Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32.1 - CATALYST RESOURCE GROUP, INC. | jntx0909qex321.htm |

| EX-31 - EXHIBIT 31.1 - CATALYST RESOURCE GROUP, INC. | jntx0909qex311.htm |

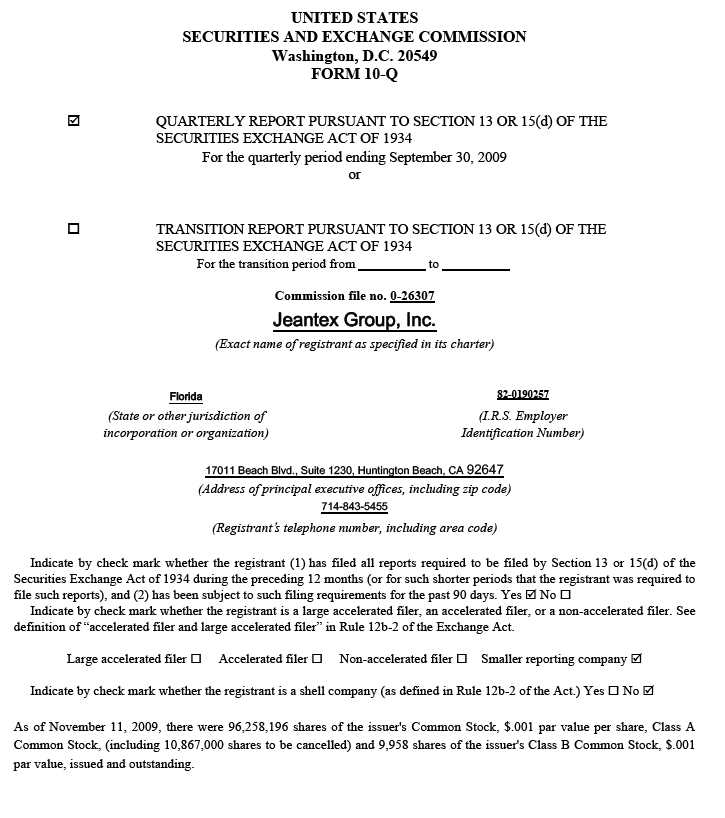

JEANTEX GROUP, INC.

INDEX

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

Balance Sheets as of September 30, 2009 and December 31, 2008 (unaudited)

Statements of Operations for the Three Months and Nine Months Ended September 30, 2009 and 2008 and

the period from January 1, 2007 (Inception) to September 30, 2009 (unaudited)

Statements of Cash Flows for the Nine Months Ended September 30, 2009 and 2008 and the period from

January 1, 2007 (Inception) to September 30, 2009(unaudited)

Notes to Unaudited Financial Statements

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Item 3. Quantitative and Qualitative Disclosure about Market Risk

Item 4. Control and Procedures

Item 4T. Internal Control over Financial Reporting

PART II – OTHER INFORMATION

Item 1. Legal Proceedings

Item 2. Unregistered Sales of Equity and Use of Proceeds

Item 3. Defaults upon Senior Securities

Item 4. Submission of Matters to a Vote of Security Holders

Item 5. Other Information

Item 6. Exhibits

Signatures

2

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

Jeantex Group, Inc.

Notes to Unaudited Consolidated Financial Statements

September 30, 2009

1. Basis of Presentation and Recent Accounting Pronouncements

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with generally accepted accounting principles applicable to interim financial statements. Accordingly, they do not include all of the information and notes required for complete financial statements. In the opinion of management, all adjustments necessary to present fairly the financial position, results of operations and cash flows at September 30, 2009 and for all the periods presented have been made.

The financial information included in this quarterly report should be read in conjunction with the consolidated financial statements and related notes thereto in our Form 10-K for the year ended December 31, 2008.

The results of operations for the nine months ended September 30, 2009 are not necessarily indicative of the results to be expected for the full year ending December 31, 2009.

Development Stage Company

The Company has not earned significant revenue from planned principal operations since 2006. Accordingly, effective January 1, 2007, the Company's activities have been accounted for as those of a "Development Stage Enterprise" as set forth in Financial Accounting Standards Board Statement No. 7 ("SFAS 7"). Among the disclosures required by SFAS 7 are that the Company's financial statements be identified as those of a development stage company, and that the statements of operations, stockholders' equity (deficit) and cash flows disclose activity since the date of the Company's inception of development stage.

Recently Adopted Accounting Pronouncements

Effective June 30, 2009, the Company adopted a new accounting standard issued by the FASB related to the disclosure requirements of the fair value of the financial instruments. This standard expands the disclosure requirements of fair value (including the methods and significant assumptions used to estimate fair value) of certain financial instruments to interim period financial statements that were previously only required to be disclosed in financial statements for annual periods. In accordance with this standard, the disclosure requirements have been applied on a prospective basis and did not have a material impact on the Company’s financial statements.

In June 2009, the Financial Accounting Standards Board ("FASB") established the FASB Accounting Standards Codification ( the "Codification") as the source of authoritative accounting principles recognized by the FASB to be applied by non-governmental entities in the preparation of financial statements in conformity with GAAP. Rules and interpretive releases of the Securities and Exchange Commission ("SEC") under authority of federal securities laws are also sources of authoritative GAAP for SEC registrants. The introduction of the Codification does not change GAAP and other than the manner in which new accounting guidance is referenced, the adoption of these changes had no impact on the our consolidated financial statements.

Recently Issued Accounting Standards

In August 2009, the FASB issued an amendment to the accounting standards related to the measurement of liabilities that are recognized or disclosed at fair value on a recurring basis. This standard clarifies how a company should measure the fair value of liabilities and that restrictions preventing the transfer of a liability should not be considered as a factor in the measurement of liabilities within the scope of this standard. This standard is effective for the Company on October 1, 2009. The Company does not expect the impact of its adoption to be material to its financial statements.

In October 2009, the FASB issued an amendment to the accounting standards related to the accounting for revenue in arrangements with multiple deliverables including how the arrangement consideration is allocated among delivered and undelivered items of the arrangement. Among the amendments, this standard eliminated the use of the residual method for allocating arrangement considerations and requires an entity to allocate the overall consideration to each deliverable based on an estimated selling price of each individual deliverable in the arrangement in the absence of having vendor-specific objective evidence or other third party evidence of fair value of the undelivered items. This standard also provides further guidance on how to determine a separate unit of accounting in a multiple-deliverable revenue arrangement and expands the disclosure requirements about the judgments made in applying the estimated selling price method and how those judgments affect the timing or amount of revenue recognition. This standard, for which the Company is currently assessing the impact, will become effective for the Company on January 1, 2011.

In October 2009, the FASB issued an amendment to the accounting standards related to certain revenue arrangements that include software elements. This standard clarifies the existing accounting guidance such that tangible products that contain both software and non-software components that function together to deliver the product’s essential functionality, shall be excluded from the scope of the software revenue recognition accounting standards. Accordingly, sales of these products may fall within the scope of other revenue recognition standards or may now be within the scope of this standard and may require an allocation of the arrangement consideration for each element of the arrangement. This standard, for which the Company is currently assessing the impact, will become effective for the Company on January 1, 2011.

2. GOING CONCERN

The Company's consolidated financial statements are prepared using the generally accepted accounting principles applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, the Company has accumulated deficits of $17,685,459 at September 30, 2009. At September 30, 2009, the Company’s current liabilities exceeded its current assets by $958,325. In view of the matters described above, recoverability of a major portion of the recorded asset amounts shown in the accompanying balance sheet is dependent upon continued operations of the Company, which in turn is dependent upon the Company's ability to raise additional capital, obtain financing and to succeed in its future operations. The financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

3. NOTES PAYABLE

At September 30, 2009 and December 31, 2008, notes payable consisted of the following:

Interest expense on these notes for the nine month periods ended September 30, 2009 and 2008 was $26,130 for each period.

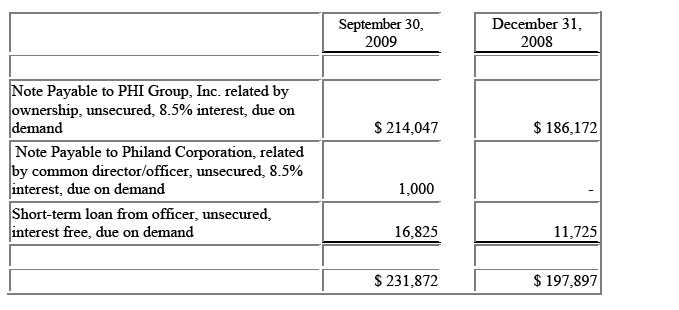

4. PAYABLES TO RELATED PARTIES

At September 30, 2009 and December 31, 2008, notes payable to related parties consisted of the following:

The increases in note payable to PHI Group, Inc., Philand Corporation and short-term loan from officer by $27,875, $1,000 and $5,100 respectively, were for amounts lent to the Company to pay for operating expenses.

Imputed interest on the interest free short-term loan from officer in the amount of $901 and $2,498 were included as an increase to additional paid in capital at September 30, 2009 and December 31, 2008, respectively.

5. SUBSEQUENT EVENTS

There were not any subsequent events through November 11, 2009.

Item 2. Management's Discussion and Analysis

Forward Looking Information

The Private Securities Litigation Reform Act of 1995 provides a "safe harbor" from liability for forward-looking statements. Certain information included in this Form 10-Q and other materials filed or to be filed by the Company with the Securities and Exchange Commission (as well as information included in oral statements or other written statements made or to be made by or on behalf of the Company) are forward-looking statements. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance and underlying assumptions that are not statements of historical facts. This document and any other written or oral statements made by us or on our behalf may include forward-looking statements, which reflect our current views with respect to future events and financial performance. The words "believe," "expect," "anticipate," "intends," "estimates," "forecast," "project" and similar expressions identify forward-looking statements.

Such forward-looking statements involve important risks and uncertainties, many of which will be beyond the control of the Company. These risks and uncertainties could significantly affect anticipated results in the future, both short-term and long-term, and accordingly, such results may differ from those expressed in forward-looking statements made by or on behalf of the Company. These risks and uncertainties include, but are not limited to, changes in external competitive market factors or in the Company's internal budgeting process which might impact trends in the Company's results of operations, unanticipated working capital or other cash requirements, changes in the Company's business strategy or an inability to execute its strategy due to unanticipated change in the industries in which it operates, and various competitive factors that may prevent the Company from competing successfully in the marketplace. Although we believe that these assumptions were reasonable when made, these statements are not guarantees of future performance and are subject to certain risks and uncertainties, some of which are beyond our control, and are difficult to predict. Actual results could differ materially from those expressed in forward-looking statements.

Readers are cautioned not to place undue reliance on any forward-looking statements, which reflect management's view only as of the date of this report. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect subsequence events or circumstances. Readers are also encouraged to review the Company's publicly available filings with the Securities and Exchange Commission.

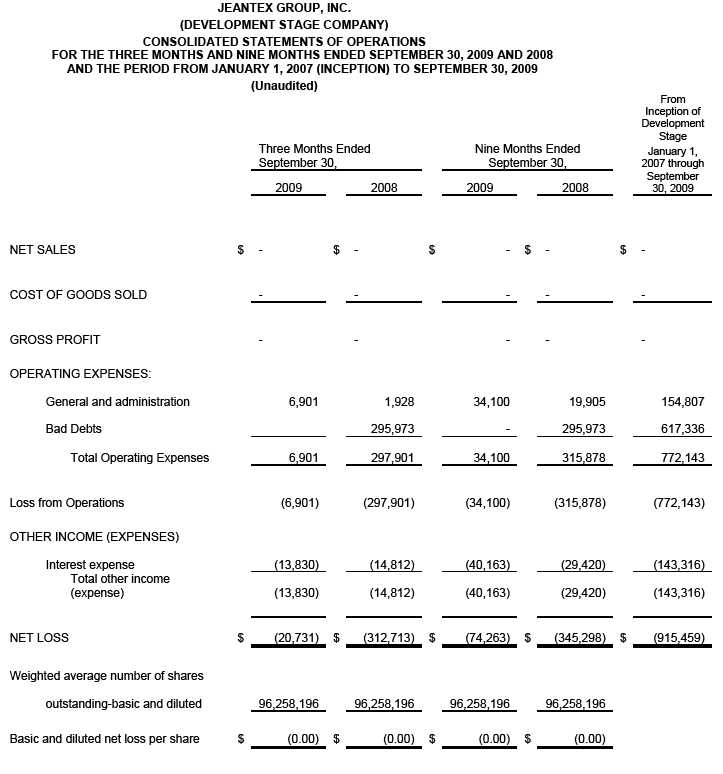

Results of Operations

Three Months Ended September 30, 2009 Compared to Three Months Ended September 30, 2008

Revenues:

The Company had no revenue for the quarters ended September 30, 2009 or 2008.

Operating Expenses:

The Company incurred total operating expenses of $6,901 for the quarter ended September 30, 2009 as compared to $1,928 for the same quarter in 2008. The increase is due to increase in general and administration expenses in the current period compared to the corresponding quarter in 2008.

Loss from operations:

The Company had losses from operations of $6,901 for the quarter ended September 30, 2009 as compared to a loss from operations of $1,928 for the quarter ended September 30, 2008. This increase of loss was due to the increase in general and administration expenses in the current quarter.

Net loss:

The Company had a net loss of $20,731 for the quarter ended September 30, 2009 as compared to a net loss of $312,713 in the same quarter in 2008. The net loss based on the basic and diluted weighted average number of common shares outstanding for the quarters ended September 30, 2009 and 2008 was $0.00 for both periods.

Nine Months Ended September 30, 2009 Compared to Nine Months Ended September 30, 2008

Revenues:

The Company had no revenue for the periods ended September 30, 2009 or 2008.

Operating Expenses:

The Company incurred total operating expenses of $34,100 for the period ended September 30, 2009 as compared to $19,905 for the same period in 2008. The operating expenses consisted of general and administration expenses. The general administration expenses increased in the period ended September 30, 2009 by $14,195 compared to the same period in the prior year due to an increase in audit fees.

Loss from operations:

The Company had losses from operations of $34,100 for the period ended September 30, 2009 as compared to a loss from operations of $19,905 for the same period in 2008. This increase of loss was due to an increase in general and administration expense in the period ended September 30, 2009.

Net loss:

The Company had a net loss of $74,263 for the period ended September 30, 2009 as compared to a net loss of $59,312 in the same period in 2008. The net loss based on the basic and diluted weighted average number of common shares outstanding for the periods ended September 30, 2009 and 2008 was $0.00 for both periods.

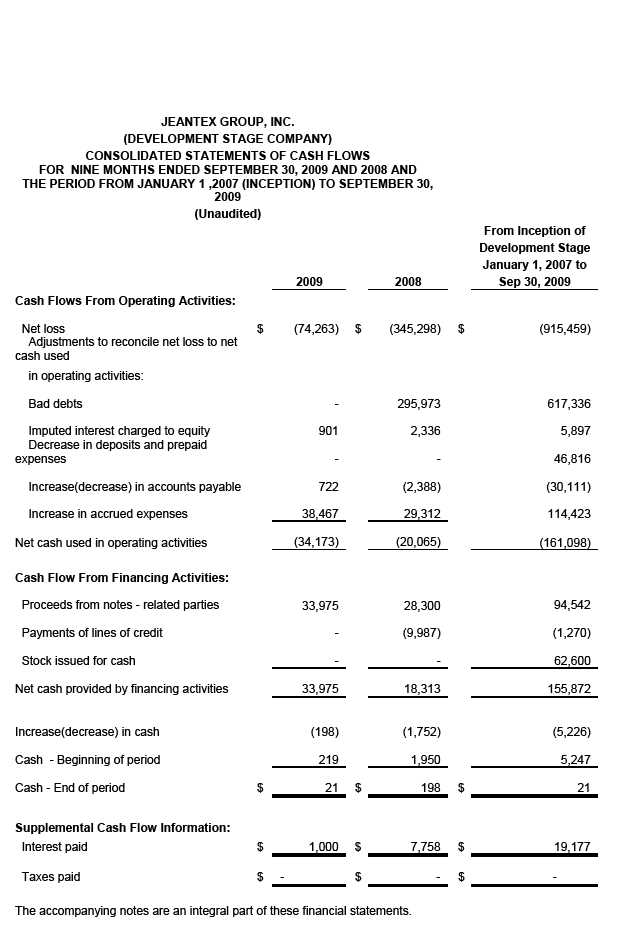

Liquidity and Capital Resources

At September 30, 2009, the Company's had $21 in cash. The Company used $34,173 for operating activities during the nine-month period ended September 30, 2009 compared to $30,052 for the same period in 2008.

The use of cash in operating activities in 2009 and 2008 were for the payments of some accounts payable and interest.

In financing activities, the Company obtained $33,975 and $28,300, respectively from proceeds on notes from a related party during the nine-month period ended September 30, 2009 and 2008.

The Company has incurred an accumulated deficit as of September 30, 2009 of $17,685,459.

The future of the Company is dependent on its ability to generate cash from future acquisition of a business. There can be no assurance that the Company will be able to implement its current plan.

Item 3. Quantitative and Qualitative Disclosure about Market Risk

None

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

An evaluation was carried out under the supervision and with the participation of the Company's management, including the Chief Executive Officer ("CEO") and Chief Financial Officer ("CFO") (in this case the same person), of the effectiveness of the Company's disclosure controls and procedures as of September 30, 2009. Based on that evaluation, the CEO/CFO has concluded that the Company's disclosure controls and procedures are not effective to provide reasonable assurance that: (i) information required to be disclosed by the Company in reports that it files or submits under the Securities Exchange Act of 1934 is accumulated and communicated to the Company's management, including the CEO/CFO, as appropriate to allow timely decisions regarding required disclosure by the Company; and (ii) information required to be disclosed by the Company in reports that it files or submits under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in Securities and Exchange Commission rules and forms.

Changes in Internal Controls

There was no change in our internal control over financial reporting that occurred during this fiscal quarter that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Item 4T. Internal Control over Financial Reporting

This quarterly report does not include an attestation report of the Company's registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the Company's registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management's report in this quarterly report.

PART II. OTHER INFORMATION

Item 1. Legal Proceedings

Christopher Long vs. Jeantex Group, Inc. et al., Case Number 07CC02012

On January 22, 2007, Christopher Long, former President and CEO of the Company, filed a claim with the Superior Court of California, County of Orange, Central Justice Center, against the Company and Henry Fahman, Interim President of the Company, for a total of $250,000 and accrued interest at 8% per annum in connection with the promissory note dated March 31, 2005 which was made to Christopher Long as a part of the Rescission Agreement between the Company and Lexor International, Inc. While these amounts have been recorded in the books of the Company, due to the fact that Christopher Long and his spouse failed to surrender the 10,867,000 shares of the Company’s common stock to the Company as a condition of the referenced Rescission Agreement and because of the legal costs incurred by the Company as a result the legal proceedings against Lexor International, Inc. for personal injuries allegedly sustained by patrons of certain nail salons that purchased foot spas designed and manufactured by Lexor International, Inc. and Christopher Long, the Company believes these claims have no merit and intends to defend these claims.

Ulrich vs. Than, et al. and related cross-action, Case Number 1-05-CV-040356; Welby, et al. vs. Le, et al. and related cross-action, Case Number 1-05-CV-038287; Feezor, et al. vs. Le, et al. and related cross-action, Case Number 1-04-CV-029940; Eakins vs. Lexor International, Inc., et al., Case Number 1-05-CV-045817; Jordan, et al. vs. Lexor International, et al., Case Number 1-05-CV-040365.

Santa Clara County Superior Court, Civil - Unlimited Jurisdiction, 191 North First Street, San Jose, CA 95113:

These claims noted above are for the personal injuries allegedly sustained by Plaintiffs as a result of their patronage of certain nail salons and the use of foot spas designed and manufactured by Defendants Lexor International, Inc., a Maryland corporation, and Christopher Lac Long, and sold by Defendants Lexor International, Inc., Christopher Lac Long and David Vo, individually and DBA Little Saigon Beauty Supply, which were allegedly defective and allegedly improperly designed, maintained, sanitized, disinfected, labeled and/or instructed by Defendants.

Management believes these claims have no merit as far as Jeantex, Inc. and Jeantex Group, Inc. are concerned and will defend them vigorously.

Yves Castaldi Corp.’s Filing for Chapter 11 Bankruptcy Protection

As a result of Yves Castaldi Corp.’s filing for Chapter 11 protection with the United States Bankruptcy Court of the Central District of California and naming the Company as a creditor during the first quarter of Fiscal Year 2007, the Company has written off its cash investments in Yves Castaldi Corp. and relinquished its equity ownership in Yves Castaldi Corp. The Company will also reclaim all the 10,000,000 shares that were issued to Yves Castaldi Corp according the Stock Purchase Agreement dated December 20, 2005 between Yves Castaldi Corp. and the Company.

Item 2. Unregistered Sales of Equity and Use of Proceeds

None

Item 3. Default upon senior Securities

None

Item 4. Submission of matters to a vote of security holders

None

Item 5. Other information

None

Item 6. Exhibits and Reports on Form 8-K

(A) Exhibits

Index to Exhibits.

|

Exhibit 31.1 |

CERTIFICATION OF THE PRINCIPAL EXECUTIVE/FINANCIAL OFFICER PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 |

|

Exhibit 32.1 |

CERTIFICATION PURSUANT TO 18 U.S.C. Sections 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(b) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

JEANTEX GROUP, INC.

(Registrant)

Date: November 12, 2009

By: /s/ Henry D. Fahman

Henry D. Fahman,

Principal Executive/Financial Officer