Attached files

| file | filename |

|---|---|

| 8-K - HOUSTON AMERICAN ENERGY 8-K 11-09-2009 - HOUSTON AMERICAN ENERGY CORP | form8-k.htm |

Exhibit

99.1

November

2009

Investor

Presentation

HOUSTON

AMERICAN ENERGY

CORP

CORP

1

Forward-Looking

Statements

This

presentation contains forward-looking statements, including those relating to

our future financial and operational

results, reserves or transactions, that are subject to various risks and uncertainties that could cause the Company’s future

plans, objectives and performance to differ materially from those in the forward-looking statements. Forward-looking

statements can be identified by the use of forward-looking terminology such as “may,” “expect,” “intend,” “plan,” “subject

to,” “anticipate,” “estimate,” “continue,” “present value,” “future,” “reserves,” “appears,” “prospective,” or other variations

thereof or comparable terminology. Factors that could cause or contribute to such differences could include, but are not

limited to, those relating to the results of exploratory drilling activity, the Company’s growth strategy, changes in oil and

natural gas prices, operating risks, availability of drilling equipment, availability of capital, weaknesses in the Company’s

internal controls, the inherent variability in early production tests, dependence on weather conditions, seasonality,

expansion and other activities of competitors, changes in federal or state environmental laws and the administration of

such laws, the general condition of the economy and its effect on the securities market, the availability, terms or

completion of any strategic alternative or any transaction and other factors described in “Risk Factors” and elsewhere in

the Company’s Form 10-K and other filings with the SEC. While we believe our forward-looking statements are based

upon reasonable assumptions, these are factors that are difficult to predict and that are influenced by economic and other

conditions beyond our control.

results, reserves or transactions, that are subject to various risks and uncertainties that could cause the Company’s future

plans, objectives and performance to differ materially from those in the forward-looking statements. Forward-looking

statements can be identified by the use of forward-looking terminology such as “may,” “expect,” “intend,” “plan,” “subject

to,” “anticipate,” “estimate,” “continue,” “present value,” “future,” “reserves,” “appears,” “prospective,” or other variations

thereof or comparable terminology. Factors that could cause or contribute to such differences could include, but are not

limited to, those relating to the results of exploratory drilling activity, the Company’s growth strategy, changes in oil and

natural gas prices, operating risks, availability of drilling equipment, availability of capital, weaknesses in the Company’s

internal controls, the inherent variability in early production tests, dependence on weather conditions, seasonality,

expansion and other activities of competitors, changes in federal or state environmental laws and the administration of

such laws, the general condition of the economy and its effect on the securities market, the availability, terms or

completion of any strategic alternative or any transaction and other factors described in “Risk Factors” and elsewhere in

the Company’s Form 10-K and other filings with the SEC. While we believe our forward-looking statements are based

upon reasonable assumptions, these are factors that are difficult to predict and that are influenced by economic and other

conditions beyond our control.

The

United States Securities and Exchange Commission permits oil and gas companies,

in their filings with the SEC, to

disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be

economically and legally producible under existing economic and operating conditions. We use certain terms in this

document, such as non-proven, resource potential, Probable, Possible, Exploration and unrisked resource potential that

the SEC's guidelines strictly prohibit us from including in filings with the SEC. These terms include reserves with

substantially less certainty, and no discount or other adjustment is included in the presentation of such reserve numbers.

The recipient is urged to consider closely the disclosure in our Form 10-K, File No. 001-32955, available from us at 801

Travis, Suite 1425, Houston, Texas 77002. You can also obtain this form from the SEC by calling 1-800-SEC-0330.

disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be

economically and legally producible under existing economic and operating conditions. We use certain terms in this

document, such as non-proven, resource potential, Probable, Possible, Exploration and unrisked resource potential that

the SEC's guidelines strictly prohibit us from including in filings with the SEC. These terms include reserves with

substantially less certainty, and no discount or other adjustment is included in the presentation of such reserve numbers.

The recipient is urged to consider closely the disclosure in our Form 10-K, File No. 001-32955, available from us at 801

Travis, Suite 1425, Houston, Texas 77002. You can also obtain this form from the SEC by calling 1-800-SEC-0330.

2

Company

Overview

§ Houston American

Energy Corp (NASDAQ:HUSA), the “Company”, is a growth-

oriented independent energy company engaged in the exploration, development and

production of crude oil and natural gas resources

oriented independent energy company engaged in the exploration, development and

production of crude oil and natural gas resources

§ Operations focused

in Colombia

• Current production

of approximately 850 barrels of oil equivalent per day

• Participated in

drilling of 100 wells in Colombia to date

• Developing new

international projects with a focus on Colombia, Peru and Brazil

§ Significant

concessions in Colombia with substantial drilling inventory identified

by

advanced 3-D seismic interpretation

advanced 3-D seismic interpretation

• Over 895,000 gross

acres with more than 100 currently identified drilling prospects

|

Market

Cap:

|

$112.0

MM

|

Debt

Outstanding:

|

$0.0

|

|

Average

Volume:

|

54,000

|

Shares

Outstanding:

|

28,000,772

|

3

Investment

Opportunity

§ Unique portfolio of

high impact, large reserve potential projects in Colombia

• Pure-play small cap

oil focused investment opportunity with substantial upside

potential

• Significant acreage

position focused in the Llanos Basin in Colombia

• Favorable government

royalties and fiscal terms on existing contracts

§ Significant

Technical Partner with SK Energy, a leading Asian integrated oil and

gas

company

company

§ Proven Track

Record

• Participating in

successful drilling program led by Hupecol

• Drilled 100 wells in

Colombia with a 70% success rate to date

• With approximately

$19.8MM in invested capital management has generated in excess of

$112.0MM of market capital to date

$112.0MM of market capital to date

§ Low cost

structure

• Non-operator

strategy allows for minimal corporate staff

• Colombian properties

have lower finding and development costs versus U.S. conventional

and unconventional reserves

and unconventional reserves

§ Experienced

management and board of directors with access to proprietary deal

flow

§ Simple

capitalization structure

4

Business

Strategy

§ Explore and develop

existing properties through the drill bit

• Increase production

and cash flow by drilling and completing identified well locations

• Quantify value of

our asset base through an aggressive testing and drilling program

• Explore for and

develop additional proved reserves on approximately 150,000 net

acres

§ Acquire additional

interest in oil and gas properties through partnerships and joint

ventures with experienced operators

ventures with experienced operators

• Target acquisitions

that enhance our core areas

• Focus on high

impact, lower risk drilling prospects

§ Capitalize on the

expertise, experience and strategic relationships of the

management team and board of directors

management team and board of directors

5

International

Assets

International

Operations - Llanos Basin Colombia

|

Interest

in Eight Concessions and One Technical Evaluation

Agreement

|

|

Operator Interest

SK Energy 25.0%

working interest in the CPO 4 concession covering ~ 345,452

acres

|

|

Shona 12.5%

working interest in the Serrania concession covering ~ 110,769

acres

|

|

Hupecol 12.5%

interest in the Los Picachos Technical Evaluation Agreement (the “TEA") ~

86,235 acres

|

|

Hupecol 12.5%

working interest in the Las Garzas concession covering ~ 103,000

acres

|

|

Hupecol 12.5%

working interest in the Leona concession covering ~ 70,343

acres

|

|

Hupecol 12.5%

working interest in the Cabiona concession covering ~ 86,066

acres

|

|

Hupecol 12.5%

working interest in Dorotea concession covering ~ 51,321

acres

|

|

Hupecol 6.25%

working interest in the Surimena concession covering ~ 69,000

acres

Hupecol 1.6%

working interest in

La Cuerva contract

covering ~ 48,000

acres

|

6

Overview

of Colombia

§ President Alvaro

Uribe Velez (re-elected

May 28, 2006) - Pro Business

May 28, 2006) - Pro Business

§ Main US ally in

South America

§ Population:

45,644,023

§ Capital Bogotá:

7,881,156 citizens

§ Exchange rate 2009:

1,949 COP$/US$

§ Gross domestic

product, GDP, 2008: US$

395.4 Billion

395.4 Billion

§ GDP / Capita, 2008:

$8,800

§ Current Production

of 600,000 bbl/day

§ Estimated 1.36

Billion barrels of proven

reserves

reserves

Source:

Wood Mackenzie, IHS, CIA.GOV

7

Overview

of Colombia

§ Colombia is

currently a net exporter (~ 282,000 bbls/d) of crude

oil, but the country's reserves and production have been

declining

oil, but the country's reserves and production have been

declining

§ To combat this

decline, the Colombian government enacted a

number of incentives aimed to attract foreign investment:

number of incentives aimed to attract foreign investment:

• Sliding scale

royalty rates based on field size, with an

8% royalty rate for most fields

8% royalty rate for most fields

• 100% company

ownership of production projects

• Eliminated

government back-in rights on new

concessions

concessions

• Vastly improved

security environment - President Uribe

on offensive with broad popular support

on offensive with broad popular support

• Military increased

273,000 to 370,000 personnel in 2

years. US assistance at US$600 million/year

years. US assistance at US$600 million/year

• Progressive Colombia

fiscal changes similar to those in

UK which spurred renewed interest in the North Sea

UK which spurred renewed interest in the North Sea

§ Colombia has a well

developed infrastructure system

comprising of over 3,700 miles of crude and product pipelines.

This system is concentrated on transporting crude from the

main producing basins (Llanos and Magdalenas)

comprising of over 3,700 miles of crude and product pipelines.

This system is concentrated on transporting crude from the

main producing basins (Llanos and Magdalenas)

Source:

Wood Mackenzie, IHS, CIA.GOV

8

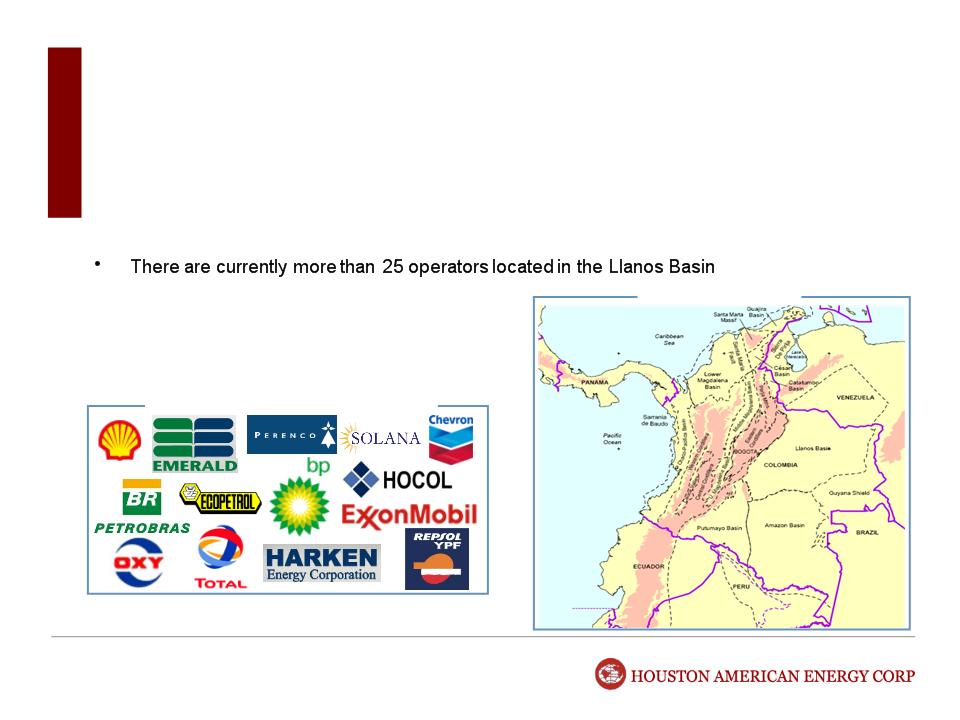

Llanos

Basin

• The Llanos Basin

covers an area of approximately 125,000 square miles

• Its primary geologic

formations are: the Upper Cretaceous, Paleocene and

Eocene

Eocene

• The Llanos Basin is

one of the most

active

basins in Colombia

Colombia

Other

Llanos Basin Operators

Source:

Wood Mackenzie, IHS, CIA.GOV

9

SK

Energy - CPO 4 Block

10

Overview

of SK Energy

Large

Asian conglomerate with an integrated business model

Continued

Operating Profit Growth

Source:

SK Energy Presentation

1 USD =

1189 KRW

SK

Energy Participates in 34 oil and gas blocks and four LNG projects

in 17 countries, with proved oil equivalent reserves of 520 million

barrels (BOE).

in 17 countries, with proved oil equivalent reserves of 520 million

barrels (BOE).

E&P

Business

Petrochemical

Business

SK

Energy is the undisputed leader in the petrochemical business in

Korea. During 2008 SK sold 8,445,000 tons of petrochemical products

for $8.75 billion USD in sales in 2009

Korea. During 2008 SK sold 8,445,000 tons of petrochemical products

for $8.75 billion USD in sales in 2009

Lubricants

Business

Leading

lubricant manufacturer in Korea. During

2008 SK Energy sold

9,531,000 barrels of Lubricants

9,531,000 barrels of Lubricants

Refining and

Petroleum Business

In

2008, SK Energy had $27.12 billion USD in sales (71% of

revenues), with refining capacity of 1.1 million barrels of oil per day.

This represents the largest capacity in Korea, as well as one of the

largest in all of Asia

revenues), with refining capacity of 1.1 million barrels of oil per day.

This represents the largest capacity in Korea, as well as one of the

largest in all of Asia

It

should also be noted that SK Energy has Research and Development

and Technology businesses that are leaders in the industry.

and Technology businesses that are leaders in the industry.

75%

17

12

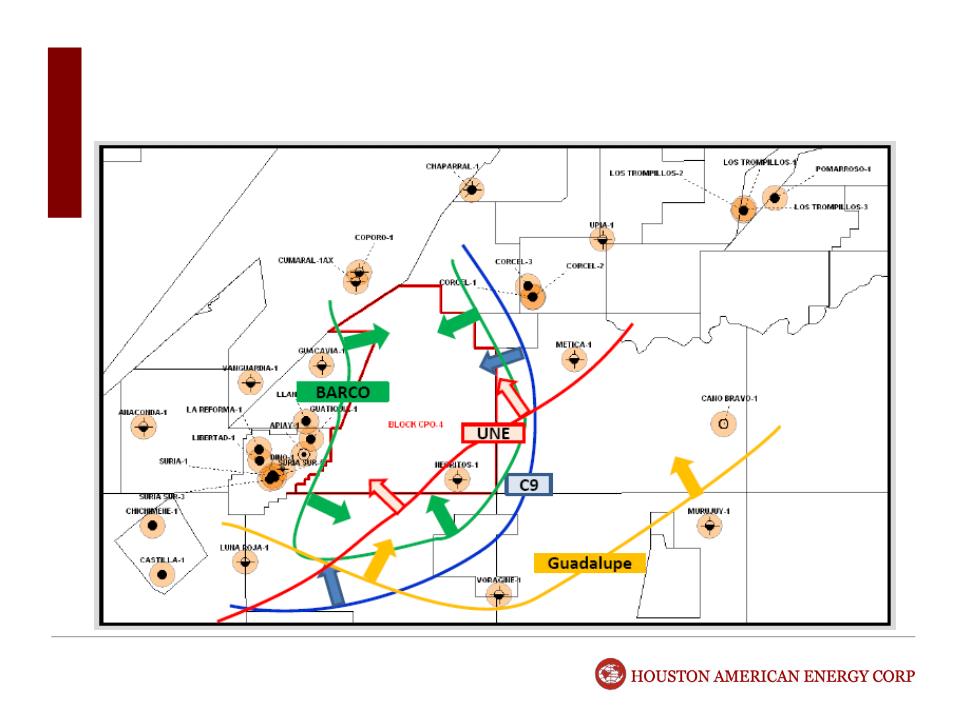

SK

Energy - Farmout Agreement and JOA - CPO 4

§ Contract entered

between National Hydrocarbon Agency of Colombia and SK Energy, a

leading

Korean conglomerate

Korean conglomerate

§ Right to earn an

undivided 25% of the rights of the CPO 4 Contract located in the Western

Llanos

Basin in the Republic of Colombia

Basin in the Republic of Colombia

§ CPO 4 Block consists

of 345,452 net acres and contains over 100 identified leads or prospects

with

estimated recoverable reserves of 1 to 4 billion barrels

estimated recoverable reserves of 1 to 4 billion barrels

§ The Block is located

along the highly productive western margin of the Llanos Basin and is

adjacent

to Apiay field which is estimated to have in excess of 610 million barrels of 25-33 API oil

recoverable. On the CPO 4 Block’s Northeast side lies the Corcel Block where well rates of 2,000 to

14,000 barrels of initial production per day have been announced for recent discoveries.

to Apiay field which is estimated to have in excess of 610 million barrels of 25-33 API oil

recoverable. On the CPO 4 Block’s Northeast side lies the Corcel Block where well rates of 2,000 to

14,000 barrels of initial production per day have been announced for recent discoveries.

§ In addition, the CPO

4 Block is located nearby oil and gas pipeline infrastructure.

§ The Company has

agreed to pay 25% of all past and future cost related to the CPO 4 block as

well

as an additional 12.5% of the seismic acquisition costs incurred during Phase 1 Work Program

as an additional 12.5% of the seismic acquisition costs incurred during Phase 1 Work Program

§ All future cost and

revenue sharing (excluding the phase 1 seismic cost) will be on a heads

up

basis; 75% SK Energy and 25% HUSA - no carried interest or other promoted interest on the block

basis; 75% SK Energy and 25% HUSA - no carried interest or other promoted interest on the block

Corcel

Current

average production of 18,000 Bbl/d

from 8 wells drilled since July of 2007

from 8 wells drilled since July of 2007

15

Reservoir

Distribution

18

Multiple

Reservoir Plays

19

Corcel

Overview

Source:

Petrominerales.com

20

Corcel

Overview (continued)

Source:

Petrominerales.com

21

Corcel

Overview (continued)

Source:

Petrominerales.com

22

Corcel

Overview (continued)

§ Production from

Corcel’s wells have averaged in excess of 5,500 barrels of oil per

day for the first thirty days of production declining to approximately 2,000 barrels of oil

per day after the first year of production.

day for the first thirty days of production declining to approximately 2,000 barrels of oil

per day after the first year of production.

§ Production after the

first year of production is expected to decline marginally at 5 to

10% per annum

10% per annum

§ Multiple stacked pay

sands

§ Active water drive

is expected to result in high ultimate recoveries

§ The Corcel-A2

side-track well (drilled Sept. 09) is producing over 10,000 barrels of

oil

per day of 30 API oil at less than 1% water cut from the Lower Mirador, Upper

Guadalupe and Lower Guadalupe sands.

per day of 30 API oil at less than 1% water cut from the Lower Mirador, Upper

Guadalupe and Lower Guadalupe sands.

Source:

Petrominerales.com

23

Proposed

3D Areas with Structure Maps

24

Land

Satellite Image with Structures and 3D Areas

25

Serrania

Block and Los Picachos

26

Serrania

Block and Los Picachos

§ Contract entered

between Shona Energy (Colombia) Limited (major investors of which

include

Encap and Nabors) and Houston American Energy on June 24, 2009

Encap and Nabors) and Houston American Energy on June 24, 2009

§ Right to earn an

undivided twelve and one half percent (12.5%) of the rights to the Serrania

Contract

for Exploration and Production (the Serrania Contract) which covers the Serrania Block located in

the municipalities of Uribe and La Macarena in the Department of Meta

for Exploration and Production (the Serrania Contract) which covers the Serrania Block located in

the municipalities of Uribe and La Macarena in the Department of Meta

§ Serrania Block

consists of approximately 110,769 acres

§ Oil Royalty: 8% to

5,000 BOPD and sliding scale to 20% at 125,000 BOPD

§ The Block is located

adjacent to the recent Ombu discovery, which is estimated to have

potentially

over one billion barrels of oil in place

over one billion barrels of oil in place

§ The Company has

agreed to pay 25% of Phase 1 Work Program. The

Phase 1 work program

consist of completing a geochemical study, reprocessing existing 2-D seismic data, and the

acquisition, processing and interpretation of 2D seismic program containing approximately 116

kilometers of 2-D data

consist of completing a geochemical study, reprocessing existing 2-D seismic data, and the

acquisition, processing and interpretation of 2D seismic program containing approximately 116

kilometers of 2-D data

§ The Company's is

expected to drill its first well on Serrania Block in the 1st quarter of

2010

§ Los Picachos

Technical Evaluation Agreement encompasses an 86,235 acre region located to

the

west and northwest of the Serrania block

west and northwest of the Serrania block

27

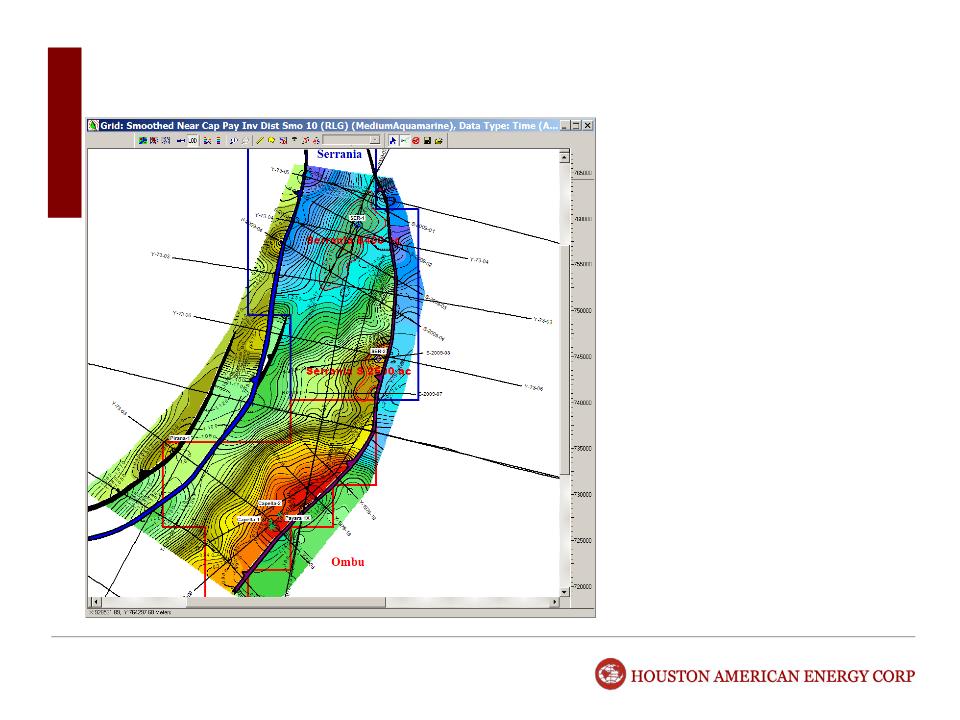

Serrania

Phase One Seismic Program

The

Phase One Seismic program

was competed in September of

2009. We plan on drilling our first

Serrania well in the first quarter of

2010

was competed in September of

2009. We plan on drilling our first

Serrania well in the first quarter of

2010

28

Picture

of Ombu field extension onto Serrania

Key

Points

Ombu

Field

Emerald

Energy - 90% owner and operator

of the Ombu field recently sold to

Sinochem Resources for approximately

$836 million USD. Emerald’s major assets

were located in Syria and Colombia.

Emerald’s major Colombian asset was the

Ombu field in the Llanos Basin

of the Ombu field recently sold to

Sinochem Resources for approximately

$836 million USD. Emerald’s major assets

were located in Syria and Colombia.

Emerald’s major Colombian asset was the

Ombu field in the Llanos Basin

Canacol

Energy LTD (TSX-V: CNE) - 10%

owner of the Ombu field is estimating that

there is up to 1.1 billion barrels of original

oil in place on the Ombu field

owner of the Ombu field is estimating that

there is up to 1.1 billion barrels of original

oil in place on the Ombu field

In 2009

Emerald Energy after drilling 5

wells on the Ombu field was given potential

recoverable reserves of 122 million barrels

by Netherland, Sewell & Associates, Inc.

Production rates of the five wells ranged

from 100 to 400 bbl/d

wells on the Ombu field was given potential

recoverable reserves of 122 million barrels

by Netherland, Sewell & Associates, Inc.

Production rates of the five wells ranged

from 100 to 400 bbl/d

Source:

Emeraldenergy.com, Canacolenergy.com

29

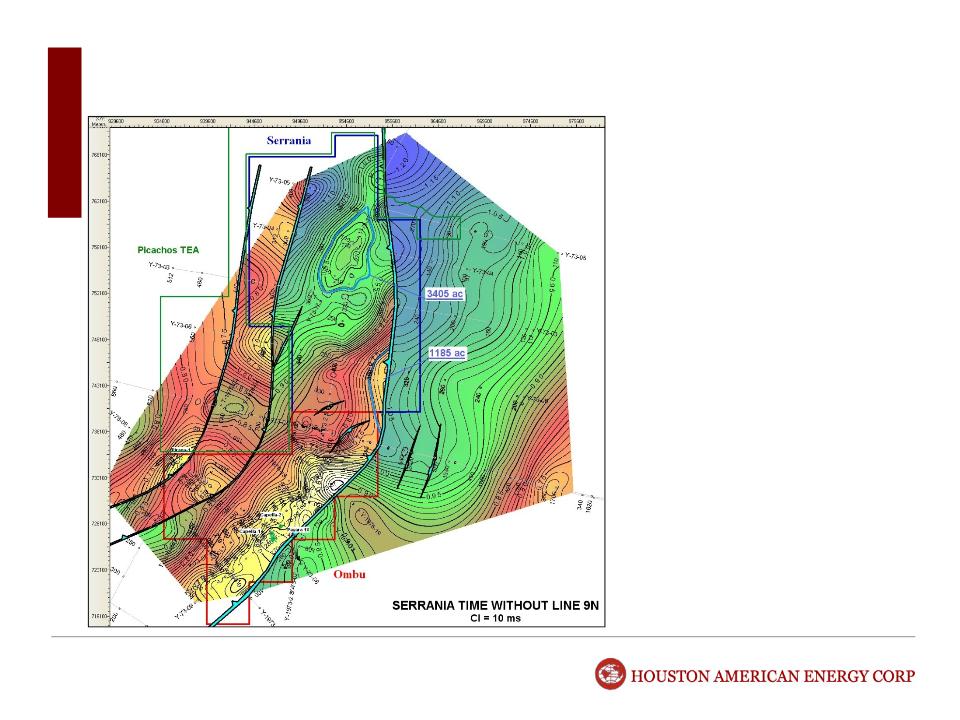

Los

Picachos TEA

Los

Picachos establishes a future

growth area for the Serrania

concession

growth area for the Serrania

concession

Initial

2-D data has identified several

large prospects located on the Los

Picachos TEA similar to those found

on the Ombu Block to the south east

large prospects located on the Los

Picachos TEA similar to those found

on the Ombu Block to the south east

Los

Picachos encompasses an

86,235 acre region located to the

west and northwest of the Serrania

block

86,235 acre region located to the

west and northwest of the Serrania

block

30

Hupecol

Operated Assets

31

• Operator:

Hupecol

• Hupecol has acquired

significant

concessions in the Llanos Basin since

Houston American Energy’s inception in April

2001. The following are HUSA’s effective

working interests based on its indirect

ownership interests in Hupecol:

concessions in the Llanos Basin since

Houston American Energy’s inception in April

2001. The following are HUSA’s effective

working interests based on its indirect

ownership interests in Hupecol:

• Current net

production of 850 boe/d

• Currently 5 of the

six concessions operated

by Hupecol are for sale by Scotia Waterous

by Hupecol are for sale by Scotia Waterous

Hupecol

Colombian Operations

|

• La

Cuerva

|

1.6%

W.I.

|

|

• Dorotea

|

12.5%

W.I.

|

|

• Leona

|

12.5%

W.I.

|

|

• Cabiona

|

12.5%

W.I.

|

|

• Las

Garzas

|

12.5%

W.I.

|

|

• Surimena

|

6.25%

W.I.

|

Colombia

Operations

*

Highlighted Concessions are currently for sale

32

Overview

of Hupecol (Private

Company)

§ Operator of the

majority of the Company’s existing producing Colombian assets

§ Privately held

E&P company with offices in Colombia and Texas

• Hupecol’s managing

partner currently operates significant production and gathering

facilities

domestically in the U.S.

domestically in the U.S.

• Operates with an

extensive staff of geologists, petroleum engineers, geophysical and

accounting professionals

accounting professionals

§ One of the more

active independents operating in Colombia

• Hupecol currently

produces approximately 7,500 barrels of oil equivalent per day in

Colombia

Colombia

• Hupecol sits on the

Board of Directors of the Colombian Petroleum Association General

Assembly along with Perenco, Petrobras, ExxonMobil, Hocol, and Terpel

Assembly along with Perenco, Petrobras, ExxonMobil, Hocol, and Terpel

§ Proven track

record

• In June 2008, the

Company, through Hupecol Caracara LLC as owner/operator, sold all of

the Caracara assets to Cepsa, covering approximately 232,500 acres for USD $920 million

the Caracara assets to Cepsa, covering approximately 232,500 acres for USD $920 million

• As a result of the

sale of the Caracara assets, HUSA received net proceeds of $11.55

mm

• Drilled over 100

wells in Colombia to date with a 70% success ratio

33

Appendix

34

Budget

through December 2010

(1) Per

the SK Farm-Out agreement, HUSA pays an additional 12.5% of the Seismic

Acquisition Cost.

(2) Per

the Shona Farm-Out Agreement, HUSA pays an additional 12.5% of the Seismic

Acquisition Cost.

(3) Cash

flow from existing production is expected to fund all future Capex. Select

properties are presently being offered for sale.

35

36

HUSA

Financial Overview

§ Strong Balance Sheet

with no debt.

§ Significant

production growth since the first quarter of 2009 from existing Hupecol

operated

properties.

properties.

37

Management

Biography

John F.

Terwilliger, President and CEO

John F.

Terwilliger has served as the Company's President, Chairman and Chief Executive

Officer since its

inception in April 2001. From 1988 to 2001, Mr. Terwilliger served as Chairman of the Board and President of

Moose Oil and Gas Company, a Houston based exploration and production company focused on operations in the

Texas Gulf Coast region. Prior to 1988, Mr. Terwilliger was Chairman of the Board and President of Cambridge Oil

Company, a Texas based exploration and production company. John is a member of the Houston Geological

Society, Houston Producers Forum, Independent Petroleum Association of America and the Society of Petroleum

Engineers.

inception in April 2001. From 1988 to 2001, Mr. Terwilliger served as Chairman of the Board and President of

Moose Oil and Gas Company, a Houston based exploration and production company focused on operations in the

Texas Gulf Coast region. Prior to 1988, Mr. Terwilliger was Chairman of the Board and President of Cambridge Oil

Company, a Texas based exploration and production company. John is a member of the Houston Geological

Society, Houston Producers Forum, Independent Petroleum Association of America and the Society of Petroleum

Engineers.

James

J. Jacobs -Chief Financial Officer

James

“Jay” Jacobs has served as the Company’s Chief Financial Officer since joining

the Company in July 2006.

From April 2003 until joining the Company in July 2006, Mr. Jacobs served as an Associate and as Vice President

in the Energy Investment Banking division at Sanders Morris Harris, Inc., an investment banking firm

headquartered in Houston Texas, where he specialized in energy sector financings and transactions for a wide

variety of energy companies. Prior to joining Sanders Morris Harris, Mr. Jacobs worked as a financial analyst for

Duke Capital Partners where he worked on the execution of senior secured, mezzanine, volumetric production

payment, and equity transactions for exploration and production companies. Prior to joining Duke Capital Partners,

Mr. Jacobs worked in the Corporate Tax Group of Deloitte and Touché LLP. Mr. Jacobs holds a B.B.A. and a

Masters in Professional Accounting from the McCombs School of Business at the University of Texas in Austin and

is a Certified Public Accountant.

From April 2003 until joining the Company in July 2006, Mr. Jacobs served as an Associate and as Vice President

in the Energy Investment Banking division at Sanders Morris Harris, Inc., an investment banking firm

headquartered in Houston Texas, where he specialized in energy sector financings and transactions for a wide

variety of energy companies. Prior to joining Sanders Morris Harris, Mr. Jacobs worked as a financial analyst for

Duke Capital Partners where he worked on the execution of senior secured, mezzanine, volumetric production

payment, and equity transactions for exploration and production companies. Prior to joining Duke Capital Partners,

Mr. Jacobs worked in the Corporate Tax Group of Deloitte and Touché LLP. Mr. Jacobs holds a B.B.A. and a

Masters in Professional Accounting from the McCombs School of Business at the University of Texas in Austin and

is a Certified Public Accountant.

38

Lee

Tawes

Mr.

Tawes is Executive Vice President, Head of Investment Banking and a Director of

Northeast Securities, Inc. Prior to

joining Northeast Securities, Mr. Tawes held management and research analyst positions with C.E. Unterberg, Towbin,

Oppenheimer & Co. Inc., CIBC World Markets and Goldman Sachs & Co. from 1972 to 2001. Mr. Tawes has served as a

Director of Baywood International, Inc. since 2001 and of GSE Systems, Inc. since 2006. Mr. Tawes is a graduate of Princeton

University and received his MBA from Darden School at the University of Virginia

joining Northeast Securities, Mr. Tawes held management and research analyst positions with C.E. Unterberg, Towbin,

Oppenheimer & Co. Inc., CIBC World Markets and Goldman Sachs & Co. from 1972 to 2001. Mr. Tawes has served as a

Director of Baywood International, Inc. since 2001 and of GSE Systems, Inc. since 2006. Mr. Tawes is a graduate of Princeton

University and received his MBA from Darden School at the University of Virginia

Ted

Broun

Mr.

Broun is the owner/operator of Broun Energy, LLC, an oil and gas exploration and

production company. He co-founded,

and, from 1994 to 2003, was Vice President and Managing Partner of Sierra Mineral Development, L.C., an oil and gas

exploration and production company. Previously, Mr. Broun was a partner and consultant in Tierra Mineral Development, L.C.

and served in various petroleum engineering and management capacities with Atlantic Richfield Company, Tenneco Oil

Company, ITR Petroleum, Inc. General Atlantic Resources, Inc. and West Hall Associates, Inc. Mr. Broun received his B.S. in

Petroleum Engineering from the University of Texas and an M.S. in Engineering Management from the University of Alaska.

and, from 1994 to 2003, was Vice President and Managing Partner of Sierra Mineral Development, L.C., an oil and gas

exploration and production company. Previously, Mr. Broun was a partner and consultant in Tierra Mineral Development, L.C.

and served in various petroleum engineering and management capacities with Atlantic Richfield Company, Tenneco Oil

Company, ITR Petroleum, Inc. General Atlantic Resources, Inc. and West Hall Associates, Inc. Mr. Broun received his B.S. in

Petroleum Engineering from the University of Texas and an M.S. in Engineering Management from the University of Alaska.

Stephen

Hartzell

Since

2003, Mr. Hartzell has been an owner/operator of Southern Star Exploration, LLC,

an independent oil and gas company.

From 1986 to 2003, Mr. Hartzell served as an independent consulting geologist. From 1978 to 1986, Mr. Hartzell served as a

petroleum geologist, division geologist and senior geologist with Amoco Production Company, Tesoro Petroleum Corporation,

Moore McCormack Energy and American Hunter Exploration. Mr. Hartzell received his B.S. in Geology from Western Illinois

University and an M.S. in Geology from Northern Illinois University.

From 1986 to 2003, Mr. Hartzell served as an independent consulting geologist. From 1978 to 1986, Mr. Hartzell served as a

petroleum geologist, division geologist and senior geologist with Amoco Production Company, Tesoro Petroleum Corporation,

Moore McCormack Energy and American Hunter Exploration. Mr. Hartzell received his B.S. in Geology from Western Illinois

University and an M.S. in Geology from Northern Illinois University.

John

Boylan

Mr.

Boylan has served as a financial consultant to the oil and gas industry since

January 2008. Mr. Boylan served as a

manager of Atasca Resources, an independent oil and gas exploration and production company, from 2003 through 2007.

Previously, Mr. Boylan served in various executive capacities in the energy industry, including both the exploration and

production and oil services sectors. Mr. Boylan’s experience also includes work as a senior auditor for KPMG Peat Marwick

and a senior associate project management consultant for Coopers & Lybrand Consulting. Mr. Boylan holds a B.B.A. with a

major in Accounting from the University of Texas and an M.B.A. with majors in Finance, Economics and International Business

from New York University.

manager of Atasca Resources, an independent oil and gas exploration and production company, from 2003 through 2007.

Previously, Mr. Boylan served in various executive capacities in the energy industry, including both the exploration and

production and oil services sectors. Mr. Boylan’s experience also includes work as a senior auditor for KPMG Peat Marwick

and a senior associate project management consultant for Coopers & Lybrand Consulting. Mr. Boylan holds a B.B.A. with a

major in Accounting from the University of Texas and an M.B.A. with majors in Finance, Economics and International Business

from New York University.

Board

of Directors