Attached files

Exhibit 10.19

Execution

Version

SENIOR

SUBORDINATED NOTE PURCHASE AND SECURITY AGREEMENT

AMONG

PHYSICIANS

FORMULA, INC.,

as the

Borrower,

THE

GUARANTORS PARTY HERETO

AND

MILL ROAD

CAPITAL, L.P.,

as the

Purchaser, a Holder and the Holder Representative

Dated as

of November 6, 2009

SENIOR SUBORDINATED NOTE

PURCHASE AND SECURITY AGREEMENT

Physicians

Formula, Inc.

1055 West

8th

Street

Azusa, CA

91702

|

Dated

as of November 6, 2009

|

Mill Road

Capital, L.P.,

as

the Purchaser, a Holder and

the

Holder Representative,

Two Sound

View Drive

Greenwich,

CT 06830

Ladies

and Gentlemen:

Physicians

Formula, Inc., a New York corporation (the “Borrower”),

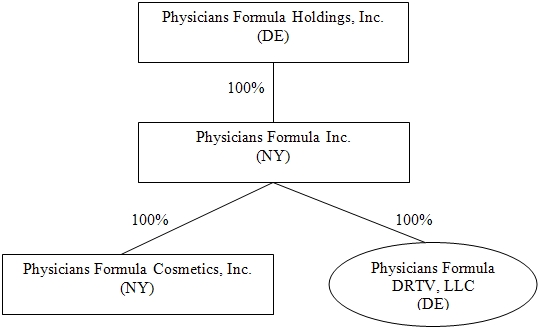

Physicians Formula Holdings, Inc., a Delaware corporation (“Holdings”) and the

direct parent of the Borrower, and the other direct and indirect Subsidiaries of

Holdings from time to time party to this Agreement, as Guarantors, hereby agree

with you as follows:

ARTICLE

I.

PURCHASE

AND SALE OF THE SENIOR SUBORDINATED NOTES

1.1

The Notes.

The

Borrower has authorized the issuance and sale of its Senior Subordinated Notes

due May 6, 2013 in the aggregate original principal amount of eight million

dollars ($8,000,000) in the form set forth as Exhibit A attached

hereto (referred to herein individually as a “Note” and

collectively as the “Notes”, which terms

shall also include any notes delivered in exchange therefor or replacement

thereof). Commencing on the date of issuance, the Notes will accrue

interest on the unpaid principal amount thereof at an interest rate per annum

(the “Interest

Rate”) consisting of (i) fifteen percent (15.00%) per annum in cash

interest plus

(ii) four percent (4.00%) per annum to be added automatically to the unpaid

principal amount of the Notes (“PIK Interest”) on

each Interest Payment Date.

(b)

Interest on the Notes shall be computed based on a 360-day year and actual days

elapsed. Cash interest on the Notes shall be payable monthly in

arrears on the first day of each calendar month (each, an “Interest Payment

Date”) commencing on December 1, 2009, by wire transfer of immediately

available funds to one or more accounts designated by the relevant

Holders. All accrued PIK Interest shall be compounded quarterly on

the first day of each calendar quarter. The records of the Holders

shall, absent manifest error, be conclusive evidence of the outstanding

principal balance of the Notes, including all PIK Interest added to the

principal amount thereof and the compounding thereof, but any failure of any

Holder to record, or any error in so recording, any such amount on such Holder’s

records shall not limit or otherwise affect the obligations of the Borrower

under the Notes to make all payments of principal of and interest thereon when

due.

1

1.2

Purchase and Sale of the

Notes. The

Borrower agrees to issue and sell to the Purchaser, and, subject to and in

reliance upon the representations, warranties, covenants, terms and conditions

of this Agreement, the Purchaser agrees to purchase from the Borrower a Note in

the principal amount of eight million dollars ($8,000,000) at a closing (the

“Closing”) to

be held at the offices of Foley Hoag LLP located in Boston, Massachusetts at

10:00 a.m. Boston time, or at such other location and time as agreed to by the

Borrower and the Purchaser, on the date on which this Agreement is executed and

delivered and upon satisfaction or waiver of the conditions described in Article VI hereof

(the “Closing

Date”). At the Closing, the Borrower will issue and deliver

one Note to the Purchaser, payable to the Purchaser or its registered assigns,

in the principal amount of eight million dollars ($8,000,000), against receipt

of the aggregate face amount of such Note in immediately available funds by wire

transfer to an account of the Borrower or an account of such other third party

as directed by the Borrower on or prior to the date hereof; provided that it is

understood and agreed that the Purchaser may, upon notice to the Borrower,

deduct from such issue price payable by the Purchaser to the Borrower at the

Closing the amount of any fees and expenses due the Purchaser hereunder,

including, without limitation, pursuant to Sections 1.11 and

6.11.

1.3

Payments and

Endorsements.

(a)

Payments of principal, interest and premium,

if any, on the Notes and other payments under the Operative Documents shall be

made prior to 2:00 p.m. (Greenwich, Connecticut time) on the date due, and shall

be made without set-off or counterclaim, directly by wire transfer of

immediately available funds to the account or accounts designated in writing by

the Holder Representative, without any presentment or notation of payment,

except that prior to any transfer of any Note the Holder thereof shall endorse

on such Note a record of the date to which interest has been paid and all

payments made on account of principal of such Note. All payments and

prepayments of principal of and interest on the Notes shall be applied (to the

extent thereof) to all of the Notes pro rata based on the principal amount

outstanding and held by each Holder thereof. The Borrower hereby

authorizes each Holder to endorse on the Notes held by such Holder the PIK

Interest paid thereon, and the Borrower shall, upon the request of any Holder of

one or more Notes and in lieu of endorsement of such PIK Interest, issue to such

Holder one or more additional Notes evidencing the PIK Interest paid on the

Notes held by such Holder, in each case, promptly upon the request of such

Holder, all of which shall be made, issued and otherwise effected in accordance

with the terms of Section

1.8.

(b)

Each Holder that is not a United States person (as such term

is defined in Section 7701(a)(30) of the Code) shall submit to the Borrower and

the Holder Representative on or before the Closing Date or, if later, the date

such Person becomes a Holder of one or more Notes hereunder, two duly completed

and signed copies of (i) either Form W-8 BEN (relating to such Holder and

entitling it to a complete exemption from withholding under the Code on all

amounts to be received by such Holder, including fees, pursuant to the Operative

Documents and the Obligations) or Form W-8 ECI (relating to all amounts to be

received by such Holder, including fees, pursuant to the Operative Documents and

the Obligations) of the United States Internal Revenue Service or (ii) solely if

such Holder is claiming exemption from United States withholding tax under

Section 871(h) or 881(c) of the Code with respect to payments of “portfolio

interest”, a Form W-8 BEN, or any successor form prescribed by the Internal

Revenue Service, and a certificate representing that such Holder is not a bank

for purposes of Section 881(c) of the Code, is not a 10-percent shareholder

(within the meaning of Section 871(h)(3)(B) of the Code) of the Borrower and is

not a controlled foreign corporation related to the Borrower (within the meaning

of Section 864(d)(4) of the Code). Thereafter and from time to time,

each Holder of one or more Notes shall submit to the Borrower and the Holder

Representative such additional duly completed and signed copies of one or the

other of such Forms (or such successor forms as shall be adopted from time to

time by the relevant United States taxing authorities) and such other

certificates as may be (i) requested by the Borrower in a written notice,

directly or through the Holder Representative, to such Holder and (ii) required

under then-current United States law or regulations to avoid or reduce United

States withholding taxes on payments in respect of all amounts to be received by

such Holder, including fees, pursuant to the Operative Documents or the

Obligations. Upon the request of the Borrower or the Holder

Representative, each Holder of one or more Notes that is a United States person

(as such term is defined in Section 7701(a)(30) of the Code) shall submit to the

Borrower and the Holder Representative two duly completed and signed copies of

form W-9 (or such successor forms as shall be adopted from time to time by the

relevant United States taxing authorities) or such other certificate, as

requested, to the effect that it is such a United States person.

2

(c)

If any Holder of one or more Notes determines, as

a result of any change in applicable law, regulation or treaty, or in any

official application or interpretation thereof, that it is unable to submit to

the Borrower or the Holder Representative any form or certificate that such

Holder is obligated to submit pursuant to subsection (b) of this Section 1.3 or that

such Holder is required to withdraw or cancel any such form or certificate

previously submitted or any such form or certificate otherwise becomes

ineffective or inaccurate, such Holder shall promptly notify the Borrower and

the Holder Representative of such fact and the Holder shall to that extent not

be obligated to provide any such form or certificate and will be entitled to

withdraw or cancel any affected form or certificate, as applicable.

(d)

The obligations of the Borrower and the Guarantors

under this Section

1.3 shall survive the payment in full of all amounts due hereunder or

under the Notes and the termination of this Agreement and the other Operative

Documents.

1.4

Redemptions; Prepayments;

Repurchases.

(a)

Redemptions at

Maturity. Unless

the maturity of the Notes is accelerated pursuant to Article VIII hereof,

the Notes shall mature and be redeemed by the Borrower in one installment which

shall be paid on May 6, 2013. On the stated or accelerated maturity

date of the Notes, the Borrower will pay in cash the principal amount of the

Notes then outstanding together with all accrued and unpaid interest thereon,

including, without limitation, all PIK Interest. No redemption of

less than all of the Notes shall affect the obligation of the Borrower to make

the redemption required by the preceding sentence.

(b)

Optional

Prepayments. The

Borrower may voluntarily prepay the Notes, in whole or in part, at any time

(subject to clause (e) below). Optional prepayments permitted

pursuant to this clause (b) may only be made upon payment to the Holder

Representative (on behalf of the relevant Holders) of an amount equal to the sum

of the principal amount to be prepaid, together with all accrued and unpaid

interest (including PIK Interest) on the principal amount so prepaid through the

date of prepayment, plus the Prepayment

Premium, if any, indicated in clause (d) below corresponding to the period in

which the prepayment occurs. Written notice of any prepayment

pursuant to this Section 1.4(b) shall

be given to the Holder Representative at least five (5) Business Days prior to

the date of any such prepayment.

3

(c)

Repurchase upon a Change of

Control. Without in any way limiting the Holders’ rights under

Article VIII

hereof with respect to any event described in this clause (c) that also

constitutes an Event of Default, but subject to clause (e) below, if there shall

occur a Change of Control, then the Borrower shall, immediately upon the

occurrence of such Change in Control, offer in writing to repurchase Notes at a

purchase price equal to the entire principal amount of the Notes, together with

all accrued and unpaid interest (including PIK Interest) on the principal amount

through the date of repurchase, plus the Prepayment Premium, if any, indicated

in clause (d) below corresponding to the period in which the repurchase

occurs. If any Holder shall not have responded to any such offer

within ten Business Days of receipt of same, such Holder shall be deemed to have

rejected such offer.

(d)

Prepayment

Premium. In the event of any prepayment or repurchase of the

Notes prior to the Maturity Date pursuant to clauses (b) or (c) above, the

Borrower shall pay to the Holder Representative (on behalf of the Holders) the

prepayment premium indicated below corresponding to the time period in which

such prepayment or repurchase occurs or is required to occur (the “Prepayment Premium”)

(which prepayment premium shall be paid to the Holder Representative (on behalf

of the Holders) as liquidated damages and compensation for the costs of making

funds available with respect to the loans evidenced by the Notes):

|

Period

|

Prepayment Premium

(%

of the aggregate principal amount of the Notes prepaid or

repurchased)

|

|

Closing

Date through November 5, 2010

|

5%

|

|

November

6, 2010 through November 5, 2011

|

4%

|

|

November

6, 2011 through November 5, 2012

|

2%

|

|

November

6, 2012 through May 5, 2013

|

1%

|

(e)

Consent of Senior

Lender. Notwithstanding

the foregoing provisions of clauses (b) and (c) above, the Borrower shall have

no right to voluntarily prepay the Notes under clause (b) above or obligation to

mandatorily repurchase the Notes under clause (c) above unless the Borrower or

the Senior Lender (if required pursuant to the Intercreditor Agreement) shall

have delivered (or caused to be delivered) to the Holder Representative all

required written consents, if any, of the Senior Lender and any other holders of

the Senior Obligations to such optional prepayment or repurchase in form and

substance reasonably satisfactory to the Required Holders, which delivery shall

be made, in the case of any such voluntary prepayment, at least five (5)

Business Days prior to the date of such voluntary prepayment.

4

(f)

Pro

Rata Prepayment. Except as set forth in Section 11.5, each

prepayment or other repayment of the Notes shall be made as to all of the Notes

and shall be made so that the Notes held by each Holder shall be prepaid or

repaid in a principal amount which shall bear the same ratio to the aggregate

unpaid principal amount being redeemed, prepaid or repaid on all of the Notes as

the unpaid principal amount of the Notes then held by such Holder bears to the

aggregate unpaid principal amount of all of the Notes.

(g)

No Other Acquisition of

Notes. The

Borrower will not purchase, redeem, prepay, tender for or otherwise acquire or

repay, directly or indirectly, any of the outstanding Notes except upon the

redemption, prepayment or repurchase of the Notes in accordance with the other

terms of this Section

1.4. The Borrower will promptly cancel all Notes acquired by

it pursuant to any purchase, redemption, prepayment or tender for the Notes

pursuant to any provision of this Agreement or otherwise, and no Notes may be

issued in substitution or exchange for any such Notes.

1.5

Default Rate of

Interest. If

an Event of Default has occurred and is continuing, from and after the date such

Event of Default has occurred, the entire outstanding unpaid principal balance

of the Notes and any unpaid interest from time to time in default shall (both

before and after acceleration and entry of judgment) bear interest, payable in

cash on demand, at a rate per annum equal to the Interest Rate payable pursuant

to Section 1.1

hereof plus

three percent (3%) per annum; provided, however, that upon

the cessation or cure of such Event of Default, if no other Event of Default is

then continuing, the Notes shall again bear interest at the Interest Rate as set

forth in Section

1.1 hereof.

1.6

Maximum Legal Rate of

Interest.

Notwithstanding any provision to the contrary contained herein, in the Notes or

in any other Operative Document, no such provision shall require the payment or

permit the collection of any amount of interest in excess of the maximum amount

of interest permitted by applicable law (“Excess

Interest”). If any Excess Interest is provided for, or is

adjudicated to be provided for, herein, in the Notes or in any other Operative

Document, then in such event: (a) the provisions of this Section shall govern

and control; (b) neither the Borrower nor any guarantor or endorser shall be

obligated to pay any Excess Interest; (c) any Excess Interest that the Holders

may have received hereunder shall, at the option of the Required Holders, be (i)

applied as a credit against the then-outstanding principal amount of Obligations

hereunder and accrued and unpaid interest thereon (not to exceed the maximum

amount permitted by applicable law), (ii) refunded to the Borrower, or (iii) any

combination of the foregoing; (d) the interest rate payable hereunder, under the

Notes or under any other Operative Document shall be automatically subject to

reduction to the maximum lawful contract rate allowed under applicable usury

laws (the “Maximum

Rate”), and this Agreement, the Notes and the other Operative Documents

shall be deemed to have been, and shall be, reformed and modified to reflect

such reduction in the relevant interest rate; and (e) neither the Borrower nor

any guarantor or endorser shall have any action against the Holders for any

damages whatsoever arising out of the payment or collection of any Excess

Interest. Notwithstanding the foregoing, if for any period of time

interest on any of Obligations is calculated at the Maximum Rate rather than the

applicable rate under this Agreement and the Operative Documents, and thereafter

such applicable rate becomes less than the Maximum Rate, the rate of interest

payable on the Obligations shall remain at the Maximum Rate until each Holder

has received the amount of interest which it would have received during such

period on the Obligations had the rate of interest not been limited to the

Maximum Rate during such period.

5

1.7

Payment or Delivery on

Non-Business Days. Whenever

any payment or delivery to be made shall be due on a day which is not a Business

Day, such payment or delivery may be made on the next succeeding Business Day,

and, if a payment, such extension of time shall in such case be included in the

computation of payment of interest due.

1.8

Transfer and Exchange of

Notes. The

Borrower shall keep a register in which it shall provide for the registration of

the Notes and the registration of transfers of Notes. The Holder of

any Note may, prior to maturity, prepayment or repurchase of such Note,

surrender such Note at the principal office of the Borrower for transfer or

exchange. Any Holder desiring to transfer or exchange any Note

(including, but not limited to, any assignment of a Note or Notes contemplated

by Section 11.5

hereof) shall first notify the Borrower in writing at least ten (10) Business

Days in advance of such transfer or exchange. Promptly, but in any

event within ten (10) Business Days after such notice to the Borrower from the

Holder Representative (on behalf of a Holder of one or more Notes)

of a Holder’s intention to make such an exchange of such Holder’s

Note(s) and without expense (other than transfer taxes, if any) to such Holder,

the Borrower shall issue in exchange therefor another Note or Notes in the same

aggregate principal amount, as of the date of such issuance, as the unpaid

principal amount of the Note so surrendered and having the same maturity and

rate of interest, containing the same provisions and subject to the same terms

and conditions as the Note so surrendered (provided that no

minimum shall apply to a liquidating distribution of Notes to investors in a

Holder and any Notes so distributed may be subsequently transferred by such

investor and its successors in the original denomination thereof without further

restriction). Each new Note shall be made payable to such Person or

Persons, or assigns, as the Holder of such surrendered Note may designate, and

such transfer or exchange shall be made in such a manner that no gain or loss of

principal or interest shall result therefrom. The Borrower shall have

no obligation or liability under any Note to any Person other than the

registered Holder of each such Note. Assignments and transfers of

Notes by the Holders shall be made in compliance with Section 11.5

hereof.

1.9

Replacement of

Notes. Upon

receipt of evidence satisfactory to the Borrower of the loss, theft, destruction

or mutilation of any Note and, if requested in the case of any such loss, theft

or destruction, upon delivery of an indemnity agreement reasonably satisfactory

to the Borrower, or, in the case of any such mutilation, upon surrender and

cancellation of such Note the Borrower will issue a new Note of like tenor and

amount and dated the date to which interest has been paid, in lieu of such lost,

stolen, destroyed or mutilated Note; provided, however, if any Note

of which a Holder, its nominee, or any of its partners is the Holder is lost,

stolen or destroyed, the affidavit of an authorized partner or officer of the

Holder setting forth the circumstances with respect to such loss, theft or

destruction shall be accepted as satisfactory evidence thereof, and no

indemnification shall be required as a condition to the execution and delivery

by the Borrower of a new Note in replacement of such lost, stolen or destroyed

Note other than the Holder’s written agreement to indemnify the

Borrower.

1.10 Ranking. The

Obligations and the rights and remedies of the Holders under the Operative

Documents relating to the indebtedness evidenced by the Notes shall be senior in

right of payment to all Subordinated Debt (other than any indebtedness which has

priority by operation of law) of Holdings, the Borrower and the other

Subsidiaries. The Obligations and the rights and remedies of the

Holders under the Operative Documents relating to the indebtedness evidenced by

the Notes shall be subordinate and junior in right of payment to the Senior

Obligations in the manner and to the extent provided in the Intercreditor

Agreement.

6

1.11 Closing Fee;

Expenses.

At the Closing the Borrower shall pay to the Purchaser or its designee a closing

fee of $160,000 (the “Closing Fee”),

payable in cash, and such fee shall be in addition to the other amounts required

to be paid at the Closing pursuant to Section 6.15

hereof. At the option of the Purchaser by notice to the Borrower, the

amount of such fee and the other amounts required to be paid pursuant to Section 6.15 hereof

may be paid by the Purchaser by deducting such amounts from the purchase price

of the Notes payable at the Closing.

1.12 Original Issue

Discount.

The Borrower and the Holders intend, for applicable income tax purposes: (i)

that the Notes are debt for U.S. federal income tax purposes, that the issuance

of the Notes and the Holders’ right to receive warrants constitutes an

“investment unit” as of the date hereof within the meaning of Section 1273 of

the Code, and that the right to receive warrants is not received in exchange for

any debt owned by the Borrower to any Holders as of the date hereof, (ii) that

the Notes issued to the Holder (other than any notes delivered in exchange

therefor or replacement thereof) constitute a single debt instrument for

purposes of Sections 1271 through 1275 of the Code and the Treasury Regulations

thereunder (pursuant to Treasury Regulations Section 1.1275-2(c)), (iii) that

the Notes are issued with original issue discount (“OID”), and (iv) that

the Borrower shall timely calculate and report the amount of OID as required by

applicable law. The Borrower and the Holders agree to adhere to the

terms of this Note for U.S. federal income tax purposes and not to take any

action or file any tax return, report or declaration inconsistent herewith

(including with respect to the amount of OID on the Notes), except as required

by applicable law.

1.13 Security

Interest. The

Obligations shall be secured by a perfected security interest (subject, in terms

of priority, only to Liens created under the Senior Loan Documents and Permitted

Liens entitled to priority under applicable law) in all of the assets of the

Borrower, Holdings and the other Guarantors, whether now owned or hereafter

acquired, pursuant to and subject to the limitations and the terms and

conditions of Article

II herein, the Guarantor Security Agreement and the other Security

Documents.

1.14 Amendments for Mezzanine

Financing and Warrants. The

parties agree to amend the Operative Documents to reflect the terms and

conditions set forth in Annex A attached

hereto (the “Mezzanine

Financing”) and to cause Holdings to issue warrants to Purchaser on the

terms and conditions set forth in Annex A; provided that all

such terms and conditions and the issuance of the warrants are approved by the

stockholders of Holdings. Holdings agrees (i) as soon as reasonably

practicable following the date of this Agreement, Holdings shall prepare in

accordance with the provisions of the Securities Exchange Act of 1934, as

amended, and file with the Commission a proxy statement (the “Proxy Statement”) to

be sent to the stockholders of Holdings in connection with a meeting for the

purpose of approving the issuance of the warrants and the other terms of the

Mezzanine Financing (the “Stockholders

Meeting”); (ii) as soon as reasonably practicable after such filing with

the Commission (if Holdings learns that no review of the Proxy Statement will be

made by the staff of the Commission) or as soon as reasonably practicable after

the completion of any review of the Proxy Statement made by staff of the

Commission, Holdings shall mail, or cause to be mailed, the Proxy Statement in

which Holdings shall make a recommendation that the stockholders of Holdings

approve the issuance of the warrants and the other terms of the Mezzanine

Financing; and (iii) within 60 days of such mailing, Holdings shall hold the

Stockholders Meeting. Purchaser will cooperate with Holdings in the

preparation of the Proxy Statement. For the avoidance of doubt, any

amendments to the Operative Documents as a result of the transactions set forth

in Annex A shall not result in any payment of a Prepayment

Premium. Upon the approval of such terms and conditions by the

stockholders of Holdings, the parties shall execute and deliver documentation to

effect such terms and conditions and to issue the warrants, including without

limitation, an amendment to this Agreement substantially in the form attached

hereto as Annex

A-1, an amended and restated promissory note substantially in the form

attached hereto as Annex A-2, a warrant

substantially in the form attached hereto as Annex A-3 and a

registration rights agreement substantially in the form attached hereto as Annex

A-4.

7

1.15 Standstill.

Until

September 30, 2012, MRC and its Affiliates shall not (a) acquire more than 35%

of the common stock of Holdings or (b) seek to elect voting seats on the Board

of Directors of Holdings (except as permitted in Section 7.33 herein), in each

case, without the prior written consent of the Board of Directors of

Holdings. These

restrictions shall be released upon the receipt by the Borrower of any bid

(other than a bid from MRC or its Affiliates) for the acquisition of Holdings

and its Subsidiaries. The Borrower shall provide MRC with notice of

the receipt of any such bid within three Business Days of receipt by the

Borrower or any of its Affiliates.

ARTICLE

II.

SECURITY

INTEREST.

2.1

Grant of Security

Interest. The

Borrower hereby pledges, collaterally assigns and grants to the Holder

Representative and to the Holders, a Lien and security interest (collectively

referred to as the “Security Interest”)

in the Collateral, as security for the payment and performance of all

Obligations; provided, however,

notwithstanding the foregoing, no Lien is hereby granted on any Excluded

Property, and such Excluded Property shall not be deemed to be “Collateral”;

provided further that if and

when any property shall cease to be Excluded Property, a Lien on and security

interest in such property shall be deemed granted therein and such property

shall be deemed to be “Collateral.” Following the written request by

the Required Holders, the Borrower shall grant the Holder Representative and the

Holders, a Lien and security interest in all commercial tort claims that it may

have against any Person.

2.2

Notifying Account

Debtors and Other Obligors; Collection of Collateral. The

Holder Representative may at any time (whether or not a Default Period then

exists) deliver a Record giving an account debtor or other Person obligated to

pay an Account, a General Intangible, or other amount due, notice that the

Account, General Intangible, or other amount due has been assigned to the Holder

Representative for security and must be paid directly to the Holder

Representative. The Borrower shall join in giving such notice and

shall Authenticate any Record giving such notice upon the Holder

Representative’s request. After the Borrower or the Holder

Representative gives such notice, the Holder Representative may, but need not,

in the Holder Representative’s or in the Borrower’s name, demand, sue for,

collect or receive any money or property at any time payable or receivable on

account of, or securing, such Account, General Intangible, or other amount due,

or grant any extension to, make any compromise or settlement with or otherwise

agree to waive, modify, amend or change the obligations (including collateral

obligations) of any account debtor or other obligor. The Holder

Representative may, in the Holder Representative’s name or in the Borrower’s

name, as the Borrower’s agent and attorney-in-fact, notify the United States

Postal Service to change the address for delivery of the Borrower’s mail to any

address designated by the Holder Representative, otherwise intercept the

Borrower’s mail, and receive, open and dispose of the Borrower’s mail, applying

all Collateral as permitted under this Agreement and holding all other mail for

the Borrower’s account or forwarding such mail to the Borrower’s last known

address.

8

2.3

Collateral Assignment of

Insurance. As

additional security for the Obligations, the Borrower hereby collaterally

assigns to the Holder Representative and to the Holders, all rights of the

Borrower under every policy of insurance covering the Collateral and all

business records and other documents relating to it, and all monies (including,

without limitation, all proceeds and refunds) that may be payable under any

policy, and the Borrower hereby directs the issuer of each policy to pay all

such monies directly to the Holder Representative. At any time,

whether or not a Default Period then exists, the Holder Representative may (but

need not), in the Holder Representative’s or the Borrower’s name, execute and

deliver proofs of claim, receive payment of proceeds and endorse checks and

other instruments representing payment of the policy of insurance, and adjust,

litigate, compromise or release claims against the issuer of any

policy. Any monies received under any insurance policy assigned to

the Holder Representative, other than liability insurance policies, or received

as payment of any award or compensation for condemnation or taking by eminent

domain, shall be paid to the Holder Representative and, as determined by the

Holder Representative in its sole discretion, either be applied to prepayment of

the Obligations or disbursed to the Borrower under staged payment terms

reasonably satisfactory to the Holder Representative for application to the cost

of repairs, replacements, or restorations which shall be effected with

reasonable promptness and shall be of a value at least equal to the value of the

items or property destroyed.

2.4

Borrower’s

Premises.

(a)

Holder Representative’s

Right to Occupy the Borrower’s Premises. The Borrower hereby

grants to the Holder Representative the right, at any time during a Default

Period and without notice or consent, to take exclusive possession of all

locations where the Borrower conducts its business or has any rights of

possession, including without limitation the locations described on Schedule 2.4 (the

“Premises”),

until the earlier of (i) payment in full and discharge of all Obligations or

(ii) final sale or disposition of all items constituting Collateral and delivery

of those items to purchasers.

(b)

Holder Representative’s Use

of the Borrower’s Premises. During any Default Period, the

Holder Representative may use the Premises to store, process, manufacture, sell,

use, and liquidate or otherwise dispose of items that are Collateral, and for

any other incidental purposes deemed appropriate by the Holder Representative in

good faith.

(c)

Borrower’s Obligation to

Reimburse the Holder Representative. The Holder Representative

shall not be obligated to pay rent or other compensation for the possession or

use of any Premises, but if the Holder Representative elects to pay rent or

other compensation to the owner of any Premises in order to have access to the

Premises, then the Borrower shall promptly reimburse the Holder Representative

all such amounts, as well as all actual out-of-pocket taxes, fees, charges and

other expenses at any time payable by the Holder Representative with respect to

the Premises by reason of the execution, delivery, recordation, performance or

enforcement of any terms of this Agreement.

9

2.5

License. Without

limiting the generality of any other Security Document, the Borrower hereby

grants to the Holder Representative a non-exclusive, worldwide and royalty-free

license during any Default Period to use or otherwise exploit all Intellectual

Property Rights of the Borrower for the purpose of: (a) completing the

manufacture of any in-process materials during any Default Period so that such

materials become saleable Inventory, all in accordance with the same quality

standards previously adopted by the Borrower for its own manufacturing and

subject to the Borrower’s reasonable exercise of quality control; and (b)

selling, leasing or otherwise disposing of any or all Collateral.

2.6

Financing

Statements.

(a)

Authorization to

File. The Borrower authorizes the Holder Representative to

file financing statements describing Collateral to perfect the Holder

Representative’s Security Interest in the Collateral, and the Holder

Representative may describe the Collateral as “all personal property” or “all

assets” or describe specific items of Collateral including without limitation

any commercial tort claims. All financing statements filed before the

date of this Agreement to perfect the Security Interest were authorized by the

Borrower and are hereby re-authorized. Following the termination of

this Agreement and payment of all Obligations, the Holder Representative shall,

at the Borrower’s expense and within the time periods required under applicable

law, release or terminate any filings or other agreements that perfect the

Security Interest.

(b)

Termination. The

Holder Representative shall, at the Borrower’s expense, release or terminate any

filings or other agreements that perfect the Security Interest, provided that

there are no suits, actions, proceedings or claims pending or threatened against

any Indemnitee under this Agreement with respect to any Indemnified Liabilities,

upon the Holder Representative’s receipt of the following, in form and content

satisfactory to the Holder Representative: (i) cash payment in full of all

payment Obligations and a completed performance by the Borrower with respect to

its other Obligations under this Agreement, (ii) a release of all claims against

the Holder Representative by the Borrower relating to the Holder

Representative’s performance and obligations under the Operative Documents, and

(iii) an agreement by the Borrower and any Guarantor, and any new lender to the

Borrower to indemnify the Holder Representative for any payments received by the

Holder Representative that are applied to the Obligations as a final payoff that

may subsequently be returned or otherwise not paid for any reason.

2.7

Setoff. The

Holder Representative may at any time during a Default Period, in its sole

discretion and without demand or notice to anyone, setoff any liability owed to

the Borrower by the Holder Representative against any Obligations, whether or

not due; provided that in no

event shall Holder Representative offset against the Borrower’s payroll account

number 4121973010 maintained at Senior Lender so long as the funds held in such

payroll account are limited to the amount required to satisfy the Borrower’s

payroll obligations during the following seven day period (as of any date of

determination).

10

2.8

Collateral Related

Matters. This

Agreement does not contemplate a sale of Accounts or chattel paper, and, as

provided by law, the Borrower is entitled to any surplus and shall remain liable

for any deficiency. The Holder Representative’s duty of care with

respect to Collateral in its possession (as imposed by law) will be deemed

fulfilled if it exercises reasonable care in physically keeping such Collateral,

or in the case of Collateral in the custody or possession of a bailee or other

third Person, exercises reasonable care in the selection of the bailee or third

Person, and the Holder Representative need not otherwise preserve, protect,

insure or care for such Collateral. The Holder Representative shall

not be obligated to preserve rights the Borrower may have against prior parties,

to liquidate the Collateral at all or in any particular manner or order or apply

the Proceeds of the Collateral in any particular order of

application. The Holder Representative has no obligation to clean-up

or prepare Collateral for sale. The Borrower waives any right it may

have to require the Holder Representative to pursue any third Person for any of

the Obligations.

2.9

Notices Regarding

Disposition of Collateral. If

notice to the Borrower of any intended disposition of Collateral or any other

intended action is required by applicable law in a particular situation, such

notice will be deemed commercially reasonable if given in the manner specified

in Section 11.3

at least ten (10) calendar days before the date of intended disposition or other

action.

2.10 Limitation on Security

Interest. Notwithstanding

anything herein to the contrary, the Security Interest granted hereunder

together with any other security interest granted under the other Security

Documents shall be capped at an amount equal to the lesser of (a) 10% of the

aggregate market value of all assets of the Holdings, the Borrower and its

Subsidiaries and (b) 10% of the aggregate market value of all outstanding

Capital Stock of Holdings, in each case, as determined on the Closing

Date.

2.11 Senior Lender Acting as

Bailee. With

respect to any provision in this Agreement, the Guarantor Security Agreement or

any other Security Document which requires the Borrower, Holdings or any other

Guarantor to deliver possession or control of any negotiable document,

instrument, certificated securities, promissory notes, deposit accounts,

security accounts, commodity accounts, and letter of credit rights, other

Collateral or other assets that are collateral requiring possession or control

thereof in order to perfect the security interest of the Holder Representative

and the Holders therein under the Uniform Commercial Code, no such delivery or

giving of control to the Holder Representative shall be required to the extent

such Collateral or other assets are required to be delivered to or control is

required to be given to Senior Lender in accordance with the Senior Credit

Agreement, it being understood that the Senior Lender is acting as agent and

bailee for the benefit of the Holder Representative and the Holders pursuant to

the terms of the Intercreditor Agreement.

11

ARTICLE

III.

DEFINITIONS;

INTERPRETATION

3.1

Definitions. As

used herein, the following terms shall have the following meanings:

“Accounts” shall have

the meaning given it under the UCC.

“Additional Guarantor

Supplement” means a Guaranty in the form of Exhibit D attached

hereto.

“Adjusted EBITDA”

means, determined on a consolidated basis for the Borrower and its wholly-owned

subsidiaries, the Borrower’s net income, calculated before (in each case, to the

extent included in determining net income) (i) interest expense, (ii) provision

for income taxes, (iii) depreciation and amortization expense, (iv) gains

arising from the write-up of assets, (v) any extraordinary gains, (vi)

stock-based compensation expenses, (vii) changes resulting from the valuation of

goodwill and intangible assets made in accordance with FASB Accounting Standard

142, (viii) changes resulting from foreign exchange adjustments arising from a

revaluation of assets subject to foreign currency revaluation, and (ix)

provisions arising from adjustments to the Borrower’s inventory reserves for

obsolete, excess, or slow-moving inventory.

“Affiliate” or “Affiliates” means, as

to any Person, any other Person controlled by, controlling or under common

control with the first Person. For purposes of this definition,

“control,” when used with respect to any specified Person, means the power to

direct the management and policies of such Person, directly or indirectly,

whether through the ownership of voting securities, by contract or

otherwise.

“Agreement” means this

Senior Subordinated Note Purchase and Security Agreement.

“Approved Fund” means

any Fund that is administered, managed or serviced by (a) a Holder, (b) an

Affiliate of a Holder that is under common control with such Affiliate, or (c)

an entity or an Affiliate of an entity that administers, manages or services a

Holder that is under common control with such Affiliate.

“Authenticated” means

(a) to have signed; or (b) to have executed or to have otherwise adopted a

symbol, or have encrypted or similarly processed a Record in whole or in part,

with the present intent of the authenticating Person to identify the Person and

adopt or accept a Record.

“Book Net Worth” means

the aggregate of the Owners’ equity in the Borrower, determined in accordance

with GAAP, and calculated without regard to any change in the valuation of

goodwill and intangible assets made in accordance with FASB Accounting Standard

142.

“Borrower” shall have

the meaning assigned to that term in the first paragraph of this

Agreement.

12

“Borrower Inventory G/L

Reserve” means the dollar amount carried in the Borrower’s general ledger

reserve for inventory considered to be obsolete, excessive, or otherwise having

a value less than cost. For clarification purposes, as of September

30, 2009, the Borrower’s general ledger reserve was $5,446,000.

“Business Day” means

any day (other than a Saturday or Sunday) on which banks are not authorized or

required to close in Greenwich, Connecticut, the State of New York or the State

of California.

“Capital Expenditures”

means for a period, any expenditure of money during such period for the lease,

purchase or other acquisition of any capital asset (including fixtures for

in-store displays) and any capitalized costs incurred as a result of the

Borrower’s move from Covina, CA to City of Industry, CA, or for the lease of any

other asset whether payable currently or in the future, but excluding any

prepaid operating expenses.

“Capital Stock” means

any and all shares, interests, participation or other equivalents (however

designated) of capital stock of a corporation, any and all equivalent ownership

interests in a Person (other than a corporation), any and all warrants, options

or rights to purchase or any other securities convertible into any of the

foregoing.

“Capitalized Lease

Obligation” means any obligations for the payment of rent for any real or

personal property under leases or agreements to lease that, in accordance with

GAAP, have been or should be capitalized on the books of the lessee and, for

purposes hereof, the amount of any such obligation shall be the capitalized

amount thereof determined in accordance with GAAP.

“Cash Equivalents”

shall have the meaning assigned to such term in Section 7.6

hereof.

“Change of Control”

means the occurrence of any of the following events:

(a)

Any Person or “group” (as such term is used

in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934) who does not

have an ownership interest in the Borrower on the Closing Date is or becomes the

“beneficial owner” (as defined in Rules 13d-3 and 13d-5 under the Securities

Exchange Act of 1934, except that any such Person, entity or group will be

deemed to have “beneficial ownership” of all securities that such Person, entity

or group has the right to acquire, whether such right is exercisable immediately

or only after the passage of time), directly or indirectly, of more than

twenty-five percent (25%) of the voting power of all classes of ownership of the

Borrower;

(b)

During any consecutive two-year period,

individuals who at the beginning of such period constituted the board of

Directors of the Borrower (together with any new Directors whose election to

such board of Directors, or whose nomination for election by the Owners of the

Borrower, was approved by a vote of two thirds of the Directors then still in

office who were either Directors at the beginning of such period or whose

election or nomination for election was previously so approved) cease for any

reason to constitute a majority of the board of Directors of the Borrower then

in office;

13

(c)

Holdings ceases to own, directly or

indirectly, beneficially and of record, 100% of the Borrower; or

(d)

Either Ingrid Jackel ceases to be employed

as the Chief Executive Officer of the Borrower or Jeffrey P. Rogers ceases to be

employed as the President of the Borrower, and not replaced by a Person with

substantially comparable experience within 90 days of any such

event.

“Closing” shall have

the meaning assigned to such term in Section 1.2

hereof.

“Closing Date” shall

have the meaning assigned to such term in Section 1.2

hereof.

“Closing Fee” shall

have the meaning given to such term in Section 1.11

hereof.

“Code” means the

Internal Revenue Code of 1986 and the rules and regulations thereunder, as the

same may from time to time be supplemented or amended and remain in

effect.

“Collateral” means all

of the Borrower’s Accounts, chattel paper and electronic chattel paper, deposit

accounts, documents, Equipment, General Intangibles, goods, instruments,

Inventory, Investment Property, letter-of-credit rights, letters of credit, all

sums on deposit in any collection account, and any items in any lockbox;

together with (a) all substitutions and replacements for and products of such

property; (b) in the case of all goods, all accessions; (c) all accessories,

attachments, parts, Equipment and repairs now or subsequently attached or

affixed to or used in connection with any goods; (d) all warehouse receipts,

bills of lading and other documents of title that cover such goods now or in the

future; (e) all collateral subject to the Lien of any of the Security Documents;

(f) any money, or other assets of the Borrower that come into the possession,

custody, or control of the Holder Representative now or in the future; (g)

Proceeds of any of the above Collateral; (h) books and records of the Borrower,

including without limitation all mail or e-mail addressed to the Borrower; and

(i) all of the above Collateral, whether now owned or existing or acquired now

or in the future or in which the Borrower has rights now or in the

future.

“Collateral Access

Agreement” means a landlord waiver, bailee letter, or acknowledgement

agreement of any lessor, warehouseman, processor, consignee, or other Person in

possession of, having a Lien upon, or having rights or interests in the

Borrower’s, Holdings’, or a Subsidiary’s books and records, equipment, or

inventory, in each case, in form and substance satisfactory to the Holder

Representative in the Holder Representative’s Permitted Discretion.

“Collateral Pledge

Agreement” means each of those certain Collateral Pledge Agreements of

each of Holdings and the Borrower dated as of November 6, 2009 in the forms

attached hereto as Exhibit

D.

“Commission” means the

United States Securities and Exchange Commission (or any other federal agency at

that time administering the Securities Act).

14

“Compliance

Certificate” shall have the meaning assigned to such term in Section 7.1(a) hereof

and is in the form of Exhibit C attached

hereto or

in such form that is acceptable to the Required Holders in their sole

discretion.

“Constituent

Documents” means with respect to any Person, as applicable, that Person’s

certificate of incorporation, articles of incorporation, by-laws, certificate of

formation, articles of organization, limited liability company agreement,

management agreement, operating agreement, shareholder agreement, partnership

agreement or similar document or agreement governing such Person’s existence,

organization or management or concerning disposition of ownership interests of

such Person or voting rights among such Person’s owners.

“December G/L

Adjustment” means an amount equal to the product of (i) $11,484,000 minus

the Borrower Inventory G/L Reserve as of December 31, 2009, times (ii)

sixty-percent (60%). The December G/L Adjustment shall reflect the

Borrower’s estimate of the effect of its customers’ annual product line

adjustments. Any reversals of such December G/L Adjustment in

subsequent months will also increase each of the foregoing minimum required

amounts by the amount of such reversal.

“Default” means any

Event of Default or any event or condition the occurrence of which would, with

the passage of any applicable grace period or the giving of notice, or both,

constitute an Event of Default.

“Default Period” means

any period commencing on the day an Event of Default occurs, through and

including the date identified by the Holder Representative (on behalf of the

Required Holders) in a Record as the date that the Event of Default has been

cured or waived.

“Director” means with

respect to any Person, a director if such Person is a corporation, or a governor

or manager if such Person is a limited liability company.

“Domestic Subsidiary”

shall mean, with respect to any Person, any Subsidiary of such Person which is

incorporated or organized under the laws of any state of the United States or

the District of Columbia.

“Electronic Record”

means a Record that is created, generated, sent, communicated, received, or

stored by electronic means, but does not include any

Record that is sent, communicated, or received by fax.

“Environmental Law”

means any federal, state, local or other governmental statute, regulation, law

or ordinance dealing with the protection of human health and the

environment.

“Equipment” shall have

the meaning given it under the UCC.

“ERISA” means the

Employee Retirement Income Security Act of 1974, as amended from time to

time.

“ERISA Affiliate”

means any trade or business (whether or not incorporated) that is a member of a

group which includes the Borrower and which is treated as a single employer

under Section 414 of the Code.

15

“Event of Default”

means any event or condition identified as such in Section 8.1

hereof.

“Excess Interest”

shall have the meaning assigned to such term in Section 1.6

hereof.

“Excluded Property”

means, collectively, (i) any permit, lease or license or any contractual

obligation entered into by the Borrower (A) that prohibits or requires the

consent of any Person other than the Borrower, Holdings and its Subsidiaries

which has not been obtained as a condition to the creation by the Borrower of a

Lien on any right, title or interest in such permit, lease, license or

contractual obligation or any Capital Stock or equivalent thereof related

thereto or that contains terms stating that the granting of a lien therein would

otherwise result in a material loss by the Borrower of any material rights

therein, (B) to the extent that any law applicable thereto prohibits the

creation of a Lien thereon or (C) to the extent that a Lien thereon would give

any other party a legally enforceable right to terminate such permit, lease,

license or any contractual obligation, but only, with respect to the prohibition

in (A), (B) and (C) to the extent, and for as long as, such prohibition is not

terminated or rendered unenforceable or otherwise deemed ineffective by the UCC

or any other applicable law, (ii) property or assets owned by the Borrower that

is subject to a purchase money Lien or a Capital Lease Obligation permitted

hereunder if the contractual obligation pursuant to which such Lien is granted

(or in the document providing for such Capital Lease Obligation) prohibits or

requires the consent of any Person other than the Borrower, Holdings and its

Subsidiaries which has not been obtained as a condition to the creation of any

other Lien on such property or such assets, (iii) any “intent to use” trademark

applications for which a statement of use has not been filed (but only until

such statement is filed with, and accepted by, the United States Patent and

Trademark Office) (each such trademark, an “Intent To Use

Trademark”), (iv) any Intellectual Property Right owned by the Borrower

if the grant of a security interest in such Intellectual Property Right would

result in the cancellation or voiding of such Intellectual Property Right, and

(iv) shares of capital stock having voting power in excess of 65% of the voting

power of all classes of capital stock of a first tier controlled foreign

corporation (as that term is defined in the Code); provided, however, “Excluded Property”

shall not, except as explicitly stated herein, include any proceeds, products,

substitutions or replacements of Excluded Property (unless such proceeds,

products, substitutions or replacements would otherwise constitute Excluded

Property).

“Foreign Subsidiary”

of any Person, shall mean any Subsidiary of such Person that is not organized or

incorporated in the United States or any State or territory

thereof.

“Fund” means any

Person (other than a natural person) and any other special purpose investment

vehicle, securitization vehicle, money market account, investment account or

other account that is (or will be) engaged in making, purchasing, holding or

otherwise investing in commercial loans, subordinated loans, similar extensions

of credit or any of the foregoing, whether or not in combination with warrants

or other equity securities.

“GAAP” means United

States generally accepted accounting principles, consistently

applied.

“General Intangibles”

shall have the meaning given it under the UCC.

16

“Guarantor” and “Guarantors” means

Holdings and each direct or indirect Domestic Subsidiary of the Borrower or

Holdings (including any Domestic Subsidiary formed or acquired after the Closing

Date) other than the Borrower.

“Guarantor Security

Agreement” means that certain Guarantor Security Agreement dated as of

November 6, 2009 among Holdings, the other Guarantors and the Purchaser in the

form attached hereto as Exhibit

B.

“Guaranty” and “Guaranties” shall

have the meanings assigned to such term in Section 9.1

hereof.

“Hazardous Substances”

means pollutants, contaminants, hazardous substances, hazardous wastes, or

petroleum, and all other chemicals, wastes, substances and materials listed in,

regulated by or identified in any Environmental Law.

“Holder

Representative-Related Persons” means MRC and any successor Holder

Representative pursuant to Section 10.9,

together with their respective affiliates, and the officers, directors,

employees, agents and attorneys-in-fact of such Persons and

affiliates.

“Holder” or “Holders” shall mean

the Purchaser (so long as it holds one or more Notes) and any other holder or

holders from time to time of one or more Notes.

“Holdings” shall have

the meaning assigned to that term in the first paragraph of this

Agreement.

“Indemnitee” shall

have the meaning assigned to such term in Section 11.8

hereof.

“Indemnified

Liability” shall have the meaning assigned to such term in Section 11.8

hereof.

“Information” shall

have the meaning assigned to such term in Section 11.22

hereof.

“Infringement” or

“Infringing”

when used with respect to Intellectual Property Rights means any infringement or

other violation of Intellectual Property Rights.

“Intellectual Property

Rights” means all actual or prospective rights arising in connection with

any intellectual property or other proprietary rights, including without

limitation all rights arising in connection with copyrights, patents, service

marks, trade dress, trade secrets, trademarks, trade names or mask

works.

“Intent to Use

Trademark” is defined in the definition of Excluded

Property.

“Intercreditor

Agreement” means that certain Intercreditor Agreement dated as of the

date hereof among the Senior Lender, the Borrower and the Purchaser, including

(subject to the terms of such agreement) any successor agreement pursuant to a

refinancing of the Senior Obligations.

17

“Interest Payment

Date” shall have the meaning assigned to such term in Section 1.1(b)

hereof.

“Interest Rate” shall

have the meaning assigned to such term in Section 1.1(a)

hereof.

“Inventory” shall have

the meaning given it under the UCC.

“Investment Property”

shall have the meaning given it under the UCC.

“Licensed Intellectual

Property” shall have the meaning assigned to such term in Section 5.8

hereof.

“Lien” means any

security interest, mortgage, deed of trust, pledge, lien, charge, adverse claim,

trust claim, encumbrance, title retention agreement or analogous instrument or

device, including without limitation the interest of each lessor under any

capitalized lease and the interest of any bondsman under any payment or

performance bond, in, of or on any assets or properties of a Person, whether now

owned or subsequently acquired and whether arising by agreement or operation of

law.

“Material Adverse

Effect” means any of the following:

(a)

A material adverse effect on the business,

operations, results of operations, assets, liabilities or financial condition of

the Borrower;

(b)

A material adverse effect on the ability of

the Borrower to perform its obligations under the Operative Documents, or any

other document or agreement related to this Agreement; or

(c)

A material adverse effect on the ability of

the Holder Representative or the Holders to enforce the Obligations or to

realize the intended benefits of the Security Documents, including without

limitation a material adverse effect on the validity or enforceability of any

Operative Document or of any rights against any Guarantor, or on the status,

existence, perfection, priority (subject to Permitted Liens) or enforceability

of any Lien securing payment or performance of the Obligations.

“Maturity Date” shall

be May 6, 2013.

“Maximum Rate” shall

have the meaning assigned to such term in Section 1.6

hereof.

“Mezzanine Financing”

shall have the meaning assigned to such term in Section 1.14

hereof.

“MRC” means Mill Road

Capital, L.P.

“MRC’s Designee” shall

have the meaning assigned to such term in Section 7.33

hereof.

“Multiemployer Plan”

means a multiemployer plan (as defined in Section 4001(a)(3) of ERISA) to which

the Borrower or any ERISA Affiliate contributes or is obligated to

contribute.

18

“Net Cash Proceeds”

means the cash proceeds of any asset sale (including cash proceeds received as

deferred payments pursuant to a note, installment receivable or otherwise, but

only upon actual receipt) net of (a) attorney, accountant, and investment

banking fees, (b) brokerage commissions, (c) amounts required to be applied to

prior Liens or the repayment of debt secured by a Lien not prohibited by this

Agreement on the asset being sold, and (d) taxes paid or reasonably estimated to

be payable as a result of such asset sale.

“Net Income” means

after-tax net income from continuing operations, including extraordinary losses

but excluding extraordinary gains, all as determined in accordance with

GAAP.

“Note” and “Notes” shall have the

meaning assigned to that term in Section 1.1(a)

hereof.

“Obligations” shall

mean all indebtedness, obligations and liabilities of the Borrower and/or the

Guarantors to any of the Holders, individually or collectively, whether existing

on the date of this Agreement or arising thereafter, direct or indirect, joint

or several, absolute or contingent, matured or unmatured, liquidated or

unliquidated, secured or unsecured, arising by contract, operation of law or

otherwise, arising or incurred or owing under this Agreement, the Notes or any

of the other Operative Documents or in respect of any of the Notes or other

instruments, agreements or documents at any time evidencing any of the

foregoing, in each case whether on account of principal, interest, premium,

reimbursement obligations, fees, indemnities, costs, expenses or otherwise

(including all interest, fees and other amounts that, but for the filing of a

petition in bankruptcy, would otherwise accrue (whether or not a claim for

post-filing or post-petition interest is allowed in such proceeding), and

including all fees and disbursements of counsel that are required to be paid by

the Borrower or any Guarantor pursuant to any of the Operative Documents), and

including obligations to perform acts and refrain from taking actions as well as

obligations to pay money.

“OFAC” shall have the

meaning assigned to such term in Section 5.12

hereof.

“Officer” means with

respect to any Person, an officer if such Person is a corporation, an officer or

a manager if such Person is a limited liability company, or an officer or a

partner if such Person is a partnership.

“Operative Documents”

means this Agreement, the Notes, the Guaranties, the Security Documents, the

Intercreditor Agreement and each other agreement, instrument or document now or

hereafter executed and pursuant to or in connection with any of the

foregoing.

“Owned Intellectual

Property” shall have the meaning assigned to such term in Section 5.8

hereof.

“Owner” means with

respect to the Borrower, each Person having legal or beneficial title to an

ownership interest in the Borrower or a right to acquire such an

interest.

“Patent and Trademark

Security Agreement” means each Patent and Trademark Security Agreement

entered into between the Borrower or any of the Guarantors and the Holder

Representative in the forms attached hereto as Exhibit

C.

19

“Pension Plan” means a

pension plan (as defined in Section 3(2) of ERISA) maintained for employees of

the Borrower or any ERISA Affiliate and covered by Title IV of

ERISA.

“Permitted Discretion”

means a determination made by the Holder Representative from the perspective of

a secured lender.

“Permitted Lien” and

“Permitted

Liens” shall have the meaning assigned to such term in Section 7.3(a)

hereof.

“Person” means any

individual, corporation, partnership, joint venture, limited liability company,

association, joint stock company, trust, unincorporated organization or

government or any agency or political subdivision of a governmental

entity.

“PIK Interest” shall

have the meaning assigned to that term in Section 1.1(a)

hereof.

“Plan” means an

employee benefit plan (as defined in Section 3(3) of ERISA) maintained for

employees of the Borrower or any ERISA Affiliate.

“Premises” shall have

the meaning assigned to such term in Section 2.4(a)

hereof.

“Proceeds” shall have

the meaning given it under the UCC.

“Prepayment Premium”

shall have the meaning assigned to such term in Section 1.4(d)

hereof.

“Property” means, as

to any Person, all types of real, personal, tangible, intangible or mixed

property owned by such Person, whether or not included in the most recent

balance sheet of such Person and its subsidiaries under GAAP.

“Proxy Statement”

shall have the meaning assigned to such term in Section 1.14

hereof.

“Purchaser” shall mean

MRC and its successors and assigns.

“Record” means

information that is inscribed on a tangible medium or that is stored in an

electronic or other medium and is retrievable in perceivable form, and includes

all information that is required to be reported by the Borrower to Holder

Representative pursuant to Section

7.1.

“Refinancing

Indebtedness” means refinancings, renewals, or extensions of indebtedness

so long as:

(a)

the principal amount of such refinancings, renewals, or

extensions of indebtedness does not exceed the principal amount of indebtedness

refinanced, renewed, or extended (plus all accrued interest on the indebtedness

and the amount of all reasonable amounts of fees and expenses reasonably

incurred, including premiums, incurred in connection therewith),

(b)

such refinancings, renewals, or

extensions do not result in a shortening of the average weighted maturity

(measured as of the refinancing, renewal, or extension) of the indebtedness so

refinanced, renewed, or extended (excluding the effects of prepayments of such

indebtedness in connection with such refinancing), nor are they on terms or

conditions that, after being compared to the terms or conditions of the existing

indebtedness and taken as a whole, are or could reasonably be expected to be

materially more burdensome or restrictive to the Borrower,

20

(c)

if the indebtedness that is

refinanced, renewed, or extended was subordinated in right of payment to the

Obligations, then the terms and conditions of the refinancing, renewal, or

extension must include subordination terms and conditions that are at least as

favorable to the Holders (as determined by Holder Representative in Holder

Representative’s sole discretion) as those that were applicable to the

refinanced, renewed, or extended indebtedness, and

(d)

the indebtedness that is refinanced, renewed, or

extended is not recourse to any Person that is liable on account of the

indebtedness other than those Persons which were obligated with respect to the

indebtedness that was refinanced, renewed, or extended.

“Reportable Event”

means a reportable event (as defined in Section 4043 of ERISA), other than an

event for which the 30-day notice requirement under ERISA has been waived in

regulations issued by the Pension Benefit Guaranty Corporation.

“Required Holders”

means, as of the date of determination, for so long as any of the Notes remain

outstanding, Holders holding Notes representing at least a majority of the

aggregate outstanding principal amount of all Notes then outstanding, acting or

voting together as a single class.

“Responsible Officer”

means the chief executive officer, the president, the chief financial officer,

or any vice president responsible for financial affairs of the Borrower,

Holdings or any other Guarantor, as applicable.

“San Gabriel Valley Site

Liabilities” means any and all losses and obligations arising from or

related to any of the following: (a) any hazardous substances or

other contamination present at, in, on or under, or that originated at or

migrated from, the Borrower’s or any Subsidiary’s leased real property in the

City of Industry, California on or prior to the date hereof, including any

obligations to or asserted by the California Regional Water Quality Control

Board, the United States Environmental Protection Agency or other government

agency; (b) any involvement in, with or at the San Gabriel Valley Superfund Site

and/or the Puente Valley Area or Operable Unit thereof in connection with the

Borrower’s or any Subsidiary’s leased real property in the City of Industry,

California (collectively, the “San Gabriel Valley Superfund Site”); and (c) all

pending and any future asserted personal injury, property or natural resource

damage, toxic tort or other lawsuits or claims related to hazardous substances

or other contaminants within the San Gabriel Valley Superfund Site and/or any

Hazardous Substances or other contamination present at, in, on or under, or that

originated at or migrated from, the Borrower’s or any Subsidiary’s leased real

property in the City of Industry, California on or prior to the date hereof,

including any contamination related claims or lawsuits filed or to be filed by

water suppliers located within the San Gabriel Valley Superfund Site thereof in

connection with the Borrower’s or any Subsidiary’s leased real property in the

City of Industry, California.

21

“San Gabriel Valley Superfund

Site” has the meaning set forth in the definition of “San Gabriel Valley

Site Liabilities.

“Securities Act” shall

mean the Securities Act of 1933, as amended, or any similar successor federal

statute, and the rules and regulations of the Commission thereunder, all as the

same shall be in effect at the time.

“Security Documents”

means this Agreement, the Guarantor Security Agreement, each Collateral Pledge

Agreement, each Patent and Trademark Security Agreement, and any other document

delivered to the Holder Representative from time to time to create and/or

perfect a security interest in Collateral or other assets that are collateral,

directly or indirectly, for the Obligations.

“Security Interest”

shall have the meaning assigned to such term in Section 2.1

hereof.

“Senior Collateral”

means all of the property, rights and interests of Holdings, the Borrower and

any other Subsidiaries that are or are intended to be subject to the security

interests and Liens created by the Senior Credit Agreement and the other Senior

Loan Documents.

“Senior Credit

Agreement” means that certain Wells Fargo Business Credit and Security

Agreement dated as of the date hereof between the Borrower, as borrower and

Senior Lender, as lender, including any successor agreement pursuant to a

refinancing of the Senior Obligations.

“Senior Lender” shall

mean Wells Fargo Bank, National Association acting through its Wells Fargo

Business Credit operating division, as the lender under the Senior Credit

Agreement, and its successors or assigns thereunder.

“Senior Loan

Documents” shall mean the Senior Credit Agreement plus the “Loan

Documents” as such term is defined in the Senior Credit Agreement (or to any

substantially equivalent term or concept in any amended or successor Senior

Credit Agreement).

“Senior Obligations”

shall have the meaning assigned to such term in the Intercreditor Agreement

(with respect to Senior Lender only) and the

term “Indebtedness” in the Senior Credit Agreement (or to any substantially

equivalent term or concept in any amended or successor Senior Credit

Agreement).

“Stockholders Meeting”

shall have the meaning assigned to such term in Section 1.14

hereof.

“Subordinated Debt”

means indebtedness of Holdings, the Borrower or any other Subsidiaries other

than the Senior Obligations, including without limitation all interest on

Subordinated Debt, whether payable in cash or in kind, all on terms and

conditions, and in amounts, satisfactory to the Required Holders in their sole

discretion (as evidenced by their written approval).

“Subordination Agreement” means any

agreement providing for the subordination of any Subordinated Debt on terms and

conditions satisfactory to the Required Holders in their sole discretion (as

evidenced by their written approval).

22

“Subsidiary” means any

Person of which more than 50% of the outstanding ownership interests having

general voting power under ordinary circumstances to elect a majority of the

board of directors or the equivalent of such Person, irrespective of whether or

not at the time ownership interests of any other class or classes shall have or

might have voting power by reason of the happening of any contingency, is at the

time directly or indirectly owned by the Borrower, by the Borrower and one or

more other Subsidiaries, or by one or more other Subsidiaries.

“Uniform Commercial

Code” or “UCC” means the

Uniform Commercial Code as adopted in the State of New York from time to

time.

“U.S. Dollars” and

“$” each means

the lawful currency of the United States of America.

3.2

Interpretation. The

foregoing definitions are equally applicable to both the singular and plural