Attached files

| file | filename |

|---|---|

| EX-3.3 - ARTICLES OF AMENDMENT - InfrastruX Group, Inc. | dex33.htm |

| EX-23.1 - CONSENT OF KPMG LLP - InfrastruX Group, Inc. | dex231.htm |

| EX-23.2 - CONSENT OF KPMG LLP - InfrastruX Group, Inc. | dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on November 12, 2009

Registration No. 333-161234

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

InfrastruX Group, Inc.

(Exact name of registrant as specified in its charter)

| Washington | 1623 | 91-2063014 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

600 University Street, Suite 600

Seattle, Washington 98101-1176

(206) 494-4010

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael T. Lennon

President and Chief Executive Officer

InfrastruX Group, Inc.

600 University Street, Suite 600

Seattle, Washington 98101-1176

(206) 494-4010

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

| Mark Stegemoeller Latham & Watkins LLP 355 South Grand Avenue Los Angeles, California 90071-1560 (213) 485-1234 |

Stacy J. Kanter Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, New York 10036-6522 (212) 735-3000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ |

Accelerated filer ¨ | |

| Non-accelerated filer x (Do not check if smaller reporting company) |

Smaller reporting company ¨ |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until the registration statement shall become effective, on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| SUBJECT TO COMPLETION, DATED NOVEMBER 12, 2009 | ||

Shares

Common Stock

This is our initial public offering of common stock. We are offering shares and the selling shareholder is offering shares of our common stock. The initial public offering price of our common stock is expected to be between $ and $ per share.

Prior to this offering, there has been no public market for our common stock. We are applying to list our common stock on the New York Stock Exchange under the symbol “IFR.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 13.

| Price to Public |

Underwriting Discounts and Commissions |

Proceeds to InfrastruX Group, Inc. |

Proceeds to Selling Shareholder | |||||

| Per Share |

$ | $ | $ | $ | ||||

| Total |

$ | $ | $ | $ |

The underwriters have an option to purchase a maximum of additional shares of common stock from the selling shareholder at the public offering price, less the underwriting discounts and commissions, to cover over-allotment of shares, if any. The underwriters can exercise this option at any time within 30 days from the date of this prospectus.

Delivery of the common stock will be made on or about , 2009.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Credit Suisse | UBS Investment Bank |

The date of this prospectus is , 2009

Table of Contents

You should rely only on the information contained in this document or any free writing prospectus prepared by or on behalf of us. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document.

We obtained the industry and market data used throughout this prospectus from industry journals and publications, data on websites maintained by private and public entities, including independent industry associations, or general publications and other publicly available information. In particular, we have based much of our discussion of the electric power and natural gas transmission and distribution markets on information published by the American Society of Civil Engineers (ASCE), the American Wind Energy Association (AWEA), the Edison Electric Institute (EEI), the Emerging Energy Research (EER), the Energy Information Administration (EIA), the Federal Energy Regulatory Commission (FERC), the National Renewable Energy Laboratory, the U.S. Department of Labor Bureau of Labor Statistics and the U.S. Department of Energy (DoE). Because the ASCE, AWEA, EEI and EER serve the interests of their constituents within their respective industries, they may present information in a manner that is more favorable to their respective industries than would be presented by an independent source. Further, forecasts are particularly susceptible to being inaccurate, especially over long periods of time and when made in economic circumstances different than those that exist during the forecast period. As a result, investors are urged to use caution when relying on the industry and market data contained in this prospectus, and beliefs, estimates and forecasts based on such data may not be correct.

Until (25 days after the commencement of the offering), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

i

Table of Contents

This summary highlights the information contained elsewhere in this prospectus and does not contain all of the information you need to consider in making your investment decision. For a more complete understanding of the information that you may consider important in making your investment decision, we encourage you to read this entire prospectus. Among the other information in this prospectus, you should carefully consider the information set forth under the heading “Risk Factors” and our consolidated financial statements and accompanying notes included elsewhere in this prospectus. Unless the context requires otherwise, the words “we,” “us,” “our,” “Company” and “InfrastruX” refer to InfrastruX Group, Inc. and its subsidiaries taken as a whole, including our subsidiaries prior to their acquisition by us.

Except as otherwise indicated, all share and per share information included in this prospectus has been adjusted for the -for- stock split of our common stock, effective as of , 2009.

Our Company

We are a leading national provider of maintenance and construction services to the electric power and natural gas transmission and distribution, or T&D, infrastructure markets based on revenue. We combine our project management expertise, large skilled workforce and equipment fleet to provide utilities and energy companies with a broad range of complementary T&D services, including maintenance, construction, repair and emergency storm response. We are one of only a small number of companies that can offer “end-to-end” energy infrastructure services, covering the entire delivery process from the energy source to the end user.

In the electric power market, we are one of the largest national contractors serving the T&D sector based on revenue, and our comprehensive infrastructure capabilities include maintaining and constructing overhead and underground electric power transmission lines, substations and distribution lines. In the natural gas market, we serve our customers’ gas transportation infrastructure needs from the wellhead to gathering lines, pipelines, compressor stations and local distribution systems. To supplement our core offerings, we also provide a range of complementary specialty services, including CableCURE® underground cable restoration, which we also offer internationally, utility-line locating and large-bore directional drilling. From our regional centers in the Southwest, Midwest and East, we are able to pursue and execute projects throughout the country.

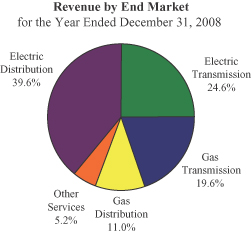

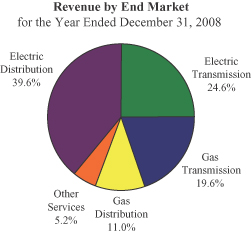

We have long-standing relationships with many electric power and natural gas utilities, cooperatives, municipalities, pipeline companies and other owners and developers of energy infrastructure. Our relationships with many of our customers, including Alliant Energy, American Electric Power, ChevronTexaco, Coserv Electric, Dominion, Duke Energy, Equitable Resources, Oncor (formerly TXU) and Progress Energy, extend for more than 20 years. In 2008, we served approximately 650 customers across electric power and natural gas end markets. The following chart presents the percentage of our consolidated revenue generated by end markets in 2008. Electric power and natural gas T&D specialty services performed for customers are reflected in our electric power and natural gas T&D revenues, respectively. Any other specialty services performed for customers are recorded as revenue from “other services.”

1

Table of Contents

Our business consists of a mix of recurring work and project-based bid work. We have recurring revenues under long-term master service and alliance agreements, which generated approximately 70% of our 2008 revenues. Master service agreements, or MSAs, are typically one to three year contracts and are often renewed. MSAs establish a long-term working framework, including terms, conditions and pricing, for providing our customers a wide array of maintenance and construction services. In late 2008, we expanded on the MSA concept by entering into what we describe as an “alliance agreement” with Oncor, the largest utility in Texas and our largest customer, which we believe represents a new contractual approach to strengthening our customer relationships. Through this 10.5 year contract, we currently serve as Oncor’s primary contractor for T&D maintenance and construction. This alliance approach significantly enhances the alignment of our interests with those of our customer through joint project planning, stipulated target work volumes and incentive structures. Based on the initial success of our alliance agreement with Oncor, we will seek to establish similar arrangements with other leading utilities.

Key Industry Trends

We believe the opportunity for T&D infrastructure service providers is significant and that growth in our end markets will be driven by the following principal factors:

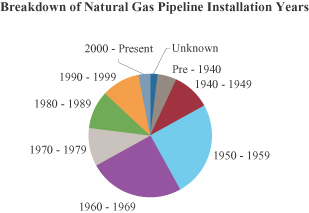

Inadequacy and deterioration of existing energy T&D infrastructure. Long-term increases in energy consumption, historically insufficient investment in T&D and geographic shifts in population have stressed the current T&D infrastructure and increased the need for new maintenance, upgrades and expansion. The need to modernize America’s electric transmission grid is widely acknowledged. According to the EIA, 70% of transmission lines and power transformers are at least 25 years old. In addition, the DoE estimates that nearly 65% of natural gas pipelines in the U.S. were built prior to 1970.

More efficient use of electricity generation. The current electric power infrastructure is congested and regionalized. Congestion limits the efficient movement of electricity throughout the U.S. and results in areas with high electricity costs that are unable to efficiently receive power from lower cost or more environmentally friendly generation sources. In addition, we believe there is a growing recognition of the need for a more flexible “Smart Grid” to increase reliability and reduce electricity costs by improving the efficiency of electric power delivery and more effectively matching electric power supply with demand. The installation of a “Smart Grid” will require significant infrastructure spending.

2

Table of Contents

Expanded development of new energy sources. We expect to benefit from the development of new sources of electric power generation and natural gas production that will require specialty contractors to upgrade, build and maintain additional transmission infrastructure.

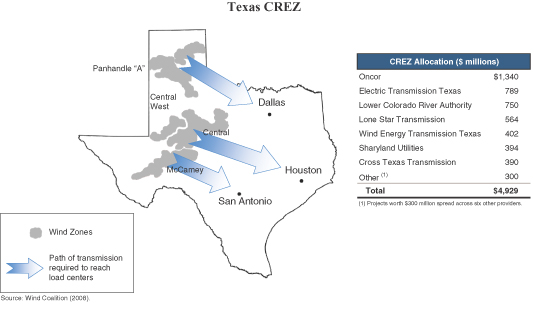

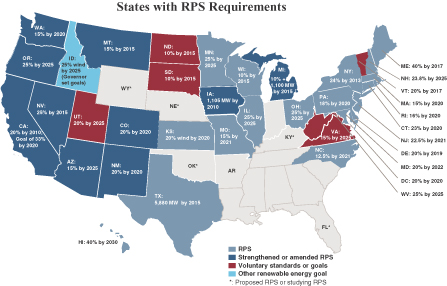

| • | Renewable electric power sources. Wind is expected to be the fastest growing source of new electricity supply in the U.S., with installed capacity expected to double between 2008 and 2015 and associated annual investment expected to average over $5 billion during this period. Because the major U.S. wind corridors are generally located away from urban demand centers, we expect significant transmission spending will be required to connect new wind generation facilities to end users. Twenty-nine states and Washington D.C. have adopted mandatory Renewable Portfolio Standards, or RPS, programs that require a certain percentage of electric power to come from renewable sources, and five other states have enacted non-binding RPS-like goals. In addition, the U.S. House of Representatives recently passed the Combined Efficiency and Renewable Electricity Standard (CERES) that would impose renewable energy standards on utilities nationally. We expect to benefit, in particular, from the Texas plan for Competitive Renewable Energy Zones, or CREZ, which are geographic areas in the state suitable for the development of renewable energy resources, principally wind power. Planned CREZ spending includes $4.9 billion of transmission projects, of which $1.3 billion has been allocated, subject to certain state convenience and necessity approvals, to Oncor, our largest customer, although the substantial majority of this work has not yet been committed to InfrastruX. |

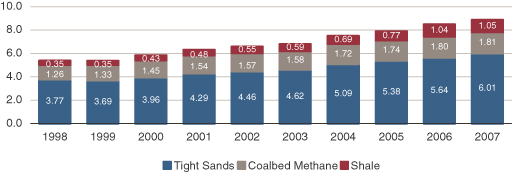

| • | Development of natural gas sources. Advances in technology have expanded the economic viability of extracting natural gas from unconventional sources such as the vast shale basins throughout the U.S. and extended the production of conventional natural gas sources. We believe the development of domestic natural gas reserves will continue over the long term, creating opportunities for specialty contractors to build and maintain the associated gathering lines and transmission infrastructure that will be needed to deliver the gas to market. |

Greater use of natural gas for electric power generation. Natural gas is increasingly being viewed as an economic and environmentally favorable alternative to other fossil fuels for electric power generation. In some U.S. markets, lower natural gas prices, combined with the uncertainty surrounding potential U.S. greenhouse gas regulations that could discourage the use of coal (such as the cap-and-trade provisions of the CERES bill recently passed by the U.S. House of Representatives), as well as the knowledge that natural gas produces significantly lower greenhouse gas emissions, have begun to influence some electric power generators to switch from coal to natural gas for new power plants. We believe an increase in the use of natural gas for electric power generation will be a major driver of long-term demand for domestic natural gas production and result in a substantial increase in transmission infrastructure spending.

Increased outsourcing of infrastructure services. Due to cost control initiatives, the ability to improve service levels and aging workforce trends, utilities have increased the outsourcing of their T&D maintenance and construction services needs. We believe that a majority of utility infrastructure services are still conducted in-house and that our customers, especially electric utilities, will expand outsourcing of utility infrastructure services over time. Outsourced service providers are often able to provide the same services at a lower cost because of their specialization, larger scale and ability to better utilize their workforce and equipment across a larger geographic footprint.

Our Competitive Strengths

Our competitive strengths include the following:

Comprehensive service offerings. We believe that utilities will continue to seek efficiencies by focusing on a more limited number of service providers that offer comprehensive capabilities. Our wide range of services allows us to address this demand and provides us with cross-selling opportunities. In particular, we believe our

3

Table of Contents

significant experience in more complex, high-voltage electric power transmission and substation work differentiates us from many of our electric T&D competitors. We also offer our natural gas T&D customers a full spectrum of maintenance and construction solutions from large diameter transmission pipelines to the maintenance and installation of local distribution infrastructure. Our specialty services, such as CableCURE® underground cable restoration, utility-line locating and large-bore directional drilling, complement our portfolio of services.

Critical scale and geographic presence. We have a significant presence in key U.S. energy markets including the Southwest, Midwest and East with approximately 4,400 employees as of June 30, 2009 and an equipment fleet that can be mobilized quickly throughout the continental U.S. Our geographic coverage allows us to serve customers whose operations span multiple states or regions, and our scale allows us to quickly deploy large numbers of skilled workers on short notice. We believe we are well positioned to assist our customers in constructing new electric power transmission infrastructure to connect remotely located alternative energy sources to the existing grid.

Long-term customer relationships. We have relationships of more than 20 years with a number of utilities and energy companies, including Alliant Energy, American Electric Power, ChevronTexaco, Coserv Electric, Dominion, Duke Energy, Equitable Resources, Oncor and Progress Energy. Our relationships with Oncor and American Electric Power span more than 50 years. The basis for many of our long-term customer relationships has been and will continue to be the comprehensive, cost-efficient and timely maintenance and construction services we provide. The relationships we have with our core group of customers often allow us to be integrated into the planning stages of their larger projects, which we believe increases the likelihood of maintaining these relationships and securing additional bid work. In addition, these long-term relationships often lead to cross-selling opportunities as many customers prefer to deal with fewer, trusted service providers.

Enhanced revenue visibility and stability through MSAs and alliance agreements. We believe our long-term MSAs and our alliance agreement with Oncor provide us with enhanced revenue visibility and stability as compared to project-by-project bid work. Approximately 70% of our 2008 revenue was generated under MSAs and our alliance agreement. Our MSAs have allowed us to build and to strengthen enduring client relationships and have provided us key advantages in bidding projects and enhanced our opportunities to perform incremental maintenance and construction work. Our alliance agreement with Oncor includes incentives for Oncor to meet aggregate revenue thresholds more than 40% greater than our 2007 revenue from Oncor, a mechanism to provide us additional Oncor work if threshold spending levels are not projected to be met, indexed annual price adjustments and other key terms designed to further align our interests with those of Oncor.

Successful track record of completing and integrating acquisitions. Since 2000, we have enhanced our growth through a series of strategic acquisitions. These acquisitions have expanded our geographic footprint, the scope of services we offer and the number of customers we serve. In addition, we believe our acquisition strategy has allowed us to access new markets with lower risk and more quickly than entering as a new market participant. For example, our 2002 acquisition of Chapman Construction strengthened our position as a leading provider of electric power transmission and substation services in Texas and enhanced our relationship with Oncor. Our November 2006 acquisition of Hawkeye, LLC and certain of its affiliates, sometimes referred to in this prospectus as the “Hawkeye Acquisition,” broadened our capabilities in key electric power T&D services in the Northeast, particularly in underground transmission services. We believe our information systems, standardized processes and disciplined business practices around project management provide an effective platform for integrating acquired businesses, closely monitoring our projects across operating units and improving labor and equipment utilization.

High quality workforce and strong, experienced management team. Our track record in winning desirable and profitable projects and our commitment to safety have allowed us to attract and maintain a highly skilled workforce capable of handling complex projects, such as high-voltage electric power transmission and

4

Table of Contents

specialized underground utility projects. We believe our abilities to attract, develop, retain and deploy our workforce position us to capitalize on increasing demand for skilled services in an era of shrinking and aging utility workforces. We also have the ability to quickly mobilize, expand or contract our workforce to respond to customer needs and effectively staff our projects. Our high quality workforce is led by our strong, experienced management team.

Our Business Strategy

Our business strategy positions us to take advantage of a number of long-term favorable trends:

Capitalize on alternative energy trends. We believe our broad geographic platform and strong customer relationships will allow us to capitalize on favorable trends in key alternative energy end markets such as wind power development. For example, as a major provider of T&D maintenance and construction services in Texas, with approximately 1,600 total employees in the state as of June 30, 2009, we believe we are well positioned to perform a significant portion of the transmission work announced under the CREZ plan, which includes $1.3 billion of work awarded to Oncor, subject to certain state convenience and necessity approvals, although the substantial majority of this work has not yet been committed to InfrastruX. Similarly, with over 1,700 total employees in the Northeast, we believe we are a leading candidate to perform work resulting from RPS programs in the region.

Benefit from new natural gas development. We believe our comprehensive natural gas T&D capabilities and geographic presence will allow us to capitalize on the expected long-term demand for domestic natural gas resource development from traditional gas fields and unconventional resources such as tight sand, coal bed methane, methane hydrates and shale. These resources require significant infrastructure development of gathering systems and transmission pipelines to gather and transport the natural gas from remote regions of supply to areas of consumption.

Pursue alliance agreements. We will continue our efforts to capitalize on the trend of utilities outsourcing T&D maintenance and construction services. We have formalized long-term relationships with many of our customers by entering into MSAs. In addition to continuing to pursue MSAs, we will seek to establish alliance agreements with additional leading utilities, building on the model of the Oncor alliance agreement. We believe that these alliance agreements will improve the alignment of our goals and objectives with those of our customers and increase our revenue visibility and growth potential.

Focus on enhancing operating efficiencies, expanding margins and controlling risk. We seek to improve profitability and control risk by emphasizing the most profitable services in our portfolio, pursuing projects that we believe will generate attractive returns, enhancing safety measures and constantly monitoring our projects. We also continue to seek opportunities for improved labor and equipment resource utilization, to incentivize our management to create and realize profitable cross-selling opportunities across operating units and to share best practices across our operations.

Attract, develop and retain quality employees. A key tenet of our growth strategy has been and will continue to be our ability to attract and maintain the workforce and management talent necessary to provide quality, safe and timely services to our customers. We continue to invest in the recruiting, development and retention of our valuable workforce by focusing training and compensation on safe operation, efficient production and customer satisfaction. As our customers increasingly outsource energy infrastructure services and as their workforces continue to decline in number and grow older, our ability to maintain a highly skilled workforce will become increasingly valuable. To meet anticipated increased business demand, we have expanded our personnel recruiting efforts by extending our relationships with universities, technical colleges, unions and trade schools through scholarships, tuition assistance, course development and internships.

Pursue strategic acquisitions. To complement our organic growth, we continue to search for attractive acquisition opportunities that expand our geographic presence, enhance our service offerings and increase our

5

Table of Contents

customer base. We are particularly interested in opportunities that would expand our electric power T&D services or provide turn-key program management. We are also interested in technology-based services, including those that complement our CableCURE® offering. Geographically, we anticipate focusing on expanding the breadth and depth of our service offerings around our existing regional centers of operation in the Southwest, Midwest and East, as well as expanding our geographic reach into the West Coast. We believe that attractive acquisition opportunities will continue to be available due to the fragmented nature of our industry, the desire for many business owners to achieve liquidity and the difficulty many companies face in modernizing and expanding due to capital constraints, particularly under the current financial market conditions.

Risks Affecting Our Business and Strategy

There are a number of risks and uncertainties that may affect our financial and operating performance, including:

| • | if business conditions in the industries we serve do not improve or continue to deteriorate due to the current economic downturn, decreases in electricity demand, depressed oil and natural gas prices, the credit crisis or other factors, our customers’ current and future spending, as well as their ability to pay for our services, may continue to be adversely impacted, and as a result, our results of operations, cash flow and business prospects may continue to suffer; |

| • | a continued reduction or lack of improvement in the level of capital expenditures on infrastructure, particularly by oil and natural gas pipeline companies and electric power utilities, could continue to adversely affect our results of operations, cash flow and business prospects; |

| • | we derive a significant portion of our revenue from a small number of customers and the loss or reduction of business or projects from one or more of them (particularly Oncor) could negatively impact us; |

| • | federal and state legislation and regulations relating to electric power transmission and natural gas pipeline infrastructure, including alternative energy and related end markets, may fail to result in increased demand for our services; |

| • | our acquisition strategy or our integration of acquired businesses may be unsuccessful, and as a result, we may not achieve expected benefits and our performance could decline; |

| • | if we are unable to access the capital or credit markets, our future growth opportunities and ability to refinance indebtedness and to fund acquisitions and sufficient capital expenditures to meet our business needs could be adversely affected; and |

| • | skilled labor shortages and increased labor costs could negatively affect our ability to operate efficiently and profitably and delay or prevent achievement of our business strategy. |

These and other risks are discussed under “Risk Factors” and elsewhere in this prospectus and should be carefully considered before investing in our common stock.

Our Sponsor

Our sponsor, Tenaska Power Fund, L.P., or TPF, is a private equity fund that has investments in power generation, natural gas storage and electric power and natural gas T&D infrastructure. As of December 31, 2008, TPF had approximately $2.5 billion of assets under management. Tenaska Capital Management, LLC, an affiliate of TPF, provides portfolio management and administrative services to TPF and provides management services to us. TCM is also the manager of TPF II, L.P., or TPF II, the successor fund to TPF. As of December 31, 2008,

6

Table of Contents

TPF II, together with its affiliated funds, had approximately $2.4 billion of assets under management. As of June 30, 2009, InfrastruX Holdings, LLC (our parent and the selling shareholder in this offering) owned 48,950,360 shares (without giving effect to the -for- stock split), or 100%, of our common stock, and after giving effect to this offering, it will own shares, or %, of our common stock, assuming no exercise of the underwriters’ over-allotment option. In connection with the October 2009 amendment to our credit facilities, we issued and InfrastruX Holdings, LLC acquired 20,000 shares, or 100%, of our 15% Senior Redeemable Convertible Cumulative Preferred Stock. We intend to redeem all of such preferred stock with proceeds from this offering. InfrastruX Holdings, LLC, is approximately 95.3% owned on a fully-diluted basis by TPF InfrastruX Holdings, LLC, a wholly-owned subsidiary of TPF.

At an initial public offering price of $ per share (the mid-point of the estimated price range on the cover page of this prospectus), TPF will beneficially own more than 50% of the outstanding shares of our common stock, and we will be a “controlled company” under the rules of the New York Stock Exchange (NYSE). If we are a controlled company, we will be exempt from certain independence requirements with respect to the composition of our board and committees of the board, including the requirements that a majority of the board of directors be comprised of independent directors, and that the compensation committee and the nominating and corporate governance committee be comprised solely of independent directors. See “Risk Factors—Risks Relating to This Offering” and related information contained elsewhere in this prospectus.

Our acquisition by TPF in May 2006 is sometimes referred to in this prospectus as the “TPF Acquisition.”

Company Information

We were incorporated in the State of Washington in 2000. Our principal executive offices are located at 600 University Street, Suite 600, Seattle, Washington 98101-1176, and our telephone number is (206) 494-4010. Our website is located at www.infrastrux.com. The information on, or accessible through, our website does not constitute part of, and is not incorporated into, this prospectus.

7

Table of Contents

THE OFFERING

| Common stock offered by us |

shares |

| Common stock offered by the selling shareholder |

shares |

| Common stock to be outstanding immediately after this offering |

shares |

| Over-allotment option offered by the selling shareholder |

shares |

| Use of proceeds |

We estimate that the net proceeds from the sale of shares by us in the offering (based on an offering price of $ per share, the midpoint of the estimated price range shown on the cover page of this prospectus), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, will be $ million. We will not receive any of the proceeds from the sale of common stock by the selling shareholder. |

We intend to use the net proceeds of this offering to repay approximately $ million of indebtedness outstanding under our credit facilities, to redeem approximately $ of our 15% Senior Redeemable Convertible Cumulative Preferred Stock (representing all the outstanding shares of such stock), and to retain approximately $ for general corporate purposes, including working capital purposes and to fund future acquisitions. See “Use of Proceeds.”

| Risk Factors |

You should read the “Risk Factors” section of this prospectus for a discussion of some of the factors that you should consider carefully before deciding to invest in shares of our common stock. |

| Proposed New York Stock Exchange symbol |

“IFR” |

The number of shares of common stock to be outstanding after this offering is based on shares outstanding as of , 2009 (before giving effect to the -for- stock split) and:

| • | excludes shares and shares of common stock issuable upon the exercise of outstanding stock appreciation rights (SARs) and restricted stock units (RSUs), respectively; and |

| • | excludes shares of common stock reserved for issuance under our equity incentive plan. |

Unless otherwise indicated, this prospectus reflects and assumes the following:

| • | our common stock will be sold at $ per share, which is the midpoint of the estimated offering price range shown on the front cover page of this prospectus; |

| • | redemption of all outstanding shares of our 15% Senior Redeemable Convertible Cumulative Preferred Stock; |

| • | no exercise by the underwriters of their over-allotment option; |

| • | a -for- stock split of our outstanding common stock to be effective immediately prior to the effectiveness of this offering; and |

| • | the filing of our amended and restated articles of incorporation and the adoption of our amended and restated bylaws immediately prior to the effectiveness of the offering. |

8

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

The summary consolidated statement of operations for the periods January 1, 2006 to May 7, 2006 and May 8, 2006 to December 31, 2006 and for the years ended December 31, 2007 and 2008 have been derived from our audited consolidated financial statements included elsewhere in this prospectus, which include, with respect to the periods presented below, our results prior to the TPF Acquisition for the period January 1, 2006 to May 7, 2006 and our results since the TPF Acquisition for the period May 8, 2006 (inception) to December 31, 2006 and for the years ended December 31, 2007 and 2008. The summary consolidated statement of operations for each of the six months ended June 30, 2008 and 2009 and the consolidated balance sheet data as of June 30, 2009 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. You should read the following summary consolidated financial and other data in conjunction with “Selected Consolidated Financial and Other Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and related notes included elsewhere in this prospectus.

| Predecessor(1) | Successor(1) | |||||||||||||||||||||||||||||

| Period January 1, 2006 to May 7, 2006 |

Period May 8, 2006 to December 31, 2006 |

Combined Year Ended December 31, 2006 |

Year Ended December 31, |

Six Months Ended June 30, |

||||||||||||||||||||||||||

| 2007 | 2008 | 2008 | 2009 | |||||||||||||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||||||||||||

| (dollars in thousands, except per share data) | ||||||||||||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||||||||||||

| Revenues |

$ | 141,606 | $ | 341,586 | $ | 483,192 | $ | 657,180 | $ | 826,962 | $ | 401,675 | $ | 316,788 | ||||||||||||||||

| Cost of revenues |

119,956 | 284,609 | 404,565 | 581,666 | 701,035 | 347,593 | 285,689 | |||||||||||||||||||||||

| Gross profit |

21,650 | 56,977 | 78,627 | 75,514 | 125,927 | 54,082 | 31,099 | |||||||||||||||||||||||

| Selling, general and administrative |

21,037 | 31,733 | 52,770 | 51,122 | 85,882 | (2) | 31,188 | 30,378 | ||||||||||||||||||||||

| Goodwill / intangibles impairment |

— | — | — | 35,484 | 52,888 | 34,104 | — | |||||||||||||||||||||||

| Amortization of intangibles(3) |

459 | 3,190 | 3,649 | 7,818 | 7,445 | 3,830 | 3,606 | |||||||||||||||||||||||

| Total operating expenses |

21,496 | 34,923 | 56,419 | 94,424 | 146,215 | 69,122 | 33,984 | |||||||||||||||||||||||

| Income (loss) from operations |

154 | 22,054 | 22,208 | (18,910 | ) | (20,288 | ) | (15,040 | ) | (2,885 | ) | |||||||||||||||||||

| Interest expense, net |

2,934 | 16,028 | 18,962 | 33,029 | 27,468 | 13,298 | 7,443 | |||||||||||||||||||||||

| Other expenses (income), net |

(11 | ) | 9,122 | 9,111 | 4,238 | 2,840 | 1,372 | 1,551 | ||||||||||||||||||||||

| Loss before income taxes |

(2,769 | ) | (3,096 | ) | (5,865 | ) | (56,177 | ) | (50,596 | ) | (29,710 | ) | (11,879 | ) | ||||||||||||||||

| Income tax benefit |

237 | 1,152 | 1,389 | 14,376 | 14,028 | 8,722 | 2,818 | |||||||||||||||||||||||

| Net loss |

$ | (2,532 | ) | $ | (1,944 | ) | $ | (4,476 | ) | $ | (41,801 | ) | $ | (36,568 | ) | $ | (20,988 | ) | $ | (9,061 | ) | |||||||||

| Net Loss Per Share Data: |

||||||||||||||||||||||||||||||

| Basic |

$ | (0.04 | ) | $ | (0.09 | ) | $ | (0.85 | ) | $ | (0.75 | ) | $ | (0.43 | ) | $ | (0.18 | ) | ||||||||||||

| Diluted |

$ | (0.04 | ) | $ | (0.09 | ) | $ | (0.85 | ) | $ | (0.75 | ) | $ | (0.43 | ) | $ | (0.18 | ) | ||||||||||||

| Weighted average shares outstanding, basic and diluted |

46,541,862 | 48,950,360 | 48,950,360 | 48,950,360 | 48,950,360 | 49,099,673 | ||||||||||||||||||||||||

| Other Data: |

||||||||||||||||||||||||||||||

| Adjusted EBITDA(4) |

$ | 11,146 | $ | 48,561 | $ | 59,707 | $ | 58,241 | $ | 95,155 | $ | 41,301 | $ | 21,439 | ||||||||||||||||

| Backlog(5) |

266,000 | 340,000 | 340,000 | 368,000 | 472,000 | 476,000 | 384,000 | |||||||||||||||||||||||

| Capital expenditures |

2,242 | 15,995 | 18,237 | 24,502 | 34,521 | 23,687 | 18,394 | |||||||||||||||||||||||

| Working capital(6) |

61,850 | 117,018 | 117,018 | 103,316 | 101,955 | 118,698 | 109,314 | |||||||||||||||||||||||

9

Table of Contents

| June 30, 2009 | ||||||

| Actual | As Adjusted | |||||

| (unaudited) | ||||||

| Consolidated Balance Sheet Data: |

(dollars in thousands) | |||||

| Cash and cash equivalents |

$ | 13,363 | $ | |||

| Total assets |

519,431 | |||||

| Long-term debt, including current portion |

279,170 | |||||

| Total shareholder’s equity |

97,591 | |||||

| (1) | Our financial statements for the period prior to May 8, 2006 (our predecessor period) were prepared on the historical cost basis of accounting. Our financial statements for periods subsequent to May 8, 2006 (our successor periods) reflect the application of purchase accounting to the TPF Acquisition, which required that we record our assets and liabilities at fair value as of May 8, 2006. This included $82.2 million of goodwill, $67.1 million of intangibles and $14.2 million of property and equipment, which caused an increase in amortization of intangibles and depreciation expense in our successor periods as compared to our predecessor period. In addition, our financial statements for the successor periods include Hawkeye from the date of the Hawkeye Acquisition on November 3, 2006. As a result, our results for the successor periods are not comparable to the predecessor period, and our combined results for the year ended December 31, 2006 are not comparable to other periods presented. Loss per share amounts for the combined year ended December 31, 2006 are based on 48,950,360 shares outstanding as of December 31, 2006. |

| (2) | Includes $17.5 million relating to an earnout paid to the former owners of Hawkeye and $4.3 million in share-based compensation under our equity incentive plan. |

| (3) | Excludes developed technology intangible amortization recorded to cost of revenues. See Note 4 of our consolidated financial statements. |

| (4) | Adjusted EBITDA is defined as net loss plus net interest expense, income tax benefit, depreciation and amortization, as adjusted for items that management does not consider to be reflective of our core operating performance. |

Our management uses Adjusted EBITDA:

| • | as a measurement of operating performance; |

| • | in developing our internal budgets, forecasts and strategic plan; |

| • | as a significant factor in evaluating our management for compensation purposes, see “Compensation Discussion and Analysis”; |

| • | to evaluate potential acquisitions; |

| • | in comparing our current operating results with corresponding historical periods and with the operational performance of other companies in our industry; and |

| • | in presentations to the members of our board of directors to enable our board to have the same measurement basis of operating performance as is used by management in their assessments of performance and in forecasting and budgeting, both for individual operating units and for our company as a whole. |

Most of the adjustments reflected in Adjusted EBITDA are also included in performance metrics under our credit facilities. However, Adjusted EBITDA is not a financial measurement recognized under U.S. generally accepted accounting principles, or GAAP, and when analyzing our operating performance, investors should use Adjusted EBITDA in addition to, and not as an alternative for, net income, operating income, or any other performance measure derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of our liquidity. Because not all companies use identical calculations, our presentation of Adjusted EBITDA may not be comparable to similarly titled measures of other companies. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Discussion.”

10

Table of Contents

The following table provides a reconciliation of net loss to Adjusted EBITDA:

| Predecessor(1) | Successor(1) | |||||||||||||||||||||||||||||

| Period January 1, 2006 to May 7, 2006 |

Period May 8, 2006 to December 31, 2006 |

Combined Year Ended December 31, 2006 |

Year Ended December 31, |

Six Months Ended June 30, |

||||||||||||||||||||||||||

| 2007 | 2008 | 2008 | 2009 | |||||||||||||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||||||||

| Net loss |

$ | (2,532 | ) | $ | (1,944 | ) | $ | (4,476 | ) | $ | (41,801 | ) | $ | (36,568 | ) | $ | (20,988 | ) | $ | (9,061 | ) | |||||||||

| Plus: interest expense, net |

2,934 | 16,028 | 18,962 | 33,029 | 27,468 | 13,298 | 7,443 | |||||||||||||||||||||||

| Plus: income tax (benefit) |

(237 | ) | (1,152 | ) | (1,389 | ) | (14,376 | ) | (14,028 | ) | (8,722 | ) | (2,818 | ) | ||||||||||||||||

| Plus: depreciation and amortization |

7,150 | 22,806 | 29,956 | 42,469 | 41,582 | 20,822 | 20,137 | |||||||||||||||||||||||

| EBITDA |

7,315 | 35,738 | 43,053 | 19,321 | 18,454 | 4,410 | 15,701 | |||||||||||||||||||||||

| Plus: impairment of goodwill |

— | — | — | 35,484 | (a) | 45,268 | (b) | 26,484 | — | |||||||||||||||||||||

| Plus: impairment of intangible assets |

— | — | — | — | 7,620 | (c) | 7,620 | — | ||||||||||||||||||||||

| Plus: refinancing charges |

— | 8,518 | (d) | 8,518 | (d) | 1,373 | (e) | — | — | — | ||||||||||||||||||||

| Plus: financing costs and bank fees |

— | 1,750 | 1,750 | 2,569 | 2,839 | 1,377 | 1,586 | |||||||||||||||||||||||

| Plus: TCM management fees(f) |

— | 1,290 | 1,290 | 2,013 | 2,000 | 1,000 | 1,000 | |||||||||||||||||||||||

| Plus: Hawkeye earnout(g) |

— | — | — | — | 17,500 | — | — | |||||||||||||||||||||||

| Plus: change of control bonuses(h) |

3,537 | — | 3,537 | — | — | — | — | |||||||||||||||||||||||

| Plus: non-cash equity compensation(i) |

274 | — | 274 | — | 4,308 | 3,176 | 888 | |||||||||||||||||||||||

| Plus: restructuring costs |

— | — | — | — | — | — | 66 | |||||||||||||||||||||||

| Plus: other, net |

20 | (j) | 1,265 | (k) | 1,285 | (k) | (2,519 | )(l) | 1,419 | (m) | 34 | (j) | 2,198 | (n) | ||||||||||||||||

| Minus: gain on litigation resolution |

— | — | — | — | (4,253 | )(o) | (2,800 | )(o) | — | |||||||||||||||||||||

| Adjusted EBITDA |

$ | 11,146 | $ | 48,561 | $ | 59,707 | $ | 58,241 | $ | 95,155 | $ | 41,301 | $ | 21,439 | ||||||||||||||||

| (a) | Represents goodwill impairment charges of $29.5 million and $6.0 million in our Eastern and Midwest regions, respectively. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Year Ended December 31, 2007 Compared to the Year Ended December 31, 2006—Impairment Charges.” |

| (b) | Represents a goodwill impairment charge of $26.5 million in our Eastern region, during the second quarter of 2008, as well as an additional $18.8 million impairment charge in the same region during the fourth quarter of 2008. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Year Ended December 31, 2008 Compared to the Year Ended December 31, 2007—Impairment Charges.” |

| (c) | Represents a non-cash intangible asset impairment charge relating to a small operating unit that experienced the departure of its president and former owner during the year. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Year Ended December 31, 2008 Compared to the Year Ended December 31, 2007—Impairment Charges.” |

| (d) | In 2006, we refinanced the debt we incurred to facilitate the TPF Acquisition and, as a result, wrote off $7.4 million of deferred financing costs and paid $1.1 million in prepayment penalties. |

| (e) | Represents bank costs we incurred in amending certain provisions of our credit facilities. |

| (f) | Represents the management fee payable to TCM. Excludes interest charges on the unpaid management fees, which are included in interest expense, net. This fee will no longer be payable upon completion of this offering. |

11

Table of Contents

| (g) | Represents a non-recurring earnout payment to the former owners of Hawkeye. |

| (h) | Represents payments funded by our predecessor owner in connection with the TPF Acquisition but reflected in our results of operations. |

| (i) | Represents non-cash share-based compensation under our equity incentive plan. |

| (j) | Represents gains and losses on the sale of certain assets. |

| (k) | Represents certain legal fees relating to an abandoned transaction, as well as gains and losses on the sale of certain assets. |

| (l) | Primarily represents a $2.5 million gain from the proceeds of a key person life insurance policy following the death of one of our operating unit executives. |

| (m) | Primarily represents $1.4 million of professional fees incurred in preparation for this offering. |

| (n) | Represents gains and losses on the sale of certain assets and professional fees incurred in preparation for this offering. |

| (o) | Represents a gain from the resolution of a litigation matter. |

| (5) | Backlog represents the amount of revenue that we expect to realize over the next 12 months from work to be performed on uncompleted contracts, including new contracts on which work has not begun. Our backlog estimate includes amounts under MSAs, our alliance agreement with Oncor and project-by-project bid work. We estimate the amount of work under MSAs to be disclosed as backlog based upon recurring historical trends inherent in the current MSAs, factoring in management’s expectations given seasonal demands and economic conditions and projected customer needs based upon ongoing communications with the customer. However, our MSAs rarely have minimum volume or spending obligations, and many of our contracts may be terminated on short notice, typically zero to 90 days. There can be no assurance as to our customers’ requirements or that our estimates are accurate. In addition, many of our MSAs are subject to renewal options. For purposes of calculating backlog, we have included future renewal options only to the extent we consider the renewals highly likely to occur. With respect to project-by-project bid work, we include the full amount of revenue we expect to realize in the next 12 months on the uncompleted portion of the contract in our estimate of backlog. Our reported backlog as of June 30, 2009 reflects only nominal amounts of work to be performed under the CREZ plan. |

| (6) | Working capital represents total current assets less total current liabilities. |

12

Table of Contents

Before deciding to invest in our common stock, you should carefully consider each of the following risk factors and all of the other information set forth in this prospectus. The following risks and the risks described elsewhere in this prospectus, including in the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” could materially harm our business, financial condition, results of operations, cash flow and business prospects. If any such event were to occur, the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks Relating to Our Business and Our Industry

If the business conditions in the industries we serve do not improve, or continue to deteriorate, due to the current economic downturn, decreases in electricity demand, depressed oil and natural gas prices, the credit crisis or other factors, our customers’ current and future spending, as well as their ability to pay for our services, may be adversely impacted, and as a result, our operations, cash flow and business prospects may suffer.

The U.S. economy is experiencing a severe downturn. The rate at which the economy may further slow and the timing and strength of any recovery is uncertain. The recession is directly affecting our end markets. Electricity demand decreased in 2008 as compared to 2007 and has continued to decrease in 2009. Certain commodity prices, particularly natural gas, have not recovered from their decline in the second half of 2008. As a result of the current economic downturn and depressed energy prices, certain of our customers do not have the ability or desire to fund capital expenditures or have decided to outsource less work. For example, demand for wind generation equipment has fallen from pre-recession levels and depressed natural gas prices have led some of our customers to conclude that exploration and production of certain gas fields are not economically viable. Such capital and outsourcing decisions have led and may continue to lead to a decreased demand for our services and a reduction in the number of projects available for bid, and are adversely affecting our operations, cash flow and growth. In addition, the continuing weakness in the residential and commercial construction markets, which reduces demand for utility infrastructure, continues to adversely affect our distribution business.

Furthermore, many of our customers finance their projects through cash flow from operations, the incurrence of debt or the issuance of equity. The downturn and lower electricity and energy prices have adversely affected the operating performance and cash flow of many of our customers, has caused a significant decline in the availability of credit and has led to substantial declines in many of our customers’ equity values. A reduction in cash flow and the limited availability of debt or equity financing have adversely affected our customers’ capital expenditure plans and the economic viability of alternative energy and other projects and may also impact the ability of our customers to pay amounts owed to us, which could impact our operations, cash flow, growth and financial condition.

We cannot predict the impact of the current economic downturn, the declines in oil and natural gas prices, or the credit crisis, on our customers, our operations or our business prospects, and we cannot predict when or whether projected growth in demand for infrastructure services to the electric power and natural gas utility industries, including alternative energy infrastructure, will materialize.

In addition to the economy, a number of other factors beyond our control could significantly impact the level of capital expenditures by our customers and, as a result, adversely affect our operations, cash flow and business prospects.

Numerous factors beyond our control could also influence the level of capital expenditures by our customers, including:

| • | exploration, production and transportation costs; |

| • | the rate of discovery of new oil and natural gas reserves; |

13

Table of Contents

| • | the sale and expiration dates of oil and natural gas leases and concessions; |

| • | regulatory restraints on the rates that power companies may charge their customers and recoup capital expenditures; |

| • | new home construction rates; |

| • | local and international political conditions; and |

| • | technological advances. |

In addition, our customers may delay, suspend, postpone or fail to pursue any infrastructure project for other reasons. Changes in the expected return, anticipated completion date, planned cost to complete or other factors affecting the viability of a project may reduce the number or size of in-process and planned infrastructure projects and therefore may reduce the opportunities available to us. Our results of operations, cash flow and business prospects could be adversely affected if the level of capital expenditures of our customers does not recover for any of these or for other reasons.

The award of new contracts and the timing of these awards may result in unpredictable fluctuations in the size of our workforce and our revenue, cash flow and profitability.

A substantial portion of our revenue is derived from project-based work, including from our MSA customers. It is generally very difficult to predict with precision whether and when we will be awarded a project, when we may start work on a project once awarded and the expected project timetable or completion date, resulting in unpredictability in our revenue, cash flow and profitability. Going forward, we expect to generate a significant percentage of revenues from large-scale projects, particularly projects we may be awarded as a result of the implementation of CREZ but for which we have not yet received any significant commitments, further exacerbating the unpredictability of our operating results. In addition, some of our contracts are subject to regulatory approval, permitting, financing and other contingencies that may delay or result in termination of projects (including under CREZ), particularly in an economic environment where financing is difficult to obtain. The uncertainty of our contract award timing can also present difficulties in matching workforce size with contract needs. In some cases, we maintain and bear the cost of a ready workforce that is larger than necessary in anticipation of future workforce needs for expected contract awards. If expected contract awards are delayed or not received, or if the volume of projects is lower than expected under our MSAs, in some cases we could incur costs that could be substantial without receipt of corresponding revenues. Finally, the winding down or completion of work on significant projects that were active in previous periods will reduce our revenue and earnings if such significant projects are not replaced in the current period.

Our industry is highly competitive, which could adversely affect our business and profitability.

Our industry is served by numerous small, owner-operated private companies and several large national and regional private and public companies. Relatively few barriers prevent entry into some of the markets in which we operate. As a result, any organization that has adequate financial resources and access to technical expertise may become a competitor with respect to one or more of the services we provide. Competitiveness in our industry depends on a number of factors, including reputation, quality of services, safety record and price. The current economic recession has intensified competition in our industry as industry participants pursue reduced work volumes. Our competitors may have lower overhead cost structures, greater resources or other advantages and, therefore, may be able to provide their services at lower rates than ours or elect to place bids on projects that drive down margins to lower levels than we would accept. We cannot be certain that our competitors do not have or will not develop the expertise, experience and resources that allow them to offer lower prices, higher quality of services or both. Similarly, we cannot be certain that we will be able to maintain or enhance our competitive position in the markets in which we operate or maintain our customer base at current levels. We also face competition from our existing and prospective customers since electric power and natural gas companies often directly employ personnel to perform many of the same types of services we provide. This competition from some customers has increased during the economic recession and may increase further as they seek to keep their

14

Table of Contents

workforces engaged during periods of reduced demand and postponed projects. In addition, some of our customers’ ability to outsource work may be limited by their relations or agreements with their unions. We cannot be certain that our existing or prospective customers will continue to contract for or outsource services in the future at current levels or at all.

In recent years we have begun to face increasing competition from alternative technologies in our cable restoration business. Our CableCURE® product sales may be adversely affected by technological improvements by one or more of our competitors and/or the expiration of our exclusive intellectual property rights in such technology. If we are unable to keep pace with current or future technological advances in cable restoration, our business, financial condition and results of operations may suffer.

We derive a significant portion of our revenue from a small group of customers, including our largest customer, Oncor. The loss of, or our failure to sustain our revenues from, one or more of these customers could negatively impact our results of operations, cash flow and business prospects.

Our top ten customers accounted for 48.8% and 52.9% of our revenues for the year ended December 31, 2008, and the six months ended June 30, 2009, respectively. Our revenue could significantly decline if we lose one or more of our significant customers or if they significantly reduce their use of our services. In addition, revenues under our contracts with significant customers may vary from period-to-period depending on the timing and volume of work that such customers order in a given period due to their own spending plans and budgetary considerations or as a result of competition, including from the in-house service organizations of our customers.

Oncor accounted for $138.4 million, or 16.7%, of revenues for the year ended December 31, 2008 and $96.4 million, or 30.4%, of revenues for the six months ended June 30, 2009. At December 31, 2008 and June 30, 2009, Oncor represented $35.6 million, or 20.3%, and $48.9 million, or 35.6%, of accounts receivable, respectively. In 2008, we entered into an alliance agreement with Oncor. We expect this agreement and the approval of the CREZ buildout in Texas to increase the percentage of our revenues from Oncor. The agreement provides for certain anticipated levels of business from Oncor through 2018, subject to a reduction in levels of business and termination for cause by Oncor under agreed circumstances. The agreement provides for termination without cause at Oncor’s discretion or upon an anticipated or actual change of control of Oncor, subject to a termination fee payable to us as determined pursuant to the agreement. The consummation of this offering will not constitute a change of control of InfrastruX under the agreement. In some cases, the required termination payments could be similar to or less than the maximum volume-based adjustment Oncor would incur if threshold spending levels are not met, which could create an incentive for Oncor to terminate the contract. Oncor can also terminate without cause upon an anticipated or actual change of control of InfrastruX without paying any termination fee and can similarly terminate for cause. See “Business—Contractual Arrangements” for more information. Although the agreement contains certain anticipated spending levels, Oncor has not guaranteed any specific volume of business and revenue under the agreement (including CREZ- related revenue) may vary significantly from period-to-period. Furthermore, we may incur costs in maintaining a workforce available to service the Oncor alliance agreement that may not be fully utilized.

The agreement includes a provision whereby Oncor receives at least as favorable pricing as we charge to other customers for any “similar services” (which is not a defined term under the agreement). Management believes, based on our pricing practices and the nature and scope of the services we provide to Oncor, that we are in compliance with this provision, but we cannot assure you that obligations or disputes will not arise concerning this provision, which could adversely affect us and our revenues and profitability.

The agreement also requires that we continually meet or exceed minimum service levels as measured by specified performance indicators. We have had, and continue to have, service level issues with Oncor from time to time that we have historically been able to resolve to Oncor’s and our mutual satisfaction. However, we cannot assure you that we will be able to do so in the future. If we are unable to perform our obligations under our agreement with Oncor in a manner satisfactory to Oncor, Oncor could in some cases seek to terminate for cause or limit our activity or seek to assess penalties against us under the agreement, any of which could materially adversely affect our results of operations, cash flow and business prospects.

15

Table of Contents

Federal and state legislative and regulatory developments that we believe should encourage electric power transmission and natural gas pipeline infrastructure spending may fail to result in increased demand for our services.

In recent years, federal and state legislation has been passed and resulting regulations have been adopted that could significantly increase spending on electric power transmission and natural gas pipeline infrastructure, including the Energy Act of 2005, the American Recovery and Reinvestment Act of 2009 (ARRA) and state RPS programs. However, much fiscal, regulatory and other uncertainty remains as to the impact this legislation and regulation will ultimately have on the demand for our services. For instance, regulations implementing provisions of the Energy Act of 2005 that may affect demand for our services remain, in some cases, subject to review in various federal courts. In one such case, decided in February 2009, a federal court of appeals vacated FERC’s interpretation of the scope of its backstop transmission line siting authority for electric power transmission projects. Accordingly, the effect of these regulations, once finally implemented, is uncertain and may not result in increased spending on the electric power transmission infrastructure. Continued uncertainty regarding the implementation of the Energy Act of 2005 and ARRA may result in slower growth in demand for our services.

Renewable energy initiatives, including Texas’ CREZ plan, other RPS initiatives and ARRA, may not lead to increased demand for our services. While 29 states and Washington D.C. have mandatory RPS programs that require certain percentages of power to be generated from renewable sources, the RPS programs adopted in many states became law during periods of substantially higher oil and natural gas prices. As a result, or for budgetary or other reasons, states may reduce those mandates or make them optional or extend deadlines, which could reduce, delay or eliminate renewable energy development in the affected states. In addition, states may limit, delay or otherwise alter existing RPS programs in anticipation of a potential federal renewable energy standard. Furthermore, renewable energy is generally more expensive to produce and may require additional power generation sources as backup. Funding for RPS programs may not be available or may be further constrained as a result of the significant declines in government budgets and subsidies and in the availability of credit to finance the significant capital expenditures necessary to build renewable generation capacity. These factors could lead to fewer projects resulting from RPS programs than anticipated or a delay in the timing of these projects and the related infrastructure, which would negatively affect the demand for our services. Moreover, even if the RPS programs are fully developed and funded, we cannot be certain that we will be awarded any resulting contracts. In addition, we cannot predict when programs under ARRA will be implemented or the timing and scope of any investments to be made under these programs, particularly in light of capital constraints on potential developers of these projects. Infrastructure projects such as those envisioned by CREZ and RPS initiatives are also subject to delays or cancellation due to local factors such as siting disputes, protests and litigation. Before we will receive revenues from infrastructure buildouts associated with any of these projects, substantial advance preparations are required such as engineering, procurement, and acquisition and clearance of rights-of-way, all of which are beyond our control. Investments for renewable energy and electric power infrastructure under ARRA may not occur, may be less than anticipated or may be delayed, may be concentrated in locations where we do not have significant capabilities, and any resulting contracts may not be awarded to us, any of which could negatively impact demand for our services.

In addition, the increase in long-term demand for natural gas that we believe will benefit from anticipated U.S. greenhouse gas regulations, such as a cap-and-trade program or carbon taxes, may be delayed or may not occur. For example, we cannot predict whether or in what form the cap-and-trade provisions and renewable energy standards in the CERES bill recently passed by the U.S. House of Representatives will become law. We cannot predict the timing and scope of any potential greenhouse gas regulations or whether such regulation will ultimately be adopted or the extent to which demand for natural gas will increase as a result of any such regulations.

16

Table of Contents

Our customers often have no obligation to award work to us and many of our contracts may be terminated on short notice. As a result, we are at risk of losing significant business on short notice and may not realize our backlog.

Our customers generally have no obligation to assign work to us. Most of our contracts may be terminated by our customers on short notice, typically zero to 90 days. In addition, our customers could materially reduce, eliminate or reassign a portion of the work we have historically performed because our contracts rarely have any minimum volume or spending obligations. Moreover, many of our contracts, including our MSAs, are open to competitive bidding, and we have been displaced on these contracts by competitors from time to time. For example, one of our large customers recently switched a significant portion of its MSA work to a competitor after a bidding process. Our revenues and backlog could materially decline if our customers do not assign work to us or if they cancel a significant number of projects and we cannot replace them with similar projects.

Our backlog may not be realized or may not result in expected revenues and profits.

Our twelve-month backlog as of June 30, 2009 was $384.0 million. However, backlog is difficult to determine with certainty. Our backlog includes anticipated projects under MSAs based to a significant degree on recurring historical trends inherent in the current MSAs, factoring in seasonal demand and projected customer needs based upon ongoing communications with the customer. However, our MSAs rarely have minimum volume or spending obligations, and many of our contracts may be terminated by our customers on short notice, typically zero to 90 days. The failure of our customers to assign projects to us under our MSAs consistent with our expectations or the cancellation by our customers of any other projects could significantly reduce the revenue and profit we actually realize from projects included in backlog. In the event a project on which we have commenced work is cancelled, we may be reimbursed for certain costs but typically have no contractual right to the total revenues included in our backlog. Fixed-price contracts may also remain in our backlog for an extended period of time due to their long-term nature, delays and decisions by our customers to extend the timing of performance. In addition, the backlog we obtain in connection with any companies that we acquire may not be as large as we believe or may not result in the revenue or profit we expect. We cannot give any assurance that the estimates on which our backlog is based are accurate or that the backlog we report will accurately predict our results of operations for future periods.

Our storm restoration revenues are highly volatile and unpredictable, which could result in substantial variations in, and uncertainties regarding, our results of operations.

Revenues derived from our storm restoration services are highly volatile and uncertain due to the unpredictable nature of weather-related events. Our annual storm restoration revenues have been as high as $67.0 million in 2008 when we experienced the largest storm restoration revenues in our history as several significant hurricanes impacted the Gulf Coast and Florida and ice storms affected the Northeast, but storm restoration revenues have been substantially lower in 2009. Therefore, our storm restoration revenues for 2008 are not indicative of the revenues that we typically generate in any period or can be expected to generate in any future period. Our revenues and net income will likely continue to be subject to significant variations and uncertainties due to the volatility of our storm restoration volume. We may not be able to generate incremental revenues from storm activities to the extent that we do not receive permission from our regular customers (including Oncor) to divert resources to the restoration work for customers with which we do not have ongoing MSA relationships, sometimes referred to in this prospectus as “off-system” work. In addition, our storm restoration revenues are offset in part by declines in our T&D services because we staff storm restoration mobilizations by diverting resources from our T&D services.

Seasonal variations and inclement weather may cause significant fluctuations in our operating results, profitability, cash flow and working capital needs.

A significant portion of our business is performed outdoors, exposing our results of operations to seasonal variations and inclement weather. We perform less work in the winter months and work is hindered during other inclement weather events. Our revenue and profitability often decrease during the winter months and during

17

Table of Contents

severe weather conditions because work performed during these periods is more costly to complete. During periods of peak electric power demand in the summer, utilities generally are unable to remove their electric power T&D equipment from service, decreasing the demand for our maintenance services during such periods. Accordingly, our operating results in any particular quarter may not be indicative of the results that can be expected for any other quarter or for the entire year. The seasonality of our business also causes our working capital needs to fluctuate. Because our operating cash flow is usually lower during and following the winter months, we typically experience a need to finance a portion of our working capital during the spring and summer.

Our inability to hire, retain or replace key personnel could disrupt our business.

We depend on the continued efforts of our executive officers and senior management, including management at each operating unit. The relationships between our executive officers and operating unit management and our customers are often important to our being retained. A number of senior managers at our operating units, including the presidents of our operating units, have been working in the industry, or for companies we acquired, for decades and have developed extensive operating expertise in their markets, including strong working relationships with customers and unions. Many of these managers are approaching retirement age and have the ability and resources to leave at any time, and some have had health problems. Although we would seek to replace these managers as necessary with qualified senior personnel, preferably from management within our operating units, we can give no assurance that those replacements would be able to sustain or improve the performance levels achieved by their predecessors.

We are also dependent upon our project managers and field supervisors who are responsible for managing and staffing employees to our projects. Industry-wide competition for managerial talent has been substantial and the loss of one or more of our key employees could have an adverse effect on our business. There can be no assurance that any individual will continue in his or her capacity for any particular period of time. The loss of key personnel, or the inability to hire and retain qualified employees, could negatively impact our ability to manage our business and relationships with our customers. We generally do not carry key person life insurance on our officers or employees. In certain cases, we do not have employment or non-competition/non-solicitation agreements with our officers and key employees, and the non-competition agreements currently in place with other officers and key employees are limited in time and scope or could be found to be unenforceable. As a result, we could be materially adversely affected if any of our experienced managers becomes a competitor.

Our use of unit-price and fixed-price contracts could result in reduced profitability or losses on projects.

We currently generate, and expect to continue to generate, a significant portion of our revenues under unit-price and fixed-price contracts. Under our unit-price contracts, we agree to perform identified units of work for an agreed price. A “unit” can be as small as the installation of a single bolt or a foot of cable or as large as a transmission tower or foundation. The resulting profitability of a particular unit is primarily dependent upon the labor and equipment hours expended to complete the task that comprises the unit. Under fixed-price contracts, we agree to perform the contract for a fixed price. Failure to accurately estimate the costs of completing a particular project could result in reduced profits or losses, including reversals of previously estimated profits. We expect that industry trends could result in an increase in the proportion of our contracts being performed on a unit-price or fixed-price basis, resulting in more profitability risk.