Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark one) | |||

| [ X ] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

| For the Fiscal Year Ended: September 27, 2009 | |||

| OR | |||

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

| For the transition period from __________ to __________ | |||

|

Commission File Number: 1-6905 | |||

| RUDDICK CORPORATION |

| (Exact name of registrant as specified in its charter) |

| North Carolina | 56-0905940 | ||

| (State or other jurisdiction of | (I.R.S. Employer | ||

| incorporation or organization) | Identification Number) | ||

| 301 S. Tryon St., Suite 1800, Charlotte, North Carolina | 28202 | ||||

| (Address of principal executive offices) | (Zip Code) | ||||

Registrant's telephone number, including area code: (704) 372-5404

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of exchange on which registered: | |

| Common Stock | New York Stock Exchange, Inc. | |

| Rights to Purchase Series A Junior | ||

| Participating Additional Preferred Stock | New York Stock Exchange, Inc. |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes X No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No X

Indicate by check mark whether the

registrant (1) has filed all reports required to be filed by Section 13 or 15(d)

of the Securities Exchange Act of 1934 during the preceding 12 months (or for

such shorter period that the registrant was required to file such reports), and

(2) has been subject to such filing requirements for the past 90 days.

Yes X

No

Indicate by check mark whether the

registrant has submitted electronically and posted on its corporate Web site, if

any, every Interactive Data File required to be submitted and posted pursuant to

Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12

months (or for such shorter period that the registrant was required to submit

and post such files).

Yes

No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer X | Accelerated filer | |

| Non-accelerated filer | Smaller reporting company | |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No X

The aggregate market value of the voting stock held by non-affiliates of the registrant, computed by reference to the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter, March 29, 2009, was $949,348,000. The registrant has no non-voting stock.

As of November 13, 2009, the registrant had outstanding 48,572,319 shares of Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

Part III: Portions of the Definitive Proxy Statement to be filed with the Securities and Exchange Commission in connection with the solicitation of proxies for the Company’s 2010 Annual Meeting of Shareholders to be held on February 18, 2010 are incorporated by reference into Part III. (With the exception of those portions which are specifically incorporated by reference in this Form 10-K, the Proxy Statement is not deemed to be filed or incorporated by reference as part of this report.)

RUDDICK CORPORATION

AND

CONSOLIDATED SUBSIDIARIES

FORM 10-K FOR THE FISCAL YEAR ENDED SEPTEMBER 27, 2009

TABLE OF CONTENTS

| PART I | |||

| Page | |||

| Item 1. | Business | 1 | |

| Item 1A. | Risk Factors | 3 | |

| Item 1B. | Unresolved Staff Comments | 6 | |

| Item 2. | Properties | 6 | |

| Item 3. | Legal Proceedings | 7 | |

| Item 4. | Submission of Matters to a Vote of Security Holders | 7 | |

| Item 4A. | Executive Officers of the Registrant | 8 | |

| PART II | |||

| Item 5. | Market for Registrant's Common Equity, Related Shareholder | ||

| Matters and Issuer Purchases of Equity Securities | 9 | ||

| Item 6. | Selected Financial Data | 11 | |

| Item 7. | Management's Discussion and Analysis of Financial Condition | ||

| and Results of Operations | 12 | ||

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 25 | |

| Item 8. | Financial Statements and Supplementary Data | 26 | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting | ||

| and Financial Disclosure | 50 | ||

| Item 9A. | Controls and Procedures | 51 | |

| Item 9B. | Other Information | 51 | |

| PART III | |||

| Item 10. | Directors and Executive Officers of the Registrant | 52 | |

| Item 11. | Executive Compensation | 52 | |

| Item 12. | Security Ownership of Certain Beneficial Owners and | ||

| Management and Related Shareholder Matters | 52 | ||

| Item 13. | Certain Relationships and Related Transactions, and Director | ||

| Independence | 52 | ||

| Item 14. | Principal Accountant Fees and Services | 52 | |

| PART IV | |||

| Item 15. | Exhibits and Financial Statement Schedules | 53 | |

PART I

Item 1. Business

Ruddick Corporation (the “Company”) is a holding company which, through its wholly-owned subsidiaries, is engaged in two primary businesses: Harris Teeter, Inc. (“Harris Teeter”) currently operates a regional chain of supermarkets in eight states primarily in the southeastern and mid-Atlantic United States, including the District of Columbia; and American & Efird, Inc. (“A&E”) manufactures and distributes industrial sewing thread, embroidery thread and technical textiles on a global basis.

At September 27, 2009, the Company and its subsidiaries had total consolidated assets of $1,844,321,000 and had approximately 24,800 employees. The principal executive office of the Company is located at 301 S. Tryon Street, Suite 1800, Charlotte, North Carolina, 28202.

Ruddick Corporation, which is incorporated under North Carolina law, was created in 1968 through the consolidation of the predecessor companies of Ruddick Investment Company (which was subsequently merged into Ruddick Operating Company) and A&E. In 1969, the Company acquired Harris Teeter. Ruddick Operating Company is not classified as a separate operating component of the Company due to its limited operations and relative size to the consolidated group. Ruddick Operating Company manages venture capital holdings in a limited number of entities and has investments in various independently managed venture capital investment funds. For information regarding the Company’s investments, see the Note entitled “Summary of Significant Accounting Policies” of the Notes to Consolidated Financial Statements in Item 8 hereof.

The two primary businesses of the Company, together with financial information and competitive aspects of such businesses, are discussed separately below. For other information regarding industry segments, see the Note entitled “Industry Segment Information” of the Notes to Consolidated Financial Statements in Item 8 hereof.

The only foreign operations conducted by the Company are through A&E. Neither of the two primary businesses would be characterized as seasonal. The following analysis is based upon the Company’s operating locations for the fiscal periods and year end (in thousands):

| 2009 | 2008 | 2007 | ||||||

| Net Sales for the Fiscal Year: | ||||||||

| Domestic United States | $ | 3,940,608 | $ | 3,810,635 | $ | 3,454,198 | ||

| Foreign Countries | 137,214 | 181,762 | 185,010 | |||||

| $ | 4,077,822 | $ | 3,992,397 | $ | 3,639,208 | |||

| Net Long-Lived Assets at Fiscal Year End: | ||||||||

| Domestic United States | $ | 1,088,602 | $ | 978,363 | $ | 860,493 | ||

| Foreign Countries | 36,238 | 40,625 | 41,990 | |||||

| $ | 1,124,840 | $ | 1,018,988 | $ | 902,483 | |||

The Company’s consolidated working capital as of September 27, 2009 consisted of $474,286,000 in current assets and $402,865,000 in current liabilities. Normal operating fluctuations in these balances can result in changes to cash flow from operating activities presented in the statements of consolidated cash flows that are not necessarily indicative of long-term operating trends. There are no unusual industry practices or requirements relating to working capital items in either of the Company’s subsidiary operations.

The Company employs fifteen people at its corporate headquarters, including two executive officers who formulate and implement overall corporate objectives and policies. The Company’s employees perform functions in a number of areas including finance, accounting, internal audit, risk management, financial reporting, employee benefits and public and shareholder relations. The Company assists its subsidiaries in developing long-range goals, in strengthening management personnel and their operations and financing. Management of each subsidiary is responsible for implementing operating policies and reports directly to management of the Company.

1

Harris Teeter

As of September 27, 2009, Harris Teeter operated 189 supermarkets located in North Carolina (132), Virginia (33), South Carolina (11), Maryland (3), Tennessee (4), Delaware (2), District of Columbia (2), Florida (1) and Georgia (1). These supermarkets offer a full assortment of groceries, produce, meat and seafood, delicatessen items, bakery items, wines and non-food items such as health and beauty care, general merchandise and floral. In addition, Harris Teeter operated pharmacies in 118 of their supermarkets as of September 27, 2009. Retail supermarket operations are supported by two company-owned distribution centers and one company-owned dairy production facility. Other than milk and ice cream produced by the company-owned facility, Harris Teeter purchases most of the products it sells, including its store brand products, from outside suppliers or directly from the manufacturers. Harris Teeter’s sales constituted 94% of the Company’s consolidated sales in fiscal 2009 (92% in fiscal 2008 and 91% in fiscal 2007).

The supermarket industry is highly competitive. Harris Teeter competes with local, regional and national food chains along with independent merchants. In addition to the more traditional food stores, Harris Teeter also competes with discount retailers (including supercenters that carry a full line of food items), many of which are larger in terms of assets and sales. The consolidation of competitors within the supermarket industry that has occurred over the past several years has reduced the number of local food chains and independent merchants. Additionally, some discount supercenter operators, such as Wal-Mart and Target, are continuing to expand and offer more items typically found in supermarket formats. As a result, Harris Teeter is likely to compete with more, larger food chains in its markets. Principal competitive factors include store location, price, service, convenience, cleanliness, product quality and product variety. No one customer or group of related customers has a material effect upon the business of Harris Teeter.

As of September 27, 2009, Harris Teeter employed approximately 10,000 full-time and 11,900 part-time individuals, none of whom were represented by a union. Harris Teeter considers its employee relations to be good.

American & Efird, Inc.

A&E is one of the world’s largest global manufacturers and distributors of industrial sewing thread, embroidery thread and technical textiles, produced from natural and synthetic fibers. Manufacturers of apparel, automotive materials, home furnishings, medical supplies and footwear rely on A&E industrial sewing thread to manufacture their products. A&E’s primary products are industrial sewing thread, embroidery thread and technical textiles sold through its employed sales representatives, commissioned agents and distributors. A&E also distributes sewing supplies manufactured by other companies. A&E sales constituted 6% of the Company’s consolidated sales in fiscal 2009 (8% in fiscal 2008 and 9% in fiscal 2007).

A majority of A&E’s sales are industrial thread for use in apparel products. The apparel market is made up of many categories servicing both genders and diverse age groups, including jeanswear, underwear, menswear, womenswear, outerwear, intimate apparel, workwear and childrenswear. A&E also manufactures industrial thread for use in a wide variety of non-apparel products including home furnishings, automotive, footwear, upholstered furniture, sporting goods, caps and hats, gloves, leather products, medical products and tea bag strings.

Headquartered in Mt. Holly, North Carolina, A&E operated six modern manufacturing facilities in North Carolina and four distribution centers strategically located in the United States as of the fiscal year ended September 27, 2009. Subsequent to the end of fiscal 2009, A&E completed the consolidation of one of its manufacturing facilities into one of its other North Carolina operations, thus reducing the number of manufacturing facilities in North Carolina to five. The manufacturing facilities have been designed for flexibility and efficiency to accommodate changing customer product demands.

A&E also has wholly-owned operations in Canada, China, Colombia, Costa Rica, El Salvador, England, Honduras, Hong Kong, Italy, Mexico, Malaysia, The Netherlands, Turkey, Poland and Slovenia; majority-owned joint ventures in China (two), Dominican Republic and South Africa; minority interest in ventures with ongoing operations in Bangladesh, Brazil, India and Sri Lanka; and a 50% ownership interest in a joint venture in China. A&E’s consolidated assets in these foreign operations total approximately $169 million at the end of fiscal 2009. Management expects to continue to expand foreign production and distribution operations, through acquisitions, joint ventures or new start-up operations.

The domestic order backlog, believed to be firm, as of September 27, 2009, was approximately $10,770,000 versus $10,535,000 at the end of the preceding fiscal year. The international order backlog as of the end of fiscal 2009 was approximately $1,984,000 versus $2,685,000 at the end of the preceding fiscal year. The majority of the domestic and international order backlog was filled within five weeks of the fiscal 2009 year end. As of September 27, 2009, A&E had approximately 7,500 domestic and 6,000 international active customer accounts. In fiscal 2009, no single customer accounted for more than 4% of A&E’s total net sales, and the ten largest customers accounted for approximately 14% of A&E’s total net sales.

2

A&E purchases cotton from farmers and domestic cotton merchants. There is presently a sufficient supply of cotton worldwide and in the domestic market. Synthetic fibers are bought from the principal American synthetic fiber producers for domestic operations and from the principal Asian and American synthetic fiber producers for operations in China. There is currently an adequate supply of synthetic fiber for A&E’s global operations.

A&E has three patents issued. There are no material licenses, franchises or concessions held by A&E. Research and development expenditures were $428,000, $509,000, and $487,000 in fiscal 2009, 2008 and 2007, respectively, none of which were sponsored by customers. Two full-time employees are currently engaged in this activity.

The industrial sewing thread industry is highly competitive. A&E is one of the world’s largest manufacturers of industrial sewing threads and also manufactures and distributes consumer sewing thread, embroidery thread and technical textiles. A&E competes globally with Coats plc, as well as regional producers and merchants in the industrial thread, embroidery thread and technical textile markets. The key competitive factors are quality, service and price.

A&E and its consolidated subsidiaries employed approximately 2,900 individuals worldwide as of September 27, 2009. None of the domestic employees and an insignificant number of employees of foreign operations are represented by a union. A&E considers its employee relations to be good.

Available Information

The Company’s Internet address is www.ruddickcorp.com. The Company makes available, free of charge, on or through its website, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, and beneficial ownership reports on Forms 3, 4, and 5 as soon as reasonably practicable after electronically filing such material with, or furnishing it to, the Securities and Exchange Commission.

Item 1A. Risk Factors

This report contains certain statements that are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Actual outcomes and results may differ materially from those expressed in, or implied by, our forward-looking statements. Words such as “expects,” “anticipates,” “believes,” “estimates” and other similar expressions or future or conditional verbs such as “will,” “should,” “would” and “could” are intended to identify such forward-looking statements. Readers of this report should not rely solely on the forward-looking statements and should consider all uncertainties and risks throughout this report. The statements are representative only as of the date they are made, and we undertake no obligation to update any forward-looking statement.

All forward-looking statements, by their nature, are subject to risks and uncertainties. Our actual future results may differ materially from those set forth in our forward-looking statements. We face risks that are inherent in the businesses and the market places in which Harris Teeter and A&E operate. The following discussion sets forth certain risks and uncertainties that we believe could cause actual future results to differ materially from expected results. In addition to the factors discussed below, other factors that might cause our future financial performance to vary from that described in our forward-looking statements include: (i) changes in federal, state or local laws or regulations; (ii) cost and stability of energy sources; (iii) cost and availability of energy and raw materials; (iv) management’s ability to predict accurately the adequacy of the Company’s present liquidity to meet future financial requirements; (v) continued solvency of any third parities on leases the Company has guaranteed; (vi) management’s ability to predict the required contributions to the pension plans of the Company; (vii) the Company’s requirement to impair recorded goodwill or long-lived assets; (viii) changes in labor and employee benefit costs, such as increased health care and other insurance costs; (ix) ability to recruit, train and retain effective employees and management in both of the Company’s operating subsidiaries; (x) the extent and speed of successful execution of strategic initiatives; (xi) volatility of financial and credit markets which would affect access to capital for the Company; and, (xii) unexpected outcomes of any legal proceedings arising in the normal course of business of the Company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations and also could cause actual results to differ materially from those included, contemplated or implied by the forward-looking statements made in this report, and the reader should not consider any of the above list of factors and the following discussion to be a complete set of all potential risks or uncertainties.

3

Risks Related to Harris Teeter

The Supermarket Industry is Highly Competitive. The supermarket industry is characterized by narrow profit margins and competes on value, location and service. Harris Teeter faces increased competitive pressure in all of its markets from existing competitors and from the threatened entry by one or more major new competitors. The number and type of competitors faced by Harris Teeter vary by location and include: traditional grocery retailers (both national and regional), discount retailers such as “supercenters” and “club and warehouse stores,” specialty supermarkets, drug stores, dollar stores, convenience stores and restaurants. In addition, certain Harris Teeter supermarkets also compete with local video stores, florists, book stores and pharmacies. Aggressive supercenter expansion, increasing fragmentation of retail formats, entry of non-traditional competitors and market consolidation have further contributed to an increasingly competitive marketplace.

Additionally, increasingly competitive markets and economic uncertainty have made it difficult generally for grocery store operators to achieve comparable store sales gains. Because sales growth has been difficult to attain, Harris Teeter’s competitors have attempted to maintain market share through increased levels of promotional activities and discount pricing, creating a more difficult environment in which to achieve consistent sales gains. Some of Harris Teeter’s competitors have greater financial resources and could use these resources to take measures which could adversely affect Harris Teeter’s competitive position. Accordingly, Harris Teeter’s business, financial condition or results of operations could be adversely affected by competitive factors, including product mix and pricing changes which may be made in response to competition from existing or new competitors.

Harris Teeter’s Expansion Plans Are Subject to Risk. Harris Teeter has spent, and intends to continue to spend, significant capital and management resources on the development and implementation of expansion and renovation plans. Harris Teeter’s new store opening program has accelerated in recent years and involves expanding the company’s Washington, D.C. metro market area which incorporates northern Virginia, the District of Columbia, southern Maryland and coastal Delaware. The successful implementation of Harris Teeter’s renovation and expansion plans are subject to several factors including: the availability of new, suitable locations on reasonable commercial terms, or at all; the success of new stores, including those in new markets; management’s ability to manage expansion, including the effect on sales at existing stores when a new store is opened nearby; the ability to secure any necessary financing; change in regional and national economic conditions; and increasing competition or changes in the competitive environment in Harris Teeter’s markets.

Harris Teeter’s new stores may initially operate at a loss, depending on factors such as prevailing competition and market position in the surrounding communities and the level of sales and profit margins in existing stores may not be duplicated in new stores. Pursuing a strategy of growth, renovation and expansion in light of current highly competitive industry conditions could lead to a near-term decline in earnings as a result of opening and operating a substantial number of new stores, particularly with respect to stores in markets where Harris Teeter does not have a significant presence. If Harris Teeter’s expansion and renovation plans are unsuccessful, it could adversely affect Harris Teeter’s cash flow, business and financial condition due to the significant amount of capital and management resources invested.

Food Safety Issues Could Result in a Loss of Consumer Confidence and Product Liability Claims. Harris Teeter could be adversely affected if consumers lose confidence in the safety and quality of the food supply chain. These concerns could cause shoppers to avoid purchasing certain products from Harris Teeter, or to seek alternative sources of supply for their food needs, even if the basis for the concern is not valid and/or is outside of the company’s control. Adverse publicity about these types of concerns, whether or not valid, could discourage consumers from buying our products and any lost confidence on the part of our customers would be difficult and costly to reestablish. As such, any issue regarding the safety of any food items sold by Harris Teeter, regardless of the cause, could have a substantial and adverse effect on the company’s operations.

Harris Teeter’s Geographic Concentration May Expose it to Regional or Localized Downturns. Harris Teeter operates primarily in the southeastern United States, with a strong concentration in North Carolina, Virginia and South Carolina. As a result, Harris Teeter’s business is more susceptible to regional factors than the operations of more geographically diversified competitors. These factors include, among others, changes in the economy, weather conditions, demographics and population. Although the southeast region has experienced economic and demographic growth in the past, a significant economic downturn in the region could have a material adverse effect on Harris Teeter’s business, financial condition or results of operations.

The Ownership and Development of Real Estate May Subject Harris Teeter to Environmental Liability. Under applicable environmental laws, as an owner or developer of real estate, Harris Teeter may be responsible for remediation of environmental conditions that may be discovered and may be subject to associated liabilities (including liabilities resulting from lawsuits brought by private litigants) relating to Harris Teeter supermarkets and other buildings and the land on which those building are situated, whether the properties are leased or owned, and whether such environmental conditions, if in existence, were created by Harris Teeter or by a prior owner or tenant. The discovery of contamination from hazardous or toxic substances, or the failure to properly remediate such contaminated property, may adversely affect Harris Teeter’s ability to sell or rent real property or to borrow using real property as collateral. Liabilities or costs resulting from noncompliance with current or future applicable environmental laws or other claims relating to environmental matters could have a material adverse effect on Harris Teeter’s business, financial condition or results of operations.

4

Risks Related to A&E

A&E Operates in a Competitive Global Industry. A&E competes on a global basis with a large number of manufacturers in the highly competitive sewing thread, embroidery thread and technical textile industries. Maintaining A&E’s competitive position may require substantial investments in product development efforts, manufacturing facilities, distribution network and sales and marketing activities. Competitive pressures may also result in decreased demand for A&E’s products or force A&E to lower its prices. Other generally adverse economic and industry conditions, including a decline in consumer demand for apparel products, could have a material adverse effect on A&E’s business.

A&E may not Succeed at Integrating Its Acquisitions. In recent years, A&E has expanded its foreign production and distribution capacity by acquiring other manufacturers, entering into joint ventures or starting new businesses. Management expects A&E to continue this activity and expand foreign production and distribution operations through acquisitions, joint ventures or new start-up operations. The process of combining these acquisitions with A&E’s existing businesses involves risks. A&E will face challenges in consolidating functions, integrating organizations, procedures, operations and product lines in a timely and efficient manner and retaining key personnel. Failure to successfully manage and integrate acquisitions, joint ventures or new start-up businesses could lead to the potential loss of customers, the potential loss of employees who may be vital to the new operations, the potential loss of business opportunities or other adverse consequences that could affect A&E’s financial condition and results of operations. Even if integration occurs successfully, failure of future acquisitions to achieve levels of anticipated sales growth, profitability or productivity may adversely impact A&E’s financial condition and results of operations. Additionally, expansions involving foreign markets may present other complexities that may require additional attention from members of management. The diversion of management attention and any difficulties encountered in the transition and integration process could have a material adverse effect on A&E’s revenues, level of expenses and operating results.

A&E Has Substantial International Operations. In fiscal 2009, approximately 55% of A&E’s net sales and a large portion of A&E’s production occurred outside the United States, primarily in Europe, Latin America and Asia. A&E’s corporate strategy includes the expansion and growth of its international business on a worldwide basis, with an emphasis on Asia. As a result, A&E’s operations are subject to various political, economic and other uncertainties, including risks of restrictive taxation policies, changing political conditions and governmental regulations. A&E’s foreign operations also subjects A&E to the risks inherent in currency translations. A&E’s global operations make it impossible to eliminate completely all foreign currency translation risks and its impact on A&E’s financial results.

A&E Has Raw Material Price Volatility. The significant price volatility of many of A&E’s raw materials may result in increased production costs, which A&E may not be able to pass on to its customers. A significant portion of the raw materials A&E uses in manufacturing thread and technical textiles are petroleum-based. The prices for petroleum and petroleum-related products are volatile. While A&E at times in the past has been able to increase product prices due to raw material increases, A&E generally is not able to immediately raise product prices and may be unable to completely pass on underlying cost increases to its customers. Additional raw material and energy cost increases that A&E is not able to fully pass on to customers or the loss of a large number of customers to competitors as a result of price increases could have a material adverse effect on its business, financial condition, results of operations or cash flows.

Other Risks

Narrow Profit Margins may Adversely Affect the Company’s Business. Profit margins in the supermarket and thread industries are very narrow. In order to increase or maintain the Company’s profit margins, strategies are used to reduce costs, such as productivity improvements, shrink reduction, distribution efficiencies, energy efficiency programs and other similar strategies. Changes in product mix also may negatively affect certain financial measures. If the Company is unable to achieve forecasted cost reductions there may be an adverse effect on the Company’s business.

Our Self-Insurance Reserves are Subject to Variability and Unpredictable External Factors. As discussed in more detail below in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies—Self-insurance Reserves for Workers’ Compensation, Healthcare and General Liability,” the Company is primarily self-insured for most U.S. workers’ compensation claims, healthcare claims and general liability and automotive liability losses. Accordingly, the Company determines the estimated reserve required for claims in each accounting period, which requires that management determine estimates of the costs of claims incurred and accrue for such expenses in the period in which the claims are incurred. The liabilities that have been recorded for these claims represent our best estimate of the ultimate obligations for reported claims plus those incurred but not reported. Changes in legal trends and interpretations, variability in inflation rates, changes in the nature and method of claims settlement, benefit level changes due to changes in applicable laws, and changes in discount rates could all affect ultimate settlements of claims or the assumptions underlying our liability estimates, which could cause a material change for our self-insurance liability reserves and impact earnings.

5

The Company may Incur Increased Pension Expenses. The Company maintains certain retirement benefit plans for substantially all domestic full-time employees and a supplemental retirement benefit plan for certain selected officers of the Company and its subsidiaries, including a qualified pension plan which is a non-contributory, funded defined benefit plan and a non-qualified supplemental pension plan for executives which is an unfunded, defined benefit plan. The Company has frozen participation and benefit accruals under the Company-sponsored defined benefit plan effective September 30, 2005 for all participants, with certain transition benefits provided to those participants that have achieved specified age and service levels on December 31, 2005; however, at September 27, 2009, the Company’s pension plans had projected benefit obligations in excess of the fair value of plan assets. The amount of any increase or decrease in our required contributions to our pension plans will depend on government regulation, returns on plan assets and actuarial assumptions regarding our future funding obligations. For more information, refer to the Note entitled “Employee Benefit Plans” in the Notes to Consolidated Financial Statements in Item 8 hereof.

Adverse Economic Conditions may Negatively Impact the Company’s Operating Results. The increase in unemployment and loss of consumer confidence can alter the consumers’ buying habits and demand for apparel products. In addition, consumers may decrease their purchases of more discretionary items and increase their purchase of lower cost food products. Adverse economic conditions in the financial markets, including the availability of financing, could also adversely affect the Company's operating results by increasing costs related to obtaining financing at acceptable rates and reduce our customers’ liquidity position. These conditions could materially affect the Company’s customers causing reductions or cancellations of existing sales orders and inhibit the Company’s ability to collect receivables. In addition, the Company’s suppliers may be unable to fulfill the Company’s outstanding orders or could change credit terms that would negatively affect the Company’s liquidity. All of these factors could adversely impact the Company’s results of operations, financial condition and cash flows.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

The executive office of the Company is located in a leased space of a downtown office tower at 301 S. Tryon Street, Suite 1800, Charlotte, North Carolina, 28202.

Harris Teeter owns its principal offices near Charlotte, North Carolina, a 517,000 square foot distribution facility east of Charlotte, a 913,000 square foot distribution facility in Greensboro, North Carolina, and a 90,500 square foot dairy processing plant in High Point, North Carolina. Both distribution facilities contain dry grocery warehousing space and refrigerated storage for perishable goods. In addition, the Greensboro facility has frozen goods storage and a single pick facility for health and beauty care products and other general merchandise. Harris Teeter operates its retail stores primarily from leased properties. As of September 27, 2009, Harris Teeter held title to the land and buildings of four of its supermarkets. The remaining supermarkets are either leased in their entirety or the building is owned and situated on leased land. In addition, Harris Teeter holds interest in properties that are under development for store sites. Harris Teeter’s supermarkets range in size from approximately 16,000 square feet to 73,000 square feet, with an average size of approximately 47,300 square feet.

6

The following table sets forth selected statistics with respect to Harris Teeter stores for each of the last three fiscal years:

| 2009 | 2008 | 2007 | ||||||

| Stores Open at Period End | 189 | 176 | 164 | |||||

| Average Weekly Net Sales Per Store* | $ | 405,356 | $ | 414,101 | $ | 402,982 | ||

| Average Square Footage Per Store at Period End | 47,277 | 46,708 | 46,197 | |||||

| Average Square Footage Per New Store Opened | ||||||||

| During Period | 51,698 | 48,330 | 51,737 | |||||

| Total Square Footage at Period End | 8,935,271 | 8,220,583 | 7,576,302 | |||||

| ____________________ | ||||||||

| *Computed on the basis of aggregate sales of stores open for a full year. | ||||||||

A&E's principal offices, six domestic manufacturing plants and one distribution center are all owned by A&E and are all located in North Carolina. Domestic manufacturing and related warehouse facilities have an aggregate of approximately 1,537,000 square feet of floor space. A&E has a domestic dyeing production capacity of approximately 27,000,000 pounds per year. Capacities are based on 168 hours of operations per week. In addition, A&E leases three distribution centers strategically located in its domestic markets with an aggregate of approximately 84,000 square feet of floor space.

Through consolidated subsidiaries, A&E also owns seven international manufacturing and/or distribution facilities with an aggregate of approximately 799,000 square feet of floor space. A&E also leases another 19 international manufacturing and/or distribution facilities with an aggregate of approximately 427,000 square feet of floor space. The foreign consolidated subsidiaries engaged in manufacturing have a dyeing production capacity of approximately 22,480,000 pounds per year. Capacities are based on 168 hours of operations per week. In addition to its consolidated subsidiaries, A&E also has minority interests in various joint ventures and a 50% ownership interest in a joint venture in China.

The Company believes its facilities and those of its operating subsidiaries are adequate for its current operations and expected growth for the foreseeable future.

Item 3. Legal Proceedings

The Company and its subsidiaries are involved in various legal matters from time to time in connection with their operations, including various lawsuits and patent and environmental matters. These matters considered in the aggregate have not had, nor does the Company expect them to have, a material effect on the Company’s results of operations, financial position or cash flows.

Item 4. Submission of Matters to a Vote of Security Holders

Not applicable.

7

Item 4A. Executive Officers of the Registrant

The following list contains the name, age, positions and offices held and period served in such positions or offices for each of the executive officers of the Registrant.

Thomas W. Dickson, age 54, is the Chairman of the Board of Directors, President and Chief Executive Officer of the Company, and has been Chairman of the Board of Directors since March 2006 and President and principal executive officer since February 1997. Prior to that time, he served as Executive Vice President of the Company from February 1996 to February 1997. Prior to that time, from February 1994 to February 1996 he served as President of, and from February 1991 to February 1994 he served as Executive Vice President of, A&E.

John B. Woodlief, age 59, is the Vice President – Finance and Chief Financial Officer of the Company, and has been the Vice President – Finance and principal financial officer of the Company since November 1999. Prior to that time, he served as a partner in PricewaterhouseCoopers since 1998 and a partner in Price Waterhouse from 1985 to 1998. He served as Managing Partner of the Charlotte, North Carolina office of Price Waterhouse and PricewaterhouseCoopers from January of 1997 to June of 1999. He joined Price Waterhouse in 1972.

Frederick J. Morganthall, II, age 58, was elected President of Harris Teeter on October 30, 1997. Prior to that time, and beginning in October 1996, he served as Executive Vice President of Harris Teeter. He was also Harris Teeter’s Senior Vice President of Operations from October 1995 to October 1996, Vice President of Operations from April 1994 to October 1995 and Vice President of Sales and Distribution from October 1992 to April 1994.

Fred A. Jackson, age 59, has been President of A&E since August 1996. Prior to that time, and beginning in January 1996, he served as Executive Vice President of A&E. He was also A&E’s Senior Vice President - Industrial Thread Sales from October 1993 to January 1996.

The executive officers of the Company and its subsidiaries are elected annually by their respective Boards of Directors. Thomas W. Dickson is the nephew of Alan T. Dickson who is a director of the Company. No other executive officer has a family relationship as close as first cousin with any other executive officer or director or nominee for director.

8

PART II

Item 5. Market for Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

Information regarding the principal market for the Company’s common stock (the “Common Stock”), number of shareholders of record, market price information per share of Common Stock and dividends declared per share of Common Stock for each quarterly period in fiscal 2009 and 2008 is set forth below.

The Common Stock is listed on the New York Stock Exchange. As of November 13, 2009, there were approximately 4,500 holders of record of Common Stock.

Quarterly Information

| First | Second | Third | Fourth | ||||||||

| Quarter | Quarter | Quarter | Quarter | ||||||||

| Fiscal 2009 | |||||||||||

| Dividend Per Share | $ | 0.12 | $ | 0.12 | $ | 0.12 | $ | 0.12 | |||

| Market Price Per Share | |||||||||||

| High | 33.74 | 29.20 | 26.87 | 28.00 | |||||||

| Low | 23.81 | 18.86 | 22.00 | 21.77 | |||||||

| Fiscal 2008 | |||||||||||

| Dividend Per Share | $ | 0.12 | $ | 0.12 | $ | 0.12 | $ | 0.12 | |||

| Market Price Per Share | |||||||||||

| High | 38.03 | 36.99 | 39.79 | 38.98 | |||||||

| Low | 31.15 | 31.71 | 33.89 | 29.47 | |||||||

The Company expects to continue paying dividends on a quarterly basis which is at the discretion of the Board of Directors and subject to legal and contractual requirements. Information regarding restrictions on the ability of the Company to pay cash dividends is set forth in "Management's Discussion and Analysis of Financial Condition and Results of Operations - Capital Resources and Liquidity" in Item 7 hereof.

Equity Compensation Plan Information

The following table provides information as of September 27, 2009 regarding the number of shares of Common Stock that may be issued under the Company’s equity compensation plans.

| Number of securities remaining | ||||||

| Number of securities to be | Weighted-average exercise | available for future issuance under | ||||

| issued upon exercise of | price of outstanding options, | equity compensation plans | ||||

| outstanding options, | warrants and rights | (excluding securities | ||||

| warrants and rights | reflected in column (a)) | |||||

| Plan category | (a) (1) | (b) (2) | (c) | |||

| Equity compensation plans | ||||||

| approved by security | ||||||

| holders | 509,184 | $19.29 | 1,465,221 | |||

| Equity compensation plans | ||||||

| not approved by security | ||||||

| holders | -0- | -0- | -0- | |||

| Total | 509,184 | $19.29 | 1,465,221 |

| (1) |

Includes grants of 136,700 performance shares outstanding as of September 27, 2009. Excludes 106,884 shares of Common Stock that are deliverable in connection with the 106,884 stock units outstanding under the Ruddick Corporation Director Deferral Plan (the “Deferral Plan”) that have been accumulated in a rabbi trust for the purpose of funding distributions from the Deferral Plan. Does not include any shares of restricted stock that were outstanding as of September 27, 2009 since these shares are already outstanding and do not represent potential dilution. For more information on the Company’s restricted stock and performance share grants, see the Note entitled “Stock Options and Stock Awards” of the Notes to Consolidated Financial Statements in Item 8 hereof. | |

| (2) |

The weighted average exercise price does not take into account performance share awards or restricted stock units outstanding as of September 27, 2009. |

9

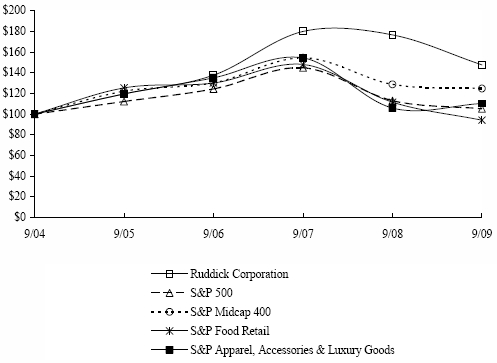

Comparison of Total Cumulative Shareholder Return for Five-Year Period Ending September 27, 2009

The following graph presents a comparison of the yearly percentage change in the Company’s cumulative total shareholders’ return on Common Stock with the (i) Standard & Poor’s 500 Index, (ii) Standard & Poor’s Midcap 400 Index, (iii) Standard & Poor’s Food Retail Index, and (iv) Standard & Poor’s Apparel, Accessories & Luxury Goods Index for the five-year period ended September 27, 2009.

Comparison of Five-Year Cumulative Total

Return*

Among Ruddick Corporation and Certain Indicies**

| Cumulative Total Return | ||||||||||||

| 9/30/04 | 9/30/05 | 9/30/06 | 9/30/07 | 9/30/08 | 9/30/09 | |||||||

| Ruddick Corporation | 100.00 | 119.64 | 137.71 | 180.08 | 176.60 | 147.73 | ||||||

| S & P 500 | 100.00 | 112.25 | 124.37 | 144.81 | 112.99 | 105.18 | ||||||

| S & P Midcap 400 | 100.00 | 122.16 | 130.17 | 154.59 | 128.81 | 124.80 | ||||||

| S & P Food Retail | 100.00 | 125.44 | 130.21 | 148.10 | 111.51 | 94.10 | ||||||

| S & P Apparel, Accessories & Luxury Goods | 100.00 | 119.54 | 135.07 | 154.44 | 105.89 | 110.34 | ||||||

* $100 invested on 9/30/04 in stock or index, including reinvestment of dividends.

** The Company utilizes two indices, rather than a single index, for its peer group comparison: Standard & Poor’s Food Retail Index and Standard & Poor’s Apparel, Accessories & Luxury Goods Index. The Company believes that the separate presentation of these indices more accurately corresponds to the Company’s primary lines of business.

10

Issuer Purchases of Equity Securities

The following table summarizes the Company’s purchases of its common stock during the quarter ended September 27, 2009.

| Total Number of | Maximum Number | |||||||

| Shares Purchased as | of Shares that May | |||||||

| Part of Publicly | Yet Be Purchased | |||||||

| Total Number of | Average Price | Announced Plans or | Under the Plans or | |||||

| Period | Shares Purchased | Paid per Share | Programs (1) | Programs | ||||

| June 29, 2009 to | ||||||||

| August 2, 2009 | - 0 - | n.a. | - 0 - | 2,822,469 | ||||

| August 3, 2009 to | ||||||||

| August 30, 2009 | - 0 - | n.a. | - 0 - | 2,822,469 | ||||

| August 31, 2009 to | ||||||||

| September 27, 2009 | - 0 - | n.a. | - 0 - | 2,822,469 | ||||

| Total | - 0 - | n.a. | - 0 - | 2,822,469 | ||||

| (1) |

In February 1996, the Company announced the adoption of a stock buyback program, authorizing, at management’s discretion, the Company to purchase and retire up to 4,639,989 shares, 10% of the then-outstanding shares of the Company’s common stock, for the purpose of preventing dilution as a result of the operation of the Company’s comprehensive stock option and awards plans. The stock purchases are effected from time to time pursuant to this authorization. As of September 27, 2009, the Company had purchased and retired 1,817,520 shares under this authorization and no shares were purchased during the quarter ended September 27, 2009. The stock buyback program has no set expiration or termination date. |

Item 6. Selected Financial Data (dollars in thousands, except per share data)

| 2009 (1) | 2008 | 2007 | 2006 | 2005 | ||||||||||

| Net sales | $ | 4,077,822 | $ | 3,992,397 | $ | 3,639,208 | $ | 3,265,856 | $ | 2,964,655 | ||||

| Operating profit | 154,851 | 173,785 | 148,174 | 123,069 | 115,260 | |||||||||

| Net income | 85,964 | 96,752 | 80,688 | 72,336 | 68,598 | |||||||||

| Net income per share | ||||||||||||||

| Basic | 1.79 | 2.02 | 1.69 | 1.53 | 1.45 | |||||||||

| Diluted | 1.78 | 2.00 | 1.68 | 1.52 | 1.44 | |||||||||

| Dividend per share | 0.48 | 0.48 | 0.44 | 0.44 | 0.44 | |||||||||

| Total assets | 1,844,321 | 1,696,407 | 1,529,689 | 1,362,936 | 1,203,640 | |||||||||

| Long-term debt -- including | ||||||||||||||

| current portion | 365,087 | 320,578 | 264,392 | 237,731 | 163,445 | |||||||||

| Shareholders' equity | 812,179 | 823,835 | 736,610 | 670,517 | 608,942 | |||||||||

| Book value per share | 16.73 | 17.06 | 15.31 | 14.10 | 12.82 |

Note: The Company’s fiscal year ends on the Sunday nearest to September 30. Fiscal years 2009, 2008, 2007, 2006 and 2005 includes the 52 weeks ended September 27, 2009, September 28, 2008, September 30, 2007, October 1, 2006 and October 2, 2005.

| (1) |

Reference is made to Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Results of Operations – Goodwill and Long-Lived Asset Impairments” which describes certain asset impairment charges as follows: |

- Fiscal 2009 – Non-cash charges of $9,891,000 ($6,099,000 after tax benefits, or $0.13 per diluted share) related to goodwill and long-lived asset impairments recognized by A&E.

11

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

This Management’s Discussion and Analysis of Financial Condition and Results of Operations includes forward-looking statements. We have based these forward-looking statements on our current plans, expectations and beliefs about future events. In light of the risks, uncertainties and assumptions discussed under Item 1A “Risk Factors” of this Annual Report on Form 10-K and other factors discussed in this section, there are risks that our actual experience will differ materially from the expectations and beliefs reflected in the forward-looking statements in this section and throughout this report. For more information regarding what constitutes a forward-looking statement, please refer to “Risk Factors” in Item 1A hereof.

Overview

The Company operates primarily in two business segments through two wholly owned subsidiaries: retail grocery (including related real estate and store development activities) – operated by Harris Teeter, and industrial sewing thread (textile primarily), including embroidery thread and technical textiles – operated by A&E. Harris Teeter is a regional supermarket chain operating primarily in the southeastern and mid-Atlantic United States, including the District of Columbia. A&E is a global manufacturer and distributor of sewing thread for the apparel and other markets, embroidery thread and technical textiles. The Company evaluates the performance of its two businesses utilizing various measures which are based on operating profit.

The economic environment has motivated changes in the consumption habits of the retail consumer which has impacted the financial results of both operating subsidiaries. Unprecedented economic uncertainty, tumultuous market conditions, and a decreasing level of consumer confidence has created a more cautious consumer and increased the competitive environment in Harris Teeter’s primary markets. Harris Teeter competes with other traditional grocery retailers, as well as other retail outlets including, but not limited to, discount retailers such as “neighborhood or supercenters” and “club and warehouse stores,” specialty supermarkets and drug stores. Generally, Harris Teeter’s markets continue to experience new store opening activity and aggressive feature pricing or everyday low prices by competitors. In response, Harris Teeter utilizes information gathered from various sources, including its Very Important Customer ("VIC") loyalty card program, and works with suppliers to deliver effective retail pricing and targeted promotional spending programs that drive customer traffic and create value for Harris Teeter customers. In addition, Harris Teeter differentiates itself from its competitors with its product selection, assortment and variety, and its focus on customer service. These efforts along with Harris Teeter’s new store development program have resulted in overall gains in market share within Harris Teeter’s primary markets.

Harris Teeter continued its planned new store development program and has opened 15 new stores during fiscal 2009, 15 new stores during fiscal 2008 and 19 new stores during fiscal 2007. Much of Harris Teeter’s new store growth is focused on expanding its Washington, D.C. metro market area which incorporates northern Virginia, the District of Columbia, southern Maryland and coastal Delaware. The new store activity, and its associated pre-opening and incremental start-up costs, has required additional borrowings under the Company’s revolving credit facility.

Business conditions for A&E’s customers have also been negatively impacted by the current economic environment and the cautious consumer. A&E has experienced a significant decline in sales as a result of the serious global economic conditions facing its customers in the apparel and non-apparel markets. In addition, apparel production in the Americas has continued to decline due to the shift of apparel sourcing from the Americas to other regions of the world, predominately Asia. It has been estimated by the U.S. Department of Commerce Office of Textiles and Apparel that Asia and the Indian sub-continent accounted for approximately 69% of the apparel imports into the U.S. in 2006, approximately 73% in 2007, approximately 74% in 2008 and approximately 76% for the first eight months in 2009. This has greatly impacted A&E’s operations in the Americas. As a result, A&E’s strategic plans have included the expansion of its operations in the Asian markets and the expansion of product lines beyond apparel sewing thread.

12

A&E’s growth in China, India and other Asian markets has been accomplished through additional investments in its wholly owned subsidiaries by way of capital expenditures and through strategic joint ventures. In fiscal 2003, A&E entered into a joint venture in China resulting in a 50% ownership interest in Huamei Thread Company Limited, which is one of the largest thread producers in the China market. During fiscal 2005, A&E acquired an 80% ownership interest in Jimei Spinning Company Limited (a thread yarn spinning company located in China) and increased its ownership interest in Hengmei Spinning Company Limited (another thread yarn spinning company in China) from 60% to 80%. During the third quarter of fiscal 2008, A&E entered into a joint venture with Vardhman Textiles Limited in India (“Vardhman”) to manufacture, distribute and sell sewing thread for industrial and consumer markets within India and for export markets. During the first quarter of fiscal 2009, A&E exercised its option to purchase an additional 14% ownership interest in Vardhman under the terms of the original joint venture agreement, which increased A&E’s total ownership interest in Vardhman to 49%. A&E continues to transform its business to be more Asian centric, which is in line with the global shifting of A&E’s customer base.

A&E also expanded its global presence during fiscal 2005 by entering into a joint venture in Brazil resulting in a 30% ownership interest in Linhas Bonfio S.A (“Linhas”). During the first quarter of fiscal 2009, A&E acquired an additional 13% ownership interest in Linhas, which increased A&E’s total ownership interest in Linhas to 43%. In addition, A&E obtained a majority ownership interest in its two joint ventures in South Africa during fiscal 2006.

A&E’s fiscal 2004 acquisition of certain assets and the U.S. business of Synthetic Thread Company, Inc. provided A&E with an entry into the technical textiles market. A&E expanded its customer base and product line offerings in the technical textiles arena by acquiring certain assets and the U.S. business of Ludlow Textiles Company, Inc. in fiscal 2005. Technical textiles represent non-apparel yarns A&E supplies to its customers in the automotive, telecommunication, wire and cable, paper production and other industries. Further diversification was achieved in fiscal 2005 by A&E’s acquisition of certain assets and the business of Robison-Anton Textile Co., a U.S. producer of high-quality embroidery threads. The sale of non-apparel threads and yarns resulting from these acquisitions has partially offset sales declines in the U.S. resulting from the shifting of apparel manufacturing. In fiscal 2006, A&E expanded its production and distribution of non-apparel products through the acquisition of TSP Tovarna Sukancev in Trakov d.d. (“TSP”) located in Maribor, Slovenia. A&E continues to expand the manufacturing and distribution of non-apparel products throughout its global operations.

A&E continues to face increased operating costs and highly competitive pricing in its markets. A&E has completed the integration and consolidation of the strategic investments made in the past few years. Management at A&E intends to continue to reduce expenses at its U.S. operations and certain foreign operations, and focus on its strategic plans to become more Asian centric.

Results of Operations

Goodwill and Long-Lived Asset Impairments

The continuing deterioration of the economic environment during 2009, particularly with respect to A&E’s customers in the retail apparel and non-apparel markets, caused management to lower the expected future cash flows of A&E’s U.S. operating segment during the Company’s annual strategic planning process. Based on the revised expectations, A&E was required to perform an interim test for goodwill impairment and, as a result, recorded non-cash impairment charges related to its U.S. operating segment during the third quarter of fiscal 2009. Impairment charges included the write-off of all of the goodwill associated with its U.S. acquisitions previously made in 1995 and 1996 and the write-down of certain long-lived assets of its U.S. operating segment. During fiscal 2009, A&E wrote off $7,654,000 of goodwill and wrote down certain long-lived assets of its U.S. operating segment by $2,237,000. A&E also recorded deferred tax benefits of $3,792,000 related to the impairment charges.

13

Consolidated Overview

The following table sets forth the operating profit components by each of the Company's operating segments and for the holding company ("Corporate") for the 52 weeks ended September 27, 2009 (fiscal 2009), September 28, 2008 (fiscal 2008), and September 30, 2007 (fiscal 2007). The table also sets forth each of the segment’s net income components as a percent to total net sales and the percentage increase or decrease of such components over the prior year (in thousands):

| Fiscal 2009 | Fiscal 2008 | Fiscal 2007 | % Inc. (Dec.) | |||||||||||||||||||||||

| % to | % to | % to | 09 vs | 08 vs | ||||||||||||||||||||||

| Sales | Sales | Sales | 08 | 07 | ||||||||||||||||||||||

| Net Sales | ||||||||||||||||||||||||||

| Harris Teeter | $ | 3,827,005 | 93.8 | $ | 3,664,804 | 91.8 | $ | 3,299,377 | 90.7 | 4.4 | 11.1 | |||||||||||||||

| American & Efird | 250,817 | 6.2 | 327,593 | 8.2 | 339,831 | 9.3 | (23.4 | ) | (3.6 | ) | ||||||||||||||||

| Total | $ | 4,077,822 | 100.0 | $ | 3,992,397 | 100.0 | $ | 3,639,208 | 100.0 | 2.1 | 9.7 | |||||||||||||||

| Gross Profit | ||||||||||||||||||||||||||

| Harris Teeter | $ | 1,169,441 | 28.68 | $ | 1,138,857 | 28.53 | $ | 1,021,739 | 28.07 | 2.7 | 11.5 | |||||||||||||||

| American & Efird | 47,916 | 1.17 | 69,590 | 1.74 | 74,608 | 2.05 | (31.1 | ) | (6.7 | ) | ||||||||||||||||

| Total | 1,217,357 | 29.85 | 1,208,447 | 30.27 | 1,096,347 | 30.12 | 0.7 | 10.2 | ||||||||||||||||||

| SG&A Expenses | ||||||||||||||||||||||||||

| Harris Teeter | 993,850 | 24.37 | 961,092 | 24.08 | 867,656 | 23.84 | 3.4 | 10.8 | ||||||||||||||||||

| American & Efird | 52,646 | 1.29 | 67,262 | 1.68 | 73,184 | 2.01 | (21.7 | ) | (8.1 | ) | ||||||||||||||||

| Corporate | 6,119 | 0.15 | 6,308 | 0.16 | 7,333 | 0.20 | (3.0 | ) | (14.0 | ) | ||||||||||||||||

| Total | 1,052,615 | 25.81 | 1,034,662 | 25.92 | 948,173 | 26.05 | 1.7 | 9.1 | ||||||||||||||||||

| Impairment Charges – A&E | ||||||||||||||||||||||||||

| Goodwill | 7,654 | 0.19 | - | - | - | - | n.m. | n.m. | ||||||||||||||||||

| Long-Lived Assets | 2,237 | 0.05 | - | - | - | - | n.m. | n.m. | ||||||||||||||||||

| Total | 9,891 | 0.24 | - | - | - | - | n.m. | n.m. | ||||||||||||||||||

| Operating Profit (Loss) | ||||||||||||||||||||||||||

| Harris Teeter | 175,591 | 4.31 | 177,765 | 4.45 | 154,083 | 4.23 | (1.2 | ) | 15.4 | |||||||||||||||||

| American & Efird | (14,621 | ) | (0.36 | ) | 2,328 | 0.06 | 1,424 | 0.04 | n.m. | 63.6 | ||||||||||||||||

| Corporate | (6,119 | ) | (0.15 | ) | (6,308 | ) | (0.16 | ) | (7,333 | ) | (0.20 | ) | (3.0 | ) | (14.0 | ) | ||||||||||

| Total | 154,851 | 3.80 | 173,785 | 4.35 | 148,174 | 4.07 | (10.9 | ) | 17.3 | |||||||||||||||||

| Other Expense, net | 16,662 | 0.41 | 19,674 | 0.49 | 17,683 | 0.48 | (15.3 | ) | 11.3 | |||||||||||||||||

| Income Tax Expense | 52,225 | 1.28 | 57,359 | 1.44 | 49,803 | 1.37 | (9.0 | ) | 15.2 | |||||||||||||||||

| Net Income | $ | 85,964 | 2.11 | $ | 96,752 | 2.42 | $ | 80,688 | 2.22 | (11.1 | ) | 19.9 | ||||||||||||||

Consolidated net sales increased 2.1% in fiscal 2009 and 9.7% in fiscal 2008 when compared to prior years as a result of strong sales gains at Harris Teeter. The fiscal 2009 and 2008 increases were partially offset by sales declines at A&E. Foreign sales for fiscal 2009 represented 3.4% of the consolidated sales of the Company, compared to 4.6% for fiscal 2008 and 5.1% for fiscal 2007. Over the past several years, A&E has pursued a global expansion strategy along with the diversification of its product lines; however, the percentage of foreign sales to consolidated net sales has declined during these periods as a result of the sales mix between the operating subsidiaries. Refer to the discussion of segment operations under the captions “Harris Teeter, Retail Grocery Segment” and “American & Efird, Industrial Thread Segment” for a further analysis of the segment operating results.

The gross profit increase for fiscal 2009 was driven by increased gross profit at Harris Teeter that was offset, in part, by a gross profit decline at A&E when compared to fiscal 2008. The increase in gross profit, and its percent to sales, for fiscal 2008 was driven by a gross profit increase at Harris Teeter that was offset, in part, by a gross profit decline at A&E from fiscal 2007 to fiscal 2008. Refer to the discussion of segment operations under the captions “Harris Teeter, Retail Grocery Segment” and “American & Efird, Industrial Thread Segment” for a further analysis of the segment operating results.

Consolidated selling, general & administrative (“SG&A”) expenses increased during fiscal 2009, when compared to the prior year, as a result of the increased operating costs at Harris Teeter driven by store expansion. The increase in SG&A expenses in fiscal 2009 was partially offset by reduced SG&A expenses at A&E and Corporate. SG&A expenses, as a percent to consolidated net sales, decreased in fiscal 2009 from fiscal 2008 and fiscal 2007 as a result of the leverage created through sales gains that apply against fixed costs at Harris Teeter and lower SG&A expenses at A&E and Corporate. Refer to the discussion of segment operations under the caption “Harris Teeter, Retail Grocery Segment” and “American & Efird, Industrial Thread Segment” for a further analysis of the segment operating results.

14

As discussed previously, A&E recorded non-cash impairment charges of $9,891,000 related to its U.S. operating unit during fiscal 2009. The related income tax benefit of these charges amounted to $3,792,000, resulting in a net income reduction of $6,099,000. Refer to the discussion of segment operations under the caption “American & Efird, Industrial Thread Segment” for a further analysis of the segment operating results.

Other expense, net includes interest expense, interest income, investment gains and losses, and minority interest. Net interest expense (interest expense less interest income) decreased $2.3 million in fiscal 2009 from fiscal 2008. The decrease in interest expense was driven by lower average interest rates on outstanding debt balances. Average outstanding debt balances increased between the comparable periods as a result of increased borrowings under the Company’s credit facility and new capital leases entered into in support of Harris Teeter’s new store development program. Net interest expense increased $1.8 million in fiscal 2008 over fiscal 2007 as a result of additional interest expense associated with increased borrowings under the Company’s credit facility in support of Harris Teeter’s new store development program. In addition, incremental borrowings were required for A&E’s fiscal 2008 equity investment in Vardhman. The increase in interest expense was offset, in part, by a lower weighted average interest rate realized during fiscal 2008.

The effective consolidated income tax rate for fiscal 2009 was 37.8% as compared to 37.2% for fiscal 2008 and 38.2% for fiscal 2007. Income tax expense for fiscal 2009 included the removal of $1.6 million of valuation allowances associated with foreign tax credits which management now believes will be realized and adjustments made for an increase in the Company’s state income taxes. Income tax expense for fiscal 2008 included refund claims related to prior years of approximately $2.4 million associated with A&E’s foreign operations.

As a result of the items discussed above, consolidated net income for fiscal 2009 decreased by $10.8 million, or 11.1%, over fiscal 2008 and net income per diluted share decreased by 11.0% to $1.78 per share in fiscal 2009 from $2.00 per share in fiscal 2008. The non-cash impairment charges recorded by A&E during fiscal 2009 reduced consolidated net income by $6.1 million, or $0.13 per diluted share. Consolidated net income for fiscal 2008 increased by $16.1 million, or 19.9%, over fiscal 2007 and net income per diluted share increased by 19.0% to $2.00 per share in fiscal 2008 from $1.68 per share in fiscal 2007.

Harris Teeter, Retail Grocery Segment

The following table sets forth the consolidated operating profit components for the Company's Harris Teeter supermarket subsidiary for fiscal years 2009, 2008, and 2007. The table also sets forth the percent to sales and the percentage increase or decrease over the prior year (in thousands):

| Fiscal 2009 | Fiscal 2008 | Fiscal 2007 | % Inc. (Dec.) | ||||||||||||||||

| % to | % to | % to | 09 vs | 08 vs | |||||||||||||||

| Sales | Sales | Sales | 08 | 07 | |||||||||||||||

| Net Sales | $ | 3,827,005 | 100.00 | $ | 3,664,804 | 100.00 | $ | 3,299,377 | 100.00 | 4.4 | 11.1 | ||||||||

| Cost of Sales | 2,657,564 | 69.44 | 2,525,947 | 68.92 | 2,277,638 | 69.03 | 5.2 | 10.9 | |||||||||||

| Gross Profit | 1,169,441 | 30.56 | 1,138,857 | 31.08 | 1,021,739 | 30.97 | 2.7 | 11.5 | |||||||||||

| SG&A Expenses | 993,850 | 25.97 | 961,092 | 26.23 | 867,656 | 26.30 | 3.4 | 10.8 | |||||||||||

| Operating Profit | $ | 175,591 | 4.59 | $ | 177,765 | 4.85 | $ | 154,083 | 4.67 | (1.2 | ) | 15.4 | |||||||

Sales increased 4.4% in fiscal 2009 over fiscal 2008 and 11.1% in fiscal 2008 over fiscal 2007. The increase in sales in fiscal 2009 was attributable to incremental new stores that was partially offset by a decline in comparable store sales, whereas the increase in sales in fiscal 2008 was attributable to both incremental new stores and comparable store sales increases. During fiscal 2009, Harris Teeter opened 15 new stores (2 of which were replacements) and closed 2 stores. During fiscal 2008, Harris Teeter opened 15 new stores (2 of which were replacements) and closed 3 stores and during fiscal 2007 Harris Teeter opened 19 new stores (2 of which were replacements) and closed 7 stores. The increase in sales from new stores exceeded the loss of sales from closed stores by $225.4 million in fiscal 2009, $275.7 million in fiscal 2008 and $230.1 million in fiscal 2007. Comparable store sales (see definition below) decreased 1.49% ($53.1 million) for fiscal 2009, as compared to increases of 2.86% ($91.3 million) for fiscal 2008 and 4.87% ($136.4 million) for fiscal 2007. Comparable store sales were negatively impacted by retail price deflation and, to some extent, the cannibalization created by strategically opening stores in key major markets that have a close proximity to existing stores. In addition, Harris Teeter customers, in theses economic times, are choosing lower priced store branded products and reducing their purchases of more discretionary categories such as floral, tobacco, and certain general merchandise. Store brand product penetration was 25.38% in fiscal 2009, an increase of 10 basis points over fiscal 2008. The number of shopping visits and items sold increased, however the average ticket size was down in fiscal 2009 from fiscal 2008. In addition, Harris Teeter experienced average increases in active households per comparable store (based on VIC data) in fiscal 2009 of 3.31% for the fourth quarter and 1.86% for year, evidencing a growing customer base in those stores. Harris Teeter’s strategy of opening additional stores in its core markets that have a close proximity to existing stores can negatively impact comparable store sales. However, management expects these stores, and any similar new additions in the foreseeable future, to have a strategic benefit of enabling Harris Teeter to capture sales and expand market share as the markets it serves continue to grow.

15

Harris Teeter considers its reporting of comparable store sales growth to be effective in determining core sales growth during periods of fluctuation in the number of stores in operation, their locations and their sizes. While there is no standard industry definition of "comparable store sales," Harris Teeter has been consistently applying the following definition. Comparable store sales are computed using corresponding calendar weeks to account for the occasional extra week included in a fiscal year. A new store must be in operation for 14 months before it enters into the calculation of comparable store sales. A closed store is removed from the calculation in the month in which its closure is announced. A new store opening within an approximate two-mile radius of an existing store that is to be closed upon the new store opening is included as a replacement store in the comparable store sales measurement as if it were the same store. Sales increases resulting from existing comparable stores that are expanded in size are included in the calculations of comparable store sales, if the store remains open during the construction period.

Fiscal 2009 gross profit as a percent to sales declined 52 basis points from fiscal 2008 as a result of additional promotional activity designed to provide more value to Harris Teeter’s customers. Management continues to adjust Harris Teeter’s promotional spending programs in response to the changing purchasing habits of Harris Teeter’s customers. The decline in the gross profit margin for fiscal 2009 was offset, in part, by management’s emphasis on distribution and manufacturing cost controls, decreasing fuel costs and a lower LIFO charge. Gross profit, and its percent to sales, for fiscal 2008 improved as a result of changes in Harris Teeter’s market mix and its retail pricing and targeted promotional spending strategies. The annual LIFO charge reduced gross profit by $4.4 million (0.12% to sales) in fiscal 2009, $8.8 million (0.24% to sales) in fiscal 2008 and $1.4 million (0.04% to sales) in fiscal 2007.

SG&A expenses for fiscal 2009 increased from fiscal 2008 as a result of incremental costs associated with Harris Teeter’s new store program (pre-opening costs and incremental start-up costs), increased credit and debit card fees and other occupancy costs. However, SG&A expenses as a percent to sales decreased 26 basis points in fiscal 2009 from fiscal 2008 as a result of the leverage created through sales gains that apply against fixed costs, along with improved labor management and additional cost controls in support departments. SG&A expenses as a percent to sales decreased in fiscal 2008 from fiscal 2007 as a result of the leverage created through sales gains that apply against fixed costs. Included with SG&A expenses are pre-opening costs, which consist of pre-opening rent, labor and associated fringe benefits and recruiting and relocations costs incurred prior to a new store opening and amounted to $14.4 million (0.37% of sales) in fiscal 2009, $15.4 million (0.42% of sales) in fiscal 2008 and $17.9 million (0.54% of sales) in fiscal 2007. Pre-opening costs fluctuate between periods depending on the new store opening schedule and market location.

As a result of the sales and cost elements described above, operating profit declined 1.2% in fiscal 2009 from fiscal 2008 and increased 15.4% in fiscal 2008 from fiscal 2007. Harris Teeter continues to invest within its core markets, which management believes have greater potential for improved returns on investment in the foreseeable future. Harris Teeter had 189 stores in operation at September 27, 2009, compared to 176 stores at September 28, 2008 and 164 stores at September 30, 2007.

16

American & Efird, Industrial Thread Segment

The following table sets forth the consolidated operating profit components for the Company's A&E textile subsidiary for fiscal years 2009, 2008 and 2007. The table also sets forth the percent to sales and the percentage increase or decrease over the prior year (in thousands):

| Fiscal 2009 | Fiscal 2008 | Fiscal 2007 | % Inc. (Dec.) | |||||||||||||||||||

| % to | % to | % to | 09 vs | 08 vs | ||||||||||||||||||

| Sales | Sales | Sales | 08 | 07 | ||||||||||||||||||

| Net Sales | $ | 250,817 | 100.00 | $ | 327,593 | 100.00 | $ | 339,831 | 100.00 | (23.4 | ) | (3.6 | ) | |||||||||

| Cost of Sales | 202,901 | 80.90 | 258,003 | 78.76 | 265,223 | 78.05 | (21.4 | ) | (2.7 | ) | ||||||||||||

| Gross Profit | 47,916 | 19.10 | 69,590 | 21.24 | 74,608 | 21.95 | (31.1 | ) | (6.7 | ) | ||||||||||||

| SG&A Expenses | 52,646 | 20.99 | 67,262 | 20.53 | 73,184 | 21.53 | (21.7 | ) | (8.1 | ) | ||||||||||||

| Goodwill Impairment | 7,654 | 3.05 | - | - | - | - | n.m. | n.m. | ||||||||||||||

| Long-Lived Asset Impairments | 2,237 | 0.89 | - | - | - | - | n.m. | n.m. | ||||||||||||||

| Operating (Loss) Profit | $ | (14,621 | ) | (5.83 | ) | $ | 2,328 | 0.71 | $ | 1,424 | 0.42 | n.m. | 63.6 | |||||||||

Sales decreased 23.4% in fiscal 2009 from fiscal 2008 and 3.6% in fiscal 2008 from fiscal 2007. The decrease in fiscal 2009 was driven primarily by sales declines for all regions between the comparable fiscal years. The global recession and its continuing negative impact on consumer spending is depressing the worldwide supply chain and A&E’s customers have cut back orders in response to the reduction of retail sales. The decrease in fiscal 2008 was driven primarily by sales declines in the United States, Canada and Mexico (the North American Free Trade Association Region or “NAFTA”) from fiscal 2007. Sales gains during fiscal 2008 in A&E’s Asian operations were offset by the sales declines realized in NAFTA.

Foreign sales accounted for approximately 55% of total A&E sales in both fiscal 2009 and fiscal 2008, and 54% in fiscal 2007. Foreign sales, especially in the Asian markets, will continue to be a significant proportion of total A&E sales due to the shifting global production of its customers and A&E's strategy of increasing its presence in such global markets. Management recognizes that a major challenge facing A&E is the geographic shift of its customer base and, as a result, management remains committed to its strategic plans that will transform A&E’s business to a more Asian-centric global supplier of sewing thread, embroidery thread and technical textiles.

Gross profit, and its percent to net sales, decreased during fiscal 2009 and fiscal 2008 when compared to the prior fiscal years primarily as a result of weak sales and poor overhead absorption in the U.S. operations and certain other foreign operations. Fiscal 2009 gross profit was reduced by $300,000 for severance costs associated with the consolidation of one of A&E’s manufacturing facilities in North Carolina into one of A&E’s other North Carolina operations, which was completed subsequent to the end of fiscal 2009. The shifting of apparel production from the Americas to Asia has continued and management is focused on optimizing costs and manufacturing capacities in its domestic and foreign operations.