Attached files

| file | filename |

|---|---|

| EX-31.1 - Puda Coal, Inc. | v165917_ex31-1.htm |

| EX-32 - Puda Coal, Inc. | v165917_ex32-1.htm |

| EX-31.2 - Puda Coal, Inc. | v165917_ex31-2.htm |

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

l0-Q

(Mark

One)

|

x

|

QUARTERLY

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

quarterly period ended September 30, 2009

|

¨

|

TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE

ACT

|

For the

transition period from __________to _________

Commission

file number 333-85306

PUDA

COAL, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

65-1129912

|

|

|

(State or other jurisdiction of incorporation or

organization)

|

(IRS Employer Identification No.)

|

|

426 Xuefu Street, Taiyuan, Shanxi Province, The

People’s Republic of China

|

030006

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

|

011

86 351 228 1302

|

|

(Registrant’s

telephone number, including area

code)

|

Indicate by check mark whether the

registrant (1) filed all reports required to be filed by Section 13 or 15(d) of

the Exchange Act during the past 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days. Yes x No ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definition of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

Large

accelerated filer ¨ Accelerated

filer ¨

Non-accelerated

filer x (Do

not check if a smaller reporting company) Smaller reporting

company ¨

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes ¨ No

x

State the

number of shares outstanding of each of the issuer’s classes of common equity,

as of the latest practicable date, November 10, 2009, 15,637,484 shares of

common stock.

TABLE

OF CONTENTS

|

Page

|

|

|

PART

I. FINANCIAL INFORMATION

|

|

|

Item

1. Financial Statements

|

|

|

Consolidated

Balance Sheets as of September 30, 2009 (unaudited) and December 31,

2008

|

3-4

|

|

Unaudited

Consolidated Statements of Operations for the three and nine months

ended September 30, 2009 and 2008

|

5

|

|

Unaudited

Consolidated Statements of Cash Flows for the nine months ended September

30, 2009 and 2008

|

6

|

|

Notes

to Unaudited Consolidated Financial Statements

|

7-30

|

|

Item

2. Management’s Discussion and Analysis of Financial Condition and

Results of Operations

|

31-36

|

|

Item

3. Quantitative and Qualitative Disclosures about Market

Risk

|

36-37

|

|

Item

4T. Controls and Procedures

|

37

|

|

PART

II. OTHER INFORMATION

|

|

|

Item

1A. Risk Factors

|

39

|

|

Item

6. Exhibits

|

38

|

|

Signatures

|

39

|

|

Certifications

|

|

2

PUDA

COAL, INC.

CONSOLIDATED

BALANCE SHEETS

September

30, 2009 and December 31, 2008

(In

thousands of United States dollars)

|

Note(s)

|

September 30,

2009

|

December 31,

2008

|

||||||||||

|

(Unaudited)

|

||||||||||||

|

ASSETS

|

||||||||||||

|

CURRENT

ASSETS

|

||||||||||||

|

Cash

and cash equivalents

|

22 | $ | 17,880 | $ | 39,108 | |||||||

|

Accounts

receivable, net

|

3 | 29,791 | 14,645 | |||||||||

|

Other

receivables

|

- | 7 | ||||||||||

|

Advances

to suppliers

|

||||||||||||

|

-

Related parties

|

4 | 835 | 879 | |||||||||

|

-

Third parties

|

2,996 | 5,635 | ||||||||||

|

Prepayment

|

5 | 8,790 | - | |||||||||

|

Inventories

|

6 | 27,952 | 21,589 | |||||||||

|

Total

current assets

|

88,244 | 81,863 | ||||||||||

|

PROPERTY,

PLANT AND EQUIPMENT, NET

|

7 | 12,112 | 13,370 | |||||||||

|

INTANGIBLE

ASSETS, NET

|

8 | 3,334 | 3,399 | |||||||||

|

TOTAL

ASSETS

|

$ | 103,690 | $ | 98,632 | ||||||||

|

LIABILITIES

AND STOCKHOLDERS’ EQUITY

|

||||||||||||

|

CURRENT

LIABILITIES

|

||||||||||||

|

Current

portion of long-term debt

|

||||||||||||

|

-

Related party

|

4,9 | $ | 1,300 | $ | 1,300 | |||||||

|

Accounts

payable

|

5,432 | 4,272 | ||||||||||

|

Other

payables

|

||||||||||||

|

-

Related parties

|

4 | 1,031 | 1,030 | |||||||||

|

-

Third parties

|

2,462 | 2,714 | ||||||||||

|

Accrued

expenses

|

1,752 | 1,991 | ||||||||||

|

Income

taxes payable

|

1,112 | 1,319 | ||||||||||

|

VAT

payable

|

525 | 1,726 | ||||||||||

|

Distribution

payable

|

||||||||||||

|

-

Related party

|

4 | 117 | 117 | |||||||||

|

Total

current liabilities

|

13,731 | 14,469 | ||||||||||

|

LONG-TERM

LIABILITIES

|

||||||||||||

|

Long-term

debt

|

||||||||||||

|

-

Related party

|

4, 9 | 6,825 | 7,800 | |||||||||

|

Derivative

warrants

|

10, 23 | 7,571 | 4,086 | |||||||||

|

Total

long-term liabilities

|

14,396 | 11,886 | ||||||||||

3

PUDA

COAL, INC.

CONSOLIDATED

BALANCE SHEETS (Continued)

September

30, 2009 and December 31, 2008

(In

thousands of United States dollars)

|

Note(s)

|

September 30,

2009

|

December 31,

2008

|

||||||||||

|

(Unaudited)

|

||||||||||||

|

COMMITMENTS

AND CONTINGENCIES

|

11 | |||||||||||

|

STOCKHOLDERS’

EQUITY

|

||||||||||||

|

Preferred

stock, authorized 5,000,000 shares, par value $0.01, issued and

outstanding None

|

- | - | ||||||||||

|

Common

stock, authorized 150,000,000 shares, par value $0.001, issued and

outstanding 15,400,308 (2008: 15,333,680)

|

12 | 15 | 15 | |||||||||

|

Paid-in

capital

|

12 | 31,947 | 31,647 | |||||||||

|

Statutory

surplus reserve fund

|

1,366 | 1,366 | ||||||||||

|

Retained

earnings

|

34,976 | 31,752 | ||||||||||

|

Accumulated

other comprehensive income

|

7,259 | 7,497 | ||||||||||

|

Total

stockholders’ equity

|

75,563 | 72,277 | ||||||||||

|

TOTAL

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

$ | 103,690 | $ | 98,632 | ||||||||

The

accompanying notes are an integral part of these unaudited consolidated

financial statements.

4

PUDA

COAL, INC.

UNAUDITED

CONSOLIDATED STATEMENTS OF OPERATIONS

For

the three and nine months ended September 30, 2009 and 2008

(In

thousands of United States dollars, except per share data)

|

Note(s)

|

Three months

ended

September

30, 2009

|

Three months

ended

September

30, 2008

|

Nine months

ended

September

30, 2009

|

Nine months

ended

September

30, 2008

|

||||||||||||||||

|

NET

REVENUE

|

$ | 56,106 | $ | 74,051 | 153,817 | $ | 177,837 | |||||||||||||

|

COST

OF REVENUE

|

50,731 | 63,861 | 140,969 | 153,497 | ||||||||||||||||

|

GROSS

PROFIT

|

5,375 | 10,190 | 12,848 | 24,340 | ||||||||||||||||

|

OPERATING

EXPENSES

|

||||||||||||||||||||

|

Selling

expenses

|

655 | 783 | 1,765 | 2,395 | ||||||||||||||||

|

General

and administrative expenses

|

682 | 422 | 1,427 | 1,525 | ||||||||||||||||

|

TOTAL

OPERATING EXPENSES

|

1,337 | 1,205 | 3,192 | 3,920 | ||||||||||||||||

|

INCOME

FROM OPERATIONS

|

4,038 | 8,985 | 9,656 | 20,420 | ||||||||||||||||

|

INTEREST

INCOME

|

16 | 31 | 72 | 84 | ||||||||||||||||

|

INTEREST

EXPENSE

|

13 | (127 | ) | (191 | ) | (396 | ) | (588 | ) | |||||||||||

|

DEBT

FINANCING COSTS

|

14 | - | (118 | ) | - | (740 | ) | |||||||||||||

|

DERIVATIVE

UNREALIZED FAIR VALUE (LOSS)/GAIN

|

15 | (3,436 | ) | 121 | (3,549 | ) | 341 | |||||||||||||

|

OTHER

EXPENSE

|

16 | - | - | - | (719 | ) | ||||||||||||||

|

INCOME

BEFORE INCOME TAXES

|

491 | 8,828 | 5,783 | 18,798 | ||||||||||||||||

|

INCOME

TAXES

|

17 | (1,112 | ) | (2,289 | ) | (2,559 | ) | (5,101 | ) | |||||||||||

|

NET

(LOSS)/INCOME

|

(621 | ) | 6,539 | 3,224 | 13,697 | |||||||||||||||

|

OTHER

COMPREHENSIVE INCOME

|

||||||||||||||||||||

|

Foreign

currency translation adjustment

|

(42 | ) | 483 | (238 | ) | 3,943 | ||||||||||||||

|

COMPREHENSIVE

(LOSS)/INCOME

|

$ | (663 | ) | $ | 7,022 | $ | 2,986 | $ | 17,640 | |||||||||||

|

EARNINGS

PER SHARE - BASIC

|

$ | (0.04 | ) | $ | 0.43 | $ | 0.21 | $ | 0.91 | |||||||||||

|

-

DILUTED

|

$ | (0.04 | ) | $ | 0.43 | $ | 0.21 | $ | 0.91 | |||||||||||

|

WEIGHTED

AVERAGE NUMBER OF SHARES OUTSTANDING - BASIC

|

18 | 15,387,110 | 15,327,393 | 15,360,301 | 15,133,857 | |||||||||||||||

|

-

DILUTED

|

18 | 15,387,110 | 15,327,393 | 15,386,790 | 15,133,857 | |||||||||||||||

The

accompanying notes are an integral part of these unaudited consolidated

financial statements.

5

PUDA

COAL, INC.

UNAUDITED

CONSOLIDATED STATEMENTS OF CASH FLOWS

For

the nine months ended September 30, 2009 and 2008

(In

thousands of United States dollars)

|

Nine months ended September 30,

|

||||||||||

|

Notes

|

2009

|

2008

|

||||||||

|

CASH

FLOWS FROM OPERATING ACTIVITIES:

|

||||||||||

|

Net

income

|

$ | 3,224 | $ | 13,697 | ||||||

|

Adjustments

to reconcile net income to net cash provided by operating

activities

|

||||||||||

|

Amortization

of land-use rights

|

65 | 65 | ||||||||

|

Depreciation

|

1,258 | 1,244 | ||||||||

|

Allowance

for doubtful debts

|

46 | 6 | ||||||||

|

Amortization

of discount on convertible notes and warrants

|

- | 361 | ||||||||

|

Derivative

unrealized fair value loss/(gain)

|

3,549 | (341 | ) | |||||||

|

Stock

compensation

|

73 | 29 | ||||||||

|

Changes

in operating assets and liabilities:

|

||||||||||

|

Increase

in accounts receivable

|

(15,187 | ) | (1,895 | ) | ||||||

|

Decrease

in other receivables

|

7 | 8 | ||||||||

|

Decrease/(increase)

in advances to suppliers

|

2,677 | (6,081 | ) | |||||||

|

(Increase)/decrease

in inventories

|

(6,370 | ) | 13,088 | |||||||

|

Increase

in accounts payable

|

1,161 | 2,107 | ||||||||

|

(Decrease)/increase

in accrued expenses

|

(225 | ) | 221 | |||||||

|

Decrease

in other payables

|

(248 | ) | (562 | ) | ||||||

|

Decrease

in income tax payable

|

(206 | ) | (85 | ) | ||||||

|

(Decrease)/increase

in VAT payable

|

(1,199 | ) | 318 | |||||||

|

Increase

in penalty payable

|

- | 379 | ||||||||

|

Net

cash (used in)/provided by operating activities

|

(11,375 | ) | 22,559 | |||||||

|

CASH

FLOWS FROM INVESTING ACTIVITIES:

|

||||||||||

|

Prepayment

for equity purchase of coal mine

|

(8,782 | ) | - | |||||||

|

Purchase

of property, plant and equipment

|

- | (2 | ) | |||||||

|

Net

cash used in investing activities

|

(8,782 | ) | (2 | ) | ||||||

|

CASH

FLOWS FROM FINANCING ACTIVITIES:

|

||||||||||

|

Exercise

of note warrants

|

150 | - | ||||||||

|

Repayment

of long-term debt

|

(975 | ) | (975 | ) | ||||||

|

Net

cash used in financing activities

|

(825 | ) | (975 | ) | ||||||

|

Effect

of exchange rate changes on cash

|

(246 | ) | 1,466 | |||||||

|

Net

(decease)/increase in cash and cash equivalents

|

(21,228 | ) | 23,048 | |||||||

|

Cash

and cash equivalents at beginning of period

|

39,108 | 16,381 | ||||||||

|

Cash

and cash equivalents at end of period

|

$ | 17,880 | $ | 39,429 | ||||||

|

Supplementary

cash flow information

|

19

|

|||||||||

The

accompanying notes are an integral part of these unaudited consolidated

financial statements.

6

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

1.

The Company

Puda

Coal, Inc. (formerly Purezza Group, Inc.)(the “Company" or “Puda”) is a

corporation organized under Delaware Law and headquartered in Shanxi Province,

China. The Company was originally incorporated on August 9, 2001 in

Florida.

On July

15, 2005, the Company acquired all the outstanding capital stock and ownership

interests of Puda Investment Holding Limited (“BVI”) and BVI became a

wholly-owned subsidiary of the Company. In exchange, Puda issued to

the BVI members 1,000,000 shares of its Series A convertible preferred stock,

par value $0.01 per share, of the Company, which are convertible into

678,500,000 shares of Puda’s common stock. The purchase agreement provided that

the preferred shares would immediately and automatically be converted into

shares of Puda’s common stock (the “Mandatory Conversion”), following an

increase in the number of authorized shares of Puda’s common stock from

100,000,000 to 150,000,000, and a 10 to 1 reverse stock split of Puda’s

outstanding common stock (the “10-to-1 Reverse Split”). On

August 2, 2005, the authorized number of shares of common stock of the Company

was increased from 100,000,000 shares to 150,000,000 shares. On

September 8, 2005, Puda completed the 10-to-1 Reverse Split.

Effective

on July 30, 2009 (the “Effective Date”), the Company completed a reincorporation

from a Florida corporation to a Delaware corporation. Each issued and

outstanding share of common stock, par value $0.001 per share, of the

Florida-incorporated Company was automatically converted into 0.142857 issued

and outstanding share of common stock, par value $0.001 per share, of the

Delaware-incorporated Company (the “7-to-1 Share Conversion”). No

fractional shares were or will be issued in connection with the conversion;

instead, the Company rounded up the fractional share to the nearest whole

number. Any common shares exercised from the warrants or stock options which

were issued before the Effective Date were also subject to the conversion ratio

of 7 to 1. The total number of authorized shares of common stock and preferred

stock did not change as a result of the conversion. Although the

7-to-1 Share Conversion occurred on July 30, 2009, it was retroactively

reflected in the consolidated financial statements as if the reverse split was

effective from January 1, 2008.

BVI is an

International Business Company incorporated in the British Virgin Islands on

August 19, 2004 and it has a registered capital of $50,000. BVI did

not have any operating activities from August 19, 2004 (inception) to September

30, 2009.

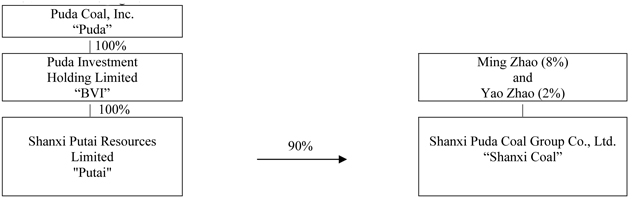

BVI, in

turn, owns all of the registered capital of Shanxi Putai Resources Limited

(formerly, Taiyuan Putai Business Consulting Co., Ltd.) (“Putai”), a wholly

foreign owned enterprise (“WFOE”) registered under the wholly foreign-owned

enterprises laws of the People’s Republic of China (“PRC”). Putai was

incorporated on November 5, 2004 and has a registered capital of

$20,000. Putai owns 90% of Shanxi Puda Coal Group Co.,

Ltd. (formerly, Shanxi Puda Resources Co. Ltd.)(“Shanxi Coal”), a company with

limited liability established under the laws of the PRC.

Shanxi

Coal was established on June 7, 1995. Shanxi Coal mainly processes

and washes raw coal and sells from its plants in Shanxi Province, high-quality,

low sulfur refined coal for industrial clients mainly in Central and Northern

China. Shanxi Coal has a registered capital of RMB22,500,000

($2,717,000) which is fully paid-up. The owners of Shanxi Coal were

Putai (90%), Mr. Ming Zhao (8%) and Mr. Yao Zhao (2%). Ming

Zhao is the chairman and was the president and chief executive officer of Puda

until his resignation on June 25, 2008. Yao Zhao was the chief

operating officer of Puda until his resignation became effective on November 20,

2006. Ming Zhao and Yao Zhao are brothers.

7

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1.

The Company (continued)

As of

September 30, 2009, the percentages owned by Mr. Ming Zhao and Mr. Yao Zhao in

the Group companies are as follows:

|

|

l

|

Puda

Coal, Inc.: Mr. Ming Zhao (approximately 49%); Mr. Yao Zhao (approximately

12%) held directly.

|

|

|

l

|

Puda

Investment Holding Limited: Mr. Ming Zhao (approximately 49%); Mr. Yao

Zhao (approximately 12%) held indirectly through

Puda.

|

|

|

l

|

Shanxi

Putai Resources Limited: Mr. Ming Zhao (approximately 49%); Mr. Yao Zhao

(approximately 12%) held indirectly through Puda and

BVI.

|

|

|

l

|

Shanxi

Puda Coal Group Co., Ltd.: Mr. Ming Zhao (8%); Mr. Yao Zhao (2%) held

directly, Mr. Ming Zhao (approximately 44%); Mr. Yao Zhao (approximately

11%) held indirectly through Puda, BVI and

Putai.

|

After the

above reorganization and as of September 30, 2009, the organizational structure

of the Group is as follows:

2.

Summary of Significant Accounting Policies

(a)

Basis of Presentation and Consolidation

The

unaudited consolidated financial statements include Puda (Registrant and Legal

Parent), BVI, Putai and Shanxi Coal (Operating Company), collectively referred

to as “the Group”. Intercompany items have been eliminated.

The

accompanying unaudited consolidated financial statements as of September 30,

2009 and for the three and nine month periods ended September 30, 2009 and 2008

have been prepared in accordance with generally accepted accounting principles

for interim financial information and with the instructions to Form 10-Q and of

Regulation S-X. Certain information and footnote disclosures normally

included in financial statements prepared in accordance with accounting

principles generally accepted in the United States have been condensed or

omitted pursuant to the Securities and Exchange Commission’s(“SEC”) rules and

regulations. In the

opinion of management, these unaudited consolidated interim financial statements

include all adjustments and disclosures considered necessary to a fair statement

of the results for the interim periods presented. All adjustments are

of a normal recurring nature. The results of operations for the nine

months ended September 30, 2009 are not necessarily indicative of the results

for the full fiscal year ending December 31, 2009. The unaudited

consolidated interim financial statements should be read in conjunction with the

Company’s audited consolidated financial statements and notes thereto for the

year ended December 31, 2008 as reported in Form 10-K.

8

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2.

Summary of Significant Accounting Policies (continued)

(b)

Accounting Standards Codifications

In

June 2009, the Financial Accounting Standards Board (“FASB”) issued

Accounting Standards Codifications (“ASC”) 105 “Generally Accepted Accounting

Principles”. This section designates ASC as the source of authoritative

U.S. GAAP. ASC 105 is effective for interim or fiscal periods ending

after September 15, 2009. We have used the new guidelines and

numbering system when referring to GAAP in our quarter ended September 30,

2009. The adoption of ASC 105 did not have a material impact on our financial

position, results of operation or cash flows.

(c)

Use of Estimates

In

preparing financial statements in conformity with accounting principles

generally accepted in the United States of America, management is required to

make estimates and assumptions that affect the reported amounts of assets and

liabilities and the disclosure of contingent assets and liabilities at the date

of the financial statements and revenues and expenses during the reported

periods. Significant estimates include depreciation and allowance for doubtful

accounts receivable. Actual results could differ from those

estimates.

(d)

Cash and Cash Equivalents

The Group

considers all highly liquid investments with original maturities of three months

or less at the time of purchase to be cash equivalents. As of September 30, 2009

and December 31, 2008, the Group did not have any cash equivalents.

(e)

Allowance for Doubtful Accounts

The Group

recognizes an allowance for doubtful accounts to ensure accounts receivable are

not overstated due to uncollectibility. An allowance for doubtful accounts is

maintained for all customers based on a variety of factors, including the length

of time the receivables are past due, significant one-time events and historical

experience. An additional reserve for individual accounts is recorded when the

Group becomes aware of a customer’s inability to meet its financial obligations,

such as in the case of bankruptcy filings or deterioration in the customer’s

operating results or financial position. If circumstances related to customers

change, estimates of the recoverability of receivables would be further

adjusted.

(f)

Inventories

Inventories

are comprised of raw materials and finished goods and are stated at the lower of

cost or market value. Substantially all inventory costs are determined using the

weighted average basis. Costs of finished goods include direct labor, direct

materials, and production overhead before the goods are ready for

sale.

9

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2.

Summary of Significant Accounting Policies (continued)

(g)

Property, Plant and Equipment, Net

Property,

plant and equipment are stated at cost. Depreciation is provided principally by

use of the straight-line method over the useful lives of the related assets.

Expenditures for maintenance and repairs, which do not improve or extend the

expected useful lives of the assets, are expensed to operations while major

repairs are capitalized.

Management

considers that the Company has a 10% residual value for buildings, and a 5%

residual value for other property, plant and equipment. The estimated useful

lives are as follows:

|

Buildings

and facility

|

20

years

|

|

Machinery

and equipment

|

10

years

|

|

Motor

vehicles

|

10

years

|

|

Office

equipment and others

|

10

years

|

The gain

or loss on disposal of property, plant and equipment is the difference between

the net sales proceeds and the carrying amount of the relevant assets, and, if

any, is recognized in the consolidated statement of operations.

(h)

Land-use Rights and Amortization

Land-use

rights are stated at cost, less amortization. Amortization of land-use rights is

calculated on the straight-line method, based on the period over which the right

is granted by the relevant authorities in Shanxi Province, PRC.

(i)

Impairment of Assets

In

accordance with ASC 360 "Property, Plant, and Equipment", the Group evaluates

its long-lived assets to determine whether later events and circumstances

warrant revised estimates of useful lives or a reduction in carrying value due

to impairment. If indicators of impairment exist and if the value of the assets

is impaired, an impairment loss would be recognized.

(j)

Derivative Financial Instruments

Derivative

financial instruments are accounted for under ASC 815 “Derivatives and

Hedging”. Under ASC 815, all derivative instruments are recorded on

the balance sheet as assets or liabilities and measured at fair

value. Changes in the fair value of derivative instruments are

recorded in current earnings.

10

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2.

Summary of Significant Accounting Policies (continued)

(k)

Income Taxes

The Group

accounts for income taxes under ASC 740 "Income Taxes". Under ASC

740, deferred tax assets and liabilities are recognized for the future tax

consequences attributable to differences between the financial statement

carrying amounts of existing assets and liabilities and their respective tax

bases. Deferred tax assets and liabilities are measured using enacted

tax rates expected to apply to taxable income in the years in which those

temporary differences are expected to be recovered or settled. Under

ASC 740, the effect on deferred tax assets and liabilities of a change in tax

rates is recognized in income in the period that includes the enactment

date.

The Group

reviewed the differences between the tax bases under PRC tax laws and financial

reporting under US GAAP, and no material differences were found, thus, there

were no deferred tax assets or liabilities as of September 30, 2009 and December

31, 2008.

Under

current PRC tax laws, no tax is imposed in respect to distributions paid to

owners except for individual income tax.

(l)

Revenue Recognition

Revenue

from goods sold is recognized when (i) persuasive evidence of an arrangement

exists, which is generally represented by a contract with the buyer; (ii) title

has passed to the buyer, which generally is at the time of delivery; (iii) the

price is agreed with the buyer; and (iv) collectibility is reasonably

assured.

Net

revenue represents the invoiced value of products, less returns and discounts

and net of VAT.

(m)

Foreign Currency Transactions

The

reporting currency of the Group is the U.S. dollar. Shanxi Coal uses

its local currency, Renminbi, as its functional currency. Results of operations

and cash flow are translated at average exchange rates during the period, and

assets and liabilities are translated at the end of period exchange

rates. Translation adjustments resulting from this process are

included in accumulated other comprehensive income in stockholders’

equity. Transaction gains and losses that arise from exchange rate

fluctuations from transactions denominated in a currency other than the

functional currency are included in the results of operations as incurred. These

amounts are not material to the unaudited consolidated financial statements for

the three and nine months ended September 30, 2009 and 2008.

The PRC

government imposes significant exchange restrictions on fund transfers out of

the PRC that are not related to business operations. These restrictions have not

had a material impact on the Group because it has not engaged in any significant

transactions that are subject to the restrictions.

(n)

Fair Value of Financial Instruments

ASC 825

“Financial Instruments”, requires disclosing fair value to the extent

practicable for financial instruments that are recognized or unrecognized in the

balance sheet. The fair value of the financial instruments disclosed

herein is not necessarily representative of the amount that could be realized or

settled, nor does the fair value amount consider the tax consequences of

realization or settlement.

For

certain financial instruments, including cash, accounts, related party and other

receivables, accounts payable, other payables and accrued expenses, it was

assumed that the carrying amounts approximate fair value because of the near

term maturities of such obligations. For long-term debt, the carrying amount is

assumed to approximate fair value based on the current rates at which the Group

could borrow funds with similar remaining maturities.

11

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2.

Summary of Significant Accounting Policies (continued)

(o)

Earnings Per Share

Basic

earnings per share is computed by dividing the earnings for the period by the

weighted average number of common shares outstanding for the

period. Diluted earnings per share reflects the potential dilution of

securities by including other potential common stock, including stock options

and warrants, in the weighted average number of common shares outstanding for

the period, if dilutive.

(p)

Accumulated Other Comprehensive Income

Accumulated

other comprehensive income represents the change in equity of the Group during

the periods presented from foreign currency translation

adjustments.

(q)

Share-Based Compensation Expense

ASC 718

“Compensation-Stock Compensation”, requires the measurement and recognition of

compensation expense for all share-based payment awards made to employees and

directors including employee stock options and employee stock purchases based on

estimated fair values. ASC 718 requires companies to estimate the

fair value of share-based payment awards on the date of grant using an

option-pricing model. The value of awards that are ultimately expected to vest

is recognized as expense over the requisite service periods in the Company’s

consolidated statements of operations.

(r)

Subsequent Events

The

Company has evaluated subsequent events through November13, 2009, the date the

consolidated financial statements were issued and has determined that there were

no subsequent events to recognize or disclose in these financial

statements.

(s)

Reclassifications

Certain

reclassifications have been made to prior period balances in order to conform to

the current period’s presentation.

3.

Allowance for Doubtful Receivables

Details

of allowance for doubtful receivables deducted from accounts receivable are as

follows:-

|

September 30,

2009

|

December 31,

2008

|

|||||||

|

$’000

|

$’000

|

|||||||

|

Balance,

beginning of period

|

$ | 70 | $ | 48 | ||||

|

Additions

|

45 | 22 | ||||||

|

Balance,

end of period

|

$ | 115 | $ | 70 | ||||

The Group

did not write off any bad debts in the three and nine months ended September 30,

2009 and 2008.

12

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

4.

Related Party Transactions

As of

September 30, 2009 and December 31, 2008, the Group had the following amounts

due from/to related parties:-

|

September 30,

2009

|

December 31,

2008

|

|||||||

|

$’000

|

$’000

|

|||||||

|

Advance

to Shanxi Liulin Jucai Coal Industry Co., Limited (“Jucai Coal”), a

related company with a common owner

|

$ | 835 | $ | 879 | ||||

|

Other

payable to Shanxi Puda Resources Group Limited (“Resources

Group”), a related company with common owners

|

$ | 795 | $ | 796 | ||||

|

Other

payable to Yao Zhao, manager and shareholder of Puda

|

236 | 234 | ||||||

| $ | 1,031 | $ | 1,030 | |||||

|

Distribution

payable to Ming Zhao and Yao Zhao

|

$ | 117 | $ | 117 | ||||

|

Loan

payable to Resources Group

|

||||||||

|

-current

portion

|

$ | 1,300 | $ | 1,300 | ||||

|

-long-term

portion

|

6,825 | 7,800 | ||||||

| $ | 8,125 | $ | 9,100 | |||||

The

balances, except for the loan payable to Resources Group, are unsecured,

interest-free and there are no fixed terms for repayment.

The

balance payable to Resources Group of $795,000 includes professional and

regulatory charges related to the public listing paid by Resources Group on

behalf of the Company of $901,000, netted against other receivables of $106,000

due from Resources Group.

The

amount payable to Yao Zhao represents land-use rights paid by him on behalf of

Shanxi Coal.

In 2001,

Shanxi Coal entered into agreements with Resources Group to lease an office and

certain equipment. In the three months ended September 30, 2009 and

2008, rental expenses paid to Resources Group were $40,000 and $7,000,

respectively. In the nine months ended September 30, 2009 and 2008,

rental expenses paid to Resources Group were $119,000 and $7,000, respectively

(see Note 11).

In the

three months ended September 30, 2009 and 2008, Shanxi Coal purchased raw coal

from Jucai Coal in the amounts of $4,039,000 and $5,236,000,

respectively. In the nine months ended September 30, 2009 and

2008, Shanxi Coal purchased raw coal from Jucai Coal in the amounts of

$11,122,000 and $11,710,000, respectively.

On

November 17, 2005, Shanxi Coal entered into a coal supply agreement with Jucai

Coal, pursuant to which Shanxi Coal has priority to Jucai Coal’s high grade

metallurgical coking coal supply over Jucai Coal’s other

customers. Under the terms of the agreement, Shanxi Coal receives a

discount of approximately $4 to $6 per metric ton of coal from the price Jucai

Coal charges to its other customers.

13

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

4.

Related Party Transactions (continued)

On

November 17, 2005, Shanxi Coal entered into two conveyance agreements with

Resources Group. The two agreements transfer two new coal washing

plants, related land-use rights and coal washing equipment in Liulin County and

Zhongyang County, Shanxi Province. The Liulin County plant has an

annual clean coal washing capacity of 1.1 million metric tons while the

Zhongyang County plant has an annual clean coal washing capacity of 1.2 million

metric tons. The Liulin County plant started formal production in

December 2005. The Liulin County plant, land-use rights and related

equipment were purchased for a cost of $5,800,000. The Zhongyang

County plant started formal production at the end of March 2006. The

Zhongyang County plant, land-use rights and related equipment were purchased for

a cost of $7,200,000. Each conveyance agreement provides that the

purchase price paid by Shanxi Coal to Resources Group, which totals $13,000,000,

should be amortized over ten years from December 31, 2005 and bear interest at a

rate of 6% per annum payable quarterly. In the three months ended

September 30, 2009 and 2008, Shanxi Coal paid principal of $325,000 (2008:

$325,000) and interest of $127,000 (2008: $146,000) to Resources

Group. In the nine months ended September 30, 2009 and 2008, Shanxi

Coal paid principal of $975,000 (2008: $975,000) and interest of $396,000 (2008:

$453,000) to Resources Group. Shanxi Coal pledged the land use

rights, plant and equipment of the plants to Resources Group until such time

when the purchase price and interest thereon is fully paid by Shanxi Coal to

Resources Group. If Shanxi Coal fails to pay the principal or

interest of the purchase price of the new plants financed by Resources Group in

full when due, the properties acquired by Shanxi Coal, which have been pledged

to Resources Group as collateral, are revertible to Resources Group (see Notes

7, 8 and 9).

5. Prepayment

On May

14, 2009, Shanxi Coal entered into an agreement of shares transfer with two

unrelated individuals to purchase their equity, constituting 18% ownership, in

Shanxi Jianhe Coal Industry Limited Company (“Jianhe Coal”) for an aggregate

purchase price of RMB 100 million (approximately $14.6 million). As

of September 30, 2009, Shanxi Coal has prepaid 60% of the purchase price of

$8,790,000 and the remaining 40% will be due at the time of the consummation of

the transaction, which is to take place around the end of November 2009 when the

governmental registration of the share transfer is completed (see Note

11).

6.

Inventories

As of

September 30, 2009 and December 31, 2008, inventories consist of the

following:

|

September 30,

2009

|

December 31,

2008

|

|||||||

|

$’000

|

$’000

|

|||||||

|

Raw

materials

|

$ | 12,732 | $ | 7,816 | ||||

|

Finished

goods

|

15,220 | 13,773 | ||||||

|

Total

|

$ | 27,952 | $ | 21,589 | ||||

There was

no allowance for losses on inventories as of September 30, 2009 and December 31,

2008.

14

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

7.

Property, Plant and Equipment, Net

As of

September 30, 2009 and December 31, 2008, property, plant and equipment consist

of following:

|

September 30,

2009

|

December 31,

2008

|

|||||||

|

$’000

|

$’000

|

|||||||

|

Cost:

|

||||||||

|

Buildings

and facilities

|

$ | 3,344 | $ | 3,344 | ||||

|

Machinery

equipment

|

13,611 | 13,611 | ||||||

|

Motor

vehicles

|

104 | 104 | ||||||

|

Office

equipment and others

|

32 | 32 | ||||||

| 17,091 | 17,091 | |||||||

|

Accumulated

depreciation:

|

||||||||

|

Buildings

and facilities

|

558 | 427 | ||||||

|

Machinery

equipment

|

4,394 | 3,278 | ||||||

|

Motor

vehicles

|

21 | 13 | ||||||

|

Office

equipment and others

|

6 | 3 | ||||||

| 4,979 | 3,721 | |||||||

|

Carrying

value:

|

||||||||

|

Buildings

and facilities

|

2,786 | 2,917 | ||||||

|

Machinery

equipment

|

9,217 | 10,333 | ||||||

|

Motor

vehicles

|

83 | 91 | ||||||

|

Office

equipment and others

|

26 | 29 | ||||||

| $ | 12,112 | $ | 13,370 | |||||

Shanxi

Coal pledged the Liulin and Zhongyang coal washing plant and related equipment

to Resources Group until such time when the purchase price and interest thereon

is fully paid by Shanxi Coal. If Shanxi Coal fails to

pay the principal and interest of the purchase prices of the new plants financed

by Resources Group in full when due, the properties acquired by Shanxi Coal,

which have been pledged to Resources Group as the collateral, are revertible to

Resources Group (see

Notes 4 and 9).

Depreciation

expense for the three months ended September 30, 2009 and 2008 was approximately

$419,000 and $431,000, respectively. Depreciation expense for the

nine months ended September 30, 2009 and 2008 was approximately $1,258,000 and

$1,244,000, respectively. In the three months ended September 30,

2009 and 2008, the amount included in cost of sales and general and

administrative expenses was approximately $411,000 (2008: $422,000) and $8,000

(2008: $9,000), respectively. In the nine months ended September 30, 2009 and

2008, the amount included in cost of sales and general and administrative

expenses was approximately $1,234,000 (2008: $1,220,000) and $24,000 (2008:

$24,000), respectively.

15

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

8.

Intangible Assets

|

Land-use rights

|

||||||||

|

September 30,

2009

|

December 31,

2008

|

|||||||

|

$’000

|

$’000

|

|||||||

|

Cost

|

$ | 3,634 | $ | 3,634 | ||||

|

Accumulated

amortization

|

300 | 235 | ||||||

|

Carrying

value

|

$ | 3,334 | $ | 3,399 | ||||

Land-use

rights of $2,242,000 in Liulin County purchased from Resources Group are located

in Shanxi Province and are amortized over fifty years up to August 4,

2055. Land-use rights of $1,392,000 in Zhongyang County purchased

from Resources Group are located in Shanxi Province and are amortized over fifty

years up to May 20, 2055. Shanxi Coal pledged these land-use rights

to Resources Group until such time when the purchase price and interest thereon

is fully paid by Shanxi Coal (see Notes 4 and 9).

Amortization

expense for the three months ended September 30, 2009 and 2008 was approximately

$21,000 and $23,000, respectively. Amortization expense for the nine

months ended September 30, 2009 and 2008 was approximately $65,000 and $65,000,

respectively. The estimated aggregate amortization expense for the

five years ending December 31, 2009 (remaining three months), 2010, 2011, 2012

and 2013 amounts to approximately $21,000, $84,000, $84,000, $84,000 and

$84,000, respectively.

9.

Long-term Debt

|

September 30,

2009

|

December 31,

2008

|

|||||||

|

$’000

|

$’000

|

|||||||

|

Conveyance

loan

|

$ | 8,125 | $ | 9,100 | ||||

|

Less:

current portion

|

(1,300 | ) | (1,300 | ) | ||||

|

Long-term

portion

|

$ | 6,825 | $ | 7,800 | ||||

The

conveyance loan is seller-financed, payable over ten years from December 31,

2005 and bears interest at a rate of 6% per annum, payable

quarterly. In the three months ended September 30, 2009 and 2008,

Shanxi Coal paid principal of $325,000 (2008: $325,000) and interest of $127,000

(2008: $146,000) to Resources Group. In the nine months ended

September 30, 2009 and 2008, Shanxi Coal paid principal of $975,000 (2008:

$975,000) and interest of $396,000 (2008: $453,000) to Resources

Group. Shanxi Coal pledged the land-use rights and plant and

equipment until such time when the purchase price and interest thereon is fully

paid by Shanxi Coal to Resources Group (see Notes 4, 7 and 8).

16

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

9.

Long-term Debt (continued)

The

future principal payments under the conveyance loan as of September 30, 2009 are

as follows:

|

September 30,

2009

|

||||

|

$’000

|

||||

|

Year

|

||||

|

2009

(remaining three months)

|

$ | 325 | ||

|

2010

|

1,300 | |||

|

2011

|

1,300 | |||

|

2012

|

1,300 | |||

|

2013

|

1,300 | |||

|

Thereafter

|

2,600 | |||

| $ | 8,125 | |||

10. Derivative

Warrants

(a) On

November 18, 2005, the Company issued $12,500,000 8% unsecured convertible notes

due October 31, 2008 and related warrants to purchase shares of common stock of

the Company. The notes are convertible into common stock at $.50 per

share over the term of the debt. As of September 30, 2009,

$10,260,000 was converted into 2,931,429 shares (after adjusting for the 7-to-1

Share Conversion) of common stock, $2,115,000 was redeemed upon maturity, and

the remaining $125,000 will be paid off upon the receipt of the original notes

from the investors. The balance of $125,000 is included in other

payables in the consolidated balance sheet as of September 30,

2009. The related warrants to purchase 3,571,429 shares (after

adjusting for the 7-to-1 Share Conversion) of common stock, exercisable at $4.20

per share (after adjusting for the 7-to-1 Share Conversion), have a term of five

years from the date of issuance. As of September 30, 2009, 9,350,000

warrants were exercised into 1,335,715 shares (after adjusting for the 7-to-1

Share Conversion) of common stock.

Investors

were given "full ratchet" anti-dilution protection under the

warrants, meaning that the exercise price under the warrants will be adjusted to

the lowest per share price for future issuances of Puda's common stock should

such per share price be lower than the exercise price of the

warrants, with carve-outs for (i) issuance of shares of common stock in

connection with the exercise of the warrants, or (ii) the issuance of common

stock to employees or directors pursuant to an equity incentive plan approved by

Puda's stockholders. The exercise price of the warrants is also

subject to proportional adjustments for issuance of shares as payment of

dividends, stock splits, and rights offerings to shareholders in conjunction

with payment of cash dividends. Investors were also given registration rights in

connection with the resale of the common stock underlying the warrants, on a

registration statement to be filed with the SEC. Puda may redeem all,

but not less than all, of the warrants at $0.001 per share subject to 30

business days’ prior notice to the holders of the warrants, and provided that

(i) a registration statement is in effect covering the common stock underlying

the warrants, (ii) the closing bid price of the common stock of Puda exceeds

$2.50 per share on an adjusted basis for at least 20 consecutive trading days

(prior to the adjustment for the 7-to-1 share conversion) and (iii) the average

daily trading volume of the common stock exceeds 50,000 shares per day during

the same period.

17

PUDA

COAL, INC.

NOTES

TO UNAUDIATED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. Derivative

Warrants (continued)

The

warrants require the Company to register the resale of the shares of common

stock upon exercise of these securities. The warrants are

freestanding derivative financial instruments. The Company accounts

for the fair value of these outstanding warrants to purchase common stock in

accordance with ASC 815 “Derivative and Hedging,” which requires the Company to

account for the warrants as derivatives. Since the effective

registration of the securities underlying the warrants is an event outside of

the control of the Company, pursuant to ASC 815, the Company recorded the fair

value of the warrants as liabilities. The Company is required to

carry these derivatives on its balance sheet at fair value and unrealized

changes in the values of these derivatives are reflected in the consolidated

statement of operations as “Derivative unrealized fair value gain/

(loss)”.

The

warrants are classified as a derivative liability because they embody an

obligation to issue a variable number of shares. This obligation is generated by

the Registration Rights and Late Filing Penalties described

above. Warrants are being amortized over the term of five years using

the effective interest method up to October 31, 2010, and the amount amortized

in the nine months ended September 30, 2009 and 2008 was $nil and $33,000,

respectively. Upon exercise, the pro rata % of the amount actually

exercised in relation to the total exercisable is multiplied by the remaining

derivative liability, and transferred to equity. The amount

transferred to equity upon exercise was $64,000 and $nil,

respectively in the nine months ended September 30, 2009 and

2008.

(b) In

conjunction with the issuance of the notes, the placement agent was issued five

year warrants, exercisable from November 18, 2005, to purchase 357,143 shares

(after adjusting for the 7-to-1 Share Conversion) of common stock of the Company

at an exercise price of $4.20 per share (after adjusting for the 7-to-1 Share

Conversion). The warrants issued to the placement agent have the same

terms and conditions as the warrants issued to the investors, including "full

ratchet" anti-dilution protection, proportional exercise price adjustments based

on issuances of stock as dividends and share splits, and Puda’s right to redeem

the warrants subject to an effective registration statement covering the

underlying shares of the placement agent’s warrant, and certain share price and

trading volume requirements. However, the warrants issued to the placement

agent, unlike the warrants issued to the investors, have a cashless exercise

feature. With a cashless exercise feature, the warrant holders have the option

to pay the exercise price of $4.20 (after adjusting for the 7-to-1 Share

Conversion) not in cash, but by reducing the number of common share

issued to them. As with the warrants related to the notes, the

placement agent warrants are classified as a derivative liability and are

freestanding derivative financial instruments and contain Registration Rights

and Late Filing Penalties identical to those held by the

investors. These warrants are being amortized over the term of five

years using the effective interest method, up to October 31,

2010. Upon exercise, the pro rata % of the amount actually exercised

in relation to the total exercisable is multiplied by the remaining derivative

liability, and transferred to equity. As of September 30, 2009,

1,742,040 placement agent warrants were exercised in a cashless method and

resulted in the issuance of 184,723 shares (after adjusting for the 7-to-1 Share

Conversion) of common stock.

18

PUDA

COAL, INC.

NOTES

TO UNAUDIATED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. Derivative

Warrants (continued)

(c) The

derivative warrants as of September 30, 2009 and December 31, 2008:

|

September 30,

2009

|

December 31,

2008

|

|||||||

|

$000

|

$000

|

|||||||

|

Amount

allocated to investor warrants

|

$ | 6,363 | $ | 6,363 | ||||

|

Placement

agent warrants

|

5,625 | 5,625 | ||||||

|

Less:

amount transferred to equity upon exercise of note warrants in

2006

|

(789 | ) | (789 | ) | ||||

|

Less:

amount transferred to equity upon exercise of placement agent warrants in

2006

|

(882 | ) | (882 | ) | ||||

|

Less:

amount transferred to equity upon exercise of note warrants in

2007

|

(1,527 | ) | (1,527 | ) | ||||

|

Less:

amount transferred to equity upon exercise of placement agent warrants in

2007

|

(2,716 | ) | (2,716 | ) | ||||

|

Less:

change in fair value in 2005

|

(700 | ) | (700 | ) | ||||

|

Less:

change in fair value in 2006

|

(1,237 | ) | (1,237 | ) | ||||

|

Add:

change in fair value in 2007

|

343 | 343 | ||||||

|

Less:

change in fair value in 2008

|

(394 | ) | (394 | ) | ||||

|

Less:

amount transferred to equity upon exercise of note warrants in

2009

|

(64 | ) | - | |||||

|

Add:

change in fair value in 2009

|

3,549 | - | ||||||

| $ | 7,571 | $ | 4,086 | |||||

In

August 2009, FASB issued ASU 2009-05 “Fair Value Measurements and

Disclosure (Topic 820)”. ASU 2009-05 provides amendments for the fair value

measurement of liabilities and clarification on fair value measuring techniques.

ASU 2009-05 is effective for the first reporting period, including interim

periods, beginning after the issuance of the ASU. The Company adopted this ASU

in the quarter ended September 30, 2009 and the adoption of this ASU did not

have a material impact on our financial position or results of

operations. The following table shows (i) fair values of

derivative instruments in a statement of financial position as of September 30,

2009, and (ii) the effect of derivative instruments on the statement of

financial performance for the nine months ended September 30, 2009:

19

PUDA

COAL, INC.

NOTES

TO UNAUDIATED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. Derivative

Warrants (continued)

|

(i) Fair values of derivative instruments

|

||||||

|

Liability derivatives

|

||||||

|

September 30, 2009

|

||||||

|

Balance sheet location

|

Fair

Value

|

|||||

|

$000

|

||||||

|

Derivatives

not designated as hedging instruments under ASC 815

|

||||||

|

Derivative

warrants

|

Long-term

liabilities

|

$ | 7,571 | |||

|

Total

derivatives

|

$ | 7,571 | ||||

|

(ii)

Effect of derivative instruments on the statement of

operations

|

||||||

|

Derivatives

not designated as hedging instruments under ASC

815

|

||||||

|

Nine months ended September 30, 2009

|

||||||

|

Location of gain or (loss)

recognized in income on

derivatives

|

Amount of gain or

(loss) recognized

in income on

derivatives

|

|||||

|

$000

|

||||||

|

Derivative

warrants

|

Derivative

unrealized fair value loss

|

$ | (3.549 | ) | ||

|

Total

|

$ | (3,549 | ) | |||

20

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

11.

Commitments and Contingencies

As of

September 30, 2009, the Group leased office premises under the operating lease

agreement expiring on December 31, 2013.

The

future minimum lease payments under the above-mentioned lease as of September

30, 2009 are as follows:-

|

September 30,

2009

|

||||

|

$’000

|

||||

|

Year

|

||||

|

2009

(remaining three months)

|

$ | 40 | ||

|

2010

|

160 | |||

|

2011

|

160 | |||

|

2012

|

160 | |||

|

2013

|

160 | |||

| $ | 680 | |||

The above

future lease payments represent amounts payable to Resources Group (see Note

4).

On May

14, 2009, Shanxi Coal entered into an agreement of share transfer with two

unrelated individuals to purchase their equity, constituting 18% ownership, in

Shanxi Jianhe Coal Industry Limited Company (“Jianhe Coal”) for an aggregate

purchase price of RMB 100 million (approximately $14.6

million). In addition, under the agreement, the individual owning the

other 82% of Jianhe Coal guaranteed Shanxi Coal first priority in the right to

purchase other shares of Jianhe Coal within the 24-month period following

execution of the agreement. Shanxi Coal will not take part in

the operational management of the coal mine but will be paid dividends

semiannually based on its 18% ownership in Jianhe Coal and such

dividends will be no less than 80% of the annual net profits of Jianhe

Coal. The government approval of the share transfer has been delayed

as the Shanxi Government has postponed all equity transfer approvals and the

issuance of new business licenses to coal mines due to the

coal mine consolidations and reconstruction happening in the province since

early 2009. The transaction is expected to close around the end of

November 2009. As of September 30, 2009 Shanxi Coal prepaid 60% of

the purchase price of $8,790,000 and the remaining 40% (approximately

$5,815,000) will be paid at the time of closing; provided, however, if the

closing does not occur, the purchase price paid and any transferred shares will

be returned by the parties (see Note 5).

On

September 28, 2009, the Shanxi provincial government appointed Shanxi Coal as a

consolidator of eight coal mines in Yucheng City, Pinglu County. Shanxi Coal has

the government’s permission to consolidate the eight coal mines into five, which

should increase their total annual capacity from approximately 1.6 million to

3.6 million metric tons. The Company has already commenced the technical

geological prospecting process for the targeted coal reserves. The Company will

also perform a comprehensive financial analysis of the project and then

determine the most efficient plan to develop and construct the targeted

consolidated coal mines. As of the date of this report, Shanxi

Coal has not entered into any definitive agreements for the acquisition of these

eight coal mines.

As of

September 30, 2009, the Group did not have any contingent

liabilities.

21

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

12.

Common Stock and Paid-in Capital

|

Common Stock

|

Paid-in Capital

|

|||||||||||

|

No. of shares

|

$000

|

$000

|

||||||||||

|

Balance, January

1, 2009 (after adjusting for the 7-to-1 Share Conversion)

|

15,333,680 | $ | 15 | $ | 31,647 | |||||||

|

Issue

of directors shares (after adjusting for the 7-to-1 Share

Conversion)

|

27,721 | - | 65 | |||||||||

|

Issue

of director warrants

|

- | - | 21 | |||||||||

|

Exercise

of note warrants

|

35,715 | - | 150 | |||||||||

|

Derivative

note warrants transferred to equity upon exercise

|

- | - | 64 | |||||||||

|

Round

up fractional shares for the 7-to-1 Share Conversion

|

3,192 | - | - | |||||||||

|

Balance,

September 30, 2009

|

15,400,308 | $ | 15 | $ | 31,947 | |||||||

13.

Interest Expense

Interest

expense for the three months ended September 30, 2009 includes a $127,000 (2008:

$146,000) interest payment for the 6% loan from Resources Group for the purchase

of the Liulin and Zhongyang plants, and $nil (2008: $45,000) interest

payment for the 8% convertible notes. Interest expense

for the nine months ended September 30, 2009 includes a $396,000 (2008:

$453,000) interest payment for the 6% loan from Resources Group for the purchase

of the Liulin and Zhongyang plants, and $nil (2008: $135,000) interest

payment for the 8% convertible notes.

14.

Debt Financing Costs

Debt

financing costs for the three months ended September 30, 2008 include

amortization of discount on convertible notes and warrants of

$118,000. Debt financing costs for the nine months ended

September 30, 2008 include amortization of discount on convertible notes and

warrants of $361,000 and penalty for the delay in getting the registration

statement effective by March 17, 2006 of $379,000.

15.

Derivative Unrealized Fair Value Gain/Loss

Derivative

unrealized fair value loss of $3,436,000 in the three months ended September 30,

2009 (2008: derivative unrealized fair value gain of $121,000) and

derivative unrealized fair value loss of $3,549,000 in the nine months ended

September 30, 2009 (2008: derivative unrealized fair value gain of $341,000)

represents the change in fair value of the derivative warrants (see Note

10).

16.

Other Expense

Other

expense of $719,000 in the nine months ended September 30, 2008 represents the

donation for earthquake rescue efforts in Sichuan Province, PRC.

22

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

17.

Income Taxes

No

provision for taxation has been made for Puda, BVI and Putai for the three and

nine months ended September 30, 2009 and 2008, as they did not generate any

taxable profits during these periods.

Pursuant

to the PRC Income Tax Laws, Shanxi Coal is subject to enterprise income tax at a

statutory rate of 25% for the three and nine months ended September 30, 2009 and

2008.

Details

of income taxes in the statements of operations are as follows:-

|

Three months

ended

September 30,

2009

|

Three months

ended

September 30,

2008

|

Nine months

ended

September 30,

2009

|

Nine months

ended

September 30,

2008

|

|||||||||||||

|

$’000

|

$’000 |

$’000

|

$’000

|

|||||||||||||

|

Current

period provision

|

$ | 1,112 | $ | 2,289 | $ | 2,559 | $ | 5,101 | ||||||||

A

reconciliation between taxes computed at the United States statutory rate of 34%

and the Group’s effective tax rate is as follows:-

|

Three months

ended

September 30,

2009

|

Three months

ended

September 30,

2008

|

Nine months

ended

September

30, 2009

|

Nine months

ended

September

30, 2008

|

|||||||||||||

| $’000 |

$’000

|

$’000

|

$’000

|

|||||||||||||

|

Income

before income taxes

|

$ | 491 | $ | 8,828 | $ | 5,783 | $ | 18,798 | ||||||||

|

Income

tax on pretax income at statutory rate

|

167 | 3,001 | 1,966 | 6,391 | ||||||||||||

|

Tax

effect of expenses that are not deductible in determining taxable

profits

|

1,195 | (8 | ) | 1,269 | 226 | |||||||||||

|

Effect

of different tax rates of subsidiary operating in other

jurisdictions

|

(396 | ) | (827 | ) | (907 | ) | (1,808 | ) | ||||||||

|

Valuation

allowance

|

146 | 123 | 231 | 292 | ||||||||||||

|

Income

tax at effective rate

|

$ | 1,112 | $ | 2,289 | $ | 2,559 | $ | 5,101 | ||||||||

As at

September 30, 2009 and December 31, 2008, the Group had accumulated net

operating loss carryforwards for United States federal tax purposes of

approximately $6,864,000 and $5,871,000, respectively, that are available to

offset future taxable income. Realization of the net operating loss

carryforwards is dependent upon future profitable operations. In

addition, the carryforwards may be limited upon a change of control in

accordance with Internal Revenue Code Section 382, as

amended. Accordingly, management has recorded a valuation allowance

to reduce deferred tax assets associated with the net operating loss

carryforwards to zero at September 30, 2009 and December 31,

2008. The net operating loss carryforwards expire in years

2021, 2022, 2023, 2024, 2025, 2026, 2027, 2028 and 2029 in the amounts of

$132,000, $394,000, $153,000, $371,000, $287,000, $1,968,000, $1,341,000 and

$1,225,000 and $993,000, respectively.

23

PUDA

COAL, INC.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

17.

Income Taxes (continued0

At

September 30, 2009 and December 31, 2008, deferred tax assets consist

of:

|

September 30, 2009

|

December 31, 2008

|

|||||||

|

$’000

|

$’000

|

|||||||

|

Net

operating loss carryforwards

|

$ | 2,334 | $ | 1,996 | ||||

|

Less:

Valuation allowance

|

(2,334 | ) | (1,996 | ) | ||||

|

Net

|

$ | - | $ | - | ||||

18. Basic and Diluted Weighted Average

Number of Shares

|

Three months

ended

September 30,

2009

|

Three months

ended

September 30,

2008

|

Nine months

ended

September 30,

2009

|

Nine months

ended

September 30,

2008

|

|||||||||||||

|

Basic

weighted average number of shares (after

adjusting

for the 7-to-1 Share Conversion)

|

15,387,110 | 15,327,393 | 15,360,301 | 15,133,857 | ||||||||||||

|

Issuance

of directors’/employees’ shares (after

adjusting

for the 7-to-1 Share Conversion)

|

- | - | 26,489 | - | ||||||||||||

|

Diluted

weighted average number of shares

|

15, 387,110 | 15,327,393 | 15,386,790 | 15,133,857 | ||||||||||||

The

7-to-1 Share Conversion at July 30, 2009 was retroactively reflected in the

calculation of weighted average number of shares as if the reverse split was

effective from January 1, 2008 (see Note 1). The warrants have no

dilutive effect on the basic income per share for the nine months ended

September 30, 2009, but this item could potentially dilute earnings per share in

the future. If the exercise of warrants had not been anti-dilutive,

the number of additional shares that would have been assumed from the exercise

is 2,344,019 shares for the nine months ended September 30, 2009.

19.

Supplementary Cash Flow Information

|

Nine months ended September 30,

|

||||||||

|

2009

|

2008

|

|||||||

|

$’000

|

$’000 | |||||||

|

Cash

paid during the period for:

|

||||||||

|

Interest

|

$ | 396 | $ | 588 | ||||

|

Income

taxes

|

$ | 2,764 | $ | 5,228 | ||||

|

Major

non-cash transactions:

|

||||||||

|

Issue

of penalty shares

|

$ | - | $ | 2,104 | ||||

|

Issue

of directors’ shares

|

$ | 86 | $ | 49 | ||||

|

Dividend

declared

|

$ | - | $ | 116 | ||||

24

PUDA

COAL, INC.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

20.

Equity incentive plan

On

December 29, 2008, the shareholders of the Company approved a Puda Coal, Inc.

2008 Equity Incentive Plan (the “2008 Plan”). Any employee or

director of the Company is eligible to participate in the 2008 Plan and may be

granted stock awards and/or options (collectively, “Awards”) by the

administrator of the 2008 Plan, which is the Board of Directors, the

Compensation Committee or their delegates. The 2008 Plan became

effective upon its approval by the shareholders of the Company and will continue

in effect for a term of ten years unless terminated by the administrator of the

2008 Plan earlier. The aggregate number of shares of common stock

that may be issued pursuant to the Awards under the 2008 Plan is 714,286 shares

(after adjusting for the 7-to-1 Share Conversion). The aggregate

number of shares subject to the Awards under the 2008 Plan during any calendar

year to any one awardee will not exceed 7,143 shares (after adjusting for the

7-to-1 Share Conversion). The fair market value of the common stock

should be determined by the administrator of the 2008 Plan in good faith using a

reasonable valuation method in a reasonable manner in accordance with Section

409A of the Internal Revenue Code of 1986, as amended. Whenever

possible, the determination of fair market value should be based upon the

average of the highest and lowest quoted sales prices for such common stock as

of such date as reported in sources as determined by the

administrator.

21.

Stock Compensation

On June

29, 2007, Puda entered into a contract with a director. Pursuant to the

contract, in consideration of his service to the Company as an independent

director commencing on July 1, 2007, he will receive compensation in the form of

warrants to purchase 1,429 (after adjusting for the 7-to-1 Share Conversion)

shares of common stock of the Company per year. The term of the warrants is 5

years and the exercise price is $17.50 (after adjusting for the 7-to-1 Share

Conversion) per share. On December 29, 2008, Puda entered into an

amendment to the director’s contract dated June 29,

2007. Pursuant to the amendment, in consideration of his continued

service to the Company as an independent director, the annual stock compensation

will be $25,000 worth of shares of common stock, calculated based on the closing

sale price of the Company’s common stock on the grant date of August 11, 2008

and then on each anniversary date of the grant date, and such stock grants are

subject to the 2008 Plan.

On August

3, 2007, Puda entered into a contract with another director. Pursuant

to the contract, in consideration of his service to the Company as an

independent director commencing on August 3, 2007, he will receive an annual fee

of $40,000 in cash and 1,786 shares (after adjusting for the 7-to-1 Share

Conversion) of common stock of the Company. On December 29, 2008,

Puda entered into an amendment to the director’s contract dated August 3,

2007. Pursuant to the amendment, in consideration of his continued

service to the Company as an independent director, the annual fee will be

$40,000 cash plus stock compensation of $25,000 worth of shares of common stock

of the Company, calculated based on the closing sale price of the Company’s

common stock on the grant date of August 11, 2008 and then on each anniversary

date of the grant date, and such stock grants are subject to the 2008

Plan.

On

October 9, 2007, Puda entered into a contract with another

director. Pursuant to the contract, in consideration of his service

to the Company as an independent director commencing on October 9, 2007, he will

receive an annual fee of $40,000 in cash and 1,861 shares (after adjusting for

the 7-to-1 Share Conversion) of common stock of the Company. On

December 29, 2008, the Company entered into an amendment to the director’s

contract dated October 9, 2007. Pursuant to the amendment, in

consideration of his continued service to the Company as an independent

director, the annual fee will be $25,000 cash plus stock compensation of $15,000

worth of shares of common stock, calculated based on the closing sale price of

the Company’s common stock on the grant date of October 9, 2008 and then on each

anniversary date of the grant date, and such stock grants are subject to the

2008 Plan.

25

PUDA

COAL, INC.

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

21.

Stock Compensation (continued)

On August

11, 2008 and December 11, 2008, the Company granted an officer 2,858 and

5,715 shares (after adjusting for the 7-to-1 Share Conversion) of common stock,

respectively. The shares granted vested in full on their respective

grant dates and are subject to the restricted stock unit grant agreement under

the 2008 Plan.

On August

11, 2008 and December 11, 2008, the Company granted Ming Zhou 2,858 and 5,715

shares (after adjusting for the 7-to-1 Share Conversion) of common stock,

respectively. The shares granted will vest on the dates that are the

one-year anniversary of their respective grant dates and are subject to the

restricted stock unit grant agreement under the 2008 Plan.

The stock

compensation expenses for the three and nine months ended September 30, 2009 and

2008 were as follows:

|

Three months

ended

September 30,

2009

|

Three months

ended

September 30,

2008

|

Nine months

ended

September 30,

2009

|

Nine months

ended

September 30,

2008

|

|||||||||||||