Attached files

Exhibit 10.1

ALPINVEST PARTNERS

THE BLACKSTONE GROUP

THE CARLYLE GROUP

HELLMAN & FRIEDMAN

KOHLBERG KRAVIS ROBERTS & CO.

THOMAS H. LEE PARTNERS

VALCON ACQUISITION HOLDING (LUXEMBOURG) S.A.R.L.

VALCON ACQUISITION HOLDING B.V.

VALCON ACQUISITION B.V.

AMENDED SHAREHOLDERS’ AGREEMENT

REGARDING

THE NIELSEN COMPANY B.V. (FORMERLY VNU GROUP

B.V.)

4 SEPTEMBER 2009

Clifford Chance LLP

Droogbak 1A

1013 GE Amsterdam

The Netherlands

CONTENTS

| Clause |

Page | |||

| 1. Definitions and Interpretation |

6 | |||

| 1.1 |

Definitions | 6 | ||

| 1.2 |

Interpretation | 18 | ||

| 2. Implementation Matters |

18 | |||

| 2.1 |

Organizational Documents | 18 | ||

| 2.2 |

Conflicts or Inconsistencies | 19 | ||

| 2.3 |

Effectuating the Intent of the Parties | 19 | ||

| 2.4 |

Applicable Law | 19 | ||

| 3. Luxco Board of Managers |

19 | |||

| 3.1 |

Composition of the Luxco Board | 19 | ||

| 3.2 |

Abstention on Related Party Transactions | 22 | ||

| 3.3 |

Changes in Shareholding | 22 | ||

| 3.4 |

Meetings of the Luxco Board; Observers | 22 | ||

| 3.5 |

Decisions of the Luxco Board | 23 | ||

| 3.6 |

Representation of Luxco | 23 | ||

| 3.7 |

Intermediate Holdco Boards | 24 | ||

| 3.8 |

Formalities | 24 | ||

| 4. VNU Supervisory Board |

24 | |||

| 4.1 |

Composition of the VNU Supervisory Board | 24 | ||

| 4.2 |

Related Party Transactions; Independent VNU Directors’ Approval | 27 | ||

| 4.3 |

Changes in Shareholding | 27 | ||

| 4.4 |

Meetings of the VNU Supervisory Board; Observers | 28 | ||

| 4.5 |

Decisions of the VNU Supervisory Board | 29 | ||

| 4.6 |

Formalities | 29 | ||

| 5. Board Committees; Financing Committee; Management |

29 | |||

| 5.1 |

Luxco and Intermediate Holdco Committees | 29 | ||

| 5.2 |

VNU Board Committees; Finance Committee | 30 | ||

| 5.3 |

VNU Management | 30 | ||

| 6. Investors’ Committee |

30 | |||

| 6.1 |

Purpose of the Investors’ Committee; Effectuating Intent | 30 | ||

| 6.2 |

Composition of Investors’ Committee | 31 | ||

| 6.3 |

Abstention on Related Party Transactions | 33 | ||

| 6.4 |

Changes in Shareholding | 33 | ||

| 6.5 |

Meetings of the Investors’ Committee | 33 | ||

| 6.6 |

Decisions of the Investors’ Committee | 34 | ||

| 6.7 |

Approvals in this Agreement | 35 | ||

| 7. Indemnification |

35 | |||

| 7.1 |

Indemnification | 35 | ||

| 7.2 |

Insurance by VNU | 37 | ||

| 8. Issues of Securities |

37 | |||

| 8.1 |

Equal Treatment of Investors | 37 | ||

| 9. Transfers |

38 | |||

- 2 -

| 9.1 |

Limitations on Transfer | 38 | ||

| 9.2 |

Permitted Transfers | 39 | ||

| 9.3 |

Drag-Along | 40 | ||

| 9.4 |

Tag-Along | 41 | ||

| 10. IPO and Public Offering Rights |

45 | |||

| 10.1 |

Structural Considerations | 45 | ||

| 10.2 |

Piggyback Offerings | 46 | ||

| 10.3 |

Requested Offerings | 48 | ||

| 10.4 |

Obligations of Issuer in Connection with Public Offerings | 51 | ||

| 10.5 |

Holdback | 53 | ||

| 10.6 |

Post-IPO Sales | 53 | ||

| 10.7 |

Sales in a Tender Offer | 54 | ||

| 10.8 |

Acknowledgment by Subsidiaries | 54 | ||

| 11. Subsequent share acquisitions; additional equity funding |

55 | |||

| 11.1 |

Acquisition of 100% of the Shares in VNU | 55 | ||

| 11.2 |

Additional Equity Funding | 55 | ||

| 11.3 |

Equity Syndication and Certain Reallocations Among Investors | 55 | ||

| 12. Representations and Warranties |

56 | |||

| 12.1 |

Representations and Warranties of the Investors | 56 | ||

| 13. Additional Covenants and Agreements |

57 | |||

| 13.1 |

Advisory Services Agreement | 57 | ||

| 13.2 |

Directors’ Fees and Expenses | 57 | ||

| 13.3 |

Certain Tax Matters | 58 | ||

| 13.4 |

Corporate Opportunities | 58 | ||

| 13.5 |

Non-Competition | 59 | ||

| 13.6 |

Non-Solicitation | 60 | ||

| 13.7 |

Access to Information, Financial Statements, Confidentiality and Public Announcements | 60 | ||

| 13.8 |

Standstill | 62 | ||

| 14. Miscellaneous |

62 | |||

| 14.1 |

Waiver; Amendment | 62 | ||

| 14.2 |

Effectiveness; Termination | 63 | ||

| 14.3 |

Notices | 63 | ||

| 14.4 |

Applicable Law | 63 | ||

| 14.5 |

Disputes | 63 | ||

| 14.6 |

Assignment | 64 | ||

| 14.7 |

Specific Performance | 64 | ||

| 14.8 |

Fiduciary Duties; Exculpation Clause | 64 | ||

| 14.9 |

No Recourse | 65 | ||

| 14.10 |

Further Assurances | 65 | ||

| 14.11 |

Several Obligations | 65 | ||

| 14.12 |

Third Parties | 65 | ||

| 14.13 |

Entire Agreement | 65 | ||

| 14.14 |

Titles and Headings | 65 | ||

| 14.15 |

No Other Agreements | 65 | ||

| 14.16 |

Binding Effect | 66 | ||

| 14.17 |

Severability | 66 | ||

| 14.18 |

Counterparts | 66 | ||

- 3 -

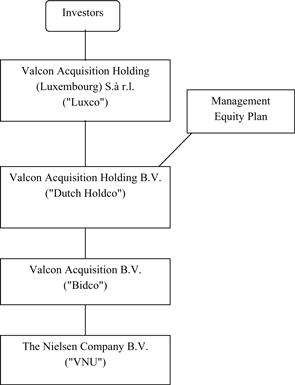

| SCHEDULE 1 |

Investors |

68 | ||

| SCHEDULE 2 |

Initial Investments and Remaining Equity Commitments |

70 | ||

| SCHEDULE 3 |

Simplified Acquisition Structure chart |

71 | ||

| SCHEDULE 4 |

Form of Accession Agreement |

72 | ||

| SCHEDULE 5 |

Initial Members of Boards and Committees |

76 | ||

| Part A Luxco Managers |

76 | |||

| Part B VNU Directors |

76 | |||

| Part C Executive Committee |

77 | |||

| Part D Audit Committee |

77 | |||

| Part E Compensation Committee |

77 | |||

| Part F Finance Committee |

77 | |||

| Part G Investors’ Committee |

78 | |||

| Part H Observers to Luxco Board and VNU Supervisory Board |

78 | |||

| SCHEDULE 6 |

Actions Requiring Approval |

79 | ||

| Part A Actions Requiring Unanimous Approval |

79 | |||

| Part B Actions Requiring Requisite Majority Approval |

80 | |||

| Part C Actions Requiring Simple Majority Approval |

83 | |||

| SCHEDULE 7 |

Forms of Advisory Services Agreements |

85 | ||

| Part A Form of Valcon Advisory Services Agreement |

85 | |||

| Part B Form of Bidco Advisory Services Agreement |

88 | |||

| SCHEDULE 8 |

Addresses and Fax Numbers for Notices |

97 | ||

| SCHEDULE 9 |

Named Competitors |

100 | ||

| SCHEDULE 10 |

Equity Syndication |

101 | ||

- 4 -

SHAREHOLDERS AGREEMENT

This Shareholders Agreement (this “Agreement”), is amended as of 4 September 2009 among:

| (1) | Each of the AlpInvest Funds (as listed in Schedule 1 – Part B, together “AlpInvest”); |

| (2) | Each of the Blackstone Funds (as listed in Schedule 1 – Part B, together “Blackstone”); |

| (3) | Each of the Carlyle Funds (as listed in Schedule 1 – Part B, together “Carlyle”); |

| (4) | Each of the Hellman & Friedman Funds (as listed in Schedule 1 – Part B, together “Hellman & Friedman”); |

| (5) | Each of the KKR Funds (as listed in Schedule 1 – Part B, together “KKR”); |

| (6) | Each of the Thomas H. Lee Partners Funds (as listed in Schedule 1 – Part B, together “Thomas H. Lee Partners”); |

| (7) | VALCON ACQUISITION HOLDING (LUXEMBOURG) S.À R.L., a private limited company (société à responsabilité limitée) incorporated under the laws of Luxembourg, having its registered office at 59, rue de Rollingergrund, L-2440 Luxembourg, Luxembourg (“Luxco”); |

| (8) | VALCON ACQUISITION HOLDING B.V., a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid), incorporated under the laws of The Netherlands, having its registered office at Jachthavenweg 118, 1081 KJ Amsterdam, The Netherlands and registered with the Chamber of Commerce for Amsterdam under file number 3424 8449 (“Dutch Holdco”); and |

| (9) | VALCON ACQUISITION B.V., a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) incorporated under the laws of The Netherlands, having its registered office at Jachthavenweg 118, 1081 KJ Amsterdam, The Netherlands and registered with the Chamber of Commerce for Amsterdam under file number 3424 1179 (the “Bidco”), |

Each of the AlpInvest Funds, the Blackstone Funds, the Carlyle Funds, the Hellman & Friedman Funds, the KKR Funds and the Thomas H. Lee Partners Funds, and their respective permitted successors and assigns, are collectively referred to herein as the “Investors” and each of them is referred to as an “Investor”. The Investors, Luxco, Dutch Holdco and Bidco, together with any person in the future acceding to this Agreement as envisaged below, are collectively referred to herein as the “Parties”.

WHEREAS:

| (A) | Luxco has been formed for the purposes of the acquisition of VNU N.V., a public company with limited liability organized under the laws of the Netherlands, and subsequently converted into VNU Group B.V. and then renamed The Nielsen Company B.V., a private company with limited liability organized under the laws of the Netherlands (“VNU”), by way of an all-cash public tender offer for any and all of the outstanding ordinary shares and listed 7% preference shares of VNU (the “Offer”), in accordance with the terms and conditions of a Merger Protocol dated 8 March 2006 and subsequently amended (the “Merger Protocol”), between VNU and Valcon Acquisition B.V., a private company with limited liability organized under the laws of the Netherlands (“Bidco”), a wholly-owned indirect subsidiary of Luxco. |

| (B) | The Investors and certain Affiliates of the Investors entered into an interim investors agreement dated 15 March 2006, as amended on 22 May 2006, 2 June 2006 and August 4, 2006 (the “Interim Investors Agreement”), providing for certain matters relating to the conduct of the Offer, together with a term sheet describing the principal terms of an agreement to be entered into at or after the first settlement date of the Offer, that would provide for certain matters relating to the Investors’ direct and indirect ownership of interests in Luxco and its direct and indirect subsidiaries including VNU and its direct and indirect subsidiaries (collectively, the “Group”) and the governance of the Group on and after the Last Settlement Date. |

- 5 -

| (C) | The acceptance period with respect to the Offer ended on May 19, 2006 and the post-acceptance period with respect to the Offer ended on June 9, 2006; settlement with respect to the last VNU shares tendered into the Offer took place on June 14, 2006 (the “Last Settlement Date,” provided that, after the “squeeze-out” as contemplated by Article 11.1, the “Last Settlement Date” shall be the day that the “squeeze-out” is consummated and Bidco owns all of the shares in VNU). |

| (D) | Pursuant to the terms of the Interim Investors Agreement, the Investors have provided initial equity funding to Luxco by subscribing for the numbers of yield free convertible preferred equity certificates, convertible preferred equity certificates and ordinary shares set forth behind their respective names in the second, fifth and seventh columns of Schedule 2 and paying up the respective amounts on those securities set forth behind their respective names in the third, sixth and eighth columns of Schedule 2. |

| (E) | A diagram of the simplified acquisition structure as of the date hereof is attached as Schedule 3. |

| (F) | This Agreement was originally entered into by the Parties on 21 December 2006, has been amended from time to time and was amended, in accordance with the terms of the Agreement to its current form by an Amendment Agreement between the Parties dated 4 September 2009. |

NOW, THEREFORE, in consideration of the mutual agreements and covenants contained herein, the Parties agree as follows:

| 1. | DEFINITIONS AND INTERPRETATION |

| 1.1 | Definitions |

For purposes of this Agreement, the following terms shall have the following meanings:

| Accession Agreement | shall mean an agreement substantially in the form of Schedule 4. | |

| Action, Suit or Proceeding | shall have the meaning specified in Article 7.1.1. | |

| ADSs | shall mean American Depositary Shares. | |

| Advisory Services Agreement | shall have the meaning specified in Article 13.1. | |

| Affiliate or Affiliated Fund | shall mean (a) with respect to any Investor, any other Person Controlled directly or indirectly by such Investor, Controlling directly or indirectly such Investor or directly or indirectly under the same Control as such Investor, or, in each case, a successor entity to such Investor, provided, however, that (i) Affiliate or Affiliated Fund shall not include any portfolio companies of the relevant Investor or its Affiliates and (ii) with respect to each of the AlpInvest Funds, Affiliate or Affiliated Fund shall not include Stichting Pensioenfonds ABP, Stichting Pensioenfonds voor | |

- 6 -

| de Gezondheid, Geestelijke en Maatschappelijke Belangen or any of their respective Affiliates; and provided further, for the avoidance of doubt, that all of the funds mentioned underneath a single heading as a group of funds in Schedule 1 shall in any event be considered Affiliates and Affiliated Funds of each other; and (b) with respect to any Person who is not an Investor, another Person Controlled directly or indirectly by such first Person, Controlling directly or indirectly such first Person or directly or indirectly under the same Control as such first Person. | ||

| Affiliated | shall have a meaning correlative to the foregoing. | |

| AFM | shall mean the Netherlands Authority for the Financial Markets. | |

| Agreement | shall mean this Agreement, as the same may be amended, supplemented or otherwise modified from time to time in accordance with the terms hereof. | |

| AlpInvest and AlpInvest Funds | shall have the meaning specified in the preamble to this Agreement. | |

| Applicable Offering Document | shall mean, in respect of a Public Offering (i) in The Netherlands, a prospectus required to be filed with the AFM under the Dutch Securities Market Supervision Act 1995 (Wet toezicht effectenverkeer 1995) as amended from time to time, (ii) in the United States, a prospectus (including a prospectus covering ADSs) required to be filed with the SEC under the Securities Act, and (iii) in any other jurisdiction, a prospectus or other document required to be filed with any Applicable Regulatory Authority and/or in a form and including substantive disclosure customary to an offering of shares to similarly situated purchasers in such jurisdiction. | |

| Applicable Regulatory Authority | shall mean in respect of a Public Offering under (i) the Dutch Securities Market Supervision Act 1995 (Wet toezicht effectenverkeer 1995) as amended from time to time in The Netherlands, the AFM, (ii) the Securities Act in the United States, the SEC, and (iii) the applicable securities laws in any other jurisdiction, the appropriate governmental agency regulating the listing or public offering of securities, if any, in such jurisdiction. | |

| Assumed Number | shall have the meaning specified in Article 10.1.2. | |

| Audit Committee | shall have the meaning specified in Article 5.2.1. | |

| Authorized Recipients | shall have the meaning specified in Article 13.7.2. | |

| Bidco | shall have the meaning specified in the recitals to this Agreement. | |

- 7 -

| Bidco Advisory Services Agreement | shall have the meaning specified in Article 13.1. | |

| Bidco Board | shall mean the management board of Bidco. | |

| Blackstone and Blackstone Funds | shall have the meaning specified in the preamble to this Agreement. | |

| Board | shall mean any of the Luxco Board, the Dutch Holdco Board, the Bidco Board and the VNU Supervisory Board. | |

| Brokered Exchange Transaction | shall have the meaning specified in Article 10.6. | |

| Budget | shall mean the annual budget of the Group. | |

| Business Day | shall mean a day on which banks are open for business in Amsterdam, London, New York and Luxembourg (which, for avoidance of doubt, shall not include Saturdays, Sundays and public holidays in any of these cities). | |

| Carlyle and Carlyle Funds | shall have the meaning specified in the preamble to this Agreement. | |

| Change in Control | shall mean any transaction (including, without limitation, any merger, consolidation or sale of assets or equity interests) the result of which is that any Person or “group” (as defined within the meaning of Rules 13d-3 and 13d-5 under the U.S. Securities Exchange Act of 1934 as in effect on the Effective Date), other than any of the Investors or their Affiliated Funds, obtains (i) direct or indirect ownership of more than 50% of the voting rights of VNU, (ii) the right to appoint the majority of the members of the board of directors (or similar governing body) or to manage on a discretionary basis the assets of Luxco, any Intermediate Holdco or VNU, or (iii) all or substantially all of the assets of Luxco, any Intermediate Holdco or VNU. | |

| Compensation Committee | shall have the meaning specified in Article 5.2.1. | |

| Competing Action | shall have the meaning specified in Article 13.4. | |

| Competing Enterprise | shall have the meaning specified in Article 13.4. | |

| Confidential Information | shall have the meaning specified in Article 13.7. | |

| Control | shall mean with respect to a Person (other than an individual) (i) direct or indirect ownership of more than 50% of the voting rights of such Person, or (ii) the right to | |

- 8 -

| appoint the majority of the members of the board of directors (or similar governing body) or to manage on a discretionary basis the assets of such Person and, for avoidance of doubt, a general partner is deemed to control a limited partnership and, solely for the purposes of this Agreement, a fund advised or managed directly or indirectly by a Person shall also be deemed to be controlled by such Person (and the terms Controlling and Controlled shall have meanings correlative to the foregoing). | ||

| Corporate Director | shall have the meaning specified in Article 3.7. | |

| Corporate Opportunity | shall have the meaning specified in Article 13.4. | |

| Drag-Along Notice | shall have the meaning specified in Article 9.3.2. | |

| Drag-Along Purchaser | shall have the meaning specified in Article 9.3.1. | |

| Drag-Along Sale | shall have the meaning specified in Article 9.3.1. | |

| Drag-Along Sale Costs | shall have the meaning specified in Article 9.3.2. | |

| Dragged Investor | shall have the meaning specified in Article 9.3.1. | |

| Dragging Investor | shall have the meaning specified in Article 9.3.1. | |

| Dutch Corporate Governance Code | shall mean the code of conduct designated pursuant to Section 2:391 paragraph 4 of the Dutch Civil Code, currently being the code of conduct published in the Dutch State Gazette (Staatscourant) on 27 December 2004 (issue 250, 2004). | |

| Dutch Holdco | shall have the meaning specified in the preamble to this Agreement. | |

| Dutch Holdco Board | shall mean the board of management of Dutch Holdco. | |

| Exchange Act | shall mean the U.S. Securities Exchange Act of 1934, as amended, or any similar federal statute then in effect, and a reference to a particular section thereof shall be deemed to include a reference to the comparable section, if any, of any such similar federal statute. | |

| Finance Committee | shall have the meaning specified in Article 5.2.4. | |

| Group | shall have the meaning specified in the recitals to this Agreement. | |

| Hellman & Friedman and Hellman & Friedman Funds | shall have the meaning specified in the preamble to this Agreement. | |

| Holders’ Counsel | shall mean (i) for any Piggyback Offering, one firm of legal counsel to represent all Piggybacking Holders for each | |

- 9 -

| Selected Offering Jurisdiction in which shares are being sold in such Piggyback Offering and, if different and to the extent necessary, one firm of legal counsel in the jurisdiction of incorporation of Issuer and (ii) for any Requested Offering, one firm of legal counsel to represent the Requesting Holders and all Participating Holders for each Selected Offering Jurisdiction in which shares are being sold in such Requested Offering and, if different and to the extent necessary, one firm of legal counsel in the jurisdiction of incorporation of Issuer. | ||

| Incur | shall mean to issue, create, assume, guarantee, incur or otherwise become liable for and the terms Incurred and Incurrence shall have meanings correlative to the foregoing. | |

| Indemnity-Related Entities | shall have the meaning specified in Article 7.1.4. | |

| Indemnitees | shall have the meaning specified in Article 7.1.1. | |

| Independent VNU Directors | shall have the meaning specified in Article 4.1.1(g), subject to Article 4.1.2. | |

| Information | shall mean the books and records of any member of the Group and information relating to such member of the Group, its properties, operations, financial condition and affairs. | |

| Intermediate Holdcos | shall mean Dutch Holdco, Bidco and any other entity that from time to time is wholly-owned, directly or indirectly, by Luxco, or its successors, and wholly-owns, directly or indirectly, Bidco or its successors and that becomes a Party to this Agreement. | |

| Intermediate Holdco Boards | Shall mean the boards of management (directie) of Dutch Holdco, Bidco and any other Intermediate Holdco. | |

| Interim Investors Agreement | shall have the meaning specified in the recitals to this Agreement. | |

| Investor | shall have the meaning specified in the preamble to this Agreement. | |

| Investor Fund | shall mean, individually and collectively, any of the AlpInvest Funds, the Blackstone Funds, the Carlyle Funds, the Hellman & Friedman Funds, the KKR Funds and the Thomas H. Lee Partners Funds. | |

| Investor Fund Manager | means (i) in respect of any AlpInvest Fund, AlpInvest Partners 2006 B.V. or AlpInvest Partners Later Stage Co-Investments Custodian IIA B.V., in its capacity of custodian of AlpInvest Partners Later Stage Co-Investments IIA C.V. | |

- 10 -

| (ii) in respect of any Blackstone Fund, Blackstone Management Partners V L.L.C., (iii) in respect of any Carlyle Fund, TC Group, L.L.C., (iv) in respect of any Hellman & Friedman Fund, Hellman & Friedman LLC, (v) in respect of any KKR Fund, Kohlberg Kravis Roberts & Co. L.P. or Kohlberg Kravis Roberts & Co. Ltd., and (vi) in respect of any Thomas H. Lee Partners Fund, THL Managers V, LLC or THL Managers VI, LLC. | ||

| Investor Representative | shall have the meaning specified in Article 6.2.1 | |

| Investors’ Committee | shall have the meaning specified in Article 6.1. | |

| Investors’ Committee Chairman | shall have the meaning specified in Article 6.2.2. | |

| Investors’ IPO Number | shall have the meaning specified in Article 10.2.1 | |

| IPO | shall mean an initial Public Offering of a class of shares of Luxco, any Intermediate Holdco or VNU, as determined by the Investors’ Committee. | |

| IRC | shall have the meaning specified in Article 10.1.21. | |

| Issuer | shall have the meaning specified in Article 10.1.1. | |

| Jointly Indemnifiable Claims | shall have the meaning specified in Article 7.1.4. | |

| KKR and KKR Funds | shall have the meaning specified in the preamble to this Agreement. | |

| Last Settlement Date | shall have the meaning specified in the preamble to this Agreement. | |

| Listed Shares | shall have the meaning specified in Article 10.1.2. | |

| Losses | shall have the meaning specified in Article 7.1.1. | |

| LP Distribution | shall have the meaning specified in Article 10.6. | |

| Luxco | shall have the meaning specified in the preamble to this Agreement. | |

| Luxco Board | shall mean the board of managers of Luxco. | |

| Luxco Chairman | shall have the meaning specified in Article 3.1.1. | |

| Luxco Manager | shall have the meaning specified in Article 3.1.1. | |

| Luxco Manager A | shall have the meaning specified in Article 3.1.1. | |

| Luxco Manager B | shall have the meaning specified in Article 3.1.1. | |

| Management | shall mean such senior members of management of VNU as | |

- 11 -

| shall be designated by the Investors’ Committee in accordance with Article 6.6. | ||

| Maximum Allocation | shall have the meaning specified in Article 9.4.2(b). | |

| Maximum Offering Size | shall have the meaning specified in Article 10.2.2. | |

| Merger Protocol | shall have the meaning specified in the recitals to this Agreement. | |

| Named Competitor | shall have the meaning specified in Article 13.5. | |

| New Securities | shall mean any shares or options, warrants or other securities or rights convertible or exchangeable into or exercisable for shares of Luxco or any other member of the Group (which term shall include securities deemed to be shares by the US Internal Revenue Service, such as YFCPECs); provided, however, that New Securities shall not include: (i) securities to be issued by Issuer in connection with an IPO or any other Public Offerings; (ii) securities to be issued in connection with any pro rata stock split or stock dividend of Luxco; (iii) securities to be issued as consideration for, or in connection with, an acquisition of any business or all or substantially all of such business’s assets by any member of the Group whether by merger or otherwise; (iv) securities to be issued in connection with any employee equity incentive plan or similar benefit programs or agreements approved by the Investors’ Committee where the principal purpose is not to raise additional equity capital; and (v) any Replacement Securities issued pursuant to Article 10.1.1. | |

| Offer | shall have the meaning specified in the recitals to this Agreement. | |

| Offering Expenses | shall mean any and all expenses incident to performance of or compliance with the provisions of Article 10 or any underwriting agreement entered into in accordance therewith, including, without limitation, (i) all listing, registration, qualification and quotation fees of any Applicable Regulatory Authority or of any securities exchange or securities quotation system, (ii) all fees and expenses of complying with all applicable securities laws, (iii) all road show, printing, messenger and delivery expenses, (iv) all rating agency fees, (v) the fees and disbursements of legal counsel in each relevant jurisdiction for the (proposed) Issuer or its independent public accountants, including the expenses of any special audits and/or comfort letters required by or incident to such performance and compliance, (vi) the reasonable fees and disbursements of Holders’ Counsel, (vii) all fees and | |

- 12 -

| disbursements of underwriters customarily paid by the issuers or sellers of securities, including liability insurance if the (proposed) Issuer so desires or if the underwriters so require, and the reasonable fees and expenses of any special experts retained in connection with the requested registration, but excluding underwriting discounts and commissions and transfer taxes, if any, (viii) all fees and expenses incurred in connection with the creation of ADSs, including the reasonable fees and disbursements of the depositary for such ADSs that the (proposed) Issuer, and not the depositary, is required to pay, and (ix) other reasonable out-of-pocket expenses of Selling Holders in connection therewith. | ||

| Offering Request | shall have the meaning specified in Article 10.3.1. | |

| Participating Holders | shall have the meaning specified in Article 10.3.1. | |

| Participating Investors | shall have the meaning specified in Article 10.3.2 | |

| Permitted Transfer | shall have the meaning specified in Article 9.2. | |

| Permitted Transferee | shall have the meaning specified in Article 9.2. | |

| Person | shall mean a natural person, partnership, corporation, limited liability company, business trust, joint stock company, trust, unincorporated association, joint venture or other entity or organization. | |

| Piggyback Offering | shall have the meaning specified in Article 10.2.1. | |

| Piggyback Right | shall have the meaning specified in Article 10.2.1. | |

| Piggybacking Holder | shall have the meaning specified in Article 10.2.1. | |

| Piggybacking Investor | shall have the meaning specified in Article 10.2.1. | |

| Post-IPO Sale | shall have the meaning specified in Article 10.6. | |

| Pre-emptive Right. | shall have the meaning specified in Article 8.1.1 | |

| Privately Negotiated Transaction | shall have the meaning specified in Article 10.6. | |

| Proportionate Percentage | shall have the meaning specified in Article 8.1.1. | |

| Pro Rata Portion | shall have the meaning specified in Article 10.2.1 | |

| Public Offering | shall mean, with respect to any securities of a class that is the same as any class of Listed Shares: (i) any sale of such securities to the public in an offering under the laws, rules and regulations of any non-U.S. jurisdiction or (ii) any sale of such securities to the public in an offering pursuant to an | |

- 13 -

| effective registration statement under the Securities Act (other than a registration on Form S-4, F-4 or S-8, or any successor or other forms promulgated for similar purposes). | ||

| Related Party | shall mean the parties to a Related Party Transaction. | |

| Related Party Transaction | shall mean any transaction between, on the one hand, any members of the Group and, on the other hand, any Investor or any Affiliate of any Investor (excluding any member of the Group), provided, however, that the following will not be deemed to be Related Party Transactions: (i) the Advisory Services Agreement or the Bidco Advisory Services Agreements or any amount contemplated by or paid in accordance with any such agreement, (ii) the directors’ fees and expenses contemplated by Article 13.2, (iii) any subscription of New Securities in accordance with a Pre-emptive Right, (iv) any VCOC Management Rights Agreements, and (v) the transactions contemplated by Article 10.1. | |

| Remaining Equity Commitment | shall have the meaning specified in Article 11.2. | |

| Remaining Shares | shall have the meaning specified in Article 10.2.2 | |

| Reorganization Transaction | shall have the meaning specified in Article 10.1.1. | |

| Replacement Securities | shall have the meaning specified in Article 10.1.1. | |

| Representatives | shall mean, for any Investor, the Investor Representative(s) and the Affiliates (excluding, for the avoidance of doubt, any member of the Group) of such Investor and such Investor’s and each such Affiliate’s respective directors, managers, officers, partners, members, principals, employees, professional advisers and agents. | |

| Requested Offering | shall have the meaning specified in Article 10.3.1. | |

| Requesting Holders | shall have the meaning specified in Article 10.3.1. | |

| Requisite Majority | shall have the meaning specified in Article 6.6.4(a). | |

| SEC | shall mean the U.S. Securities and Exchange Commission or any other federal agency at the time administering the Securities Act or the Exchange Act. | |

| Securities Act | shall mean the U.S. Securities Act of 1933, as amended, or any similar federal statute then in effect, and a reference to a particular section thereof shall be deemed to include a reference to the comparable section, if any, of any such similar federal statute. | |

- 14 -

| Selected Offering Jurisdiction | shall mean (i) for an IPO, (x) The Netherlands, the United States and/or any other jurisdiction or market where a Public Offering could reasonably be expected to optimize the price and liquidity for the shares proposed to be sold; and (ii) for any Public Offering after an IPO, (x) the jurisdiction(s) in which such IPO was conducted and/or (y) any other jurisdiction or market where a Public Offering could reasonably be expected to optimize the price and liquidity for the shares proposed to be sold. | |

| Selected Securities Exchange | shall mean (i) for a Public Offering in The Netherlands, the Euronext Amsterdam securities exchange, (ii) for a Public Offering in the United States, the New York Stock Exchange or the National Association of Securities Dealers’ automated quotation system or (iii) for a Public Offering in any other jurisdiction, any regulated national securities exchange in such jurisdiction. | |

| Selling Holders | shall mean the Piggybacking Holders (in the case of a Piggyback Offering) and the Requesting Holders and the Participating Holders (in the case of a Requested Offering). | |

| Selling Investors | shall mean the Piggybacking Investors (in the case of a Piggyback Offering) and the Requesting Holders and the Participating Investors (in the case of a Requested Offering). | |

| Shares | shall mean the ordinary shares, par value €25 per share, of Luxco. | |

| shares | when used herein shall be deemed to include ordinary shares, preferred shares and any other class of equity securities, including partnership interests or equity interests in other non-corporate entities, as the context requires. | |

| Tag-Along Beneficiary | shall have the meaning specified in Article 9.4.2. | |

| Tag-Along Notice | shall have the meaning specified in Article 9.4.2. | |

| Tag-Along Notice Period | shall have the meaning specified in Article 9.4.2. | |

| Tag-Along Offer | shall have the meaning specified in Article 9.4.2. | |

| Tag-Along Portion | shall have the meaning specified in Article 9.4.2. | |

| Tag-Along Purchaser | shall have the meaning specified in Article 9.4.2. | |

| Tag-Along Response Notice | shall have the meaning specified in Article 9.4.2. | |

| Tag-Along Right | shall have the meaning specified in Article 9.4.2. | |

- 15 -

| Tag-Along Sale | shall have the meaning specified in Article 9.4.2. | |

| Tag-Along Sale Costs | shall have the meaning specified in Article 9.4.7 | |

| Tag-Along Sale Settlement Date | shall have the meaning specified in Article 9.4.2. | |

| Tag-Along Seller | shall have the meaning specified in Article 9.4.2. | |

| Tagging Person | shall have the meaning specified in Article 9.4.2. | |

| Temporary Unit Transfers | shall have the meaning specified in Article 10.7. | |

| Tender | shall have the meaning specified in Article 10.7. | |

| Tender Offer | shall have the meaning specified in Article 10.7. | |

| Third Party | shall mean any Person (or group of Persons) that is not an Investor or an Affiliate of an Investor. | |

| Thomas H. Lee Partners and Thomas H. Lee Partners Funds | shall have the meaning specified in the preamble to this Agreement. | |

| Trading Date | shall have the meaning specified in Article 10.6. | |

| Trading Volume Limitation | shall have the meaning specified in Article 10.6. | |

| Transfer | shall mean a transfer, sale, assignment, pledge, hypothecation or other disposition by a Person of a legal or beneficial interest in another Person, whether directly or indirectly, including pursuant to the creation of a derivative security (other than phantom stock or similar incentive plans for employees), the grant of an option or other right, the imposition of a restriction on disposition or voting or by operation of law. | |

| Units | shall mean, individually and collectively, the Shares, the YFCPECs and any New Securities and, following any Reorganization Transaction pursuant to Article 10.1 as a result of which all or any portion of the Shares, the YFCPECs are exchanged for or otherwise replaced by any Replacement Securities, Units shall also mean such Replacement Securities (unless the context otherwise requires). | |

| VCOC Management Rights Agreement | shall mean those certain management rights agreements by and among Luxco, VNU and the Investors (or funds) party thereto granting such Investors (or funds) certain informational and other rights with respect to the Group. | |

- 16 -

| VNU | shall have the meaning specified in the recitals to this Agreement. | |

| VNU Articles | Shall mean the articles of association (statuten) of VNU from time to time in effect. | |

| VNU Board Committees | shall have the meaning specified in Article 5.2.1. | |

| VNU Director | shall have the meaning specified in Article 4.1.1. | |

| VNU General Meeting | shall mean the general meeting of all shareholders of VNU. | |

| VNU Supervisory Board | shall mean the supervisory board (raad van commissarissen) of VNU. | |

| VNU Supervisory Board Chairman | shall have the meaning specified in Article 4.1(a). | |

| VNU Supervisory Board Rules | shall mean the supervisory board rules (commissarissen reglement) adopted by the VNU Supervisory Board in accordance with the VNU Articles form time to time. | |

| Voting Interest | shall mean the aggregate number of votes exercisable at a general meeting of shareholders of Luxco, attached to the shares in Luxco comprised in the Units (i) held by an Investor or group of Investors at a particular time or (ii) with respect to which an Investor or group of Investors has the authority and power to vote, pursuant to a power of attorney, transfer of voting rights or otherwise, subject to Article. | |

| Wholly-Owned Subsidiary | shall mean, with respect to any Person, any other Person of which 100% of its securities are owned at the time of determination, directly or indirectly, by such first Person (other than any shares required by any applicable law or regulation to be held by any other Person, such as directors’ qualifying shares). | |

- 17 -

| YFCPECs | shall mean each class and series of yield free convertible preferred equity certificates of Luxco. |

| 1.2 | Interpretation |

| (a) | Whenever the words “include,” “includes” or “including” are used in this Agreement they shall be deemed to be followed by the words “without limitation.” |

| (b) | The words “hereof,” “herein” and “herewith” and words of similar import shall, unless otherwise stated, be construed to refer to this Agreement as a whole and not to any particular provision of this Agreement, and article, section, paragraph, exhibit and schedule references are to the articles, sections, paragraphs, exhibits and schedules of this Agreement unless otherwise specified. |

| (c) | The meaning assigned to each term defined herein shall be equally applicable to both the singular and the plural forms of such term, and words denoting any gender shall include all genders. Where a word or phrase is defined herein, each of its other grammatical forms shall have a corresponding meaning. |

| (d) | A reference to any Party or any party to any other agreement or document shall include such Party or party’s successors and permitted assigns. |

| (e) | A reference to any legislation or to any provision of any legislation shall include any amendment to, and any modification or re-enactment thereof, any legislative provision substituted therefor and all regulations and statutory instruments issued thereunder or pursuant thereto. |

| 2. | IMPLEMENTATION MATTERS |

| 2.1 | Organizational Documents |

Each Investor shall, and shall instruct its representative(s), nominee(s) or designee(s), as the case may be, on the Investors’ Committee, on each Board and on any committee thereof to, take any and all action within its power to procure that the organizational documents of Luxco and each other member of the Group (including any rules, regulations or policies of any governing body thereof) shall reflect the terms of this Agreement to the extent recommended by Luxembourg, United States and/or Dutch counsel to the Group, so as to effectuate and preserve the intent of the Parties as set out herein. Without limiting the generality of the foregoing, each Investor shall take, and shall instruct its representative(s), nominee(s) or designee(s), as the case may be, on the Investors’ Committee, on each Board and on any committee thereof to take, any and all action within its power to adopt any and all amendments to the VNU Articles and the VNU Supervisory Board Rules which are necessary, appropriate or desirable and which are approved in accordance with the terms of this Agreement, including the actions or matters that require the prior approval of the Investors’ Committee as set forth in Article 6.6 or elsewhere in this Agreement and that have been so approved.

- 18 -

| 2.2 | Conflicts or Inconsistencies |

In all events this Agreement will govern and prevail as among the Investors in the event of any conflict or inconsistency between the provisions of this Agreement and the provisions of the organizational documents of Luxco or any other member of the Group.

| 2.3 | Effectuating the Intent of the Parties |

Each Investor shall (i) vote its Shares, grant powers of attorney, execute documents and take all other action in its power and authority as a shareholder of Luxco and (ii) cause its representative(s), nominee(s) or designee(s), as the case may be, on the Investors’ Committee, on each Board and on any committee thereof to exercise their voting rights on each such body, in a manner consistent with the rights and obligations of the Parties under this Agreement so as to effectuate and preserve the intent of the Parties as set out herein, including voting in favour of and consenting to any transactions involving any member of the Group that are approved by the Investors’ Committee.

| 2.4 | Applicable Law |

The Parties acknowledge that in certain instances a provision of this Agreement may not be enforceable or that its enforceability may be limited by applicable law. Nevertheless, the Parties agree that they intend to be bound by the terms of this Agreement and, if any provision is held to be unenforceable, the Parties agree to use their reasonable efforts to implement an alternative enforceable mechanism that would effect, as closely as possible, the intent of the Parties as reflected in or provided by the unenforceable provision. Moreover, each Party agrees that, if any corporate formality or other procedure is not expressly mandated by law or the provisions of this Agreement to be taken by the Parties but the enforceability of any provision of this Agreement would be enhanced if the Parties act in accordance with such corporate formality or other procedure, the Parties agree to act in accordance with such corporate formality or other procedure to the extent recommended by counsel to the Group in the relevant jurisdiction.

| 3. | LUXCO BOARD OF MANAGERS |

| 3.1 | Composition of the Luxco Board |

| 3.1.1 | The Luxco Board shall be composed of twelve members: |

| (a) | ten individuals shall be managers B (the “Luxco Managers B”) and shall be nominated by the Investors as follows: |

| (i) | one individual shall be nominated by AlpInvest; |

| (ii) | two individuals shall be nominated by Blackstone (one of such individuals shall be designated by Blackstone Capital Partners (Cayman) V, L.P. until such time as Blackstone ceases to hold a Voting Interest at least equal to 50% of the Voting Interest attached to the Units it held on the Last Settlement Date and the other shall be designated by Blackstone Capital Partners (Cayman) V, L.P. until such time as Blackstone ceases to hold a Voting Interest at least equal to 25% of the Voting Interest attached to the Units it held on the Last Settlement Date); |

| (iii) | two individuals shall be nominated by Carlyle (one of such individuals shall be designated by CEP II Participations Sarl SICAR until such time as Carlyle ceases to hold a Voting Interest at least equal to 50% of the Voting Interest |

- 19 -

| attached to the Units it held on the Last Settlement Date and the other shall be designated by Carlyle Partners IV Cayman, L.P. until such time as Carlyle ceases to hold a Voting Interest at least equal to 25% of the Voting Interest attached to the Units it held on the Last Settlement Date); |

| (iv) | one individual shall be nominated by Hellman & Friedman Capital Partners V (Cayman), L.P.; |

| (v) | two individuals shall be nominated by KKR (one of such individuals shall be designated by KKR Millennium Fund (Overseas), Limited Partnership until such time as KKR ceases to hold a Voting Interest at least equal to 50% of the Voting Interest attached to the Units it held on the Last Settlement Date and the other shall be designated by KKR Millennium Fund (Overseas), Limited Partnership until such time as KKR ceases to hold a Voting Interest at least equal to 25% of the Voting Interest attached to the Units it held on the Last Settlement Date); |

| (vi) | two individuals shall be nominated by Thomas H. Lee Partners (one of such individuals shall be designated by Thomas H. Lee (Alternative) Fund V, L.P. until such time as Thomas H. Lee Partners ceases to hold a Voting Interest at least equal to 50% of the Voting Interest attached to the Units it held on the Last Settlement Date and the other shall be designated by Thomas H. Lee Partners Equity VI, L.P. until such time as Thomas H. Lee Partners ceases to hold a Voting Interest at least equal to 25% of the Voting Interest attached to the Units it held on the Last Settlement Date); and |

| (b) | two individuals shall be managers A (the “Luxco Managers A”), shall be required to be resident in the Grand Duchy of Luxembourg, and shall be nominated by a Requisite Majority of the Investors’ Committee. The Investors’ Committee may also decide by a Requisite Majority to increase or decrease the number of Luxco Managers A (provided that there shall always be at least one Luxco Manager A). |

The Luxco Managers A and the Luxco Managers B are together referred to as the “Luxco Managers”. The initial Luxco Managers are set forth in Part A of Schedule 5 to this Agreement. The right to nominate Luxco Managers for appointment to the Luxco Board is personal to each group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) entitled to do so and may not be assigned by any such Investor (or the applicable fund of such group of Affiliated Investors) as part of a Transfer or otherwise without the consent of the Investors’ Committee (except as permitted pursuant to the proviso in the last sentence of Article 14.6).

| 3.1.2 | The Parties shall take all reasonable action necessary to procure that the Luxco Manager designated by the Investors’ Committee to serve as the chairman of the Luxco Board (the “Luxco Chairman”) shall be so appointed by the Luxco Board. |

| 3.1.3 | Each group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) entitled to nominate one or more Luxco Managers for appointment shall nominate the same individual(s) for such appointment as have been appointed as its Investor Representative(s) on the Investors’ Committee pursuant to Article 6.2.1, unless the Investors’ Committee has approved a different appointment (such approval not to be unreasonably withheld). |

- 20 -

| 3.1.4 | Each group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) entitled to nominate a Luxco Manager for appointment shall also be entitled, by notice in writing to Luxco and to each other group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors), at any time or from time to time to nominate for removal any Luxco Manager nominated by it and to nominate for appointment in place thereof another individual to serve as its Luxco Manager in accordance with the provisions of this Article 3. In such event, (i) the nominating group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) shall take all reasonable action necessary to procure that such Luxco Manager resigns from the Luxco Board and (ii) if such Luxco Manager will not resign, each Investor (including the nominating Investor) agrees that it shall take all reasonable action necessary to effect such removal and appointment as promptly as practicable on request. In addition, each group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) entitled to nominate a Luxco Manager for appointment shall, upon the death or resignation of such Luxco Manager, be entitled to nominate for appointment in place thereof another individual to serve as its Luxco Manager in accordance with the provisions of this Article 3. Without limiting the preceding provisions, no group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) shall be entitled to nominate for removal, appointment or re-appointment any Luxco Manager except for the Luxco Manager it is entitled to nominate for removal, appointment or re-appointment pursuant to the provisions of this Article 3. Each Investor agrees to vote its Shares in favour of the appointment or re-appointment of the Luxco Managers nominated for appointment or re-appointment by each other group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) entitled to do so hereunder. Notwithstanding the foregoing provisions of this Article 3.1.4, if a group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) nominates for appointment as a Luxco Manager an individual who is not a director, manager, officer or employee of the Investor Fund Manager to such Investor or to an Affiliated Fund of such Investor (as the case may be), or of a subsidiary of that Investor Fund Manager, then such individual shall be subject to the prior approval of a majority of the Investor Representatives on the Investors’ Committee (excluding any Investor Representatives designated by such Investor or its Affiliates). None of the Luxco Managers shall be entitled to receive any severance payments upon his removal, death, resignation or otherwise vacating his position as a Luxco Manager. Each group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) agrees, in respect of any Luxco Manager nominated by such group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors), to indemnify Luxco and each other Investor from any claims and liabilities with respect to any severance payment that becomes payable to any such Luxco Manager. |

| 3.1.5 | Each Investor agrees to take (to the extent such action is within such Investor’s power or control in its capacity as an investor in Luxco or through its nominees, designees or representatives on the Luxco Board), and agrees to cause Luxco to take, any and all action necessary to approve the designation and appointment of the Luxco Managers designated by a group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) in accordance with this Article 3.1. |

- 21 -

| 3.2 | Abstention on Related Party Transactions |

An Investor’s Luxco Manager(s) shall abstain from the vote of the Luxco Board on any Related Party Transaction in respect of which such Investor or any Affiliate thereof is a Related Party. Such Investor’s Luxco Manager(s) shall not be entitled to receive board materials relating to a Related Party Transaction or to participate in board deliberations relating to such Related Party Transaction if such receipt or participation would create a conflict of interest for the Related Party or any member of the Group, as determined by a Requisite Majority of the Investors’ Committee.

| 3.3 | Changes in Shareholding |

| 3.3.1 | In the event an Investor (together with any Investor that is Affiliated with such Investor) entitled to nominate for appointment two Luxco Managers ceases to hold a Voting Interest at least equal to 50% of the Voting Interest attached to the Units held by that Investor (together with any Investor that is Affiliated with that Investor) on the Last Settlement Date, then (i) such Investor (together with any Investor that is Affiliated with such Investor) shall take all action necessary to procure that one of the Luxco Managers nominated by such Investor (together with any Investor that is Affiliated with such Investor) shall immediately resign, and (ii) such Investor (together with any Investor that is Affiliated with such Investor) shall from that time forward only have the right to nominate for removal, appointment or re-appointment one Luxco Manager. |

| 3.3.2 | In the event an Investor (together with any Investor that is Affiliated with such Investor) entitled to nominate for appointment only one Luxco Manager (either on the basis of Article 3.1.1 or on the basis of Article 3.3.1) ceases to hold a Voting Interest at least equal to 25% of the Voting Interest attached to the Units held by that Investor (together with any Investor that is Affiliated with that Investor) on the Last Settlement Date, then (i) such Investor (together with any Investor that is Affiliated with such Investor) shall take all action necessary to procure that the Luxco Manager nominated by such Investor (together with any Investor that is Affiliated with such Investor) shall immediately resign, and (ii) such Investor (together with any Investor that is Affiliated with such Investor) shall from that time forward not have the right to nominate for removal, appointment or re-appointment any Luxco Manager. |

| 3.4 | Meetings of the Luxco Board; Observers |

| 3.4.1 | The Luxco Board will meet as often as it deems necessary or appropriate or upon the request of the Luxco Chairman. Any Luxco Manager may request that the Luxco Chairman call a meeting of the Luxco Board to discuss any matter requiring action or consideration by the Luxco Board and, upon receipt of any such request, together with a description of the matter(s) to be discussed at such meeting and any supporting materials necessary or appropriate for the Luxco Managers to prepare for such meeting, the Luxco Chairman will call such meeting as soon as reasonably practicable, provided, however, that the Luxco Chairman will not be required to call any such meeting if a meeting of the Luxco Board was held within four weeks prior to such request and such matter was raised at such meeting or if a meeting is scheduled to be held within four weeks after such request. The Luxco Board may meet in person, by teleconference or by videoconference (or by any combination thereof). Notwithstanding the foregoing, the Luxco Board will meet in person (to the greatest extent possible) at least two times each year in Luxembourg. |

- 22 -

| 3.4.2 | Quorum for any meeting of the Luxco Board shall require the presence (in person or by telephone, or by proxy or power of attorney) of a majority of the Luxco Managers, provided that a meeting of the Luxco Board shall not be quorate unless (i) at least one Luxco Manager B nominated by each group of Affiliated Investors is present (in person or by telephone or by proxy or power of attorney) and (ii) at least one Luxco Manager A is present in person. If a quorum is not present at a meeting of the Luxco Board, the Luxco Managers present at such meeting shall require that the meeting be adjourned and reconvened on a date at least 2 Business Days following the time of such adjourned meeting. The quorum for such reconvened meeting shall require the presence (in person or by telephone or by proxy or power of attorney) of a majority of the Luxco Managers. |

| 3.4.3 | A Luxco Manager may only give a proxy or power of attorney to attend and vote at a meeting of the Luxco Board to another Luxco Manager. |

| 3.4.4 | Each group of Affiliated Investors that has the right to nominate one or more Luxco Managers shall have the right to designate (and remove) one observer to the Luxco Board, provided that such observer shall only be entitled to attend any meeting of the Luxco Board at which one or more of the Luxco Managers nominated by such group of Affiliated Investors does not attend. The initial observers for the Luxco Board are set forth in Part H of Schedule 5 to this Agreement. An observer shall not be entitled to participate in or observe any Luxco Board deliberations in which the Luxco Manager(s) nominated by the group of Affiliated Investors that designated such observer are not entitled to participate pursuant to Article 3.2. If an observer is entitled to attend a Luxco Board meeting and sufficient advance notice is provided to the Luxco Chairman of such observer’s intention to attend such meeting, such observer shall be entitled to receive the same documentation (including, without limitation, the agenda, minutes, committee reports and any other documentation) for such meeting as is given to the Luxco Managers. An observer shall not have the right to vote on any matter under consideration by the Luxco Board. The observer rights granted pursuant to this Article 3.4.4 shall be in addition to, and not in limitation of, any rights granted to Investors (or funds) pursuant to the VCOC Management Rights Agreements. |

| 3.5 | Decisions of the Luxco Board |

Subject to prior approval of the Investors’ Committee with respect to items mentioned in Articles 6.6.3 and 6.6.4, decisions of the Luxco Board shall be taken by simple majority vote of the Luxco Managers present at a meeting of the Luxco Board for which there is a quorum, and each Luxco Manager shall have one vote (provided that, for avoidance of doubt, a Luxco Manager representing one or more absent Luxco Managers by proxy or power of attorney shall be entitled to cast the vote of each such absent Luxco Manager). Decisions of the Luxco Board may be taken or ratified by unanimous written consent. The powers and activities of the Luxco Board shall be subject to the provisions of Article 6.6.

| 3.6 | Representation of Luxco |

No single member of the Luxco Board shall be entitled to represent Luxco or to take any action on its behalf without the prior authorization and approval of the Luxco Board at any meeting duly convened or pursuant to any written resolutions (including any standing resolutions) duly taken. Each action taken on behalf of Luxco, once duly authorized in accordance with the preceding sentence, shall require the signature of at least one Luxco Manager A and at least one Luxco Manager B.

- 23 -

| 3.7 | Intermediate Holdco Boards |

The Parties agree that, subject to the requirements of applicable laws and regulations, the Dutch Holdco Board and the Bidco Board shall be composed of two members as follows:

| (f) | Luxco; and |

| (g) | an individual who shall be resident in The Netherlands, nominated by a Requisite Majority of the Investors’ Committee. |

Provided that at any time the Investors’ Committee may determine that Luxco and the individual referred to in Article 3.7(g) should resign as members of either the Dutch Holdco Board or the Bidco Board and be replaced by individuals, and in such event the provisions of Articles 3.1 through 3.6 shall apply, mutatis mutandis, in respect of the Dutch Holdco Board or the Bidco Board, as the case may be.

| 3.8 | Formalities |

The Investors acknowledge that, in accordance with applicable law, members of the Luxco Board, the Dutch Holdco Board and the Bidco Board are elected by the general meeting (or written resolution) of the shareholders of the relevant entity. Accordingly, to enhance the enforceability of the rights and obligations of the Investors under this Article 3, the Investors agree to comply with all such formalities to the extent recommended by Luxembourg and/or Dutch counsel to the Group. For avoidance of doubt, the Parties intend that their respective rights and obligations shall be as set forth under this Article 3 and further intend that such rights and obligations shall not be, nor be deemed to be, adversely affected in any way by the additional requirements (if any) under this Article 3.8.

| 4. | VNU SUPERVISORY BOARD |

| 4.1 | Composition of the VNU Supervisory Board |

| 4.1.1 | Until November 24, 2007, the VNU Supervisory Board shall be composed of at least twelve members (each, a “VNU Director”) as follows: |

| (a) | one individual nominated by AlpInvest; |

| (b) | two individuals nominated by Blackstone (one of such individuals shall be designated by Blackstone Capital Partners (Cayman) V, L.P. until such time as Blackstone ceases to hold a Voting Interest at least equal to 50% of the Voting Interest attached to the Units it held on the Last Settlement Date and the other shall be designated by Blackstone Capital Partners (Cayman) V, L.P. until such time as Blackstone ceases to hold a Voting Interest at least equal to 25% of the Voting Interest attached to the Units it held on the Last Settlement Date); |

| (c) | two individuals nominated by Carlyle (one of such individuals shall be designated by CEP II Participations Sarl SICAR until such time as Carlyle ceases to hold a Voting Interest at least equal to 50% of the Voting Interest attached to the Units it held on the Last Settlement Date and the other shall be designated by Carlyle Partners IV Cayman, L.P. until such time as Carlyle ceases to hold a Voting Interest at least equal to 25% of the Voting Interest attached to the Units it held on the Last Settlement Date); |

- 24 -

| (d) | one individual nominated by Hellman & Friedman Capital Partners V (Cayman), L.P.; |

| (e) | two individuals nominated by KKR (one of such individuals shall be designated by KKR Millennium Fund (Overseas), Limited Partnership until such time as KKR ceases to hold a Voting Interest at least equal to 50% of the Voting Interest attached to the Units it held on the Last Settlement Date and the other shall be designated by KKR Millennium Fund (Overseas), Limited Partnership until such time as KKR ceases to hold a Voting Interest at least equal to 25% of the Voting Interest attached to the Units it held on the Last Settlement Date); |

| (f) | two individuals nominated by Thomas H. Lee Partners (one of such individuals shall be designated by Thomas H. Lee (Alternative) Fund V, L.P. until such time as Thomas H. Lee Partners ceases to hold a Voting Interest at least equal to 50% of the Voting Interest attached to the Units it held on the Last Settlement Date and the other shall be designated by Thomas H. Lee Partners Equity VI, L.P. until such time as Thomas H. Lee Partners ceases to hold a Voting Interest at least equal to 25% of the Voting Interest attached to the Units it held on the Last Settlement Date); and |

| (g) | at least two individuals (the “Independent VNU Directors”) who shall (i) be independent within the meaning of the relevant provisions of the Merger Protocol, and be nominated by the Investors’ Committee, subject to Article 6.6.4(b). |

The initial VNU Directors are set forth in Part B of Schedule 5 to this Agreement. The right to nominate VNU Directors for appointment to the VNU Supervisory Board is personal to each group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) entitled to do so and may not be assigned by any such group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) as part of a Transfer or otherwise without the consent of the Investors’ Committee (except as permitted pursuant to the proviso in the last sentence of Article 14.6).

| 4.1.2 | From November 25, 2007 onwards, the VNU Supervisory Board shall be composed of at least ten members, nominated in accordance with Article 4.1.1, paragraphs (a) through (f) inclusive, without prejudice to the right of the Investors’ Committee to decide to retain or appoint one or more Independent VNU Directors, subject to and in accordance with Article 4.1.1, paragraph (g) and Article 6.6.4(b), and provided that from that date onwards any such Independent VNU Directors shall no longer be required to be independent within the meaning of the relevant provisions of the Merger Protocol. |

| 4.1.3 | Each group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) entitled to nominate one or more VNU Directors for appointment shall nominate the same individual(s) for such appointment as have been appointed as its Investor Representative on the Investors’ Committee, unless the Investors’ Committee has approved a different appointment (such approval not to be unreasonably withheld). |

| 4.1.4 | The Parties shall take all reasonable action necessary to procure that the VNU Director designated by the Investors’ Committee to serve as chairman of the VNU Supervisory Board (the “VNU Chairman”) shall be so appointed by the VNU Supervisory Board. |

| 4.1.5 | Each group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) entitled to designate a VNU Director shall be entitled, by notice in writing to |

- 25 -

| each other group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors), at any time or from time to time, to request the removal of any VNU Director designated by it and to designate for appointment in place thereof another individual to serve as its VNU Director in accordance with the provisions of this Article 4. In such event, (i) the designating group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) shall take all reasonable action necessary to procure that such VNU Director resigns from the VNU Supervisory Board and (ii) if such VNU Director will not resign, Holdco agrees that it shall take all reasonable action necessary to effect such removal and appointment as promptly as practical upon request. In addition, each Investor entitled to nominate a VNU Director for appointment shall, upon the death or resignation of such VNU Director, be entitled to nominate for appointment in place thereof another individual to serve as its VNU Director in accordance with the provisions of this Article 4.1. If a group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) designates as a VNU Director an individual who is not a director, manager, officer or employee of the Investor Fund Manager to such group of Affiliated Investors or to an Affiliated Fund of such group of Affiliated Investors (as the case may be), or of a subsidiary of that Investor Fund Manager, then such individual shall be subject to the prior approval of a majority of the Investor Representatives on the Investors’ Committee (excluding any Investor Representatives designated by such Investor or its Affiliates). |

| 4.1.6 | A Requisite Majority of the Investors’ Committee may decide, at any time or from time to time, subject to Article 6.6.4, to request the removal of any Independent VNU Director and to designate for appointment in place thereof another individual to serve as Independent VNU Director in accordance with the provisions of Article 6.6.4(b). In such event Holdco agrees that it shall take all reasonable action necessary to effect such removal and appointment as promptly as practical upon request. |

| 4.1.7 | Without limiting the preceding provisions of this Agreement, no group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) shall take any action, directly or indirectly through its nominees, designees or representatives on the Luxco Board or any Intermediate Holdco Board to cause Luxco or the relevant Intermediate Holdco to seek to remove, appoint or re-appoint any VNU Director except for any VNU Director such Investor is entitled to designate for removal, appointment or re-appointment pursuant to the provisions of this Article 4. Each group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) agrees to take all action necessary (to the extent such action is within the power or control of such group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) in its capacity as an investor in Luxco or through its nominees, designees or representatives on the Luxco Board or any Intermediate Holdco Board) to cause Luxco and the Intermediate Holdcos to take, and agrees to cause each VNU Director designated by it to take, any and all action necessary to approve the designation and appointment of the VNU Directors designated by a group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) and the Independent VNU Directors designated by the Investors’ Committee in accordance with this Article 4.1. |

| 4.1.8 | None of the VNU Directors shall be entitled to receive any severance payments upon his removal, resignation or otherwise vacating his position as a VNU Director, provided that this Article 4.1.8 shall be without prejudice to any entitlement versus VNU which any independent VNU Director may have. Each group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) agrees, in respect of any VNU Director designated by such group of Affiliated Investors (or the |

- 26 -

| applicable fund of such group of Affiliated Investors), to indemnify VNU and each other group of Affiliated Investors (or the applicable fund of such group of Affiliated Investors) from any claims and liabilities with respect to any severance payment that becomes payable to any such VNU Director. |

| 4.1.9 | The groups of Affiliated Investors (or the applicable funds of such groups of Affiliated Investors) shall cause, and shall instruct their respective designees to the VNU Supervisory Board to cause, the VNU Supervisory Board Rules to be amended as soon as reasonably practicable after the date hereof, to the extent recommended by Dutch counsel to the Group, so as to include a profile for Independent VNU Directors, the abstention provisions in Article 4.2.1, the provisions on convening meetings, quorum and observer rights in Article 4.4, the voting provisions in Article 4.5 and the provisions on sharing information in Article 13.7.3, all to the extent not implemented on or prior to the date hereof. |

| 4.2 | Related Party Transactions; Independent VNU Directors’ Approval |

| 4.2.1 | An Investor’s VNU Director(s) shall abstain from the vote of the VNU Supervisory Board on any Related Party Transaction in respect of which such Investor or any Affiliate thereof is a Related Party. Such Investor’s VNU Director(s) shall not be entitled to receive board materials relating to a Related Party Transaction or to participate in board deliberations relating to such Related Party Transaction if such receipt or participation would create a conflict of interest for the Related Party or any member of the Group, as determined by the Investors’ Committee. |

| 4.2.2 | If the VNU Supervisory Board is of the view, after consultation with Dutch counsel to the Group, that a particular Related Party Transaction or any other matter that comes before the VNU Supervisory Board requires the approval of the Independent VNU Directors, upon such transaction or matter having been approved by the Investors’ Committee, each Party agrees to take all action necessary (to the extent such action is within such Party’s power or control, including through its nominees, designees or representatives on the Luxco Board, the Intermediate Holdco Boards and the VNU Supervisory Board) to facilitate the Independent VNU Directors’ decision making process and to promptly provide any relevant information that the Independent VNU Directors may reasonably request. |

| 4.3 | Changes in Shareholding |

| 4.3.1 | In the event an Investor (together with any Investor that is Affiliated with such Investor) entitled to nominate for appointment two VNU Directors ceases to hold a Voting Interest at least equal to 50% of the Voting Interest attached to the Units held by that Investor (together with any Investor that is Affiliated with that Investor) on the Last Settlement Date, then (i) such Investor (together with any Investor that is Affiliated with such Investor) shall take all action necessary to procure that one of the VNU Directors nominated by such Investor shall immediately resign, and (ii) such Investor (together with any Investor that is Affiliated with such Investor) shall from that time forward only have the right to nominate for removal, appointment or re-appointment one VNU Director. |

- 27 -

| 4.3.2 | In the event an Investor (together with any Investor that is Affiliated with such Investor) entitled to nominate for appointment only one VNU Director (either on the basis of Article 4.1.1 or on the basis of Article 4.3.1) ceases to hold a Voting Interest at least equal to 25% of the Voting Interest attached to the Units held by that Investor (together with any Investor that is Affiliated with that Investor) on the Last Settlement Date, then (i) such Investor (together with any Investor that is Affiliated with such Investor) shall take all action necessary to procure that the VNU Director nominated by such Investor shall immediately resign, and (ii) such Investor (together with any Investor that is Affiliated with such Investor) shall from that time forward not have the right to nominate for removal, appointment or re-appointment any VNU Director. |

| 4.4 | Meetings of the VNU Supervisory Board; Observers |

| 4.4.1 | The VNU Supervisory Board will meet as often as it deems necessary or appropriate or upon the request of the VNU Supervisory Board Chairman. Any VNU Director may request that the VNU Supervisory Board Chairman call a meeting of the VNU Supervisory Board to discuss any matter requiring action or consideration by the VNU Supervisory Board and, upon receipt of any such request, together with a description of the matter(s) to be discussed at such meeting and any supporting materials necessary or appropriate for the VNU Directors to prepare for such meeting, the VNU Supervisory Board Chairman, as the case may be, will call such meeting as soon as reasonably practicable, provided, however, that the VNU Supervisory Board Chairman will not be required to call any such meeting if a meeting of the VNU Supervisory Board was held within four weeks prior to such request and such matter was raised at such prior meeting or if a meeting is scheduled to be held within four weeks after such request. The VNU Supervisory Board may meet in person, by teleconference or by videoconference (or by any combination thereof). |

| 4.4.2 | Quorum for any meeting of the VNU Supervisory Board shall require the presence (in person or by telephone or by proxy or power of attorney) of a majority of the VNU Directors. |

| 4.4.3 | A VNU Director may only give a proxy or power of attorney to attend and vote at a meeting of the VNU Supervisory Board to another VNU Director. |

| 4.4.4 | Each group of Affiliated Investors that has the right to designate one or more VNU Directors shall have the right to designate (and remove) one observer to the VNU Supervisory Board, provided that such observer shall only be entitled to attend any meeting of the VNU Supervisory Board at which one or more of the VNU Directors designated by such group of Affiliated Investors does not attend. The initial observers for the VNU Supervisory Board are set forth in Part H of Schedule 5 to this Agreement. An observer shall not be entitled to participate in or observe any VNU Supervisory Board deliberations in which the VNU Director(s) designated by the group of Affiliated Investors that designated such observer are not entitled to participate pursuant to Article 4.2. If an observer is entitled to attend a meeting of the VNU Supervisory Board and sufficient advance notice is provided to the VNU Supervisory Board Chairman of such observer’s intention to attend such meeting, such observer shall be entitled to receive the same documentation (including, without limitation, the agenda, minutes, committee reports and any other documentation) for such meeting as is given to the VNU Directors. An observer shall not have the right to vote on any matter under consideration by the VNU Supervisory Board. If a group of Affiliated Investors designates as an observer to |

- 28 -

| the VNU Supervisory Board an individual who is not a director, manager, officer or employee of the Investor Fund Manager to such Investor or to an Affiliated Fund of such Investor (as the case may be), or of a subsidiary of that Investor Fund Manager, then such individual shall be subject to the prior approval of a majority of the Investor Representatives on the Investors’ Committee (excluding any Investor Representatives designated by such Investor or its Affiliates). The observer rights granted pursuant to this Article 4.4.4 shall be in addition to, and not in limitation of, any rights granted to Investors (or funds) pursuant to the VCOC Management Rights Agreements. |

| 4.5 | Decisions of the VNU Supervisory Board |

| 4.5.1 | For as long as there are Independent VNU Directors, decisions of the VNU Supervisory Board shall be taken by the affirmative vote of at least a majority of the VNU Directors who are not Independent VNU Directors. From the time VNU ceases to have Independent VNU Directors, decisions of the VNU Supervisory Board shall be taken by simple majority. |

| 4.5.2 | Each VNU Director shall have one vote (provided that, for avoidance of doubt, a VNU Director representing one or more absent VNU Directors by proxy or power of attorney shall be entitled to cast the vote of each such absent VNU Director). Decisions of the VNU Supervisory Board may be taken or ratified by unanimous written consent. |