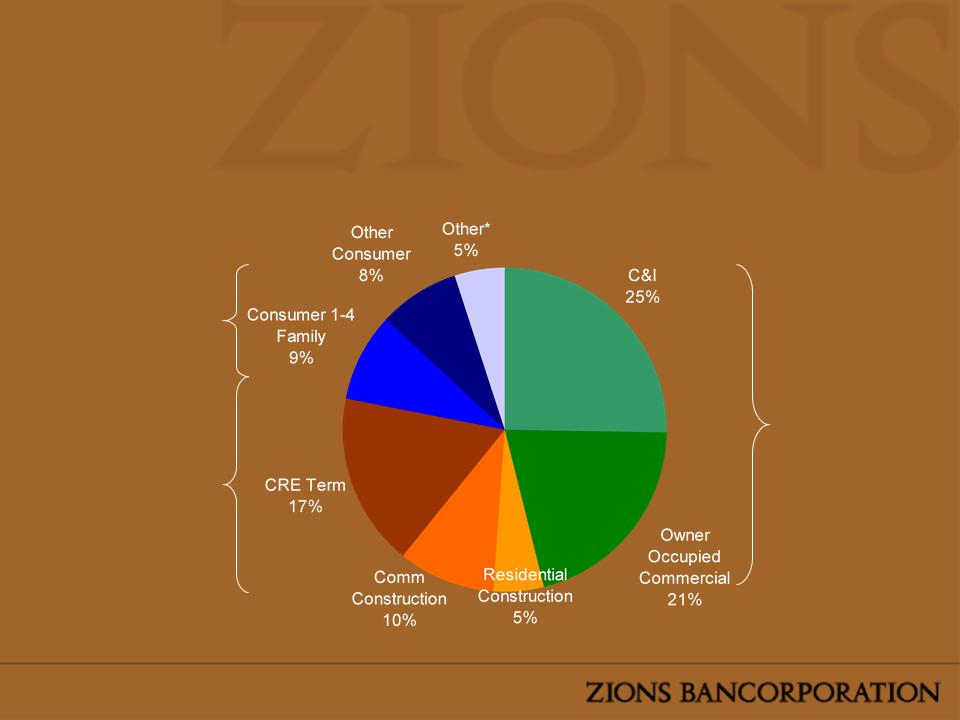

46%

32%

22%

*Includes FDIC

Supported Assets

Loan

Portfolio Composition

(9/30/2009)

(9/30/2009)

Based

on Total Loan Commitments

CRE

Portfolio Change Summary

(Dollar Change from 4Q07 to 3Q09 in billions)

(Dollar Change from 4Q07 to 3Q09 in billions)

Loan

Portfolio Performance

(9/30/2009)

(9/30/2009)

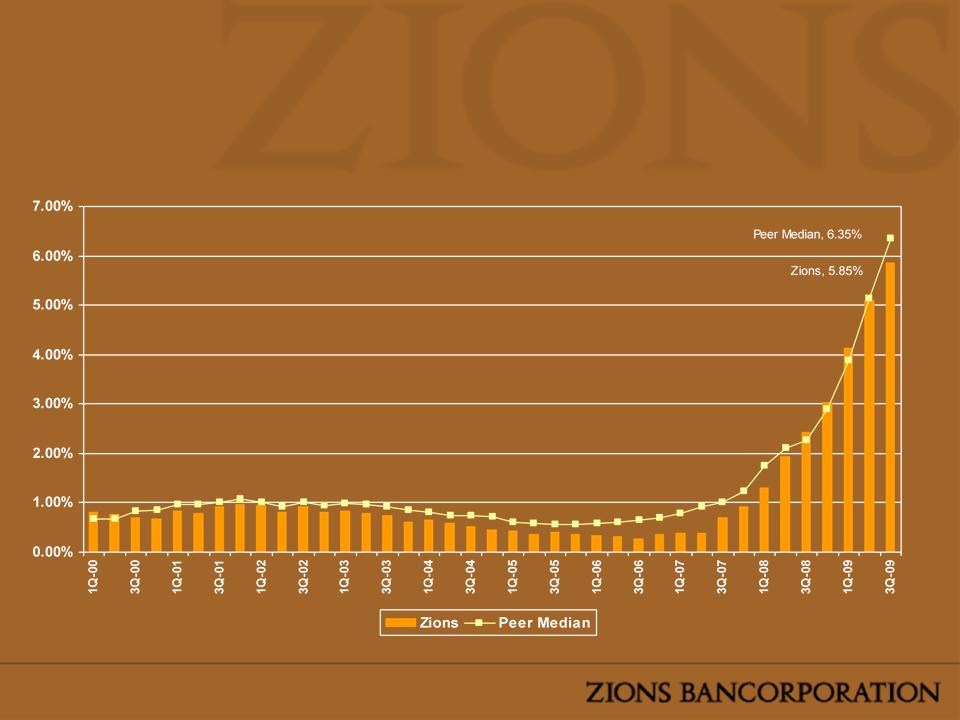

NPAs

+ Greater than 90 Days Delinquent / Loans + OREO

Note:

Peer group includes U.S. regional banks with assets greater than $20 billion

and

less than $200 billion plus footprint competitors WFC and USB.

less than $200 billion plus footprint competitors WFC and USB.

Source:

SNL

NPAs

& Delinquency Trends

(Regional Bank Peers)

(Regional Bank Peers)

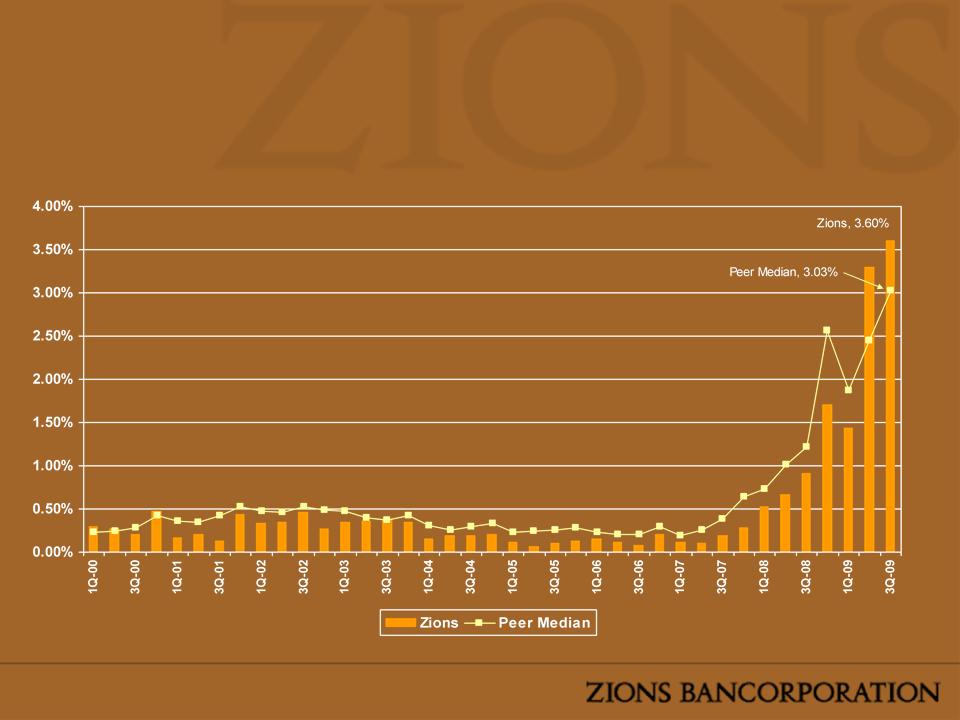

*Annualized

Note:

Peer group includes U.S. regional banks with assets greater than $20 billion

and

less than $200 billion plus footprint competitors WFC and USB.

less than $200 billion plus footprint competitors WFC and USB.

Source:

SNL

Net

Charge-offs as % of Loans*

(Regional Bank Peers)

(Regional Bank Peers)

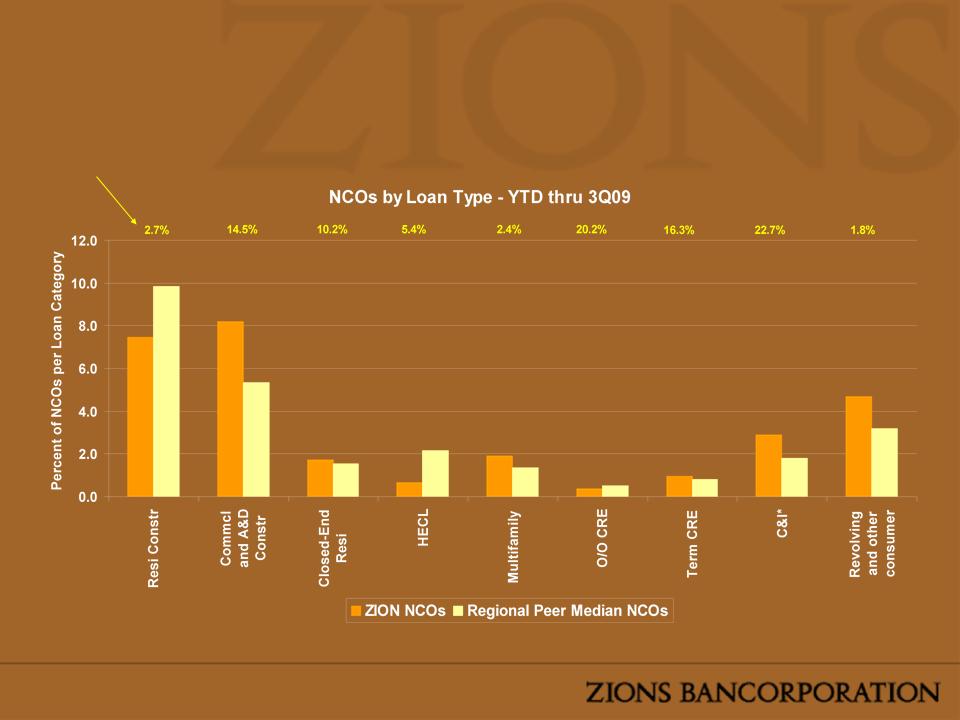

Note:

Peer group includes U.S. regional banks with assets greater than $20 billion and

less than $200 billion plus

footprint competitors WFC and USB. Source: SNL

footprint competitors WFC and USB. Source: SNL

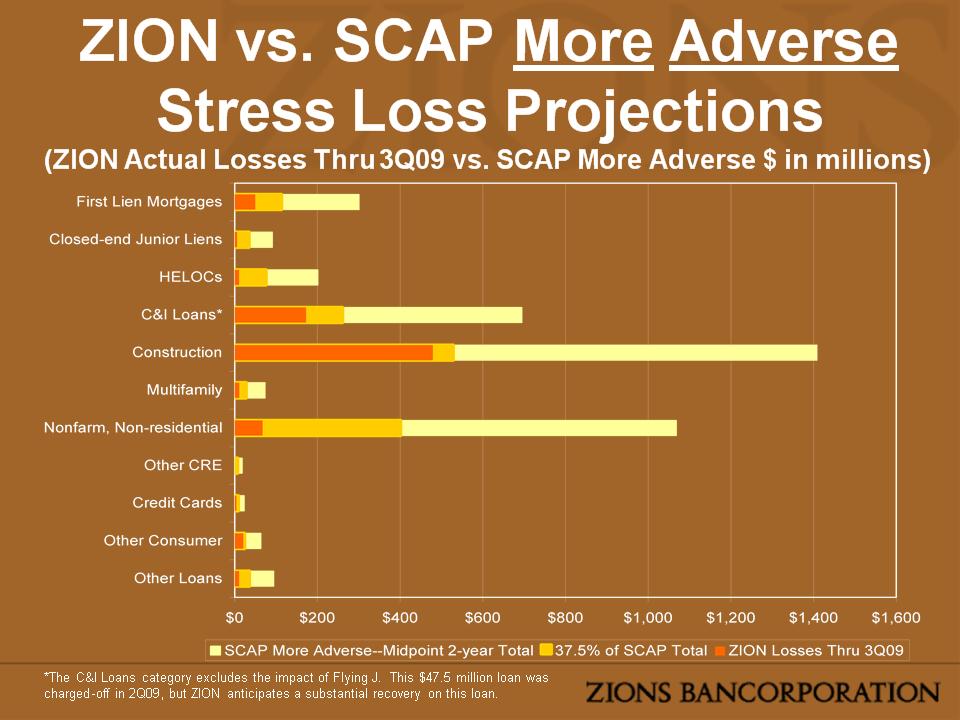

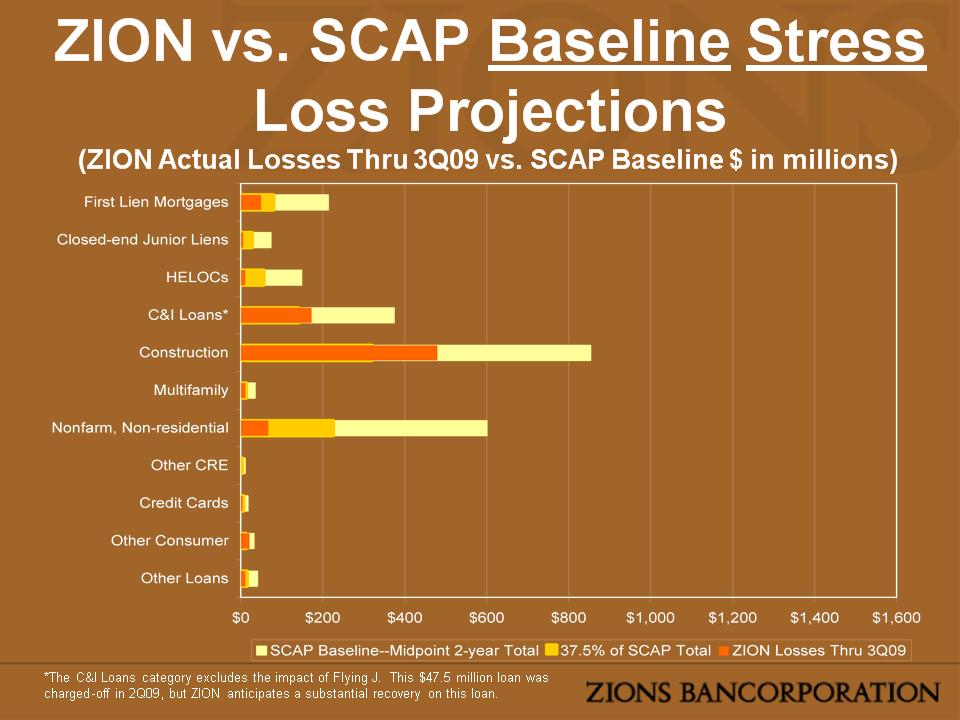

*The

C&I Loans category excludes the impact of Flying J. This

$47.5 million loan was charged-off in 2Q09, but

ZION anticipates a substantial recovery on this loan.

ZION anticipates a substantial recovery on this loan.

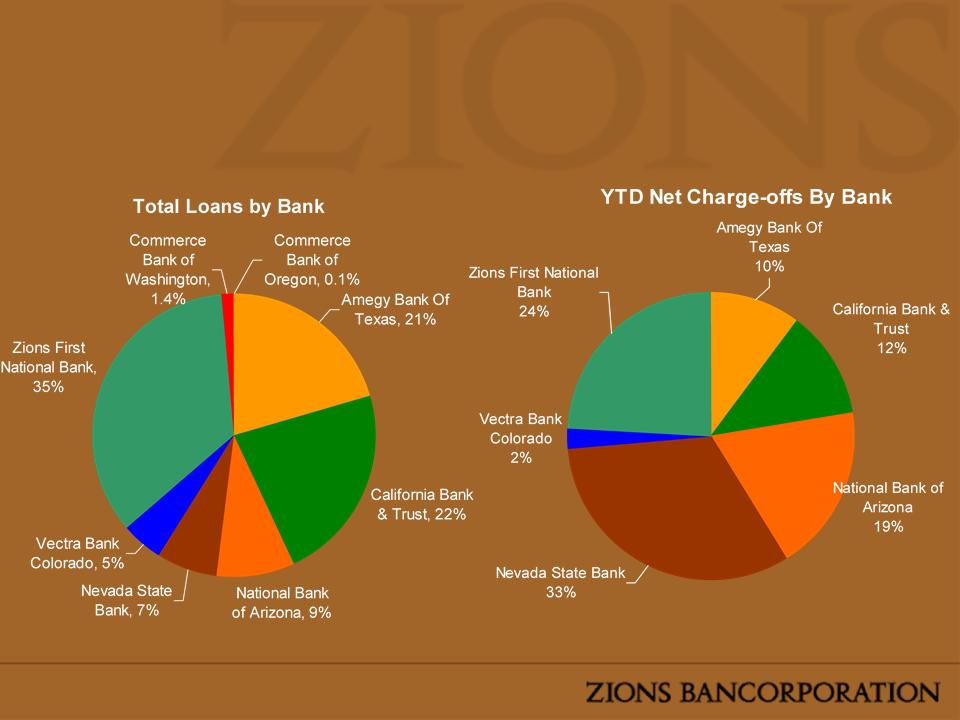

Percentage

of Zions

Total Loans

Total Loans

Net

Charge Offs

(Regional Bank Peers)

(Regional Bank Peers)

Source:

SNL

Reserves

& Net Charge Offs

(Regional Bank Peers)

(Regional Bank Peers)

Credit

Quality

Outlook

Outlook

• Residential

construction problem credits

stable to improving

stable to improving

• Commercial

construction problem

credits rising, although at a slower rate

credits rising, although at a slower rate

• Classified loans are

stabilizing

• Continued elevated

levels of NPAs,

provisions and net losses

provisions and net losses

• Continued ALLL build

likely in 4Q09, but

less than 3Q09

less than 3Q09

Agenda

|

Key

Issues Going Forward

–Net Interest

Margin

–Credit

Quality

–Term

CRE

–Securities

Portfolio

–Capital &

Deferred Tax Asset

|

|

Outlook

Summary

|

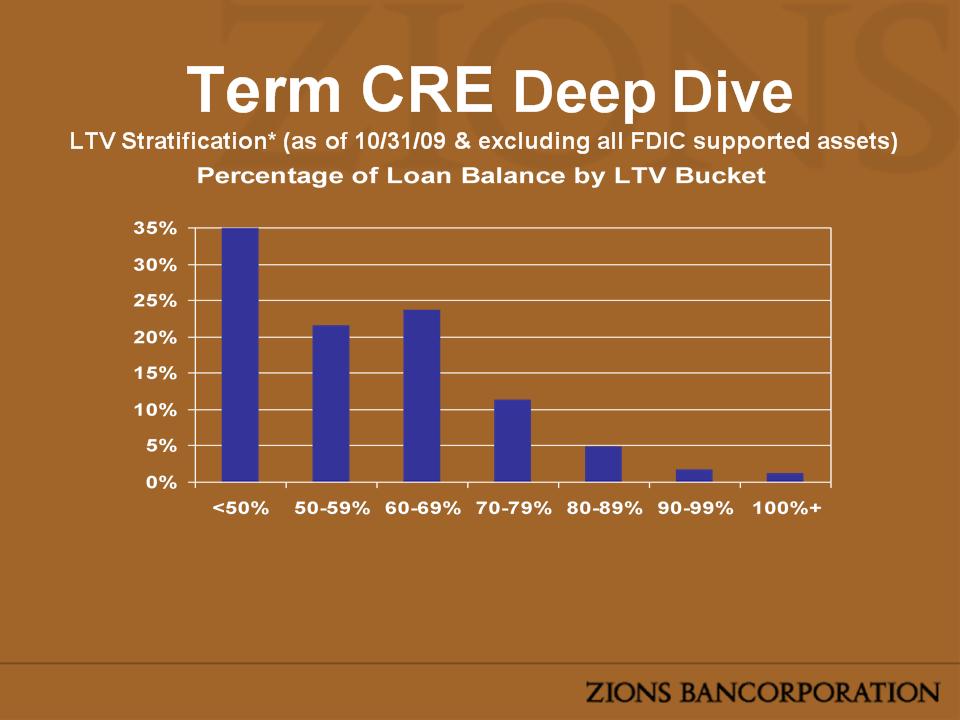

|

Percentage

of Loans within each bucket that are Non-Accrual

|

|||||||

|

Bucket

|

<50%

|

50-59%

|

60-69%

|

70-79%

|

80-89%

|

90-99%

|

100%+

|

|

NALs

|

0.8%

|

1.4%

|

1.2%

|

4.6%

|

22.0%

|

6.6%

|

19.2%

|

*Based

on most recent LTV; loans are generally reappraised when downgraded to

classified status

Takeaway: Limited

High LTV or “Tail Risk”

|

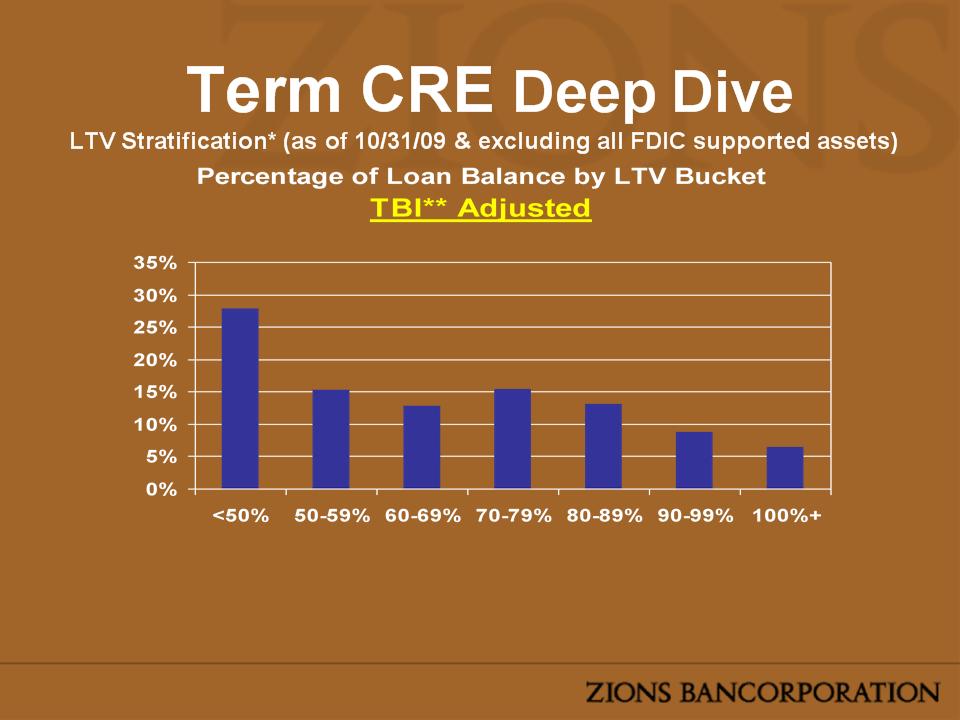

Percentage

of Loans within each bucket that are Non-Accrual

|

|||||||

|

Bucket

|

<50%

|

50-59%

|

60-69%

|

70-79%

|

80-89%

|

90-99%

|

100%+

|

|

NALs

|

1.1%

|

1.1%

|

2.5%

|

2.6%

|

7.2%

|

2.4%

|

7.9%

|

*Based

on most recent LTV; loans are generally reappraised when downgraded to

classified status

**The

MIT Transaction Based Index is a national index that has been applied to ZBC's

mostly

regional CRE Portfolio

regional CRE Portfolio

Takeaway: Limited

High LTV or “Tail Risk”

|

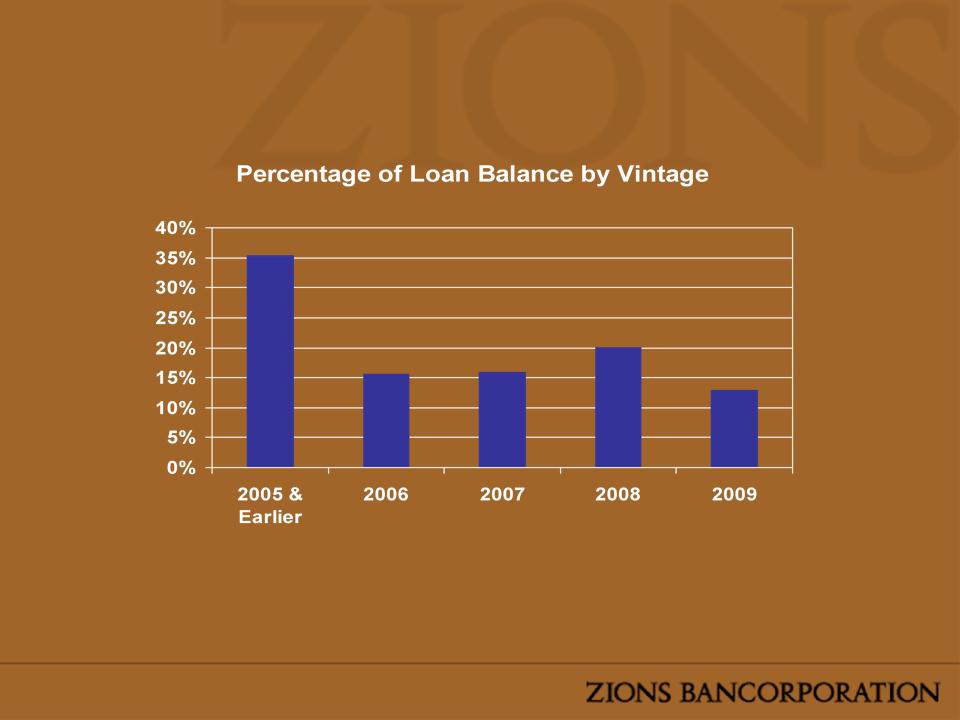

Percentage

of Loans within each bucket that are Non-Accrual

|

|||||

|

Bucket

|

<=

2005

|

2006

|

2007

|

2008

|

2009

|

|

NALs

|

1.6%

|

6.7%

|

4.4%

|

2.4%

|

0.4%

|

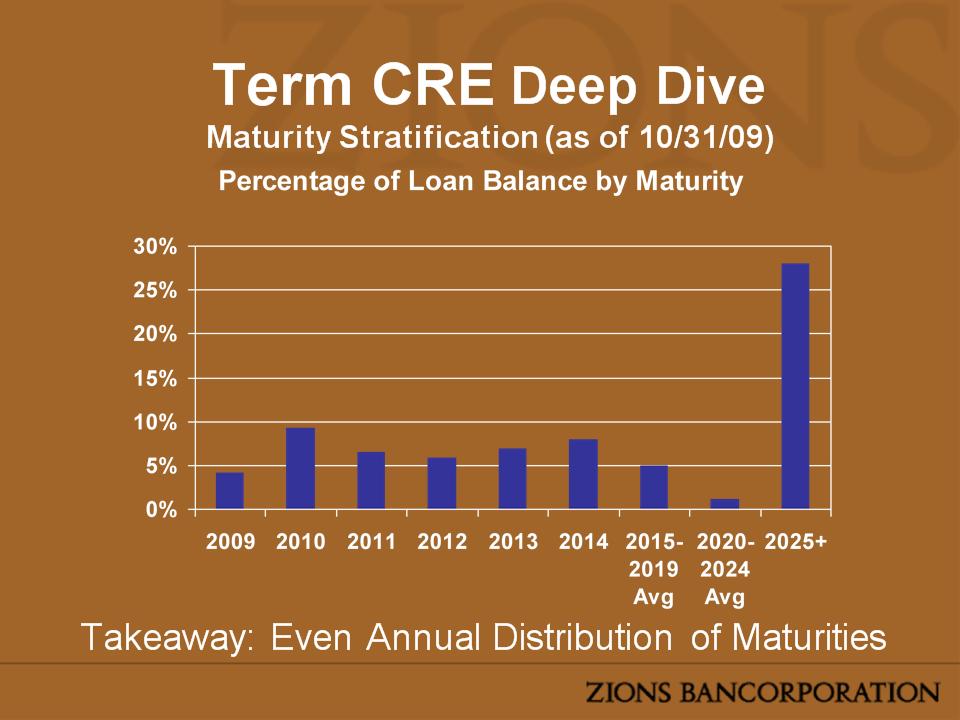

Term

CRE Deep Dive

Vintage Stratification (as of 10/31/09 & excluding all FDIC supported assets)

Vintage Stratification (as of 10/31/09 & excluding all FDIC supported assets)

Takeaway: Limited

Exposure to 2007 Vintage

Agenda

|

Key

Issues Going Forward

–Net Interest

Margin

–Credit

Quality

–Term

CRE

–Securities

Portfolio

–Capital &

Deferred Tax Asset

|

|

Outlook

Summary

|

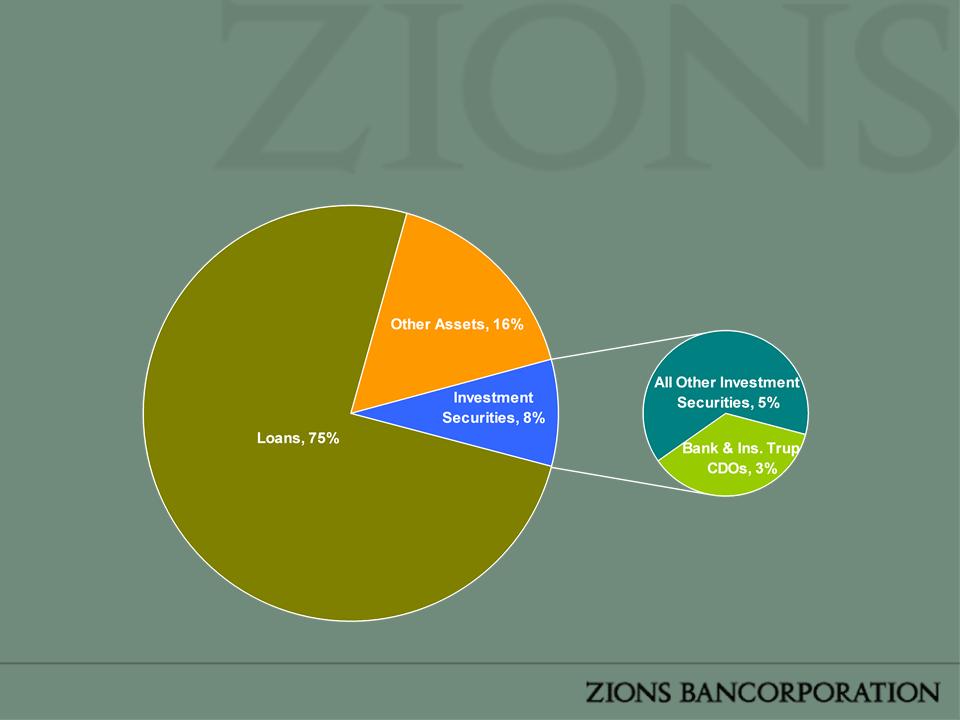

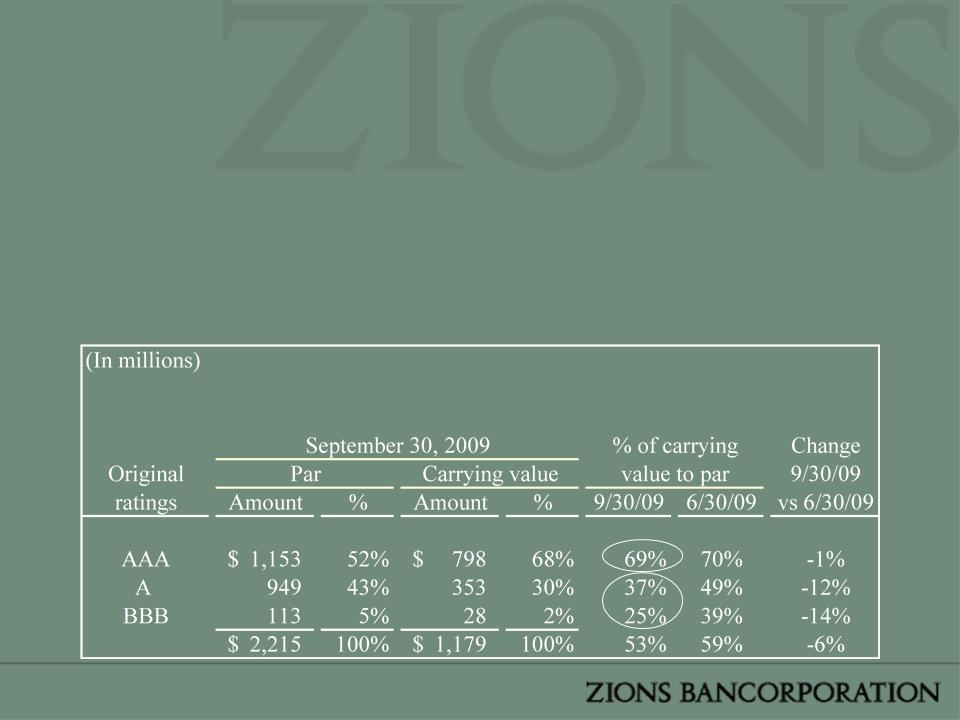

Bank

& Ins. Trup CDOs 3% of Assets

• Credit-related OTTI

losses $56.5 million in 3Q09

• Noncredit-related

OTTI on securities of $141.9 million in

3Q09 recognized in OCI

3Q09 recognized in OCI

Investment

Securities Performance 3Q09

Agenda

|

Key

Issues Going Forward

–Net Interest

Margin

–Credit

Quality

–Term

CRE

–Securities

Portfolio

–Capital

& Deferred Tax Asset

|

|

Outlook

Summary

|

• DTA = $688 million

in 3Q09 vs. $644 million in 2Q09 and

$402 million in 3Q08

$402 million in 3Q08

• Asset/liability

management strategy announced on Monday,

November 23rd reduced net DTA by ~$148 million

November 23rd reduced net DTA by ~$148 million

• No valuation

allowance currently expected

• Sources of Positive

Evidence

– Track record of

earnings through prior difficult cycles

– Stable income

pre-tax, pre-credit

– Decelerating or

declining non-accrual, classified, and special mention loans

– Taxes paid in prior

years

– Tax planning

strategies

Deferred

Tax Asset

Source:

SNL - Estimated where data was unavailable

|

|

3Q08

|

2Q09

|

3Q09

|

|

Tangible

Common Equity

|

6.05%

|

5.66%

|

5.43%

|

|

Tier

1 Leverage

|

7.64%

|

9.89%

|

10.06%

|

|

Tier

1 Risk Based

|

8.07%

|

9.66%

|

10.00%

|

|

Total

Risk Based

|

12.30%

|

12.87%

|

13.24%

|

|

Minimum

Regulatory Requirement for “well capitalized”

|

|

|

Tier 1 Risk

Based

|

6.0%

|

|

Total Risk

Based

|

10.0%

|

Capital

Ratios

Outlook

Summary

• Continued elevated

levels of credit losses, loss

provisions, and some reserve build in a weak economy;

rate of deterioration slowing

provisions, and some reserve build in a weak economy;

rate of deterioration slowing

• Future OTTI losses

likely stable, possibly declining

• Estimated 4Q09 GAAP

NIM ≈ 3.8%

– continued strong

core net interest margin

– impacted by new

senior debt and sub debt-to-preferred

conversion

conversion

• Reduced dividend and

asset levels will help preserve

capital ratios

capital ratios

• No DTA valuation

allowance

Outlook

Summary

Long-term

outlook remains strong when

economy begins to recover

economy begins to recover

– Best long-term

growth markets

– Sustainable

competitive advantage in

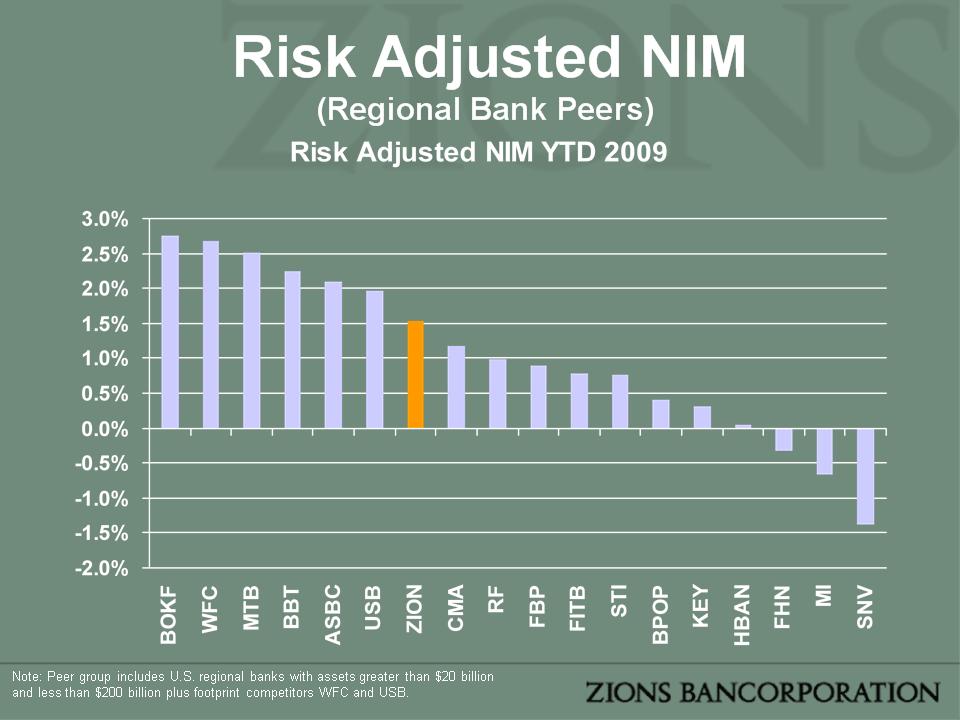

operating model

operating model

– Superior

risk-adjusted NIM through the

business cycle

business cycle

Goldman

Sachs

Financial Services

Conference

8

December, 2009

New

York

Appendix

|

|

Million

|

$

Per Share

|

|

Net Income To

Common

|

($179)

|

($1.41)

|

|

OTTI

Impairment on Securities

|

($57)

|

|

|

Provisions For

Credit Losses

|

$566

|

|

|

Net

Charge-offs

|

$381

|

|

|

OREO

Expense

|

$30

|

|

|

Core Pretax

Income (ex

provision,

impairment, OREO exp, & non-recurring items) |

$253

|

|

Q3

2009 Earnings Highlights

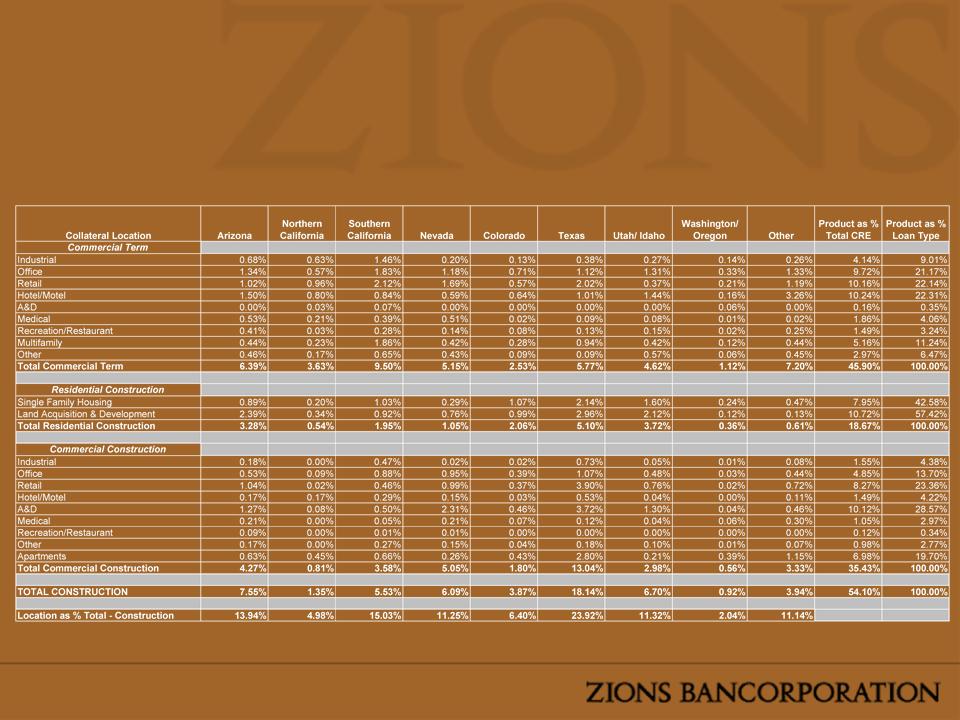

CRE

Portfolio Composition

Loans by Product Type and Location - 9/30/09

Loans by Product Type and Location - 9/30/09

|

Collateral

Location

|

Arizona

|

Northern

California |

Southern

California |

Nevada

|

Colorado

|

Texas

|

Utah/

Idaho

|

Washington

|

Other

|

Total

|

|

Commercial

Term

|

Arizona

|

|

|

|

|

|

|

|

|

|

|

Industrial

|

$30,953

|

$10,796

|

($3,662)

|

$10,679

|

($6,260)

|

$42,705

|

$26,238

|

$3,419

|

$36,357

|

$151,225

|

|

Office

|

$44,352

|

$54,931

|

$84,313

|

($6,233)

|

($52,341)

|

($27,283)

|

$15,951

|

$21,605

|

$70,137

|

$205,434

|

|

Retail

|

$44,788

|

$71,769

|

$136,873

|

$18,048

|

$50,557

|

$167,385

|

$33,161

|

$17,957

|

$179,383

|

$719,922

|

|

Hotel/Motel

|

$43,599

|

$67,521

|

$30,428

|

$25,020

|

$23,690

|

$80,726

|

$63,212

|

$7,004

|

$180,004

|

$521,203

|

|

A&D

|

$0

|

$0

|

($6,523)

|

$80

|

$0

|

$24,956

|

$0

|

($6,818)

|

$1,566

|

$13,261

|

|

Medical

|

$14,190

|

$22,200

|

$22,822

|

$61,957

|

$9,288

|

$10,401

|

$11,448

|

$756

|

($1,088)

|

$151,974

|

|

Recreation/Restaurant

|

$37,105

|

$7,456

|

$40,383

|

$5,858

|

$483

|

$13,420

|

$12,057

|

$2,470

|

$16,236

|

$135,468

|

|

Multifamily

|

$17,072

|

($6,596)

|

$101,810

|

$18,466

|

$9,543

|

$102,258

|

$6,889

|

$7,351

|

$984

|

$257,776

|

|

Other

|

($78,306)

|

($4,930)

|

($24,084)

|

($4,675)

|

($53,168)

|

($19,621)

|

$5,185

|

($258)

|

($121,665)

|

($301,523)

|

|

Total

Commercial Term

|

$153,753

|

$223,147

|

$382,360

|

$129,200

|

($18,208)

|

$394,947

|

$174,141

|

$53,486

|

$361,914

|

$1,854,740

|

|

Location

as % Total - Term

|

-1.7%

|

1.5%

|

0.0%

|

-1.3%

|

-2.1%

|

2.3%

|

-0.2%

|

0.2%

|

1.2%

|

-0.1%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential

Construction

|

|

|

|

|

|

|

|

|

|

|

|

Single Family

Housing

|

($809,719)

|

($168,964)

|

($441,724)

|

($168,347)

|

($93,182)

|

($268,268)

|

($320,242)

|

$16,693

|

($41,115)

|

($2,294,868)

|

|

Land

Acquisition & Development

|

($469,720)

|

($75,039)

|

($176,116)

|

($146,639)

|

($19,509)

|

($152,347)

|

($99,882)

|

($22,358)

|

($40,910)

|

($1,202,521)

|

|

Total

Residential Construction

|

($1,279,439)

|

($244,003)

|

($617,840)

|

($314,986)

|

($112,691)

|

($420,615)

|

($420,124)

|

($5,665)

|

($82,025)

|

($3,497,389)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial

Construction

|

|

|

|

|

|

|

|

|

|

|

|

Industrial

|

($45,627)

|

$497

|

($7,512)

|

($26,003)

|

($3,515)

|

($4,034)

|

($2,938)

|

$2,000

|

($167)

|

($87,298)

|

|

Office

|

($98,769)

|

$12,253

|

$18,659

|

($64,847)

|

$29,778

|

$91,682

|

($6,804)

|

($8,879)

|

($8,789)

|

($35,714)

|

|

Retail

|

($76,236)

|

$804

|

($16,504)

|

($115,613)

|

$14,346

|

($168,465)

|

($5,739)

|

($5,953)

|

($21,360)

|

($394,719)

|

|

Hotel/Motel

|

($30,455)

|

$21,623

|

$28,397

|

$15,153

|

($8,291)

|

$47,247

|

($36,068)

|

$0

|

($5,373)

|

$32,234

|

|

A&D

|

($103,220)

|

($24,062)

|

$15,248

|

($155,852)

|

$31,217

|

($424,635)

|

$50,052

|

($10,738)

|

($26,034)

|

($648,026)

|

|

Medical

|

($12,649)

|

$0

|

($13,690)

|

($11,098)

|

($2,572)

|

($3,643)

|

($2,643)

|

$8,400

|

($10,448)

|

($48,344)

|

|

Recreation/Restaurant

|

($10,899)

|

$0

|

$748

|

$2,173

|

$0

|

($161)

|

$589

|

$0

|

$0

|

($7,550)

|

|

Other

|

($66,376)

|

($4,150)

|

($39,488)

|

($32,803)

|

($2,863)

|

$32,390

|

$1,246

|

($9,638)

|

($277,446)

|

($399,128)

|

|

Apartments

|

($89,201)

|

($8,900)

|

($51,526)

|

($9,306)

|

$13,434

|

$40,259

|

($9,791)

|

($55,376)

|

($47,039)

|

($217,447)

|

|

Total

Commercial Construction

|

($533,432)

|

($1,935)

|

($65,668)

|

($398,196)

|

$71,534

|

($389,360)

|

($12,096)

|

($80,184)

|

($396,656)

|

($1,805,992)

|

|

TOTAL

CONSTRUCTION

|

($1,812,871)

|

($245,938)

|

($683,508)

|

($713,182)

|

($41,157)

|

($809,975)

|

($432,220)

|

($85,849)

|

($478,681)

|

($5,303,381)

|

|

Location

as % Total -

Construction |

-9.1%

|

-0.8%

|

-0.9%

|

-1.3%

|

2.7%

|

8.1%

|

2.1%

|

0.1%

|

-0.9%

|

0.0%

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan

Portfolio Net Charge Offs

(9/30/2009)

(9/30/2009)

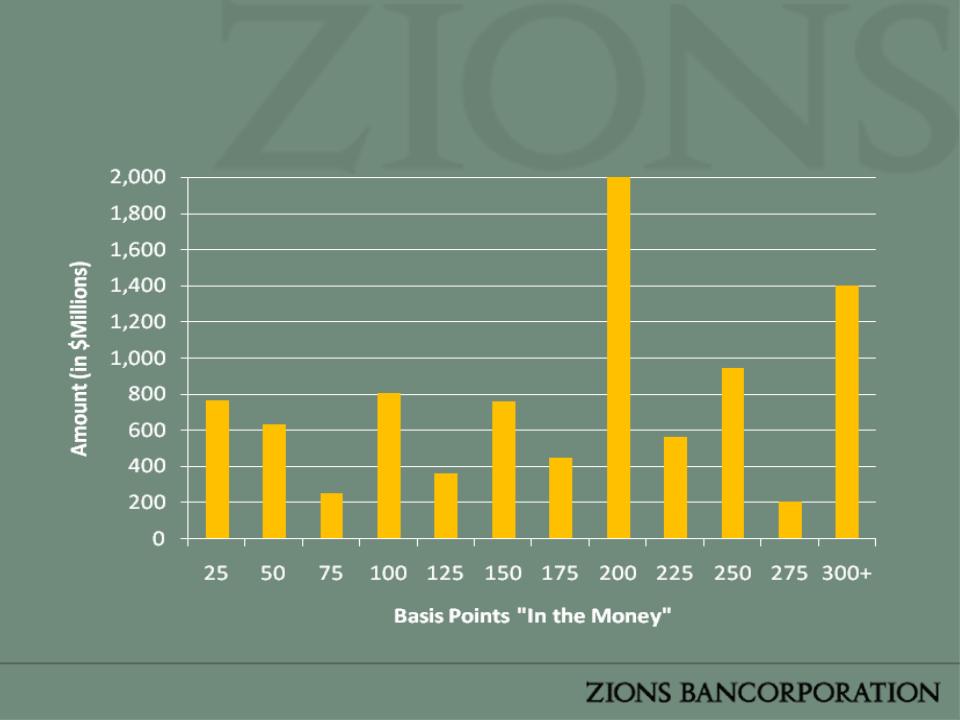

• Fixed-rate

loans:

– 26% of

portfolio

– Duration of about 1

year

• Variable-rate

loans:

– 74% of

portfolio

– Floors on 42% of

variable-rate loans (78% of those loans are at

the floor rate)

the floor rate)

– Continual reduction

of interest rate swaps (increasing asset

sensitivity)

sensitivity)

• Non-interest bearing

deposits to average earning assets

is 23% (rank #1 among peers; peer median 16%)

is 23% (rank #1 among peers; peer median 16%)

Peer

data source: SNL

Note:

Peer group includes U.S. regional banks with assets greater than $20

billion

and less than $200 billion plus footprint competitors WFC and USB.

and less than $200 billion plus footprint competitors WFC and USB.

Asset

Sensitivity

Loans

with Floors