Attached files

| file | filename |

|---|---|

| 8-K - MIDAMERICAN ENERGY HOLDINGS COMPANY FORM 8-K - BERKSHIRE HATHAWAY ENERGY CO | mehc8k10302009.htm |

2009

EEI Financial Conference

Patrick J. Goodman

Senior Vice President and Chief Financial Officer

Patrick J. Goodman

Senior Vice President and Chief Financial Officer

Forward-Looking

Statements

This

report contains statements that do not directly or exclusively relate to

historical facts. These statements are “forward-

looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, as amended. Forward-looking statements can typically be identified by the use of forward-looking

words, such as “may,” “could,” “project,” “believe,” “anticipate,” “expect,” “estimate,” “continue,” “intend,” “potential,”

“plan,” “forecast” and similar terms. These statements are based upon MidAmerican Energy Holdings Company’s (“MEHC”)

and its subsidiaries’ (collectively, the “Company”) current intentions, assumptions, expectations and beliefs and are subject to

risks, uncertainties and other important factors. Many of these factors are outside the Company’s control and could cause

actual results to differ materially from those expressed or implied by the Company’s forward-looking statements. These

factors include, among others:

looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, as amended. Forward-looking statements can typically be identified by the use of forward-looking

words, such as “may,” “could,” “project,” “believe,” “anticipate,” “expect,” “estimate,” “continue,” “intend,” “potential,”

“plan,” “forecast” and similar terms. These statements are based upon MidAmerican Energy Holdings Company’s (“MEHC”)

and its subsidiaries’ (collectively, the “Company”) current intentions, assumptions, expectations and beliefs and are subject to

risks, uncertainties and other important factors. Many of these factors are outside the Company’s control and could cause

actual results to differ materially from those expressed or implied by the Company’s forward-looking statements. These

factors include, among others:

– general

economic, political and business conditions in the jurisdictions in which the

Company’s facilities operate;

– changes in

governmental, legislative or regulatory requirements affecting the Company or

the electric or gas

utility, pipeline or power generation industries;

utility, pipeline or power generation industries;

– changes

in, and compliance with, environmental laws, regulations, decisions and policies

that could increase

operating and capital costs, reduce plant output or delay plant construction;

operating and capital costs, reduce plant output or delay plant construction;

– the

outcome of general rate cases and other proceedings conducted by regulatory

commissions or other

governmental and legal bodies;

governmental and legal bodies;

– changes in

economic, industry or weather conditions, as well as demographic trends, that

could affect customer

growth and usage or supply of electricity and gas or the Company’s ability to obtain long-term contracts with

customers;

growth and usage or supply of electricity and gas or the Company’s ability to obtain long-term contracts with

customers;

– a high

degree of variance between actual and forecasted load and prices that could

impact the hedging strategy and

costs to balance electricity and load supply;

costs to balance electricity and load supply;

– changes in

prices and availability for both purchases and sales of wholesale electricity,

coal, natural gas, other fuel

sources and fuel transportation that could have a significant impact on generation capacity and energy costs;

sources and fuel transportation that could have a significant impact on generation capacity and energy costs;

– the

financial condition and creditworthiness of the Company’s significant customers

and suppliers;

– changes in

business strategy or development plans;

– availability,

terms and deployment of capital, including severe reductions in demand for

investment-grade

commercial paper, debt securities and other sources of debt financing and volatility in the London Interbank

Offered Rate, the base interest rate for MEHC’s and its subsidiaries’ credit facilities;

commercial paper, debt securities and other sources of debt financing and volatility in the London Interbank

Offered Rate, the base interest rate for MEHC’s and its subsidiaries’ credit facilities;

Forward-Looking

Statements

– changes in

MEHC’s and its subsidiaries’ credit ratings;

– performance

of the Company’s generating facilities, including unscheduled outages or

repairs;

– risks

relating to nuclear generation;

– the impact

of derivative instruments used to mitigate or manage volume, price and interest

rate risk, including

increased collateral requirements, and changes in the commodity prices, interest rates and other conditions that

affect the value of derivative instruments;

increased collateral requirements, and changes in the commodity prices, interest rates and other conditions that

affect the value of derivative instruments;

– the impact

of increases in healthcare costs and changes in interest rates, mortality,

morbidity, investment

performance and legislation on pension and other postretirement benefits expense and funding requirements;

performance and legislation on pension and other postretirement benefits expense and funding requirements;

– changes in

the residential real estate brokerage and mortgage industries that could affect

brokerage transaction

levels;

levels;

– unanticipated

construction delays, changes in costs, receipt of required permits and

authorizations, ability to fund

capital projects and other factors that could affect future generating facilities and infrastructure additions;

capital projects and other factors that could affect future generating facilities and infrastructure additions;

– the impact

of new accounting pronouncements or changes in current accounting estimates and

assumptions on

financial results;

financial results;

– the

Company’s ability to successfully integrate future acquired operations into its

business;

– other

risks or unforeseen events, including litigation, wars, the effects of

terrorism, embargoes and other

catastrophic events; and

catastrophic events; and

– other

business or investment considerations that may be disclosed from time to time in

MEHC’s filings with the

United States Securities and Exchange Commission (the “SEC”) or in other publicly disseminated written

documents.

United States Securities and Exchange Commission (the “SEC”) or in other publicly disseminated written

documents.

Further

details of the potential risks and uncertainties affecting the Company are

described in MEHC’s filings with the SEC.

The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of

new information, future events or otherwise. The foregoing review of factors should not be construed as exclusive.

The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of

new information, future events or otherwise. The foregoing review of factors should not be construed as exclusive.

MidAmerican

Energy Holdings

Company Energy Assets

Company Energy Assets

• $42

billion of assets as of

June 30, 2009

June 30, 2009

• $11.8

billion of revenue(1)

• 7 million

electric and

natural gas customers

worldwide

natural gas customers

worldwide

• Nearly

17,000 miles of

interstate natural gas

pipeline with

approximately 7.0 bcf

capacity

interstate natural gas

pipeline with

approximately 7.0 bcf

capacity

• Approximately

18,000

megawatts(2) of owned

generation

megawatts(2) of owned

generation

• Approximately

23 percent

of this generation is

renewable or noncarbon

of this generation is

renewable or noncarbon

___________________________

(1) $11.8

billion of revenue for the twelve

months ended June 30, 2009

months ended June 30, 2009

(2) Net

owned megawatts in operation and

under construction as of June 30, 2009

under construction as of June 30, 2009

Corporate

Strategy

• Own

and operate a portfolio of high quality utility businesses

– Focus on

operational efficiency, cost control and customer service

– Cooperative

approach with regulators and customers

– Pursue

internal capital investment opportunities to expand regulated asset

base

• Maintain

prudent financial and risk management policies

– Committed

to improve holding company and subsidiary credit profile

– Stable and

highly diversified asset base

• Grow

and diversify through a disciplined acquisition strategy

– Target

additional energy assets

– Focus on

long-term risk-adjusted cash flow returns

– Continue

to utilize ring-fencing approach

– Capitalize

on access to long-term capital from Berkshire Hathaway

– Continue

track record of proven integration capabilities and improving

financial performance

financial performance

MidAmerican’s

Strategy Has Delivered Outstanding Results

MidAmerican

Competitive Advantage

• Diversified

portfolio of regulated assets

– Weather,

customer, regulatory, generation, economic and catastrophic risk

diversity

• Berkshire

Hathaway provides MidAmerican with a $3.5 billion equity

commitment

commitment

– Access to

capital even in times of utility and general market stress

• No

other utility has this quality of explicit financial support

• No

dividend requirement

– Cash flow

is retained in the business and used to help fund growth and improve

credit

metrics

metrics

• Berkshire

Hathaway ownership

– Access to

capital from Berkshire Hathaway allows us to take advantage of market

opportunities

opportunities

– Berkshire

Hathaway is a long-term holder of assets, and its owner for life

philosophy

promotes stability and helps make MidAmerican the buyer of choice among regulators

promotes stability and helps make MidAmerican the buyer of choice among regulators

7

Constellation

Energy

Termination

Fee

Cash in

Lieu of Shares

Repayment

of 14% Note

Proceeds

on Sale of Shares

Total

Proceeds

Initial

Investment in Constellation Energy

8%

Series A Preferred Stock

Net

Proceeds

Cash Flows

from Operating Activities Impact

Cash Flows

from Investing Activities Impact

Net Income

Attributable to MEHC Impact

$ 175

418

-

-

593

$ -

-

1,000

536

1,536

-

$ 1,536

$ 175

418

1,000

536

2,129

$ 1,129

Proceeds

($

millions)

2008

2009

Total

(1,000)

$ (407)

(1,000)

$ 175

$ 128

$ 303

$ 646

$ 418

$ 1,000

$ 668

$ (582)

$ 22

8

Growth

in Shareholders’ Equity

• Termination

of the Constellation Energy transaction and sale of stock

added more than $668 million to MEHC shareholders’ equity

added more than $668 million to MEHC shareholders’ equity

• BYD

investment of $232 million in July 2009 is valued at more than $1.8

billion as of September 30, 2009

billion as of September 30, 2009

• Despite

the difficult economic environment, MEHC shareholders’ equity

has grown from $9.3 billion at December 31, 2007, to $11 billion as of

June 30, 2009

has grown from $9.3 billion at December 31, 2007, to $11 billion as of

June 30, 2009

– BYD

after-tax gain will be reflected in September 30, 2009,

results

9

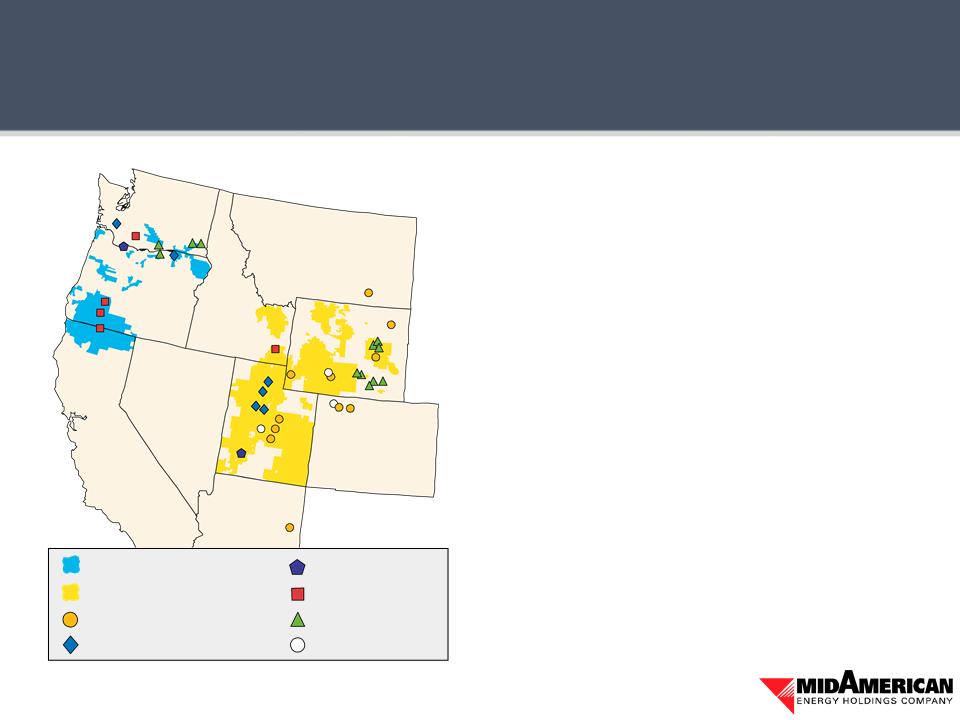

PacifiCorp

Calif.

Nev.

Ariz.

Utah

Wyo.

Ore.

Wash.

Mont.

Colo.

Idaho

Pacific

Power Service Territory

Coal

Plants

Natural

Gas Plants

Wind

Projects

Coal

Mines

Geothermal

and Other

Hydro

Systems

Rocky

Mountain Power Service

Territory

Territory

___________________________

(1) Net

owned megawatts in operation and under construction as of

June 30, 2009

June 30, 2009

• Headquartered

in Portland, Oregon

• 6,568

employees

• 1.7

million electricity customers in six western

states

states

• 10,595

megawatts(1)

of owned

generation

capacity

capacity

• Generating

capacity by fuel type

06/30/09(1) 03/31/06

– Coal 58% 72%

– Natural

gas 21% 13%

– Hydro 11% 14%

– Wind and

geothermal

10% 1%

10

PacifiCorp

- Business Update

Regulatory

• Active

regulatory agenda including rate cases, power cost adjustment mechanisms

and

renewable adjustment clauses

renewable adjustment clauses

– Completed

in 2009

– Power cost

adjustment mechanism approved in Idaho effective July 1, 2009

– Utah

general rate case completed - $45.0 million annual revenue increase effective

May 8, 2009

– Oregon

renewable cost recovery - $30.8 million effective January 21, 2009

– Oregon

Senate Bill 408 tax surcharge - $20.1 million effective June 1,

2009

– Oregon

transition adjustment mechanism - $9.2 million effective January 1,

2009

– Wyoming

general rate case - $18.0 million annual revenue increase effective May 24,

2009

– Wyoming

power cost adjustment mechanism settlement - $7.0 million effective April 1,

2009

– Idaho

general rate case - $4.4 million annual revenue increase effective April 18,

2009

– Pending

– Power cost

adjustment mechanism requested in Utah

– Oregon

rate case and transition adjustment mechanism settlement - $50.0 million annual

increase

for general rates and power costs; settlement filed and order pending

for general rates and power costs; settlement filed and order pending

– Oregon

Senate Bill 408 tax surcharge - $45.1 million filed October 15,

2009

– Washington

rate case settlement - $13.5 million base rate increase and $18.0 million

Chehalis

deferral; new rates expected to be effective January 1, 2010

deferral; new rates expected to be effective January 1, 2010

– Utah

general rate case - $66.9 million annual increase requested June 23, 2009; new

rates

expected to be effective February 18, 2010

expected to be effective February 18, 2010

– Wyoming

general rate case - $70.9 million annual increase requested October 2, 2009; new

rates

expected to be effective August 1, 2010

expected to be effective August 1, 2010

11

PacifiCorp

- Regulatory Environment

Utah

• Integrated

resource planning

• As part of

RFP process, regulatory approval of investment prudence may be obtained prior to

construction/acquisition

• Rates

effective no later than eight months after filed date

• Regulators

have accepted use of forecast test periods

• Regulators

are required to allow utility to use single issue rate case or deferred

accounting for major plant additions (>1% of

rate base)

rate base)

• Regulators

may approve power cost recovery mechanisms - PacifiCorp filed an application in

2009 for approval of a mechanism

Oregon

• Integrated

resource planning

• Rate case

test periods are based on forecast data

• 10-month

time limit on consideration of proposed rate increase

• Regulators

authorized to approve power cost recovery mechanisms

• Annual

update to forecast power costs outside of general rate case; i.e. transition

adjustment mechanism

• Annual

renewable resource cost recovery outside of general rate case with deferral of

cost of renewable resources that come on-line

between annual proceedings

between annual proceedings

Washington

• Integrated

resource planning

• Rate case

test periods are based on historical data with known and measurable

adjustments

• 11-month

time limit on consideration of proposed rate increase

• Regulators

authorized to approve power cost recovery mechanisms

• Commission

required to allow deferral of costs related to eligible base-load and renewable

generation resources

between rate

cases

for future recovery

for future recovery

12

PacifiCorp

- Regulatory Environment

Idaho

• Integrated

resource planning

• Rates

effective no later than seven months after filed date

• Rate case

test periods based on historic data with known and measurable

adjustments

• Ability to

use single issue rate cases for significant new investment when filed within

approximately six months of prior rate change

• PacifiCorp

application for power cost adjustment mechanism approved; effective July 1,

2009, with annual true-up to actual costs

• New

legislation implemented that allows pre-construction regulatory approval and

binding rate-making principles (as in Iowa)

Wyoming

• 10-month

time period on consideration of proposed rate increase

• Rate case

test periods may be historical with known and measurable adjustments or

forecasted data based on each case circumstance

• Power cost

adjustment mechanism in place with annual true-up

California

• Rate case

test periods are based on forecast data

• Three-year

rate case cycle with adjustment mechanisms

– Dollar-for-dollar

recovery of power costs and annual update to forecast power costs

– Annual

inflation-based adjustment mechanism

– Single-item

filings provide for recovery

of costs of capital additions in excess of $50 million total

company

13

PacifiCorp

- Business Update

• Retail

load for the six-month period ended June 30, 2009, was 25,313

gigawatt hours, a 4.8% decrease versus the first six months of 2008

gigawatt hours, a 4.8% decrease versus the first six months of 2008

• 377

megawatts of new wind generation to be added in 2009-2010

– Total

owned wind generation capacity projected to be 1,033 megawatts by

year-end 2010

year-end 2010

– Total wind

capacity under long-term contract is projected to be 682 megawatts

by year-end 2010

by year-end 2010

• Populus-to-Terminal

segment of Energy Gateway Transmission Expansion

Project under construction

Project under construction

– Expected

to be in-service during 2010

– $905

million project on budget

14

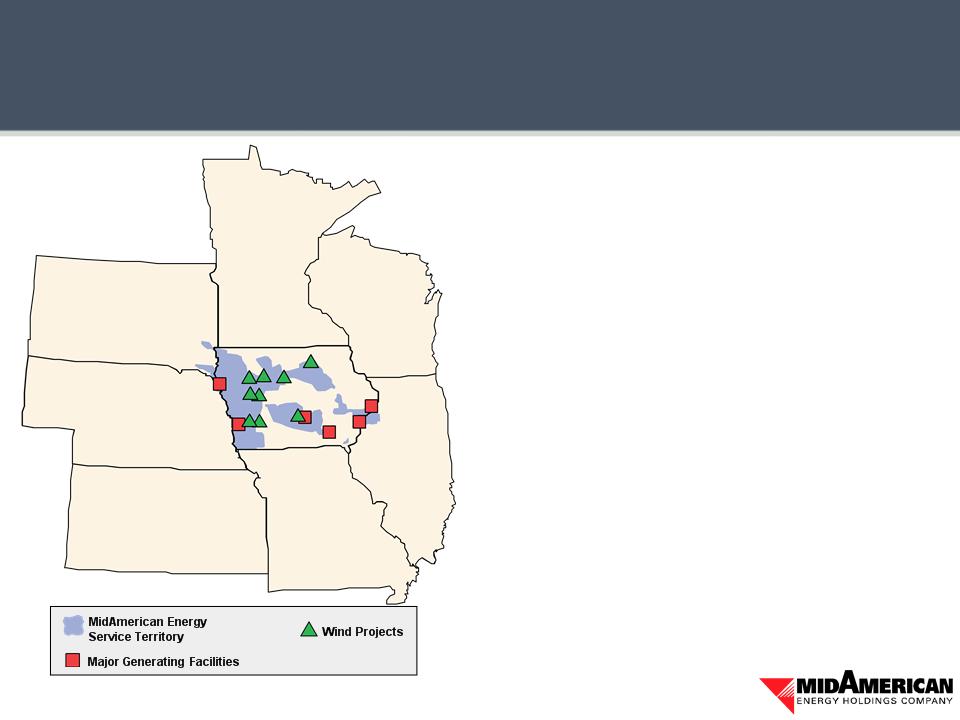

MidAmerican

Energy

Iowa

Ill.

Kan.

Neb.

S.D.

Wis.

Minn.

Mo.

___________________________

(1) Net

owned megawatts in operation as of June 30, 2009

• Headquartered

in Des Moines, Iowa

• 3,565

employees

• 1.4

million electric and natural gas customers in

four Midwestern states

four Midwestern states

• 6,443 net

megawatts generation capacity(1)

• Generating

capacity by fuel type

06/30/09(1) 12/31/00

– Coal 52% 70%

– Natural

gas 20% 19%

– Wind

20% 0%

– Nuclear

and

other

8%

11%

15

MidAmerican

Energy - Business Update

• Retail

load for the six-month period ended June 30, 2009, was 9,889 gigawatt

hours, a 3.5% decrease versus the first six months of 2008

hours, a 3.5% decrease versus the first six months of 2008

• On

September 1, 2009, MidAmerican Energy Company became a transmission-

owning member of MISO

owning member of MISO

• Update on

environmental capital expenditures

– Walter

Scott, Jr. Energy Center Unit 3 scrubber in-service May 2009

– 1,679

megawatts of coal generation in-service with scrubbers

• Regulatory

approval pending for up to 1,001 megawatts (nameplate ratings) of

additional wind development in Iowa for potential construction through 2012

additional wind development in Iowa for potential construction through 2012

• Continue

to receive high J.D. Power and Associates customer satisfaction ratings

for gas and electric service

for gas and electric service

16

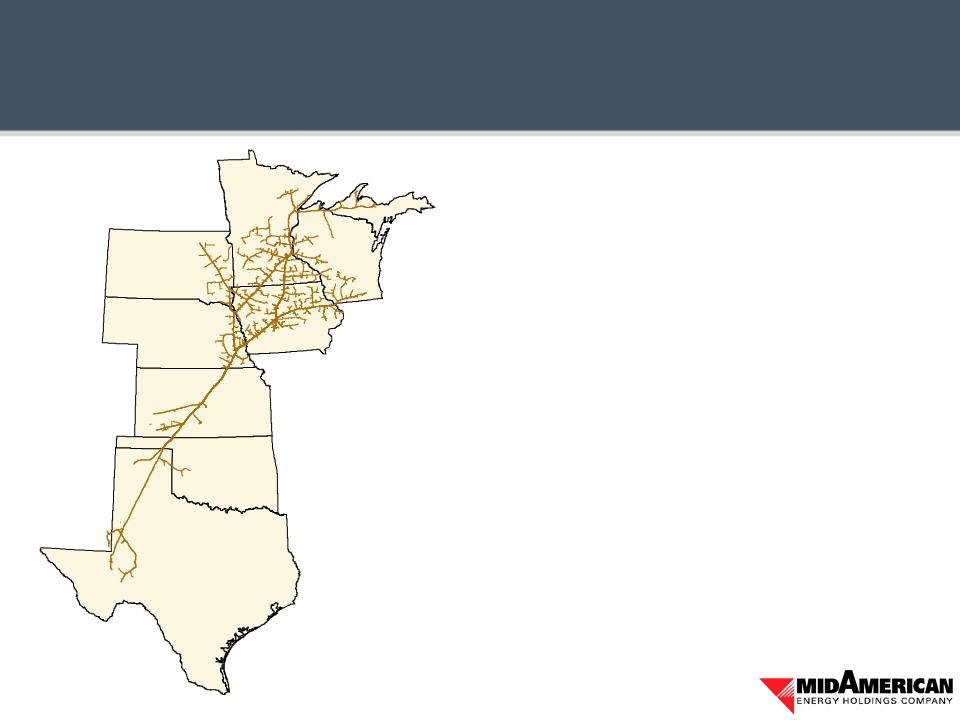

Business

Overview

• 15,200

miles of natural gas pipeline

• 5.3 Bcf

per day of market area design

capacity, plus 2.0 Bcf per day field

area capacity

capacity, plus 2.0 Bcf per day field

area capacity

• 73 Bcf

firm storage capacity

• 78% of

2008 revenue based on

demand charges

demand charges

Major

Accomplishments

• Northern

Lights project — growth

in

market-area transportation business

market-area transportation business

2007 400,000

Dth/day

2008 100,000

Dth/day

2009/2010 150,000

Dth/day

• Firm gas

storage expansions

2006 — 6

Bcf

2008 — 8

Bcf

Northern

Natural Gas

Minn.

Wis.

Iowa

S.D.

Neb.

Kan.

Okla.

Texas

17

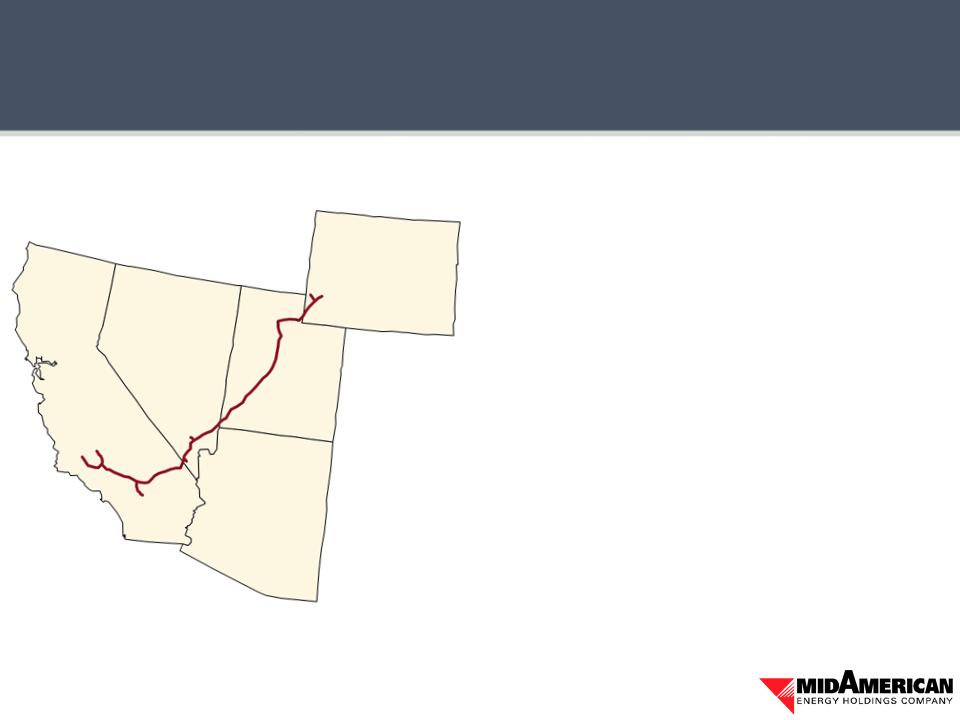

Business

Overview

• 1,700

miles of natural gas pipeline

• 1.8

million Dth/day of natural gas to

markets in Utah, Nevada and California

markets in Utah, Nevada and California

• 65% of

2008 revenue based on demand

charges

charges

Major

Accomplishments

• Received

FERC approval for 2010

Expansion for 145,000 Dth/day,

in-service anticipated December 31, 2009

Expansion for 145,000 Dth/day,

in-service anticipated December 31, 2009

• Anticipate

FERC approval in December

2010 for Apex expansion for 266,000

Dth/day

2010 for Apex expansion for 266,000

Dth/day

Kern

River

Calif.

Nev.

Ariz.

Utah

Wyo.

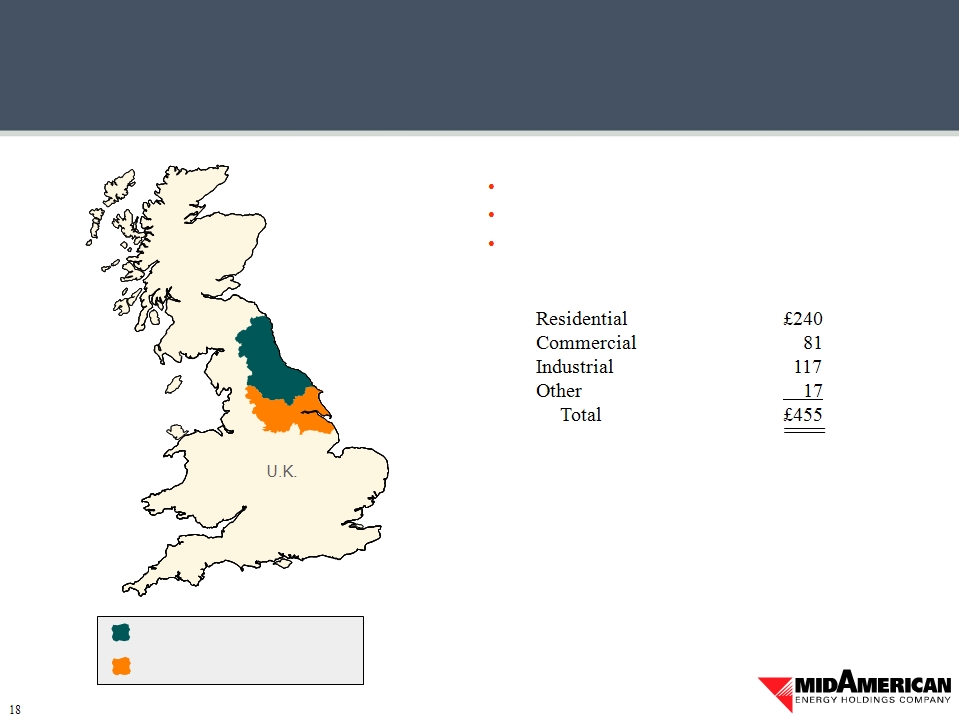

Business

Overview

• 3.8

million end-users in northeast England

• 57,000

miles of distribution lines

• 72% of

2008 distribution revenue from

residential and commercial customers

residential and commercial customers

2008

Distribution Revenue (£ millions)

Accomplishments

• Continuing

negotiations with Ofgem in

preparation for next price control period; final

proposals expected in December 2009

preparation for next price control period; final

proposals expected in December 2009

• Improvement

in customer service standards

continues

continues

• Excellent

safety performance in each of the last

five years

five years

• Financial

performance remains stable despite

economic climate

economic climate

CE

Electric UK

Northern

Electric service territory

Yorkshire

Electricity service territory

Financial

Results

A2/A-/A

Regulated

Gas and

Electric Utility

Electric Utility

Independent

Electric Power

Producer

Electric Power

Producer

A2/A/A

Regulated

Gas

Transmission

Transmission

A3/A-/A-

Regulated

Gas

Transmission

Transmission

Real

Estate

Brokerage

Brokerage

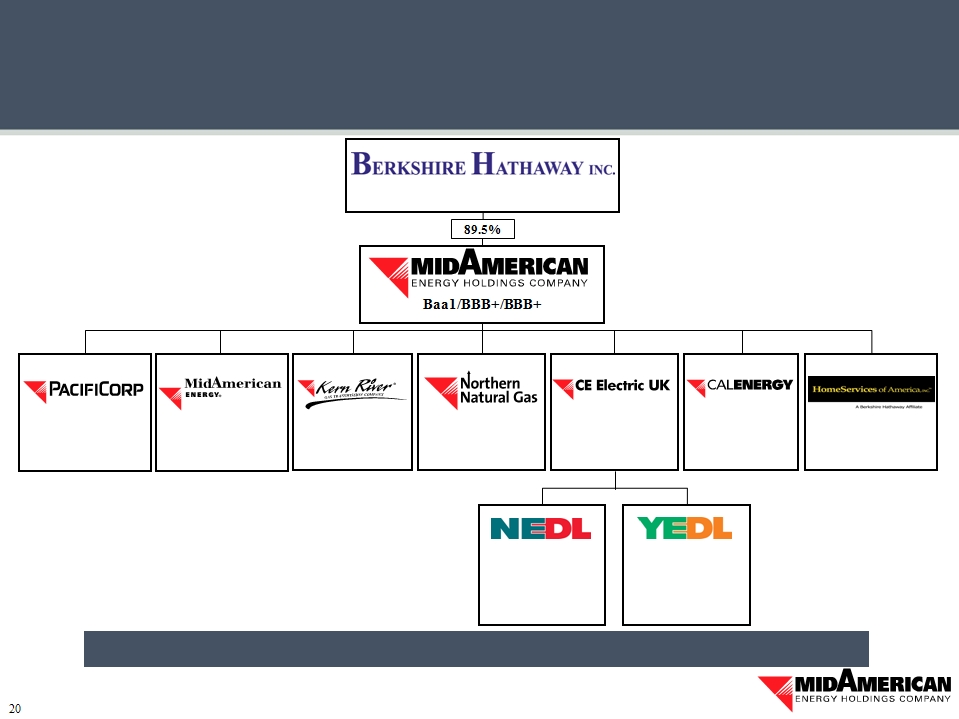

Baa1/BBB+/BBB+

Holding

Company

A2/A/A-(2)

Regulated

Electric

Utility

Utility

Aa2(1)/AAA/AA+(1)

A3/A-/A

U.K.

Regulated

Electric

Distribution

Electric

Distribution

A3/A-/A

U.K.

Regulated

Electric

Distribution

Electric

Distribution

“Forever

is our holding period” - Berkshire ownership philosophy

___________________________

(1) Moody’s and Fitch

ratings for Berkshire Hathaway Inc.

are Issuer Ratings

are Issuer Ratings

(2) PacifiCorp ratings

are Senior Secured

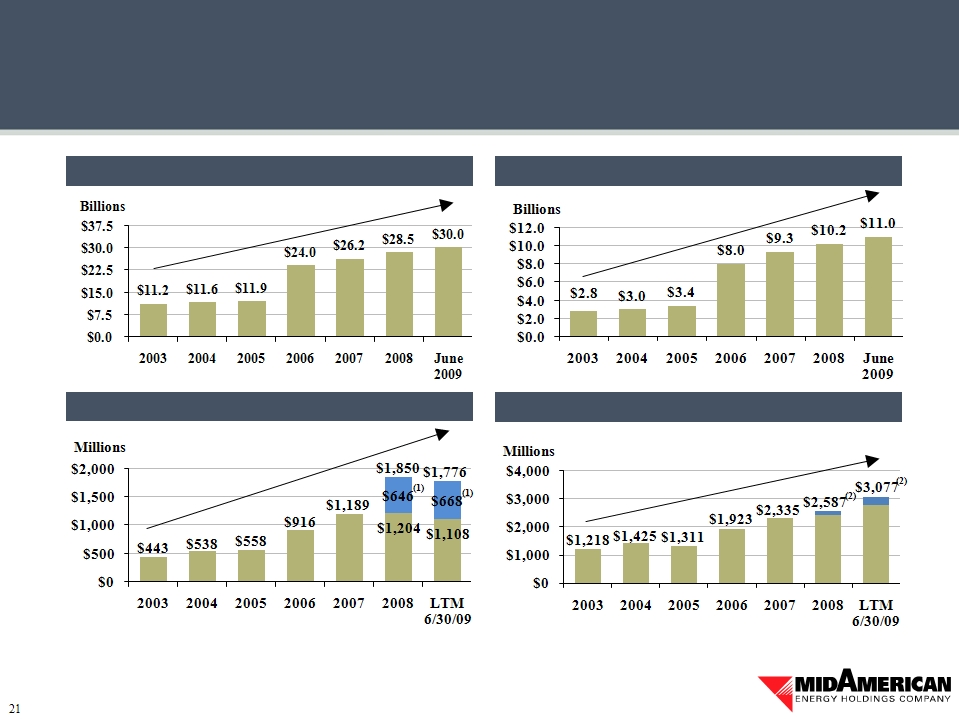

Organizational

Structure

MEHC

Growth Summary

Net

Income Attributable to MEHC

MEHC

Shareholders’ Equity

Property,

Plant and Equipment (Net)

Cash

Flows From Operations

CAGR

= 18.1%

CAGR

= 16.1%

CAGR

= 28.2%

CAGR

= 19.6%

(1) $646m and $668m

after-tax gains are related to the termination fee and profit from investment

in

Constellation Energy; CAGR calculation excludes this amount

Constellation Energy; CAGR calculation excludes this amount

(2) $2,587m and $3,077m

cash flows from operations include $175 and $303 for 2008 and LTM 6/30/09,

respectively, related

to the termination fee and profit from investment in Constellation Energy; CAGR calculation excludes this amount

to the termination fee and profit from investment in Constellation Energy; CAGR calculation excludes this amount

22

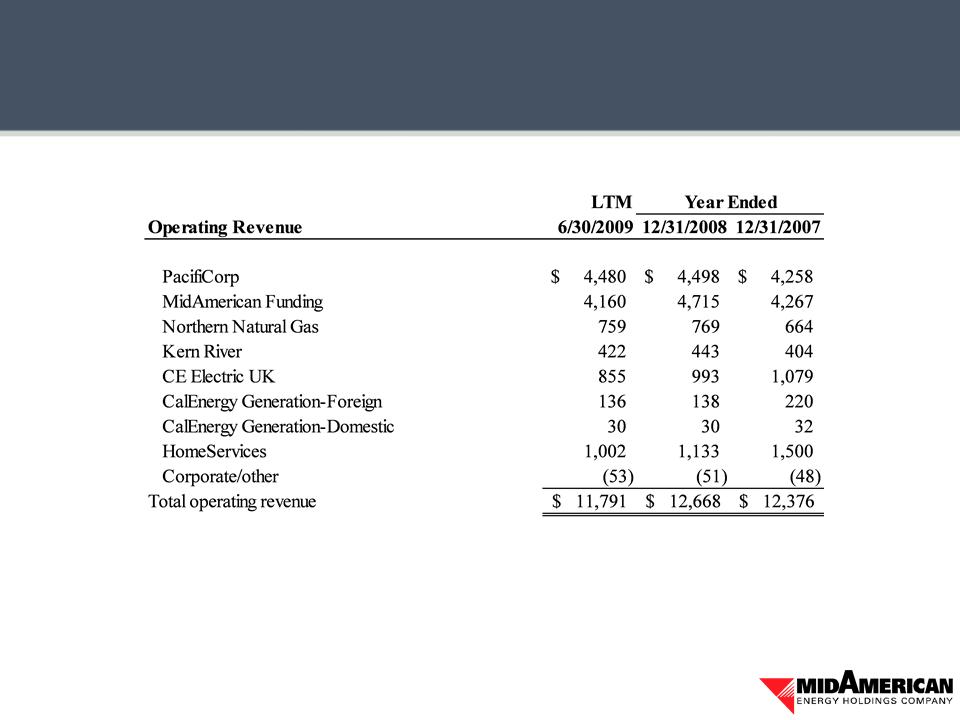

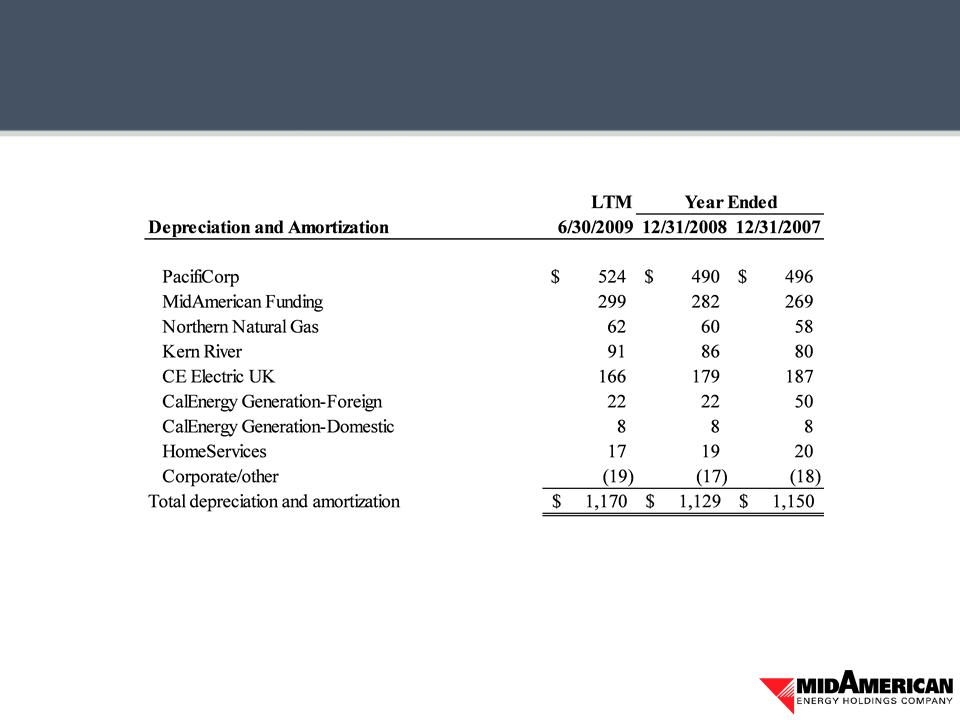

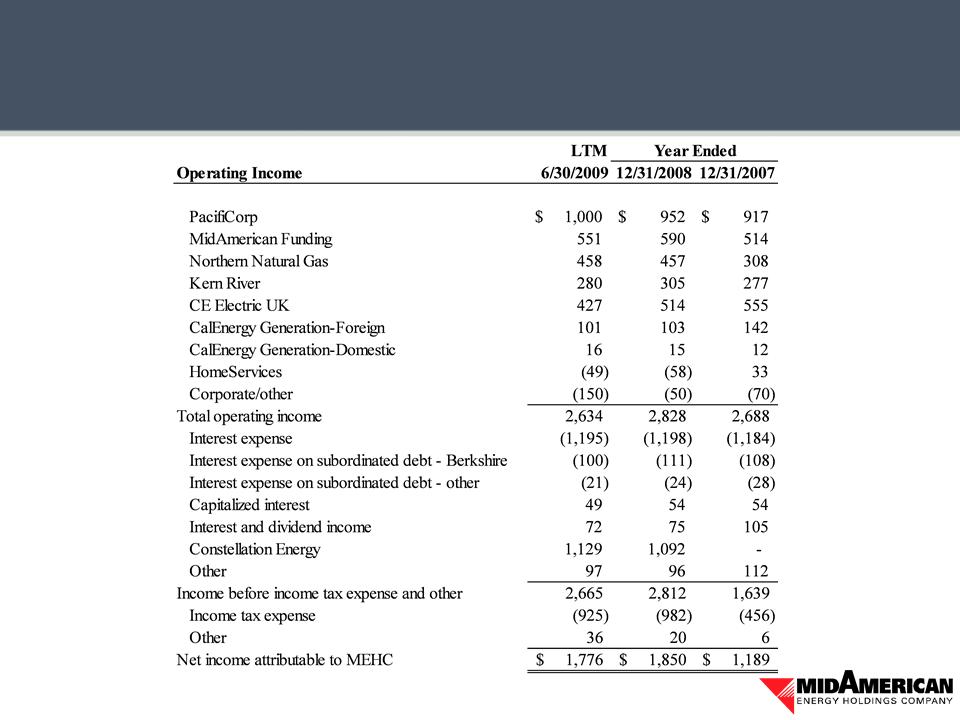

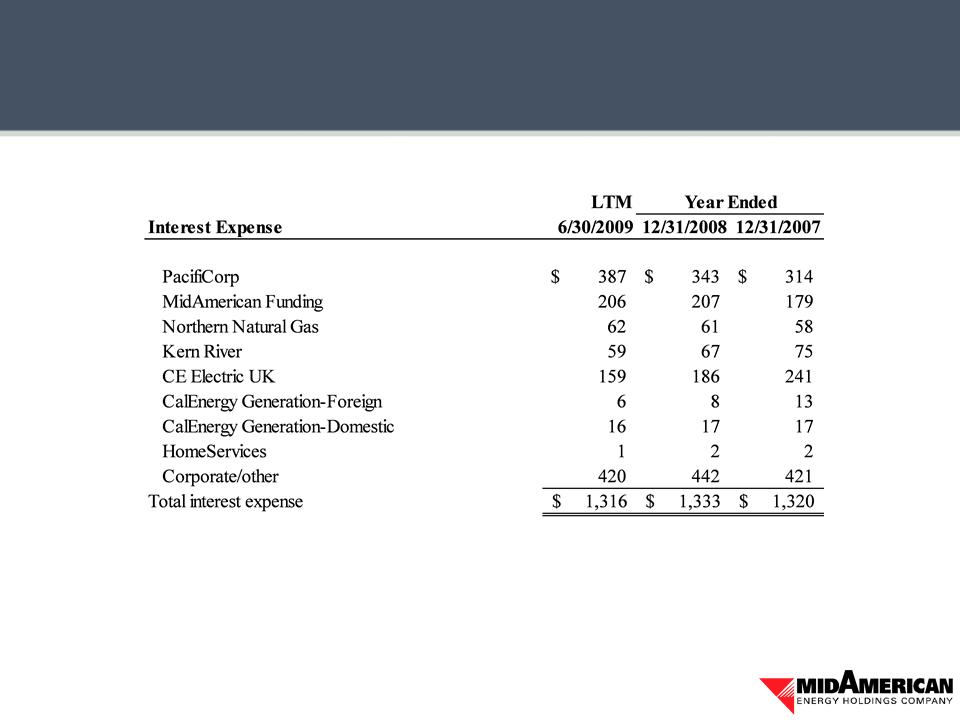

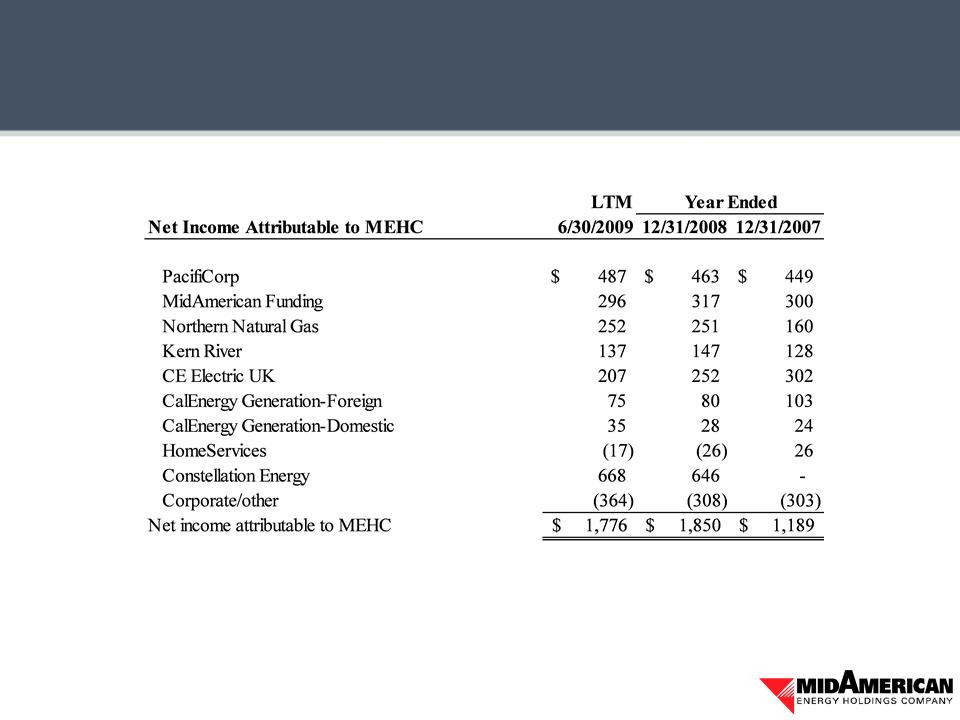

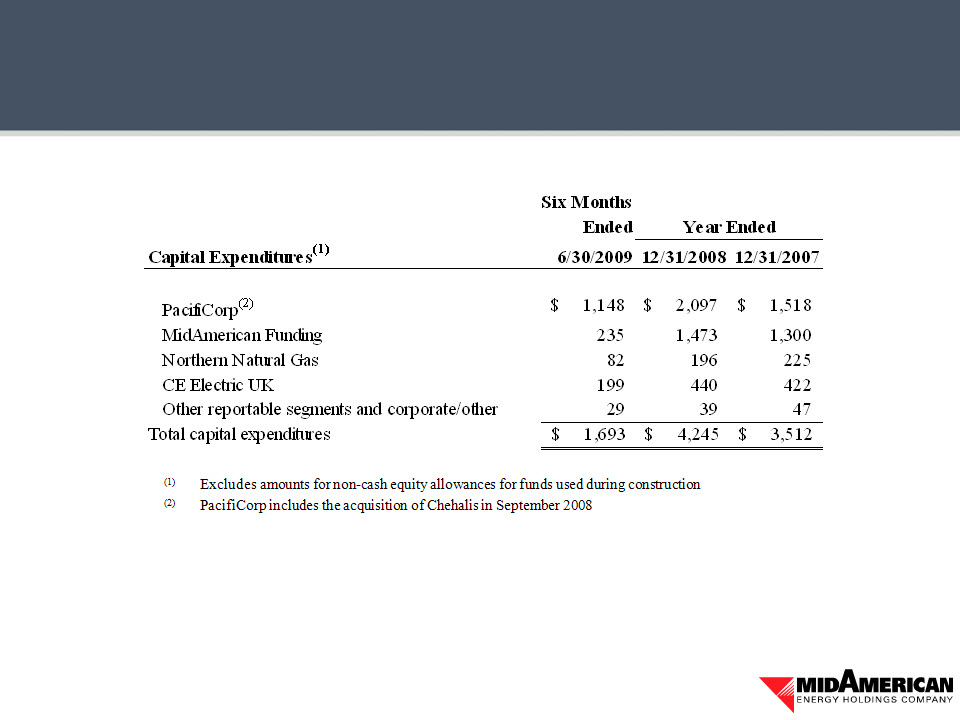

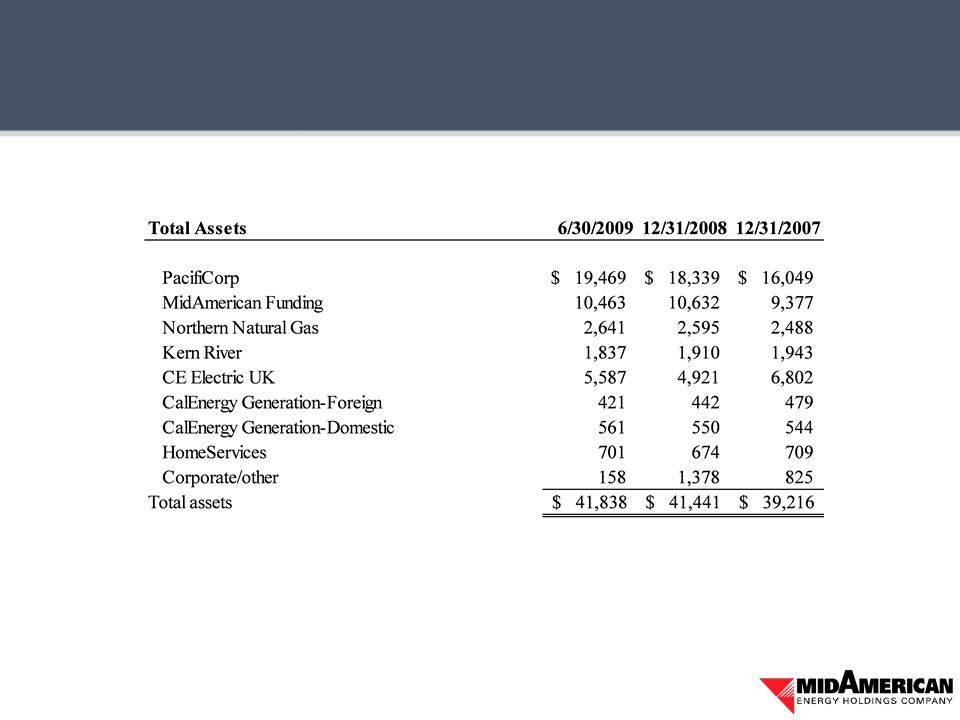

Business

Information ($ millions)

23

Business

Information ($ millions)

24

Business

Information ($ millions)

25

Business

Information ($ millions)

26

Business

Information ($ millions)

27

Business

Information ($ millions)

28

Business

Information ($ millions)

29

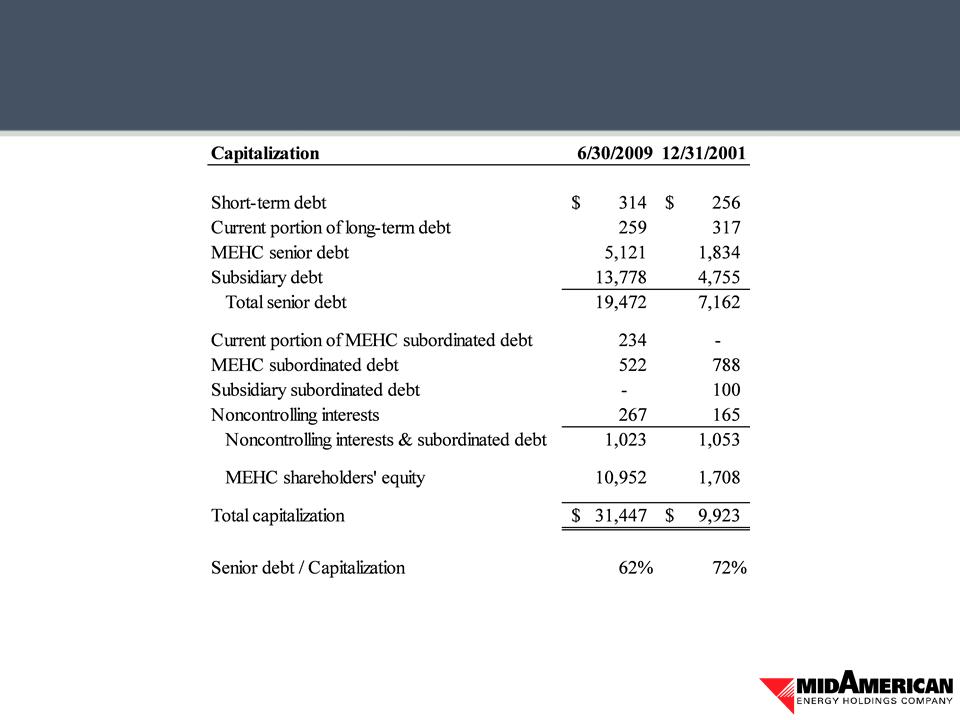

Capitalization

($ millions)

• As of June

30, 2009, approximately 96% of total debt was fixed rate debt

• As of June

30, 2009, long-term debt had a weighted average life of approximately

16.6 years and a weighted average interest rate of approximately 6.0%

16.6 years and a weighted average interest rate of approximately 6.0%