Attached files

| file | filename |

|---|---|

| 8-K - JOINT FORM 8-K KC SECURITIES ASSN IR DECK - KANSAS CITY POWER & LIGHT CO | f8kkcirdeck.htm |

Great Plains Energy

Kansas City

Securities Association Presentation

November 18, 2009

Exhibit

99.1

1

Terry

Bassham

Executive

Vice President

Finance

& Strategic Development

and

Chief Financial Officer

Ellen

Fairchild, Director

Investor Relations

Investor Relations

816-556-2083

ellen.fairchild@kcpl.com

Michael

Cline, Vice President

Investor

Relations & Treasurer

816-556-2622

michael.cline@kcpl.com

Eula

Jones

Investor

Relations Analyst

816-556-2080

eula.jones@kcpl.com

Company

Representatives

2

Statements made in

this presentation that are not based on historical facts are forward-looking,

may involve risks and uncertainties,

and are intended to be as of the date when made. Forward-looking statements include, but are not limited to, the outcome of

regulatory proceedings, cost estimates of the Comprehensive Energy Plan and other matters affecting future operations. In

connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the registrants are providing a

number of important factors that could cause actual results to differ materially from the provided forward-looking information. These

important factors include: future economic conditions in regional, national and international markets and their effects on sales, prices

and costs, including, but not limited to, possible further deterioration in economic conditions and the timing and extent of any

economic recovery; prices and availability of electricity in regional and national wholesale markets; market perception of the energy

industry, Great Plains Energy, KCP&L and GMO; changes in business strategy, operations or development plans; effects of current or

proposed state and federal legislative and regulatory actions or developments, including, but not limited to, deregulation, re-regulation

and restructuring of the electric utility industry; decisions of regulators regarding rates KCP&L and GMO can charge for electricity;

adverse changes in applicable laws, regulations, rules, principles or practices governing tax, accounting and environmental matters

including, but not limited to, air and water quality; financial market conditions and performance including, but not limited to, changes in

interest rates and credit spreads and in availability and cost of capital and the effects on nuclear decommissioning trust and pension

plan assets and costs; impairments of long-lived assets or goodwill; credit ratings; inflation rates; effectiveness of risk management

policies and procedures and the ability of counterparties to satisfy their contractual commitments; impact of terrorist acts; increased

competition including, but not limited to, retail choice in the electric utility industry and the entry of new competitors; ability to carry out

marketing and sales plans; weather conditions including, but not limited to, weather-related damage and their effects on sales, prices

and costs; cost, availability, quality and deliverability of fuel; ability to achieve generation planning goals and the occurrence and

duration of planned and unplanned generation outages; delays in the anticipated in-service dates and cost increases of additional

generating capacity and environmental projects; nuclear operations; workforce risks, including, but not limited to, retirement

compensation and benefits costs; the ability to successfully integrate KCP&L and GMO operations and the timing and amount of

resulting synergy savings; and other risks and uncertainties.

and are intended to be as of the date when made. Forward-looking statements include, but are not limited to, the outcome of

regulatory proceedings, cost estimates of the Comprehensive Energy Plan and other matters affecting future operations. In

connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the registrants are providing a

number of important factors that could cause actual results to differ materially from the provided forward-looking information. These

important factors include: future economic conditions in regional, national and international markets and their effects on sales, prices

and costs, including, but not limited to, possible further deterioration in economic conditions and the timing and extent of any

economic recovery; prices and availability of electricity in regional and national wholesale markets; market perception of the energy

industry, Great Plains Energy, KCP&L and GMO; changes in business strategy, operations or development plans; effects of current or

proposed state and federal legislative and regulatory actions or developments, including, but not limited to, deregulation, re-regulation

and restructuring of the electric utility industry; decisions of regulators regarding rates KCP&L and GMO can charge for electricity;

adverse changes in applicable laws, regulations, rules, principles or practices governing tax, accounting and environmental matters

including, but not limited to, air and water quality; financial market conditions and performance including, but not limited to, changes in

interest rates and credit spreads and in availability and cost of capital and the effects on nuclear decommissioning trust and pension

plan assets and costs; impairments of long-lived assets or goodwill; credit ratings; inflation rates; effectiveness of risk management

policies and procedures and the ability of counterparties to satisfy their contractual commitments; impact of terrorist acts; increased

competition including, but not limited to, retail choice in the electric utility industry and the entry of new competitors; ability to carry out

marketing and sales plans; weather conditions including, but not limited to, weather-related damage and their effects on sales, prices

and costs; cost, availability, quality and deliverability of fuel; ability to achieve generation planning goals and the occurrence and

duration of planned and unplanned generation outages; delays in the anticipated in-service dates and cost increases of additional

generating capacity and environmental projects; nuclear operations; workforce risks, including, but not limited to, retirement

compensation and benefits costs; the ability to successfully integrate KCP&L and GMO operations and the timing and amount of

resulting synergy savings; and other risks and uncertainties.

This

list of factors is not all-inclusive because it is not possible to predict all

factors. Other risk factors are detailed from time to time in

Great Plains Energy’s and KCP&L’s most recent quarterly report on Form 10-Q or annual report on Form 10-K filed with the Securities

and Exchange Commission. Any forward-looking statement speaks only as of the date on which such statement is made. Great

Plains Energy and KCP&L undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of

new information, future events or otherwise.

Great Plains Energy’s and KCP&L’s most recent quarterly report on Form 10-Q or annual report on Form 10-K filed with the Securities

and Exchange Commission. Any forward-looking statement speaks only as of the date on which such statement is made. Great

Plains Energy and KCP&L undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of

new information, future events or otherwise.

Forward Looking

Statement

3

• Strong Midwest

electric utilities focused on regulated operations in Missouri and

Kansas

• Diversified

customer base includes 820,000 residential, commercial, and industrial

customers

• ~6,000 Megawatts of

generation capacity

• Low-cost generation

mix - projected 76% coal, 17% nuclear (Wolf Creek) in 2009

100%

Regulated

Electric Utility

Operations Focus

Electric Utility

Operations Focus

• Growth and

stability in earnings driven by sizable regulated investments as part of

the

Comprehensive Energy Plan (“CEP”)

Comprehensive Energy Plan (“CEP”)

• Wind and

environmental retrofit components of CEP in place; Iatan 2 baseload coal

plant

targeted for completion in late summer 2010

targeted for completion in late summer 2010

• Anticipated growth

beyond 2010 driven by additional environmental capex and wind

Attractive

Platform

for Long-Term

Earnings Growth

for Long-Term

Earnings Growth

• Successful outcomes

in 2006, 2007 and 2008 rate cases in Missouri and Kansas

• Combined annual

rate increases from 2008 cases of $59mm in Kansas and $159mm in

Missouri;

new rates effective August 1st in Kansas and September 1st in Missouri

new rates effective August 1st in Kansas and September 1st in Missouri

Focused

Regulatory

Approach

Approach

• Cash flow and

earnings heavily driven by regulated operations and cost recovery

mechanisms

• Ample liquidity

currently available under $1.5bn credit facilities

• Sustainable

dividend and pay-out, right-sized to fund growth and to preserve

liquidity

• Committed to

maintaining current investment grade credit ratings

Stable

and

Improving Financial

Position

Improving Financial

Position

Strong Platform

for Long-Term Growth

4

Pro

Forma 2008 Revenue by Customer Segment

Pro

Forma 2008 Revenue by Utility Jurisdiction

Service

Territories: KCP&L and GMO

Business

Highlights

• Solid Midwest

electric utility - KCP&L brand

• Transformational

events in 2008 to focus business model on

fully regulated utility operations

fully regulated utility operations

– Sale of Strategic

Energy

– Acquisition of

Aquila

• Company attributes

post-acquisition

• 820,000 customers /

3,200+ employees

• ~6,000 MW of

primarily low-cost baseload generation

• 5-year projected

synergies of $723 million

• ~$7.9bn in assets

and $3.6bn in rate base at 2008YE

Total:

$1.7bn

Total:

$1.7bn

Solid

Foundation

5

|

|

Project

description

|

Comments

|

|

100 MW plant

in Spearville, KS

Began

construction in 2005

|

ü Completed in

Q3 2006

ü In rate base

from 1/1/2007

ü No

regulatory disallowance

|

|

|

Selective

Catalytic Reduction (SCR) unit at LaCygne

1 plant |

ü Completed in

Q2 2007

ü In rate base

from 1/1/2008

ü No

regulatory disallowance

|

|

|

Air Quality

Control System at Iatan 1 coal plant

|

ü Completed in

Q2 2009

ü In rate base

starting 3Q 2009 (KS 08/1 & MO

9/1)

ü No regulatory

disallowance in 2009 MO and KS

cases; minimal exposure in 2010 cases |

|

|

Construction

of Iatan 2 super-critical coal plant (850

MW; 73% GXP ownership share)1 |

ü On track for

completion late summer 2010

ü Expected in

rate base Q4 2010 / 1Q 2011

|

Iatan

2

Iatan

1

Environmental

LaCygne

Environmental

Wind

Great

Plains Energy has effectively executed all elements of its Comprehensive

Energy

Plan to date and received positive, just, and reasonable regulatory treatment

Plan to date and received positive, just, and reasonable regulatory treatment

Comprehensive

Energy Plan

1 Includes

post-combustion environmental technologies including an SCR system, wet flue gas

desulphurization system and fabric

filter to control emissions

filter to control emissions

Strong Track

Record of Execution

6

Iatan

Site Photographs - October 2009

Iatan

2 Fabric Filter

Cooling

Tower

Construction

Campus

Iatan

1 SCR

Iatan

2 Boiler

Iatan

2 SCR

Gypsum

Storage

Reagent

Prep Bldg

Iatan

2 Absorber

Recycle

Pump Building

Tank

Farm and Coal Yard

7

|

|

|

|

2008

rate cases

|

|

|

||||

|

Company

|

Last

Allowed

ROE |

Effective

Date of Last Allowed ROE |

ROE

requested1 |

Requested

revenue increase |

Stipulated

/

settled revenue increase |

Tariff

implementation

|

RPS2

|

Fuel

Clause? |

|

|

|

|

10.25%

|

6/1/07

|

11.55%

|

$66mm

|

$48mm

|

9/1/09

|

ü

|

Yes

(95%) |

|

|

|

10.25%

|

6/1/07

|

11.55%

|

17mm

|

$15mm

|

9/1/09

|

ü

|

Yes

(95%) |

|

|

|

—3

|

N/A

|

11.55%

|

1mm

|

$1mm

|

7/1/09

|

ü

|

Yes

(85%) |

|

|

|

10.75%

|

1/1/08

|

11.55%

|

102mm

|

$95mm

|

9/1/09

|

ü

|

No

|

|

—3

|

N/A

|

11.40%

|

72mm

|

$59mm

|

8/1/09

|

ü

|

Yes

(100%) |

||

GMO-MPS

GMO-L&P

GMO-Steam

KCP&L-KS

KCP&L-MO

1 ROE of 10.75%

originally requested in all cases; requests increased in rebuttal testimony

based on financial market developments. All

cases settled; ROE not

disclosed

disclosed

2 Missouri mandatory

Renewable Portfolio Standard of 2% by 2011, 10% by 2018 and 15% by

2021;

Kansas has targets of 10% by 2011, 15% by 2016 and 20% by 2020

Kansas has targets of 10% by 2011, 15% by 2016 and 20% by 2020

3 “Black Box” settlement

- ROE not

disclosed

Focused Regulatory

Approach

8

• Address supply

opportunities including:

• environmental

mandates,

• renewable

portfolio standards

• fuel

alternatives

• Help customers

understand and manage

consumption

• smart

grid

• energy

efficiency

• Explore

transmission in our region

What’s

Next

9

The

Green Impact Zone

Adjacent

to Green Impact

Zone:

Zone:

•

Stowers Institute

•

Midwest Research Institute

(NREL)

(NREL)

•

UMKC Volker Campus

•

Kauffman Foundation

•

Rockhurst University

•

DNR Gorman Center

•

Nelson-Atkins Museum

10

KCP&L

filed an application for ARRA Stimulus funding to advance energy efficiency and

conduct a Smart Grid demonstration

project in the Green Impact Zone. We will invest approximately $14 million and requested Federal matching funds for

approximately $24 million and key partner funds of $10 million for a total estimated project value of $48 million.

project in the Green Impact Zone. We will invest approximately $14 million and requested Federal matching funds for

approximately $24 million and key partner funds of $10 million for a total estimated project value of $48 million.

Advancement of

Existing Residential & C&I Energy Efficiency Programs

n Weatherization

& Energy Audits

n Efficient

Appliances, Lighting and HVAC Equipment

n Efficient Motors,

Drives and Data Centers

Smart Grid

Demonstration

n Smart

Distribution

– Substation

– IP/RF 2-way Field

Area Network (FAN)

– Distribution

Management System (DMS)

n Generation and

Storage

– Commercial Solar

and Photovoltaic

– Battery and Thermal

Storage

n Smart

End-Use

– Residential &

Commercial EMS Demonstration

– In-Home Display and

Interval Data

– PHEV

Charging

– Smart Appliances

and Pilot RTP or CPP Rates

Customer/Community

Benefits:

Lower

utility bills

Increased

environmental stewardship

Improved

energy information

Increased

local energy sector jobs

KCP&L

Benefits:

New

business model development

Increased

reliability

Reduced

costs

Greater

asset utilization

Environmental

Customer

satisfaction

Regional

economic development

Green

Impact Zone Investments: Benefits

For Customers and KCP&L

For Customers and KCP&L

11

• Address supply

opportunities including:

• environmental

mandates,

• renewable

portfolio standards

• fuel

alternatives

• Help customers

understand and manage

consumption

• smart

grid

• energy

efficiency

• Explore

transmission in our region

What’s Next

Continued

Financial

Overview

13

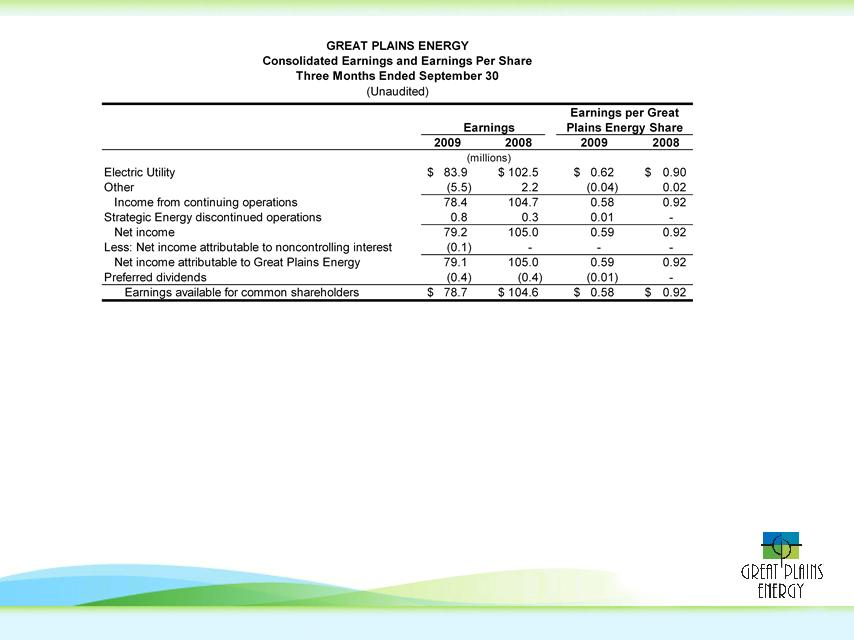

• Electric Utility

segment earnings decreased $18.6 million primarily as a result of a) $14.3

million decrease in

operating income driven by lower wholesale revenue, higher operating expenses and depreciation, partially offset by

higher retail revenue and lower purchased power; and b) an $11.6 million increase in interest expense.

operating income driven by lower wholesale revenue, higher operating expenses and depreciation, partially offset by

higher retail revenue and lower purchased power; and b) an $11.6 million increase in interest expense.

• Other segment

earnings decreased $7.8 million primarily as a result of increased interest from

the equity units issued

in May and a favorable 2008 impact from the reversal of interest expense related to unrecognized tax benefits.

in May and a favorable 2008 impact from the reversal of interest expense related to unrecognized tax benefits.

• A 21.0 million

increase in the average number of shares outstanding since the third quarter of

2008 resulted in $0.11

per share dilution

per share dilution

14

Earnings

Key

Earnings Drivers:

+ Increased retail

revenue of $22.2 million driven by GMO’s inclusion for full quarter in 2009 and

new

retail rates partially offset by mild weather and lower weather-normalized demand

retail rates partially offset by mild weather and lower weather-normalized demand

+ Decline in

purchased power expense of $24.2 million

+ Increased AFUDC of

$2.7 million

- Decline in

wholesale revenue of $28.5 million

- Increased

depreciation & amortization of $12.5 million; including $3.8 million of

additional amortization

- Increased non-fuel

operating expense including $7.5 million wind termination fee and $5.2

million

increase

for GMO driven by inclusion for a full quarter in 2009

- Increased interest

expense, net of AFUDC, of $11.6 million

- Higher shares

outstanding caused electric utility segment dilution of $0.12 per

share.

(millions

except

where indicated)

where indicated)

Earnings

Per Share

$83.9

$0.90

$0.62

$102.5

15

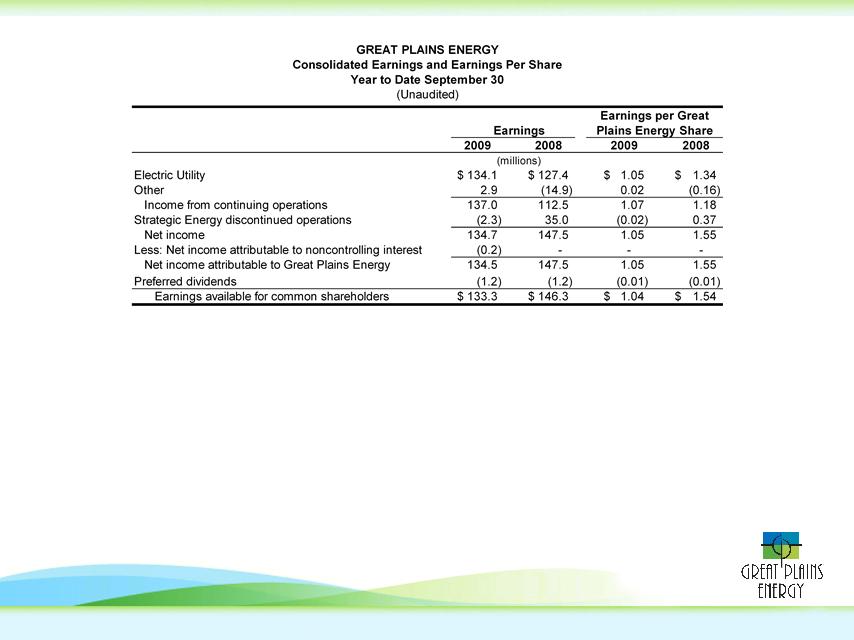

• Increased Electric

Utility segment earnings of $6.7 million mainly attributable to the inclusion of

GMO’s regulated utility

operations for the full period in 2009;

operations for the full period in 2009;

• Increased Other

segment earnings of $17.6 million including a $16.0 million tax benefit from an

audit settlement in

GMO’s non-utility operation;

GMO’s non-utility operation;

• Loss of $2.3

million in 2009 related to the discontinued operations of Strategic Energy

compared to earnings of $35.0

million for the first nine months of 2008.

million for the first nine months of 2008.

• Increase of 32.3

million average dilutive shares outstanding resulted in dilution of $0.36 per

share.

16

Earnings

Per Share

Earnings

(millions

except

where indicated)

where indicated)

Earnings

Drivers:

+ GMO utility

earnings increased $6.6 million

+ Decreased fuel and

purchase power expense of $51.0 million at KCP&L

+ Decreased income

taxes of $20.9 million at KCP&L

+ Increase in

KCP&L’s AFUDC equity of $8.3 million

- Reduced KCP&L

revenues of $58.5 million, including $52.4 million drop in

wholesale

- Increased

depreciation and amortization of $13.7 million including $3.8 million

of

additional

amortization at KCP&L

- Increased interest

expense, net of AFUDC, of $9.4 million at KCP&L

- Dilution of $0.36

per share caused by additional shares outstanding

$134.1

$1.34

$1.05

$127.4

Electric Utility

Year-to-Date Results

17

|

|

3Q

2009 Compared to 3Q 2008

|

YTD

2009 Compared to YTD 2008

|

||||

|

GPE

|

Customers

|

Use/Customer

|

Change

MWh Sales |

Customers

|

Use/Customer

|

Change

MWh Sales |

|

Residential

|

0.2%

|

-0.1%

|

0.1%

|

0.4%

|

-0.4%

|

0.0%

|

|

Commercial

|

-0.4%

|

-2.2%

|

-2.5%

|

0.1%

|

-0.5%

|

-0.4%

|

|

Industrial

|

||||||

|

Weighted

Avg. |

||||||

Retail

MWh Sales by Customer Class - Third Quarter 2009

Weather-Normalized

Retail MWh Sales and Customer Growth Rates

Note: Includes

GMO for full periods presented

Electric Utility

Segment

18

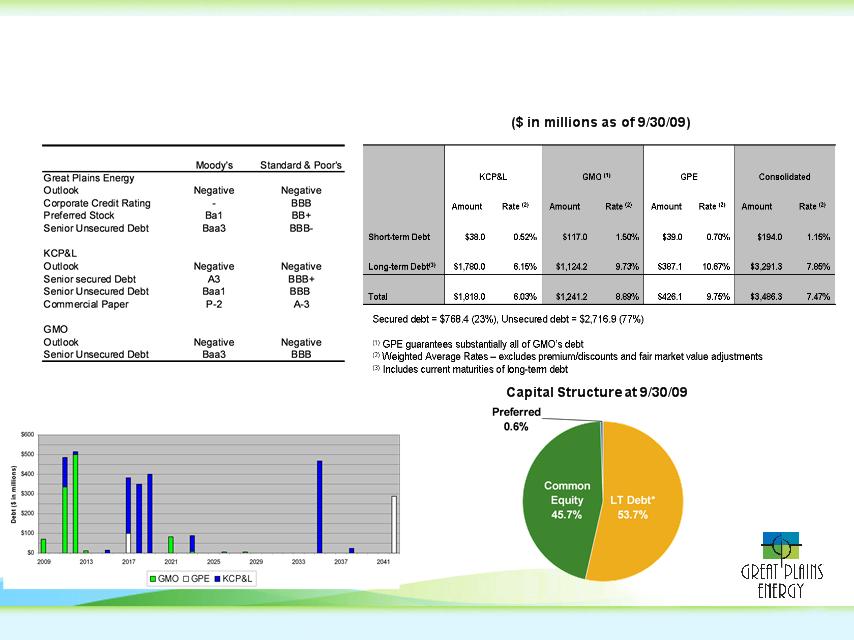

Great

Plains Energy Debt

Long-term

Debt Maturities

Credit

Ratings

*Includes current

maturities

Credit Ratings,

Debt, Capital Structure

19

• Strong Midwest

electric utilities focused on regulated operations in Missouri and

Kansas

• Diversified

customer base includes 820,000 residential, commercial, and industrial

customers

• ~6,000 Megawatts of

generation capacity

• Low-cost generation

mix - projected 76% coal, 17% nuclear (Wolf Creek) in 2009

100%

Regulated

Electric Utility

Operations Focus

Electric Utility

Operations Focus

• Growth and

stability in earnings driven by sizable regulated investments as part of

the

Comprehensive Energy Plan (“CEP”)

Comprehensive Energy Plan (“CEP”)

• Wind and

environmental retrofit components of CEP in place; Iatan 2 baseload coal

plant

targeted for completion in late summer 2010

targeted for completion in late summer 2010

• Anticipated growth

beyond 2010 driven by additional environmental capex and wind

Attractive

Platform

for Long-Term

Earnings Growth

for Long-Term

Earnings Growth

• Successful outcomes

in 2006, 2007 and 2008 rate cases in Missouri and Kansas

• Combined annual

rate increases from 2008 cases of $59mm in Kansas and $159mm in

Missouri;

new rates effective August 1st in Kansas and September 1st in Missouri

new rates effective August 1st in Kansas and September 1st in Missouri

Focused

Regulatory

Approach

Approach

• Cash flow and

earnings heavily driven by regulated operations and cost recovery

mechanisms

• Ample liquidity

currently available under $1.5bn credit facilities

• Sustainable

dividend and pay-out, right-sized to fund growth and to preserve

liquidity

• Committed to

maintaining current investment grade credit ratings

Stable

and

Improving Financial

Position

Improving Financial

Position

Strong Platform

for Long-Term Growth

Great Plains Energy

Kansas City

Securities Association Presentation

November 18, 2009