Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K REG FD MERRILL LYNCH PRESENTATION - Celanese Corp | form8k_regfdmlpres.htm |

Celanese

Corporation

December

2009

2

Forward

Looking Statements

Reconciliation

and Use of Non-GAAP Measures to U.S. GAAP

Forward-Looking

Statements

This

presentation may contain “forward-looking statements,” which include information

concerning the company’s plans, objectives, goals, strategies, future revenues

or performance, capital

expenditures, financing needs and other information that is not historical information. When used in this release, the words “outlook,” “forecast,” “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,”

“believes,” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements are based upon current expectations and beliefs and various

assumptions. There can be no assurance that the company will realize these expectations or that these beliefs will prove correct. There are a number of risks and uncertainties that could cause actual results to differ

materially from the forward-looking statements contained in this release. Numerous factors, many of which are beyond the company’s control, could cause actual results to differ materially from those expressed as

forward-looking statements. Certain of these risk factors are discussed in the company’s filings with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which it is

made, and the company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or

unanticipated events or circumstances.

expenditures, financing needs and other information that is not historical information. When used in this release, the words “outlook,” “forecast,” “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,”

“believes,” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements are based upon current expectations and beliefs and various

assumptions. There can be no assurance that the company will realize these expectations or that these beliefs will prove correct. There are a number of risks and uncertainties that could cause actual results to differ

materially from the forward-looking statements contained in this release. Numerous factors, many of which are beyond the company’s control, could cause actual results to differ materially from those expressed as

forward-looking statements. Certain of these risk factors are discussed in the company’s filings with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which it is

made, and the company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or

unanticipated events or circumstances.

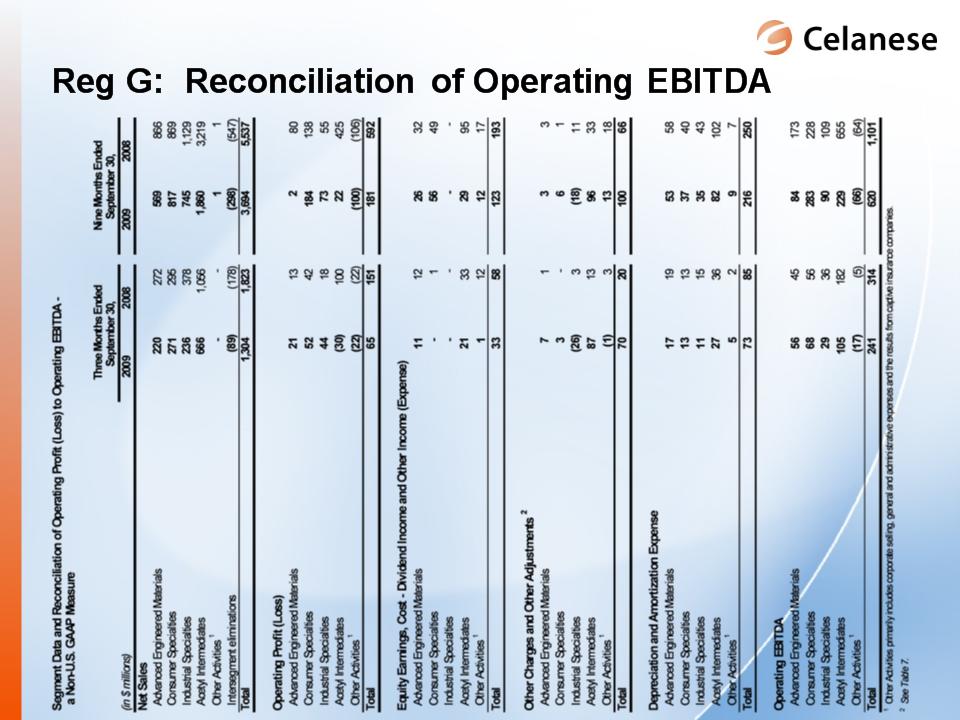

Reconciliation

of Non-U.S. GAAP Measures to U.S. GAAP

This

presentation reflects five performance measures, operating EBITDA, affiliate

EBITDA, adjusted earnings per share, net debt and adjusted free cash flow, as

non-U.S. GAAP measures. The

most directly comparable financial measure presented in accordance with U.S. GAAP in our consolidated financial statements for operating EBITDA is operating profit; for affiliate EBITDA is equity in net earnings of

affiliates; for adjusted earnings per share is earnings per common share-diluted; for net debt is total debt; and for adjusted free cash flow is cash flow from operations.

most directly comparable financial measure presented in accordance with U.S. GAAP in our consolidated financial statements for operating EBITDA is operating profit; for affiliate EBITDA is equity in net earnings of

affiliates; for adjusted earnings per share is earnings per common share-diluted; for net debt is total debt; and for adjusted free cash flow is cash flow from operations.

Use

of Non-U.S. GAAP Financial Information

►Operating

EBITDA, a measure used by management to measure performance, is defined as

operating profit from continuing operations, plus equity in net earnings from

affiliates, other income and depreciation and

amortization, and further adjusted for other charges and adjustments. We may provide guidance on operating EBITDA and are unable to reconcile forecasted operating EBITDA to a U.S.GAAP financial measure

because a forecast of Other Charges and Adjustments is not practical. Our management believes operating EBITDA is useful to investors because it is one of the primary measures our management uses for its

planning and budgeting processes and to monitor and evaluate financial and operating results. Operating EBITDA is not a recognized term under U.S. GAAP and does not purport to be an alternative to operating

profit as a measure of operating performance or to cash flows from operating activities as a measure of liquidity. Because not all companies use identical calculations, this presentation of operating EBITDA may not

be comparable to other similarly titled measures of other companies. Additionally, operating EBITDA is not intended to be a measure of free cash flow for management’s discretionary use, as it does not consider

certain cash requirements such as interest payments, tax payments and debt service requirements nor does it represent the amount used in our debt covenants.

amortization, and further adjusted for other charges and adjustments. We may provide guidance on operating EBITDA and are unable to reconcile forecasted operating EBITDA to a U.S.GAAP financial measure

because a forecast of Other Charges and Adjustments is not practical. Our management believes operating EBITDA is useful to investors because it is one of the primary measures our management uses for its

planning and budgeting processes and to monitor and evaluate financial and operating results. Operating EBITDA is not a recognized term under U.S. GAAP and does not purport to be an alternative to operating

profit as a measure of operating performance or to cash flows from operating activities as a measure of liquidity. Because not all companies use identical calculations, this presentation of operating EBITDA may not

be comparable to other similarly titled measures of other companies. Additionally, operating EBITDA is not intended to be a measure of free cash flow for management’s discretionary use, as it does not consider

certain cash requirements such as interest payments, tax payments and debt service requirements nor does it represent the amount used in our debt covenants.

►Affiliate

EBITDA, a measure used by management to measure performance of its equity

investments, is defined as the proportional operating profit plus the

proportional depreciation and amortization of its equity

investments. Affiliate EBITDA, including Celanese Proportional Share of affiliate information on Table 8, is not a recognized term under U.S. GAAP and is not meant to be an alternative to operating cash flow of the

equity investments. The company has determined that it does not have sufficient ownership for operating control of these investments to consider their results on a consolidated basis. The company believes that

investors should consider affiliate EBITDA when determining the equity investments’ overall value in the company.

investments. Affiliate EBITDA, including Celanese Proportional Share of affiliate information on Table 8, is not a recognized term under U.S. GAAP and is not meant to be an alternative to operating cash flow of the

equity investments. The company has determined that it does not have sufficient ownership for operating control of these investments to consider their results on a consolidated basis. The company believes that

investors should consider affiliate EBITDA when determining the equity investments’ overall value in the company.

►Adjusted

earnings per share is a measure used by management to measure performance. It is

defined as net earnings (loss) available to common shareholders plus preferred

dividends, adjusted for other charges

and adjustments, and divided by the number of basic common shares, diluted preferred shares, and options valued using the treasury method. We may provide guidance on an adjusted earnings per share basis and

are unable to reconcile forecasted adjusted earnings per share to a GAAP financial measure without unreasonable effort because a forecast of Other Items is not practical. We believe that the presentation of this

non-U.S. GAAP measure provides useful information to management and investors regarding various financial and business trends relating to our financial condition and results of operations, and that when U.S.

GAAP information is viewed in conjunction with non-U.S. GAAP information, investors are provided with a more meaningful understanding of our ongoing operating performance. This non-U.S. GAAP information is

not intended to be considered in isolation or as a substitute for U.S. GAAP financial information.

and adjustments, and divided by the number of basic common shares, diluted preferred shares, and options valued using the treasury method. We may provide guidance on an adjusted earnings per share basis and

are unable to reconcile forecasted adjusted earnings per share to a GAAP financial measure without unreasonable effort because a forecast of Other Items is not practical. We believe that the presentation of this

non-U.S. GAAP measure provides useful information to management and investors regarding various financial and business trends relating to our financial condition and results of operations, and that when U.S.

GAAP information is viewed in conjunction with non-U.S. GAAP information, investors are provided with a more meaningful understanding of our ongoing operating performance. This non-U.S. GAAP information is

not intended to be considered in isolation or as a substitute for U.S. GAAP financial information.

►The

tax rate used for adjusted earnings per share approximates the midpoint in a

range of forecasted tax rates for the year, excluding changes in uncertain tax

positions, discrete items and changes in

management’s assessments regarding the ability to realize deferred tax assets. We analyze this rate quarterly and adjust if there is a material change in the range of forecasted tax rates; an updated forecast would

not necessarily result in a change to our tax rate used for adjusted earnings per share. The adjusted tax rate is an estimate and may differ significantly from the tax rate used for U.S. GAAP reporting in any given

reporting period. It is not practical to reconcile our prospective adjusted tax rate to the actual U.S. GAAP tax rate in any future period.

management’s assessments regarding the ability to realize deferred tax assets. We analyze this rate quarterly and adjust if there is a material change in the range of forecasted tax rates; an updated forecast would

not necessarily result in a change to our tax rate used for adjusted earnings per share. The adjusted tax rate is an estimate and may differ significantly from the tax rate used for U.S. GAAP reporting in any given

reporting period. It is not practical to reconcile our prospective adjusted tax rate to the actual U.S. GAAP tax rate in any future period.

►Net

debt is defined as total debt less cash and cash equivalents. We

believe that the presentation of this non-U.S. GAAP measure provides useful

information to management and investors regarding changes to

the company’s capital structure. Our management and credit analysts use net debt to evaluate the company's capital structure and assess credit quality. This non-U.S. GAAP information is not intended to be

considered in isolation or as a substitute for U.S. GAAP financial information.

the company’s capital structure. Our management and credit analysts use net debt to evaluate the company's capital structure and assess credit quality. This non-U.S. GAAP information is not intended to be

considered in isolation or as a substitute for U.S. GAAP financial information.

►Adjusted

free cash flow is defined as cash flow from operations less capital

expenditures, other productive asset purchases, operating cash from discontinued

operations and certain other charges and adjustments.

We believe that the presentation of this non-U.S. GAAP measure provides useful information to management and investors regarding changes to the company’s cash flow. Our management and credit analysts use

adjusted free cash flow to evaluate the company’s liquidity and assess credit quality. This non-U.S. GAAP information is not intended to be considered in isolation or as a substitute for U.S. GAAP financial

information.

We believe that the presentation of this non-U.S. GAAP measure provides useful information to management and investors regarding changes to the company’s cash flow. Our management and credit analysts use

adjusted free cash flow to evaluate the company’s liquidity and assess credit quality. This non-U.S. GAAP information is not intended to be considered in isolation or as a substitute for U.S. GAAP financial

information.

Results

Unaudited

The

results presented in this presentation, together with the adjustments made to

present the results on a comparable basis, have not been audited and are based

on internal financial data furnished to management.

Quarterly results should not be taken as an indication of the results of operations to be reported for any subsequent period or for the full fiscal year.

Quarterly results should not be taken as an indication of the results of operations to be reported for any subsequent period or for the full fiscal year.

3

Celanese

($

million)

2009

3Q YTD Revenue: $3,694

2009

3Q YTD Op. EBITDA: $620

Consumer

Specialties

2009

3Q YTD Revenue: $817

2009

3Q YTD Op. EBITDA: $283

Advanced

Engineered

Materials

Materials

2009

3Q YTD Revenue $569

2009

3Q YTD Op. EBITDA: $84

Industrial

Specialties

2009

3Q YTD Revenue: $745

2009

3Q YTD Op. EBITDA: $90

Acetyl

Intermediates

2009

3Q YTD Revenue: $1,860

2009

3Q YTD Op. EBITDA: $229

Strong

financial performance in a challenging year

Celanese

diversified portfolio delivers

shareholder value through leading franchises

shareholder value through leading franchises

4

|

|

Portfolio

Characteristics

|

Financial

Impact

|

|

Acetyl

Intermediates

(Acetic

Acid, Vinyl Acetate

Monomer, Acetyl Derivatives) |

► A global

leader

► Advantaged

technology

► Superior cost

position

|

► Capital

efficient

► More stable

EBITDA

|

|

Advanced

Engineered

Materials (Engineered

Thermoplastics and

Polymers) |

► Industry-leading

technology

► Strong product

pipeline

|

► Higher

growth

► Margin

expansion

|

|

Industrial

Specialties

(Vinyl

Emulsions and Polymers)

|

► Upstream

integration

► Emerging

economy opportunities

► Growth through

innovation

|

► Asia

growth

► Increased

demand for low VOC

|

|

Consumer

Specialties

(Acetate

Flake and Tow, High

Intensity Food Sweetener) |

► Stable cash

generation

► Industry-leading

partnerships in

Asia |

► Cash

flow

► Stable

|

Balanced

portfolio creates a unique hybrid business model

Portfolio

well-positioned to deliver and

execute

execute

5

Divest

non-core assets and

revitalize underperforming

businesses

revitalize underperforming

businesses

Aggressively

align

with our customers

and their markets to

capture growth

and their markets to

capture growth

Participate

in

businesses

where we have

a

sustainable competitive

advantage

advantage

Leverage

and build on

advantaged positions that

optimize our portfolio

advantaged positions that

optimize our portfolio

FOCUS

GROWTH

REDEPLOYMENT

INVESTMENT

Celanese

Strategic

Pillars

Strategic

Pillars

Celanese’s

strategic DNA remains consistent

6

► Balanced footprint

in key

regions

regions

► Recovering

conditions in key

end-use industries

end-use industries

► Attractive balance

sheet with

strong cash generation

strong cash generation

Geographic

Demand

Capital

Structure

► Sustainable fixed

spending

reductions

reductions

► Efficient and

scalable capital

► Global macro trends

driving

customer growth

customer growth

Operating

Innovation

Celanese

Advantages Celanese

Levers of Value

Increasing

the earnings power of the business through multiple levers

Why

Celanese? Why

Celanese Now?

7

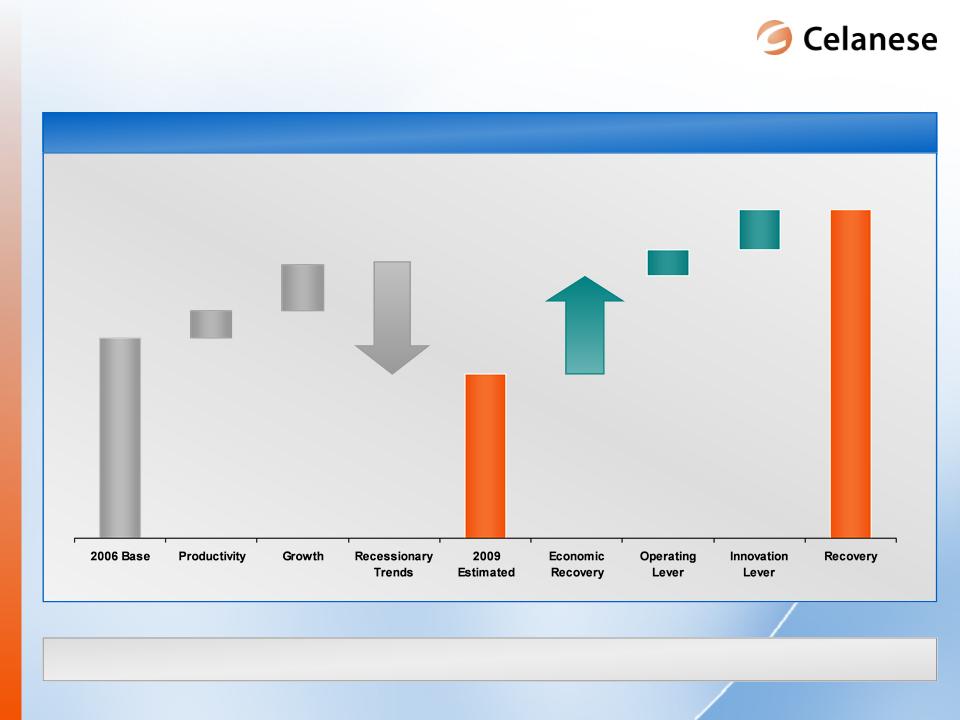

Operating

EBITDA

~$1,100

million

$1,600-1,800

million

Second

half 2009 performance provides platform for future growth

Increased

earnings power drives significant

shareholder value

shareholder value

8

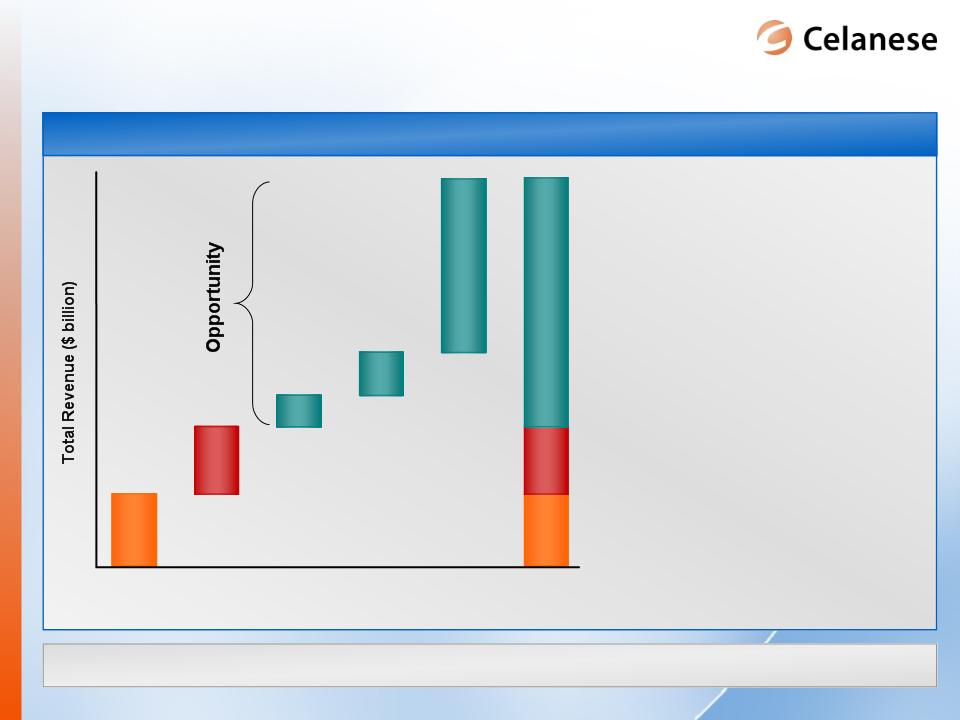

Earnings

power of portfolio expected to double from today’s level

|

|

|

|

Expanded

Earnings Power

|

|||||

|

|

Group

|

Capital

Structure Lever |

Demand

Lever |

Geographic

Lever |

|

Operating

Lever |

Innovation

Lever |

2009E

to

Recovery EBITDA Growth* |

|

|

Advanced

Engineered Materials |

|

X

|

X

|

|

X

|

X

|

$275-325MM

|

|

Consumer

Specialties |

|

|

X

|

|

X

|

|

$10-60MM

|

|

|

|

X

|

X

|

|

X

|

X

|

$275-375MM

|

||

|

Industrial

Specialties |

|

X

|

X

|

|

X

|

X

|

$75-125MM

|

|

*

“2009 to Recovery EBITDA Growth” based on Nov. 20, 2009 first call consensus

EBITDA estimate and management’s previous Recovery range of $1.6 - 1.8

billion.

Levers

build significant earnings power of

the portfolio

the portfolio

9

Recent

strategic actions build earnings power of portfolio

► MOU announced for

Acetate

expansion project with current

China partner

expansion project with current

China partner

Consumer

Specialties

Specialties

► 2011+: Increased

earnings

through JV dividends

through JV dividends

► Nanjing VAE /

Emulsion

capacity expansion

capacity expansion

Industrial

Specialties

Specialties

► 2011+: Volume

expansion

supporting

growth in China

Well

defined path forward - delivering

today

today

► Nanjing successfully

expanded

to 1.2 kt/a acid capacity

to 1.2 kt/a acid capacity

► Pardies site closure

project on

schedule for completion end of

2009

schedule for completion end of

2009

► Jiangxi Jiangwei VAM

sourcing

agreement

agreement

Acetyl

Intermediates

Intermediates

► 2010+: $40-50

million

operating

margin

improvement

► Strengthen

derivatives

position

position

► Launch of innovative

impact

modified POM

modified POM

Advanced

Engineered

Materials

Engineered

Materials

► 2010+: $500

million

application opportunity

growth

application opportunity

growth

10

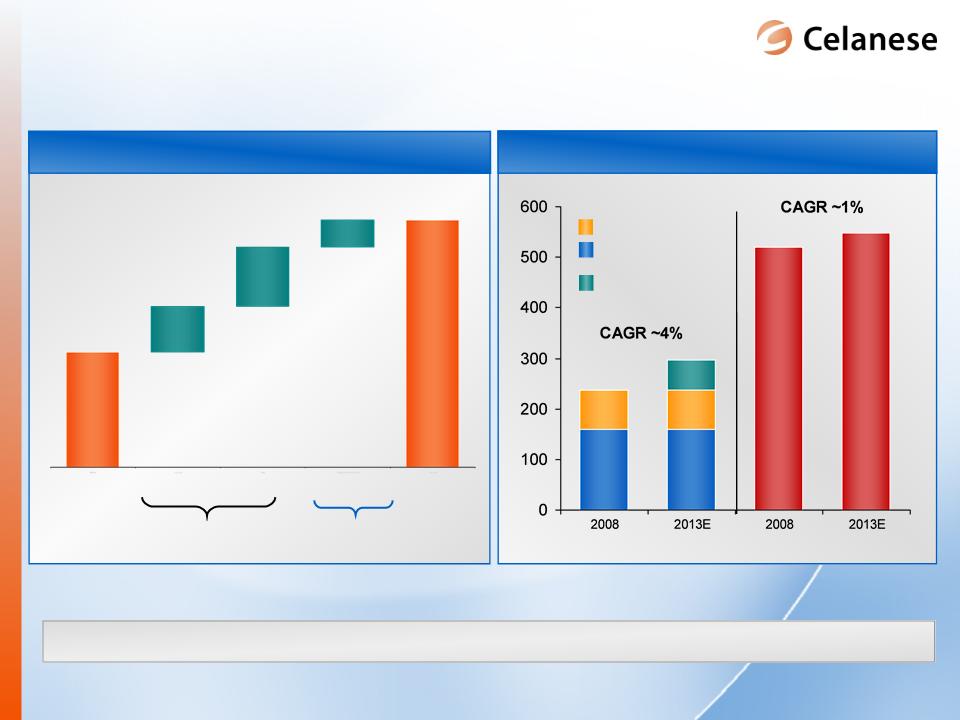

Automotive

Opportunity

► Current

“best-in-class”

translation to all models

yields translation

opportunity

translation to all models

yields translation

opportunity

► Westernization

of current

China production drives

China opportunity

China production drives

China opportunity

► Successful

commercialization of

application R&D creates

pipeline opportunity

commercialization of

application R&D creates

pipeline opportunity

3.0

Total

AEM

Today

Total

Competitors

Today

Translation

China

Pipeline

Total

Opportunity

Opportunity

Significant

opportunities exist in ~$3 billion industry space

AEM: Application

development creates

current - and future - opportunities

current - and future - opportunities

11

Improvement

in POM Technical

Performance

Performance

New

Ticona

POM Space

POM Space

Existing

POM

Space

Increase

weldline strain @ break %

Technology

enables additional $500 million application space

opportunity

opportunity

Automotive

Applications

► Chemical

resistance

► Superior impact

& weldline strength

► Elevated heat

deflection temperature

Industrial

Applications

► Higher stiffness

(Modulus)

► Improved slip &

wear performance

► Less mold

deposit

Consumer

Applications

► Design

freedom

► Superior impact and

weldline strength

Incremental

$500 Million

Application Opportunity

Application Opportunity

Ticona:

Growing application space through

innovation

innovation

12

Source:

Celanese internal estimates

MOU

announced for expansion project with current China partner

kT

China

ROW

Chinese

Imports

Chinese

Domestic

Production

Production

Tow

Demand Growth

Additional

Demand

Growth

Growth

$230

million

Operating

EBITDA

2005

Base

Productivity

Recovery

Growth

Operating

&

Innovation

2006

- 2010

Strategic Objectives

Strategic Objectives

>$50

million

2009

to “Recovery”

Strategic Objectives

Strategic Objectives

$20-30

million

$350-400

million

CS:

Acetate Tow demand in China will drive

worldwide growth

worldwide growth

13

A

Growing

Franchise

Franchise

► Proven execution and

leadership capability

► Significant value

from downstream derivatives

► Build upon

advantages to optimize returns over the

long-term

long-term

► Long-term growth

rates in excess of GDP

► Favorable position

on a steep industry cost curve

► Advantaged raw

material and conversion position

► Flexible

manufacturing and low-cost capacity

An

Advantaged

Business in an

Attractive Industry

Business in an

Attractive Industry

Technology

leadership at the heart of Acetyl competitive position

AI: A

growing franchise in an attractive industry

14

► Manufacturing

realignment and

Nanjing expansion

further improving cost

position

realignment and

Nanjing expansion

further improving cost

position

► Reinvestment

economics challenged

for non-leading

technologies

economics challenged

for non-leading

technologies

2009/2011E

Acetic Acid Cost Curve (kT)

By

Prod

Avg

Other Leading

Technology

Effective

Industry Utilization Rates

Ethylene

Highest

Cost

China MeOH

China MeOH

Ethanol

Average

Celanese

Lower

Cost

China MeOH

China MeOH

Source:

Celanese internal estimates

Pricing

for CE to

earn

>15% EBITDA

AI: New

capacity not expected to impact

Celanese’s advantaged position

on the cost curve

Celanese’s advantaged position

on the cost curve

15

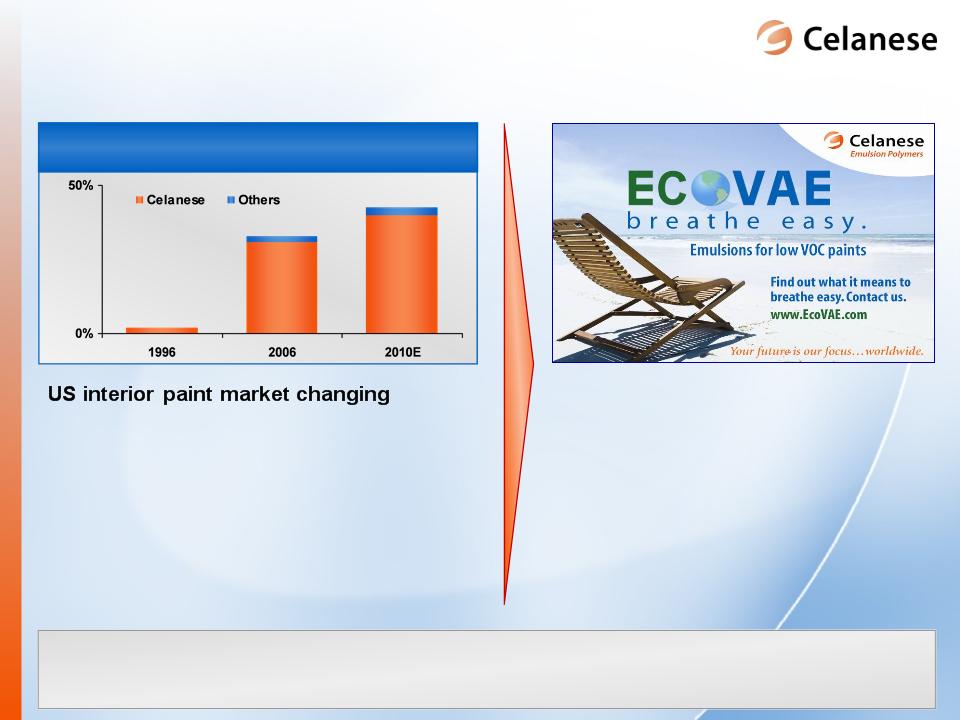

IS: Global

leader in emulsions systems for

environmentally-friendly paints and coatings

environmentally-friendly paints and coatings

► Consumer perception

favoring “greener”

building products

building products

► Regulation shifting

to low-VOC content

► Celanese building

off of a European

leadership position

leadership position

Global

opportunity of $400-500 million - Nanjing expansion

announced to meet growing China demand

announced to meet growing China demand

European

VAE Growth

Celanese

EcoVAE®

Progress

► 14 new customers

utilizing EcoVAE®

► Projects with six

major paint producers

► Launching new

EcoVAE®

products

• Low-VOC exterior

paint

• Acrylic replacement

in Non-Flats

► Expanding

EcoVAE® products

to Asia

16

Productivity

Driven

Tax

Rate

Represents

approximately $1.00 per share in

2010

earnings improvement

2010

Earnings Improvement

► AEM: Destocking

complete

► AI: Technology,

2009 FIFO effect

► IS: Asia

growth focus

► CS: Sustain

performance

► Pardies &

Cangrejera closures

► Other manufacturing

realignment

► SG&A

realignment

► Sustain lower tax

rate

► Benefits of

manufacturing and

administrative

restructuring

► Cash taxes rate

expected

to be

similar

Volume

Driven

$80

- $100

At

least $100

Low

20% range

vs. 29%

vs. 29%

$

in millions

17

Strong

cash generation continues throughout economic cycle

|

2010E

Cash Generation off EBITDA Base

|

||

|

$

in

millions

|

2010E

|

Comments

|

|

Cash

Taxes

|

$140

- $160

|

Consistent

with earnings growth and lower tax rate

|

|

Capital

Expenditures

|

$240

- $260

|

Continued

focus on cost reduction and growth

through Nanjing VAE expansion |

|

Reserve/Other

|

$110

- $130

|

Increase

primarily related to fixed spending

reduction efforts |

|

Net

Interest

|

$200

- $210

|

Unchanged

from 2009

|

|

Pension

|

$40

- $50

|

No

significant increase expected in 2010

|

|

Adjusted

Free Cash

Outflows |

$730

- $810

|

|

Hybrid

portfolio well positioned

18

|

Available

Cash

|

|

|

Cash

(as

of 9/30/2009)

|

$1,293

|

|

Kelsterbach

Spending

|

~($300)

|

|

Operating

Cash

|

~($300)

|

|

Cash

Available for

Strategic Purposes |

~$700

|

► Ticona

Kelsterbach relocation

cash flow neutral through end of

2010

cash flow neutral through end of

2010

► Expect

to continue to generate

positive free cash flow

positive free cash flow

► Productivity

investments

expected to be self-funding

expected to be self-funding

Significant

cash available for strategic purposes after anticipated

cash commitments

cash commitments

$

million

Positive

cash generation and portfolio

improvements enhance our cash position

improvements enhance our cash position

19

Term

Loan - $2.8 billion

Other

Debt Obligations - $775 million

Cash

- $1.3 billion

Net

Debt - $2.3 billion

Revolver

- $600 million

Cost

Stability

Flexibility

Structure

Characteristics

Primary

Components

Solid

liquidity position and covenant-lite term loan create

advantaged capital structure

advantaged capital structure

Credit

Linked Facility - $136 million

Celanese

capital structure

20

Why

Celanese? Why

Celanese Now?

Significant

value upside over current share price

Geographic

Demand

Capital

Structure

Operating

Innovation

Track

record

of execution

of execution

High

return

opportunities

opportunities

► $1.6-1.8 billion

recovery

earnings

earnings

► Rapid earnings

growth of

the current base -

$1.00/share growth in

2010

the current base -

$1.00/share growth in

2010

► Over $2 billion of

cash

generation through 2014

generation through 2014

► Returns continue

to

exceed weighted

average cost of capital

exceed weighted

average cost of capital

► More stable

earnings

profile

profile

Levers

of Value Shareholder

Value

Celanese

Corporation

December

2009

22

Acetyl

Intermediates

Industrial

Specialties

Advanced

Engineered Materials

Consumer

Specialties

JVs

Dividends

PVOH

Divesture

3Q

2009

Segment

Operating EBITDA Recovery

23

Celanese

Global Manufacturing Locations

All

values shown in kT per year

Singapore

Acid =

600

VAM =

210

Esters =

130

Frankfurt,

Germany

VAM =

285

Esters =

40

Tarragona,

Spain

VAM =

200

Bay

City, TX

VAM =

300

Clear

Lake, TX

Acid =

1,200

VAM = 310

Cangrejera,

Mexico

Mexico

Anhydride = 90

Esters =

105

VAM =

115

Pardies,

France

(announced

closure)

Acid =

440

VAM =

150

Nanjing,

China

Acid =

1,200

(expansion)

VAM = 300

(expansion)

VAM = 300

Anhydride =

100

► Utilization of

all

global Celanese

acetic acid and

downstream sites to

meet global customer

needs

global Celanese

acetic acid and

downstream sites to

meet global customer

needs

► Ensure all

Celanese

sites have a leading

cost structure

sites have a leading

cost structure

► Strategy to

remove

high cost facilities

high cost facilities

Roussillon,

France

Anhydride =

30

Celanese

well-positioned globally to meet changing demand landscape

Pampa,

TX

(site

closed)

Acid =

290

Anhydride =

145

Esters =

60

Leading

global footprint positioned to meet

customer demand

customer demand

24

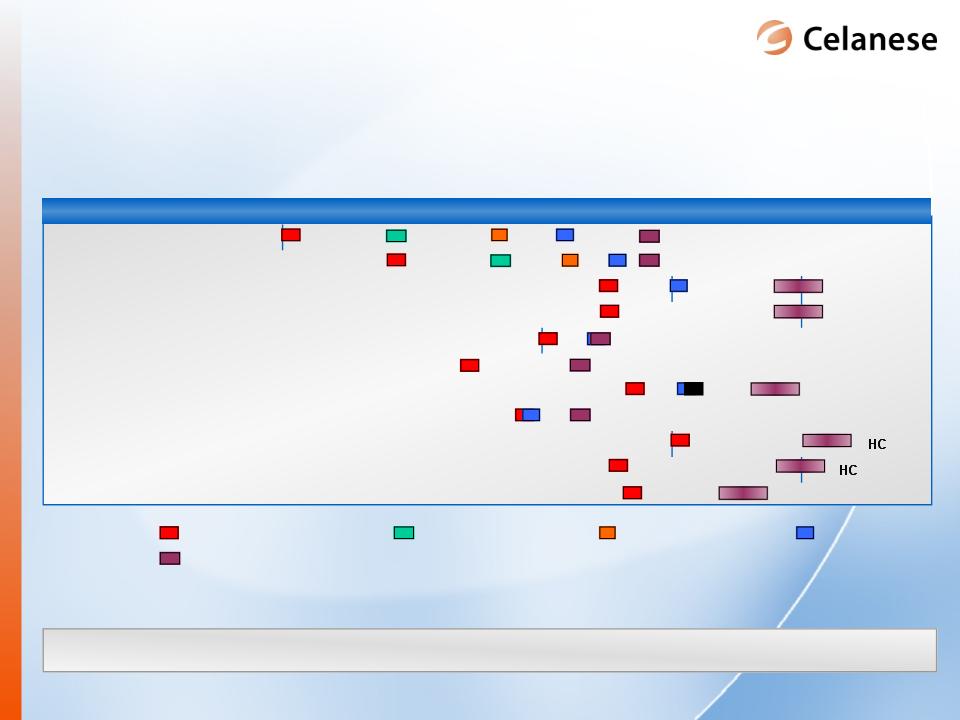

|

Company

|

Capacity

|

2007

|

2008

|

2009

|

2010

|

2011

|

|

BP

/ Sinopec

|

550

kt

|

|

|

|

|

|

|

Sipchem

|

430

kt

|

|

|

|

|

|

|

Sopo

(expansion)

|

600

kt

|

|

|

|

||

|

Wujing

(expansion)

|

500

kt

|

|

|

|

|

|

|

Yangkuang

Cathay

|

350

kt

|

|

|

|

|

|

|

Henan

Shunda

|

200

kt

|

|

|

|

|

HC

|

|

Tianjin

Bohei

|

200

kt

|

|

|

|

HC

|

|

|

Hualu

Hensheng

|

200

kt

|

|

|

|

|

HC

|

|

Henan

Yima

|

200

kt

|

|

|

|

||

|

Yunan

Yunwei

|

200

kt

|

|

|

|

|

|

|

Kingboard

|

400

kt

|

|

|

|

|

|

A

A

A

A

A

A

A

A

X

X

X

X

X

X

X

X

X

Company

Announced Startup

Current

Update

A

CE 2005

Update

SU

=

Actual plant startup

X

CE 2006

Update

HC

= Highest Cost

X

CE 2007

Update

X

X

X

X

X

X

X

SU

X

SU

Viability

of many higher cost projects is in question

1Celanese internal

analysis and opinion

?

A

SU

X

A

A

?

Timing

in question

Timing

in question

Forecast

Capacity Expansions1

Delays

in project startups likely to continue

25

Majority

of announced capacity additions challenged in today’s

pricing environment

pricing environment

1Source: Celanese

internal estimates, Tecnon 2008. Based on

nameplate capacity

Disadvantaged

technology

Significant

differentiation in technology of

announced expansions

announced expansions

26

Balance

for “high return” productivity and capital efficient growth

Note:

Not including Kelsterbach plant relocation

Maintain

Plant

Other

Growth

Nanjing

Productivity

Capital

Spending by Category

Efficient

use of cash

27