Attached files

| file | filename |

|---|---|

| 8-K - AIRTRAN AIRWAYS FORM 8-K 12.03.09 - AIRTRAN HOLDINGS INC | form8-k.htm |

EXHIBIT

99.1

December

2009

December

2009

Investor

Update

Investor

Update

2

Certain

of the statements contained herein should be considered “forward-looking

statements,” including

within the meaning of the

Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may”, “will”,

“expect,” “intend,” “indicate,” “anticipate,” “believe,” “forecast,” “estimate,” “plan, “ “guidance,” “outlook,” “could, “ “should,” “continue”

and similar terms used in connection with statements regarding the outlook of AirTran Holdings, Inc., (the “Company” or “AirTran”). Such

statements include, but are not limited to, statements about the Company’s: expected financial performance and operations, expected fuel

costs, the revenue and pricing environment, future financing plans and needs, overall economic condition and its business plans, objectives,

expectations and intentions. Other forward-looking statements that do not relate solely to historical facts include, without limitation,

statements that discuss the possible future effects of current known trends or uncertainties or which indicate that the future effects of known

trends or uncertainties cannot be predicted, guaranteed or assured. Such statements are based upon the current beliefs and expectations of

the Company’s management and are subject to significant risks and uncertainties that could cause the Company’s actual results and financial

position to differ materially from the Company’s expectations. Such risks and uncertainties include, but are not limited to, the following: the

Company’s ability to grow new and existing markets, the Company’s ability to maintain or expand cost advantages in comparison to various

competitors, the impact of high fuel costs; significant disruptions in the supply of aircraft fuel and further significant increases to fuel prices;

the Company’s ability to attract and retain qualified personnel; labor costs and relations with unionized employees generally and the impact

and outcome of labor negotiations; the impact of global instability, including the current instability in the Middle East, the continuing impact of

the U.S. military presence in Iraq and Afghanistan and the terrorist attacks of September 11, 2001 and the potential impact of future hostilities,

terrorist attacks, infectious disease outbreaks or other global events that affect travel behavior; adequacy of insurance coverage; reliance on

automated systems and the potential impact of any failure or disruption of these systems; the potential impact of future significant operating

losses; the Company’s ability to obtain and maintain commercially reasonable terms with vendors and service providers and its reliance on

those vendors and service providers; security-related and insurance costs; changes in government legislation and regulation; competitive

practices in the industry, including significant fare restructuring activities, capacity reductions and in-court or out-of-court restructuring by

major airlines and industry consolidation; interruptions or disruptions in service at one or more of the Company’s hub or focus airports;

weather conditions; the impact of fleet concentration and changes in fleet mix; the impact of increased maintenance costs as aircraft age

and/or utilization increases; the Company’s ability to maintain adequate liquidity; the Company’s ability to maintain contracts that are critical to

its operations; the Company’s fixed obligations and its ability to obtain and maintain financing for operations, aircraft financing and other

purposes; changes in prevailing interest rates; the Company’s ability to operate pursuant to the terms of any financing facilities (particularly

the financial covenants) and to maintain compliance with credit card agreements; the Company’s ability to attract and retain customers; the

cyclical nature of the airline industry; economic conditions; risks associated with actual or potential acquisitions or other business

transactions including the Company’s ability to achieve any synergies anticipated as a result of such transactions and to achieve any such

synergies in a timely manner, and other risks and uncertainties listed from time to time in the Company’s reports to the Securities and

Exchange Commission. There may be other factors not identified above of which the Company is not currently aware that may affect matters

discussed in the forward-looking statements, and may also cause actual results to differ materially from those discussed. All forward-looking

statements are based on information currently available to the Company. Except as may be required by applicable law, AirTran assumes no

obligation to publicly update or revise any forward-looking statement to reflect actual results, changes in assumptions or changes in other

factors affecting such estimates. Additional factors that may affect the future results of the Company are set forth in the section entitled “Risk

Factors” in the Company’s Annual Report on Form 10-K for the period ended December 31, 2008, or as supplemented in the Company’s

subsequently filed periodic reports, which are available at www.sec.gov and at www.AirTran.com.

Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may”, “will”,

“expect,” “intend,” “indicate,” “anticipate,” “believe,” “forecast,” “estimate,” “plan, “ “guidance,” “outlook,” “could, “ “should,” “continue”

and similar terms used in connection with statements regarding the outlook of AirTran Holdings, Inc., (the “Company” or “AirTran”). Such

statements include, but are not limited to, statements about the Company’s: expected financial performance and operations, expected fuel

costs, the revenue and pricing environment, future financing plans and needs, overall economic condition and its business plans, objectives,

expectations and intentions. Other forward-looking statements that do not relate solely to historical facts include, without limitation,

statements that discuss the possible future effects of current known trends or uncertainties or which indicate that the future effects of known

trends or uncertainties cannot be predicted, guaranteed or assured. Such statements are based upon the current beliefs and expectations of

the Company’s management and are subject to significant risks and uncertainties that could cause the Company’s actual results and financial

position to differ materially from the Company’s expectations. Such risks and uncertainties include, but are not limited to, the following: the

Company’s ability to grow new and existing markets, the Company’s ability to maintain or expand cost advantages in comparison to various

competitors, the impact of high fuel costs; significant disruptions in the supply of aircraft fuel and further significant increases to fuel prices;

the Company’s ability to attract and retain qualified personnel; labor costs and relations with unionized employees generally and the impact

and outcome of labor negotiations; the impact of global instability, including the current instability in the Middle East, the continuing impact of

the U.S. military presence in Iraq and Afghanistan and the terrorist attacks of September 11, 2001 and the potential impact of future hostilities,

terrorist attacks, infectious disease outbreaks or other global events that affect travel behavior; adequacy of insurance coverage; reliance on

automated systems and the potential impact of any failure or disruption of these systems; the potential impact of future significant operating

losses; the Company’s ability to obtain and maintain commercially reasonable terms with vendors and service providers and its reliance on

those vendors and service providers; security-related and insurance costs; changes in government legislation and regulation; competitive

practices in the industry, including significant fare restructuring activities, capacity reductions and in-court or out-of-court restructuring by

major airlines and industry consolidation; interruptions or disruptions in service at one or more of the Company’s hub or focus airports;

weather conditions; the impact of fleet concentration and changes in fleet mix; the impact of increased maintenance costs as aircraft age

and/or utilization increases; the Company’s ability to maintain adequate liquidity; the Company’s ability to maintain contracts that are critical to

its operations; the Company’s fixed obligations and its ability to obtain and maintain financing for operations, aircraft financing and other

purposes; changes in prevailing interest rates; the Company’s ability to operate pursuant to the terms of any financing facilities (particularly

the financial covenants) and to maintain compliance with credit card agreements; the Company’s ability to attract and retain customers; the

cyclical nature of the airline industry; economic conditions; risks associated with actual or potential acquisitions or other business

transactions including the Company’s ability to achieve any synergies anticipated as a result of such transactions and to achieve any such

synergies in a timely manner, and other risks and uncertainties listed from time to time in the Company’s reports to the Securities and

Exchange Commission. There may be other factors not identified above of which the Company is not currently aware that may affect matters

discussed in the forward-looking statements, and may also cause actual results to differ materially from those discussed. All forward-looking

statements are based on information currently available to the Company. Except as may be required by applicable law, AirTran assumes no

obligation to publicly update or revise any forward-looking statement to reflect actual results, changes in assumptions or changes in other

factors affecting such estimates. Additional factors that may affect the future results of the Company are set forth in the section entitled “Risk

Factors” in the Company’s Annual Report on Form 10-K for the period ended December 31, 2008, or as supplemented in the Company’s

subsequently filed periodic reports, which are available at www.sec.gov and at www.AirTran.com.

Safe

Harbor

3

AirTran

Airways Profile

n Lowest cost major

airline in U.S.

― 138 aircraft

(Youngest all-Boeing fleet in U.S.)

n More than 700 daily

flights to over 60 destinations

― Over 24 million

enplanements annually

n Ranked #1 in the

Airline Quality Ranking

n Stable and

experienced management team

n Acted quickly in

2008 to mitigate record high oil, and now

better positioned to weather current economic uncertainty

better positioned to weather current economic uncertainty

― Record net income in

2009

n Business Class on

every flight

n Assigned

seating

n Wi-Fi on every

flight

n Over 100 channels of

free XM Satellite Radio

n Oversized luggage

bins

n Friendly Crew

Members

n Broad distribution

network

n New aircraft -

average age is 6 years

4

AirTran

Product: Low Fares and Major Airline Amenities

5

n Industry leading low

costs

n Conservative fleet

plan and modest growth

n Strong ancillary

revenues

― Less dependent on

initial sale to passenger

n Better diversified

network

― Fewer price

sensitive connections, less exposure to any single competitor

n Improved fuel hedge

portfolio

n Better

capitalized

― $172.5MM capital

raise and extension of $175MM credit facility

n Industry backdrop

remains favorable

AirTran

is Well Prepared for Economic Uncertainty

6

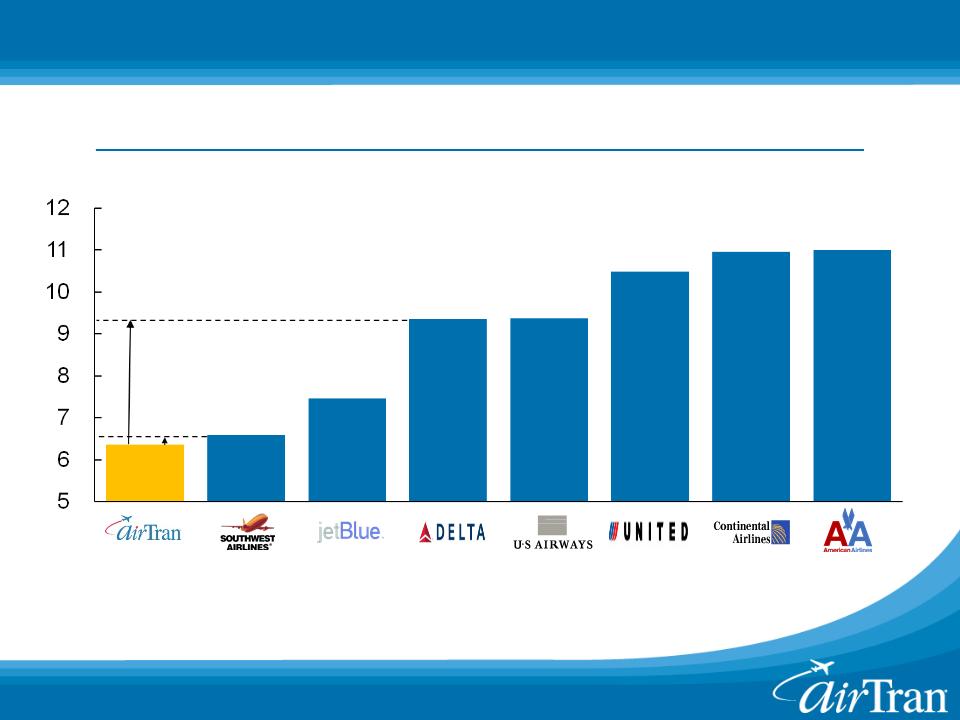

(Cents)

Note:

Excludes fuel and special items

Industry Cost

Comparison

Non-Fuel Unit Costs

at 740 Miles for First Nine Months 2009

AirTran’s

Cost Advantage Remains Strong

47%

Higher

4%

Higher

7

n Productive workforce

at all levels

n Young, simplified

fleet

― Fuel

efficient

― Attractive ownership

costs

n Efficient use of

facilities

n Competition for

heavy maintenance contracts

n Low cost

distribution

― Over 70% of sales

are directly with AirTran (1-800-AirTran and airtran.com)

What

Creates AirTran’s Low Cost Advantage?

JetBlue

AirTran

Independence

Southwest

United

America

West

Northwest

Continental

Alaska

American

JetBlue

AirTran

Southwest

United

Alaska

America

West

Northwest

American

Continental

ATA

AirTran

JetBlue

Northwest

Alaska

Southwest

Frontier

Continental

American

US

Airways

United

AirTran

JetBlue

Southwest

Northwest

Frontier

Continental

Alaska

United

American

Delta

JetBlue

AirTran

Frontier

Northwest

Southwest

Continental

United

Alaska

American

ATA

8

Notes:

(1) AQR

Rating compiled by Wichita State University / University of Nebraska,

Omaha.

(2) Based on

DOT reports for on-time performance, denied boardings, mishandled baggage, and

customer complaints

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Airline

Quality Rating for Major Continental U.S. Airlines

2007

2006

2005

2008

2009

AirTran

Has High Quality & Industry Leading Low Costs

9

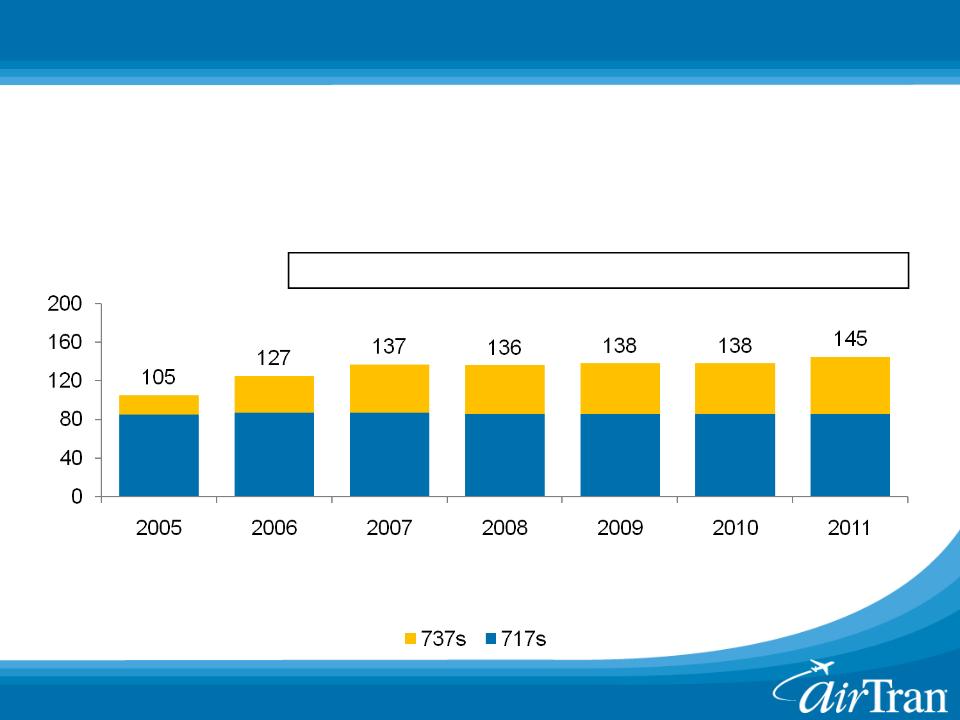

(Aircraft)

Previous

Plan:

Fleet

Plan Well-Suited for Economic Uncertainty

n Currently 138

aircraft: 86 717s

/ 52 737-700s

― Deferred / sold 47

aircraft from 2008-2011 fleet plan

― Reduced capital

requirements by nearly $1 billion through 2010

― No permanent

aircraft financing requirements until Q2 2011

|

28%

|

24%

|

20%

|

5%

|

(2-3)%

|

3-4%

|

2-3%

|

ASM

Growth

Growth

147

161

175

188

10

(Millions)

Strong

Ancillary Revenue Growth

43%

45%

54%

36%

>45%

Yr/Yr Growth

*

Select ancillary revenues are recorded in passenger revenues

|

28%

|

24%

|

20%

|

5%

|

(2-3)%

|

ASM

Growth

Growth

AirTran

Ancillary Revenue

n Well-suited for low

cost carriers

n High net

margins

11

AirTran

Has Successfully Diversified Its Network

|

%

ASMs

|

2000

|

2002

|

2004

|

2006

|

2008

|

2010E

|

|

Atlanta

|

91%

|

76%

|

67%

|

64%

|

58%

|

48%

|

|

Florida

|

29%

|

35%

|

34%

|

38%

|

45%

|

43%

|

|

Baltimore

|

0%

|

13%

|

13%

|

9%

|

11%

|

14%

|

|

Milwaukee

|

0%

|

3%

|

3%

|

2%

|

7%

|

13%

|

|

Caribbean

|

0%

|

1%

|

1%

|

0%

|

3%

|

7%

|

|

|

|

|

|

|

|

|

|

Daily

Flights

|

278

|

362

|

492

|

650

|

713

|

713

|

Note:

Totals >100% as percentage of ASMs represents capacity from a city/region to

the entire AirTran network at year-

end

end

Source:

2010E based on March 2010 schedule

12

Boston

Flint

Moline

Buffalo

Dayton

Dallas/Ft.

Worth

Houston

New

Orleans

Memphis

Bloomington

Minneapolis

Akron/

Canton

Newport

News

New

York (LGA)

Ft.

Lauderdale

AirTran

Had a Regional Route Network in 2000

Gulfport/Biloxi

Fort

Walton Beach

Miami

Ft.

Myers

Orlando

Jacksonville

Savannah

Myrtle

Beach

Atlanta

Raleigh/Durham

Greensboro

Washington,

D.C. (IAD)

Philadelphia

Newark

Chicago

Tampa

Cities:

31

Routes:

40

13

Portland

Boston

Las

Vegas

Burlington

Flint

San

Juan

Cancun

Montego

Bay

Aruba

Moline

Pittsburgh

Buffalo

Rochester

Dayton

San

Diego

Los

Angeles

Phoenix

Seattle

San

Francisco

Dallas/Ft.

Worth

Houston

San

Antonio

New

Orleans

Atlanta

Pensacola

Memphis

Branson

Wichita

Kansas

City

St.

Louis

Bloomington

Knoxville

Indianapolis

Charleston

Columbus

Milwaukee

Minneapolis

Chicago

Detroit

Akron/

Canton

Richmond

Washington,

D.C. (IAD)

Washington,

D.C. (DCA)

Newport

News

Asheville

Raleigh/Durham

Charlotte

Harrisburg

Allentown

New

York (LGA)

Philadelphia

Atlantic

City

Baltimore

White

Plains

Charleston

Jacksonville

Tampa

Sarasota

Ft.

Myers

Miami

Nassau

Ft.

Lauderdale

West

Palm Beach

Orlando

Key

West

Denver

Lexington

Routes:

59

AirTran’s

2009 Atlanta Network Has Grown to 59 Cities

Omaha

Des

Moines

14

Portland

Boston

Las

Vegas

Burlington

Flint

San

Juan

Cancun

Montego

Bay

Aruba

Pittsburgh

Buffalo

Rochester

Dayton

San

Diego

Los

Angeles

Phoenix

Seattle

San

Francisco

Dallas/Ft.

Worth

Houston

San

Antonio

New

Orleans

Branson

Wichita

Kansas

City

St.

Louis

Knoxville

Indianapolis

Charleston

Columbus

Milwaukee

Minneapolis

Chicago

Detroit

Akron/

Canton

Richmond

Washington,

D.C. (IAD)

Washington,

D.C. (DCA)

Newport

News

Raleigh/Durham

Charlotte

Harrisburg

Allentown

New

York (LGA)

Philadelphia

Atlantic

City

Baltimore

White

Plains

Charleston

Jacksonville

Tampa

Sarasota

Ft.

Myers

Miami

Nassau

Ft.

Lauderdale

West

Palm Beach

Orlando

Key

West

Denver

Lexington

Asheville

AirTran

Now Serves the Most Destinations from Orlando

Routes:

43

Memphis

Omaha

Des

Moines

Atlanta

Bloomington

Moline

Pensacola

15

Portland

Boston

Las

Vegas

Burlington

Flint

San

Juan

Cancun

Montego

Bay

Aruba

Moline

Pittsburgh

Buffalo

Rochester

Dayton

San

Diego

Los

Angeles

Phoenix

Seattle

San

Francisco

Dallas/Ft.

Worth

Houston

San

Antonio

New

Orleans

Atlanta

Pensacola

Memphis

Branson

Wichita

Kansas

City

St.

Louis

Bloomington

Knoxville

Indianapolis

Charleston

Milwaukee

Minneapolis

Chicago

Detroit

Akron/

Canton

Washington,

D.C. (DCA)

Newport

News

Asheville

Raleigh/Durham

Charlotte

Harrisburg

Allentown

New

York (LGA)

Philadelphia

Atlantic

City

Baltimore

White

Plains

Charleston

Jacksonville

Tampa

Sarasota

Ft.

Myers

Miami

Nassau

Ft.

Lauderdale

West

Palm Beach

Orlando

Key

West

Denver

Lexington

Routes:

24

AirTran

Has Replaced US Airways’ Baltimore Network

Omaha

Des

Moines

Columbus

Washington,

D.C. (IAD)

Richmond

16

Portland

Boston

Las

Vegas

Burlington

Flint

San

Juan

Cancun

Montego

Bay

Aruba

Moline

Pittsburgh

Buffalo

Rochester

Dayton

San

Diego

Los

Angeles

Phoenix

Seattle

San

Francisco

Dallas/Ft.

Worth

Houston

San

Antonio

New

Orleans

Atlanta

Pensacola

Memphis

Branson

Wichita

Kansas

City

Knoxville

Charleston

Columbus

Minneapolis

Detroit

Akron/

Canton

Richmond

Washington,

D.C. (IAD)

Washington,

D.C. (DCA)

Newport

News

Asheville

Raleigh/Durham

Charlotte

Harrisburg

Allentown

New

York (LGA)

Philadelphia

Atlantic

City

Baltimore

White

Plains

Charleston

Jacksonville

Tampa

Sarasota

Ft.

Myers

Miami

Nassau

Ft.

Lauderdale

West

Palm Beach

Orlando

Key

West

Denver

Lexington

Routes:

24

AirTran

is Now Milwaukee’s Largest Mainline Carrier

Omaha

Des

Moines

Milwaukee

St.

Louis

Indianapolis

Bloomington

Chicago

17

Portland

Boston

Dallas/Ft.

Worth

Las

Vegas

Denver

Minneapolis

Burlington

San

Antonio

Flint

Houston

San

Juan

Cancun

Montego

Bay

Aruba

Ft.

Myers

Tampa

Charleston

Knoxville

Charlotte

Raleigh/Durham

Detroit

Allentown

Pittsburgh

Newport

News

Washington,

D.C. (DCA)

Baltimore

Atlantic

City

Philadelphia

New

York (LGA)

White

Plains

Buffalo

Rochester

West

Palm Beach

Ft.

Lauderdale

Miami

Nassau

Key

West

Sarasota

New

Orleans

Kansas

City

Branson

Wichita

Columbus

Dayton

Charleston

Akron/

Canton

San

Diego

Los

Angeles

Phoenix

Seattle

San

Francisco

Lexington

Asheville

Jacksonville

Orlando

AirTran’s

2009 Network is Nationwide and Diversified

Cities:

From 31 to 69

Routes:

From 40 to 173

Memphis

Omaha

Des

Moines

Milwaukee

Pensacola

Atlanta

Moline

Harrisburg

Chicago

Bloomington

St.

Louis

Indianapolis

Washington,

D.C. (IAD)

Richmond

18

18

|

|

|

Crude

Price

|

||

|

Period

|

Hedge

%

|

$50

|

$70

|

$90

|

|

Q409

|

54%

|

$62

|

$69

|

$70

|

|

Q110

|

46%

|

$61

|

$73

|

$79

|

|

Q210

|

41%

|

$62

|

$75

|

$81

|

|

Q310

|

33%

|

$63

|

$77

|

$85

|

|

Q410

|

35%

|

$63

|

$77

|

$85

|

|

2010

|

38%

|

$62

|

$75

|

$82

|

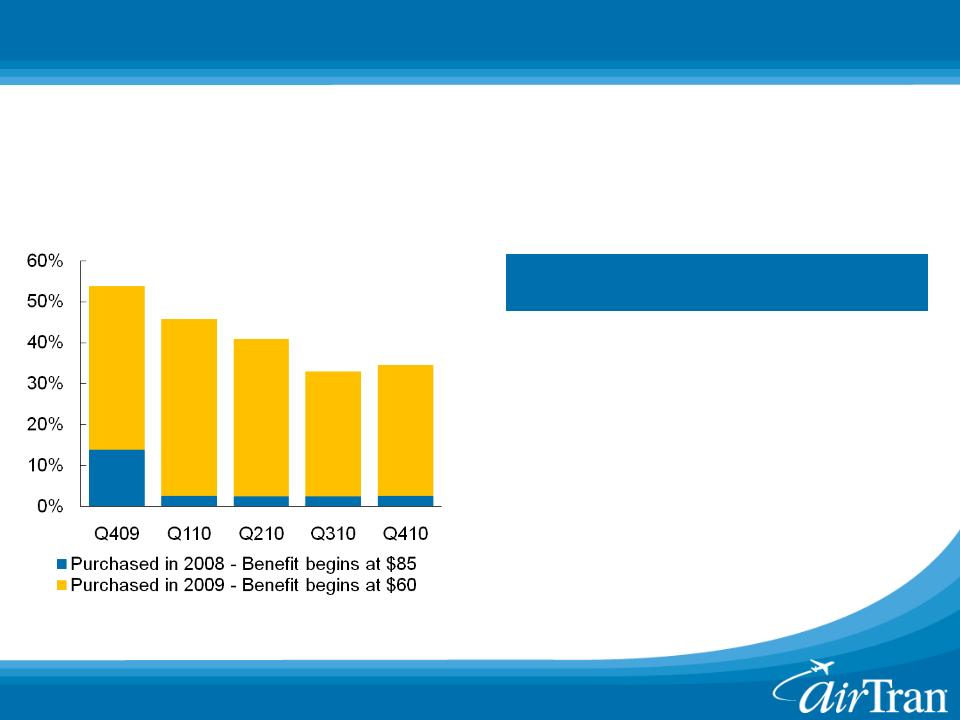

AirTran

is Committed to Reducing Fuel Cost Volatility

n Hedge portfolio was

restructured in 2008

n One of few airlines

to actively hedge in 2009

Example: If

crude was $90 in 2010, our cost would

be the equivalent of $82/bbl on 38% of our fuel

be the equivalent of $82/bbl on 38% of our fuel

54%

46%

41%

35%

33%

Note: Assumes

crack spread at 15% of crude price

19

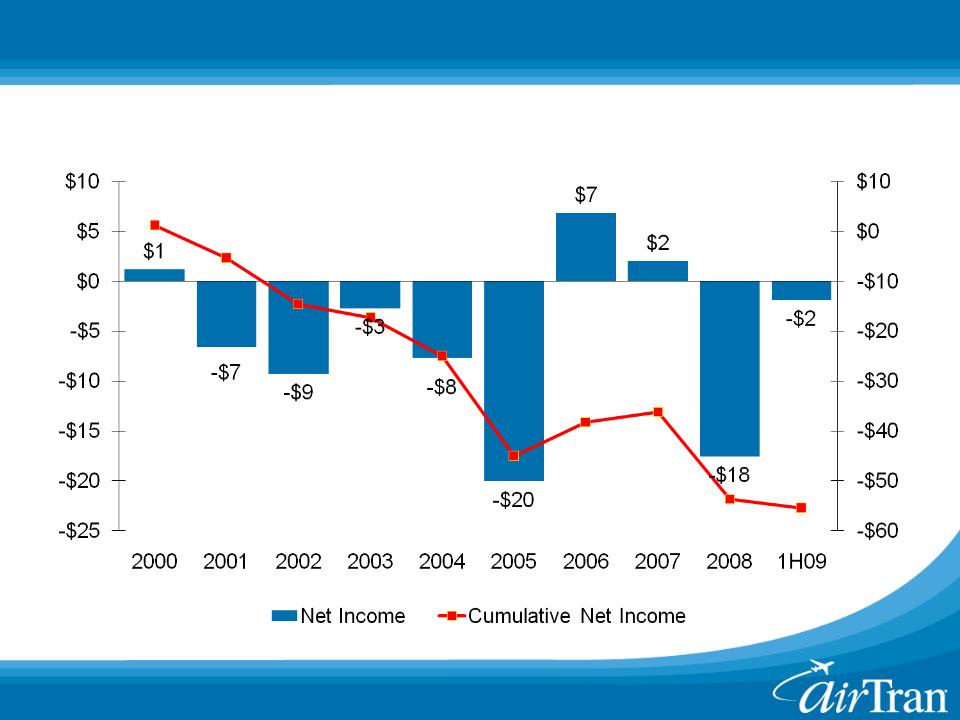

(Billions)

(Billions)

Legacy

Airline Domestic Net Income

Legacy

Airline’s Domestic Networks Remain Unprofitable

Source:

DOT Form 41 Filings

Annual

Cumulative

20

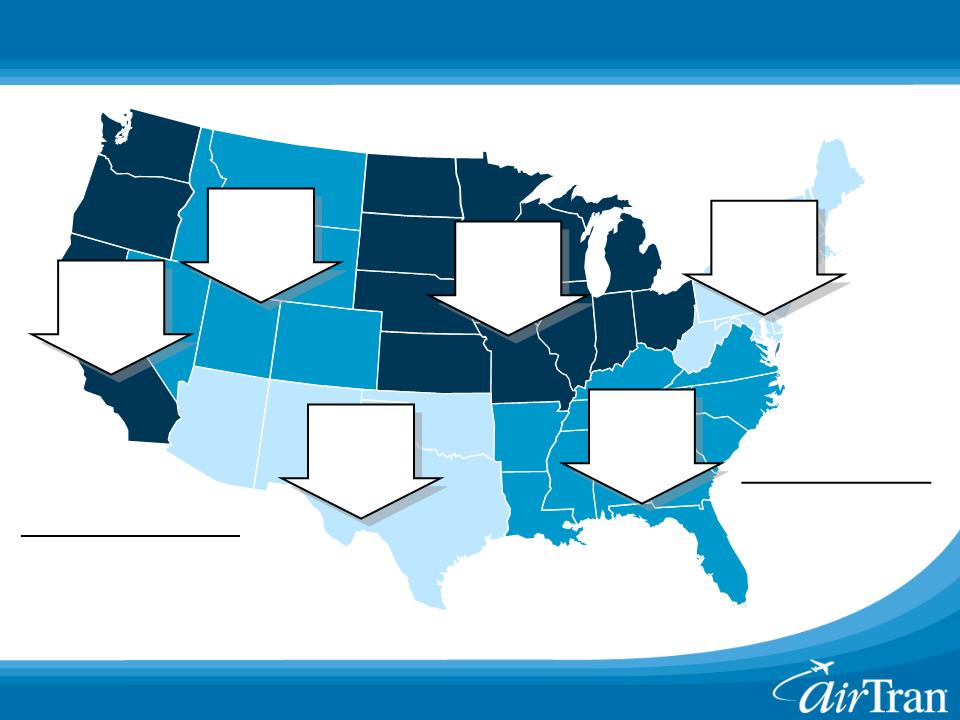

AirTran:

Delta:

Southwest:

-2%

to -3%

-7% to

-9%

-5% to

-6%

2009

Planned

Domestic Capacity

Domestic Capacity

Note:

Domestic capacity change for 2009

Northeast

-6%

Midwest

-8%

Southwest

-5%

Mountain

-6%

West

-8%

South

-8%

Industry

Losses Results in Disciplined Domestic Capacity

Las

Vegas:

St.

Louis:

Cincinnati:

Major

Capacity Reductions

US

Airways

American

Delta

21

21

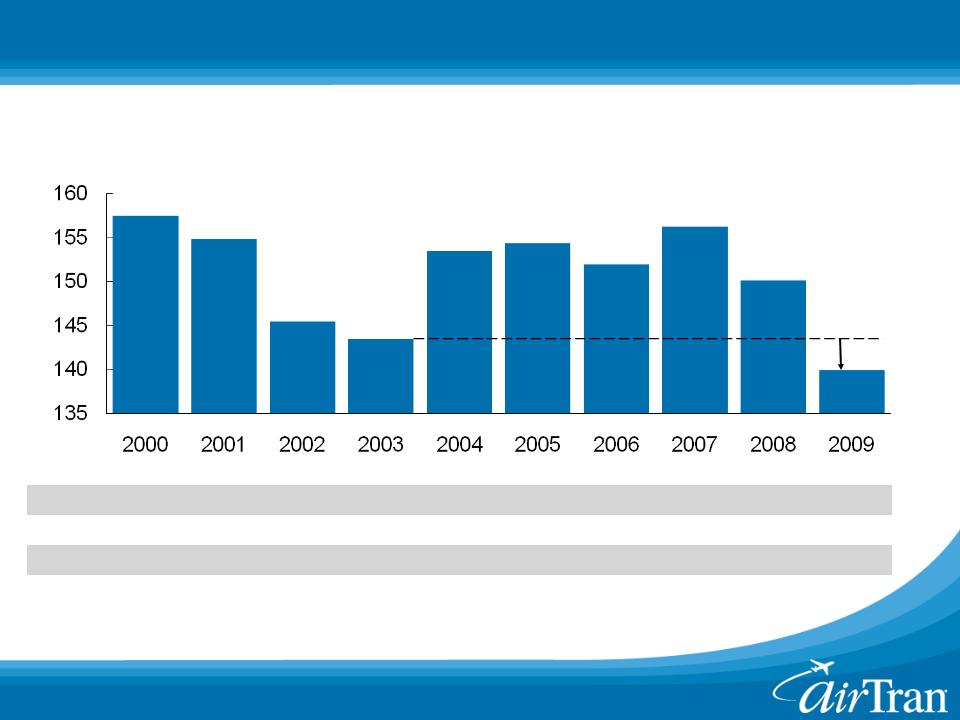

Source:

DOT Form 41 Filings

(Trillions)

Continental U.S.

Available Seat Miles

|

|

82%

|

79%

|

76%

|

72%

|

69%

|

64%

|

61%

|

59%

|

57%

|

56%

|

|

|

6%

|

7%

|

8%

|

10%

|

12%

|

14%

|

14%

|

14%

|

14%

|

15%

|

|

|

12%

|

14%

|

16%

|

18%

|

19%

|

22%

|

25%

|

27%

|

29%

|

29%

|

Legacy

Regional

LCC

Domestic

Capacity Now at Lowest Level In Over a Decade

(2-3%)

22

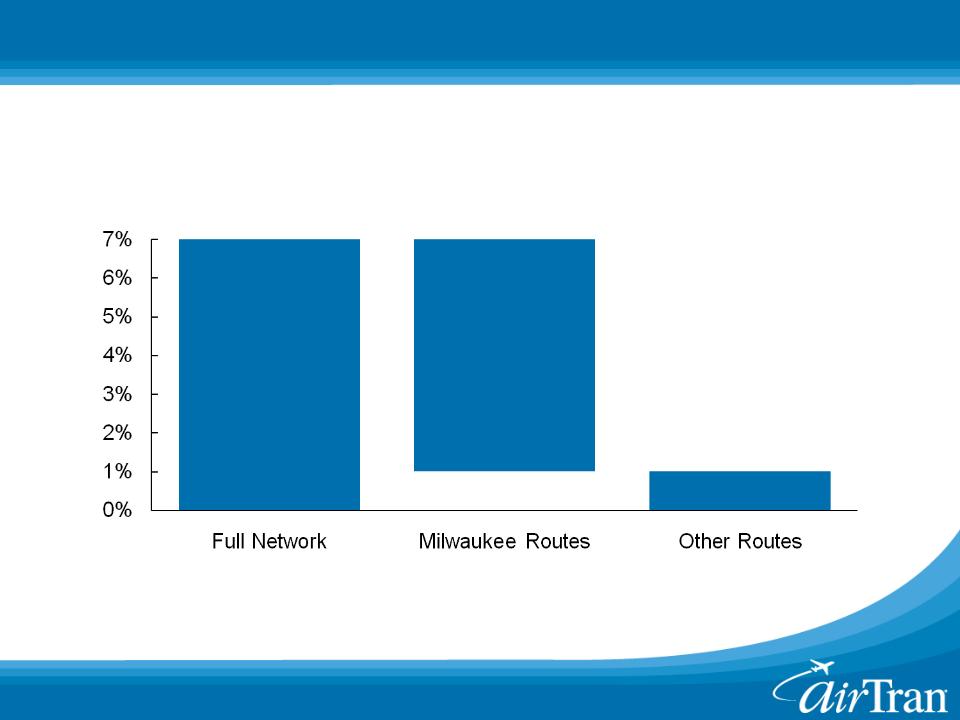

(ASM

Growth)

AirTran

Yr/Yr Growth Largely Focused in Milwaukee

7%

6%

1%

AirTran

Q409 Available Seat Mile Growth

23

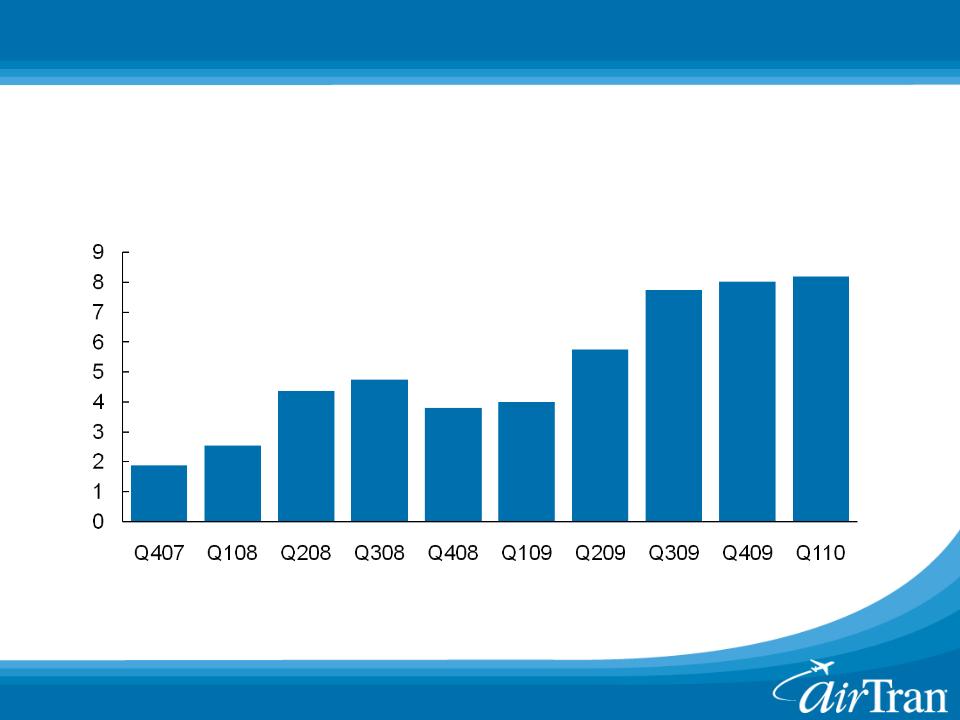

(ASMs

in

Millions)

Millions)

AirTran’s

Milwaukee Network Has Matured

Milwaukee Daily

ASMs

n AirTran now serves

18 of the top 20 markets

24

n Track record of

profitability was restored in 2009

― Record net income in

2009

― Consumers are

increasingly value-oriented

― Softening consumer

demand has been offset by lower fuel, capacity reductions,

and strong growth in ancillary revenues

and strong growth in ancillary revenues

n Significant non-fuel

cost advantage versus competitors will

remain intact

remain intact

n Balance sheet has

been strengthened

― $172.5MM capital

raise and extension of $175MM credit facility

n Q4 2009

outlook

― Capacity up

7%

― Total unit revenue

down -7% to -8%

― All-in fuel price

net of hedges $2.08 to $2.12

― Non-fuel unit costs

up 1% to 2%

Outlook

for AirTran Remains Positive

25

n AirTran’s industry

leading low-costs and a high quality

product drives profitability across multiple market segments

product drives profitability across multiple market segments

― Business /

leisure

― Hub /

point-to-point

n Significant cost

advantage in leisure markets

― Share shift to low

cost carriers to continue in leisure markets

n Record 2009

profitability paves path for manageable growth

― Disciplined fleet

plan

― Diversified

network

― Effective hedge

portfolio

n Opportunities to

capitalize in a weak or strong economy

― Business Class /

Wi-Fi / Assigned Seats appeal to high-yielding travelers

― Low-cost reputation

attracts value-minded consumers

n Remain poised to

capitalize on opportunities

AirTran

Investment Summary