Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 30, 2009

CHINA MEDIA INC.

(Exact name of registrant as specified in its charter)

|

Nevada |

333-150952 |

N/A | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

12/F, Block D, Chang An Guo Ji

No. 88 Nan Guan Zheng Street

Beilin District, Xi'An, Shaan'Xi Province

China - 710068

(Address of principal executive offices)

(86) 298765-1114

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

TABLE OF CONTENTS

| 2 | ||

| 2 | ||

| 4 | ||

| 16 | ||

| 21 | ||

| 21 | ||

| 23 | ||

| 26 | ||

| 27 | ||

| 27 | ||

| 27 | ||

| 28 | ||

| 29 | ||

| 30 | ||

| 31 | ||

| 32 | ||

| 32 | ||

| 32 | ||

| 32 | ||

1

As used in this Current Report on Form 8-K, unless otherwise stated, all references to the “Company”, “we,” “our” and “us” refer to China Media Inc.

Share Exchange

On September 16, 2009 we entered into a share exchange agreement (the “Share Exchange Agreement”) with Vallant Pictures Entertainment Co., Ltd., a company incorporated under the laws of the British Virgin Islands (“Vallant”) and Bin Li, our Director and the former sole shareholder of Vallant. According to the terms

of the Share Exchange Agreement, we agreed to acquire the sole issued and outstanding common share of Vallant from Bin Li in exchange for 7,000 shares of our common stock.

On November 30, 2009 we closed the transactions contemplated by the Share Exchange Agreement and acquired Vallant as our wholly owned subsidiary. Vallant has entered into a series of contractual obligations with Xi’An TV Media Co., Ltd., a company incorporated under the laws of the People’s Republic of China (“Xi’An

TV”) that is engaged in the business of producing and developing television programming for the Chinese market, as well as the holders of 62.61% of the voting shares of Xi’An TV. A full description of these contractual arrangements is included under the heading “Organization”, below.

We had 39,743,000 shares of our common stock issued and outstanding before the closing of the transactions contemplated by the Share Exchange Agreement. Upon the closing of the transactions, we issued 7,000 shares of our common stock to Bin Li, our Director and the former sole shareholder of Vallant. Mr. Li is the beneficial owner

of 2,000,000 additional shares of our common stock. The 7,000 shares were issued in reliance upon an exemption from registration pursuant to Regulation S promulgated under the Securities Act of 1933, as amended (the “Securities Act”). As of the filing of this Current Report on Form 8-K there were 39,750,000 shares of our common stock issued and outstanding.

Prior to our entry into the Share Exchange Agreement, Bin Li was our Director and the sole officer, director and beneficial owner of Vallant. Further details on the transactions contemplated by the Share Exchange Agreement can be found in our Current Report on Form 8-K filed with the Securities and Exchange Commission on September 18, 2009.

Accounting Treatment

The share exchange is being accounted for as a reverse merger, since the former sole shareholder of Vallant, Bin Li, acquired the majority of our common stock with the aim of completing the share exchange with Vallant. We have now abandoned our original business and adopted the business of Vallant, who is deemed to be the acquirer in the

reverse merger. Consequently, the assets, liabilities and historical operations that will be reflected in the financial statements prior to the closing of the share exchange will be those of Vallant and will be recorded at the historical cost basis of Vallant. The consolidated financial statements after the closing of the share exchange will include the assets and liabilities of us and Vallant, the historical operations of Vallant, and our operations from the closing date of the share exchange.

2

Organization

Our relationship with Xi’An TV and its shareholders is governed by a series of contractual arrangements between Vallant, Xi’An TV and the holders of 62.61% of the share capital of Xi’An TV (the “Xi’An TV Shareholders”). Under the laws of the People’s Republic of China (“China”), the contractual

arrangements constitute valid and binding obligations of the parties of such agreements. Each of the contractual arrangements and the rights and obligations of the parties thereto are enforceable and valid in accordance with the laws of China. Other than pursuant to the contractual arrangements between Vallant and Xi’An TV described below, Xi’An TV cannot transfer 62.61% of the funds generated from their operations.

On June 20, 2007, Vallant entered into the following contractual arrangements with Xi’An TV and the Xi’An TV Shareholders:

Business Operations Agreement. Pursuant to this agreement, the Xi’An TV Shareholders must designate the candidates recommended by Vallant as their representatives on the Board of Directors of Xi’An TV, and Vallant acquired the right to appoint the senior executives

of Xi’An TV. In addition, Vallant must guarantee Xi’An TV’s performance under any agreements or arrangements relating to Xi’An TV’s business arrangements with any third party, and upon request from Xi’An TV, Vallant will provide loans to support the operational capital requirements of Xi’An TV and loan guarantees if third party loans are necessary. In return, Xi’An TV must pledge its accounts receivable and all of its assets to Vallant. This

agreement is effective for an indefinite term and may be terminated by Vallant with 30 days notice.

Business Services Agreement. Pursuant to this agreement among Vallant and Xi’An TV, Vallant acquired the exclusive rights to provide Xi’An TV with all services required by Xi’An TV in the regular course of business, including services pertaining to administration,

human resources, production, screenplay drafting and marketing. As part of this agreement, Vallant must also undertake the following tasks:

|

· |

develop business opportunities on behalf of Xi’An TV; |

|

· |

provide relevant market information research; |

|

· |

receive payments from customers on behalf of Xi’An TV; |

|

· |

administer staff training and human resources for Xi’An TV; and |

|

· |

provide daily accounting and financial services. |

In exchange, Xi’An TV must provide Vallant with 62.61% of its income. This agreement is effective for an indefinite term and may be terminated by Vallant at any time.

Option Agreement. Pursuant to this agreement between the Xi’An TV Shareholders, Xi’An TV and Vallant, the Xi’An TV Shareholders irrevocably granted Vallant

or its designees the exclusive option to purchase, to the extent permitted under the laws of China, all or part of their equity interest in Xi’An TV for the cost of the initial contributions to the registered capital or the minimum amount of consideration permitted by applicable Chinese law. The proceeds of the exercise of the option will be applied to repay loans extended by the Xi’An TV Shareholders to Xi’An TV, unless otherwise agreed. Vallant or its designees have sole

discretion to decide when to exercise the option, whether in part or in full. This agreement is effective for an indefinite term and may be terminated by Vallant at any time.

Equity Pledge Agreement. Pursuant to this agreement between Xi'An TV, the Xi’An TV Shareholders and Vallant, the Xi’An TV Shareholders pledged all of their equity interests in Xi’An TV to Vallant to guarantee Xi’An

TV’s performance of its obligations under the business operations agreement described above. If Xi’An TV or the Xi’An TV Shareholders breach their respective contractual obligations, Vallant, as the pledgee, will be entitled to certain rights, including the right to sell the pledged equity interests. The Xi’An TV Shareholders also agreed that upon the occurrence of any event of default, Vallant will acquire an exclusive, irrevocable power of attorney to take actions

in the place and stead of the Xi’An TV Shareholders to carry out the security provisions of this agreement and take any action and execute any instrument that Vallant may deem necessary or advisable to accomplish the purposes of this agreement. The Xi’An TV Shareholders must not to dispose of their pledged equity interests or take any actions that would prejudice Vallant’s interests. This agreement is effective for an indefinite term and may be terminated by Vallant at

any time.

Since the Xi’An TV Shareholders do not have the characteristics of a controlling financial interest or do not have sufficient equity at risk for Xi’An TV to finance its activities without additional subordinated financial support from other parties, Xi’An TV’s financial statements become consolidated as our own. As

such, and due to the interest we hold in Xi’An TV through Vallant, the following business description describes the business and operations of Xi’An TV as our own.

3

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements. To the extent that any statements made in this report contain information that is not historical, these statements are essentially forward-looking. Forward-looking statements can be identified by the use of words such as “expects”, “plans”, “will”,

“may,”, “anticipates”, “believes”, “should”, “intends”, “estimates”, and other words of similar meaning. These statements are subject to risks and uncertainties that cannot be predicted or quantified and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, our ability to raise additional capital to finance

our activities; the effectiveness, profitability and marketability of our products; legal and regulatory risks associated with the share exchange; the future trading of our common stock; our ability to operate as a public company; our ability to protect our proprietary information; general economic and business conditions; the volatility of our operating results and financial condition; our ability to attract or retain qualified senior management personnel and research and development staff; and other risks detailed

from time to time in our filings with the Securities and Exchange Commission (the “SEC”), or otherwise.

Information regarding market and industry statistics contained in this report is included based on information available to us that we believe is accurate. It is generally based on industry and other publications that are not produced for purposes of securities offerings or economic analysis. We have not reviewed or included data from all

sources, and cannot assure investors of the accuracy or completeness of the data included in this report. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. We do not undertake any obligation to publicly update any forward-looking statements. As a result, investors should not place undue reliance

on these forward-looking statements.

Overview

We were incorporated under the name Protecwerx Inc. on October 16, 2007 under the laws of the State of Nevada. On July 7, 2009 we experienced a change of control pursuant to which Fullead Overseas Limited, a company over which our director, Bin Li, has sole voting and investment power, acquired approximately 85% of our common stock. On

August 6, 2009 we filed an amendment to our articles of incorporation to change our name to China Media Inc., and on September 16, 2009 we entered into a share exchange agreement with Vallant, now our wholly owned subsidiary. The closing of the transactions contemplated by the share exchange agreement occurred on November 30, 2009, at which time we adopted the business of Vallant. Our principal offices are located at 12/F, Block D, Chang

An Guo Ji, No. 88 Nan Guan Zheng Street, Beilin District, Xi'An, Shaan'Xi Province, China 710068. Our telephone number is (86) 298765-1114. Our fiscal year end is June 30.

Previous Business

Before we experienced the change of control and closed the transactions contemplated by the share exchange agreement with Vallant, we planned to acquire, develop, manufacture and distribute recreational vehicle protection products through a variety of distribution channels. Our first product was Ankle Armor. We intended to patent,

manufacture, distribute and sell Ankle Armor through recreational goods retail stores. We were not able to raise sufficient funds to continue this business and our management consequently began to focus on opportunities for business combinations with revenue-generating companies.

Current Business

Upon acquiring Vallant pursuant to the share exchange, we adopted the business of Vallant. We are now engaged in the development of films and television series’ for the Chinese market.

4

Principal Products

Since our incorporation we have produced or begun to produce one feature-length film, eleven television series’ and one documentary. All of them have been released and distributed except for one television series that we plan to release in early 2010 and two television series’ in which we recently sold our interest. Our

programming that we have either produced or begun to produce consists of the following:

|

Name |

Programming Type |

Status |

|

Invisible Wings |

Film |

Released and Sold |

|

Special Mission |

TV Series |

Released |

|

Lotus Lantern Prequel |

TV Series |

Released |

|

Lucky Chicken |

TV Series |

Released |

|

Hard Corps |

TV Series |

Released |

|

Tianshan Urgency Action |

TV Series |

Released |

|

Drive Dragon Gate |

TV Series |

Released |

|

Lover’s Grief |

TV Series |

Released |

|

Plum Blossom Archives |

TV Series |

Released |

|

Gongtan Ancient Town of China |

Documentary |

Released |

|

Doctor County Mayor |

TV Series |

To Be Released |

|

Fox-Hunting |

TV Series |

Sold |

|

Desert Love Story |

TV Series |

Sold |

Television series’ in China are similar to those in the North American market, but they do not operate on the basis of seasons. Each series has a definite lifetime of anywhere from 10 to 50 episodes, at which point the series ends and a new one is developed. The new series may be based on previous ones, but the development

of a new series does not follow the same type of recurring seasonal structure as in North America.

In 2007, our television series Special Mission received a viewership rating of 4% of the entire Chinese market when it was broadcast on China Central Television (“CCTV”), Channel 8. In the same year Invisible Wings received

the Outstanding Children’s Film and Outstanding Young Actress awards during the 12th Film Ornamental Column Awards, the Golden Elephant Award during the Indian International Film Festival, the Golden Angel Award during the Hollywood China-USA Film Festival, and was featured as the opening film of Beijing International Sport Film Week.

Our revenue sources include sales of broadcast rights for television series’, sales of broadcast rights for films, and advertising and title sponsorship sales for television series’. Our revenues for the fiscal years ended June 30, 2009 and 2008 were as follows:

|

Year Ended June 30 |

||||||||

|

2009 |

2008 |

|||||||

|

Invisible Wings |

$ | 452,180 | $ | 75,056 | ||||

|

Special Mission |

- | $ | 1,955,198 | |||||

|

Lotus Lantern Prequel |

$ | 1,223,275 | - | |||||

|

Total Revenues |

$ | 1,675,455 | $ | 2,030,254 | ||||

5

Below is a summary of some of our more successful programming that we have already released:

Invisible Wings – A 90 minute feature film, this motivational drama describes the story of a 15-year old Chinese girl who lost her arms in an accident, and whose mother was diagnosed with schizophrenia and anxiety. The young girl’s love for her mother motivates her to apply

herself diligently to her studies and athletics. She also takes care of her mother while battling her disabilities. The girl overcomes all odds and wins a medal in the Chinese national games for the disabled and represents her country at the Paralympics.

In 2007, Invisible Wings received the Outstanding Children’s Film and Outstanding Young Actress awards during the 12th Film Ornamental Column Awards, the Golden Elephant Award during the Indian International Film Festival, the Golden Angel Award during the Hollywood China-USA Film Festival,

and was featured as the opening film of Beijing International Sport Film Week.

6

Special Mission – A 40-episode television series with each episode lasting 40 minutes, Special Mission is a war drama that focuses on the actions of members of the Chinese military intelligence community as they fight against the Japanese

army which invaded China. The series describes various characters who sacrificed their lives in order to protect their country and uncover the plans of the Japanese forces.

The program was very successful upon its release. After being broadcast on CCTV-8 in October of 2007, Special Mission achieved a record-breaking first-run audience rating of 4% in prime time and was then broadcasted by over 20 regional Chinese television stations.

7

Lotus Lantern Prequel – A 46 episode television series with each episode lasting 52 minutes, Lotus Lantern Prequel is a drama based on traditional Chinese mythology that describes the story of God Erlang, a popular mythological figure,

who battles through adversity and many enemies to reunite with his mother and younger sister.

After being broadcast on CCTV-8 in April 2009, Lotus Lantern Prequel achieved a first-run audience rating of 3.9% during prime time and was syndicated on many Chinese regional television stations.

We plan to invest approximately $8,650,000 in producing and distributing one new film and eight new television series’ over the next two years, including Doctor County Mayor, which we plan to release on CCTV in 2010. We

anticipate raising sufficient capital for these expenditures through debt or equity financing as well as engaging in joint venture productions with other established production companies.

8

The following table summarizes the approximate quarterly calendar periods during which we anticipate our planned programming will undergo various stages of production:

|

Television Series |

Development |

Pre-Production |

Production |

Post-Production |

Distribution |

|

Doctor County Mayor |

Q1, 2009 |

Q2, 2009 |

Q3, 2009 |

Q4, 2009 |

Q1, 2010 |

|

Song of Old People Home |

Q2, 2009 |

Q3, 2009 |

Q4, 2009 |

Q1, 2010 |

Q2, 2010 |

|

Returning Silly Girl |

Q3, 2009 |

Q4, 2009 |

Q2, 2010 |

Q3, 2010 |

Q4, 2010 |

|

Infinitude Sky |

Q3, 2009 |

Q4, 2009 |

Q2, 2010 |

Q3, 2010 |

Q4, 2010 |

|

Justice of Guangong |

Q4, 2009 |

Q1, 2010 |

Q3, 2010 |

Q4, 2010 |

Q1, 2011 |

|

Orphan of the Zhao Family |

Q1, 2010 |

Q2, 2010 |

Q3, 2010 |

Q4, 2010 |

Q1, 2011 |

|

Third Sister Liu |

Q1, 2010 |

Q2, 2010 |

Q3, 2010 |

Q4, 2010 |

Q1, 2011 |

|

Six Men’s Disasters in Tang Dynasty |

Q1,2010 |

Q3, 2010 |

Q4, 2010 |

Q1, 2011 |

Q2, 2011 |

|

Pantaloon is a Tree |

Q1, 2010 |

Q3, 2010 |

Q4, 2010 |

Q1, 2011 |

Q2, 2011 |

This one film and eight television series’ will require an approximate total investment of $23,150,000, of which we plan to contribute approximately $8,650,000. We anticipate that we will cooperate with other investors to secure the remaining funding in order to limit our financial participation and risk exposure. We also

plan on raising additional financing through the sale of our debt or equity securities in order to meet our obligations with respect to these projects. The following is a summary of the estimated expenditures involved in producing our planned programming and our anticipated financial contribution to each project:

|

Television Series |

Number of Episodes |

Total Investment ($) |

Percentage Involvement |

Amount of our Financial Contribution ($) |

|

Doctor County Mayor |

35 |

3,000,000 |

25 |

750,000 |

|

Song of Old People Home |

1 (Film) |

750,000 |

100 |

750,000 |

|

Returning Silly Girl |

30 |

3,000,000 |

25 |

750,000 |

|

Infinitude Sky |

TBD |

3,000,000 |

25 |

750,000 |

|

Justice of Guangong |

TBD |

3,000,000 |

50 |

1,500,000 |

|

Orphan of the Zhao Family |

TBD |

3,000,000 |

25 |

750,000 |

|

Third Sister Liu |

TBD |

3,000,000 |

50 |

1,500,000 |

|

Six Men’s Disasters in Tang Dynasty |

TBD |

2,200,000 |

53 |

1,167,000 |

|

Pantaloon is a Tree |

TBD |

2,200,000 |

33 |

733,000 |

As described above, we plan to undertake the development and production of our programming through a series of different stages from development to post-production. The process can be summarized as follows:

Development Stage

This is the initial stage during which we develop and research a concept. We undertake market research and hold focus groups to establish whether demand exists for a particular type of programming. Once we receive positive feedback on a concept we instruct our writers to produce a plot of the program based on suggestions from the

focus groups and the results of our market research. Alternatively, we can acquire original works or rights to adapt classic works, both from China and abroad, that we believe will be marketable to the Chinese market. If we complete any such acquisition, we generally produce a plot based on the work which may be further revised as we continue developing the project. The plot provides a basic outline of the program and provides a foundation upon which our writers can produce a

screenplay or script.

9

Our plot is then reviewed by our development committee. This committee is made up of recognized television and film professionals in China as well as members of our local Shaan’Xi Province Administration of Radio, Film and Television (“ARFT”) agency, who are responsible for approving the programming for distribution to television

stations. By having a development committee in place, we hope to avoid producing works that will either not be granted government approval for distribution, will be too difficult to produce or will not be attractive to television stations and viewers.

Once we have decided upon the basic plot for a project, we determine its production schedule, a rough budget and terms of financing. We may provide the financing directly or through a joint venture with one or more third parties interested in participating in the project. Potential investors include advertisers and distributors,

home vide publishers and private investors. Currently, we partner primarily with such investors to provide the financing required to develop our television programming, but we also plan on raising capital through the sale of our debt or equity securities.

The development stage usually takes six months to several years, subject to our market research, co-production negotiations and script judgment from focus groups and the development committee.

Pre-Production Stage

The next stage involves developing a detailed script or screenplay based on the basic plot outline produced in the first stage of the process. The script generally incorporates all of the themes and major characteristics of the outline while taking into account production scenarios. Our scripts and screenplays are based on our

own original work as well as adaptations of books, musical works, folklore and classic Chinese or international stories.

We hire part-time writers who work out of our offices to create the screenplays and scripts for our television series’ and films. Occasionally, we also purchase completed screenplays and scripts from suppliers such as professional writers, other film producers or the general public.

After the screenplay or script is finalized, our financial department plans the investment budget and our film and television series production center prepares a detailed production plan and searches for a suitable director, production manager and executive producer, as well as actors and crew. The production manager is responsible

for executing all facets of production, the executive producer supervises the production process and the director is responsible for the actors, crew and cinematography.

This part of the process generally takes one to two months depending on the complexity of the script and the production.

Production Stage

This stage deals with the actual filming of the television series or film. The director, actors and crew gather at a studio at our offices, at a sound stage we rent out or that is provided by one of the production partners, or at another location to film a particular scene or scenes. Our involvement in this stage is minimal unless

modifications to the script or screenplay must be made. Currently, we outsource the principal photography and filming of the various scenes to the Xi’An Television Production Center. We do not directly employ any directors, actors or crew.

Depending on the complexity of the project, the production stage can last up to six months for a television series and up to three months for a film.

10

Post-Production Stage

Once production has wrapped up, we are responsible for coordinating all of the tasks required to produce a finished product for television or the cinema. We assign an editor to assemble the various pieces of film and determine scene transitions, and we add musical elements, subtitles, visual and/or digital effects to the television series

or film. Once the editing process is complete, which takes up to three months, the director provides input on any changes and a final version of the program or film is produced.

Markets

According to an article titled “China Film Industry Development Status” on www.chinafilm.com, the Chinese film industry generated revenues of approximately 8.4 billion Chinese Yuan Renminbi (“RMB”), or $1.2 billion, from film sales during 2008. This represents an increase of 25% over sales numbers in 2007 and includes

7.15 million film screenings to an audience of 1.6 billion people. Sixty percent of the films were produced domestically in China.

During early 2009, the television series department of the National Administration of Radio, Film and Television agency completed a review of the television series industry in China. They found that Chinese television stations invested approximately 5.5 billion RMB, or $800 million, into the production and purchase of television series’

in 2008. This represents an increase of 38% compared to the amounts spent in 2007.

Additionally, according to www.people.com.cn, Chinese film and television series producers generated revenue of approximately 3 billion RMB, or $440 million, by exporting their productions outside of China.

The Chinese government has also provided figures on the type of programming that is popular in China. Below is a table, gathered from www.china.com, comparing the types of programming shown on Chinese television during the specified years as well as the percentage of total viewership per program type:

|

2006 |

2007 |

To June 30, 2008 |

||||||||||||||||||||||

|

% of Total Programs Aired |

% of Total

Viewership |

% of Total Programs Aired |

% of Total

Viewership |

% of Total Programs Aired |

% of Total

Viewership |

|||||||||||||||||||

|

Series |

24 | 33.48 | 23.371 | 33.52 | 23.29 | 33.24 | ||||||||||||||||||

|

News/Current Affairs |

7.1 | 12.57 | 6.84 | 11.44 | 8.76 | 14.99 | ||||||||||||||||||

|

Variety Shows |

6.37 | 8.81 | 6.13 | 8.41 | 4.13 | 7.65 | ||||||||||||||||||

The major purchasers of television series’ are regional and national television stations. The demand for such programming from other media providers, such as internet television stations who distribute programs through an internet connection or directly onto a client’s mobile phone, is limited, and as such we have not considered

producing programs intended for these types of media.

Since the major regional and national television networks are subject to heavy government influence, we develop our television series’ and films with this consideration in mind. Generally, we plan to focus on topics that the government supports, such as revolutionary history or modern Chinese culture, which will make our programming

more attractive for networks such as CCTV to broadcast and release through their stations.

11

Distribution Methods

After we complete the production and editing of a film or television series, we must file an application for approval to broadcast the program with the State Administration of Radio, Film and Television of China (“SARFT”), a government agency. Once we are granted approval and provided with a broadcasting permit for the film or

series, we are free to distribute the program, which, in the case of a television series, we normally begin following the completion of one or two episodes.

Our main customers include the following networks:

|

· |

CCTV; |

|

· |

Hunan Satellite Television; |

|

· |

Jiangsu Satellite Television; |

|

· |

Zhejiang Satellite Television; |

|

· |

Jiangxi Satellite Television; |

|

· |

Anhui Satellite Television; and |

|

· |

all the other provincial broadcast television networks in China. |

CCTV is the major state television broadcaster in mainland China. It has a network of 19 channels that broadcast different programs and is accessible to more than one billion viewers. The programming on Channels 1 and 8 of the CCTV network is most closely aligned with the characteristics of our films and television series’. Once

our programming is televised on CCTV, regional television networks regularly purchase the same programming to use for their television stations.

We distribute our films and television series’ primarily through our direct sales channel. Occasionally, we may also use the services of an outside distributor to facilitate sales to a wider range of customers. However, even though we devote a significant amount of our resources to ensuring that the programming we produce

appeals to our customers and have had success distributing it in the past, there can be no assurance that any film or television series we produce will be purchased by any distributors or television networks.

Competition

We face competition from various television and film production companies ranging from small, private businesses to large, state-sponsored enterprises. Some of our major competitors include China Film Group, Huayi Brothers Media Group and PolyBona Film Distribution Co.

Many of our competitors have longer operating histories, better brand recognition and greater financial resources than we do. In order for us to successfully compete in our industry we will need to:

|

· |

develop highly marketable programming; |

|

· |

continue developing our relationships with major television networks; and |

|

· |

increase our financial resources. |

12

However, there can be no assurance that even if we do these things we will be able to compete effectively with the other companies in our industry.

As of December 2008, there were approximately 300 film and television producers registered in China, with approximately 270 operated by the private sector and 30 that were state-owned. Among these, approximately one-third had not produced any films or television series’ between 2006 and 2008, and the majority of the others only produced

an average of two to three films or series’ per year. The film and television industry in China is highly de-centralized and there are no truly dominant producers with whom we must compete.

We believe that we will be able to compete effectively in our industry because of a successful product development strategy that we have already used to produce profitable programming. Our past productions have been successful due to the detailed production process and strategy described above as well as the strong relationships we have forged

with television networks.

We also attempt to increase the probability that our programming will be profitable and will be purchased by television networks by having all of our concepts vetted by our programming committee. This committee is comprised of established professionals in the Chinese film and television industry as well as members of the examination team

of the Shaan’Xi Province ARFT agency, which provides approval for programming to be distributed to television networks. We believe that having our programming vetted by this committee increases our competitiveness in the industry and the chance that any television series or film we produce will be approved by the government and subsequently purchased by one or more television networks.

Additionally, we have established relationships with actors, directors and production agencies through previous collaborations, and have created cooperative relationships with the major television station in the city of Xi’An and the Xi’An television series center that have provided us with access to partners of theirs as well as major television

networks throughout the country. This resulted in our television series, Special Mission, being distributed to over 90% of the television stations throughout China.

Intellectual Property

We have not filed for any protection of our name or trademark. Since we produce film and television scripts and screenplays, we develop and sell intellectual property for these productions. The following is a list of films and television series’ in which we hold, or used to hold, intellectual property rights:

|

Name |

Programming Type |

Current Intellectual Property Ownership |

|

Special Mission |

TV Series |

Yes |

|

Invisible Wings |

Film |

No (Sold) |

|

Doctor County Mayor |

TV Series |

Yes |

|

Lotus Lantern Prequel |

TV Series |

Yes |

|

Fox-Hunting |

TV Series |

No (Sold) |

|

Lucky Chicken |

TV Series |

Yes |

|

Hard Corps |

TV Series |

Yes |

|

Tianshan Urgency Action |

TV Series |

Yes |

|

Drive Dragon Gate |

TV Series |

Yes |

|

Lover’s Grief |

TV Series |

Yes |

|

Desert Love Story |

TV Series |

No (Sold) |

|

Gongtan Ancient Town of China |

Documentary |

Yes |

|

Song of Old People Home |

Film Screenplay |

Yes |

|

Six Men’s Disasters in Tang Dynasty |

TV Series Script |

Yes |

|

Pantaloon is a Tree |

TV Series Script |

Yes |

We also own the copyright of our logo and all of the contents of our website, www.xatvm.com.

13

Research and Development

We did not incur any research and development expenses during the years ended June 30, 2009 and 2008. All costs incurred in connection with the development of our film and television series’ were capitalized as film costs on our balance sheet. Our total film costs were $1,767,152 (of which $1,172,240 was held for sale) and

$2,557,583 at June 30, 2009 and 2008, respectively.

Reports to Security Holders

We are subject to the reporting and other requirements of the Exchange Act and we intend to furnish our shareholders with annual reports containing financial statements audited by our independent auditors and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year.

The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy

and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

Government Regulations

Regulation on Screenplay (Outline) Keeping On Record and Film Management enacted by the SARFT on April 3, 2006

This regulation affects the following two procedures we undertake:

|

· |

before producing a film, the producer of the film is required to submit the screenplay to the local Provincial AFRT for backup and record keeping, and if the film deals with subjects pr themes of historical or revolutionary importance, the screenplay must be supervised and approved by the SARFT; and |

|

· |

each film produced in China must be submitted to the examination committee of SARFT, which examines the film’s content and decides whether the film should be allowed to be broadcast in China. Films that receive approval receive a Film Public Show Permit and Film Examination Written Decision designation, and without this designation, a film cannot

be aired on television in China and will therefore not be distributed. |

Effect on our operations. We need to submit any films we produce to the SARFT for approval prior to their distribution and broadcasting. It generally takes approximately two or three months to complete the examination, and it may take longer if we receive comments

that we must revise the film in some way. Since we work with a number of individuals who form part of the SARFT examination group, we limit the risk of not receiving broadcast approval or being required to revise our scripts and screenplays. However, if revisions are required or a screenplay is rejected, this could increase our costs of production and impact our profitability.

Regulations on Radio and Television Program Production and Operation Management enacted by the SARFT on June 15, 2004

This regulation states that all Chinese enterprises operating in the business of radio and television program production must acquire a Permit Certificate of Radio and Television Program Production and Operation. The regular term of this license is two years and it may be renewed every two years. Additionally, the regulation specifies

that television series’ may only be produced by companies or entities that have received a Permit Certificate distributed by the SARFT.

14

Effect on our operations. We currently hold the appropriate Permit Certificate, and as such we are qualified to operate a film and television program production business in China. Renewing the Permit Certificate is a very straightforward process and we do not anticipate

that it will cost us much or have a significant effect on our operations.

Regulation on Radio Television Management enacted by the State Council on August 1, 1997

This regulation was enacted to provide guidance on establishing Chinese radio and television stations as well as planning and constructing radio and television networks under the supervision of the SARFT. The regulation also states that radio and television programs may not be produced by companies or entities that do not hold the relevant

Permit Certificate, that radio and television programs may not be broadcasted without the approval of the SARFT and that any companies or entities that act in violation of these regulations will face regulatory action.

Effect on our operations. This is a general administrative regulation relating to all radio and television programming companies. We currently comply with all of the requirements of the regulation and if at any time we do not possess any specific permits that may

be required, we plan to locate cooperative companies that do and partner with them to produce of our films and television series’.

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any

environmental regulations or other requirements.

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect

on our results of operations.

Employees

We currently have 47 employees including our Chief Financial Officer and Chief Executive Officers. We engage seven of the employees on a full-time basis and 40 on a part-time basis.

15

Management's Discussion and Analysis of Financial Condition and Results of Operations

The following is a discussion of Vallant’s financial statements for the quarterly period ended September 30, 2009 and for the years ended June 30, 2009 and 2008. As described above, the financials of Vallant will be our financials going forward due to the reverse take-over accounting treatment of the share exchange transaction. Pro-forma

financial statements which combine both our financial statements and Vallant’s financial statements for the quarterly period ended September 30, 2009 are filed as Exhibit 99.1 to this Current Report on Form 8-K.

The following discussion should be read in conjunction with our financial statements, including the notes thereto, appearing elsewhere in this report. The discussion of results, causes and trends should not be construed to imply any conclusion that these results or trends will necessarily continue into the future. All references

to currency in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section are to U.S. dollars, unless otherwise noted.

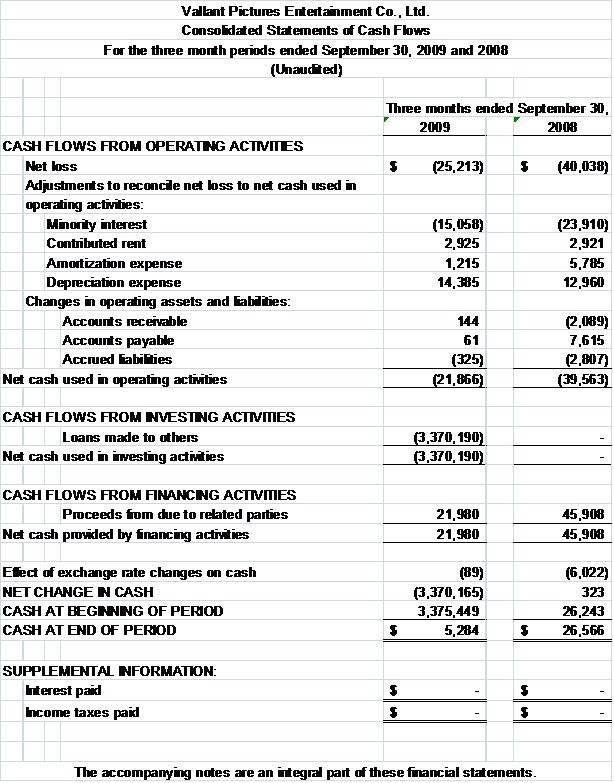

Liquidity and Capital Resources

For the three months ended September 30, 2009

As of September 30, 2009 we had $5,284 in cash, current assets of $4,901,827, current liabilities of $382,927 and a working capital surplus of $4,518,900. As of September 30, 2009 we had total assets of $6,903,261.

During the three months ended September 30, 2009 we spent net cash of $21,866 on operating activities, compared to net cash spending of $39,563 on operating activities during the same period in 2008. The decrease in expenditures on operating activities for the three months ended September 30, 2009 was primarily due to a decrease in our net

operating loss.

During the three months ended September 30, 2009 we spent net cash of $3,370,190 on investing activities, all of which was on loans made to others. We did not engage in any investing activities during the same period in 2008.

During the three months ended September 30, 2009 we received net cash of $21,980 from financing activities, compared to net cash received of $45,908 from financing activities during the same period in 2008. All of our receipts from financing activities during the three months ended September 30, 2009 and 2008 were in the form of proceeds

from related parties.

During the three months ended September 30, 2009 we recognized a loss of $89 due to the effect of exchange rates on our cash, compared to a loss of $6,022 due to the same effect during the same period in 2008. Our net cash decreased by $3,370,165 during the quarterly period ended September 30, 2009, compared to a net cash increase of $323

during the same period in 2008. The decrease in cash during the three months ended September 30, 2009 was largely a result of the $3,370,190 loan we made to Shaan’Xi Railroad Transportation Trading Ltd. on July 12, 2009 under a six month term note. The maturity date of the note is January 11, 2010 and the note bears interest at an annual rate of 2%. We entered into this loan to use excess cash which we had on hand, as we did not anticipate

requiring the cash for any film or television series development.

16

For the years ended June 30, 2009 and June 30, 2008

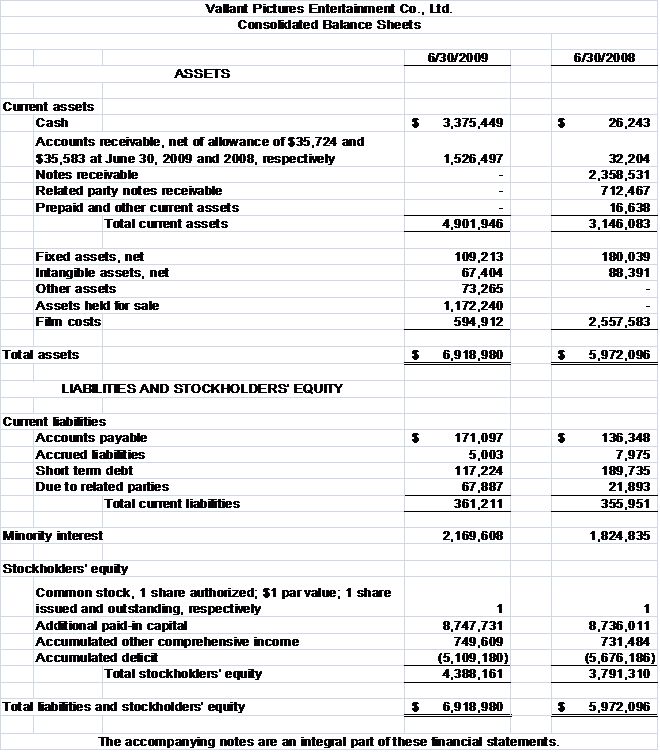

As of June 30, 2009 we had $3,375,449 in cash, current assets of $4,901,946, current liabilities of $361,211 and a working capital surplus of $4,540,735. As of June 30, 2008 we had $26,243 in cash, current assets of $3,146,083, current liabilities of $355,951 and a working capital surplus of $2,790,132. As of June 30, 2009 we had total assets

of $6,918,980, compared to total assets of $5,972,096 as of June 30, 2008.

During the year ended June 30, 2009 we received net cash of $574,764 from operating activities, compared to net cash received of $1,347,836 from operating activities during the year ended June 30, 2008. The decrease in receipts from operating activities during the year ended June 30, 2009 was primarily due to an increase in our accounts receivable

and a decrease in our net income. These changes were somewhat offset by increases in our cost or revenues and accounts payable and a decrease in our accrued interest on notes receivable during the same year.

During the year ended June 30, 2009 we received net cash of $2,801,324 from investing activities, including $2,156,892 from collecting notes receivable and $644,432 from collecting notes receivable from related parties. We did not spend any cash on any investing activities during that year. During the year ended June 30, 2008 we

spent net cash of $1,319,806 on investing activities, including $1,015,812 on film costs, $53,091 on the purchase of fixed assets, $1,459,500 on loans and $240,818 on loans to related parties, but we also received $1,434,820 from collecting notes receivable.

During the year ended June 30, 2009 we spent net cash of $27,353 on financing activities, compared to net cash spending of $338,733 on financing activities during the year ended June 30, 2008. The decrease in net cash spending on financing activities during the year ended June 30, 2009 was primarily due to decreases in proceeds from short

term debt and principal payments both on short term debt and to related parties. During the year ended June 30, 2009 we spent $73,265 on payments on short term debt and we did not spend any cash on payments to related parties, whereas we spent $291,900 and $265,758, respectively, on such payments during the year ended June 30, 2008.

During the year ended June 30, 2009 we recognized a gain of $471 due to the effect of exchange rates on our cash, compared to a gain of $138,359 due to the same effect during the year ended June 30, 2008. Our net cash increased by $3,349,206 during the year ended June 30, 2009, compared to a net cash decrease of $172,344 during the year ended

June 30, 2008. The increase in cash for the year ended June 30, 2009 was largely the result of our investing activities, and specifically the collection of notes receivable.

We anticipate that we will meet our ongoing cash requirements by retaining income as well as through equity or debt financing. We plan to cooperate with various individuals and institutions to acquire the financing required to produce and distribute our products and anticipate this will continue until we accrue sufficient capital reserves

to finance all of our productions independently.

We estimate that our expenses over the next 12 months (beginning December 2009) will be approximately $11,150,000 as described in the table below. These estimates may change significantly depending on the nature of our future business activities and our ability to raise capital from shareholders or other sources.

|

Description |

Estimated Completion Date |

Estimated Expenses

($) |

|

Legal and accounting fees |

12 months |

300,000 |

|

Film and television series development costs |

12 months |

8,500,000 |

|

Marketing and advertising |

12 months |

300,000 |

|

Investor relations and capital raising |

12 months |

150,000 |

|

Management and operating costs |

12 months |

250,000 |

|

Salaries and consulting fees |

12 months |

100,000 |

|

Fixed asset purchases |

12 months |

1,500,000 |

|

General and administrative expenses |

12 months |

50,000 |

|

Total |

11,150,000 |

We intend to meet our cash requirements for the next 12 months through a combination of debt financing and equity financing by way of private placements. We currently do not have any arrangements in place to complete any private placement financings and there is no assurance that we will be successful in completing any private placement financings. If

we are not able to successfully complete any private placement financings, we plan to cooperate with film and television producers or obtain shareholder loans to meet our cash requirements. However, there is no assurance that any such financing will be available or if available, on terms that will be acceptable to us. We may not raise sufficient funds to fully carry out our business plan.

17

Share Cancellations

On July 7, 2009 we entered into an agreement with Fullead Overseas Limited, a company over which Bin Li, our Director, has sole voting and investment power, to issue Fullead 32,500,000 shares of our common stock at a price of $0.002 for cash proceeds of $65,000. Pursuant to the terms of this agreement, we were required to enter into share

cancellation agreements with holders of 30,800,000 shares of our issued and outstanding common stock and appoint new directors and officers to serve as our Board of Directors and management. The details of the share cancellations were disclosed in a Current Report on Form 8-K filed with the SEC on July 7, 2009.

Subsequent Events

On September 16, 2009 we entered into a share exchange agreement with Vallant. The transaction was closed on November 30, 2009. According to the terms of the share exchange agreement, Vallant agreed to sell its sole issued and outstanding common share in exchange for 7,000 shares of our common stock. Therefore, Vallant became

our wholly owned subsidiary.

On October 16, 2009 we loaned Shanxi Goethe Business Trading Ltd., a company unrelated to us, $1,078,245 under a three month term note. The maturity date of the note is January 15, 2010 and the note bears interest at a three month rate of 1%. We entered into this loan to use excess cash which we had on hand, as we did not anticipate

requiring the cash for any film or television series development.

On October 25, 2009 we entered into a sales agreement to transfer our interest in Fox-Hunting for approximately $878,000.

On October 27, 2009 we entered into a sales agreement to transfer our interest in Desert Love Story for approximately $293,000.

Results of Operations

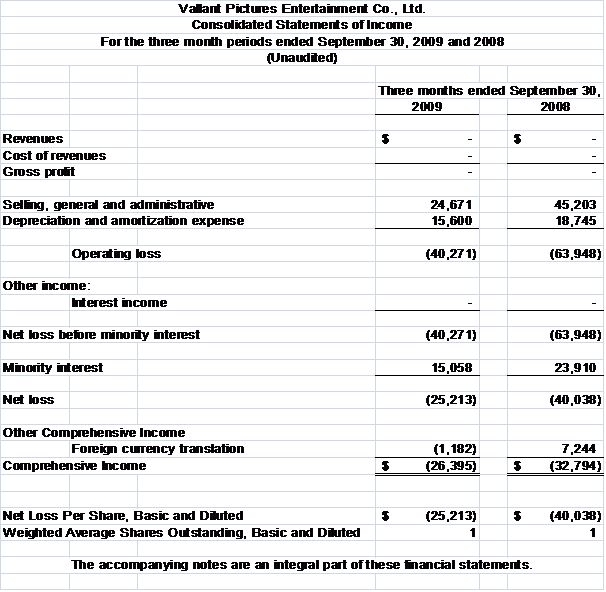

For the three months ended September 30, 2009 and September 30, 2008

Revenues

During the three months ended September 30, 2009 we did not earn any revenues, we incurred an operating loss of $40,271 and we incurred a net loss of $25,213. During the three months ended September 30, 2008 we did not earn any revenues, we incurred an operating loss of $63,948 and we incurred a net loss of $40,038.

Expenses

During the three months ended September 30, 2009 we incurred $24,671 in general and administrative expenses and $15,600 in depreciation and amortization expenses, compared to $45,203 in general and administrative expenses and $18,745 in depreciation and amortization expenses during the same period in 2008.

18

For the years ended June 30, 2009 and June 30, 2008

Revenues

During the year ended June 30, 2009 we generated $1,675,455 in revenues, compared to revenues of $2,030,254 during the year ended June 30, 2008. Our cost of revenues increased from $486,914 to $800,431 from the year ended June 30, 2008 to June 30, 2009. As a result, our gross profit decreased from $1,543,340 during the year ended

June 30, 2008 to $875,024 during the year ended to June 30, 2009.

We also generated interest income of $278,331 during the year ended June 30, 2009 and $197,283 during the year ended June 30, 2008.

Expenses

For the years ended June 30, 2009 and June 30, 2008 our expenses were as follows:

|

Type of Expense |

June 30, 2009

($) |

June 30, 2008

($) |

||||||

|

Cost of revenues |

800,431 | 486,914 | ||||||

|

Selling, general and administrative |

153,098 | 295,956 | ||||||

|

Depreciation and amortization |

92,860 | 92,660 | ||||||

|

Impairment loss |

- | 41,169 | ||||||

For the year ended June 30, 2009 our total expenses were $1,046,389 including cost of revenues, compared to total expenses of $916,699 during the year ended June 30, 2008. Not accounting for cost of revenues, our total expenses during the year ended June 30, 2009 were $245,958 compared to total expenses of $429,785 during the year ended June

30, 2008.

Net Income

For the year ended June 30, 2009 we generated net income of $907,397 before minority interest, compared to net income before minority interest of $1,310,838 for the year ended June 30, 2008.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

Inflation

The effect of inflation on our revenues and operating results has not been significant.

19

Critical Accounting Policies

Our financial statements are affected by the accounting policies used and the estimates and assumptions made by management during their preparation. A complete listing of these policies is included in Note 2 of the notes to our financial statements for the years ended June 30, 2009 and 2008. We have identified below the accounting

policies that are of particular importance in the presentation of our financial position, results of operations and cash flows, and which require the application of significant judgment by management.

Principles of Consolidation

Our consolidated financial statements include our accounts and the accounts of Xi’An TV Media, which is a variable interest entity with us as the primary beneficiary. In accordance with Financial Accounting Standards Board Interpretation No. 46 (Revised) (“FIN46R”), Consolidation of Variable Interest Entities, we identify entities

for which control is achieved through means other than through voting rights (a "variable interest entity" or "VIE") and determine when and which business enterprise, if any, should consolidate the VIE.

We evaluated our participating interest in Xi’An TV Media and concluded we are the primary beneficiary of Xi’An TV Media, a variable interest entity as defined under FIN46R. We consolidated Xi’An TV Media and all significant intercompany transactions and balances have been eliminated.

Use of Estimates

The preparation of financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes, including estimates of ultimate revenues and ultimate costs of film and television product, estimates

of product sales that will be returned and the amount of receivables that ultimately will be collected, the potential outcome of future tax consequences of events that have been recognized in our financial statements and loss contingencies. Actual results could differ from those estimates. To the extent that there are material differences between these estimates and actual results, our financial condition or results of operations will be affected. Estimates are based on past experience

and other assumptions that management believes are reasonable under the circumstances, and management evaluates these estimates on an ongoing basis.

Earnings Per Share

We calculate net income per share in accordance with FASB ASC 260 “Earnings Per Share”. Basic earnings per share is computed by dividing net income by the weighted average number of shares of common stock outstanding during each period. Diluted earnings per share is computed by dividing net income by the weighted average number

of shares of common stock, common stock equivalents and potentially dilutive securities outstanding during each period.

Costs of Revenues

Film Costs – We capitalize film costs in accordance with FASB ASC 926, “Accounting by Producers or Distributors of Films”. Film costs are stated at the lower of cost, less accumulated amortization, or fair value. Production overhead, a component of film costs, includes allocable costs of individuals or departments with exclusive

or significant responsibility for the production of films. Substantially all of our resources are dedicated to the production of our films. Capitalized production overhead does not include selling, general and administrative expenses. Interest expense on funds invested in production is capitalized into film costs until production is completed. In addition to the films being produced, costs of productions in development are capitalized as development film costs in accordance

with the provisions of ASC 926 and are transferred to film production costs when a film is set for production. In the event a film is not set for production within three years from the time the first costs are capitalized or the film is abandoned, all such costs are generally expensed.

20

Film Cost Amortization – Once a film is released, film costs are amortized and participations and residual costs are accrued on an individual film basis in the proportion that the revenue during the period for each film (“Current Revenue”) bears to the estimated remaining total revenue to be received from all sources for each film

(“Ultimate Revenue”) as of the beginning of the current fiscal period as required by ASC 926. The amount of film costs that is amortized each period will depend on the ratio of Current Revenue to Ultimate Revenue for each film for such period. We make certain estimates and judgments of Ultimate Revenue to be received for each film based on information received from our distributor and our knowledge of the industry. Ultimate Revenue does not include estimates of revenue

that will be earned beyond ten years of a film’s initial theatrical release date.

Unamortized film production costs are evaluated for impairment each reporting period on a film-by-film basis in accordance with the requirements of ASC 926. If estimated remaining net cash flows are not sufficient to recover the unamortized film costs for that film, the unamortized film costs will be written down to fair value determined

using a net present value calculation.

We currently rent two offices totaling 1,321 square meters in area, each of which serves a different business purpose:

|

· |

Production Center: Room B 2802, Yiyuange Building B, Huashuo Garden, No. 190, Wenyi Road, Yanta District, Xi’An, Shaan’Xi Province, China, with an area of 209 square meters. We rent this office from our shareholder Zheng Shao Kang at a cost of approximately $1,000 per month;

and |

|

· |

Corporate Office: 12/F Building D, Chang An International Plaza, No. 88 Nanguanzheng Street, Beilin District, Xi’An, Shaan’Xi Province, China, with an area of 1,112 square meters. We rent this office at a cost of approximately $18,300 per month. |

For the year ended June 30, 2009 our total rent expenses were $48,204 for all our office space, including a temporary accounting office at Room 1102, Building B, Prince Chamber, South 2nd Cycle, Yanta District, Xi’An, Shaan’Xi Province, P.R. China, with an area

of 144 square meters that we no longer use and that was provided to us free of charge. All of our rental arrangements are on a month-to–month basis.

The following table sets forth the ownership, as of November 30, 2009, of our common stock by each of our directors, by all of our executive officers and directors as a group and by each person known to us who is the beneficial owner of more than 5% of any class of our securities. As of November 30, 2009, there were 39,750,000 shares of our common stock

issued and outstanding. All persons named have sole or shared voting and investment control with respect to the shares, except as otherwise noted. The number of shares described below includes shares which the beneficial owner described has the right to acquire within 60 days of the date of this Form 8-K.

21

|

Title of Class |

Name and Address of

Beneficial Owner |

Amount and Nature of

Beneficial Ownership |

Percent of Class

(5) |

|

Common

Stock |

Bin Li (1)

12/F, Block D, Chang An Guo Ji

No. 88 Nan Guan Zheng Street

Beilin District, Xi’An

Shaan’Xi Province, China |

2,007,000 |

5.0 |

|

Common

Stock |

Dean Li (2)

5/F, Huaxing Building

No. 57 Keji 3 Road

Gaoxing District, Xi'An

Shaan'Xi Province, China |

0 |

0 |

|

Common

Stock |

Shengli Liu (3)

4/F, Building A

No. 12 Xiangzimiao Street

Nanmenli District, Xi'An

Shaan’Xi Province, China |

0 |

0 |

|

Common

Stock |

Ying Xue (4)

Room 705, 7/F, Shiguang 2000 Building No. 8 Wu Xing Street

Lianhu District, Xi'An

Shaan'Xi Province, China |

0 |

0 |

|

All Officers and Directors as a Group |

2,007,000 |

5.0 | |

|

Common

Stock |

Chen Tao

Room 502, Unit 2, 8/F, Xiying Village Yanta District, Xi’An

Shaan’Xi Province, China |

2,005,000 |

5.0 |

|

Common

Stock |

Jing Mu

Room 11, Building 1

No. 62 Daxing Road

Lianhu District, Xi’An

Shaan’Xi Province, China |

11,500,000 |

28.9 |

|

Common Stock |

Hao Sun

No. 201 Shangqin Road

Xincheng District, Xi’An

Shaan’Xi Province, China |

10,000,000 |

25.2 |

|

Common Stock |

Wenqian Shen

12/F, Chang An International Plaza

No. 88 Nanguanzheng Street

Beilin District, Xi’An

Shaan’Xi Province, China |

5,000,000 |

12.6 |

|

Common Stock |

Zhongchi Li

Room 106 2/F

No. 1 Xisi Road

Xincheng District, Xi’An

Shaan’Xi Province, China |

3,000,000 |

7.5 |

|

All Others as a Group |

31,505,000 |

79.3 |

|

(1) |

Bin Li is our Director. |

|

(2) |

Dean Li is our President, Chief Executive Officer, Secretary and Director. |

|

(3) |

Shengli Liu is our Director. |

|

(4) |

Ying Xue is our Chief Financial Officer, Principal Accounting Officer and Treasurer. |

|

(5) |

Based on 39,750,000 issued and outstanding shares of our common stock as of November 30, 2009. |

Changes in Control

As of November 30, 2009 we had no pension plans or compensatory plans or other arrangements which provide compensation in the event of termination of employment or a change in our control.

22

Directors and Officers

Our Articles state that our authorized number of directors shall be not less than one and shall be set by resolution of our Board of Directors. Our Board of Directors has fixed the number of directors at three, and we currently have three directors.

Our current directors and officers are as follows:

|

Name |

Age |

Position |

|

Dean Li |

46 |

President, Chief Executive Officer, Secretary and Director |

|

Ying Xue |

38 |

Chief Financial Officer, Principal Accounting Officer and Treasurer |

|

Bin Li |

41 |

Director |

|

Shengli Liu |

38 |

Director |

Our Directors will serve in that capacity until our next annual shareholder meeting or until their successors are elected and qualified. Officers hold their positions at the will of our Board of Directors. There are no arrangements, agreements or understandings between non-management security holders and management under which

non-management security holders may directly or indirectly participate in or influence the management of our affairs.

Dean Li, President, Chief Executive Officer, Secretary and Director

Dean Li has served as our President, Chief Executive Officer, Secretary and Director since July 7, 2009. Mr. Li has significant experience in China’s capital markets and corporate management. He received his Bachelor’s degree in radio engineering technology from the Chinese People’s Liberation Military Academy

in 1985, and was awarded the military rank of Technical Captain in 1987. After ending his military career in 1993, Mr. Li was appointed as the General Manager of the Shanghai Branch Company of Shaan’Xi Province International Trust Investment Holding Co., where he remained until 1998.

From 1998 to 2001, Mr. Li worked as the Assistant to the General Manager of Wuhan International Financial Leasing Co., and he also held the position of General Manager of Wuhan Zhongnan Securities Corp.. From 2001 to 2005, Mr. Li served as the Northern Area General Manager of Wuhan Securities Co.. Ltd. From 2000 to 2001, he also

served as a Director in a Chinese publicly listed company, Dalian Thermoelectricity Holding Ltd.

Mr. Li earned a Master’s degree of enterprise culture from the Central China Normal University in 2004. Since 2006 he has served on the board of directors of Xi’An TVMEDIA Co., Ltd. and Shaan’Xi Western Capital Investment Management Co., Ltd.

Ying Xue, Financial Officer, Principal Accounting Officer and Treasurer

Ying Xue has served as our Chief Financial Officer, Principal Accounting Officer and Treasurer since July 7, 2009. Ms. Xue has 18 years of experience in accounting and financial management. She earned a Bachelor’s degree in economic management from Shaan’Xi Provincial Administrative College in 2001. From

1991 to 1992, she worked as an accountant for Xi’An City Mechanism Research Institute., and from 1992 to 2006 she worked as an accounting officer for Xi’An International Economic Technical Trading Co.

In 2006, Ms. Xue joined Xi’An TVMEDIA Co., Ltd. as a financial manager. She acquired an intermediate accountant certificate in 2002 and a Chinese CPA certificate in 2005.

23

Bin Li, Director

Bin Li has served as our Director since July 7, 2009. Mr. Li has 18 years of experience in the movie and TV industry in China. In 2006, Mr. Li invested in Xi’An TVMEDIA Co., Ltd. and became one of its major shareholders. From 1987 to 1990, he served in the 77th unit of the Chinese People’s Liberation Army,

and since 1991 he has worked for Xi’An Movie Studio, one of the most famous movie studios in China.

Shengli Liu, Director

Shengli Liu has served as our Director since July 7, 2009. Mr. Liu has over 10 years of experience in business management. He was one of the founders of Shaan’Xi Li Bao Ecological Technology Stock Co., Ltd. and has served as the company’s as Chairman since 2002.

In 1998, Mr. Liu acted as the manager of the Xi’An Railroad Bureau, a position he left in the same year before founding Shaan’Xi Heng Li Da Real Estate Co. Ltd., with whom he is currently engaged in various aspects of the real estate business and serves as its Chairman and General Manager. In 2001, Mr. Liu founded Shaan’Xi Henglida

Commercial Co., Ltd., a company of which he is also the Chairman and General Manager. From 2000 to 2002, Mr. Liu was in charge of the reorganization of the ZhongShanMen Printing Factor in Xi’An, where he facilitated an asset acquisition valued at approximately $1,250,000.

Other Directorships

None of our directors hold any other directorships in any company with a class of securities registered pursuant to section 12 of the Exchange Act or subject to the requirements of section 15(d) of such Act or any company registered as an investment company under the Investment Company Act of 1940.

Board of Directors and Director Nominees

Since our Board of Directors does not include a majority of independent directors, the decisions of the Board regarding director nominees are made by persons who have an interest in the outcome of the determination. The Board will consider candidates for directors proposed by security holders, although no formal procedures for submitting

candidates have been adopted. Unless otherwise determined, at any time not less than 90 days prior to the next annual Board meeting at which a slate of director nominees is adopted, the Board will accept written submissions from proposed nominees that include the name, address and telephone number of the proposed nominee; a brief statement of the nominee’s qualifications to serve as a director; and a statement as to why the security holder submitting the proposed nominee believes that the nomination

would be in the best interests of our security holders. If the proposed nominee is not the same person as the security holder submitting the name of the nominee, a letter from the nominee agreeing to the submission of his or her name for consideration should be provided at the time of submission. The letter should be accompanied by a résumé supporting the nominee's qualifications to serve on the Board, as well as a list of references.

The Board identifies director nominees through a combination of referrals from different people, including management, existing Board members and security holders. Once a candidate has been identified, the Board reviews the individual's experience and background and may discuss the proposed nominee with the source of the recommendation. If

the Board believes it to be appropriate, Board members may meet with the proposed nominee before making a final determination whether to include the proposed nominee as a member of the slate of director nominees submitted to security holders for election to the Board.

Some of the factors which the Board considers when evaluating proposed nominees include their knowledge of and experience in business matters, finance, capital markets and mergers and acquisitions. The Board may request additional information from each candidate prior to reaching a determination, and it is under no obligation to formally

respond to all recommendations, although as a matter of practice, it will endeavor to do so.

Conflicts of Interest

Our directors are not obligated to commit their full time and attention to our business and, accordingly, they may encounter a conflict of interest in allocating their time between our operations and those of other businesses. In the course of their other business activities, they may become aware of investment and business opportunities

which may be appropriate for presentation to us as well as other entities to which they owe a fiduciary duty. As a result, they may have conflicts of interest in determining to which entity a particular business opportunity should be presented. They may also in the future become affiliated with entities that are engaged in business activities similar to those we intend to conduct.

In general, officers and directors of a corporation are required to present business opportunities to the corporation if:

|

· |

the corporation could financially undertake the opportunity; |

|

· |

the opportunity is within the corporation’s line of business; and |

|

· |

it would be unfair to the corporation and its stockholders not to bring the opportunity to the attention of the corporation. |

We plan to adopt a code of ethics that obligates our directors, officers and employees to disclose potential conflicts of interest and prohibits those persons from engaging in such transactions without our consent.

24

Significant Employees

Other than as described above, we do not expect any other individuals to make a significant contribution to our business.

Legal Proceedings

None of our directors, executive officers, promoters or control persons has been involved in any of the following events during the past five years:

|

· |

any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

|

· |

any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offences); |

|

· |

being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or |

|

· |

being found by a court of competent jurisdiction (in a civil action), the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, where the judgment has not been reversed, suspended, or vacated. |

Audit Committee

We do not currently have an audit committee or a committee performing similar functions. The Board of Directors as a whole participates in the review of our financial statements and disclosure.

Family Relationships

There are no family relationships among our officers, directors, or persons nominated for such positions.

Code of Ethics

We have not yet adopted a code of ethics that applies to our officers, directors and employees. When we do adopt a code of ethics, we will disclose it in a Current Report on Form 8-K.

25

The following summary compensation table sets forth the total annual compensation paid or accrued by us to or for the account of our principal executive officer during the last completed fiscal year and each other executive officer whose total compensation exceeded $100,000 in either of the last two fiscal years:

Summary Compensation Table (1)

|

Name and Principal Position |

Year |

Salary

($) |

Total

($) |

|

Darrin Zinger (2) |

2008 |

1,600 (3) |

1,600 (3) |

|

(1) |

We have omitted certain columns in the summary compensation table pursuant to Item 402(a)(5) of Regulation S-K as no compensation was awarded to, earned by, or paid to any of the executive officers or directors required to be reported in that table or column in any fiscal year covered by that table. |

|

(2) |

Darrin Zinger served as our President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Secretary, Treasurer and Director from September 13, 2008 to July 7, 2009. |

|

(3) |

Consisted of a monthly fee of $400 for management services paid pursuant to the terms of a consulting agreement. |

Option Grants

As of November 30, 2009 we had not granted any options or stock appreciation rights to our named executive officers or directors.

Management Agreements

We have not yet entered into any consulting or management agreements with any of our current executive officers or directors.

Compensation of Directors

Our directors did not receive any compensation for their services as directors from our inception to November 30, 2009. We have no formal plan for compensating our directors for their services in the future in their capacity as directors, although such directors are expected in the future to receive options to purchase shares of our common