Attached files

| file | filename |

|---|---|

| EX-32.1 - Duff & Phelps Corp | v164527_ex32-1.htm |

| EX-31.2 - Duff & Phelps Corp | v164527_ex31-2.htm |

| EX-32.2 - Duff & Phelps Corp | v164527_ex32-2.htm |

| EX-31.1 - Duff & Phelps Corp | v164527_ex31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

|

þ

|

QUARTERLY REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934.

|

For

the quarterly period ended September 30, 2009

OR

|

¨

|

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934.

|

Commission

File Number: 001-33693

DUFF

& PHELPS CORPORATION

(Exact

name of registrant as specified in its charter)

|

DELAWARE

|

20-8893559

|

|

(State

of other jurisdiction or

incorporation

or organization)

|

(I.R.S.

employer

identification

no.)

|

55

East 52nd Street,

31st

Floor

New

York, New York 10055

(Address

of principal executive offices)

(Zip

code)

(212) 871-2000

(Registrant’s

telephone number, including area code)

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days. Yes þ No ¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulations S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes o No ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

Large

accelerated filer o

Accelerated filer þ

Non-accelerated filer o Smaller reporting

company o

Indicated

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act.) Yes o No þ

The

number of shares outstanding of the registrant’s Class A common stock, par value

$0.01 per share, was 23,985,989 as of October 15, 2009. The number of

shares outstanding of the registrant’s Class B common stock, par value $0.0001

per share, was 16,243,979 as of October 15, 2009.

DUFF

& PHELPS CORPORATION

AND

SUBSIDIARIES

TABLE

OF CONTENTS

|

Part

I.

|

Financial

Information

|

||

|

Item

1.

|

Financial

Statements

|

1

|

|

|

|

|||

|

Item

2.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations.

|

27

|

|

|

Item

3.

|

Quantitative

and Qualitative Disclosures About Market Risk.

|

51

|

|

|

Item

4.

|

Controls

and Procedures.

|

51

|

|

|

Part

II.

|

Other

Information

|

||

|

Item

1.

|

Legal

Proceedings

|

52

|

|

|

Item

1A.

|

Risk

Factors

|

52

|

|

|

Item

2.

|

Unregistered

Sales of Equity Securities and Use of Proceeds

|

52

|

|

|

Item

3.

|

Defaults

Upon Senior Securities

|

52

|

|

|

Item

4.

|

Submission

of Matters to a Vote of Security Holders

|

52

|

|

|

Item

5.

|

Other

Information

|

52

|

|

|

Item

6.

|

Exhibits

|

53

|

|

|

Signatures

|

54

|

||

PART

I – FINANCIAL INFORMATION

Item

1. Financial Statements.

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(In

thousands, except per share amounts)

(Unaudited)

|

Three

Months Ended

|

Nine

Months Ended

|

|||||||||||||||

|

September

30,

|

September

30,

|

September

30,

|

September

30,

|

|||||||||||||

|

2009

|

2008

|

2009

|

2008

|

|||||||||||||

|

Revenues

|

$ | 93,240 | $ | 96,314 | $ | 272,558 | $ | 287,268 | ||||||||

|

Reimbursable

expenses

|

3,394 | 2,781 | 8,057 | 7,946 | ||||||||||||

|

Total

revenues

|

96,634 | 99,095 | 280,615 | 295,214 | ||||||||||||

|

Direct

client service costs

|

||||||||||||||||

|

Compensation

and benefits (including $4,294 and $7,551 of equity-based compensation for

the three months ended September 30, 2009 and 2008, respectively, and

$13,631 and $17,182 for the nine months ended September 30, 2009 and 2008,

respectively)

|

52,287 | 57,280 | 155,115 | 166,276 | ||||||||||||

|

Other

direct client service costs

|

2,954 | 2,410 | 5,801 | 5,828 | ||||||||||||

|

Acquisition

retention expenses

|

- | 206 | - | 782 | ||||||||||||

|

Reimbursable

expenses

|

3,468 | 2,813 | 8,120 | 7,926 | ||||||||||||

|

Subtotal

|

58,709 | 62,709 | 169,036 | 180,812 | ||||||||||||

|

Operating

expenses

|

||||||||||||||||

|

Selling,

general and administrative expenses (including $2,018 and $2,845 of

equity-based compensation for the three months ended September 30, 2009

and 2008, respectively, and $5,574 and $8,164 for the nine months ended

September 30, 2009 and 2008, respectively)

|

24,620 | 29,538 | 74,048 | 83,301 | ||||||||||||

|

Depreciation

and amortization

|

2,594 | 2,446 | 7,712 | 6,903 | ||||||||||||

|

Subtotal

|

27,214 | 31,984 | 81,760 | 90,204 | ||||||||||||

|

Operating

income

|

10,711 | 4,402 | 29,819 | 24,198 | ||||||||||||

|

Other

expense/(income)

|

||||||||||||||||

|

Interest

income

|

(17 | ) | (90 | ) | (34 | ) | (654 | ) | ||||||||

|

Interest

expense

|

91 | 847 | 1,079 | 2,569 | ||||||||||||

|

Loss

on early extinguishment of debt

|

- | - | 1,737 | - | ||||||||||||

|

Other

expense

|

50 | (21 | ) | 137 | (92 | ) | ||||||||||

|

Subtotal

|

124 | 736 | 2,919 | 1,823 | ||||||||||||

|

Income

before income taxes

|

10,587 | 3,666 | 26,900 | 22,375 | ||||||||||||

|

Provision

for income taxes

|

2,999 | 1,348 | 7,532 | 6,343 | ||||||||||||

|

Net

income

|

7,588 | 2,318 | 19,368 | 16,032 | ||||||||||||

|

Less: Net

income attributable to noncontrolling interest

|

4,136 | 2,165 | 12,417 | 13,204 | ||||||||||||

|

Net

income attributable to Duff & Phelps Corporation

|

$ | 3,452 | $ | 153 | $ | 6,951 | $ | 2,828 | ||||||||

|

Weighted

average shares of Class A common stock outstanding

|

||||||||||||||||

|

Basic

|

21,625 | 13,299 | 17,517 | 13,166 | ||||||||||||

|

Diluted

|

22,448 | 13,673 | 18,197 | 13,397 | ||||||||||||

|

Net

income per share attributable to stockholders of Class A common stock of

Duff & Phelps Corporation (Note 5)

|

||||||||||||||||

|

Basic

|

$ | 0.15 | $ | 0.01 | $ | 0.37 | $ | 0.20 | ||||||||

|

Diluted

|

$ | 0.14 | $ | 0.01 | $ | 0.35 | $ | 0.20 | ||||||||

|

Cash

dividends declared per common share

|

$ | 0.05 | $ | - | $ | 0.10 | $ | - | ||||||||

See

accompanying notes to the condensed consolidated financial

statements.

1

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(In

thousands, except per share amounts)

|

September

30,

|

December

31,

|

|||||||

|

2009

|

2008

|

|||||||

|

(Unaudited)

|

||||||||

|

ASSETS

|

||||||||

|

Current

assets

|

||||||||

|

Cash

and cash equivalents

|

$ | 84,196 | $ | 81,381 | ||||

|

Restricted

cash

|

689 | - | ||||||

|

Accounts

receivable, net

|

62,340 | 55,876 | ||||||

|

Unbilled

services

|

26,949 | 17,938 | ||||||

|

Prepaid

expenses and other current assets

|

5,996 | 6,599 | ||||||

|

Net

deferred income taxes, current

|

3,191 | 4,304 | ||||||

|

Total

current assets

|

183,361 | 166,098 | ||||||

|

Property

and equipment, net

|

28,266 | 28,350 | ||||||

|

Goodwill

|

117,012 | 116,456 | ||||||

|

Intangible

assets, net

|

28,812 | 32,197 | ||||||

|

Other

assets

|

2,758 | 3,541 | ||||||

|

Investments

related to deferred compensation plan (Note 10)

|

16,368 | 7,946 | ||||||

|

Net

deferred income taxes, non-current

|

91,633 | 61,609 | ||||||

|

Total

non-current assets

|

284,849 | 250,099 | ||||||

|

Total

assets

|

$ | 468,210 | $ | 416,197 | ||||

|

LIABILITIES

AND STOCKHOLDERS' EQUITY

|

||||||||

|

Current

liabilities

|

||||||||

|

Accounts

payable

|

$ | 4,250 | $ | 3,692 | ||||

|

Accrued

expenses

|

7,944 | 4,424 | ||||||

|

Accrued

compensation and benefits

|

21,315 | 39,282 | ||||||

|

Accrued

benefits related to deferred compensation plan (Note 10)

|

17,167 | 8,479 | ||||||

|

Deferred

revenue

|

4,499 | 3,280 | ||||||

|

Equity-based

compensation liability

|

441 | 1,115 | ||||||

|

Current

portion of long-term debt (Note 8)

|

- | 794 | ||||||

|

Current

portion due to non-controlling unitholders

|

3,148 | 3,148 | ||||||

|

Total

current liabilities

|

58,764 | 64,214 | ||||||

|

Long-term

debt, less current portion (Note 8)

|

- | 42,178 | ||||||

|

Other

long-term liabilities

|

15,916 | 16,715 | ||||||

|

Due

to non-controlling unitholders, less current portion

|

88,879 | 55,331 | ||||||

|

Total

non-current liabilities

|

104,795 | 114,224 | ||||||

|

Total

liabilities

|

163,559 | 178,438 | ||||||

|

Commitments

and contingencies (Note 11)

|

||||||||

|

Stockholders'

equity

|

||||||||

|

Preferred

stock (50,000 shares authorized; zero issued and

outstanding)

|

- | - | ||||||

|

Class

A common stock, par value $0.01 per share (100,000 shares authorized;

23,984 and 14,719 shares issued and outstanding at September 30, 2009

and December 31, 2008, respectively)

|

240 | 147 | ||||||

|

Class

B common stock, par value $0.0001 per share (50,000 shares authorized;

16,244 and 20,889 shares issued and outstanding at September 30, 2009

and December 31, 2008, respectively)

|

2 | 2 | ||||||

|

Additional

paid-in capital

|

176,904 | 100,985 | ||||||

|

Accumulated

other comprehensive income

|

1,048 | 122 | ||||||

|

Retained

earnings/(accumulated deficit)

|

3,446 | (1,127 | ) | |||||

|

Total

stockholders' equity of Duff & Phelps Corporation

|

181,640 | 100,129 | ||||||

|

Noncontrolling

interest

|

123,011 | 137,630 | ||||||

|

Total

stockholders' equity

|

304,651 | 237,759 | ||||||

|

Total

liabilities and stockholders' equity

|

$ | 468,210 | $ | 416,197 | ||||

See

accompanying notes to the condensed consolidated financial

statements.

2

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In

thousands)

(Unaudited)

|

Nine

Months Ended

|

||||||||

|

September

30,

|

September

30,

|

|||||||

|

2009

|

2008

|

|||||||

|

Cash

flows from operating activities:

|

||||||||

|

Net

income

|

$ | 19,368 | $ | 16,032 | ||||

|

Adjustments

to reconcile net income to net cash provided by operating

activities:

|

||||||||

|

Depreciation

and amortization

|

7,712 | 6,903 | ||||||

|

Equity-based

compensation

|

19,205 | 25,345 | ||||||

|

Bad

debt expense

|

1,698 | 1,251 | ||||||

|

Net

deferred income taxes

|

4,637 | 8,575 | ||||||

|

Loss

on early extinguishment of debt

|

1,674 | - | ||||||

|

Other

|

(582 | ) | 1,163 | |||||

|

Changes

in assets and liabilities providing/(using) cash:

|

||||||||

|

Accounts

receivable

|

(8,065 | ) | (12,168 | ) | ||||

|

Unbilled

services

|

(9,012 | ) | (2,216 | ) | ||||

|

Prepaid

expenses and other current assets

|

973 | 63 | ||||||

|

Other

assets

|

(2,396 | ) | 1,542 | |||||

|

Accounts

payable and accrued expenses

|

4,668 | (2,070 | ) | |||||

|

Accrued

compensation and benefits

|

(10,019 | ) | (29,998 | ) | ||||

|

Deferred

revenues

|

1,219 | (3,004 | ) | |||||

|

Other

liabilities

|

(1,399 | ) | 690 | |||||

|

Due

to noncontrolling unitholders

|

- | (3,092 | ) | |||||

|

Net

cash provided by operating activities

|

29,681 | 9,016 | ||||||

|

Cash

flows from investing activities:

|

||||||||

|

Purchase

of property and equipment

|

(4,744 | ) | (8,093 | ) | ||||

|

Business

acquisitions, net of cash acquired

|

(61 | ) | (16,427 | ) | ||||

|

Purchase

of investments for deferred compensation plan

|

(6,409 | ) | (9,991 | ) | ||||

|

Proceeds

from sale of investments in deferred compensation plan

|

- | 1,692 | ||||||

|

Net

cash used in investing activities

|

(11,214 | ) | (32,819 | ) | ||||

|

Cash

flows from financing activities:

|

||||||||

|

Net

proceeds from sale of Class A common stock

|

111,808 | - | ||||||

|

Proceeds

from exercises of IPO Options

|

456 | - | ||||||

|

Redemption

of noncontrolling unitholders

|

(67,112 | ) | - | |||||

|

Repayments

of debt

|

(42,763 | ) | (595 | ) | ||||

|

Distributions

and other payments to noncontrolling unitholders

|

(15,510 | ) | (7,888 | ) | ||||

|

Increase

in restricted cash

|

(689 | ) | - | |||||

|

Dividends

|

(2,394 | ) | - | |||||

|

Repurchases

of Class A common stock

|

(821 | ) | - | |||||

|

Fees

associated with early extinguishment of debt

|

(63 | ) | - | |||||

|

Net

cash used in financing activities

|

(17,088 | ) | (8,483 | ) | ||||

|

Effect

of exchange rate on cash and cash equivalents

|

1,436 | (853 | ) | |||||

|

Net

increase/(decrease) in cash and cash equivalents

|

2,815 | (33,139 | ) | |||||

|

Cash

and cash equivalents at beginning of period

|

81,381 | 90,243 | ||||||

|

Cash

and cash equivalents at end of period

|

$ | 84,196 | $ | 57,104 | ||||

See

accompanying notes to the condensed consolidated financial

statements.

3

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

AND

COMPREHENSIVE INCOME

(In

thousands)

(Unaudited)

|

Stockholders

of Duff & Phelps Corporation

|

||||||||||||||||||||||||||||||||||||||||

|

Accumulated

|

Retained

|

|||||||||||||||||||||||||||||||||||||||

|

Total

|

Other

|

Earnings/

|

||||||||||||||||||||||||||||||||||||||

|

Stockholders'

|

Comprehensive

|

Common

Stock - Class A

|

Common

Stock - Class B

|

Additional

|

Comprehensive

|

(Accumulated

|

Noncontrolling

|

|||||||||||||||||||||||||||||||||

|

Equity

|

Income

|

Shares

|

Dollars

|

Shares

|

Dollars

|

Paid-in-Capital

|

Income

|

Deficit)

|

Interest

|

|||||||||||||||||||||||||||||||

|

Balance

as of December 31, 2008

|

$ | 237,759 | 14,719 | $ | 147 | 20,889 | $ | 2 | $ | 100,985 | $ | 122 | $ | (1,127 | ) | $ | 137,630 | |||||||||||||||||||||||

|

Comprehensive

income

|

||||||||||||||||||||||||||||||||||||||||

|

Net

income for the nine months ended September 30, 2009

|

19,368 | $ | 19,368 | - | - | - | - | - | - | 6,951 | 12,417 | |||||||||||||||||||||||||||||

|

Currency

translation adjustment

|

1,435 | 1,435 | - | - | - | - | - | 1,035 | - | 400 | ||||||||||||||||||||||||||||||

|

Amortization

of post-retirement benefits

|

28 | 28 | - | - | - | - | - | 16 | - | 12 | ||||||||||||||||||||||||||||||

|

Total

comprehensive income

|

20,831 | $ | 20,831 | - | - | - | - | - | 1,051 | 6,951 | 12,829 | |||||||||||||||||||||||||||||

|

Sale

of Class A common stock

|

111,808 | 8,050 | 81 | - | - | 111,727 | - | - | - | |||||||||||||||||||||||||||||||

|

Allocation

of noncontrolling interest in D&P Acquisitions

|

- | - | - | - | - | (62,153 | ) | - | - | 62,153 | ||||||||||||||||||||||||||||||

|

Issuance

of Class A common stock

|

180 | 10 | - | - | - | 78 | - | - | 102 | |||||||||||||||||||||||||||||||

|

Net

issuance of restricted stock awards

|

(807 | ) | 1,292 | 13 | - | - | (371 | ) | - | - | (449 | ) | ||||||||||||||||||||||||||||

|

Redemption

of New Class A Units

|

(67,112 | ) | - | - | (4,550 | ) | - | (29,060 | ) | - | - | (38,052 | ) | |||||||||||||||||||||||||||

|

Adjustment

to Tax Receivable Agreement as a result of the redemption of New

Class A Units

|

(543 | ) | - | - | - | - | (543 | ) | - | - | - | |||||||||||||||||||||||||||||

|

Exercise

of IPO Options

|

793 | 51 | - | - | - | 448 | - | - | 345 | |||||||||||||||||||||||||||||||

|

Forfeitures

|

1 | (138 | ) | (1 | ) | (95 | ) | - | 2 | - | - | - | ||||||||||||||||||||||||||||

|

Equity-based

compensation

|

19,798 | - | - | - | - | 10,457 | - | - | 9,341 | |||||||||||||||||||||||||||||||

|

Income

tax benefit on equity-based compensation

|

(103 | ) | - | - | - | - | (103 | ) | - | - | - | |||||||||||||||||||||||||||||

|

Distributions

to noncontrolling unitholders

|

(15,510 | ) | - | - | - | - | (6,187 | ) | - | - | (9,323 | ) | ||||||||||||||||||||||||||||

|

Change

in ownership interests between periods

|

- | - | - | - | - | 51,791 | (125 | ) | - | (51,666 | ) | |||||||||||||||||||||||||||||

|

Adjustment

to due to noncontrolling unitholders

|

(3,579 | ) | - | - | - | - | (3,579 | ) | - | - | - | |||||||||||||||||||||||||||||

|

Deferred

tax asset effective tax rate conversion

|

3,513 | - | - | - | - | 3,412 | - | - | 101 | |||||||||||||||||||||||||||||||

|

Dividends

on Class A common stock

|

(2,378 | ) | - | - | - | - | - | - | (2,378 | ) | - | |||||||||||||||||||||||||||||

|

Balance

as of September 30, 2009

|

$ | 304,651 | 23,984 | $ | 240 | 16,244 | $ | 2 | $ | 176,904 | $ | 1,048 | $ | 3,446 | $ | 123,011 | ||||||||||||||||||||||||

See

accompanying notes to the condensed consolidated financial

statements.

4

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

AND

COMPREHENSIVE INCOME

(In

thousands)

(Unaudited)

|

Stockholders

of Duff & Phelps Corporation

|

||||||||||||||||||||||||||||||||||||||||

|

Accumulated

|

Retained

|

|||||||||||||||||||||||||||||||||||||||

|

Total

|

Other

|

Earnings/

|

||||||||||||||||||||||||||||||||||||||

|

Stockholders'

|

Comprehensive

|

Common

Stock - Class A

|

Common

Stock - Class B

|

Additional

|

Comprehensive

|

(Accumulated

|

Noncontrolling

|

|||||||||||||||||||||||||||||||||

|

Equity

|

Income

|

Shares

|

Dollars

|

Shares

|

Dollars

|

Paid-in-Capital

|

Income/(Loss)

|

Deficit)

|

Interest

|

|||||||||||||||||||||||||||||||

|

Balance

as of December 31, 2007

|

$ | 181,483 | 13,125 | $ | 131 | 21,090 | $ | 2 | $ | 75,375 | $ | 348 | $ | (6,352 | ) | $ | 111,979 | |||||||||||||||||||||||

|

Comprehensive

income/(loss)

|

||||||||||||||||||||||||||||||||||||||||

|

Net

income for the nine months ended September 30, 2008

|

16,032 | $ | 16,032 | - | - | - | - | - | - | 2,828 | 13,204 | |||||||||||||||||||||||||||||

|

Currency

translation adjustment

|

(853 | ) | (853 | ) | - | - | - | - | - | (353 | ) | - | (500 | ) | ||||||||||||||||||||||||||

|

Amortization

of post-retirement benefits

|

36 | 36 | - | - | - | - | - | 15 | - | 21 | ||||||||||||||||||||||||||||||

|

Total

comprehensive income/(loss)

|

15,215 | $ | 15,215 | - | - | - | - | - | (338 | ) | 2,828 | 12,725 | ||||||||||||||||||||||||||||

|

Issuance

of common stock

|

5,443 | 322 | 3 | - | - | 2,221 | - | - | 3,219 | |||||||||||||||||||||||||||||||

|

Issuance

of restricted stock awards

|

12 | 1,156 | 12 | - | - | - | - | - | - | |||||||||||||||||||||||||||||||

|

Exercise

of IPO options

|

114 | 7 | - | - | - | 114 | - | - | - | |||||||||||||||||||||||||||||||

|

Forfeitures

|

- | (13 | ) | - | (46 | ) | - | - | - | - | - | |||||||||||||||||||||||||||||

|

Equity-based

compensation

|

25,274 | - | - | - | - | 10,418 | - | - | 14,856 | |||||||||||||||||||||||||||||||

|

Income

tax benefit on equity-based compensation

|

175 | - | - | - | - | 175 | - | - | - | |||||||||||||||||||||||||||||||

|

Distributions

to noncontrolling unitholders

|

(7,888 | ) | - | - | - | - | (3,160 | ) | - | - | (4,728 | ) | ||||||||||||||||||||||||||||

|

Change

in ownership interests between periods

|

- | - | - | - | - | 4,821 | (202 | ) | - | (4,619 | ) | |||||||||||||||||||||||||||||

|

Other

|

(762 | ) | - | - | - | - | (577 | ) | - | - | (185 | ) | ||||||||||||||||||||||||||||

|

Balance

as of September 30, 2008

|

$ | 219,066 | 14,597 | $ | 146 | 21,044 | $ | 2 | $ | 89,387 | $ | (192 | ) | $ | (3,524 | ) | $ | 133,247 | ||||||||||||||||||||||

See

accompanying notes to the condensed consolidated financial

statements.

5

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(In

thousands, except per share amounts)

(Unaudited)

|

Note 1 -

|

DESCRIPTION

OF BUSINESS

|

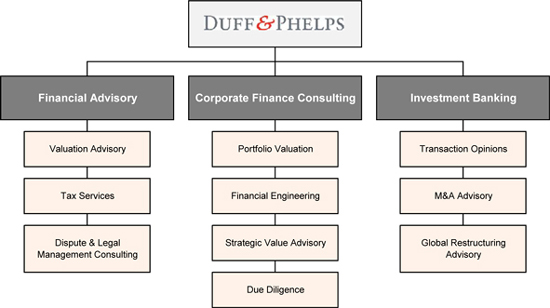

Duff

& Phelps Corporation (the “Company”) is a leading provider of independent

financial advisory, corporate finance consulting and investment banking

services. Its mission is to help its clients protect, maximize and

recover value. The foundation of its services is its ability to

provide independent advice on issues involving highly technical and complex

assessments in the areas of valuation, taxation, dispute consulting, financial

restructuring and M&A advisory. The Company believes the Duff

& Phelps brand is associated with a high level of professional service and

integrity, knowledge leadership and independent, trusted advice. The

Company serves a global client base through offices in 24 cities, comprised of

offices in 18 U.S. cities, including New York, Chicago, Dallas and Los Angeles,

and six international offices located in Amsterdam, London, Munich, Paris,

Shanghai and Tokyo.

|

Note 2 -

|

BASIS

OF PRESENTATION

|

The

Company was incorporated on April 23, 2007 as a Delaware corporation and formed

as a holding company for the purpose of facilitating an initial public offering

(“IPO”) of the Company’s common equity and to become the sole managing member of

Duff & Phelps Acquisitions, LLC and subsidiaries (“D&P

Acquisitions”).

IPO

and Related Transactions

As a

result of the IPO and the Recapitalization Transactions (as defined and

described below), the Company became the sole managing member of and has a

controlling interest in D&P Acquisitions. The Company’s only

business is to act as the sole managing member of D&P Acquisitions, and, as

such, the Company operates and controls all of the business and affairs of

D&P Acquisitions and consolidates the financial results of D&P

Acquisitions into the Company’s consolidated financial statements effective as

of the close of business October 3, 2007.

Immediately

prior to the closing of the IPO of the Company on October 3, 2007, D&P

Acquisitions effectuated certain transactions intended to simplify the capital

structure of D&P Acquisitions (the “Recapitalization

Transactions”). Prior to the Recapitalization Transactions, D&P

Acquisitions' capital structure consisted of seven different classes of

membership interests (Classes A through G, collectively “Legacy Units”), each of

which had different capital accounts and amounts of aggregate distributions

above which its holders share in future distributions. The net effect

of the Recapitalization Transactions was to convert the multiple-class structure

into a single new class of units called “New Class A Units.” Pursuant

to the Recapitalization Transactions and IPO, the Company issued a number of

shares of Class B common stock to existing unitholders of D&P Acquisitions

in an aggregate amount equal to the number of New Class A Units held by existing

unitholders of D&P Acquisitions. The IPO, Recapitalization

Transactions and the Company’s capital structure are further detailed in its

Annual Report on Form 10-K for the year ended December 31, 2008.

Offering

of Class A Common Stock

On May

18, 2009, the Company consummated a follow-on offering with the sale of 8,050

newly issued shares of Class A common stock at $14.75 per share, less an

underwriting discount of $0.7375 per share, as summarized in the following table

(“May 2009 Follow-On Offering”):

|

Stock

subscription of 7,000 shares at $14.75 per share

|

$ | 103,250 | ||

|

Over

allotment of 1,050 shares at $14.75 per share

|

15,488 | |||

|

Underwriting

discount of 8,050 shares at $0.7375 per share

|

(5,937 | ) | ||

|

Offering

related expenses

|

(993 | ) | ||

|

Net

proceeds

|

$ | 111,808 |

6

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(In

thousands, except per share amounts)

(Unaudited)

The

Company used $67,112 of net proceeds to redeem 3,500 New Class A Units of

D&P Acquisitions held by entities affiliated with Lovell Minnick Partners

and Vestar Capital Partners and 1,050 New Class A Units of D&P Acquisitions

held by employees (including executive officers), directors and entities

affiliated with directors. Units were redeemed at a price per unit

equal to the public offering price. In connection with the

redemption, a corresponding number of shares of Class B common stock were

cancelled. In addition, the Company used $42,366 of the net proceeds

to repay outstanding borrowings and terminated its former credit facility with

GE Capital Corporation (see Note 8). In connection with the

repayment, the Company incurred a nonrecurring charge of $1,737 to reflect the

accelerated amortization of the debt discount and issuance costs of which $1,674

was non-cash.

Basis

of Presentation

The

accompanying unaudited condensed consolidated financial statements have been

prepared in accordance with accounting principles generally accepted in the

United States of America and with the rules and regulations of the SEC for

interim financial reporting, and include all adjustments which are, in the

opinion of management, necessary for a fair presentation. The

financial statements require the use of management estimates and include the

accounts of the Company, its controlled subsidiaries and other entities

consolidated as required by GAAP. References to the “Company,” “its”

and “itself,” refer to Duff & Phelps Corporation and its subsidiaries,

unless the context requires otherwise.

The

balance sheet at December 31, 2008 was derived from audited financial

statements, but does not include all disclosures required by accounting

principles generally accepted in the United States of

America. Accordingly, certain information and footnote disclosures

normally included in financial statements prepared in accordance with generally

accepted accounting principles have been condensed or omitted pursuant to such

rules and regulations. In management’s opinion, all adjustments

necessary for a fair presentation are reflected in the interim periods

presented. All significant intercompany accounts and transactions

have been eliminated in consolidation.

Recently

Adopted Accounting Pronouncements

In

September 2009, the Company adopted FASB ASC 105-10, Generally Accepted Accounting

Principles – Overall. FASB ASC 105-10 establishes the

FASB Accounting Standards CodificationTM

(“Codification”) to become the source of authoritative U.S. generally accepted

accounting principles (“U.S. GAAP”) recognized by the FASB to be applied by

nongovernmental entities. Rules and interpretive releases of the

Securities and Exchange Commission (“SEC”) under authority of federal securities

laws are also sources of authoritative U.S. GAAP for SEC registrants. FASB

ASC 105-10 and the Codification are effective for financial statements

issued for interim and annual periods ending after September 15,

2009. The adoption of this standard will not have a material impact

on the Company’s consolidated financial position or results of

operations.

In June

2009, the Company adopted Financial Accounting Standards Board (“FASB”)

Accounting Standards Codification (“ASC”) 855-10, Subsequent

Events – Overall. FASB ASC 855-10

establishes principles and requirements for subsequent events and sets

forth (a) the period after the balance sheet date during which management of a

reporting entity should evaluate events or transactions that may occur for

potential recognition or disclosure in the financial statements, (b) the

circumstances under which an entity should recognize events or transactions

occurring after the balance sheet date in its financial statements and (c) the

disclosures that an entity should make about events or transactions that

occurred after the balance sheet date. The adoption of FASB ASC 855-10

did not have a material impact on the Company’s consolidated financial

position or results of operations.

Effective January 1, 2009, the Company implemented FASB

ASC 810-10, Business Combinations – Identifiable

Assets and Liabilities, and Any Noncontrolling Interest. The

implementation of this standard primarily effected the presentation of the

Company’s consolidated financial statements whereby noncontrolling interest is

presented as a component of stockholders’ equity. The presentation

and disclosure requirements were applied retrospectively for all periods

presented.

7

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(In

thousands, except per share amounts)

(Unaudited)

Effective

January 1, 2009, the Company adopted FASB

ASC 805-20, Business Combinations – Identifiable

Assets and Liabilities, and Any Noncontrolling Interest. FASB

ASC 805-20 requires the

acquiring entity in a business combination to recognize the full fair value of

assets acquired and liabilities assumed in the transaction, establishes the

acquisition-date fair value as the measurement objective for all assets acquired

and liabilities assumed, requires expensing of most transaction costs, and

requires the acquirer to disclose to investors and other users all of the

information needed to evaluate and understand the nature and financial effect of

the business combination. The effect this pronouncement will have on

the Company is dependent upon each specific acquisition which may or may not

occur in the current or future periods.

Effective

January 1, 2009, the Company adopted the remaining provisions of FASB ASC 820-10-65,

Fair

Value Measurements and Disclosures – Overall –Transition and Open Effective Date

Information, related to fair-value measurements of certain nonfinancial

assets and liabilities. The adoption of the remaining provisions of

FASB

ASC 820-10-65 did not have a material impact on the Company’s

consolidated financial position or results of operations.

Recently

Issued Accounting Pronouncements

In

August 2009, the FASB issued Accounting Standards Update (“ASU”)

No. 2009-05, Measuring

Liabilities at Fair Value

(“ASU 2009-05”). ASU 2009-05 amends FASB ASC 820,

Fair Value Measurements and

Disclosures, by providing additional guidance clarifying the measurement

of liabilities at fair value. ASU 2009-05 applies to the fair

value measurement of liabilities within the scope of ASC 820 and addresses

several key issues with respect to estimating fair value of liabilities. Among

other things, ASU 2009-05 clarifies how the price of a traded debt security

(an asset value) should be considered in estimating the fair value of the

issuer’s liability. ASU 2009-05 is effective for the first reporting period

beginning after its issuance. The Company does not expect the

adoption of ASU 2009-05 to have a material impact on its consolidated

financial statements.

In

October 2009, the FASB issued ASU No. 2009-13, Multiple-Deliverable Revenue

Arrangements. ASU 2009-13 supersedes certain guidance in

FASB ASC 605-25, Revenue

Recognition – Multiple-Element Arrangements and requires an entity to

allocate arrangement consideration at the inception of an arrangement to all of

its deliverables based on their relative selling prices (the

relative-selling-price method). ASU 2009-13 eliminates the use of the

residual method of allocation in which the undelivered element is measured at

its estimated selling price and the delivered element is measured as the

residual of the arrangement consideration, and requires the

relative-selling-price method in all circumstances in which an entity recognizes

revenue for an arrangement with multiple deliverable subject to

ASU 2009-13. ASU 2009-13 must be adopted no later than the

beginning of the first fiscal year beginning on or after June 15, 2010,

with early adoption permitted through either prospective application for revenue

arrangement entered into, or materially modified, after the effective date or

through retrospective application to all revenue arrangement for all periods

presented. The Company is evaluating the impact that the adoption of

ASU 2009-13 will have on its consolidated financial

statements.

Critical

Accounting Policies

There

have been no other significant changes in new accounting pronouncements or in

our critical accounting policies and estimates from those that were disclosed in

our Annual Report on Form 10-K for the year ended December 31,

2008. The Company believes that the disclosures herein are adequate

so that the information presented is not misleading; however, it is suggested

that these financial statements be read in conjunction with the financial

statements and the notes thereto in our Annual Report on Form 10-K for the year

ended December 31, 2008. The financial data for the interim periods

may not necessarily be indicative of results to be expected for the

year.

8

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(In

thousands, except per share amounts)

(Unaudited)

|

Note 3 -

|

NONCONTROLLING

INTEREST

|

The

Company has sole voting power in and controls the management of D&P

Acquisitions, and it owns a majority economic interest in D&P Acquisitions

(59.6% at September 30, 2009). As a result, the Company consolidates

the financial results of D&P Acquisitions and records noncontrolling

interest for the economic interest in D&P Acquisitions held by the existing

unitholders to the extent the book value of their interest in D&P

Acquisitions is greater than zero. Net income attributable to

noncontrolling interest on the statement of operations represents the portion of

earnings or loss attributable to the economic interest in D&P Acquisitions

held by the noncontrolling unitholders. Noncontrolling interest on

the balance sheet represents the portion of net assets of D&P Acquisitions

attributable to the noncontrolling unitholders based on the portion of total New

Class A Units owned by such unitholders. The ownership of the New

Class A Units is summarized as follows:

|

Duff

&

|

Non-

|

|||||||||||

|

Phelps

|

Controlling

|

|||||||||||

|

Corporation

|

Unitholders

|

Total

|

||||||||||

|

December

31, 2008

|

14,719 | 20,889 | 35,608 | |||||||||

|

Sale

of Class A common stock

|

8,050 | - | 8,050 | |||||||||

|

Issuance

of Class A common stock

|

10 | - | 10 | |||||||||

|

Redemption

of New Class A Units

|

- | (4,550 | ) | (4,550 | ) | |||||||

|

Net

issuance of restricted stock awards

|

1,292 | - | 1,292 | |||||||||

|

Exercises

of IPO Options

|

51 | - | 51 | |||||||||

|

Forfeitures

|

(138 | ) | (95 | ) | (233 | ) | ||||||

|

September

30, 2009

|

23,984 | 16,244 | 40,228 | |||||||||

|

Percent

of total New Class A Units

|

||||||||||||

|

December

31, 2008

|

41.3 | % | 58.7 | % | 100 | % | ||||||

|

September

30, 2009

|

59.6 | % | 40.4 | % | 100 | % | ||||||

As a

result of the May 2009 Follow-On Offering, the Company’s economic interest in

D&P Acquisitions changed from a minority to a majority

position. This change did not result in a change of control as the

Company has always maintained sole voting power in and control of the management

of D&P Acquisitions.

9

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(In

thousands, except per share amounts)

(Unaudited)

A

reconciliation from “Income before income taxes” to “Net income attributable to

the noncontrolling interest” and “Net income attributable to Duff & Phelps

Corporation” is detailed as follows:

|

Three

Months Ended

|

Nine

Months Ended

|

|||||||||||||||

|

September

30,

|

September

30,

|

|||||||||||||||

|

2009

|

2008

|

2009

|

2008

|

|||||||||||||

|

Income

before income taxes

|

$ | 10,587 | $ | 3,666 | $ | 26,900 | $ | 22,375 | ||||||||

|

Less:

provision for income taxes for entities other than Duff & Phelps

Corporation(a)(b)

|

(292 | ) | (101 | ) | (964 | ) | (162 | ) | ||||||||

|

Income

before income taxes, as adjusted

|

10,295 | 3,565 | 25,936 | 22,213 | ||||||||||||

|

Ownership

percentage of noncontrolling interest(d)

|

40.2 | % | 60.7 | % | 47.9 | % | 59.4 | % | ||||||||

|

Net

income attributable to noncontrolling interest

|

4,136 | 2,165 | 12,417 | 13,204 | ||||||||||||

|

Income

before income taxes, as adjusted, attributable to Duff &

Phelps Corporation

|

6,159 | 1,400 | 13,519 | 9,009 | ||||||||||||

|

Less:

provision for income taxes of Duff & Phelps Corporation(a)(c)

|

(2,707 | ) | (1,247 | ) | (6,568 | ) | (6,181 | ) | ||||||||

|

Net

income attributable to Duff & Phelps Corporation

|

$ | 3,452 | $ | 153 | $ | 6,951 | $ | 2,828 | ||||||||

|

(a)

|

The

consolidated provision for income taxes is equal to the sum of (i) the

provision for income taxes for entities other than Duff & Phelps

Corporation and (ii) the provision for income taxes of Duff & Phelps

Corporation. The consolidated provision for income taxes

totaled $2,999 and $1,348 for the three months ended September 30, 2009

and 2008, respectively, and $7,532 and $6,343 for the nine months ended

September 30, 2009 and 2008,

respectively.

|

|

|

(b)

|

The

provision for income taxes for entities other than Duff & Phelps

Corporation represents taxes imposed directly on Duff & Phelps, LLC, a

wholly-owned subsidiary of D&P Acquisitions, and its subsidiaries,

such as taxes imposed on certain domestic subsidiaries (e.g., Rash &

Associates, L.P.), taxes imposed by certain foreign jurisdictions, and

taxes imposed by certain local and other jurisdictions (e.g., New York

City). Since Duff & Phelps, LLC is taxed as a partnership

and a flow-through entity for U.S. federal and state income tax purposes,

there is no provision for these taxes on income allocable to the

noncontrolling interest.

|

|

|

(c)

|

The

provision of income taxes of Duff & Phelps Corporation includes all

U.S. federal and state income

taxes.

|

|

|

(d)

|

Income

before income taxes, as adjusted, is allocated to the noncontrolling

interest based on the total New Class A Units vested for income tax

purposes (“Tax-Vested Units”) owned by the noncontrolling interest as a

percentage of the aggregate amount of all Tax-Vested

Units. This percentage may not necessarily correspond to the

total number of New Class A Units at the end of each respective

period.

|

10

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(In

thousands, except per share amounts)

(Unaudited)

Distributions

and Other Payments to Noncontrolling Unitholders

The

following table summarizes distributions and other payments to noncontrolling

unitholders, as described more fully below:

|

Nine

Months Ended

|

||||||||

|

September

30,

|

September

30,

|

|||||||

|

2009

|

2008

|

|||||||

|

Distributions

for taxes

|

$ | 14,197 | $ | 7,888 | ||||

|

Other

distributions

|

1,313 | - | ||||||

|

Payments

pursuant to the Tax Receivable Agreement

|

- | - | ||||||

| $ | 15,510 | $ | 7,888 | |||||

Distributions for

taxes

As a

limited liability company, D&P Acquisitions does not incur significant

federal or state and local taxes, as these taxes are primarily the obligations

of the members of D&P Acquisitions. As authorized by the Third

Amended and Restated LLC Agreement of D&P Acquisitions, D&P Acquisitions

is required to distribute cash, generally, on a pro rata basis, to its members

to the extent necessary to provide funds to pay the members' tax liabilities, if

any, with respect to the earnings of D&P Acquisitions. The tax

distribution rate has been set at 45%. During the nine months ended

September 30, 2009 and 2008, D&P Acquisitions made aggregate distributions

to its members totaling $14,197 and $7,888, respectively, not including the

Company, with respect to estimated taxable income for year-to-date 2009 and

2008, respectively. D&P Acquisitions is only required to make

such distributions if cash is available for such purposes as determined by the

Company. The Company expects cash will be available to make these

distributions. Upon completion of its tax returns with respect to the

prior year, D&P Acquisitions may make true-up distributions to its members,

if cash is available for such purposes, with respect to actual taxable income

for the prior year.

Other

distributions

During

the nine months ended September 30, 2009, the Company distributed $1,313 to

holders of New Class A Units of D&P Acquisitions (other than Duff &

Phelps Corporation). The distributions were made concurrently with

the dividend of $0.05 per share of Class A common stock outstanding to

shareholders of record on June 12, 2009 and August 18,

2009. Concurrent with the payment of the dividends, holders of New

Class A Units received a $0.05 distribution per vested unit which will be

treated as a reduction in basis of each member’s ownership

interests. Pursuant to the terms of the Third Amended and Restated

LLC Agreement of D&P Acquisitions, a distribution of $0.05 per unvested unit

was deposited into a segregated account and will be released once a year with

respect to units that vested during that year. The segregated amount for

unvested units totaled $312 and is included as a component of “Restricted cash”

on the Consolidated Balance Sheet at September 30, 2009. The

distribution on unvested units that forfeit will be returned to the

Company.

Payments pursuant to the Tax

Receivable Agreement

As a

result of the Company’s acquisition of New Class A Units of D&P

Acquisitions, the Company expects to benefit from depreciation and other tax

deductions reflecting D&P Acquisitions' tax basis for its

assets. Those deductions will be allocated to the Company and

will be taken into account in reporting the Company’s taxable

income. Further, as a result of a federal income tax election made by

D&P Acquisitions applicable to a portion of the Company’s acquisition of New

Class A Units of D&P Acquisitions, the income tax basis of the assets of

D&P Acquisitions underlying a portion of the units the Company has and will

acquire (pursuant to the exchange agreement) will be adjusted based upon the

amount that the Company has paid for that portion of its New Class A Units of

D&P Acquisitions.

11

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(In

thousands, except per share amounts)

(Unaudited)

The

Company has entered into a tax receivable agreement (“TRA”) with the existing

unitholders of D&P Acquisitions (for the benefit of the existing unitholders

of D&P Acquisitions) that provides for the payment by the Company to the

unitholders of D&P Acquisitions of 85% of the amount of cash savings, if

any, in U.S. federal, state and local income tax that the Company realizes (i)

from the tax basis in its proportionate share of D&P Acquisitions' goodwill

and similar intangible assets that the Company receives as a result of the

exchanges and (ii) from the federal income tax election referred to

above. There were no payments under the TRA in the nine months ended

September 30, 2009 as these payments are typically made in the fourth quarter of

each year. In December 2009, the Company expects to make payments

under the TRA of $3,148 relating to the year ended December 31,

2008. In December 2008, the Company made payments of $791 with

respect to the period from October 4 through December 31,

2007. D&P Acquisitions expects to make future payments under the

TRA to the extent cash is available for such purposes.

At

September 30, 2009, the Company recorded a liability of $92,027, representing

the payments due to D&P Acquisitions’ unitholders under the

TRA. This amount includes additional obligations generated from the

redemption of 4,550 New Class A Units of D&P Acquisitions (see Note 2) in

conjunction with the May 2009 Follow-On Offering. This transaction

resulted in an increase in the TRA liability of $33,548 and an associated

increase in net deferred tax assets.

Within

the next 12 month period, the Company expects to pay $3,148 of the total

amount. The basis for determining the current portion of the payments

due to D&P Acquisitions’ unitholders under the TRA is the expected amount of

payments to be made within the next 12 months. The long-term portion of

the payments due to D&P Acquisitions’ unitholders under the tax receivable

agreement is the remainder. Payments are anticipated to be made

annually over 15 years, commencing from the date of each event that gives rise

to the TRA benefits, beginning with the date of the closing of the IPO on

October 3, 2007. The payments are made in accordance with the terms of the

TRA. The timing of the payments is subject to certain contingencies

including Duff & Phelps Corporation having sufficient taxable income to

utilize all of the tax benefits defined in the TRA.

To

determine the current amount of the payments due to D&P Acquisitions’

unitholders under the tax receivable agreement, the Company estimated the amount

of taxable income that Duff & Phelps Corporation has generated over the

previous fiscal year. Next, the Company estimated the amount of the

specified TRA deductions at year end. This was used as a basis for

determining the amount of tax reduction that generates a TRA

obligation. In turn, this was used to calculate the estimated

payments due under the TRA that the Company expects to pay in the next 12

months. These calculations are performed pursuant to the terms of the

TRA, filed as Exhibit 10.3 to the Quarterly Report on Form 10-Q as filed with

the SEC on November 14, 2007.

Obligations

pursuant to the Tax Receivable Agreement are obligations of Duff & Phelps

Corporation. They do not impact the noncontrolling interest. These

obligations are not income tax obligations and have no impact on the tax

provision or the allocation of taxes. Furthermore, the TRA has no

impact on the allocation of the provision for income taxes to the Company’s net

income. In general, items of income and expense are allocated on the basis

of member’s ownership interests pursuant to the Third Amended and Restated

Limited Liability Company Agreement of Duff & Phelps Acquisitions, LLC,

filed as Exhibit 10.1 to the Quarterly Report on Form 10-Q as filed with the SEC

on November 14, 2007.

During

the nine months ended September 30, 2009, the Company recorded an immaterial

adjustment to increase the payments due to D&P Acquisitions’ unitholders

under the tax receivable agreement by $3,579 with an offsetting credit to

additional paid-in-capital. The adjustment resulted from a correction

to the calculation of the tax receivable agreement liability in conjunction with

the IPO transactions. Although the revision related to the date of

the closing of the IPO transactions, it did not have a material impact on the

Company’s financial position through and as of September 30,

2009.

12

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(In

thousands, except per share amounts)

(Unaudited)

|

Note

4 -

|

ACQUISITIONS

|

The

following table summarizes the Company’s recent acquisitions:

|

Effective

|

||||

|

Date

|

Acquisition

|

Description

|

||

|

4/11/08

|

Dubinsky

& Company, P.C.

|

Washington,

D.C. metro based specialty consulting primarily

|

||

|

focused

on litigation support and forensic services.

|

||||

|

7/15/08

|

World

Tax Service US, LLC

|

Tax

advisory firm focused on the delivery of sophisticated

|

||

|

international

and domestic tax services.

|

||||

|

7/31/08

|

Kane

Reece Associates, Inc.

|

Valuation,

management and technical consulting firm with a

|

||

|

focus

on the communications, entertainment and media

industries.

|

||||

|

8/8/08

|

Financial

and IP Analysis, Inc.

|

Financial

consulting firm that specializes in intellectual

|

||

|

(d/b/a

The Lumin Expert Group)

|

property

dispute support and expert

testimony.

|

The

purchase price of each of these acquisitions is immaterial to the Company’s

consolidated financial statements, both individually and in the

aggregate. Each of these acquisitions operates as part of the

Financial Advisory segment.

Pursuant

to the terms of the acquisition of Chanin Capital Partners, LLC (“Chanin”) by

D&P Acquisitions on October 31, 2006, the Chanin sellers are eligible for

one remaining earn-out payment estimated to be a minimum of approximately $4,000

up to a maximum of approximately $5,000 for the annual period ending October 31,

2009. This earn-out payment is subject to the achievement of certain

contingent performance results of Chanin.

13

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(In

thousands, except per share amounts)

(Unaudited)

|

Note 5 -

|

EARNINGS

PER SHARE

|

Basic

earnings per share (“EPS”) measures the performance of an entity over the

reporting period. Diluted earnings per share measures the performance

of an entity over the reporting period while giving effect to all potentially

dilutive common shares that were outstanding during the period. The

treasury stock method is used to determine the dilutive potential of stock

options, restricted stock awards, restricted stock units, and D&P

Acquisitions’ units and Class B common stock that are exchangeable into D&P

Class A common stock.

In June

2008, the FASB issued FASB ASC 260-10-45, Earnings Per Share – Overall – Other

Presentation Matters which is effective for fiscal years beginning

January 1, 2009. FASB ASC 260-10-45 provides that all

outstanding unvested share-based payments that contain rights to non-forfeitable

dividends participate in the undistributed earnings with the common stockholders

and are therefore participating securities. Companies with participating

securities are required to apply the two-class method in calculating basic and

diluted net income per share. FASB ASC 260-10-45 requires

retrospective application to all prior period net income per share

calculations.

Our

restricted stock awards are considered participating securities as they receive

nonforfeitable dividends at the same rate as our common stock. In

accordance with FASB ASC 260-10-45, the computation of basic and diluted

net income per share is reduced for a presumed hypothetical distribution of

earnings to the holders of our unvested restricted

stock. Accordingly, the effect of the allocation required under FASB

ASC 260-10-45 reduces earnings available for common

stockholders.

The

effect of applying FASB ASC 260-10-45 changed basic net income per share

from $0.16 to $0.15 for the three months ended September 30, 2009, from $0.40 to

$0.37 for the nine months ended September 30, 2009, and from $0.21 to $0.20 for

the nine months ended September 30, 2008. There was no change in

basic earnings per share for the three months ended September 30,

2008. The effect of applying FASB ASC 260-10-45 changed fully

diluted net income per share from $0.15 to $0.14 for the three months ended

September 30, 2009, from $0.38 to $0.35 for the nine months ended September 30,

2009, and from $0.21 to $0.20 for the nine months ended September 30,

2008. There was no change in diluted earnings per share for the three

months ended September 30, 2008.

14

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(In

thousands, except per share amounts)

(Unaudited)

The

following is a reconciliation of the numerator and denominator used in the basic

and diluted EPS calculations:

|

Three

Months Ended

|

Nine

Months Ended

|

|||||||||||||||

|

September

30,

|

September

30,

|

September

30,

|

September

30,

|

|||||||||||||

|

2009

|

2008

|

2009

|

2008

|

|||||||||||||

|

Basic

and diluted net income per share attributable to holders of Class A

common stock:

|

||||||||||||||||

|

Numerator:

|

||||||||||||||||

|

Net

income attributable to Duff & Phelps Corporation

|

$ | 3,452 | $ | 153 | $ | 6,951 | $ | 2,828 | ||||||||

|

Earnings

allocated to participating securities

|

(220 | ) | (12 | ) | (493 | ) | (179 | ) | ||||||||

|

Earnings

available for common stockholders

|

$ | 3,232 | $ | 141 | $ | 6,458 | $ | 2,649 | ||||||||

|

Denominator

for basic net income per share attributable to holders of Class A

common stock:

|

||||||||||||||||

|

Weighted

average shares of Class A common stock

|

21,625 | 13,299 | 17,517 | 13,166 | ||||||||||||

|

Denominator

for diluted net income per share attributable to holders of Class A

common stock:

|

||||||||||||||||

|

Weighted

average shares of Class A common stock

|

21,625 | 13,299 | 17,517 | 13,166 | ||||||||||||

|

Add

dilutive effect of the following:

|

||||||||||||||||

|

Ongoing

RSAs

|

823 | 374 | 680 | 231 | ||||||||||||

|

Assumed conversion of

New Class A Units for Class A common stock(a)

|

- | - | - | - | ||||||||||||

|

Dilutive

weighted average shares of Class A common stock

|

22,448 | 13,673 | 18,197 | 13,397 | ||||||||||||

|

Net

income per share attributable to holders of Class A common stockof

Duff & Phelps Corporation

|

||||||||||||||||

|

Basic

|

$ | 0.15 | $ | 0.01 | $ | 0.37 | $ | 0.20 | ||||||||

|

Diluted

|

$ | 0.14 | $ | 0.01 | $ | 0.35 | $ | 0.20 | ||||||||

|

_______________________________

|

||||||||||||||||

|

(a) The

following shares were anti-dilutive and excluded from this

calculation:

|

||||||||||||||||

|

Weighted

average New Class A Units outstanding

|

16,246 | 20,684 | 18,584 | 20,693 | ||||||||||||

|

Weighted

average IPO Options outstanding

|

1,889 | 2,032 | 1,935 | 2,048 | ||||||||||||

Anti-dilution

is the result of (i) the allocation of income or loss associated with the

exchange of New Class A Units for Class A common stock and (ii) IPO Options

and/or Ongoing RSAs listed above exceeding those outstanding under the treasury

stock method. The shares of Class B common stock do not share in the

earnings of the Company and are therefore not participating

securities. Accordingly, basic and diluted earnings per share of

Class B common stock have not been presented.

15

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(In

thousands, except per share amounts)

(Unaudited)

|

Note 6 -

|

EQUITY-BASED

COMPENSATION

|

For a

detailed description of past equity-based compensation activity, please refer to

the Company’s Annual Report on Form 10-K for the year ended December 31,

2008. Except for adjustments to estimated forfeiture rates based on

the most recent available information, there have been no significant changes in

the Company’s equity-based compensation accounting policies and assumptions from

those that were disclosed in the Company’s Annual Report on Form 10-K for

the year ended December 31, 2008.

Equity-based

compensation with respect to (a) grants of Legacy Units, (b) options to purchase

shares of the Company’s Class A common stock granted in connection with the IPO

(“IPO Options”) and (c) restricted stock awards and units issued in connection

with the Company’s ongoing long-term compensation program (“Ongoing RSAs”) is

detailed in the table below:

|

Three

Months Ended

|

Three

Months Ended

|

|||||||||||||||||||||||

|

September

30, 2009

|

September

30, 2008

|

|||||||||||||||||||||||

|

Client

|

Client

|

|||||||||||||||||||||||

|

Service

|

SG&A

|

Total

|

Service

|

SG&A

|

Total

|

|||||||||||||||||||

|

Legacy

Units

|

$ | 1,610 | $ | 758 | $ | 2,368 | $ | 5,237 | $ | 1,548 | $ | 6,785 | ||||||||||||

|

IPO

Options

|

514 | 347 | 861 | 1,348 | 572 | 1,920 | ||||||||||||||||||

|

Ongoing

RSAs

|

2,170 | 913 | 3,083 | 966 | 725 | 1,691 | ||||||||||||||||||

|

Total

|

$ | 4,294 | $ | 2,018 | $ | 6,312 | $ | 7,551 | $ | 2,845 | $ | 10,396 | ||||||||||||

|

Nine

Months Ended

|

Nine

Months Ended

|

|||||||||||||||||||||||

|

September

30, 2009

|

September

30, 2008

|

|||||||||||||||||||||||

|

Client

|

Client

|

|||||||||||||||||||||||

|

Service

|

SG&A

|

Total

|

Service

|

SG&A

|

Total

|

|||||||||||||||||||

|

Legacy

Units

|

$ | 6,138 | $ | 2,046 | $ | 8,184 | $ | 11,350 | $ | 4,273 | $ | 15,623 | ||||||||||||

|

IPO

Options

|

1,866 | 913 | 2,779 | 3,741 | 1,657 | 5,398 | ||||||||||||||||||

|

Ongoing

RSAs

|

5,627 | 2,615 | 8,242 | 2,091 | 2,234 | 4,325 | ||||||||||||||||||

|

Total

|

$ | 13,631 | $ | 5,574 | $ | 19,205 | $ | 17,182 | $ | 8,164 | $ | 25,346 | ||||||||||||

Restricted

stock awards and restricted stock units were granted as a form of incentive

compensation and are accounted for similarly. Corresponding expense is

recognized based on the fair market value on the date of grant. Restricted

stock units are granted to certain of our international employees, are generally

contingent on continued employment and are typically converted to Class A common

stock when restrictions on transfer lapse after three years.

During

the nine months ended September 30, 2009, the Company issued 1,426 Ongoing RSAs

related to annual bonus incentive compensation, performance incentive

initiatives, promotions and recruiting efforts. Expense is recognized

based on the fair market value on the date of grant over the service

period. The restrictions on transfer and forfeiture provisions are

generally eliminated after three years for all awards granted to non-executives

with certain exceptions related to retiree eligible employees and termination of

employees without cause.

Of the

1,426 Ongoing RSAs granted, 221 awards were granted to executives on February

26, 2009 and 18 to the Board of Directors on April 30, 2009. The

restrictions on transfer and forfeiture provisions are eliminated annually over

three years based on ratable vesting for grants made to executives and four

years for non-employee members of our Board of Directors.

16

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(In

thousands, except per share amounts)

(Unaudited)

The

following table summarizes activity for IPO Options and Ongoing

RSAs:

|

Restricted

|

Restricted

|

|||||||||||

|

IPO

|

Stock

|

Stock

|

||||||||||

|

Options

|

Awards

|

Units

|

||||||||||

|

Balance

as of December 31, 2008

|

1,997 | 1,248 | 92 | |||||||||

|

Grants

of Ongoing RSAs

|

- | 1,345 | 81 | |||||||||

|

Converted

to Class A common stock upon lapse of restrictions

|

- | (74 | ) | - | ||||||||

|

Ongoing

RSAs withheld for payroll taxes

|

- | (53 | ) | - | ||||||||

|

Exercises

of IPO Options

|

(51 | ) | - | - | ||||||||

|

Forfeitures

|

(106 | ) | (138 | ) | - | |||||||

|

Balance

as of September 30, 2009

|

1,840 | 2,328 | 173 | |||||||||

|

Vested

|

900 | - | - | |||||||||

|

Unvested

|

940 | 2,328 | 173 | |||||||||

|

Weighted

average fair value on grant date

|

$ | 7.33 | $ | 14.12 | $ | 13.88 | ||||||

|

Weighted

average exercise price

|

$ | 16.00 | ||||||||||

|

Weighted

average remaining contractual term

|

8.00 | |||||||||||

|

Total

intrinsic value of exercised options

|

$ | 202 | ||||||||||

|

Total

fair value of options vested

|

$ | 6,597 | ||||||||||

|

Aggregate

intrinsic value

|

$ | 5,814 | ||||||||||

|

Options

expected to vest

|

807 | |||||||||||

|

Aggregate

intrinsic value of options expected to vest

|

$ | 2,550 | ||||||||||

The

following table summarizes activity for New Class A Units attributable to

equity-based compensation:

|

New

|

||||

|

Class

A Units

|

||||

|

Attributable

to

|

||||

|

Equity-Based

|

||||

|

Compensation

|

||||

|

Balance

as of December 31, 2008

|

6,615 | |||

|

Redemptions

|

(708 | ) | ||

|

Forfeitures

|

(95 | ) | ||

|

Balance

as of September 30, 2009

|

5,812 | |||

|

Vested

|

4,121 | |||

|

Unvested

|

1,691 | |||

The total

unamortized compensation cost related to all non-vested awards was approximately

$24,452 at September 30, 2009. The weighted-average period over which

this is expected to be recognized is approximately 1.6 years. A tax

benefit of $1,581 and $1,121 was recognized for IPO Options and Ongoing RSAs for

the nine months ended September 30, 2009 and 2008,

respectively.

17

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(In

thousands, except per share amounts)

(Unaudited)

|

Note 7 -

|

FAIR

VALUE MEASUREMENTS

|

The

following table presents assets and liabilities measured at fair value on a

recurring basis at September 30, 2009:

|

Quoted

Prices

|

||||||||||||||||

|

in

Active

|

Significant

|

|||||||||||||||

|

Markets

for

|

Other

|

Significant

|

||||||||||||||

|

Identical

|

Observable

|

Unobservable

|

||||||||||||||

|

Assets

|

Inputs

|

Inputs

|

||||||||||||||

|

Description

|

(Level 1)

|

(Level 2)

|

(Level 3)

|

Total

|

||||||||||||

|

Investments

held in conjunction with deferred compensation plan(1)(2)

|

$ | - | $ | 16,368 | $ | - | $ | 16,368 | ||||||||

|

Total

assets

|

$ | - | $ | 16,368 | $ | - | $ | 16,368 | ||||||||

|

Benefits

payable in conjunction with deferred compensation plan(1)

|

$ | - | $ | 17,167 | $ | - | $ | 17,167 | ||||||||

|

Interest

rate swap(3)

|

- | 443 | - | 443 | ||||||||||||

|

Total

liabilities

|

$ | - | $ | 17,610 | $ | - | $ | 17,610 | ||||||||

____________________________

|

|

(1)

|

The

investments held and benefits payable to participants in conjunction with

the deferred compensation plan were primarily based on quoted prices for

similar assets in active markets. Changes in the fair value of

the investments are recognized as compensation expense (or

credit). Changes in the fair value of the benefits payables to

participants are recognized as a corresponding offset to compensation

expense (or credit). The net impact of changes in fair value is

not material. The deferred compensation plan is further

discussed in Note 10.

|

|

(2)

|

Investments

held in conjunction with the deferred compensation plan exclude

approximately $727 which is included in cash and cash equivalents at

September 30, 2009.

|

|

(3)

|

The

fair value of the interest rate swap was based on quoted prices for

similar assets or liabilities in active markets. The Company’s

interest rate swap is further discussed in Note

8.

|

The

Company does not have any material financial assets in a market that is not

active.

18

DUFF

& PHELPS CORPORATION AND SUBSIDIARIES

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(In

thousands, except per share amounts)

(Unaudited)

|

Note

8 -

|

LONG-TERM

DEBT

|

The

Company’s long-term obligations are summarized in the following

table:

|

September 30,

|

December 31,

|

|||||||

|

2009

|

2008

|

|||||||

|

Outstanding

balance of credit facility

|

$ | - | $ | 42,763 | ||||

|

Less: current

amounts due in following year

|

- | (794 | ) | |||||

|

Long-term

portion

|

- | 41,969 | ||||||

|

Debt

discount and interest rate swap

|

- | 209 | ||||||

|

Long-term

debt, less current portion

|

$ | - | $ | 42,178 | ||||

On May 22

, 2009, the Company terminated its Amended and Restated Credit Agreement

(“Former Credit Facility”), dated as of July 30, 2008, by and among Duff &

Phelps, LLC, the primary operating subsidiary of the Company, D&P