Attached files

| file | filename |

|---|---|

| EX-31.2 - STELLAR RESOURCES 10K, CERTIFICATION 302, CFO - STELLAR RESOURCES LTD | stellarexh31_2.htm |

| EX-32.2 - STELLAR RESOURCES 10K, CERTIFICATION 906, CFO - STELLAR RESOURCES LTD | stellarexh32_2.htm |

| EX-31.1 - STELLAR RESOURCES 10K, CERTIFICATION 302, CEO - STELLAR RESOURCES LTD | stellarexh31_1.htm |

| EX-32.1 - STELLAR RESOURCES 10K, CERTIFICATION 906, CEO - STELLAR RESOURCES LTD | stellarexh32_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended July 31, 2009

or

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

Commission File Number 0-51400

STELLAR RESOURCES LTD.

(Exact name of registrant as it appear in its charter)

|

NEVADA |

98-0373867 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

375 N. Stephanie Street, Suite 1411

Henderson, Nevada 89014-8909

Registrant’s telephone number including area code: (702) 574-4614(Address of principal executive offices) (Zip Code)

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class | Name of each exchange on which registered |

| Common Stock (0.001 par value) | OTCBB |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate by a check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files). x Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment

to this Form 10-K. o

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. | ||||

|

Large accelerated filer |

o |

Accelerated filer |

o | |

| Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | x | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). x Yes o No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. As

of October 29, 2009 there were 31,060,650 issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE - None

1

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

From time to time, our management or persons acting on our behalf make forward-looking statements to inform existing and potential security holders about our company. These statements may include projections and estimates concerning the timing and success of specific projects and our future backlog, revenues, income and capital spending.

Forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “plan,” “intend,” “seek,” “will,” “should,” “goal” or other words that convey the uncertainty of future events or outcomes. These forward-looking statements speak only as of the date on which they are first made, which in the case

of forward-looking statements made in this report is the date of this report. Sometimes we will specifically describe a statement as being a forward-looking statement and refer to this cautionary statement. In addition, various statements that this Annual Report on Form 10-K contains, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. Those forward-looking statements appear in Item 1—“Business”

and Item 3—“Legal Proceedings” in Part I of this report; in Item 5—“Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities,” Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” Item 7A—“Quantitative and Qualitative Disclosures About Market Risk” and in the Notes to Consolidated Financial Statements we have included in Item 8 of Part

II of this report; and elsewhere in this report. These forward-looking statements speak only as of the date of this report. We disclaim any obligation to update these statements, and we caution you not to rely on them unduly. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory

and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks, contingencies and uncertainties relate to, among other matters, the following:

• general economic and business conditions and industry trends;

• risks associated with the current global crisis and its impact on capital markets and liquidity;

• the continued strength of the drilling services or production services in the geographic areas where we operate;

• levels and volatility of mineral prices;

• the highly competitive nature of our business;

• the success or failure of our acquisition strategy, including our ability to finance acquisitions and manage growth;

• our future financial performance, including availability, terms and deployment of capital;

• the continued availability of qualified personnel; and

• changes in, or our failure or inability to comply with, governmental regulations, including those relating to the environment.

We believe the items we have outlined above are important factors that could cause our actual results to differ materially from those expressed in a forward-looking statement contained in this report or elsewhere. We have discussed many of these factors in more detail elsewhere in this report. These factors are not necessarily all 1 the

important factors that could affect us. Unpredictable or unknown factors we have not discussed in this report could also have material adverse effects on actual results of matters that are the subject of our forward-looking statements.

We do not intend to update our description of important factors each time a potential important factor arises, except as required by applicable securities laws and regulations. We advise our security holders that they should (1) be aware that important factors not referred to above could affect the accuracy of our forward-looking statements and (2) use caution and common

sense when considering our forward-looking statements. Also, please read the risk factors set forth in Item 1A—“Risk Factors.”

The Company was incorporated in the State of Nevada on April 9, 1999 and is in the exploration stage of its resource property activities. Effective January 6, 2003, the Company changed its name from V.I.P.C. Com to Stellar Resources Ltd (the “Company”). The accompanying financial statements have been prepared assuming the Company will

continue as a going concern. This contemplates that assets will be realized and liabilities and commitments satisfied in the normal course of business.

On October 20, 2006, the Board of Directors authorized a 1 for 6 forward stock-split on the issued and outstanding common shares. The authorized number of common shares remains at 200,000,000 common shares with a par value of $0.001. All references in the accompanying financial statements to the number of common

shares have been restated to retroactively reflect the forward stock split.

On October 3, 2006, under a restricted stock award agreement, the Company issued 6,000,000 post-split shares of restricted common stock with a fair value of $750,000 to the Company’s President.

On October 3, 2006, pursuant to two separate share-for-debt agreements, the Company issued 1,230,876 post-split common shares in settlement of notes payable amounting to $89,006 and accrued interest of $13,567.

On December 19, 2008, the Company issued 801,294 common shares at $0.01 for aggregate proceeds of $8,103.

On March 9, 2009 the Company issued 1,619,160 common shares at $0.02 for aggregate proceeds of $32,293.

RESOURCE PROPERTIES

Fort St. John Region, British Columbia

By an agreement dated June 28, 2002 with Diamant Resources Ltd., (a company with a former director in common) the Company acquired an option to acquire a 50% interest in certain mineral claims located in the Fort St. John region of British Columbia Canada. In order to earn a 50% interest, the Company was required to pay

$3,298 (Cdn.$5,000) by June 30, 2002, $3,619 (Cdn$5,000) by June 30, 2003 and must incur certain other property expenditures. The Company decided not to pursue this property and abandoned it during the fiscal year ended July 31, 2008. All costs associated with this property have been fully impared.

Chunya mining district of Mbeya Tanzania

On September 9, 2008, the Company entered into a Farm-In Agreement with Canafra Mineral Exploration Corp., a Canadian private company, and Two Drums G & C Company Limited, a Tanzanian private company, (jointly “Canafra”), whereby the Company has the right to acquire a 50% net profit interest in the subject mineral property in Tanzania. The property consists

of three Mining and Prospecting Licenses and the Granted Mining and Prospecting Concessions comprising approximately 26 square kilometers, in the Chunya mining district of Mbeya Tanzania. The operator of the property will be Canafra.

The funding provisions are subject to the Company receiving the Mining and Prospecting Licenses for the subject property, which to date have not yet been received.

In order to acquire its full interest in the property the Company will advance to the operator $1,100,000 to fund exploration expenditures and provide working capital in phased payments and also issue 4,000,000 restricted common shares to the operator in stages as described below. The Company will earn its interest at a vested rate of 10% based on its funding efforts

until fully funded.

|

Common |

||||||||

|

Cash |

Stock to be |

|||||||

|

Consideration |

Issued |

|||||||

|

Phase I – Conditional upon receipt of Mining and |

||||||||

|

Prospecting Licenses |

||||||||

|

Within 30 days of receiving the Mining and Prospecting Licenses |

$ | 60,000 | - | |||||

|

Within 60 days of receiving the Mining and Prospecting Licenses |

80,000 | - | ||||||

|

Within 90 days of receiving the Mining and Prospecting Licenses |

80,000 | - | ||||||

|

Within 120 days of receiving the Mining and Prospecting Licenses |

80,000 | - | ||||||

|

Within 150 days of receiving the Mining and Prospecting Licenses |

80,000 | - | ||||||

| 380,000 | - | |||||||

|

Phase II – Within 90 days of completion of Phase I |

||||||||

|

including geological work to be done by Canafra |

380,000 | 2,000,000 | ||||||

|

Phase III – Within 90 days of completion of Phase II or |

||||||||

|

within a mutually agreed timeframe, including |

||||||||

|

further geological work done by Canafra |

340,000 | 2,000,000 | ||||||

| $ | 1,100,000 | 4,000,000 | ||||||

The Company awaits formal licensing documentation from Canafra showing that the Mining and Prospecting Licenses with the geographic coordinates are 100% owned by Canafra. The delay is as a result of Canafra experiencing certain setbacks, due to the current economic conditions, and there can be no assurances that we will be able

to obtain sufficient funding in order to complete our obligations under the agreement.

Texada Island British Columbia, Earn In Agreement

On June 15, 2009, the Company entered into a proposed Earn In Agreement with Zyrox Mining Company Ltd. (“Zyrox”), to further explore and develop Zyrox’s mineral tenures located on Texada Island, British Columbia.

Under the terms of the earn in Arrangement, Zyrox agreed to make available to the Company its 250 ton per day processing plant, historical exploration data, its bulk test permit to extract 10,000 tons, reclamation bond and intellectual property pertaining to the mineral tenures which comprise 104 mining claims totaling 3846 hectares. Zyrox also granted the Company the exclusive right to acquire

a 70% working interest in the property on or before June 15, 2010.

In order to acquire its 70% interest in the property the Company must provide $1,000,000 working capital in order to commission the production facility and commence bulk testing, explore and bulk test Zyrox’s portfolio of mining assets and commission a geological report that is 43-101 compliant.The Company has also agreed to pay Cdn$ 4,000 per month for the use of the processing plant during the

life of the agreement.

As of July 31, 2009 the Company has incurred property investigation costs amounting to US$14,270 (2008 - $nil) in relation to this agreement.

To date, the Company has not generated any revenues from operations and had a working capital deficit of $212,888 and an accumulated deficit of $1,190,833 at July 31, 2009. The Company’s continuance of operations is contingent on raising additional working capital, and on the future development of its potential resource property interests. Accordingly, these factors raise substantial

doubt about the Company’s ability to continue as a going concern. The Company is currently negotiating with several parties to provide equity financing sufficient to finance additional exploration work and provide working capital for the next twelve months. Although there is no assurance that management’s plans will be realized, management believes that the Company will be able to continue operations in the future.

The information set forth in this Item 1A should be read in conjunction with the rest of the information included in this report, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 the historical financial statements and related notes this report contains. While we attempt to identify, manage and mitigate risks and uncertainties

associated with our business to the extent practical under the circumstances, some level of risk and uncertainty will always be present. Additional risks and uncertainties not presently known to us or that we currently believe are immaterial also may negatively impact our business, financial condition or operating results.

Our acquisition strategy exposes us to various risks, including those relating to difficulties in identifying suitable acquisition opportunities and integrating businesses, assets and/or personnel, as well as difficulties in obtaining financing for our targeted acquisitions and the potential for increased leverage or debt service requirements

A key component of our business strategy is that, we have pursued and intend to continue to pursue acquisitions of complementary assets and businesses.

Our acquisition strategy in general and our recent acquisitions in particular, involve numerous inherent risks, including:

• unanticipated costs and assumption of liabilities and exposure to unforeseen liabilities of acquired businesses, including environmental liabilities;

• difficulties in integrating the operations and assets of the acquired business and the acquired personnel;

• limitations on our ability to properly assess and maintain an effective internal control environment over an acquired business in order to comply with applicable periodic reporting requirements;

• potential losses of key employees and customers of the acquired businesses;

• risks of entering markets in which we have limited prior experience; and

• increases in our expenses and working capital requirements. The process of integrating an acquired business may involve unforeseen costs and delays or other operational, technical and financial difficulties that may require a disproportionate amount of management attention and financial and other resources. Possible future acquisitions

may be for purchase prices significantly higher than those we paid for previous acquisitions. Our failure to achieve consolidation savings, to incorporate the acquired businesses and assets into our existing operations successfully or to minimize any unforeseen operational difficulties could have a material adverse effect on our financial condition and results of operations.

In addition, we may not have sufficient capital resources to complete additional acquisitions. Historically, we have funded the growth of our rig fleet through a combination of debt and equity financing. We may incur substantial additional indebtedness to finance future acquisitions and also may issue equity securities or convertible securities

in connection with such acquisitions. Debt service requirements could represent a significant burden on our results of operations and financial condition and the issuance of additional equity or convertible securities could be dilutive to our existing shareholders. Furthermore, we may not be able to obtain additional financing on satisfactory terms.

Even if we have access to the necessary capital, we may be unable to continue to identify additional suitable acquisition opportunities, negotiate acceptable terms or successfully acquire identified targets.

Not applicable.

Fort St. John Region, British Columbia

By an agreement dated June 28, 2002 with Diamant Resources Ltd., (a company with a former director in common) the Company acquired an option to acquire a 50% interest in certain mineral claims located in the Fort St. John region of British Columbia Canada. In order to earn a 50% interest, the Company was required to pay

$3,298 (Cdn$5,000) by June 30, 2002, $3,619 (Cdn$5,000) by June 30, 2003 and must incur certain other property expenditures. As of July 31, 2007, the Company decided not to pursue this property and has abandoned it during the fiscal year ended July 31, 2008. All costs associated with this property have been fully impared.

Chunya Mining District of Mbeya, Tanzania

On September 9, 2008, the Company entered into a Farm-In Agreement with Canafra Mineral Exploration Corp., a Canadian private company, and Two Drums G & C Company Limited, a Tanzanian private company, (jointly “Canafra”), whereby the Company has the right to acquire a 50% net profit interest in the subject mineral property

in Tanzania. The property consists of three Mining and Prospecting Licenses and the Granted Mining and Prospecting Concessions comprising approximately 26 square kilometers, in the Chunya mining district of Mbeya Tanzania. The operator of the property will be Canafra.

The funding provisions are subject to the Company receiving the Mining and Prospecting Licenses for the subject property, which to date have not yet been received.

In order to acquire its full interest in the subject property the Company will advance to the operator $1,100,000 to fund exploration expenditures and provide working capital in phased payments and also issue 4,000,000 restricted common shares to the operator in stages as described below. The Company will earn its interest at a vested rate

of 10% based on its funding efforts until fully funded.

|

Common |

||||||||

|

Cash |

Stock to be |

|||||||

|

Consideration |

Issued |

|||||||

|

Phase I – Conditional upon receipt of Mining and |

||||||||

|

Prospecting Licenses |

||||||||

|

Within 30 days of receiving the Mining and Prospecting Licenses |

$ | 60,000 | - | |||||

|

Within 60 days of receiving the Mining and Prospecting Licenses |

80,000 | - | ||||||

|

Within 90 days of receiving the Mining and Prospecting Licenses |

80,000 | - | ||||||

|

Within 120 days of receiving the Mining and Prospecting Licenses |

80,000 | - | ||||||

|

Within 150 days of receiving the Mining and Prospecting Licenses |

80,000 | - | ||||||

| 380,000 | - | |||||||

|

Phase II – Within 90 days of completion of Phase I |

||||||||

|

including geological work to be done by Canafra |

380,000 | 2,000,000 | ||||||

|

Phase III – Within 90 days of completion of Phase II or |

||||||||

|

within a mutually agreed timeframe, including |

||||||||

|

further geological work done by Canafra |

340,000 | 2,000,000 | ||||||

| $ | 1,100,000 | 4,000,000 | ||||||

The Company awaits formal licensing documentation from Canafra showing that the Mining and Prospecting Licenses with the geographic coordinates are 100% owned by Canafra. The delay is as a result of Canafra experiencing certain setbacks, due to the general economic and business industry trends and current economic conditions,

there can be no assurances that we will be able to obtain sufficient funding in order to complete our obligations under the agreement.

Texada Island British Columbia, Earn In Agreement

On June 15, 2009, the Company entered into an Earn In Agreement with Zyrox Mining Company Ltd. (“Zyrox”), to further explore and develop Zyrox’s mineral tenures located on Texada Island, British Columbia.

Under the terms of the earn in Arrangement, Zyrox agreed to make available to the Company its 250 ton per day processing plant, historical exploration data, its bulk test permit to extract 10,000 tons, reclamation bond and intellectual property pertaining to the mineral tenures which comprise 104 mining claims totaling 3846 hectares. Zyrox also granted the

Company the exclusive right to acquire a 70% working interest in the property on or before June 15, 2010.

In order to acquire its 70% interest in the property the Company must provide $1,000,000 working capital in order to commission the production facility and commence bulk testing, explore and bulk test Zyrox’s portfolio of mining assets and commission a geological report that is 43-101 compliant.The Company has also agreed to pay Cdn$4,000 per month for the use

of the processing plant during the life of the agreement. Within 30 days of receipt of a third party evaluation of the mineral interests and pilot plant, the Company will negotiate the definitive terms to acquire a 70% working interest in the property. To date this has not been completed.

We are not currently a party to any pending legal proceeding or litigation and the Claim Groups were not the subject of any pending legal proceeding. Further, our officers and directors know of no legal proceedings against us, or our property contemplated by any governmental authority.

There were no matters submitted to a vote of shareholders by the Company during this Fiscal Year.

Item 5. Market for Registrants Common Equity, Related Shareholder Matters and Business Issuer Purchases of Equity Securities

Our common equity is registered under the Over the Counter Bulletin Board (“OTCBB Symbol “SRRL”). We have no common equity which is subject to outstanding purchase options or warrants, or securities convertible into common equity.

The following table sets forth the periods indicated the range of high and low closing bid quotations per share as reported by the over-the-counter market for the past two (2) years. These quotations represent inter-dealer prices, without retail markups, markdowns or commissions and may not necessarily represent actual transactions.

|

Year – 2009 |

High |

Low |

||||||

|

First Quarter |

$ | 0.036 | $ | 0.010 | ||||

|

Second Quarter |

$ | 0.025 | $ | 0.004 | ||||

|

Third Quarter |

$ | 0.080 | $ | 0.020 | ||||

|

Fourth Quarter |

$ | 0.215 | $ | 0.050 | ||||

|

Year – 2008 |

High |

Low |

||||||

|

First Quarter |

$ | 0.14 | $ | 0.07 | ||||

|

Second Quarter |

$ | 0.08 | $ | 0.06 | ||||

|

Third Quarter |

$ | 0.12 | $ | 0.06 | ||||

|

Fourth Quarter |

$ | 0.36 | $ | 0.06 | ||||

As of July 31, 2009, the closing price of our common stock as reported on the OTCBB was $0.07 and there were 31,060,650 shares of our common equity outstanding, held by 34 shareholders of record. Of our common stock outstanding, 7,361,200 shares are held in brokerage accounts, and therefore we are unable to give an accurate statement as to the number of shareholders.

Rule 144 Shares

Under Rule 144, as currently in effect, a person who has beneficially owned shares of a company’s common stock for at least one year is entitled to sell within any three month period a number of shares that does not exceed the greater of:

|

1. |

1% of the number of shares of the company’s common stock then outstanding, which in our case equals approximately 286,402 shares as of the date of this filing; or |

|

2. |

the average weekly trading volume of the company’s common stock during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale. |

Sales under Rule 144 are also subject to manner of sale provisions and notice requirements and to the availability of current public information about us.

Under Rule 144 (k), a person who is not one of the Company’s affiliates at any time during the three months preceding a sale, and who has beneficially owned the shares proposed to be sold for at least two (2) years, is entitled to sell their shares without complying with the manner of sale, public information, volume limitation

or notice provisions of Rule 144.

As of the date of this filing, persons who are affiliates hold 7,327,254 of the 31,060,650 common shares that may be sold pursuant to Rule 144.

Dividends

We have not paid any dividends on our common stock and do not anticipate paying any cash dividends in the foreseeable future. If any earnings are realized, we intend to finance the growth of our business. We cannot assure you that we will ever pay cash dividends. Whether we pay any cash dividends in the

future will depend on the financial condition, results of operations and other factors that the Board of Directors (“Board”) will consider at that time.

Recent Sale of Unregistered Security

We have had no sale of unregistered security during the year ended July 31, 2009.

Repurchase of Securities

We did not repurchase any shares of our common stock during the year ended July 31, 2009.

The following information derives from our audited financial statements. You should review this information in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 of this report and the historical financial statements and related notes this report

contains.

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

FINANCIAL STATEMENTS

JULY 31, 2009 AND 2008

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

BALANCE SHEETS

STATEMENTS OF OPERATIONS

STATEMENT OF STOCKHOLDERS’ DEFICIT

STATEMENTS OF CASH FLOWS

NOTES TO FINANCIAL STATEMENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Stockholders and Board of Directors of Stellar Resources Ltd.

We have audited the accompanying balance sheets of Stellar Resources Ltd (an exploration stage company) as of July 31, 2009 and 2008 and the related statements of operations, stockholders’ deficit and cash flows for the years ended July 31, 2009 and 2008 and the period from April 9, 1999 (inception) through July 31, 2009. These

financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. The Company is not required to have,

nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts

and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, these financial statements present fairly, in all material respects, the financial position of Stellar Resources Ltd as of July 31, 2009 and 2008 and the results of its operations and its cash flows for the years ended July 31, 2009 and 2008 and the period from April 9, 1999 (inception) through July 31, 2009 in conformity

with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, to date the Company has reported losses since inception from operations and requires additional funds to meet its obligations and fund the costs of its operations. These

factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in this regard are described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

“DMCL”

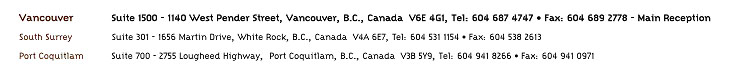

DALE MATHESON CARR-HILTON LABONTE LLP

CHARTERED ACCOUNTANTS

Vancouver, Canada

October 29, 2009

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

BALANCE SHEETS

|

JULY 31 |

JULY 31 |

|||||||

|

2009 |

2008 |

|||||||

|

ASSETS |

||||||||

|

Current |

||||||||

|

Cash |

$ | 1,193 | $ | - | ||||

| $ | 1,193 | $ | - | |||||

|

LIABILITIES |

||||||||

|

Current |

||||||||

|

Bank indebtedness |

$ | - | $ | 38 | ||||

|

Accounts payable and accrued liabilities |

4,314 | 4,940 | ||||||

|

Notes payable (Note 4) |

26,722 | 22,837 | ||||||

|

Due to related parties (Note 6) |

183,045 | 177,251 | ||||||

| 214,081 | 205,066 | |||||||

|

STOCKHOLDERS’ DEFICIT |

||||||||

|

Capital stock (Note 5) |

||||||||

|

Authorized: |

||||||||

|

200,000,000 common shares with a par value of $0.001 per share |

||||||||

|

Issued and outstanding: |

||||||||

|

31,060,650 common shares (2008: 28,640,196 common shares) |

31,060 | 28,640 | ||||||

|

Additional paid-in capital |

952,142 | 914,166 | ||||||

|

Deferred stock compensation (Note 6) |

- | (39,700 | ) | |||||

|

Deficit accumulated during the exploration stage |

(1,190,833 | ) | (1,101,977 | ) | ||||

|

Accumulated other comprehensive loss |

(5,257 | ) | (6,195 | ) | ||||

| (212,888 | ) | (205,066 | ) | |||||

| $ | 1,193 | $ | - | |||||

The accompanying notes are an integral part of these financial statements

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

STATEMENTS OF OPERATIONS

|

CUMULATIVE RESULTS OF OPERATIONS FROM APRIL 9, 1999 (INCEPTION) |

||||||||||||

|

TO |

||||||||||||

|

YEARS ENDED JULY 31 |

JULY 31, |

|||||||||||

|

2009 |

2008 |

2009 |

||||||||||

|

Expenses |

||||||||||||

|

Consulting fees |

$ | - | $ | - | $ | 27,780 | ||||||

|

Filing fees |

6,975 | 6,915 | 38,914 | |||||||||

|

Foreign exchange (gain) loss |

(122 | ) | 243 | 13,824 | ||||||||

|

General and administrative |

841 | 1,125 | 21,253 | |||||||||

|

Interest expense |

458 | 768 | 15,862 | |||||||||

|

Investor relations |

500 | 2,175 | 17,989 | |||||||||

|

Management fees - stock-based compensation (Note 6) |

39,700 | 244,750 | 750,000 | |||||||||

|

Professional fees |

26,234 | 29,696 | 139,886 | |||||||||

|

Resource property expenditures |

- | 9,066 | 150,114 | |||||||||

|

Property examination costs (Note 3) |

14,270 | - | 14,270 | |||||||||

|

Travel |

- | - | 941 | |||||||||

|

Net Loss |

$ | (88,856 | ) | $ | (294,738 | ) | $ | (1,190,833 | ) | |||

|

Basic and Diluted Net Loss Per Common Share |

$ | (0.01 | ) | $ | (0.01 | ) | ||||||

|

Weighted Average Number of Common Shares Outstanding – Basic and Diluted |

29,739,689 | 27,372,316 | ||||||||||

The accompanying notes are an integral part of these financial statements

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

STATEMENT OF STOCKHOLDERS’ DEFICIT

FOR THE PERIOD APRIL 9, 1999 TO JULY 31, 2009

|

Deficit |

||||||||||||||||||||||||||||

|

Accumulated |

||||||||||||||||||||||||||||

|

Additional |

Share |

Deferred |

During The |

|||||||||||||||||||||||||

|

Common stock |

Paid-In |

Subscriptions |

Stock |

Exploration |

||||||||||||||||||||||||

|

Shares |

Amount |

Capital |

Received |

Compensation |

Stage |

Total |

||||||||||||||||||||||

|

Issuance of common stock for cash at $0.001 per share – April 12, 1999 |

18,000,000 | $ | 18,000 | $ | (15,000 | ) | $ | - | $ | - | $ | - | $ | 3,000 | ||||||||||||||

|

Net loss, April 9, 1999 (inception) to July 31, 1999 |

- | - | - | - | - | (2,090 | ) | (2,090 | ) | |||||||||||||||||||

|

Balance, July 31, 1999 |

18,000,000 | 18,000 | (15,000 | ) | - | - | (2,090 | ) | 910 | |||||||||||||||||||

|

Net loss |

- | - | - | - | - | (680 | ) | (680 | ) | |||||||||||||||||||

|

Balance, July 31, 2000 |

18,000,000 | 18,000 | (15,000 | ) | - | - | (2,770 | ) | 230 | |||||||||||||||||||

|

Net loss |

- | - | - | - | - | (180 | ) | (180 | ) | |||||||||||||||||||

|

Balance, July 31, 2001 |

18,000,000 | 18,000 | (15,000 | ) | - | - | (2,950 | ) | 50 | |||||||||||||||||||

|

Subscriptions received |

- | - | - | 35,981 | - | - | 35,981 | |||||||||||||||||||||

|

Net loss |

- | - | - | - | - | (43,953 | ) | (43,953 | ) | |||||||||||||||||||

|

Balance, July 31, 2002 |

18,000,000 | $ | 18,000 | $ | (15,000 | ) | $ | 35,981 | $ | - | $ | (46,903 | ) | $ | (7,922 | ) | ||||||||||||

The accompanying notes are an integral part of these financial statements

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

STATEMENT OF STOCKHOLDERS’ DEFICIT

FOR THE PERIOD APRIL 9, 1999 TO JULY 31, 2009

|

Deficit |

||||||||||||||||||||||||||||

|

Accumulated |

||||||||||||||||||||||||||||

|

Additional |

Share |

Deferred |

During The |

|||||||||||||||||||||||||

|

Common stock |

Paid-In |

Subscriptions |

Stock |

Exploration |

||||||||||||||||||||||||

|

Shares |

Amount |

Capital |

Received |

Compensation |

Stage |

Total |

||||||||||||||||||||||

|

Balance, July 31, 2002 |

18,000,000 | $ | 18,000 | $ | (15,000 | ) | $ | 35,981 | $ | - | $ | (46,903 | ) | $ | (7,922 | ) | ||||||||||||

|

Issuance of common stock for cash at $0.10 per share – October 2, 2002 |

2,192,856 | 2,193 | 34,354 | (35,981 | ) | - | - | 566 | ||||||||||||||||||||

|

Issuance of common stock for cash at $0.25 per share – October 2, 2002 |

722,976 | 723 | 29,401 | - | - | - | 30,124 | |||||||||||||||||||||

|

Issuance of common stock for cash at $0.25 per share – October 15, 2002 |

96,000 | 96 | 3,904 | - | - | - | 4,000 | |||||||||||||||||||||

|

Issuance of common stock for cash at $0.25 per share – January 9, 2003 |

120,000 | 120 | 4,880 | - | - | - | 5,000 | |||||||||||||||||||||

|

Issuance of common stock for cash at $0.25 per share – March 21, 2003 |

277,488 | 277 | 11,285 | - | - | - | 11,562 | |||||||||||||||||||||

|

Net loss |

- | - | - | - | - | (54,823 | ) | (54,823 | ) | |||||||||||||||||||

|

Balance, July 31, 2003 |

21,409,320 | 21,409 | 68,824 | - | - | (101,726 | ) | (11,493 | ) | |||||||||||||||||||

|

Net loss |

- | - | - | - | - | (76,798 | ) | (76,798 | ) | |||||||||||||||||||

|

Balance, July 31, 2004 |

21,409,320 | 21,409 | 68,824 | - | - | (178,524 | ) | (88,291 | ) | |||||||||||||||||||

|

Net Loss |

- | - | - | - | - | (35,127 | ) | (35,127 | ) | |||||||||||||||||||

|

Balance, July 31, 2005 |

21,409,320 | $ | 21,409 | $ | 68,824 | $ | - | $ | - | $ | (213,651 | ) | $ | (123,418 | ) | |||||||||||||

The accompanying notes are an integral part of these financial statements

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

STATEMENT OF STOCKHOLDERS’ DEFICIT

FOR THE PERIOD APRIL 9, 1999 TO JULY 31, 2009

|

Deficit |

||||||||||||||||||||||||||||||||

|

Accumulated |

Accumulated |

|||||||||||||||||||||||||||||||

|

Additional |

Share |

Deferred |

During The |

Other |

||||||||||||||||||||||||||||

|

Common stock |

Paid-In |

Subscriptions |

Stock |

Exploration |

Comprehensive |

|||||||||||||||||||||||||||

|

Shares |

Amount |

Capital |

Received |

Compensation |

Stage |

Loss |

Total |

|||||||||||||||||||||||||

|

Balance, July 31, 2005 |

21,409,320 | $ | 21,409 | $ | 68,824 | $ | - | $ | - | $ | (213,651 | ) | $ | - | $ | (123,418 | ) | |||||||||||||||

|

Net loss |

- | - | - | - | - | (62,279 | ) | - | (62,279 | ) | ||||||||||||||||||||||

|

Balance July 31, 2006 |

21,409,320 | 21,409 | 68,824 | - | - | (275,930 | ) | - | (185,697 | ) | ||||||||||||||||||||||

|

Issuance of common stock in settlement of notes payable and accrued interest at $0.0833 per share – October 3, 2006 |

1,230,876 | 1,231 | 101,342 | - | - | - | - | 102,573 | ||||||||||||||||||||||||

|

Issuance of common stock on grant of stock award at $0.125 per share – October 4, 2006 |

6,000,000 | 6,000 | 744,000 | - | (750,000 | ) | - | - | - | |||||||||||||||||||||||

|

Amortization of deferred compensation |

- | - | - | - | 465,550 | - | - | 465,550 | ||||||||||||||||||||||||

|

Foreign currency translation adjustment |

- | - | - | - | - | - | (5,034 | ) | (5,034 | ) | ||||||||||||||||||||||

|

Net loss |

- | - | - | - | - | (531,309 | ) | - | (531,309 | ) | ||||||||||||||||||||||

|

Balance July 31, 2007 |

28,640,196 | $ | 28,640 | $ | 914,166 | $ | - | $ | (284,450 | ) | $ | (807,239 | ) | $ | (5,034 | ) | $ | (153,917 | ) | |||||||||||||

The accompanying notes are an integral part of these financial statements

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

STATEMENT OF STOCKHOLDERS’ DEFICIT

FOR THE PERIOD APRIL 9, 1999 TO JULY 31, 2009

|

Deficit |

||||||||||||||||||||||||||||||||

|

Accumulated |

Accumulated |

|||||||||||||||||||||||||||||||

|

Additional |

Share |

Deferred |

During The |

Other |

||||||||||||||||||||||||||||

|

Common stock |

Paid-In |

Subscriptions |

Stock |

Exploration |

Comprehensive |

|||||||||||||||||||||||||||

|

Shares |

Amount |

Capital |

Received |

Compensation |

Stage |

Loss |

Total |

|||||||||||||||||||||||||

|

Balance July 31, 2007 |

28,640,196 | $ | 28,640 | $ | 914,166 | $ | - | $ | (284,450 | ) | $ | (807,239 | ) | $ | (5,034 | ) | $ | (153,917 | ) | |||||||||||||

|

Amortization of deferred compensation |

- | - | - | - | 244,750 | - | - | 244,750 | ||||||||||||||||||||||||

|

Foreign currency translation adjustment |

- | - | - | - | - | - | (1,161 | ) | (1,161 | ) | ||||||||||||||||||||||

|

Net loss |

- | - | - | - | - | (294,738 | ) | - | (294,738 | ) | ||||||||||||||||||||||

|

Balance July 31, 2008 |

28,640,196 | 28,640 | 914,166 | - | (39,700 | ) | (1,101,977 | ) | (6,195 | ) | (205,066 | ) | ||||||||||||||||||||

|

Issuance of common stock for cash at $0.01 per share – December 19, 2008 |

801,294 | 801 | 7,302 | - | - | - | - | 8,103 | ||||||||||||||||||||||||

|

Issuance of common stock for cash at $0.02 per share – March 16, 2009 |

1,619,160 | 1,619 | 30,674 | - | - | - | - | 32,293 | ||||||||||||||||||||||||

|

Amortization of deferred compensation |

- | - | - | - | 39,700 | - | - | 39,700 | ||||||||||||||||||||||||

|

Foreign currency translation adjustment |

- | - | - | - | - | - | 938 | 938 | ||||||||||||||||||||||||

|

Net loss |

- | - | - | - | - | (88,856 | ) | - | (88,856 | ) | ||||||||||||||||||||||

|

Balance July 31, 2009 |

31,060,650 | $ | 31,060 | $ | 952,142 | $ | - | $ | - | $ | (1,190,833 | ) | $ | (5,257 | ) | $ | (212,888 | ) | ||||||||||||||

The accompanying notes are an integral part of these financial statements

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

STATEMENTS OF CASH FLOWS

|

CUMULATIVE RESULTS OF OPERATIONS FROM APRIL 9, 1999 (INCEPTION) |

||||||||||||

|

TO |

||||||||||||

|

YEARS ENDED JULY 31, |

JULY 31, |

|||||||||||

|

2009 |

2008 |

2009 |

||||||||||

|

Cash Flows from Operating Activities |

||||||||||||

|

Net loss |

$ | (88,856 | ) | $ | (294,738 | ) | $ | (1,190,833 | ) | |||

|

Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||||||

|

Realized foreign exchange losses on settlement of notes payable |

- | - | 12,523 | |||||||||

|

Stock-based compensation |

39,700 | 244,750 | 750,000 | |||||||||

|

Accrued interest |

458 | 768 | 17,850 | |||||||||

|

Changes in operating assets and liabilities: |

||||||||||||

|

Prepaid expenses |

- | 900 | - | |||||||||

|

Accounts payable and accrued liabilities |

(626 | ) | (2,761 | ) | 4,314 | |||||||

|

Net cash used in operating activities |

(49,324 | ) | (51,081 | ) | (406,146 | ) | ||||||

|

Cash Flows from Financing Activities |

||||||||||||

|

Increase (decrease) in bank indebtedness |

(38 | ) | 38 | - | ||||||||

|

Proceeds from issuance of common stock |

40,396 | - | 130,629 | |||||||||

|

Proceeds from notes payable |

4,365 | - | 93,665 | |||||||||

|

Advances from related parties |

5,794 | 50,884 | 183,045 | |||||||||

|

Net cash provided by financing activities |

50,517 | 50,922 | 407,339 | |||||||||

|

Net Increase (Decrease) in Cash |

1,193 | (159 | ) | 1,193 | ||||||||

|

Cash, Beginning |

- | 159 | - | |||||||||

|

Cash, Ending |

$ | 1,193 | $ | - | $ | 1,193 | ||||||

|

Supplemental Disclosures of Cash Flow Information and Non-Cash Investing and Financing Activities |

||||||||||||

|

Interest paid |

$ | - | $ | - | $ | - | ||||||

|

Income taxes paid |

$ | - | $ | - | $ | - | ||||||

|

Common shares issued on settlement of notes payable and accrued interest |

$ | - | $ | - | $ | 102,573 | ||||||

The accompanying notes are an integral part of these financial statements

20

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

JULY 31, 2009 AND 2008

|

1. |

NATURE OF CONTINUED OPERATIONS AND BASIS OF PRESENTATION |

The Company was incorporated in the State of Nevada on April 9, 1999 and is in the exploration stage of its resource property activities.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. This contemplates that assets will be realized and liabilities and commitments satisfied in the normal course of business. To date, the Company has not generated any revenues from operations and had a working capital

deficit of $212,888 and an accumulated deficit of $1,190,833 at July 31, 2009. The Company’s continuance of operations is contingent on raising additional working capital, and on the future development of its potential resource property interests. Accordingly, these factors raise substantial doubt about the Company’s ability to continue as a going concern. The Company is currently negotiating with several parties to provide equity financing sufficient to finance all corporate operations

and provide working capital for the next twelve months. Although there is no assurance that management’s plans will be realized, management believes that the Company will be able to continue operations in the future. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts and classification of liabilities that might be necessary in the event the Company cannot continue operating as a going concern.

|

2. |

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States and are presented in United States dollars. Because a precise determination of many assets and liabilities is dependent upon future events, the preparation of financial statements for a

period necessarily involves the use of estimates which have been made using judgement.

|

|

a) |

Exploration Stage Company |

The Company is an exploration stage company. The Company is devoting substantially all of its present efforts to establish a new business and has only recently commenced operations. All losses accumulated since inception have been considered as part of the Company’s exploration stage activities.

|

|

b) |

Cash and Cash Equivalents |

For purposes of the balance sheet and statement of cash flows, the Company considers all highly liquid debt instruments purchased with maturity of three months or less to be cash and equivalents. At July 31, 2009 and 2008, the Company had no cash equivalents.

21

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

JULY 31, 2009 AND 2008

|

2. |

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) |

|

|

c) |

Mineral Property Costs |

The Company classified its mineral rights as tangible assets and accordingly acquisition costs are capitalized as mineral property costs. Generally accepted accounting principles require that long-lived assets be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset

may not be recoverable. In performing the review for recoverability, the Company is to estimate the future cash flows expected to result from the use of the asset and its eventual disposition. If the sum of the undiscounted expected future cash flows is less than the carrying amount of the asset, an impairment loss is recognized. Mineral exploration costs are expensed as incurred until commercially mineable deposits are determined to exist within a particular property. To date

the Company has not established any proven or probable reserves and accordingly, the Company has expensed all mineral exploration costs.

The Company recognizes liabilities associated with retirement of longlived assets in the period the liability becomes determinable, with an offsetting increase in the carrying amount of the associated assets. The increase in the carrying value of the associated asset is depreciated over the estimated useful life of the asset. The

liabilities are recorded at fair value and an accretion expense is recognized over time as the discounted cash flows are accreted to the expected settlement value. The fair value of the liabilities are measured using expected cash flows discounted at the Company’s adjusted risk free interest rate.

|

|

d) |

Loss Per Share |

Basic loss per share is computed by dividing net loss available to common shareholders by the weighted average number of outstanding common shares during the period. Diluted loss per share gives effect to all dilutive potential common shares outstanding during the period. Dilutive loss per share excludes all potential common shares if

their effect is anti-dilutive. Because the Company does not have any potentially dilutive securities, diluted loss per share is equal to basic loss per share.

|

|

e) |

Financial Instruments |

The Company determines the estimated fair value of financial instruments using available market information and appropriate valuation methodologies. The carrying values of cash, accounts payable and notes payable approximate their fair values due to the short-term maturity of these instruments. Unless otherwise noted, it is

management’s opinion that the Company is not exposed to significant interest, currency or credit risks arising from these financial instruments. The fair value of the amounts due to related parties is not determinable as they have no specific repayment terms.

|

|

f) |

Use of Estimates and Assumptions |

The preparation of financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts

of revenues and expenses during the period. Accordingly, actual results could differ from those estimates. Significant areas requiring management’s estimates and assumptions are determining the fair value of transactions involving common stock and valuation of deferred tax balances.

22

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

JULY 31, 2009 AND 2008

|

2. |

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) |

|

|

g) |

Foreign Currency Translation |

Foreign denominated monetary assets and liabilities are translated to their United States dollar equivalents using foreign exchange rates which prevailed at the balance sheet date. Revenue and expenses are translated at average rates of exchange during the period. Related translation adjustments are reported as a

separate component of stockholders' equity, whereas gains or losses resulting from foreign currency transactions are included in results of operations.

|

|

h) |

Stock Based Compensation |

The Company accounts for stock based compensation arrangements using a fair value method and records such expense on a straight-line basis over the vesting period. The Company has not granted any stock options since inception.

|

|

i) |

Income Taxes |

Deferred income taxes are provided for tax effects of temporary differences between the tax basis of asset and liabilities and their reported amounts in the financial statements. The Company uses the liability method to account for income taxes, which requires deferred taxes to be recorded at the statutory rate expected to being

in effect when the taxes are paid. Valuation allowances are provided for a deferred tax asset when it is more likely than not that such asset will not be realized.

Management evaluates tax positions taken or expected to be taken in a tax return. The evaluation of a tax position includes a determination of whether a tax position should be recognized in the financial statements, and such a position should only be recognized if the Company determines that it is more likely than not that the

tax position will be sustained upon examination by the tax authorities, based upon the technical merits of the position. For those tax positions that should be recognized, the measurement of a tax position is determined as being the largest amount of benefit that is greater than fifty percent likely of being realized upon ultimate settlement.

|

|

|

|

j) |

New Accounting Standards |

Recently Adopted Accounting Standards

In May 2009, the Financial Accounting Standards Board (“FASB”) issued FAS No. 165 “Subsequent Events” (“FAS 165”). FAS 165 requires companies to recognize in the financial statements the effects of subsequent events that provide additional

evidence about conditions that existed at the date of the balance sheet, including the estimates inherent in the process of preparing financial statements. An entity shall disclose the date through which subsequent events have been evaluated, as well as whether that date is the date the financial statements were issued. Companies are not permitted to recognize subsequent events that provide evidence about conditions that did not exist at the date of the balance sheet but arose after the balance sheet

date and before financial statements are issued. Some non recognized subsequent events must be disclosed to keep the financial statements from being misleading. For such events a company must disclose the nature of the event, an estimate of its financial effect, or a statement that such an estimate cannot be made. This Statement applies prospectively for interim or annual financial periods ending after June 15, 2009. The adoption of FAS 165 did not have a material impact on the Company’s results

of operations and financial position.

23

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

JULY 31, 2009 AND 2008

|

2. |

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) |

|

|

k) |

New Accounting Standards (Continued) |

Recent Accounting Standards Not Yet Adopted

In June 2009, the FASB issued Statement No. 167, “Amendments to FASB Interpretation No. 46(R).” Statement 167 amends the evaluation criteria to identify the primary beneficiary of a variable interest entity provided by FASB Interpretation No. 46(R) “Consolidation of Variable Interest Entities—An Interpretation of

ARB No. 51”. Additionally, Statement 167 requires ongoing reassessments of whether an enterprise is the primary beneficiary of the variable interest entity. The adoption of Statement 167 will have no effect on the financial position orresults of operations of the Company.

In June 2009, the FASB issued SFAS No. 168, FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting Principles, a replacement of SFAS No. 162 (“Statement 168”). Statement 168 establishes the FASB Accounting Standards Codification

as the source of authoritative accounting principles recognized by the FASB to be applied in the preparation of financial statements in conformity with generally accepted accounting principles. Statement 168 explicitly recognizes rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under federal securities laws as authoritative GAAP for SEC registrants. Statement 168 is effective for financial statements issued for fiscal years and interim periods ending after September

15, 2009. The Company will adopt Statement 168 in the first quarter of fiscal year 2010.

In June 2008, the FASB ratified EITF Issue No. 07-5, Determining Whether an Instrument (or an Embedded Feature) is Indexed to an Entity’s Own Stock (“EITF 07-5”). EITF 07-5 provides that an entity should use a two step approach to evaluate whether an equity-linked financial instrument (or embedded feature)

is indexed to its own stock, including evaluating the instrument’s contingent exercise and settlement provisions. It also clarifies on the impact of foreign currency denominated strike prices and market-based employee stock option valuation instruments on the evaluation. EITF 07-5 is effective for fiscal years beginning after December 15, 2008. The adoption of this standard will have no effect on the financial position or results of operations of the Company.

|

3. |

RESOURCE PROPERTIES |

Texada Island, British Columbia, Proposed Earn In Agreement

On June 15, 2009, the Company entered into an Earn In Agreement with Zyrox Mining Company Ltd. (“Zyrox”), to further explore and develop Zyrox’s mineral tenures located on Texada Island, British Columbia. Under the terms of the Earn In Agreement, Zyrox agreed to make available to the Company its 250 ton per

day processing plant, historical exploration data, its bulk test permit to extract 10,000 tons, reclamation bond and intellectual property pertaining to the mineral tenures which comprise 104 mining claims totaling 3,846 hectares. Zyrox also granted the Company the exclusive right to acquire a 70% working interest in the property on or before June 15, 2010.

In order to acquire its 70% interest in the property the Company must provide Cdn$1,000,000 working capital in order to commission the production facility and commence bulk testing, explore and bulk test Zyrox’s portfolio of mining assets and commission a geological report. The Company has also agreed to pay Cdn$4,000

per month for the use of the processing plant during the life of the agreement. Within 30 days of receipt of a third party evaluation of the mineral interests and pilot plant, the Company will negotiate the definitive terms to acquire a 70% working interest in the property.

As of July 31, 2009 the Company has incurred property investigation costs amounting to US$14,270 (2008 - $nil) in relation to this agreement.

24

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

JULY 31, 2009 AND 2008

|

3. |

RESOURCE PROPERTIES (Continued) |

|

|

Chunya Mining District of Mbeya Tanzania, Earn-in Agreement |

On September 9, 2008, the Company entered into a Farm-In Agreement with Canafra Mineral Exploration Corp., a Canadian private company, and Two Drums G & C Company Limited, a Tanzanian private company, (jointly “Canafra”), whereby the Company has the right to acquire a 50% interest in a mineral property in Tanzania. The

property consists of three Mining and Prospecting Licenses and the Granted Mining and Prospecting Concessions comprising approximately 26 square kilometers, in the Chunya mining district of Mbeya Tanzania. The operator of the property will be Canafra.

The funding provisions and share issuance are subject to the Company receiving the Mining and Prospecting Licenses for the property, which to date have not yet been received.

In order to acquire its full interest in the property the Company will advance to the operator $1,100,000 to fund exploration expenditures and provide working capital in phased payments and also issue 4,000,000 restricted common shares to Canafra in stages as described below. The Company will earn its interest at a vested rate of 10% based

on its funding efforts until fully funded.

|

Common |

||||||||

|

Cash |

Stock to be |

|||||||

|

Consideration |

Issued |

|||||||

|

Phase I – Conditional upon receipt of Mining and |

||||||||

|

Prospecting Licenses |

||||||||

|

Within 30 days of receiving the Mining and Prospecting Licenses |

$ | 60,000 | - | |||||

|

Within 60 days of receiving the Mining and Prospecting Licenses |

80,000 | - | ||||||

|

Within 90 days of receiving the Mining and Prospecting Licenses |

80,000 | - | ||||||

|

Within 120 days of receiving the Mining and Prospecting Licenses |

80,000 | - | ||||||

|

Within 150 days of receiving the Mining and Prospecting Licenses |

80,000 | - | ||||||

| 380,000 | - | |||||||

|

Phase II – Within 90 days of completion of Phase I |

||||||||

|

including geological work to be done by Canafra |

380,000 | 2,000,000 | ||||||

|

Phase III – Within 90 days of completion of Phase II or |

||||||||

|

within a mutually agreed timeframe, including |

||||||||

|

further geological work done by Canafra |

340,000 | 2,000,000 | ||||||

| $ | 1,100,000 | 4,000,000 | ||||||

Fort St John Region of British Columbia, Canada

By an agreement dated June 28, 2002 with Diamant Resources Ltd., a company with a former director in common, the Company acquired an option to acquire a 50% interest in certain mineral claims located in the Fort St. John region of British Columbia, Canada. In order to earn a 50% interest, the Company was required to pay $3,298

(Cdn$5,000) by June 30, 2002, $3,619 (Cdn$5,000) by July 30, 2003, and must incur certain other property expenditures. As of July 31, 2007, the Company had satisfied these requirements and earned its 50% interest in all the mineral claims listed in the agreement. The Company decided not to pursue this property and abandoned it during the fiscal year ended July 31, 2008. All costs associated with this property have been fully impaired in the year ended July 31, 2008.

25

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

JULY 31, 2009 AND 2008

|

4. |

NOTES PAYABLE |

As of July 31, 2009 the Company had received a total of $17,178 (Cdn$23,000), (2008 -$12,813 Cdn$18,000) from unrelated third parties by way of demand promissory notes bearing interest at the Bank of Canada prime rate plus 2% (2.50% as of July 31, 2009). As at July 31, 2009 $21,181 (2008: $17,586) was due on these notes, and

$5,541 (2008 - $5,251) of accrued interest is payable.

During the year ended July 31, 2009, the Company recorded foreign exchange transaction gains of $938 (2008 – loss of $1,161) in connection with these notes payable and accrued interest payable as a result of fluctuations in the foreign exchange rate.

|

5. |

CAPITAL STOCK |

The Company’s capitalization is 200,000,000 authorized common shares with a par value of $0.001 per share.

On December 19, 2008, the Company issued 801,294 common shares at $0.01 per share for aggregate proceeds of $8,103.

On March 9, 2009 the Company issued 1,619,160 common shares at $0.02 per share for aggregate proceeds of $32,293.

As of July 31, 2009 and 2008 the Company has no outstanding stock options or warrants.

|

6. |

RELATED PARTY TRANSACTIONS |

During the year the newly appointed Company President was owed $689 (2008:- $nil) in relation to expenses incurred on behalf of the Company.

As at July 31, 2009 $182,356 (2008 - $177,251) was owed to the former Company President. These advances are unsecured, non-interest bearing and have no specific terms of repayment.

On October 4, 2006, under a restricted stock award agreement, the Company issued 6,000,000 post-split shares of common stock with a fair value of $750,000 to the former Company President. These shares have a vesting provision as follows: 2,100,000 shares vested immediately, 1,950,000 shares vest on October 3, 2007 and the final

1,950,000 shares vest on October 3, 2008. The fair value of the restricted stock award amounted to $750,000 which was being charged to operations over the vesting period. The stock award was accounted for as deferred compensation whereby the fair value of the award was recorded as a component of stockholders’ deficit until vested. Pursuant to this stock award the Company recorded stock based compensation of $39,700 (2008:- $244,750) in fiscal 2009. The award was

fully vested as of October 3, 2008.

26

STELLAR RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

JULY 31, 2009 AND 2008

|

7. |

INCOME TAXES |

The provision for income taxes differs from the result which would be obtained by applying the statutory income tax rate of 34% to income before income taxes. The difference results from the following items:

|

2008 |

2008 |

|||||||

|

Net loss before income taxes |

$ | (88,856 | ) | $ | (294,738 | ) | ||

|

Statutory tax rate |

34 | % | 34 | % | ||||

|

Expected tax expense (recovery) |

(30,200 | ) | (100,200 | ) | ||||

|

Unrecognized items for tax purposes |

13,500 | 83,200 | ||||||

|

Increase in valuation allowance |

16,700 | 17,000 | ||||||

|

Income tax provision |

$ | - | $ | - | ||||

Significant components of the Company’s deferred income tax assets are as follows:

|

2009 |

2008 |

|||||||

|

Net operating losses |

$ | 149,956 | $ | 133,256 | ||||

|

Valuation allowance |

(149,956 | ) | (133,256 | ) | ||||

|

Net deferred tax assets |

$ | - | $ | - | ||||

The Company has approximately $442,000 of net operating loss carry forwards which may be used to offset future taxable income that expire between 2019 and 2028.

The Company has provided a valuation allowance against its deferred tax assets given that it is in the exploration stage and there is substantial uncertainty as to the Company’s ability to realize future tax benefits through utilization of operating loss carry forwards.

The Company has not filed income tax returns since inception in the United States. Inherent uncertainties arise over tax positions taken with respect to transfer pricing, related party transactions, tax credits, tax based incentives and stock based transactions. Management has considered the likelihood and significance of possible

penalties associated with its intended filing positions and has determined, based on their assessment, that such penalties, if any, would not be expected to be material.

|

8. |

SUBSEQUENT EVENTS |

Subsequent to July 31, 2009 the Company received loans of C$17,000 from a shareholder, which currently have no specified terms of repayment, are unsecured and bear no interest. The Company will be negotiating terms to these loans.

The Company evaluated subsequent events through the financial statements filing date of October 29, 2009.

Item 7. Management’s Discussion and Analysis Of Financial Condition and Results of Operation

Statements we make in the following discussion that express a belief, expectation or intention, as well as those that are not historical fact, are forward-looking statements that are subject to risks, uncertainties and assumptions. Our actual results, performance or achievements, or industry results, could differ materially from those we express in the following discussion

as a result of a variety of factors, including general economic and business conditions and industry trends, the continued strength or weakness of the contract land drilling industry in the geographic areas in which we operate, decisions about onshore exploration and development projects to be made by oil and gas companies, the highly competitive nature of our business, the availability, terms and deployment of capital, the availability of qualified personnel, and changes in, or our failure or inability to comply

with, government regulations, including those relating to the environment. We have discussed many of these factors in more detail elsewhere in this report, including under the headings “Special Note Regarding Forward-Looking Statements” in the Introductory Note to Part I and “Risk Factors” in Item 1A. These factors are not necessarily all the important factors that could affect us. Unpredictable or unknown factors we have not discussed in this report or could also have material adverse

effect on actual results of matters that are the subject of our forward-looking statements. All forward-looking statements speak only as the date on which they are made and we undertake no duty to update or revise any forward-looking statements. We advise our shareholders that they should (1) be aware that important factors not referred to above could affect the accuracy of our forward-looking statements and (2) use caution and common sense when considering our forward-looking statements.

The following plan of operation should be read in conjunction with the financial statements and accompanying notes and the other financial information appearing elsewhere in this Annual Report.

From inception on April 9, 1999, we have expended $139,886 on legal, audit and accounting fees; $15,862 on interest; $150,114 on resource property expenses; $14,270 on property examination costs; $27,780 on consulting fees; $21,253 on office expenses, $38,914 on filing fees, $17,989 on investor relations, $941 on travel, and $750,000 on management fees - stock-based compensation.

OVERVIEW

We have been in the pre-exploration stage since our formation on April 9, 1999, and are not operators of any mines nor are we engaged in any mineral production or sales activities. We have a minimum amount of cash and have not yet developed any producing mines. We have no history of any earnings. There is no assurance that we will be a

profitable company. We presently operate with minimum overhead costs and need to raise additional funds in the next 12 months, either in the forms of loans or issuance of equity, in order to continue our operations. We are primarily engaged in the acquisition and exploration of resource properties.

Pursuant to EITF 04-2, the Company classified its mineral rights as tangible assets and accordingly acquisition costs are capitalized as mineral property costs. Generally accepted accounting principles require that long-lived assets be reviewed for impairment whenever events or changes in circumstances indicate that the carrying

amount of an asset may not be recoverable. In performing the review for recoverability, the Company is to estimate the future cash flows expected to result from the use of the asset and its eventual disposition. If the sum

of the undiscounted expected future cash flows is less than the carrying amount of the asset, an impairment loss is recognized. Mineral exploration costs are expensed as incurred until commercially mineable deposits are determined to exist within a particular

property. To date the Company has not established any proven or probable reserves.

The Company has adopted the provisions of SFAS No. 143 “Accounting for Asset Retirement Obligations” which establishes standards for the initial measurement and subsequent accounting for obligations associated with the sale, abandonment, or other disposal of long-term tangible assets arising from the acquisition, construction

or development and for normal operations of such assets. As of July 31 2009, the Company does not have any asset retirement obligation.

We currently do not know of any research and development activities planned for the next 12 months.

We currently have no plans to purchase or sell any property or significant equipment in the next 12 months.

We do not expect any significant changes in the number of employees over the next 12 months.

21. On December 4, 2006 Michael Rezac resigned his respective position as Chief Financial Officer in the Company. However, Mr. Rezac continues to maintain his current position as Secretary of the Company. On January

12, 2009 Ms. Kathy Whyte resigned her position as President and Chief Financial Officer in the Company and Mr. Luigi Rispoli was appointed as President and Chief Financial Officer of the Company. On May 8, 2008 Mr. Lee Balak was appointed Chief Executive Officer of the Company.

Comparison of Twelve Months Ended July 31, 2009 and 2008

We have not generated any revenues from operations since our incorporation on April 9, 1999 through July 31, 2009. During the year ended July 31, 2009 we incurred management fees - stock based compensation of $39,700 (2008 - $244,750) as a result of the vesting of stock award granted to the president in October 2006. Professional

fees, comprising legal, accounting and audit costs decreased to $26,234 (2008 - $29,696) as a result of a decrease in accounting activity and fees. Investor relations costs decreased to $500 (2008 - $2175) as a result of ceasing the investor relations activities in November 2007. Interest expenses reduced to $458 (2008 - $768) due to the reduction in interest rates throughout the period from 7.25% to 2.5%. General and administrative expenses amounted to $841 (2008 - $1,125). We

also experienced a foreign exchange gain of $122 (2008 – loss of $243) as a result of the US dollar in general strengthening throughout the year. We incurred $nil (2008 - $9,066) in resource property maintenance expenditures. Property examination costs increased to $14,270 (2008 - $nil) as a result of preliminary due diligence on the Texada Property and rent payments for the ore processing plant. Filing fees increased slightly to $6,975 (2008 - $6,915).

Sales and Marketing Expenses: We have incurred no sales and marketing expense since the date of inception due to the fact that we are in the pre-exploration stage of our business.

Our activities have been financed from proceeds of shareholders, related or third party subscriptions and loans. We do not anticipate earning revenues until such time as we have entered into commercial production of any mineral claims. We are presently in the pre-exploration stage of our business and we can provide

no assurance that we will discover commercially exploitable levels of mineral resources on any properties, or if such resources are discovered, that we will enter into commercial production of any claims.

Net Loss

For the year ended July 31, 2009, we recorded an operating loss of $88,856, consisting of management fee - stock based compensation $39,700, filing fees of $6,975; interest expense of $458, general and administrative expenses of $841; professional fees of $26,234, resource property maintenance expenditure of $nil, property examination

costs of $14,270 investor relations of $500 and a gain on foreign exchange of $122. There can be no assurance that we will ever achieve profitability or that revenues will be generated and sustained in the future. We are dependent upon obtaining additional and future financing to pursue our exploration activities.

Comparison of Fourth Quarter Ended July 31, 2009 and 2008

During the three month period ended July 31, 2009 we incurred management fees - stock based compensation of $nil (2008 - $61,450) as a result of the stock award granted to the president in October 2006. Professional fees, comprising legal, accounting and audit costs increased to $5,603 (2008 - $4,456) as a result of a decrease