Ally Financial Inc. - FORM 8-K - EX-99.2 - November 4, 2009

Attached files

Preliminary

Preliminary

2009 Third Quarter Results

November 4, 2009

9:00 AM EST

Contact GMAC Investor Relations at (866) 710-4623 or investor.relations@gmacfs.com

Forward-Looking Statements

In the presentation that follows and related comments by GMAC Inc. (“GMAC”) management, the use of the words “expect,”

Forward-Looking Statements

In the presentation that follows and related comments by GMAC Inc. (“GMAC”) management, the use of the words “expect,”

“anticipate,” “estimate,” “forecast,”

“initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “intend,”

“evaluate,” “pursue,” “seek,” “may,”

“would,” “could,” “should,” “believe,” “potential,” “continue,” or similar expressions is intended

to identify forward-looking statements. All statements herein and in related management comments,

other than statements of

historical fact, including without limitation, statements about future events and financial performance, are forward-looking

statements that involve certain risks and uncertainties. While these statements represent our current

judgment on what the future

may hold, and we believe these judgments are reasonable, these statements are not guarantees of any events or financial

results, and GMAC’s and Residential Capital, LLC’s (“ResCap”) actual results may

differ materially due to numerous important

factors that are described in the most recent reports on SEC Forms 10-K and 10-Q for GMAC and ResCap, each of which may

be revised or supplemented in subsequent reports on SEC Forms 10-Q and 8-K. Such factors

include, among others, the

following: our inability to successfully accommodate the additional risk exposure relating to providing wholesale and retail

financing to Chrysler dealers and customers and the resulting impact to our financial stability;

uncertainty related to Chrysler’s

and GM’s recent exits from bankruptcy; uncertainty related to the new financing arrangement between GMAC and Chrysler;

securing low cost funding for GMAC and ResCap and maintaining the mutually beneficial

relationship between GMAC and GM,

and GMAC and Chrysler; our ability to maintain an appropriate level of debt and capital; the profitability and financial condition of

GM and Chrysler; our ability to realize the anticipated benefits associated with

our recent conversion to a bank holding company,

and the increased regulation and restrictions that we are subject to; continued challenges in the residential mortgage and capital

markets; the potential for deterioration in the residual value of off-lease

vehicles; the continuing negative impact on ResCap of

the decline in the U.S. housing market; changes in U.S. government-sponsored mortgage programs or disruptions in the markets

in which our mortgage subsidiaries operate; disruptions in the market

in which we fund GMAC’s and ResCap’s operations, with

resulting negative impact on our liquidity; changes in our accounting assumptions that may require or that result from changes in

the accounting rules or their application, which could

result in an impact on earnings; changes in the credit ratings of ResCap,

GMAC, Chrysler or GM; changes in economic conditions, currency exchange rates or political stability in the markets in which we

operate; and changes in the existing or the adoption

of new laws, regulations, policies or other activities of governments,

agencies and similar organizations. Investors are cautioned not to place undue reliance on forward-looking statements. GMAC

undertakes no obligation to update publicly

or otherwise revise any forward-looking statements except where expressly required

by law. A reconciliation of certain non-GAAP financial measures included within this presentation is provided in

the supplemental charts.

Use of the term “loans” describes products associated with direct and indirect lending activities of GMAC’s global operations.

The specific products include retail installment sales

contracts, loans, lines of credit, leases or other financing products. The term

“originate” refers to GMAC’s purchase, acquisition or direct origination of various “loan” products.

2

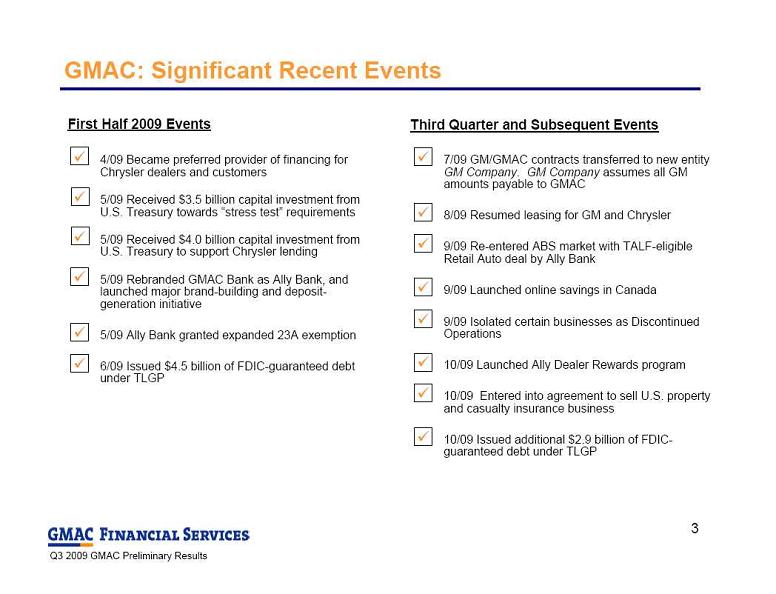

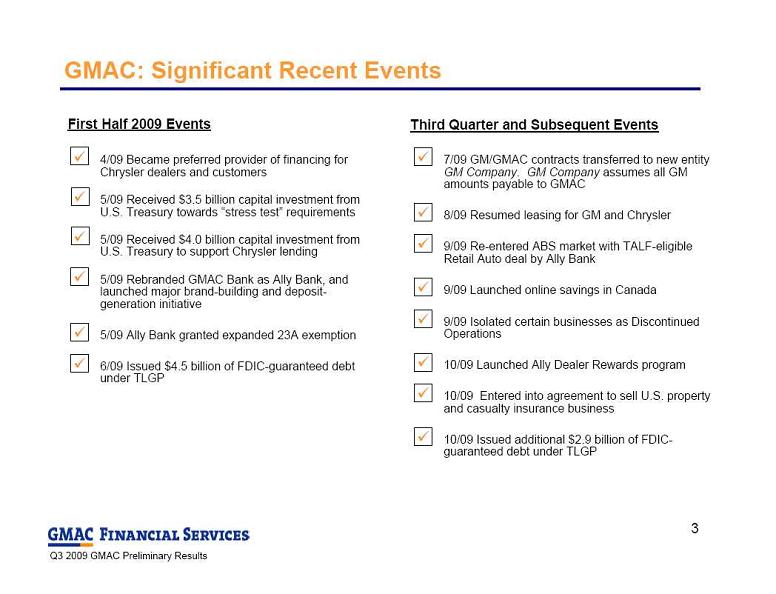

GMAC: Significant Recent Events

4/09 Became preferred provider of financing for

GMAC: Significant Recent Events

4/09 Became preferred provider of financing for

Chrysler dealers and customers

5/09 Received $3.5 billion capital investment from

U.S. Treasury towards “stress test” requirements

5/09 Received $4.0 billion capital investment from

U.S. Treasury to support Chrysler lending

5/09 Rebranded GMAC Bank as Ally Bank, and

launched major brand-building and deposit-

generation initiative

5/09 Ally Bank granted expanded 23A exemption

6/09 Issued $4.5 billion of FDIC-guaranteed debt

under TLGP

7/09 GM/GMAC contracts transferred to new entity

GM Company

. GM Company assumes all GM

amounts payable to GMAC

8/09 Resumed leasing for GM and Chrysler

9/09 Re-entered ABS market with TALF-eligible

Retail Auto deal by Ally Bank

9/09 Launched online savings in Canada

9/09 Isolated certain businesses as Discontinued

Operations

10/09 Launched Ally Dealer Rewards program

10/09 Entered into agreement to sell U.S. property

and casualty insurance business

10/09 Issued additional $2.9 billion of FDIC-

guaranteed debt under TLGP

First Half 2009 Events

Third Quarter and Subsequent Events

3

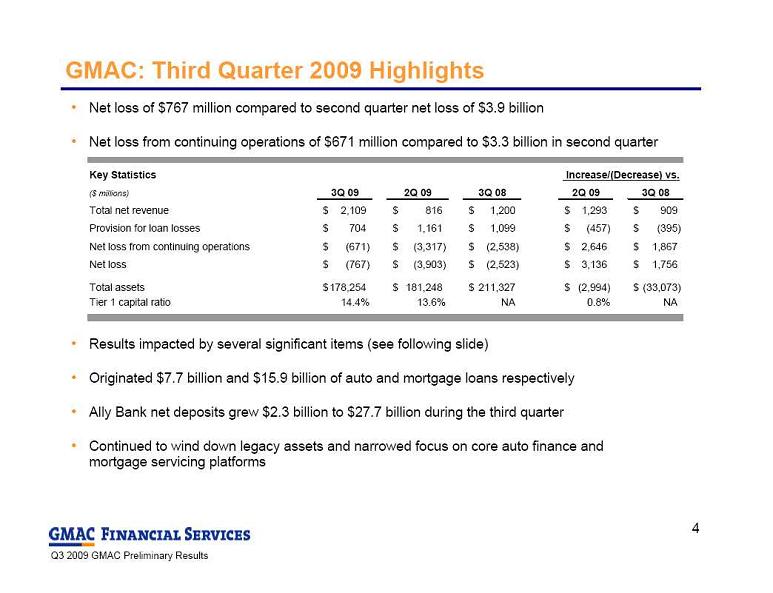

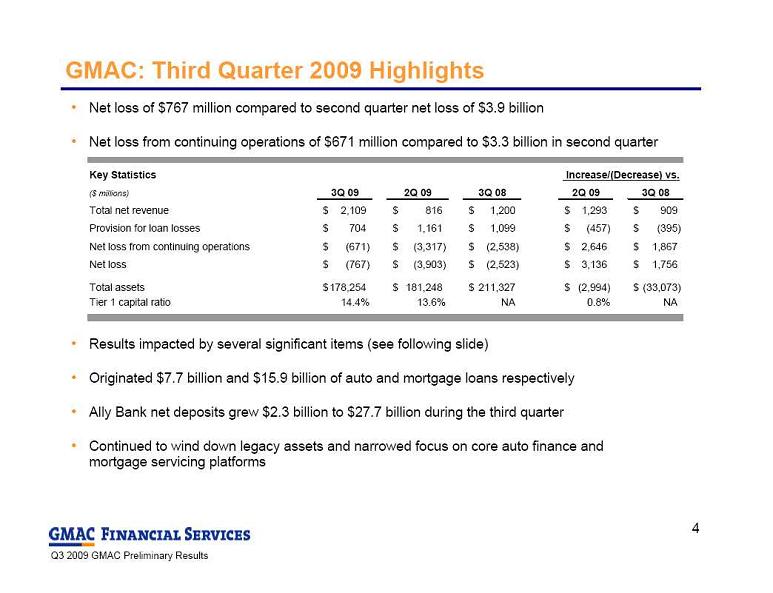

Net loss of $767 million compared to second quarter net loss of $3.9 billion

Net loss from continuing operations of $671 million compared to $3.3 billion in second quarter

Results impacted by several significant items (see following slide)

Originated $7.7 billion and $15.9 billion of auto and mortgage loans respectively

Ally Bank net deposits grew $2.3 billion to $27.7 billion during the third quarter

Continued to wind down legacy assets and narrowed focus on core auto finance and

Net loss of $767 million compared to second quarter net loss of $3.9 billion

Net loss from continuing operations of $671 million compared to $3.3 billion in second quarter

Results impacted by several significant items (see following slide)

Originated $7.7 billion and $15.9 billion of auto and mortgage loans respectively

Ally Bank net deposits grew $2.3 billion to $27.7 billion during the third quarter

Continued to wind down legacy assets and narrowed focus on core auto finance and

mortgage servicing platforms

GMAC: Third Quarter 2009 Highlights

Key Statistics

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Total net revenue

2,109

$

816

$

1,200

$

1,293

$

909

$

Provision for loan losses

704

$

1,161

$

1,099

$

(457)

$

(395)

$

Net loss from continuing operations

(671)

$

(3,317)

$

(2,538)

$

2,646

$

1,867

$

Net loss

(767)

$

(3,903)

$

(2,523)

$

3,136

$

1,756

$

Total assets

178,254

$

181,248

$

211,327

$

(2,994)

$

(33,073)

$

Tier 1 capital ratio

14.4%

13.6%

NA

0.8%

NA

Increase/(Decrease) vs.

4

Certain business lines were isolated as discontinued operations as they are being sold

Several significant items impacted third quarter results

GMAC: Significant Items Impacting Earnings

(1) Includes provision, impairments and reserves on certain non-bank mortgage assets.

Note: Loss of ($266) million includes additional significant items that were not reflected in the ($429) million loss shown in the second quarter earnings

Certain business lines were isolated as discontinued operations as they are being sold

Several significant items impacted third quarter results

GMAC: Significant Items Impacting Earnings

(1) Includes provision, impairments and reserves on certain non-bank mortgage assets.

Note: Loss of ($266) million includes additional significant items that were not reflected in the ($429) million loss shown in the second quarter earnings

presentation: $344 million amortization of bond

exchange discount and $62 million of mark-to-market on auto retained interests. 2Q09 loss above excludes $114

million of tax expense related to discontinued operations.

($ millions)

3Q 09

2Q 09

Loss from continuing operations

(671)

$

(3,317)

$

Income tax (benefit) expense from continuing operations

(292)

1,099

Loss from continuing operations before income tax expense

(963)

(2,218)

Mortgage repurchase reserve expense

515

231

Loss provision on resort finance assets

161

105

Legacy mortgage provision expense

1

79

504

Commercial and International mortgage portfolio marks / write-downs

(23)

830

Amortization of bond exchange discount

309

344

Mark-to-market on auto retained interests (gain)

(155)

(62)

Loss excluding above items

(77)

$

(266)

$

5

GMAC: Income by Segment

(1) Corporate and Other segment includes Commercial Finance, equity investments, amortization of original issue discount from GMAC bond exchange, and

GMAC: Income by Segment

(1) Corporate and Other segment includes Commercial Finance, equity investments, amortization of original issue discount from GMAC bond exchange, and

other corporate activities.

(2) Discontinued Operations currently includes: U.S. property and casualty insurance (Insurance segment); Argentina operations, United Kingdom full-service

leasing and Italy full-service leasing from International

Operations (Global Automotive Finance Segment). Other businesses may be included in discontinued

operations in the future.

Global Auto Finance: Continued normalization of origination volumes, credit expenses

and used vehicle

prices

Insurance: Increased focus on dealer related products to complement auto finance business

Mortgage Operations: Further credit related costs outweigh stronger net revenue

Corporate/Other: Continued amortization of original issue discount from the 2008 bond exchanges and loss

provision on the Resort Finance

portfolio

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

North American Automotive Finance

345

$

302

$

(323)

$

43

$

668

$

International Automotive Finance

50

45

(56)

5

106

Global Automotive Finance

395

347

(379)

48

774

Insurance

81

95

73

(14)

8

Mortgage Operations

(747)

(2,044)

(1,949)

1,297

1,202

Corporate and Other

1

(692)

(616)

(384)

(76)

(308)

Loss from continuing operations

(963)

(2,218)

(2,639)

1,255

1,676

Income tax (benefit) expense

(292)

1,099

(101)

(1,391)

(191)

Discontinued Operations

2

(96)

(586)

15

490

(111)

Loss

(767)

$

(3,903)

$

(2,523)

$

3,136

$

1,756

$

Increase/(Decrease) vs.

6

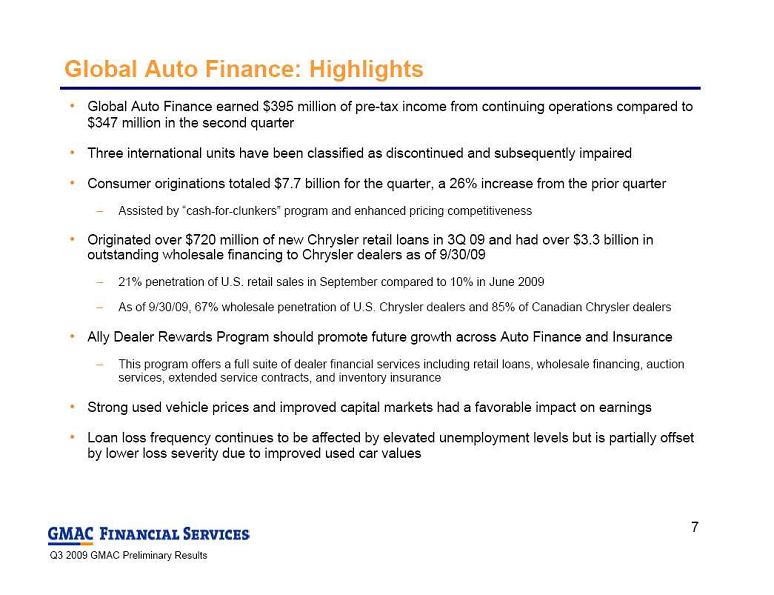

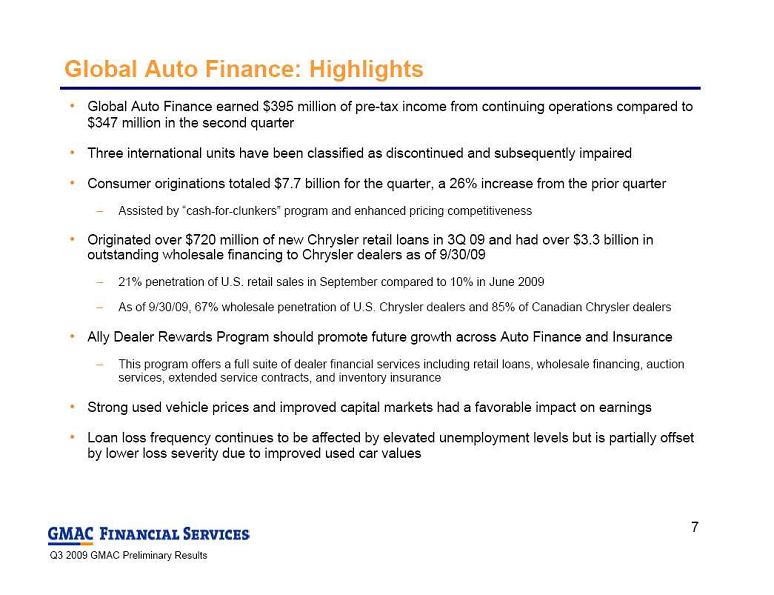

Global Auto Finance: Highlights

Global Auto Finance earned $395 million of pre-tax income from continuing operations compared to

Global Auto Finance: Highlights

Global Auto Finance earned $395 million of pre-tax income from continuing operations compared to

$347

million in the second quarter

Three international units have been classified as discontinued and subsequently impaired

Consumer originations totaled $7.7 billion for the quarter, a 26% increase from the prior quarter

Assisted by “cash-for-clunkers” program and enhanced pricing competitiveness

Originated over $720 million of new Chrysler retail loans in 3Q 09 and had over $3.3 billion in

outstanding wholesale financing to Chrysler dealers as

of 9/30/09

21% penetration of U.S. retail sales in September compared to 10% in June 2009

As of 9/30/09, 67% wholesale penetration of U.S. Chrysler dealers and 85% of Canadian Chrysler dealers

Ally Dealer Rewards Program should promote future growth across Auto Finance and Insurance

This program offers a full suite of dealer financial services including retail loans, wholesale financing, auction

services, extended service contracts, and inventory insurance

Strong used vehicle prices and improved capital markets had a favorable impact on earnings

Loan loss frequency continues to be affected by elevated unemployment levels but is partially offset

by lower loss severity due to improved used car values

7

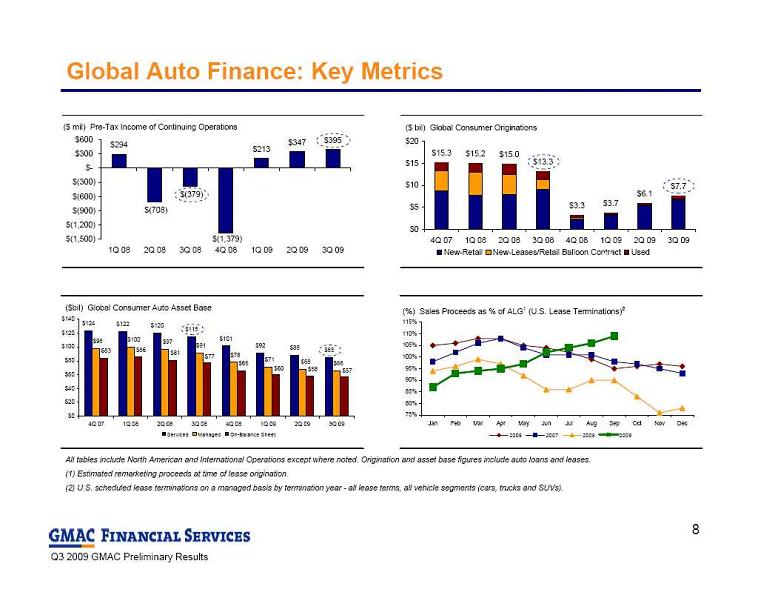

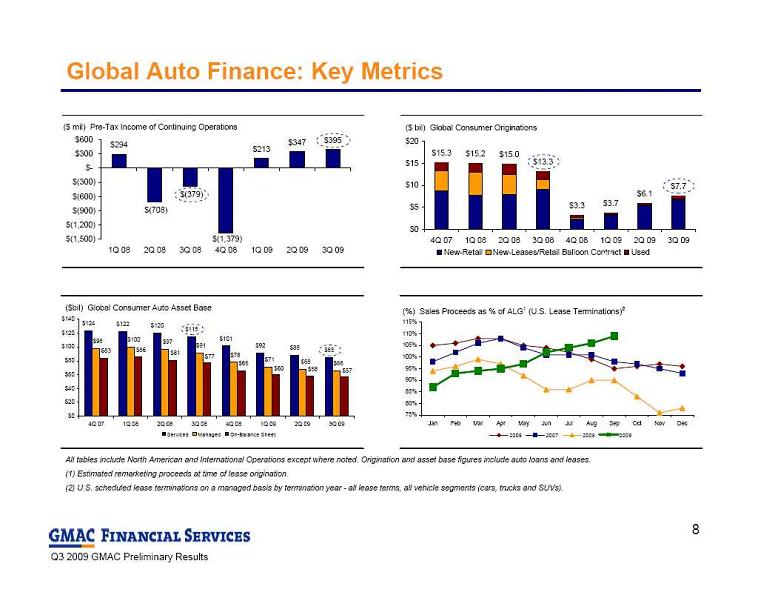

Global Auto Finance: Key Metrics

All tables include North American and International Operations except where noted. Origination and asset base figures include auto loans and leases.

(1) Estimated remarketing proceeds at time of lease origination.

(2) U.S. scheduled lease terminations on a managed basis by termination year - all lease terms, all vehicle segments (cars, trucks and SUVs).

0.4

($ mil) Pre-Tax Income of Continuing Operations

$294

$(708)

$(379)

$213

$347

$395

$(1,379)

$(1,500)

$(1,200)

$(900)

$(600)

$(300)

$-

$300

$600

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

($ bil) Global Consumer Originations

$15.3

$15.2

$15.0

$13.3

$3.3

$3.7

$6.1

$7.7

$0

$5

$10

$15

$20

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

New-Retail

New-Leases/Retail Balloon Contract

Used

Total

($bil) Global Consumer Auto Asset Base

$124

$122

$120

$115

$101

$92

$88

$85

$66

$68

$71

$78

$91

$97

$100

$98

$57

$58

$60

$66

$77

$81

$86

$83

$0

$20

$40

$60

$80

$100

$120

$140

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

Serviced

Managed

On-Balance Sheet

(%) Sales Proceeds as % of ALG

1

(U.S. Lease Terminations)

2

75%

80%

85%

90%

95%

100%

105%

110%

115%

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2006

2007

2008

2009

8

Global Auto Finance: Key Metrics

All tables include North American and International Operations except where noted. Origination and asset base figures include auto loans and leases.

(1) Estimated remarketing proceeds at time of lease origination.

(2) U.S. scheduled lease terminations on a managed basis by termination year - all lease terms, all vehicle segments (cars, trucks and SUVs).

0.4

($ mil) Pre-Tax Income of Continuing Operations

$294

$(708)

$(379)

$213

$347

$395

$(1,379)

$(1,500)

$(1,200)

$(900)

$(600)

$(300)

$-

$300

$600

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

($ bil) Global Consumer Originations

$15.3

$15.2

$15.0

$13.3

$3.3

$3.7

$6.1

$7.7

$0

$5

$10

$15

$20

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

New-Retail

New-Leases/Retail Balloon Contract

Used

Total

($bil) Global Consumer Auto Asset Base

$124

$122

$120

$115

$101

$92

$88

$85

$66

$68

$71

$78

$91

$97

$100

$98

$57

$58

$60

$66

$77

$81

$86

$83

$0

$20

$40

$60

$80

$100

$120

$140

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

Serviced

Managed

On-Balance Sheet

(%) Sales Proceeds as % of ALG

1

(U.S. Lease Terminations)

2

75%

80%

85%

90%

95%

100%

105%

110%

115%

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2006

2007

2008

2009

8

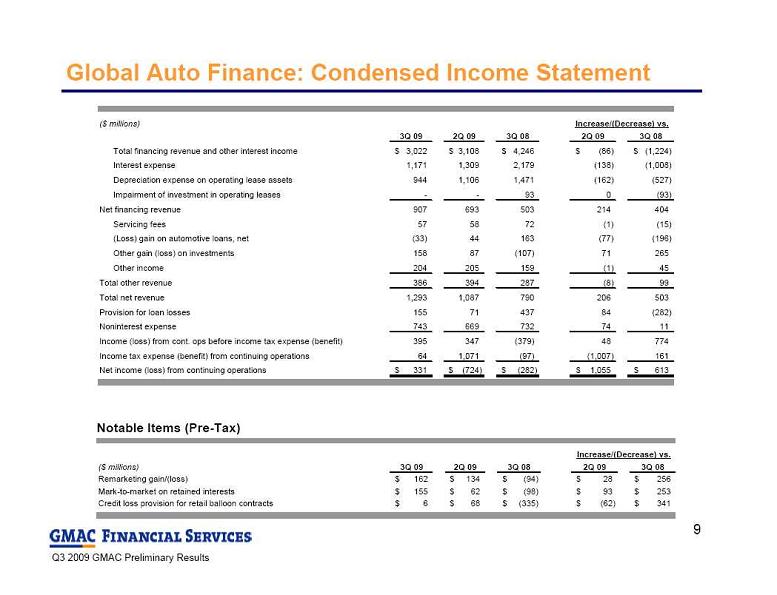

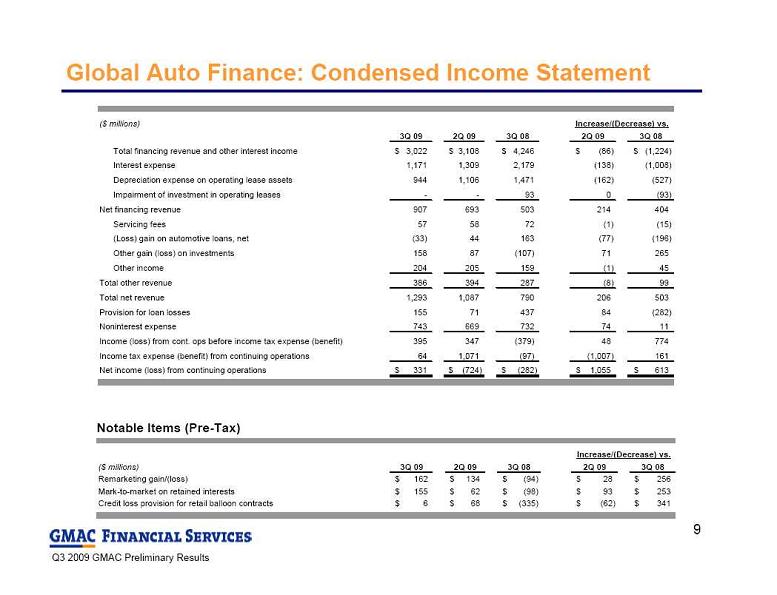

Global Auto Finance: Condensed Income Statement

Notable Items (Pre-Tax)

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Total financing revenue and other interest income

3,022

$

3,108

$

4,246

$

(86)

$

(1,224)

$

Interest expense

1,171

1,309

2,179

(138)

(1,008)

Depreciation expense on operating lease assets

944

1,106

1,471

(162)

(527)

Impairment of investment in operating leases

-

-

93

0

(93)

Net financing revenue

907

693

503

214

404

Servicing fees

57

58

72

(1)

(15)

(Loss) gain on automotive loans, net

(33)

44

163

(77)

(196)

Other gain (loss) on investments

158

87

(107)

71

265

Other income

204

205

159

(1)

45

Total other revenue

386

394

287

(8)

99

Total net revenue

1,293

1,087

790

206

503

Provision for loan losses

155

71

437

84

(282)

Noninterest expense

743

669

732

74

11

Income (loss) from cont. ops before income tax expense (benefit)

395

347

(379)

48

774

Income tax expense (benefit) from continuing operations

64

1,071

(97)

(1,007)

161

Net income (loss) from continuing operations

331

$

(724)

$

(282)

$

1,055

$

613

$

Increase/(Decrease) vs.

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Remarketing gain/(loss)

162

$

134

$

(94)

$

28

$

256

$

Mark-to-market on retained interests

155

$

62

$

(98)

$

93

$

253

$

Credit loss provision for retail balloon contracts

6

$

68

$

(335)

$

(62)

$

341

$

Increase/(Decrease) vs.

9

Global Auto Finance: Condensed Income Statement

Notable Items (Pre-Tax)

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Total financing revenue and other interest income

3,022

$

3,108

$

4,246

$

(86)

$

(1,224)

$

Interest expense

1,171

1,309

2,179

(138)

(1,008)

Depreciation expense on operating lease assets

944

1,106

1,471

(162)

(527)

Impairment of investment in operating leases

-

-

93

0

(93)

Net financing revenue

907

693

503

214

404

Servicing fees

57

58

72

(1)

(15)

(Loss) gain on automotive loans, net

(33)

44

163

(77)

(196)

Other gain (loss) on investments

158

87

(107)

71

265

Other income

204

205

159

(1)

45

Total other revenue

386

394

287

(8)

99

Total net revenue

1,293

1,087

790

206

503

Provision for loan losses

155

71

437

84

(282)

Noninterest expense

743

669

732

74

11

Income (loss) from cont. ops before income tax expense (benefit)

395

347

(379)

48

774

Income tax expense (benefit) from continuing operations

64

1,071

(97)

(1,007)

161

Net income (loss) from continuing operations

331

$

(724)

$

(282)

$

1,055

$

613

$

Increase/(Decrease) vs.

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Remarketing gain/(loss)

162

$

134

$

(94)

$

28

$

256

$

Mark-to-market on retained interests

155

$

62

$

(98)

$

93

$

253

$

Credit loss provision for retail balloon contracts

6

$

68

$

(335)

$

(62)

$

341

$

Increase/(Decrease) vs.

9

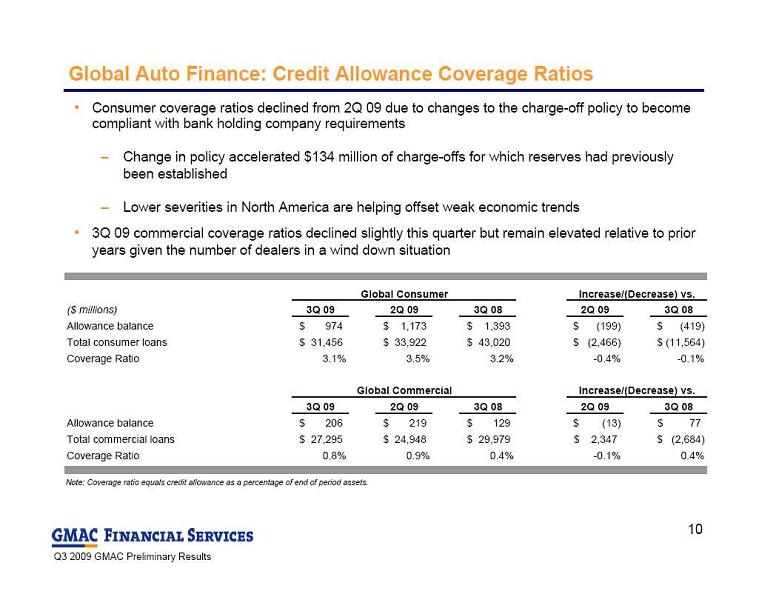

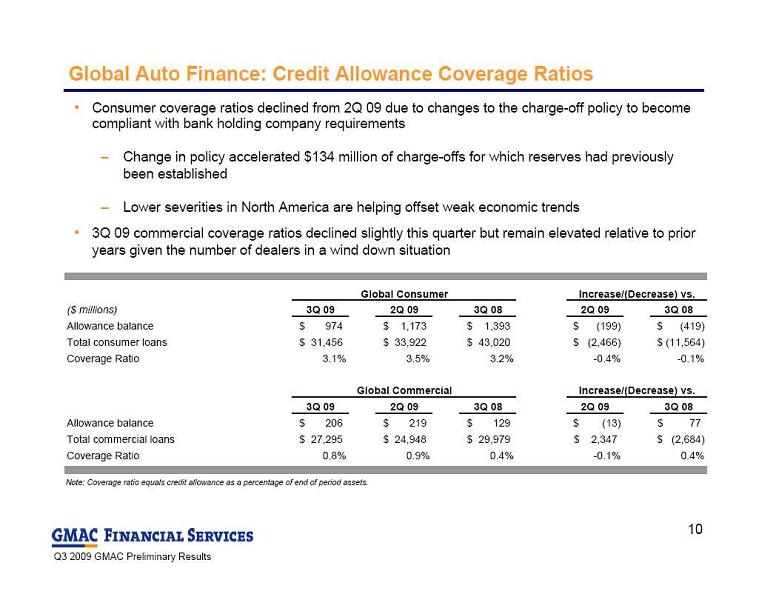

Global Auto Finance: Credit Allowance Coverage Ratios

Consumer coverage ratios declined from 2Q 09 due to changes to the charge-off policy to become

Global Auto Finance: Credit Allowance Coverage Ratios

Consumer coverage ratios declined from 2Q 09 due to changes to the charge-off policy to become

compliant with bank holding company requirements

Change in policy accelerated $134 million of charge-offs for which reserves had previously

been established

Lower severities in North America are helping offset weak economic trends

3Q 09 commercial coverage ratios declined slightly this quarter but remain elevated relative to prior

years given the number of dealers in a wind down

situation

Note: Coverage ratio equals credit allowance as a percentage of end of period assets.

Global Consumer

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Allowance balance

974

$

1,173

$

1,393

$

(199)

$

(419)

$

Total consumer loans

31,456

$

33,922

$

43,020

$

(2,466)

$

(11,564)

$

Coverage Ratio

3.1%

3.5%

3.2%

-0.4%

-0.1%

Global Commercial

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Allowance balance

206

$

219

$

129

$

(13)

$

77

$

Total commercial loans

27,295

$

24,948

$

29,979

$

2,347

$

(2,684)

$

Coverage Ratio

0.8%

0.9%

0.4%

-0.1%

0.4%

Increase/(Decrease) vs.

Increase/(Decrease) vs.

10

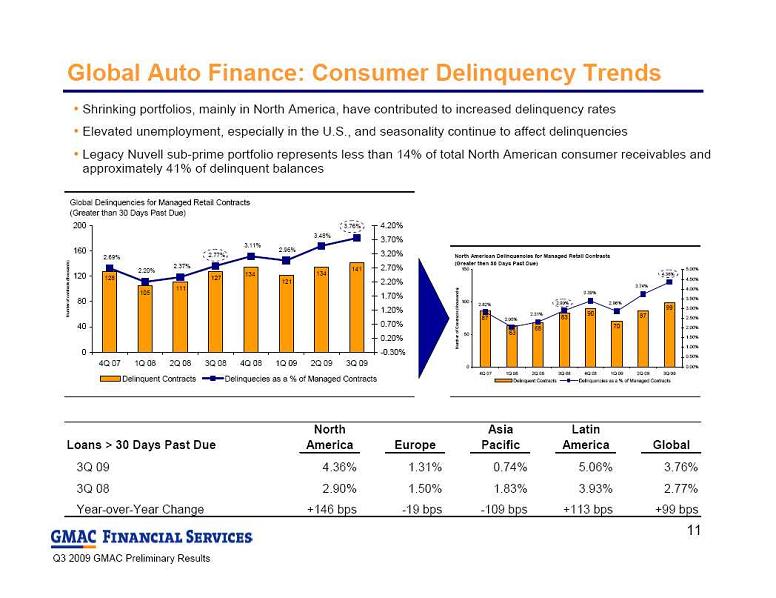

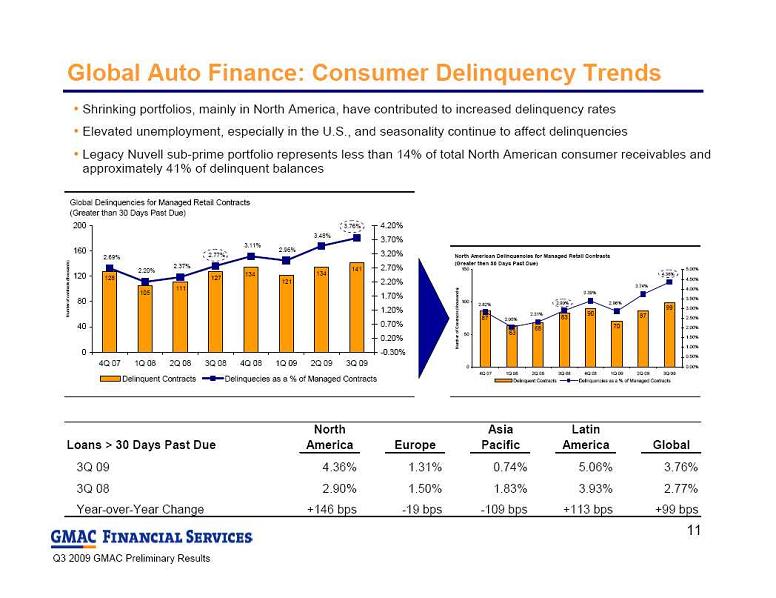

Shrinking portfolios, mainly in North America, have contributed to increased delinquency rates

Elevated unemployment, especially in the U.S., and seasonality continue to affect delinquencies

Legacy Nuvell sub-prime portfolio represents less than 14% of total North American consumer receivables and

Shrinking portfolios, mainly in North America, have contributed to increased delinquency rates

Elevated unemployment, especially in the U.S., and seasonality continue to affect delinquencies

Legacy Nuvell sub-prime portfolio represents less than 14% of total North American consumer receivables and

approximately 41% of delinquent balances

Global Auto Finance: Consumer Delinquency Trends

Global Delinquencies for Managed Retail Contracts

(Greater than 30 Days Past Due)

141

134

134

127

111

105

128

121

3.76%

3.48%

2.96%

3.11%

2.77%

2.37%

2.20%

2.69%

0

40

80

120

160

200

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

-0.30%

0.20%

0.70%

1.20%

1.70%

2.20%

2.70%

3.20%

3.70%

4.20%

Delinquent Contracts

Delinquecies as a % of Managed Contracts

North American Delinquencies for Managed Retail Contracts

(Greater then 30 Days Past Due)

99

87

70

90

83

68

63

87

4.36%

3.74%

2.86%

3.39%

2.90%

2.31%

2.05%

2.82%

0

50

100

150

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

5.00%

Delinquent Contracts

Delinquencies as a % of Managed Contracts

Loans > 30 Days Past Due

North

America

Europe

Asia

Pacific

Latin

America

Global

3Q 09

4.36%

1.31%

0.74%

5.06%

3.76%

3Q 08

2.90%

1.50%

1.83%

3.93%

2.77%

Year-over-Year Change

+146 bps

-19 bps

-109 bps

+113 bps

+99 bps

11

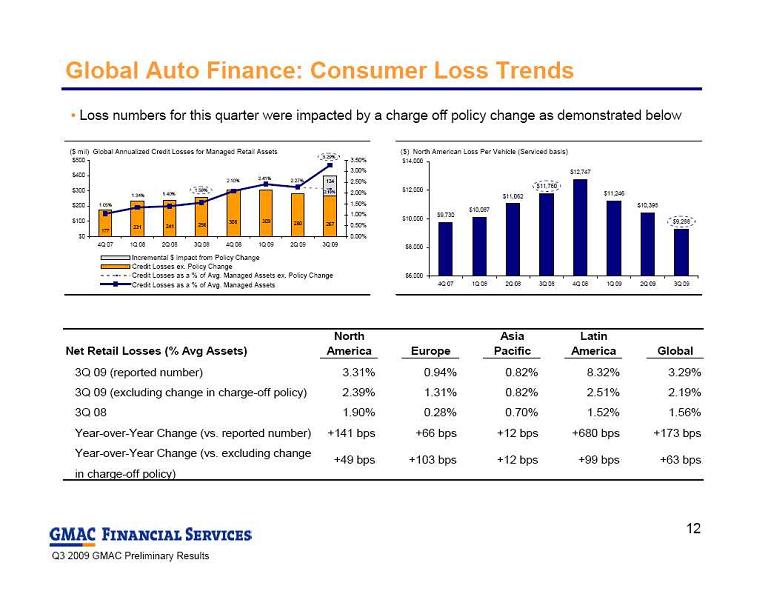

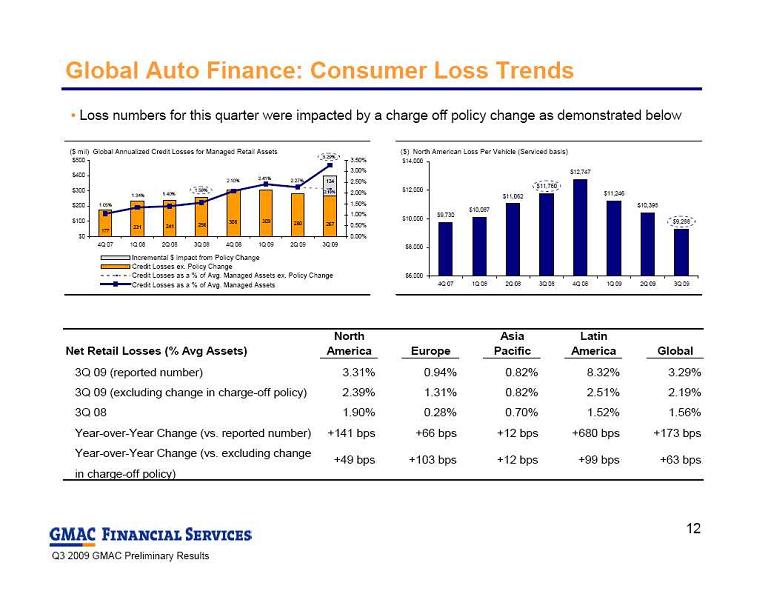

Global Auto Finance: Consumer Loss Trends

Loss numbers for this quarter were impacted by a charge off policy change as demonstrated below

($ mil) Global Annualized Credit Losses for Managed Retail Assets

267

280

306

256

241

231

177

309

134

3.29%

2.27%

2.41%

2.10%

1.56%

1.40%

1.34%

1.05%

2.19%

$0

$100

$200

$300

$400

$500

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

Incremental $ Impact from Policy Change

Credit Losses ex. Policy Change

Credit Losses as a % of Avg. Managed Assets ex. Policy Change

Credit Losses as a % of Avg. Managed Assets

Delinquent

Contracts

Delinquencies

as a % of

Managed

Contracts

($) North American Loss Per Vehicle (Serviced basis)

$9,730

$10,087

$11,062

$11,760

$12,747

$11,246

$10,398

$9,288

$6,000

$8,000

$10,000

$12,000

$14,000

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

Net Retail Losses (% Avg Assets)

North

America

Europe

Asia

Pacific

Latin

America

Global

3Q 09 (reported number)

3.31%

0.94%

0.82%

8.32%

3.29%

3Q 09 (excluding change in charge-off policy)

2.39%

1.31%

0.82%

2.51%

2.19%

3Q 08

1.90%

0.28%

0.70%

1.52%

1.56%

Year-over-Year Change (vs. reported number)

+141 bps

+66 bps

+12 bps

+680 bps

+173 bps

Year-over-Year Change (vs. excluding change

in charge-off policy)

+63 bps

+49 bps

+103 bps

+12 bps

+99 bps

12

Global Auto Finance: Consumer Loss Trends

Loss numbers for this quarter were impacted by a charge off policy change as demonstrated below

($ mil) Global Annualized Credit Losses for Managed Retail Assets

267

280

306

256

241

231

177

309

134

3.29%

2.27%

2.41%

2.10%

1.56%

1.40%

1.34%

1.05%

2.19%

$0

$100

$200

$300

$400

$500

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

Incremental $ Impact from Policy Change

Credit Losses ex. Policy Change

Credit Losses as a % of Avg. Managed Assets ex. Policy Change

Credit Losses as a % of Avg. Managed Assets

Delinquent

Contracts

Delinquencies

as a % of

Managed

Contracts

($) North American Loss Per Vehicle (Serviced basis)

$9,730

$10,087

$11,062

$11,760

$12,747

$11,246

$10,398

$9,288

$6,000

$8,000

$10,000

$12,000

$14,000

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

Net Retail Losses (% Avg Assets)

North

America

Europe

Asia

Pacific

Latin

America

Global

3Q 09 (reported number)

3.31%

0.94%

0.82%

8.32%

3.29%

3Q 09 (excluding change in charge-off policy)

2.39%

1.31%

0.82%

2.51%

2.19%

3Q 08

1.90%

0.28%

0.70%

1.52%

1.56%

Year-over-Year Change (vs. reported number)

+141 bps

+66 bps

+12 bps

+680 bps

+173 bps

Year-over-Year Change (vs. excluding change

in charge-off policy)

+63 bps

+49 bps

+103 bps

+12 bps

+99 bps

12

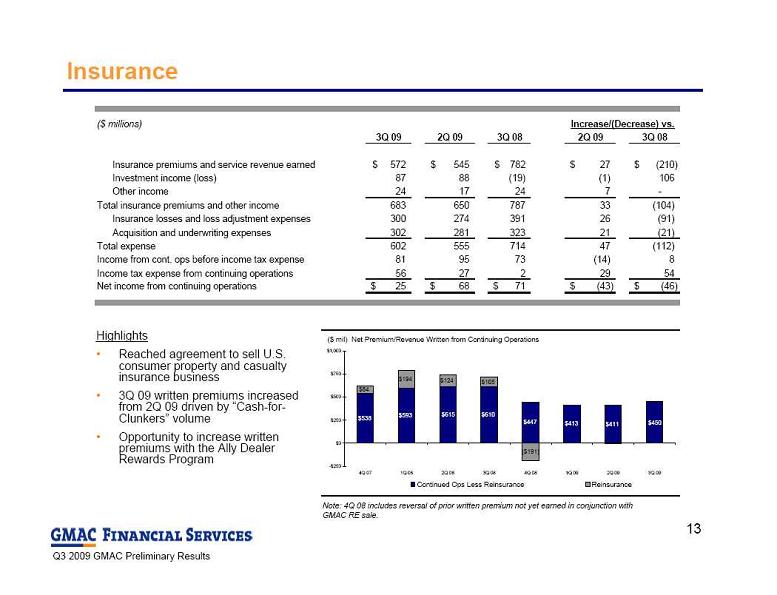

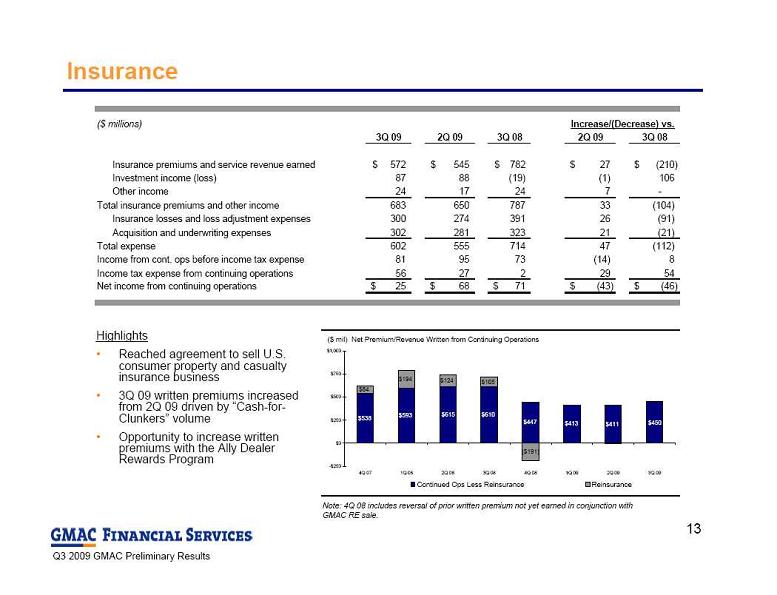

Insurance

Highlights

Reached agreement to sell U.S.

Insurance

Highlights

Reached agreement to sell U.S.

consumer property and casualty

insurance business

3Q 09 written premiums increased

from 2Q 09 driven by “Cash-for-

Clunkers” volume

Opportunity to increase written

premiums with the Ally Dealer

Rewards Program

Note: 4Q 08 includes reversal of prior written premium not yet earned in conjunction with

GMAC RE sale.

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Insurance premiums and service revenue earned

572

$

545

$

782

$

27

$

(210)

$

Investment income (loss)

87

88

(19)

(1)

106

Other income

24

17

24

7

-

Total insurance premiums and other income

683

650

787

33

(104)

Insurance losses and loss adjustment expenses

300

274

391

26

(91)

Acquisition and underwriting expenses

302

281

323

21

(21)

Total expense

602

555

714

47

(112)

Income from cont. ops before income tax expense

81

95

73

(14)

8

Income tax expense from continuing operations

56

27

2

29

54

Net income from continuing operations

25

$

68

$

71

$

(43)

$

(46)

$

Increase/(Decrease) vs.

($ mil) Net Premium/Revenue Written from Continuing Operations

$593

$610

$411

$84

$194

$124

$105

($191)

$538

$615

$447

$413

$450

-$250

$0

$250

$500

$750

$1,000

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

Continued Ops Less Reinsurance

Reinsurance

13

Mortgage Operations: Highlights

Mortgage Operations includes ResCap, LLC as well as the mortgage activities of Ally Bank and

Mortgage Operations: Highlights

Mortgage Operations includes ResCap, LLC as well as the mortgage activities of Ally Bank and

ResMor Trust

Mortgage Operations results differ materially from ResCap, LLC

The Mortgage Operations segment experienced a net loss for the quarter driven primarily by repurchase

reserve expense

Provision for loan losses decreased to $349 million in the third quarter from $916 million in the

second quarter

Loan repurchase reserves were increased resulting in an expense of $515 million

Stronger net revenue of $585 million driven by improved core business margins and net servicing

revenue

Originated $15.9 billion of new mortgage loans consisting of conforming, government and limited

amount of high quality jumbo loans

Down slightly from last quarter due to lower refinancing volume but up 34% year over year

GMAC continues to help homeowners restructure their loans through participation in the Home

Affordable Modification Program

14

Mortgage Operations: Key Metrics

Note: Government and prime second liens are included in prime non-conforming.

Total assets include $3.8 billion of assets securitized

Mortgage Operations: Key Metrics

Note: Government and prime second liens are included in prime non-conforming.

Total assets include $3.8 billion of assets securitized

on-balance sheet and $1.8 billion of assets related to

other balance sheet gross-ups at 9/30/09

($ mil) Pre-Tax Income

$(932)

$(905)

$(1,761)

$(1,949)

$(1,068)

$(1,138)

$(2,044)

$(747)

$(2,500)

$(2,000)

$(1,500)

$(1,000)

$(500)

$-

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

($ bil) Total Assets

$82

$74

$65

$58

$48

$50

$54

$57

$-

$20

$40

$60

$80

$100

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

($ bil) Mortgage Loan Production by Type

$20.8

$20.9

$18.1

$11.9

$8.5

$13.4

$18.8

$15.9

$0

$5

$10

$15

$20

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

Total Originations

Prime Conforming

Prime Non Conforming

Government

Non Prime

Prime Second Lien

Total International

($ bil) Primary Servicing - Period End

$462

$460

$437

$426

$394

$386

$381

$380

$0

$100

$200

$300

$400

$500

$600

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

Prime Conforming

Prime Non-Conforming

Non Prime

1

15

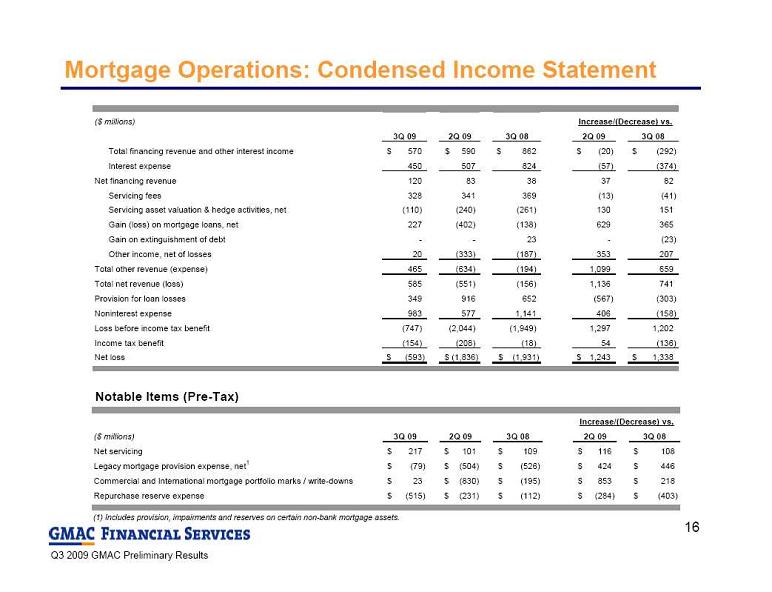

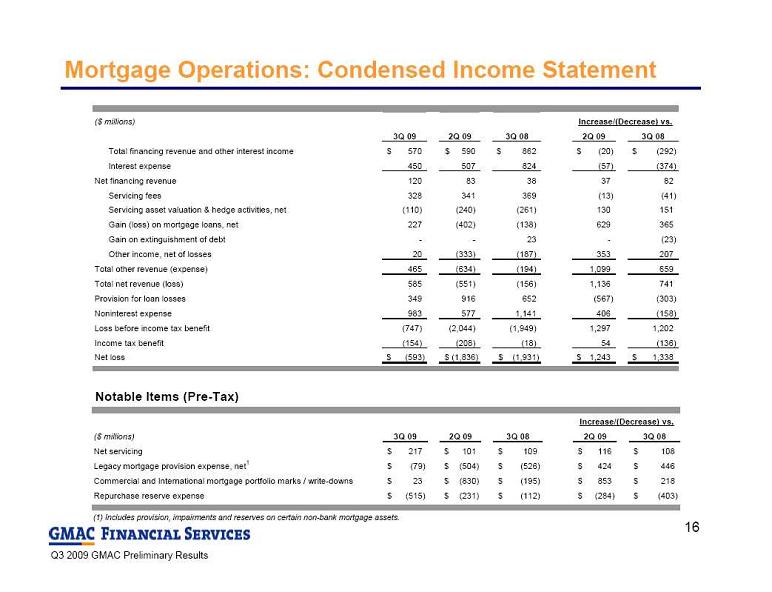

Mortgage Operations: Condensed Income Statement

Notable Items (Pre-Tax)

(1) Includes provision, impairments and reserves on certain non-bank mortgage assets.

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Total financing revenue and other interest income

570

$

590

$

862

$

(20)

$

(292)

$

Interest expense

450

507

824

(57)

(374)

Net financing revenue

120

83

38

37

82

Servicing fees

328

341

369

(13)

(41)

Servicing asset valuation & hedge activities, net

(110)

(240)

(261)

130

151

Gain (loss) on mortgage loans, net

227

(402)

(138)

629

365

Gain on extinguishment of debt

-

-

23

-

(23)

Other income, net of losses

20

(333)

(187)

353

207

Total other revenue (expense)

465

(634)

(194)

1,099

659

Total net revenue (loss)

585

(551)

(156)

1,136

741

Provision for loan losses

349

916

652

(567)

(303)

Noninterest expense

983

577

1,141

406

(158)

Loss before income tax benefit

(747)

(2,044)

(1,949)

1,297

1,202

Income tax benefit

(154)

(208)

(18)

54

(136)

Net loss

(593)

$

(1,836)

$

(1,931)

$

1,243

$

1,338

$

Increase/(Decrease) vs.

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Net servicing

217

$

101

$

109

$

116

$

108

$

Legacy mortgage provision expense, net

1

(79)

$

(504)

$

(526)

$

424

$

446

$

Commercial and International mortgage portfolio marks / write-downs

23

$

(830)

$

(195)

$

853

$

218

$

Repurchase reserve expense

(515)

$

(231)

$

(112)

$

(284)

$

(403)

$

Increase/(Decrease) vs.

16

Mortgage Operations: Condensed Income Statement

Notable Items (Pre-Tax)

(1) Includes provision, impairments and reserves on certain non-bank mortgage assets.

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Total financing revenue and other interest income

570

$

590

$

862

$

(20)

$

(292)

$

Interest expense

450

507

824

(57)

(374)

Net financing revenue

120

83

38

37

82

Servicing fees

328

341

369

(13)

(41)

Servicing asset valuation & hedge activities, net

(110)

(240)

(261)

130

151

Gain (loss) on mortgage loans, net

227

(402)

(138)

629

365

Gain on extinguishment of debt

-

-

23

-

(23)

Other income, net of losses

20

(333)

(187)

353

207

Total other revenue (expense)

465

(634)

(194)

1,099

659

Total net revenue (loss)

585

(551)

(156)

1,136

741

Provision for loan losses

349

916

652

(567)

(303)

Noninterest expense

983

577

1,141

406

(158)

Loss before income tax benefit

(747)

(2,044)

(1,949)

1,297

1,202

Income tax benefit

(154)

(208)

(18)

54

(136)

Net loss

(593)

$

(1,836)

$

(1,931)

$

1,243

$

1,338

$

Increase/(Decrease) vs.

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Net servicing

217

$

101

$

109

$

116

$

108

$

Legacy mortgage provision expense, net

1

(79)

$

(504)

$

(526)

$

424

$

446

$

Commercial and International mortgage portfolio marks / write-downs

23

$

(830)

$

(195)

$

853

$

218

$

Repurchase reserve expense

(515)

$

(231)

$

(112)

$

(284)

$

(403)

$

Increase/(Decrease) vs.

16

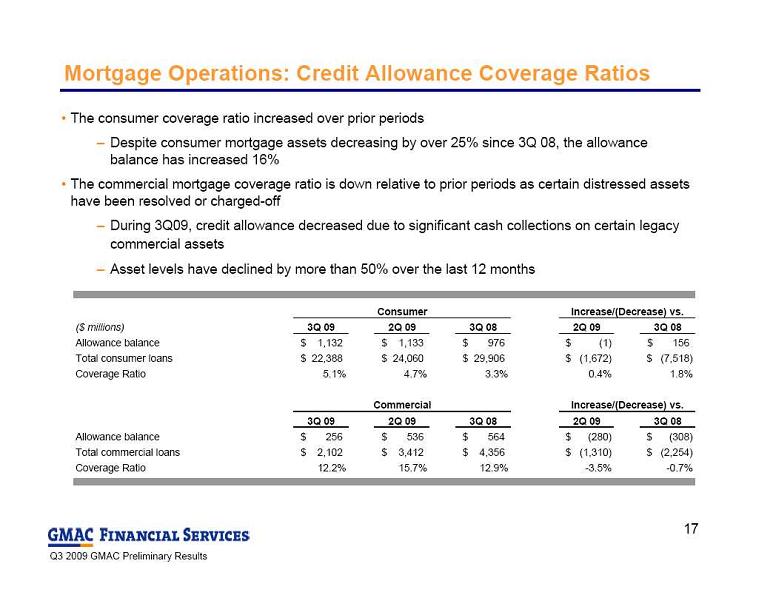

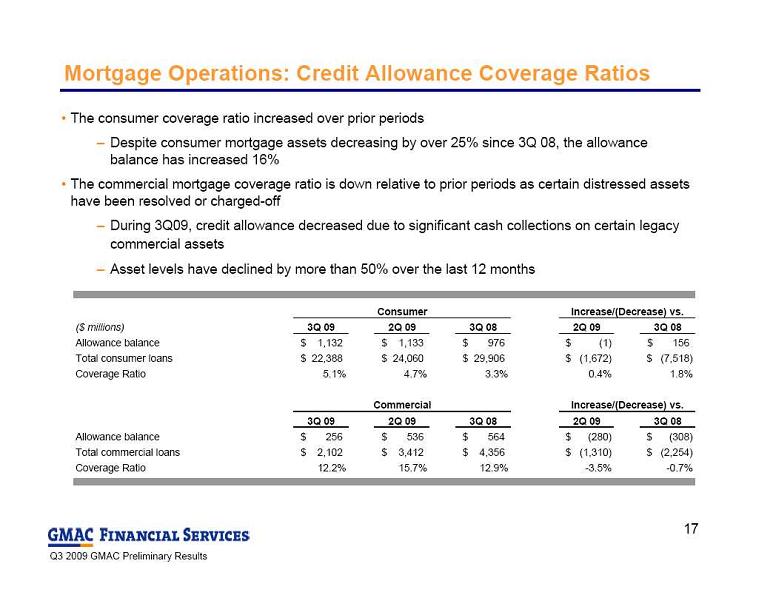

Mortgage Operations: Credit Allowance Coverage Ratios

The consumer coverage ratio increased over prior periods

Despite consumer mortgage assets decreasing by over 25% since 3Q 08, the allowance

Mortgage Operations: Credit Allowance Coverage Ratios

The consumer coverage ratio increased over prior periods

Despite consumer mortgage assets decreasing by over 25% since 3Q 08, the allowance

balance has increased 16%

The commercial mortgage coverage ratio is down relative to prior periods as certain distressed assets

have been resolved or charged-off

During 3Q09, credit allowance decreased due to significant cash collections on certain legacy

commercial assets

Asset levels have declined by more than 50% over the last 12 months

Consumer

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Allowance balance

1,132

$

1,133

$

976

$

(1)

$

156

$

Total consumer loans

22,388

$

24,060

$

29,906

$

(1,672)

$

(7,518)

$

Coverage Ratio

5.1%

4.7%

3.3%

0.4%

1.8%

Commercial

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Allowance balance

256

$

536

$

564

$

(280)

$

(308)

$

Total commercial loans

2,102

$

3,412

$

4,356

$

(1,310)

$

(2,254)

$

Coverage Ratio

12.2%

15.7%

12.9%

-3.5%

-0.7%

Increase/(Decrease) vs.

Increase/(Decrease) vs.

17

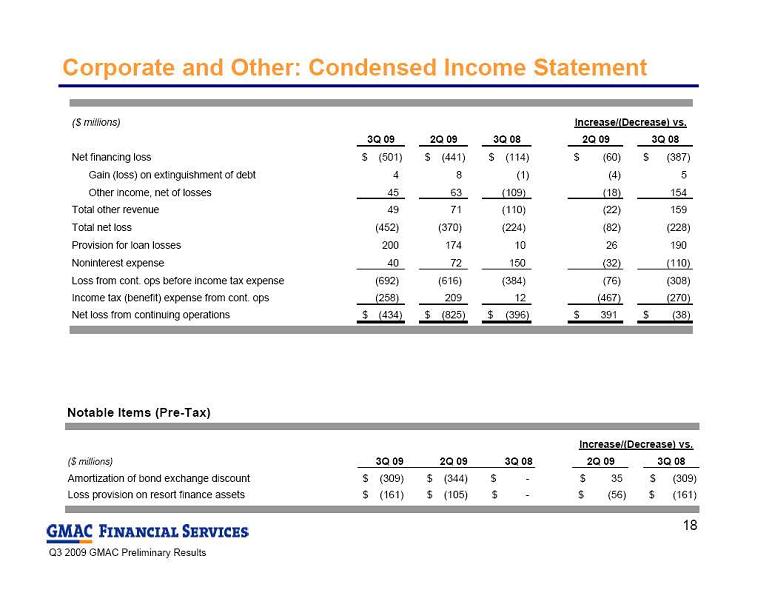

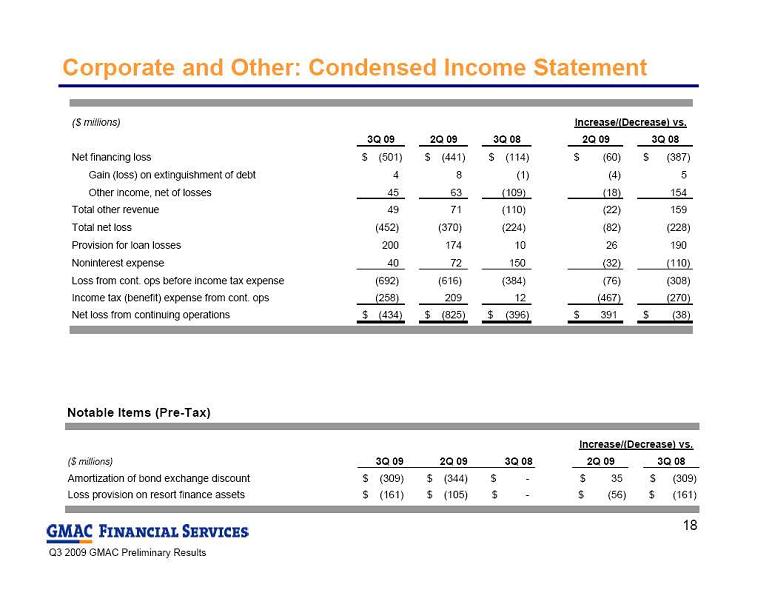

Corporate and Other: Condensed Income Statement

Notable Items (Pre-Tax)

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Net financing loss

(501)

$

(441)

$

(114)

$

(60)

$

(387)

$

Gain (loss) on extinguishment of debt

4

8

(1)

(4)

5

Other income, net of losses

45

63

(109)

(18)

154

Total other revenue

49

71

(110)

(22)

159

Total net loss

(452)

(370)

(224)

(82)

(228)

Provision for loan losses

200

174

10

26

190

Noninterest expense

40

72

150

(32)

(110)

Loss from cont. ops before income tax expense

(692)

(616)

(384)

(76)

(308)

Income tax (benefit) expense from cont. ops

(258)

209

12

(467)

(270)

Net loss from continuing operations

(434)

$

(825)

$

(396)

$

391

$

(38)

$

Increase/(Decrease) vs.

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Amortization of bond exchange discount

(309)

$

(344)

$

-

$

35

$

(309)

$

Loss provision on resort finance assets

(161)

$

(105)

$

-

$

(56)

$

(161)

$

Increase/(Decrease) vs.

18

Corporate and Other: Condensed Income Statement

Notable Items (Pre-Tax)

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Net financing loss

(501)

$

(441)

$

(114)

$

(60)

$

(387)

$

Gain (loss) on extinguishment of debt

4

8

(1)

(4)

5

Other income, net of losses

45

63

(109)

(18)

154

Total other revenue

49

71

(110)

(22)

159

Total net loss

(452)

(370)

(224)

(82)

(228)

Provision for loan losses

200

174

10

26

190

Noninterest expense

40

72

150

(32)

(110)

Loss from cont. ops before income tax expense

(692)

(616)

(384)

(76)

(308)

Income tax (benefit) expense from cont. ops

(258)

209

12

(467)

(270)

Net loss from continuing operations

(434)

$

(825)

$

(396)

$

391

$

(38)

$

Increase/(Decrease) vs.

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Amortization of bond exchange discount

(309)

$

(344)

$

-

$

35

$

(309)

$

Loss provision on resort finance assets

(161)

$

(105)

$

-

$

(56)

$

(161)

$

Increase/(Decrease) vs.

18

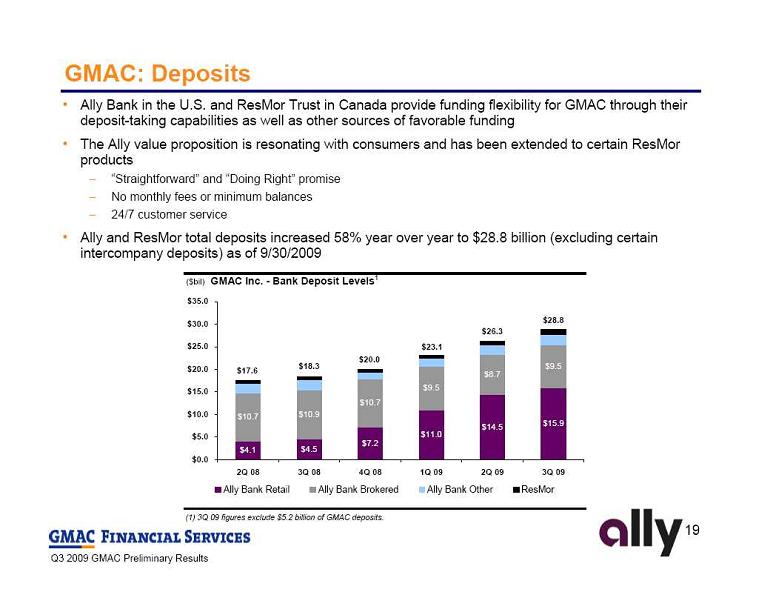

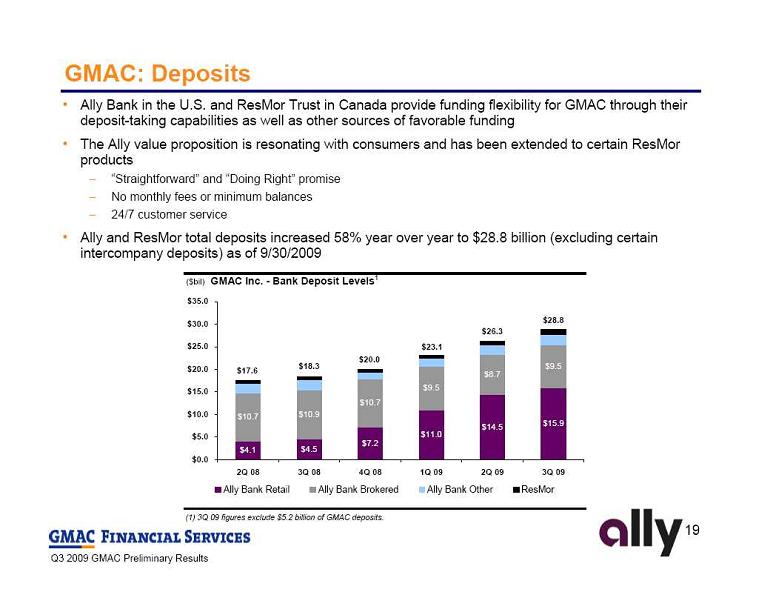

Ally Bank in the U.S. and ResMor Trust in Canada provide funding flexibility for GMAC through their

Ally Bank in the U.S. and ResMor Trust in Canada provide funding flexibility for GMAC through their

deposit-taking capabilities as well as other sources of favorable funding

The Ally value proposition is resonating with consumers and has been extended to certain ResMor

products

“Straightforward” and “Doing Right” promise

No monthly fees or minimum balances

24/7 customer service

Ally and ResMor total deposits increased 58% year over year to $28.8 billion (excluding certain

intercompany deposits) as of 9/30/2009

GMAC: Deposits

(1) 3Q 09 figures exclude $5.2 billion of GMAC deposits.

($bil)

GMAC Inc. - Bank Deposit Levels

1

$4.1

$4.5

$7.2

$11.0

$14.5

$15.9

$10.7

$10.9

$10.7

$9.5

$8.7

$9.5

$17.6

$18.3

$20.0

$23.1

$26.3

$28.8

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

Ally Bank Retail

Ally Bank Brokered

Ally Bank Other

ResMor

19

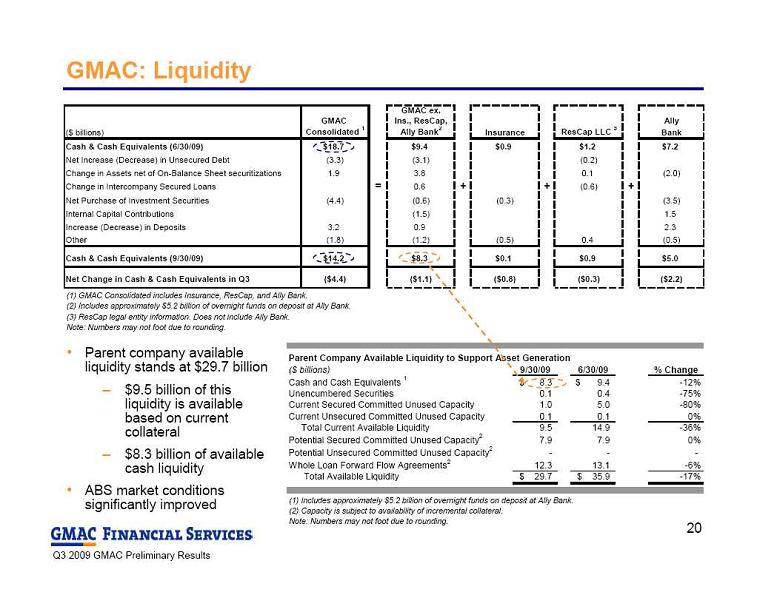

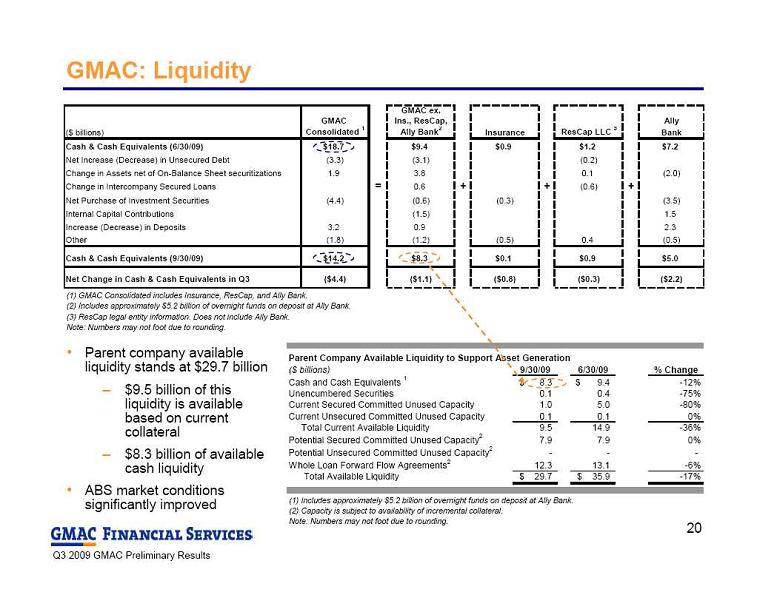

GMAC: Liquidity

Parent company available

GMAC: Liquidity

Parent company available

liquidity stands at $29.7 billion

$9.5 billion of this

liquidity is available

based on current

collateral

$8.3 billion of available

cash liquidity

ABS market conditions

significantly improved

(1) GMAC Consolidated includes Insurance, ResCap, and Ally Bank.

(2) Includes approximately $5.2 billion of overnight funds on deposit at Ally Bank.

(3) ResCap legal entity information. Does not include Ally Bank.

Note: Numbers may not foot due to rounding.

(1) Includes approximately $5.2 billion of overnight funds on deposit at Ally Bank.

(2) Capacity is subject to availability of incremental collateral.

Note: Numbers may not foot due to rounding.

GMAC ex.

GMAC

Ins., ResCap,

Ally

($ billions)

Consolidated

1

Ally Bank

2

Insurance

ResCap LLC

3

Bank

Cash & Cash Equivalents (6/30/09)

$18.7

$9.4

$0.9

$1.2

$7.2

Net Increase (Decrease) in Unsecured Debt

(3.3)

(3.1)

(0.2)

Change in Assets net of On-Balance Sheet securitizations

1.9

3.8

0.1

(2.0)

Change in Intercompany Secured Loans

=

0.6

+

+

(0.6)

+

Net Purchase of Investment Securities

(4.4)

(0.6)

(0.3)

(3.5)

Internal Capital Contributions

(1.5)

1.5

Increase (Decrease) in Deposits

3.2

0.9

2.3

Other

(1.8)

(1.2)

(0.5)

0.4

(0.5)

Cash & Cash Equivalents (9/30/09)

$14.2

$8.3

$0.1

$0.9

$5.0

Net Change in Cash & Cash Equivalents in Q3

($4.4)

($1.1)

($0.8)

($0.3)

($2.2)

Parent Company Available Liquidity to Support Asset Generation

($ billions)

9/30/09

6/30/09

% Change

Cash and Cash Equivalents

1

8.3

$

9.4

$

-12%

Unencumbered Securities

0.1

0.4

-75%

Current Secured Committed Unused Capacity

1.0

5.0

-80%

Current Unsecured Committed Unused Capacity

0.1

0.1

0%

Total Current Available Liquidity

9.5

14.9

-36%

Potential Secured Committed Unused Capacity

2

7.9

7.9

0%

Potential Unsecured Committed Unused Capacity

2

-

-

-

Whole Loan Forward Flow Agreements

2

12.3

13.1

-6%

Total Available Liquidity

29.7

$

35.9

$

-17%

20

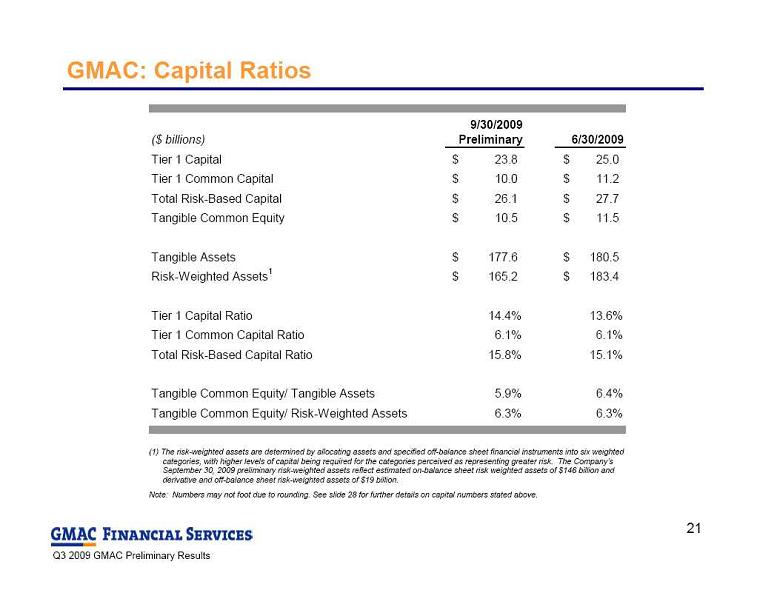

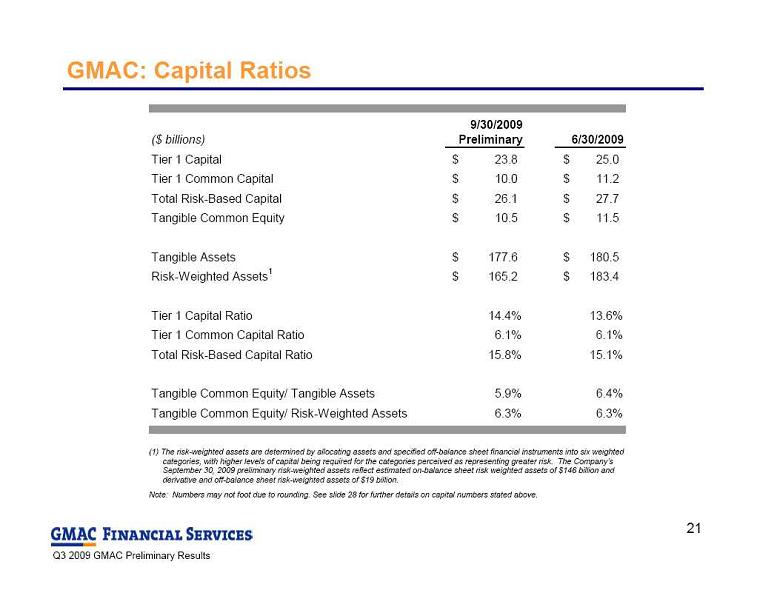

GMAC: Capital Ratios

(1) The risk-weighted assets are determined by allocating assets and specified off-balance sheet financial instruments into six weighted

GMAC: Capital Ratios

(1) The risk-weighted assets are determined by allocating assets and specified off-balance sheet financial instruments into six weighted

categories, with higher levels of capital being required for the categories

perceived as representing greater risk. The Company’s

September 30, 2009 preliminary risk-weighted assets reflect estimated on-balance sheet risk weighted assets of $146 billion and

derivative and off-balance sheet risk-weighted assets

of $19 billion.

Note: Numbers may not foot due to rounding. See slide 28 for further details on capital numbers stated above.

($ billions)

9/30/2009

Preliminary

6/30/2009

Tier 1 Capital

23.8

$

25.0

$

Tier 1 Common Capital

10.0

$

11.2

$

Total Risk-Based Capital

26.1

$

27.7

$

Tangible Common Equity

10.5

$

11.5

$

Tangible Assets

177.6

$

180.5

$

Risk-Weighted Assets

1

165.2

$

183.4

$

Tier 1 Capital Ratio

14.4%

13.6%

Tier 1 Common Capital Ratio

6.1%

6.1%

Total Risk-Based Capital Ratio

15.8%

15.1%

Tangible Common Equity/ Tangible Assets

5.9%

6.4%

Tangible Common Equity/ Risk-Weighted Assets

6.3%

6.3%

21

GMAC: Conclusion

Third quarter results affected by continued cleanup of credit costs and several significant items

GMAC continues its strategic review of businesses and additional platforms may be impacted in the future

Auto business was profitable again this quarter and origination volumes continue to increase

Used car values have recovered

Ally Dealer Rewards program was introduced

Mortgage Operations continues to experience losses while resolving legacy issues

Positive trends in mortgage origination and servicing business resulted in stronger net revenue

Utilized GMAC’s improved capital position to support core businesses

Ally Bank continues to build brand awareness and retail deposit base

GMAC team remains focused on five core strategic initiatives:

Transition to and meet all bank holding company requirements

Strengthen the company’s liquidity and capital position by transforming to a deposit funded institution

Build a world class GMAC organization

Expand and diversify customer-focused revenue opportunities in auto and mortgage, with available funding

GMAC: Conclusion

Third quarter results affected by continued cleanup of credit costs and several significant items

GMAC continues its strategic review of businesses and additional platforms may be impacted in the future

Auto business was profitable again this quarter and origination volumes continue to increase

Used car values have recovered

Ally Dealer Rewards program was introduced

Mortgage Operations continues to experience losses while resolving legacy issues

Positive trends in mortgage origination and servicing business resulted in stronger net revenue

Utilized GMAC’s improved capital position to support core businesses

Ally Bank continues to build brand awareness and retail deposit base

GMAC team remains focused on five core strategic initiatives:

Transition to and meet all bank holding company requirements

Strengthen the company’s liquidity and capital position by transforming to a deposit funded institution

Build a world class GMAC organization

Expand and diversify customer-focused revenue opportunities in auto and mortgage, with available funding

driving originations

Drive returns by repositioning GMAC’s risk profile and maximizing efficiencies

22

Supplemental Charts

Supplemental Charts

23

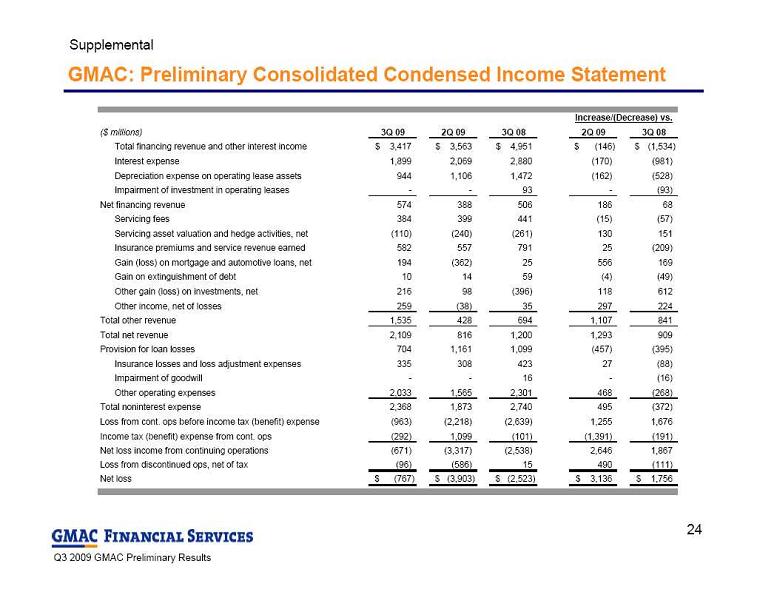

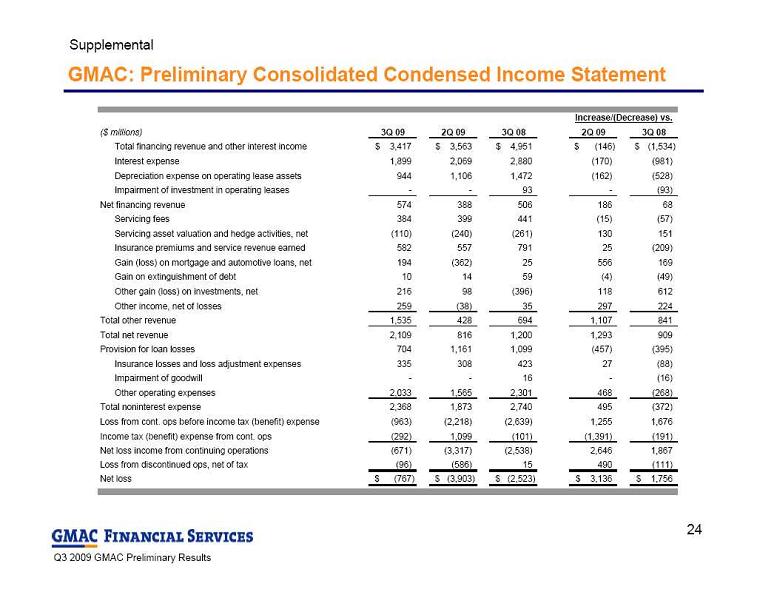

GMAC: Preliminary Consolidated Condensed Income Statement

Supplemental

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Total financing revenue and other interest income

3,417

$

3,563

$

4,951

$

(146)

$

(1,534)

$

Interest expense

1,899

2,069

2,880

(170)

(981)

Depreciation expense on operating lease assets

944

1,106

1,472

(162)

(528)

Impairment of investment in operating leases

-

-

93

-

(93)

Net financing revenue

574

388

506

186

68

Servicing fees

384

399

441

(15)

(57)

Servicing asset valuation and hedge activities, net

(110)

(240)

(261)

130

151

Insurance premiums and service revenue earned

582

557

791

25

(209)

Gain (loss) on mortgage and automotive loans, net

194

(362)

25

556

169

Gain on extinguishment of debt

10

14

59

(4)

(49)

Other gain (loss) on investments, net

216

98

(396)

118

612

Other income, net of losses

259

(38)

35

297

224

Total other revenue

1,535

428

694

1,107

841

Total net revenue

2,109

816

1,200

1,293

909

Provision for loan losses

704

1,161

1,099

(457)

(395)

Insurance losses and loss adjustment expenses

335

308

423

27

(88)

Impairment of goodwill

-

-

16

-

(16)

Other operating expenses

2,033

1,565

2,301

468

(268)

Total noninterest expense

2,368

1,873

2,740

495

(372)

Loss from cont. ops before income tax (benefit) expense

(963)

(2,218)

(2,639)

1,255

1,676

Income tax (benefit) expense from cont. ops

(292)

1,099

(101)

(1,391)

(191)

Net loss income from continuing operations

(671)

(3,317)

(2,538)

2,646

1,867

Loss from discontinued ops, net of tax

(96)

(586)

15

490

(111)

Net loss

(767)

$

(3,903)

$

(2,523)

$

3,136

$

1,756

$

Increase/(Decrease) vs.

24

GMAC: Preliminary Consolidated Condensed Income Statement

Supplemental

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Total financing revenue and other interest income

3,417

$

3,563

$

4,951

$

(146)

$

(1,534)

$

Interest expense

1,899

2,069

2,880

(170)

(981)

Depreciation expense on operating lease assets

944

1,106

1,472

(162)

(528)

Impairment of investment in operating leases

-

-

93

-

(93)

Net financing revenue

574

388

506

186

68

Servicing fees

384

399

441

(15)

(57)

Servicing asset valuation and hedge activities, net

(110)

(240)

(261)

130

151

Insurance premiums and service revenue earned

582

557

791

25

(209)

Gain (loss) on mortgage and automotive loans, net

194

(362)

25

556

169

Gain on extinguishment of debt

10

14

59

(4)

(49)

Other gain (loss) on investments, net

216

98

(396)

118

612

Other income, net of losses

259

(38)

35

297

224

Total other revenue

1,535

428

694

1,107

841

Total net revenue

2,109

816

1,200

1,293

909

Provision for loan losses

704

1,161

1,099

(457)

(395)

Insurance losses and loss adjustment expenses

335

308

423

27

(88)

Impairment of goodwill

-

-

16

-

(16)

Other operating expenses

2,033

1,565

2,301

468

(268)

Total noninterest expense

2,368

1,873

2,740

495

(372)

Loss from cont. ops before income tax (benefit) expense

(963)

(2,218)

(2,639)

1,255

1,676

Income tax (benefit) expense from cont. ops

(292)

1,099

(101)

(1,391)

(191)

Net loss income from continuing operations

(671)

(3,317)

(2,538)

2,646

1,867

Loss from discontinued ops, net of tax

(96)

(586)

15

490

(111)

Net loss

(767)

$

(3,903)

$

(2,523)

$

3,136

$

1,756

$

Increase/(Decrease) vs.

24

GMAC: Preliminary Consolidated Condensed Balance Sheet

Supplemental

Increase/

(Decrease) vs.

($ millions)

9/30/09

12/31/08

12/31/08

Cash and cash equivalents

14,225

$

15,151

$

(925)

$

Investment securities

14,376

7,444

6,932

Loans held-for-sale

14,963

7,919

7,044

Finance receivables and loans, net of unearned Income

87,452

100,073

(12,621)

Allowance for loan losses

(2,974)

(3,433)

459

Total finance receivables and loans, net

84,478

96,640

(12,162)

Investment in operating leases, net

18,867

26,390

(7,524)

Other assets

28,906

35,932

(7,026)

Assets of discontinued operations held-for-sale

2,439

-

2,439

Total assets

178,254

$

189,476

$

(11,222)

$

Unsecured debt

45,295

$

53,213

$

(7,918)

$

Secured debt

56,746

73,108

(16,362)

Total debt

102,041

126,321

(24,280)

Deposit liabilities

29,324

19,807

9,517

Other liabilities

20,166

21,494

(1,328)

Liabilities of discontinued operation held-for-sale

1,782

-

1,782

Total liabilities

153,313

167,622

(14,309)

Equity

24,941

21,854

3,087

Total liabilities and equity

178,254

$

189,476

$

(11,222)

$

25

GMAC: Preliminary Consolidated Condensed Balance Sheet

Supplemental

Increase/

(Decrease) vs.

($ millions)

9/30/09

12/31/08

12/31/08

Cash and cash equivalents

14,225

$

15,151

$

(925)

$

Investment securities

14,376

7,444

6,932

Loans held-for-sale

14,963

7,919

7,044

Finance receivables and loans, net of unearned Income

87,452

100,073

(12,621)

Allowance for loan losses

(2,974)

(3,433)

459

Total finance receivables and loans, net

84,478

96,640

(12,162)

Investment in operating leases, net

18,867

26,390

(7,524)

Other assets

28,906

35,932

(7,026)

Assets of discontinued operations held-for-sale

2,439

-

2,439

Total assets

178,254

$

189,476

$

(11,222)

$

Unsecured debt

45,295

$

53,213

$

(7,918)

$

Secured debt

56,746

73,108

(16,362)

Total debt

102,041

126,321

(24,280)

Deposit liabilities

29,324

19,807

9,517

Other liabilities

20,166

21,494

(1,328)

Liabilities of discontinued operation held-for-sale

1,782

-

1,782

Total liabilities

153,313

167,622

(14,309)

Equity

24,941

21,854

3,087

Total liabilities and equity

178,254

$

189,476

$

(11,222)

$

25

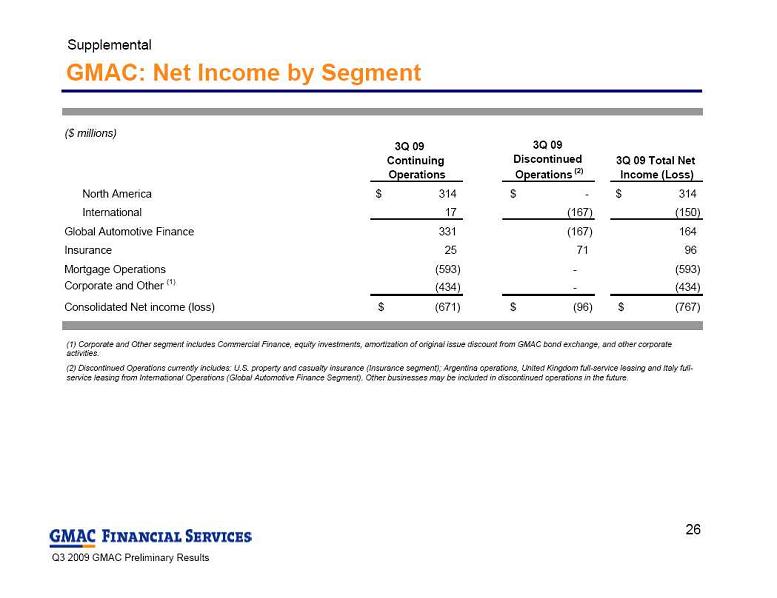

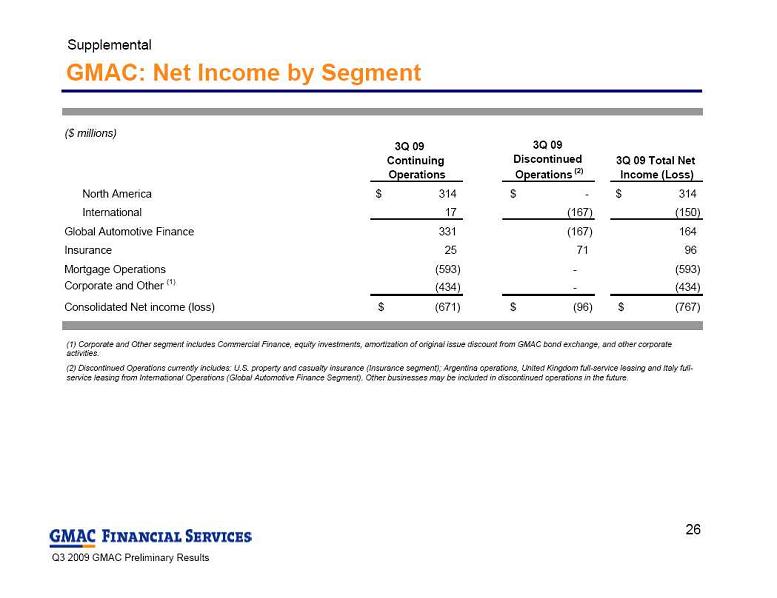

GMAC: Net Income by Segment

Supplemental

(1) Corporate and Other segment includes Commercial Finance, equity investments, amortization of original issue discount from GMAC bond exchange, and other corporate

GMAC: Net Income by Segment

Supplemental

(1) Corporate and Other segment includes Commercial Finance, equity investments, amortization of original issue discount from GMAC bond exchange, and other corporate

activities.

(2) Discontinued Operations currently includes: U.S. property and casualty insurance (Insurance segment); Argentina operations, United Kingdom full-service leasing and Italy full-

service leasing from International

Operations (Global Automotive Finance Segment). Other businesses may be included in discontinued operations in the future.

($ millions)

3Q 09

Continuing

Operations

3Q 09

Discontinued

Operations

(2)

3Q 09 Total Net

Income (Loss)

North America

314

$

-

$

314

$

International

17

(167)

(150)

Global Automotive Finance

331

(167)

164

Insurance

25

71

96

Mortgage Operations

(593)

-

(593)

Corporate and Other

(1)

(434)

-

(434)

Consolidated Net income (loss)

(671)

$

(96)

$

(767)

$

26

ResCap, LLC: Key Financial Information

(1) For the purpose of ResCap’s tangible net worth covenants, consolidated tangible net worth is defined as the company’s

ResCap, LLC: Key Financial Information

(1) For the purpose of ResCap’s tangible net worth covenants, consolidated tangible net worth is defined as the company’s

consolidated equity, excluding intangible assets and any equity in Ally

Bank to the extent included in ResCap’s consolidated

balance sheet.

Note: Results as they appear on a ResCap, LLC reported basis and include ownership of ResMor Trust through 1/1/2009 and

Ally Bank through 1/30/2009.

Supplemental

ResCap, LLC met its covenants at quarter end with tangible net worth of $409 million at the

end of the third quarter

($ millions)

3Q 09

3Q 08

Net loss

(649)

$

(1,912)

$

Net loss excluding gain on debt extinguishment

(649)

$

(1,954)

$

($ millions)

9/30/2009

12/31/2008

Cash & cash equivalents

919

$

6,983

$

Tangible net worth

409

$

350

$

Total assets

19,749

$

57,961

$

27

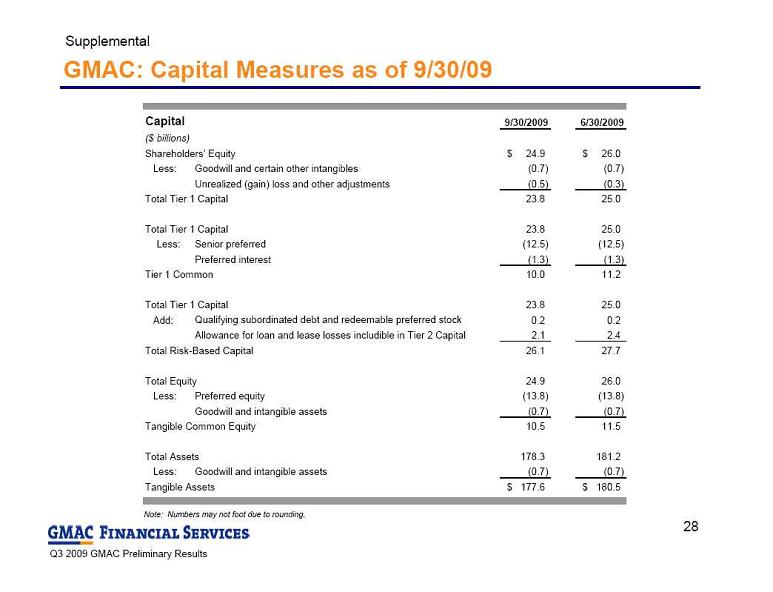

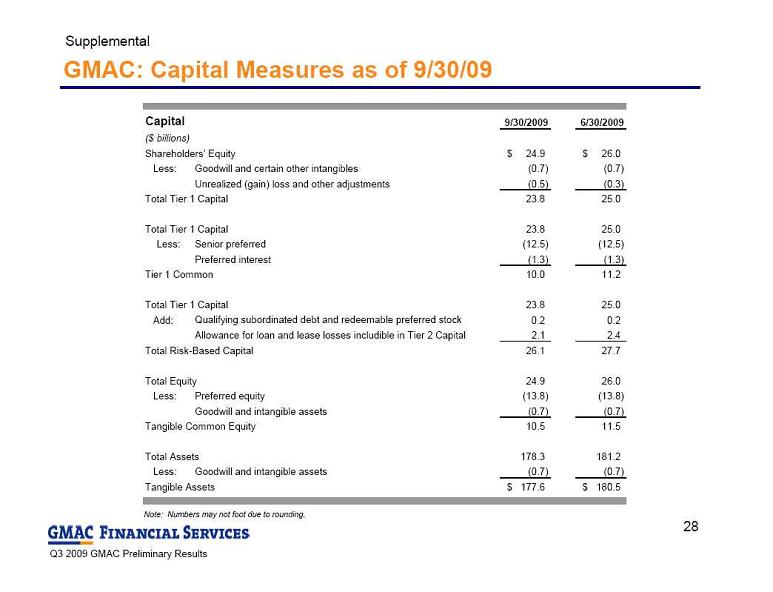

GMAC: Capital Measures as of 9/30/09

Supplemental

Note: Numbers may not foot due to rounding.

Capital

9/30/2009

6/30/2009

Shareholders’ Equity

24.9

$

26.0

$

Less:

Goodwill and certain other intangibles

(0.7)

(0.7)

Unrealized (gain) loss and other adjustments

(0.5)

(0.3)

Total Tier 1 Capital

23.8

25.0

Total Tier 1 Capital

23.8

25.0

Less:

Senior preferred

(12.5)

(12.5)

Preferred interest

(1.3)

(1.3)

Tier 1 Common

10.0

11.2

Total Tier 1 Capital

23.8

25.0

Add:

Qualifying subordinated debt and redeemable preferred stock

0.2

0.2

Allowance for loan and lease losses includible in Tier 2 Capital

2.1

2.4

Total Risk-Based Capital

26.1

27.7

Total Equity

24.9

26.0

Less:

Preferred equity

(13.8)

(13.8)

Goodwill and intangible assets

(0.7)

(0.7)

Tangible Common Equity

10.5

11.5

Total Assets

178.3

181.2

Less:

Goodwill and intangible assets

(0.7)

(0.7)

Tangible Assets

177.6

$

180.5

$

($ billions)

28

GMAC: Capital Measures as of 9/30/09

Supplemental

Note: Numbers may not foot due to rounding.

Capital

9/30/2009

6/30/2009

Shareholders’ Equity

24.9

$

26.0

$

Less:

Goodwill and certain other intangibles

(0.7)

(0.7)

Unrealized (gain) loss and other adjustments

(0.5)

(0.3)

Total Tier 1 Capital

23.8

25.0

Total Tier 1 Capital

23.8

25.0

Less:

Senior preferred

(12.5)

(12.5)

Preferred interest

(1.3)

(1.3)

Tier 1 Common

10.0

11.2

Total Tier 1 Capital

23.8

25.0

Add:

Qualifying subordinated debt and redeemable preferred stock

0.2

0.2

Allowance for loan and lease losses includible in Tier 2 Capital

2.1

2.4

Total Risk-Based Capital

26.1

27.7

Total Equity

24.9

26.0

Less:

Preferred equity

(13.8)

(13.8)

Goodwill and intangible assets

(0.7)

(0.7)

Tangible Common Equity

10.5

11.5

Total Assets

178.3

181.2

Less:

Goodwill and intangible assets

(0.7)

(0.7)

Tangible Assets

177.6

$

180.5

$

($ billions)

28

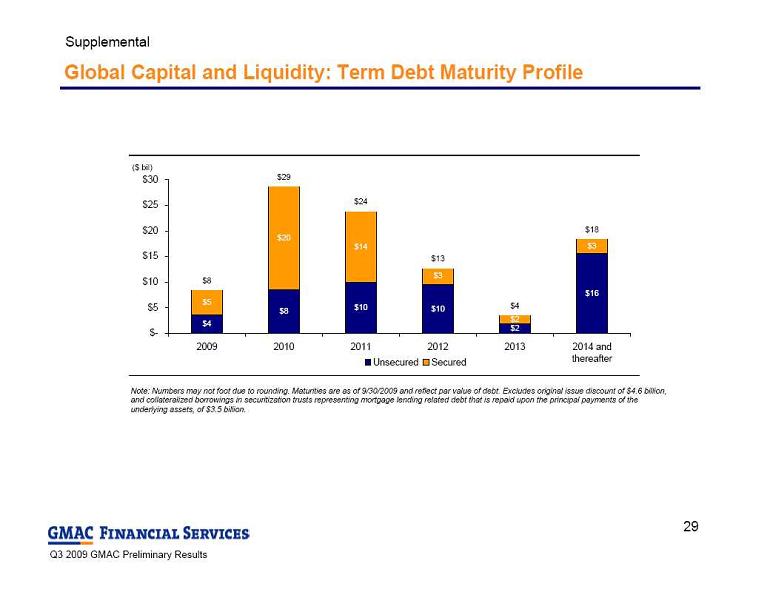

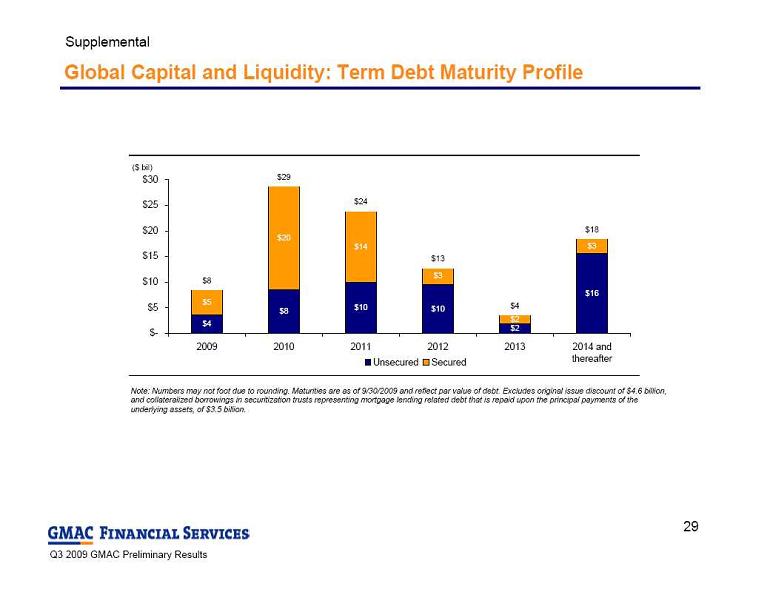

Global Capital and Liquidity: Term Debt Maturity Profile

Supplemental

Note: Numbers may not foot due to rounding. Maturities are as of 9/30/2009 and reflect par value of debt. Excludes original issue discount of $4.6 billion,

Global Capital and Liquidity: Term Debt Maturity Profile

Supplemental

Note: Numbers may not foot due to rounding. Maturities are as of 9/30/2009 and reflect par value of debt. Excludes original issue discount of $4.6 billion,

and collateralized borrowings in securitization

trusts representing mortgage lending related debt that is repaid upon the principal payments of the

underlying assets, of $3.5 billion.

($ bil)

$4

$8

$10

$10

$2

$16

$5

$20

$14

$3

$2

$3

$8

$29

$24

$13

$4

$18

$-

$5

$10

$15

$20

$25

$30

2009

2010

2011

2012

2013

2014 and

thereafter

Unsecured

Secured

Total

29

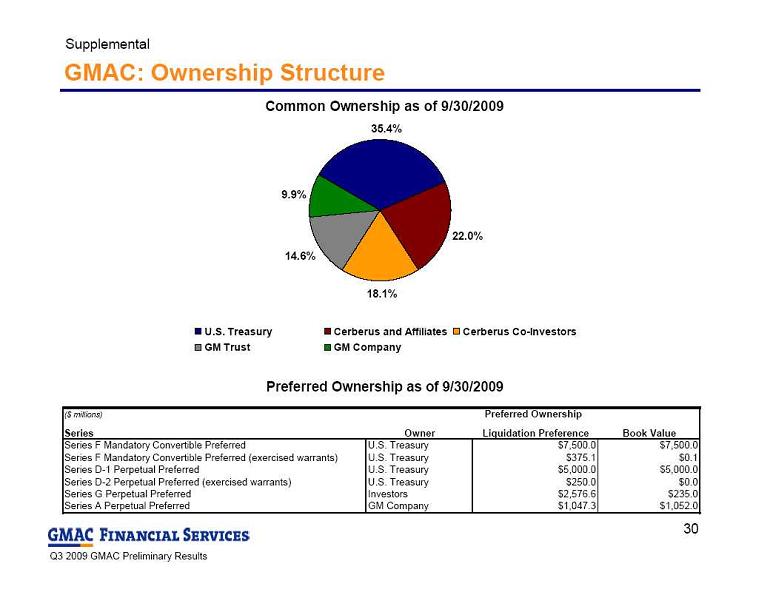

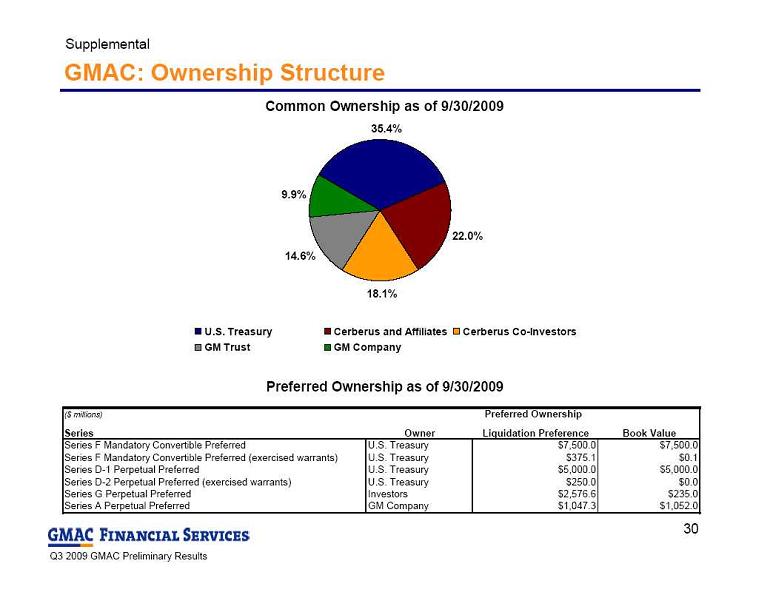

GMAC: Ownership Structure

Supplemental

Preferred Ownership as of 9/30/2009

Common Ownership as of 9/30/2009

35.4%

22.0%

18.1%

14.6%

9.9%

U.S. Treasury

Cerberus and Affiliates

Cerberus Co-Investors

GM Trust

GM Company

($ millions)

Series

Owner

Liquidation Preference

Book Value

Series F Mandatory Convertible Preferred

U.S. Treasury

$7,500.0

$7,500.0

Series F Mandatory Convertible Preferred (exercised warrants)

U.S. Treasury

$375.1

$0.1

Series D-1 Perpetual Preferred

U.S. Treasury

$5,000.0

$5,000.0

Series D-2 Perpetual Preferred (exercised warrants)

U.S. Treasury

$250.0

$0.0

Series G Perpetual Preferred

Investors

$2,576.6

$235.0

Series A Perpetual Preferred

GM Company

$1,047.3

$1,052.0

Preferred Ownership

30

GMAC: Ownership Structure

Supplemental

Preferred Ownership as of 9/30/2009

Common Ownership as of 9/30/2009

35.4%

22.0%

18.1%

14.6%

9.9%

U.S. Treasury

Cerberus and Affiliates

Cerberus Co-Investors

GM Trust

GM Company

($ millions)

Series

Owner

Liquidation Preference

Book Value

Series F Mandatory Convertible Preferred

U.S. Treasury

$7,500.0

$7,500.0

Series F Mandatory Convertible Preferred (exercised warrants)

U.S. Treasury

$375.1

$0.1

Series D-1 Perpetual Preferred

U.S. Treasury

$5,000.0

$5,000.0

Series D-2 Perpetual Preferred (exercised warrants)

U.S. Treasury

$250.0

$0.0

Series G Perpetual Preferred

Investors

$2,576.6

$235.0

Series A Perpetual Preferred

GM Company

$1,047.3

$1,052.0

Preferred Ownership

30

Preliminary

Preliminary  Forward-Looking Statements

In the presentation that follows and related comments by GMAC Inc. (“GMAC”) management, the use of the words “expect,”

Forward-Looking Statements

In the presentation that follows and related comments by GMAC Inc. (“GMAC”) management, the use of the words “expect,”  GMAC: Significant Recent Events

4/09 Became preferred provider of financing for

GMAC: Significant Recent Events

4/09 Became preferred provider of financing for  Net loss of $767 million compared to second quarter net loss of $3.9 billion

Net loss from continuing operations of $671 million compared to $3.3 billion in second quarter

Results impacted by several significant items (see following slide)

Originated $7.7 billion and $15.9 billion of auto and mortgage loans respectively

Ally Bank net deposits grew $2.3 billion to $27.7 billion during the third quarter

Continued to wind down legacy assets and narrowed focus on core auto finance and

Net loss of $767 million compared to second quarter net loss of $3.9 billion

Net loss from continuing operations of $671 million compared to $3.3 billion in second quarter

Results impacted by several significant items (see following slide)

Originated $7.7 billion and $15.9 billion of auto and mortgage loans respectively

Ally Bank net deposits grew $2.3 billion to $27.7 billion during the third quarter

Continued to wind down legacy assets and narrowed focus on core auto finance and  Certain business lines were isolated as discontinued operations as they are being sold

Several significant items impacted third quarter results

GMAC: Significant Items Impacting Earnings

(1) Includes provision, impairments and reserves on certain non-bank mortgage assets.

Note: Loss of ($266) million includes additional significant items that were not reflected in the ($429) million loss shown in the second quarter earnings

Certain business lines were isolated as discontinued operations as they are being sold

Several significant items impacted third quarter results

GMAC: Significant Items Impacting Earnings

(1) Includes provision, impairments and reserves on certain non-bank mortgage assets.

Note: Loss of ($266) million includes additional significant items that were not reflected in the ($429) million loss shown in the second quarter earnings  GMAC: Income by Segment

(1) Corporate and Other segment includes Commercial Finance, equity investments, amortization of original issue discount from GMAC bond exchange, and

GMAC: Income by Segment

(1) Corporate and Other segment includes Commercial Finance, equity investments, amortization of original issue discount from GMAC bond exchange, and  Global Auto Finance: Highlights

Global Auto Finance earned $395 million of pre-tax income from continuing operations compared to

Global Auto Finance: Highlights

Global Auto Finance earned $395 million of pre-tax income from continuing operations compared to

Global Auto Finance: Key Metrics

All tables include North American and International Operations except where noted. Origination and asset base figures include auto loans and leases.

(1) Estimated remarketing proceeds at time of lease origination.

(2) U.S. scheduled lease terminations on a managed basis by termination year - all lease terms, all vehicle segments (cars, trucks and SUVs).

0.4

($ mil) Pre-Tax Income of Continuing Operations

$294

$(708)

$(379)

$213

$347

$395

$(1,379)

$(1,500)

$(1,200)

$(900)

$(600)

$(300)

$-

$300

$600

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

($ bil) Global Consumer Originations

$15.3

$15.2

$15.0

$13.3

$3.3

$3.7

$6.1

$7.7

$0

$5

$10

$15

$20

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

New-Retail

New-Leases/Retail Balloon Contract

Used

Total

($bil) Global Consumer Auto Asset Base

$124

$122

$120

$115

$101

$92

$88

$85

$66

$68

$71

$78

$91

$97

$100

$98

$57

$58

$60

$66

$77

$81

$86

$83

$0

$20

$40

$60

$80

$100

$120

$140

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

Serviced

Managed

On-Balance Sheet

(%) Sales Proceeds as % of ALG

1

(U.S. Lease Terminations)

2

75%

80%

85%

90%

95%

100%

105%

110%

115%

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2006

2007

2008

2009

8

Global Auto Finance: Key Metrics

All tables include North American and International Operations except where noted. Origination and asset base figures include auto loans and leases.

(1) Estimated remarketing proceeds at time of lease origination.

(2) U.S. scheduled lease terminations on a managed basis by termination year - all lease terms, all vehicle segments (cars, trucks and SUVs).

0.4

($ mil) Pre-Tax Income of Continuing Operations

$294

$(708)

$(379)

$213

$347

$395

$(1,379)

$(1,500)

$(1,200)

$(900)

$(600)

$(300)

$-

$300

$600

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

($ bil) Global Consumer Originations

$15.3

$15.2

$15.0

$13.3

$3.3

$3.7

$6.1

$7.7

$0

$5

$10

$15

$20

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

New-Retail

New-Leases/Retail Balloon Contract

Used

Total

($bil) Global Consumer Auto Asset Base

$124

$122

$120

$115

$101

$92

$88

$85

$66

$68

$71

$78

$91

$97

$100

$98

$57

$58

$60

$66

$77

$81

$86

$83

$0

$20

$40

$60

$80

$100

$120

$140

4Q 07

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

Serviced

Managed

On-Balance Sheet

(%) Sales Proceeds as % of ALG

1

(U.S. Lease Terminations)

2

75%

80%

85%

90%

95%

100%

105%

110%

115%

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2006

2007

2008

2009

8

Global Auto Finance: Condensed Income Statement

Notable Items (Pre-Tax)

($ millions)

3Q 09

2Q 09

3Q 08

2Q 09

3Q 08

Total financing revenue and other interest income

3,022

$

3,108

$

4,246

$

(86)

$

(1,224)

$

Interest expense

1,171