Attached files

| file | filename |

|---|---|

| EX-4.2 - EXHIBIT 4.2 - IRONWOOD PHARMACEUTICALS INC | a2195489zex-4_2.htm |

| EX-3.3 - EXHIBIT 3.3 - IRONWOOD PHARMACEUTICALS INC | a2195489zex-3_3.htm |

| EX-3.1 - EXHIBIT 3.1 - IRONWOOD PHARMACEUTICALS INC | a2195489zex-3_1.htm |

| EX-21.1 - EXHIBIT 21.1 - IRONWOOD PHARMACEUTICALS INC | a2195489zex-21_1.htm |

| EX-23.1 - EXHIBIT 23.1 - IRONWOOD PHARMACEUTICALS INC | a2195489zex-23_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

Index to Financial Statements of Ironwood Pharmaceuticals, Inc.

As filed with the Securities and Exchange Commission on November 20, 2009

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

IRONWOOD PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

2834 (Primary Standard Industrial Classification Code Number) |

04-3404176 (I.R.S. Employer Identification Number) |

320 Bent Street

Cambridge, Massachusetts 02141

(617) 621-7722

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Peter M. Hecht

Chief Executive Officer

320 Bent Street

Cambridge, Massachusetts 02141

(617) 621-7722

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

Paul M. Kinsella Ropes & Gray LLP One International Place Boston, MA 02110 Telephone (617) 951-7000 Fax (617) 951-7050 |

Richard D. Truesdell, Jr. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 Telephone (212) 450-4000 Fax (212) 701-5800 |

|

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the "Securities Act"), check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee(2) |

||

|---|---|---|---|---|

Class A Common Stock, $0.001 par value per share |

$172,500,000 | $9,625.50 | ||

|

||||

- (1)

- Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act.

- (2)

- Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

PROSPECTUS (Subject to Completion)

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Issued November 20, 2009

Shares

CLASS A COMMON STOCK

This is the initial public offering of Class A common stock by Ironwood Pharmaceuticals, Inc. We are offering shares of Class A common stock. The estimated initial public offering price is between $ and $ per share.

Currently, no public market exists for our Class A common stock. We intend to apply to list our shares of Class A common stock on The NASDAQ Global Market under the symbol "IRWD."

Following this offering, we will have two classes of authorized common stock, Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting. In certain circumstances pertaining to change in control matters, holders of our Class A common stock are entitled to one vote per share and holders of our Class B common stock are entitled to ten votes per share.

Investing in our Class A common stock involves risks. See "Risk Factors" beginning on page 8.

Price $ Per Share

| |

Price to Public |

Underwriting Discounts and Commissions(1) |

Proceeds to Us, Before Expenses |

|||

|---|---|---|---|---|---|---|

Per Share |

$ | $ | $ | |||

Total |

$ | $ | $ |

- (1)

- The underwriters will not receive any underwriting discount or commission on the sale of shares of our Class A common stock to certain of our existing stockholders and certain specified affiliated entities.

We have granted the underwriters an option for a period of 30 days to purchase up to additional shares of Class A common stock on the same terms and conditions set forth above.

Neither the Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or passed on the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of Class A common stock to purchasers on or about , 2010.

| J.P.Morgan | Morgan Stanley | Credit Suisse |

BofA Merrill Lynch

Wedbush PacGrow Life Sciences

, 2010

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with additional information or information different from that contained in this prospectus. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only, regardless of the time of delivery of this prospectus or of any sale of our Class A common stock. Our business, prospects, financial condition and results of operations may have changed since that date.

Until , 2010, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

The Ironwood logo is a trademark of Ironwood Pharmaceuticals, Inc. All other trademarks and service marks appearing in this prospectus are the property of their respective holders. All rights reserved.

i

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our Class A common stock. You should read this entire prospectus carefully, especially the risks of investing in our Class A common stock discussed under "Risk Factors" beginning on page 8 and the consolidated financial statements and notes to those consolidated financial statements, before making an investment decision.

Overview

We are an entrepreneurial pharmaceutical company that discovers, develops and intends to commercialize innovative medicines targeting important therapeutic needs. Our goal is to build the next great pharmaceutical company, an outstanding business that will thrive and endure well beyond our lifetimes and generate substantial returns for our shareholders. Our experienced team of researchers is focused on a portfolio of internally discovered drug candidates that includes one Phase 3 drug candidate (linaclotide), one Phase 1 pain drug candidate, and multiple preclinical programs.

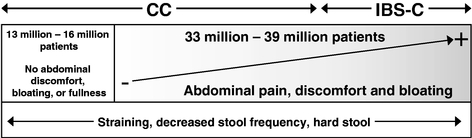

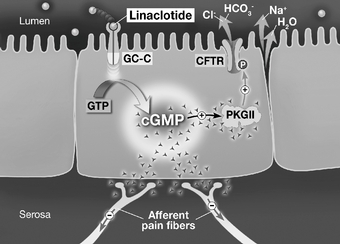

We believe that linaclotide could present patients and healthcare practitioners with a unique therapy for a major medical need not yet met by existing therapies. Linaclotide is a first-in-class compound currently in confirmatory Phase 3 clinical trials evaluating its safety and efficacy for the treatment of patients with irritable bowel syndrome with constipation (IBS-C) or chronic constipation (CC), gastrointestinal disorders that affect millions of sufferers worldwide. Linaclotide recently achieved favorable efficacy and safety results in two Phase 3 CC trials, meeting all 32 primary and secondary endpoints, including the improvement of abdominal symptoms such as bloating and discomfort as well as constipation symptoms, across both doses evaluated in these independent trials involving 1,287 subjects. We expect to have data from our Phase 3 IBS-C trials in the second half of 2010. If those trials are successful, we intend to file a New Drug Application with the U.S. Food and Drug Administration, or the FDA, in the first half of 2011, seeking approval to market linaclotide to IBS-C and CC patients age 18 and older in the U.S. If the FDA approves linaclotide for those indications, we may seek to expand linaclotide's market opportunity by exploring its utility in other gastrointestinal indications and in the pediatric population.

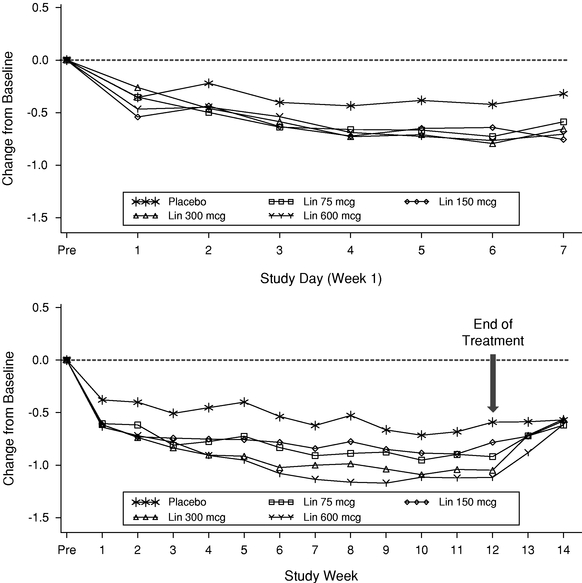

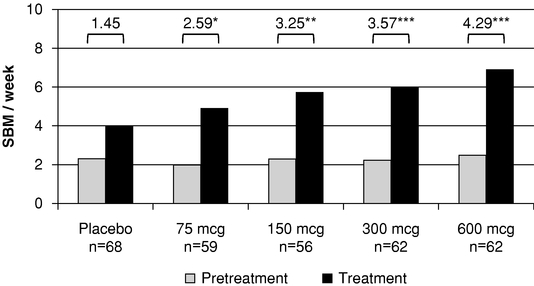

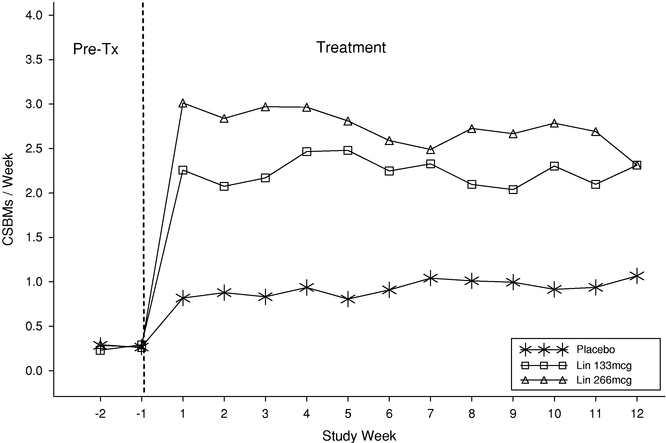

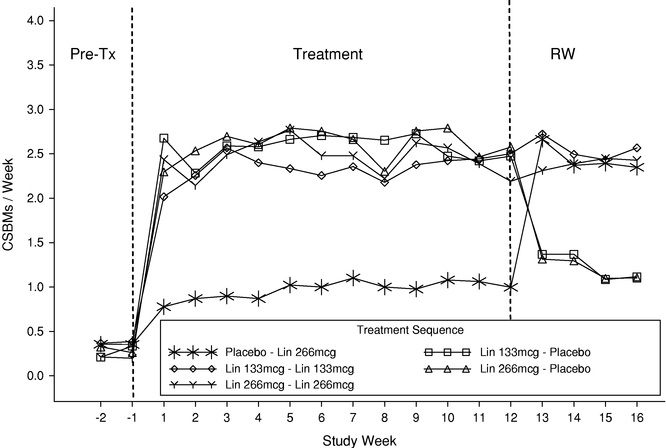

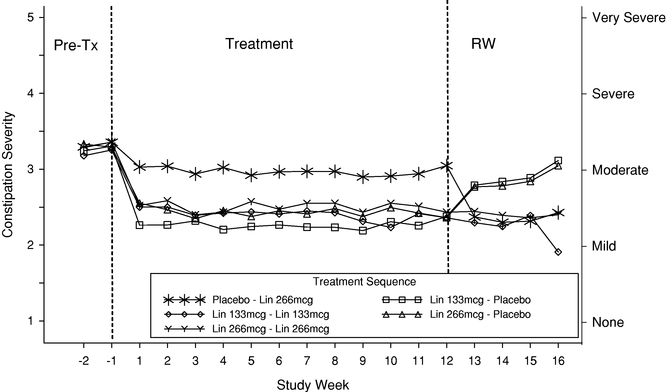

Linaclotide was designed by Ironwood scientists to target the defining attributes of IBS-C: abdominal pain, discomfort, bloating and constipation. Linaclotide acts locally in the gut with no detectable systemic exposure in humans at therapeutic doses. In the six Phase 2 and Phase 3 clinical trials we have completed to date in over 2,000 IBS-C and CC patients, linaclotide has demonstrated rapid and sustained improvement of the multiple symptoms of IBS-C and CC, with favorable tolerability and convenient once-daily oral dosing.

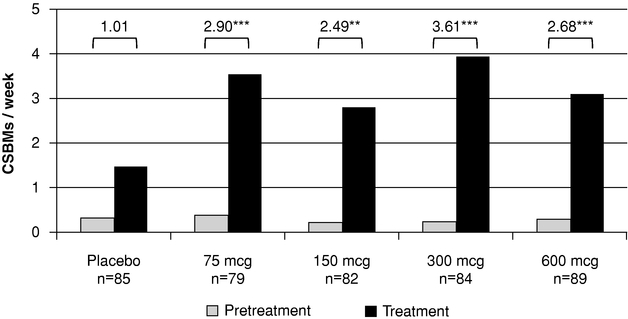

In Phase 2b studies in patients with IBS-C, linaclotide rapidly reduced abdominal pain, abdominal discomfort and bloating, and improved constipation symptoms, throughout the treatment period of the trial, with a clinically meaningful response noted for all symptoms assessed within the first week of initiation of therapy. In particular, abdominal pain was reduced 37% to 47%, and pain reduction was observed within three days of initiation of therapy and was sustained throughout the treatment period, even among patients with severe or very severe abdominal pain.

In Phase 2b studies in patients with CC, linaclotide rapidly reduced abdominal discomfort and bloating, and improved constipation symptoms, throughout the treatment periods of the trials.

In five of the six Phase 2 and Phase 3 trials, diarrhea was the most common adverse event (seen in 5% to 20% of subjects) and the most common cause for discontinuation (1% to 7% of the patients discontinued participation in the trials). Diarrhea has generally been mild to moderate.

We have pursued a partnering strategy for commercializing linaclotide that has enabled us to retain significant control over linaclotide's development and commercialization, share the costs with high-quality

1

collaborators whose capabilities complement ours, and, should linaclotide meet our sales expectations, retain approximately half of linaclotide's future long-term value in the major pharmaceutical markets. In September 2007, we entered into a partnership with Forest Laboratories, Inc., or Forest, to co-develop and co-market linaclotide in the U.S. In April 2009, we entered into a license agreement with Almirall, S.A., or Almirall, to develop and commercialize linaclotide in Europe for the treatment of IBS-C and other gastrointestinal conditions. In November 2009, we entered into a license agreement with Astellas Pharma Inc., or Astellas, to develop and commercialize linaclotide for the treatment of IBS-C and other gastrointestinal conditions in several Asian countries. To date, licensing fees, milestone payments, related equity investments and development costs received from our linaclotide partners total greater than $250 million. We have retained all rights to linaclotide outside of the territories discussed above.

In addition to five years of exclusivity under the Drug Price Competition and Patent Term Restoration Act of 1984, or the Hatch-Waxman Act, that would be granted if the FDA approves linaclotide, linaclotide is covered by a U.S. composition of matter patent that expires in 2025, subject to possible patent term extension. Linaclotide is also covered by a European Union composition of matter patent that expires in 2024, subject to possible patent term extension. A patent application is pending in Japan, and if issued, would expire in 2024.

If linaclotide continues to advance to regulatory submission in the U.S., the European Union and Asia, we expect to receive an additional $190 million in pre-commercial payments from our partners. We believe that these milestone payments, together with our existing cash and the anticipated proceeds of this offering, should enable us to launch and commercialize linaclotide in the U.S. with our partner Forest and to fund our currently contemplated research and development efforts for at least the next five years, based on our current business plan.

Our Strategy

Our goal is to build the next great pharmaceutical company by discovering, developing and commercializing innovative and differentiated medicines that target important unmet needs. Key elements of our strategy include:

- •

- attract and incentivize a team with a singular passion for creating and commercializing medicines that can make a

significant difference in patients' lives;

- •

- successfully commercialize linaclotide in collaboration with Forest in the U.S.;

- •

- support our international partners to commercialize linaclotide outside of the U.S.;

- •

- if approved for IBS-C and CC, develop linaclotide for the treatment of other gastrointestinal disorders and

for the pediatric population;

- •

- invest in our pipeline of novel product candidates and evaluate candidates outside of the company for

in-licensing or acquisition opportunities;

- •

- participate in a meaningful way in the economics of the drugs that we bring to the market; and

- •

- execute our strategy with our shareholders' long-term interests in mind by seeking to maximize long-term per share cash flows.

2

Risks Affecting Us

Our ability to implement our business strategy is subject to numerous risks and uncertainties. As an early stage pharmaceutical company, we face many risks inherent in our business and our industry generally. You should carefully consider all of the information set forth in this prospectus and, in particular, the information under the heading "Risk Factors," prior to making an investment in our Class A common stock.

Corporate Information

We were incorporated in Delaware in 1998. Prior to April 7, 2008, we were named Microbia, Inc., which is now the name of our majority-owned subsidiary (formerly Microbia Precision Engineering, Inc.). Our address is 320 Bent Street, Cambridge, Massachusetts 02141. Our telephone number is 617-621-7722. Our website address is www.ironwoodpharma.com. Information contained in, and that can be accessed through, our website is not incorporated into and does not form a part of this prospectus.

3

Class A common stock we are offering |

shares | ||

Over-allotment option |

shares | ||

Common stock to be outstanding after this offering |

|||

Class A common stock |

shares | ||

Class B common stock |

shares | ||

Total common stock |

shares | ||

Voting rights |

Until at least December 31, 2018, each share of Class A common stock and each share of Class B common stock has one vote per share, except on the following matters (in which each share of Class A common stock has one vote per share and each share of Class B common stock has ten votes per share): | ||

|

• adoption of a merger or consolidation agreement involving Ironwood; |

||

|

• a sale of all or substantially all of Ironwood's assets; |

||

|

• a dissolution or liquidation of Ironwood; or |

||

|

• every matter, if and when any individual, entity or "group" (as such term is used in Regulation 13D of the Securities Exchange Act of 1934, as amended, or the Exchange Act) has, or has publicly disclosed (through a press release or a filing with the Securities and Exchange Commission, or the SEC) an intent to have, beneficial ownership of 30% or more of the number of outstanding shares of Class A common stock and Class B common stock, combined. |

||

|

See "Description of Capital Stock" for a description of the material terms of our Class A common stock and our Class B common stock. | ||

Use of proceeds after expenses |

We estimate that the net proceeds from this offering will be approximately $ million, or approximately $ million if the underwriters exercise their over-allotment option in full. We expect to use the net proceeds from this offering to fund the development and commercialization of linaclotide, to fund research and development of other products and for other general corporate purposes. See "Use of Proceeds." | ||

Risk Factors |

You should read the "Risk Factors" section of this prospectus beginning on page 8 for a discussion of factors to consider carefully before deciding whether to purchase shares of our Class A common stock. | ||

Proposed NASDAQ Global Market symbol |

IRWD | ||

4

The number of shares of our common stock to be outstanding after this offering is based on 77,423,208 shares of Class B common stock outstanding as of September 30, 2009, after giving effect to the conversion of 69,223,024 shares of convertible preferred stock outstanding as of September 30, 2009 into 69,709,801 shares of our Class B common stock at the completion of this offering. Unless otherwise indicated, it does not give effect to the issuance of 681,819 shares of our convertible preferred stock, which occurred on November 13, 2009, or the conversion of such shares into 681,819 shares of our Class B common stock, which will occur at the completion of this offering.

The number of shares of our common stock outstanding immediately after this offering excludes:

- •

- 14,094,470 shares of Class B common stock issuable upon the exercise of options outstanding as of

September 30, 2009, with exercise prices ranging from $0.10 to $5.48 per share and a weighted average exercise price of $2.45 per share; and

- •

- 1,293,820 additional shares of Class B common stock reserved for future grants under our 2002 Stock Incentive Plan and 2005 Stock Incentive Plan as of September 30, 2009.

Unless otherwise indicated, all information in this prospectus:

- •

- assumes an initial public offering price of $ per share

of Class A common stock, the

mid-point of the range set forth on the cover page of this prospectus;

- •

- gives effect to the automatic conversion of all outstanding shares of our convertible preferred stock into shares of our

Class B common stock upon the completion of this offering;

- •

- gives effect to our eleventh amended and restated certificate of incorporation that we will file with Delaware immediately

prior to the closing of this offering;

- •

- assumes no conversion of our Class B common stock into our Class A common stock prior to the completion of

this offering; and

- •

- assumes no exercise by the underwriters of their option to purchase up to shares of our Class A common stock in this offering to cover over-allotments.

5

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables present a summary of our historical consolidated financial information and pro forma net loss per common share. You should read the following summary financial data in conjunction with "Selected Consolidated Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes, all included elsewhere in this prospectus.

| |

December 31, | Nine Months Ended September 30, |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2006 | 2007 | 2008 | 2008 | 2009 | ||||||||||||

| |

|

|

|

(unaudited) |

|||||||||||||

| |

(in thousands, except share and per share data) |

||||||||||||||||

Consolidated Statement of Operations Data: |

|||||||||||||||||

Revenue: |

|||||||||||||||||

Collaborative arrangements |

$ | — | $ | 4,608 | $ | 18,383 | $ | 13,933 | $ | 25,917 | |||||||

Services |

3,140 | 5,856 | 3,833 | 3,309 | 1,581 | ||||||||||||

Total revenue |

3,140 | 10,464 | 22,216 | 17,242 | 27,498 | ||||||||||||

Operating expenses: |

|||||||||||||||||

Research and development |

35,543 | 57,246 | 59,809 | 43,309 | 58,824 | ||||||||||||

General and administrative |

7,192 | 10,833 | 18,328 | 13,054 | 17,309 | ||||||||||||

Total operating expenses |

42,735 | 68,079 | 78,137 | 56,363 | 76,133 | ||||||||||||

Loss from operations |

(39,595 | ) | (57,615 | ) | (55,921 | ) | (39,121 | ) | (48,635 | ) | |||||||

Other income (expense): |

|||||||||||||||||

Interest expense |

(217 | ) | (263 | ) | (334 | ) | (253 | ) | (370 | ) | |||||||

Interest and investment income |

2,533 | 4,118 | 2,124 | 1,901 | 214 | ||||||||||||

Remeasurement of forward purchase contracts |

— | 600 | (900 | ) | (5,900 | ) | (100 | ) | |||||||||

Other income (expense), net |

2,316 | 4,455 | 890 | (4,252 | ) | (256 | ) | ||||||||||

Net loss before income tax benefit |

(37,279 | ) | (53,160 | ) | (55,031 | ) | (43,373 | ) | (48,891 | ) | |||||||

Income tax benefit |

— | — | — | — | (153 | ) | |||||||||||

Net loss prior to amounts attributable to noncontrolling interest |

(37,279 | ) | (53,160 | ) | (55,031 | ) | (43,373 | ) | (48,738 | ) | |||||||

Net loss attributable to noncontrolling interest |

99 | 408 | 1,157 | 726 | 1,483 | ||||||||||||

Net loss |

$ | (37,180 | ) | $ | (52,752 | ) | $ | (53,874 | ) | $ | (42,647 | ) | $ | (47,255 | ) | ||

Net loss per share—basic and diluted |

$ |

(5.79 |

) |

$ |

(7.91 |

) |

$ |

(7.82 |

) |

$ |

(6.22 |

) |

$ |

(6.70 |

) |

||

Weighted average number of common shares used in net loss per share—basic and diluted |

6,417,499 |

6,666,601 |

6,889,817 |

6,859,285 |

7,054,291 |

||||||||||||

Pro forma net loss per share—basic and diluted (unaudited)(1) |

$ |

(0.72 |

) |

$ |

(0.62 |

) |

|||||||||||

Pro forma weighted average number of common shares used in net loss per share—basic and diluted (unaudited)(1) |

74,495,452 | 75,574,117 | |||||||||||||||

- (1)

- Pro forma basic and diluted net loss per share have been calculated assuming: (a) the automatic conversion of all outstanding shares of convertible preferred stock as of December 31, 2008 into 67,605,635 shares of

6

our Class B common stock and as of September 30, 2009 into 69,709,801 shares of our Class B common stock upon the closing of this offering; (b) the issuance of 681,819 shares of our convertible preferred stock sold at a price of $22.00 per share for cash proceeds of $15.0 million, which were received on November 13, 2009, including a $0.7 million gain on the final remeasurement of the forward purchase contract at the time of settlement, and the conversion of such shares into 681,819 shares of our Class B common stock upon the closing of this offering and (c) compensation expense of approximately $56,000 and $107,000 related to 30,000 and 45,000 time-accelerated stock options at December 31, 2008 and September 30, 2009, respectively, that will fully vest upon the closing of this offering. Pro forma basic and diluted net loss per share does not give effect to the sale of shares of Class A common stock that we are offering pursuant to this prospectus.

| |

As of September 30, 2009 (unaudited) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Actual | Pro Forma(a) | Pro Forma as Adjusted(b) |

|||||||

| |

(in thousands) |

|||||||||

Consolidated Balance Sheet Data: |

||||||||||

Cash, cash equivalents and available-for-sale securities |

$ | 98,928 | $ | 113,928 | $ | |||||

Working capital (excluding deferred revenue) |

99,412 | 108,612 | ||||||||

Total assets |

149,647 | 158,847 | ||||||||

Deferred revenue, including current portion |

104,487 | 104,487 | ||||||||

Long-term debt, including current portion |

3,406 | 3,406 | ||||||||

Capital lease obligations, including current portion |

220 | 220 | ||||||||

Total liabilities |

135,640 | 135,640 | ||||||||

Convertible preferred stock |

289,849 | — | ||||||||

Noncontrolling interest |

3,856 | 3,856 | ||||||||

Total stockholders' equity (deficit) |

(275,842 | ) | 23,207 | |||||||

- (a)

- The

pro forma consolidated balance sheet data gives effect to: (i) the automatic conversion of all outstanding shares of our convertible preferred

stock into 69,709,801 shares of our Class B common stock upon the closing of this offering; (ii) the issuance of 681,819 shares of our convertible preferred stock sold at a price of

$22.00 per share for cash proceeds of $15.0 million, which were received on November 13, 2009, including a $0.7 million gain on the final remeasurement of the forward purchase

contract at the time of settlement, and the conversion of such shares into 681,819 shares of our Class B common stock upon the closing of this offering and (iii) compensation expense of

approximately $107,000 related to 45,000 time-accelerated stock options at September 30, 2009 that will fully vest upon the closing of this offering.

- (b)

- The pro forma as adjusted consolidated balance sheet data also gives effect to the sale of shares of our Class A common stock in this offering at an assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

7

Investing in our Class A common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as the other information in this prospectus, before deciding to invest in our Class A common stock. The occurrence of any of the following risks could harm our business, financial condition, results of operations or prospects. In that case, the trading price of our Class A common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business and Industry

We are largely dependent on the success of linaclotide, which may never receive regulatory approval or be successfully commercialized.

We currently have one product candidate, linaclotide, in Phase 3 clinical development. Our other drug candidates are in earlier stages of development. Our business depends entirely on the successful development and commercialization of our product candidates. We currently generate no revenue from sales, and we may never be able to develop marketable drugs. The research, testing, manufacturing, labeling, approval, sale, marketing and distribution of pharmaceutical products is subject to extensive regulation by the FDA and foreign regulatory authorities, and regulations differ from jurisdiction to jurisdiction. We are not permitted to market any of our product candidates in the U.S. until we receive approval of a new drug application, or an NDA, from the FDA, or in any foreign jurisdictions until we receive the requisite approvals from such jurisdictions. We have neither submitted an NDA nor received marketing approval for linaclotide in any jurisdiction. Obtaining approval of an NDA is a lengthy, expensive and uncertain process. The FDA also has substantial discretion in the drug approval process, including the ability to delay, limit or deny approval of a product candidate for many reasons. For example:

- •

- the FDA may not deem linaclotide or another product candidate safe and effective;

- •

- the FDA may not find the data from preclinical studies and clinical trials sufficient to support approval;

- •

- the FDA may not approve of manufacturing processes and facilities; or

- •

- the FDA may change its approval policies or adopt new regulations.

Linaclotide is a first-in-class compound that is currently in Phase 3 clinical development for the treatment of irritable bowel syndrome with constipation, or IBS-C, and chronic constipation, or CC, and will require the successful completion of at least two Phase 3 clinical trials for each indication before submission of an NDA to the FDA for potential approval in such indication. In November 2009, we announced that we achieved favorable results in our CC trials. Even though linaclotide met the endpoints of the CC trial, it may not be approved for the CC indication or for any other indication for which we are seeking approval from the FDA. The FDA may disagree with our trial design or our interpretation of data from clinical trials, or may change the requirements for approval even after it has reviewed and commented on the design for our clinical trials. The FDA might also approve linaclotide for fewer or more limited indications than we request, or may grant approval contingent on the performance of costly post-approval clinical trials. In addition, the FDA may not approve the labeling claims that we believe are necessary or desirable for the successful commercialization of linaclotide. Any failure to obtain regulatory approval of linaclotide would significantly limit our ability to generate revenues, and any failure to obtain such approval for all of the indications and labeling claims we deem desirable could reduce our potential revenue.

8

Our clinical trials may fail to demonstrate acceptable levels of safety and efficacy of linaclotide, which could prevent or significantly delay regulatory approval.

Our product candidates are prone to the risks of failure inherent in drug development—most pharmaceutical product candidates fail. Before obtaining regulatory approvals for the commercial sale of linaclotide or any other product candidate for a specific indication, we must demonstrate with substantial evidence gathered in well-controlled clinical trials and to the satisfaction of the FDA, with respect to approval in the U.S., and to the satisfaction of similar regulatory authorities in other jurisdictions, with respect to approval in those jurisdictions, that the product candidate is safe and effective for use for the target indication.

The results from the preclinical and clinical trials that we have completed for linaclotide may not be replicated in future trials, or we may be unable to demonstrate sufficient safety and efficacy to obtain the requisite regulatory approvals for linaclotide. A number of companies in the biotechnology and pharmaceutical industries have suffered significant setbacks in advanced clinical trials, even after promising results in earlier trials. If linaclotide is not shown to be safe and effective, our clinical development programs could be delayed or terminated. Our failure to adequately demonstrate the efficacy and safety of linaclotide or any other product candidates that we may develop, in-license or acquire would prevent receipt of regulatory approval and, ultimately, the commercialization of that product candidate.

The positive top-line results from our two Phase 3 clinical trials assessing the safety and efficacy of linaclotide in patients with CC may not be indicative of our two Phase 3 clinical trials assessing the safety and efficacy of linaclotide in patients with IBS-C.

In November 2009, we announced that the primary endpoint was achieved in each of our two Phase 3 clinical trials assessing the safety and efficacy of linaclotide in patients with CC. Additional data from each of these Phase 3 clinical trials may become available and may have a bearing on the safety and efficacy of linaclotide. In addition, the primary efficacy endpoint in each of these two clinical trials is only one of the three primary efficacy endpoints in each of our two Phase 3 clinical trials assessing the safety and efficacy of linaclotide in patients with IBS-C. Positive results in the CC trial or from earlier clinical trials are not necessarily indicative of future success in the IBS-C trials, even with respect to similar endpoints. Therefore, unless we meet all three primary efficacy endpoints in our two IBS-C clinical trials, we may be unable to demonstrate sufficient safety and efficacy of linaclotide in patients with IBS-C. Finally, our partners Almirall and Astellas intend to seek approval from regulatory authorities in each of their respective territories solely for the IBS-C indication. Accordingly, if we are unable to establish safety and efficacy of linaclotide in our U.S. IBS-C trials, our partners may be unable to utilize our data in the U.S. in their regulatory filings, and may be hindered from obtaining approval for linaclotide in their respective territories.

Linaclotide may cause undesirable side effects or have other properties that could delay or prevent its regulatory approval or limit its commercial potential.

Undesirable side effects caused by linaclotide could cause us or regulatory authorities to interrupt, delay or halt clinical trials and could result in the denial of regulatory approval by the FDA or other regulatory authorities and potential products liability claims. We are currently completing our evaluation of the data from our CC studies and conducting two Phase 3 IBS-C trials as well as a long-term safety study in patients dosed with linaclotide over a 78-week period. Serious adverse events deemed to be caused by linaclotide could have a material adverse effect upon the linaclotide program and our business as a whole.

If linaclotide receives marketing approval, and we or others later identify undesirable side effects caused by the product, a number of potentially significant negative consequences could result, including:

- •

- regulatory authorities may withdraw approvals of linaclotide;

9

- •

- regulatory authorities may require additional warnings on the label;

- •

- we may be required to create a medication guide outlining the risks of such side effects for distribution to patients;

- •

- we could be sued and held liable for harm caused to patients; and

- •

- our reputation may suffer.

Any of these events could prevent us from achieving or maintaining market acceptance of linaclotide and could substantially increase commercialization costs.

Delays in the completion of clinical testing could result in increased costs and delay or limit our ability to generate revenues.

Delays in the completion of clinical testing could significantly affect our product development costs. We do not know whether planned clinical trials will be completed on schedule, if at all. The commencement and completion of clinical trials can be delayed for a number of reasons, including delays related to:

- •

- obtaining regulatory approval to commence a clinical trial;

- •

- reaching agreement on acceptable terms with prospective clinical research organizations, or CROs, and trial sites, the

terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites;

- •

- manufacturing sufficient quantities of a product candidate for use in clinical trials;

- •

- obtaining institutional review board approval to conduct a clinical trial at a prospective site;

- •

- recruiting and enrolling patients to participate in clinical trials for a variety of reasons, including competition from

other clinical trial programs for the treatment of similar conditions; and

- •

- signing-up patients who have initiated a clinical trial but may be prone to withdraw due to side effects from the therapy, lack of efficacy or personal issues, or who are lost to further follow-up.

Clinical trials may also be delayed as a result of ambiguous or negative interim results. In addition, a clinical trial may be suspended or terminated by us, an institutional review board overseeing the clinical trial at a clinical trial site (with respect to that site), the FDA, or other regulatory authorities due to a number of factors, including:

- •

- failure to conduct the clinical trial in accordance with regulatory requirements or the study protocols;

- •

- inspection of the clinical trial operations or trial sites by the FDA or other regulatory authorities resulting in the

imposition of a clinical hold;

- •

- unforeseen safety issues; and

- •

- lack of adequate funding to continue the clinical trial.

Additionally, changes in regulatory requirements and guidance may occur, and we may need to amend clinical trial protocols to reflect these changes. Amendments may require us to resubmit our clinical trial protocols to institutional review boards for reexamination, which may impact the costs, timing or successful completion of a clinical trial. If we experience delays in completion of, or if we terminate any of our clinical trials, the commercial prospects for our product candidates may be harmed, and our ability to generate product revenues will be delayed. In addition, many of the factors that cause, or lead to, a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of our product candidates.

10

Because we work with Forest Laboratories, Inc. to develop, promote and manufacture linaclotide in North America, we are dependent upon a third party in our efforts to obtain regulatory approval for, and to commercialize, linaclotide within our expected timeframes.

We co-develop and plan to co-promote linaclotide in the U.S. with Forest Laboratories, Inc., or Forest. Forest plays a significant role in the conduct of the clinical trials for linaclotide and the subsequent collection and analysis of data. In addition, Forest is responsible for completing the manufacturing process of linaclotide upon production of the active pharmaceutical ingredient, or API, which consists of finishing and packaging linaclotide into capsules. Employees of Forest are not our employees, and we have limited ability to control the amount or timing of resources that they devote to linaclotide. If Forest fails to devote sufficient time and resources to linaclotide, or if its performance is substandard, it will delay the potential approval of our regulatory applications as well as the commercialization and manufacturing of linaclotide. A material breach by Forest of our collaboration agreement could also delay regulatory approval and commercialization of linaclotide. In addition, the execution of clinical trials, and the subsequent compilation and analysis of the data produced, requires coordination among various parties. These functions may not be carried out effectively and efficiently if these parties fail to communicate and coordinate with one another. Moreover, although we have non-compete restrictions in place with Forest, Forest may have relationships with other commercial entities, some of which may compete with us. If Forest assists our competitors, it could harm our competitive position.

We may face competition in the IBS-C and CC marketplace for linaclotide, and new products may emerge that provide different or better alternatives for treatment of gastrointestinal conditions.

If approved and commercialized, linaclotide will compete with one existing prescription therapy for the treatment of IBS-C and CC, Amitiza. In addition, over the counter products are also used to treat certain symptoms of IBS-C and CC. The availability of prescription competitors and over the counter products for gastrointestinal conditions could limit the demand, and the price we are able to charge, for linaclotide unless we are able to differentiate linaclotide on the basis of its clinical benefits in our clinical trials. New developments, including the development of other drug technologies and methods of preventing the incidence of disease, occur in the pharmaceutical and medical technology industries at a rapid pace. These developments may render linaclotide obsolete or noncompetitive.

We believe certain companies are developing other products which could compete with linaclotide should they be approved by the FDA. Currently, there is only one compound in late stage development, and it is being developed by Theravance, Inc. This compound has completed Phase 2 trials for CC. To our knowledge, other potential competitors are in earlier stages of development. If our potential competitors are successful in completing drug development for their drug candidates and obtain approval from the FDA, they could limit the demand for linaclotide.

Many of our competitors have substantially greater financial, technical and human resources than us. Mergers and acquisitions in the pharmaceutical industry may result in even more resources being concentrated in our competitors. Competition may increase further as a result of advances made in the commercial applicability of technologies and greater availability of capital for investment in these fields.

We have limited sales and marketing experience and resources, and we may not be able to effectively market and sell linaclotide.

With linaclotide, we are developing a product candidate for large markets traditionally served by general practitioners and internists, as well as gastrointestinal specialists. Traditional pharmaceutical companies employ groups of sales representatives to call on these large generalist physician populations. In order to adequately address these physician groups, we must optimize our co-development and co-promotion relationship in the U.S., Canada and Mexico with Forest, our license and commercialization relationship in Europe with Almirall, and our license and commercialization relationship in certain Asian

11

countries with Astellas. Likewise, we must either establish sales and marketing collaborations or co-promotion arrangements or expend significant resources to develop our own sales and marketing presence outside of North America, Europe, and those Asian countries. We currently possess limited resources and may not be successful in establishing additional collaborations or co-promotion arrangements on acceptable terms, if at all. We also face competition in our search for collaborators, co-promoters and sales force personnel. By entering into strategic collaborations or similar arrangements, we rely on third parties for financial resources and for development, commercialization, sales and marketing and regulatory expertise. Our collaborators may fail to develop or effectively commercialize linaclotide because they cannot obtain the necessary regulatory approvals, lack adequate financial or other resources or decide to focus on other initiatives.

Even if linaclotide receives regulatory approval, it may still face future development and regulatory difficulties.

Even if U.S. regulatory approval is obtained, the FDA may still impose significant restrictions on a product's indicated uses or marketing or impose ongoing requirements for potentially costly post-approval studies. Linaclotide and our other product candidates would also be subject to ongoing FDA requirements governing the labeling, packaging, storage, advertising, promotion, recordkeeping and submission of safety and other post-market information. In addition, manufacturers of drug products and their facilities are subject to continual review and periodic inspections by the FDA and other regulatory authorities for compliance with current good manufacturing practices, or GMP, regulations. If we or a regulatory agency discovers previously unknown problems with a product, such as adverse events of unanticipated severity or frequency, or problems with the facility where the product is manufactured, a regulatory agency may impose restrictions on that product or the manufacturer, including requiring withdrawal of the product from the market or suspension of manufacturing. If we, our product candidates or the manufacturing facilities for our product candidates fail to comply with applicable regulatory requirements, a regulatory agency may:

- •

- issue warning letters or untitled letters;

- •

- impose civil or criminal penalties;

- •

- suspend regulatory approval;

- •

- suspend any ongoing clinical trials;

- •

- refuse to approve pending applications or supplements to applications filed by us;

- •

- impose restrictions on operations, including costly new manufacturing requirements; or

- •

- seize or detain products or require us to initiate a product recall.

Even if linaclotide receives regulatory approval in the U.S., we or our collaborators may never receive approval to commercialize linaclotide outside of the U.S.

In May 2009, we entered into an out-license agreement with Almirall for European rights to develop and commercialize linaclotide. In November 2009, we entered into an out-license agreement with Astellas for rights to develop and commercialize linaclotide in certain Asian countries. In the future, we may seek to commercialize linaclotide in foreign countries outside of Europe and those Asian countries with other parties or by ourselves. In order to market any products outside of the U.S., we must establish and comply with numerous and varying regulatory requirements of other jurisdictions regarding safety and efficacy. Approval procedures vary among jurisdictions and can involve product testing and administrative review periods different from, and greater than, those in the U.S. The time required to obtain approval in other jurisdictions might differ from that required to obtain FDA approval. The regulatory approval process in other jurisdictions may include all of the risks detailed above regarding FDA approval in the U.S. as well as other risks. Regulatory approval in one jurisdiction does not ensure regulatory approval in another, but a

12

failure or delay in obtaining regulatory approval in one jurisdiction may have a negative effect on the regulatory processes in others. Failure to obtain regulatory approvals in other jurisdictions or any delay or setback in obtaining such approvals could have the same adverse effects detailed above regarding FDA approval in the U.S. As described above, such effects include the risks that linaclotide may not be approved for all indications requested, which could limit the uses of our linaclotide and have an adverse effect on its commercial potential or require costly post-marketing studies.

If the manufacturers upon whom we rely fail to produce linaclotide in the volumes that we require on a timely basis, or fail to comply with stringent regulations applicable to pharmaceutical drug manufacturers, we may face delays in the development and commercialization of our product candidates.

We do not currently possess internal manufacturing capacity. We currently utilize the services of contract manufacturers to manufacture our clinical supplies. With respect to the manufacturing of linaclotide, we are currently pursuing long-term commercial supply agreements with multiple manufacturers. These manufacturers will be responsible for the linaclotide API. These third party manufacturers acquire the raw materials for the API from a limited number of sources. Any curtailment in the availability of these raw materials could result in production or other delays with consequent adverse effects on us. In addition, because regulatory authorities must generally approve raw material sources for pharmaceutical products, changes in raw material suppliers may result in production delays or higher raw material costs.

We may be required to agree to minimum volume requirements, exclusivity arrangements or other restrictions with the contract manufacturers. We may not be able to enter into long-term agreements on commercially reasonable terms, or at all. If we change or add manufacturers, the FDA and comparable foreign regulators must approve these manufacturers' facilities and processes prior to use, which would require new testing and compliance inspections, and the new manufacturers would have to be educated in or independently develop the processes necessary for the production of our product candidates. Peptide manufacturing is a highly specialized manufacturing business. While we believe we will have long term arrangements with a sufficient number of API manufacturers, if we lose a manufacturer, it would take us a substantial amount of time to identify and develop a relationship with an alternative manufacturer.

Upon production of our API, each of our collaboration partners, Forest, Almirall and Astellas, is responsible for completing the manufacturing process of linaclotide which consists of finishing and packaging linaclotide into capsules, and we will be dependent upon those parties' success in producing drug product for commercial sale. No party has experience producing the API or finished drug product for linaclotide at commercial scale, and such efforts may fail. Traditionally, peptide manufacturing is costly, time consuming, resulting in low yields and poor stability. We cannot give any assurances that we will not encounter these issues when scaling up manufacturing for linaclotide.

The manufacture of pharmaceutical products requires significant expertise and capital investment, including the development of advanced manufacturing techniques and process controls. Manufacturers of pharmaceutical products often encounter difficulties in production, particularly in scaling up production. These problems include difficulties with production costs and yields, quality control, including stability of the product and quality assurance testing, shortages of qualified personnel, as well as compliance with federal, state and foreign regulations. We are currently evaluating the stability of different batch sizes of linaclotide at various points in time. If we are unable to demonstrate stability in accordance with commercial requirements, or if our manufacturers were to encounter difficulties or otherwise fail to comply with their obligations to us, our ability to obtain FDA approval and market linaclotide would be jeopardized. In addition, any delay or interruption in the supply of clinical trial supplies could delay the completion of our clinical trials, increase the costs associated with conducting our clinical trials and, depending upon the period of delay, require us to commence new trials at significant additional expense or to terminate a trial.

13

Each of the linaclotide manufacturers would need to comply with GMP requirements enforced by the FDA through its facilities inspection program. These requirements include, among other things, quality control, quality assurance and the maintenance of records and documentation. Manufacturers of linaclotide may be unable to comply with these GMP requirements and with other FDA and foreign regulatory requirements. We have little control over our manufacturers' or collaboration partners' compliance with these regulations and standards. A failure to comply with these requirements may result in fines and civil penalties, suspension of production, suspension or delay in product approval, product seizure or recall, or withdrawal of product approval. If the safety of linaclotide is compromised due to a manufacturers' or collaboration partners' failure to adhere to applicable laws or for other reasons, we may not be able to obtain regulatory approval for or successfully commercialize linaclotide, and we may be held liable for any injuries sustained as a result. Any of these factors could cause a delay of clinical trials, regulatory submissions, approvals or commercialization of linaclotide or our other product candidates, entail higher costs or result in our being unable to effectively commercialize linaclotide or our other product candidates. Furthermore, if our manufacturers or collaboration partners fail to deliver the required commercial quantities on a timely basis and at commercially reasonable prices, we may be unable to meet demand for any approved products and would lose potential revenues.

Guidelines and recommendations published by various organizations can reduce the use of our products.

Government agencies promulgate regulations and guidelines directly applicable to us and to our products. In addition, professional societies, practice management groups, private health and science foundations and organizations involved in various diseases from time to time may also publish guidelines or recommendations to the health care and patient communities. Recommendations of government agencies or these other groups or organizations may relate to such matters as usage, dosage, route of administration and use of concomitant therapies. Recommendations or guidelines suggesting the reduced use of our products or the use of competitive or alternative products that are followed by patients and health care providers could result in decreased use of our products.

We are subject to uncertainty relating to reimbursement policies which, if not favorable for linaclotide, could hinder or prevent linaclotide's commercial success.

Our ability to commercialize linaclotide successfully will depend in part on the coverage and reimbursement levels set by governmental authorities, private health insurers and other third-party payors. As a threshold for coverage and reimbursement, third-party payors generally require that drug products have been approved for marketing by the FDA. Third-party payors also are increasingly challenging the effectiveness of and prices charged for medical products and services. We may not obtain adequate third-party coverage or reimbursement for linaclotide or we may be required to sell linaclotide at a discount.

We expect that private insurers will consider the efficacy, cost effectiveness and safety of linaclotide in determining whether to approve reimbursement for linaclotide and at what level. Obtaining these approvals can be a time consuming and expensive process. Our business would be materially adversely affected if we do not receive approval for reimbursement of linaclotide from private insurers on a timely or satisfactory basis. Our business could also be adversely affected if private insurers, including managed care organizations, the Medicare program or other reimbursing bodies or payors limit the indications for which linaclotide will be reimbursed to a smaller set than we believe it is effective in treating.

In some foreign countries, particularly Canada and the countries of Europe, the pricing of prescription pharmaceuticals is subject to strict governmental control. In these countries, pricing negotiations with governmental authorities can take six to 12 months or longer after the receipt of regulatory approval and product launch. To obtain favorable reimbursement for the indications sought or pricing approval in some countries, we may be required to conduct a clinical trial that compares the cost-effectiveness of our products, including linaclotide, to other available therapies. If reimbursement for

14

our products is unavailable in any country in which reimbursement is sought, limited in scope or amount, or if pricing is set at unsatisfactory levels, our business could be materially harmed.

We expect to experience pricing pressures in connection with the sale of linaclotide and our future products due to the potential healthcare reforms discussed below, as well as the trend toward programs aimed at reducing health care costs, the increasing influence of health maintenance organizations and additional legislative proposals.

We face potential product liability exposure, and, if successful claims are brought against us, we may incur substantial liabilities.

The use of our product candidates in clinical trials and the sale of any products for which we obtain marketing approval expose us to the risk of product liability claims. If we cannot successfully defend ourselves against product liability claims, we could incur substantial liabilities. In addition, regardless of merit or eventual outcome, product liability claims may result in:

- •

- decreased demand for any approved product;

- •

- impairment of our business reputation;

- •

- withdrawal of clinical trial participants;

- •

- initiation of investigations by regulators;

- •

- costs of related litigation;

- •

- distraction of management's attention from our primary business;

- •

- substantial monetary awards to patients or other claimants;

- •

- loss of revenues; and

- •

- the inability to commercialize our product candidates.

We have obtained product liability insurance coverage for our clinical trials. Our insurance coverage may not be sufficient to reimburse us for any expenses or losses we may suffer. Moreover, insurance coverage is becoming increasingly expensive, and, in the future, we may not be able to maintain insurance coverage at a reasonable cost or in sufficient amounts to protect us against losses. If and when we obtain marketing approval for any of our product candidates, we intend to expand our insurance coverage to include the sale of commercial products; however, we may be unable to obtain this product liability insurance on commercially reasonable terms. On occasion, large judgments have been awarded in class action lawsuits based on drugs that had unanticipated side effects. A successful product liability claim or series of claims brought against us could cause our stock price to decline and, if judgments exceed our insurance coverage, could decrease our cash and adversely affect our business.

Our failure to successfully discover, acquire, develop and market additional product candidates or approved products would impair our ability to grow.

As part of our growth strategy, we intend to develop and market additional products and product candidates. We are pursuing various therapeutic opportunities through our pipeline. We may spend several years completing our development of any particular current or future internal product candidate, and failure can occur at any stage. The product candidates to which we allocate our resources may not end up being successful. In addition, because our internal research capabilities are limited, we may be dependent upon pharmaceutical and biotechnology companies, academic scientists and other researchers to sell or license products or technology to us. The success of this strategy depends partly upon our ability to identify, select, discover and acquire promising pharmaceutical product candidates and products.

15

The process of proposing, negotiating and implementing a license or acquisition of a product candidate or approved product is lengthy and complex. Other companies, including some with substantially greater financial, marketing and sales resources, may compete with us for the license or acquisition of product candidates and approved products. We have limited resources to identify and execute the acquisition or in-licensing of third-party products, businesses and technologies and integrate them into our current infrastructure. Moreover, we may devote resources to potential acquisitions or in-licensing opportunities that are never completed, or we may fail to realize the anticipated benefits of such efforts. We may not be able to acquire the rights to additional product candidates on terms that we find acceptable, or at all.

In addition, future acquisitions may entail numerous operational and financial risks, including:

- •

- exposure to unknown liabilities;

- •

- disruption of our business and diversion of our management's time and attention to develop acquired products or

technologies;

- •

- incurrence of substantial debt, dilutive issuances of securities or depletion of cash to pay for acquisitions;

- •

- higher than expected acquisition and integration costs;

- •

- difficulty in combining the operations and personnel of any acquired businesses with our operations and personnel;

- •

- increased amortization expenses;

- •

- impairment of relationships with key suppliers or customers of any acquired businesses due to changes in management and

ownership; and

- •

- inability to motivate key employees of any acquired businesses.

Further, any product candidate that we acquire may require additional development efforts prior to commercial sale, including extensive clinical testing and approval by the FDA and applicable foreign regulatory authorities. All product candidates are prone to risks of failure typical of pharmaceutical product development, including the possibility that a product candidate will not be shown to be sufficiently safe and effective for approval by regulatory authorities.

Healthcare reform measures could hinder or prevent our product candidates' commercial success.

The U.S. government and other governments have shown significant interest in pursuing healthcare reform. Any government-adopted reform measures could adversely impact the pricing of healthcare products and services in the U.S. or internationally and the amount of reimbursement available from governmental agencies or other third party payors. The continuing efforts of the U.S. and foreign governments, insurance companies, managed care organizations and other payors of health care services to contain or reduce health care costs may adversely affect our ability to set prices for our products which we believe are fair, and our ability to generate revenues and achieve and maintain profitability.

New laws, regulations and judicial decisions, or new interpretations of existing laws, regulations and decisions, that relate to healthcare availability, methods of delivery or payment for products and services, or sales, marketing or pricing, may limit our potential revenue, and we may need to revise our research and development programs. The pricing and reimbursement environment may change in the future and become more challenging due to several reasons, including policies advanced by the current executive administration in the U.S., new healthcare legislation or fiscal challenges faced by government health administration authorities. Specifically, in both the U.S. and some foreign jurisdictions, there have been a number of legislative and regulatory proposals to change the health care system in ways that could affect our ability to sell our products profitably. In the U.S., changes in federal health care policy are being

16

considered by Congress this year. Some of these proposed reforms could result in reduced reimbursement rates for linaclotide and our other potential products, which would adversely affect our business strategy, operations and financial results.

In addition, the Medicare Prescription Drug Improvement and Modernization Act of 2003 reforms the way Medicare will cover and reimburse for pharmaceutical products. This legislation could decrease the coverage and price that we may receive for our products. Other third-party payors are increasingly challenging the prices charged for medical products and services. It will be time consuming and expensive for us to go through the process of seeking reimbursement from Medicare and private payors. Our products may not be considered cost-effective, and coverage and reimbursement may not be available or sufficient to allow us to sell our products on a profitable basis. Further federal and state proposals and health care reforms are likely which could limit the prices that can be charged for the product candidates that we develop and may further limit our commercial opportunity. Our results of operations could be materially adversely affected by the proposed healthcare reforms, by the Medicare prescription drug coverage legislation, by the possible effect of such current or future legislation on amounts that private insurers will pay and by other health care reforms that may be enacted or adopted in the future.

In September 2007, the Food and Drug Administration Amendments Act of 2007 was enacted, giving the FDA enhanced post-marketing authority, including the authority to require post-marketing studies and clinical trials, labeling changes based on new safety information, and compliance with risk evaluations and mitigation strategies approved by the FDA. The FDA's exercise of this authority could result in delays or increased costs during product development, clinical trials and regulatory review, increased costs to assure compliance with post-approval regulatory requirements, and potential restrictions on the sale and/or distribution of approved products.

If our strategic alliances are unsuccessful, our operating results will be negatively impacted.

Our three primary strategic alliances are with Forest, Almirall and Astellas. The success of these arrangements is largely dependent on the resources, efforts and skills of these partners. Disputes and difficulties in such relationships are common, often due to conflicting priorities or conflicts of interest. Merger and acquisition activity may exacerbate these conflicts. The benefits of these alliances are reduced or eliminated when strategic partners:

- •

- terminate the agreements covering the strategic alliance;

- •

- fail to devote financial or other resources to the alliances and thereby hinder or delay development, manufacturing or

commercialization activities; or

- •

- fail to maintain the financial resources necessary to continue financing their portion of the development, manufacturing or commercialization costs, or become insolvent or declare bankruptcy.

We will need to increase the size of our organization, and we may experience difficulties in managing growth.

We will need to expand our managerial, operational, financial and other resources in order to manage our operations and clinical trials, continue our development activities and commercialize our product candidates. Our personnel, systems and facilities currently in place may not be adequate to support this future growth. Our need to effectively execute our growth strategy requires that we:

- •

- manage our clinical trials effectively, including our Phase 3 clinical trials for linaclotide;

- •

- manage our internal development efforts effectively while complying with our contractual obligations to licensors, licensees, contractors, collaborators and other third parties;

17

- •

- improve our operational, financial and management controls, reporting systems and procedures;

and

- •

- attract and motivate sufficient numbers of talented employees.

We may not be able to manage our business effectively if we lose any of our current management team or if we are unable to attract and motivate key personnel.

We may not be able to attract or motivate qualified management and scientific and clinical personnel in the future due to the intense competition for qualified personnel among biotechnology, pharmaceutical and other businesses, particularly in the greater-Boston area. Our industry has experienced a high rate of turnover of management personnel in recent years. If we are not able to attract and motivate necessary personnel to accomplish our business objectives, we may experience constraints that will significantly impede the achievement of our objectives.

We are highly dependent on the development, regulatory, commercial and financial expertise of our management, particularly Peter M. Hecht, Ph.D., our Chief Executive Officer; Mark G. Currie, Ph.D., our Senior Vice President of Research and Development and our Chief Scientific Officer; Michael J. Higgins, our Senior Vice President, Chief Operating Officer and Chief Financial Officer; and Thomas McCourt, our Senior Vice President, Marketing and Sales and Chief Commercial Officer. If we lose any members of our management team, we may not be able to find suitable replacements, and our business may be harmed as a result. In addition to the competition for personnel, the Boston area in particular is characterized by a high cost of living. As such, we could have difficulty attracting experienced personnel to our company and may be required to expend significant financial resources in our employee recruitment efforts.

We also have scientific and clinical advisors who assist us in formulating our product development and clinical strategies. These advisors are not our employees and may have commitments to, or consulting or advisory contracts with, other entities that may limit their availability to us, or may have arrangements with other companies to assist in the development of products that may compete with ours.

We will need to obtain FDA approval of any proposed product names, and any failure or delay associated with such approval may adversely impact our business.

Any name we intend to use for our product candidates will require approval from the FDA regardless of whether we have secured a formal trademark registration from the U.S. Patent and Trademark Office. The FDA typically conducts a review of proposed product names, including an evaluation of potential for confusion with other product names. The FDA may also object to a product name if it believes the name inappropriately implies medical claims. If the FDA objects to any of our proposed product names, we may be required to adopt an alternative name for our product candidates. If we adopt an alternative name, we would lose the benefit of our existing trademark applications for such product candidate, such as linaclotide, and may be required to expend significant additional resources in an effort to identify a suitable product name that would qualify under applicable trademark laws, not infringe the existing rights of third parties and be acceptable to the FDA. We may be unable to build a successful brand identity for a new trademark in a timely manner or at all, which would limit our ability to commercialize our product candidates.

If we fail to comply with healthcare regulations, we could face substantial penalties and our business, operations and financial condition could be adversely affected.

As a manufacturer of pharmaceuticals, even though we do not and will not control referrals of healthcare services or bill directly to Medicare, Medicaid or other third-party payors, certain federal and state healthcare laws and regulations pertaining to fraud and abuse and patients' rights are and will be applicable to our business. We could be subject to healthcare fraud and abuse and patient privacy

18

regulation by both the federal government and the states in which we conduct our business. The regulations include:

- •

- the federal healthcare program anti-kickback law, which prohibits, among other things, persons from

soliciting, receiving or providing remuneration, directly or indirectly, to induce either the referral of an individual, for an item or service or the purchasing or ordering of a good or service, for

which payment may be made under federal healthcare programs such as the Medicare and Medicaid programs;

- •

- federal false claims laws which prohibit, among other things, individuals or entities from knowingly presenting, or

causing to be presented, claims for payment from Medicare, Medicaid, or other third-party payors that are false or fraudulent, and which may apply to entities like us which provide coding and billing

advice to customers;

- •

- the federal Health Insurance Portability and Accountability Act of 1996, which prohibits executing a scheme to defraud any

healthcare benefit program or making false statements relating to healthcare matters and which also imposes certain requirements relating to the privacy, security and transmission of individually

identifiable health information;

- •

- the Federal Food, Drug, and Cosmetic Act, which among other things, strictly regulates drug product marketing, prohibits

manufacturers from marketing drug products for off-label use and regulates the distribution of drug samples; and

- •

- state law equivalents of each of the above federal laws, such as anti-kickback and false claims laws which may apply to items or services reimbursed by any third-party payor, including commercial insurers, and state laws governing the privacy and security of health information in certain circumstances, many of which differ from each other in significant ways and often are not preempted by federal laws, thus complicating compliance efforts.

If our operations are found to be in violation of any of the laws described above or any governmental regulations that apply to us, we may be subject to penalties, including civil and criminal penalties, damages, fines and the curtailment or restructuring of our operations. Any penalties, damages, fines, curtailment or restructuring of our operations could adversely affect our ability to operate our business and our financial results. Although compliance programs can mitigate the risk of investigation and prosecution for violations of these laws, the risks cannot be entirely eliminated. Any action against us for violation of these laws, even if we successfully defend against it, could cause us to incur significant legal expenses and divert our management's attention from the operation of our business. Moreover, achieving and sustaining compliance with applicable federal and state privacy, security and fraud laws may prove costly.

Our business involves the use of hazardous materials, and we must comply with environmental laws and regulations, which can be expensive and restrict how we do business.

Our activities involve the controlled storage, use and disposal of hazardous materials. We are subject to federal, state, city and local laws and regulations governing the use, manufacture, storage, handling and disposal of these hazardous materials. Although we believe that the safety procedures we use for handling and disposing of these materials comply with the standards prescribed by these laws and regulations, we cannot eliminate the risk of accidental contamination or injury from these materials. In the event of an accident, local, city, state or federal authorities may curtail the use of these materials and interrupt our business operations. We do not currently maintain hazardous materials insurance coverage.

Our business and operations would suffer in the event of system failures.

Despite the implementation of security measures, our internal computer systems and those of our contractors and consultants are vulnerable to damage from computer viruses, unauthorized access, natural disasters, terrorism, war and telecommunication and electrical failures. Such an event could cause

19

interruption of our operations. For example, the loss of clinical trial data from completed or ongoing clinical trials for linaclotide could result in delays in our regulatory approval efforts and significantly increase our costs. To the extent that any disruption or security breach were to result in a loss of or damage to our data, or inappropriate disclosure of confidential or proprietary information, we could incur liability and the development of our product candidates could be delayed.

If the proprietary strain-development platform of our biomanufacturing segment does not succeed, we may lose our investment in Microbia, Inc.