Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K 3RD QTR INVESTOR PRESENTATION - COMFORT SYSTEMS USA INC | form8-k.htm |

As

of November 10, 2009

This

presentation contains “forward-looking statements” within the meaning of the

Private Securities Litigation

Reform Act of 1995. These statements are based on the current plans and expectations of future events of

Comfort Systems USA, Inc. and involve risks and uncertainties that could cause actual future activities and

results of operations to be materially different from those set forth in the forward-looking statements. Important

factors that could cause actual results to differ include, among others, the use of incorrect estimates for bidding

a fixed-price contract, undertaking contractual commitments that exceed our labor resources, failing to perform

contractual obligations efficiently enough to maintain profitability; national or regional weakness in construction

activity and economic conditions, financial difficulties affecting projects, vendors, customers, or subcontractors,

difficulty in obtaining or increased costs associated with bonding and insurance, shortages of labor and

specialty building materials, retention of key management, our backlog failing to translate into actual revenue or

profits, errors in our percentage-of-completion method of accounting, the result of competition in our markets,

seasonal fluctuation in the demand for HVAC systems, the imposition of past and future liability from

environmental, safety, and health regulations including the inherent risk associated with self-insurance, adverse

litigation results and other risks detailed in our reports filed with the Securities and Exchange Commission. A

further list and description of these risks, uncertainties and other factors are discussed under “Item 1A.

Company Risks Factors” in the Company’s Annual Report on

Reform Act of 1995. These statements are based on the current plans and expectations of future events of

Comfort Systems USA, Inc. and involve risks and uncertainties that could cause actual future activities and

results of operations to be materially different from those set forth in the forward-looking statements. Important

factors that could cause actual results to differ include, among others, the use of incorrect estimates for bidding

a fixed-price contract, undertaking contractual commitments that exceed our labor resources, failing to perform

contractual obligations efficiently enough to maintain profitability; national or regional weakness in construction

activity and economic conditions, financial difficulties affecting projects, vendors, customers, or subcontractors,

difficulty in obtaining or increased costs associated with bonding and insurance, shortages of labor and

specialty building materials, retention of key management, our backlog failing to translate into actual revenue or

profits, errors in our percentage-of-completion method of accounting, the result of competition in our markets,

seasonal fluctuation in the demand for HVAC systems, the imposition of past and future liability from

environmental, safety, and health regulations including the inherent risk associated with self-insurance, adverse

litigation results and other risks detailed in our reports filed with the Securities and Exchange Commission. A

further list and description of these risks, uncertainties and other factors are discussed under “Item 1A.

Company Risks Factors” in the Company’s Annual Report on

Form

10-K for the

year ended December 31, 2008. These forward-looking statements speak only as of

the

date of this filing. Comfort Systems USA, Inc. expressly disclaims any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statement contained herein to reflect any change in our

expectations with regard thereto or any change in events, developments, conditions or circumstances on which

any such statement is based.

date of this filing. Comfort Systems USA, Inc. expressly disclaims any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statement contained herein to reflect any change in our

expectations with regard thereto or any change in events, developments, conditions or circumstances on which

any such statement is based.

Safe Harbor

Statement

3

To

be the nation’s premier

HVAC and mechanical

systems installation

HVAC and mechanical

systems installation

and

services provider.

Vision

4

Mission

To

provide the best value HVAC and

mechanical systems installation and

service, principally in the mid-market

commercial, industrial, and institutional

sectors, while caring for our customers,

employees and the environment and

realizing superior returns for our

stockholders.

mechanical systems installation and

service, principally in the mid-market

commercial, industrial, and institutional

sectors, while caring for our customers,

employees and the environment and

realizing superior returns for our

stockholders.

5

● Act

with honesty and integrity.

● Show

respect for all stakeholders.

● Exceed

customer expectations.

● Seek

“win-win” solutions.

● Demonstrate

spirit, drive, and teamwork.

● Pursue

innovation.

● Achieve

premier safety performance.

● Commit

to energy efficiency.

● Communicate

openly…..and often.

● Impact

our communities positively.

Values

6

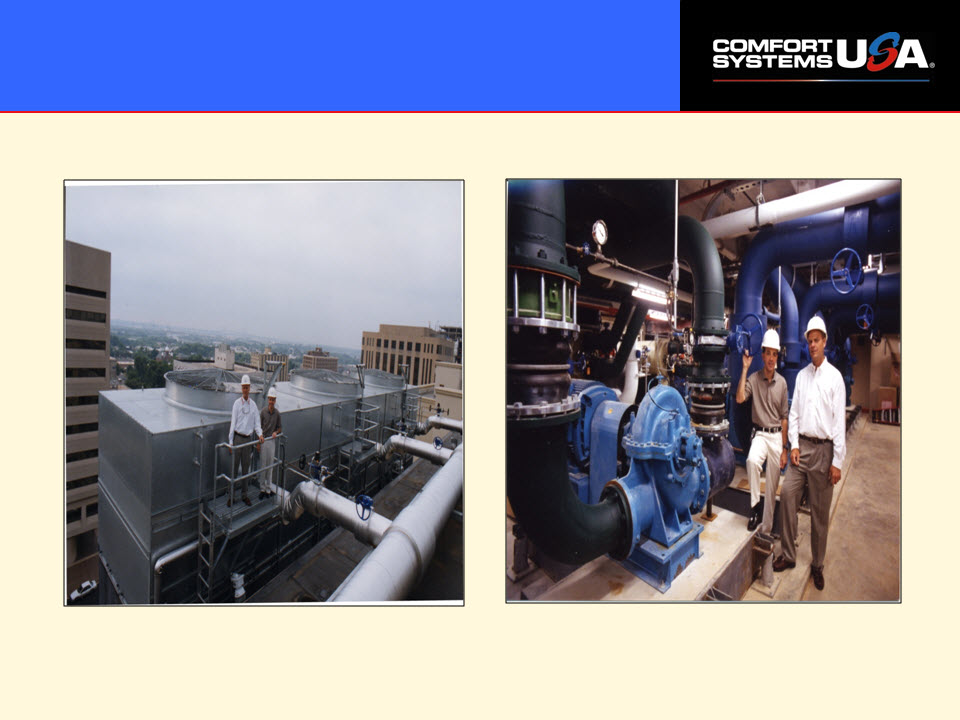

Comfort Systems

USA

§ National

§ Commercial,

Industrial, Institutional

§ HVAC/Piping/Plumbing/Energy

Efficiency

§ Strong

balance sheet

§ Substantial

positive cash flow

§ 52%

new construction; 48% service, repair,

retrofit (YTD Q3 09)

retrofit (YTD Q3 09)

§ 2008

Full Year Revenues $1.3 billion

§ 2009

Full Year Run Rate $1.15 billion

7

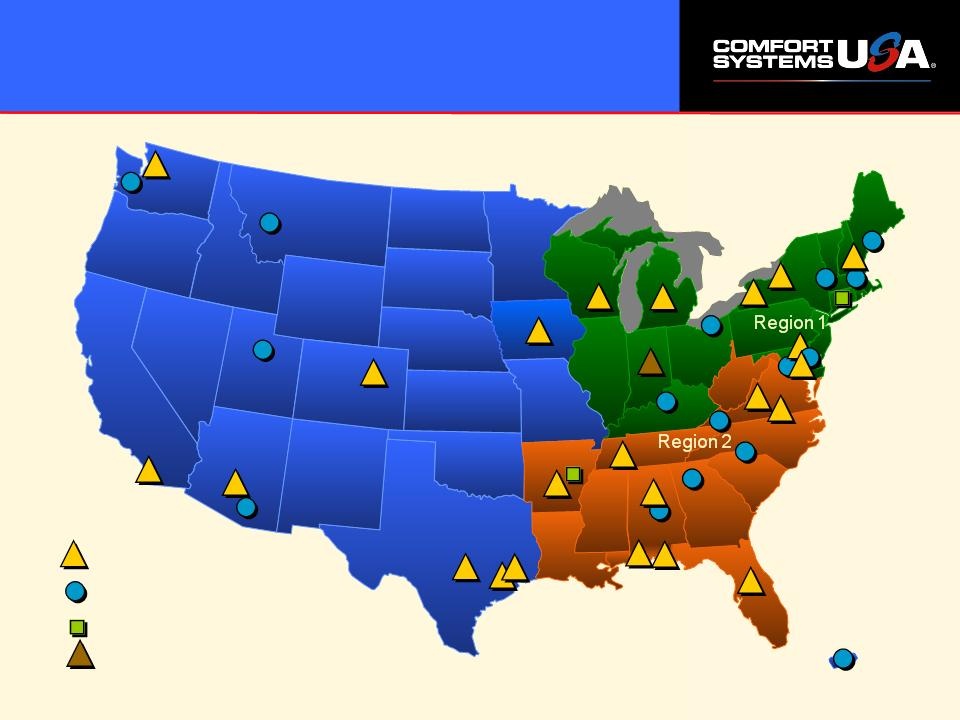

Comfort

Today

Over $20M

$10M

- $20M

Comfort

Systems USA Energy Services

Comfort

Systems USA National Accounts

ANNUAL

REVENUES

Region

3

8

What We

Do

Commercial

HVAC

§ Building

comfort

a “necessity”

a “necessity”

§ Mechanical

equipment -

requires service, repair,

replacement

requires service, repair,

replacement

§ Increasing

technical

content and building

automation

content and building

automation

§ Energy

efficiency and

Indoor Air Quality (IAQ)

emerging

Indoor Air Quality (IAQ)

emerging

§ Outsourcing

D

R I V E R S

Commercial,

Industrial, Institutional HVAC - A $40B+ Industry

Applied

Systems

Piping

Energy

Efficiency

9

Industry Trend

Toward Service &

Replacement (Recurring Revenue)

Replacement (Recurring Revenue)

§ 5+

million

commercial

buildings (DOE)

commercial

buildings (DOE)

§ Recurring

service

§ 20

year

replacement

cycle

replacement

cycle

§ “Inventory”

of

future business

future business

§ OEMs

note

significant deferred

maintenance &

replacement over

recent years

significant deferred

maintenance &

replacement over

recent years

Source:

The Trane Company

NEW

CONSTRUCTION

70%

30%

0%

50%

100%

1980

Share

of

Industry

Revenues

Industry

Revenues

Time

70%

30%

SERVICE

& REPLACEMENT

10

14%

34%

52%

Revenues by

Activity

New

Construction/

Installation

Installation

Replacement

Service

and

Maintenance

Maintenance

September

2009 YTD

11

PROJECT

SIZE

#

OF PROJECTS (As

of September 30, 2009)

Diverse Project

Mix

Average

Project Size

$425,000

$425,000

Average

Project Length

6-9 months

6-9 months

Value

of Projects >$1M

$1,286.0M

$1,286.0M

Value

of Projects <$1M

$612.5M

$612.5M

4,149

241

53

19

6

TOTAL

PROJECTS = 4,468

12

Healthcare

Education

Government

Manufacturing

Office

Building

Multi-Family

Retail/Restaurants

Other

Residential

24%

14%

12%

11%

9%

8%

12

%

%

1%

2%

Top

Ten Customers

Diverse End-Use

Base

§ Served

by 10 different Comfort operating units

§ Largest

customer = less than 2% of revenues

Lodging

& Entertainment

September

2009 YTD

4%

3%

Religious

& Not-for-Profit

13

Diverse End-Use

Base

Omni

Orlando Resort at ChampionsGate

Orlando,

Florida

University

Hospital

Little

Rock, Arkansas

Arboretum

Elementary School

Waunakee,

Wisconsin

Iowa

Renewal Energy

Washington,

Iowa

14

Competitive

Advantages

§ High

quality operations

§ Ability

to leverage and proliferate

technical expertise

technical expertise

§ Ability

to collaborate on large jobs

and share labor

and share labor

§ Energy

efficiency services

§ National

multi-location service capability

§ Purchasing

economics

§ Balance

sheet strength

§ Bonding

and insurance

§ Strong

safety record

15

§ OSHA

Incident Rate decreased from

3.21 to 2.94

3.21 to 2.94

§ Lost

Time Injury Rate is 63% less than

industry average

industry average

§ WC

claims cost per payroll dollar down

from 3.5% to <1%

from 3.5% to <1%

§ Achieved

97.6% training completed

§ 26%

reduction in the overall CSUSA

Composite Safety Index Score from

January to September

Composite Safety Index Score from

January to September

Source: Bureau

of Labor Statistics, Standard Industry Classification (SIC)

Code 20 1710 - Specialty Trades Contractors - HVAC and Plumbing & North American

Industry Classification System (NAICS) Code 23822

Code 20 1710 - Specialty Trades Contractors - HVAC and Plumbing & North American

Industry Classification System (NAICS) Code 23822

Safety

48% Difference

20% Difference

Industry

Average

(October

2008 - latest available data)

Comfort

Systems USA

(September

2009 data)

Our

safety record is no accident.

16

History -

Financial

Nonresidential

Construction

Spending

(FW

Dodge)

9/11/01

298

854

1,370

1,591

1,546

819

785

767

893

1,057

1,110

1,329

Revenues

Acquisition

Phase

and Industry Growth

and Industry Growth

Sale

of Assets

Financial

Overview

18

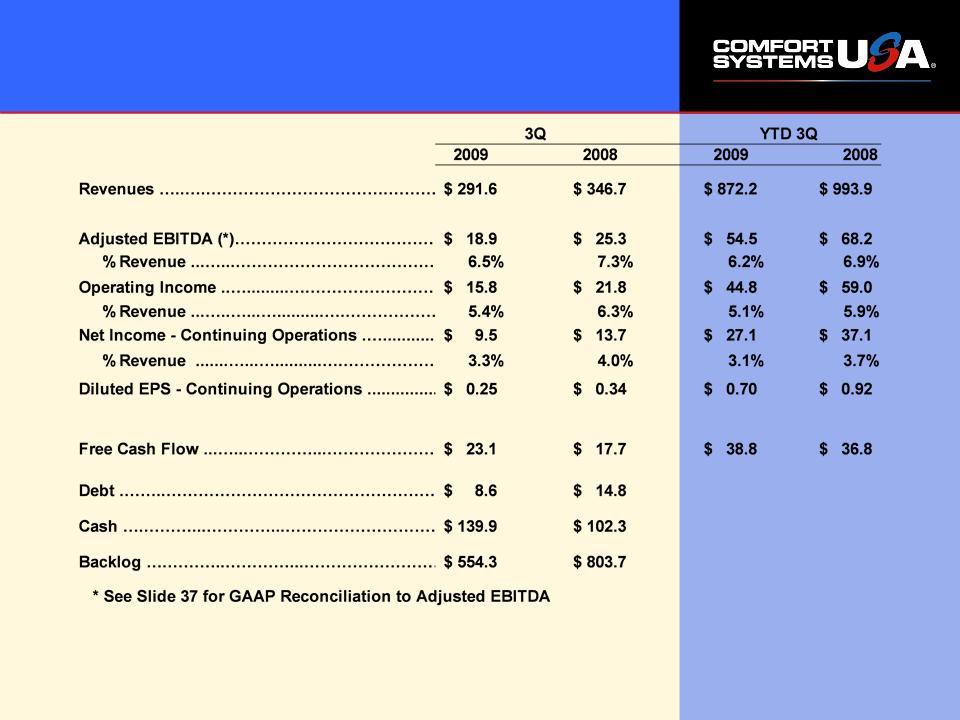

Financial

Profile

($ in millions, except per share amounts)

($ in millions, except per share amounts)

19

Revenues

Note:

Excludes all divested and discontinued operations

20

Operating Margins

(a)

(a) This

table includes non-GAAP financial information as the information

provided excludes goodwill impairment charges of $0.6 million and

$33.9 million for 2004 and 2005, respectively. No goodwill impairment

charge was recorded for 2006, 2007 or 2008.

provided excludes goodwill impairment charges of $0.6 million and

$33.9 million for 2004 and 2005, respectively. No goodwill impairment

charge was recorded for 2006, 2007 or 2008.

(b) Operating

margins for the nine months ended September 30, 2009 were

5.1%.

5.1%.

Backlog (in

millions)

Note:

Excludes all divested and discontinued operations

22

Strong Cash Flows

(in millions)

23

Financial

Strengths

§ Market

share up - revenue and profit

performance better than industry

performance better than industry

§ Commitment

to cost containment

§ $139.9

million cash at 9/30/09; substantial

credit capacity if needed

credit capacity if needed

§ Positive

free cash flow for ten calendar

years

years

24

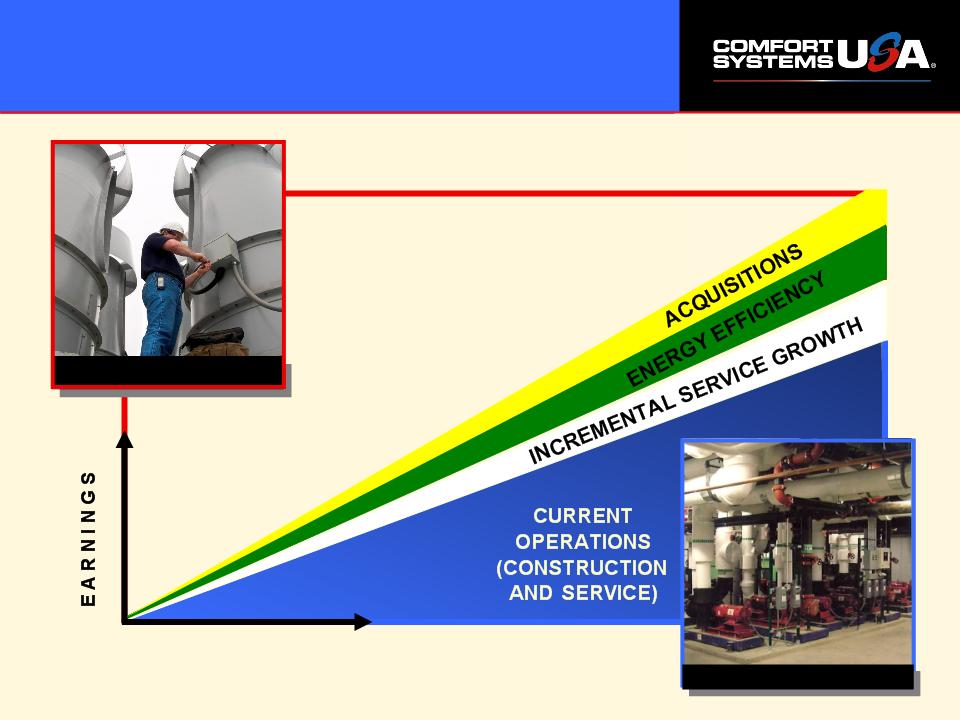

Profile For

Growth

T

I M E

Service

Commercial

HVAC

25

Operations

Increase

Productivity

§ Education

– Leadership

– Project

Managers

– Superintendents

– Service

Sales

– Service

Operations

– Craft

– Safety

§ Best

Practices

– Project

Management

– Estimating

§ Cooperation

with suppliers

§ Prefabrication

§ New

materials and methods

26

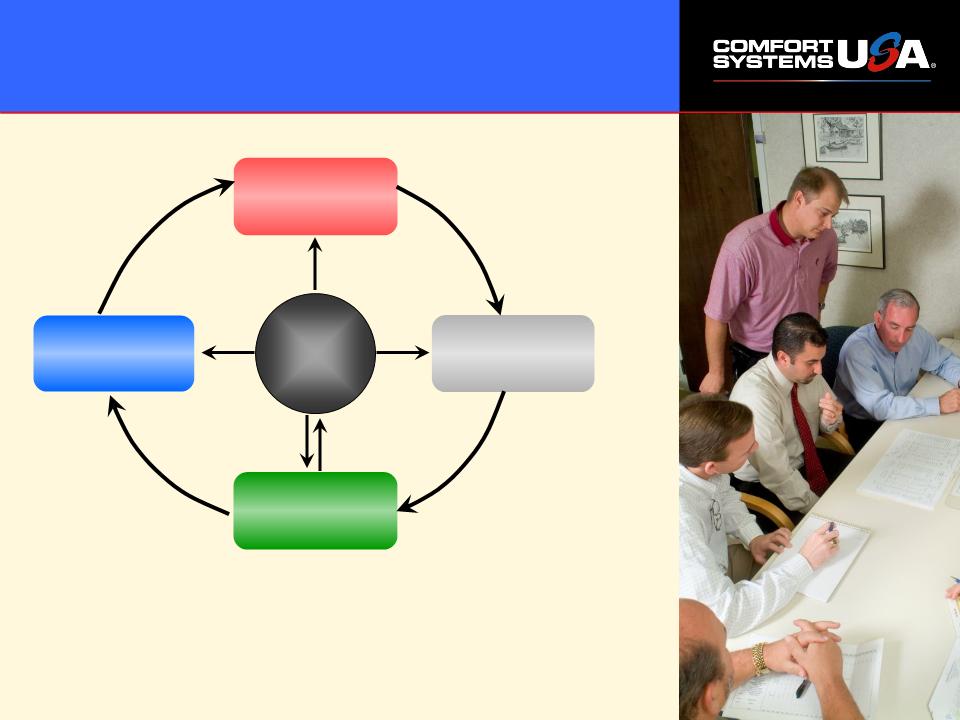

Job

Loop

Project

Estimating

Post-Project

Review

Review

We

review projects and apply what we have

learned to improve our performance.

learned to improve our performance.

Project

Pricing

Project

Qualification

Project

Management

27

The

only things that evolve by

themselves in an organization are

disorder, friction and

malperformance.

themselves in an organization are

disorder, friction and

malperformance.

-Peter

Drucker

28

Service

Increase

Service*

§ Grow

Maintenance Base

§ Education

–Employees and

Customers

§ Higher

margin opportunity

§ Recurring

revenue

§ National

accounts

§ $2.50+

of repair and replacement

for every $1.00 of maintenance

for every $1.00 of maintenance

§ Target

Retrofit Projects

–Energy

Efficiency

–Indoor Air Quality

(IAQ)

*

Maintenance, service, repair, retrofit

29

National Account

Customers

*Trademarks

and logos are the property of their respective owners.

30

Energy

Efficiency-Retrofitting HVAC

Green

Is Part Of Our Business

§ Energy

costs drive need for efficiency

§ HVAC

30% - 65 % electric usage

§ Energy

Star (Dept. of Energy/EPA) / LEED

(USGBC)

(USGBC)

Use

Our Energy to Save Yours! ™

31

Growth

§ Internal

– More of what we do

best

– Service

– Energy

efficiency

§ Step

Out Growth

– New locations for

existing companies

– Techs “on their

own”

§ Targeted

acquisitions

– Best HVAC oriented

mechanical in

new area

new area

32

● $20

million + in revenue

● Construction

and service

● In

a growing market in new area

● Company

that has performed well in the

past and has continuing demonstrable

upside

past and has continuing demonstrable

upside

● Organizational

structure capable of

sustaining/improving the company

sustaining/improving the company

● Ownership/management

that wants to

stay on to operate company

stay on to operate company

The Ideal

Candidate

33

● Boise,

ID

● Charleston,

SC

● Columbia/Florence,

SC

● Dallas/Fort

Worth, TX

● El

Paso, TX

● Ft.

Lauderdale, FL

● Los

Angeles, CA

● Nashville,

TN

● Norfolk,

VA

Target

Markets

(Listed

Alphabetically)

● Omaha,

NE

●

Portland,

OR

● Raleigh,

NC

● Richmond,

VA

● San

Antonio, TX

● Savannah,

GA

●

Spartanburg/Greenville,

SC

● Tampa,

FL

● Tulsa,

OK

34

Outlook

Long-Term

§ $40+

billion fragmented industry

§ HVAC

is a basic necessity

§ Commercial

construction continuing

§ Growing

installed base for recurring

maintenance, service, repair and retrofit

maintenance, service, repair and retrofit

§ Scale

opportunities - service, purchasing,

prefab, bonding, best practices

prefab, bonding, best practices

§ Diverse

customer base and geography

§ Energy

efficiency and

Indoor Air Quality

§ Financially

and operationally sound - continuing

to grow organically and by acquisition

to grow organically and by acquisition

35

What We

Do

37

Appendix

38

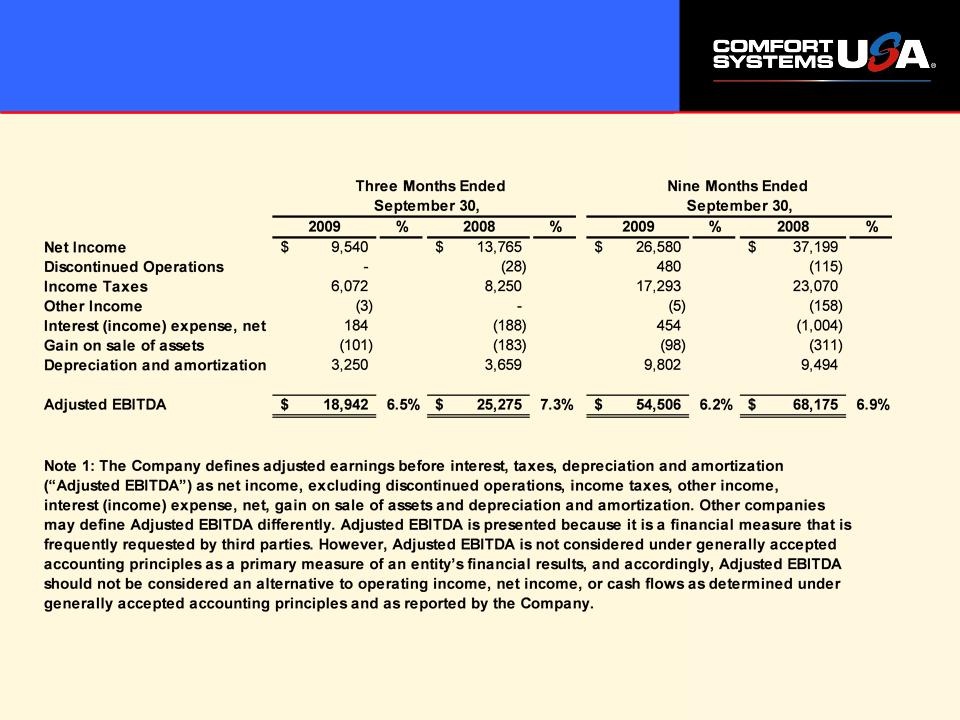

Appendix - GAAP

Reconciliation To

Adjusted EBITDA (in thousands)

Adjusted EBITDA (in thousands)

C

O N T A C T:

Bill

George

Executive

Vice President and CFO

1-800-723-8431

bgeorge@comfortsystemsusa.com

www.comfortsystemsusa.com