Attached files

| file | filename |

|---|---|

| 8-K - COPANO ENERGY FORM 8-K - Copano Energy, L.L.C. | form8-k.htm |

| EX-99.2 - COPANO ENERGY PRESS RELEASE - Copano Energy, L.L.C. | exhibit99-2.htm |

Copano Energy

Bank of America - Merrill Lynch 2009 Energy Conference

New York, NY

NASDAQ: CPNO

New York, NY

NASDAQ: CPNO

November 17, 2009

Copano Energy

2

Disclaimer

Statements made by representatives of Copano Energy, L.L.C. (“Copano”) during this

presentation will include “forward-looking statements,” as defined in the federal securities laws.

All statements that address activities, events or developments that Copano expects, believes or

anticipates will or may occur in the future are forward-looking statements. Underlying these

forward-looking statements are certain assumptions made by Copano’s management based on

their experience and perception of historical trends, current conditions, expected future

developments and other factors management believes are appropriate under the circumstances.

presentation will include “forward-looking statements,” as defined in the federal securities laws.

All statements that address activities, events or developments that Copano expects, believes or

anticipates will or may occur in the future are forward-looking statements. Underlying these

forward-looking statements are certain assumptions made by Copano’s management based on

their experience and perception of historical trends, current conditions, expected future

developments and other factors management believes are appropriate under the circumstances.

Whether actual results and developments in the future will conform to Copano’s expectations is

subject to a number of risks and uncertainties, many of which are beyond Copano’s control. If

one or more of these risks or uncertainties materializes, or if underlying assumptions prove

incorrect, then Copano’s actual results may differ materially from those implied or expressed by

forward-looking statements made during this presentation. These risks and uncertainties include

the volatility of prices and market demand for natural gas and natural gas liquids; Copano’s ability

to complete any pending acquisitions and integrate any acquired assets or operations; Copano’s

ability to continue to obtain new sources of natural gas supply; the ability of key producers to

continue to drill and successfully complete and attach new natural gas supplies; Copano’s ability

to retain key customers; the availability of local, intrastate and interstate transportation systems

and other facilities to transport natural gas and natural gas liquids; Copano’s ability to access

sources of liquidity when needed and to obtain additional financing, if necessary, on acceptable

terms; the effectiveness of Copano’s hedging program; unanticipated environmental or other

liability; general economic conditions; the effects of government regulations and policies; and

other financial, operational and legal risks and uncertainties detailed from time to time in the Risk

Factors sections of Copano’s annual and quarterly reports filed with the Securities and Exchange

Commission.

subject to a number of risks and uncertainties, many of which are beyond Copano’s control. If

one or more of these risks or uncertainties materializes, or if underlying assumptions prove

incorrect, then Copano’s actual results may differ materially from those implied or expressed by

forward-looking statements made during this presentation. These risks and uncertainties include

the volatility of prices and market demand for natural gas and natural gas liquids; Copano’s ability

to complete any pending acquisitions and integrate any acquired assets or operations; Copano’s

ability to continue to obtain new sources of natural gas supply; the ability of key producers to

continue to drill and successfully complete and attach new natural gas supplies; Copano’s ability

to retain key customers; the availability of local, intrastate and interstate transportation systems

and other facilities to transport natural gas and natural gas liquids; Copano’s ability to access

sources of liquidity when needed and to obtain additional financing, if necessary, on acceptable

terms; the effectiveness of Copano’s hedging program; unanticipated environmental or other

liability; general economic conditions; the effects of government regulations and policies; and

other financial, operational and legal risks and uncertainties detailed from time to time in the Risk

Factors sections of Copano’s annual and quarterly reports filed with the Securities and Exchange

Commission.

Copano undertakes no obligation to update any forward-looking statements, whether as a result

of new information or future events.

of new information or future events.

Copano Energy

3

Introduction to Copano

• Serves natural gas producers in three leading producing

regions

regions

• Founded in 1992 - built through more than 50 acquisitions

and major capital projects

and major capital projects

Texas

South Texas and

North Texas

Oklahoma

Central and Eastern Oklahoma

Rocky Mountains

Wyoming’s Powder River Basin

Copano Energy

4

Key Metrics

• Service throughput volumes approximate

2 Bcf per day of natural

gas(1)

gas(1)

• Approximately 6,700 miles of active pipelines

• 7 natural gas processing plants with over 1 Bcf/d of combined

processing capacity

processing capacity

• Equity market cap: $1.1 billion(2)

• Enterprise value: $1.9 billion(2)

• Copano has outperformed its peer group since its IPO with a total

return of 154%(2) compared to the Alerian MLP Total Return Index

(AMZX) total return of 61%(2) over the same period

return of 154%(2) compared to the Alerian MLP Total Return Index

(AMZX) total return of 61%(2) over the same period

(1) Based on 3Q09 results. Includes

unconsolidated affiliates.

(2) As of November 11, 2009.

Copano Energy

5

Copano’s LLC Structure

|

Characteristic |

Typical MLP |

Copano Energy |

Typical Corporation |

|

Non-Taxable Entity |

|

|

|

|

Tax Shield on Distributions |

|

|

|

|

Tax Reporting |

|

|

|

|

General Partner |

|

|

|

|

Incentive Distribution Rights |

|

|

|

|

Voting Rights |

|

|

|

Schedule K-1

Schedule K-1

Form 1099

Copano Energy

6

Agenda

Throughput

Volume Outlook

Volume Outlook

Commodity

Prices and

Margin

Sensitivities

Prices and

Margin

Sensitivities

Capital Access

Distribution Policy

and Outlook

and Outlook

Copano Energy

• Total service throughput volumes decreased 3% from 2Q09 to 3Q09

• Processed volumes decreased 2% from 2Q09 to 3Q09

Total Volume Trends

Note: Includes affiliates, net of intercompany volumes.

Copano Energy

8

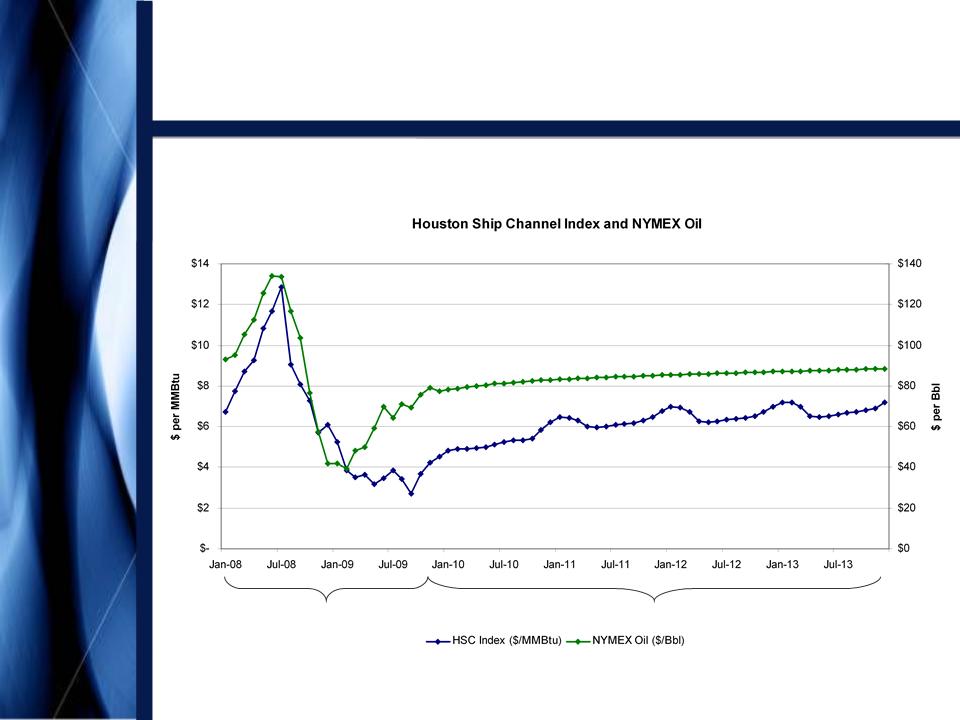

Actual Prices: 1/08 - 11/09

Forward Prices as of 11/9/09: 12/09 - 12/13

Oklahoma Natural Gas Price

Outlook

Outlook

Copano Energy

Oklahoma Rich Gas vs. Lean Gas

(1) Full value prior to deduction of Copano’s margin. Excludes

value of condensate and crude oil recovered by the

producer at the wellhead.

producer at the wellhead.

(2) Implied NGL prices are based on a three-year historical

regression analysis.

(3) Assumes 9 GPM gas with a Btu factor of 1.375 processed

at Copano’s cryogenic plant, and field fuel of 6.25%.

(4) Assumes unprocessed gas with a Btu factor of 1.0 and field

fuel of 6%.

9

Prices as of 11/9/09

Copano Energy

10

• Rich gas (primarily Hunton de-watering play)

– Drilling activity increasing due to current

commodity prices and

long-term price outlook

long-term price outlook

– 3 rigs running currently in the Hunton and

12 rigs in other rich

gas areas

gas areas

– High BTU gas, processing upgrade and low

geologic risk

enhance drilling economics, but activity remains subject to

market conditions

enhance drilling economics, but activity remains subject to

market conditions

– 4Q09 volumes are expected to be flat vs.

3Q09

• Lean gas (primarily Woodford Shale and Coalbed methane)

– Drilling activity increasing due to current

commodity prices and

long-term price outlook

long-term price outlook

– 5 rigs currently running

– 4Q09 volumes are expected to be slightly

down from 3Q09

due to lag between drilling and production

due to lag between drilling and production

Oklahoma Volume Outlook

Copano Energy

11

Actual Prices: 1/08 - 11/09

Forward Prices as of 11/9/09: 12/09 - 12/13

South Texas Natural Gas Price

Outlook

Outlook

Copano Energy

12

South Texas Volume Outlook

• Despite reduced rig counts, activity in the traditional supply area

continues

continues

• Pending acquisition of Transco McMullen lateral awaiting FERC

approval

approval

• 4Q09 volumes are expected to be slightly down from 3Q09

• On November 13, 2009, Copano announced a joint venture

with Kinder Morgan to provide gathering, transportation and

processing services to gas producers in the Eagle Ford Shale

with Kinder Morgan to provide gathering, transportation and

processing services to gas producers in the Eagle Ford Shale

Copano Energy

13

North Texas Volume Outlook

• Copano’s Saint Jo processing and treating plant placed in service

in September 2009

in September 2009

– Eliminates the need for third-party processing

– High efficiency and high recovery plant

• 7 rigs running in the area with 12 rigs anticipated in early 2010

• Drilling economics are driven by associated crude oil production

• Production from this area requires a full slate of midstream

services

services

• Based on drilling and fractionation schedules, plant inlet volumes

are expected to decrease slightly in early 2010 before ramping up

to anticipated levels by late 2010

are expected to decrease slightly in early 2010 before ramping up

to anticipated levels by late 2010

Copano Energy

14

Actual Prices: 1/08 - 11/09

Forward Prices as of 11/9/09: 12/09 - 12/13

Rocky Mountains Natural Gas Price

Outlook

Outlook

Copano Energy

15

Rocky Mountains Volume Outlook

• Development of extensive acreage dedication will be driven by drilling

economics and commodity prices

economics and commodity prices

• Timing of dewatering will also drive volume levels

• 4Q09 volumes are expected to be flat vs. 3Q09 due to previously

drilled wells

drilled wells

• For Bighorn, 130 previously drilled wells can be connected with

minimal capital expenditures

minimal capital expenditures

• An additional 70 drilled wells can be connected

with moderate capital

expenditures

expenditures

• On Fort Union, during the third and fourth quarters, roughly 150

MMcf/d was temporarily shut in by producers due to commodity prices;

by mid-October, volumes were back to near pre-shut-in levels

MMcf/d was temporarily shut in by producers due to commodity prices;

by mid-October, volumes were back to near pre-shut-in levels

Copano Energy

Rocky Mountains Takeaway

Capacity Outlook

Capacity Outlook

Source: Bentek Energy, LLC

(1) Historical and future prices as of 11/3/09. 11/9/09

spot: $3.38/Mcf

16

(1)

Copano Energy

17

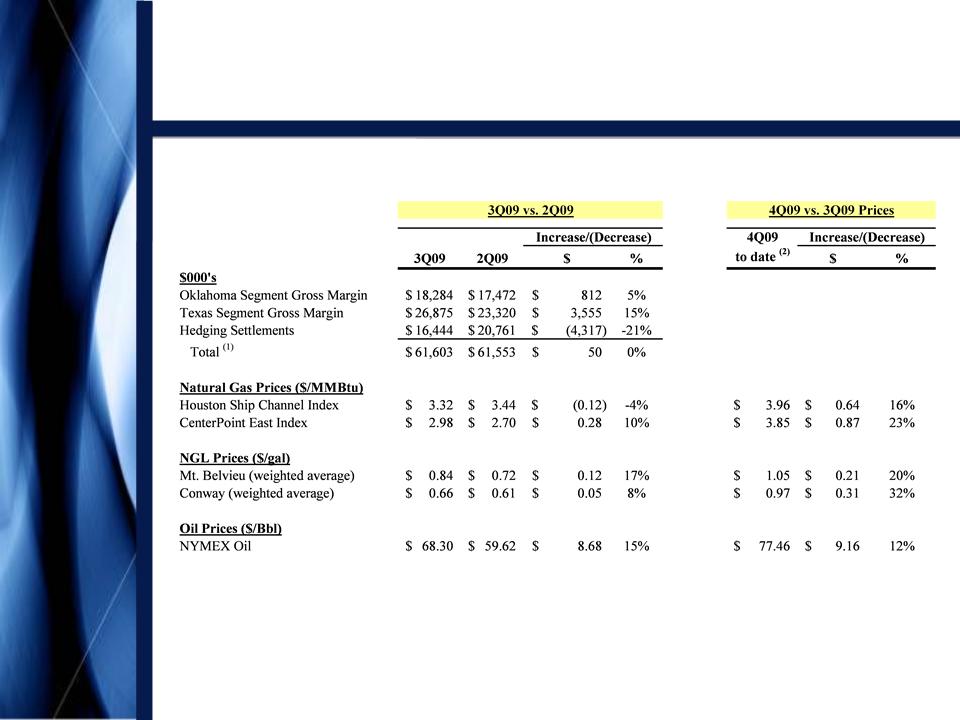

Commodity Prices and Margin

Sensitivities

Sensitivities

Commodity

Prices and

Margin

Sensitivities

Prices and

Margin

Sensitivities

Distribution Policy

and Outlook

and Outlook

Capital Access

Throughput

Volume Outlook

Volume Outlook

Copano Energy

Oklahoma Commodity Prices

18

Copano Energy

19

Oklahoma Commercial Update

• Third Quarter 2009

– Total service throughput volumes: 260,000 MMBtu/d(1)

– Unit margin: $0.76/MMBtu(2)

– Margins from approximately 75% of contract volumes

are directly

correlated with NGL prices

correlated with NGL prices

– Significant percentage of contract volumes (51%)

contain fee-based

components, including volumes subject to minimum margin provisions

components, including volumes subject to minimum margin provisions

• Operated in full processing mode for third and fourth quarter 2009

to date

to date

(1) Excludes 13,857 MMBtu/d

service throughput for Southern Dome, a majority-owned affiliate.

(2) Refers to Oklahoma segment gross margin ($18.3 million)

divided by Oklahoma service throughput volumes

(268,000 MMBtu/d) for the period. See Appendix for reconciliation of Oklahoma segment gross margin.

(268,000 MMBtu/d) for the period. See Appendix for reconciliation of Oklahoma segment gross margin.

Copano Energy

20

Texas Commodity Prices

Copano Energy

21

Texas Commercial Update

• Third Quarter 2009

– Total service throughput

volumes: 613,000 MMBtu/d(1)

– Unit margin: $0.48/MMBtu(2)

– Margins from approximately 85% of contract volumes

are directly

correlated with NGL prices

correlated with NGL prices

– Approximately 91% of contract volumes have fee-based

components,

including volumes subject to minimum margin provisions

including volumes subject to minimum margin provisions

• Operated in full processing mode for third and fourth quarter 2009

to date

to date

(1) Excludes 72,985 MMBtu/d

service throughput for Webb Duval, a majority-owned affiliate.

(2) Refers to Texas segment gross margin ($26.9 million) divided

by Texas service throughput volumes (613,000

MMBtu/d) for the period. See Appendix for reconciliation of Texas segment gross margin.

MMBtu/d) for the period. See Appendix for reconciliation of Texas segment gross margin.

Copano Energy

22

Texas Fractionation Strategy

• Capacity at NGL fractionation facilities along the Texas Gulf Coast

has become constrained

has become constrained

• For a portion of the second and third quarters of 2009, Copano

realized lower revenue for sales of mixed NGLs from the tailgate of

the Houston Central plant under a short term pricing arrangement

realized lower revenue for sales of mixed NGLs from the tailgate of

the Houston Central plant under a short term pricing arrangement

– In August, Copano entered into a new contract

to sell NGLs from

Houston Central at a higher price

Houston Central at a higher price

• Utilizing Houston Central’s fractionation unit and extensive tailgate

NGL pipelines, Copano plans to produce purity products by 2Q

2010

NGL pipelines, Copano plans to produce purity products by 2Q

2010

– Copano is expanding its de-ethanization capacity

in order to produce

purity ethane and propane

purity ethane and propane

– Iso-butane and normal butane will be sold as

purity products by tank

truck

truck

Copano Energy

23

Rocky Mountains Commercial

Update

Update

• Third Quarter 2009

– Total service throughput volumes:

• Consolidated affiliates (producer services):

157,000 MMBtu/d

• Unconsolidated affiliates:

§ Bighorn: 190,000 MMBtu/d

§ Fort Union: 762,000 MMBtu/d

• All Bighorn and Fort Union margins are fixed fee

• Virtually all producer services margins are fixed margin

Copano Energy

Combined Commodity-Sensitive Segment Margins

and Hedging Settlements

and Hedging Settlements

• Copano’s hedge portfolio supports cash flow stability based on

combined segment gross margins and cash hedging settlements

combined segment gross margins and cash hedging settlements

Copano Energy

25

Commodity-Related Margin

Sensitivities

Sensitivities

Note: Please see Appendix for definitions of processing modes and additional details.

• Matrix reflects 3Q09 wellhead and plant inlet volumes,

adjusted using Copano’s 2009 planning model

adjusted using Copano’s 2009 planning model

(1) Consists of Texas and Oklahoma Segment gross margins.

Copano Energy

26

Combined Commodity-Sensitive Segment Margins

and Hedging Settlements

and Hedging Settlements

(1) Does not include non-cash expenses included in Corporate and Other for

purposes of calculating Total Segment

Gross Margin. See Appendix for reconciliation of Total Segment Gross Margin.

Gross Margin. See Appendix for reconciliation of Total Segment Gross Margin.

(2) Reflects prices as of 11/9/09.

Copano Energy

27

Capital Access

Capital Access

Distribution Policy

and Outlook

and Outlook

Commodity

Prices and

Margin

Sensitivities

Prices and

Margin

Sensitivities

Throughput

Volume Outlook

Volume Outlook

Copano Energy

28

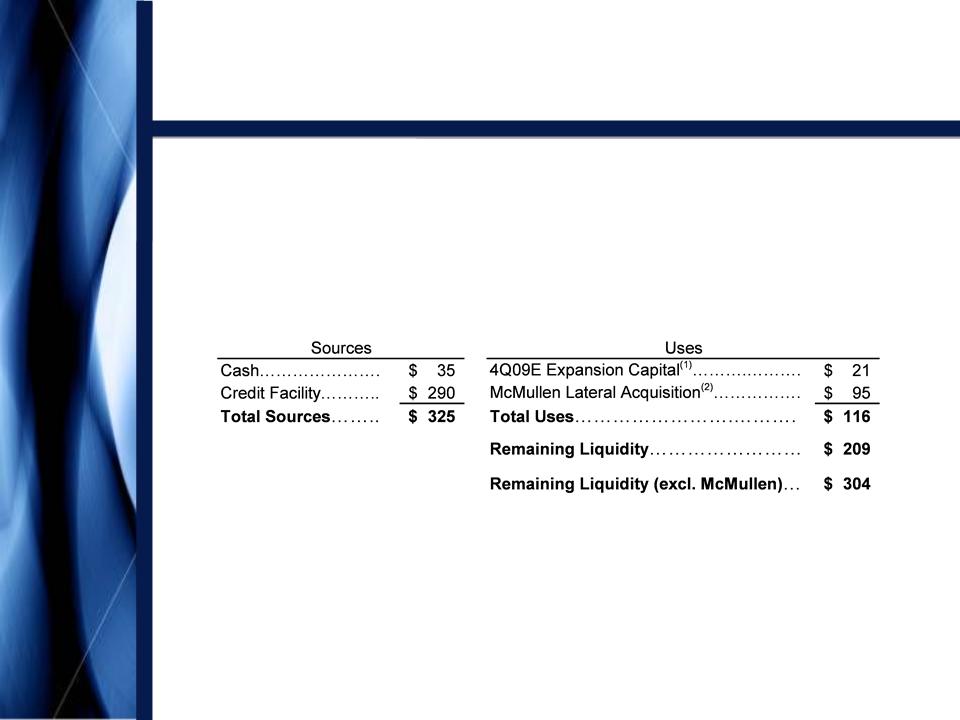

Capital Access

• Copano has no need to access capital markets to support

currently approved projects

currently approved projects

– At September 30, 2009:

($ in millions)

• Debt access available

• Equity access available privately

– Would only make sense for accretive transactions

or projects

(1) Includes Copano’s net share for unconsolidated affiliates. Does

not include future potential acquisitions.

(2) Includes integration costs. The

McMullen Lateral acquisition remains subject to FERC approval.

Copano Energy

29

Liquidity and Debt Facilities

• At September 30, 2009:

– Cash: $35 million

– $550 million revolving credit facility

• Approximately $290 million available

• Remaining term: approximately 3.1 years

• LIBOR + 175 bps

– $582 million senior notes

• $332,665,000 8 ⅛% due 2016

• $249,525,000 7 ¾% due 2018

• Weighted average rate: 7.96%

• Weighted average maturity: 7.4 years

Copano Energy

• Senior Secured Revolving Credit Facility

– $550 million facility with $100 million accordion

– Maintenance tests:

• 5x total debt to defined EBITDA(1) limitation

§ 3.99x at September 30, 2009

• Minimum required interest coverage 2.5x defined

EBITDA

§ 3.41x at September 30, 2009

• Defined EBITDA adds back hedge amortization

and other non-cash

expenses

expenses

– Following an acquisition, Copano may increase

total debt to defined

EBITDA limitation to 5.5x for three quarters

EBITDA limitation to 5.5x for three quarters

• Senior Notes

– Incurrence tests:

• Minimum defined EBITDA to interest test of 2.00x

for debt incurrence

• Minimum defined EBITDA to interest test of 1.75x

for restricted payments

• Defined EBITDA is similar to that for credit

facility

30

Key Debt Terms and Covenants

(1) See this Appendix for reconciliation of defined EBITDA, which is referred

to in our credit facility as

“Consolidated EBITDA.”

“Consolidated EBITDA.”

Copano Energy

31

Distribution Policy and Outlook

Distribution Policy

and Outlook

and Outlook

Capital Access

Commodity

Prices and

Margin

Sensitivities

Prices and

Margin

Sensitivities

Throughput

Volume Outlook

Volume Outlook

Copano Energy

32

Distribution Track Record

• On October 14, 2009, Copano announced a cash distribution for

the third quarter of 2009 of $0.575 per common unit

the third quarter of 2009 of $0.575 per common unit

(3)(4)

(5)

(1) All pre-1Q 2007 distributions are adjusted to reflect Copano’s 3/30/07

two-for-one unit split.

(2) Assumes generic MLP splits with 10%, 25% & 50% increases

in distributable cash flow to LP units resulting in

incremental 13%, 23% and 48% increases in the percentage of total distributable cash flow applicable to the GP.

incremental 13%, 23% and 48% increases in the percentage of total distributable cash flow applicable to the GP.

(3) Actual $0.10 distribution per unit was for the period

from November 15, 2004 through December 31, 2004.

(4) 4Q 2004 annualized.

(5) First nine months of 2009 annualized.

Copano Energy

33

Distribution Outlook

|

Driver |

Potential 2011 - 2012

Annual Incremental Total DCF Impact(1) ($ in millions) |

Comments and Risk Factors |

|

Forward Commodity Prices (3Q09 vs. 2012 forward curve(2) and without hedges) |

$47 |

• Reflects November 2009

forward curve(2) • Future market conditions |

|

North Texas(2) |

$35 - $45 |

• Resource play

• Drilling activity

• Product prices

• New suppliers |

|

Rocky Mountains |

$20 - $40 |

• Resource play

• Drilling activity

• Dewatering rates

• Fort Union expansion

• New projects |

|

South Texas expansion and integration projects, including Transco McMullen Lateral(2) |

$20 - $25 |

• FERC approval

• Product prices

• New attachments |

(1) Compared to 3Q09 annualized levels. See

Appendix for an explanation of how we calculate total distributable

cash flow.

cash flow.

(2) Reflects November 2009 forward price curves with regression-based

NGL prices.

Copano Energy

34

Distribution Outlook

|

Driver |

Potential 2011 - 2012

Annual Incremental Total DCF Impact(1) ($ in millions) |

Comments and Risk Factors |

|

Oklahoma Volumes(2) |

$15 - $20 |

• Resource play

• Drilling activity

• Product prices |

|

Future Acquisitions and Major Projects |

TBD |

• Opportunities

• Execution |

(1) Compared to 3Q09 annualized levels. See

Appendix for an explanation of how we calculate total distributable

cash flow.

cash flow.

(2) Reflects November 2009 forward price curves with regression-based

NGL prices.

Copano Energy

• On October 14, 2009, EnergyPoint Research, Inc. announced

results of its Natural Gas Midstream Services Survey

results of its Natural Gas Midstream Services Survey

• Copano placed first overall among 16 midstream energy

companies. Copano also rated first in many categories for

gathering and processing/treating

companies. Copano also rated first in many categories for

gathering and processing/treating

#1 in Customer Satisfaction

Copano Energy

• Current cash flow trends remain solid

• Forward market prices should drive increased drilling activity in our

cost-competitive operating regions

cost-competitive operating regions

• Copano’s liquidity and access to capital remain strong

• Copano continues to enjoy an abundant opportunity environment

36

Conclusions

Copano Energy

37

Appendix

Copano Energy

38

Oklahoma Assets

Appendix

Copano Energy

South Texas Assets

Appendix

(1) The McMullen Lateral acquisition remains subject to FERC approval.

(1)

Copano Energy

40

North Texas Assets

Appendix

Copano Energy

Rocky Mountains Assets

Appendix

Copano Energy

42

Processing Modes

• Full Recovery

• Ethane Rejection

• Conditioning Mode

→ Texas and Oklahoma - If the value of

recovered NGLs exceeds the fuel and gas

shrinkage costs of recovering NGLs

recovered NGLs exceeds the fuel and gas

shrinkage costs of recovering NGLs

→ Texas - If the value of recovered NGLs is less

than the fuel and gas shrinkage cost of

recovering NGLs (available at Houston

Central plant and at Saint Jo plant in North

Texas)

than the fuel and gas shrinkage cost of

recovering NGLs (available at Houston

Central plant and at Saint Jo plant in North

Texas)

→ Texas and Oklahoma - If the value of ethane

is less than the fuel and shrinkage costs to

recover ethane (in Oklahoma, ethane

rejection at Paden plant is limited by nitrogen

rejection facilities)

is less than the fuel and shrinkage costs to

recover ethane (in Oklahoma, ethane

rejection at Paden plant is limited by nitrogen

rejection facilities)

Appendix

Copano Energy

43

Oklahoma Contract Mix

• Third quarter 2009 contract mix(1)

(1) Source: Copano Energy internal financial planning models for consolidated

subsidiaries.

(2) Excludes 13,857 MMBtu/d service throughput for Southern

Dome, a majority-owned affiliate.

Copano Energy

44

Oklahoma Net Commodity

Exposure

Exposure

Note: See explanation of processing modes in this Appendix. Values reflect rounding.

(1) Source: Copano

Energy internal financial planning models for consolidated subsidiaries.

(2) Ethane rejection at Paden plant is limited by nitrogen

rejection facilities.

(3) Reflects impact of producer delivery point allocations,

offset by field condensate collection and stabilization.

Appendix

Copano Energy

45

Oklahoma Net Commodity

Exposure(1)

Exposure(1)

Appendix

Note: See explanation of processing modes in this Appendix.

(1) Source: Copano

Energy internal financial planning models for consolidated subsidiaries. Based on 3Q09 daily

wellhead/plant inlet volumes.

wellhead/plant inlet volumes.

Copano Energy

46

Oklahoma Commodity Price

Sensitivities

Sensitivities

• Oklahoma segment gross margins excluding hedge

settlements

settlements

– Matrix reflects 3Q09 volumes, adjusted using

Copano’s 2009

planning model

planning model

Appendix

Copano Energy

47

Texas Contract Mix

• Third quarter 2009 contract mix(1)

Appendix

(1) Source: Copano

Energy internal financial planning models for consolidated subsidiaries.

(2) Excludes 72,985 MMBtu/d service throughput for Webb Duval,

a majority-owned affiliate.

Copano Energy

48

Texas Net Commodity Exposure

Note: See explanation of processing modes in this Appendix.

(1) Source: Copano

Energy internal financial planning models for consolidated subsidiaries. Based on 3Q09 daily

wellhead/plant inlet volumes.

wellhead/plant inlet volumes.

(2) Fractionation at Houston Central processing plant permits

significant reductions in ethane recoveries in ethane

rejection mode and full ethane rejection in conditioning mode. To optimize profitability, plant operations can

also be adjusted to partial recovery mode.

rejection mode and full ethane rejection in conditioning mode. To optimize profitability, plant operations can

also be adjusted to partial recovery mode.

(3) At the Houston Central processing plant, pentanes+ may

be sold as condensate.

Appendix

Copano Energy

49

Texas Net Commodity Exposure(1)

Note: See explanation of processing modes in this Appendix.

(1) Source: Copano

Energy internal financial planning models for consolidated subsidiaries. Based on 3Q09 daily

wellhead/plant inlet volumes.

wellhead/plant inlet volumes.

Copano Energy

50

Texas Commodity Price

Sensitivities

Sensitivities

• Texas segment gross margins excluding hedge settlements

– Matrix reflects 3Q09 volumes and operating conditions,

adjusted using Copano’s 2009 planning model

adjusted using Copano’s 2009 planning model

Appendix

Copano Energy

51

Rocky Mountains Sensitivities

Appendix

Note: See this Appendix for reconciliation of Adjusted EBITDA. Values reflect rounding.

(1) Impact on Adjusted EBITDA based on Copano’s interest

in the unconsolidated affiliate.

• Third Quarter 2009

– Adjusted EBITDA volume sensitivity (positive

or negative impact)

• Consolidated (producer services): 10,000 MMBtu/d

= $28,000

• Unconsolidated affiliates:

§ Bighorn: 10,000 MMBtu/d = $249,000(1)

§ Fort Union: 10,000 MMBtu/d = $70,000(1)

Copano Energy

52

Hedging Impact

of Commodity Price Sensitivities

of Commodity Price Sensitivities

• Commodity hedging program supplements cash flow in 2009

through 2011 during less favorable commodity price periods

through 2011 during less favorable commodity price periods

Appendix

Note: For calendar 2012, Copano currently has WTI crude puts of 300 barrels per day with a strike price of $79/Bbl.

Copano Energy

53

Hedging Impact

• Fourth Quarter 2009 NGLs Hedge Settlement Matrix

Note: All hedge instruments are reported in Copano’s SEC filings. Hedge settlements are based on monthly average

Mt. Belvieu NGL and NYMEX WTI prices. Positive amounts reflect payments from hedge counterparties under

swap and put option instruments. Negative amounts reflect payments to hedge counterparties under swap

instruments.

Mt. Belvieu NGL and NYMEX WTI prices. Positive amounts reflect payments from hedge counterparties under

swap and put option instruments. Negative amounts reflect payments to hedge counterparties under swap

instruments.

Appendix

Copano Energy

54

Hedging Impact

• 2010 NGLs Hedge Settlement Matrix

Note: All hedge instruments are reported in Copano’s SEC filings. Hedge settlements are based on monthly average

Mt. Belvieu NGL and NYMEX WTI prices. Positive amounts reflect payments from hedge counterparties under

swap and put option instruments. Negative amounts reflect payments to hedge counterparties under swap

instruments.

Mt. Belvieu NGL and NYMEX WTI prices. Positive amounts reflect payments from hedge counterparties under

swap and put option instruments. Negative amounts reflect payments to hedge counterparties under swap

instruments.

Appendix

Copano Energy

55

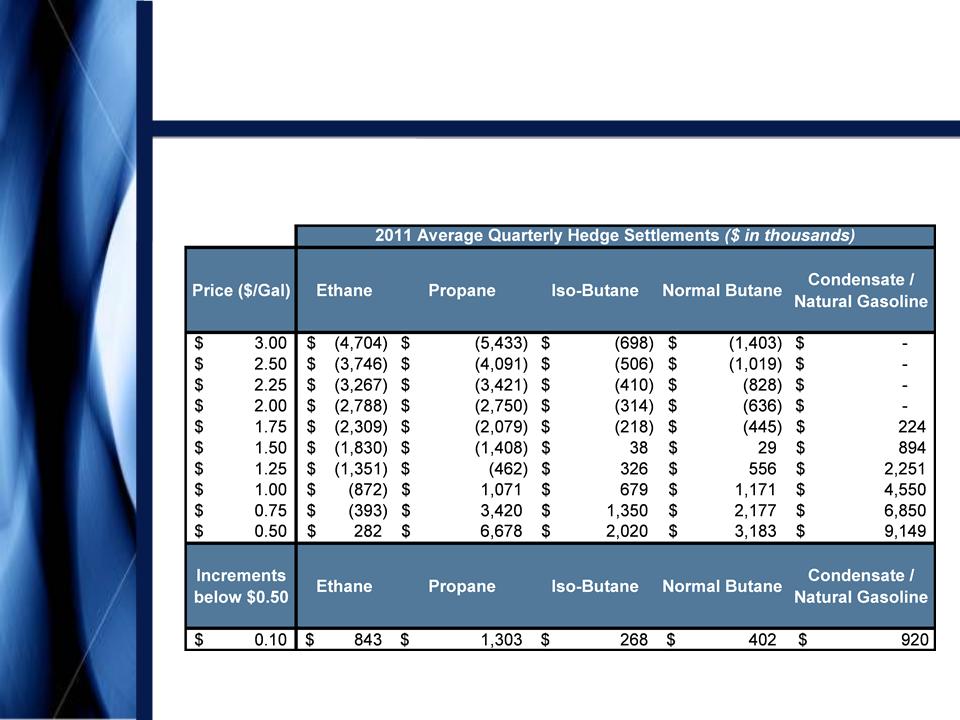

Hedging Impact

• 2011 NGLs Hedge Settlement Matrix

Note: All hedge instruments are reported in Copano’s SEC filings. Hedge settlements are based on monthly average

Mt. Belvieu NGL and NYMEX WTI prices. Positive amounts reflect payments from hedge counterparties under

swap and put option instruments. Negative amounts reflect payments to hedge counterparties under swap

instruments.

Mt. Belvieu NGL and NYMEX WTI prices. Positive amounts reflect payments from hedge counterparties under

swap and put option instruments. Negative amounts reflect payments to hedge counterparties under swap

instruments.

Appendix

Copano Energy

56

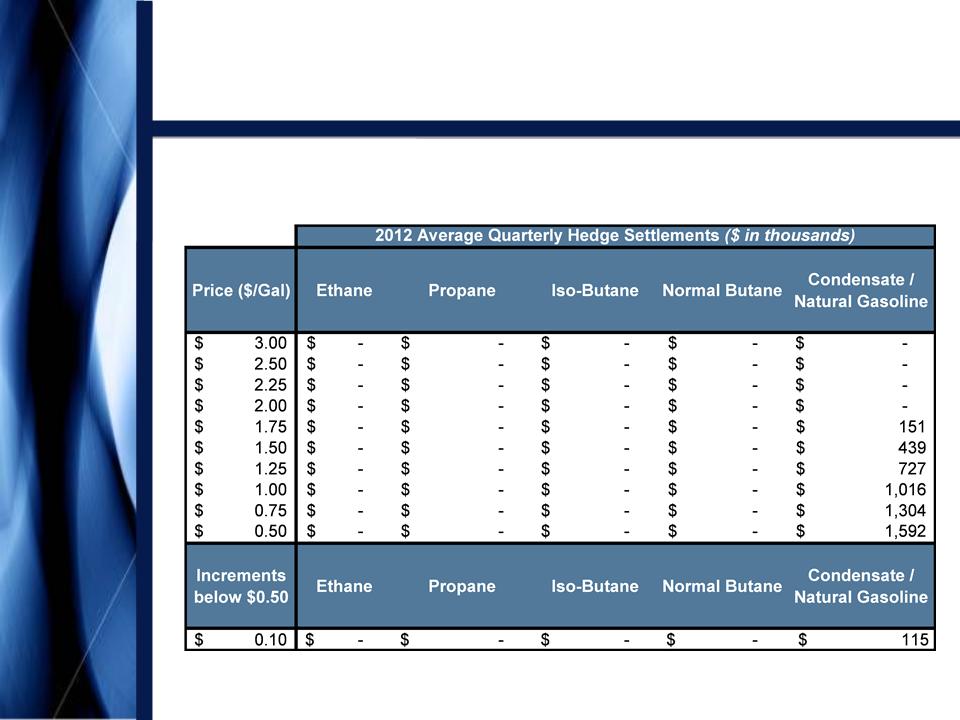

Hedging Impact

• 2012 NGLs Hedge Settlement Matrix

Note: All hedge instruments are reported in Copano’s SEC filings. Hedge settlements are based on monthly average

Mt. Belvieu NGL and NYMEX WTI prices. Positive amounts reflect payments from hedge counterparties under

swap and put option instruments. Negative amounts reflect payments to hedge counterparties under swap

instruments.

Mt. Belvieu NGL and NYMEX WTI prices. Positive amounts reflect payments from hedge counterparties under

swap and put option instruments. Negative amounts reflect payments to hedge counterparties under swap

instruments.

Appendix

Copano Energy

57

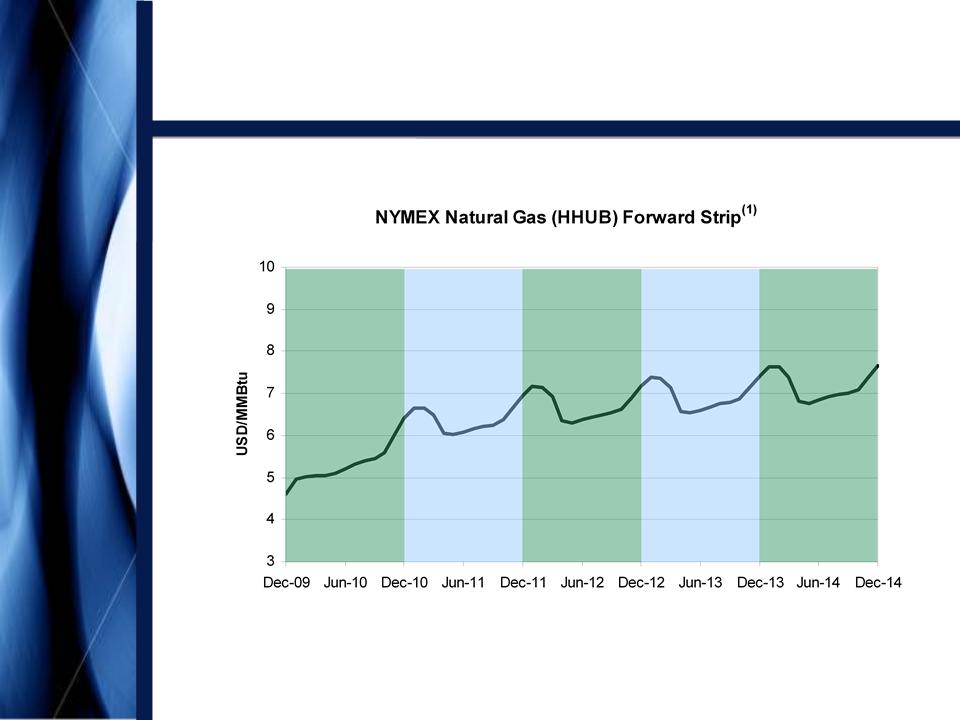

Hedging Impact

• 2009 - 2011 Natural Gas Hedge Settlement Matrix

Note: All hedge instruments are reported in Copano’s SEC filings. Hedge settlements are based on first of the month

Houston Ship Channel and CenterPoint East natural gas prices. Positive amounts reflect payments from hedge

counterparties under call and put option instruments.

Houston Ship Channel and CenterPoint East natural gas prices. Positive amounts reflect payments from hedge

counterparties under call and put option instruments.

Appendix

Copano Energy

58

• At September 30, 2009:

– Moody’s

• Corporate Family Rating: Ba3

• Senior Unsecured Rating: B1

• Outlook: Stable

– Standard & Poor’s

• Corporate Credit Rating: BB-

• Senior Unsecured Rating: B+

• Outlook: Stable

Credit Ratings

Copano Energy

59

Limited Liability Company Agreement

• Distributions based on “Available Cash”

– Cash on hand at the end of a quarter less reserves

established

by the Board

by the Board

– Board may increase or decrease reserves quarterly

• Since IPO and as of September 30, 2009:

– Initial available cash and reserve at IPO: $20

million

– Cumulative cash from operations: $476 million

– Cumulative distributions: $376 million

– Cumulative reserves established by the Board:

$150 million

Appendix

Copano Energy

60

Oil Price Trends

(1) As of November 9, 2009.

Appendix

Copano Energy

61

Natural Gas Price Trends

(1) As of November 9, 2009.

Appendix

Copano Energy

62

Reconciliation of Non-GAAP

Financial Measures

Financial Measures

Segment Gross Margin and Total Segment Gross Margin

• We define segment gross margin, with respect to a Copano operating segment, as segment revenue less cost of sales. Cost

of sales includes the following:

cost of natural gas and NGLs purchased from third parties, cost of natural gas and NGLs purchased from affiliates, cost of crude oil purchased from third

parties, costs paid to third parties to transport volumes and costs paid to affiliates to transport volumes. Total segment gross margin is the sum of the

operating segment gross margins and the results of Copano’s risk management activities that are included in Corporate and other. We view total segment

gross margin as an important performance measure of the core profitability of our operations. Segment gross margin allows Copano’s senior management

to compare volume and price performance of the segments and to more easily identify operational or other issues within a segment. The GAAP measure

most directly comparable to total segment gross margin is operating income.

cost of natural gas and NGLs purchased from third parties, cost of natural gas and NGLs purchased from affiliates, cost of crude oil purchased from third

parties, costs paid to third parties to transport volumes and costs paid to affiliates to transport volumes. Total segment gross margin is the sum of the

operating segment gross margins and the results of Copano’s risk management activities that are included in Corporate and other. We view total segment

gross margin as an important performance measure of the core profitability of our operations. Segment gross margin allows Copano’s senior management

to compare volume and price performance of the segments and to more easily identify operational or other issues within a segment. The GAAP measure

most directly comparable to total segment gross margin is operating income.

Appendix

Copano Energy

63

Reconciliation of Non-GAAP

Financial Measures

Financial Measures

Adjusted EBITDA

• We define EBITDA as net income (loss) plus interest expense, provision for income taxes and depreciation and amortization expense. Because

a portion of

our net income (loss) is attributable to equity in earnings (loss) from our equity investees (which include Bighorn, Fort Union, Webb Duval and Southern

Dome), our management also calculates Adjusted EBITDA to reflect the depreciation and amortization expense embedded in equity in earnings (loss) from

unconsolidated affiliates. Specifically, our management determines Adjusted EBITDA by adding to EBITDA (i) the amortization expense attributable to the

difference between our carried investment in each unconsolidated affiliate and the underlying equity in its net assets, (ii) the portion of each unconsolidated

affiliate’s depreciation and amortization expense, which is proportional to our ownership interest in that unconsolidated affiliate and (iii) the portion of each

unconsolidated affiliate’s interest and other financing costs, which is proportional to our ownership interest in that unconsolidated affiliate.

our net income (loss) is attributable to equity in earnings (loss) from our equity investees (which include Bighorn, Fort Union, Webb Duval and Southern

Dome), our management also calculates Adjusted EBITDA to reflect the depreciation and amortization expense embedded in equity in earnings (loss) from

unconsolidated affiliates. Specifically, our management determines Adjusted EBITDA by adding to EBITDA (i) the amortization expense attributable to the

difference between our carried investment in each unconsolidated affiliate and the underlying equity in its net assets, (ii) the portion of each unconsolidated

affiliate’s depreciation and amortization expense, which is proportional to our ownership interest in that unconsolidated affiliate and (iii) the portion of each

unconsolidated affiliate’s interest and other financing costs, which is proportional to our ownership interest in that unconsolidated affiliate.

• External users of our financial statements such as investors, commercial banks and research analysts use EBITDA or Adjusted EBITDA, and our

management uses Adjusted EBITDA, as a supplemental financial measure to assess:

management uses Adjusted EBITDA, as a supplemental financial measure to assess:

– The financial performance of our assets without

regard to financing methods, capital structure or historical cost basis;

– The ability of our assets to generate cash sufficient

to pay interest costs and support our indebtedness;

– Our operating performance and return on capital

as compared to those of other companies in the midstream energy sector, without regard to

financing or capital structure; and

financing or capital structure; and

– The viability of acquisitions and capital expenditure

projects and the overall rates of return on alternative investment opportunities.

• The following table presents a reconciliation of the portion of our EBITDA and Adjusted EBITDA attributable to each of our segments to the

GAAP financial

measure of net income (loss):

measure of net income (loss):

Appendix

Copano Energy

64

Reconciliation of Non-GAAP

Financial Measures

Financial Measures

Consolidated EBITDA

§ EBITDA is also a financial measure that, with negotiated pro forma adjustments relating to acquisitions completed during the

period, is reported to our lenders as Consolidated EBITDA and is used to compute our financial covenants under our senior

secured revolving credit facility.

period, is reported to our lenders as Consolidated EBITDA and is used to compute our financial covenants under our senior

secured revolving credit facility.

§ The following table presents a reconciliation of the non-GAAP financial measure of Consolidated EBITDA to the GAAP

financial measure of net income (loss):

financial measure of net income (loss):

Appendix

Copano Energy

65

Definitions of Non-GAAP

Financial Measures

Financial Measures

Total Distributable Cash Flow

§ We define total distributable cash flow as net income plus: (i) depreciation, amortization and impairment expense (including

amortization expense relating to the option component of our risk management portfolio); (ii) cash distributions received from

investments in unconsolidated affiliates and equity losses from such unconsolidated affiliates; (iii) provision for deferred

income taxes; (iv) the subtraction of maintenance capital expenditures; (v) the subtraction of equity in earnings from

unconsolidated affiliates and (vi) the addition of losses or subtraction of gains relating to other miscellaneous non-cash

amounts affecting net income for the period, such as equity-based compensation, mark-to-market changes in derivative

instruments, and our line fill contributions to third-party pipelines and gas imbalances. Maintenance capital expenditures are

capital expenditures employed to replace partially or fully depreciated assets to maintain the existing operating capacity of

our assets and to extend their useful lives, or other capital expenditures that are incurred in maintaining existing system

volumes and related cash flows.

amortization expense relating to the option component of our risk management portfolio); (ii) cash distributions received from

investments in unconsolidated affiliates and equity losses from such unconsolidated affiliates; (iii) provision for deferred

income taxes; (iv) the subtraction of maintenance capital expenditures; (v) the subtraction of equity in earnings from

unconsolidated affiliates and (vi) the addition of losses or subtraction of gains relating to other miscellaneous non-cash

amounts affecting net income for the period, such as equity-based compensation, mark-to-market changes in derivative

instruments, and our line fill contributions to third-party pipelines and gas imbalances. Maintenance capital expenditures are

capital expenditures employed to replace partially or fully depreciated assets to maintain the existing operating capacity of

our assets and to extend their useful lives, or other capital expenditures that are incurred in maintaining existing system

volumes and related cash flows.

§ Total distributable cash flow is a significant performance metric used by senior management to compare basic cash flows

generated by us (prior to the establishment of any retained cash reserves by our Board of Directors) to the cash distributions

we expect to pay our unitholders, and it also correlates with the metrics of our existing debt covenants. Using total

distributable cash flow, management can quickly compute the coverage ratio of estimated cash flows to planned cash

distributions. Total distributable cash flow is also an important non-GAAP financial measure for our unitholders because it

serves as an indicator of our success in providing a cash return on investment — specifically, whether or not we are

generating cash flow at a level that can sustain or support an increase in our quarterly distribution rates. Total distributable

cash flow is also used by industry analysts with respect to publicly traded partnerships and limited liability companies

because the market value of such entities’ equity securities is significantly influenced by the amount of cash they can

distribute to unitholders.

generated by us (prior to the establishment of any retained cash reserves by our Board of Directors) to the cash distributions

we expect to pay our unitholders, and it also correlates with the metrics of our existing debt covenants. Using total

distributable cash flow, management can quickly compute the coverage ratio of estimated cash flows to planned cash

distributions. Total distributable cash flow is also an important non-GAAP financial measure for our unitholders because it

serves as an indicator of our success in providing a cash return on investment — specifically, whether or not we are

generating cash flow at a level that can sustain or support an increase in our quarterly distribution rates. Total distributable

cash flow is also used by industry analysts with respect to publicly traded partnerships and limited liability companies

because the market value of such entities’ equity securities is significantly influenced by the amount of cash they can

distribute to unitholders.

Appendix

Copano Energy

NASDAQ: CPNO

November 2009