Attached files

| file | filename |

|---|---|

| 8-K - 111609 ROSE UPDATED PRESENTATION - NBL Texas, LLC | roseupdatedpres.htm |

2009

Exhibit 99.1

2

Experienced team driving successful transformation

Significant upside from unique formula

Core assets re-engineered

for predictable growth from low risk inventory

Conservative financial approach balances

growth and returns

Catalysts provide

exciting opportunity to participate in new play entry

Very attractive risk-reward profile for a company our size

Trades at discount on valuation basis to companies with resource-based

business model

business model

It’s a Great Time to Look at Rosetta

3

2009 Accomplishments

Not Missing a Beat…

Not Missing a Beat…

Refinanced existing debt

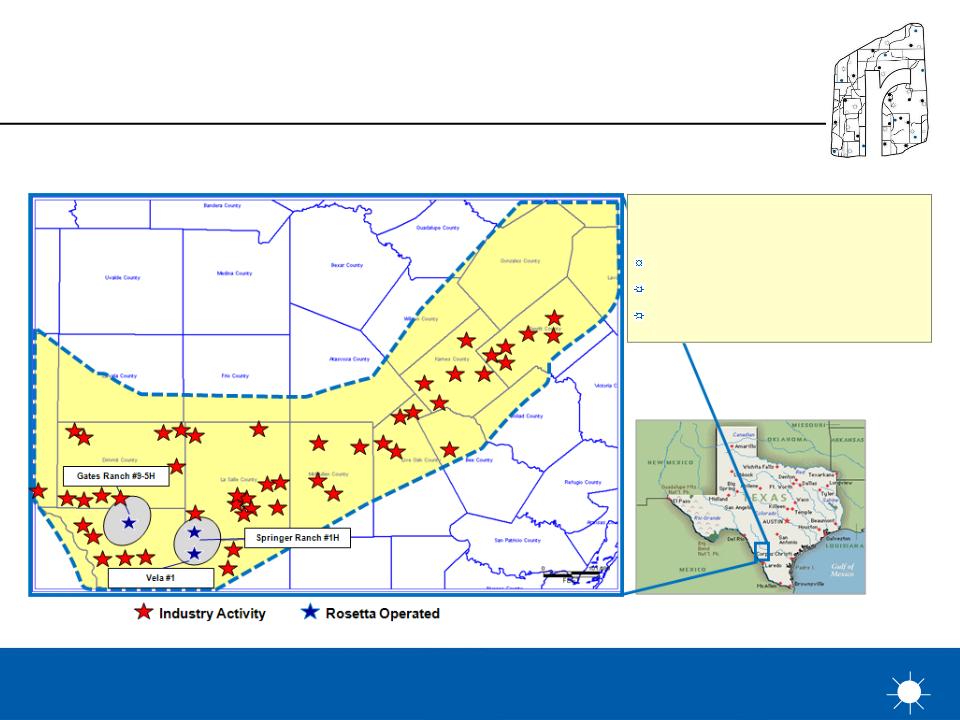

Increased Eagle Ford acreage almost 90% to 47,000 net acres

Drilled 3 Eagle Ford wells

Springer Ranch #1H produced 39 MMcf during first seven days

Gates 05D#9H produced 25 MMcf and 2,200 Bbls of condensate during first seven days

Vela #1 set up for horizontal drilling

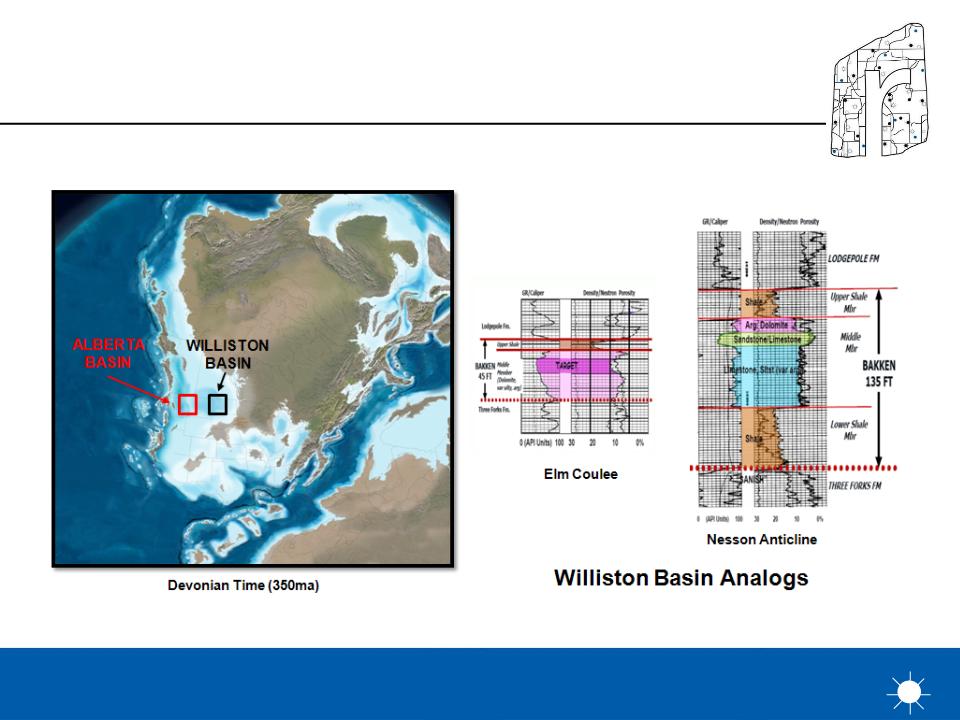

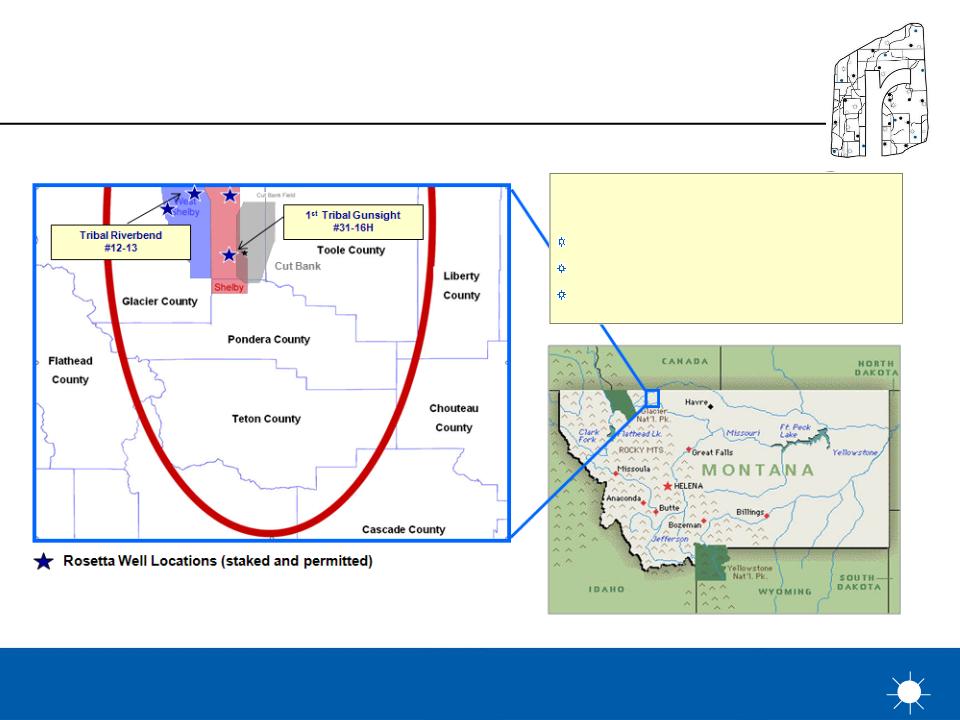

Drilled 2 Bakken Wells; 2 additional wells permitted

Tribal Gunsight #31 drilled horizontally and being

completed

Tribal Riverbed #12 spud

Added 2010-2011 hedges

5 BBtu/d Rocky Mountain hedges at $5.72

10 BBtu/d collars at $5.75-$7.55

Completed non-core asset sales of $20MM

4

Additional Initiatives

Gas marketing function insourced

South Texas compressor sale and leaseback completed

DJ Basin salt water disposal wells in service

Sacramento Basin gathering de-bottlenecking completed

5

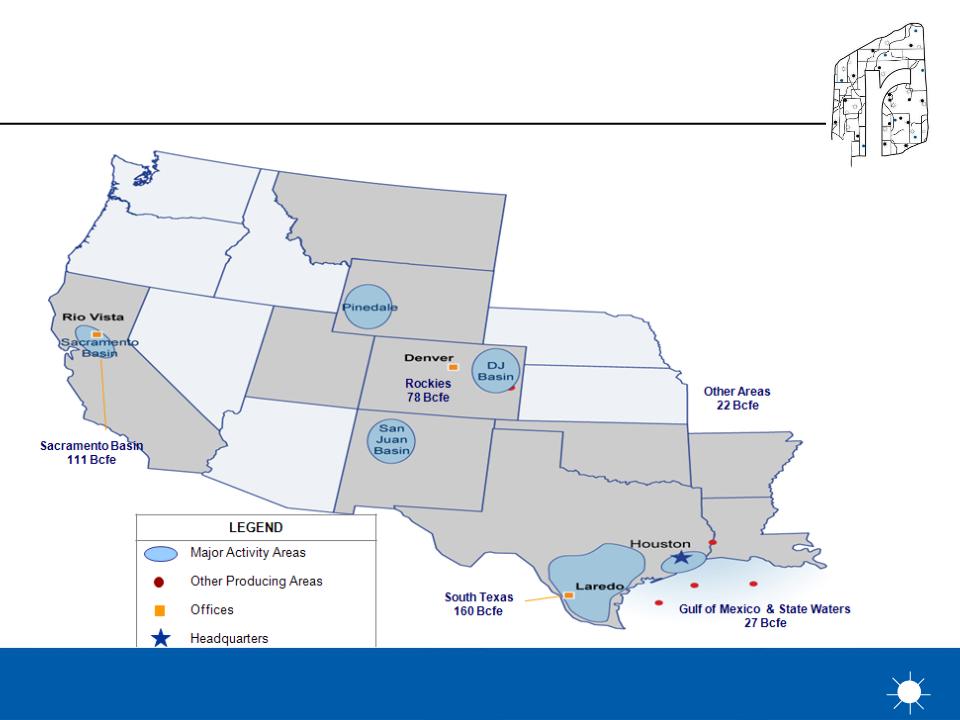

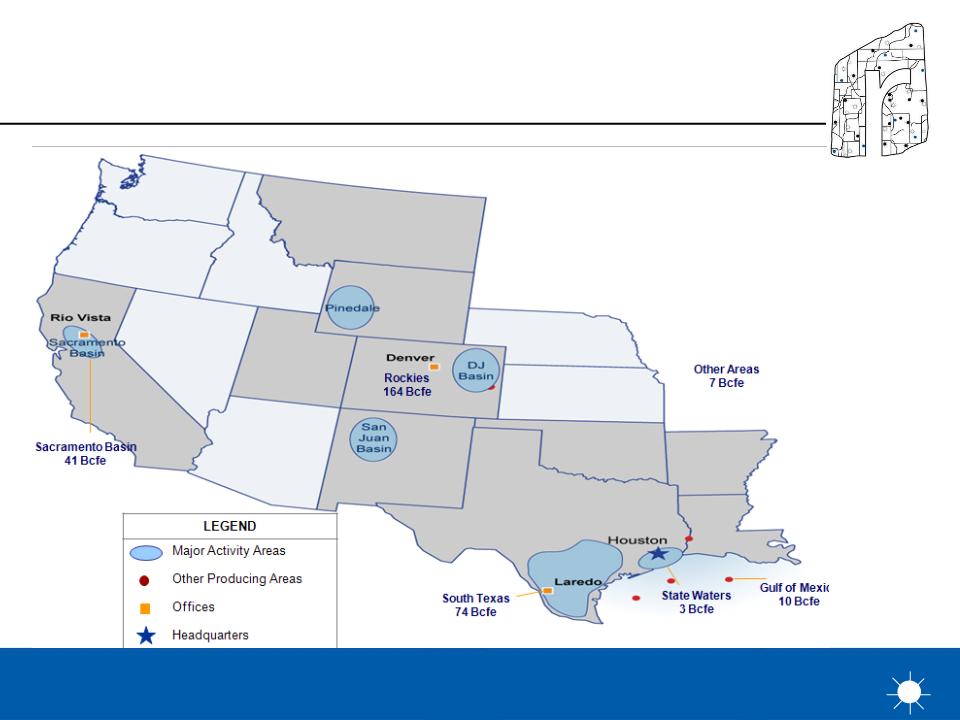

Proved Reserves

398 Bcfe

398 Bcfe

2008 Year End Reserves

6

2008 Year End Capital Inventory

|

71 |

BCFE PUD |

|

228 |

BCFE Probable & Possible |

|

299 |

Total BCFE |

7

Blocking & Tackling

Sacramento Basin “By-Passed” Resources

Economies of Scale

Denver Julesburg Basin Niobrara Chalk

Opportunistic Growth

South Texas Eagle Ford Shale

Creative Growth

Alberta Basin Bakken Shale

Additional Resource Potential

Beyond Reserves & Inventory

Beyond Reserves & Inventory

8

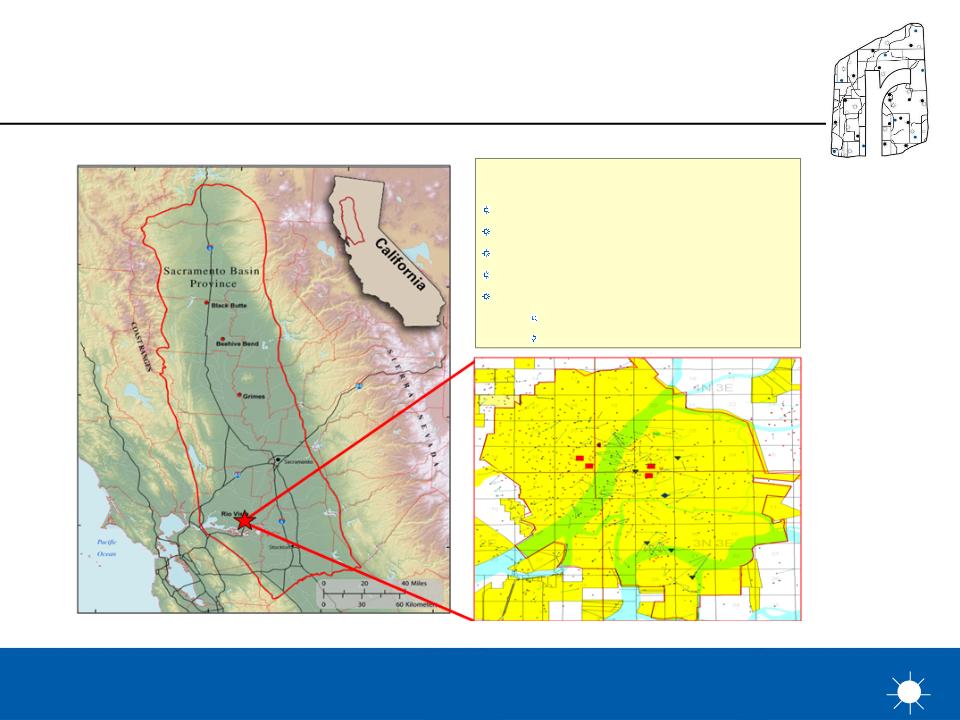

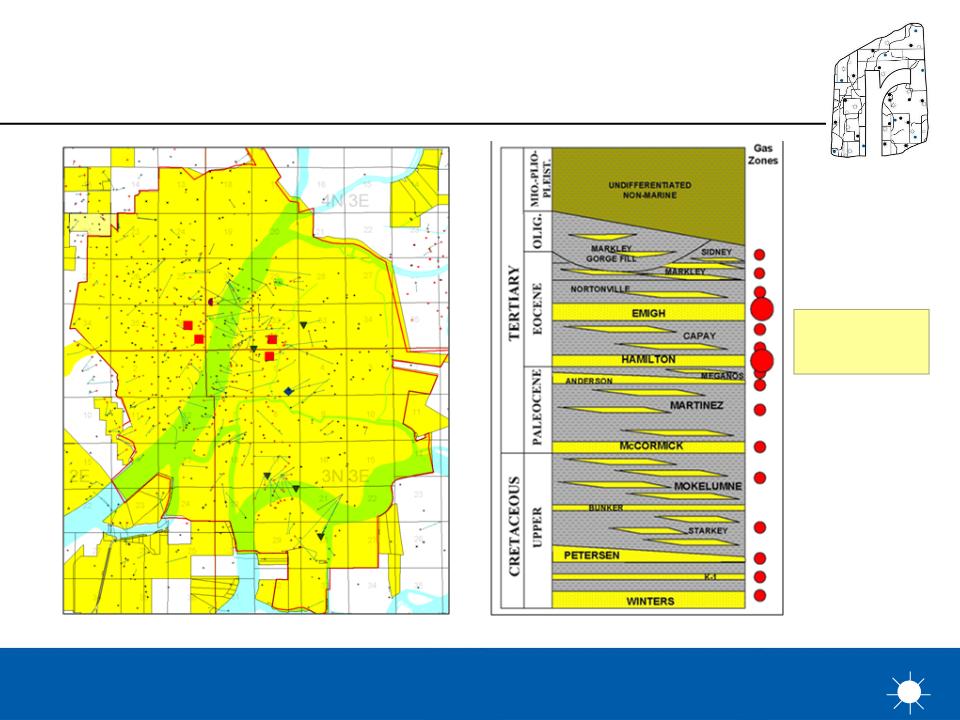

Blocking & Tackling

Sacramento Basin: “The ideal basin for resource assessments…”

Sacramento Basin: “The ideal basin for resource assessments…”

Rio Vista Gas Unit

Key Statistics

Discovery Date: 1936

Aerial Extent: 30,500

acres

Gross Cumulative Production: 3.6 TCFE

Number of Producing Horizons: 16

Number of Wells: 303

Producing: 143

Idle 160

9

Blocking & Tackling

The Playground: 16 Proven Hydrocarbon Reservoirs

The Playground: 16 Proven Hydrocarbon Reservoirs

Depth Range

2,500 - 13,000’

10

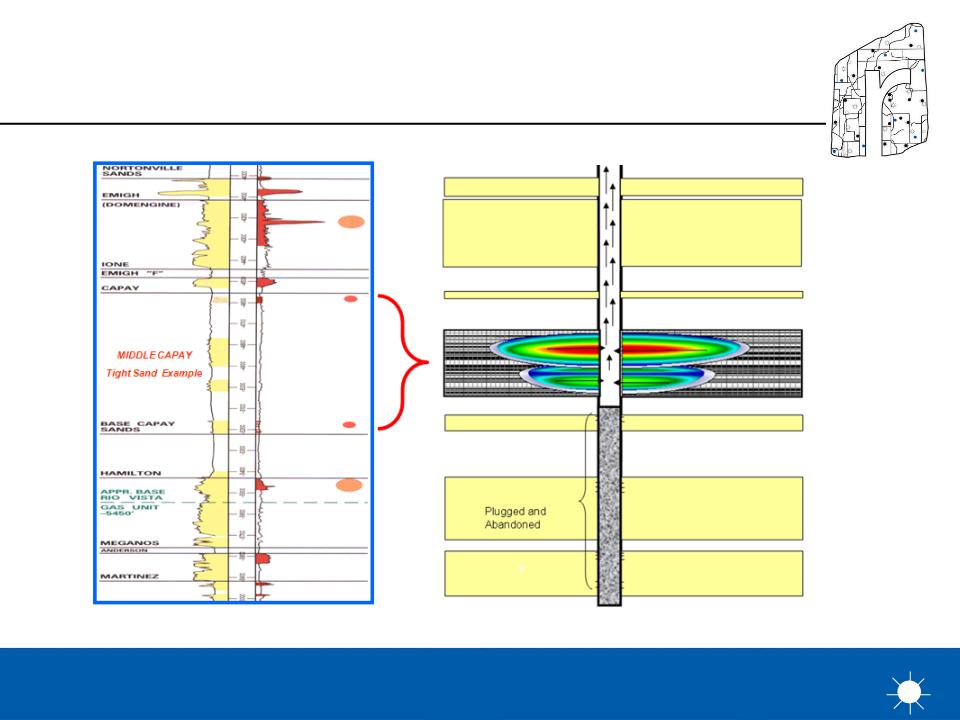

Blocking & Tackling

The Game: “By-Passed” Resources Through Identification and Technology Applications

The Game: “By-Passed” Resources Through Identification and Technology Applications

11

|

ACTUAL PROGRAM RESULTS | |

|

Group 1

(6 well program) | |

|

Well |

IP (Mcfe/d) |

|

RVGU 242 |

475 |

|

RVGU 222 |

200 |

|

RVGU 296 |

130 |

|

RVGU 299 |

1300 |

|

Jordan 8 |

1250 |

|

RVGU 269U |

550 |

|

Group 1 Average |

651 |

|

Group 2

(14 well program) | |

|

Well |

IP (Mcfe/d) |

|

RVGU 294 |

660 |

|

RVGU 208 |

1282 |

|

RVGU 167 |

450 |

|

RVGU 295 |

892 |

|

Welch 17 |

1046 |

|

Welch 14 |

1041 |

|

RVGU 301 |

536 |

|

Detering 2 |

1265 |

|

Detering 7 |

1299 |

|

RVGU 247 |

1200 |

|

RVGU 200 |

50 |

|

RVGU 299 |

300 |

|

Welch 18 |

1100 |

|

Emigh 17 |

184 |

|

Group 2 Average |

808 |

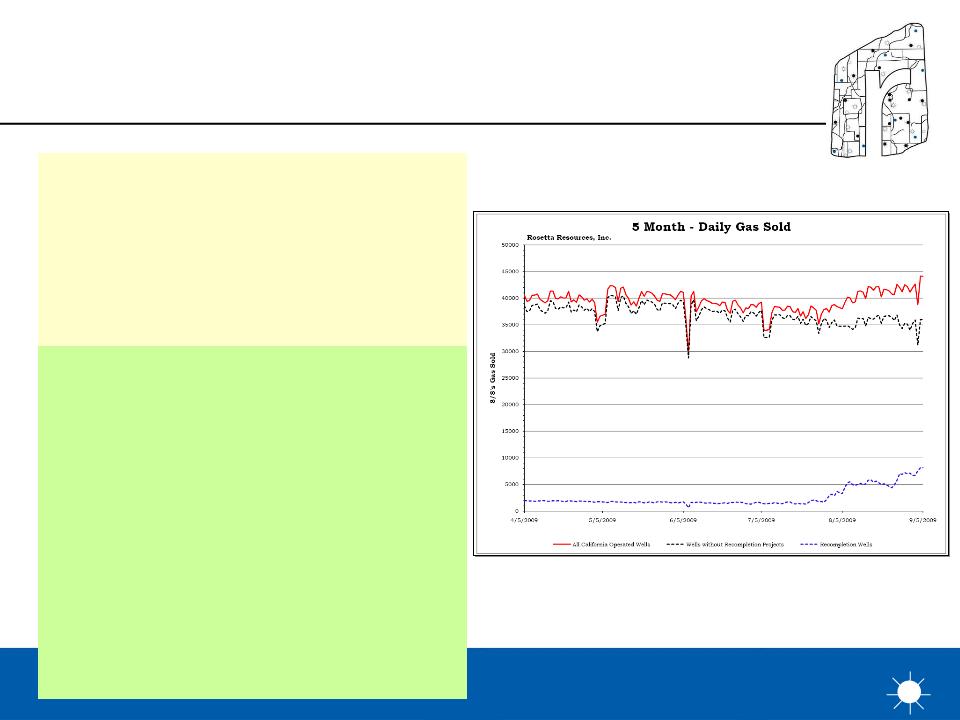

Blocking & Tackling

The Results: “New production yielding unique reserves…”

The Results: “New production yielding unique reserves…”

12

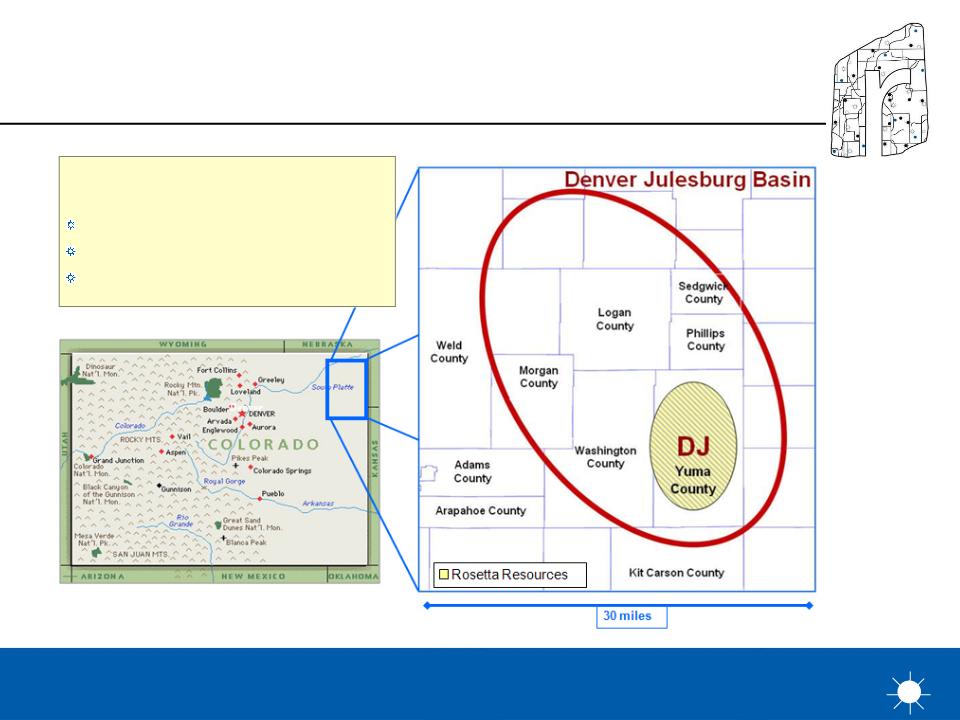

Denver Julesburg Basin Niobrara Play

Rosetta Resources’ Position:

Net Undeveloped Acreage: 90,000 acres

Net Projects: 1750

wells*

Net Resource Potential: 350 Bcfe

* Not including the 500 locations already in inventory

Economies of Scale

DJ Basin: Niobrara Chalk Resource Play

DJ Basin: Niobrara Chalk Resource Play

13

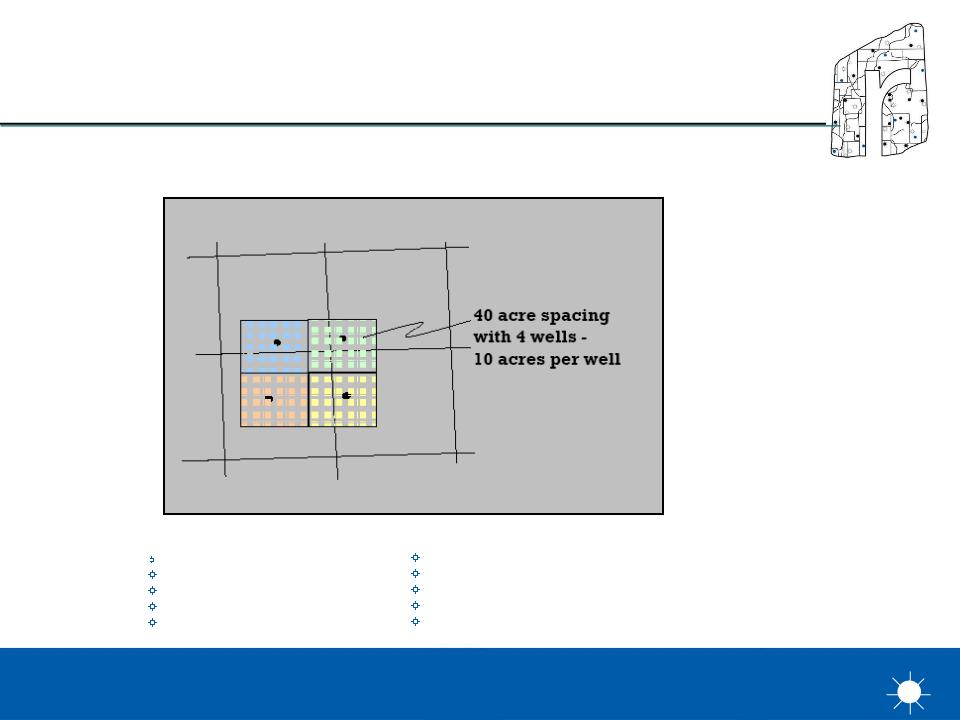

Economies of Scale

DJ Basin: Niobrara Chalk Resource Play

DJ Basin: Niobrara Chalk Resource Play

NIOBRARA INFILL PILOT PROGRAM

160 acre Block

Typical well results

$180,000

CWC

300 MMCF EUR

100% AVG. WI; 80% AVG. NRI

200 MCFPD initial rate

>20% AFIT IRR @ $5.00 NYMEX

Optimizing Future Development

Resource potential (advanced open hole logging)

Drainage patterns (effective tighter spacing)

Stimulation orientation (micro-seismic)

Pressure drawdown (pressure observation wells)

Optimum stimulation (differing technical designs)

14

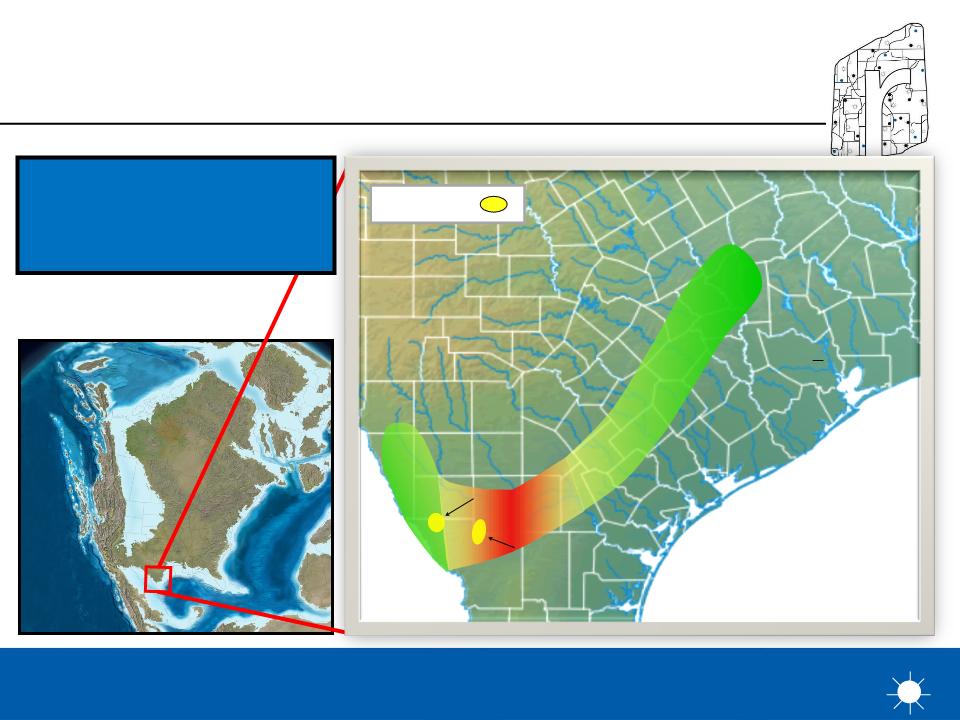

Houston

Gulf of Mexico

Mexico

Rosetta

Oil Gas Oil

Opportunistic Growth

South Texas Eagle Ford Shale Resource Play

South Texas Eagle Ford Shale Resource Play

Cretaceous Time (80ma)

Gates Ranch Area

16,000 net acres

Springer Ranch Area

15,000 net acres

Net Acreage

Gates Ranch Area: 16,000 net

Springer Ranch Area: 15,000 net

Undisclosed: 16,000 net

Total 47,000 net

15

Opportunistic Growth

South Texas Eagle Ford Shale Resource Play

South Texas Eagle Ford Shale Resource Play

Eagle Ford Shale Play

Rosetta Resources’ Position:

Net Undeveloped Acreage: 47,000 acres

Net Projects: 290

wells

Net Resource Potential: 870 Bcfe

Note: Assumes 160 acre development and 4 Bcfe gross EUR per well.

16

Creative Growth

Alberta Basin Bakken Shale Resource Play

Alberta Basin Bakken Shale Resource Play

17

Creative Growth

Alberta Basin Bakken Shale Resource Play

Alberta Basin Bakken Shale Resource Play

Alberta Basin Bakken Play

Rosetta Resources’ Position:

Net Undeveloped Acreage: 239,000 acres

Net Projects: 747

wells*

Net Resource Potential: 60 - 300 MMBOE

* 320 acre development

18

Additional Resource Potential*

|

|

Areal Extent

(Net Acres) |

|

Projects

(Project Count) |

|

Net Resource

(Bcfe) |

|

Sacramento Basin “By-Passed” Resources |

30,000 |

|

375 |

|

100 |

|

DJ Basin Niobrara Chalk |

90,000 |

|

1,750 |

|

350 |

|

South Texas Eagle Ford Shale |

47,000 |

|

290 |

|

870 |

|

Alberta Basin Bakken Shale |

239,000 |

|

747 |

|

1080 |

|

TOTAL |

406,000 |

|

3,162 |

|

2,400 |

* Summary of projects in addition to our PUD, Probable & Possible inventories; leasehold is either assigned and/or committed.

19

Potential Reserve Summary (Bcfe)

|

|

Reported

Proved Reserves (12/31/09) |

Probable Possible Inventory |

Total

P1-P2-P3 Reserves |

|

Additional Resources Potential |

|

California |

111 |

19 |

130 |

|

100 |

|

Rockies |

78 |

159 |

237 |

|

350 |

|

Alberta Basin |

- |

- |

- |

|

1080 |

|

South Texas |

160 |

32 |

192 |

|

- |

|

Eagle Ford |

- |

- |

- |

|

870 |

|

Onshore Other |

22 |

7 |

29 |

|

- |

|

State/Federal Waters |

27 |

11 |

38 |

|

- |

|

TOTAL |

398 |

228 |

626 |

|

2,400 |

20

Amended Revolving Credit Facility

Maximum credit amount increased to $600MM

Borrowing base reset to $350MM

Maturity date is July 1, 2012

Amended Second Lien Term Loan

Borrowing increased to $100MM

Maturity date is October 2, 2012

Liquidity from unused Revolver capacity and cash at $225MM at 9/30/09

Financial Status

21

2009

Protected 2009 natural gas production with 52 BBtu/d swapped at an average

price of $7.65 and 5 BBtu/d of collars at $8.00 by $10.05

price of $7.65 and 5 BBtu/d of collars at $8.00 by $10.05

2010-2011

Protected 2010 natural gas production of 10 BBtu/d swapped at $8.31

Swapped 5 BBtu/d in DJ Basin from July 2010 to December 2011 at $5.72

Added 10 BBtu/d of collars from July 2010 to December 2011 at $5.75 by $7.55

Hedge Status

22

Maintain balance between cash flow and capital activity

Re-engineer existing opportunity set

Sacramento Basin workovers

Lobo program

Possible DJ Basin program

Evaluate new play opportunities

Eagle Ford

Bakken

Pursue bolt-on/strategic acquisitions

Selective sale of non-core assets

Focus on cost reductions in all business areas

2009-2010 Business Plan

23

Experienced team driving successful transformation

Significant upside from unique formula

Core assets re-engineered

for predictable growth from low risk inventory

Conservative financial approach balances

growth and returns

Catalysts provide

exciting opportunity to participate in new play entry

Very attractive risk-reward profile for company our size

Trades at discount on valuation basis to companies with resource-based

business model

business model

It’s a Great Time to Look at Rosetta

24

Forward-Looking Statements

All statements, other than statements of historical fact, included in this presentation are forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements

are based upon current expectations and are subject to a number of risks, uncertainties and assumptions,

which are more fully described in Rosetta Resources Inc.'s Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q filed with the Securities and Exchange Commission. These risks, uncertainties

and assumptions could cause actual results to differ materially from those described in the forward-

looking statements. Rosetta assumes no obligation and expressly disclaims any duty to update the

information contained herein except as required by law.

statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements

are based upon current expectations and are subject to a number of risks, uncertainties and assumptions,

which are more fully described in Rosetta Resources Inc.'s Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q filed with the Securities and Exchange Commission. These risks, uncertainties

and assumptions could cause actual results to differ materially from those described in the forward-

looking statements. Rosetta assumes no obligation and expressly disclaims any duty to update the

information contained herein except as required by law.