Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - James River Coal CO | jrcc_8k-110309.htm |

| EX-99.1 - PRESS RELEASE - James River Coal CO | jrcc_8k-ex9901.htm |

Exhibit 99.2

Shareholder

Update

November

2009

2

Forward-Looking

Statements

Certain statements

in this press release, and other written or oral statements made by or

on behalf of us are "forward-looking statements" within the meaning of the federal

securities laws. Statements regarding future events and developments and our future

performance, as well as management's expectations, beliefs, plans, estimates, guidance

or projections relating to the future, are forward-looking statements within the meaning of

these laws. These forward-looking statements are subject to a number of risks and

uncertainties. These risks and uncertainties include, but are not limited to, the following:

changes in the demand for coal by electric utility customers; the loss of one or more of

our largest customers; inability to secure new coal supply agreements or to extend

existing coal supply agreements at market prices; failure to diversify our operations;

failure to exploit additional coal reserves; the risk that reserve estimates are inaccurate;

increased capital expenditures; encountering difficult mining conditions; increased costs

of complying with mine health and safety regulations; our dependency on one railroad for

transportation of a large percentage of our products; bottlenecks or other difficulties in

transporting coal to our customers; delays in the development of new mining projects;

increased costs of raw materials; lack of availability of financing sources; our compliance

with debt covenants; the effects of litigation, regulation and competition; and the other

risks detailed in our reports filed with the Securities and Exchange Commission (SEC).

on behalf of us are "forward-looking statements" within the meaning of the federal

securities laws. Statements regarding future events and developments and our future

performance, as well as management's expectations, beliefs, plans, estimates, guidance

or projections relating to the future, are forward-looking statements within the meaning of

these laws. These forward-looking statements are subject to a number of risks and

uncertainties. These risks and uncertainties include, but are not limited to, the following:

changes in the demand for coal by electric utility customers; the loss of one or more of

our largest customers; inability to secure new coal supply agreements or to extend

existing coal supply agreements at market prices; failure to diversify our operations;

failure to exploit additional coal reserves; the risk that reserve estimates are inaccurate;

increased capital expenditures; encountering difficult mining conditions; increased costs

of complying with mine health and safety regulations; our dependency on one railroad for

transportation of a large percentage of our products; bottlenecks or other difficulties in

transporting coal to our customers; delays in the development of new mining projects;

increased costs of raw materials; lack of availability of financing sources; our compliance

with debt covenants; the effects of litigation, regulation and competition; and the other

risks detailed in our reports filed with the Securities and Exchange Commission (SEC).

Agenda

● Opening

Comments

● Market

Review

● Miscellaneous

4

Opening

Comments

Summary

● A Very Quiet Quarter

at James River Coal Company

● A Very Quiet Quarter

at James River Coal Company

● Continuing our

Strong Financial Performance

● Continuing our

Strong Financial Performance

● Reached Agreements

to Sell 428,000 Tons of CAPP at an Average Price of

$73.16 Per Ton and 1.5 Million Tons of ILB at an Average of $44.57 Per

Ton

$73.16 Per Ton and 1.5 Million Tons of ILB at an Average of $44.57 Per

Ton

● Reached Agreements

to Sell 428,000 Tons of CAPP at an Average Price of

$73.16 Per Ton and 1.5 Million Tons of ILB at an Average of $44.57 Per

Ton

$73.16 Per Ton and 1.5 Million Tons of ILB at an Average of $44.57 Per

Ton

● Continuing to Make

Minor Adjustments to Production Schedules in

Response to Soft Coal Markets

Response to Soft Coal Markets

● Continuing to Make

Minor Adjustments to Production Schedules in

Response to Soft Coal Markets

Response to Soft Coal Markets

● Continuing to

Maintain Close Relationships with Domestic Utility Customers

and International Market Participants

and International Market Participants

● Continuing to

Maintain Close Relationships with Domestic Utility Customers

and International Market Participants

and International Market Participants

● Continuing to

Position JRCC for the Next Strong Market Cycle Through

Investments in our People and our Fleet of Equipment

Investments in our People and our Fleet of Equipment

● Continuing to

Position JRCC for the Next Strong Market Cycle Through

Investments in our People and our Fleet of Equipment

Investments in our People and our Fleet of Equipment

Agenda

● Operations

Review

● Market

Review

● Opening

Comments

● Miscellaneous

6

Operations

Review

Q-3

Safety

● Continued Strong

Trend in Safety Performance

● Continued Strong

Trend in Safety Performance

● NFDL Rate Reduced

36% Over 2008, Well Below National

Average

Average

● NFDL Rate Reduced

36% Over 2008, Well Below National

Average

Average

● McCoy, Triad

Underground and James River Coal Service had

Zero Lost Time Accidents for the Quarter

Zero Lost Time Accidents for the Quarter

● McCoy, Triad

Underground and James River Coal Service had

Zero Lost Time Accidents for the Quarter

Zero Lost Time Accidents for the Quarter

● Mine 16 (McCoy)

Awarded Safest Underground Mine in Pikeville

District for 2008 by Kentucky OMSL

District for 2008 by Kentucky OMSL

● Mine 16 (McCoy)

Awarded Safest Underground Mine in Pikeville

District for 2008 by Kentucky OMSL

District for 2008 by Kentucky OMSL

● Beechfork

(Bledsoe) Awarded Safest Underground Mine in

Barboursville District for 2008 by Kentucky OMSL

Barboursville District for 2008 by Kentucky OMSL

● Beechfork

(Bledsoe) Awarded Safest Underground Mine in

Barboursville District for 2008 by Kentucky OMSL

Barboursville District for 2008 by Kentucky OMSL

7

Operations

Review

Q-3

Central Appalachia

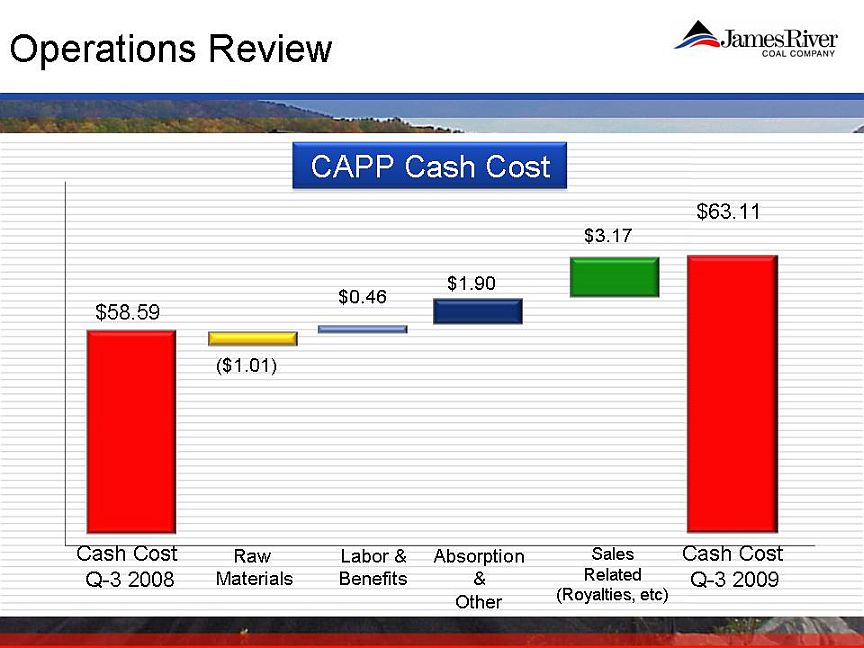

● Reduced Costs

$1.82 a Ton While Cutting Production by 81,000 Tons

● Reduced Costs

$1.82 a Ton While Cutting Production by 81,000 Tons

● Managed

Inventories Through Adjustments to Operating Schedules

● Managed

Inventories Through Adjustments to Operating Schedules

● CAPP Mines Idled

for One Unplanned Day During Q-3

● CAPP Mines Idled

for One Unplanned Day During Q-3

● Began Construction

of a New Impoundment for McCoy

● Began Construction

of a New Impoundment for McCoy

● Began Production

at Jellico Underground Replacement Mine at Bell

● Began Production

at Jellico Underground Replacement Mine at Bell

● Completed

Development of New Portal for Mine 75 at Blue Diamond

● Completed

Development of New Portal for Mine 75 at Blue Diamond

● Permitting Delays

Continue Both on State and Federal Level

● Permitting Delays

Continue Both on State and Federal Level

9

Operations

Review

Q-3

Illinois Basin

● Managed Production

to Match Shipping Schedules

● Managed Production

to Match Shipping Schedules

● Surface Production

Decreased from Q-2 While Underground

Production Increased

Production Increased

● Surface Production

Decreased from Q-2 While Underground

Production Increased

Production Increased

● Continued

Development of the Freelandville West Underground

Mine Site

Mine Site

● Continued

Development of the Freelandville West Underground

Mine Site

Mine Site

● Costs Increased

$1.34 a Ton Due Mainly to Decreased Surface

Production and Increased Repair & Maintenance Activities

Production and Increased Repair & Maintenance Activities

● Costs Increased

$1.34 a Ton Due Mainly to Decreased Surface

Production and Increased Repair & Maintenance Activities

Production and Increased Repair & Maintenance Activities

Agenda

● Operations

Review

● Market

Review

● Opening

Comments

● Miscellaneous

Market

Review

EPA

Seeks to Appoint an Ad Hoc Science

Panel to Study Surface Mining

Panel to Study Surface Mining

Vietnam

Raises Coal Prices

to

Reduce Exports

News

and Notes

EPA

Revokes Validly Issued Permit

Eskom

(South Africa) to Increase Their Coal Burn

From

125 Million Tons Today to 200 Million Tons in 2018

European

Court Repeals

Cuts

in CO²

Caps

Watch

Russia Not India

South

Korea Substantially

Increases

Their

Coking Coal Imports

Somali

Pirates Capture Ship

Loaded

with Coal

Russia

Building New Rail Tunnels to

Increase Exports to Asia

Increase Exports to Asia

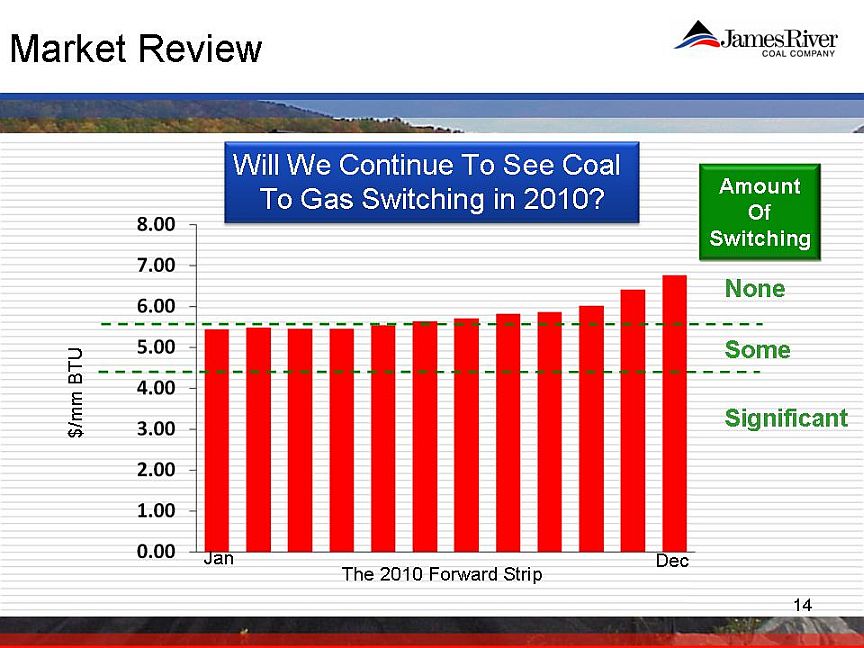

Market

Review

2009

Net CAPP to South Atlantic Utilities

Source:

Genscape

Source:

Genscape

CAPP

Midwest

Market

Review

New

Sales Commitments

● Sold 389,000 Tons

for 2010 at $72.62

● Sold 389,000 Tons

for 2010 at $72.62

● Sold 39,000 Tons

for 2011 at $78.57

● Sold 39,000 Tons

for 2011 at $78.57

● Sold 1,000,000

Tons for 2011 at $44.36

● Sold 1,000,000

Tons for 2011 at $44.36

● Sold 500,000 Tons

for 2012 at $45.00

● Sold 500,000 Tons

for 2012 at $45.00

We

Have Seen an Improvement in the Market

For

Industrial Stoker Coal and Crossover Met Blends

15

Market

Review

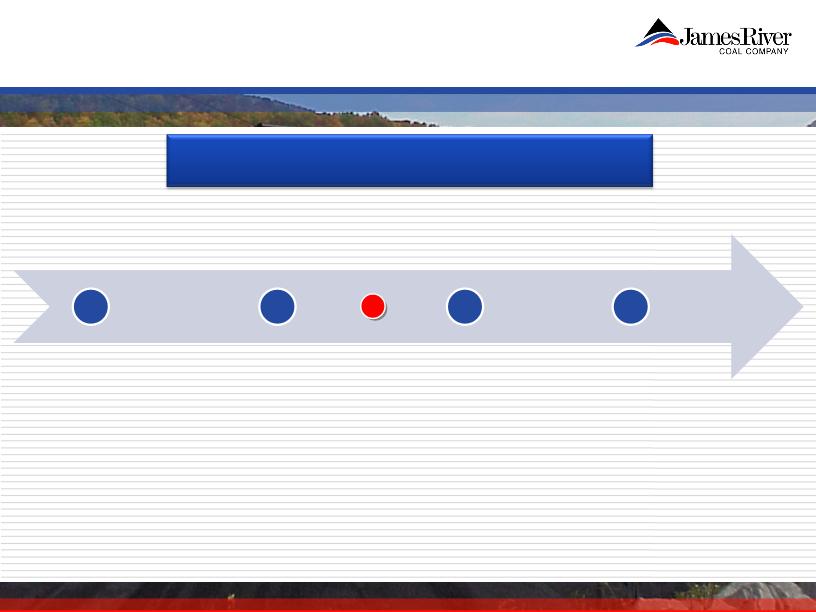

*

Our

Summary View of The World

Today

Today

Phase

I

Phase

II

Phase

III

Phase

IV

Demand

Falls

Demand

Falls

Hard

Hard

Inventories

Adjust

Adjust

Inventories

Adjust

Adjust

Supply

Falls

Supply

Falls

Hard

Hard

Markets

Adjust

Adjust

Markets

Adjust

Adjust

Market

Review

Our

Summary View of The World

● The Eastern U.S.

Thermal Coal Market Continues to Need an

Overall Shift of +/- 30 Million Tons to Improve

Overall Shift of +/- 30 Million Tons to Improve

● The Eastern U.S.

Thermal Coal Market Continues to Need an

Overall Shift of +/- 30 Million Tons to Improve

Overall Shift of +/- 30 Million Tons to Improve

● The Most Likely

Source of This Shift Will be a Combination of:

● The Most Likely

Source of This Shift Will be a Combination of:

- Lower CAPP

Production

- Lower CAPP

Production

- Less Fuel

Switching to Natural Gas

- Less Fuel

Switching to Natural Gas

- Improved Electric

Generation for Industrial Activity

- Improved Electric

Generation for Industrial Activity

- Crossover (Flex)

Tons Moving into the Met Market

- Crossover (Flex)

Tons Moving into the Met Market

We

Believe that the Market Will Adjust in Late 2010 or Early 2011.

Our

Contract Portfolio Gives Us Flexibility to Manage Through the

Downturn

Agenda

● Operations

Review

● Market

Review

● Opening

Comments

● Miscellaneous

18

Temporary Change

to Shareholder Rights Plan

● Lower Threshold

From 20% to 4.9%

● Lower Threshold

From 20% to 4.9%

● Temporary Change

That Will Expire on December 5, 2010

● Temporary Change

That Will Expire on December 5, 2010

● Necessary to

Protect Substantial Tax Assets

● Necessary to

Protect Substantial Tax Assets

- Regular Net

Operating Loss (NOL) Tax Carryforwards of

approximately $240 Million

approximately $240 Million

- Regular Net

Operating Loss (NOL) Tax Carryforwards of

approximately $240 Million

approximately $240 Million

- Alternative

Minimum Tax (AMT) NOL’s of

approximately $150 Million

approximately $150 Million

- Alternative

Minimum Tax (AMT) NOL’s of

approximately $150 Million

approximately $150 Million

Miscellaneous

Miscellaneous

|

Upcoming

Investor Conferences and Meetings

(Webcast

May be Accessed at www.jamesrivercoal.com)

|

||

|

November 05,

2009

|

Davenport

and Company

4th Annual Metals

and Mining Conference

|

New

York

|

|

November 10,

2009

|

Raymond

James

2nd Annual Coal

Investors Conference

|

New

York

|

|

November 30,

2009

|

Macquarie

Global

Metals and Mining Conference

|

New

York

|

|

December 01,

2009

|

UBS

Coal 1 on 1

Conference

|

Boston

|

|

December 02,

2009

|

Bank of

America

2009 Credit

Conference

|

New

York

|

19

|

Late

February

|

4th Quarter

Earnings Release

2010

Guidance

|

20

Question and

Answer

Session

Session