Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - Ventas, Inc. | dex991.htm |

| 8-K - FORM 8-K - Ventas, Inc. | d8k.htm |

Exhibit 99.2

Third Quarter 2009 Supplemental Data

St. Francis Millennium Medical Office Building - Greenville, SC

All amounts shown in this report are unaudited and in U.S. dollars unless otherwise noted.

Ventas, Inc.

Third Quarter 2009 Supplemental Data

Table of Contents

| Debt Summary |

1-2 | |

| Debt Covenants |

3-4 | |

| Triple-Net, Managed and Loan Portfolio |

5-8 | |

| Operating Portfolio |

9-10 | |

| Kindred Healthcare Same-Store TTM EBITDARM Coverage Ratios |

11 | |

| Revenue Rollover Schedule |

12 | |

| Company Development Data |

13 | |

Ventas, Inc.

Third Quarter 2009 Supplemental Data

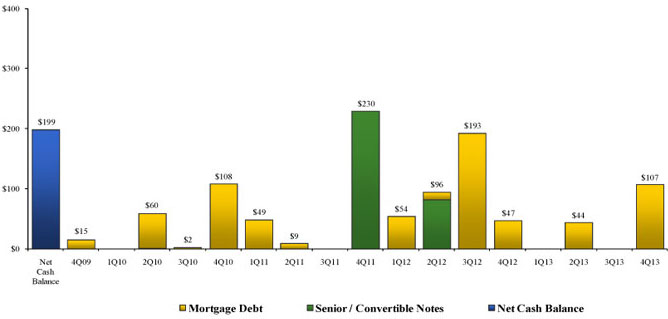

Debt Maturity Schedule:1

| 1 | Dollars in millions; data as of October 28, 2009 and excludes normal monthly principal amortization. The Company’s joint venture partners’ pro rata share of total maturities is approximately $143 million. Reflects Ventas’s ability and intent to extend certain mortgage loans until 2010. |

1

Ventas, Inc.

Third Quarter 2009 Supplemental Data

Debt Summary as of September 30, 2009

Debt Maturities and Scheduled Principal Amortization1

| Credit Facility | Senior/Convertible Notes | Mortgage Debt | Total Debt | |||||||||||||||||||||||

| Period |

Amount | Rate2 | Amount | Rate2 | Amount3 | Rate2 | Amount | Rate2 | ||||||||||||||||||

| 2009 |

$ | — | — | $ | — | — | $ | 22,754 | 1.9 | % | $ | 22,754 | 1.9 | % | ||||||||||||

| 2010 |

— | — | 1,375 | 6.8 | % | 195,517 | 4.1 | % | 196,892 | 4.1 | % | |||||||||||||||

| 2011 |

— | — | 230,412 | 3.9 | % | 83,632 | 5.0 | % | 314,044 | 4.2 | % | |||||||||||||||

| 2012 |

9,713 | 2.5 | % | 82,433 | 9.0 | % | 328,457 | 6.2 | % | 420,603 | 6.7 | % | ||||||||||||||

| 2013 |

— | — | — | — | 167,326 | 5.9 | % | 167,326 | 5.9 | % | ||||||||||||||||

| 2014 |

— | — | 71,654 | 6.6 | % | 14,217 | 6.2 | % | 85,871 | 6.6 | % | |||||||||||||||

| 2015 |

— | — | 142,669 | 7.1 | % | 77,142 | 6.0 | % | 219,811 | 6.7 | % | |||||||||||||||

| 2016 |

— | — | 400,000 | 6.5 | % | 204,533 | 6.1 | % | 604,533 | 6.4 | % | |||||||||||||||

| 2017 |

— | — | 225,000 | 6.8 | % | 47,096 | 6.1 | % | 272,096 | 6.6 | % | |||||||||||||||

| 2018 |

— | — | — | — | 19,971 | 6.5 | % | 19,971 | 6.5 | % | ||||||||||||||||

| Thereafter |

— | — | — | — | 324,211 | 4.7 | % | 324,211 | 4.7 | % | ||||||||||||||||

| Subtotal |

9,713 | 2.5 | % | 1,153,543 | 6.3 | % | 1,484,856 | 5.4 | % | 2,648,112 | 5.9 | % | ||||||||||||||

| Discounts and Fair Market Value, net |

— | (45,307 | ) | 12,337 | (32,970 | ) | ||||||||||||||||||||

| Total |

$ | 9,713 | $ | 1,108,236 | $ | 1,497,193 | $ | 2,615,142 | ||||||||||||||||||

| Weighted Average Maturity in Years |

1.9 | 5.4 | 5.6 | 5.5 | ||||||||||||||||||||||

Debt Composition1

| September 30, 2009 | |||||||||

| Amount | Rate2 | % of Total | |||||||

| Fixed Rate Debt |

|||||||||

| Senior/Convertible Notes |

1,153,543 | 6.3 | % | 43.6 | % | ||||

| Mortgage Debt |

1,270,759 | 6.3 | % | 48.0 | % | ||||

| Total Fixed Rate Debt |

$ | 2,424,302 | 6.3 | % | 91.5 | % | |||

| Variable Rate Debt |

|||||||||

| Credit Facility |

9,713 | 2.5 | % | 0.4 | % | ||||

| Mortgage Debt |

214,097 | 1.7 | % | 8.1 | % | ||||

| Total Variable Rate Debt |

223,810 | 1.7 | % | 8.5 | % | ||||

| Total Debt |

$ | 2,648,112 | 5.9 | % | 100.0 | % | |||

| 1 | Dollars in thousands. |

| 2 | Rates are based on the cash interest paid on the outstanding debt and do not include amortization of discounts, fair market value or debt costs. |

| 3 | The Company’s joint venture partners’ pro rata share of total mortgage debt is approximately $160 million. |

2

Ventas, Inc.

Third Quarter 2009 Supplemental Data

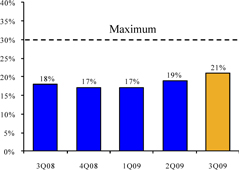

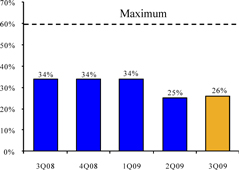

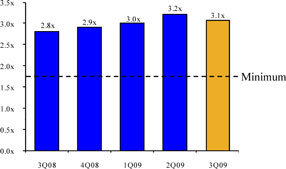

Debt Covenants:

| Credit Facility |

|||||

| Required |

09/30/09 | ||||

| Total Liabilities / Gross Asset Value |

Not greater than 60% | 38 | % | ||

| Secured Debt / Gross Asset Value |

Not greater than 30% | 21 | % | ||

| Unsecured Debt / Unencumb. Gross Asset Value |

Not greater than 60% | 26 | % | ||

| Fixed Charge Coverage |

Not less than 1.75x | 3.1 | x | ||

| Unencumbered Interest Coverage |

Not less than 2.00x | 5.3 | x | ||

| Bonds due 2012 |

|||||

| Required |

09/30/09 | ||||

| Incurrence of Debt |

Not greater than 60% | 31 | % | ||

| Incurrence of Secured Debt |

Not greater than 40% | 10 | % | ||

| Total Unencumbered Assets |

Not less than 150% | 370 | % | ||

| Consolidated Income Available for Debt Service to Debt Service |

Not less than 2.00x | 5.1 | x | ||

3

Ventas, Inc.

Third Quarter 2009 Supplemental Data

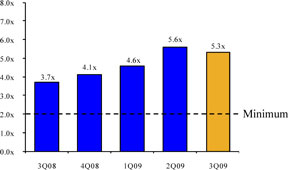

Debt Covenants:

| Secured Debt / Gross Asset Value | Unsecured Debt / Unencumbered Gross Asset Value | |

|

| |

| Fixed Charge Coverage | Unencumbered Interest Coverage | |

|

| |

4

Ventas, Inc.

Third Quarter 2009 Supplemental Data

Owned Portfolio - Overview by Type (Dollars in Millions):1

| Property Type |

Number of Properties |

Number of Beds/Units/Square Feet |

Number of States/ Provinces |

Ventas Investment |

Cash Flow Coverage |

Occupancy2 | Annualized NNN Revenue3 |

Annualized Operating Property Revenue3 |

Total Annualized Revenue3 |

Annualized NNN NOI3 |

Annualized Operating Property NOI3 |

Total Annualized NOI3 |

|||||||||||||||||||||||||||||

| Hospital - Stabilized Triple-Net |

40 | 3,517 | Beds | 17 | $ | 345 | 2.5 | x | 59.2 | % | $ | 94 | $ | 0 | $ | 94 | $ | 94 | $ | 0 | $ | 94 | |||||||||||||||||||

| Skilled Nursing - Stabilized Triple-Net |

187 | 22,435 | Beds | 29 | 809 | 1.9 | x | 89.5 | % | 179 | 0 | 179 | 179 | 0 | 179 | ||||||||||||||||||||||||||

| Seniors Housing - Triple-Net |

164 | 16,691 | Units | 31 | 2,256 | 1.3 | x | 87.0 | % | 194 | 0 | 194 | 194 | 0 | 194 | ||||||||||||||||||||||||||

| Seniors Housing - Operating |

79 | 6,513 | Units | 21 | 2,033 | N/A | 88.1 | % | 0 | 363 | 363 | 0 | 114 | 114 | |||||||||||||||||||||||||||

| Medical Office - Stabilized |

19 | 1,046,828 | Square Feet | 9 | 223 | N/A | 94.0 | % | 0 | 28 | 28 | 0 | 18 | 18 | |||||||||||||||||||||||||||

| Medical Office - Lease-Up |

4 | 355,479 | Square Feet | 4 | 76 | N/A | 70.6 | % | 0 | 8 | 8 | 0 | 5 | 5 | |||||||||||||||||||||||||||

| Other - Stabilized Triple-Net |

8 | 122 | Beds | 1 | 7 | 5.1 | x | N/A | 1 | 0 | 1 | 1 | 0 | 1 | |||||||||||||||||||||||||||

| Total |

501 | 45 | $ | 5,750 | 1.8 | x | $ | 468 | $ | 399 | $ | 867 | $ | 468 | $ | 137 | $ | 604 | |||||||||||||||||||||||

| 54 | % | 46 | % | 100 | % | 77 | % | 23 | % | 100 | % | ||||||||||||||||||||||||||||||

Loan Portfolio - Overview by Investment (Dollars in Millions):1

| Borrower |

Original Investment |

Outstanding Principal |

Secured/ Unsecured |

Borrower/ Asset Type |

Effective Interest Rate |

Annualized Revenue3 |

Balance Sheet Line | |||||||||||

| Manor Care |

$ | 99 | $ | 112 | Secured | SNF/ALF | L + 533 bps | $ | 6 | Loans Receivable | ||||||||

| HCA |

45 | 50 | Unsecured | Hospital | 9.2 | % | 4 | Other Assets | ||||||||||

| Emeritus Senior Living |

15 | 15 | Secured | Seniors Housing | 7.8 | % | 1 | Loans Receivable | ||||||||||

| Brookdale Senior Living |

9 | 0 | Secured | Seniors Housing | L + 600 bps | 4 | 0 | Loans Receivable | ||||||||||

| Other - Secured5 |

13 | 9 | Secured | Seniors Housing | N/A | 0 | Loans Receivable | |||||||||||

| Other - Unsecured |

19 | 20 | Unsecured | Hospital | 8.8 | % | 2 | Other Assets | ||||||||||

| Total |

$ | 199 | $ | 206 | $ | 13 | ||||||||||||

Owned Portfolio - Overview by State/Province:1

| Totals | Hospital | Skilled Nursing | Seniors Housing | Medical Office | Other | ||||||||||||||||||||

| State/Province |

No. | % | No. | Beds | No. | Beds | No. | Units | No. | Sq. Feet | No. | Beds | |||||||||||||

| California |

37 | 7 | % | 5 | 455 | 6 | 771 | 26 | 3,304 | 0 | 0 | 0 | 0 | ||||||||||||

| Pennsylvania |

34 | 7 | % | 2 | 115 | 6 | 797 | 24 | 1,597 | 2 | 111,671 | 0 | 0 | ||||||||||||

| Massachusetts |

34 | 7 | % | 2 | 109 | 26 | 2,694 | 6 | 856 | 0 | 0 | 0 | 0 | ||||||||||||

| Ohio |

30 | 6 | % | 0 | 0 | 12 | 1,599 | 16 | 1,152 | 2 | 144,639 | 0 | 0 | ||||||||||||

| Kentucky |

29 | 6 | % | 2 | 424 | 27 | 3,054 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||

| Florida |

26 | 5 | % | 6 | 511 | 0 | 0 | 14 | 1,452 | 6 | 206,533 | 0 | 0 | ||||||||||||

| Indiana |

23 | 5 | % | 1 | 59 | 13 | 1,867 | 9 | 1,001 | 0 | 0 | 0 | 0 | ||||||||||||

| North Carolina |

23 | 5 | % | 1 | 124 | 16 | 1,802 | 6 | 438 | 0 | 0 | 0 | 0 | ||||||||||||

| Illinois |

22 | 4 | % | 4 | 431 | 1 | 82 | 17 | 2,634 | 0 | 0 | 0 | 0 | ||||||||||||

| Texas |

21 | 4 | % | 7 | 496 | 0 | 0 | 3 | 261 | 3 | 78,222 | 8 | 122 | ||||||||||||

| All Other |

222 | 44 | % | 10 | 793 | 80 | 9,769 | 122 | 10,509 | 10 | 861,242 | 0 | 0 | ||||||||||||

| Total |

501 | 100 | % | 40 | 3,517 | 187 | 22,435 | 243 | 23,204 | 23 | 1,402,307 | 8 | 122 | ||||||||||||

| 1 | Totals may not add due to rounding. |

| 2 | Occupancy shown for Seniors Housing excludes communities in lease-up. Occupancy for triple-net properties is as of 2Q09 and occupancy for operating properties is as of 3Q09. |

| 3 | Annualized third quarter Ventas revenue/NOI assuming all events occurred at the beginning of the period. Revenue/NOI reflects Ventas’s portion only for joint venture assets. |

| 4 | LIBOR floor of 3%. Excludes upfront fee equating to 0.67% per annum. |

| 5 | Outstanding principal is the approximate carrying value. |

5

Ventas, Inc.

Third Quarter 2009 Supplemental Data

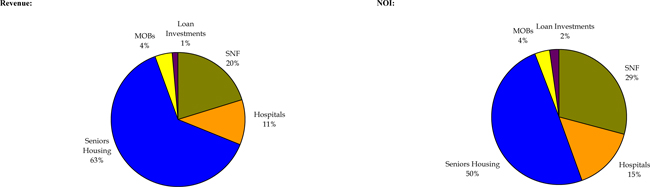

Owned and Loan Portfolio - Property Type Concentration (Dollars in Millions):1

| Investment Type |

Owned Property Count |

Ventas Investment |

% | Annualized Rent/ Revenue2 |

% | Annualized Rent/NOI2 |

% | |||||||||||||

| Seniors Housing |

243 | $ | 4,289 | 72 | % | $ | 557 | 63 | % | $ | 308 | 50 | % | |||||||

| Skilled Nursing |

187 | 809 | 14 | % | 179 | 20 | % | 179 | 29 | % | ||||||||||

| Hospital |

40 | 345 | 6 | % | 94 | 11 | % | 94 | 15 | % | ||||||||||

| Medical Office |

23 | 300 | 5 | % | 36 | 4 | % | 23 | 4 | % | ||||||||||

| Other |

8 | 7 | NM | 1 | NM | 1 | NM | |||||||||||||

| Loans |

N/A | 206 | 3 | % | 13 | 1 | % | 13 | 2 | % | ||||||||||

| Total |

501 | $ | 5,955 | 100 | % | $ | 880 | 100 | % | $ | 617 | 100 | % | |||||||

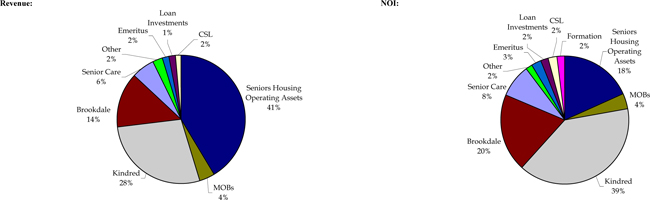

Owned and Loan Portfolio - Operator Concentration (Dollars in Millions):1

| Operator/Manager |

Owned Property Count |

Ventas Investment |

% | Annualized Rent/ Revenue2 |

% | Annualized Rent/NOI2 |

% | |||||||||||||

| Sunrise Senior Living |

79 | $ | 2,033 | 34 | % | $ | 363 | 41 | % | $ | 114 | 18 | % | |||||||

| Brookdale Senior Living |

84 | 1,403 | 24 | % | 122 | 14 | % | 122 | 20 | % | ||||||||||

| Kindred Healthcare |

197 | 906 | 15 | % | 244 | 28 | % | 244 | 39 | % | ||||||||||

| Senior Care |

65 | 621 | 10 | % | 51 | 6 | % | 51 | 8 | % | ||||||||||

| Emeritus Senior Living |

11 | 168 | 3 | % | 17 | 2 | % | 17 | 3 | % | ||||||||||

| Capital Senior Living |

11 | 158 | 3 | % | 14 | 2 | % | 14 | 2 | % | ||||||||||

| Manor Care |

N/A | 112 | 2 | % | 6 | 1 | % | 6 | 1 | % | ||||||||||

| NexCore |

4 | 93 | 2 | % | 12 | 1 | % | 7 | 1 | % | ||||||||||

| Formation |

11 | 88 | 1 | % | 11 | 1 | % | 11 | 2 | % | ||||||||||

| Greenfield |

7 | 51 | 1 | % | 6 | 1 | % | 4 | 1 | % | ||||||||||

| HCA |

1 | 51 | 1 | % | 4 | NM | 4 | 1 | % | |||||||||||

| Assisted Living Concepts |

8 | 50 | 1 | % | 5 | 1 | % | 5 | 1 | % | ||||||||||

| All Other |

23 | 221 | 4 | % | 25 | 3 | % | 19 | 3 | % | ||||||||||

| Total |

501 | $ | 5,955 | 100 | % | $ | 880 | 100 | % | $ | 617 | 100 | % | |||||||

Owned Portfolio - State/Province Concentration (Dollars in Millions):1

| State/Province |

Owned Property Count |

Annualized Rent/ Revenue2 |

% | Annualized Rent/NOI2 |

% | |||||||||

| California |

37 | $ | 111 | 13 | % | $ | 77 | 13 | % | |||||

| Illinois |

22 | 89 | 10 | % | 66 | 11 | % | |||||||

| Ontario |

9 | 50 | 6 | % | 12 | 2 | % | |||||||

| Massachusetts |

34 | 49 | 6 | % | 42 | 7 | % | |||||||

| Pennsylvania |

34 | 47 | 5 | % | 26 | 4 | % | |||||||

| New Jersey |

11 | 40 | 5 | % | 17 | 3 | % | |||||||

| Florida |

26 | 38 | 4 | % | 36 | 6 | % | |||||||

| Colorado |

15 | 34 | 4 | % | 19 | 3 | % | |||||||

| Georgia |

16 | 30 | 3 | % | 17 | 3 | % | |||||||

| New York |

14 | 29 | 3 | % | 19 | 3 | % | |||||||

| All Other |

283 | 350 | 40 | % | 273 | 45 | % | |||||||

| Total |

501 | $ | 867 | 100 | % | $ | 604 | 100 | % | |||||

| 1 | Totals may not add due to rounding. NM = not material. |

| 2 | Annualized third quarter Ventas revenue/NOI assuming all events occurred at the beginning of the period. Operating asset revenue/NOI reflects Ventas’s portion only for joint venture assets. |

6

Ventas, Inc.

Third Quarter 2009 Supplemental Data

Owned and Loan Portfolio - Property Type Concentration: 1

Owned and Loan Portfolio - Operator Concentration: 1

| 1 | Annualized third quarter Ventas revenue/NOI assuming all events occurred at the beginning of the period. Operating asset revenue/NOI reflects Ventas’s portion only for joint venture assets. Totals may not add due to rounding. |

7

Ventas, Inc.

Third Quarter 2009 Supplemental Data

Same-Store Triple-Net Portfolio Trend Data for Properties Owned for the Full 2nd Quarters of 2009 & 2008:1,2

| Sequential Quarter Comparison | Year-Over-Year Comparison | |||||||||||||||||||||||||

| Property Type |

Number of Properties |

2Q09 Cash Flow Coverage |

1Q09 Cash Flow Coverage |

2Q09 Occupancy |

1Q09 Occupancy |

2Q09 Cash Flow Coverage |

2Q08 Cash Flow Coverage |

2Q09 Occupancy |

2Q08 Occupancy |

|||||||||||||||||

| Hospital |

40 | 2.5 | x | 2.5 | x | 59.2 | % | 61.7 | % | 2.5 | x | 2.6 | x | 59.2 | % | 62.4 | % | |||||||||

| Skilled Nursing |

186 | 1.9 | x | 2.0 | x | 89.5 | % | 89.9 | % | 1.9 | x | 2.0 | x | 89.5 | % | 89.5 | % | |||||||||

| Seniors Housing |

164 | 1.3 | x | 1.3 | x | 87.0 | % | 87.2 | % | 1.3 | x | 1.3 | x | 87.0 | % | 87.7 | % | |||||||||

| Other |

8 | 5.1 | x | 5.2 | x | N/A | N/A | 5.1 | x | 4.9 | x | N/A | N/A | |||||||||||||

| Total |

398 | 1.8 | x | 1.8 | x | 1.8 | x | 1.8 | x | |||||||||||||||||

Same-Store Triple-Net Portfolio Trend Data for Properties Owned for the Full 1st and 2nd Quarters of 2009:1,2

| Sequential Quarter Comparison | ||||||||||||||

| Property Type |

Number of Properties |

2Q09 Cash Flow Coverage |

1Q09 Cash Flow Coverage |

2Q09 Occupancy |

1Q09 Occupancy |

|||||||||

| Hospital |

40 | 2.5 | x | 2.5 | x | 59.2 | % | 61.7 | % | |||||

| Skilled Nursing |

186 | 1.9 | x | 2.0 | x | 89.5 | % | 89.9 | % | |||||

| Seniors Housing |

164 | 1.3 | x | 1.3 | x | 87.0 | % | 87.2 | % | |||||

| Other |

8 | 5.1 | x | 5.2 | x | N/A | N/A | |||||||

| Total |

398 | 1.8 | x | 1.8 | x | |||||||||

| 1 | Second quarter 2009 is most recent quarter available. |

| 2 | Cash flow coverages are for trailing twelve months or annualized where the Company’s ownership is for a shorter period. |

8

Ventas, Inc.

Third Quarter 2009 Supplemental Data

Medical Office Portfolio Statistics:1

| Year-Over-Year Comparison | ||||||||||||||||||||||||

| Stabilized | Same-Store Stabilized2,3 | Lease-Up | ||||||||||||||||||||||

| 3Q09 | 3Q084 | 3Q09 | 3Q084 | 3Q09 | 3Q08 | |||||||||||||||||||

| Number of properties: |

19 | 19 | 17 | 17 | 4 | 2 | ||||||||||||||||||

| Number of square feet: |

1,046,828 | 1,046,828 | 870,700 | 870,700 | 355,479 | 181,952 | ||||||||||||||||||

| Average occupancy: |

94.0 | % | 95.6 | % | 93.1 | % | 95.2 | % | 70.6 | % | 57.8 | % | ||||||||||||

| Average annual rate per square foot:5 |

$ | 29 | $ | 27 | $ | 29 | $ | 27 | $ | 30 | $ | 26 | ||||||||||||

| Operating revenue: |

$ | 7.3 | $ | 6.3 | $ | 6.1 | $ | 5.9 | $ | 1.8 | $ | 0.8 | ||||||||||||

| Less expenses: |

2.6 | 1.9 | 2.3 | 1.8 | 0.7 | 0.4 | ||||||||||||||||||

| Total NOI: |

4.7 | 4.4 | 3.8 | 4.1 | 1.1 | 0.4 | ||||||||||||||||||

| Less Company’s partners’ share: |

0.2 | 0.4 | 0.2 | 0.4 | 0.1 | 0.0 | ||||||||||||||||||

| Ventas NOI: |

$ | 4.5 | $ | 4.0 | $ | 3.6 | $ | 3.7 | $ | 1.0 | $ | 0.4 | ||||||||||||

| Sequential Quarter Comparison | ||||||||||||||||||||||||

| Stabilized | Same-Store Stabilized2,3 | Lease-Up | ||||||||||||||||||||||

| 3Q09 | 2Q09 | 3Q09 | 2Q09 | 3Q09 | 2Q09 | |||||||||||||||||||

| Number of properties: |

19 | 19 | 19 | 19 | 4 | 3 | ||||||||||||||||||

| Number of square feet: |

1,046,828 | 1,046,828 | 1,046,828 | 1,046,828 | 355,479 | 280,363 | ||||||||||||||||||

| Average occupancy: |

94.0 | % | 93.5 | % | 94.0 | % | 93.5 | % | 70.6 | % | 67.2 | % | ||||||||||||

| Average annual rate per square foot:5 |

$ | 29 | $ | 29 | $ | 29 | $ | 29 | $ | 30 | $ | 28 | ||||||||||||

| Operating revenue: |

$ | 7.3 | $ | 7.3 | $ | 7.3 | $ | 7.3 | $ | 1.8 | $ | 1.0 | ||||||||||||

| Less expenses: |

2.6 | 2.6 | 2.6 | 2.6 | 0.7 | 0.3 | ||||||||||||||||||

| Total NOI: |

4.7 | 4.7 | 4.7 | 4.7 | 1.1 | 0.7 | ||||||||||||||||||

| Less Company’s partners’ share: |

0.2 | 0.2 | 0.2 | 0.2 | 0.1 | 0.0 | ||||||||||||||||||

| Ventas NOI: |

$ | 4.5 | $ | 4.5 | $ | 4.5 | $ | 4.5 | $ | 1.0 | $ | 0.7 | ||||||||||||

| 1 | Dollars in millions except for rate data. Totals may not add due to rounding. |

| 2 | Includes only those MOBs owned for the full period. |

| 3 | Includes only those MOBs owned in both comparison periods. |

| 4 | Restated to include two MOBs previously classified as non-operating. |

| 5 | Average annual rate includes CAM adjustments. |

9

Ventas, Inc.

Third Quarter 2009 Supplemental Data

Seniors Housing Operating Portfolio Statistics:1

| Year-Over-Year Comparison | ||||||||||||||||||||||||

| Stabilized | Same-Store Stabilized2 | Lease-Up | ||||||||||||||||||||||

| 3Q09 | 3Q08 | 3Q09 | 3Q08 | 3Q09 | 3Q08 | |||||||||||||||||||

| Number of properties: |

78 | 76 | 76 | 76 | 1 | 3 | ||||||||||||||||||

| Number of units: |

6,284 | 6,141 | 6,141 | 6,141 | 229 | 372 | ||||||||||||||||||

| Resident day capacity: |

684,752 | 668,656 | 668,836 | 668,656 | 23,552 | 39,468 | ||||||||||||||||||

| Average resident occupancy: |

88.1 | % | 91.5 | % | 88.3 | % | 91.5 | % | 72.0 | % | 59.1 | % | ||||||||||||

| Average daily rate / resident fees: |

$ | 173 | $ | 171 | $ | 173 | $ | 171 | $ | 136 | $ | 160 | ||||||||||||

| Operating revenue: |

$ | 104.2 | $ | 104.9 | $ | 101.9 | $ | 104.9 | $ | 2.3 | $ | 3.7 | ||||||||||||

| Less expenses: |

71.2 | 69.9 | 69.3 | 69.9 | 1.9 | 3.5 | ||||||||||||||||||

| Total NOI: |

33.0 | 34.9 | 32.6 | 34.9 | 0.4 | 0.3 | ||||||||||||||||||

| Less Company’s partner’s share: |

4.9 | 5.1 | 4.8 | 5.1 | 0.1 | 0.1 | ||||||||||||||||||

| Ventas NOI: |

$ | 28.1 | $ | 29.8 | $ | 27.8 | $ | 29.8 | $ | 0.3 | $ | 0.2 | ||||||||||||

| Sequential Quarter Comparison | ||||||||||||||||||||||||

| Stabilized | Same-Store Stabilized2 | Lease-Up | ||||||||||||||||||||||

| 3Q09 | 2Q09 | 3Q09 | 2Q09 | 3Q09 | 2Q09 | |||||||||||||||||||

| Number of properties: |

78 | 78 | 78 | 78 | 1 | 1 | ||||||||||||||||||

| Number of units: |

6,284 | 6,284 | 6,284 | 6,284 | 229 | 229 | ||||||||||||||||||

| Resident day capacity: |

684,752 | 677,131 | 684,752 | 677,131 | 23,552 | 23,296 | ||||||||||||||||||

| Average resident occupancy: |

88.1 | % | 87.2 | % | 88.1 | % | 87.2 | % | 72.0 | % | 67.9 | % | ||||||||||||

| Average daily rate / resident fees: |

$ | 173 | $ | 172 | $ | 173 | $ | 172 | $ | 136 | $ | 125 | ||||||||||||

| Operating revenue: |

$ | 104.2 | $ | 101.4 | $ | 104.2 | $ | 101.4 | $ | 2.3 | $ | 2.0 | ||||||||||||

| Less expenses: |

71.2 | 67.7 | 71.2 | 67.7 | 1.9 | 1.8 | ||||||||||||||||||

| Total NOI: |

33.0 | 33.7 | 33.0 | 33.7 | 0.4 | 0.2 | ||||||||||||||||||

| Less Company’s partner’s share: |

4.9 | 5.1 | 4.9 | 5.1 | 0.1 | 0.0 | ||||||||||||||||||

| Ventas NOI: |

$ | 28.1 | $ | 28.6 | $ | 28.1 | $ | 28.6 | $ | 0.3 | $ | 0.1 | ||||||||||||

| 1 | Dollars in millions except for rate data. Totals may not add due to rounding. |

| 2 | Includes only those communities stabilized in both comparison periods. |

10

Ventas, Inc.

Third Quarter 2009 Supplemental Data

Kindred Healthcare Same-Store TTM EBITDARM Coverage Ratios:1

| Number of Properties |

Sequential Quarter Comparison | Year-Over-Year Comparison | ||||||||||||

| Ventas - Kindred Master Lease |

2Q09 | 1Q09 | 2Q09 | 2Q08 | ||||||||||

| 1 |

81 | 2.3 | x | 2.3 | x | 2.3 | x | 2.4 | x | |||||

| 2 |

40 | 2.0 | x | 1.9 | x | 2.0 | x | 2.1 | x | |||||

| 3 |

36 | 1.7 | x | 1.9 | x | 1.7 | x | 2.0 | x | |||||

| 4 |

40 | 2.3 | x | 2.3 | x | 2.3 | x | 2.4 | x | |||||

| Total |

197 | 2.1 | x | 2.2 | x | 2.1 | x | 2.3 | x | |||||

| Property Type |

Number of Properties |

2Q09 | 1Q09 | 2Q09 | 2Q08 | |||||||||

| Hospital |

38 | 2.5 | x | 2.5 | x | 2.5 | x | 2.7 | x | |||||

| Skilled Nursing |

159 | 1.9 | x | 2.0 | x | 1.9 | x | 2.0 | x | |||||

| Total |

197 | 2.1 | x | 2.2 | x | 2.1 | x | 2.3 | x | |||||

| 1 | Coverage reflects the ratio of Kindred’s EBITDARM to rent. EBITDARM is defined as earnings before interest, income taxes, depreciation, amortization, rent and management fees. In the calculation of trailing twelve months EBITDARM, intercompany profit pertaining to services provided by Kindred’s PeopleFirst Rehabilitation Division has been eliminated from purchased ancillary expenses within the Ventas portfolio. Second quarter 2009 is most recent quarter available. |

11

Ventas, Inc.

Third Quarter 2009 Supplemental Data

Triple-Net and Operating Portfolio Revenue Rollover Schedule Excluding Seniors Housing Operating Communities:1

| Lease Rollover Year | ||||||||||||||||||||||||||||

| Totals | 2009 | 2010 | 2011 | 2012 | 2013 | Thereafter | ||||||||||||||||||||||

| Hospital - Stabilized Triple-Net: |

||||||||||||||||||||||||||||

| Annualized Revenue |

$ | 94.3 | — | — | — | — | $ | 46.9 | $ | 47.4 | ||||||||||||||||||

| Skilled Nursing - Stabilized Triple-Net: |

||||||||||||||||||||||||||||

| Annualized Revenue |

178.6 | — | — | — | $ | 2.2 | 70.5 | 105.9 | ||||||||||||||||||||

| Seniors Housing - Stabilized Triple-Net: |

||||||||||||||||||||||||||||

| Annualized Revenue |

193.8 | — | — | — | 1.7 | — | 192.2 | |||||||||||||||||||||

| Medical Office - Stabilized: |

||||||||||||||||||||||||||||

| Annualized Revenue2 |

28.0 | $ | 0.9 | $ | 3.2 | $ | 3.3 | 2.7 | 2.3 | 15.6 | ||||||||||||||||||

| Medical Office - Lease-Up: |

||||||||||||||||||||||||||||

| Annualized Revenue2 |

6.9 | — | 0.1 | 0.4 | 0.2 | 0.2 | 6.0 | |||||||||||||||||||||

| Other - Stabilized Triple-Net: |

||||||||||||||||||||||||||||

| Annualized Revenue |

1.0 | — | 1.0 | — | — | — | — | |||||||||||||||||||||

| Total: |

||||||||||||||||||||||||||||

| Annualized Revenue |

$ | 502.6 | $ | 0.9 | $ | 4.3 | $ | 3.7 | $ | 6.8 | $ | 119.9 | $ | 367.1 | ||||||||||||||

| Percent of Total: |

100 | % | 0 | % | 1 | % | 1 | % | 1 | % | 24 | % | 73 | % | ||||||||||||||

| 1 | Annualized third quarter Ventas revenue assuming all events occurred at the beginning of the period. Dollars in millions. Totals may not add due to rounding. |

| 2 | Company’s partners’ share has not been eliminated from revenue. |

12

Ventas, Inc.

Third Quarter 2009 Supplemental Data

Company Development Data:

| Status |

Property Name |

Ventas Ownership % |

MSA | Property Type |

Number of |

Actual/ Projected Opening Date |

Ventas Estimated/ Actual Acquisition Date |

Total Development Cost1 |

Ventas Fixed Purchase Price (incl. FPAC)1 |

Expected Stabilized Yield | |||||||||||||

| In Lease-up |

Sunrise of Thorne Mills on Steeles | 80 | % | Toronto | IL/AL/ALZ | 256 Residents /229 Units / 210,000 SF | September 2007 | December 2007 | Cdn $ | 62.8 | Cdn $ | 52.7 | 8.0%-8.5% | ||||||||||

| To Be Acquired |

Carroll MOB2 | 90 | % | Baltimore | MOB | 77,242 RSF | December 2009 | November 2011 | $ | 21.0 | N/A | 8.0%-8.5% | |||||||||||

| 1 | Dollars in millions. |

| 2 | Development cost is estimated cost to Ventas, subject to adjustments. |

13