Attached files

Exhibit 10.4

OFFICE LEASE

Between

WELLS VAF – 6000 NATHAN LANE, LLC,

a Delaware limited liability company,

and

BROCADE COMMUNICATIONS SYSTEMS, INC.,

a DELAWARE CORPORATION

6000 NATHAN LANE, PLYMOUTH, MINNESOTA

TABLE OF CONTENTS

| Page No. | ||

| ARTICLE 1 Premises and Term |

1 | |

| ARTICLE 2 Base Rent |

3 | |

| ARTICLE 3 Additional Rent |

4 | |

| ARTICLE 4 Use and Rules |

8 | |

| ARTICLE 5 Services and Utilities |

9 | |

| ARTICLE 6 Alterations and Liens |

11 | |

| ARTICLE 7 Repairs |

12 | |

| ARTICLE 8 Casualty Damage |

12 | |

| ARTICLE 9 Insurance, Subrogation, and Waiver of Claims |

13 | |

| ARTICLE 10 Condemnation |

15 | |

| ARTICLE 11 Return of Possession |

16 | |

| ARTICLE 12 Holding Over |

16 | |

| ARTICLE 13 No Waiver |

17 | |

| ARTICLE 14 Attorneys’ Fees and Jury Trial |

17 | |

| ARTICLE 15 Personal Property Taxes, Rent Taxes and Other Taxes |

17 | |

| ARTICLE 16 Subordination, Attornment and Mortgagee Protection |

17 | |

| ARTICLE 17 Estoppel Certificate |

18 | |

| ARTICLE 18 Assignment and Subletting |

19 | |

| ARTICLE 19 Rights Reserved By Landlord |

21 | |

| ARTICLE 20 Landlord’s Remedies |

23 | |

| ARTICLE 21 Landlord’s Right to Cure |

25 | |

| ARTICLE 22 Conveyance by Landlord and Liability |

26 | |

| ARTICLE 23 Indemnification |

26 | |

| ARTICLE 24 Safety and Security Devices, Services and Programs |

27 | |

| ARTICLE 25 Communications and Computer Lines |

27 | |

| ARTICLE 26 Hazardous Materials |

29 | |

| ARTICLE 27 Offer |

30 | |

| ARTICLE 28 Notices |

30 | |

| ARTICLE 29 Real Estate Brokers |

31 | |

| ARTICLE 30 Common Area Improvements |

31 | |

| ARTICLE 31 Exculpatory Provisions |

31 | |

| ARTICLE 32 Mortgagee’s Consent |

31 | |

| ARTICLE 33 Miscellaneous |

32 | |

| ARTICLE 34 Entire Agreement |

33 | |

| ARTICLE 35 Parking |

34 | |

| ARTICLE 36 Right of First Offer |

34 | |

| ARTICLE 37 Termination Option |

35 | |

| ARTICLE 38 Prior Lease |

36 | |

| ARTICLE 39 Roof Rights |

36 | |

| ARTICLE 40 Generator |

37 | |

| ARTICLE 41 Alternative Dispute Mechanism |

37 | |

| ARTICLE 42 UPS; Chilled Water Fan Units and Chiller |

38 | |

i

RIDER ONE RULES

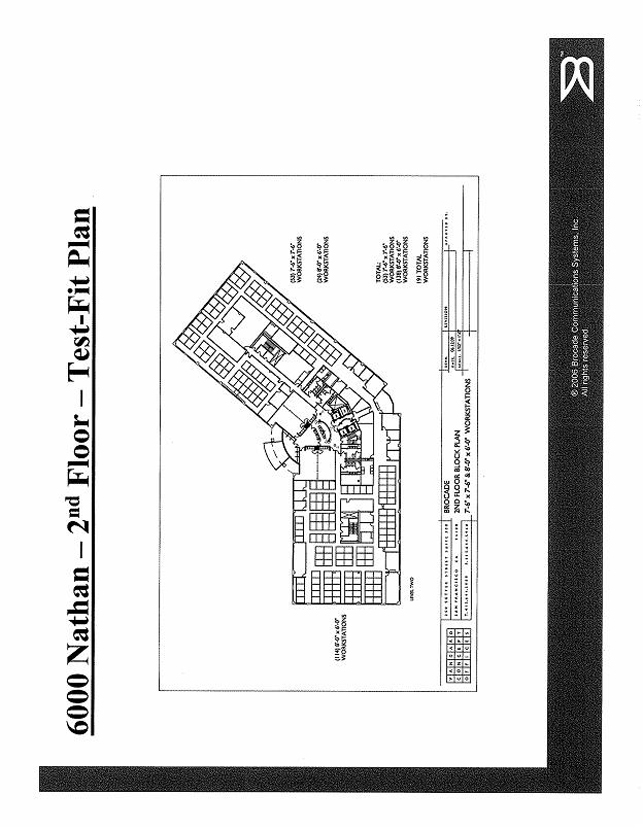

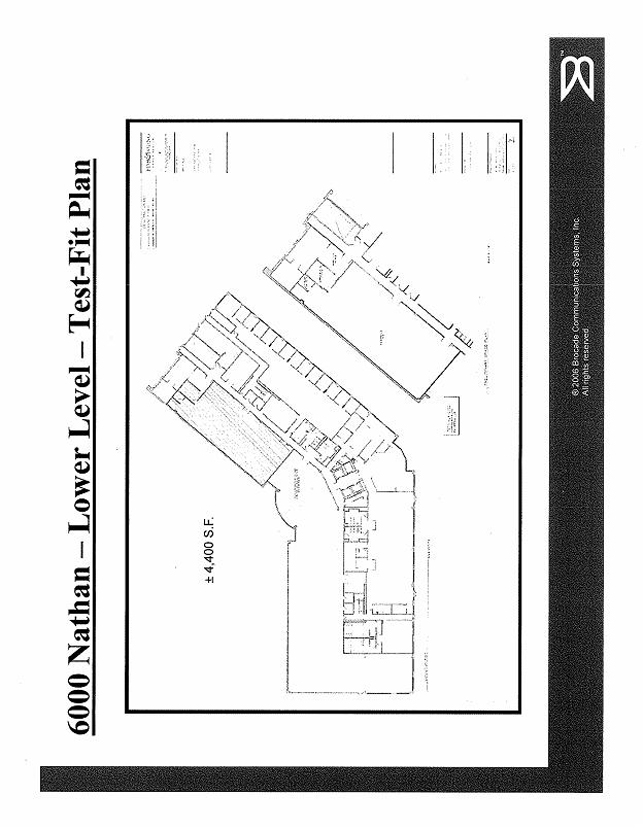

| EXHIBIT A |

(Floor plan(s) showing Premises cross-hatched) | |

| EXHIBIT B |

WORKLETTER AGREEMENT | |

| EXHIBIT C |

RENEWAL OPTION | |

| EXHIBIT D |

LEGAL DESCRIPTION | |

| EXHIBIT E |

COMMENCEMENT DATE CONFIRMATION | |

| EXHIBIT F |

EXERCISE FACILITY CONSENT AND WAIVER OF LIABILITY | |

| EXHIBIT G |

INTENTIONALLY DELETED | |

| EXHIBIT H |

SUBORDINATION NON-DISTURBANCE AND ATTORNMENT AGREEMENT |

ii

List of Defined Terms

| Additional Rent |

8 | |

| Affiliate |

21 | |

| Alterations |

11 | |

| Approval Criteria |

2 | |

| Arbitration Request |

1 | |

| Architect |

1 | |

| Base Rent |

3 | |

| Building |

1 | |

| Commencement Date |

1 | |

| Completed Application for Payment |

4 | |

| Construction Allowance |

4 | |

| CPA |

8 | |

| Current Market Rate |

1 | |

| Default |

23 | |

| Default Rate |

25 | |

| Dish |

36 | |

| Estimates |

1 | |

| Expiration Date |

1 | |

| Extension Option |

1 | |

| Extension Term |

1 | |

| Fitness Facility |

9 | |

| Force Majeure Delays |

32 | |

| Hazardous Material |

29 | |

| Holder |

18 | |

| Holidays |

9 | |

| Landlord |

1 | |

| Law |

33 | |

| Lease Month |

4 | |

| Lease Year |

4 | |

| Line Problems |

28 | |

| Lines |

27 | |

| Lower Level Premises |

1 | |

| Mortgage |

18 | |

| MSDS |

29 | |

| Offer Notice |

34 | |

| Offer Space |

34 | |

| Operating Expenses |

4 | |

| Permitted Transfer |

21 | |

| Permitted Transferee |

21 | |

| Person |

33 | |

| Premises |

1 | |

| Prime Rate |

24 | |

| Prior Lease |

36 | |

| Property |

1 | |

| Rent |

8 | |

| Rules |

9 | |

| Second Floor Premises |

1 | |

| Space Plans |

1 | |

| Statement |

7 | |

| Subject Space |

19 |

iii

List of Defined Terms

| Substantial Completion |

3 | |

| Substantially Completed |

3 | |

| Systems and Equipment |

1 | |

| Tangible Net Worth |

21 | |

| Taxes |

4 | |

| Tenant |

1 | |

| Tenant Work |

11 | |

| Tenant’s Prorata Share |

4 | |

| Term |

1 | |

| Termination Effective Date |

35 | |

| Termination Fee |

35 | |

| Termination Option |

35 | |

| Third Party Offer |

35 | |

| Total Construction Costs |

3 | |

| Transfer Premium |

20 | |

| Transferee |

19 | |

| Transfers |

19 | |

| Work |

2 | |

| Working Drawings |

2 | |

| Workletter |

2 |

iv

OFFICE LEASE

THIS LEASE made as of the 20th day of October, 2009, between WELLS VAF – 6000 NATHAN LANE, LLC, a Delaware limited liability company (“Landlord”) BROCADE COMMUNICATIONS SYSTEMS, INC., a Delaware corporation (“Tenant”).

WITNESSETH:

ARTICLE 1

Premises and Term

(A) Premises, Building and Property. Landlord hereby leases to Tenant and Tenant hereby leases from Landlord that certain space known as Suite 200 containing approximately thirty nine thousand eight hundred sixty two (39,862) rentable square feet (“Second Floor Premises”) and approximately four thousand four hundred (4,400) rentable square feet on the lower level (“Lower Level Premises”) (The Second Floor Premises and the Lower Level Premises are collectively referred to as the “Premises”) described or shown on Exhibit A attached hereto, in the building commonly known as 6000 Nathan Lane, Plymouth, Minnesota 55442 (the “Building”), subject to the terms of this Lease. The term “Property” shall mean the Building, and any common or public areas or facilities, easements, corridors, lobbies, sidewalks, loading areas, driveways, landscaped areas, skywalks, parking garages and lots, and any and all other structures or facilities operated or maintained in connection with or for the benefit of the Building, and all parcels or tracts of land on which all or any portion of the Building or any of the other foregoing items are located, and any fixtures, machinery, equipment, apparatus, Systems and Equipment, furniture and other personal property located thereon or therein and used in connection therewith owned or leased by Landlord. Possession of areas necessary for utilities, services, safety and operation of the Property, including the Systems and Equipment, fire stairways, perimeter walls, space between the finished ceiling of the Premises and the slab of the floor or roof of the Building there above, and the use thereof together with the right to install, maintain, operate, repair and replace the Systems and Equipment, including any of the same in, through, under or above the Premises in locations that will not materially interfere with Tenant’s use of the Premises, are hereby excepted and reserved by Landlord, and not demised to Tenant. “Systems and Equipment” shall mean any common (shared) plant, machinery, transformers, duct work, cable, wires, and other equipment, facilities, and systems designed to supply heat, ventilation, air conditioning and humidity or any other services or utilities, or comprising or serving as any component or portion of the electrical, gas, steam, plumbing, sprinkler, communications, alarm, security, or fire/life/safety systems or equipment, or any other mechanical, electrical, electronic, computer or other systems or equipment serving more than one tenant at the Property.

(B) Commencement Date: The “Commencement Date” shall be May 1, 2010. The “Term” of this Lease shall be eighty seven (87) months, commencing on the Commencement Date and ending at 5:00 p.m. local time on the last day of the eighty seventh full calendar month (July 31, 2017) following the Commencement Date (“Expiration Date”), subject to adjustment and earlier termination as provided herein and subject to Tenant’s option to extend in accordance with Exhibit C attached hereto and incorporated herein by reference.

(C) Commencement Date Confirmation. Tenant is currently in occupancy of the Premises and therefore Landlord shall have no responsibility to Tenant based on any alleged claim of a prior tenant holding over in the space or any other claim of failure to deliver possession. At either party’s request, Landlord and Tenant shall execute a Commencement Date Confirmation substantially in the form of Exhibit E promptly following the Commencement Date.

1

(D) Required Tenant Deliveries. Prior to the Commencement Date, Tenant shall deliver to Landlord: (i) this Lease fully executed by Tenant; (ii) to the extent not already in Landlord’s possession, executed copies of policies of insurance or certificates thereof as required under Article 11 of this Lease; (iii) copies of all governmental permits and authorizations, if any, required in connection with Tenant’s operation of its business within the Premises; and (iv) if Tenant is an entity, evidence of formation, good standing, and authority as Landlord may reasonably require. Failure to timely deliver any of the foregoing shall not defer the Commencement Date or impair Tenant’s obligation to pay Rent.

(E) Acceptance. Tenant has inspected the Premises, Property, Systems and Equipment and agrees to accept the same “as is” without any agreements, representations, understandings or obligations on the part of Landlord to perform any alterations, repairs or improvements and no representations respecting the condition of the Premises or the Property have been made to Tenant by or on behalf of Landlord, except as expressly provided herein or in the Workletter attached hereto as Exhibit B (“Workletter”).

2

ARTICLE 2

Base Rent

Tenant shall pay Landlord Base Rent (“Base Rent”) of:

Second Floor Premises

| Time Period |

Annual Amount |

Monthly Amount |

Annual Base Rent | |||

| Lease Months 1-12 |

$597,930.00 | $49,827.50 | $15.00 | |||

| Lease Months 13-24 |

$615,867.90 | $51,322.33 | $15.45 | |||

| Lease Months 25-36 |

$634,204.42 | $52,850.37 | $15.91 | |||

| Lease Months 37-48 |

$653,338.18 | $54,444.85 | $16.39 | |||

| Lease Months 49-60 |

$672,870.56 | $56,072.55 | $16.88 | |||

| Lease Months 61-72 |

$693,200.18 | $57,766.68 | $17.39 | |||

| Lease Months73 –84 |

$713,928.42 | $59,494.04 | $17.91 | |||

| Lease Months 85-87 |

$61,278.86 | $18.45 | ||||

Lower Level Premises

| Time Period |

Annual Amount |

Monthly Amount |

Annual Base Rent | |||

| Lease Months 1-12 |

$30,800.00 | $2,566.67 | $7.00 | |||

| Lease Months 13-24 |

$31,900.00 | $2,658.33 | $7.25 | |||

| Lease Months 25-36 |

$33,000.00 | $2,750.00 | $7.50 | |||

| Lease Months 37-48 |

$34,100.00 | $2,841.67 | $7.75 | |||

| Lease Months 49-60 |

$35,200.00 | $2,933.33 | $8.00 | |||

| Lease Months 61-72 |

$36,300.00 | $3,025.00 | $8.25 | |||

| Lease Months73-84 |

$37,400.00 | $3,116.67 | $8.50 | |||

| Lease Months 85-87 |

$3,208.33 | $8.75 | ||||

in advance on or before the first day of each calendar month during the Term. If the Term commences on a day other than the first day of a calendar month, or ends on a day other than the last day of a calendar

3

month, then the Base Rent for such month shall be prorated on the basis of the number of days in that month. Rent shall be paid without any prior demand or notice therefor and without any deduction, set-off or counterclaim, or relief from any valuation or appraisement laws. Landlord may apply payments received from Tenant to any obligations of Tenant then accrued, without regard to such obligations as may be designated by Tenant. As used herein, the term “Lease Month” shall mean each calendar month during the Term (and if the Commencement Date does not occur on the first day of a calendar month, the period from the Commencement Date to the first day of the next calendar month shall be included in the first Lease Month for purposes of determining the duration of the Term and the monthly Base Rent rate applicable for such partial month) and the term “Lease Year” shall mean each consecutive period of twelve (12) Lease Months.

ARTICLE 3

Additional Rent

(A) Taxes. Tenant shall pay Landlord Tenant’s Prorata Share of Taxes. “Taxes” shall mean all federal, state, county, or local taxes, fees, charges or other impositions of every kind and nature, whether general, special, ordinary or extraordinary (including without limitation, real estate taxes, general and special assessments, transit taxes, water and sewer rents, rent taxes, sales taxes, and personal property taxes imposed upon Landlord) payable by Landlord in any calendar year during the Term. However, “Taxes” shall not include: Landlord’s income taxes, franchise taxes, gift taxes, capital stock taxes, inheritance and succession taxes, and estate taxes; provided that if an income or excise tax is levied by any governmental entity in lieu of or as a substitute for ad valorem real estate taxes (in whole or in part), then any such tax or excise shall constitute and be included within the term “Taxes.” Taxes shall include the costs of consultants retained in an effort to lower taxes and all costs incurred in disputing any taxes or in seeking to lower the tax valuation of the Property. Tenant waives all rights to protest or appeal the appraised value of the Premises and the Property; however, Landlord agrees that it will make reasonable efforts to protest taxes and assessed value, if requested to do so by Tenant and a reasonable basis exists to do so. If Taxes for any period during the Term or any extension thereof, shall be increased after payment thereof by Landlord for any reason, Tenant shall pay Landlord, within five (5) days of written notice from Landlord, Tenant’s Prorata Share of such increased Taxes. Notwithstanding the foregoing, if any Taxes shall be paid based on assessments or bills by a governmental or municipal authority using a fiscal year other than a calendar year, Landlord may elect to average the assessments or bills for the subject calendar year, based on the number of months of such calendar year included in each such assessment or bill. “Tenant’s Prorata Share” of Taxes and Operating Expenses shall be the rentable area of the Premises divided by the rentable area of the Property on the last day of the calendar year for which Taxes or Operating Expenses are being determined, excluding any parking facilities. If the Property or any development of which it is a part, shall contain non-office uses, Landlord shall have the right (but not the obligation) to determine in accordance with sound accounting and management principles, Tenant’s Prorata Share of Taxes and Operating Expenses for only the office portion of the Property or of such development, in which event, Tenant’s Prorata Share shall be based on the ratio of the rentable area of the Premises to the rentable area of such office portion. Taxes and Operating Expenses are estimated to be $10.52 per rentable square foot in 2010. Tenant acknowledges that Landlord provided Tenant with a breakdown of estimate Taxes and Operating Expenses prior to the date hereof.

(B) Operating Expenses. Tenant shall pay Landlord Tenant’s Prorata Share of Operating Expenses. “Operating Expenses” shall mean all expenses of every kind (other than Taxes) which are paid, incurred or accrued for, by or on behalf of Landlord during any calendar year any portion of which occurs during the Term, in connection with the management, repair, maintenance, restoration and operation of the Property and the complex of which the Property is a part, including without limitation,

4

any amounts paid for: (a) utilities for the Property, including but not limited to electricity, power, gas, steam, chilled water, oil or other fuel, water, sewer, lighting, heating, air conditioning and ventilating (including, without limitation, taxes on utility usage), (ii) permits, licenses and certificates necessary to operate, manage and lease the Property or for the operation of any transportation to or from the Property, except to the extent that any such permits, licenses and certificates relate to some but not all tenants of the Property, (c) insurance applicable to the Property, but not limited to the amount of coverage Landlord is required to provide under this Lease, (d) supplies, tools, equipment and materials used in the operation, repair and maintenance of the Property including, without limitation, costs of the maintenance, operation, and repair of the HVAC systems serving the Building, exclusive of systems which serve only a particular tenant’s space, (e) accounting, legal, inspection, consulting, concierge, and other services, (f) any equipment rental of any kind (or installment equipment purchase or equipment financing agreements) for equipment necessary for and used exclusively in connection with the maintenance and operation of the Property, (g) management fees of not more than two percent (2%) of the gross revenues of the Building, amounts payable under management agreements, and the fair rental value of any office space provided for a management office, (h) wages, salaries and other compensation and benefits (including the fair value of any parking privileges provided) for all persons engaged in the operation, maintenance or security of, or transportation to or from, the Property, and employer’s Social Security taxes, unemployment taxes or insurance, and any other taxes which may be levied on such wages, salaries, compensation and benefits, provided that such wages and benefits for persons who do not work full time at the Building shall be prorated based on time spent working on Building matters, (i) payments under any easement, operating agreement, declaration, restrictive covenant, or instrument pertaining to the sharing of costs in any planned development, (j) operation, repair, and maintenance of all Systems and Equipment and components thereof (including replacement of components), janitorial service, alarm and security service, window cleaning, trash removal, elevator maintenance, cleaning of walks, parking facilities and Property walls, removal of ice and snow, replacement of wall and floor coverings, ceiling tiles and fixtures in lobbies, corridors, restrooms and other common or public areas or facilities, maintenance and replacement of shrubs, trees, grass, sod and other landscaped items, irrigation systems, drainage facilities, fences, curbs, and walkways, re-paving and re-striping parking facilities, and roof repairs; (k) all expenses incurred and costs associated with the operation and maintenance of building amenities including, without limitation, the cost of repair or replacement of kitchen equipment and restaurant furniture in any cafeteria or deli at the Property and the cost to maintain any cafeteria or deli at the Property, any exercise equipment in any fitness center at the Property and the cost to maintain any fitness center, the cost of providing utilities, cleaning and other services to such building amenities, and third party costs incurred in connection with the operation and maintenance of any building amenities; (l) any carbon tax, carbon credit, or other so-called carbon offset cost payable by Landlord with respect to Building operations, whether pursuant to a cap and trade carbon emission system or otherwise; and (m) subject to Article 6, costs incurred by Landlord in connection with any environmental initiative and/or operations & maintenance plan implemented by Landlord at the Property whether or not such initiatives are mandated by law including, without limitation, costs to: install water efficient irrigation, plumbing and fixtures; reduce heat islands; control stormwater; reduce chemical emissions; manage refrigerants; optimize energy performance and increase efficiencies; store and collect recyclables; promote usage of recycled content; and implement sustainable purchasing and waste management policies. Notwithstanding the foregoing, Operating Expenses shall not include:

(i) depreciation, interest and amortization on Mortgages, and other debt costs or ground lease payments, if any; legal fees in connection with leasing, tenant disputes or enforcement of leases; real estate brokers’ leasing commissions; improvements or alterations to tenant spaces; the cost of providing any service directly to and paid directly by, any tenant; any costs expressly excluded from Operating Expenses elsewhere in this Lease; costs of any items to the extent Landlord receives reimbursement from insurance proceeds or from a third party (such proceeds to be deducted from Operating Expenses in the year in which received); and

5

(ii) any costs which would normally be capitalized rather than expensed under generally accepted accounting principles (including, without limitation, drainage and landscaping improvements that are considered capital improvements under GAAP), except those: (a) made primarily to reduce Operating Expenses, or to comply with any Laws or other governmental requirements, or (b) for replacements (as opposed to additions or new improvements) of non-structural items located in the common areas of the Property required to keep such areas in good condition; provided, all such permitted capital expenditures (together with reasonable financing charges) shall be amortized for purposes of this Lease over the shorter of: (i) their useful lives or (ii) the period during which the reasonably estimated savings in Operating Expenses equals the expenditures.

(iii) leasehold improvements; financing and refinancing costs, including interest on debts of any mortgages and rental fees under any ground or underlying leases; business or income taxes; depreciation and amortization expense; utility costs paid by Tenant or any other lessee of the Building directly to a utility company; repairs to the Building following casualty loss; leasing commissions and costs of leasing incurred by Landlord; and rebuilding costs following condemnation.

(iv) costs and expenses of correcting defects in or inadequacies of the design or construction of the Building; costs incurred for marketing or promotional activities; all travel, entertainment and related expenses incurred by Landlord or its agents; costs or expenses incurred as a result of the negligent or intentional acts of other lessees of the Building;

(v) repairs, restoration or other work occasioned by fire, windstorm or other insured casualty; Landlord’s insurance deductible; expenses incurred in leasing or procuring tenants; leasing commissions; advertising expenses; expenses for renovating space for Landlord or new tenants; cost of the Work; payments made to affiliates of Landlord including inside or related contractors and executives (but only to the extent the amount paid exceeds market rate for the services provided); legal expenses incident to enforcement by Landlord of the terms of any lease, interest or principal payments on any mortgage or other indebtedness of Landlord; depreciation allowances or expenses, costs associated with the removal and clean-up of asbestos, hazardous substances and/or toxic substances (as defined in applicable federal, state or local laws or regulations); depreciation; and costs to cure construction defects to the extent covered under warranty.

With respect to any calendar year or partial calendar year in which the Building is not occupied to the extent of 95% of the rentable area thereof, Operating Expenses which vary with occupancy for such period shall, for the purposes hereof, be increased to the amount which would have been incurred had the Building been occupied to the extent of 95% of the rentable area thereof. If the Property shall be part of or shall include a complex, development or group of buildings or structures, Landlord may allocate Taxes and Operating Expenses within such complex, development or group, and between such buildings and structures and the parcels on which they are located, in accordance with sound accounting and management principles. In the alternative, Landlord shall have the right to determine, in accordance with sound accounting and management principles, Tenant’s Prorata Share of Taxes and Operating Expenses based upon the totals of each of the same for all such buildings and structures, the land constituting parcels on which the same are located, and all related facilities, including common areas and easements, corridors, lobbies, sidewalks, elevators, loading areas, parking facilities and driveways and other appurtenances and public areas, in which event Tenant’s Prorata Share shall be based on the ratio of the rentable area of the Premises to the rentable area of all such buildings.

6

(C) Manner of Payment. Taxes and Operating Expenses shall be paid in the following manner:

(i) Landlord may reasonably estimate in advance the amounts Tenant shall owe for Taxes and Operating Expenses for any full or partial calendar year of the Term. In such event, Tenant shall pay such estimated amounts, on a monthly basis in installments equal to one-twelfth of the annual estimate, on or before the first day of each calendar month, together with Tenant’s payment of Base Rent. Such estimate may be reasonably adjusted from time to time by Landlord.

(ii) Within one hundred twenty (120) days after the end of each calendar year, or as soon thereafter as practicable, Landlord shall provide a statement (the “Statement”) to Tenant showing: (a) the amount of actual Taxes and Operating Expenses for such calendar year, with a listing of amounts for major categories of Operating Expenses, (b) any amount paid by Tenant towards Taxes and Operating Expenses during such calendar year on an estimated basis, and (c) any revised estimate of Tenant’s obligations for Taxes and Operating Expenses for the current calendar year.

(iii) If the Statement shows that Tenant’s estimated payments were less than Tenant’s actual obligations for Taxes and Operating Expenses for such year, Tenant shall pay the difference. If the Statement shows an increase in Tenant’s estimated payments for the current calendar year, Tenant shall pay the difference between the new and former estimates, for the period from January 1 of the current calendar year through the month in which the Statement is sent. Tenant shall make such payments within thirty (30) days after Landlord sends the Statement.

(iv) If the Statement shows that Tenant’s estimated payments exceeded Tenant’s actual obligations for Taxes and Operating Expenses, Tenant shall receive a credit for the difference against payments of Rent next due. If the Term shall have expired and no further Rent shall be due, Tenant shall receive a refund of such difference, within thirty (30) days after Landlord sends the Statement.

(v) So long as Tenant’s obligations hereunder are not materially adversely affected thereby, Landlord reserves the right to reasonably change, from time to time, the manner or timing of the foregoing payments upon reasonable advance notice from Landlord to Tenant. In lieu of providing one Statement covering Taxes and Operating Expenses, Landlord may provide separate statements, at the same or different times. No delay by Landlord in providing the Statement (or separate statements) shall be deemed a default by Landlord or a waiver of Landlord’s right to require payment of Tenant’s obligations for actual or estimated Taxes or Operating Expenses.

(D) Proration. If the Term commences other than on January 1, or ends other than on December 31, Tenant’s obligations to pay estimated and actual amounts towards Taxes and Operating Expenses for such first or final calendar years shall be prorated to reflect the portion of such years included in the Term. Such proration shall be made by multiplying the total estimated or actual (as the case may be) Taxes and Operating Expenses, for such calendar years, by a fraction, the numerator of which shall be the number of days of the Term during such calendar year, and the denominator of which shall be three hundred and sixty-five (365).

(E) Landlord’s Records. Landlord shall maintain separate and complete records (including but not limited to books of account and all vouchers, invoices, statements, payroll records and other papers evidencing Taxes and Operating Expenses) respecting Taxes and Operating Expenses for at least

7

twenty four (24) months after the close of each calendar year and determine the same in accordance with sound accounting and management practices, consistently applied. Taxes and Operating Expenses shall be calculated on a full accrual basis. Landlord reserves the right to change to a cash system of accounting and, in such event, Landlord shall make reasonable and appropriate accrual adjustments to ensure that each calendar year includes substantially the same recurring items. Tenant and its authorized representatives (including accountants and attorneys) shall have the right to examine such records upon reasonable prior notice specifying the records Tenant desires to examine, during normal business hours at the place or places where such records are normally kept by sending such notice no later than ninety (90) days following the furnishing of the Statement. Tenant may take exception to matters included in Taxes or Operating Expenses, or Landlord’s computation of Tenant’s Prorata Share of either, by sending notice specifying such exception and the reasons therefor to Landlord no later than thirty (30) days after Landlord makes such records available for examination. Such Statement shall be considered final, except as to matters to which exception is taken after examination of Landlord’s records in the foregoing manner and within the foregoing times. Tenant acknowledges that Landlord’s ability to budget and incur expenses depends on the finality of such Statement. If Tenant takes exception to any matter contained in the Statement as provided herein, Landlord and Tenant, subject to the provisions of the next sentence, shall refer the matter to an independent certified public accountant (“CPA”), whose certification as to the proper amount shall be final and conclusive as between Landlord and Tenant. Landlord shall allow Tenant a credit against Rent next due for the amount of any overpayment and Tenant shall pay Landlord, within five (5) business days, the amount of any underpayment and, unless such CPA’s certification determines that Tenant was overbilled by more than five percent (5%), Tenant shall promptly pay the cost of such CPA, otherwise such cost will be paid by Landlord. The CPA’s compensation shall not be determined or paid on a contingency, percentage, bonus or similar basis. If Landlord has already retained, in response to another tenant’s exceptions, a CPA to certify one or more of the matters to which Tenant has taken exception, then, upon Landlord’s receipt of such CPA’s certification, Landlord shall provide a copy of the relevant portions thereof to Tenant and, based upon such certification, Landlord shall recalculate, to the extent applicable and for the period of time in question, the amount of those particular matters included in Tenant’s Share of Taxes or Operating Expenses to which Tenant took exception. Pending resolution of any such exceptions in the foregoing manner, Tenant shall continue paying Tenant’s Prorata Share of Taxes and Operating Expenses in the amounts determined by Landlord, subject to adjustment after any such exceptions are so resolved.

(F) Rent and Other Charges. “Additional Rent” means Tenant’s Prorata Share of Taxes and Tenant’s Prorata Share of Operating Expenses. Base Rent, Additional Rent and any other amounts which Tenant is or becomes obligated to pay Landlord under this Lease or other agreement entered in connection herewith, are sometimes herein referred to collectively as “Rent,” and all remedies applicable to the non-payment of Rent shall be applicable thereto. Rent shall be paid at any office maintained by Landlord or its agent at the Property or at such other place as Landlord may designate.

ARTICLE 4

Use and Rules

Tenant shall use the Premises for general office use, training purposes, customer support, and accounting, computer room and technology lab purposes related to Tenant’s office use, and for any other purpose as approved by Landlord which approval shall not be unreasonably withheld, in compliance with all applicable Laws and all covenants, conditions and restrictions of record applicable to Tenant’s use or occupancy of the Premises, and without disturbing or interfering with any other tenant or occupant of the Property. Tenant shall not use the Premises in any manner so as to cause a cancellation of Landlord’s insurance policies or an increase in the premiums thereunder. Tenant shall comply with, and shall cause its permitted subtenants, permitted assignees, invitees, employees, contractors and agents to comply with,

8

all rules set forth in Rider One attached hereto (the “Rules”). Landlord shall have the right to reasonably amend such Rules and supplement the same with other reasonable Rules (not expressly inconsistent with this Lease) relating to the Property, or the promotion of safety, care, cleanliness or good order therein, and all such amendments or new Rules shall be binding upon Tenant after five (5) days notice thereof to Tenant. All Rules shall be applied on a non-discriminatory basis, but nothing herein shall be construed to give Tenant or any other Person any claim, demand or cause of action against Landlord arising out of the violation of such Rules by any other tenant, occupant, or visitor of the Property, or out of the enforcement or waiver of the Rules by Landlord in any particular instance.

ARTICLE 5

Services and Utilities

Landlord shall provide the following services and utilities to the Second Floor Premises (the cost of which shall be included in Operating Expenses unless otherwise stated herein):

(A) Landlord shall repair and replace, at Tenant’s expense, all electric lighting bulbs, tubes, ballasts, and starters within the Premises. Tenant shall be responsible for the payment of the cost of all modifications to the existing electrical circuit(s) and facilities serving the Premises and, in accordance with Section 5(H) below, the cost of all electricity furnished to the Premises, including electricity used during the performance of janitor service, the making of alterations or repairs in the Premises, or the operation of any special air conditioning systems which may be required for data processing or computer equipment or other special equipment or machinery installed by Tenant.

(B) Heat and air-conditioning at such temperatures and in such amounts as are standard for comparable buildings in the vicinity of the Building from 8:00 a.m. until 6:00 p.m. Monday through Friday and 8:00 a.m. until 1:00 p.m. on Saturday, except on Holidays. “Holidays” shall mean all federally observed holidays, including New Year’s Day, President’s Day, Memorial Day, Independence Day, Labor Day, Veterans’ Day, Thanksgiving Day, Christmas Day, and all other holidays observed by members of unions who provide services at the Building.

(C) Water for drinking, lavatory and toilet purposes at those points of supply provided for nonexclusive general use of other tenants at the Property.

(D) Customary office cleaning and trash removal service Monday through Friday or Sunday through Thursday in and about the Premises, excluding holidays.

(E) Operatorless passenger elevator service in common with Landlord and other tenants and their visitors. One of such elevators may be a “swing” elevator for use also as a freight elevator. Landlord may restrict use of elevators for freight purposes to the “swing” elevator and to hours reasonably designated by Landlord. Landlord shall have the right to restrict the number of operating elevators outside of normal business hours, provided that at least one elevator is in operation.

(F) The non exclusive right to use the unstaffed fitness facility within the Building (“Fitness Facility”) during the Fitness Facility’s hours of operation. Use of the Fitness Facility will be limited to tenants (including any permitted assignees and subtenants) of the Building and their employees on a non exclusive basis. Tenant and its employees shall use the Fitness Facility at their own risk and will provide any certifications of waiver of liability as Landlord may request from time to time. Without limiting the generality of the foregoing, each user of the Fitness Facility shall be required to execute and deliver a waiver of liability in the form attached hereto as Exhibit F (or in another similar form provided by and acceptable to Landlord). Landlord shall have the right at any time, in its sole and absolute discretion to

9

relocate the Fitness Facility within the Building. While Landlord may include the cost to maintain the Fitness Facility in Operating Expenses as set forth in Article 3 above, neither Tenant nor Tenant’s employees shall be charged a separate usage fee to use the Fitness Facility.

(G) If reasonable and feasible, Landlord shall seek to provide extra utilities or services requested by Tenant provided the request does not involve modifications or additions to existing Systems and Equipment. Tenant shall pay for extra utilities or services at rates set by Landlord in its reasonable discretion. Payment shall be due at the same time as Base Rent or, if billed separately, shall be due within thirty (30) days after billing. If Tenant shall fail to make any payment for additional services, Landlord may, without notice to Tenant and in addition to all other remedies available to Landlord, discontinue the additional services. Landlord may install and operate meters or any other reasonable system for monitoring or estimating any services or utilities used by Tenant in excess of those required to be provided by Landlord under this Article (including a system for Landlord’s engineer to reasonably estimate any such excess usage). If such system indicates such excess services or utilities, Tenant shall pay Landlord’s reasonable charges for installing and operating such system and any supplementary air-conditioning, ventilation, heat, electrical or other systems or equipment (or adjustments or modifications to the existing Systems and Equipment), and Landlord’s reasonable charges for such amount of excess services or utilities used by Tenant. Landlord may impose a reasonable charge for any utilities and services, including, without limitation, air conditioning, electricity, and water, provided by Landlord by reason of: (i) any use of the Premises at any time other than the hours set forth above; (ii) any utilities or services beyond what Landlord agrees herein to furnish; or (iii) special electrical, cooling and ventilating needs created by Tenant’s telephone equipment, computer, electronic date processing equipment, copying equipment and other such equipment or uses. Landlord may impose a three hour minimum for extra hours HVAC service. Landlord, at its option, may require installation of metering devices at Tenant’s expense for the purpose of metering Tenant’s utility consumption. Tenant must notify Landlord by 3:00 p.m. if Tenant will require HVAC after the hours stated above (or 3:00 p.m. on the preceding business day if extra service will be required on a Saturday, Sunday, or Holiday).

(H) Electricity used by Tenant in the Premises shall, at Landlord’s option, be paid by Tenant either (1) through inclusion in Operating Expenses (except as provided in Section 5(G) with respect to excess usage by Tenant); (2) by a separate charge payable by Tenant to Landlord within thirty (30) days after billing by Landlord; or (3) by a separate charge billed by the applicable utility company and payable directly by Tenant. Electrical service to the Premises may be furnished by one or more companies providing electrical generation, transmission and distribution services, and the cost of electricity may consist of several different components or separate charges for such services, such as generation, distribution and stranded cost charges. Landlord shall have the exclusive right (i) to choose the company or companies to provide electrical service to the Property and the Premises, (ii) to aggregate the electrical service for the Property and the Premises with other buildings or properties, (iii) to purchase electrical service through an agent, broker or buyer’s group, and (iv) to change the electrical service provider or manner of purchasing electrical service from time to time in a economically reasonable manner. Landlord shall be entitled to receive a reasonable fee (over and above any management fees or other fees) for the services Landlord performs in connection with the selection of utility companies and the administration and negotiation of contracts for the provision of electrical service.

(I) Landlord shall use reasonable efforts to restore any service required of it that becomes unavailable; however, such unavailability shall not render Landlord liable for any damages caused thereby, be a constructive eviction of Tenant, constitute a breach of any implied warranty, or, except as provided in the next sentence, entitle Tenant to any abatement of Tenant’s obligations hereunder. If, however, Tenant is prevented from using the Premises because of the unavailability of any service to be provided by Landlord hereunder for a period of five (5) consecutive business days following Landlord’s receipt from Tenant of a written notice regarding such unavailability and such unavailability was not

10

caused by or through Tenant or a governmental directive, then Tenant shall, as its exclusive remedy be entitled to a reasonable abatement of Rent for each consecutive day (after such five (5) business day period) that Tenant is so prevented from using the Premises. Landlord in no event shall be liable for damages by reason of loss of profits, business interruption or other consequential damages.

(J) Landlord shall provide to the Lower Level Premises lighting and Building standard HVAC service for the lower level, plus stair and elevator access to the Lower Level Premises. The cost to provide such services shall be included in Operating Expenses.

ARTICLE 6

Alterations and Liens

Tenant shall not make any additions, changes, alterations or improvements (“Alterations”) outside the Premises. Tenant shall not make any Alterations within the Premises (”Tenant Work”) without the prior written approval of Landlord, which shall not be unreasonably withheld; provided, however, that Tenant shall not be required to obtain Landlord’s approval to decorative alterations to the Premises or other Alterations not requiring a building permit, as long as: (a) the Alterations will not adversely affect the Building’s systems or structure, (b) the Alterations cost less than $200,000 in any year, (c) Tenant gives Landlord at least ten (10) days prior written notice before commencing the Alterations, and (d) Tenant otherwise complies with the requirements of this Lease with respect to such Alterations, other than the requirement to obtain Landlord’s approval. Landlord may impose reasonable requirements in connection with Alterations by Tenant including without limitation the submission of plans and specifications for Landlord’s prior written approval, obtaining necessary permits, posting bonds, obtaining insurance, prior approval of contractors, subcontractors and suppliers, prior receipt of copies of all contracts and subcontracts, contractor and subcontractor lien waivers, affidavits listing all contractors, subcontractors and suppliers, use of union labor (if Landlord uses union labor), affidavits from engineers acceptable to Landlord stating that the Tenant Work will not adversely affect the Systems and Equipment or the structure of the Property, and requirements as to the manner and times in which such Tenant Work shall be done. All Tenant Work shall be performed in a good and workmanlike manner and all materials used shall be of a quality comparable to or better than those in the Premises and Property and shall be in accordance with plans and specifications approved by Landlord, and Landlord may require that all such Tenant Work for which Tenant is required to obtain Landlord’s approval be performed under Landlord’s supervision. If Landlord supervises, Tenant shall pay a fee of three percent (3%) of the cost of the Alterations to cover Landlord’s overhead in reviewing Tenant’s plans and specifications and supervising the Tenant Work. Approval or supervision by Landlord shall not be deemed a warranty as to the adequacy of the design, workmanship or quality of materials, and Landlord hereby expressly disclaims any responsibility or liability for the same. Landlord shall under no circumstances have any obligation to repair, maintain or replace any portion of the Tenant Work.

Tenant shall keep the Property and Premises free from any mechanic’s, materialman’s or similar liens or other such encumbrances in connection with any Tenant Work on or respecting the Premises not performed by or at the request of Landlord, and shall indemnify and hold Landlord harmless from and against any claims, liabilities, judgments, or costs (including reasonable attorneys’ fees) arising out of the same or in connection therewith. Tenant shall give Landlord notice at least twenty (20) days prior to the commencement of any Tenant Work (or such additional time as may be necessary under applicable Laws), to afford Landlord the opportunity of posting and recording appropriate notices of non-responsibility. If Tenant fails, within 20 days after the date of the filing of the lien, to discharge such lien or pursuant to Minn. Stat. § 514.10 to deposit into court a sum determined by the court, Landlord may, but shall not be required or expected to, remove such lien in such manner as Landlord may, in its sole discretion, determine, and the full cost thereof, together with all Landlord’s fees and costs, including

11

attorney fees, shall be due and payable by Tenant to Landlord immediately upon Tenant’s receipt of Landlord’s notice therefor. The amount so paid shall be deemed additional Rent under this Lease payable upon demand, without limitation as to other remedies available to Landlord under this Lease. Nothing contained in this Lease shall authorize Tenant to do any act which shall subject Landlord’s title to the Property or Premises to any lien or encumbrance whether claimed by operation of law or express or implied contract. Any claim to a lien or encumbrance upon the Property or Premises arising in connection with any Tenant Work on or respecting the Premises not performed by or at the request of Landlord shall be null and void, or at Landlord’s option shall attach only against Tenant’s interest in the Premises and shall in all respects be subordinate to Landlord’s title to the Property and Premises.

Construction in the Premises by Tenant shall comply with the Building’s environmental and energy efficiency initiatives in effect at the time of construction. Such initiatives may include, but shall not be limited to, usage of low VOC construction materials (including, without limitation, low VOC paint and carpet); energy efficient lighting (and controls), equipment, and appliances; HVAC efficiencies; water use reduction; CFC reduction; recycling; construction waste management; usage of locally manufactured materials; usage of rapidly renewable materials; and usage of recycled materials. In connection with Tenant’s initial construction of the Premises, Tenant shall cooperate with Landlord’s reasonable requests in order to achieve Energy Star status for the Building, provided however, there shall be no requirement that Tenant replace, upgrade nor incur any additional cost and expense in connection with Tenant’s existing equipment including but not limited to Tenant’s computer equipment and servers.

ARTICLE 7

Repairs

Except for customary cleaning and trash removal provided by Landlord under Article 5, damage covered under Article 8, and normal wear and tear, Tenant shall keep the Premises in good condition, working order and repair (including without limitation, carpet, wall-covering, doors, plumbing fixtures and other fixtures, alterations and improvements within the Premises whether installed by Landlord or Tenant). In the event that any repairs, maintenance or replacements are required, Tenant shall promptly arrange for the same either through (a) Landlord for such reasonable charges as Landlord may from time to time establish, or (b) contractors that Landlord generally uses at the Property, or (c) other contractors approved in writing in advance by Landlord which approval shall not be unreasonably withheld. If Tenant does not promptly make such arrangements, Landlord may, but need not, make such repairs, maintenance and replacements, and the costs paid or incurred by Landlord therefor shall be reimbursed by Tenant promptly after request by Landlord. Except to the extent caused by the negligence or willful misconduct of Landlord, Tenant shall pay or reimburse Landlord for any repairs, maintenance and replacements to areas of the Property outside the Premises, to the extent incurred as a result of moving any of Tenant’s furniture, fixtures, or other property to or from the Premises, or by Tenant or its employees, agents, contractors, or visitors (notwithstanding anything to the contrary contained in this Lease). Except as provided in the preceding sentence, or for damage covered under Article 8, Landlord shall keep the Building structure and common areas of the Property and the Systems and Equipment in good condition, working order and repair (the cost of which shall be included in Operating Expenses).

ARTICLE 8

Casualty Damage

Subject to Article 6 and the remainder of this Article 8, Landlord shall use available insurance proceeds to restore the Premises or any common areas of the Property providing access thereto which are damaged by fire or other casualty during the Term. Such restoration shall be to substantially the

12

condition prior to the casualty, except for modifications required by zoning and building codes and other Laws or by any Holder, any other modifications to the common areas deemed desirable by Landlord (provided access to the Premises is not materially impaired), and except that Landlord shall not be required to repair or replace any of Tenant’s furniture, furnishings, fixtures or equipment, or any alterations or improvements in excess of any work performed or paid for by Landlord under the terms, covenants and conditions of any separate agreement therefor signed by the parties hereto. Landlord shall not be liable for any inconvenience or annoyance to Tenant or its visitors, or injury to Tenant’s business resulting in any way from such damage or the repair thereof. However, Landlord shall allow Tenant a proportionate abatement of Rent during the time and to the extent the Premises are unfit for occupancy for the purposes permitted under this Lease and not occupied by Tenant as a result thereof (unless Tenant or its employees or agents intentionally caused the damage). Notwithstanding the foregoing, Landlord may terminate this Lease by giving Tenant written notice of termination within sixty (60) days after the date of damage (such termination notice to include a termination date providing at least ninety (90) days for Tenant to vacate the Premises), if the Property shall be materially damaged by Tenant or its employees or agents, or if the Property shall be damaged by fire or other casualty such that: (a) repairs to the Premises and access thereto cannot reasonably be completed within two hundred seventy (270) days after the casualty without the payment of overtime or other premiums, (b) more than twenty-five percent (25%) of the Premises is affected by the damage and fewer than twenty-four (24) months remain in the Term, or any material damage occurs to the Premises during the last twelve (12) months of the Term, (c) any Holder shall require that the insurance proceeds or any portion thereof be used to retire the Mortgage debt (or shall terminate the ground lease, as the case may be), or the damage is not fully covered by Landlord’s insurance policies (excluding the deductible), or (d) the cost of the repairs, alterations, restoration or improvement work would exceed twenty-five percent (25%) of the replacement value of the Property, or (e) the nature of such work would make termination of this Lease necessary or convenient and Landlord also terminates the leases of all other similarly situated tenants. Tenant agrees that Landlord’s obligation to restore, and the abatement of Rent provided herein, shall be Tenant’s sole recourse in the event of such damage, and waives any other rights Tenant may have under any applicable Law to terminate the Lease by reason of damage to the Premises or Property. Tenant acknowledges that this Article represents the entire agreement between the parties respecting casualty damage to the Premises or the Property.

ARTICLE 9

Insurance, Subrogation, and Waiver of Claims

(A) Tenant shall not conduct or permit to be conducted any activity, or place or permit to be placed any equipment or other item in or about the Premises, the Building or the Property, which will in any way increase the rate of property insurance or other insurance on the Property. If any increase in the rate of property or other insurance is due to any activity, equipment or other item of Tenant, then (whether or not Landlord has consented to such activity, equipment or other item) Tenant shall pay as additional rent due hereunder the amount of such increase. The statement of any applicable insurance company or insurance rating organization (or other organization exercising similar functions in connection with the prevention of fire or the correction of hazardous conditions) that an increase is due to any such activity, equipment or other item shall be conclusive evidence thereof.

(B) Throughout the Term, Tenant shall obtain and maintain the following insurance coverages written with companies with an A.M. Best A-, X or better rating and S&P rating of at least A-:

(i) Commercial General Liability (“CGL”) insurance (written on an occurrence basis) with limits not less than One Million Dollars ($1,000,000) combined single limit per occurrence, Two Million Dollar ($2,000,000) annual general aggregate (on a per location basis), Two Million Dollars ($2,000,000) products/completed operations aggregate, One Million Dollars

13

($1,000,000) personal and advertising injury liability, Fifty Thousand Dollars ($50,000) fire damage legal liability, and Five Thousand Dollars ($5,000) medical payments. CGL insurance shall be written on ISO occurrence form CG 00 01 96 (or a substitute form providing equivalent or broader coverage) and shall cover liability arising from Premises, operations, independent contractors, products-completed operations, personal injury, advertising injury and liability assumed under an insured contract.

(ii) Workers Compensation insurance as required by the applicable state law, and Employers Liability insurance with limits not less than One Million Dollars ($1,000,000) for each accident, One Million Dollars ($1,000,000) disease policy limit, and One Million Dollars ($1,000,000) disease each employee.

(iii) Commercial Auto Liability insurance (if applicable) on a standard ISO form or similar covering automobiles owned, hired or used by Tenant in carrying on its business with limits not less than One Million Dollars ($1,000,000) combined single limit for each accident.

(iv) Umbrella/Excess Insurance coverage on a follow form basis in excess of the CGL, Employers Liability and Commercial Auto Policy with limits not less than Five Million Dollars ($5,000,000) per occurrence and Five Million Dollars ($5,000,000) annual aggregate.

(v) All Risk Property Insurance covering Tenant’s property, furniture, furnishings, fixtures, improvements, and equipment located at the Building. If Tenant is responsible for any machinery, Tenant shall maintain boiler and machinery insurance.

(vi) Business Interruption and Extra Expenses insurance in amounts typically carried by prudent tenants engaged in similar operations, but in no event in an amount less than double the annual Base Rent then in effect. Such insurance shall reimburse Tenant for direct and indirect loss of earnings and extra expense attributable to all perils insured against.

(vii) Builder’s Risk (or Building Constructions) insurance during the course of construction of any Alteration, including during the performance of Tenant’s Work and until completion thereof. Such insurance shall be on a form covering Landlord, Landlord’s architects, Landlord’s contractor or subcontractors, Tenant and Tenant’s contractors, as their interest may appear, against loss or damage by fire, vandalism, and malicious mischief and other such risks as are customarily covered by the so-called “broad form extended coverage endorsement” upon all Alterations or Tenant’s Work in place and all materials stored at the Premises, and all materials, equipment, supplies and temporary structures of all kinds incident to Alterations or Tenant’s Work and builder’s machinery, tools and equipment, all while forming a part of, or on the Premises, or when adjacent thereto, while on drives, sidewalks, streets or alleys, all on a completed value basis for the full insurable value at all times. Said Builder’s Risk Insurance shall contain an express waiver of any right of subrogation by the insurer against Landlord, its agents, employees and contractors.

(C) Landlord and Landlord’s agents shall be endorsed on each policy as additional insureds as it pertains to the CGL policy and coverage shall be primary and noncontributory. Landlord shall be a loss payee on the Property policy in respect of Tenant’s improvements to the extent that Landlord is responsible for the repair and replacement of same under this Lease. All insurance shall (1) contain an endorsement that such policy shall remain in full force and effect notwithstanding that the insured may have waived its right of action against any party prior to the occurrence of a loss (Tenant hereby waiving its right of action and recovery against and releasing Landlord and Landlord’s Representatives from any and all liabilities, claims and losses for which they may otherwise be liable to the extent Tenant is covered

14

by insurance carried or required to be carried under this Lease); (2) provide that the insurer thereunder waives all right of recovery by way of subrogation against Landlord and Landlord’s representatives in connection with any loss or damage covered by such policy (and Tenant shall provide evidence of such waiver); (3) be acceptable in form and content to Landlord; and (4) contain an endorsement prohibiting cancellation without the insurer first giving Landlord thirty (30) days’ prior written notice of such proposed action. No such policy shall contain any deductible provision except as otherwise approved in writing by Landlord, which approval shall not be unreasonably withheld. Landlord reserves the right from time to time to reasonably require higher minimum amounts or different types of insurance. Tenant shall deliver an ACORD 25 certificate with respect to all liability and personal property insurance and an ACORD 28 certificate with respect to all commercial property insurance and receipts evidencing payment therefor (and, upon request, copies of all required insurance policies, including endorsements and declarations) to Landlord on or before the Commencement Date and at least annually thereafter. If Tenant fails to provide evidence of insurance required to be provided by Tenant hereunder, prior to commencement of the Lease Term and thereafter within thirty (30) days following Landlord’s request during the Term (and in any event within thirty (30) days prior to the expiration date of any such coverage, any other cure or grace period provided in this Lease not being applicable hereto), Landlord shall be authorized (but not required) after ten (10) days’ prior notice to procure such coverage in the amount stated with all costs thereof to be chargeable to Tenant and payable as additional rent upon written invoice therefor.

(D) Landlord agrees to carry and maintain all-risk property insurance (with replacement cost coverage) covering the Building and Landlord’s property therein in an amount required by its insurance company to avoid the application of any coinsurance provision. Landlord hereby waives its right of recovery against Tenant and releases Tenant from any and all liabilities, claims and losses for which Tenant may otherwise be liable to the extent Landlord receives proceeds from its property insurance therefor. Landlord shall secure a waiver of subrogation endorsement from its insurance carrier. Landlord also agrees to carry and maintain commercial general liability insurance in limits it reasonably deems appropriate (but in no event less than the limits required by Tenant above). Landlord may elect to carry such other additional insurance or higher limits as it reasonably deems appropriate. Tenant acknowledges that Landlord shall not carry insurance on, and shall not be responsible for damage to, Tenant’s personal property or any Alterations (including Tenant’s Work), and that Landlord shall not carry insurance against, or be responsible for any loss suffered by Tenant due to, interruption of Tenant’s business.

ARTICLE 10

Condemnation

If (a) the whole or any material part of the Premises or the Property shall be taken by power of eminent domain or condemned by any competent authority for any public or quasi-public use or purpose; (b) any adjacent property or street shall be so taken or condemned, or reconfigured or vacated by such authority in such manner as to require the use, reconstruction or remodeling of any part of the Premises or the Property, or (c) Landlord shall grant a deed or other instrument in lieu of such taking by eminent domain or condemnation, then Landlord shall have the option to terminate this Lease upon ninety (90) days notice, provided such notice is given no later than one hundred eighty (180) days after the date of such taking, condemnation, reconfiguration, vacation, deed or other instrument. Tenant shall have reciprocal termination rights if the whole or any material part of the Premises is permanently taken or if access to the Premises is permanently and materially impaired. Landlord shall be entitled to receive the entire award or payment in connection therewith, except that Tenant shall have the right to file any separate claim available to Tenant for any taking of Tenant’s personal property and of fixtures belonging to Tenant and removable by Tenant upon expiration of the Term and for moving and other relocation expenses (so long as such claim does not diminish the award available to Landlord or any Holder, and

15

such claim is payable separately to Tenant). All Rent shall be apportioned as of the date of such termination, or the date of such taking, whichever shall first occur. Rent shall be proportionately abated if any part of the Premises shall be taken and this Lease shall not be so terminated.

ARTICLE 11

Return of Possession

At the expiration or earlier termination of this Lease or Tenant’s right of possession of the Premises, Tenant shall surrender possession of the Premises in the condition required under Article 7, ordinary wear and tear excepted, and shall surrender all keys, any key cards, and any parking stickers or cards, to Landlord, and advise Landlord as to the combination of any locks or vaults then remaining in the Premises, and shall remove all trade fixtures and personal property. All improvements, fixtures and other items in or upon the Premises (except trade fixtures and personal property belonging to Tenant), whether installed by Tenant or Landlord, shall be Landlord’s property and shall remain upon the Premises, all without compensation, allowance or credit to Tenant. Without limitation of Article 12, if Tenant shall fail to perform any repairs or restoration, or fail to remove any items from the Premises or the Property required hereunder, following five (5) days written notice from Landlord to Tenant, Landlord may do so, and Tenant shall pay Landlord the cost thereof within thirty (30) days after receipt of an invoice therefor. Following five (5) days notice to Tenant, any and all property that may be removed from the Premises or the Property by Landlord pursuant to any provisions of this Lease or any Law, to which Tenant is or may be entitled, may be handled, removed or stored in a commercial warehouse or otherwise by Landlord at Tenant’s risk, cost or expense, and Landlord shall in no event be responsible for the value, preservation or safekeeping thereof. Tenant shall pay to Landlord, within thirty (30) days after receipt of an invoice therefor, any and all expenses incurred in any removal and all storage charges as long as the same is in Landlord’s possession or under Landlord’s control. Any property, which is not removed from the Premises or which is not retaken from storage by Tenant within thirty (30) days after expiration or earlier termination of this Lease or of Tenant’s right to possession of the Premises, shall, at Landlord’s option, be conclusively presumed to have been abandoned and thus to have been conveyed by Tenant to Landlord as if by bill of sale without payment by Landlord.

ARTICLE 12

Holding Over

Unless Landlord expressly agrees otherwise in writing, if Tenant shall retain possession of the Premises or any part thereof after expiration or earlier termination of this Lease, Tenant shall pay Landlord one hundred fifty percent (150%) of the amount of Rent then applicable on a per month basis without reduction for partial months during the holdover. In addition, if Tenant holds over for more than thirty (30) days after the expiration or earlier termination of this Lease, Tenant shall be responsible for all consequential damages sustained by Landlord on account of Tenant holding over. The foregoing provisions shall not serve as permission for Tenant to holdover, nor serve to extend the Term (although Tenant shall remain bound to comply with all provisions of this Lease until Tenant vacates the Premises, and shall be subject to the provisions of Article 11). The provisions of this Article do not waive Landlord’s right of re-entry or right to regain possession by actions at law or in equity or any other rights hereunder, and any receipt of payment by Landlord shall not be deemed a consent by Landlord to Tenant’s remaining in possession or be construed as creating or renewing any lease or right of tenancy between Landlord and Tenant.

16

ARTICLE 13

No Waiver

No provision of this Lease will be deemed waived by either party unless expressly waived in writing signed by the waiving party. No waiver shall be implied by delay or any other act or omission of either party. No waiver by either party of any provision of this Lease shall be deemed a waiver of such provision with respect to any subsequent matter relating to such provision, and Landlord’s consent or approval respecting any action by Tenant shall not constitute a waiver of the requirement for obtaining Landlord’s consent or approval respecting any subsequent action. Acceptance of Rent by Landlord shall not constitute a waiver of any breach by Tenant of any term or provision of this Lease. No acceptance of a lesser amount than the Rent herein stipulated shall be deemed a waiver of Landlord’s right to receive the full amount due, nor shall any endorsement or statement on any check or payment or any letter accompanying such check or payment be deemed an accord and satisfaction, and Landlord may accept such check or payment without prejudice to Landlord’s right to recover the full amount due. The acceptance of Rent or of the performance of any other term or provision from any Person other than Tenant, including any Transferee, shall not constitute a waiver of Landlord’s right to approve any Transfer.

ARTICLE 14

Attorneys’ Fees and Jury Trial

In the event of any litigation between the parties, the prevailing party shall be entitled to obtain, as part of the judgment, all reasonable attorneys’ fees, costs and expenses incurred in connection with such litigation, except as may be limited by applicable Law. In the interest of obtaining a speedier and less costly hearing of any dispute, the parties hereby each irrevocably waive the right to trial by jury.

ARTICLE 15

Personal Property Taxes, Rent Taxes and Other Taxes

Tenant shall pay prior to delinquency all taxes, charges or other governmental impositions assessed against or levied upon Tenant’s fixtures, furnishings, equipment and personal property located in the Premises, and any Tenant Work to the Premises which is deemed to be personal property by any governmental agency or subdivision thereof. Whenever possible, Tenant shall cause all such items to be assessed and billed separately from the property of Landlord. In the event any such items shall be assessed and billed with the property of Landlord, Tenant shall pay Landlord its share of such taxes, charges or other governmental impositions within thirty (30) days after Landlord delivers a statement and a copy of the assessment or other documentation showing the amount of such impositions applicable to Tenant’s property. Tenant shall pay any rent tax or sales tax, service tax, transfer tax or value added tax, or any other applicable tax on Rent or services provided herein or otherwise respecting this Lease.

ARTICLE 16

Subordination, Attornment and Mortgagee Protection

This Lease is subject and subordinate to all Mortgages now or hereafter placed upon the Property, and all other encumbrances and matters of public record applicable to the Property. If any foreclosure proceedings are initiated by any Holder or a deed in lieu is granted (or if any ground lease is terminated), Tenant agrees to attorn and pay Rent to any Holder which is a successor to Landlord hereunder or a

17

purchaser at a foreclosure sale and to execute and deliver any instruments necessary or appropriate to evidence or effectuate such attornment (provided such Holder or purchaser shall agree to accept this Lease and not disturb Tenant’s occupancy, so long as Tenant does not default and fail to cure within the time permitted hereunder). However, in the event of attornment, no Holder shall be: (i) liable for any act or omission of Landlord, or subject to any offsets or defenses which Tenant might have against Landlord (prior to such Holder becoming Landlord under such attornment), (ii) liable for or bound by any prepaid Rent not actually received by such Holder, (iii) bound by any future modification of this Lease not consented to by such Holder, (iv) be liable for any accrued obligation, act or omission of any prior landlord (including, without limitation, Landlord), whether prior to or after foreclosure or termination of the superior lease, as the case may be, (v) be bound by any covenant to undertake or complete any improvement to the Property or the Premises, or to reimburse or pay Tenant for the cost of any such improvement, (vi) be required to perform or provide any services not related to possession or quiet enjoyment of the Premises, or (vii) be required to abide by any provisions for the diminution or abatement of rent. “Holder” shall mean the holder of any Mortgage at the time in question, and where such Mortgage is a ground lease, such term shall refer to the ground lessor. “Mortgage” shall mean all mortgages, deeds of trust, ground leases and other such encumbrances now or hereafter placed upon the Property or any part thereof and all renewals, modifications, consolidations, replacements or extensions thereof. Any Holder may elect to make this Lease prior to the lien of its Mortgage, by written notice to Tenant, and if the Holder of any prior Mortgage shall require, this Lease shall be prior to any subordinate Mortgage. Tenant shall execute such documentation as Landlord may reasonably request from time to time, in order to confirm the matters set forth in this Article in recordable form. In the event of any default on the part of Landlord, arising out of or accruing under the Lease, whereby the validity or the continued existence of the Lease might be impaired or terminated by Tenant, or Tenant might have a claim for partial or total eviction, Tenant shall not pursue any of its rights with respect to such default or claim, and no notice of termination of the Lease as a result of such default shall be effective, unless and until Tenant has given written notice of such default or claim to the applicable Holder (but not later than the time that Tenant notifies Landlord of such default or claim) and granted to such Holder a reasonable time, which shall not be less than the greater of (i) the period of time granted to Landlord under the Lease, or (ii) thirty (30) days, after the giving of such notice by Tenant to such Holder, to cure or to undertake the elimination of the basis for such default or claim, after the time when Landlord shall have become entitled under the Lease to cure the cause of such default or claim; it being expressly understood that (a) if such default or claim cannot reasonably be cured within such cure period, such Holder shall have such additional period of time to cure same as it reasonably determines is necessary, so long as it continues to pursue such cure with reasonable diligence, and (b) such Holder’s right to cure any such default or claim shall not be deemed to create any obligation for such Holder to cure or to undertake the elimination of any such default or claim.

As a condition to the effectiveness of this Lease, Landlord and Tenant shall execute and deliver a mutually acceptable Subordination, Non-Disturbance and Attornment Agreement with Landlord’s current lender in the form attached hereto as Exhibit H.

ARTICLE 17

Estoppel Certificate

Tenant shall from time to time, within twenty (20) days after written request from Landlord, execute, acknowledge and deliver a certificate affirming that, except as otherwise expressly stated in the certificate, (A) this Lease is unmodified and in full force and effect; (B) to Tenant’s knowledge, Landlord is not in default hereunder; (C) Tenant is in possession of the Premises; (D) Tenant has no off-sets or defenses to the performance of its obligations under this Lease; (E) that the Premises have been completed in accordance with the terms, covenants and conditions hereof or the Workletter, that Tenant

18

has accepted the Premises and the condition thereof and of all improvements thereto and has no claims against Landlord or any other party with respect thereto; and (F) certifying such other matters as Landlord may reasonably request, or as may be requested by Landlord’s current or prospective Holders, insurance carriers, auditors, rating agencies, and prospective purchasers. The certificate shall also confirm the dates to which the Rent has been paid in advance. The certificate may be relied upon by Landlord, its Holder(s), insurance carriers, auditors, rating agencies, and prospective purchasers. If Tenant shall fail to timely execute and return an estoppel certificate which has been delivered to Tenant, Tenant shall be deemed to have agreed with the matters originally set forth therein.

ARTICLE 18

Assignment and Subletting

(A) Transfers. Tenant shall not, without the prior written consent of Landlord, which consent shall not be unreasonably withheld (as further described below): (i) assign, mortgage, pledge, hypothecate, encumber, or permit any lien to attach to, or otherwise transfer, this Lease or any interest hereunder, by operation of law or otherwise, (ii) sublet the Premises or any part thereof, or (iii) permit the occupancy of the Premises by any Person other than Tenant and its employees (all of the foregoing are hereinafter sometimes referred to collectively as “Transfers” and any Person to whom any Transfer is made or sought to be made is hereinafter sometimes referred to as a “Transferee”). If Tenant shall desire Landlord’s consent to any Transfer, Tenant shall notify Landlord in writing, which notice shall include: (a) the proposed effective date (which shall not be less than thirty (30) nor more than one hundred and eighty (180) days after Tenant’s notice), (b) the portion of the Premises to be Transferred (herein called the “Subject Space”), (c) the terms of the proposed Transfer and the consideration therefor, the name and address of the proposed Transferee, and a copy of all documentation pertaining to the proposed Transfer, and (d) current financial statements of the proposed Transferee certified by an officer, partner or owner thereof, and any other information to enable Landlord to determine the financial responsibility, character, and reputation of the proposed Transferee, nature of such Transferee’s business and proposed use of the Subject Space, and such other information as Landlord may reasonably require. If Landlord requests additional information, Tenant’s notice will not be deemed to have been received and Landlord may withhold consent to such Transfer until Landlord receives and has a reasonable opportunity to review such additional information. Any Transfer made without complying with this Article shall, at Landlord’s option, be null, void and of no effect, or shall constitute a Default under this Lease. Whether or not Landlord shall grant consent, Tenant shall pay Landlord $1,000 to compensate Landlord for its review and processing expenses.