Attached files

| file | filename |

|---|---|

| EX-10.1 - STOCK PURCHASE AGREEMENT - SOKO FITNESS & SPA GROUP, INC. | fs1a5ex10i_soko.htm |

| EX-23.1 - ACOUNTANTS CONSENT - SOKO FITNESS & SPA GROUP, INC. | fs1a5ex23i_soko.htm |

| EX-21.1 - LIST OF SUBSIDIARIES - SOKO FITNESS & SPA GROUP, INC. | fs1a5ex21i_soko.htm |

| EX-10.4 - SECURITY PURCHASE AGREEMENT - SOKO FITNESS & SPA GROUP, INC. | fs1a5ex10iv_soko.htm |

| EX-10.3 - SECURITY PURCHASE AGREEMENT - SOKO FITNESS & SPA GROUP, INC. | fs1a5ex10iii_soko.htm |

| EX-10.39 - FORM OF STOCK OPTION AGREEMENT - SOKO FITNESS & SPA GROUP, INC. | fs1a5ex10xxxix_soko.htm |

| EX-10.37 - LETTER AGREEMENT - SOKO FITNESS & SPA GROUP, INC. | fs1a5ex10xxxvii_soko.htm |

| S-1/A - AMENDED REGISTRATION STATEMENT - SOKO FITNESS & SPA GROUP, INC. | fs1a5_soko.htm |

Exhibit

10.38

Dear

Dongmei Sheng,

We herein

confirm our agreement with you as follows:

| 1. | Etech Securities Inc. (hereinafter referred to as "we" or the "ESI") hereby engage Luck Eagle Limited [hereinafter collectively referred to as "you" or the "Luck Eagle") as ESI's consultant to assist ESI and ESI's investment banking; client, Harbin Mege Union (HK) International Group and its related holding entities and joint venture affiliates [hereinafter together collectively referred as the "Company"), to raise capital through a private investment in public equity [the "PIPE") for the Company for a period of 6 month. | |

| 2. | Luck Eagle accepts the engagement described in the preceding paragraph and agrees to assist Company with: | |

| a. | Assist the Company to prepare for investors* due diligence (including on-site visit) during the proposed PIPE transaction under ESI's guidance; | |

| b. | Assist rite Company in all verbal and written communications with all Company-hired professionals, and with investors through ESI during the proposed PIPE transaction; | |

| c. | Accommodate all Company's needs to all roadshows in China or U-S. if it is necessary to meet Company-hired professionals and investors during the proposed PIPE transaction under ESI's guidance; | |

| d. | Assist the Company to prepare (including translation) all original materials for ESI in connection with the PIPE; | |

| 3. | The terms and conditions set forth herein shall be and remain in effect for a period of six (6) months from the date that the agreement signed (the "Sign Date") by ESI and Luck Eagle and is terminable by either party, with or without cause, upon ten (10) day written notice to the other. | |

| 4. | Luck Eagle agrees to include ESI in all communications (electronic, written, verbal, etc.) with the Company (including but not limited to its management employee, officers, and outside consulted and hired professionals). Luck Eagle also agrees not to directly or indirectly contact any investors in connection with proposed PIPE without presence of ESI. | |

1

|

5.

|

In consideration of the services to be provided by Luck Eagle under

the agreement set forth herein, concurrently with the consummation, of the

PIPE, Luck Eagle will receive:

|

| a. |

Three percent (3%] of the total number of shares of the Company's

publicly traded parent company following the

PIPE.

|

|

6.

|

All notices or communications relating to the agreement set forth

herein shall be in writing. If send to Luck Eagle, such notices and

communications shall be mailed, delivered or telegraphed and confirmed to

Luck Eagle at the following address:

|

No. 3 Building, 6& District CBD

188 South Sihuan Wst Road, Fengtai

Fengtai, Bejing, China

If sent

to ESI, such notices and communications shall be mailed, delivered or

telegraphed and confirmed to ESI at the following address:

800 E. Colorado Blvd., Suite 100

Pasadena, CA 91101

ESI may

change its address for receiving notices by giving written notice to Luck Eagle.

Luck Eagle may change its address for receiving notices by giving written notice

to ESI.

Please

confirm that the foregoing correctly sets forth out understanding by signing the

enclosed duplicate of this letter where indicated below and return to us,

whereupon this letter shall constitute a binding agreement between

us.

Very

truly yours.

2

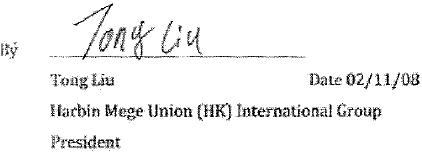

Ratified.,

acknowledged and agreed to with respect to Section 5 of the

foregoing agreement

3