Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BLACK & DECKER CORP | d8k.htm |

0 A POWERFUL LEGACY, A FUTURE OF GROWTH November 3, 2009 Exhibit 99.1 |

1 Forward Looking Statements CAUTIONARY STATEMENTS Under the Private Securities Litigation Reform Act of 1995 Statements in this presentation that are not historical, including but not limited to

those regarding the consummation of the proposed transaction between Stanley and Black & Decker and the realization of synergies in connection therewith, are “forward looking statements” and, as such, are subject to risk and uncertainty. Stanley’s and Black & Decker’s ability to deliver the results as discussed

in this presentation is based on current expectations and involves inherent risks and uncertainties, including factors listed below and other factors that could delay, divert, or change any of them, and could cause actual outcomes and results

to differ materially from current expectations. In addition to the risks, uncertainties and other factors discussed in this presentation, the risks, uncertainties and other factors that could cause or contribute to actual results

differing materially from those expressed or implied in the forward looking statements include, without limitation, those set forth in the “Risk Factors” section, the “Legal Proceedings” section, the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section and other sections of Stanley’s and Black & Decker’s Annual Reports on Form 10-K and any material changes thereto set forth in any subsequent Quarterly

Reports on Form 10-Q, those contained in Stanley’s and Black & Decker’s other filings with the Securities and Exchange Commission, and those set forth below. Neither Stanley nor Black and Decker undertake any obligation to publicly update or revise any forward-looking statements to reflect events or

circumstances that may arise after the date hereof. Additional Information

The proposed transaction involving Stanley and Black & Decker will be submitted

to the respective stockholders of Stanley and Black & Decker for their consideration. In connection with the proposed transaction, Stanley will file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that will include a joint proxy statement of Stanley and Black & Decker that will also constitute a prospectus of Stanley. Investors and security holders are urged to read the joint proxy statement/prospectus and any other relevant documents filed with the SEC when they become available, because they will contain important information. Investors and security holders may obtain a free copy of the joint proxy statement/prospectus and other documents (when available) that Stanley and Black & Decker file with the SEC at the SEC’s website at www.sec.gov and Stanley’s website related to the transaction at

www.stanleyblackanddecker.com. In addition, these documents may be obtained from Stanley or Black & Decker free of charge by directing a request to Investor Relations, The Stanley Works, 1000 Stanley Drive, New Britain, CT 06053, or to Investor Relations, The Black & Decker Corporation, 701 E. Joppa Road, Towson, Maryland 21286, respectively. Stanley, Black & Decker and certain of their respective directors and executive officers may be deemed to be participants in the proposed transaction under the rules of the SEC. Investors and security holders may obtain information regarding the names, affiliations and interests of Stanley’s directors

and executive officers in Stanley’s Annual Report on Form 10-K for the year ended January 3, 2009, which was filed with the SEC on February 26, 2009, and its proxy statement for its 2009 Annual Meeting, which was filed with the SEC on March 20, 2009. Investors and security holders may

obtain information regarding the names, affiliations and interests of Black & Decker’s directors and executive officers in Black & Decker’s Annual Report on Form 10-K for the year ended December 31, 2008, which was filed with the SEC on February 17, 2009, and its proxy statement for its 2009 Annual Meeting, which was filed with the SEC on March 16, 2009. These documents can be obtained free of charge from the sources listed above. Additional information regarding the interests of these individuals will also be included in the joint proxy statement/prospectus regarding the

proposed transaction when it becomes available. Non-Solicitation A registration statement relating to the securities to be issued by Stanley in the proposed transaction will be filed with the SEC, and Stanley will not issue, sell or accept offers to buy such securities prior to the time such registration statement becomes effective. This document shall not constitute an

offer to sell or the solicitation of an offer to buy, nor shall there be any sale of such securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to appropriate registration or qualification under the

securities laws of such jurisdiction. These factors include but are not limited to the risk that

regulatory and stockholder approvals of the transaction are not obtained on the proposed terms and schedule; the future business operations of Stanley or Black & Decker will not be successful; the risk that the proposed transaction between Stanley and

Black & Decker will not be consummated; the risk that Stanley and Black & Decker will not realize any or all the risk that of the anticipated benefits from the transaction; the risk that cost synergy, customer

retention and revenue expansion goals for the transaction will not be met and that disruptions from the transaction will harm relationships with customers, employees and suppliers; the risk that unexpected costs

will be incurred; the outcome of litigation (including with respect to the transaction) and regulatory proceedings to which Stanley and Black & Decker may be a party; pricing pressure and other changes

within competitive markets; the continued consolidation of customers particularly in consumer channels; inventory management pressures on Stanley’s and Black & Decker’s customers; the impact the

tightened credit markets may have on Stanley or Black & Decker or customers or suppliers; the extent to which Stanley or Black & Decker has to write off accounts receivable or assets or experiences supply chain

disruptions in connection with bankruptcy filings by customers or suppliers; increasing competition; changes in laws, regulations and policies that affect Stanley or Black & Decker, including, but not

limited to trade, monetary, tax and fiscal policies and laws; the timing and extent of any inflation or deflation in 2009 and beyond; currency exchange fluctuations; the impact of dollar/foreign currency exchange and interest

rates on the competitiveness of products and Stanley’s and Black & Decker’s debt programs; the strength of the U.S. and European economies; the extent to which world wide markets associated with

homebuilding and remodeling continue to deteriorate; the impact of events that cause or may cause disruption in Stanley’s or Black & Decker’s manufacturing, distribution and sales networks

such as war, terrorist activities, and political unrest; and recessionary or expansive trends in the economies of the world in which Stanley or Black & Decker operates, including but not limited to the extent and duration

of the current recession in the US economy. |

2 2 Chairman & Chief Executive Officer The Stanley Works John F. Lundgren Chairman, President & Chief Executive Officer The Black & Decker Corporation Nolan D. Archibald |

3 • Established In 1843 By Frederick Trent Stanley, Who Founded A Small Hardware Manufacturing Shop In New Britain, CT • 166 Year Reputation For Product Quality And Service • 133 Years Of Consecutive Dividends • World Class Hand Tools Portfolio • Established In 1910 By S. Duncan Black And Alonzo G. Decker, Who Founded A Small Machine Shop In Baltimore, MD • 100 Year Reputation For Product Innovation And Customer Focus • 72 Years Of Consecutive Dividends • World Class Power Tools Portfolio Two Companies With Great Legacies Rich and Enduring Histories |

4 Compelling Strategic And Financial Benefits Strategic Benefits Financial Benefits A Global Leader In Hand and Power Tools Iconic Brand Portfolio – Over 250 Years Of Combined History Greater Scale In Hand And Power Tools & Storage, Mechanical Security, And Engineered Fastening World Class Innovation Process Global Low Cost Sourcing And Manufacturing Platforms Additional Presence In High-Growth Emerging Markets Highly Accretive To EPS; Approximately $1.00 Per Share Projected By Year 3 $350M In Cost Synergies Annually Opportunity For Margin Improvement Free Cash Flow Of Approximately $1.0B And Over $1.5B In EBITDA By Year 3 Increased Resources To Invest In Security Solutions, Engineered Fastening And Other High-Growth Platforms Strong Balance Sheet |

5 Transaction Highlights Exchange Ratio Fixed Ratio Of 1.275 Shares Of SWK For Each Share Of BDK Implied 22.1% Premium To BDK As Of 10/30/09 Ownership 50.5% Stanley / 49.5% Black & Decker Accretion EPS Accretion Of Approximately $1.00 Per Share Projected By Year 3 Synergies $350M Cost Synergies Annually, Fully Realized Within 3 Years Board of Directors 9 Directors From Stanley / 6 Directors From Black & Decker Nolan D. Archibald, Executive Chairman Management Team John F. Lundgren, President & CEO James M. Loree, EVP & COO Donald Allan, Jr., SVP & CFO Company Name Stanley Black & Decker Headquarters Corporate HQ In New Britain, CT / Power Tools HQ In Towson, MD Transaction Close Expected In The First Half Of 2010 Transaction Currently Valued At Approximately $4.5B |

6 Highly Complementary Iconic Brands World- Class Brand Portfolio Well Known Brands Across All Segments CDIY Security Industrial Industrial Engineered Fastening Hardware & Home Improvement |

7 Comprehensive Product Offering No Significant Product Line Overlap |

8 Attractive Positions In Markets And Channels Worldwide Operations In 45 Countries With Strong Positions In North America, Europe, Middle East and Latin America Growing Presence In Emerging Markets Including Asia & Eastern Europe Outstanding Access To Key End Markets Including Industrial, Construction, Automotive Repair and DIY An Industry Leading Array Of Products & Services Branded Hand Tools & Storage Cordless And Corded Power Tools & Accessories Mechanical Security & Hardware Electronic Security Systems & Services Engineered Fastening Systems Superior Track Record Of Innovation Laser Focus On End Users Strong Value Propositions Compatible Cultures Robust New Product Pipeline & Continued Commitment To Focused R&D World Class Operations And Global Sourcing Stanley Fulfillment System Operating Model Low Cost Country Manufacturing & Sourcing Overlapping Physical Distribution Systems Committed To Best-In-Class Working Capital Efficiency Compelling Strategic Combination |

9 Executive Vice President & Chief Operating Officer, The Stanley Works James M. Loree |

10 Consistent With Strategic Objectives Stanley Strategic Framework In Place Since 2004 Be A Consolidator Of The Tool Industry Increase Relative Weighting Of Emerging Markets Be Selective and Operate In Markets Where: Brand Is Meaningful (Stanley Or Sub-Brand) Value Proposition Is Definable And Sustainable Through Innovation Global Cost Leadership Is Achievable Pursue Growth On Multiple Fronts Through: Building On Existing Growth Platforms Developing New Growth Platforms Over Time Accelerate Progress Via Stanley Fulfillment System Increased Scale In Hand And Power Tools Greater Presence In Latin America, Middle East and Eastern Europe Significant Brand Equity Extensive Array of High Value-Added Products And Strong Culture Of Innovation Bringing Together Two Cost Leaders Increased Size And Scale Adds Attractive New Engineered Fastening Growth Platform Maintain Portfolio Transition Momentum Strategic Benefits Of Combination Approximately $1B In Free Cash Flow Annually To Build Growth Platforms

|

11 Growth Platforms Existing Growth Platforms 1. Convergent Security 2. Mechanical Security 3. Industrial & Automotive Tools New Growth Platforms 4. Engineered Fastening 5. Healthcare 6. Infrastructure Capital Focused On Driving Growth Within Both Core and New Platforms… Build Out Existing Platforms Expand Into Adjacent Markets Grow Through Acquisitions Expand Existing Platforms Grow Organically Expand Internationally Via Acquisitions New |

12 Long-Term Capital Allocation Strategy Long-Term Capital Allocation Objectives Target Strong Investment Grade Credit Rating Invest Approximately 2/3 In Acquisitions And Growth Return Approximately 1/3 To Shareholders Committed To Continued Dividend Growth Capital Allocation Strategy Supports Strong Balance Sheet, Shareholder Returns & Continued Growth Capital Allocation Objectives Remain Intact Share Repurchase 1/6 Acquisitions 2/3 Dividends 1/6 |

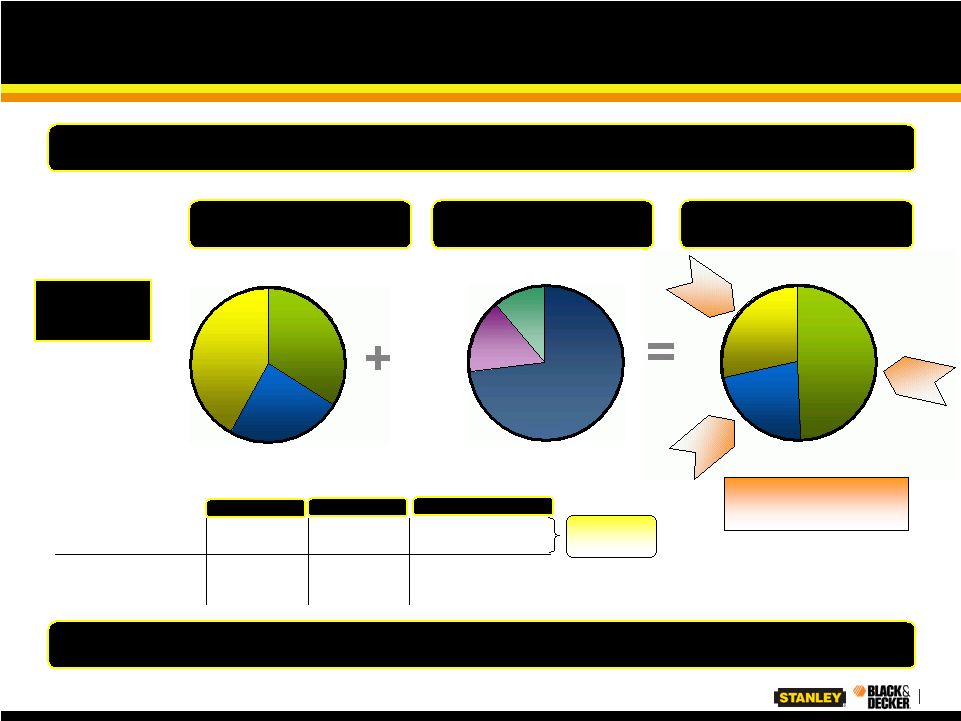

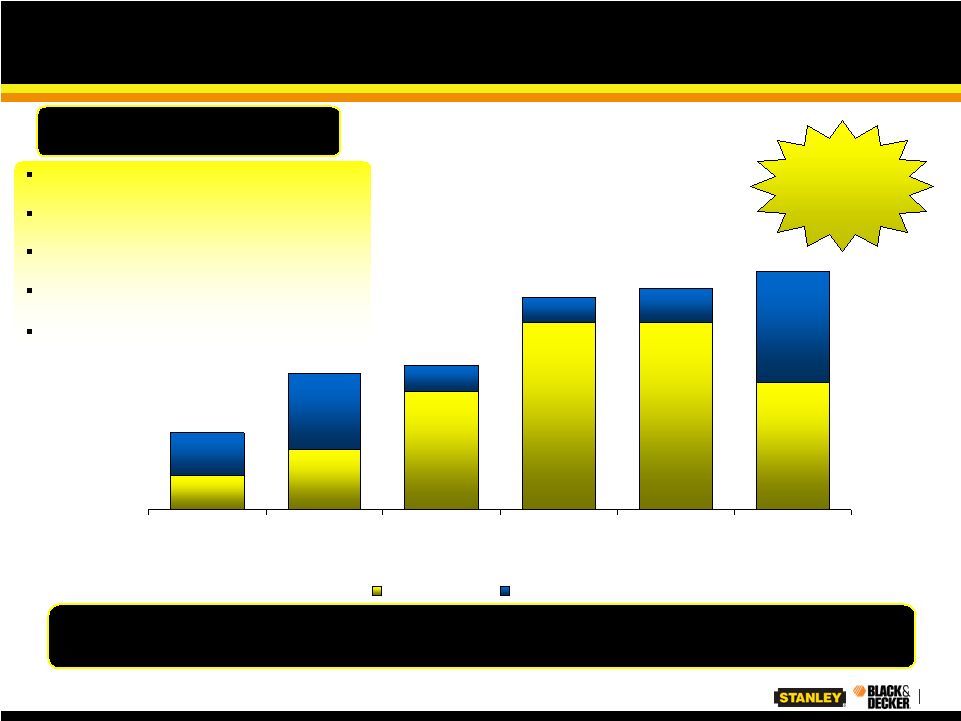

13 A Diversified Global Leader Revenue by Segment Revenues Remain Diversified… Industrial 24% Largest Customer 22% ~6% ~12% U.S. Home Centers & Mass Merchants 40% ~13% ~24% 2002 2008 Pro Forma Back to Stanley 2006 Levels …With 49% In CDIY Stanley 2009E Revenue: $3.7B* Black & Decker 2009E Revenue: $4.7B* Security 42% CDIY 34% Fastening & Assembly Systems 11% Hardware & Home Improvement 16% Pro Forma 2009E Revenue: $8.4B Power Tools & Accessories 73% Security 28% CDIY 49% Industrial 23% $740M $1B $2.9B Additive Revenue From Black & Decker to Existing Stanley Business Segments *Source: Wall Street Estimates |

14 SFS Can Be Leveraged Across Black & Decker Platform… Added Value of Stanley Fulfillment System (SFS) …With The Potential To Generate Significant Cash Flow From Higher Working Capital Turns 4.3x 5.0x 6.1x 3.7x 3.7x 4.1x 2006A 2007A 2008A SWK BDK 7.0x 6.0x 5.0x 4.0x 3.0x 2.0x 1.0x 0.0x = ~$500M |

15 Vice President & Chief Financial Officer, The Stanley Works Donald Allan Jr. |

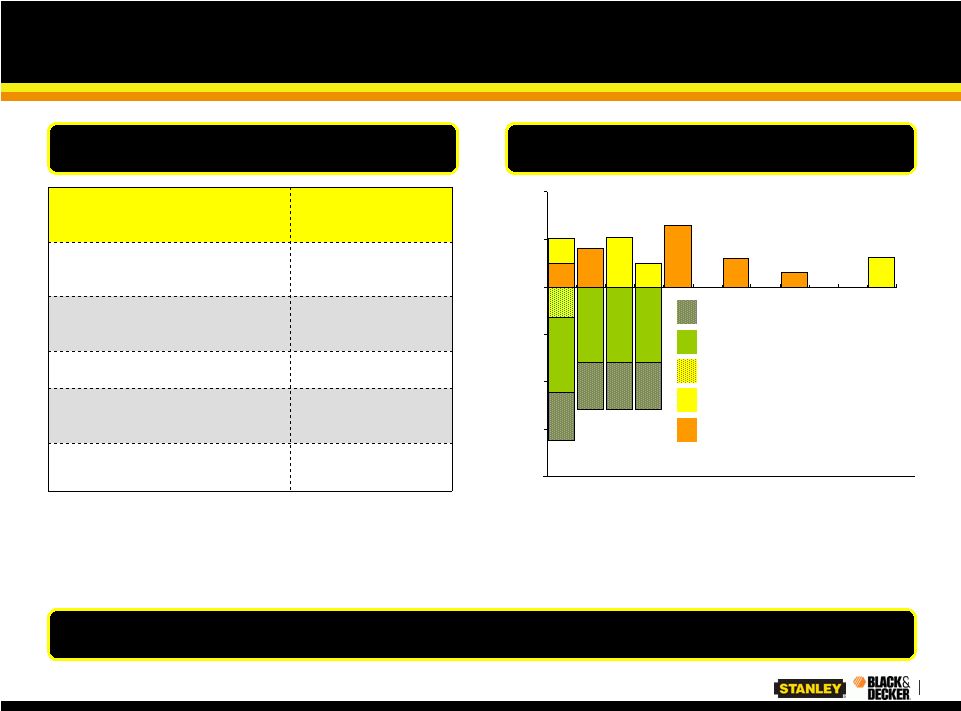

16 Successful Integration Track Record 4% 7% 14% 22% 22% 15% 28% 26% 25% 9% 16% 17% National Hardware Best Access Facom HSM Sonitrol X-Mark Pre-Acquisition Post-Integration Proven Integration Process Drives Significant Synergy Realization Operating Margin % Integration Plan For First 100 Days Finalized Prior To Close Consensus On Integration Plan With Both Management Teams Prior To Close Integration Management Team Rhythms And Milestones Each Week Experienced Integration Managers On Each Team In-Country Integration Teams Worldwide Integration Process Best Practices Yields 6% Margin Improvement On Average |

17 Cost Synergy Drivers Manufacturing And Distribution Purchasing Business Unit & Regional Integration Corporate Overhead Plant Footprint Consolidation Distribution Network Consolidation Direct And Indirect Materials Freight $350 Million Of Cost Synergies Identified (4% Of Pro Forma Sales) One Time Cost To Achieve $400M Over Three Years One Time Cost Of $400 Million To Achieve $0 $100 $200 $300 $400 Cost Synergies ($M) $350M Public Company Costs Management, Facility And IT Integration Management And Sales Force Integration Regional Shared Service Consolidation Corporate Overhead ~$95M Business Unit & Regional Consolidation ~$135M Purchasing ~$75M Manufacturing & Distribution ~$45M |

18 Revenue Synergies Cross-Selling Opportunities For Products Of Both Companies In Mature Markets Expanded Product Distribution Reach For Both Companies Increased Presence And Scale In Emerging Markets Will Accelerate Penetration And Growth Increased Scope And Scale Of Innovation Process Will Accelerate New Product Development Increased Cash Flow Will Allow Greater Re- Investment In Existing Brands, Channels And Operations Combination Also Provides Substantial Revenue Synergy Potential Any Realized Revenue Synergies Represent Additional Future Upside To Financial Forecasts Utilize Stanley’s Global Industrial And Automotive Repair Channels To Sell Additional DeWalt Power Tools Distribute Stanley Hand Tools And Hardware Through Black & Decker’s Latin American Sales Force Leverage Black & Decker’s Strong Presence In The STAFDA * Channels To Sell Additional Stanley Hand Tools Specific Examples * Specialty Tools & Fasteners Distributors Association

|

19 Pro Forma Financial Impact To Stanley Year 1 Year 2 Year 3 Annual Cost Synergies ($M) $125 $250 $350 Pro Forma GAAP EPS Accretion ($ per Fully Diluted Share) ($3.25) - ($3.00) $0.25 - $0.35 $0.95 - $1.05 Pro Forma Adjusted EPS Accretion ($ per Fully Diluted Share) ($0.45) - ($0.20) $0.50 - $0.60 $1.05 - $1.15 Pro Forma Cash EPS Accretion ($ per Fully Diluted Share) ($0.05) - $0.20 $0.90 - $1.00 $1.40 - $1.50 Highly Accretive Transaction Results In Approximately $5.00 Of EPS In Year 3 Creates A Global Leader With Pro Forma 2009E Revenues Of $8.4B Free Cash Flow In Year 3 To Be ~$1B EBITDA Of $1.3B Including Full Run- Rate Synergies in 2009 Adjusted EPS Cash EPS

• Annual

Additional ~ $80-90M Pre-Tax Intangible Amortization GAAP EPS Adjusted

EPS • Costs To Achieve Synergies $400M (Yr 1 - $330M, Yr 2 - $50M, Yr 3 - $20M) • Non-Cash Inventory Charge $200M

(Yr 1 Only) • Transaction/Other Expense

$70M (Yr 1 Only)

|

20 Strong Credit Position Standalone Combined 2009 Forecast 2009 PF Forecast Year 3 PF Forecast Synergies ($M) - - $350 EBITDA ($M) ~ $600 ~ $1,000 ~ $1,500 Free Cash Flow > $300 ~ $650 ~ $1,000 Debt/EBITDA 1.7x 2.9x ~1.4x Total Debt / Capitalization ~ 30% ~ 30% ~ 25% Current SWK Standalone Credit Rating: S&P: A Moody’s: A3 Fitch: A Current BDK Standalone Credit Rating S&P: BBB Moody’s: Baa3 Fitch: BBB A Strong Capacity To Maintain A Conservative Financial Position… …Will Create An Even Stronger Company With A Solid Foundation Combined Company Credit Ratings Strong Investment Grade |

21 $240 $400 $650 $300 $150 $277 $520 $250 $312 -$320 -$800 -$800-$800 -$800 -$500 -$500-$500 -$500 $(2,000) $(1,500) $(1,000) $(500) $- $500 $1,000 2010 2011 2012 2013 2014 2015 2016 … 2028 2029 2030 2045 Liquidity Post Closing Forecast Forecasted Cash Position $1.0B Existing Stanley Committed Credit Facilities Expiring 2013 $.8B Planned New Credit Facilities $.5B - $.75B Stanley’s Stock Purchase Contract Maturing Q2 2010 $.32B Total Near Term Liquidity $2.62B - $2.87B Ample Liquidity To Meet The Needs Of The New Company Debt Maturities Combined Debt Maturities ($M) Near Term Liquidity Sources New Credit Facility (Assumes 364day Renewed Annually) SWK Credit Facility SWK Stock Purchase Contract SWK BDK Note: 2010 Maturities includes forecasted Y/E short term debt of SWK and BDK as well as acceleration of $175MM of BDK term debt |

22 Consistent With Stanley’s Financial Objectives Sales Growth 3-5% Organic ~10% Total Financial Performance Mid-Teens % EPS Growth FCF > Net Income ROCE In The Range Of 12-15% Dividend Continued Growth Credit Rating Strong Investment Grade Stanley’s Financial Objectives In Place Since 2004 |

23 Chairman & Chief Executive Officer, The Stanley Works John F. Lundgren |

24 Unique Opportunity Complementary Global Product Offerings Comprehensive Array Of Iconic Brands Enhances Core Strengths Of Each Company Creates Stronger Global Company Shared Commitment To Operational Excellence Substantial Synergy Opportunities Combination Of Two Outstanding Companies |

25 A POWERFUL LEGACY, A FUTURE OF GROWTH |