Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Molecular Insight Pharmaceuticals, Inc. | d8k.htm |

Molecular Insight Pharmaceuticals, Inc. Convertible Preferred Offering Investor Presentation December 3, 2009 Exhibit 99.1 |

2 Disclaimer and Safe Harbor Disclaimer This document is based on information provided by Molecular Insight Pharmaceuticals,

Inc. (the “Company”) and other sources that the Company believes

are reliable and includes additional and updated disclosure where available. CRT Investment Banking LLC, as Placement Agent, is not making any representation or warranty that the information in this document is accurate or

complete and is not responsible for this information. The Placement Agent has not acted on your behalf to independently verify the information in this

document. Nothing in this document is, or may be relied upon as, a promise or representation by the Placement Agent or the Company as to the past or the

future. You should not construe the contents of this document as investment,

legal or tax advice. You should consult your counsel, accountant and other advisors as to legal, tax, business, financial and related aspects of a purchase of the securities offered by this document. The Company is not making any representation to you regarding the legality of an investment in the securities by you under appropriate legal investment or similar laws. Neither the Company nor the Placement Agent does or can guarantee that purchase of the securities

will result in any economic gain and may result in the loss of an

investor’s entire investment. In making an investment decision regarding the securities offered by this document, you must rely on your own examination of our Company and the terms of this offering, including, without limitation, the merits and risks involved.

No dealer, salesman or other person is authorized by the Company to give any information or make any representation other than as contained in this document in connection with this offering and other documents or information furnished by the Company in response to investor requests for additional information as provided herein. The delivery of this document at any time does not

imply that the information contained herein is correct as of any time subsequent to the date hereof. Safe Harbor Statement This presentation contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Such forward looking statements include, but are not limited to, the

available patient population for our products; our partnering opportunities and capabilities; our ability to obtain covenant relief on our bonds; and our continued

clinical trial progress, among others. The words "may," "would," "will," "expect," "estimate," "anticipate," "plan,” “believe," "intend,“ “target,” “strategy,” “potential” and similar expressions and variations are intended to identify forward-looking statements. Readers are cautioned that any such

forward-looking statements are not guarantees of future performance and involve risks and uncertainties, many of which are beyond our ability to control.

These forward-looking statements are subject to a number of risks and uncertainties that may cause actual results to differ materially from those described in the forward-looking statements. These risks include changes in laws and regulations effecting radiopharmaceuticals, our ability to raise capital to fund ongoing development and operations, completing our manufacturing capability, the price and availability of raw materials for manufacturing,

timing and results of product development and certification of our product,

unanticipated costs and delays in product development and manufacturing, our ability to hire and retain key management and technical personnel, interest of channel partners, competitive factors, and our ability to manage

growth, as well as the risks and other factors set forth in our periodic

filings with the U.S. Securities and Exchange Commission (including our Form 10-K for the year ended December 31, 2008 and our other periodic reports as filed from time to time). |

3 Company Overview Publicly traded, clinical-stage biopharmaceutical company (NasdaqGM: MIPI)

Portfolio of five clinical stage drugs, all with significant potential product

value Focused on the discovery and development of targeted therapeutic radiopharmaceuticals and molecular imaging agents for use in oncology Experienced scientific and regulatory management team, world class scientific and

clinical advisory boards Patents 32 issued; 25 pending in US (1) 163 issued; 94 pending outside US (1) Headquartered in Cambridge, MA (1) Including in-licensed. |

4 Investment Highlights Pioneer in the emerging field of molecular medicine Five clinical-stage candidates addressing seven indications with significant unmet patient needs with no visible potentially competing products in development Significant near-term partnering opportunities in oncology and cardiology; one completed partnership (Onalta), one in late stage negotiations, and one targeted for out

licensing (Zemiva) Clinical risk for certain products reduced through established history of use outside the United States Ultratrace™ is a proprietary radiolabeling technology Key clinical and corporate milestones within two years Highly experienced management team with history of success and value creation Near term value drivers have the potential to provide significant lift in equity value Partnerships with pharma companies validate the science / market opportunity Elimination of default risk on the Notes via this fund raise and anticipated covenant relief by bondholders suggests significant near term equity value recovery

|

5 Investment Highlights (continued) Commitment of Cerberus and other existing investors to participate in current fund raise provides validation of products and strategy Business development opportunities are anticipated to supply a significant portion of the needed cash for further advancement of the confirmation of the science and targeted

drugs Product value strategy can be broken into three categories: Azedra value is expected to more than “defease” the total accreted bond value Zemiva value may fund other development via the off licensing of the only cardio product Trofex is expected to provide significant upside equity value as both an imaging and therapeutic product Others (Onalta and Solazed) are bonus points |

6 Broad and Diverse Pipeline Product Candidate Indication Current Phase Status Pre PI PII PIII Azedra™ Treatment of neuroendocrine tumors using tumor’s norepinephrine uptake mechanism • Molecule commercialized outside the US • Pivotal trial – Phase II • Orphan Drug status • Fast Track designation Onalta™ Treatment of carcinoid tumors using receptor-based radiotherapeutic • Orphan Drug status • Sub-licensed to BioMedica in certain non-US territories Trofex™ Detection and monitoring of prostate cancer via binding to prostate-specific membrane antigen (PSMA) • Completed proof of concept – Phase I Solazed™ Treatment of metastatic melanoma based on melanin-binding small molecule • Orphan Drug status • Initiated proof of concept 131 I-MIP- 1375 Prostate therapeutic • In discovery 99m Tc- Octreotide Neuroendocrine cancer diagnostic • In discovery Zemiva™ Detection and management of cardiac ischemia by imaging metabolic changes in the heart • Molecule commercialized outside the US • Phase III discussions ongoing with FDA • Targeted for out-licensing Pheochromocytoma Neuroblastoma |

7 Clinical Development Timeline 2009 2010 2011 2012 2013 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 Azedra Neuro Azedra Pheo Trofex Onalta Solazed Zemiva IBN201 Pivotal Phase II Trial Phase III Confirmatory Trial Submit NDA NDA Approval IB12b Pivotal Phase II Trial Phase III Confirmatory Trial Submit NDA NDA Approval Phase I Clinical and Nonclinical Studies EU Phase III Confirmatory Trial Submit MAA MAA Approval Phase I Dosimetry Study (NIH Funded) Phase III FDA Agreement |

8 Proven Management Team Executive Experience Daniel Peters President and CEO Chairman of the Board of Phidias AB and also serves on the board of MDRNA, Inc. Previously served as President and CEO of Medical Diagnostics for GE Healthcare

Successfully integrated Amersham Health into GE Healthcare Former Chief Operating Officer of Amersham Health John W. Babich, PhD Co-Founder, CSO, Executive VP, and President of R&D Former Assistant Professor of Radiology at Harvard Medical School and Staff Radiopharmaceutical Chemist at Massachusetts General Hospital Former Principal Scientist and Head of the Radiopharmaceuticals at the Institute of

Cancer Research in England BS degree in Pharmaceutical Sciences from St. John’s University; MS from

University of Southern California; PhD from the University of London

Charles Abdalian CFO, and Senior VP of Finance Over 30 years of experience in executive financial management; has been responsible for building value at early- to mid-stage biopharmaceutical companies Former Chief Financial Officer at Coley Pharmaceutical Group, Inc. Successfully negotiated and completed sale of Coley to Pfizer Former Audit Partner at Coopers & Lybrand (PWC) Norman LaFrance, MD CMO, and Senior VP More than 20 years of experience with molecular imaging and therapeutic companies

Widely published and experienced in imaging and therapeutic medical research

Board-certified in Internal Medicine and Nuclear Medicine and a Fellow in the American College of Physicians and the American College of Nuclear Physicians

Masters and BS in Nuclear Engineering and Science from Rensselaer Polytechnic

Institute; MD from the University of Arizona |

9 Board of Directors Board Member Experience Joseph M. Limber Chairman of the Board Current President and Chief Executive Officer of Prometheus Laboratories John W. Babich, PhD David R. Epstein President and Chief Executive Officer of Novartis Oncology and former Chief Operating Officer of Novartis Pharmaceuticals Corporation Daniel Frank Managing Director at Cerberus Capital Management Scott Gottlieb, MD Yvonne Greenstreet, MD Senior Vice President and Chief of Strategy, R&D at GlaxoSmithKline Daniel L. Peters President and Chief Executive Officer of Molecular Insight Pharmaceuticals David M. Stack Executive Partner of MPM Capital and Managing Partner of Stack Pharmaceutical

Lionel Sterling Founder and Partner of Equity Resources Executive Vice President, Chief Scientific Officer and President of Research Former Deputy Commissioner for Medical and Scientific Affairs at the FDA |

10 Scientific Advisory Board Board Member Experience William C. Eckelman, PhD Chairman Former Chief of Positron Emission Tomography (PET) Department, National Institutes of Health (NIH) Ronald Van Heertum, MD Professor of Radiology, Acting Chairman of Radiology, Director of the Division of

Nuclear Medicine and PET, Columbia University College of Physicians &

Surgeons Duncan Hunter, PhD Professor and Associate Dean of Science, University of Western Ontario Rob Mairs, PhD Head of Pediatric Oncology, Cancer Research UK Beatson Laboratories, University of Glasgow Martin Pomper, MD Professor of Radiology, Pharmacology, Molecular Sciences and Oncology, Johns

Hopkins University John Thornback, PhD Chairman, Sestria Limited John F. Valliant, PhD Associate Professor of Chemistry, McMaster University Jon A Zubieta, PhD Distinguished Professor of Chemistry, Syracuse University

|

11 MIPI’s Transformational Molecular Imaging Products Enables early detection, appropriate staging and monitoring of disease Low radiation dose Sensitivity to detect disease when anatomy is still normal Specificity allows disease to be characterized and identified Whole body scanning and 3-D imaging easily performed Large installed base of imaging equipment exists at accredited hospitals Trofex, Zemiva & 99m Tc-Octreotide |

12 A New Generation of Targeted Oncology Therapeutics Specific targeting delivery of systemic radiotherapy – spares normal tissue Potentially effective anti-cancer treatment Minimal side effects compared to chemotherapy Potential to improve safety and efficacy of cancer therapy Palliation and combination therapy possible Azedra, Onalta, Solazed & 131 I-MIP-1375 |

13 Business Strategy Establish a market leading oncology-focused specialty pharmaceutical company

committed to the discovery, development and commercialization of both

targeted radio-therapeutic compounds and targeted molecular imaging

radiopharmaceuticals Primary areas of focus include neuroendocrine tumors, prostate cancer and metastatic melanoma Pursue near term and significant partnering opportunities where appropriate Azedra: standalone development and commercialization with a potential partner Trofex: therapeutic standalone development and commercialization with a potential partner Zemiva: out licensing to a cardio oriented nuclear medicine partner Onalta: additional partnering opportunities in regions not covered by BioMedica transaction Solazed: potential partnering at latter stage |

14 Leadership in Oncologic Radiopharmaceuticals Targeted radiotherapy is an increasingly important contributor in cancer treatment

Rational care Proven means to effect tumor remission Logical option in delivering treatment efficacy Imaging is critical in the diagnosis and management of most cancer; it is expected to be

increasingly deployed to determine treatment options reflecting new

technologies with greater discrimination MIP has deployed extensive resources to advance targeted radioimaging and radiotherapeutics, and is a leader in the field The market for radiotherapeutics is expected to grow substantially over the next 10

years, reflecting targeted products with more defined therapeutic

efficacy |

15 Enhanced Imaging Technology Enhanced imaging, directed at clinically relevant targets, will increasingly impact

cancer treatment selection and monitoring Essentially non-invasive method to determine tumor size and location Visualize pathology-associated physiological, cellular, and molecular processes in active tumor disease Quantify clinically relevant variables Blood flow, oxygen consumption, glucose metabolism, proliferation, hypoxia, apoptosis, etc. Molecular Imaging Broadly expands capabilities of conventional anatomical imaging to include staging of disease Enables earlier cancer detection Facilitates individualized treatment Allows for effective monitoring of therapeutic response Directs therapeutic intervention by tumor mass and location(s) and tumor-receptor targets imaged Cancer Treatment |

16 Treatment Options Available to Oncologists Treatment Alternatives Limitations Targets rapidly proliferating tumors Systemic administration enables treatment of primary and metastatic lesions Neo-adjuvant/adjuvant therapy options broaden efficacy Targeted therapy increases efficacy and/or reduced toxicity Severe side effects Immunosuppression Organ toxicity Secondary neoplasia Treats many solid tumors and diffuse leukemia and lymphomas Improved safety with tighter beam focus, CT-scanning and MRI tumor localization has delivered improved safety and efficacy Frequently adjunctive to other treatment options Acute and long term radiation side effects May achieve complete disease resolution alone or in combination with chemo/radiation Palliative de-bulking of late-stage/aggressive/invasive solid tumors Prevention by removing lesions that are pre-malignant or encapsulated Surgical complications Potential for tumor reseeding Can only treat solid tumors Limited to accessible tumor sites Less invasive and less toxic than conventional therapy Targets specific cancers with reduced side effects Utilizes immune system to target cancer cells Anaphylactic reactions Potential for other side effects Multiple and increasingly diverse treatment options are available to oncologists, each

with unique modes of intervention, outcomes benefit, and use

limitations Targeted radiotherapy (“TRT”) representing an

important new treatment option |

17 Targeted Radiotherapeutics Provide Unique Benefits As a single agent, radiotherapeutics have: Cured cancer: I-131 in thyroid cancer Effected complete remission: I-131-MIBG in neuroblastoma And are: Utilized as first-line treatment Effective in consolidation therapy Effective for palliation Targeted Radiotherapy Demonstrated benefit in solid tumors where no alternative treatment options are available High energy induced destruction of cancer cells independent of pathway activity Treats disseminated diseases with exquisite targeting accomplished with targeting molecules Ability to non-surgically debulk large tumor masses (decompression) |

18 Targeted Radiotherapy Debulking of Tumors Advantages Non-invasive Reaches physically inaccessible locations Performed under direct visualization Instantaneous response Minimally invasive procedure Spares healthy tissue Reduces blood loss Short recuperative time Non-invasive Reaches inaccessible locations Spares healthy tissue Short recovery period Disadvantages Severe side effects Unacceptable impact on patient QoL Limited utility Painful Potential for infection Potential for long recovery time Limited accessibility Potential for infection Contraindicated due to limited accessibility Longer response time than surgery or ablation Not universally applicable Chemotherapeutic Debulking Surgical Debulking RF / Laser Ablation Targeted Radiotherapy Debulking |

Product Overview Leadership in Oncologic Radiopharmaceuticals |

20 Ultratrace™ Delivers Unique Ultrapure Radiotherapeutics Cancer cell Cancer cell Ultratrace™ maximizes delivery of radioactivity to the tumor Optimal tumor uptake means improved efficacy Low amount of drug administered significantly reduces risk of pharmacological or toxicity Ultratrace™ Technology Sub-optimal chemistry results in excess of non-radioactive molecules Non-radioactive molecules compete for “chair” on tumor cell Low number of radioactive molecules on tumor reduces therapeutic efficacy Extraneous non-radioactive molecules have the potential of producing serious pharmacological or toxic side effects Current Methods |

21 Azedra – Neuroendocrine Cancers Tumor Sites for Azedra Indications Overview Radiotherapeutic product for the treatment of metastatic neuroendocrine tumors, specifically pheochromocytoma, carcinoid and neuroblastoma Description I-131-Metaiodobenzylguanidine (“MIBG”) Mechanism of Action Azedra binds to MIBG receptors, which are commonly expressed on neuroendocrine tumors Therapy is targeted since beta particles only travel a short distance from drug- bound receptor Expected Performance Provides treatment for patients that are not amenable to treatment with surgery or conventional chemotherapy Product Status Orphan Drug status and a Fast Track designation from the US FDA Pivotal trial – Phase II Molecule commercialized both inside and outside the US for diagnostic imaging Currently available in the US on a compassionate-use basis through Draximage but contains cold contaminants and is not approved by the FDA Adrenal Glands (Pheochromocytoma and Neuroblastoma) Gastro- Intestinal Tract (Carcinoid) Posterior |

22 Azedra – Mechanism of Action Developed at the University of Michigan to image the adrenal medulla MIBG is a substrate for the norepinephrine transporter also known as Uptake-1, which is found in some normal tissues and over- expressed in a range of neuroendocrine tumors Norepinephrine uptake is responsible for MI BG uptake in neuroendocrine tumors The success of targeted radionuclide therapy is directly related to: The ability to deliver sufficient number of radioactive molecules to the tumor Maintaining an acceptable radiation dose to normal tissues MIBG Uptake Mechanism |

23 Azedra – Proven Efficacy Efficacy of I-131-MIBG has been demonstrated in children with neuroblastoma and in adults with pheochromocytoma and carcinoid J Clinical Oncology 2007 • 35% RR, improved survival Annals of New York Academy of Science 1073: 465–490 (2006) • 35% RR Cancer 2004;101:1987–93. 2004 • Improved survival; dose response Current trials in Europe combining MIBG with topotecan Multiple tumors are seen throughout the abdomen and skeleton |

24 Clinical Literature Supports Azedra Development Study Name High-Dose 131I-MBIG Therapy for Patients with Malignant Pheochromocytoma Phase II Study on Response to 131I-MBIG Therapy Refractory Neuroblastoma 131I-MBIG Double Infusion With Autologous Stem-Cell Rescue for Neuroblastoma Phase I Study Patients N=12 N=148 Rx 18mCi/kg N=16 Rx 12mCi/kg N=21 Rx ranges from 22 to 50mCi/kg Authors Rose B, Matthay KK, Price D, Huberty J, Klencke B, Norton JA, Fitzgerald PA Matthay KK, Yanik G, Messina J, Quach A, Huberty J, Chen S, Veatch J, Goldsby, Brophy P, Kersu L, Hawkins R, Maris J Matthay KK, Quach A, Huberty J, Franc B, Hawkins R, Jackson H, Groshen S, Shusterman S, Yanik G, Veatch J, Brophy P, Villablanca J, Maris J Research Centers Department of Medicine, UC San Francisco Department of Pediatrics, UC San Francisco Department of Pediatrics, UC San Francisco Journal Cancer (July 15, 2003) Journal of Clinical Oncology (March 20, 2007) Journal of Clinical Oncology (January 26, 2009) Conclusion “High-dose 131I-MIBG may lead to long-term survival in patients with malignant pheochromocytoma” “The high response rate and low nonhematologic toxicity with 131-I-MIBG suggest incorporation of this agent into initial multimodal therapy of neuroblastoma” “The lack of toxicity with this approach allowed dramatic dose intensification of 131-I- MIBG, with minimal toxicity and promising activity” |

25 Azedra – Targeted Therapeutic for Neuroendocrine Tumors Utilizes the Company’s patented Ultratrace™ technology to target the neuroendocrine cancers: neuroblastoma (children), pheochromocytoma (adults) and carcinoid Demonstrated excellent tumor targeting in initial clinical trials Demonstrated enhanced tumor kill in preclinical models of human disease Largely avoids cardiovascular side effects of other MIBG preparations Fast Track designation and Orphan Drug status granted for two indications Neuroblastoma and Pheochromocytoma • Serious life-threatening diseases • No known effective treatments • Annual incidents: 20,000 refractory patients of 100,000 patient base (1) (1) Campbell Alliance market research, December 2009. |

26 Azedra – Points of Differentiation Ultratrace technology = Improved product purity Greater tumor uptake Reduced pharmacological toxicity/side effects There are no known effective treatments for relapsed refractory neuroblastoma or

pheochromocytoma “Cold carrier” MIBG (I-131-metaiodobenzylguanidine) does not have FDA approval, and

is unlikely to pose a commercial threat Options for patients with advanced neuroendocrine tumors refractory to surgery:

Chemotherapy • Causes serious side effects with minimal benefit Experimental protocols |

27 Azedra – Development Status Pheochromocytoma (“pheo”) / Paragangaloima (“para”) Fast Track and Orphan Drug status Phase 1 dosimetry study (IB-11) completed Phase 2a dose escalation study (IB-12) completed Phase 2 therapeutic trial (IB-12b) begun June 2009 Neuroblastoma (“neuro”) P2a MTD study (IB-13/NANT-1-2007) underway with NANT consortium P2b (IB-N-201) targeted begin 4Q09 / 1Q10 depending on IRB processes |

28 Azedra – IB-12 Study Overview (Adult Pheo / Para) Study Overview Process Phase I Dose-Escalation (“IB-12”) Identify the maximum tolerated dose (“MTD”) of Ultratrace iobenguane I 131 Evaluate the safety and efficacy of Azedra in patients with malignant pheo Duke University Medical Center, New York Presbyterian Hospital, Rhode Island Hospital Dose escalation began at 6 mCi/kg and proceeded according to the 3+3 trial design with dose increases at 1 mCi/kg increments Patients were dosed by weight up to 75 kg Long term follow-up is

ongoing Safety and Toxicity Dose-limiting Toxicities (“DLTs”) Febrile neutropenia (temperature 38.5°C and ANC <1000/µL) Grade 3 thrombocytopenia with active bleeding Grade 4 hematologic toxicity > 1 week duration Grade 3-4 non-hematologic toxicity Patient Population Study Type 6.0 mCi/kg (n=3) 7.0 mCi/kg (n=6) 8.0 mCi/kg (n=6) 9.0 mCi/kg (n=6) Total Average Age Mean Range 52 36 – 72 54 30 – 72 48 39 – 55 48 34 – 65 50 30 – 72 Gender Male % Female % 0% 100% 83% 17% 67% 33% 67% 33% 62% 38% Weight in kg Mean Range 62.3 56 – 70 68.9 42 – 84 97.6 60 – 126 91.3 78 – 103 82.6 42 – 126 Race Black % White % Other % 33% 67% 0% 0% 83% 17% 17% 67% 17% 17% 83% 0% 14% 76% 10% Dose (mCi) Mean Range 375 333 – 423 463 325 – 536 572 473 – 609 661 633 – 696 538 325 – 696 |

29 Azedra – IB-12 Study Results (Adult Pheo / Para) Overview of Results Best response per RECIST was partial response (“PR”) for 3 patients (14%), stable disease for 14 (67%), progressive disease for 2 (10%), and not evaluable for 2 (10%) All 3 PRs were documented at 3 months and continued through 12 months Mean serum chromogranin A and vanillylmandelic acid levels were decreased from baseline at 3, 6 and 9 months Furthermore, 5 of 15 (33%) patients taking anti- hypertensives at time of therapy reduced or discontinued use following treatment Posterior Bone Scans 12 Months Post-Azedra Baseline 18 Months Post-Azedra Best Change in Sum of Longest Diameters of Target Lesions (1) 16% 7% (4%) (4%) (5%) (7%) (9%) (18%) (23%) (24%) (26%) (28%) (31%) (33%) (39%) (51%) (64%) (100%) (75%) (50%) (25%) 0% 25% A B C D E Patient F G H I J K L M N O P Q (1) Change from baseline displayed in this figure is each patient’s largest decrease

from baseline or smallest increase if no decrease, as viewed from Reviewer 1

of 2 Reviewers. |

30 Azedra – IB12B Study Overview (Phase II Pheo / Para) Study Overview Study Population (target n = 58) Phase 2 Pivotal Efficacy and Safety (“IB12B”) Evaluate the efficacy of Azedra in patients with malignant relapsed/refractory pheo / para Evaluate the safety of Azedra in patients with malignant relapsed/refractory pheo / para Males and females of at least 12 years of age Histologically confirmed para/pheo Failed prior therapy and not eligible for chemotherapy or other potential curative therapies Stable antihypertensive regimen At least one measurable lesion Adequate renal and hepatic function Adequate hematologic status Study Conduct Twelve US centers participating Duke Washington University Cornell Lousiana State University Johns Hopkins University of Pennsylvania MD Anderson University of Miami Mt. Sinai University of California (SF) RI Hospital University of Iowa Study currently enrolling patients Two open-label doses of Ultratrace Iobenguane I 131 (Azedra) three months apart Follow-up:1 year for primary efficacy; 5 years for survival Key Endpoints Reduction (at least 50%) in antihypertensive medication for at least 6 months Status of hypertension and changes in blood pressure Proportion of patients with complete response (“CR”) or partial response (“PR”) by RECIST criteria Quality of life Overall survival Safety |

31 Azedra – IB-N201 Study Overview (Phase II Neuro) Study Overview Study Population (target n = 100) Phase 2 Pivotal Efficacy and Safety (“IB-N201”) Evaluate the efficacy of Azedra in patients with relapsed/refractory high-risk neuroblastoma Evaluate the safety of Azedra in patients with relapsed/refractory high-risk neuroblastoma Males and females of at least 12 years of age Diagnosis of high-risk neuroblastoma that is relapsed/refractory At least one measurable, MIBG avid lesion Adequate renal, hepatic, cardiac, lung, and thyroid function Adequate hematologic status and recovery from prior chemotherapy, immunotherapy, and radiation therapy Eligible for at least one 15 mCi/kg dose of Azedra per dosimetry findings Study Conduct Eighteen US centers selected to participate Two UK centers under consideration Institutional review board/ethics committee reviews in process Two open-label doses of Ultratrace Iobenguane I 131 (Azedra) 2 - 3 months apart Follow-up: 1 year for primary efficacy; 2 years for survival Key Endpoints Proportion of patients with CR or PR by RECIST criteria over the course of two efficacy assessments Duration of response in patients with CR or PR Change in use of pain medication Quality of life Overall survival Safety |

32 Trofex – Revolutionary Prostate Cancer Diagnostic Trofex Prostate Cancer Imaging Overview Radiotherapeutic for the imaging of prostate cancer Description I-123 radiolabeled small molecule Mechanism of Action Detection of metastatic disease in men with elevated prostate specific antigen (“PSA”), but no other obvious symptoms to identify prostate cancer Expected Performance Improves therapeutic treatment strategy • Identifies presence and extent of localized, regional or distant metastatic disease • Suggests pretreatment disease burden • Monitors post treatment effects of therapy • Potential therapeutic application Product Status Completed proof of concept – Phase I Market Opportunity One out of every six U.S. men will develop prostate cancer (1) US population: prevalence >2.2 million; annual incidence >200,000; annual deaths 30,000 (1) Cancer Facts and Figures (2009) |

33 Trofex – Superior Imaging Technology Bladder Normal Kidneys Posterior Planar Image SPECT / CT Fused Slices of 3D Image Normal Liver Known Bone Tumor Lesion Unknown Soft Tissue (Lymph Node) Lesion |

34 Trofex – Points of Differentiation Potential to change the prostate cancer imaging landscape Current technologies lack both sensitivity and specificity for detecting metastatic

disease Small molecular size compounds have a definitive advantage

Achieve greater permeability into solid tumors, which leads to higher percent

uptake per gram of tumor tissue and a high percentage of specific

binding Likely to display improved blood clearance and tissue distribution in

normal tissues as compared with intact immunoglobulins, making lesion

detection more conspicuous Time: 4-5 days Large molecule = poor tumor penetration Prolonged blood levels = low contrast Binds to intracellular component of PSMA Limited sensitivity and specificity Unable to detect bone metastases ProstaScint ® * Prostate Cancer Imaging In Relapsed and High Risk Patients Time: 4 Hours Trofex Small molecule = good tumor penetration Rapid tumor uptake = high contrast Binds to extracellular component of PSMA Detects soft tissue and bone metastases Potential to accurately detect and stage prostate cancer * Currently available treatment Source: Health Advances (2007 Market Research) |

35 Trofex – 101 Study Overview (Prostate Cancer) Study Objectives Study Design Randomized, single blind, cross-over study patients to receive 123I-MIP-1072 & 123I-MIP-1095 10 mCi with

2 weeks between treatments Whole body A/P and SPECT images acquired several times post-injections Blood samples for pharmacokinetics and metabolism obtained several times post-injection Urine collected for clearance and metabolism several times post-injections Safety parameters monitored for 2 weeks after second administration Examine the PK, organ dosimetry, metabolism and safety of 123I-MIP-1072 & 123I-MIP-1095 in patients

with prior histological diagnosis of prostate cancer and evidence of recurrent metastatic disease Safety and Toxicity Expanded acute toxicity rat study No adverse effects observed at doses > 300X the human equivalent dose Cardiovascular effects in conscious dogs (arterial pressure, heart rate and ECG) No adverse effects observed at doses > 300 times human equivalent dose General pharmacology screen (NovaScreen™) No effects observed at 1 µM Patient Population Charac- teristic Patient Mean Std. Dev. 101 201 202 203 301 302 303 Age 66 53 67 76 70 79 86 71 10.7 Height (cm) 174 175 161 176 173 178 168 172 5.8 Weight (kg) 99 93 62 71 77 112 95 87 17.6 Race BK WH BK WH BK WH WH NA NA PSA (µg/L) 4.6 30.7 517 85.3 15.9 87.6 104.8 140.2 187.9 |

36 Trofex – 101 Study Results Tumor Uptake (Decay Corrected) Tumor to Background Ratios Planar Imaging SPECT Imaging Tumor Uptake (Not Decay Corrected) |

37 Trofex – 101 Study Conclusion Both 123I-MIP 1072 & 123I-MIP 1095 detect suspected tumors between 1 & 4

hr post- injection Both compounds have similar tumor uptake and adequate T/B ratios on a per tumor basis 123I-MIP 1072 clears the circulation more rapidly and is excreted renally while 123I-MIP 1095 does not clear as readily over the time period studied 123I-MIP 1072 is excreted intact while some metabolism was observed with

123I-MIP 1095 Human dosimetry supports a 123I diagnostic dose of 10-15 mCi Extrapolation to 131I therapy demonstrates that the kidney will be the dose-limiting

organ (assumes adequate thyroid blockade) at administered doses for

131I-MIP 1072 of 539 mCi and for 131I-MIP 1095 of 162 mCi

|

38 Onalta – Metastatic Carcinoid and Pancreatic Tumors Pancreas (Pancreatic Neuroendocrine Tumors) Posterior Tumor Sites for Onalta Indications Gastro- Intestinal Tract (Carcinoid) Overview Radiotherapeutic for the treatment of metastatic carcinoid and pancreatic tumors in patients whose symptoms are not controlled by conventional therapy Description Yttrium-90 somatostatin 487 Radioisotope Y-90 is carried by somatostatin analog Mechanism of Action Somatostatin analog binds to somatostatin receptors SST2 and SST5 expressed on neuroendocrine tumors Therapy is targeted since beta particles only travel a short distance from drug- bound receptor Expected Performance Provides treatment for patients that are refractory to somatostatin therapy Allows targeted radionuclide therapy at tumor sites expressing somatostatin receptors Product Status Orphan Drug designation in EU Completed three Phase I and three Phase II clinical trials in the U.S. EMEA has approved MIPI’s Phase 3 protocol design |

39 Onalta – Development History Time Event Q2 1997 Originating IND filed with the US FDA 3 Phase 1 trials (n = 66), 3 Phase 2 trials (n = 278) completed 2005 FDA grants Orphan Drug status for the treatment of somatostatin receptor- positive neuroendocrine gastroenteropancreatic tumors Q1 2007 Molecular Insight in-licenses Onalta program from Novartis Q4 2007 Bachem grants sub-license from Molecular Insight to produce and distribute DOTATOC peptide Q2 2008 Molecular Insight supports a physician-sponsored Phase I study in children

with refractory somatostatin receptor positive tumors at University of Iowa • Submits protocols to Sloan Kettering to complete dosimetry studies Q1 / Q2 2008 Scientific Advice Meetings with MHRA (UK) and BfArM to formalize regulatory endpoints in Phase 3 registration studies in the EU Q4 2008 EMEA grants Orphan Drug status for the treatment of somatostatin receptor- positive neuroendocrine gastroenteropancreatic tumors |

40 Onalta – Points of Differentiation Targeted radiotherapeutic with minimal pharmacological side effects Chemotherapy with single or combination cytotoxic agents has produced little

benefit Currently, patients with an endocrine-active tumor that cannot be

treated by surgery are given drugs to decrease hormone production; however,

symptom control often disappears in 6 to 18 months Competitive Landscape Class of Compound Products in Development Level of Threat Anti-angiogenic compounds • Avastin Low Multi-Kinase inhibitor • Sunitinib • Sorafenib Low mTOR Inhibitor • Everolimus (RAD-001) Low Radiotherapy • Lutate Medium Cold SST analogue • SOM-230 Low |

41 Onalta – Opportunities in the EU Currently being utilized as a first-line or second-line treatment for

refractory, somatostatin- positive patients in the EU Current patient population is unsatisfied and seeking new options Metastatic pancreatic neuroendocrine tumors (PNET) affect ~7,500 patients; ~700 currently on radiolabeled therapy Availability of a commercial radiolabeled product is anticipated to expand addressable PNET population to ~2,100 Metastatic carcinoid tumors affect ~85,000 patients; ~6,500 currently on radiolabeled

therapy Availability of a commercial radiolabeled therapy is anticipated to expand addressable carcinoid patient population to ~26,300 |

42 Onalta – Sub-Licensing Agreement Overview Sub-licensed Onalta in June 2009 to BioMedica Life Sciences, S.A., for distribution

in certain countries in Europe, Middle East, North Africa, Russia and

Turkey - BioMedica receives exclusive sub-license to intellectual property rights and

know- how - Onalta has Orphan Drug designation in EU - EMEA accepted MIPI’s Phase III protocol design and plan for EU development

MIPI retains all rights to all other markets, including the U.S., Japan, and

Asia BioMedica Responsibilities Conduct clinical studies Market, distribute and commercialize Onalta Secure all regulatory approvals Will purchase from MIPI (for 5 years with a 5-year renewal option): - Finished product (including compassionate use) - Clinical trial supplies exclusively Sub-licensing Terms Receives $4.4 million initial payment and is eligible for additional regulatory

milestone payments Total pre-commercial milestones worth >$10 million (regulatory and

upfront payments, net of license payments) MIPI eligible to receive milestone and tiered royalties on Onalta sales

|

43 Onalta – Clinical Program Overview Summary Clinical Studies Performed 338 patients treated with 90Y-edotreotide Administered doses ranged from 1.8 – 32.6 GBq Mean cumulative dose 13.8 GBq Adverse effects minimized by: Individualized dosing based upon dosimetry Concomitant amino acid infusion Monitoring renal function Clinical Benefits Study Type Phase Agent # of Subjects Disease PK & Safety 1 Y-86 24 Somatostatin-Receptor Positive Malignant Tumors PK & Safety 1 Y-86 42 Somatostatin-Receptor Positive Malignant Tumors Safety & Efficacy 1 Y-90 60 (1) Refractory Somatostatin Receptor-Positive Tumors Safety & Efficacy 2 Y-90 168 Advanced Metastatic Cancers Safety & Efficacy 2 Y-90 20 Pancreatic Endocrine Tumors Safety & Efficacy 2 Y-90 90 Symptomatic Malignant Carcinoid Tumors (1) All patients enrolled in Study B151 previously participated in Studies 0101 or B102

. Adverse Events Most commonly observed adverse events are those frequently found in advanced cancer patients: Nausea 74.9% Fatigue 39.9% Abdominal pain 21.9% Dizziness 16.0% Anorexia 13.9% Vomiting 61.8% Diarrhea 26.3% Flushing 17.2% Headache 15.7% Majority (85%) of patients with refractory carcinoid reported improvement in at least one symptom Nearly half (49%) reported improvement in four or more symptoms Majority of patients (62%) with insulinoma achieved normalization of insulin/glucose ratios Half experienced decreased requirement for somatostatin analog use |

44 (1) National Cancer Institute. Solazed – Therapeutic for Malignant Metastatic Melanoma Tumor Sites for Solazed Indications Overview Targeted radiotherapeutic for treatment of malignant metastatic melanoma Description Ioflubenzamide I 131 Mechanism of Action The drug selectively binds to melanin that is found in high concentration in melanoma cells and delivers a lethal dose of radiation Expected Performance Exhibits excellent dose response and efficacy in a model of human melanoma Exhibits favorable toxicity profile in preclinical evaluations Product Status Currently initiating Phase I clinical study to confirm proof of concept in man Market Opportunity The incidence of malignant melanoma is the fastest growing of any cancer in the US (1) Effective treatment still represents a challenge to oncologists because chemotherapeutic agents have limited activity in the treatment of metastatic melanoma |

45 Solazed – Points of Differentiation Selective targeting of metastatic melanoma Selective delivery of radiation to tumors Highly effective in human models of melanoma Minimal pharmacological toxicity of nonradioactive Solazed

|

46 Solazed – Pre-Clinical Data Time after initiation of treatment (days) 0 5 10 15 20 0 25 50 75 100 125 3 x dacarbazin 1 x Solazed 3 x Solazed + 3 x dacarbazin saline 2 x Solazed 3 x Solazed |

47 Zemiva – Improved Cardiac Ischemia Imaging Myocardium Metabolism During Ischemic Event Overview Diagnostic product for the early detection of ischemic myocardium via SPECT imaging in conjunction with early standard cardiac diagnostic data Description Iodofiltic acid I 123 Mechanism of Action Binds to fatty acid metabolizing tissue rather than tissue undergoing glycolysis Changes in fatty acid metabolism are visualized for up to 30 hours following the ischemic event Expected Performance Utility in emergency department acute setting • Improved sensitivity and specificity Proven safe • More than 400,000 patients dosed in Japan for over 10 years • Over 800 patients injected in MIP clinical trials with no major drug related adverse events • Single injection uses 1/10th radiation dose vs. Cardiac CT Product Status Molecule commercialized outside the US Phase III discussions ongoing with FDA |

48 Zemiva – Cardiac Ischemia Detection and management of cardiac ischemia by imaging metabolic changes in the heart

in the emergency department acute setting Cardiac tissue shifts from fatty-acid metabolism to glucose metabolism when

ischemic Healthy cardiac tissue accumulates Zemiva but ischemic tissue has

significantly reduced accumulation which appears as a defect on SPECT

imaging No additional stress event is necessary for imaging Ischemic Heart Insufficient oxygen supply (ischemia) causes the heart to switch from fat to carbohydrates as primary energy source Non-Ischemic Heart A healthy heart requires sufficient oxygen supply to metabolize fat |

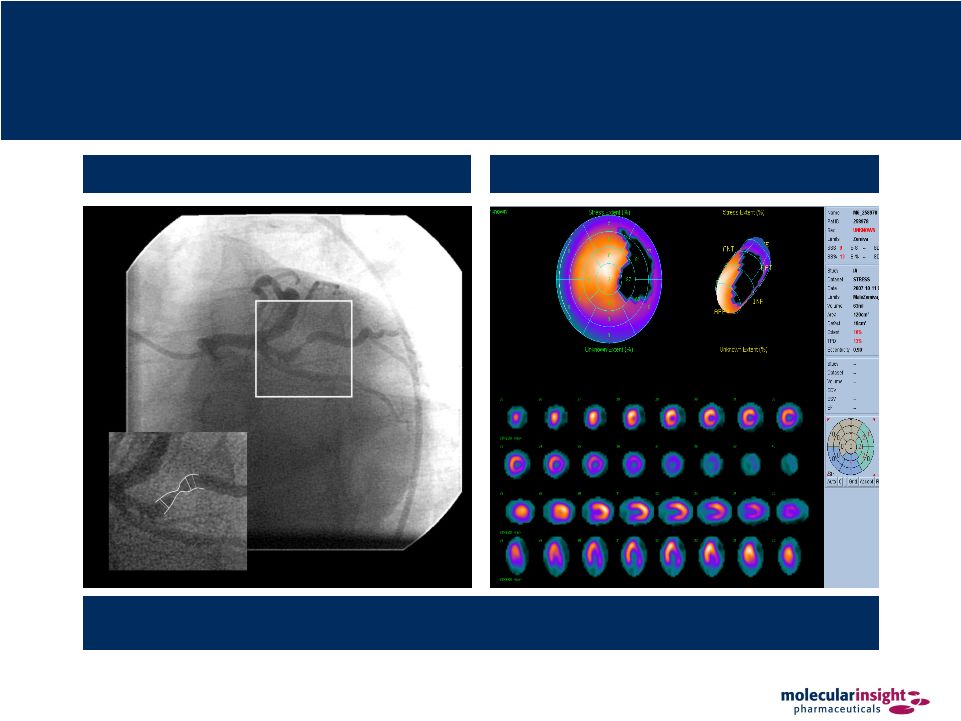

49 Zemiva – Imaging Capabilities Angiogram Zemiva SPECT Images A large defect is observed with Zemiva in the lateral wall, consistent with the

stenosis and the potential culprit lesion seen in the left circumflex

coronary artery in the angiogram |

50 Zemiva – Market Opportunity 3.5 Million Patients Equivocal Admitted for Observation ($6 billion in unnecessary hospitalizations) 1.5 Million Patients Ischemia Ruled Out Discharged (40,000 Missed Heart Attacks) 1.0 Million Patients Definitive Heart Attack Admitted for Intervention / Treatment 6 Million Patients Annually Admitted to Emergency Departments for Potential Heart

Attacks Cardiac Ischemia / ACS Life Saving Non-Cardiac Diagnosis Cost Saving Zemiva Source: Advance Data From Vital & Health Statistics Number 386, June 2007, National

Hospital Ambulatory Medical Care Survey: 2005 Emergency Dept. Summary by Eric

Nawar, M.H.S.; Richard Niska, M.D., F.A.C.E.P.; and Jianmin Xu, M.S., Division of Health Care Statistics |

51 Zemiva – Points of Differentiation Provides improved visualization that leads to more immediate and accurate diagnosis of cardiac causes of chest pain compared to either rest sestamibi perfusion scans or stress

perfusion imaging tests High negative predictive value (“NPV”) and sensitivity Immediate readout available Can detect ischemic event up to 30 hours after occurring Zemiva imaging of FA metabolism may have advantages in the diagnosis of ACS compared

with existing techniques: More rapid and sensitive detection of ischemia due to “Ischemic Memory” up to 30 hours after symptoms subside Reduced radiation exposure Eliminating need for stress (1) Source: Campbell Alliance Nov. 2009. Health Advances Nov.2005 Chest X-Ray Observation Serial Enzymes Admit to Hospital Serial ECGs Stress Test Perfusion Imaging Time: 86 Hours Cost: $7,500 (1) Zemiva Imaging Time: <1 Hour Cost: $1,750 – 2,250 (1) Current Standard of Care Zemiva |

52 Intellectual Property Overview Azedra: The Company has in-licensed patents and a pending application from The University of Western Ontario that relate to the precursor material, a process of preparing the precursor material, and the Ultratrace™ technology used to produce Azedra™ These patents are set to expire in October 2018 • The pending US application in the family has recently received a Notice of Allowance Trofex: The Company owns patent applications related to the composition and methods of use for MIP 1072 and MIP 1095 but no application has been granted Should any rights be granted in these applications, they would expire in November 2027 Onalta: The Company entered into a license agreements with Novartis Pharma AG and Mallinckrodt for Onalta The patents for Onalta will expire between November 2009 and September 2017 Solazed: The Company acquired Solazed™ from Bayer Schering Pharma through an exclusive, worldwide license Patent term for this family expire between March 2024 and March 2025 Zemiva: The Company owns patents directed to specific stereoisomers of Zemiva™ and the use of these stereoisomers as imaging agents All patents in this family are set to expire in November 2016 |

Key

Milestones and Offering Discussion |

54 Recent Molecular Insight Milestones Event Timing Clinical Advances Azedra into pivotal Phase II therapeutic trial 3Q 2009 Receives EMEA approval to proceed with Phase III trial of Onalta 2Q 2009 Releases positive Phase II exploratory trial results for Zemiva (1) 1Q 2009 Corporate Licenses Onalta for development to BioMedica 3Q 2009 Appoints Charles Abdalian to CFO and VP of Finance 3Q 2009 Appoints Daniel Peters to CEO and President 2Q 2009 (1) Although key secondary endpoints, including clinical benefit, were met, the initial

analysis of the Phase 2 clinical trial primary endpoint did not meet

predetermined performance thresholds. The reported results reflected the subsequent analysis of a subset of the sample population with sufficient objective evidence for evaluation of the diagnosis of cardiac

ischemia or myocardial infarction. These results and exclusion criteria were

determined to be the appropriate conclusion of the Phase 2 program. The Company is currently in discussions with the FDA on the design of the Phase 3 trial. |

55 Upcoming Molecular Insight Milestones Event Timing Clinical Begin Phase III Confirmatory Trial for Onalta in EU 1H 2010 Complete Phase I Clinical and Nonclinical Trofex Studies 1H 2010 Initiate Azedra pivotal Phase II study in neuroblastoma 1H 2010 Submit Azedra NDA for neuroblastoma 2011 Begin Phase III Confirmatory Trial for Azedra for neuroblastoma 1H 2011 Complete Phase III Confirmatory Trial for Onalta in EU 2H 2011 Receive Azedra NDA for neuroblastoma 2H 2011 / 1H 2012 Corporate Oncology licensing deal with partner 1Q 2010 Raise additional capital 1Q 2010 License development of Zemiva to partner 2010 |

56 Ownership and Capitalization Proceeds from offering to fund Azedra and Trofex clinical development and enhance the Company’s liquidity position Concurrently pursuing modifications to key covenants to the Senior Secured Floating Rate Bonds Liquidity and strategic validation to be further enhanced by potential partnering opportunities Source: Capital IQ. Ownership as of 6/30/09 Top 10 Holders # of Shares (MM) % Out Cerberus Capital Management, L.P. 3.7 14.8% Barlow, David S. 2.7 10.7% Savitr Capital, LLC 2.1 8.4% Poitras, James 1.3 5.2% Clough Capital Partners, L.P. 0.8 3.2% Barclays Global Investors UK Holdings 0.6 2.2% Perennial Investors, LLC 0.5 1.9% U Capital Group LP 0.5 1.8% Dimensional Fund Advisors LP 0.4 1.6% QVT Financial LP 0.4 1.4% Total Top 10 12.9 51.3% Total Other 12.3 48.7% Total Shares 25.2 100.0% Capitalization as of 11/20/09 (Amounts in millions, except per share data) Share Price (11/20/09) $4.23 Total Diluted Shares Outstanding 25.2 Equity Value $106.6 Plus Debt (Face Value) 150.0 Plus: PIK Interest 28.7 Less: Cash and Cash Equivalents (71.8) Total Eneterprise Value $213.5 |

57 Investment Highlights Pioneer in the emerging field of molecular medicine Five clinical-stage candidates addressing seven indications with significant unmet patient needs with no visible potentially competing products in development Significant near-term partnering opportunities in oncology and cardiology; one completed partnership (Onalta), one in late stage negotiations, and one targeted for out

licensing (Zemiva) Clinical risk for certain products reduced through established history of use outside the United States Ultratrace™ is a proprietary radiolabeling technology Key clinical and corporate milestones within two years Highly experienced management team with history of success and value creation Near term value drivers have the potential to provide significant lift in equity value Partnerships with pharma companies validate the science / market opportunity Elimination of default risk on the Notes via this fund raise and anticipated covenant relief by bondholders suggests significant near term equity value recovery

|

58 Investment Highlights (continued) Commitment of Cerberus and other existing investors to participate in current fund

raise provides validation of products and strategy Business development opportunities are anticipated to supply a significant portion of the needed cash for further advancement of the confirmation of the science and targeted

drugs Product value strategy can be broken into three categories:

Azedra value is expected to more than “defease” the total accreted bond value Zemiva value may fund other development via the off licensing of the only cardio product

Trofex is expected to provide significant upside equity value as both an imaging and therapeutic product Others (Onalta and Solazed) are bonus points |