Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GEORESOURCES INC | d8k.htm |

GeoResources, Inc Corporate Profile November 2009 Exhibit 99.1 |

2 Forward-Looking Statements Information herein contains forward-looking statements that involve significant risks and uncertainties, including our need to replace production and acquire or develop additional oil and gas reserves, intense competition in the oil and gas industry, our dependence on our management, volatile oil and gas prices, costs associated with hedging activities and uncertainties of our oil and gas estimates of proved reserves and reserve potential, which may be substantial. In addition, all statements or estimates made by the company, other than statements of historical fact, related to matters that may or will occur in the

future are forward-looking statements. Readers are encouraged to read our December 31, 2008 Annual Report on Form 10-K/A and any and all our other documents filed with the SEC regarding

information about GeoResources for meaningful cautionary language in respect of the forward-looking statements herein. Interested persons are able to

obtain free copies of filings containing information about GeoResources,

without charge, at the SEC’s Internet site (http://www.sec.gov). There is no duty to update the statements herein. |

The

disclosures below apply to the contents of this presentation: On April 17, 2007, GeoResources, Inc. (“GEOI” or the “Company”) merged with Southern Bay Oil & Gas, L.P. (“Southern Bay”) and a subsidiary of Chandler Energy, LLC (“Chandler”), and

acquired certain Chandler-associated oil and gas properties

(collectively, the “Merger”). At the time of the Merger, the former Southern Bay partners received approximately 57% of the Company’s outstanding common stock. Although GEOI was the legal

acquirer in the Merger, for financial reporting purposes the Merger was

accounted for as a reverse acquisition of GEOI by Southern Bay. Therefore, any information prior to 2007 relates solely to Southern Bay. In connection with the

Merger, officers and directors affiliated with Southern Bay and Chandler

were appointed to most of our board seats and executive officer positions. Proved reserves, and estimates of discounted present values associated therewith

(“PV-10”), as shown throughout this profile, are estimated by

GEOI management as of 10/1/09 and based on NYMEX strip pricing at 9/30/09. The NYMEX oil strip used for the estimates ranged from $70.65 per BO for 2009 to $90.16 per BO for

years 2017 and beyond. The NYMEX gas strip ranged from $4.83 per MCF for

2009 to $7.52 per MCF for years 2017 and beyond. Actual prices realized will likely vary materially from the NYMEX strip at 9/30/09. The company’s independent

engineers are Cawley, Gillespie & Associates, Inc. and while they have

not reviewed nor audited the reserves and economics presented herein, the company believes it has estimated reserves in a manner similar to external independent engineers.

Non-proved reserve potential represents the company’s estimated reserve

exposure associated with existing fields, acreage and prospects. These

estimated reserves do not include certain exploratory objectives associated with proved undeveloped reserves or “work-in-progress”, which may result in additional

prospects or drilling locations. Current SEC regulations do not recognize non-proved reserves. As used herein, EBITDAX is calculated as earnings before interest, income taxes,

depreciation, depletion and amortization, and exploration expense and

further includes impairments and hedge ineffectiveness and income or loss on derivative contracts. EBITDAX should not be considered as an alternative to net income (as an indicator of operating performance) or as an alternative to cash flow (as a measure of liquidity or ability to service debt

obligations) and is not in accordance with, nor superior to, generally

accepted accounting principles, but provides additional information for evaluation of our operating performance. Estimates of partnership reserves and values associated therewith do not include

potential reversionary interests, if any. 3 Additional Disclosures |

4 Key Investment Highlights Value Creation Experienced Management and Technical Staff with Large Ownership Stake Board and management own approximately 53% of the company Successful track record of creating value and liquidity for shareholders Attractive Value Proposition Trading at a significant discount to NAV Strong Asset Base Strategically located and geographically diverse Balanced oil vs. gas High level of operating control Significant Identified Growth Opportunities on Existing Properties Low risk development drilling Higher impact exploration upside Strong Financial Position Moderate leverage with significant cash flow |

5 Company Overview Company Highlights Direct Direct + Ownership Partnership Proved Reserves (MMBOE) 22.5 24.3 Oil 52% 49% Proved Producing 61% 63% Proved Developed 74% 75% PV 10% (millions) $393 $419 Production (BOEpd) (1) 5,344 6,303 Operated 82% 82% Gross Acreage (2) 483,324 483,324 Net Acreage (2) 224,377 234,427 (1) Represents the company’s 3Q 2009 production rate. (2) Acreage information estimated as of 7/1/09. Maps herein exclude minor value properties.

|

6 Value-Driven Growth Strategy Asset Rationalization Selectively divest assets to upgrade portfolio Focus on maximizing IRR for investors Cost Control Operate as efficiently as possible by focusing on minimizing development, production, and G&A expenses Pursue promoted partner positions to reduce costs and generate operating fees

Pursue exploration prospects on both new and existing fields Solicit partners on a promoted basis to reduce risk Exploration Acquire operated properties with existing production, development opportunities, and exploration potential Create value by purchasing assets during market downturns Acquisitions Development and Exploitation Drill PUDs and probable reserves to enhance property value Focus on areas with development and exploitation upside Implement re-engineering and development programs to extend field life, increase proved reserves, lower unit operating costs, and enhance economics

|

7 Management Profiles Name Title Experience Frank A. Lodzinski President and Chief Executive Officer • 38 years of oil and gas industry experience • B.S.B.A. Wayne State University, 1971 • Employed in accounting, finance, operations and management positions

1971-1984 • Began career as independent with formation of Energy Resource Associates in 1984

• Thereafter successfully led Hampton (NASDAQ: “HPTR”), Texoil (NASDAQ:

“TXLI”), AROC and private entities to profitable growth and

liquidity events • Formed Southern Bay in 2005 before merging with GeoResources Robert J. Anderson Vice President, Business Development – Acquisitions and Divestitures • 23 years of oil and gas industry experience • B.S. Petroleum Engineering University of Wyoming, 1986. MBA, University of

Denver, 1988 • Significant experience with both major oil companies (ARCO International / Vastar

Resources) and independents (Hunt Oil / Hugoton Energy / Anadarko

Petroleum) • Joined AROC in 2004 and has been with Frank Lodzinski since that time Collis P. Chandler, III Executive Vice President and Chief Operating Officer – Northern Region • 17 years of oil and gas industry experience • B.S. University of Colorado, 1992 • Former President of Chandler Energy, LLC, which conducted E&P operations primarily

in the Rocky Mountain Region and Michigan Howard E. Ehler Chief Financial Officer and Principal Accounting Officer • 43 years of oil and gas industry experience • B.B.A. Texas Tech, 1966 • Former partner with Grant Thornton • Served as VP of Finance and CFO for Midland Resources, Inc. from 1997 – 1998 • Worked with Frank Lodzinski since 2001 at AROC, Southern Bay, and GeoResources

Francis M. Mury Executive Vice President and Chief Operating Officer – Southern Region • 35 years of oil and gas industry experience • B.S. Nichols State University, 1974 • Worked for Texaco and independents from 1974-1989 as a petroleum engineer

• Worked with Frank Lodzinski for last 20 years |

8 Management History 2004- 2007 Southern Bay Energy, LLC Gulf Coast, Permian Basin REVERSE MERGED INTO GEORESOURCES 2000-2007 Chandler Energy, LLC Williston Basin, Rockies ACQUIRED BY GEORESOURCES 1988-2000 Chandler Company Rockies, Williston Basin MERGED INTO SHENANDOAH THEN SOLD TO QUESTAR 1992-1996 Hampton Resources Corp, Gulf Coast SOLD TO BELLWETHER EXPLORATION Preferred investors – 30% IRR Initial investors – 7x return 1997-2001 Texoil Inc. Gulf Coast, Permian Basin SOLD TO OCEAN ENERGY Preferred investors – 2.5x return Follow-on investors – 3x return Initial investors – 10x return 2001-2004 AROC Inc. Gulf Coast, Permian Basin, Mid-Con. DISTRESSED ENTITY LIQUIDATED FOR BENEFIT OF INITIAL SHAREHOLDERS Preferred investors – 17% IRR Initial investors – 4x return Track record of profitability and liquidity Long-term repeat investors Extensive industry and financial relationships Significant operational and financial experience Cohesive management and technical staff Team has been together for up to 20 years through multiple entities |

9 Strong Financial Support GE Capital Currently participating with GeoResources through two limited partnerships Austin Chalk wells in the Giddings field Gas producing fields in Oklahoma GE has supported Lodzinski-backed projects and predecessors since 2003 GE has recently backed GeoResources in multiple acquisition bids Wachovia Bank Has led senior revolving credit facilities for three different Lodzinski-managed

companies since 1995 Wachovia Capital currently holds an approximate 10% equity interest in GeoResources and has invested in predecessor companies Vlasic Investments L.L.C. Has been an equity capital provider for five different Lodzinski-managed companies

since 1988 Has owned more than 28% of GeoResources since the reverse Merger in 2007 EnCap Investments L.P. Invested with Lodzinski from 1996-2001 Enlisted Lodzinski to recapitalize and manage AROC Inc.(2001-2004). Lodzinski and his management team implemented a turn-around plan resulting in liquidity and recovery of capital

investments for prior investors. Vlasic, Wachovia and management were “turn-around” and preferred investors |

10 Demonstrated History of Successful A&D 2007/2008: High-graded portfolio and expanded drilling

inventory April 2007: Reverse merger and Chandler acquisition October 2007: $104.0 million acquisition – primarily in Louisiana and Texas January 2008: $6.6 million sale – Michigan February 2008: $7.9 million acquisition – Williston Basin February 2008: $1.8 million sale – Louisiana May 2008: $11.8 million sale – seven fields, Louisiana and Texas May 2008: Participation in the $61.7 million formation of OKLA Energy Partners LP September 2008: $3.6 million acquisition – Oklahoma 2009: Expanded in core areas, high-graded portfolio and increased

drilling inventory January 2009: $1.6 million sale – Louisiana May 2009: $10.4 million acquisition – Williston Basin May 2009: $48.4 million acquisition – Giddings Field, Texas Summary of Acquisitions/Divestitures |

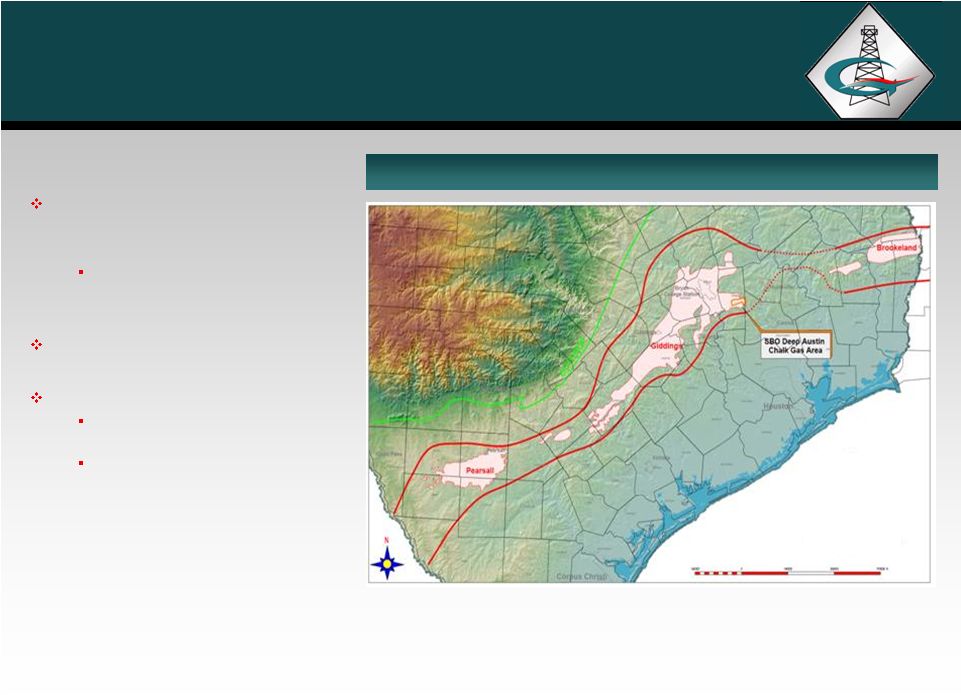

11 Bakken Shale trend of the Williston Basin Acquired through existing joint venture – net cash $10.4 million Acquired a 15% interest in 60,000 gross acres (9,000 net acres), plus interests in 59 wells Added 486 MBOE of proved reserves and numerous drilling locations Added 180 BOEpd of net production Purchase price = $12.00/BOE and $491/acre Giddings Field, Texas Purchased from affiliated partnership – net cash $48.4 million Increased working interest from 7% to between 34% and 37% Acquired 68 producing wells plus undeveloped Austin Chalk acreage Added 25 BCFE of proved reserves (96% natural gas and natural gas liquids, 73%

developed) Added daily net production of 10.6 MMCF and 85 BO liquids

Increased partnership share to 30% Purchase price = $1.27/MCFE Upside potential in Yegua, Eagle Ford and Georgetown Recent Acquisitions – May 2009 |

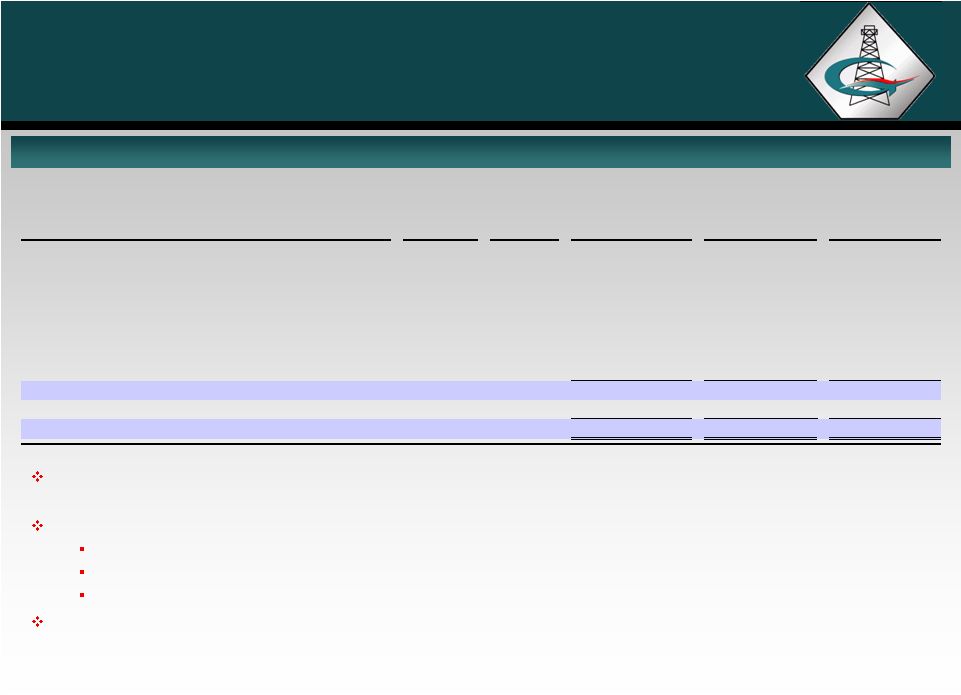

12 Net Asset Value Net Asset Value (1) As of September 30, 2009, excludes derivative financial instruments. (2) Includes Williston Basin Bakken acreage and Eagle Ford and Georgetown rights below

Austin Chalk, at cost. ($ in millions) PV-10 % of Total Proved Reserves: Proved Developed Producing $249.3 63.5% Proved Developed Non-Producing 60.9 15.5% Proved Undeveloped 82.3 21.0% Total Proved PV-10 Value $392.5 100.0% Plus: Working Capital (1) $14.4 Acreage and Other (2) 10.0 Partnership Value 26.6 Less: Total Debt (104.0) Total Net Asset Value $339.5 Shares Outstanding (thousands) 16,242 Net Asset Value Per Share $20.90 |

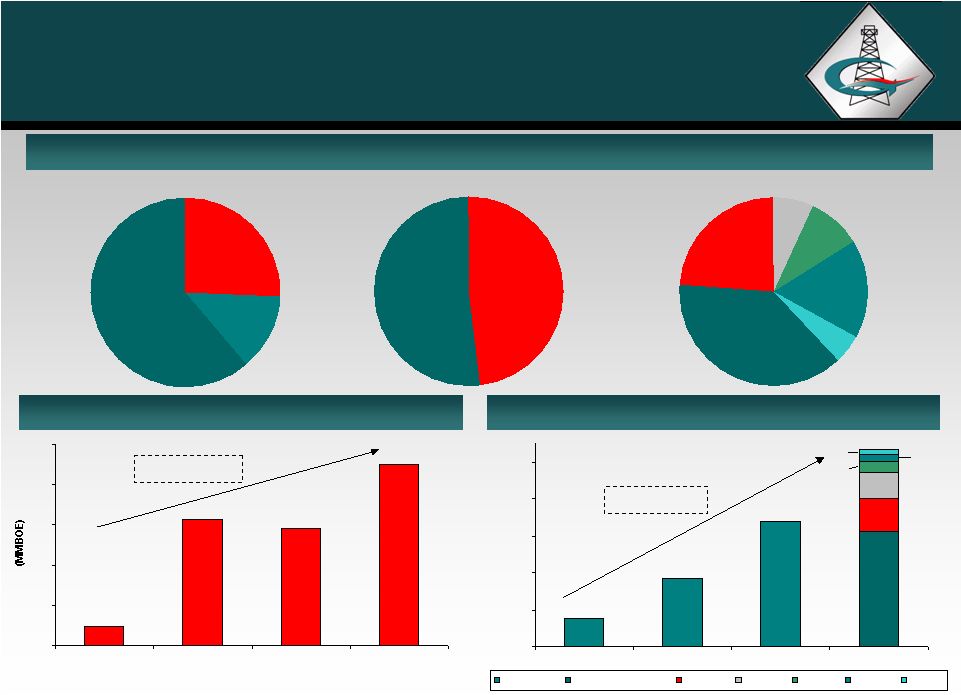

13 Proved Reserves Proved Reserves by Category Proved Reserves by Area ($ in millions) Oil Gas Total % of Corporate Interests MMBO BCF MMBOE Total PV-10 PDP 7.3 39.0 13.8 61.1% $249.3 PDNP 1.9 5.7 2.8 12.5% 60.9 PUD 2.5 20.2 5.9 26.4% 82.3 Total Proved Corporate Interests 11.7 64.9 22.5 100.0% 392.5 Partnership Interests 0.2 9.4 1.8 26.6 Total Proved Corporate and Partnerships 11.9 74.3 24.3 $419.1 Partnership Proved % of Interests Total Proved % of Total Area MMBOE Proved MMBOE MMBOE Reserves Gulf Coast/ETX/STX 8.5 37.8% 1.7 10.2 42.0% Williston 5.5 24.4% 0.0 5.5 22.6% Louisiana 3.7 16.4% 0.0 3.7 15.2% Permian 2.1 9.3% 0.0 2.1 8.6% Mid-Continent 1.6 7.1% 0.1 1.7 7.0% Other 1.1 5.0% 0.0 1.1 4.6% Total 22.5 100.0% 1.8 24.3 100.0% |

(1) Excludes partnership interests. (2) 2006 – 2008 proved reserves based on SEC guidelines. Current reserves estimated as of 10/1/09

based on 9/30/09 NYMEX strip prices. 5,344 Louisiana 17% Other 5% Williston 24% Mid-Con 7% Permian Basin 9% Gulf Coast/ETX/STX 38% 14 Proved Reserves (MMBOE) (2) Average Daily Production (BOEpd) Reserves and Production – Direct Interests (1) Current Proved Reserves – 22.5 MMBOE (2) CAGR: 102% CAGR: 125% Oil 48% Gas 52% Developed Non- Producing 13% Producing 61% Undeveloped 26% 3,388 768 1,826 58% 17% 13% 6% 3% 3% 1,000 2,000 3,000 4,000 5,000 2006 2007 2008 Current (3Q 09) Total BOE/d Gulf Coast/ETX/STX Louisiana Williston

Permian Mid-Cont Other 2.4 15.7 14.6 22.5 0.0 5.0 10.0 15.0 20.0 25.0 2006 2007 2008 Current (10/1/09) |

15 EBITDAX Total Leverage ($ in millions) Ability to control destiny without reliance on capital markets Track record of EBITDAX growth Conservative use of leverage to maintain strong balance sheet Debt increase in 2009 funded acquisitions in core areas As of September 30, 2009, the company’s total debt to Last Twelve Months

(“LTM”) EBITDAX is 2.5x The company’s borrowing base was

recently increased from $135 million to $145 million Credit facility led by Wells Fargo and is priced at LIBOR plus 2.25 – 3.00% Strong Financial Position 3.0x 0.8x 2.5x 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 2007 2008 LTM 9/30/09 $17.5 $53.0 $41.5 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 2007 2008 LTM 9/30/09 |

16 Southern Region TX NM LA Loco Hills Maljamar Harris M.A.K. Warwink Wheeler Chittim Ranch Giddings* *SBE

Partners LP properties Odem Driscoll Oak Hill Golden Meadow Quarantine Bay Eloi Bay St. Martinville Frisco OK OKLA Energy Partners LP properties Accounts for approximately 73% of reserves and 85% of total production High-impact exploration potential Development and recompletion potential Approximately 38% of the region’s proved reserves are oil Continuous successful Austin Chalk drilling program Significant working interests plus partnership interests Thirteen wells drilled with 100% success rate 69 producing wells 6-8 wells per year expected to be drilled in 2009 and in 2010 Recent additional acreage acquisitions May deploy additional rig Yegua, Eagle Ford Shale and Georgetown potential Two 3D seismic projects in South Louisiana |

17 Northern Region ALBERTA MANITOBA SASKATCHEWAN MT SD ND Newporte Sherman/Wayne Landa Starbuck Comertown Fairview/Mondak Sioux Pass Four Mile Creek Patent Gate Flat Top Note: Highlighted area represents the Williston Basin Bakken JV Accounts for approximately 27% of reserves and 15% of total production Approximately 92% of the region’s proved reserves are oil Bakken Currently: Recent acquisitions in approximately 66,000 gross acres Joint venture with 10-18% working interest in approximately 106,000 gross acres (approximately 13,900 net acres) Current three rig program, expected to increase to four rigs in 1st quarter 2010 34 joint venture operated gross wells drilled Acquired and/or participated in over 125 non-operated wells Joint venture expects to drill approximately 60 wells in the next 18 months Initial production rates as high as 1,400 BOpd on single lateral 640 acre units Williston Basin Other: Starbuck waterflood initial installation early 2008, phase two finished in early 2009 Initial response realized SW Starbuck waterflood installation completed early 2009 Additional upside in horizontal and vertical infill locations within the unit

boundaries Horizontal proved undeveloped and non-proved drilling

opportunities within producing fields |

18 Current project inventory totals $153 million and is diversified across GeoResources’ core areas with exposure to 14.8 MMBOE Estimated 24 month capital budget of ~$89 million This budget can be accelerated and expanded as deemed appropriate by management

Current budget allocation favors low-risk, high cash flow projects Exploratory success could expand drilling inventory Actual expenditures will reflect recent acquisitions, commodity prices, and risk

Flexibility between gas and oil projects Flexibility between development and exploration Southern Region Capital Expenditures Northern Region Capital Expenditures $66 million total $87 million total Near-Term Exploration & Development Projects (1) Excludes potential in-fill drilling. (1) (1) Exploratory Drilling, 9% Re-Engineering and Workover, 5% Acreage, Seismic and Other, 8% Proved Austin Chalk, 30% Development Drilling, 19% Non-Proved Austin Chalk, 29% Development Drilling, 34% Waterflood and Associated Drilling, 5% Proved Bakken Drilling, 5% Non-Proved Bakken Drilling, 43% Re-Engineering and Workover, 2% Acreage, Seismic and Other, 11% |

(1) Initial exploration well below field pay to 16,350+/-. Represents base exploratory reserve case

to test six objectives. Investment represents drilling costs only; a discovery well will

result in completion costs estimated at $1.0 million. Reserve potential for GEOI is 3.0 MMBOE and would set up additional drilling. 19 24 Month Budget – Project Reserve Potential $89 million of identified capital projects budgeted over next 24 months: 9.8 MMBOE reserve addition $9.09/boe estimated F&D cost Consistent with management prior track record Acreage and seismic expenditures will likely result in additional projects and drilling

inventory Re-engineering should result in lower per-unit lifting

costs and may result in incremental reserves by extending field lives and

lowering economic limits Current Budget Net Reserve Gross Net Potential Net Investment F&D Cost per Field Wells Wells MBOE (in $ millions) BOE Austin Chalk Proved 6 2.7 1,236 $14.5 $11.70 Non-proved 4 1.5 1,701 12.5 7.38 Bakken Proved 22 1.8 263 $3.4 $13.03 Non-proved 100 8.0 2,560 28.0 10.94 St. Martinville Non-proved 6 5.8 1,365 $5.5 $4.05 Starbuck and SW Starbuck Waterflood Proved 215 $2.4 $11.24 Non-proved 996 0.8 0.79 Total Proved/Non-Proved Projects in Budget 8,336 $67.2 $8.06 Quarantine Bay North Exploration (1) 1 0.3 1,443 $2.1 $1.46 Reengineering and Other $5.6 Acreage and Seismic 14.0 Total 24 Month Budget 9,779 $88.9 $9.09 |

20 Additional Development Potential Budget Acceleration The capital budget can be accelerated to take advantage of additional development

drilling opportunities within our current project portfolio Development Potential: 5.0 MMBOE reserve potential ~$64 million capital cost $12.76/boe estimated F&D cost Several PUD locations have exploratory objectives Net Reserve F&D Gross Net Potential Net Investment Cost per Field Wells Wells MBOE (in $ millions) BOE Other Southern Development Proved 2,079 $17.6 $8.46 Other Northern Development Proved 1,265 $22.5 $17.75 Austin Chalk Proved 5 2.3 889 $11.3 $12.71 Non-proved 7 2.7 773 12.5 16.23 Total Budget Acceleration 5,005 $63.9 $12.76 Total 24 Month Budget (previous slide) 9,779 $88.9 $9.09 Total 14,784 $152.8 $10.33 |

21 Additional Upside Shallow Yegua potential in Giddings Field (above the Austin Chalk) Eagle Ford and Georgetown potential in Giddings Field (below the Austin Chalk) Eagle Ford and Pearsall shale potential in Maverick county Three Forks/Sanish potential in the Williston basin Additional Starbuck upside 0.8 MMBOE from increased waterflood recovery and federal acreage development Quarantine Bay upside Seismic-based regional analogies below 18,000’ Other projects, consistent with management track record of expanding inventory with

growth Work in Progress Additional Reserve Potential on Current Projects (1) Additional reserve exposure on the prospects noted above and prior slides of 7.1

MMBOE. Net Reserve F&D Potential Investment Cost per Field MBOE (in $ millions) BOE Bakken Infill Non-proved 1,440 $21.0 $14.58 St. Martinville Shallow 910 $3.8 $4.18 Discorbis (10,000') 1,517 7.0 4.60 Quarantine Bay (1) SW - Exploratory 186 $3.1 $16.70 SE - Exploratory 743 3.1 4.18 Total 4,795 $38.0 $7.93 |

22 Type Well Economics Diverse set of drilling opportunities provides for growth and flexibility in changing

commodity price cycles Most drilling opportunities remain highly economic in

the current price environment (1) Well cost of $6.8 million and EUR of 6.5 BCF. (2) Well cost of $4.4 million and EUR of 1.15 BCF and 150 MBO. (3) Well cost of $3.5 million and EUR of 400 MBO. (4) Well cost of $3.5 million and EUR of 600 MBO. (5) Well cost of $1.3 million and EUR of 250 MBO. 0% 20% 40% 60% 80% 100% 120% 140% 160% 180% 200% Assumed Gas/Oil Price Chalk Gas(1) Chalk O&G(2) Bakken 400(3) Bakken 600(4) St Martinville Oil(5) |

23 Key Investment Highlights Value Creation Experienced Management and Technical Staff with Large Ownership Stake Board and management own approximately 53% of the company Successful track record of creating value and liquidity for shareholders Attractive Value Proposition Trading at a significant discount to NAV Strong Asset Base Strategically located and geographically diverse Balanced oil vs. gas High level of operating control Significant Identified Growth Opportunities on Existing Properties Low risk development drilling Higher impact exploration upside Strong Financial Position Moderate leverage with significant cash flow |

APPENDICES |

25 Partnership Operations SBE Partners LP Catena Oil & Gas, LLC General Partner OKLA Energy Partners LP 2% GP Interest 30% GP Interest Catena Oil & Gas, LLC Wholly owned subsidiary of GeoResources GE Capital is the sole limited partner 30% interest in SBE Partners acquired with recent acquisition 2% general partner interest in OKLA Energy with 34% reversionary interest 1.8 MMBOE excluding reversionary interests Partnerships generate fees, net income and cash estimated for 2009 as follows: Management fees - $1.1 million Partnership net income - $4.6 million Cash distributions - $2.8 million |

26 Financial Summary Historical Operating Data ($ in millions except per share data) YTD 9/30/09 3rd Qtr 2009 2008 2007 Key Data: Avg. realized oil price ($/BO) $59.23 $63.55 $82.42 $67.20 Avg. realized natural gas price ($/MCF) $3.95 $3.87 $8.12 $6.19 Oil production (MBO) 601 212 743 392 Natural gas production (MMCF) 3,430 1,678 2,962 1,648 Total revenue $56.8 $23.0 $94.6 $40.1 Net income before tax $12.5 $6.0 $21.3 $8.0 Net income $7.4 $3.4 $13.5 $3.1 Net income per share (basic) $0.46 $0.21 $0.87 $0.25 EBITDAX $33.0 $14.7 $53.0 $17.5 |

27 Financial Summary Historical Production Data Historical Operating Netback Data YTD 9/30/09 3rd Qtr 2009 2008 2007 Oil Production (MBO) 601 212 743 392 Gas Production (MMCF) 3,430 1,678 2,962 1,648 Total Production (MBOE) 1,173 492 1,237 667 Avg. Daily Production (BOEpd) 4,295 5,344 3,388 1,826 YTD 9/30/09 3rd Qtr 2009 2008 2007 ($ per BOE) Revenue $48.45 $46.75 $76.50 $60.17 Less: LOE $11.26 $8.94 $18.53 $16.23 G&A 5.09 3.97 5.80 9.76 Other Field Level Opex (1) 3.94 3.99 8.92 7.46 Total Field Level Operating Costs $20.29 $16.90 $33.25 $33.45 Field Level Operating Netback $28.16 $29.85 $43.25 $26.72 (1) Represents severance tax expense and re-engineering and workover expense.

|

28 Selected Balance Sheet Data Financial Summary (1) The above table does not include the balance sheet effects of hedge accounting for

derivative financial instruments which is required for financial statements

presented in accordance with generally accepted accounting principles. See the Company’s SEC filings for further information. ($ in millions) Sep. 30, 2009 Dec. 31, 2008 Dec. 31, 2007 Cash 11.9 $ 14.0 $ 24.4 $ Other Working Capital - Net (1) 2.4 $

(8.7) $

(10.5) $ Total Working Capital - Net (1) 14.4 $ 5.3 $

13.9 $ Oil & Gas Assets (Successful Efforts) 248.7 $ 181.6 $ 181.4 $ Equity in Partnerships 4.1 $

3.3 $

1.8 $

Long-Term Debt 104.0 $ 40.0 $ 96.0 $ Common Stock and Additional Paid in Capital 113.7 $ 112.7 $ 79.8 $ Retained Earnings 28.4 $ 21.0 $ 7.5 $

Common Stock Outstanding 16.2 |

29 Hedging Strategy Oil Hedges GEOI uses commodity price risk management in order to execute its business plan

throughout commodity price cycles 2009 – 2010 natural gas hedges include hedge volumes intended to cover GEOI’s share of partnership production Hedged volumes shown below are about 51% of combined production volumes Swap Fixed Contract Swap Collar 0% 20% 40% 60% 80% 100% 2009E 2010E 2011E $76.00 $74.71 $74.37 $43.85 $43.85 0% 20% 40% 60% 80% 100% 2009E 2010E 2011E $5.08 $5.12 $7.00 - $10.75 $7.00 - $9.90 $7.00 - $9.20 Natural Gas Hedges |

30 Bakken Shale Bakken Shale Note: Yellow-highlighted areas represent the Company’s acreage

position. Working interests ranging from 10% to 18% in 106,000 gross acres (approximately 13,900 net acres) 69,000 gross acres in Mountrail County (approximately 8,000 net acres) Three rigs running Joint Venture has drilled 34 wells to date and plans to drill 60 wells in the next 18 months Initial production rates up to 1,400 BOEpd per well for single laterals on 640 acre spacing units Developing on 640 acre units as well as 1,280 acre and larger units Additional upside in Three Forks and Bakken increased density wells Detailed map on next slide |

31 Bakken Shale Note: Yellow-highlighted areas represent the Company’s acreage position.

640 and 1,280 acre units being drilled Some larger units under the lake Multiple wells from single drilling pad Minimize facilities and roads Maximize infrastructure Developing reserves with difficult access Minimize disturbance and the number of locations Van Hook Area |

32 Giddings Field Austin Chalk Play Working interests range from 37% - 53% in 68,000 gross acres (approximately 29,000 net acres) 22 additional gross drilling locations (9.2 net wells) 13 wells drilled – 100% success Additional upside includes: Yegua, Eagle Ford shale and Georgetown potential Multiple wells with rate increase potential from slick water fracture stimulations |

33 Giddings Field Acreage Position Giddings Field GEOI produces oil & gas from Austin Chalk Horizontal wells Other Potential Reservoirs Yegua Wilcox Eagle Ford Shale Buda Georgetown Edwards |

34 Grimes and Montgomery Counties Austin Chalk Development Proved Undeveloped and Probable Horizontal Locations Last well: Longstreet 1H produced 1.0 BCFG in 67 days Single and multiple laterals Eastern Grimes / Western Montgomery dry gas Western Grimes gas with large volume of liquids Single rig continuous program Tight gas – severance tax exemption Longstreet 1H |

35 Eagle Ford Trend South & Central Gulf Coast Texas Significant acreage position in trend Eagle Ford shale present over much larger area than apparent trend Trend depicted where Eagle Ford is +-7,000’ to +-14,000’ Early in development |

36 Recent Activity Map Apache active in our area Majority of Apache wells vertical Our Brazos, Burleson, Fayette and Washington County holdings currently appear most prospective for Eagle Ford Central Texas Eagle Ford |

Quarantine Bay GeoResources has a 7% working interest above 10,500 feet and a 33% working interest below 10,500 feet, in approximately 14,000 acres Cumulative production = 180 MMBO and 285 BCF Shallow zone potential (<10,500 ft): Numerous behind pipe opportunities due to multiple stacked sand reservoirs Rate acceleration wells Significant hi-potential exploration deep potential: Schlumberger reprocessed and interpreted the 3-D seismic data Initial prospect Multiple objectives to 16,000 ft Deeper objectives 37 LOUISIANA Quarantine Bay Field |

38 Quarantine Bay Nearby Lake Washington East which is an analogy for deep production has produced 9 MMBO

& 14 BCF from the Big Hum +-15,000’ Significant Big Hum sand encountered at Quarantine Bay and is productive in one well on

the southeast flank New “state of the art” pre-stack depth and simultaneous inversion 3-D processing to evaluate the

pressured deep strata (14,000’-18,000’) and ultra-deep

strata (>18,000’) Multiple prospective areas have been identified on

our leases Current focus is on a opportunities identified above 16,000’ with a estimated cost of $6.5MM to test |

39 St. Martinville St. Martinville 5.3 square mile “high resolution” 3-D survey to be completed in Q4; processed and interpreted in Q1 2010 Intermediate depth salt dome Average working interest 97% and average NRI 91%. Royalty burden ranges from Zero on owned minerals to 22% on lease acreage Complex faulted structural closures provide hydrocarbon traps 534 net acres of owned minerals (green) 2,585 net acres of HBP or leased (yellow) Main objectives Miocene age, low risk, shallow, highly productive multi-sand, oil, from 3,000’ – 5,000’. Over 50 individual sands productive in field with cumulative shallow production est. 15.2 MMBO and 16.6 BCFG Exploratory objectives in Discorbis and Bol perca (gas and condensate) LOUISIANA |

40 St. Martinville Shallow Leads Example St. Martinville Shallow Leads Example Miocene 11D sand lead map (+/-4,000’) Most recent well Std. Kansas 7. Current cumulative 58 MBO (one sand), all sands EUR 250 MBO Subsurface leads at this sand level Main field production at this sand |

41 St. Martinville Discorbis Miocene lower Discorbis sand lead map Previously productive areas Cumulative 124 BCF and 1.8 MMBO Subsurface leads at this level |

42 Starbuck and SW Starbuck Waterflood Units ND HAAS North Dakota LANDA NE LEONARD ZION LANDA ROTH N ROTH SHERMAN WAYNE STARBUCK CANADA Bottineau County T163N T162N T161N R79W R81W R80W R82W R83W HAAS North Dakota LANDA NE LEONARD ZION LANDA ROTH N ROTH SHERMAN WAYNE STARBUCK CANADA Bottineau County T163N T162N T161N R79W R81W R80W R82W R83W Starbuck 6,618 acres, 96% WI SW Starbuck 560 acres, 98% WI Starbuck phase one completed 2008 Phase two and SW Starbuck expansion completed 2009 Recent initial response Primary production totals 1.4 MMBO for the Starbuck Midale and Berentson Zones Primary production for SW Starbuck totals 162 MBO Approximately $6.0 million on waterflood implementation The Company estimates additional reserves of 1.6 – 2.5 MMBO for both projects Starbuck Unit |

43 Starbuck and SW Starbuck Waterflood Units Starbuck Unit Designed as line-drive waterflood 14 producers 6 injectors One dedicated water supply well One dedicated injection facility and one shared facility with SSMU SW Starbuck Unit Single producer/injector pair Shared water supply well and injection facility with larger Starbuck Unit Additional vertical and horizontal wells planned for both units as pressure response and increased oil rate is achieved |