Attached files

Table of Contents

As filed with the Securities and Exchange Commission on December 2, 2009

Registration No. 333-162347

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Team Health Holdings, L.L.C.

(to be converted into Team Health Holdings, Inc.)

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 8099 | 36-4276525 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

1900 Winston Road

Suite 300

Knoxville, Tennessee 37919

(865) 693-1000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

c/o David Jones

Chief Financial Officer

1900 Winston Road, Suite 300

Knoxville, Tennessee 37919

(865) 693-1000

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

With Copies To:

| Edward P. Tolley III, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017-3954 Tel: (212) 455-2000 Fax: (212) 455-2502 |

Stephen L. Burns, Esq. Cravath, Swaine & Moore LLP Worldwide Plaza 825 Eighth Avenue New York, New York 10019-7475 Tel: (212) 474-1000 Fax: (212) 474-3700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act of 1934.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price per Share(2) |

Proposed Maximum Aggregate Offering Price(2) |

Amount of Registration Fee(3) | |||||||

| Common Stock, par value $0.01 per share |

23,000,000 shares | $ | 16.00 | $ | 368,000,000 | $ | 20,535 | ||||

| (1) | Includes shares of common stock that the underwriters have an option to purchase. |

| (2) | This amount represents the proposed maximum aggregate offering price of the securities registered hereunder to be sold by the Registrant and the selling shareholder. These figures are estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended. |

| (3) | The Registrant previously paid $5,580 on October 2, 2009. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

Table of Contents

Table of Contents

The information in this prospectus is not complete and may be changed. We and the selling shareholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion. Dated December 2, 2009.

P R O S P E C T U S

20,000,000 Shares

Team Health Holdings, Inc.

Common Stock

This is the initial public offering of Team Health Holdings, Inc. We are offering 10,666,667 shares of common stock. The selling shareholder identified in this prospectus is offering 9,333,333 shares of common stock. We will not receive any of the proceeds from the sale of shares being sold by the selling shareholder.

No public market currently exists for our common stock. We estimate the initial public offering price of our common stock to be between $14.00 and $16.00 per share. Our common stock has been approved for listing on The New York Stock Exchange under the symbol “TMH,” subject to official notice of issuance.

We intend to use the net proceeds received by us from this offering principally for the repayment of indebtedness.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 12 of this prospectus.

| Per Share |

Total | |||||

| Initial public offering price |

$ | $ | ||||

| Underwriting discounts and commissions |

$ | $ | ||||

| Proceeds, before expenses, to us |

$ | $ | ||||

| Proceeds, before expenses, to the selling shareholder |

$ | $ | ||||

To the extent that the underwriters sell more than 20,000,000 shares of common stock, the underwriters have the option to purchase up to an additional 1,600,000 shares from us and an additional 1,400,000 shares from the selling shareholder at the initial offering price less underwriting discounts and commissions.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock against payment in New York, New York on or about , 2009.

Joint Book-Running Managers

| BofA Merrill Lynch | Goldman, Sachs & Co. | Barclays Capital | Citi |

| Credit Suisse | Deutsche Bank Securities | UBS Investment Bank |

| Morgan Keegan & Company, Inc. | Stephens Inc. |

Prospectus dated , 2009

Table of Contents

You should rely only on the information contained in this prospectus or in any free writing prospectus that we authorize to be delivered to you. Neither we nor the underwriters have authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We, the selling shareholder and the underwriters are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information in this prospectus is accurate only as of the date on the cover page, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, prospects, financial condition and results of operations may have changed since that date.

| Page | ||

| ii | ||

| ii | ||

| 1 | ||

| 12 | ||

| 36 | ||

| 38 | ||

| 39 | ||

| 40 | ||

| 41 | ||

| 42 | ||

| 45 | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

47 | |

| 76 | ||

| 99 | ||

| 126 | ||

| 128 | ||

| 133 | ||

| 137 | ||

| 143 | ||

| Certain United States Federal Income and Estate Tax Consequences to Non-U.S. Holders |

145 | |

| 148 | ||

| 154 | ||

| 154 | ||

| 154 | ||

| F-1 |

Dealer Prospectus Delivery Obligation

Until , 2010 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

i

Table of Contents

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

Team Health is a registered trademark of Team Health, Inc. All other service marks, trademarks and trade names referred to in this prospectus are the property of their respective owners. Solely for convenience, our trademarks referred to in this prospectus may appear without the ® symbol, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks.

The market data and other statistical information used throughout this prospectus are based on independent industry publications, government publications, reports by market research firms and other published independent sources. Some data are also based on our good faith estimates, which are derived from our review of internal surveys, as well as the independent sources listed above. Although we believe these sources are reliable, we have not independently verified the information.

ii

Table of Contents

This summary highlights the information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. We encourage you to read this entire prospectus, including “Risk Factors” and the financial statements and the notes thereto, before making an investment decision.

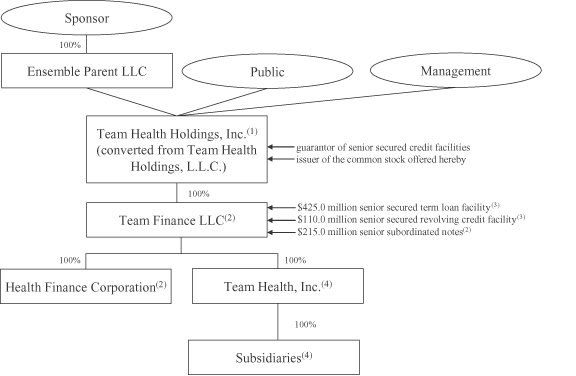

Unless the context otherwise requires, references in this prospectus to “TeamHealth,” “we,” “our,” “us” and the “Company” refer to Team Health Holdings, L.L.C. (“Team Health Holdings”) prior to the Corporate Conversion (as defined below) described in this prospectus, and Team Health Holdings, Inc. after the Corporate Conversion, and its consolidated subsidiaries and affiliated medical groups. The term “Team Health physicians or providers” or “affiliated providers” includes physicians and/or other healthcare providers who contract with Team Health’s affiliated entities. References to “Team Finance” refer to Team Finance LLC, a wholly-owned subsidiary of Team Health Holdings, which owns all of our businesses and operations. The historical financial statements and financial data included in this prospectus are those of Team Health Holdings and its consolidated subsidiaries.

Our Company

We believe we are one of the largest suppliers of outsourced healthcare professional staffing and administrative services to hospitals and other healthcare providers in the United States, based upon revenues and patient visits. We serve approximately 550 hospital clients and their affiliated clinics in 46 states with a team of approximately 6,100 healthcare professionals, including physicians, physician assistants and nurse practitioners. We recruit and contract with healthcare professionals who then provide professional services within third-party healthcare facilities. We are a physician-founded organization with physician leadership throughout our business and since our inception in 1979, we have provided outsourced services in hospital emergency departments, or EDs. We also provide comprehensive programs for hospital medicine (hospitalist), radiology, pediatrics and other healthcare services. For the year ended December 31, 2008, we generated net revenues less provision for uncollectibles of $1.33 billion and net earnings of $44.7 million. EDs and hospital medicine (hospitalist) represented approximately 79% of our 2008 net revenues less provision for uncollectibles, with locum tenens, radiology, pediatrics, military and other healthcare services representing approximately the remaining 21%.

EDs are a significant source of hospital inpatient admissions with a majority of admissions for key medical service lines starting in EDs, making successful management of this department critical to a hospital’s patient satisfaction rates and overall success. This dynamic, combined with the challenges involved in billing and collections and physician recruiting and retention, is a primary driver for hospitals to outsource their clinical staffing and management services to companies such as ours. For the year ended December 31, 2008, we provided services to over 7.6 million patients within our EDs. Our net revenues less provision for uncollectibles from ED contracts increased by approximately 42% from 2004 to 2008, or at a compound annual growth rate of approximately 9%. We have long-term relationships with customers under exclusive ED contracts with an approximate 98% renewal rate and 95% physician retention rate as of September 30, 2009 (calculated on a preceding 12 months basis), respectively. The EDs that we staff are generally located in larger hospitals. We believe our experience and expertise in managing the complexities of these high-volume EDs enable our hospital clients to provide higher quality and more efficient physician and administrative services. In this type of setting, we can establish stable long-term relationships, recruit and retain high quality physicians and other providers and staff, and obtain attractive payer mixes and reasonable margins.

The range of physician and non-physician staffing and administrative services that we provide to our clients includes the following:

| • | recruiting, scheduling and credential coordination for clinical and non-clinical medical professionals; |

1

Table of Contents

| • | coding, billing and collection of fees for services provided by medical professionals; |

| • | provision of experienced medical directors; |

| • | administrative support services, such as payroll, professional liability insurance coverage, continuing medical education services and management training; |

| • | risk and claims management services; and |

| • | standardized procedures. |

Industry Overview

We estimate the size of the domestic outsourced healthcare professional staffing market to be approximately $50 billion. With the increasing complexity of clinical, regulatory, managed care and reimbursement matters in today’s healthcare environment, healthcare facilities are under significant pressure from the government and private payers both to improve the quality and reduce the cost of care. Healthcare facilities seek third-party physician staffing and administrative service providers that not only can improve department quality, productivity and patient satisfaction while reducing overall costs, but also offer a breadth of staffing and management services, billing and reimbursement expertise, a reputation for regulatory compliance, financial stability and a demonstrated ability to recruit and retain qualified physicians, technicians and nurses. For example, many healthcare facilities are not oriented towards collecting large volumes of smaller dollar payments that are typical in the emergency and other specialty departments.

Since EDs represent a majority of admissions for key medical service lines, the operation of an ED has significant implications for hospitals in terms of revenue, cost, quality and the ability to grow market share. We believe the number of patient visits per ED is increasing while the number of EDs is decreasing. According to the American Hospital Association, ED visits increased at a compound annual growth rate of approximately 3%, from 92.8 million in 1997 to 120.8 million in 2007, and the average number of patient visits per ED grew at a compound annual growth rate of approximately 4%, from approximately 19,300 to approximately 27,000 over the same period. As the baby boomers and older generations above 55 years represent a larger percentage of the population (approximately 23% in 2008 and projected to be approximately 29% in 2020, according to the U.S. Census Bureau), the demand for ED services is likely to increase.

Competitive Strengths

Leading Market Position. We believe we are one of the largest providers of ED staffing and management services in the United States, based upon patient visits and revenue. We are among the top providers of hospital medicine (hospitalist) services in the country and we are a significant provider of contracted staffing of healthcare professionals for military facilities under the U.S. government’s military healthcare system.

Regional Operating Model Supported by a Centralized National Infrastructure. We are a national company serving approximately 550 hospital clients in 46 states from 12 regionally located operating units, which we believe results in responsive service and high physician retention rates. Our regional operating units are supported by our centralized national infrastructure, which we believe enables us to efficiently manage the operations and billing and collections processes and other administrative support functions. We believe our regional operating model supported by our centralized national infrastructure not only improves productivity and quality of care while reducing the cost of care, but also offers operating leverage to drive economies of scale as we continue to grow.

2

Table of Contents

High Quality Relationships with Clients and Physicians. Our local presence gives us the knowledge to optimally match physicians with our hospitals and their affiliated clinics while our national presence and centralized infrastructure enable us to provide physicians with a variety of attractive client locations, operating flexibility, advanced information and reimbursement systems and standardized procedures. This operating flexibility, combined with fewer administrative burdens on physicians and clients, has resulted in our strong physician and client retention rates of approximately 95% and 98% (each, as of September 30, 2009 calculated on a preceding 12 months basis), respectively, for our ED and hospital medicine operations which we believe to be among the highest in the industry.

Long-Term Relationships Generating Recurring Contractual Revenue. We have long-term relationships with customers under exclusive contracts. Within ED and hospital medicine, we have an approximate 98% annual renewal rate as of September 30, 2009 (calculated on a preceding 12 months basis). For ED and hospital medicine customers, the average tenure for our customers is approximately nine years, and our top 50 customers by net revenues have an average tenure with us of 13 years.

Strong and Stable Financial Profile. We believe our historically strong financial performance provides us with a competitive advantage in winning new contracts, renewing existing contracts and establishing and maintaining relationships with physicians and hospitals. Our existing customer relationships have generated a diversified revenue stream, with no one customer representing more than 2.1% of our net revenues less provision for uncollectibles for the nine months ended September 30, 2009.

Significant Investment in Proprietary Information Systems and Procedures. We have developed and maintained proprietary integrated, advanced systems that allow us to monitor and improve hospital performance, which we believe increases quality of care and patient satisfaction. As a result of these investments and the company-wide application of best practices policies, we believe our average cost per patient billed and average recruiting cost per physician and other healthcare professional are among the lowest in the industry.

Comprehensive and Effective Risk and Claims Management Programs. We have comprehensive risk and claims management programs designed to prevent or minimize medical errors and professional liability claims. Excluding the favorable effects of adjustments related to prior period reserves, professional liability costs as a percentage of net revenues less provision for uncollectibles have declined every year since our self-insurance program was implemented in 2003, from 6.6% in 2003 to 3.7% in 2008.

Experienced Management Team. Our senior management team has extensive experience in the outsourced physician staffing and administrative services industry and as a group has an average of more than 20 years of experience in the healthcare industry. In addition, our senior corporate and regional management team reflects a mix of both physician and non-physician leaders with an average of more than 25 years in the healthcare industry and 13 years of experience with us.

Our Growth Strategies

We intend to utilize our competitive strengths to capitalize on favorable industry trends, including increasing patient volumes, an aging population and increased ED visits, to grow our market share, net revenues, profitability and cash flow by:

Capitalizing on Outsourcing Opportunities to Win New Contracts. We believe we are well-positioned to capitalize on the growth in emergency medicine and our other target outsourcing markets by replacing competitors at hospitals that currently outsource their services, obtaining new contracts from healthcare facilities that do not currently outsource and expanding our present base of military facilities by successfully competing for new staffing contracts.

3

Table of Contents

Increasing Revenues from Existing Customers. We have a strong record of achieving growth in revenues from our existing customer base. We plan to continue to increase revenues from these customers by, among other things, capitalizing on increasing patient volumes, enhancing the services that we provide, improving documentation, billing and collection for services provided, cross-selling additional services to our existing customers and negotiating and implementing fee schedule increases, where appropriate.

Pursuing Selective Acquisitions. We believe our fragmented industry provides a number of attractive opportunities for acquisitions, as we estimate that approximately 75% of the ED outsourcing market is currently served by local and regional groups. We intend to continue to selectively acquire businesses that would enhance both our strategic and competitive positions and believe we are well-positioned to take advantage of, and integrate, acquisition opportunities.

Enhancing Profitability Through Our Operational Focus. Our regional operating units supported by our centralized national infrastructure is designed to continually drive operating leverage, improve efficiencies and align employee incentives to drive our growth. Furthermore, we believe our consolidated revenue platform and standardized processes related to managed care contracting, billing, coding, collection and compliance have driven a track record of strong revenue cycle management. We also believe our innovative patient safety and risk management initiatives and robust claims management processes have delivered favorable loss trends.

Increasing Revenues from Additional Clinical Areas. We believe we are well-positioned to increase our market share in the hospital medicine (hospitalist), radiology, temporary staffing or “locum tenens,” anesthesia, pediatrics and medical call center service areas due to our ability to leverage our infrastructure and existing client relationships as well as our recruiting and risk management expertise. We intend to grow our presence in these sectors by adding new clients with whom we do not currently have a relationship and cross-selling these services to our existing clients.

Risks Related to Our Business

Investing in our common stock involves substantial risk. You should carefully consider all of the information in this prospectus prior to investing in our common stock. There are several risks related to our business that are described under “Risk Factors” elsewhere in this prospectus. Among these important risks are the following:

| • | The current U.S. and global economic conditions could materially adversely affect our results of operations and business condition. |

| • | The current U.S. and state health reform legislative initiatives could adversely affect our operations and business condition. |

| • | Laws and regulations that regulate payments for medical services made by government sponsored healthcare programs could cause our revenues to decrease. |

| • | If governmental authorities determine that we violate Medicare, Medicaid or other government payer reimbursement laws or regulations, our revenues may decrease and we may have to restructure our method of billing and collecting Medicare, Medicaid or other government program payments, respectively. |

| • | We could be subject to professional liability lawsuits, some of which we may not be fully insured against or reserved for, which could adversely affect our financial condition and results of operations. |

4

Table of Contents

Our Sponsor

Investment funds associated with or designated by The Blackstone Group (the “Sponsor”) currently own, through Ensemble Parent LLC, approximately 92% of our voting membership interests. Ensemble Parent LLC is the selling shareholder in this offering. After giving effect to this offering, including the Corporate Conversion, our Sponsor, through Ensemble Parent LLC, will beneficially own approximately 58.0% of our issued and outstanding common stock (assuming no exercise of the underwriters’ option to purchase additional shares) and 54.2% of our issued and outstanding common stock (assuming full exercise of the underwriters’ option to purchase additional shares). Ensemble Parent will receive approximately $130.9 million in net proceeds from the shares it is selling in this offering. None of our officers and directors will receive, either directly or indirectly, any proceeds from the shares sold by Ensemble Parent or by us in this offering. However, upon completion of this offering, the Sponsor will receive a lump sum payment from our existing cash of approximately $33.4 million in the aggregate, of which the members of management who previously held Class A common units prior to the Corporate Conversion (as defined below) will receive approximately $3.5 million in the aggregate from the Sponsor, in each case based on the mid-point of the price range set forth on the cover page of this prospectus and current interest rates. Certain of our executive officers will receive a portion of the lump sum payment from the Sponsor as follows: Dr. Massingale approximately $719,200, Mr. Roth approximately $216,700, Mr. Jones approximately $135,800, Mr. Sherlin approximately $97,500, Ms. Allen approximately $22,200 and other employees and shareholders (154 individuals) approximately $2.3 million in the aggregate, in each case based on the mid-point of the price range set forth on the cover page of this prospectus and current interest rates. See “Certain Relationships and Related Party Transactions.”

Team Health Holdings, L.L.C., which will be converted into Team Health Holdings, Inc. in connection with the Corporate Conversion, is a Delaware limited liability company organized on December 15, 1998. See “Corporate Conversion.” Our principal executive offices are located at 1900 Winston Road, Knoxville, Tennessee 37919, and our telephone number at that address is (865) 693-1000. Our website address is www.teamhealth.com. The information on our website is not part of this prospectus.

Corporate Conversion

In connection with this offering, Team Health Holdings, L.L.C. will convert from a Delaware limited liability company to a corporation organized under the laws of the State of Delaware (the “Corporate Conversion”). In connection with the Corporate Conversion, each class of limited liability company interests of Team Health Holdings, L.L.C. will be converted into shares of common stock of Team Health Holdings, Inc. See “Corporate Conversion” for further information regarding the Corporate Conversion.

5

Table of Contents

THE OFFERING

| Common stock we are offering |

10,666,667 shares |

| Common stock the selling shareholder is offering |

9,333,333 shares (approximately $130.9 million of net proceeds) |

| Selling shareholder |

Ensemble Parent LLC, an affiliate of The Blackstone Group |

| Common stock to be outstanding immediately after this offering |

59,767,667 shares (or 61,367,667 shares if the underwriters exercise their over-allotment option in full) |

| Over-allotment option |

3,000,000 shares |

| Use of proceeds |

We estimate that the net proceeds to us from this offering, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, will be approximately $146.1 million. |

| We will use the net proceeds from this offering received by us and any proceeds from the sale of up to an additional 1,600,000 shares from us if the underwriters exercise their option to purchase additional shares from us principally for the repayment of indebtedness. |

| We will not receive any proceeds from the sale of shares of common stock offered by the selling shareholder, including upon the sale of 1,400,000 shares by the selling shareholder (an additional approximately $19.6 million of net proceeds) if the underwriters exercise their option to purchase additional shares from us and the selling shareholder in this offering. The selling shareholder will distribute all of the net proceeds it receives to investment funds affiliated with the Sponsor in accordance with the Ensemble Parent LLC limited liability company agreement. See “Use of Proceeds.” |

| Dividend policy |

We currently expect to retain future earnings, if any, for use in the operation and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future. Our ability to pay dividends on our common stock is limited by the covenants of our senior secured credit facilities as well as our 11.25% senior subordinated notes due 2013 (the “senior subordinated notes”) and may be further restricted by the terms of any future debt or preferred securities. See “Dividend Policy” and “Description of Certain Indebtedness.” |

| Risk factors |

See “Risk Factors” beginning on page 12 and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| Proposed NYSE symbol |

“TMH” |

6

Table of Contents

Unless we indicate otherwise, all information in this prospectus assumes:

| • | no exercise by the underwriters of their option to purchase additional shares; |

| • | an initial public offering price of $15.00 per share, the mid-point of the price range set forth on the cover page of this prospectus; and |

| • | a conversion of all of our existing limited liability company interests into an aggregate 49,101,000 shares of common stock prior to the consummation of this offering as described under “Corporate Conversion.” |

The number of shares of common stock to be outstanding immediately after this offering does not reflect:

| • | 5,297,577 shares of common stock issuable upon exercise of options to be granted to our management in connection with the conversion of our limited liability company interests into shares of common stock and 164,471 shares to be issued to our management in connection with the conversion of our limited liability company interests into shares of our common stock; and |

| • | 9,637,952 additional shares of common stock authorized and reserved for future issuance under the new stock incentive plan. See “Management—Compensation Discussion and Analysis—2009 Stock Plan.” |

7

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

Team Health Holdings, Inc. (to be converted from Team Health Holdings, L.L.C. in connection with this offering) is a holding company that conducts no operations and its only material assets are the membership interests of Team Finance LLC, which in turn owns all of our businesses through its wholly owned subsidiary, Team Health, Inc. The historical financial statements and information presented in this prospectus are of Team Health Holdings and its consolidated subsidiaries.

The summary historical financial data for the fiscal years ended December 31, 2006, 2007 and 2008 have been derived from our audited historical consolidated financial statements and the notes thereto included elsewhere in this prospectus. The summary historical financial data as of and for the nine months ended September 30, 2008 and 2009 have been derived from our unaudited historical consolidated financial statements and the notes thereto included elsewhere in this prospectus. In the opinion of management, the interim financial data set forth below include all adjustments, consisting of normal recurring accruals, necessary to present fairly our financial position. Operating results for the nine months ended September 30, 2008 and 2009 are not necessarily indicative of the results that may be expected for the entire fiscal year.

The summary unaudited as adjusted balance sheet information as of September 30, 2009 has been prepared to give effect to this offering and the application of the proceeds received by us therefrom as if they had occurred on September 30, 2009. The summary unaudited as adjusted balance sheet information is for informational purposes only and does not purport to indicate balance sheet information as of any future date.

Because the data in this table is only a summary and does not provide all of the data contained in our financial statements, the information should be read in conjunction with “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and the notes thereto included elsewhere in this prospectus.

| Year Ended December 31, | Nine Months Ended September 30, | ||||||||||||||||

| 2006 | 2007 | 2008 | 2008 | 2009 | |||||||||||||

| (Dollars in thousands, except per share data) | |||||||||||||||||

| Statement of Operations Data: |

|||||||||||||||||

| Net revenue less provision for uncollectibles |

$ | 1,095,387 | $ | 1,232,065 | $ | 1,331,317 | $ | 999,807 | $ | 1,074,657 | |||||||

| Cost of services rendered (exclusive of depreciation and amortization shown separately below): |

|||||||||||||||||

| Professional services expenses |

831,826 | 950,872 | 1,046,806 | 779,426 | 828,268 | ||||||||||||

| Professional liability costs |

37,642 | 21,057 | 15,247 | (2,986 | ) | 19,145 | |||||||||||

| General and administrative expenses |

103,744 | 114,476 | 116,942 | 88,277 | 93,182 | ||||||||||||

| Management fee and other expenses |

3,748 | 4,054 | 3,602 | 2,745 | 2,324 | ||||||||||||

| Impairment of intangibles |

— | — | 9,134 | — | — | ||||||||||||

| Depreciation and amortization |

23,308 | 14,823 | 17,281 | 12,559 | 14,028 | ||||||||||||

| Interest expense, net(1) |

57,813 | 55,234 | 45,849 | 34,033 | 27,671 | ||||||||||||

| Gain on extinguishment of debt |

— | — | (1,640 | ) | — | — | |||||||||||

| Transaction costs |

— | — | 2,386 | 1,805 | 578 | ||||||||||||

| Earnings from continuing operations before income taxes |

37,306 | 71,549 | 75,710 | 83,948 | 89,461 | ||||||||||||

| Provision for income taxes |

13,792 | 27,703 | 31,044 | 33,885 | 34,230 | ||||||||||||

| Earnings from continuing operations |

23,514 | 43,846 | 44,666 | 50,063 | 55,231 | ||||||||||||

8

Table of Contents

| Year Ended December 31, | Nine Months Ended September 30, |

|||||||||||||||||||

| 2006 | 2007 | 2008 | 2008 | 2009 | ||||||||||||||||

| (Dollars in thousands, except per share data) | ||||||||||||||||||||

| Loss from discontinued operations, net of taxes |

(7,049 | ) | (576 | ) | — | — | — | |||||||||||||

| Net earnings |

$ | 16,465 | $ | 43,270 | $ | 44,666 | $ | 50,063 | $ | 55,231 | ||||||||||

| Per Share Data:(2) |

||||||||||||||||||||

| Unaudited pro forma basic net earnings per share(2) |

||||||||||||||||||||

| Net earnings per share |

$ | 0.34 | $ | 0.89 | $ | 0.92 | $ | 1.03 | $ | 1.13 | ||||||||||

| Weighted average shares outstanding (in thousands) |

48,558 | 48,573 | 48,717 | 48,707 | 48,732 | |||||||||||||||

| Unaudited pro forma diluted net earnings per share |

||||||||||||||||||||

| Net earnings per share |

$ | 0.33 | $ | 0.88 | $ | 0.91 | $ | 1.02 | $ | 1.12 | ||||||||||

| Weighted average shares outstanding (in thousands) |

49,497 | 49,370 | 49,305 | 49,318 | 49,154 | |||||||||||||||

| Unaudited supplemental pro forma basic net earnings per share(3) |

||||||||||||||||||||

| Net earnings per share |

— | — | $ | 0.91 | — | $ | 1.05 | |||||||||||||

| Weighted average shares outstanding (in thousands) |

— | — | 59,384 | — | 59,399 | |||||||||||||||

| Unaudited supplemental pro forma diluted net earnings per share(3) |

||||||||||||||||||||

| Net earnings per share |

— | — | $ | 0.90 | — | $ | 1.04 | |||||||||||||

| Weighted average shares outstanding (in thousands) |

— | — | 59,972 | — | 59,821 | |||||||||||||||

| Cash Flows Data: |

||||||||||||||||||||

| Net cash provided by operating activities |

$ | 49,553 | $ | 70,054 | $ | 61,971 | $ | 62,869 | $ | 84,621 | ||||||||||

| Net cash used in investing activities |

(50,109 | ) | (31,256 | ) | (29,772 | ) | (21,156 | ) | (13,102 | ) | ||||||||||

| Net cash used in financing activities |

(6,089 | ) | (12,507 | ) | (16,091 | ) | (4,986 | ) | (4,923 | ) | ||||||||||

| Other Financial Data: |

||||||||||||||||||||

| EBITDA(4) |

$ | 118,427 | $ | 141,606 | $ | 138,840 | $ | 130,540 | $ | 131,160 | ||||||||||

| Favorable professional liability loss reserve adjustments associated with prior years |

12,068 | 32,089 | 34,927 | 40,364 | 18,824 | |||||||||||||||

| Capital expenditures(5) |

11,271 | 12,680 | 12,141 | 7,341 | 5,244 | |||||||||||||||

| Change in investments at insurance subsidiary(6) |

18,262 | 15,156 | 10,131 | 6,302 | 5,080 | |||||||||||||||

9

Table of Contents

| As of September 30, 2009 |

||||||||

| Actual | As Adjusted | |||||||

| (In thousands) | ||||||||

| Balance Sheet Data: |

||||||||

| Cash and cash equivalents |

$ | 112,994 | $ | 78,274 | ||||

| Working capital(7) |

128,427 | 109,557 | ||||||

| Total assets |

800,449 | 762,399 | ||||||

| Total debt |

612,088 | 475,546 | ||||||

| Total members’ deficit/stockholders’ equity |

(228,327 | ) | (107,918 | ) | ||||

| (1) | Interest expense, net for the year ended December 31, 2008 and the nine months ended September 30, 2009 as adjusted to give effect to this offering and the application of the net proceeds received by us therefrom would have been $30,488 and $16,150, respectively. |

| (2) | Per share data will be computed based upon the number of shares of common stock outstanding immediately after the Corporate Conversion applied to our historical net income amounts and will give retroactive effect to the conversion of our limited liability company interests into shares of common stock. |

| (3) | The unaudited supplemental pro forma basic and diluted net earnings per share for the year ended December 31, 2008 and the nine months ended September 30, 2009 gives effect to the issuance of 10,666,667 shares by us in this offering and the portion of the offering proceeds to be used for the repayment of indebtedness. See “Use of Proceeds.” |

| (4) | “EBITDA” is defined as net earnings before interest expense, taxes and depreciation and amortization. Other companies may define EBITDA differently and, as a result, our measure of EBITDA may not be directly comparable to EBITDA of other companies. The following table sets forth a reconciliation of EBITDA to net earnings: |

| Year Ended December 31, | Nine Months Ended September 30, | ||||||||||||||

| 2006 | 2007 | 2008 | 2008 | 2009 | |||||||||||

| (In thousands) | |||||||||||||||

| Net earnings |

$ | 16,465 | $ | 43,270 | $ | 44,666 | $ | 50,063 | $ | 55,231 | |||||

| Interest expense, net |

57,813 | 55,234 | 45,849 | 34,033 | 27,671 | ||||||||||

| Provision for income taxes |

13,792 | 27,703 | 31,044 | 33,885 | 34,230 | ||||||||||

| Depreciation and amortization |

23,308 | 14,823 | 17,281 | 12,559 | 14,028 | ||||||||||

| EBITDA |

$ | 111,378 | $ | 141,030 | $ | 138,840 | $ | 130,540 | $ | 131,160 | |||||

The following table sets forth a reconciliation of net earnings to Adjusted EBITDA. Adjusted EBITDA under the indenture governing the senior subordinated notes is defined as net earnings before interest expense, taxes, depreciation and amortization, as further adjusted to exclude unusual items, non-cash items and the other adjustments shown in the table below. We believe that the disclosure of the calculation of Adjusted EBITDA provides information that is useful to an investor’s understanding of our financial flexibility under our indenture covenants. Adjusted EBITDA is not a measurement of financial performance or liquidity under generally accepted accounting principles. It should not be considered in isolation or as a substitute for net income, operating income, cash flows from operating, investing or financing activities, or any other measure calculated in accordance with generally accepted accounting principles.

10

Table of Contents

| Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||

| 2006 | 2007 | 2008 | 2008 | 2009 | ||||||||||||

| (In thousands) | ||||||||||||||||

| Net earnings |

$ | 16,465 | $ | 43,270 | $ | 44,666 | $ | 50,063 | $ | 55,231 | ||||||

| Interest expense, net |

57,813 | 55,234 | 45,849 | 34,033 | 27,671 | |||||||||||

| Provision for income taxes |

13,792 | 27,703 | 31,044 | 33,885 | 34,230 | |||||||||||

| Depreciation and amortization |

23,308 | 14,823 | 17,281 | 12,559 | 14,028 | |||||||||||

| Loss from discontinued operations, net of taxes |

7,049 | 576 | — | — | — | |||||||||||

| Impairment of intangibles(a) |

— | — | 9,134 | — | — | |||||||||||

| Management fee and other expenses(b) |

3,748 | 4,054 | 3,602 | 2,745 | 2,324 | |||||||||||

| Gain on extinguishment of debt(c) |

— | — | (1,640 | ) | — | — | ||||||||||

| Transaction costs(d) |

— | — | 2,386 | 1,805 | 578 | |||||||||||

| Restricted unit expense(e) |

617 | 560 | 625 | 439 | 558 | |||||||||||

| Insurance subsidiary interest income |

2,024 | 2,867 | 3,341 | 3,040 | 2,138 | |||||||||||

| Severance and other charges |

1,164 | 3,693 | 1,549 | 1,340 | 301 | |||||||||||

| Adjusted EBITDA* |

$ | 125,980 | $ | 152,780 | $ | 157,837 | $ | 139,909 | $ | 137,059 | ||||||

| * | Adjusted EBITDA totals are not adjusted for the favorable effects of professional liability loss reserve adjustments associated with prior years of $12,068, $32,089, $34,927, $40,364 and $18,824 for the years ended December 31, 2006, 2007 and 2008, and the nine months ended September 30, 2008 and 2009, respectively. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.” Adjusting for the effects of professional liability loss reserve adjustments associated with prior years, Adjusted EBITDA would have been reduced to $113,912, $120,691, $122,910, $99,545 and $118,235 for the years ended December 31, 2006, 2007 and 2008, and the nine months ended September 30, 2008 and 2009, respectively. |

| (a) | Includes impairment of goodwill. |

| (b) | Reflects management sponsor fees, loss on disposal of assets and realized gain on investments. |

| (c) | Reflects the gain on the retirement of a portion of the senior subordinated notes, net of write-off of deferred financing costs. |

| (d) | Reflects expenses associated with acquisition transaction fees. |

| (e) | Reflects costs related to the recognition of expense in connection with the issuance of restricted units under the Team Health, Inc. 2005 Unit Plan. |

| (5) | Reflects expenditures for property and equipment used in our business. |

| (6) | Reflects the net funding of cash for investments held by our captive insurance subsidiary as reported in our statements of cash flows by netting purchases of investments at insurance subsidiary and proceeds from investments at insurance subsidiary. |

| (7) | Working capital means current assets minus current liabilities. |

11

Table of Contents

An investment in our common stock involves risks. Before investing in our common stock, you should carefully consider the following information about these risks, together with the other information contained in this prospectus, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and the notes thereto included elsewhere in this prospectus. If any of the following risks actually occurs, our business, financial condition, operating results and prospects could be adversely affected, which in turn could adversely affect the value of our common stock.

Risks Related to Our Business

The current U.S. and global economic conditions could materially adversely affect our results of operations and business condition.

Our operations and performance depend significantly on economic conditions. If the current economic situation continues or deteriorates further, our business could be negatively impacted by reduced demand for our services or third-party disruptions resulting from higher levels of unemployment, government budget deficits and other adverse economic conditions. For example, loss of jobs and lack of health insurance as a result of the deterioration of the economy could depress demand for healthcare services generally. Patient volume trends in our hospital EDs could be adversely affected as individuals potentially defer or forego seeking care in such departments due to the loss or reduction of coverage previously available to such individuals under commercial insurance or government healthcare programs. In addition, the continuation of the current economic downturn may adversely impact our ability to collect for the services we provide as higher unemployment and reductions in commercial managed care enrollment may increase the number of uninsured and underinsured patients seeking healthcare at one of our staffed EDs. We could also be negatively affected if the federal government or the states reduce funding of Medicare, Medicaid and other federal and state healthcare programs in response to increasing deficits in their budgets. Additionally, private third-party payers may take cost-containment measures, including lowering reimbursement rates or increasing patient co-payments and deductibles, which could adversely affect our business. Any of these risks, among other economic factors, could have a material adverse effect on our financial condition and operating results, and the risks could become more pronounced if the problems in the U.S. and global economies continue or become worse.

The current U.S. and state health reform legislative initiatives could adversely affect our operations and business condition.

The Obama Administration and Congress are considering federal legislation to reform the U.S. healthcare system. The current proposed federal health reform legislation includes various bills with various Congressional sponsors. A common issue addressed in the proposed federal health reform initiatives is increasing access to health benefits for the uninsured or underinsured populations. Some of the current proposed federal health reform legislation includes Medicare payment reforms and reductions that could reduce physician payments in the future. Some states also have pending health reform legislative initiatives. At this time, we are unable determine the ultimate content or timing of any health reform legislation. We will not be able to determine the effect that any such legislation may have on our operations and business condition until such legislation is enacted, but such legislation may adversely affect our operations and business condition.

Laws and regulations that regulate payments for medical services made by government sponsored healthcare programs could cause our revenues to decrease.

Our affiliated physician groups derive a significant portion of their net revenues less provision for uncollectibles from payments made by government sponsored healthcare programs such as Medicare and state reimbursed programs. There are public and private sector pressures to restrain healthcare costs and to restrict reimbursement rates for medical services. Any change in reimbursement policies, practices, interpretations,

12

Table of Contents

regulations or legislation that places limitations on reimbursement amounts or practices could significantly affect hospitals, and consequently affect our operations unless we are able to renegotiate satisfactory contractual arrangements with our hospital clients and contracted physicians.

Under Medicare law, Centers for Medicare & Medicaid Services, or CMS, is required to adjust the Medicare Physician Fee Schedule, or MPFS, payment rates annually based on an update formula which includes application of the sustainable growth rate, or SGR, that was adopted in the Balanced Budget Act of 1997. This formula has yielded negative updates every year beginning in 2002, although CMS was able to take administrative steps to avert a reduction in 2003 and Congress has taken a series of legislative actions to prevent reductions from 2004 to 2009.

On October 30, 2008, CMS released its final 2009 MPFS covering the period from January 1, 2009 through December 31, 2009. As a result of a 1.1% statutory increase in the 2009 MPFS and an increase in the physician work values associated with certain emergency services, we estimate that the 2009 MPFS effectively provides for an average 4.0% increase in the 2009 payment amount over the 2008 payment amount for services most commonly provided by emergency physicians. We estimate these payment updates will increase our revenues from Medicare and other revenue sources whose rates are linked to the Medicare fee schedule by an estimated $9.0 million in 2009. Additionally, the 2009 MPFS extends the Physician Quality Reporting Initiative, or PQRI, payment incentive for physicians who successfully report measures under PQRI for 2009 and 2010. The payments under the PQRI extension increased from 1.5% in 2008 to 2.0% in 2009.

On October 30, 2009, CMS released its final 2010 MPFS payment changes covering the period from January 1, 2010 through December 30, 2010. The final rule includes a 21.2% rate reduction in the MPFS for 2010 as a result of the application of the SGR. The PQRI payment incentives for physicians who successfully report measures under PQRI will remain at 2.0% for 2010. Although there are current legislative proposals that call for a delay in the application of the SGR until 2011 and increase physician payments by 0.5% for 2010, such proposals have not yet been enacted. Absent regulatory changes or further Congressional action with respect to the application of the SGR, Medicare physician services would be subject to significant reductions beginning on January 1, 2010.

Any future reductions in amounts paid by government programs for physician services or changes in methods or regulations governing payment amounts or practices could cause our revenues to decline and we may not be able to offset reduced operating margins through cost reductions, increased volume or otherwise.

If governmental authorities determine that we violate Medicare, Medicaid or other government payer reimbursement laws or regulations, our revenues may decrease and we may have to restructure our method of billing and collecting Medicare, Medicaid or other government program payments, respectively.

The Medicare Prescription Drug Improvement and Modernization Act of 2003 amended the Medicare reassignment statute as of December 8, 2003 to permit our independent contractor physicians to reassign their right to receive Medicare payments to us. We have restructured our method of billing and collecting Medicare payments in light of this statutory reassignment exception. In addition, state Medicaid programs have similar reassignment rules. While we seek to comply substantially with applicable Medicaid reassignment regulations, government authorities may find that we do not comply in all respects with these regulations.

We utilize physician assistants and nurse practitioners, sometimes referred to collectively as mid-level practitioners, to provide care under the supervision of our physicians. State and federal laws require that such supervision be performed and documented using specific procedures. We believe our billing and documentation practices related to our use of mid-level practitioners substantially comply with applicable state and federal laws, but enforcement authorities may find that our practices violate such laws.

When our services are covered by multiple third-party payers, such as a primary and a secondary payer, financial responsibility must be allocated among the multiple payers in a process known as “coordination of

13

Table of Contents

benefits,” or COB. The rules governing COB are complex, particularly when one of the payers is Medicare or another government program. Although we believe we currently have procedures in place to assure that we comply with applicable COB rules and that we process refunds appropriately when we receive overpayments or overprovisions, payers or enforcement agencies may determine that we have violated these requirements.

Reimbursement to us is typically conditioned on our providing the correct procedure and diagnosis codes and properly documenting both the service itself and the medical necessity of the service. Despite our measures to ensure coding accuracy, third-party payers may disallow, in whole or in part, requests for reimbursement based on determinations that certain amounts are not reimbursable, that the service was not medically necessary, that there was a lack of sufficient supporting documentation, or for other reasons. Incorrect or incomplete documentation and billing information, or the incorrect selection of codes, could result in nonpayment, recoupment or allegations of billing fraud.

Management is not aware of any inquiry, investigation or notice from any governmental entity indicating that we are in violation of any of the Medicare, Medicaid or other government payer reimbursement laws and regulations. However, such laws and related regulations and regulatory guidance may be ambiguous or contradictory, and may be interpreted or applied by prosecutorial, regulatory or judicial authorities in ways that we cannot predict. Accordingly, our arrangements and business practices may be the subject of government scrutiny or be found to violate applicable laws.

We may incur substantial costs defending our interpretations of federal and state government regulations and if we lose, the government could force us to restructure our operations and subject us to fines, monetary penalties and exclusion from participation in government-sponsored programs such as Medicare and Medicaid.

Our operations, including our billing and other arrangements with healthcare providers, are subject to extensive federal and state government regulation. Such regulations include numerous laws directed at payment for services, conduct of operations, preventing fraud and abuse, laws prohibiting general business corporations, such as us, from practicing medicine, controlling physicians’ medical decisions or engaging in some practices such as splitting fees with physicians, and laws regulating billing and collection of reimbursement from government programs, such as Medicare and Medicaid, and from private payers. Those laws may have related rules and regulations that are subject to interpretation and may not provide definitive guidance as to their application to our operations, including our arrangements with hospitals, physicians and professional corporations. See “Business—Regulatory Matters.”

We believe we are in substantial compliance with these laws, rules and regulations based upon what we believe are reasonable and defensible interpretations of these laws, rules and regulations. However, federal and state laws are broadly worded and may be interpreted or applied by prosecutorial, regulatory or judicial authorities in ways that we cannot predict. Accordingly, our arrangements and business practices may be the subject of government scrutiny or be found to violate applicable laws. If federal or state government officials challenge our operations or arrangements with third parties that we have structured based upon our interpretation of these laws, rules and regulations, the challenge could potentially disrupt our business operations and we may incur substantial defense costs, even if we successfully defend our interpretation of these laws, rules and regulations. In addition, if the government successfully challenges our interpretation as to the applicability of these laws, rules and regulations as they relate to our operations and arrangements with third parties, that may have a material adverse effect on our business, financial condition and results of operations.

In the event regulatory action were to limit or prohibit us from carrying on our business as we presently conduct it or from expanding our operations to certain jurisdictions, we may need to make structural, operational and organizational modifications to our company and/or our contractual arrangements with third party payers, physicians, professional corporations and hospitals. Our operating costs could increase significantly as a result. We could also lose contracts or our revenues could decrease under existing contracts. Moreover, our financing agreements may also prohibit modifications to our current structure and consequently require us to obtain the

14

Table of Contents

consent of the holders of such indebtedness or require the refinancing of such indebtedness. Any restructuring would also negatively impact our operations because our management’s time and attention would be diverted from running our business in the ordinary course.

For example, while we believe that our operations and arrangements comply substantially with existing applicable laws relating to the corporate practice of medicine and fee splitting, we cannot assure you that our existing contractual arrangements, including non-competition agreements with physicians, professional corporations and hospitals, will not be successfully challenged in certain states as unenforceable or as constituting the unlicensed practice of medicine or prohibited fee splitting. In this event, we could be subject to adverse judicial or administrative interpretations or to civil or criminal penalties, our contracts could be found to be legally invalid and unenforceable or we could be required to restructure our contractual arrangements with our affiliated physician groups.

We are subject to billing investigations by federal and state authorities that could have a material adverse effect on our business, financial conditions and results of operations.

State and federal statutes impose substantial penalties, including civil and criminal fines, exclusion from participation in government healthcare programs and imprisonment, on entities or individuals (including any individual corporate officers or physicians deemed responsible) that fraudulently or wrongfully bill governmental or other third-party payers for healthcare services. In addition, federal and certain state laws allow a private person to bring a civil action in the name of the U.S. government for false billing violations or other types of false claims. We believe that additional audits, inquiries and investigations from government agencies will continue to occur from time to time in the ordinary course of our business, which could result in substantial defense costs to us and a diversion of management’s time and attention. Such pending or future audits, inquiries or investigations, or the public disclosure of such matters, may have a material adverse effect on our business, financial condition and results of operations.

We are subject to complex rules and regulations that govern our licensing and certification, and the failure to comply with these rules can result in delays in, or loss of, reimbursement for our services or civil or criminal sanctions.

We, our affiliated physicians and the facilities in which we operate are subject to various federal, state and local licensing and certification laws and regulations and accreditation standards and other laws relating to, among other things, the adequacy of medical care, equipment, personnel and operating policies and procedures. We are also subject to periodic inspection by governmental and other authorities to assure continued compliance with the various standards necessary for licensing and accreditations.

In certain jurisdictions, changes in our ownership structure require pre- or post-notification to governmental licensing and certification agencies. Relevant laws and regulations may also require re-application and approval to maintain or renew our operating authorities or require formal application and approval to continue providing services under certain government contracts.

The relevant laws and regulations are complex and may be unclear or subject to interpretation. We are pursuing the steps we believe we must take to retain or obtain all requisite operating authorities. While we have made reasonable efforts to substantially comply with federal, state and local licensing and certification laws and regulations and accreditation standards based upon what we believe are reasonable and defensible interpretations of these laws, regulations and standards, agencies that administer these programs may find that we have failed to comply in some material respects. Failure to comply with these licensing, certification and accreditation laws, regulations and standards could result in our services being found non-reimbursable or prior payments being subject to recoupment, and can give rise to civil or, in extreme cases, criminal penalties.

In order to receive payment from Medicare, Medicaid and certain other government programs, healthcare providers are required to enroll in these programs by completing complex enrollment applications.

15

Table of Contents

Certain government programs, including Medicare and Medicaid programs, require notice or re-enrollment when certain ownership changes occur. Generally, in jurisdictions where we are required to obtain a new licensing authority, we may also be required to re-enroll in that jurisdiction’s government payer program. If the payer requires us to complete the re-enrollment process prior to submitting reimbursement requests, we may be delayed in payment, receive refund requests or be subject to recoupment for services we provide in the interim.

Compliance with these change in ownership requirements is complicated by the fact that they differ from jurisdiction to jurisdiction, and in some cases are not uniformly applied or interpreted even within the same jurisdiction. Failure to comply with these enrollment and reporting requirements could lead not only to delays in payment and refund requests, but in extreme cases could give rise to civil (including refunding of payments for services rendered) or criminal penalties in connection with prior changes in our operations and ownership structure. While we made reasonable efforts to substantially comply with these requirements in connection with prior changes in our operations and ownership structure, the agencies that administer these programs may find that we have failed to comply in some material respects.

We could be subject to professional liability lawsuits, some of which we may not be fully insured against or reserved for, which could adversely affect our financial condition and results of operations.

In recent years, physicians, hospitals and other participants in the healthcare industry have become subject to an increasing number of lawsuits alleging medical malpractice and related legal theories such as negligent hiring, supervision and credentialing, and vicarious liability for acts of their employees or independent contractors. Many of these lawsuits involve large claims and substantial defense costs. Although we do not engage in the practice of medicine or provide medical services nor do we control the practice of medicine by our affiliated physicians or affiliated medical groups or the compliance with regulatory requirements applicable to such physicians and physician groups, we have been and are involved in this type of litigation, and we may become so involved in the future. In addition, through our management of hospital departments and provision of non-physician healthcare personnel, patients who receive care from physicians or other healthcare providers affiliated with medical organizations and physician groups with whom we have a contractual relationship could sue us.

Effective March 12, 2003, we began insuring our professional liability risks principally through a program of self-insurance reserves, commercial insurance and a captive insurance company arrangement. Under our current professional liability insurance program, our exposure for claim losses under professional liability insurance policies provided to affiliated physicians and other healthcare practitioners is limited to the amounts of individual policy coverage limits but there is no limit for claim losses that exceed aggregate losses incurred under all insurance provided to affiliated physicians and other healthcare practitioners or for individual or aggregate professional liability losses incurred by us or other corporate entities that exceed aggregate losses incurred under such insurance. Further, we may be exposed to individual claim losses in excess of limits of coverage under existing or historical insurance programs. While our provisions for professional liability claims and expenses are determined through actuarial estimates, such actuarial estimates may be exceeded by actual losses and related expenses in the future. Claims, regardless of their merit or outcome, may also adversely affect our reputation and ability to expand our business.

We could also be liable for claims against our affiliated physicians for incidents that occurred but were not reported during periods for which claims-made insurance covered the related risk. Under generally accepted accounting principles, the cost of professional liability claims, which includes costs associated with litigating or settling claims, is accrued when the incidents that give rise to the claims occur. The accrual includes an estimate of the losses that will result from incidents, which occurred during the claims-made period, but were not reported during that period. These claims are referred to as incurred-but-not-reported claims, or IBNR claims. With respect to those physicians for whom we provide coverage for claims that occurred during periods prior to March 12, 2003, we have acquired extended reporting period coverage, or tail coverage, for IBNR claims from a commercial insurance company. Claim losses for periods prior to March 12, 2003 may exceed the limits of available insurance coverage or reserves established by us for any losses in excess of such insurance coverage limits.

16

Table of Contents

Furthermore, for those portions of our professional liability losses that are insured through commercial insurance companies, we are subject to the credit risk of those insurance companies. While we believe our commercial insurance company providers are currently creditworthy, such insurance companies may not remain so in the future.

The reserves that we have established for our professional liability losses are subject to inherent uncertainties and any deficiency may lead to a reduction in our net earnings.

We have established reserves for losses and related expenses that represent estimates at a given point in time involving actuarial and statistical projections of our expectations of the ultimate resolution and administration of costs of losses incurred for professional liability risks for the period on and after March 12, 2003. We have also established a reserve for potential losses in excess of commercial insurance aggregate coverage limits for the period prior to March 12, 2003. Insurance reserves are inherently subject to uncertainty. Our reserves are based on historical claims, demographic factors, industry trends, severity and exposure factors and other actuarial assumptions. Studies of projected ultimate professional liability losses are performed at least annually. We use the actuarial estimates to establish reserves. Our reserves could be significantly affected should current and future occurrences differ from historical claim trends and expectations. While claims are monitored closely when estimating reserves, the complexity of the claims and the wide range of potential outcomes often hampers timely adjustments to the assumptions used in these estimates. Actual losses and related expenses may deviate, perhaps substantially, from the reserve estimates reflected in our financial statements. If our estimated reserves are determined to be inadequate, we will be required to increase reserves at the time of such determination, which would result in a corresponding reduction in our net earnings in the period in which such deficiency is determined. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates—Insurance Reserves,” Note 14 to the audited consolidated financial statements and Note 11 to the unaudited consolidated financial statements included in this prospectus.

We depend on reimbursements by third-party payers, as well as payments by individuals, which could lead to delays and uncertainties in the reimbursement process.

We receive a substantial portion of our payments for healthcare services on a fee for service basis from third-party payers, including Medicare, Medicaid, the U.S. government’s military healthcare system and other governmental programs, private insurers and managed care organizations. We received approximately 57% of our net revenues less provision for uncollectibles from such third-party payers during 2008 and 2007. Such amounts included approximately 24% from Medicare and Medicaid, collectively, in 2008 and 2007.

The reimbursement process is complex and can involve lengthy delays. Third-party payers continue their efforts to control expenditures for healthcare, including proposals to revise reimbursement policies. While we recognize revenue when healthcare services are provided, there can be delays before we receive payment. In addition, third-party payers may disallow, in whole or in part, requests for reimbursement based on determinations that certain amounts are not reimbursable under plan coverage, that services provided were not medically necessary, that services rendered in an ED did not require ED level care or that additional supporting documentation is necessary. Retroactive adjustments may change amounts realized from third-party payers. We are subject to governmental audits of our reimbursement claims under Medicare, Medicaid, the U.S. government’s military healthcare system and other governmental programs and may be required to repay these agencies if a finding is made that we were incorrectly reimbursed. Delays and uncertainties in the reimbursement process may adversely affect accounts receivable, increase the overall costs of collection and cause us to incur additional borrowing costs.

We also may not be paid with respect to co-payments and deductibles that are the patient’s financial responsibility, or in those instances when physicians provide healthcare services to uninsured and underinsured individuals. Amounts not covered by third-party payers are the obligations of individual patients for which we may not receive whole or partial payment. We may not receive whole or partial payments from uninsured and underinsured individuals. As a result of government laws and regulations requiring hospitals to screen and treat

17

Table of Contents

patients who have an emergency medical condition regardless of their ability to pay and our obligation to provide such screening or treatment, a substantial increase in self-pay patients could result in increased costs associated with physician services for which sufficient net revenues less provision for uncollectibles are not realized to offset such additional physician service costs. In such an event, our earnings and cash flow would be adversely affected, potentially affecting our ability to maintain our restrictive debt covenant ratios and meet our financial obligations.

In summary, the risks associated with third-party payers, co-payments and deductibles and uninsured individuals and the inability to monitor and manage accounts receivable successfully could have a material adverse effect on our business, financial condition and results of operations. Furthermore, our collection policies or our provisions for allowances for Medicare, Medicaid and contractual discounts and doubtful accounts receivable may not be adequate.

We are subject to the financial risks associated with our fee for service contracts which could decrease our revenues, including changes in patient volume, mix of insured and uninsured patients and patients covered by government sponsored healthcare programs and third party reimbursement rates.

We derive our revenues primarily through two types of arrangements. If we have a flat fee contract with a hospital, the hospital bills and collects fees for physician services and remits a negotiated amount to us monthly. If we have a fee for service contract with a hospital, either we or our affiliated physicians collect the fees for physician services. Consequently, under fee for service contracts, we assume the financial risks related to changes in the mix of insured, uninsured and underinsured patients and patients covered by government sponsored healthcare programs, third party reimbursement rates and changes in patient volume. We are subject to these risks because under our fee for service contracts, our fees decrease if a smaller number of patients receive physician services or if the patients who do receive services do not pay their bills for services rendered or we are not fully reimbursed for services rendered. Our fee for service contractual arrangements also involve a credit risk related to services provided to uninsured and underinsured individuals. This risk is exacerbated in the hospital ED physician-staffing context because federal law requires hospital EDs to evaluate all patients regardless of the severity of illness or injury. We believe that uninsured and underinsured patients are more likely to seek care at hospital EDs because they frequently do not have a primary care physician with whom to consult. We also collect a relatively smaller portion of our fees for services rendered to uninsured and underinsured patients than for services rendered to insured patients. In addition, fee for service contracts also have less favorable cash flow characteristics in the start-up phase than traditional flat-rate contracts due to longer collection periods. Our revenues could also be reduced if third-party payers successfully negotiate lower reimbursement rates for our physician services.

Failure to timely or accurately bill for our services could have a negative impact on our net revenues, bad debt expense and cash flow.

Billing for ED visits in a hospital setting and other physician-related services is complex. The practice of providing medical services in advance of payment or, in many cases, prior to assessment of ability to pay for such services, may have a significant negative impact on our net revenues, bad debt expense and cash flow. We bill numerous and varied payers, including self-pay patients, various forms of commercial insurance companies and Medicare, Medicaid, the U.S. government’s military healthcare system and other government programs. These different payers typically have differing forms of billing requirements that must be met prior to receiving payment for services rendered. Reimbursement to us is typically conditioned on our providing the proper procedure and diagnosis codes. Incorrect or incomplete documentation and billing information could result in non-payment for services rendered.

Additional factors that could complicate our billing include:

| • | disputes between payers as to which party is responsible for payment; |

| • | variation in coverage for similar services among various payers; |

18

Table of Contents

| • | the difficulty of adherence to specific compliance requirements, coding and various other procedures mandated by responsible parties; |

| • | failure to obtain proper physician enrollment and documentation in order to bill various commercial and governmental payers; |

| • | failure to identify and obtain the proper insurance coverage for the patient; and |

| • | failure to properly code for services rendered. |