Attached files

| file | filename |

|---|---|

| 8-K - HELIX ENERGY SOLUTION GROUP FORM 8-K DATED 12-2-09 - HELIX ENERGY SOLUTIONS GROUP INC | form8k.htm |

| EX-99.2 - PRESS RELEASE DATED 11-30-09 - HELIX ENERGY SOLUTIONS GROUP INC | exh992.htm |

Changing the way you

succeed.

December

2009

1

Well

Enhancer and

Seawell

intervention vessels in Aberdeen, Scotland

Changing the way you

succeed.

This

presentation contains forward-looking statements within the meaning of Section

27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934. All such statements, other than statements of

historical fact, are statements that could be deemed “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, including, without limitation, any projections of revenue, gross margin,

expenses, earnings or losses from operations, or other financial items; future production volumes, results of

exploration, exploitation, development, acquisition and operations expenditures, and prospective reserve levels of

property or wells; any statements of the plans, strategies and objectives of management for future operations; any

statements concerning developments, performance or industry rankings; and any statements of assumptions

underlying any of the foregoing. Although we believe that the expectations set forth in these forward-looking

statements are reasonable, they do involve risks, uncertainties and assumptions that could cause our results to differ

materially from those expressed or implied by such forward-looking statements. The risks, uncertainties and

assumptions referred to above include the performance of contracts by suppliers, customers and partners; employee

management issues; complexities of global political and economic developments; geologic risks and other risks

described from time to time in our reports filed with the Securities and Exchange Commission (“SEC”), including the

Company’s Annual Report on Form 10-K for the year ended December 31, 2008 and subsequent quarterly reports

on Form 10-Q. You should not place undue reliance on these forward-looking statements which speak only as of the

date of this presentation and the associated press release. We assume no obligation or duty and do not intend to

update these forward-looking statements except as required by the securities laws.

1933 and Section 21E of the Securities Exchange Act of 1934. All such statements, other than statements of

historical fact, are statements that could be deemed “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, including, without limitation, any projections of revenue, gross margin,

expenses, earnings or losses from operations, or other financial items; future production volumes, results of

exploration, exploitation, development, acquisition and operations expenditures, and prospective reserve levels of

property or wells; any statements of the plans, strategies and objectives of management for future operations; any

statements concerning developments, performance or industry rankings; and any statements of assumptions

underlying any of the foregoing. Although we believe that the expectations set forth in these forward-looking

statements are reasonable, they do involve risks, uncertainties and assumptions that could cause our results to differ

materially from those expressed or implied by such forward-looking statements. The risks, uncertainties and

assumptions referred to above include the performance of contracts by suppliers, customers and partners; employee

management issues; complexities of global political and economic developments; geologic risks and other risks

described from time to time in our reports filed with the Securities and Exchange Commission (“SEC”), including the

Company’s Annual Report on Form 10-K for the year ended December 31, 2008 and subsequent quarterly reports

on Form 10-Q. You should not place undue reliance on these forward-looking statements which speak only as of the

date of this presentation and the associated press release. We assume no obligation or duty and do not intend to

update these forward-looking statements except as required by the securities laws.

The

United States Securities and Exchange Commission permits oil and gas companies,

in their filings with the SEC,

to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation

tests to be economically and legally producible under existing economic and operating conditions. Statements of

proved reserves are only estimates and may be imprecise. Any reserve estimates provided in this presentation that

are not specifically designated as being estimates of proved reserves may include not only proved reserves but also

other categories of reserves that the SEC’s guidelines strictly prohibit the Company from including in filings with the

SEC. Investors are urged to consider closely the disclosure in the Company’s 2008 Form 10-K.

to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation

tests to be economically and legally producible under existing economic and operating conditions. Statements of

proved reserves are only estimates and may be imprecise. Any reserve estimates provided in this presentation that

are not specifically designated as being estimates of proved reserves may include not only proved reserves but also

other categories of reserves that the SEC’s guidelines strictly prohibit the Company from including in filings with the

SEC. Investors are urged to consider closely the disclosure in the Company’s 2008 Form 10-K.

2

Changing the way you

succeed.

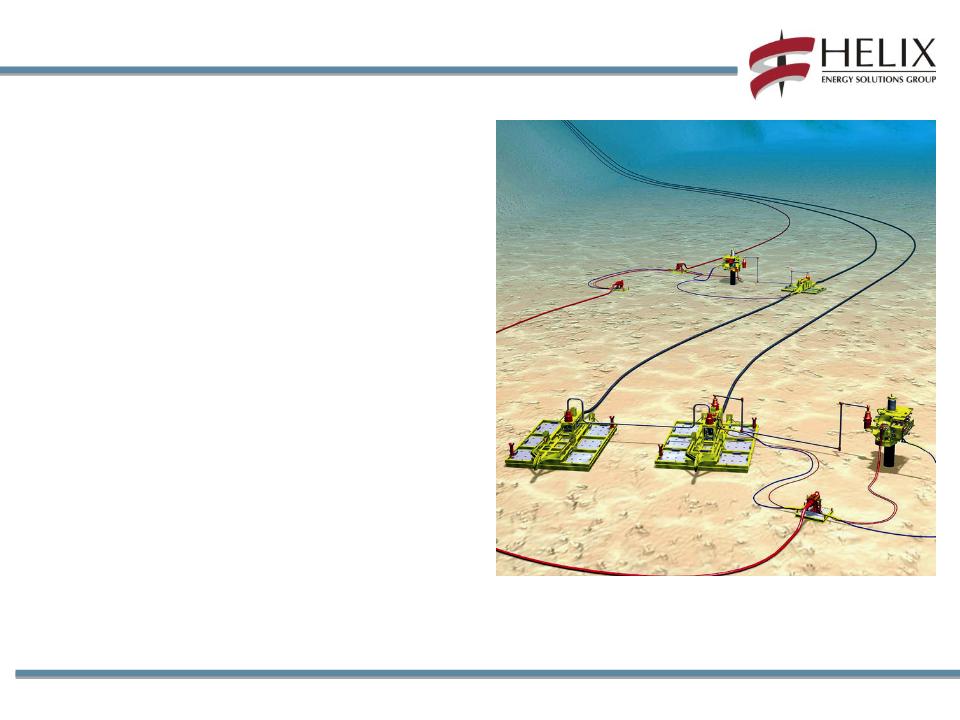

Helix

Energy Solutions Group provides life-of-field

services and development solutions to offshore

energy producers worldwide. Helix actively reduces

finding and development costs through a unique mix

of offshore production assets, service

methodologies, and highly skilled personnel.

services and development solutions to offshore

energy producers worldwide. Helix actively reduces

finding and development costs through a unique mix

of offshore production assets, service

methodologies, and highly skilled personnel.

Owen

Kratz

President

and Chief Executive Officer

Presenter

3

Changing the way you

succeed.

Historical

Profile

• Deepwater subsea

contracting

• Deepwater well

intervention

•

Robotics

• Oil and

gas

•

Deepwater

•

Shelf

•

Offshore production facilities

•

Shelf contracting (Cal Dive)

•

Reservoir evaluation and consulting

The

Future

• Deepwater

contracting services

• Well

Intervention

•

Robotics

• Subsea

Construction

• Deepwater oil and

gas

• Minimize

exploration capex

and risk

and risk

•

Offshore production facilities

The

result: A

company focused on

deepwater activities and a conservative balance sheet

deepwater activities and a conservative balance sheet

Helix

ESG: Transforming the Business Model

4

Changing the way you

succeed.

Services

For Each Stage of the Field Life Cycle

5

Changing the way you

succeed.

Production

Facilities

Marco Polo

TLP (50%)

Independence

Hub Semi (20%)

Helix

Producer I (~87%) (2010)

Subsea

Construction

Construction

Pipelay

Intrepid

Express

Intrepid

Express

Caesar- new

to fleet

ROV

39 ROVs

2 ROV Drill Units

5 Chartered Vessels

39 ROVs

2 ROV Drill Units

5 Chartered Vessels

5 Trenchers

(200 - 2000hp)

Well

Intervention

Q4000

Seawell

Well

Enhancer- new to fleet

Mobile

VDS/SILs

Helix

Oil & Gas / ERT

GOM shelf and

deepwater

PV-10 $1.9

billion @

12/31/2008

12/31/2008

Proved

reserves = 665 bcfe

(12/31/2008)

(12/31/2008)

2009

projected production

43 - 47 bcfe

43 - 47 bcfe

Helix

Business Segments

6

Changing the way you

succeed.

The

Helix Fleet

7

Caesar

departing

for sea trials, Nantong, China

Changing the way you

succeed.

MODU

DP3 Q4000

MSV

DP3 Well

Enhancer

Helix

provides well operation and decommissioning services with the Seawell

riserless well

intervention vessel, the flagship Q4000 semisubmersible, the Well Enhancer wireline / slickline /

coiled tubing intervention vessel, and the Subsea Intervention Lubricator system.

intervention vessel, the flagship Q4000 semisubmersible, the Well Enhancer wireline / slickline /

coiled tubing intervention vessel, and the Subsea Intervention Lubricator system.

SIL

System

MSV

DP2 Seawell

Well

Intervention Assets

8

Changing the way you

succeed.

DP

Reel Lay Vessel

Express

Express

DP

S-Lay Vessel

Caesar

Caesar

DP

Reel Lay Vessel

Intrepid

Intrepid

Caesar’s onboard

pipe welding and testing

capability allows the vessel to lay virtually

unlimited lengths of pipe up to 36” in diameter.

capability allows the vessel to lay virtually

unlimited lengths of pipe up to 36” in diameter.

Helix’s

flagship pipelay and subsea construction

vessel has established an extensive track record

of field installation projects around the world.

vessel has established an extensive track record

of field installation projects around the world.

Intrepid has the

flexibility to be deployed as a

pipelay, installation or saturation diving vessel.

pipelay, installation or saturation diving vessel.

Subsea

Construction Vessels

9

Changing the way you

succeed.

Helix

is an industry leading provider of ROV and subsea trenching services

to deepwater operators worldwide.

to deepwater operators worldwide.

The

Helix ROV fleet consists

of 39 vehicles, covering the

spectrum of deepwater

construction services.

of 39 vehicles, covering the

spectrum of deepwater

construction services.

The 600

hp Supertrencher II

system is designed to

operate at water depths in

excess of 6,500 feet.

system is designed to

operate at water depths in

excess of 6,500 feet.

The

state of the art I-Trencher

system trenches, lays pipe up

to 16” in diameter, and backfills

in a single operation.

system trenches, lays pipe up

to 16” in diameter, and backfills

in a single operation.

Helix

ROV Systems

10

Changing the way you

succeed.

Island

Pioneer

Olympic

Triton

Olympic

Canyon

Seacor

Canyon

Northern

Canyon

Chartered

support vessels allows Helix to adjust the size and capability of its

fleet to cost-effectively meet industry demands.

fleet to cost-effectively meet industry demands.

ROV/Construction

Support Vessel Fleet

11

Changing the way you

succeed.

• Installation

completed of Disconnectable Turret

System (DTS) receptacle, external thruster

porches, cranes and all production modules

System (DTS) receptacle, external thruster

porches, cranes and all production modules

• DTS buoy installed

on location by Q4000

• Installation of

2,500-ton production modules

completed; module interconnection underway

completed; module interconnection underway

• Expect deployment in

Phoenix field

in Q2 2010

in Q2 2010

HPI

production module installation

Disconnectable

Transfer System

Transfer System

Helix

Producer I FPU

12

Changing the way you

succeed.

Contracting

Services

New

shore base facility in Ingleside,Texas fully

operational

operational

– Pipe stalk length

5,230 feet

– 300’ x 700’slip can

accommodate two

Helix Subsea Construction vessels side

by side

Helix Subsea Construction vessels side

by side

Welding

of Helix Danny 36-mile

8 x 12-inch pipe-in-pipe began early August

8 x 12-inch pipe-in-pipe began early August

Aerial

view of Ingleside Shore Base

Helix

Danny pipe welding

Automated

pipe tension system

13

Changing the way you

succeed.

Helix

Oil & Gas

14

Gunnison

platform, Gulf of Mexico

Changing the way you

succeed.

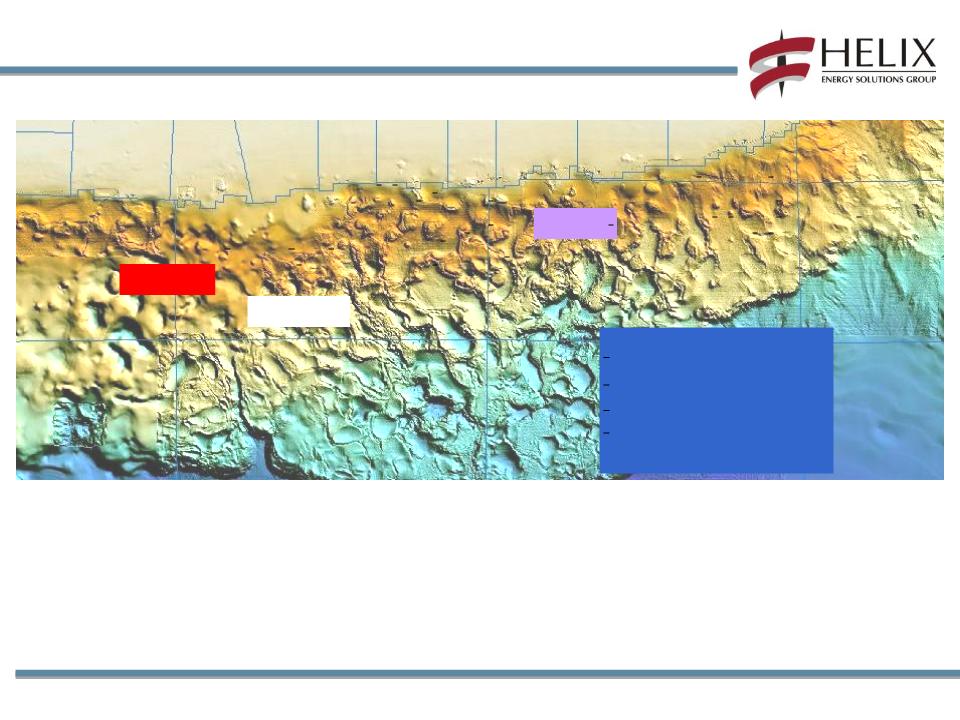

ERT

Deepwater Portfolio

15

Legend:

Producing

Field

Non

Producing Field

Discovery

Prospect

Gunnison

Bushwood

Phoenix

Interests in 47

Deepwater Blocks -13 Developed, 34 Undeveloped

379

BCFE Proved Reserves- 32 MMCFE Net Daily Production

2.7 Net

TCFE Un-Risked Reserve Potential, 1.0 TCFE Risked

Internal Prospect

Generation via Large, In-House 3-D Seismic Library Large,

Recent Long Offset 3-D Seismic Database,+1,500 Blocks

Recent Long Offset 3-D Seismic Database,+1,500 Blocks

Experienced

Exploration/Drilling/Operations Team - 25+ years avg.

Changing the way you

succeed.

• Proven Reserve,

Undiscounted

Future Net Revenues: $2.6 billion

Undiscounted, Discounted PV-10:

$1.9 billion (pre-tax)

Future Net Revenues: $2.6 billion

Undiscounted, Discounted PV-10:

$1.9 billion (pre-tax)

• 665 Bcfe Proved

Reserves

– 379 Bcfe

deepwater,

273 Bcfe shelf, 13 North Sea

273 Bcfe shelf, 13 North Sea

– Proved Developed /

PUD Ratio -

50/50

50/50

– Natural Gas / Oil

Mix - 70/30

• Discoveries and

Extensions

resulted in 176 Bcfe of reserve

additions

resulted in 176 Bcfe of reserve

additions

– 371% production

replacement rate

– 2008 F&D costs -

$2.44 / mcfe*

*2008 Exploration +

Development + Proved Property Acquisition / Exploratory Additions (U.S.

Only)

O&G

- 2008 Reserve Report Highlights

16

Changing the way you

succeed.

Helix

Outlook

Helix

Producer I topside

module installation progress at Kiewit Offshore Services fabrication

yard

17

Changing the way you

succeed.

2009

Outlook

18

• Contracting Services

demand in 2H 2009 has

softened, as expected

softened, as expected

• Express dry-dock, transit

and utilization on Helix

Danny pipeline is impacting external revenues

Danny pipeline is impacting external revenues

• Capital expenditures

of approximately $340 to

$360 million for 2009, $209 million spent

year-to-date

$360 million for 2009, $209 million spent

year-to-date

• $205 million

relates to completion of three

major vessel projects (Well Enhancer, Caesar

and Helix Producer I)

major vessel projects (Well Enhancer, Caesar

and Helix Producer I)

• $55 million relates

to development of Danny

and Phoenix oil fields

and Phoenix oil fields

• Improved liquidity

and debt levels (see slide 20)

Express

spooling pipe for Helix Danny project

Changing the way you

succeed.

2009

Outlook (continued)

19

Oil

and Gas

• Production range:

43 - 47 Bcfe

• Oil and gas

prices

• Without hedges:

$4.37 /mcfe;

$66.41 /bbl

$66.41 /bbl

• With realized

hedges and mark-to-

market adjustments (gas only):

$7.45 /mcfe; $70.91 /bbl

market adjustments (gas only):

$7.45 /mcfe; $70.91 /bbl

HPI

transfer buoy transit template

Changing the way you

succeed.

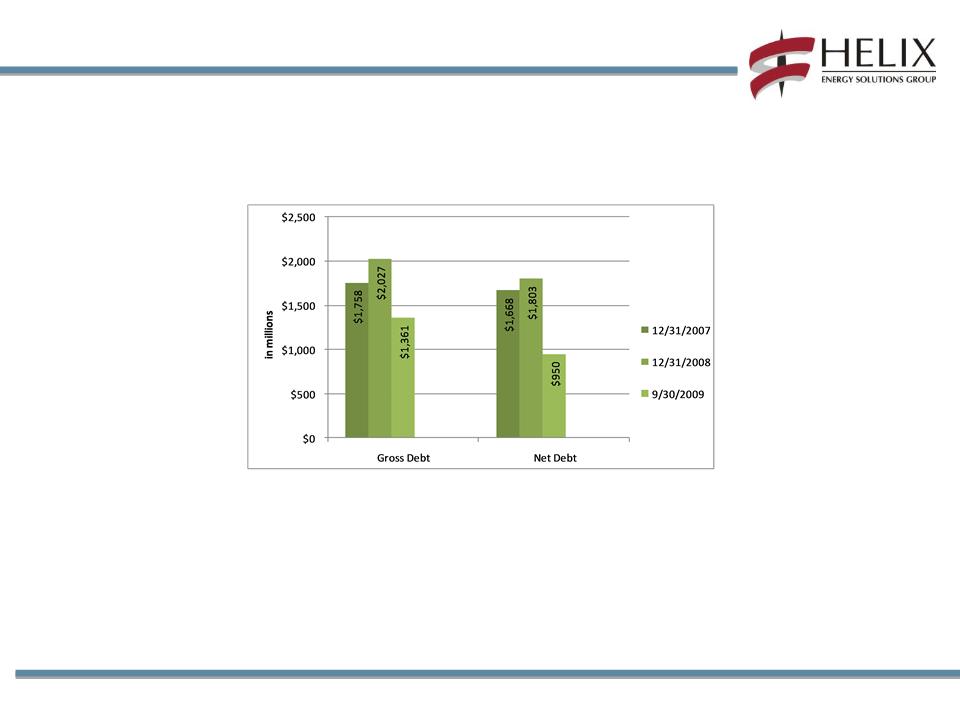

Significant

Balance Sheet Improvements

Debt

Liquidity*

of $781 million at 9/30/09

* Defined as available revolver capacity plus cash

20

Changing the way you

succeed.

Liquidity

and Capital Resources

21

• Company remains

focused on its efforts to monetize non-core assets and

businesses

businesses

• Completed (≈ $600

million pre-tax):

•Oil and gas

assets

• Bass Lite sale

December 08 & January 09 ($49 million)

• EC 316 sale in

February 09 ($18 million)

• Cal

Dive

• Sold a total of

15.2 million shares of Cal Dive common stock to Cal Dive

in January and June 2009 for aggregate proceeds of $100 million

in January and June 2009 for aggregate proceeds of $100 million

• Sold 45.8 million

Cal Dive shares in secondary offerings for proceeds of

≈ $405 million (net of offering costs) in June and September 2009

≈ $405 million (net of offering costs) in June and September 2009

• Sold

Helix RDS for $25 million in April 2009

Company

will continue to seek a sale of its shelf oil and gas

properties

Changing the way you

succeed.

Liquidity

and Capital Resources

Credit

Facilities, Commitments and Amortization

– $435

Million Revolving Credit Facility -

UNDRAWN.

• Facility extended to

November 2012.

• In July 2011,

commitments reduced to $407 million.

• $50 million of LCs

in place.

– $416

Million Term Loan B - Committed

facility through June 2013. $4.3

million

principal payments annually.

principal payments annually.

– $550

Million High Yield Notes - Interest only

until maturity (January 2016) or called

by Helix. First Helix call date is January 2012.

by Helix. First Helix call date is January 2012.

– $300

Million Convertible Notes - Interest only

until put by noteholders or called by

Helix. First put/call date is December 2012, although noteholders have the right to

convert prior to that date if certain stock price triggers are met ($38.56).

Helix. First put/call date is December 2012, although noteholders have the right to

convert prior to that date if certain stock price triggers are met ($38.56).

– $119

Million MARAD - Original 25 year

term; matures February 2027. $4.4

million

principal payments annually.

principal payments annually.

22

Changing the way you

succeed.

Financial

Information

23

Express

spooling

pipe at Ingleside Shore Base, Gulf of Mexico

Changing the way you

succeed.

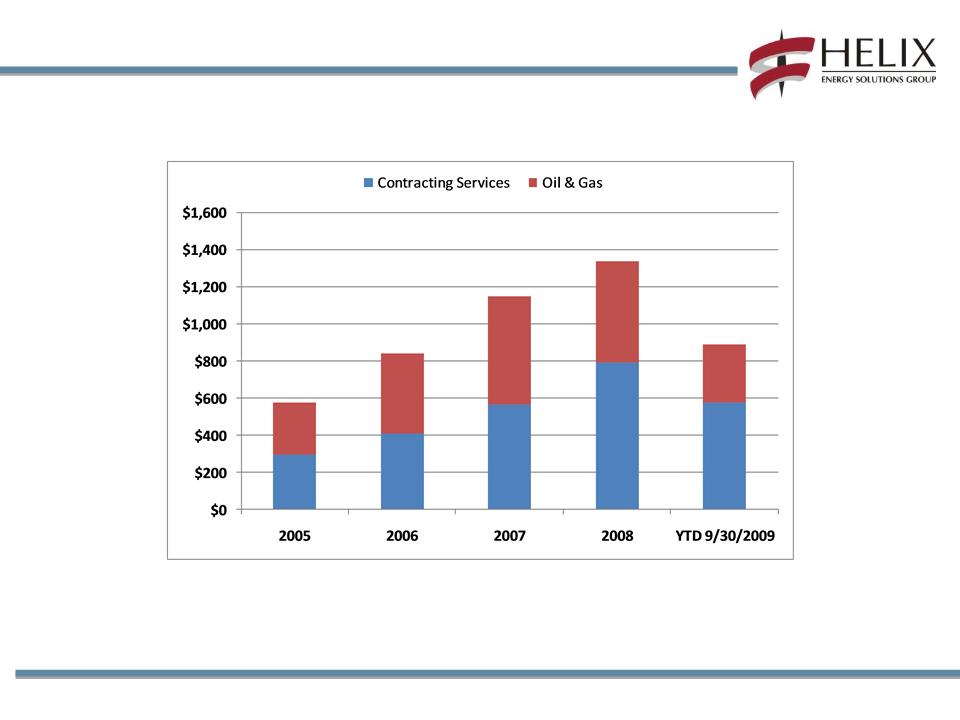

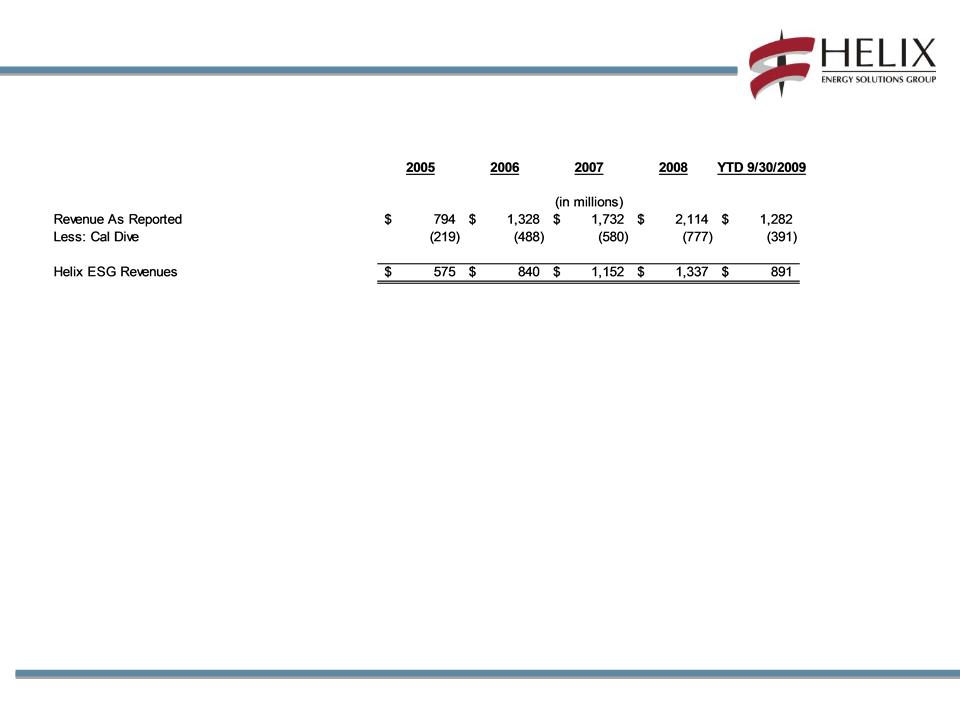

Note:

Excludes Cal Dive and Helix RDS revenues from 2005-2009.

See Non-GAAP reconciliations on slides 28-30.

See Non-GAAP reconciliations on slides 28-30.

($

amounts in millions)

$575

$840

$891

$1,337

$1,152

Consistent

Top-Line Growth

24

Changing the way you

succeed.

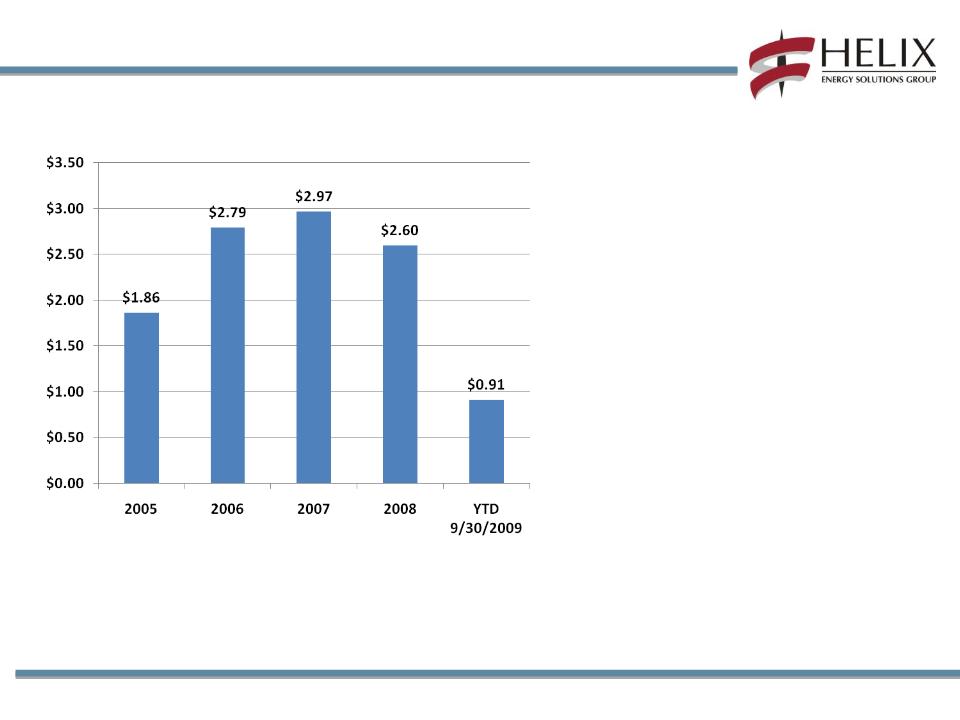

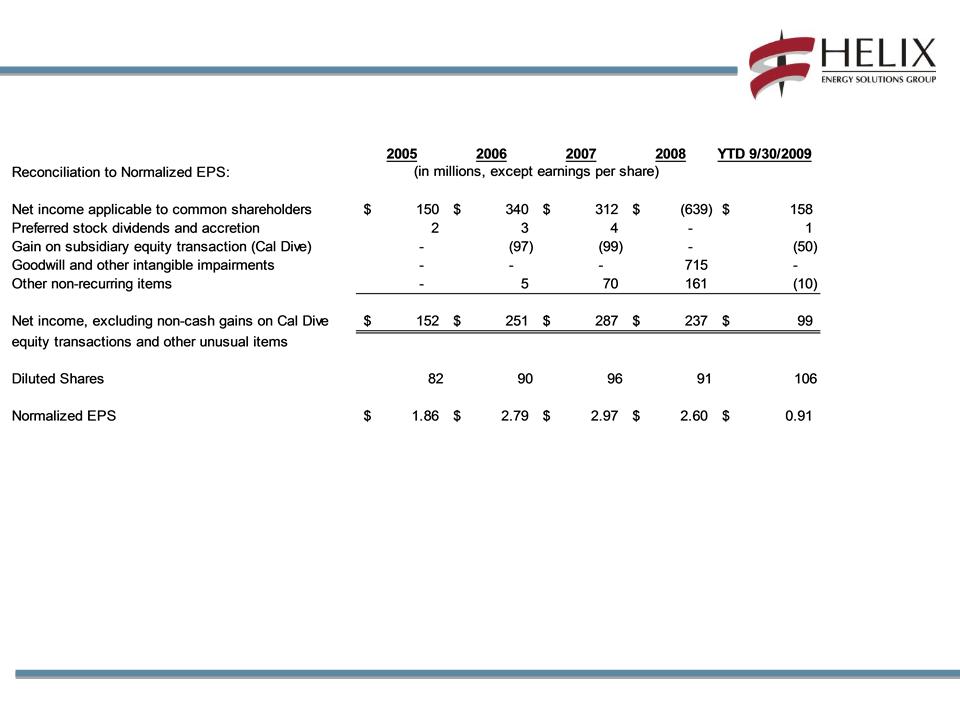

- 2006

results exclude the impact of

the gain on sale in the Cal Dive IPO

and estimated incremental

overhead costs during the year.

the gain on sale in the Cal Dive IPO

and estimated incremental

overhead costs during the year.

- 2007

results exclude the impact of

the Cal Dive gain, impairments and

other unusual items.

the Cal Dive gain, impairments and

other unusual items.

- 2008 results exclude

non-cash

charges of $964 million for

reduction in carrying values of

goodwill and certain oil and gas

properties.

charges of $964 million for

reduction in carrying values of

goodwill and certain oil and gas

properties.

- YTD 9/30/2009

results exclude the

impact of Cal Dive gains,

impairments and other unusual

items.

impact of Cal Dive gains,

impairments and other unusual

items.

(a) See

Non-GAAP reconciliations on slides 28-30.

Earnings

Per Share (a)

25

Changing the way you

succeed.

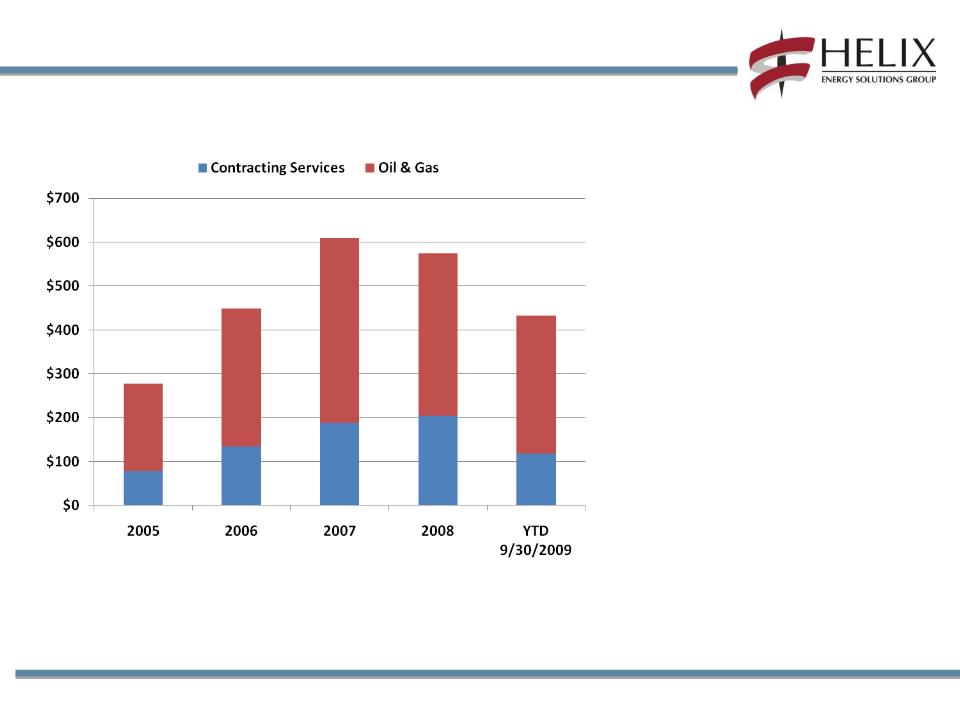

-2006

results exclude the impact

of the gain on sale in the Cal

Dive IPO and estimated

incremental overhead costs

during the year.

of the gain on sale in the Cal

Dive IPO and estimated

incremental overhead costs

during the year.

-2007

results exclude the impact

of the Cal Dive gain,

impairments and other unusual

items.

of the Cal Dive gain,

impairments and other unusual

items.

-2008 results exclude

non-cash

impairments.

impairments.

-Excludes Cal Dive

contribution.

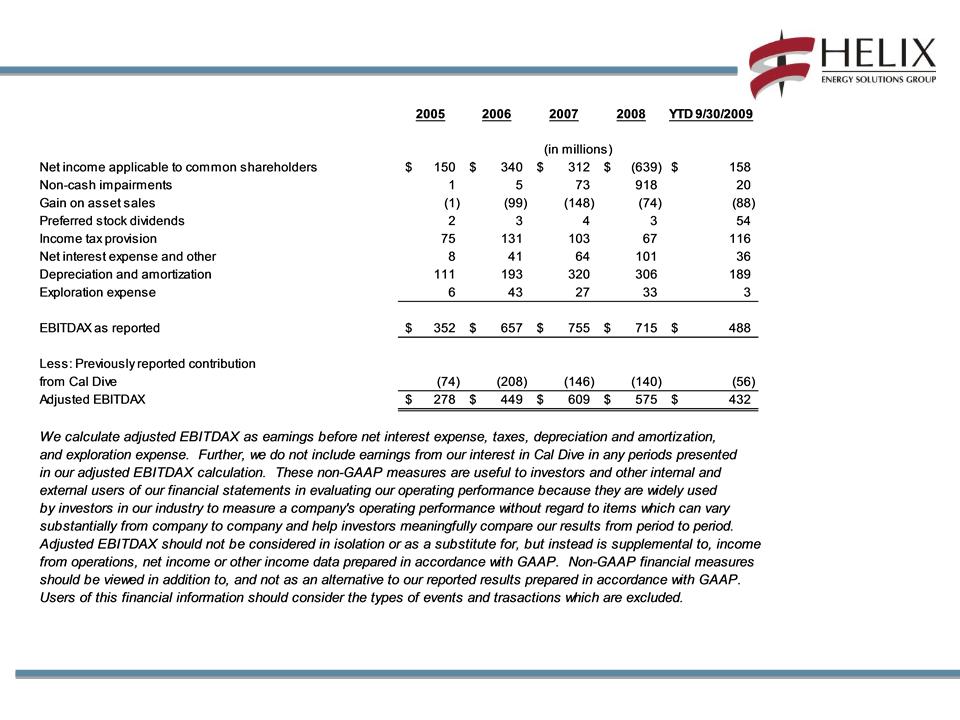

(a) See

Non-GAAP reconciliations on slides 28-30.

($

amounts in millions)

$278

$449

$432

$575

$609

Significant

Cash Generation - EBITDAX

26

Changing the way you

succeed.

Non-GAAP

Reconciliations

Reconciliations

27

Changing the way you

succeed.

Non-GAAP

Reconciliations

28

Changing the way you

succeed.

Non-GAAP

Reconciliations

29

Changing the way you

succeed.

Non-GAAP

Reconciliations

30

Changing the way you

succeed.

31