Attached files

| file | filename |

|---|---|

| 8-K - OSG America L.P. | osp3q8k.htm |

| EX-99 - OSG America L.P. | osp3qx991.htm |

Exhibit 99.2

OSG America L.P.

Third Quarter Fiscal 2009

Earnings Conference Call

November 2, 2009

This presentation may contain forward-looking statements regarding the Partnership’s prospects, including

the outlook for U.S. tanker and articulated tug barge markets, the outcome of negotiations with AMSC,

OSG’s intention to tender for the outstanding common units of the Partnership, the payment of cash

distributions, the timely delivery of newbuilds in accordance with contracted terms, projected drydocking

schedule, off hire days for the fourth quarter of 2009, forecasted 2009 EBITDA, equity distribution from

affiliates, charter hire expense, cash interest, drydocking and replacement reserves and cash available for

distribution, projected distributable cash flow for the balance of 2009 and the forecast of U.S. economic

activity and U.S. oil demand. These statements are based on certain assumptions made by the

Partnership’s management based on its experience and perception of historical trends, current conditions,

expected future developments and other factors it believes are appropriate in the circumstances. Forward-

looking statements are subject to a number of risks, uncertainties and assumptions, many of which are

beyond the control of the Partnership, which may cause actual results to differ materially from those implied

or expressed by the forward-look statements. Factors, risks and uncertainties that could cause actual

results to differ from expectations reflected in such forward-looking statements are described in the

Partnership’s Annual Report on Form 10-K for 2008 and those risks discussed in other reports the

Partnership files with the Securities and Exchange Commission.

Forward Looking Statements

Quarterly Results

Third Quarter 2009 Financial Results

Continued deterioration in spot market rates

TCE revenues up by less than $1 million

Increase in expenses, specifically charter hire

Overseas Puget Sound and Overseas Galena Bay exit layup and begin grain voyages

Distribution

Cash available for distribution was $8.5M, a decline of $3.4M from 2Q09 levels of $11.9M

Distribution coverage for third quarter was 74%

Estimated term charter coverage for 4Q09 is 85%; for 2010 59% and 2011 55%

$0.8

$63.7

$64.5

TCE Revenues

$9.6

19.3

($9.7)

3Q08

($7.2)

(6.8)

(0.4)

$2.4

Adjusted net income

12.5

Impairments

($10.1)

Reported Net Loss

3Q09

($ in millions)

Lower oil demand reduced volumes across all Jones Act markets

First nine months 2009 U.S. oil demand down by about 5% from 2008 levels

2009 USGC refinery utilization averaged 84% over first 8 months, down from 86% in same

timeframe in 2008

Reduction in FCCUs further reduced manufacturing of light products

Delaware Bay Lightering: First 9 Months Market Activity

Volumes declined by 20% from last year’s levels

East Coast refining utilization levels declined to 73% from 82% in the same period last year

Announced Sunoco shutdown of Eagle Point refinery and Valero “temporary” shutdown of

units at Delaware City could adversely impact lightering activities

68 vessels trading in Jones Act coastwise market at quarter end

Nine Jones Act vessels currently in lay up, including two OSG America ships

Four deliveries expected in 4Q09

Year-end fleet forecast at 72 vessels

Jones Act Market Update

Update on Other Activities

Dividend Suspended

AMSC Negotiations

Non-binding settlement signed

Change in provisions materially altering prior agreement

Dismissal with prejudice of all claims in arbitration among parties

Financial Overview

Henry Flinter

Chief Financial Officer

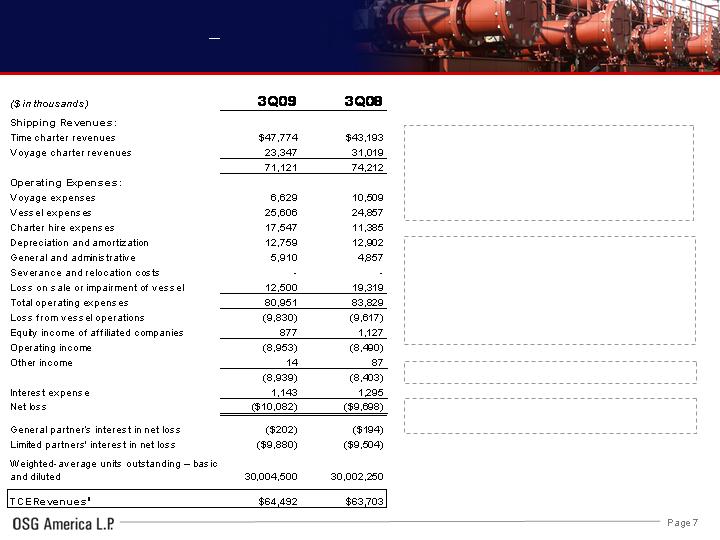

Financial Highlights Income Statement

Increase in time charter revenues primarily reflect

additional revenue days and higher rates for Jones Act

Product carriers delivered after 3Q08

TCE revenues were adversely impacted by a reduction

in international product spot rates and by the lay up of

vessels

1See Appendix for a reconciliation of this non-GAAP measure to the most directly comparable GAAP financial measure.

Lower equity income considers 2 fewer vessels under

management compared with 2008

Higher vessel expenses are due to an increase in

operating days resulting from 4 new product carriers and

the switch of the OSG 400 to bareboat charter from time

charter, somewhat offset by lower expenses for vessels

in lay up

Higher charter hire expense reflects delivery of 3 new

product carriers on bareboat from AMSC

Impairment in 2009 for 2 vessels

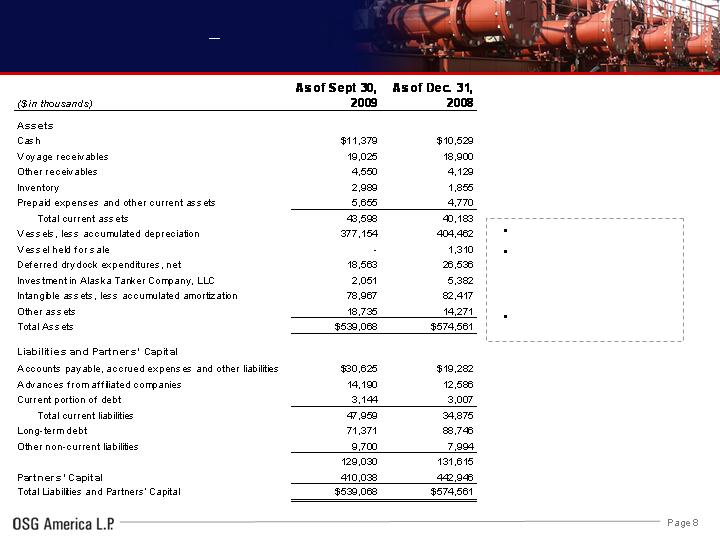

Financial Highlights Balance Sheet

Safely within debt covenants

Total debt levels have

declined by $17.2 million

over the first nine months of

2009

$170 million available under

revolver

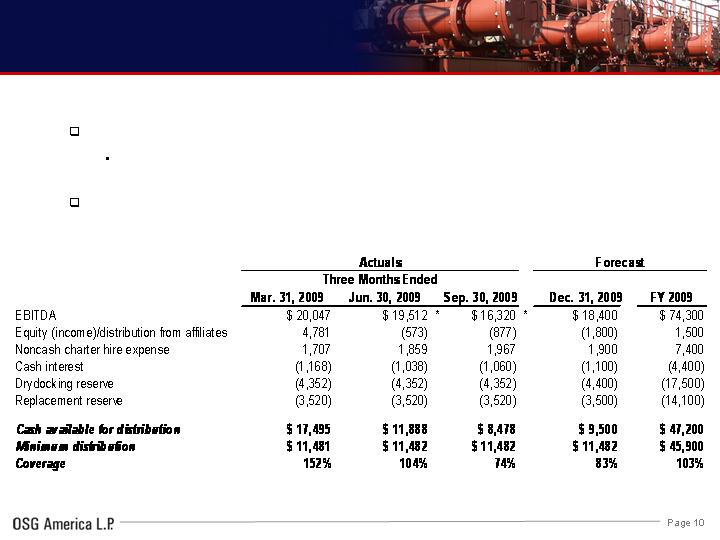

Distributable Cash Flow1

Distribution coverage was 74%

for the third quarter and 110% for

the first nine months of 2009

1See Appendix for a reconciliation of this non-GAAP measure to the most directly comparable GAAP financial measure.

2009 Forecast

Fiscal 2009 coverage distribution is expected to be 103%

Full year coverage improved slightly from August due to the grain voyage

performed by the Galena Bay which was not anticipated in the prior guidance

2009 coverage guidance has declined from 117% (March) to 103%

(November)

*Reflects add back of loss on sale or impairment of vessel

Appendix

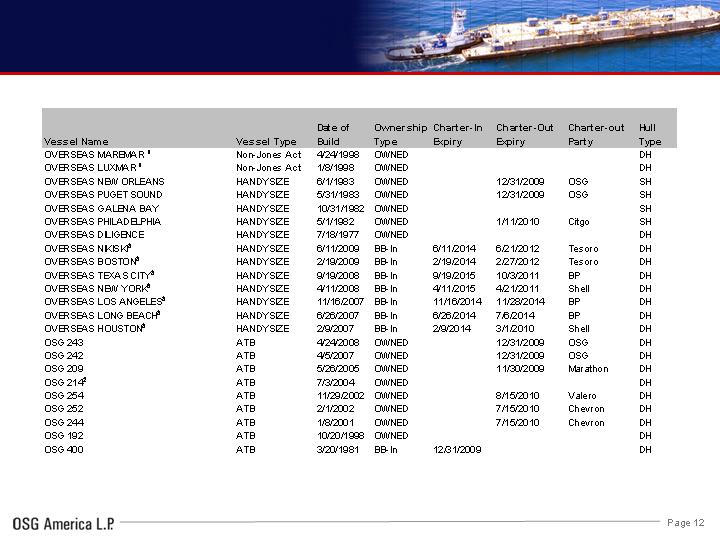

Operating Fleet

1 50% of revenue days are covered by a government contract, which has been extended through 2011; 2 Vessels in lay up;

3Charter- in

dates are for initial terms (OSG America has unlimited renewal options); charter-out dates are for initial periods only. 4 On a COA

contract servicing Sunoco in lightering. A full fleet list that includes additional information is available in the Fleet section of

osgamerica.com

As of October 31, 2009

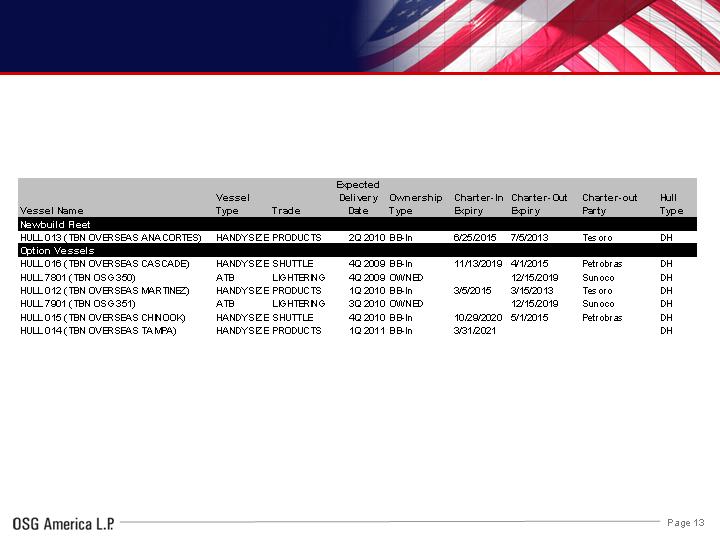

Newbuild Fleet & Option Vessels

Notes:

Newbuild vessels were contributed by OSG to OSG America at the time of its initial public offering; option vessels are

those that the Partnership has the right to acquire from OSG at to-be-negotiated purchase prices prior to the first

anniversary of the delivery of each vessel to OSG.

On October 14, 2008, American Shipping Company ("AMSC") notified OSG that AMSC was reversing the building

sequence of these two vessels. OSG disputes AMSC's ability to make this change without OSG’s consent, and OSG

has objected and requested that this dispute be arbitrated expeditiously to avoid or reduce any harm to OSG or its

ultimate customers.

As of October 31, 2009

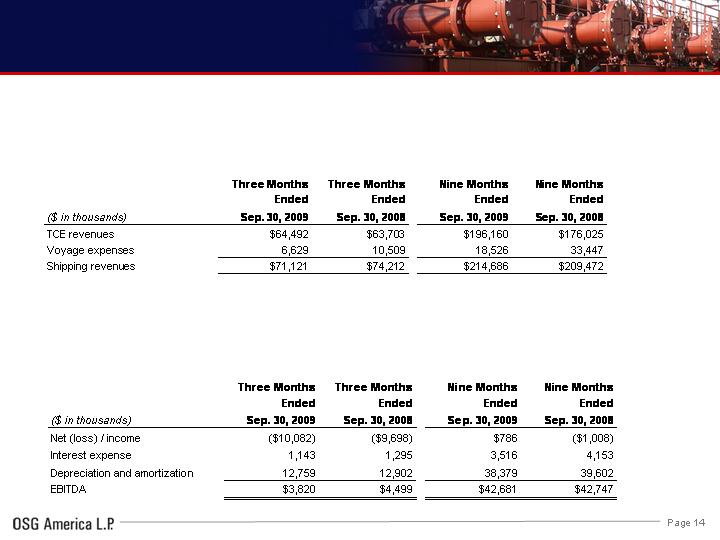

Reconciliation Tables

EBITDA

EBITDA represents operating earnings, which is before interest expense, plus other income and depreciation and amortization expense.

EBITDA is presented to provide investors with meaningful additional information that management uses to monitor ongoing operating

results and evaluate trends over comparative periods. EBITDA should not be considered a substitute for net income or cash flow from

operating activities prepared in accordance with accounting principles generally accepted in the United States or as a measure of

profitability or liquidity. While EBITDA is frequently used as a measure of operating results and performance, it is not necessarily

comparable to other similarly titled captions of other companies due to differences in methods of calculation.

TCE Revenue

Consistent with general practice in the shipping industry, the Partnership uses time charter equivalent revenues, which represents shipping

revenues less voyage expenses, as a measure to compare revenue generated from a voyage charter to revenue generated from a time charter.

Time charter equivalent revenues, a non-GAAP measure, provides additional meaningful information in conjunction with shipping revenues, the

most directly comparable GAAP measure, because it assists the Partnership’s management in making decisions regarding the deployment and

use of its vessels and in evaluating their financial performance.