Attached files

| file | filename |

|---|---|

| 8-K - MODAVOX FORM 8K DATED NOVEMBER 12, 2009 - HIPCRICKET, INC. | modavox8k111209.htm |

EXHIBIT

99.1

VALUATION

SERVICES FOR:

MODAVOX,

INC.

FAIR

MARKET VALUE ANALYSIS OF MODAVOX, INC. (AND ASSOCIATED PATENTS)

As

of October 1, 2009

|

1250

Connecticut Avenue, NW, Suite 650

Washington,

DC 20036

T :

(202) 420-7680

F :

(202) 429-5673

|

||

October

1, 2009

Shelly

Meyers

Modavox,

Inc.

1900 West

University, Suite 230

Tempe, AZ

85281

Re: Modavox,

Inc. – Project X Settlement Purposes Only

Dear Ms. Meyers:

Pursuant

to your request, The Kenrich Group LLC (“Kenrich Group”) has performed valuation

services for Modavox, Inc. (the “Company” or “Modavox”) for settlement

purposes

in order

to assist management in its evaluation of the fair market value of Modavox and

Modavox’s patented technology. Our analysis was performed as of October

1,

2009.

OBJECTIVE

AND PURPOSE

We

understand that Modavox is currently in the process of and, more specifically,

in discussions with X regarding a settlement of their

litigation.

We were

asked to provide a current opinion of the fair market business enterprise value

of Modavox on a consolidated

basis In

the course of our analysis, we have focused on the value related to the patented

technology.

Our

analysis incorporated a review of financial and other data provided to us, as

well as discussions with the Company’s senior management. Our analysis does not

constitute an audit; we relied upon the information provided to us as accurate

and representative of the operational history of the Company. The valuation

process included consideration of factors affecting the operations of Modavox

and its patented technology as well as the ability to generate future investment

returns through operations and litigation. The factors considered in our

analysis, when relevant and available, included:

|

·

|

The

nature and history of the patent technology and the

business;

|

|

·

|

Financial

and economic conditions affecting the patented technology, its industry

and the general economy;

|

|

·

|

Past

results, current operations and future prospects of the business

enterprise;

|

|

·

|

Sales

of similar businesses or capital stock of publicly and privately held

similar businesses; and

|

|

·

|

Prices,

terms and conditions affecting past sales of similar business

enterprises.

|

ii

STANDARD

OF VALUE

Fair

market value (“FMV”) is defined as the price at which property would change

hands between a willing buyer and a willing seller when the former is not under

any compulsion to buy and the latter is not under any compulsion to sell, both

parties having reasonable knowledge of relevant facts.

VALUATION

METHODOLOGY

Typically,

there are three basic, generally accepted approaches for valuing a business or

asset:

|

·

|

Income

Approach

|

|

·

|

Market

Approach

|

|

·

|

Cost

Approach

|

These

approaches utilize the line of reasoning a prudent investor would follow in

estimating the value of a business or assets. In a valuation study, all three

approaches to value should be considered, as one or

more may be appropriate. The appropriateness for the various valuation methods

in any valuation varies with the particular company and industry. Due to the

uniqueness of the current situation (Modavox’s litigation pursuits as well as

the fundamental aspects of their owned, patented technology), we expanded upon

the income approach, including an analysis of several scenarios to determine the

value of Modavox. To determine the appropriate value to a buyer in the current

marketplace,

we were required to determine the inherent value of the litigations currently

being pursued

as well as those that will inevitably occur. As discussed below, the value

associated with the alleged exceed that which would be derived from an analysis

of the Company’s current operations. We have estimated a settlement value for

both the value of the company as a pure acquisition as well as the value derived

by licensing the patented technology. Additionally, we have also estimated the

value of this technology to X internally in terms of increase profit, as well as

to the online industry.

CONCLUSION

There are

many factors that affect the ability of an appraiser to estimate the value of an

entity such as Modavox.

Some of the challenges we faced in our analysis are as follows:

|

·

|

The

relative infancy of the current behaviorally targeted advertising market.

This aspect has reduced the amount of information available to determine

both current and projected market rates associated with use of the

technology.

|

|

·

|

The

lack of detailed information regarding the amount of profitability a

potential purchaser will be able to derive from the use of the patented

technology.

|

|

·

|

The

lack of certainty that is always associated with the litigation

process.

|

These

factors make it difficult to determine a point estimate of value. Therefore, we

concentrated our analysis on developing ranges of value based on key assumptions

related to growth, profitability, risk, development of the market and value of

litigation (to both X and throughout the industry.) When possible and

appropriate, we benchmarked key assumptions with industry data currently

available as well as information received from Modavox’s senior

management.

iii

The

following analyses of value represent various value estimates indicative of the

value of Modavox:

| Preliminary FMV | Low | High | ||||||

| X Litigation/Licensing Value (Online) | $ | 146.27 | $ | 146.27 | ||||

| Industry Litigation Value for the Online Behavioral Targeting (Not Including X) | $ | 693.49 | $ | 1,456.69 | ||||

| Value to X Internally (Increased Profit) of Patent Portfolio to X (Online only) | $ | 569.99 | $ | 569.99 | ||||

| Value of Patent Portfolio to X Internally and the Industry Litigation Value (Online) Industry | $ | 1,263.48 | $ | 2,026.68 | ||||

| Litigation Value: Mobile Behavioral Targeting | $ | 141.96 | $ | 524.25 | ||||

| Value to X Internally (Increased Profit) of Patent Portfolio to X (Mobile only) | $ | 112.60 | $ | 188.35 | ||||

Based

upon the analysis presented in this report, information we have reviewed, and

the fact and circumstances surrounding Modavox’s patent portfolio,

the

of Modavox is between approximately $525 and $575 million.

This

report is subject to the attached Statement of General Assumptions and Limiting

Conditions. We appreciate the opportunity to be of service to Modavox. Please

contact us if you have any questions concerning our analysis.

Very

truly yours,

/s/ Krista F.

Holt

The

Kenrich Group

Krista F.

Holt, Vice President

iv

TABLE

OF CONTENTS

|

1.

|

EXECUTIVE

SUMMARY

|

3

|

|

| 1.1 Standard of Value |

3

|

||

|

2.

|

DESCRIPTION

OF MODAVOX AND THE PATENTED TECHNOLOGY

|

4

|

|

| 2.1 Description of Modavox, Inc. |

4

|

||

| 2.2 Description of Patents |

4

|

||

| 2.3 Description of the Patented Technology |

5

|

||

|

3.

|

INFORMATION

RELIED UPON AND CONSIDERED

|

6

|

|

|

4.

|

THE

ECONOMIC ENVIRONMENT.

|

7

|

|

| 4.1 Gross Domestic Product |

7

|

||

| 4.2 Consumer Spending |

8

|

||

| 4.3 Employment |

8

|

||

| 4.4 Inflation |

9

|

||

| 4.5 Interest Rates |

10

|

||

|

5.

|

INDUSTRY

OVERVIEW

|

11

|

|

| 5.1 Advertising |

11

|

||

| 5.2 Online Behaviorally Targeted Advertising . |

12

|

||

| 5.3 Mobile Behavioral Targeting Advertising . |

13

|

||

|

6.

|

VALUATION

METHODOLOGY

|

14

|

|

| 6.1 Premise of Value |

14

|

||

| 6.2 Methods for Determining Value |

14

|

||

| 6.3 Income Approach | 15 | ||

|

|

6.3.1

Relief-from-Royalty Approach

|

16

|

|

| 6.4 Market Approach |

17

|

||

| 6.5 Cost Approach |

17

|

||

|

7.

|

VALUATION

METHODS APPLIED

|

18

|

|

|

8.

|

PRELIMINARY

BUSINESS ENTERPRISE VALUE OF MODAVOX

|

19

|

|

| 8.1 The Income Approach |

19

|

||

|

8.1.1

Preliminary X Litigation/Licensing Value.

|

19

|

||

|

8.1.2

Preliminary X Litigation Value of the Patent Portfolio within the Industry

(Less X)

|

22

|

||

|

8.1.3

After-tax Value of Patent Portfolio to X Through Internal Use (Online

Advertising Revenues Only)

|

23

|

||

|

8.1.4

Value of Patent Portfolio and Industry Litigation (Online)..

.

|

24

|

||

|

8.1.5

Value of Mobile Behavioral Targeting Market .

|

24

|

||

|

8.1.6

Industry Litigation Value – Mobile Behavioral Targeting

Market

|

25

|

||

|

8.1.7

After Tax Value of Patent Portfolio to X for Internal Use (Mobile Market

Only)

|

25

|

||

|

8.1.8

Total Value of Patent Portfolio Internally and Industry Litigation to X

(Mobile Market Only) Summary

|

26

|

||

|

8.1.9

Preliminary Internal Value of the Patent Portfolio to the Industry for the

Online and Mobile Behavioral Targeting Market

|

26

|

||

| 8.2 The Market Approach |

26

|

||

|

8.2.1 Comparable

Transaction Analysis

|

27

|

||

|

8.2.2 The

Market Approach – Valuation Conclusion

|

28

|

||

v

| 8.3 The Cost Approach Consideration and Indication |

28

|

|

|

9.

|

PRELIMINARY

FAIR MARKET VALUE CONCLUSIONS

|

29

|

|

10.

|

COUNTERVAILING

FACTS & RISK FACTORS .

|

30

|

| 10.1 Litigation Risks |

30

|

|

| 10.2 Judicial and Legislative Risk |

30

|

|

|

11.

|

STATEMENT

OF GENERAL ASSUMPTIONS AND LIMITING CONDITIONS

|

31

|

|

12.

|

KENRICH

GROUP QUALIFICATIONS

|

33

|

|

13.

|

CERTIFICATION

|

34

|

2

1. EXECUTIVE

SUMMARY

The

Kenrich Group LLC (“Kenrich Group”) has been retained by Shaub & Williams on

behalf of Modavox, Inc. (“Modavox" or "The Company”) in

regards to assisting in determination of potential settlement

amounts

This includes assisting Company

management in its evaluation of the fair market value of Modavox. Our analysis

was performed as of October 1, 2009.

We

understand that the settlement estimates we are presenting here today are being

done at the request of Modavox as part of

Modavox’s settlement

discussions with X. We also understand that this information can be used solely

for the purposes of settlement and is considered highly confidential, and is not

to be used for any other purposes.

We have

been instructed to determine a preliminary value of Modavox as it relates to

their ownership of the patented technology. This includes an analysis of their

current business, the yet un-monetized value of the patented technology as well

as the value of the overall litigation

to X and value of the technology throughout the industry.

We have

determined the preliminary value of the Modavox patent portfolio as referenced

above. Based upon multiple analyses we have determined the preliminary value of

the litigation with X to be approximately $146 million. In addition, we have

determined that the value of the entire Modavox entity is between approximately

$525 million and $575 million, which includes utilizing the technology for

business purposes as well as for litigation.

1.1 Standard of Value

Fair

market value is generally defined as “the price at which the property would

change hands between a willing buyer and a willing seller, neither being under

any compulsion to buy or sell and both having reasonable knowledge of relevant facts.”1

1 Treasury Regulation

Section 1.170A-1(c)(2)

3

2. DESCRIPTION

OF MODAVOX AND THE PATENTED TECHNOLOGY

2.1 Description of Modavox, Inc.

Founded

in 1999, Modavox provides content targeting and consumer centric content

delivery technologies through internet products and services.2 The name Modavox, Inc. was

created

in 2006 as a result of the merger between SurfNet Media and Kino Communications.3

Founder and current board member David Ide saw the need for real-time delivery of online customized content customization and created Modavox to fill those needs in the industry. Modavox is a publicly traded company, and its shares have been listed on the NASDAQ exchange since 2001.4

Modavox owns the “Method and System for Adding Function to a Webpage” portfolio of patents, which teach of a technical process and method which are in an indispensable component of the behavioral targeting industry as it exists today. Powered by Modavox’s inventions, behavioral targeting facilitates the automatic provision of customized content to individuals based on their web activity and preferences.5 Modavox’s business revolves around three core divisions: BoomBoxTM Technologies, which streams internet radio and television programs; Interactive Communications, which provides behavioral targeting services to websites and internet companies; and Mobile Solutions, which focuses on mobile marketing solutions, including behavioral targeting.6

2.2 Description of Patents

Modavox

currently owns at least two U.S. patents. The first patent, US Patent No.

6,594,691, was issued on July 15, 2003, and is titled “Method and System for

Adding Function to a Webpage.” The second patent, US. Patent No. 7,269,636, was

issued on September 11, 2007 and is titled “Method and code module for adding

function to a Web page.”

The patented methods and systems use web browsers which adhere to the standards for Hypertext Transfer Protocol (HTTP) and add function to a web page through an easily distributed software code module. The method and system deliver services through client demands that are specific to predetermined visitor parameters. When a web page is downloaded, the technology automatically executes a first code module embedded in the web page. The first code module issues a first command to retrieve a second code module, via a network connection, from a server system, which assembles the second code module with a service response. When assembled, the second code module is executed at the user processor platform and delivers a tailored response targeted to the end user's parameters. The technology enables this process to be performed in real time during the download of the webpage."7

2 Modavox, Inc. Form 10-K, February 28, 2009

3 Modavox, Inc. Form 8-K, March 5, 2007

4 Form SB-2, March 28, 2001

5 Ibid.

6 “Modavox

Company Profile” http://www.modavox.com/

7 U.S. Patents 6,594,691 and

7,269,636

4

2.3 Description of the Patented Technology

Modavox’s developments in customized content delivery have produced a complete product line designed to capture, captivate and maximize effective communication to targeted audiences. This essentially means that an end-user accessing a website can be delivered video, audio, and other content that is customized based on geographic location, gender, age, or any other predetermined parameter in real time. This system has been used across several platforms, including e-learning, advertising, internet radio and television broadcasting, and enterprise platforms.9

In 2009, Modavox acquired Augme Mobile, which developed a web-based platform that provides marketers, brands and advertising agencies the ability to create, deliver, manage and track interactive marketing campaigns targeting mobile consumers.10 The Augme Mobile platform uses SMS, two-dimensional (2D) code, image recognition, audio detection and other leading technologies as a suite of interactive consumer response mechanisms that link mobile consumers to targeted and interactive mobile marketing content.11

8 “Modavox Company Profile”

http://www.modavox.com/

9 “Modavox Company Profile”

http://www.modavox.com/

10 “Modavox Completes

Acquisition of Augme Mobile”, http://www.quotemedia.com/

11 “Augme Mobile Launches

Personalized Mobile Marketing Campaign for Colgate-Palmolive’s

Speed

Stick

Brand”, http://www.quotemedia.com/

5

3. INFORMATION

RELIED UPON AND CONSIDERED

In

forming our preliminary opinion of fair market value, we have considered and

relied upon, without independent verification, documents and information

provided by the Company

or

obtained through publicly available resources. The following is a list of the

primary information (including Bates stamped numbers) provided by

Modavox

and

relied upon in our analysis:

Discussions

with representatives of Modavox, including:

|

·

|

Shelly

Meyers, Chairwoman of the Board of Directors

|

|

·

|

Anthony

Iacovone - Chief Innovation

Officer & President Augme Division

|

|

·

|

Nathaniel

T. Bradley - Chief Technology

& Product Officer

|

Other

publicly available information, including but not limited to:

|

·

|

X

Annual Report 2008

|

|

·

|

RoyaltySource

Database Search for similar industry licensing

agreements

|

|

·

|

Various

reports and websites as referenced in the report.

|

|

·

|

“Some

Predictions for Online Advertising in 2009”, Seeking

Alpha

|

|

·

|

“Behavioral

Targeting: Marketing Trends,” eMarketer, June

2008

|

|

·

|

"Mobile

Advertising: After the Growing Pains,” eMarketer, March

2008

|

In

addition to the information provided, we relied upon discussions with and

Modavox senior management ; and considered, when possible, the history

and nature of the patented technology and Company, the industry in which it

operates, its financial situation and current prospects. New information or

unforeseen market and business changes could affect estimates made in this

valuation.

6

4. THE

ECONOMIC ENVIRONMENT

When

valuing a company or its assets, it is important to consider the condition of,

and outlook for, the economy or economies in which the company operates and

sells its products and services. This economic analysis is required because the

financial performance, and, consequently the value, of a company or its assets

are affected to varying degrees by the economic environment in which the company

operates.The following sections provide a brief discussion of the economic

condition and outlook for the US economy over the next five years.

4.1 Gross Domestic Product

The most

widely accepted measure of overall economic growth is GDP, a measure of the

aggregate value of all goods and services produced within the country during a

specified time period.12 Real GDP growth is

forecasted to be -1.9% for 2009.13 The Federal

Reserve

predicts

modest positive growth in 2010, followed by a full recovery and higher sustained

growth from 2011 to 2014, after which growth should return to its equilibrium

rate of 2.5% to 2.7% annually.14

Table 4.115

As

investment growth slows due to numerous market factors, unemployment and

personal savings rise slightly and private consumption decreases.16 The

current economic conditions will most likely cause an extended period of

decreased consumption and production until unemployment stabilizes at a lower

rate and both households and companies become more comfortable with spending and holding inventories. When the economy rebounds, it is possible that advertisers may be willing to pay higher CPM rates in exchange for the higher return on investment that behaviorally-targeted advertising offers.18

12 Economic Terms

Glossary, http://www.economist.com/

13 “The Budget and

Economic Outlook: Fiscal Years 2009 to

2019” http://www.cbo.gov/

14 “The Budget and

Economic Outlook: Fiscal Years 2009 to

2019” http://www.cbo.gov/

15 “The Budget and

Economic Outlook: Fiscal Years 2009 to

2019” http://www.cbo.gov/

16 “Economic Effects of

Increasing Tax Rates” http://www.heritage.org/

7

4.2 Consumer Spending

Consumer spending is a key economic figure that indicates the level of private consumption in the US.19 Because consumer spending drives a large part of the American economy, this index is an important indicator of overall economic health.20 As spending recovers, capital expenditures should increase simultaneously. Companies and advertisers may be willing to spend more on behaviorally-targeted advertising to win consumers, as behavioral targeting creates campaigns that are “more likely to sway the audience”.22

2008

marked the first decrease in consumer spending after nearly 7 years of

consistent spending increases, and spending continued to drop through the rest

of 2008 and first half of 2009.23 It is my understanding

that it is unlikely that consumer spending will increase dramatically in the

near future, as households will continue to be cautious about unnecessary

expenditures until discernable economic recovery is seen.24

4.3 Employment

as

companies continue to be conservative with hiring as the economy recovers.29 By 2014,

employment should be steady at near-equilibrium rates, which will allow the

economy to obtain current growth projections, and may help increase behavioral targeting revenue.30

17 “Minutes of the Federal

Reserve Open Market Committee”

http://www.federalreserve.gov/

18 “Behavioral Targeting:

Marketing Trends”, David Hallerman. eMarketer, June 2008,

p. 2

19 Economic Terms

Glossary, http://www.economist.com/

20 “Economic Performance:

Doubts remain about the strength

of consumer demand”, http://www.eiu.com/

21 “Economic Performance:

Doubts remain about the strength

of consumer demand”, http://www.eiu.com/

22 Behavioral Targeting:

Marketing Trends”, David Hallerman. eMarketer, June 2008,

p. 9

23 “Economic Performance:

Consumer Confidence is at a record low”, http://www.eiu.com/

24“Economic Performance:

Doubts remain about the strength of consumer

demand”, http://www.eiu.com/

25 “Economic Performance:

Recent Indicators Point to the End of Recession”,

http://www.eiu.com/

26 “Economic Performance:

Recent Indicators Point to the End of Recession”,

http://www.eiu.com/

27“Labor Force Statistics

from the Current Population

Survey,” http://data.bls.gov/

28 “Labor Force Statistics

from the Current Population

Survey,” http://data.bls.gov/

29 “A Preliminary Analysis of

the President’s Budget and an Update of CBO’s Budget and Economic

Outlook”,

http://www.cbo.gov/

30 “A Preliminary Analysis of

the President’s Budget and an Update of CBO’s Budget and Economic

Outlook”,

http://www.cbo.gov/

8

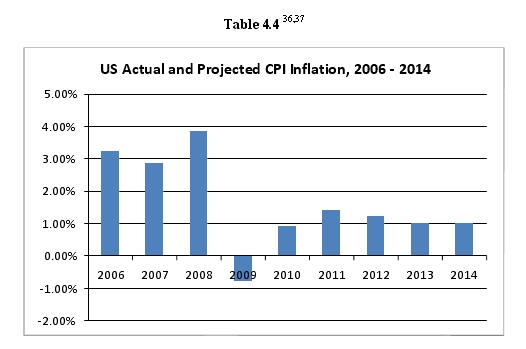

4.4 Inflation

Inflation

is a measure of the increase in prices in the market, and is typically measured

by the Consumer

Price Index (“CPI”) and the Producer Price Index (“PPI”).31 The CPI

measures the consumer’s cost of consumption and the PPI measures the average

change over time in the selling prices received by domestic producers for their

output.32,33 Inflation held steady at the

beginning of the decade but dropped into deflation in 2009 due to the widespread

Recession.34 When the

economy begins to recover, inflation will increase significantly, and the

Congressional Budget Office predicts inflation will grow at a rate slightly

above 1% over the next five years35

31 Economic Terms

Glossary, http://www.economist.com/

32 “Consumer Price

Index”, http://www.investopedia.com/

33 PPI Index, http://www.bls.gov/

34 “Consumer Price Index Data

from 1913 to 2009”, http://www.usinflationcalculator.com/

35 “A Preliminary Analysis of

the President’s Budget and an Update of CBO’s Budget and Economic

Outlook”,

http://www.cbo.gov/

9

4.5 Interest Rates

Interest

rates indicate the overall state of US debt markets. Current US interest rates

are at historical lows in order to stimulate borrowing and encourage economic

growth.38 The prolonged period of

cheap debt in the middle of this decade resulted in a credit crunch that

began in

mid-2007 and has yet to recede.39 1-month Treasury bill

rates averaged nearly zero in late 2008 and throughout 2009.40 Similarly, 10-year

Treasury note rates have fallen as investors flocked to the safety of Treasuries and the Federal Reserve pumped billions of dollars into Treasury bonds to keep rates low.41

Bank

interest rates spiked in 2007 and continued to increase through 2008, which led

to the recession and the Federal Reserve’s dramatic cut of the federal funds

target rate to 0-0.25%. The Fed is expected to hold this rate steady for the

next 12 to 18 months, indicating that economic recovery will be slow and

prolonged.42,43 Low interest rates will be

necessary over the next

12 to 24 months to ensure that banks will lend and companies can borrow.

Companies that publish and create behaviorally-targeted advertising may depend

on these low rates to continue funding their operations through the

recession.

36 “A Preliminary Analysis of

the President’s Budget and an Update of CBO’s Budget and Economic

Outlook”, http://www.cbo.gov/

37 “US Inflation”, www.inflationdata.com

38 “Outlook

for 2009-10: Monetary Policy”, http://www.eiu.com/

39 “Economic Policy: Mr.

Bernanke’s term as Fed Chairman is to be renewed”,

http://www.eiu.com/

40 Daily 1-month

Treasury bill rates, http://www.federalreserve.gov/

41 “Economic Performance: A

surge in long-term yields are a threat to recovery”,

http://www.eiu.com/

42 “Federal Reserve Leaves

Interest Rates Near Zero”, http://www.latimes.com/

43 “Economic Policy: Market

Expectations of Hikes are Misguided”, http://www.eiu.com/

10

5. INDUSTRY OVERVIEW44

5.1 Advertising

The advertising industry has suffered in the recession as companies have slashed marketing expenditures to save cash.45 Total advertising expenditures dropped 14% from 2008 to 2009, and that spending will continue to decrease in 2010 before picking up again in 2011.46 Internet advertising has fallen at a slower pace than traditional forms of advertising, as internet ads have higher ROIs and can be targeted more easily to the consumer.47

Online

advertising is a form of marketing that expressly utilizes the World Wide Web

(“internet”) to deliver product information and messages to attract customers.

There are many differing forms of online advertising utilized in today’s market

place. Several examples are contextual ads (that utilize key word search

technology) displayed on search engine results pages, banner ads, Rich Media

Ads, social networking advertising, online classifieds

and email spam, among others. Though projections and beliefs in early 200850 were

that online advertising would be able to “power through any broader economic and

advertising weakness,”51 this has not come to

fruition as the online advertising market has also experienced the backlash of the recent economic downturn. However, the behavioral targeting portion of the market is seen as a means for increasing the effectiveness of online advertising because it has generally higher click through and conversion rates.52

44 Unless otherwise

indicated, information for this section provided by eMarketer, “Behavioral

Targeting: Marketing Trends”

45 “Nothing to shout about:

things are still getting worse for the advertising industry,”

http://www.economist.com/

46 “Nothing to shout about:

things are still getting worse for the advertising industry,”

http://www.economist.com/

47 “Nothing to shout about:

things are still getting worse for the advertising industry,”

http://www.economist.com/

48 “Behavioral Targeting:

Marketing Trends,” eMarketer, June 2008

49 :”U.S. Advertising

Spending”, eMarketer, June 2008

11

5.2 Online Behaviorally Targeted Advertising

Behavioral

targeting is an online technique that utilizes software and hardware methods to

serve advertisements to specific internet viewers. This technology segments the

target audience based upon observed content and measured data. This is a data

driven process and the quantity of data is important in obtaining accurate

information about the viewer so that appropriate advertising can be delivered in

real time. Behavioral targeting has the potential to become the most

valuable and most often utilized form of online advertising. There are several

reasons that behavioral targeting holds significant underlying value, which

include:

|

·

|

Behaviorally-targeted advertising campaigns are more likely to sway targeted audiences53

|

|

·

|

Publishers may make more money from previously unsold advertising inventory54

|

|

·

|

The processes that make up behavioral targeting are complex and technologically

advanced55

|

|

·

|

Behavioral targeting provides companies extremely valuable data56

|

|

·

|

Behavioral targeting will likely be used by large companies as a facet of an overall marketing plan, in addition to being used as solely an online advertising medium57

|

|

·

|

Online advertising and behavioral targeting are seen as “glimmer[s] of hope in the recession”58

|

Due to

the continuing development of technologies that drive the behavioral targeting

market, the US market size was approximately $775 million in 2008. However,

based upon projections and a return to growth of the overall economy, this

amount is projected to exceed $4

billion by 2012. The marked increase in the size of this market is due to the

following:

|

·

|

behavioral targeting’s greater effectiveness for both branding and direct response objectives will draw in more marketers despite concerns for transparency59

|

|

·

|

brand marketers are shifting a higher portion of their advertising budget to the internet space, but this won’t have a significant impact until 201060

|

50 “US Online Ad

Market Expected to Double in

Four Years”, http://www.informationweek.com/

51 “Let’s be

serious: Online Display Ads will fall sharply in 2009”, http://www.businessinsider.com/

52 “Will the Recession

Kill Web 2.0”, http://online.wsj.com

53 “Behavioral Targeting:

Marketing Trends,” eMarketer, June 2008

54 “Behavioral Targeting:

Marketing Trends,” eMarketer, June 2008

55 “Behavioral Targeting:

Marketing Trends,” eMarketer, June 2008

56 “Behavioral Targeting: Marketing

Trends,” eMarketer, June 2008, p. 5

57 “Behavioral Targeting: Marketing

Trends,” eMarketer, June 2008, p. 8

58 “New Dynamics in

Digital Advertising”, http://www.reportlinker.com/

59 “Behavioral Targeting:

Marketing Trends,” eMarketer, June 2008

60 “Behavioral Targeting:

Marketing Trends,” eMarketer, June 2008

12

|

·

|

by 2012, online video advertising will be firmly established.61

|

Even when

the behaviorally targeted advertising market reaches $4.4 billion, it will only

represent approximately 9% of the total online advertising market still leaving

plenty of room for growth in the next decade. Behavioral targeting technology is

expected to advance and expand in the next few years, most notably into the

mobile arena.

5.3 Mobile Behavioral Targeting Advertising

Mobile behavioral targeting is an emerging form of advertising that uses behavioral targeting technology to deliver content through mobile devices.62All four major internet portals—

currently offer mobile advertising solutions.63Modavox added a mobile component to its portfolio in 2009 when it merged with Augme Mobile.64

Mobile advertising uses the same types of advertisements as traditional online advertising, but uses a chip inside of a cell phone or PDA rather than collecting data through webpage visits.65 The chip harnesses consumer information and preferences and targets advertisements based on these preferences66 granting access to consumers through a new, more profitable channel.67

61 “Behavioral Targeting:

Marketing Trends,” eMarketer, June 2008

62 “Behavioral Targeting: Marketing

Trends,” eMarketer, June 2008, p. 5

63 “Behavioral Targeting:

Marketing

Trends,” eMarketer, June 2008, p. 15

64 “Modavox Completes

Acquisition of Augme Mobile”, http://www.quotemedia.com

65 Conversation with Anthony

Iacovone

66 Conversation with Anthony

Iacovone

67 Conversation with Anthony

Iacovone

13

6. VALUATION

METHODOLOGY

6.1 Premise of Value

As

discussed earlier, Kenrich Group’s assignment was to determine settlement values

for the X litigation and the fair market value of Modavox as of October 1,

2009.

Our

analysis focused on identifying and quantifying what sellers and buyers consider

when negotiating for the sale or license of assets, specifically, the economic

value that the buyer gains by taking ownership of the assets or rights to the

assets, and the economic value that the seller gives up by transferring

ownership of, or certain rights to, the assets to another party.

6.2 Methods for Determining Value

There are

three basic, generally accepted approaches for valuing a business or

asset:

|

·

|

Income

approach

|

|

·

|

Market

approach

|

|

·

|

Cost

approach

|

These

approaches utilize the line of reasoning a prudent investor would follow in

estimating the value of an asset. The appropriateness of a particular approach

varies with the specific asset valued and the available information. When more

than one approach to value is appropriate, it is necessary to reconcile the

approaches and weigh the results in consideration of the asset being valued to

determine FMV.

14

Table

6.2: Summary of Valuation Analyses

|

Scenario (in millions)

|

Low

|

High

|

||||||

|

X Litigation/Licensing Value (Online)

|

$ | 146.3 | $ | 146.3 | ||||

|

Value

of Patent Portfolio

to X Internally

and the Industry Litigation Value (Online)

|

||||||||

|

Industry

Litigation Value for the Online Behavioral Targeting (Not Including X

)

|

$ | 693.5 | $ | 1,456.7 | ||||

|

Value

to X Internally (Increased Profit) of Patent

Portfolio

to X (Online

only)

|

$ | 570.0 | $ | 570.0 | ||||

|

Sub-Total: Value of Patent Portfolio for X Internally and Industry Litigation (Not Including

X ) (Online)

|

$ | 1,263.5 | $ | 2,026.7 | ||||

|

Value

of Patent Portfolio

for X Internally

and Industry Litigation (Mobile)

|

||||||||

|

Industry

Litigation Value: Mobile Behavioral Targeting

|

$ | 142.0 | $ | 524.2 | ||||

|

Value

to X Internally (Increased

Profit) of Patent Portfolio

to X (Mobile

only)

|

$ | 112.6 | $ | 188.3 | ||||

|

Sub-Total:

Value of Patent Portfolio and Industry Litigation (Mobile)

|

$ | 254.6 | $ | 712.6 | ||||

|

After-tax

Value to Online Behavioral Targeting Industry Internally (Increased

Profit)

|

||||||||

|

Value

of Patent Portfolio to Industry (Online Only)

|

$ | 5,001.0 | $ | 5,001.0 | ||||

|

25%

Rule of Thumb

|

25 | % | 25 | % | ||||

|

25%

Profit Split Apportionment Value

|

$ | 1,250.2 | $ | 1,250.2 | ||||

|

After-tax

Value to Mobile Behavioral Targeting Industry Internally (Increased

Profit)

|

||||||||

|

Value

of Patent Portfolio to Industry (Mobile Only)

|

$ | 1,315.4 | $ | 1,315.4 | ||||

|

25%

Rule of Thumb

|

25 | % | 25 | % | ||||

|

25%

Profit Split Apportionment Value

|

$ | 328.9 | $ | 328.9 | ||||

|

Total

Value

|

||||||||

|

Value

of X Litigation/Licensing

|

$ | 146.3 | $ | 146.3 | ||||

|

Value

of Acquisition of Modavox

|

$ | 1,518.0 | $ | 2,739.3 | ||||

6.3 Income Approach

The

income approach measures the value of a business by the present value of its

future economic benefits over its remaining economic life. These

benefits can include earnings, cost savings, tax deductions and proceeds from

its disposition.

The

duration and timing of the cash flow stream are determined by forecasting the

useful life of the asset. The useful life of the asset can be determined in many

ways, several of which include: (1) the physical or service life of the asset,

(2) the statutory or legal life of the asset, (3) the economic life of the asset

or (4) the functional or technological life.

The

primary method under the income approach is referred to as the discounted cash

flow (“DCF”) method and involves discounting expected cash flows to their

present value at a rate of return that incorporates the risk-free rate for the

use of funds, the expected rate of inflation and risks associated with the

particular investment.

The

business risk associated with the realization of the stream of expected cash

flows may be captured through the use of an appropriate discount rate,

probabilities of success within the inputs used to forecast the cash flows or

through a combination of these factors. The discount rate selected is generally

based on rates of return available from alternative investments of similar type

and quality as of the valuation date.

When the

valuation of an entity in which the primary source of value is an intellectual

property asset, the Relief-from-Royalty Approach is frequently used. The

following report section provides a discussion of this approach and how it may

be used to quantify the expected cash flows attributable to intellectual

property assets.

15

6.3.1 Relief-from-Royalty Approach

The

Relief-from-Royalty Approach determines a property’s value by looking at what

the owner of the property would pay in royalties if he did not own the property

and had to license it from a third party. This approach can be used to quantify

the royalties a company would have to pay for the rights to license their own

intellectual property.

The

lump-sum fair market value of the intellectual property under this method is

calculated as the net present value of royalty payments. The projected royalty

payments are derived by applying a royalty rate to an appropriate royalty

base. The royalty base is generally established by forecasting the

expected revenues to be generated throughout the useful life of the intellectual

property. The royalty rate is generally a percentage rate that establishes the

potential cash flow that can be associated with the intellectual property. The

royalty rate is determined by what a licensee would be willing to pay for use of

the intellectual property.

6.3.1.1 Methods for Determining the Royalty Base

Revenue

Approach

Product and services protected by Intellectual Property rights have been used to enhance market share, to create and expand the market as a whole, and to increase sales prices. In such situations, revenue increases may be an appropriate basis determining an appropriate royalty base. The primary economic benefits of the subject patent(s) are maintained/increased revenues due to enhanced customer loyalty and due to more effective sales efforts to potential new customers.

Cost

Savings Approach

The cost

savings approach is not applicable to the present situation because the benefits

provided by the patented technology are not related to cost

savings.

6.3.1.2 Methods for Determining the Royalty Rate

Market

Approach

The

Market Approach to valuation may be appropriate in determining a royalty rate

because the approach looks at actual arms-length transactions that have been

negotiated between willing buyers and willing sellers. Kenrich Group used

RoyaltySource and RoyaltyStat as its sources for market licenses in the

industry.

Excess

Earnings Approach

The

Excess Earnings Approach is based on the idea that a property’s value can be

assessed by the incremental earnings of proprietary products/service relative to

an identical but non- proprietary product/service. As used in this context, a

proprietary product/service is one that represents the property under

consideration. The excess earnings could result from the product/service

demanding a price premium, increasing manufacturing cost savings, or producing

larger sale quantities.

Profit

Apportionment Approach

The

Profit Apportionment Approach is a method used to determine a reasonable royalty

under an arm’s length transaction. The idea behind this approach is that the

licensee and licensor should share the anticipated profit. Several methodologies

have been used or suggested for achieving an appropriate profit split between

parties. Most of these approaches attempt to create a division of anticipated

profit that is appropriate with the nature of the intellectual property and

risks assumed by each party.

Profits

have been apportioned using both objective and subjective methods. Objective

methods generally focus on the licensee’s required return on capital invested or

assets used to utilize the intellectual property. In the case of licensing

intellectual property assets, there are several rules of thumb that are used

when determining a profit split. One of these rules of thumb is referred to as

the 25% Rule. The 25% Rule tends to be a starting point in licensing

transactions and should be increased or decreased depending on the particular

situation.

16

6.4 Market Approach

Asset

values calculated by using the Market Approach are derived from utilizing

comparable asset transactions between unrelated parties. The weight that a

comparable asset transaction holds is largely dependent upon if the transaction

is sufficiently similar to the assets at issue. There are several factors that

should be considered when assessing if a comparable asset transaction is

sufficiently analogous to the proposed transaction involving the parties in

question such as: the nature of the industry the assets are utilized in, the

terms of the transaction and/or agreement, the actual assets involved in the

transaction, the circumstances surrounding the parties in the comparable asset

transaction, and other elements that would affect the transaction or agreement

terms.

The

Market Approach is useful in that it references actual arms-length transactions

between a willing buyer and willing seller. Therefore, it can result in creating

a useful proxy for the value of the assets in question, and can be an important

method for determining the significance of asset value.

6.5 Cost Approach

The cost

approach measures the value of a business or asset by the cost to create and

develop the assets under consideration or the cost to replace it with another of

like utility. The assumption underlying this approach is that a party would not

pay more than the cost to purchase or develop new property that has the same

value.

When applied to the valuation of intellectual property, the cost approach may be used when a functionally equivalent non-infringing alternative may be reproduced or replaced.68 The cost of reproduction or replacement may also reflect the cost a company may avoid by buying, rather than duplicating, a similar technology.69

The cost

approach may have certain limitations such as it may lack consideration for all

elements of future income or profit streams, market considerations, useful life

and the risk associated with realizing future benefits. Due to the limitations

of the cost approach, we did not use it in our consideration of value for

Modavox.

68 Smith, Gordon

(2005) Intellectual Property: Valuation, Exploitation and Infringement Damages

69 Reilly & Schweihs

(1999) Valuing Intangible Assets, p. 96-97

17

7. VALUATION

METHODS APPLIED

In a

valuation study, all three approaches to value may need to be considered, as one

or more may be more appropriate in valuing a business or asset. The

appropriateness for the various valuation approaches in valuing the assets of an

entity varies with the particular company and industry.

For the

purpose of the present valuation, fair market value estimates were established

through application of the income approach using the discounted cash flow

method. We also

reviewed

the market approach utilizing the comparable transaction method. However, this

method was altered as the value that could be obtained by Modavox has been

greatly hindered by the large amount of infringement that has occurred

throughout the industry.

In

regards to the income approach, we determined value under several different

analyses, including the preliminary value of the damages likely to result in

litigation with X the preliminary value of X litigation associated with the

remaining allegedly infringing behavioral targeting in the industry, the

preliminary value of X’s utilization of the behavioral targeting patents in

their business operations, the preliminary value of the mobile behavioral

targeting industry litigation as well as the preliminary value of the patent

portfolio as utilized by the mobile advertising industry and by X in the

ordinary course of their business.

18

8. PRELIMINARY

BUSINESS ENTERPRISE VALUE OF MODAVOX

8.1 The Income Approach

8.1.1 Preliminary X

Litigation/Licensing Value

In

determining the preliminary value of the X litigation

for

we have

utilized the Income Approach and segmented the analysis into the following

sections:

1. Quantification

of royalty base – revenues from US Sales of X products utilizing the patented

technology

2. Establishment

of an appropriate royalty rate – a percent of sales

3. Accounting

for risk

8.1.1.1 Royalty Base

The first

step in determining the preliminary settlement amount was to determine a

reasonable preliminary royalty base. Based upon financial information we

obtained from publicly-available sources as well as independent research

performed, we estimated the preliminary amount of revenues which were relevant

for royalties related to the patented technology.

To

determine the appropriate preliminary royalty base we needed to determine which

revenues generated by X would utilize the patented technology. Secondly, we

needed to determine the percentage of these revenues that would be further

increased through use of the technology. Finally, we needed to determine the

amount these specific revenues would be increased. By performing the above three

tasks, we were able to obtain the preliminary royalty base that would be

applicable to use in regards to the patented technology. Based upon this

preliminary analysis, it was determined that the patented technology would be

used by some portion of X’s Media and Third Party Network revenues.

In order

to determine projected yearly revenue growth for these two segments, we utilized

overall projected growth for the online advertising industry as provided by a

recognized industry source, Seeking Alpha.70 We then applied this

growth rate to the total revenues obtained in X’s Media and Third Party Network

segments. For the year 2009, we annualized the average results obtained during

the first two quarters. We then applied the above methodology to obtain a

preliminary value of the litigation (including amounts for future

licensing).

We

understand that the economy did enter a recession after the projections we

utilized were published. However, it is our understanding that this would have a

minimal impact on the projections for the following reasons:

|

|

·

|

the increased effectiveness of behaviorally targeted advertising – advertisers want advertising that will reach their target audience71

|

70 “Some Predictions for Online Advertising in 2009”, http://seekingalpha.com/

71 “Behavioral Targeting”,

http://www.emc.com

19

|

|

·

|

the relatively low percentage that behavioral advertising represents in regards to total advertising – larger percentage growth is easier to obtain when the revenue base is small.72

|

Though

the overall growth of the behaviorally targeted advertising market is far

greater than the total online advertising market, the behaviorally targeted

market is still in relative infancy. As such, we believe the projections we have

utilized are conservative with the results that have been or will be obtained by

this market.

8.1.1.2 Royalty Rate

8.1.1.2.1

Comparable Patent Licensing Agreements

To

determine an appropriate preliminary royalty rate to value the subject patents,

Kenrich employed the Market Approach and used indicia of value from the Excess

Earnings Approach. The Market Approach values assets based on comparable

transactions between unrelated parties. Hence, in the context of determining a

reasonable royalty rate, use of the

Market Approach entails searching for negotiated royalty rates from licensing transactions for similar assets. We identified multiple license agreements for patents in the related industry to establish an appropriate royalty rate. The table below provides a summary of the identified agreements at this time.73

Table 8.1: Licensing Agreements of Similar Companies

|

Royalty

Rate

|

||||||

|

Licensee

|

Licensor

|

Low

|

High

|

|||

|

VALUECLICK

EUROPE LIMITED

|

VALUECLICK,

INC.

|

5.00%

|

5.00%

|

|||

|

AMERICOM

USA, INC.

|

SYSTEAM

SPA

|

8.00%

|

8.00%

|

|||

|

HIGH

SPEED NET SOLUTIONS, INC.

|

SUMMUS

LTD

|

10.00%

|

10.00%

|

|||

|

VALUECLICK

JAPAN INC.

|

VALUECLICK,

LLC

|

10.00%

|

10.00%

|

|||

|

MIND2MARKET,

INC

|

UINFO

INTERNATIONAL, INC.

|

10.00%

|

10.00%

|

|||

|

E-CENTIVES,

INC.

|

BRIGHTSTREET.COM,

INC.

|

10.00%

|

10.00%

|

|||

|

Mode

|

10.00%

|

10.00%

|

||||

The

license agreements listed in the table above include a variety of those related

to the industry of concern and indicate a royalty rate of 10%.

8.1.1.2.2

Excess Earnings Approach

The

Excess Earnings Approach has been used to calculate an implicit royalty rate

from the excess earnings from the use of the patented technology. In order to do

so, Kenrich made use of the 25% rule as mentioned previously to calculate the

implied rate and compare to the rate(s) utilized in determining the preliminary

value of the patented technology.

We

analyzed the total profitability of the industry and found it to be

approximately $5.0 billion, 25% of which is $1.25 billion.

72 “Behavioral Targeting:

Marketing Trends,” eMarketer, June 2008

73 Royalty Source

intellectual property database by AUS Consultants.

20

In order

to determine a preliminary royalty rate using the Profit Apportionment of Excess

Earnings Method, a common rule of thumb used in licensing negotiations for

intellectual property assets is the 25% Rule. The 25% Rule states that 25% of

the profits or cost savings resulting from the intellectual property assets

should go to the licensor. The rationale for this approach is to provide the

licensee with the majority of the profits for undertaking resultant business

risks associated with developing and selling the product. The 25% Rule tends to

be a

starting point in licensing transactions, and the profit split can be higher or

lower depending on the particular facts and circumstances of the intellectual

property to be licensed. The negotiated partition of profits should ultimately

reflect each party’s contribution to the venture

or, in this case, the relative importance of the patents to the revenue

generating abilities of the potential buyer.

After

excess earnings are established, a portion of this excess must be allocated to

the licensor. Kenrich Group utilized a 25% apportionment to the licensor, based

on the “25% rule of thumb,” to value the patents. The following table provides a

summary of our royalty rate analysis.

Table 8.2: 25% Rule Calculation

|

Total

(2009-2018)

|

||||

|

Total

Revenue Increased*

|

$ | 4,159 | ||

|

25%

Rule Increased Profitability*

|

$ | 520 | ||

|

Percentage

Revenue Enhanced

|

12.50 | % | ||

|

*in

millions

|

||||

Based on

the 25% rule of thumb applied to the excess profits, the resulting royalty rate

exceeds the percentage of additional revenue, at approximately

12.5%.

As

displayed above, there is a range between the rates identified by the Market

Approach above. However, the 10% rate is further reinforced through our

preliminary Excess Earnings Approach.

8.1.1.3 Accounting for Risk – Discount Rate

One of

the fundamental steps in financial valuation is the determination of a lump-sum

value of an asset as of a prescribed date. The methodology in performing such a

calculation is often termed Net Present Value (“NPV”), and this methodology is

well-established. Such NPV calculations depend on two primary factors: the

forecasted revenue stream and associated timing, and the discount rate. In

previous sections, we presented our opinion on the forecasted cash flows. In

this section, we provide our rationale for determination of the discount

rate.

As

mentioned earlier in our discussions of the Income Approach, the discount rate

used in any income-based valuation model should reflect a rate of return on

investment that is appropriate for the type of asset under consideration and for

the party investing in said asset. We examined the Weighted Average Cost of

Capital (“WACC”) for X and others in the industry, where that information was

available. The WACC is a measure of a firm’s cost of funds considering both the

cost of equity (“COE”) and the cost of debt. The results of our analysis are

presented in the following table.

21

Table 8.3: Weighted Average Cost of Capital for Similar Companies 74

|

Company

|

WACC

|

|||

|

AOL

|

8.05 | % | ||

|

Yahoo!

|

10.63 | % | ||

|

Google

|

9.79 | % | ||

|

MSN

|

8.72 | % | ||

|

Baidu

|

11.04 | % | ||

|

Expedia

|

10.74 | % | ||

|

Priceline

|

7.77 | % | ||

|

WebMD

|

10.53 | % | ||

|

United

Health Online

|

8.88 | % | ||

|

Average

|

9.57 | % | ||

Intangible

assets, especially those involved in litigation, are typically riskier than the

overall risk of a company. After

discussions with the counsel for the Company, and based upon the current status

of the litigation in which Modavox is involved, a preliminary discount rate of

25% was selected to bring the royalty income to present value

terms.

8.1.1.4 Preliminary X Litigation/Licensing Valuation Conclusion

Based

upon the royalty rate analysis

and the

fundamental nature of the patents owned by Modavox, we believe preliminary value

obtained using the 10% royalty rate are more appropriate. As such, it is our

opinion that the preliminary value oflitigation with X is approximately $146

million.

8.1.2 Preliminary Litigation Value for the online Behavioral Targeting (not including X)

These

analyses are associated with the preliminary value of the online behavioral

targeting technology patents to X or another major industry player. We

considered the preliminary value of the litigation associated with the relevant

industry, less the litigation value associated with X as discussed

above.

8.1.2.1 Royalty Base

We

determined the preliminary royalty base associated with the industry by

utilizing the eMarketer report referenced above. This report projects the

revenues associated with online behaviorally targeted advertising to be $775

million in 2008 and grow to $4.4 billion in 2012. However, as the patents do not

expire until 2019 at the earliest, we projected preliminary revenues from 2013 –

2019. We believe these estimates to be conservative predicated upon the growth

that is projected from 2008 – 2012. Though the growth may well exceed what we

have projected at this time, it is unlikely that the industry will experience

growth below these projections. As such, we have conservatively estimated the

preliminary royalty base associated with the industry litigation.

74 Bloomberg

22

8.1.2.2 Royalty Rate

We

utilized the same preliminary royalty rates referenced above in our analysis

associated with the X Litigation/Licensing analysis of 10%. Please see above

section for discussion of the royalty rate.

8.1.2.3 Accounting for Risk – Discount Rate

Due to

the infancy of the market, we have utilized discount rates of approximately 35%

and 60% in

order to determine the value associated with the industry intellectual property

litigation.

8.1.2.4 Litigation Value for the online Behavioral Targeting Conclusion

Using the

inputs described above, we have estimated that the total preliminary value of

the litigation revenues minus costs for the industry litigation to fall between

$693.5 million and $1.46 billion.75

8.1.3 Value to X internally (increased profit) of Patent Portfolio (online only)

The

preliminary value under this scenario is directly related the value of the

ownership of the patented technology on an after-tax basis as used by X. In this

method we utilized the Discounted Cash Flows (“DCF”) Method. The DCF Method is

used to estimate the present value of the increased future cash flows of X made

possible by the Modavox patented technology utilized by X. In order to calculate

our projections, we have relied upon the industry projections referenced

previously, research articles produced by industry experts, and

publicly available information. We have analyzed all of this information for

reasonableness and believe that the projections provided reflect the most

current preliminary information available for the purposes of

valuation.

The DCF

analysis using the forecasted future cash flows were prepared on an invested

capital basis. Invested capital refers to the aggregate of all classes of debt

and equity invested in the business. In preparing a DCF analysis on an invested

capital basis, forecasted debt-free cash flow is discounted to present value

using the weighted average cost of capital (“WACC”). Interest expense is

excluded from the forecast as debt-free cash flow represents an economic benefit

that is available to all capital holders of an enterprise.

75 This estimate does not

include the value of the X litigation.

23

Upon

analysis of the relevant and available information, the net cash flow of

Modavox, as operated by X was calculated as follows:

| CF = EBIT - Taxes + Depreciation - Capex =/- Change in NWC | |

|

CF

|

=

Forecasted net cash flow to invested capital

|

|

EB IT

|

=

Earnings before interest a and taxes (operating income)

|

|

Taxes

|

=

Estimated blended State and Federal income tax rate

|

|

Depreciation

|

= Depreciation (if

applicable)

|

|

Cape x

|

=

Required maintenance and deferred capital expenditures (if

applicable)

|

|

NWC

|

= Net working capital

|

In

typical valuations, a terminal value, also termed residual value at the end of

the forecast period is computed through use of an exit multiple or

capitalization of long-term cash flows. However, since patents have a limited

life of 20 years, we did not feel it was appropriate to include a terminal value

in our calculation.

After

adjusting earnings to arrive at net cash flow, it was then necessary to discount

the cash flow to present value at a rate commensurate with the inherent risk

associated with the cash flow. The WACC is predicated upon the general level of

interest rates, plus premiums for business and financial risks. Financial risk

refers to the possibility of bankruptcy and variability of the returns to equity

holders. The discount rate incorporates the level of risk in achieving the

amount of revenue and resulting profitability inherent in the projections. We

have utilized X’s WACC of 8.05% in regards to the risk associated with the

projected cash flows.

At this

time, I understand X is making use of the technology and has been doing so

since

This

usage will only increase with

time. at

this time

insures

of the

ability to continue to use the technology.

If ,

X will be able to decide in the market has access to the patented

technology. As such there is substantial value to X in owning the

patented technology.

8.1.4

Value to X internally (increased profit) of Patent Portfolio (online only)

Conclusion

Based

upon the DCF Method, the fair market value of Modavox is approximately $570

million in additional cash flows when operated under X.

8.1.5 Value of Patent Portfolio and Industry Litigation (Online)

Based

upon the acquisition of Modavox, X may be expected to gain $1.25 billion in

economic value. This value is substantially higher than the value related to

licensing the patents alone.

8.1.6 Value of Mobile Behavioral Targeting Market

The

preliminary value of the patent portfolio when applied to the mobile behavioral

targeting market is substantial and in addition to the value of the online

behavioral targeting market. We first considered the preliminary value

of litigation associated with the relevant

market

24

once

again due to the fundamental nature of the patents. Secondly, we considered the

preliminary value of the technology to X for use internally.

8.1.7 Industry Litigation Value – Mobile Behavioral Targeting Market

8.1.7.1 Royalty Base

The

industry projections provided by Mobile Stance 76 indicate the mobile

advertising market is going to grow from $2.8 billion in 2009 to $6.5 billion in

2012. In order to determine the portion of the total mobile advertising

marketing that will utilize behavioral targeting we have estimated that the

market will grow at a rate similar to that of the adoption of behavioral

targeting in the online advertising market.

8.1.7.2 Royalty Rate

We used

the previously determined royalty of 10% to estimate the litigation value of the

mobile portion. Please see previously discussed section for royalty

rate.

8.1.7.3 Accounting for Risk – Discount Rate

In

regards to the risk associated with obtaining the cash flows related to

litigation, we have utilized discount rates of approximately 33% and 60% in

order to determine the preliminary value associated with the industry

intellectual property litigation.

8.1.7.4 Industry Litigation – Mobile Behavioral Targeting Valuation Conclusion

Using the

variables described above, including the discount rate, royalty rate, and

revenue and cost projections, we estimate the litigation value of the patent

portfolio in the mobile industry to be between $142 and $524.2

million.

8.1.8 After Tax Value of Patent Portfolio to X for Internal Use (Mobile Market Only)

The

preliminary value under this scenario is directly related to the value of the

ownership of the patented technology as used by X in the mobile market. As is

the case when we determined the value of the patent portfolio in regards to X’s

online advertising use, we utilized the more classic approach related to whole

business valuation through use of Discounted Cash Flows (“DCF”) Method, as

explained in section 8.1.

We first

adjusted earnings to arrive at net cash flow, then discounted the cash flow to

present value at a rate commensurate with the inherent risk associated with the

cash flow. The WACC, as stated previously, is predicated upon the general level

of interest rates, plus premiums for business and financial risks. The discount

rate incorporates the level of risk in achieving the amount of revenue and

resulting profitability inherent in the projections. We used X’s WACC of 8.05%

to discount the cash flows.

To obtain

a range of preliminary value for X internally utilizing this technology in the

mobile market, we have used growth rates that would mirror that associated with

the growth of behavioral advertising in the online market. However, based on

discussions with Modavox management, we understand it is likely that adoption of

behavioral advertising in the mobile market may be more rapid than that of the

online market.

76 “Full Coverage: Mobile

Advertising After the Growing Pains”, http://www.mobilestance.com/

25

Because

the market has yet to be firmly established, we have added a preliminary 10%

risk premium to the industry WACC in discounting the appropriate cash flows.

This gives a discount rate of approximately 18%; we believe this is appropriate

given the current state of the market, the projections utilized and the

attributes associated with X. This is comparable to the lower range of return

generally required by venture capital firms.77 This

situation is comparable with less risky venture capital investments as the

overall technology (behavioral

targeting) and market (mobile advertising) are established and are simply being

married

to one another, thus reducing the required rate of return.

8.1.8.1 After-Tax Value of Patent Portfolio to X for Internal Use within the Mobile Market

Valuation Conclusion

Based

upon the DCF Method, the preliminary fair market value of the patent portfolio

to X when applied to Mobile Advertising revenues is approximately $112 million

and $188 million utilized internally by X.

8.1.9 Total Value of Patent Portfolio Internally and Industry Litigation to X (Mobile Market

Only) Summary

Based on

the acquisition of Modavox, X would be expected to gain between $255 million and

$712 million in economic value as a result of use of the patented technology in

the mobile market. This preliminary value is an addition to the value of the

online behavioral targeting market to X. This acquisition would give X the

rights to the patent portfolio as they relate to the mobile behavioral targeting

advertising market.

8.1.10

Preliminary Internal Value of the Patent Portfolio to the Industry for the Online and Mobile Behavioral Targeting Market

The

preliminary value associated with the online patent portfolio for the industry

(less X), of additional revenues on an after-tax basis, is approximately $5.0

billion. Additionally, the preliminary value of additional revenues on an

after-tax basis associated for the mobile industry is $1.25 billion. This

situation represents a significant competitive advantage to any company that

purchases Modavox and provides additional indicia regarding the value of Modavox

in total.

By

purchasing Modavox, X would not only be able to gain value

internally

I

understand they would most likely be able to receive a permanent injunction or

license from their competitors, directly increasing their own market share and

positively impacting the current profitability of this behavioral targeting

program.

8.2 The Market Approach

In

addition to the Income Approach, Kenrich Group also used the Market Approach to

determine the preliminary fair market value of the subject patents. The market

approach to valuation is a general way of developing a value indication of a

business by using one or more methods that compare the subject company to

similar businesses, business ownership interest and securities (investments)

that have been sold. A popular method used in the Market Approach is to consider

comparable asset transactions from unrelated parties.

77 "The Discount Rate

Used by Venture Capital Funds", http://e-articles.info/

26

The

weight that a comparable asset transaction holds is largely dependent upon if

the transaction is sufficiently similar to the assets at issue. There are

several factors that should be considered when assessing if a comparable asset

transaction is sufficiently analogous to the proposed transaction involving the

parties in question such as: the nature of the industry the assets are utilized

in, the terms of the transaction and/or agreement, the actual assets

involved

in the transaction, the circumstances surrounding the parties in the comparable

asset transaction, and other elements that would affect the transaction or

agreement terms.

The

Market Approach is useful in that it references actual arms-length transactions

between a willing buyer and willing seller. This method only applies to the

value of the Company and is not

related to any revenues from potential litigation that may be

pursued.

8.2.1 Comparable Transaction Analysis

We

considered a number of transactions within the online behaviorally targeted

marketing industry that occurred within the past couple of years. Based upon our

research, we identified six transactions during this period in which the

transactions terms were disclosed. A summary of the transactions is presented in

the table below.

Table 8.4: Comparable Transactions

|

Acquirer

|

Acquired

|

Purchase Price

|

Date

|

||||

|

Yahoo!

|

Overture

|

$ | 1.73B |

July

2003

|

|||

|

Google

|

DoubleClick

|

$ | 3.2B |

April

2007

|

|||

|

Microsoft

|

aQuantive

|

$ | 6B |

May

2007

|

|||

|

AOL

|

Tacoda

|

$ | 275M |

September

2007

|

|||

|

Yahoo!

|

BlueLithium

|

$ | 300M |

September

2007

|

|||

|

AOL

|

Quigo

|

$ | 340M |

November

2007

|

|||

|

Median

|

-

|

$ | 1,035M |

-

|

|||

From April to November 2007, significant consolidation took place in the online advertising industry. All four major internet players—AOL, Google, Microsoft, and Yahoo!—purchased companies with large online advertising platforms and targeting abilities. In total, over $10 billion in transaction activity occurred in those seven months.78

AOL bought Tacoda in September 2007 amid the frenzy of advertising consolidation among the big four internet players.79 Both Tacoda and Quigo were acquired to add to X’s Platform-A (now X Advertising), an online advertising platform that allows advertisers to display contextually-targeted advertisements and gives them superior data analytics.80 The Tacoda and Quigo acquisitions allow X to collect data and target specific individuals based

on their internet search habits.81

78 See table 8.4

http://www.clickz.com

80 , http://www.reuters.com/

http://www.reuters.com/

27