Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Amendment No. 2

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 29, 2008

UPSNAP, INC.

(Exact Name of Registrant as Specified in Charter)

|

Nevada |

0-50560 |

20-0118697 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

c/o Duratech Group Inc.

2920 9th Avenue North

Lethbridge, Alberta, Canada T1H 5E4 |

|

(Address of principal executive offices) |

Registrant’s telephone number, including area code: (403) 320-1778

|

134 Jackson Street, Suite 203 |

|

Davidson, North Carolina 20836 |

|

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 DFR 240.14a-12) |

|

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

o Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

CURRENT REPORT ON FORM 8-K |

|

UPSNAP, INC. |

|

TABLE OF CONTENTS |

|

Page | ||

|

Item 1.01. |

3 | |

|

Item 2.01. |

4 | |

|

4 | ||

|

4 | ||

|

6 | ||

|

10 | ||

|

17 | ||

|

24 | ||

|

25 | ||

|

27 | ||

|

30 | ||

|

Item 3.02. |

32 | |

|

Item 5.01. |

33 | |

|

Item 5.02. |

33 | |

|

Item 5.06. |

33 | |

|

Item 9.01. |

33 |

Item 1.01. Entry into a Material Definitive Agreement

The Share Exchange Agreement

On August 29, 2008, UpSnap Inc. (the “Registrant”) entered into a Share Exchange Agreement (the “Share Exchange Agreement”) by and among the Registrant; Tony Philipp, an officer, director and shareholder of Registrant (“Philipp”); Duratech Group Inc., an Alberta, Canada corporation (“Duratech”)

and the shareholders of Duratech (“Duratech Shareholders”), including Peter Van Hierden, a citizen of Alberta, Canada and owner directly or indirectly of approximately 96% of the share capital of Duratech (“Van Hierden”).

Upon closing of the share exchange transaction (the “Share Exchange”) on September 17, 2008, the Duratech Shareholders transferred all of their shares of common stock in Duratech to the Registrant in exchange for an agreement to issue to them an aggregate of 50,349,342 shares of Common Stock of the Registrant, resulting in Duratech

becoming a majority owned subsidiary of the Registrant. In addition, P&R Gateway Developments Inc. and 1371009 Alberta Ltd., fifty percent (50%) owned joint venture companies of Duratech became indirectly controlled by the Registrant.

As part of the Share Exchange, the Duratech Shareholders were issued options to purchase 18,950,334 shares of the Registrant’s Common Stock in substitution for options to purchase 2,235,610 shares of Duratech common stock which they owned prior to the transaction. In order to facilitate the exercise of these new options, the Registrant

has agreed to hold 18,950,334 shares of Common Stock in reserve, and instead issue the balance of 50,349,342 shares to the Duratech Shareholders pro rata pursuant to the Share Exchange Agreement.

The shares of Duratech common stock, par value $0.05 per share, are validly issued, fully paid, and nonassessable, and represent one hundred percent (100%) of the common equity ownership of Duratech, and the Duratech Shareholders are the sole record and beneficial owners thereof. The Duratech common stock represents sixty-five percent (65%)

of the issued and outstanding equity capitalization of Duratech, with the other thirty-five percent (35%) consisting of two series of preferred stock, one currently issued to three individuals and outstanding, and the other issued to Van Hierden and Duratech Shareholders on the Closing Date (as defined in the Share Exchange Agreement). Both of the series have a par value of $1.00 per share. The first series, which is currently outstanding and consists of 158,096 shares of Preferred Non-Voting stock, and has a

$1.00 liquidation preference, is not entitled to any dividend or conversion privilege, and is to be liquidated in three years. The second series, which is a new series issued to Van Hierden and Duratech Shareholders as of the Closing Date, consists of 3,198,362 shares of preferred stock and is entitled to one vote per share, has a $1.00 liquidation preference and is not to be entitled to any dividend or conversion privilege. In addition, holders of options to purchase Duratech common stock were granted options

to purchase an additional 1,203,790 shares of this second series of preferred stock. All of the outstanding Duratech share capital was offered and sold in accordance with applicable Canadian and United States Federal and local securities laws.

Also, as mentioned above, in connection with the Share Exchange, a total of 2,235,610 options to purchase Duratech common stock were converted into 18,950,334 options to purchase common stock of the Registrant, calculated according to an agreed upon formula. This will enable the Duratech Shareholders to transfer one hundred percent (100%)

of the common ownership of Duratech to the Registrant. These options are included in the 69,299,676 shares referenced above.

After the consummation of the transactions contemplated by the Share Exchange Agreement, the Registrant, on the day after the Closing Date, consummated the sale of its assets related to its mobile information search services, subject to assumption and payment of all of the Registrant’s liabilities related to periods prior to the closing,

to UpSnap Services, LLC, a North Carolina limited liability corporation (“UpSnap Services”), which is owned by Philipp, pursuant to an Asset Purchase Agreement dated as of August 29, 2008 (the “Asset Purchase Agreement”).

Pursuant to the Share Exchange Agreement and the Asset Purchase Agreement, Philipp has agreed, among other things, to indemnify and hold harmless the Registrant from and against all liabilities as of the Closing Date up to $200,000. As part of the Asset Purchase Agreement, the Registrant contributed $130,000 to UpSnap Services at Closing

(as defined in the Asset Purchase Agreement) solely toward the payment and discharge of the Assumed Liabilities (as defined in the Asset Purchase Agreement). The $130,000 contribution is not to be used to pay any of Philipp’s advances to the Registrant or his accrued salary. Duratech funded this $130,000 capital contribution by wire transfer of $130,000 to the Registrant on the Closing Date. The Asset Purchase Agreement was approved by a majority of the Board of Directors, with Philipp abstaining, in accordance

with Nevada Revised Statutes 78.140.

The UpSnap Board of Directors has three members. At Closing, Philipp and Paul Schmidt will resign from their positions as President and Chief Executive Officer and of Chief Financial Officer, respectively, of the Registrant, and Peter Van Hierden will be appointed as Chief Executive Officer and Richard von Gnechten as Chief Financial Officer.

At Closing, Mark McDowell will resign from his position as a director of the Registrant and Peter Van Hierden will be appointed to fill the vacancy created thereby. Philipp will resign as a director of the Registrant effective following the expiration of the required ten (10) day transmittal notification to the stockholders under Regulation 14f-1 of the Securities Exchange Act, which notice is effected by the mailing of an Information Statement to shareholders. At the effective time of Philipp’s resignation,

Robert Lundgren will be appointed as director of the Registrant. Mr. von Gnechten, who is currently a member of the Board of Directors of the Registrant, will remain on the Board following the closing.

In addition, pursuant to the terms and conditions of the Share Exchange Agreement:

|

● |

On the Closing Date, the Registrant paid and satisfied all of its “liabilities,” as such term is defined by U.S. GAAP as of the closing. |

|

● |

As of the day after the Closing, the parties consummated the transactions contemplated by the Asset Purchase Agreement. |

As of the date of the Share Exchange Agreement there were no material relationships between the Registrant or any of its affiliates and the Duratech Subsidiaries, or Duratech, other than in respect of the Share Exchange, except that Richard von Gnecthen is employed by Global Kingdom Finance Co., an affiliate of Duratech and he is also a

member of the Board of Directors of the Registrant.

The foregoing description of the Share Exchange Agreement and the Asset Purchase Agreement do not purport to be complete and is qualified in its entirety by reference to the complete text of the Share Exchange Agreement, which is filed as Exhibit 2.1 hereto, and the complete text of the Asset Purchase Agreement, which is filed as Exhibit

2.2 hereto, both of which are incorporated herein by reference.

As used in this Current Report on Form 8-K, all references to the “Company,” “we,” “our” and “us” for periods prior to the closing of the Share Exchange and Asset Purchase refer to Registrant, and references to the “Company,” “we,” “our” and “us”

for periods subsequent to the closing of the Share Exchange and Asset Purchase refer to the Registrant and its subsidiaries. Information regarding the Company, Duratech and the principal terms of the Share Exchange are set forth below.

Item 2.01. Completion of Acquisition or Disposition of Assets

As required by Item 2.01 of Form 8-K, the following transactions were completed and are disclosed hereby.

Share Exchange and Asset Purchase

The Share Exchange. On August 29, 2008, the Registrant entered into a Share Exchange Agreement by and among the Registrant; Philipp; Duratech and the Duratech Shareholders, including Van Hierden.

Upon closing of the share exchange transaction (the “Share Exchange”) on September 17, 2008, the Duratech Shareholders transferred all of their shares of common stock in Duratech to the Registrant in exchange for an issuance to them of an aggregate of 50,349.342 shares of common stock of the Registrant, resulting in Duratech

becoming a majority owned subsidiary of the Registrant. In addition, P&R Gateway Developments Inc. and 1371009 Alberta Ltd., fifty percent (50%) owned joint venture companies of Duratech became indirectly controlled by the Registrant.

The Asset Purchase. On August 29, 2008, the Registrant entered into the Asset Purchase Agreement with Philip, UpSnap Services and the Company. After the consummation of the transactions contemplated by the Share Exchange Agreement, the Company transferred its assets related to its

mobile information search services, subject to assumption and payment of all of the Company’s liabilities related to periods prior to the closing, to UpSnap Services, which is owned by Philipp, pursuant to an Asset Purchase Agreement dated as of August 29, 2008.

Over the past few years the Company had sustained continued financial losses and revenue declined as its business had grown more competitive, it was not able to raise additional capital to expand its operations, it had concerns about obligations to its creditors and its continuation as a going concern, and subsequent to the termination

of the proposed merger transaction with Mobile Greetings, Inc., it had explored various financing and acquisition alternatives. Based upon management’s review of alternatives, the Share Exchange Agreement and the Asset Purchase Agreement presented the most viable possibility for future enhancement of shareholder value and for payment of creditors.

Pursuant to the Share Exchange Agreement and the Asset Purchase Agreement, Philipp had agreed, among other things, to indemnify and hold harmless the Company from and against all liabilities as of the Closing Date up to $200,000. As part of the Asset Purchase Agreement, the Company contributed $130,000 to UpSnap Services at Closing solely

toward the payment and discharge of the Assumed Liabilities (as defined). The $130,000 contribution was not to be used to pay any of Philipp’s advances to the Company or his accrued salary. Duratech funded this $130,000 capital contribution by wire transfer of $130,000 to the Registrant on the Closing Date. The Asset Purchase Agreement was approved by a majority of the Board of Directors, with Philipp abstaining, in accordance with Nevada Revised Statutes 78.140.

Changes Resulting from the Share Exchange and Asset Purchase. At this time, the Company intends to carry on Duratech’s business as its sole line of business. The Company has relocated its executive offices to 2920 9th Avenue

North, Lethbridge, Alberta, Canada T1H 5E4 and its telephone number is (403) 320-1778.

Pre-Share Exchange holders of Duratech common stock and holders of options to purchase common stock of the Company may exchange their existing certificates or exercise their options for certificates of the Registrant. This will be effected through our transfer agent. The certificates of the Registrant’s Common Stock issued in the

Share Exchange are “restricted” from transfer to U.S. Persons for a period of one year pursuant to Regulation S under the Securities Act.

Changes to the Board of Directors and Officers.

On the Closing Date, the current officers of the Registrant resigned from such positions and the persons chosen by Peter Van Hierden were appointed as the officers of the Registrant, notably Mr. Peter Van Hierden, as Chairman, CEO and President and Richard A. von Gnechten as CFO. Also on the Closing Date, Philipp resigned from his position

as a director effective upon the expiration of the ten day notice period required by Rule 14f-1, at which time additional persons designated by Mr. Van Hierden will be appointed as directors of the Registrant, notably Robert Lundgren. Mr. von Gnechten, who is currently a member of the Board of Directors of the Registrant, will remain on the Board following the Closing.

All directors hold office for one-year terms until the election and qualification of their successors. Officers are elected by the board of directors and serve at the discretion of the board of directors.

Accounting Treatment; Change of Control. The Share Exchange is being accounted for as a “reverse merger,” since the Duratech Shareholders own a majority of the outstanding shares of the Registrant’s common stock immediately following the Share Exchange and Asset Purchase.

Duratech is deemed to be the acquirer in the reverse merger. Consequently, the assets and liabilities and the historical operations that are reflected in the financial statements prior to the Share Exchange are those of Duratech and are recorded at the historical cost basis of Duratech, and the consolidated financial statements after completion of the Share Exchange include the assets and liabilities of the Registrant and Duratech, historical operations of Duratech, and operations of the Registrant from the closing

date of the Share Exchange. Except as described in the previous paragraphs, no arrangements or understandings exist among present or former controlling stockholders with respect to the election of members of the Company’s board of directors and, to our knowledge, no other arrangements exist that might result in a change of control of the Company. Further, as a result of the issuance of the shares of the Registrant’s common stock pursuant to the Share Exchange, a change in control of the Company occurred

on the date of consummation of the Share Exchange and Asset Purchase. The Registrant will continue to be a “smaller reporting company,” as defined under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), following the Share Exchange and Asset Purchase.

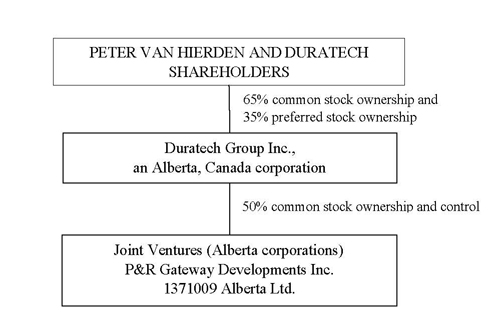

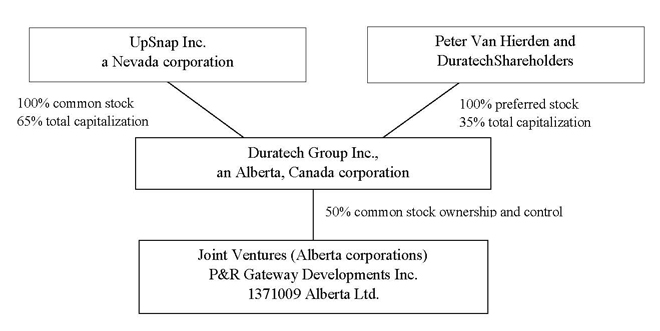

Organizational Charts

Set forth below are organization charts of the entities that existed prior to the Share Exchange, pursuant to which the Duratech Shareholders exchanged all of the Duratech common stock with the Registrant for an issuance of 50,349,342 shares of the Registrant’s common stock, and after the Share Exchange was consummated.

Before Share Exchange

After Share Exchange

DESCRIPTION OF OUR BUSINESS

All references to the “Company,” “we,” “our” and “us” for periods prior to the closing of the Share Exchange refer to the Registrant, and references to the “Company,” “we,” “our” and “us” for periods subsequent to the closing of the

Share Exchange and Stock Purchase refer to the Registrant and its subsidiaries.

COMPANY OVERVIEW

Duratech Group Inc. (“Duratech”) was founded as Duratech Contracting on December 18, 2002 as a small homebuilding company constructing about five homes a year until Peter Van Hierden (“Van Hierden”) bought out the majority partners and took control of the operations in July, 2007. Shortly thereafter, Mr.

Van Hierden identified a synergistic opportunity to acquire a modular oil camp factory which was also in distress and acquired the company in July, 2007. Since that time management has been able to turn both these operations around and now seeks to grow the company organically and through additional acquisitions. Duratech changed its name from Duratech Contracting to Duratech Group Inc. in August, 2008.

Duratech’s principle operations are building manufactured and stick-built homes and modular oil camps in Alberta and Saskatchewan, Canada.

On September 17, 2008, Duratech completed a reverse merger transaction with UpSnap, Inc. (“UpSnap”), a Nevada corporation that was formed on July 25, 2003. In connection with the reverse merger, Duratech became a wholly-owned subsidiary of UpSnap, and the Duratech Shareholders acquired control of UpSnap. The

Registrant expects to change the company’s name from UpSnap Inc. to Duratech Group Inc. as soon as the filings can be completed.

SUMMARY OF OPERATIONS

Duratech manufactures and builds homes and modular sites for its marketplace, principally Alberta and Saskatchewan. The Company has three principal products that it offers: first, the company builds on-site conventional homes through its Duratech Contracting division; second, the company builds ready-to-move

(RTM) homes in factories and brings them on foundations to sell to end users; and, third, the company builds modular camp sites for the oil mining industry, which, along with RTM homes, are done through its Duratech Structures division.

Duratech had $1.03 million in revenues for the six months ended July 31, 2009 compared to $661,050 for the six months ended July 31, 2008. Including selling, general and administrative, payroll expense and depreciation, the net income for the period ended July 31, 2009 was $(281,217) compared to $(579,212) for

the period ended July 31, 2008.

STRATEGY FOR GROWTH

Duratech has two principal strategies for growth: 1) build market share in its existing marketplace and 2) expand through strategic acquisitions both in its existing market and the United States.

Build Existing Market:

In its existing marketplace, Duratech supplies the three principal products previously described. Given its competitive advantages in these product areas and the future growth prospects within Alberta and Saskatchewan, the Company believes that it will be able to grow its three product lines within its existing

marketplace.

Expand through Strategic Acquisitions:

In addition to expanding its existing operations in its existing market, Duratech fully expects to leverage its operational success and the experience of its Chairman, CEO and largest shareholder, Peter Van Hierden, to pursue attractive and strategic acquisition targets within its existing market and also in

the United States where the real estate market and other business areas offer many potential opportunities, principally businesses with revenues of $750,000 to $10 million and profits of $250,000 to $3 million. Mr. Van Hierden has been an entrepreneur for 30 years and in the past 15 years has successfully helped restore the profitability of six corporations in the construction, feed manufacturing, furniture and steel fabricating industries that had losses to generating revenues of $1 million to $30 million. However,

Duratech currently has no specific acquisition plans or targets.

COMPANY MARKETS

Duratech’s principle operating markets are Alberta and Saskatchewan, Canada. Alberta is a business friendly province with the lowest tax load of any province in Canada, including no provincial retail tax. Alberta has massive oil reserves with some estimates as high as 1.3 trillion barrels of oil. However,

economic growth in Western Canada has been affected by the global economic recession that began late in 2008. In particular, the oil and natural gas sector, the primary industry in the provinces in which we operate, has experienced falling revenues due to the continuing uncertainty in the global economy and weak financing conditions, which has translated into several oil and gas projects being cancelled or put on hold. This, in turn, resulted in historically high, seasonally adjusted unemployment rates

in August 2009 of 7.4% and 6.1% in Alberta and Saskatchewan, respectively. The impact of the decline in the oil and natural gas sector has also been felt in the housing market in the Western Prairie provinces, which saw a decline in new housing starts of 17% in July 2009 compared to July 2008, and an expected overall decrease of 6.8% in home prices in 2009, according to data from the Canada Mortgage and Housing Corporation (“CMHC”), Canada’s national housing agency. Nevertheless,

in CMHC’s Third Quarter 2009 “Housing Market Outlook – Prairie Region Highlights” report, CMHC revised their 2009 forecast upward for housing starts and resales as price declines, government incentives, and low mortgage rates are expected to lead to stronger activity in the fourth quarter of the year. For 2010, the report also indicates that lower inventories in both the new and resale markets, a strengthening economy, and rising demand will support a healthy increase in new

home construction, along with restored price growth in the region. The Company does expect long-term growth to return as economic conditions continue to improve, with future growth expected to last well into the next decade.

COMPETITION

The homebuilding industry is highly competitive and fragmented. We do not have a significant market presence in any of the geographic areas where we are currently building homes or where we expect to build homes in the future. Most of our competitors have substantially greater financial resources than we do, and they have much larger staffs

and marketing organizations. However, we believe we compete effectively in our existing markets as a result of our product design, development expertise, and our reputation as a producer of quality homes. We compete for homebuyers on the basis of price, location, design, quality, service, and reputation. In addition to competition for homebuyers, we also compete with other homebuilders for desirable properties, raw materials and reliable, skilled labor.

The manufactured housing industry is highly competitive at both the manufacturing and retail levels, with competition based upon several factors, including price, product features, reputation for service and quality, depth of field inventory, promotion, merchandising and the terms of retail customer financing. We compete with other producers

of manufactured homes, as well as companies offering for sale homes repossessed from wholesalers or consumers. In addition, manufactured homes compete with new and existing site-built homes, as well as apartments, townhouses and condominiums.

We do not view any of our competitors as being dominant in the industry as a whole or the principal markets in which we compete, although a number of our competitors possess substantially greater financial, manufacturing, distribution and marketing resources.

The Company’s principal competitors for job site structures would be: Northern Trailer, Arcticore Structures, Atco and BCT Structures. In the homebuilding and ready-to-move homes area it would be: commercial stick builders, SRI Homes and Triple M Homes. The Company has not found competition from these larger competitors

to be a constraint to future growth given the historical growth that has occurred in the market.

BUSINESS AND COMPETITIVE ADVANTAGE

Duratech’s key business and competitive advantages are: 1) Factory construction advantage; 2) Direct sales advantage; and 3) Ready-to-move (RTM) advantage.

Factory Construction Advantage:

Alberta has unique traffic laws which allow transporting homes to a width of 35 feet on the highway. Building homes in a factory has many significant advantages, including: 1) reduced construction time from 6-8 months to 2-3 weeks; 2) improve efficiency in hours of construction by more than 40%; and 3) reduce labor costs by as much as 50%

due to using all company staff versus sub-contractors. Overall cost savings of building in a factory is at least 30% compared to on-site, stick-built homes. Using a factory also helps avoid potential weather issues.

Direct Sales Advantage:

Whereas traditional modular home builders market their product through a sophisticated dealer network, Duratech buys lots, sets the homes on the foundation and then markets their product through the local Multiple Listing Service (MLS) Real Estate. Duratech increases its profitability by 30% by bypassing

the dealer network.

Ready-to-move (RTM) Advantage:

Duratech is also not constrained to its local real estate market, because the homes it builds can be moved to “hot” real estate markets in Alberta and Saskatchewan, as necessary. This is an advantage compared to stick built homes and allows the company to put the house on a lot with basement and garage (taking out the middleman).

No marketing department is required as the company relies on realtors to determine demand levels of individual areas.

SALES AND MARKETING

Duratech does not require an extensive in-house marketing department to sell its homes because it has the flexibility of moving its homes to whatever market may be “hot” in Alberta or Saskatchewan at a particular time. The Company uses real estate brokers and realtors to identify opportunities and to sell the homes that are

constructed. The Company also engages a marketing consultant based in Calgary that helps with job site structures (camp sites for oil mining industry).

The principle factors that affect sales volumes and prices are the economies of the markets that the Company serves, principally Alberta and Saskatchewan. There are other risk factors that could impact the company’s business operations, including the impact of global geo-political issues and financial markets beyond the company’s

control

Duratech had $1.86 million in revenues for the six months ended July 31, 2009 compared to $2.18 million for the the same period in 2008.

New Products

Duratech is continually refining its manufacturing process to ensure the most efficient operations possible. The Company’s management team is experienced in cost management and process improvement and encourages this philosophy among its manufacturing personnel. The Company is also continually exploring new construction

techniques that might allow it to develop new products in the homebuilding industry. This is done through on-going discussions with subject matter experts in the construction industry, including individuals experimenting with alternative materials and construction techniques which are proprietary in nature. The company does not currently have any patents on such techniques, but may file for such in the future.

RAW MATERIALS AND SUPPLIERS

Duratech is basically an assembler of components purchased from outside sources. The major components used by Duratech are lumber, plywood, shingles, vinyl and wood siding, steel, aluminum, insulation, home appliances, furnaces, plumbing fixtures, hardware, and floor coverings. The suppliers are many and range in size from large national

companies to very small local companies. At the present time, the Company is obtaining sufficient materials to fulfill its needs.

REGULATION

The Company’s principal regulatory bodies are the building code of each respective province in which it does business. Duratech is Canadian Standards Association (CSA) Certified as part of the A277 Program and Part 9 of 2006 Alberta Building Code. CSA-A277 is the residential code and CSA-Z240 is the manufactured home code.

CSA is a governing body in the RTM, modular and manufactured home industry. It abides by and inspects to the National Building Code of Canada 1995, as well as all provincial building codes and has a higher standard than both. It has a strict quality control procedure that inspects the homes at every level of the building

process from blueprint to completion stage. Only companies meeting strict criteria can obtain CSA certification as it can overrule jurisdictions’ local codes and is recognized over provincial codes because of its high standards.

Another certification Duratech holds is Part 10 of the National Building Code of Canada, which governs relocatable commercial structures. It is regulated by a strict quality control manual and program, which Duratech has in place, and is continuously monitored and evaluated to insure compliance is being met. Both of our certifications

enable us to offer a quality product to the customer and give the customer greater assurance of a problem-free structure because of the guidelines, codes and regulations we as a builder must meet to keep the certification.

The Alberta Building Code attempts to detail the minimum provisions acceptable to maintain the safety of buildings, with specific regard to public health, fire protection, accessibility and structural sufficiency. The Building Code sets forth technical provisions for construction, renovation and demolition of structures. Part

9 is applicable to housing and small buildings and directly impacts the Company’s operations. It is very prescriptive in nature and is intended to be able to be applied by contractors.

Compliance with the Alberta Building Code is necessary in order for a structure to be deemed fit for occupancy and is a cost of doing business. The Code is enforceable by the Alberta Municipal Affairs Department, which in addition to producing the Building Code is responsible for the development and dissemination of Code interpretations,

variances and bulletins.

Saskatchewan does not have its own provincial building code but rather utilizes the standards of the National Building Code of Canada 1995, as adopted by regulations under the Uniform Building and Accessibility Standards Act. All site- and factory-built homes and structures in Saskatchewan must comply with these standards.

LEGAL PROCEEDINGS

The Company is not involved in any pending or threatened legal proceedings.

PROPERTY

The Company leases its facilities at the following locations:

The company’s headquarters is located at #1 2920 9th Avenue North, Lethbridge, Alberta, Canada T1H 5E4 and is comprised of 1,100 square feet of office space and 27,000 square feet of plant.

The Company previously had a plant in Cardston, Alberta, Canada located at 855 2nd Avenue E, which was comprised of 38,000 square feet, but decided to consolidate its operations in Lethbridge in early 2009 in an effort to reduce costs in response to the global economic environment. The Company continues to utilize a Calgary,

Alberta, Canada office located at 95 Sandringham Way NW, comprised of 1,000 square feet.

EMPLOYEES

Duratech Group Inc. has a staff of approximately 30 employees, of which 15 are employed on a full-time basis and approximately 15 are on a contract or part-time basis. This number will fluctuate on a month-to-month basis.

FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K/A contains forward-looking statements. To the extent that any statements made in this Report contain information that is not historical, these statements are essentially forward-looking. Forward-looking statements can be identified by the use of words such as “expects,” “plans,”

“will,” “may,” “anticipates,” believes,” “should,” “intends,” “estimates,” and other words of similar meaning. These statements are subject to risks and uncertainties that cannot be predicted or quantified and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties are outlined in “Risk Factors” and include, without limitation, the

Company’s ability to raise additional capital to finance the Company’s activities; the effectiveness, profitability, and the marketability of its products; legal and regulatory risks associated with the Share Exchange; the future trading of the common stock of the Company; the ability of the Company to operate as a public company; the Company’s ability to protect its proprietary information; general economic and business conditions; the volatility of the Company’s operating results and

financial condition; the Company’s ability to attract or retain qualified senior management personnel and research and development staff; and other risks detailed from time to time in the Company’s filings with the SEC, or otherwise.

Information regarding market and industry statistics contained in this Report is included based on information available to the Company that it believes is accurate. It is generally based on industry and other publications that are not produced for purposes of securities offerings or economic analysis. The Company has not reviewed or included

data from all sources, and cannot assure investors of the accuracy or completeness of the data included in this Report. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. The Company does not undertake any obligation to publicly update any forward-looking statements. As a result, investors should not place undue

reliance on these forward-looking statements.

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS

All references to the “Company,” “we,” “our” and “us” for periods prior to the closing of the Share Exchange refer to the Registrant, and references to the “Company,” “we,” “our” and “us” for periods subsequent to the closing of the Share Exchange

refer to the Registrant and its subsidiaries.

The following discussion highlights the principal factors that have affected our financial condition and results of operations as well as our liquidity and capital resources for the periods described. This discussion contains forward-looking statements. Please see “Special cautionary statement concerning forward-looking

statements” and “Risk factors” for a discussion of the uncertainties, risks and assumptions associated with these forward-looking statements. The operating results for the periods presented were not significantly affected by inflation.

In August, 2008, the management of the Registrant determined that it was in the best interests of the stockholders of the Registrant to agree to the Share Exchange and acquire Duratech Group Inc., a Canadian company that is engaged in the construction and manufacturing of homes in Alberta and Saskatchewan, Canada. As part of the reverse

merger, the Registrant will cease engaging in the mobile information search services business. As a result of the Share Exchange, Duratech Group Inc. will become a majority-owned subsidiary of the Registrant.

The financial results summarized below are based on the UpSnap, Inc. unaudited consolidated financial statements for the three and six month periods ended July 31, 2009 and 2008, audited balance sheet as of January 31, 2009 and January 31, 2008 and related audited statements of operations and retained earnings and

statements of cash flows for the years ended January 31, 2009 and January 31, 2008. The audited financial statements are attached hereto as Exhibit 99.1.

Three and Six Months Ended July 31, 2009 Compared to the Three and Six Months Ended July 31, 2008

Operating Revenues. Revenues for the three months ended July 31, 2009 were $1,030,429, compared to revenues for the three months ended July 31, 2008 of $661,050. The increase in revenues of $369,379 is principally attributable to the acquisition of Duratech

Structures in July, 2008 thus resulting in an increase in housing sales due to the combined operations versus the same period in 2008 when the company had just started to incorporate Duratech Structures into its operations. Sales for the Duratech Contracting division increase to $788,526 for the three months ended July 31, 2009 from $601,821 for period ended July 31, 2008 due to a slight increase in new home sales. The Duratech Structures division went from $59,230 for the quarter ended July 31, 2008

to $251,904 in sales for the quarter ended July 31, 2009 due to an increase in sales of modular structures.

Revenues for the six months ended July 31, 2009 were $1,859,144, compared to revenues for the six months ended July 31, 2008 of $2,176,567. The decrease in revenues of $317,423 is principally attributable to a decline in housing sales as a result of the global recession and its impact on the Canadian economy since

late 2008 compared to a very rapidly growing economy during the prior year period when oil prices were substantially higher. Sales for the Duratech Contracting division decreased to $1,387,032 for the six months ended July 31, 2009 from $1,505,071 for the same period ended July 31, 2008 because the increase in new home sales in the second quarter was more than offset by a decrease in new home sales in the first quarter. Sales for the Duratech Structures division decreased to $472,112 for

the six months ended July 31, 2009 from $671,496 in sales for the six months ended July 31, 2008 because the increase in modular home sales in the second quarter was more than offset by the decrease in sales of modular structures in the first quarter as a result of the global economic recession and decrease in oil prices from the prior year.

Selling, General and Administrative Expenses. Selling, general and administrative expenses for the period ended July 31, 2009 were $276,029, compared to selling, general and administrative expenses of $222,439 for the corresponding period in 2008, a slight increase

of about $53,590 principally due to transition costs associated with turning-around, expanding its core business and additional overhead expenses associated with taking the company public offset by reduction in expenses in response to the decrease in sales from the global economic recession.

Selling, general and administrative expenses for the six months ended July 31, 2009 were $490,836, compared to selling, general and administrative expenses of $387,155 for the corresponding period in 2008, an increase of about $103,681 principally due to transition costs associated with turning-around, expanding its

core business and additional overhead expenses associated with taking the company public offset by reduction in expenses in response to the decrease in sales from the global economic recession.

Payroll Expense. Payroll expense for the three months ended July 31, 2009 fiscal year were $252,534, compared to payroll expense for the same period in 2008 of $509,386 principally due to a reduction in expenses in 2009 in response to the global economic recession

compared to higher business operations in 2008 at Duratech Contracting division and Duratech Structures division in anticipation of greater growth that did not materialize because of global economic conditions.

Payroll expense for the six months ended July 31, 2009 fiscal year were $501,645, compared to payroll expense for the same period in 2008 of $720,614 principally due to an increase in business operations at Duratech Contracting division and Duratech Structures division in anticipation of greater growth that did not

materialize because of global economic conditions offset by reduction in expenses as a result of same.

Other Expenses. Bad debt expense for the period ended July 31, 2009 and 2008 was $0; interest expense for the three months ended July 31, 2009 was $104,395 compared to $49,082 for the corresponding period in 2008 due to larger borrowings associated with more

houses under construction; and depreciation and amortization expense for the quarter ended July 31, 2009 was $43,907 compared to $0 for the same quarter in 2008 due to greater property plant and equipment associated with larger operations and purchase of Truss Equipment which is expected to save the company money in the future.

Bad debt expense for the six months ended July 31, 2009 and 2008 was $0 and depreciation and amortization expense for the six months ended July 31, 2009 was $73,058 compared to $0 for the period in 2008 due to greater property plant and equipment associated with larger operations and purchase of Truss Equipment which

is expected to save the company money in the future.

Other Income/(Expense). Net other income for the three months ended July 31, 2009 and 2008 was $491 and $998, respectively.

Net other income for the six months ended July 31, 2009 and 2008 was $484 and 999, respectively; interest expense for the six months ended July 31, 2009 was $192,655 compared to $88,951 for the corresponding period in 2008 due to larger borrowings associated with more houses under construction.

Net Income. Net loss for the quarter ended July 31, 2009 was $385,121 compared to a net loss for the same quarter in 2008 of $627,296. The decrease in net loss is principally attributable to the increase in housing sales (although at a lower rate

than the 1st quarter) during the second quarter compared to the same period in 2008 and a reduction in payroll expenses in response to the global economic recession in the three month period ended July 31, 2009. The net loss for the period ended July 31, 2008 was $289,232 for Duratech Contracting division and a loss of $338,063 for Duratech Structures division which reflects growth of the respective divisions prior to the company’s reverse merger. The net loss for the period ended

July 31, 2009 was $230,424 for Duratech Contracting division which included overhead expenses for the Company and $154,697 for Duratech Structures division principally as a result of a decline in sales due to the global economic recession.

Net loss for the six months ended July 31, 2009 was $965,634 compared to a net loss for the period in 2008 of $611,379. The increase in net loss is principally attributable to the decrease home and modular sales during the first quarter as a result of the global economic recession and increase in selling,

general and administrative expenses in the six month period ended July 31, 2009, including turn-around costs and acquisition expenses related to reverse merger, offset by a decrease in payroll expenses in 2009 in response to the global economic recession. The net loss for the six months ended July 31, 2009 was $591,767 for Duratech Contracting division which included overhead expenses for the Company and $373,867 for Duratech Structures division principally as a result of a decline in sales

in the first quarter due to the global economic recession. The net loss for the six months ended July 31, 2008 was $386,493 for Duratech Contracting division and a loss of $224,886 for Duratech Structures division which reflects a decline in the company’s operation before being acquired by Duratech Group.

Foreign Currency Gains/Losses. Because the Company operates in Alberta and Saskatchewan, Canada, the company does incur foreign currency gains/losses for US GAAP reporting purposes. The Company incurred a loss on currency conversion of $19,307 for the three

months ended July 31, 2009 compared to a gain of $5,852 for the same period in 2008. The prevailing exchange rate used to translate the Canadian dollars to U.S dollars at July 31, 2009 and January 31, 2009 was 0.9269 and .0.81248, respectively. The average for the quarter ending July 31, 2009 and 2008 was 0.88265 and 0.9862, respectively.

Because the Company operates in Alberta and Saskatchewan, Canada, the company does incur foreign currency gains/losses for US GAAP reporting purposes. The Company incurred a loss on currency conversion of $39,818 for the six months ended July 31, 2009 compared to a gain of $5,887 for the same period in 2008. The prevailing

exchange rate used to translate the Canadian dollars to U.S dollars at July 31, 2009 and January 31, 2009 was 0.9269 and .0.81248, respectively. The average for the quarter ending July 31, 2009 and 2008 was 0.88265 and 0.9862, respectively.

Fiscal Year Ended January 31, 2009 Compared to the Fiscal Year Ended January 31, 2008

Operating Revenues. Revenues for the 2009 fiscal year were $6.68 million, compared to revenues for the 2008 fiscal year of $4.97 million. The increase in revenues of $1.71 million is principally attributable

to the growth in housing sales of $1 million through its Duratech Structures division and $650,000 through Duratech Contracting division.Sales for Duratech Contracting division increased from $3.12 million for fiscal year 2008 to $3.76 million for fiscal year 2009 due to an increase in new home sales.The Duratech Structures division went from $1.857 million for fiscal year 2008 to $2.921 million in sales for fiscal year 2009 due to the increase in sales of modular structures.

Selling, General and Administrative Expenses. Selling, general and administrative expenses for the 2009 fiscal year were $991,689, compared to selling, general and administrative expenses for the 2008 fiscal year of $306,199, an increase of about $685,490 principally

due to transition costs associated with turning-around and expanding its core business and additional overhead expenses associated with taking the company public.

Payroll Expense. Payroll expense for the 2009 fiscal year were $1,712,613, compared to payroll expense for the 2008 fiscal year expense of $489,321 principally due to an increase in business operations

at Duratech Contracting division and Duratech Structures division in anticipation of greater growth that did not materialize because of global economic conditions.The Company subsequently scaled back its operations and overhead to be more in line with expected on-going operations going forward.

Other Expenses. Bad debt expense for the 2009 fiscal year was $62 compared to $3,746 for the same period in the prior year and depreciation and amortization expense for 2009 was $124,397 compared to $21,598 for the 2008 fiscal year due to greater property plant

and equipment associated with larger operations and purchase of truss equipment which is expected to save the company money in the future.

Other Income/(Expense). Net other income for the 2009 fiscal year was $3,781 compared to $2,600 for the 2008 fiscal year. This income is from interest earned on balances carried by the company. Interest

expense for the 2009 fiscal year was $277,653 compared to $139,175 for the 2008 fiscal year due to larger borrowings associated with more houses under construction.

Net Income. Net loss for the 2009 fiscal year was $(1,050,993) compared to net loss for the 2008 fiscal year of $(321,065). The increase in net loss is principally attributable to the increase in payroll

and selling, general and administrative expenses in fiscal year 2009 including turn-around costs and acquisition expenses related to reverse merger. The company does not expect to continue incurring losses going forward as the company has scaled back its operations and overhead in line with current revenue levels and can increase staff as economic conditions improve.The net loss for 2008 was $(294,713) for Duratech Contracting division and $(26,352) for Duratech Structures division principally due to expansion

and overhead costs incurred by each entity. The net loss for fiscal year 2009 was $(774,965) for Duratech Contracting division which included overhead expenses for the Company and $(276,028) for Duratech Structures division.

Foreign Currency Gains/Losses. Because the Company operates in Alberta and Saskatchewan, Canada, the company does incur foreign currency gains/losses for US GAAP reporting purposes. The Company incurred

a gain on currency conversion of $115,077 for the 2009 fiscal year compared to a loss of $5,868 for the 2008 fiscal year. The prevailing exchange rate used to translate the Canadian dollars to U.S dollars at January 31, 2009 was 0.81248. The average was 0.907744.

Liquidity and Capital Resources

As of July 31, 2009, cash and cash equivalents totaled $0. The net cash provided by operations for the six-months ended July 31, 2009 of $96,830 increased from the net cash used in fiscal year end January 31, 2009 of $387,494 principally due to an increase in customer deposits offset by an increase in inventories

and net loss from operations. The net cash used in investing activities of $322,326 for the period was mainly due to acquisition of three parcels of land, described below in Part II, Item 2, compared to $46,867 for the fiscal year end January 31, 2009. The increase in financing activities of $265,314 for six-months ended July 31, 2009 compared to $319,284 generated for the prior fiscal year end was mainly due proceeds from notes payable for each period..

The working capital at July 31, 2009 was $(1,863,128), comprised of accounts receivable, net of $970,326, other receivables of $114,905 and inventory of $2,236,958 less payables and accrued liabilities of $1,042,636, customer deposits of $1,663,574, short term loans of $263,426; current portion of notes payable of

$2,086,317 and current portion of shareholder notes payable of $129,364.

The Company is currently experiencing decreased demand for its products as a result of slowed economic growth in Western Canada, which has been affected by the global recession that began late in 2008. In particular, the oil and natural gas sector, the primary industry in Alberta and Saskatchewan, has experienced

falling revenues due to the continuing uncertainty in the global economy and weak financing conditions, which has translated into several oil and gas projects being cancelled or put on hold. This, in turn, resulted in historically high, seasonally adjusted unemployment rates in August 2009 of 7.4% and 6.1% in Alberta and Saskatchewan, respectively. The impact of the decline in the oil and natural gas sector has also been felt in the housing market in the Western Prairie provinces, which

saw a decline in new housing starts of 17% in July 2009 compared to July 2008, and an expected overall decrease of 6.8% in home prices in 2009, according to data from the Canada Mortgage and Housing Corporation (“CMHC”), Canada’s national housing agency. However, in CMHC’s Third Quarter 2009 “Housing Market Outlook – Prairie Region Highlights” report, CMHC revised their 2009 forecast upward for housing starts and resales as price declines, government incentives, and low

mortgage rates are expected to lead to stronger activity in the fourth quarter of the year. For 2010, the report also indicates that lower inventories in both the new and resale markets, a strengthening economy, and rising demand will support a healthy increase in new home construction, along with restored price growth in the region.

Nevertheless, if economic conditions were to worsen and the Company’s products became unsellable, the Company would not be able to recover the full cost of its inventory. As a result, operations could deteriorate and our liquidity would be further diminished. This risk, however, is principally related to the

Company’s Duratech Contracting division that builds stick-built homes and has approximately $519,912 in inventory, which is substantially lower than it has been in prior periods. The Company does not expect that this inventory would be unsellable altogether or that it would have to sell such inventory below its cost, although it may well have to be sold at a lower profit then in the past. The Company’s Duratech Structures division builds modular homes and other structures on a contractual basis and

is paid as work is done, so there is little risk that the Company’s inventory for these lines of business would be impacted as almost all of the customer deposits on the Company’s balance sheet reflect deposits for Duratech Structures.

Going forward we will rely substantially on revenue from existing contracts, new business development efforts, and acquisitions. Actual sales will be recorded upon completion of each project, while sales and service revenue will be recorded as earned. To date, the Company has had investors willing to contribute equity,

convert debt to equity or offer private loans to finance on-going operations. In addition, the Company does have some relationships with lending institutions to provide financing on inventory and/or completed homes. The company has wound down its joint venture relationships with P&R Gateway Development Inc. and 1371009 Alberta Ltd. and will no longer be securing financing through these entities until the economic conditions improve.

Furthermore, the economic conditions within Canada, particularly as a result of natural resources markets, could impact future interest in housing and modular buildings. Overall, we have funded our cash needs from inception through July 31, 2009 with a series of private loan, debt and equity transactions. However,

private parties are under no legal obligation to provide us with future capital infusions and the global economic environment could impact the willingness of banks to continue to lend on real estate.

Demand for our products will be dependent upon, among other things, market acceptance of our products, the real estate market in general, and global economic conditions.Inasmuch as a major portion of our activities is the receipt of revenues from the sales of new home services, our business operations may be adversely affected by our competitors

and prolonged recessionary periods.The Company does believe that the Alberta and Saskatchewan regions, where its principle operations are located, will continue to be attractive Canadian markets, and that these areas will be less impacted by overall economic conditions, but there is no guarantee this will remain so going forward.

The Company has provided a detailed list of risks and cautionary statements later in this document.

Critical Accounting Policies and Estimates

The discussion and analysis of Duratech’s financial condition presented in this section are based upon the audited consolidated financial statements of Duratech Group Inc., which have been prepared in accordance with the generally accepted accounting principles in the United States. During the preparation of the financial statements

Duratech is required to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, Duratech evaluates its estimates and judgments, including those related to sales, returns, pricing concessions, bad debts, inventories, investments, fixed assets, intangible assets, income taxes and other contingencies. Duratech bases its estimates on historical experience and on various other assumptions

that it believes are reasonable under current conditions. Actual results may differ from these estimates under different assumptions or conditions.

In response to the SEC’s Release No. 33-8040, “Cautionary Advice Regarding Disclosure About Critical Accounting Policy,” Duratech identified the most critical accounting principles upon which its financial status depends. Duratech determined that those critical accounting principles are related to the use of estimates,

inventory valuation, revenue recognition, income tax and impairment of intangibles and other long-lived assets. Duratech presents these accounting policies in the relevant sections in this management’s discussion and analysis, including the Recently Issued Accounting Pronouncements discussed below.

Cash and Cash Equivalents—For purposes of the Consolidated Statement of Cash Flows, the Company considers liquid investments with an original maturity of three months or less to be cash equivalents.

Management’s Use of Estimates—The preparation of consolidated financial statements

in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of consolidated financial statements and the reported amounts of revenues and expenses during the reporting period.Actual results could differ from those estimates.

Presentation and Foreign Currency Translation—These consolidated financial statement have been prepared in accordance with US generally accepted accounting principles (GAAP) and translated into U.S dollars. The prevailing exchange rate used to translate

the Canadian dollars to U.S dollars at January 31, 2009 was 0.81248. The average was 0.907744.

Assets and liabilities denominated in respective functional currencies are translated into United States Dollars at the exchange rate as of the balance sheet date.The share capital and retained earnings are translated at exchange rates prevailing at the time of the transactions.Revenues, costs, and expenses denominated in respective functional

currencies are translated into United States Dollars at the weighted average exchange rate for the period.The effects of foreign currencies translation adjustments are included as a separate component of accumulated other comprehensive income.

Revenue Recognition— Revenues from long-term construction contracts (over one year) of the Duratech Contracting division, which builds on-site conventional homes, are recognized using the percentage-of-completion method.

Revenues from short-term contracts of the Duratech Structures division, which builds ready-to-move homes and modular camp sites, are recognized as the work is performed and related costs are incurred. Contract costs include all direct materials and labor costs and those indirect costs related to contract performance, such as indirect labor, supplies, tools, and repair costs. General and administrative costs are charged to expense as incurred.

Revenue and all related costs and expenses from house and land sales are recognized at the time that closing has occurred, when title and possession of the property and the risks and rewards of ownership transfer to the buyer, and we do not have a substantial continuing involvement in accordance with SFAS No.66, “Accounting

for Sales of Real Estate” (“SFAS 66”). In order to properly match revenues with expenses, we estimate construction and land development costs incurred and to be incurred, but not paid at the time of closing. Estimated costs to complete are determined for each closed home and land sale based upon historical data with respect to similar product types and geographical areas and allocated to closings along with actual costs incurred

based on a relative sales value approach. We monitor the accuracy of estimates by comparing actual costs incurred subsequent to closing to the estimate made at the time of closing and make modifications to the estimates based on these comparisons.

Revenue is recognized for long-term construction contract sales on the percentage-of-completion method when the land sale takes place prior to all contracted work being completed. Pursuant to the requirements of SFAS 66, if the seller has some continuing involvement with the property and does not transfer substantially all of the risks

and rewards of ownership, profit shall be recognized by a method determined by the nature and extent of the seller’s continuing involvement. In the case of our land sales, this involvement typically consists of final development activities. We recognize revenue and related costs as work progresses using the percentage-of-completion method, which relies on estimates of total expected costs to complete required work. Revenue is recognized in proportion to the percentage of total costs incurred in relation

to estimated total costs at the time of sale. Actual revenues and costs to complete construction in the future could differ from our current estimates. If our estimates of development costs remaining to be completed and relative sales values are significantly different from actual amounts, then our revenues, related cumulative profits and costs of sales may be revised in the period that estimates change.

Cash and Bank Overdraft—Cash consists of cash, cash equivalents and checks issued in excess of cash on deposit. Cash is put in the Bank account which has a negative balance. For the purpose of the cash flow statement, Bank overdrafts are also classified

as cash.

Net Loss per Common Share—Statement of Financial Accounting Standard (SFAS) No. 128 requires dual presentation of basic and diluted earnings per share (EPS) with a

reconciliation of the numerator and denominator of the EPS computations.Basic earnings per share amounts are based on the weighted average shares of common stock outstanding.If applicable, diluted earnings per share would assume the conversion, exercise or issuance of all potential common stock instruments such as options, warrants and convertible securities, unless the effect is to reduce a loss or increase earnings per share.Accordingly, this presentation has been adopted for the period presented.There were

no adjustments required to net loss for the period presented in the computation of diluted earnings per share.

Income Taxes—Income taxes are provided in accordance with Statement of Financial Accounting Standards (SFAS) No. 109, “Accounting for Income

Taxes.”A deferred tax asset or liability is recorded for all temporary differences between financial and tax reporting and net operating loss-carryforwards.

Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that, and some portion or the entire deferred tax asset will not be realized.Deferred tax assets and liabilities are adjusted for the effect of changes in tax laws and rates on the date of enactment.

Fair Value of Financial Instruments—The carrying amounts reported in the consolidated balance sheet for cash, accounts receivable and payable approximate fair value based on the short-term maturity of these instruments.

Accounts Receivable— Accounts deemed uncollectible are written off in the year they become uncollectible.For the years ended January 31, 2009 and 2008, no amounts were deemed uncollectible as of January 31, 2009.Outstanding Accounts Receivable as of

January 31, 2009 was $812,355. Typical payment terms for short-term contracts are 30% down, 60% upon completion and 10% holdback to be released once the structure is on-site and attached. Typical payment terms for stick-built homes (long-term construction contracts) are four draws from bank upon completion of backfill, lockup, ready-to-paint and at completion and a 10% holdback is held for 45 days to allow for builder liens by lawyer. Accounts receivable are considered current as long as there is reasonable expectation

that payments will be made as agreed upon or otherwise negotiated, but in no event longer than 12 months. The Company evaluates collectability based on receiving payments as agreed upon or as otherwise negotiated.

Impairment of Long-Lived Assets— Using the guidance of Statement of Financial Accounting Standards (SFAS) No. 144, “Accounting for the

Impairment or Disposal of Long-Lived Assets”, the Company reviews the carrying value of property, plant, and equipment for impairment whenever events and circumstances indicate that the carrying value of an asset may not be recoverable from the estimated future cash flows expected to result from its use and eventual disposition. In cases where undiscounted expected future cash flows are less than the carrying value, an impairment loss is recognized equal to an amount by which the carrying value exceeds

the fair value of assets. The factors considered by management in performing this assessment include current operating results, trends and prospects, the manner in which the property is used, and the effects of obsolescence, demand, competition, and other economic factors.

Inventory—Inventory is stated at the lower of accumulated cost or fair value, as determined in accordance with Statement of Financial Accounting Standards No.144, “Accounting for the Impairment or Disposal of Long Lived Assets” (“SFAS

144”). Accumulated cost includes costs associated with land acquisition, land development, and home construction costs, including certain direct and indirect overhead costs related to development and construction. Land acquisition and development costs are allocated to individual lots using actual lot cost determined based on the total expected land acquisition and development costs and the total expected home closings for the project. The specific identification method is used to accumulate home construction

costs.

Cost of sales includes the construction cost of the home, the actual lot cost for the home or project, and commissions and closing costs applicable to the home. The construction cost of the home includes amounts paid through the closing date of the home. Any costs incurred but not yet paidare expensed as incurred and are typically very

nominal in nature because the construction projects have been completed before recorded as sales. The construction cycles for the long-term construction projects (stick-built homes) are approximately one year and for the short-term construction projects (modular and ready-to-move homes) are approximately two to three months.

For those projects for which construction and development activities have been idled for an extended period of time, longer than three months, an impairment analysis will be performed to determine if an adjustment may be necessary. If the fair market value of a home (based on comparable units in the market) is less than its cost, this would

suggest impairment and an appropriate adjustment would be made. Recent market activity has shown that such fair market value estimates are not very sensitive or subjective. These analyses are performed on a regular basis and confirmed before filing documents with the Commission.

Customer Deposits—The cash deposit received from customers when project in progress are shown in the balance sheet as current liabilities and apply against the revenue expected from customers when the project is terminated and the customers are billed.

The deposit is without interest.

Deposits/Holdback—The deposits referenced under Deposits/Holdbacks are land deposits for future development that are refundable and not deposits from customers for home construction. The holdbacks included under Deposits/Holdback

are deficiency holdbacks that are held by the closing attorney on a completed project until it’s determined that there will not be any further claims by sub-contractors on the project.

Recently Issued Accounting Pronouncements

In December 2007, the FASB issued SFAS141(revised 2007), Business Combinations (“SFAS141R”). SFAS141R will significantly change the accounting for business combinations in a number of areas including the treatment of contingent consideration, contingencies, acquisition costs, IPR&D and restructuring costs. In addition, under

SFAS141R, changes in deferred tax asset valuation allowances and acquired income tax uncertainties in a business combination after the measurement period will impact income tax expense. SFAS141R is effective for fiscal years beginning after December15, 2008.Adoption of this standard is not expected to have a material effect on the Company’s results of operations or its financial position.

In December 2007, the FASB issued SFAS160, Noncontrolling Interests in Consolidated Financial Statements, an amendment of ARB No.51 (“SFAS160”). SFAS160 will change the accounting and reporting for minority interests, which will be recharacterized as noncontrolling interests (NCI) and classified as a component of equity. This

new consolidation method will significantly change the account with minority interest holders. SFAS160 is effective for fiscal years beginning after December15, 2008. Adoption of this standard is not expected to have a material effect on the Company’s results of operations or its financial position.

In March 2008, the FASB issued SFAS No.161, “Disclosures about Derivative Instruments and Hedging Activities — an amendment to FASB Statement No.133.” SFAS No.161 is intended to improve financial standards for derivative instruments and hedging activities by requiring enhanced disclosures to enable investors to better

understand their effects on an entity’s financial position, financial performance, and cash flows. Entities are required to provide enhanced disclosures about: (a)how and why an entity uses derivative instruments; (b)how derivative instruments and related hedged items are accounted for under Statement 133 and its related interpretations; and (c)how derivative instruments and related hedged items affect an entity’s financial position, financial performance, and cash flows. It is effective for

financial statements issued for fiscal years beginning after November15, 2008, with early adoption encouraged. The adoption of this statement, which is expected to occur in the first quarter of 2009, is not expected to have a material effect on the Company’s financial statements.

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles.” SFAS No. 162 identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of financial statements of nongovernmental entities that are presented in conformity

with generally accepted accounting principles in the United States. It is effective 60 days following the SEC’s approval of the Public Company Accounting Oversight Board amendments to AU Section 411, “The Meaning of Present Fairly in Conformity With Generally Accepted Accounting Principles.” The adoption of this statement is not expected to have a material effect on the Company’s financial statements.

In May2008, the FASB issued SFAS No.163, “Accounting for Financial Guarantee Insurance Contracts — An interpretation of FASB Statement No.60.” SFAS No.163 requires that an insurance enterprise recognize a claim liability prior to an event of default when there is evidence that credit deterioration has occurred in an insured

financial obligation. It also clarifies how Statement No.60 applies to financial guarantee insurance contracts, including the recognition and measurement to be used to account for premium revenue and claim liabilities, and requires expanded disclosures about financial guarantee insurance contracts. It is effective for financial statements issued for fiscal years beginning after December15, 2008, except for some disclosures about the insurance enterprise’s risk-management activities. SFAS No.163 requires

that disclosures about the risk-management activities of the insurance enterprise be effective for the first period beginning after issuance. Except for those disclosures, earlier application is not permitted. The adoption of this statement is not expected to have a material effect on the Company’s financial statements.

Cautionary Factors That May Affect Future Results

This Current Report on Form 8-K and other written reports and oral statements made from time to time by the Company may contain so-called “forward-looking statements,” all of which are subject to risks and uncertainties. One can identify these forward-looking statements by their use of words such as “expects,”

“plans,” “will,” “estimates,” “forecasts,” “projects” and other words of similar meaning. One can identify them by the fact that they do not relate strictly to historical or current facts. These statements are likely to address the Company’s growth strategy, financial results and product and development programs. One must carefully consider any such statement and should understand that many factors could cause actual results to differ from the

Company’s forward-looking statements. These factors include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known and some that are not. No forward-looking statement can be guaranteed and actual future results may vary materially.

The Company does not assume the obligation to update any forward-looking statement. One should carefully evaluate such statements in light of factors described in the Company’s filings with the SEC, especially on Forms 10-K(SB), 10-Q(SB) and 8-K. Listed below are some important factors that could

cause actual results to differ from expected or historic results. One should understand that it is not possible to predict or identify all such factors. Consequently, the reader should not consider any such list to be a complete list of all potential risks or uncertainties.

Risk Factors

Investing in the Company’s common stock involves a high degree of risk. Prospective investors should carefully consider the risks described below, together with all of the other information included or referred to in this Current Report on Form 8-K/A, before purchasing shares of the Company’s common stock. There are numerous

and varied risks, known and unknown, that may prevent the Registrant from achieving its goals. The risks described below are not the only ones the Company will face. If any of these risks actually occurs, the Company’s business, financial condition or results of operation may be materially adversely affected. In such case, the trading price of the Registrant’s common stock could decline and investors in the Company’s common stock could lose all or part of their investment. The risks and uncertainties

described below are not exclusive and are intended to reflect the material risks that are specific to the Company, material risks related to the Company’s industry and material risks related to companies that undertake a public offering or seek to maintain a class of securities that is registered or traded on any exchange or over-the-counter market.

The Company’s future revenues will be derived from the production of ready-to-move homes, modular units and building of site-built homes and acquisition and sale of manufactured homes produced in the United States. There are numerous risks, known and unknown, that may prevent the Company from achieving its goals including,

but not limited to, those described below. Additional unknown risks may also impair the Company’s financial performance and business operations. The Company’s business, financial condition and/or results of operations may be materially adversely affected by the nature and impact of these risks. In such case, the market value of the Company’s securities could be detrimentally affected, and investors may lose part or all of their investment. Please refer to the information contained

under “Business” in this report for further details pertaining to the Company’s business and financial condition.

Risks Related To Our Company

Our business has posted net operating losses, has limited operating history and will need capital to grow and finance its operations. For the investor, potential adverse effects of this include failure of the company to continue as a going concern. Our auditors have expressed substantial doubt about

our ability to continue as a going concern.

From the inception of our operating subsidiary, Duratech Group Inc., until June 30, 2008, the Company has had accumulated net losses of $199,368. Our auditors have raised substantial doubt about our ability to continue as a going concern due to accumulated losses from operations and net deficiency. Mr. Peter Van Hierden acquired the company

in July, 2007 and then quickly acquired another struggling company the same month. While Mr. Van Hierden and management have consolidated both entities, made substantial improvements to turn-around operations and put the company on a growth path going forward, there is no guarantee that these operations will be successful and will not continue to incur losses. The Company has limited operating history and is essentially an early-stage operation. The Company will continue to be dependent on having access to working

capital that will allow it to finance operations during its growth period. Continued net operating losses together with limited working capital make investing in our company a high-risk proposal. The adverse effects of a limited operating history include reduced management visibility into forward sales, marketing costs, customer acquisition and retention which could lead to missing targets for achievement of profitability.

A slowdown or other adverse developments in the Canadian economy may materially and adversely affect the Company’s customers, demand for the Company’s products and the Company’s business.