Attached files

| file | filename |

|---|---|

| EX-3.3 - Wollemi Mining Corp. | ex3-3.htm |

| EX-2.1 - Wollemi Mining Corp. | ex2-1.htm |

| EX-10.1 - Wollemi Mining Corp. | ex10-1.htm |

| EX-99.1 - Wollemi Mining Corp. | ex99-1.htm |

| EX-10.3 - Wollemi Mining Corp. | ex10-3.htm |

| EX-16.1 - Wollemi Mining Corp. | ex16-1.htm |

| EX-21.1 - Wollemi Mining Corp. | ex21-1.htm |

| EX-10.5 - Wollemi Mining Corp. | ex10-5.htm |

| EX-16.2 - Wollemi Mining Corp. | ex16-2.htm |

| EX-10.4 - Wollemi Mining Corp. | ex10-4.htm |

| EX-10.2 - Wollemi Mining Corp. | ex10-2.htm |

| EX-10.6 - Wollemi Mining Corp. | ex10-6.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of

Report (Date of Earliest Event Reported): November 5, 2009

WOLLEMI

MINING CORP.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

333-149898

|

26-1272059

|

|

(State

of Incorporation)

|

(Commission

File No.)

|

(IRS

Employer ID No.)

|

No.

78 Kanglong East Road, Yangdaili, Chendai Township

Jinjiang

City, Fujian Province, P. R. China

(Address

of Principal Executive Offices)

Tel:

(86 595) 8677 0999

Fax:

(86 595) 8677 5388

(Registrant’s

Telephone Number, Including Area Code)

Room

42, 4th Floor, New Henry House, 10 Ice Street, Central, Hong Kong

(Former

name or former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

|

o

|

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR.425)

|

|

o

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

o

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

|

o

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

TABLE

OF CONTENTS

|

Item

No.

|

Description

of Item

|

Page

No.

|

||

|

Item

1.01

|

Entry

Into a Material Definitive Agreement

|

3 | ||

|

Item

2.01

|

Completion

of Acquisition or Disposition of Assets

|

3 | ||

|

Item

3.02

|

Unregistered

Sales of Equity Securities

|

53 | ||

|

Item

4.01

|

Changes

in Registrant’s Certifying Accountant

|

54 | ||

|

Item

5.01

|

Changes

in Control of Registrant

|

54 | ||

|

Item

5.02

|

Departure

of Directors or Certain Officers; Election of Directors; Appointment of

Certain Officers; Compensatory Arrangements of Certain

Officers

|

55 | ||

|

Item

5.03

|

Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal

Year

|

55 | ||

|

Item

5.06

|

Change

in Shell Company Status

|

55 | ||

|

Item

8.01

|

Other

Events

|

55 | ||

|

Item

9.01

|

Financial

Statements and Exhibits

|

55 |

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

document contains forward-looking statements, which reflect our views with

respect to future events and financial performance. These

forward-looking statements are subject to certain uncertainties and other

factors that could cause actual results to differ materially from such

statements. These forward-looking statements are identified by, among

other things, the words “anticipates”, “believes”, “estimates”, “expects”,

“plans”, “projects”, “targets” and similar expressions. Readers are

cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date the statement was made. We undertake no

obligation to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. Important

factors that may cause actual results to differ from those projected include the

risk factors specified below.

USE

OF DEFINED TERMS

Except as

otherwise indicated by the context, references in this report to “Wollemi” or

“Company” are references to Wollemi Mining Corp., a Delaware corporation,

references to “Peakway” are references to Peakway worldwide Limited, a British

Virgin Islands corporation that is wholly-owned by Wollemi, and references to

“Alberta” are references to Alberta Holdings Limited, a Hong Kong corporation

that is wholly-owned by Peakway. References to “Pacific Shoes” are to Fujian

Jinjiang Pacific Shoes Co., Limited, a PRC Company, and references to “Baopiao

Shoes” are to Fujian Baopiao Light Industry Co., Limited, a PRC company,

(collectively “Chinese Subsidiaries”). References to “Cabo” are

2

references

to Cabo Development Limited, a British Virgin Islands corporation that was the

former shareholder of Peakway prior to the reverse

acquisition. References to “we,” “us” or “our” are references to the

combined business of Wollemi, Peakway, Alberta, and the Chinese

Subsidiaries. The term “Securities Act” means the Securities Act of

1933, as amended, and the term “Exchange Act” means the Securities Exchange Act

of 1934, as amended, the term “RMB” means Renminbi, the legal currency of China

and the terms “U.S. dollar,” “$” and “US$” mean the legal currency of the United

States. According to the currency exchange website www.xe.com, on November 5,

2009, $1.00 was equivalent to RMB 6.8286. References to “China” and

“PRC” are references to “People’s Republic of China.” References to “BVI” are

references to the “British Virgin Islands.”

ITEM

1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On

November 5, 2009, we entered into a share exchange agreement with Peakway

Worldwide Limited, a British Virgin Islands company, and its sole shareholder,

Cabo Development Limited (“Cabo”), a British Virgin Islands company (the “Share

Exchange Agreement”). Pursuant to the Share Exchange Agreement, Cabo

agreed to transfer all of its shares of the capital stock of Peakway, in

exchange for a number of newly issued shares of our common stock that would, in

the aggregate, constitute 70% of our issued and outstanding capital stock as of

and immediately after the consummation of the transactions contemplated by the

Share Exchange Agreement.

As a

result of the reverse acquisition, we acquired 100% of the capital stock of

Peakway and consequently, control of the business and operations of Chinese

Subsidiaries of Peakway. Prior to the reverse acquisition, we were in the

development stage of engaging in the acquisition and exploration of mining

properties and had not yet realized any revenues from our operations. From and

after the closing of the Share Exchange Agreement, our primary operations

consist of the business and operations of Peakway, which are conducted by

Chinese Subsidiaries of Peakway.

Our board

of directors (the “Board”) as well as the director and the shareholder of

Peakway, each approved the reverse acquisition.

Copies of

the Share Exchange Agreement are filed as Exhibits 2.1 to this

report.

ITEM

2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

As

described in detail in Item 1.01 above, on November 11, 2009, we completed an

acquisition of Peakway pursuant to the Share Exchange Agreement. The

acquisition was accounted for as a recapitalization effected by a share

exchange, wherein Peakway is considered the acquirer for accounting and

financial reporting purposes. The assets and liabilities of the

acquired entity have been brought forward at their book value. As a

result of the reverse acquisition, our principal business became the business of

Peakway, which is to develop, research, design, manufacture and market sports

and casual footwear mainly in the PRC. Our products are sold in 24 provinces and

administrative regions in China as well as to South America through our

distributor.

FORM

10 DISCLOSURE

As

disclosed elsewhere in this report, we acquired Peakway in a reverse acquisition

transaction. Item 2.01(f) of Form 8-K states that if the registrant

was a shell company like we were immediately before the reverse acquisition

transaction disclosed under Item 2.01, then the registrant must disclose the

information that would be required if the registrant were filing a general form

for registration of securities on Form 10.

Accordingly,

we are providing below the information that would be included in a Form 10 if we

were to file a Form 10. Please note that the information provided

below relates to the combined enterprises after the acquisition of Peakway,

except that information relating to periods prior to the date of the reverse

acquisition only relate to Wollemi unless otherwise specifically

indicated.

DESCRIPTION

OF BUSINESS

OUR

HISTORY

Overview

We are a

Delaware corporation that was incorporated on October 9, 2007 and we are

headquartered in Fujian Province, China. From our inception until

November 11, 2009, when we completed a reverse acquisition transaction with

Peakway, we were primarily engaged in the acquisition and exploration of mining

properties and had not realized any revenues from our planned

operations.

3

On

September 28, 2009, the Board approved a 1.5-for-1 forward stock split of all

issued and outstanding shares of common stock of the Company. On October 16,

2009, the Financial Industry Regulatory Authority (FINRA) approved our

application for forward stock split. As the result, the total issued

and outstanding shares of common stock of the Company prior to the reverse

acquisition were 4,500,000.

By two

stock purchase agreements dated September 29, 2009, we experienced a change in

control whereby a number of investors, acquired an aggregate of 3,000,000 post

forward split shares of common stock from a former shareholder. Upon this change

in control, our Board determined that the implementation of our business plan

prior to the change in control was no longer financially feasible, and we

adopted an acquisition strategy focused on pursuing growth by acquiring

undervalued businesses with a history of operating revenues. Our

Board approved the Share Exchange Agreement and we entered into the Share

Exchange Agreement with Peakway and Cabo on November 5, 2009.

On May

31, 2008, we sold 1,000,000 shares of common stock to 25 investors for $0.03 per

share pursuant to our S-1 registration statement for $30,000.

Background

and History of Peakway and its Operating Subsidiaries

Peakway

was incorporated in the British Virgin Islands by Cabo Development Limited, a

British Virgin Islands company, on November 3, 2006. Alberta Holdings Limited is

a Hong Kong company incorporated on November 4, 2006, which was acquired by

Peakway on November 1, 2007. Alberta presently has two direct, wholly-owned

Chinese operating subsidiaries: Fujian Jinjiang Pacific Shoes Co.,

Limited and Fujian Baopiao Light Industry Co., Limited.

Fujian

Jinjiang Pacific Shoes Co., Limited, or Pacific Shoes was established as a

sino-foreign equity joint venture entity in the PRC on April 9, 1993. On January

12, 2009, Alberta acquired 100% equity interest in Pacific

Shoes. Currently, all of our revenues have been generated from

Pacific Shoes.

Fujian

Baopiao Light Industry Co., Limited, or Baopiao Shoes was established as a

wholly foreign-owned enterprise (“WFOE”) in the PRC on February 15, 2006. On

February 26, 2009, Alberta acquired 100% equity interest in Baopiao Shoes. As of

the date of this report, Baopiao Shoes is still in its development stage and has

not yet generated any revenues.

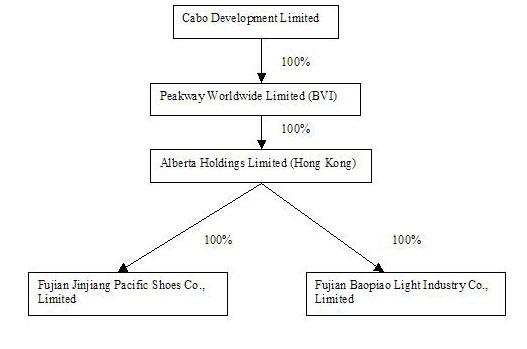

The

structure prior to the reverse acquisition is as below:

Acquisition

of Peakway Worldwide Limited

Through

the reverse acquisition of Peakway we acquired all of the issued and outstanding

capital stock of Peakway, which became our wholly-owned subsidiary, and in

exchange for that capital stock we issued to Cabo, the former stockholder of

Peakway, 10,500,000 shares of our common stock. Upon the consummation of the

reverse acquisition, Cabo becomes our controlling stockholder.

Upon the

closing of the reverse acquisition, on November 11, 2009, our sole director and

officer, Mr. Yi Chen, submitted his resignation letter pursuant to which he

resigned effective immediately from all offices of the Company that he held and

from his position as our director. Simultaneously, five new directors were

appointed, including three independent directors. Mr. Haiting Li was appointed

as our Chief Executive Officer and Chairman of the Board at the closing of the

reverse acquisition of Peakway. Descriptions of our proposed

directors and officers can be found below.

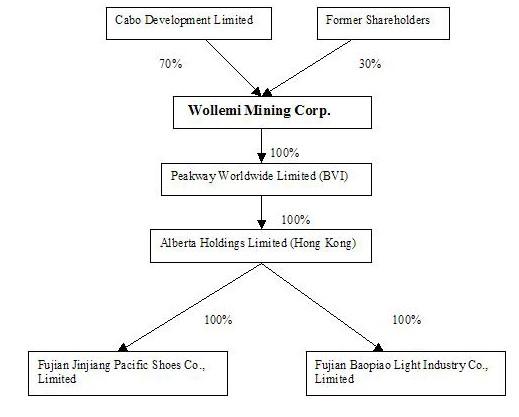

The

structure after the reverse acquisition is as below:

4

Following

the reverse acquisition, we, through our Chinese Subsidiaries, develop,

research, design, manufacture and sell series of casual footwear, men's and

ladies’ sports footwear mainly in the PRC as well as in the South America

through our distributors. Our executive offices are located at No. 78 Kanglong

East Road, Yangdaili, Chendai Township, Jinjiang City, Fujian Province, P. R.

China 300350, our telephone number is (86 595) 8677 0999, and our fax number is

(86 595) 8677 5388. Our website is www. baopiao.com .

Information on our website or any other website is not a part of this

report.

OUR

INDUSTRY

General

China

currently is the world largest footwear-making countries. There are 30, 000 to

40, 000 footwear-making enterprises worldwide, with the total number of workers

coming up to 10 million. In the 1960s and 1970s, there has been a shift of

global footwear-making centers, i.e. from Italy, Spain and Portugal to Japan,

Taiwan, Korea, Hong Kong and other countries and regions of relative low costs

and enormous industrial resources. In the late 1980s and early 1990s, the

centers moved on toward Chinese mainland and coastal areas. Lower costs for land

and labor, abundant industry resources and favorable investment environment had

served as the desirable conditions for the development of China's

footwear-making industry at the time.

Ever

since 2008, despite of unfavorable international economy and domestic natural

calamities, Chinese economy has not been deviated from its development. China

has launched a number of macro control and adjustment, which may create positive

conditions for the development of the footwear-making industry in China. China

has become the largest footwear producing and export country in the world since

1996. In the subsequent 10 years, the Chinese footwear-making industry has

outshined all the others, with an increase of 10%-20% year over year. Throughout

2008, China is still the most powerful footwear manufacturing country in the

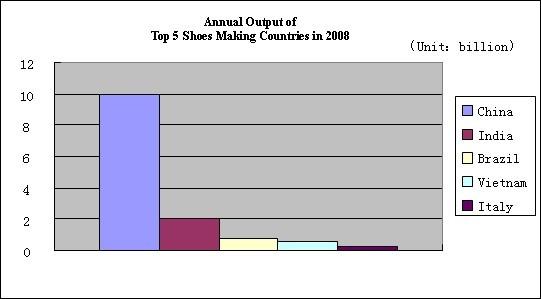

world. The table below illustrates five largest footwear producers in

2008.

5

(Sources:

http://www.chinairn.com, Analysis of the Development of

Footwear Making Industry of China in the World, Press date: Feb. 13,

2009)

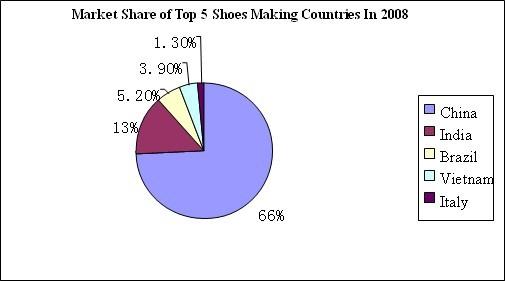

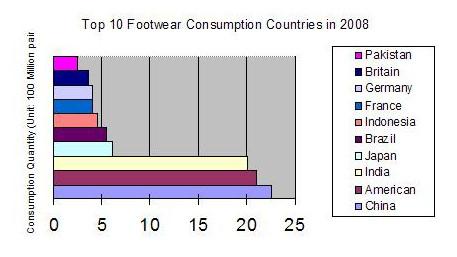

China has

maintained its position of being the largest footwear consumption country among

the top 10 annual footwear consumption countries in the world as

below:

6

(Sources:

HC 360.com, Analysis of

Development Trend of Footwear Making Industry of China in Future, Date:

January 16, 2009, 18:45)

The

footwear consumption market is huge and will expand continuously in China. From

the aspect of Chinese market, the research report released by UBS recently says

that the average consumption volume will increase among Chinese women consumers

because the economic growth and urbanization of China will render a continuous

increase of discretionary income and purchasing power. According to the report,

the urbanization has already led to the formation of mid-income Chinese

consumers who has special requirements or preference for footwear. This

indicates that the Chinese footwear market has fairly huge potentials in growth.

From the aspect of global market, relevant statistics shows that China is the

largest footwear export country for America, European Union and Russia. The

success of Chinese footwear making companies relies on whether they can create

their own brand and marketing channels, convert trade growth mode, and gradually

expand their self-branded market shares in the global market.

PRC

Footwear-making Industry

As of

today, China is the largest country in the global footwear-making sector. Asia

is now providing more than 85% of footwear products for the global market. There

includes China, Vietnam, India, Indonesia and Thailand, amongst which, the

annual output of China's footwear exceeds 10 billion pairs, with an employment

of more than 4 million persons, and a total annual output of more than 50% in

the world. A completed industrial chain ranging from R&D designs, product

processing to marketing has come into shape, so the footwear-making industry has

become the important mainstay of China's light industry. In 2007, the export of

finished footwear of China was $24.137 billion, which accounted for 36% of the

total amount of footwear export in the world; 8.177 billion pairs of footwear

were exported, which accounted for 73% of the total quantity of global footwear

export. From January to September in 2008, 6.27 billion pairs of finished

footwear were exported by China, which decreased by 2.76% compared with the same

period of last year.

Table

1 Comparison among Industry Data from 1998 to 2007

|

Year

|

Footwear

and related enterprises

|

Number

of employees

|

Enterprises

with

considerable

scale

|

Gross

output value

|

||||||

|

1998

|

More

than 3,000

|

300,000 | 4 |

RMB

9 billion

(approximately

$1.33 billion)

|

||||||

|

2003

|

More

than 4,000

|

500,000 | 216 |

RMB

23 billion

(approximately

$3.4 billion)

|

||||||

|

2007

|

More

than 5,000

|

Nearly

600,000

|

Accounting

for 60%

|

RMB

63.8 billion

(approximately

$9.4 billion)

|

||||||

(Data

source: http://www.qzshoes.org,

in November, 2008, Quanzhou

Footwear.)

7

China's

footwear production and export are mainly concentrated in coastal provinces and

cities in the eastern part, and a relatively complete industry group has formed

in Guangdong (Dongguan), Fujian (Jinjiang), Sichuan (Chengdu), Chongqing,

Zhejiang (Wenzhou), etc, with an integration of raw materials, research and

development, production, sales and the like. China’s footwear product is wide in

its variety, with superior quality, lower cost, and a strong marketing

competence in the global footwear market.

The Athletic and

Casual Footwear Industry in China

The

rising of the sports and leisure goods consumption is an inevitable outcome from

the development of the society, the economy and the improvement of the living

standards. In 1980s and 1990s, the income of Chinese people was mainly spent on

basic life necessities. In recent years, the advancement of science and

technology and the improvement of living standards have resulted in the change

in consumption mode and concept. In addition, with the push of such a series of

measures as the implementation of 5-day work system since 1995 and two long

holidays as Chinese New Year and National Holiday since 1999, people had more

time spent on sports and leisure. Moreover, 2008 Beijing Olympic led the sports

industry of China to present vibrant prosperity, and endowed a rare but good

development opportunity to the sports goods industry of China. Jinjiang, located

in coastal Fujian province, is generally accepted as the capital of footwear in

China, especially in the industry of sports and casual footwear. In 2007,

Jinjiang was just approved as the third sports industry base in China by General

Administration of Sports, and a large number of sports brands of market

competitiveness were available in Jinjiang.

Ladies

Footwear Market in China

The

population of China exceeds 1,300 million, wherein, female population is 624

million, which accounts for 48% of the total population. This constitutes a

market of significant potential. However, the huge market opportunities hide

lots of competitions, and regional brands account for 80% of the market share.

Currently, there are more than 7,200 enterprises involved in footwear-making in

China, more than 10,000 brands together with those introduced by foreign

enterprises into China, and famous international brands and leather footwear

brands out of originally-equipped manufacturers.

In 2007,

the total quantity consumed in China's female footwear market was 6.5 billion

pairs, with a total market consumption of RMB235.2 billion (approximately $34.6

billion), and China had the rapid growth rate of 12% for more than ten years.

For 13 years in a row, China has been the largest consumer market for ladies

footwear. By 2010, the total consumption of ladies footwear will exceed 8

billion pairs, and it is estimated that the total volume of business

transactions in the market will be up to RMB 330 billion (approximately $48.5

billion). Therefore, tremendous opportunities can be expected in China's ladies

footwear market. In the PRC market, the selling of ladies footwear shows a

steady upward trend, and there is a huge potential in China's consumer market

for ladies footwear in future.

OUR

BUSINESS

Our

Brand

We market

our products mainly under the brand name” ” or

“Baopiao” in English translation. In 2006, the Trademark Office of

the State Administration for Industry and Commerce of the PRC, named our

“Baopiao” trademark as one of “Chinese Well-Known Trademarks”. At the same year,

our branded footwear was named as one of “Chinese Famous Brand Products” by the

General Administration of Quality Supervision, Inspection and Quarantine of the

PRC. In 2005, “Baopiao” was listed as one of the top ten satisfied brands for

Chinese consumers. In 2002, Pacific Shoes passed the authentication

of ISO9001:2000 quality control system.

” or

“Baopiao” in English translation. In 2006, the Trademark Office of

the State Administration for Industry and Commerce of the PRC, named our

“Baopiao” trademark as one of “Chinese Well-Known Trademarks”. At the same year,

our branded footwear was named as one of “Chinese Famous Brand Products” by the

General Administration of Quality Supervision, Inspection and Quarantine of the

PRC. In 2005, “Baopiao” was listed as one of the top ten satisfied brands for

Chinese consumers. In 2002, Pacific Shoes passed the authentication

of ISO9001:2000 quality control system.

” or

“Baopiao” in English translation. In 2006, the Trademark Office of

the State Administration for Industry and Commerce of the PRC, named our

“Baopiao” trademark as one of “Chinese Well-Known Trademarks”. At the same year,

our branded footwear was named as one of “Chinese Famous Brand Products” by the

General Administration of Quality Supervision, Inspection and Quarantine of the

PRC. In 2005, “Baopiao” was listed as one of the top ten satisfied brands for

Chinese consumers. In 2002, Pacific Shoes passed the authentication

of ISO9001:2000 quality control system.

” or

“Baopiao” in English translation. In 2006, the Trademark Office of

the State Administration for Industry and Commerce of the PRC, named our

“Baopiao” trademark as one of “Chinese Well-Known Trademarks”. At the same year,

our branded footwear was named as one of “Chinese Famous Brand Products” by the

General Administration of Quality Supervision, Inspection and Quarantine of the

PRC. In 2005, “Baopiao” was listed as one of the top ten satisfied brands for

Chinese consumers. In 2002, Pacific Shoes passed the authentication

of ISO9001:2000 quality control system.Our

Product Portfolio

We

believe that casual and sports footwear are the most popular footwear in the

PRC, because they are generally accepted at either the workplace or on the

various casual occasions. Our Baopiao branded sports and casual products target

at both female and male customers, while our products are mainly available for

ladies. We aim to impress our

8

consumers

with professional designs, advanced technology, maximum comfort, function and

fashionable products. Our consumers are aged between 18 and 48 years

old. In particular, we target at consumers aged between 20 and 35 years

old. We have set moderate prices ranging from $18 to $30 that are

affordable to our consumers. Based on different ages, genders, occupations and

life styles, we mainly target following customers:

|

Targeted group

|

Gender

|

Description |

|

||

|

18-48

years old

|

Female

|

Urban

dwellers, students, office ladies, housewives, the females who live in the

second and third tier cities or countryside.

|

|||

|

18-40

years old

|

Male

|

Students,

urban dwellers, and the males who live in the second and third tier cities

or countryside.

|

|||

Each year

we offer an average of approximately 80 new footwear styles (excluding different

colors) with retail prices generally ranging from $18 to $30.

Currently,

our Baopiao branded products can be divided into the following five broad

series: Business Series, Travelling Series, Outdoor Series, Casual Series, and

Casual Sports Series. These five series approximately account for 35%, 10%, 20%,

20% and 15%, respectively in our total sales for the period ended June 30,

2009.

|

1.

|

“Business

Series”--- target at office ladies and business women. We have applied the

esthetic and fashion elements as well as the invisible height-increasing

function to this series. These products target at the middle and senior

female managers, white-collars, and business women aged between 28 and 38

years old. We focus on “elegance” while designing the shapes, colors,

concept and function of the shoes. We also intend to apply fashionable

materials to make our product decent and attractive. The core of our

design lies in the toe cap and the shoe heel shining leather used on the

shoe surface. We intend to emphasize the element of “elegance” in our

business series.

|

Under

this series, the raw materials of products include leather, buffed leather,

flexible polymers, composite fabric, and the substrate materials are PU and

rubber. The colors of this series include white, black and silver

grey.

|

2.

|

“Travelling

Series”--- target at consumers aged between 20 and 38 years old, including

young office ladies and housewives, who have interests in traveling and

shopping. The main styles of this series include platform shoes, height

increasing shoes, hidden-heels shoes and stewardess shoes with very thick

soles and heels. We found that it is a trend in our targeted consumers to

wear hidden height-increasing footwear. We have put into great

efforts in designing lighter products. Among other products, the

“Stewardess shoes” are designed with the exclusive upper surface pattern

and the font pattern.

|

Under

this series, the raw materials of products include suede, leather, buffed leather, imitation

leather, composite fabric, and the substrate materials are PU and rubber. The

colors of this series include khaki, army green, silver grey and

black.

|

3.

|

“Outdoor

series”--- target at consumers who are keen on outdoor activities. Our

targeted consumers aged between 18 and 38 and include both male and female

who like outdoor activities, especially walking and

hiking.

|

Under

this series, the raw materials of products include split leather and suede

leather and the substrate material is rubber. The main color of this series is

white.

|

4.

|

“Casual

Series”--- offer a range of classic footwear for customers who are seeking

good quality and comfortable shoes. This series help customers to relax

themselves. We believe that footwear should be natural and leisurely while

showing fashion and more dynamic sense, and they should also be

comfortable. Casual Series are applicable to all consumers who are 18 to

48 years old. They are comfortable to wear and featured with attractive

colors, for instance the dark colors are adopted in the winter for

consumers from the north of China, while in most cases, bright, cool and

popular colors are adopted so that they look neat and tidy and are

appealed to international consumers. The leisure series emphasize the

“comfort” and the convenience to match the daily

wear.

|

9

Under

this series, the raw materials of products include composite fabric, and suede

leather and the substrate material is rubber. The colors of this series include

Khaki and coffee.

|

5.

|

“Casual

Sports Series”---target at students, and people aged between 18 and 40

years old. They are suitable to wear in various casual occasions. Casual

Sports Series are the basic product structure under our Baopiao brand. In

particular, in the off-seasons except for spring and summer or when the

promotion is launched. These products are normally sold in the

supermarkets.

|

Under

this series, the raw materials of products include buffed leather and suede

leather and the substrate material is PU. The main color of this series is

white.

We have

designed exclusive symbols and icons to fit the above five series in order to

impress consumers and demonstrate the specialty and creativity of our Baopiao

brand. Some of these icons are cartoon characters to attract young

people.

Our

Business Model

Our

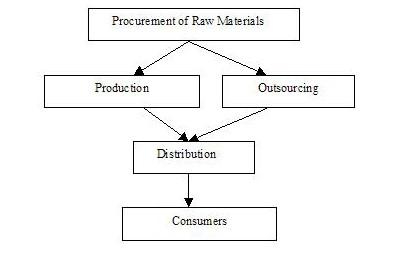

business model is illustrated in the following diagram:

Procurement

of Raw Material

In

general, raw materials used for making both sports and casual footwear are

leather, buffed leather, imitation leather, composite fabric, PU, natural

rubber, synthetic rubber, adhesive and the like. All of the Company’s raw

materials are acquired from Chinese suppliers mainly located in Fujian province.

We believe that we have good cooperation with raw material

suppliers.

As a

steady supply of quality raw materials is crucial to our production, we

constantly evaluate the suitability of our suppliers and their ability to assure

the timely delivery of quality raw materials. Our quality control department has

established internal rules and criteria to govern our procurement from our

suppliers.

For the

six months period ended June 30, 2009, our five largest suppliers accounted for

approximately 31.04% of the aggregate amount of purchases from all suppliers,

and our largest supplier accounted for approximately 12.59% of the aggregate

amount of purchases from all suppliers.

The

following table lists the name of our top five suppliers, the value of the raw

materials supplied and the percentage of total raw materials (by cost)

supplied.

10

|

Top

5 Suppliers (1/1/2009 – 6/30/2009)

|

|||||||||

| Supplier |

|

Supply

Value in US$

|

Percentage

of Total Raw

Material

Cost

|

||||||

|

Huachang

Footwear Materials Company

|

452,333 | 12.59 | % | ||||||

|

Zhida

Footwear Factory

|

265,485 | 7.39 | % | ||||||

|

Xinxiezhi

Footwear Factory

|

193,545 | 5.39 | % | ||||||

|

Fuxin

Package Factory

|

109,272 | 3.04 | % | ||||||

|

Zhimeng

Footwear Materials Company

|

94,381 | 2.63 | % | ||||||

|

Total

|

1,115,016 | 31.04 | % | ||||||

Our

Production

Our

footwear production facilities are located in Jinjiang, Fujian province, PRC,

and have a total gross floor of 11,500 square meters with three production

lines. As of December 31, 2008, we have aggregate annual production volume

amounted to approximately 2.2 million pairs of footwear. In order to meet the

increasing demand for our products, the production facilities at our Baopiao

Shoes for a total area of 57,728 square meters is currently under construction

and is expected to commence production in 2010.

The

production facilities at our Pacific Shoes began production in 1993. Our

production machinery is comprised mainly of sewing machines, moulding machines,

pressing machines, heating machines, cooling machines, compressing machines,

various kinds of testing machines and a CAD computerized design

system.

Our

Production Processes

The

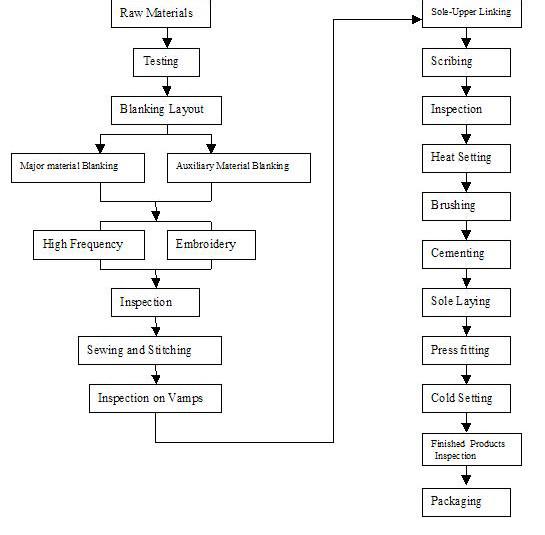

following flowchart outlines our standard production process for our footwear

products:

11

|

Blanking:

|

Auxiliary materials are tailored to form auxiliary components with various specified forms in accordance with the requirements of processing technique, including outside and inside material cutting. | |

|

High

frequency:

|

High-frequency

induction heating equipment is utilized for carrying out mold heating to

materials of soft and hard leather and material of real leather or cloth

in certain forms so as to ensure the occurrence of concavo-convex patterns

on the surface of the materials.

|

|

|

Stitching:

|

It

is also known as sewing, which are assembled into the upper of

semi-finished products by means of personal skills in accordance with the

production flow.

|

|

|

Embroidery:

|

Computerized

embroidery machines are adopted to embroider the auxiliary

components and mainly to make trademarks and

patterns.

|

|

|

Sole-upper

linking:

|

Lasting

pincers and counter lasting machines are utilized for lasting the upper

of shoes and middle bushings on the shoe tree and

shaping.

|

|

12

|

Scribing:

|

Scribers

are utilized for marking lines for the upper bushed on the shoe tree so as

to determine the position in which the upper is mutually pasted up with

the shoe sole.

|

|

Heat

setting:

|

Shoes

are put into a neat setter for heating so as to shape the vamp

of the shoes.

|

|

Cementing:

|

It

refers to a production process in which the binding agent is evenly

brushed on the upper

and the outer bottom.

|

|

Sole

laying:

|

The

shoe sole with glue is jointed with the upper bushed on the shoe

tree.

|

|

Press

fitting:

|

Gas

in the interface is further eliminated by the action of pressure when the

shoe sole just

starts

to conglutinate with the upper but is not completely cured, thereby

enhancing the

mutual

penetration of adhesive molecules and improving the bond

strength.

|

|

Cold

setting:

|

Shoes

are put into a cooling chamber for low temperature treatment so as

to

shape

the whole shoes.

|

Quality

Control Measures

Through

Pacific Shoes, we passed the ISO9001:2000 International Quality Control

System Authentication in 2002 and implemented the comprehensive quality

control in accordance with the requirements of the quality control

system. We have set up the quality control section in each production

unit, headed by the team managers who station in the workshop with other

inspectors. Pacific Shoes employs 23 quality inspectors to undertake the field

testing and inspection in the factory. The quality control department and other

relevant departments, adopts the abrasion resistance tester, tension tester,

folding resistance tester, non-yellowing tester, low-temperature bending

machine, hydrostatic pressure tester, color fastness tester and other precise

instruments and equipment to get comprehensive technical parameters and

properties of raw and auxiliary materials, semi-manufactured goods and finished

products. We apply complete quality testing and control system throughout the

production.

At

present, the Company has the following testing equipments used for carrying out

comprehensive tests to the materials, function, color change, bending

resistance, slip stopping performance and wear resistance of the whole shoe so

as to ensure the quality, service life and good wearing experience of finished

products.

|

1

|

HY-769:

low temperature resistance testing machine—mainly for carrying out

flexibility test to finished products at a low temperature state and

cracking test to flexibility test materials of out

soles.

|

|

2

|

HY-762A:

bending resistance testing machine of finished footwear—for carrying out

bending test to finished footwear at the normal

temperature.

|

|

3

|

HY-939:

pull testing machine—for testing the peeling strength of

materials.

|

|

4

|

HY-953:

fracture strength testing machine—for testing the fracture strength of

materials (such as the fracture strength tests carrying out to PU,

nubuck.)

|

|

5

|

HY-767B:

electric friction decolorization testing machine—for carrying out

decolorization degree test to all shoe making

materials.

|

|

6

|

HY-764A:

yellowing resistance testing machine—for testing the yellowing resistance

of white material.

|

|

7

|

HY-782:

slip stopping capability testing machine of soles—for testing the slip

stopping performance of finished

footwear.

|

13

|

8

|

HY-763CB:

National Standard wear resistance testing machine—for testing the wear

resistance of out soles (remark: TPR and PU

rubber).

|

|

9

|

HY-954:

standard light source box—for carrying out light source test to the colors

of shoe making materials in order to determine the saturation and purity

of the colors.

|

With all

inspection and test machines installed, the Company is capable of conducting a

series of test, such as avulsion, peeling, compression, bending resistance, over

the finished products, the semi-manufactured products, the raw materials, and

the like. This has provided more scientific and technical supports to the

Company’s production. In 2007, Pacific Shoes was awarded the “High-tech

Enterprise” by the Fujian Science and Technology Bureau for their

height-increasing function shoes.

Outsourcing

Our

products are manufactured through a combination of internal and external

production, which we believe is cost-effective and to meet unforeseen demand. We

produced majority of our footwear products in our three production lines while

we also outsourced certain of our products to six external contract

manufacturers to enhance our production cost. For the period ended June 30,

2009, approximately 10.59% of our footwear product were produced by external

contract manufacturers. We do not enter into long term agreements

with our external contract manufacturers, and these purchase contracts do not

contain any terms that will restrict our ability to engage other contract

manufacturers.

Sales

and Marketing

Distribution

Network

We sell

our products substantially on a wholesale basis to our distributors who are

responsible for distribution to retail outlets which sell our products to

consumers. Through our distributors, the sales network of our products has

covered 24 Chinese provinces and administrative regions in various modes, such

as retail outlets, counters in department stores and shopping malls, and wall

racks in large supermarkets. In addition, our products, including our branded

products and ODM products, sold in the South America account for 25.18 % of the

total sales amount for the period ended June 30, 2009.

Sales

Model

Prior to

February of 2009, we employed a wholesale business model in the Chinese market.

We entered into annual distributorship agreements with our distributors which

set out key terms, such as the geographic area within which they are authorized

to sell our products, credit and payment terms and annual sales and network

expansion targets. As of June 30, 2009, we had a total of 26

distributors including 22 independent distributors in 22 provinces and regions

and 4 authorized distributors in 2 provinces. We do not directly own or operate

any retail outlets and do not enter into any contractual relationship with third

party retail outlet operators.

Independent

Distributors. In 2009, we have 22 independent distributors covering 22

provinces and regions of China. Each distributor is entitled to sell our

products exclusively in one province or region. We sell our products to the

distributors at a uniform discount to the unified retail price. The distributors

then distribute our products through their sales network in their respective

province. Our independent distributors manage local networks through the third

party retail operators they appointed. In 2009, our independent distributors

control a total of 24 retail outlets in 22 provinces and regions.

Authorized

Distributors. To be qualified as our authorized distributors, such

distributors need to own and directly manage a minimum of three retail outlets,

counters in department stores and shopping malls, or wall racks in large

supermarkets. In 2009, we have 4 authorized distributors who own and

directly manage their branches and retail stores to sell our products in four

cities (including one city in Anhui province, and three cities in Fujian

province). The authorized distributors are required to sell our products to

consumers at our unified retail price, however, the discount to the unified

retail price we provide to these 4 authorized distributors is less than the

discount we provide to the independent distributors.

14

We

advanced cash to the independent distributors to assist them to expand the

number of retail outlets and distribution points in the related geographic areas

in which they are located. We set guidelines for our authorized distributors in

respect of the location and decoration of the outlets with the aim of increasing

their sales opportunities and improving the recognition of our Baopiao branded

products. We believe our business model enables us to achieve growth by

leveraging the resources of our distributors, as well as the expertise in retail

distribution and retail management and local relationship of our distributors.

Among others, our largest distributor, Taiwan Quanyi Xingye Co., Ltd. (through a

Jujian import and export agent ) had a total value of $2,347,552 of sales of our

products (including our branded shoes and ODM products) for the period ended

June 30, 2009.

In

addition to our traditional wholesale model, we have started to employ “On-line

Sales” model as a supplementary sale approach since February 2009. Customers in

China can browse over 300 styles of footwear (including different colors ) among

our five products series and place orders through our online retail store

(www.baopiao.com/shop or www.bepure.com.cn/shop). We accept payments through

wiring, remittance, or Alipay (a third party online payment service provider

similar to Paypal). All of our websites have registered for an internet content

provider (ICP) license which is required by PRC Ministry of Information. As our

On-line Sales is still in the early development stage and the on-line sales

amount, for the period from February, 2009 to September, 2009, is $71,000, which

accounts for approximately 0.43% of the total sales amount for the period ended

September 30, 2009.

Qualification

of Distributor

All

distributors are required to be financially and professionally competent in the

sale of sports and casual footwear. Prospective distributors should submit their

application for distribution and get assessed, and only qualified candidates may

conclude a one-year distributor agreement with us and get permission as a

regional distributor. All distributors shall sell the Baopiao branded sports and

leisure products in a specified region under our authorization, being

responsible for the market development and management and actively expanding

sales outlets. Counterfeited Baopiao branded products are denied, otherwise, the

Company shall have the right to disqualify such distributors. We believe that

our sales network through our distributors is relatively strong in second and

third-tier cities in the PRC.

Evaluation

of Distributor

We

conduct evaluation to our distributors once a quarter in terms of annual

performance, store appearance maintenance, outlet exploration scales and speed,

the timeliness and accuracy of information feedback, the scale of fixed assets,

the standardization of operation and the like. If any distributor fails to

fulfill its monthly sales target or annual sales target or target for

establishing new sales outlets for consecutive 6 months, we are entitled to

cancel the exclusive distribution right of such distributor.

Pricing

We adopt

“unified retail price” rule pursuant to which we sell our products to our

distributors at discounts to the suggested retail price. We believe that this

ensures fairness and transparency within our distribution

network. The suggested retail price in the PRC for our products

ranged from approximately $18 to $30. In determining the suggested retail

prices, we take into account of market supply and demand, cost of production,

the prices of competing products and our consumers’ purchasing power. All retail

outlets are required to follow our pricing policies. Any discount of our retail

price is generally permitted for end of season sales or holiday promotion. The

level of any such discount is decided and approved by us on a case-by-case

basis.

Credit

Control

We

generally grant line of credit to our distributors based on their

creditworthiness and credit history. We grant credit periods, normally for six

months, to some agents with good sales performance.

Customer

Services

We have

established a customer service system which deals with the feedback from

customers in time. We have set up a 400-8823-899 toll-free telephone

for customer communication and to handle complaint and dispute and quality

arbitration. Customers can dial the toll free telephone number to report quality

complaint very conveniently. All problems and complaints reported by customers

are thoroughly studied to reach a proper settlement.

15

Marketing

and Brand Promotion

We

believe that to create a strong brand image and increase brand recognition is

crucial to our operation. We primarily utilize the internet, magazines and

outdoor displays in our media advertising. We also organize other activities to

promote our Baopiao brand, and some of which are run by our distributors,

including promotional events during the holidays and the end of seasons. We hold

promotion activities in various forms focusing on the seasonal new product

launch. These promotion activities include discount sales, gifts, outdoor

advertisements, magazine advertisements, on-line activities and the like. Our

distributors also contribute to the marketing and promotion of our brand by

conducing local promotions within their geographic areas.

Original

Design Manufacturer (“ODM”)

In

addition to manufacturing footwear products for our own brands, we also engage

in ODM manufacturing whereby we are commissioned by APIS, a footwear brand in

South America to manufacture footwear according to their specifications. The

total sales of our ODM products for the period ended June 30, 2009 and for the

years ended December 31, 2008 and 2007 are listed as below:

|

Sales

in South America

|

Domestic Sales | |||||||||||||||||||||||

|

Our

own brand

|

ODM

|

|

||||||||||||||||||||||

|

US$

|

%

of Revenues

|

US$

|

%

of Revenues

|

US$

|

%

of Revenues

|

|||||||||||||||||||

|

2007

|

1,112,000 | 8.24 | % | 1,667,000 | 12.36 | % | 10,709,000 | 79.40 | % | |||||||||||||||

|

2008

|

1,615,000 | 8.02 | % | 1,616,000 | 8.03 | % | 16,900,000 | 83.95 | % | |||||||||||||||

|

2009

(first six months)

|

1,126,000 | 15.95 | % | 1,376,000 | 19.49 | % | 4,559,000 | 64.56 | % | |||||||||||||||

Our

Competition

We

compete with an increasing number of local and international players. We believe

our strongest competitors in the footwear market include sports footwear brands

Nike, Li Ning, and Anta, and casual footwear brands BELLE group, Teenmix and

Saturday in terms of brand recognition in the PRC. The market share of BELLE in

China is relatively high, being 4.6% in 2008, among which, TATA is also a brand

name of BELLE group, with a total market share of 6.8% in 2008. They

respectively account for 21.5% and 10.3% in the top ten brands in China during

2008.

We

believe that our main competitive advantages are as below:

l We offer

high quality and functional footwear products. Our R&D team enables us to

bring new footwear styles with features such as height-increasing function. We

believe that our quality control procedures combined with our design

capabilities enable us to increase the quality of our products. We

undertake quality control measures at difference stages of our production

process and we obtained ISO9001:2000 quality control certification for our

footwear production in 2002. In 2006, our branded footwear has been

named as one of “Chinese Famous Brand Products” by the General Administration of

Quality Supervision, Inspection and Quarantine of the PRC.

l Our sales

models allow us to quickly respond to changes in consumer preferences and

fashion trends. We believe that our sales model enables us to react rapidly to

market trends. Our On-line Sales enables us to observe market trends and

customer preferences, and give us a platform to test marketing initiatives and

gain direct access to consumer feedback.

l We have

dedicated management team. Our management team has extensive experience in

footwear industry. Our Chief Executive Officer, Mr. Li has approximately 15

years of experience in footwear operations and management. Our senior management

has broad experience in sales and marking, manufacturing and quality control. We

believe that the extensive experience of our senior management team has

contributed to the successful development of our business.

16

Our

Research and Development

We

believe that technological innovation is a key to increasing product quality.

Our internal research and development center was set up in 2002 and is primarily

responsible for conducting our research and development

activities. Our research and development efforts are focused on

following objectives: preparing and setting the technical strategy for the

Company, introducing and applying new technologies and materials, creating and

improving the footwear molds, materials, types and functions, detecting and

determining the technical performance of products, improving the technical

indexes of products, and providing technical support for the manufacturing

department, the sales department and the quality control

department. As of November 5, 2009, we have 30 staff members

dedicated to research and development, including 4 market analysts, 6 pattern

makers and 20 computer designers and sample makers. All of our

research staff has experience in the footwear industry. Our market

analysts attend various domestic footwear trade exhibitions to keep themselves

informed of the latest fashion trends. Our pattern makers work

closely with the sales and procurement teams in designing new products and in

improving existing products. Our design team develops and improves concepts and

ideas upon the sales records of our products and other market information. The

amount we spent on research and development activities during the fiscal years

ended December 31, 2007 and 2008 were $19,000 and $85,000 and accounted for

approximately 1%, and 4%, respectively, of our total revenues.

In 2008,

our subsidiary, Pacific Shoes introduced the CAD/CAM software developed by a

famous footwear designer from Taiwan to facilitate automatic sample design. The

main developing work is as follows:

1. CAD

(Computer Aided Design System)/CAM (CAM, Computer Aided Manufacturing System)

three dimensional aided designed upper sample so as to improve the accuracy of

designed sample and save raw materials.

2.

CAD/CAM three dimensional aided designed out sole mold so as to improve the

clearness of patterns and three-dimensional effect of out soles.

Our

Intellectual Property

Trademarks

Pacific

Shoes has registered four trademarks for “Baopiao” and “ ” with the Trademark Bureau under the State of Administration

for Industry & Commerce, PRC, as follows:

” with the Trademark Bureau under the State of Administration

for Industry & Commerce, PRC, as follows:

” with the Trademark Bureau under the State of Administration

for Industry & Commerce, PRC, as follows:

” with the Trademark Bureau under the State of Administration

for Industry & Commerce, PRC, as follows:|

Trademarks

|

Certificate

No.

|

Categories

|

Valid Term

|

|||

+ BAOPIAO +(logo) + BAOPIAO +(logo) |

No.1936521

|

No.25:

running footwear, gym footwear, and belts (apparel)

|

January

7, 2003 to January 6, 2013

|

|||

+DILKS+(logo) +DILKS+(logo) |

No.4060266

|

No.25:garment,

ties, socks, swimsuits, hats, gloves, jerseys

|

July

28, 2008 to July 27,2018

|

|||

+ BAOPIAO +(logo) + BAOPIAO +(logo) |

No.4060267

|

No.18:

horse harness

|

March

21, 2008 to March 20, 2018

|

|||

+ BAOPIAO +(logo) + BAOPIAO +(logo) |

No.4060395

|

No.35:

advertising, market research, import and export agency, soliciting,

auction, accountant, photocopy, job center

|

July

28, 2008 to July 27, 2018

|

As of the

date of this report, we have not yet produced or sold any products under the

trademark of “ +DILKS+(logo)” .

+DILKS+(logo)” .

+DILKS+(logo)” .

+DILKS+(logo)” .17

Pacific

Shoes also has applied for the following trademarks:

|

Pending

Trademarks

|

Application

No.

|

Application

Date

|

||

|

No.5511838

|

July

31, 2008

|

||

|

(Logo)

|

No.5511839

|

July

31, 2008

|

||

|

BAOPIAO

|

No.5511840

|

July

31, 2008

|

||

|

bepure-(logo)

|

No.6964726

|

Sept

22, 2008

|

||

|

bepure-(logo)

|

No.6964727

|

Sept

22, 2008

|

||

|

bepure

|

No.6964728

|

Sept

22, 2008

|

||

|

(Logo)

|

No.6964729

|

Sept

22, 2008

|

||

|

(Logo)

|

No.6964730

|

Sept

22, 2008

|

Patents

Our CEO,

Mr. Haiting Li has filed following the patent applications:

|

Categories

of

Pending

Patents

|

Application

No.

|

Application

Date

|

Description

|

|||

|

Utility

|

No.200920165757.0

|

July

29,2009

|

A

kind of shoes, especially a kind of shoe products including insole and

outsole, designed according to human engineering with shock absorption

feature.

|

|||

|

Design

|

No.200930195047.8

|

July

29,2009

|

A

kind of footwear shape

|

Mr. Li

has signed the license agreement with Baopiao Shoes and Pacific Shoes to license

above two pending patents free of charge.

Domain

Names

Pacific

has registered the following domain names:

1. “Chinabaopiao.com”

2. “Baopiao.com”

3. “Bepure.com.cn”

4. “ .com”

.com”

.com”

.com”5. “ .cn”

.cn”

.cn”

.cn”6. “ .cn”

.cn”

.cn”

.cn”7. “cnbaopiao.mobi”

Our

Employees

As of

November 5, 2009, our Chinese Subsidiaries had a total of 598 full time

employees. As required by applicable Chinese laws, we have entered into

employment contracts with all of our officers and managers. We believe that our

relationship with our employees is good. We compensate our production

line employees by unit produced (piece work) and compensate other employees by

salaries and bonus based on performance. We also provide training for

our staff from time to time to enhance their technical and product knowledge as

well as their knowledge of industry quality standards. The following

table illustrates the allocation of these personnel among the various job

functions conducted at our Chinese Subsidiaries.

18

|

Departments

|

Number

of Employees

|

|

|

Production

|

509

|

|

|

Quality

Control

|

23

|

|

|

Sales

|

11

|

|

|

Research

and Development Center

|

30

|

|

|

Finance

|

7

|

|

|

Sourcing

|

4

|

|

|

Admin

|

7

|

|

|

Storage

and Distribution

|

7

|

|

|

Total

|

598

|

We have

not experienced any significant problems or disruption to our operations due to

labor disputes, nor have we experienced any difficulties in recruitment and

retention of experienced staff.

Our

Properties and Facilities

All land

in China is stated-owned or collectively-owned. Individuals and

companies are permitted to acquire rights to use land or land use rights for

specific purposes. In the case of land used for industrial purposes,

land use rights are granted for 50 years. Granted land use rights are

transferable and may be used as security for borrowings and other

obligations. Our Chinese Subsidiaries have obtained following

properties.

Pacific

Shoes

Pacific

Shoes’ main office and manufacturing facilities are located in Jinjiang City,

Fujian Province, China, on a plot of land approximately 3,000 square meters in

size. It has been issued a Land Use Right Certificate for the land and valid

until September 29, 2057 by the municipal government of Jinjiang. It currently

owns three buildings on the property as listed below.

Pacific

Shoes’ land use rights are set forth below:

|

Land

Use Right Certificate No.

|

Jin

Guo Yong (2008) 00011

|

|

User

of the Land

|

Pacific

Shoes

|

|

Location

|

No.8

Qiguang Dong Road, Handai Village, Chendai County, Jinjiang City, Fujian

Province

|

|

Usage

|

Industrial

|

|

Area

(㎡)

|

3000

|

|

Form

of Acquisition

|

By

means of transfer

|

|

Expiration

Date

|

9/29/2057

|

|

Encumbrances

|

Pledged

to China Agricultural Bank, Jinjiang City Branch.

Pledge

period: 4/18/2008 – 4/17/2010

|

Pacific

Shoes owns the following buildings:

|

Part

1

|

Part

2

|

Part

3

|

||||||

|

Area

(㎡)

|

5127.38

|

2204.17

|

2562.07

|

|||||

|

Usage

of Design

|

Factory

|

Factory

|

Factory

|

|||||

|

Structure

|

Mixture

|

Mixture

|

Mixture

|

|||||

|

Certificate

No.

|

Jin

Fang Quan Zheng Chen Dai Zi No. 06-200132-001

|

|||||||

|

Owner

|

Pacific

Shoes

|

|||||||

|

Location

|

No.8

Qiguang Dong Road, Handai Village, Chendai County, Jinjiang City, Fujian

Province

|

|||||||

|

Encumbrances

|

Pledged

to China Agricultural Bank, Jinjiang City Branch.

Pledge

period: 4/18/2008 – 4/17/2010

|

|||||||

19

Baopiao

Shoes

Baopiao

Shoes has two plots of land located in Huian County, Quanzhou City, Fujian

Province, China. It has been issued two Land Use Right Certificates for the land

and is valid until December 31, 2056 by the municipal government of Huian

County.

Baopiao

Shoes’s land use rights are set forth below:

|

Land

Use Right Certificate No.

|

Hui

Guo Yong (2008) Chu Zi No.100002-1

|

|

User

of the Land

|

Baopiao

Shoes

|

|

Location

|

Qunxian

Village & Xiagong Village, Zhangban Town, Huian County, Quanzhou City,

Fujian Province

|

|

Usage

|

Industrial

|

|

Area

(㎡)

|

27,783.9

|

|

Form

of Acquisition

|

By

means of transfer

|

|

Expiration

Date

|

12/31/2056

|

|

Encumbrances

|

Pledged

to Huian <County> Rural Credit Cooperation Union Zhangban Credit

Association.

Pledge

period: January 22, 2009 to January 21,

2012

|

| Land Use Right Certificate No. |

Hui

Guo Yong (2008) Chu Zi No.100002-2

|

|

User

of the Land

|

Baopiao

Shoes

|

|

Location

|

Qunxian

Village &Xiagong Village, Zhangban Town, Huian County, Quanzhou City,

Fujian Province

|

|

Usage

|

Industrial

|

|

Area

(㎡)

|

29,944.0

|

|

Form

of Acquisition

|

By

means of transfer

|

|

Expiration

Date

|

12/31/2056

|

|

Encumbrances

|

Pledged

to Huian <County> Rural Credit Cooperation Union Zhangban Credit

Association

Pledge

period: January 22, 2009 to January 21,

2012

|

Baopiao

Shoes’s premise is under construction. The current construction area is

57,728㎡.

We

believe that all our properties have been adequately maintained, are generally

in good condition, and are suitable and adequate for our business

needs.

Insurance

Our

insurance coverage includes our facilities and equipment insurance.

|

Coverage

|

Insurance

Policy No.

|

Insurance

Date

|

Insurance

Subject

|

||||

|

Facilities equipment,

raw material and inventories

|

350800004051 |

June

18, 2009

|

RMB

17,256,500

(Approximately

US$2,537,720)

|

||||

|

Facilities

|

350800003259 |

June

5, 2009

|

RMB

15,862,800

(Approximately

US$2,332,765)

|

||||

We

believe our coverage and insured limits are customary for similar companies in

our industry in China. We do not have general product liability insurance for

any of our products. Nevertheless, we believe that our practice is in line with

the general practice in the PRC as product liability insurance is not required

under the PRC laws. We have not received any material claim

from customers relating to any liability arising from the use of our products

which have resulted in adverse impact to our business.

20

Licenses

Our

principal up-to-date licenses, certificates and authorizations in order to

operate our business are set forth as below:

Pacific

Shoes

|

1

|

Business

License (Registration No. 350500400016634) issued by Administration for

Industry and Commerce of Quanzhou City on March 27, 2009. Pacific Shoes

has passed the 2008 annual

inspection.

|

|

2

|

Certificate

of Approval for Establishment of Enterprises with Investment of Taiwan,

Hongkong, Macao and Overseas Chinese in the People’s Republic of China

(Approval Number: Shang Wai Zi Min Quan Wai Zi Zi [1993] 1667), issued by

People’s Government of Fujian Province on March 16,

2009

|

|

3

|

Organization

Code Certificate issued by Quality Supervision and Inspection Bureau of

Quanzhou City (code No. 61156984-5, and registration No. Zu Dai Guan

350500-054104), the valid period of which is from February 19, 2008 to

February 19, 2012. Pacific Shoes has passed the 2009 annual

inspection.

|

|

4

|

ID

Card of Foreign Exchange Registration (No. 00226252) issued by the

Jinjiang SAFE in October, 2009

|

|

5

|

Taxation

Registration Certificate (Min Guo Shui Deng Zi No. 350582611569845) issued

by State Administration of Taxation of Jinjiang City, Fujian Province, and

Local Administration of Taxation of Jinjiang City on June 18,

2009.

|

|

6

|

Social

Insurance Certificate inspected by Social Insurance Company of Jinjiang

City on October 23, 2009.

|

Baopiao

Shoes

|

1

|

Business

License (Registration No. 350500400048219) issued by Administration for

Industry and Commerce of Quanzhou City on March 24, 2009. Baopiao Shoes

has passed the 2008 annual

inspection.

|

|

2

|

Certificate

of Approval for Establishment of Enterprises with Investment of Taiwan,

Hongkong, Macao and Overseas Chinese in the People’s Republic of China

(Approval Number: Shang Wai Zi Min Quan Wai Zi Zi [2006] 0010), issued by

People’s Government of Fujian Province on March 16,

2009

|

|

3

|

Organization

Code Certificate issued by Quality Supervision and Inspection Bureau of

Quanzhou City (code No. 78218670-X, and registration No. Zu Dai Guan

350500-067857), the valid period of which is from June 19, 2009 to June

19, 2013.

|

|

4

|

ID

Card of Foreign Exchange Registration (No. 00226343) issued by Jingjiang

SAFE in October, 2009

|

|

5

|

Taxation

Registration Certificate (Min Guo Shui Deng Zi No. 35052178218670X) issued

by State Administration of Taxation of Jinjiang City, Fujian Province, and

Local Administration of Taxation of Jinjiang City in December

2006.

|

Regulations

We are

subject to a wide range of regulation covering every aspect of our business. The

most significant of these regulations are set forth below.

21

We are

subject to national and local laws of China, including China’s environmental

laws and regulations. Under the relevant Chinese environmental laws,

all manufacturing enterprises must submit an environmental impact report to the

relevant environmental protection authority before starting production

operations. In addition, manufacturing enterprises must engage

professional environmental organizations to monitor and report on pollutants and

emission regularly. We do not produce material waste during our

production. The main pollutants generated by our plants of Pacific Shoes are

solid waste and exhaust gas. We have taken the necessary measures to

control the discharge of these pollutants. We have carried out the

relevant environment impact assessments and have obtained all the required

permits and environmental approvals for our production facilities. Our Baopiao

Shoes has passed the environment impact assessment before commencing

construction of production facilities. We are in material compliance with the

Chinese environmental laws and regulations as of November 5, 2009.

Moreover,

we are subject to Product Quality Law of the PRC, which is applicable to all

activities of production and sale of any product within the territory of the

PRC, and the producers and sellers shall be liable for product quality in

accordance with such law.

In

addition, according to the Consumer Protection Law of the PRC, the rights and

interests of the consumers who buy or use commodities for the purposes of daily

consumption or those who receive services are protected and all manufacturers

and distributors involved must ensure that the products and services will not

cause damage to persons and properties.

The PRC

Production Safety Law also requires that we shall maintain conditions for safe

production as provided in the Production Safety Law and other relevant laws,

regulations, and various standards. Any entity that is not sufficiently equipped

to ensure safe production may not engage in production and business operation

activities. We are required to offer education and training programs to our

employees regarding production safety. Since the commencement of our

business, none of our employees has been involved in any major accident in the

course of their employment and we have never been subject to disciplinary

actions with respect to the labor protection issues.

Legal

Proceedings

From time

to time, we may become involved in various lawsuits and legal proceedings that

arise in the ordinary course of business. However, litigation is

subject to inherent uncertainties, and an adverse result in these or other

matters may arise from time to time that may harm our business. We

are currently not aware of any such legal proceedings or claims that we believe

will have a material adverse affect on our business, financial condition or

operating results.

RISK

FACTORS

You

should carefully consider the risks described below, which constitute all of the

material risks facing us. If any of the following risks actually

occur, our business could be harmed. You should also refer to the

other information about us contained in this report, including our financial

statements and related notes.

RISKS

RELATED TO OUR BUSINESS AND INDUSTRY

Our

Baopiao branded products have a limited history in the branded footwear industry

and failure to effectively promote or maintain our Baopiao Brand may adversely

affect our performance and sales.

Our

Baopiao branded products were first introduced to the market in 2003. We seek to

position our brand as a high quality sports and casual footwear brand targeting

consumer groups between the ages of 18 and 48. We believe our brand

is critical to our success as we believe that market perception and consumer

acceptance of a brand is a determining factor for consumers in purchasing

decisions. Our revenues from sales of our Baopiao branded products

were approximately $11,821,000 and $18,516,000 representing approximately 87.64%

and 91.97% of the total revenues in 2007 and 2008, respectively. We market our

brands mainly through media commercials including outdoor advertising and

magazine advertising. We are dependent on market perception and

consumer acceptance of our products, over which we have no

control. Any negative publicity or disputes regarding our brands,

products, or the loss of any award or accreditation associated with our Baopiao

brand such as “PRC Fujian Province Well-Known Trademark” and “China Well-Known

Trademark” could materially and adversely affect our business, financial

condition. If we fail to successfully promote our brands position, the market

recognition of our brands may suffer. As a result, consumer confidence in our

brands may be eroded and our business, profitability and results of operations

may be adversely affected.

22

We