Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

|

[X] |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended July 31, 2009 |

OR

|

[ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from ______ to ______ |

Commission file number 333-154709

PEPPER ROCK RESOURCES CORP.

Nevada

(State or other jurisdiction of incorporation or organization)

One Lincoln Centre

18 West 140 Butterfield Road, 15th Floor

Oakbrook Terrace, IL 60181

630-613-7487

|

Securities registered pursuant to Section 12(b) of the Act: |

Securities registered pursuant to section 12(g) of the Act: | |

|

NONE |

COMMON STOCK |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [X] No [ ]

Indicate by check mark whether the registrant(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No

[ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was

required to submit and post such files). Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment

to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer |

|

[ ] |

Accelerated Filer [ ] | |||

|

Non-accelerated Filer |

[ ] |

Smaller Reporting Company [X] | ||||

|

(Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [X] No [ ]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of July 31, 2009: $5,819,000.

TABLE OF CONTENTS

|

PART I |

Page |

|

Item 1. Business. |

3 |

|

Item 1A. Risk Factors. |

14 |

|

Item 1B. Unresolved Staff Comments. |

14 |

|

Item 2. Properties. |

14 |

|

Item 3. Legal Proceedings. |

14 |

|

Item 4. Submission of Matters to a Vote of Security Holders. |

14 |

|

PART II |

|

|

Item 5. Market For Common Stock and Related Stockholder Matters. |

15 |

|

Item 6. Selected Financial Data |

16 |

|

Item 7. Management’s Discussion and Analysis of Financial Condition or Plan of Operation. |

16 |

|

PART III |

|

|

Item 7A. Quantitative and Qualitative Disclosures about Market Risk. |

19 |

|

Item 8. Financial Statements and Supplementary Data. |

20 |

|

Item 9. Changes In and Disagreements With Accountants on Accounting and Financial Disclosure |

30 |

|

Item 9A. Controls and Procedures |

30 |

|

Item 9B. Other Information |

32 |

|

Item 10. Directors, Executive Officers, Promoters and Control Persons; Compliance with Section 16(a) of the Exchange Act |

32 |

|

Item 11. Executive Compensation |

35 |

|

Item 12. Security Ownership of Certain Beneficial Owners and Management |

37 |

|

Item 13. Certain Relationships and Related Transactions, and Director Independence |

37 |

|

PART IV |

|

|

Item 14. Principal Accountant Fees and Services. |

38 |

|

Item 15. Exhibits, Financial Statement Schedules. |

39 |

-2-

PART I

ITEM 1. BUSINESS

General

We were incorporated in the State of Nevada on May 29, 2008. We are an exploration stage corporation. An exploration stage corporation is one engaged in the search of mineral deposits or reserves which are not in either the development or production stage. We intend to conduct exploration activities

on the Pepper Rock Mining Claim located in Clark County, Nevada. We maintain our statutory registered agent's office at National Registered Agents, Inc. of NV, 1000 East William Street, Suite 204, Carson City, Nevada 89701 and our business office is located at One Lincoln Centre, 18 West 140 Butterfield Road - 15th Floor, Oakbrook Terrace, IL 60181. Our telephone number is 630-613-7487. This is our mailing address as well.

There is no assurance that a commercially viable mineral deposit exists on the property and further exploration will be required before a final evaluation as to the economic feasibility is determined.

We have no plans to change its business activities or to combine with another business, and are not aware of any events or circumstances that might cause its plans to change.

We have no revenues, have achieved losses since inception, have no operations, have been issued a going concern opinion and rely upon the sale of our securities and loans from our officer and director to fund operations.

The fee simple title to the property is owned by the United States of America. Sookochoff Consultants Inc. staked the land and has obtained a lease from the BLM. The property is referred to as “The Pepper Rock Claim”. We have the right to enter on

the property with our employees, representatives and agents, and to prospect, explore, test, develop, work and mine the property.

The property is unencumbered and there are no competitive conditions which affect the property. Further, there is no insurance covering the property and we believe that no insurance is necessary since the property is unimproved and contains no buildings or improvements.

To date we have not performed any work on the property. We are presently in the exploration stage and we cannot guarantee that a commercially viable mineral deposit, a reserve, exists in the property until further exploration is done and a comprehensive evaluation concludes economic and legal

feasibility.

-3-

Claim

The Pepper Lode Claim, comprising 20 acres, was located on June 14, 2008 and was filed in the Clark County recorder’s office in Las Vegas on June 19, 2008 as Instrument 20080619-0000219, File 081 Page 0073 in the official records book T20080120393. The Pepper Lode Claim

is located within Township 27S, Range 60E, in the SW of Section 31, in the Sunset Mining District of Clark County, Nevada.

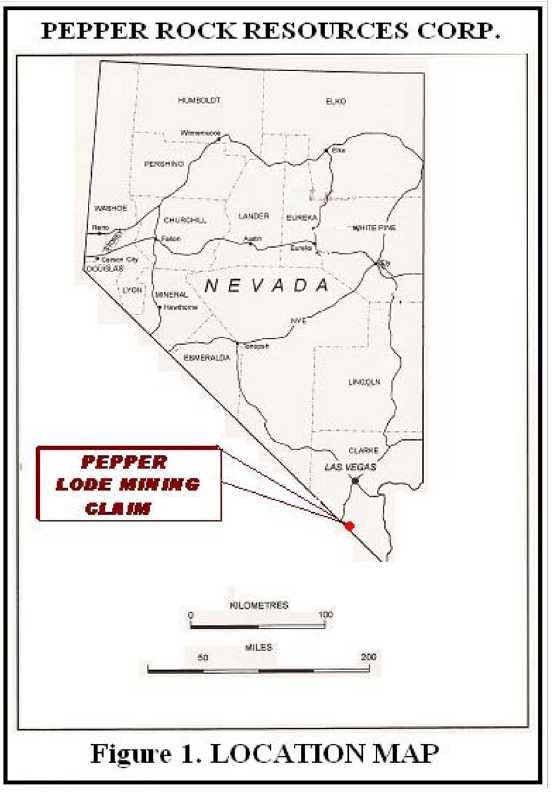

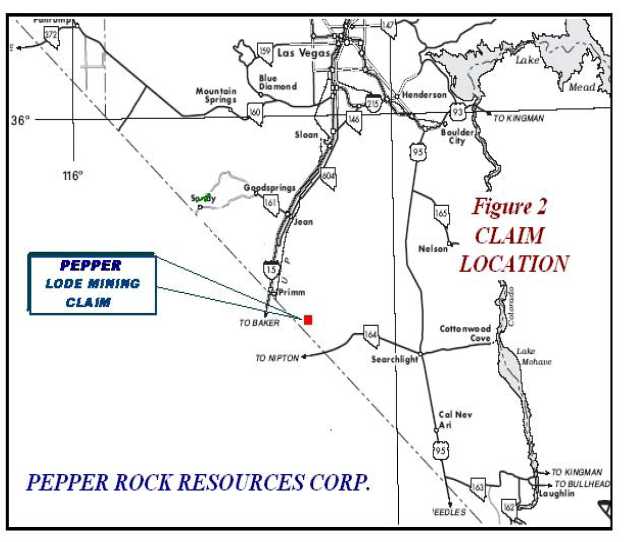

Location and Access

Access from Las Vegas, Nevada to the Pepper Lode Claim is southeastward to Boulder City, thence southward via Highway 95 to Searchlight, thence westward via Highway 164 to Crescent from where a sub-standard road is taken northward to the Pepper Lode Claim. The entire distance from Las Vegas

to the Pepper Lode Claim is approximately 84 miles.

-4-

Map 1

-5-

Map 2

-6-

Map 3

-7-

History

There is no reported production from the Pepper Rock Claim, however prospect pits within the confines of the Pepper Rock Claim indicate former exploration of mineral zones.

Physiography, Climate, Vegetation and Water

The Pepper Lode Claim is situated midway through the approximate 14 mile Lucy Grey Mountain Range, a north-south trending range of mountains with crests reaching elevations up to

2,500 feet. The claim covers the southwesterly facing slopes of a ridge bisected by an east/west trending valley. Topography on the Claim is gentle to moderate with an elevation of 800 feet at the southern portion of the Claim near the valley floor to an elevation of 850 feet along a northerly trending ridge along the centre of the Claim.

The Claim area is of a typically desert climate with relatively high temperatures and low precipitation. Vegetation consists mainly of desert shrubs and cactus. Sources of water would be

available from valley wells.

Regional Geology

Geologically, the Sunset district is the southern extension of the Yellow Pine District where the Mountain Ranges consist mainly of Paleozoic sediments which have

undergone intense folding accompanied by faulting. A series of Carboniferous sediments consist largely of siliceous limestones and include strata of pure crystalline limestone and dolomite with occasional intercalated beds of fine grained sandstone. These strata

have a general west to southwest dip of from 15 to 45 degrees which is occasionally disturbed by local folds. Igneous rocks are scarce and are represented chiefly by quartz-monzonite porphyry dikes and sills. The quartz-monzonite porphyry is intruded into these

strata and is of post-Jurassic age, perhaps Tertiary.

Property Geology

The Pepper Lode Claim is indicated to be underlain in part by basement Precambrian rocks overlain by the Cambrian to Devonian Goodsprings dolomite.

Supplies

Supplies and manpower are readily available for exploration of the property.

Other

Other than our interest in the property, we own no plants or other property.

-8-

Our Proposed Exploration Program

Working with a $22,000 budget, we plan on doing trenching work with a back-hoe to expose bedrock. Metal detecting, soil and rock chip sampling, and geological mapping will be done once the bedrock is exposed. The object of this work will be to determine if there is an economically

recoverable gold resource on this property. All sample locations will be marked and mapped. The initial phase of work will provide enough information to allow the company to decide whether or not to proceed to the next phase of exploration.

It will take us two to three weeks to complete the trenching and collect the samples. Samples will be shipped to American Assay Labs of Reno Nevada, certified assayers. It will take another two to three weeks to obtain results from the lab. We will plot all sample

locations on enlarged topo maps and provide GPS with these locations.

Funds will be used exclusively for trenching, grid installation, metal detection, sample collecting, supplies, shipping, lab costs, meals, motels, truck fuel and labor.

We must conduct exploration to determine what amount of minerals, if any, exist on our properties and if any minerals which are found can be economically extracted and profitably processed.

The property is undeveloped raw land. Exploration and surveying has not been initiated and will not be completed until we raise additional money. That is because we do not have money to complete exploration.

Before minerals retrieval can begin, we must explore for and find mineralized material. After that has occurred we have to determine if it is economically feasible to remove the mineralized material. Economically feasible means that the costs associated with the removal of the mineralized material

will not exceed the price at which we can sell the mineralized material. We can't predict what that will be until we find mineralized material.

We do not claim to have any minerals or reserves whatsoever at this time on any of the property.

The costs of our work program were provided by Professional Engineer and Geologist, Laurence Sookochoff. We will begin exploration activity in the spring of 2010.

We cannot provide you with a more detailed discussion of how our exploration program will work and what we expect will be our likelihood of success. That is because we have a piece of raw land and we intend to look for a gold ore body. We may or may not find an ore body. We

have the right to prospect, explore, test, develop, work and mine the property. We hope we do, but it is impossible to predict the likelihood of such an event. In addition, the nature and direction of the exploration may change depending upon initial results.

-9-

We do not have any plan to take our company to revenue generation. That is because we have not found economic mineralization yet and it is impossible to project revenue generation from nothing.

The following is an outline of the estimated costs of this first phase of exploration of this property:

|

Magnetometer Surveys |

$ |

8,500 |

|

Trenching |

$ |

11,500 |

|

Analyzing Samples |

$ |

2,000 |

Competitive Factors

The gold mining industry is fragmented, that is there are many, many gold prospectors and producers, small and large. We do not compete with anyone. That is because there is no competition for the exploration or removal of minerals from the property. We will either find gold on the property

or not. If we do not, we will cease or suspend operations. We are an infinitely small participant in the gold mining market. Readily available gold markets exist in the United States and around the world for the sale of gold. Therefore, we will be able to sell any gold that we are able to recover.

Rental Fee Requirement

The Federal government's Continuing Act of 2002 extends the requirement of rental or maintenance fees in place of assessment work for filing and holding mining claims with the BLM. All claimants must pay a yearly maintenance fee of $140 per claim for all or part of the mining claim assessment

year. The fee must be paid at the State Office of the Bureau of Land Management by August 31, of each year. We have paid this fee through 2010. The assessment year ends on noon of September 1 of each year. The initial maintenance fee is paid at the time the Notice of Location is filed with the BLM and covers the remainder of the assessment year in which the claim was located. There are no exemptions from the initial fee. Some claim holders may qualify for a Small Miner Exemption waiver of the maintenance

fee for assessment years after the year in which the claim was located. We do not qualify for a Small Miner Exemption. The following sets forth the BLM fee schedule:

|

Fee Schedule (per claim) | |

|

Location Fee |

$30.00 |

|

Maintenance Fee. |

$140.00 |

|

Service Charges |

$10.00 |

|

Transfer Fee |

$5.00 |

|

Proof of Labor |

$5.00 |

|

Notice of Intent to Hold |

$5.00 |

|

Transfer of Interest |

$5.00 |

|

Amendment |

$5.00 |

|

Petition for Deferment of Assessment Work |

$25.00 |

|

Notice of Intent to Locate on Stock Raising Homestead land |

$25.00 |

-10-

The BLM regulations provide for three types of operations on public lands: 1. Casual Use level, 2. Notice level and 3. Plan of Operation level.

1. Casual Use means activities ordinarily resulting in no or negligible disturbance of the public lands or resources. Casual Use operations involve simple prospecting with hand tools such as picks, shovels, and metal detectors. Small-scale mining devices such as dry washers having engines with

less than 10 brake-horsepower are allowed, provided they are fed using only hand tools. Casual Use level operations are not required to file an application to conduct activities or post a financial guarantee.

2. Notice level operations include only exploration activities in which five or less acres of disturbance are proposed. Presently, all Notice Level operations require a written notice and must be bonded for all activities other than reclamation.

3. Plans of Operation activities include all mining and processing (regardless of the size of the proposed disturbance), plus all other activities exceeding five acres of proposed public land disturbance.

Operators are encouraged to conduct a thorough inventory of the claim to determine the full extent of any existing disturbance and to meet with field office personnel at the site before developing an estimate. The inventory should include photographs taken "before" and "after" any mining activity.

If an operator constructs access or uses an existing access way for an operation and would object to BLM blocking, removing, or claiming that access, then the operator must post a financial guarantee that covers the reclamation of the access.

Concurrence by the BLM for occupancy is required whenever residential occupancy is proposed or when fences, gates, or signs will be used to restrict public access or when structures that could be used for shelter are placed on a claim. It is the claimant's responsibility to prepare a complete

notice or plan of operators.

Mining Claims On State Land

The Nevada law authorizing location of claims on State Lands was repealed in 1998. Acquisition of mineral rights on Nevada trust land can only be accomplished by application for a prospecting permit, mineral lease, or lease of common variety materials.

We will secure all necessary permits for exploration and, if development is warranted on the property, will file final plans of operation before we start any mining operations. We anticipate no discharge of water into active stream, creek, river, lake or any other body of water regulated by

environmental law or regulation. No endangered species will be disturbed. Restoration of the disturbed land will be completed according to law. All holes, pits and shafts will be sealed upon abandonment of the property. It is difficult to estimate the cost of compliance with the environmental law since the full nature and extent of our proposed activities cannot be determined until we start our operations and know what that will involve from an environmental standpoint.

We are in compliance with all laws and will continue to comply with the laws in the future. We believe that compliance with the laws will not adversely affect our business operations.

-11-

We are responsible to provide a safe working environment, not disrupt archaeological sites, and conduct our activities to prevent unnecessary damage to the property.

We will secure all necessary permits for exploration and, if development is warranted on the property, will file final plans of operation before we start any mining operations. At this point, a permit from the BLM would be required. Also, we would be required to comply with the laws of the state

of Nevada and federal regulations. We anticipate no discharge of water into active stream, creek, river, lake or any other body of water regulated by environmental law or regulation. No endangered species will be disturbed. Restoration of the disturbed land will be completed according to law. All holes, pits and shafts will be sealed upon abandonment of the property. It is difficult to estimate the cost of compliance with the environmental law since the full nature and extent of our proposed activities cannot

be determined until we start our operations and know what that will involve from an environmental standpoint.

Exploration stage companies have no need to discuss environmental matters, except as they relate to exploration activities. The only "cost and effect" of compliance with environmental regulations in the State of Nevada is returning the surface to its previous condition upon abandonment of the

property. We will only be using "non-intrusive" exploration techniques and will not leave any indication that a sample was taken from the area. Gold Property Services, Ltd. and the employees will be required to leave the area in the same condition as they found it - on a daily basis.

We have not allocated any funds for the cost of reclamation of the property. Mr. Daye, our president, has agreed to pay the cost of reclamation should we not find mineralized material.

Subcontractors

We intend to use the services of a consultant who will supervise the subcontractors for manual labor exploration work on our property. We have not selected the consultant as of the date of this prospectus and will not do so until we have completed this offering.

Employees and Employment Agreements

At present, we have no full-time employees. Our sole officer and director is a part-time employee devotes about 10% of his time or four hours per week to our operation. Our sole officer and director does not have an employment agreement with us. We presently do not have pension, health, annuity,

insurance, stock options, profit sharing or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our officer and director. Our sole officer and director will handle our administrative duties. Because our sole officer and director is inexperienced with exploration, he will hire qualified persons to perform our exploration activities. As of today, we have not looked for or talked to any geologists or engineers who will perform work

for us in the future. We do not intend to do so until we complete this offering.

-12-

Property Interests and Mining Claims in General

Mining claims are subject to the same risk of defective title that is common to all real property interests. Additionally, mining claims are self-initiated and self-maintained and therefore, possess some unique vulnerabilities not associated with other types of property interests. It is impossible

to ascertain the validity of unpatented mining claims solely from an examination of the public real estate records and, therefore, it can be difficult or impossible to confirm that all of the requisite steps have been followed for location and maintenance of a claim. If the validity of a patented mining claim is challenged by the BLM or the U.S. Forest Service on the grounds that mineralization has not been demonstrated, the claimant has the burden of proving the present economic feasibility of mining minerals

located thereon. Such a challenge might be raised when a patent application is submitted or when the government seeks to include the land in an area to be dedicated to another use.

Reclamation

We generally are required to mitigate long-term environmental impacts by stabilizing, contouring, resloping and revegetating various portions of a site after mining and mineral processing operations are completed. These reclamation efforts will be conducted in accordance with detailed plans,

which must be reviewed and approved by the appropriate regulatory agencies.

Government Regulation

Mining operations and exploration activities are subject to various national, state, and local laws and regulations in the United States, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment,

mine safety, hazardous substances and other matters. We will obtain the licenses, permits or other authorizations currently required to conduct our exploration program. We believe that we are in compliance in all material respects with applicable mining, health, safety and environmental statutes and the regulations passed thereunder in the Nevada and United States.

Our mineral exploration program is subject to the regulations of the Bureau of Land Management. The prospecting on the property is provided under the existing 1872 Mining Law and all permits for exploration and testing must be obtained through the local Bureau of Land Management (BLM)

office of the Department of Interior. Obtaining permits for minimal disturbance as envisioned by this exploration program will require making the appropriate application and filing of the bond to cover the reclamation of the test areas. From time to time, an archeological clearance may need to be contracted to allow the testing program to proceed.

Environment Regulations

Our activities are subject to various federal and state laws and regulations governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive. We intend to conduct business in a way that safeguards public health and the environment. We

will conduct our operational compliance with applicable laws and regulations.

-13-

Changes to current state or federal laws and regulations in Nevada, where we intend to operate could in the future require additional capital expenditures and increased operating and/or reclamation costs. Although we are unable to predict what additional legislation, if any, might be proposed

or enacted, additional regulatory requirements could impact the economics of our projects.

Since inception on May 29, 2008, there were no material environmental incidents or non-compliance with any applicable environmental regulations on the Pepper Lode Claim

Our Office

Our office is located at One Lincoln Centre, 18 West 140 Butterfield Road - 15th Floor, Oakbrook Terrace, IL 60181. Our telephone number is 630-613-7487. Our office is leased at a rate of $175.00 per month.

|

ITEM 1A. |

RISK FACTORS |

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

|

ITEM 1B. |

UNRESOLVED STAFF COMMENTS |

None.

|

ITEM 2. |

PROPERTIES |

We own one mining claim, the Pepper Lode Claim which is described in Item 1 of this report.

|

ITEM 3. |

LEGAL PROCEEDINGS |

We are not presently a party to any litigation.

|

ITEM 4. |

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

During the fourth quarter, there were no matters submitted to a vote of our shareholders.

-14-

PART II

|

ITEM 5. |

MARKET FOR COMMON STOCK AND RELATED STOCKHOLDER MATTERS |

Our stock was listed for trading on the Bulletin Board operated the Financial Industry Regulatory Authority (FINRA) on January 21, 2009. We trade under the symbol “PEPR”. There are no outstanding options or warrants to purchase, or securities convertible into, our common stock.

|

Fiscal Year |

|||

|

2009 |

High Bid |

Low Bid | |

|

Fourth Quarter: 5/1/09 to 7/31/09 |

$1.15 |

$1.10 | |

|

Third Quarter: 2/1/09 to 4/30/09 |

$0.00 |

$0.00 | |

|

Second Quarter: 11/1/08 to 1/31/09 |

$0.00 |

$0.00 | |

|

First Quarter: 8/1/08 to 10/31/08 |

$0.00 |

$0.00 | |

|

Fiscal Year |

|||

|

2008 |

High Bid |

Low Bid | |

|

Fourth Quarter: 5/1/08 to 7/31/08 |

$0.00 |

$0.00 | |

|

Third Quarter: 2/1/08 to 4/30/08 |

$0.00 |

$0.00 | |

|

Second Quarter: 11/1/07 to 1/31/08 |

$0.00 |

$0.00 | |

|

First Quarter: 8/1/07 to 10/31/07 |

$0.00 |

$0.00 | |

Holders

On July 31, 2009, we had 45 shareholders of record of our common stock.

Dividend Policy

We have not declared any cash dividends. We do not intend to pay dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

Section 15(g) of the Securities Exchange Act of 1934

Our shares are covered by section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in

excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser's written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary

market.

-15-

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important

to in understanding of the function of the penny stock market, such as id and offer quotes, a dealers spread and broker/dealer compensation; the broker/dealer compensation, the broker/dealers duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers rights and remedies in causes of fraud in penny stock transactions; and, the FINRA’s toll free telephone number and the central number of the North American Administrators Association, for

information on the disciplinary history of broker/dealers and their associated persons.

Securities Authorized for Issuance Under Equity Compensation Plans

We have no equity compensation plans and accordingly we have no shares authorized for issuance under an equity compensation plan.

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

This section of the report includes a number of forward- looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar

expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this report. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

Plan of Operation

We are a start-up, exploration stage corporation and have not yet generated or realized any revenues from our business activities.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay our bills. This is because we have not generated any revenues and no revenues are anticipated

until we begin removing and selling minerals. Accordingly, we must raise cash from sources other than the sale of minerals found on the property. Our only other sources for cash at this time are loans from related parties and additional sales of common stock. Our success or failure will be determined by what additional financing we obtain and what we find under the ground.

-16-

We raised money from our private placement however we have spent all of it. We have to raise additional money to complete exploring our property. If we find mineralized material and it is economically feasible to remove the mineralized material, we will attempt to raise even more

money through a subsequent private placement, public offering or through loans. If we do not have enough money to complete our exploration of the property, we will have to find alternative sources, like a public offering, an additional private placement of securities, or loans from our officer or others.

Our sole officer and director is unwilling to make any commitment at this time to loan us money. At the present time, we have not made any arrangements to raise additional cash. If we need additional cash and can't raise it, we will either have to suspend activities until we do raise the cash,

seek additional opportunities, or cease activities entirely. Other than as described in this paragraph, we have no other financing plans.

We have the right to conduct exploration activities on one property. Even if we complete our current exploration program and it is successful in identifying a mineral deposit, we will have to spend substantial funds on further drilling and engineering studies before we will know if we have a

commercially viable mineral deposit, a reserve.

We will be conducting research in the form of exploration of the property. Our exploration program is explained in as much detail as possible in the business section of our Form S-1 registration statement. We are not going to buy or sell any plant or significant equipment during the next twelve

months. We will not buy any equipment until we have located a reserve and we have determined it is economical to extract the minerals from the land.

We do not intend to involve other companies in the property if we find mineralized materials. We intend to try to develop the reserves ourselves.

If we can’t or don’t raise more money, we will either cease activities or look for other opportunities. If we cease activities, we don’t know what we will do and we don’t have any plans to do anything.

We do not intend to hire additional employees at this time. All of the work on the property will be conducted by unaffiliated independent contractors that we will hire. The independent contractors will be responsible for surveying, geology, engineering, exploration, and excavation. The geologists

will evaluate the information derived from the exploration and excavation and the engineers will advise us on the economic feasibility of removing the mineralized material.

Milestones

The milestones are as follows:

The milestones are as follows:

1. Raise additional capital.

2. Retain our consultant to manage the exploration of the property. - Maximum cost of $5,000. Time of retention 0-90 days.

-17-

3. Trenching. Trenching will cost approximately $14,000 and will be conducted by unrelated subcontractors. Trenching includes grid installation, metal detection, sample collecting and shipping the samples for testing.

4. Have an independent third party analyze the samples. We estimate that it will cost $2,000 to analyze the samples and will take 30 days.

We have nominal cash at the present time and cannot operate until we raise additional capital.

Limited Operating History; Need for Additional Capital

There is no historical financial information about us upon which to base an evaluation of our performance. We are an exploration stage corporation and have not generated any revenues from activities. We cannot guarantee we will be successful in our business activities. Our business is subject

to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of our properties, and possible cost overruns due to price and cost increases in services.

To become profitable and competitive, we conduct research and exploration of our properties before we start production of any minerals we may find. We will be seeking equity financing to provide for the capital required to implement our research and exploration phases.

We have no assurance that future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our operations. Equity financing could result in additional dilution to existing shareholders.

Liquidity and Capital Resources

Since inception, we have issued 11,560,000 shares of our common stock and received $57,100.

As of the date of this report, we have conducted limited operations and therefore have not generated any revenues.

In May 29, 2008, we issued 6,500,000 shares of common stock to our sole officer and director, Curtis C. Daye, pursuant to the exemption from registration contained in Regulation S of the Securities Act of 1933. The purchase price of the shares was $6,500. This was accounted

for as an acquisition of shares. Curtis C. Daye covered some of our initial expenses by paying $184 for incorporation documents, administrative costs, and courier costs. The amount owed to Mr. Daye is non-interest bearing, unsecured and due on demand. Further, the agreement with Mr. Daye is oral and there is no written document evidencing the agreement.

On July 8, 2008, we issued 5,060,000 shares of common stock to 46 individuals in consideration of $50,600.

As of July 31, 2009, our total assets were $940 and our total liabilities were $8,441.

-18-

Recent accounting pronouncements

We do not expect the adoption of recently issued accounting pronouncements to have a significant impact on our results of operations, financial position or cash flow.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

-19-

|

ITEM 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. |

Pepper Rock Resources Corp.

(An Exploration Stage Company)

July 31, 2009

Index

Report of Independent Registered Public Accounting Firm ......................................................................F–1

Balance Sheets ..................................................................................................................................................F–2

Statements of Expenses ...................................................................................................................................F–3

Statements of Cash Flows ...............................................................................................................................F–4

Statements of Stockholder’s Equity (Deficit) ...............................................................................................F–5

Notes to the Financial Statements .................................................................................................................F–6

-20-

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To The Board of Directors

Pepper Rock Resources Corp

We have audited the accompanying balance sheets of Pepper Rock Resources Corp, (“Pepper Rock”) as of July 31, 2009 and 2008 and the related statements of expenses, changes in stockholders’ equity (deficit) and cash flows for the years then ended July 31, 2009 and from May 29, 2008 (inception) through July 31, 2009 and 2008.

These financial statements are the responsibility of Pepper Rock’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatements. The Company is not required to have, nor were

we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures

in the consolidated financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall consolidated financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of Pepper Rock as of July 31, 2009 and 2008 and the results of its operations and its cash flows for the years then ended July 31, 2009 and the period from inception through July 31, 2009 and 2008 in

conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that Pepper Rockwill continue as a going concern. As discussed in Note 3 to the financial statements, Pepper Rock has no revenues and suffered losses from operations, which raises substantial doubt about its ability to continue as a going concern. Management’s plans

regarding those matters are described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

MALONE & BAILEY, PC

www.malone-bailey.com

Houston, Texas

October 29, 2009

-21-

Pepper Rock Resources Corp.

(An Exploration Stage Company)

Balance Sheets

|

July 31,

2009 |

July 31,

2008 |

|||||||

|

ASSETS |

||||||||

|

Current Assets |

||||||||

|

Cash |

$ | 590 | $ | 32,793 | ||||

|

Prepaid expenses |

350 | 128 | ||||||

|

Total Assets |

$ | 940 | $ | 32,921 | ||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) |

||||||||

|

Current Liabilities |

||||||||

|

Accounts payable and accrued liabilities |

$ | 8,257 | $ | – | ||||

|

Due to related party |

184 | 125 | ||||||

|

Total Liabilities |

8,441 | 125 | ||||||

|

Contingencies and Commitments |

||||||||

|

Stockholders’ Equity (Deficit) |

||||||||

|

Preferred Stock, 100,000,000 shares authorized, $0.00001 par value;

No shares issued and outstanding |

– | – | ||||||

|

Common Stock, 100,000,000 shares authorized, $0.00001 par value;

11,560,000 shares issued and outstanding |

116 | 116 | ||||||

|

Additional Paid-in Capital |

62,584 | 57,784 | ||||||

|

Deficit Accumulated During the Exploration Stage |

(70,201 | ) | (25,104 | ) | ||||

|

Total Stockholders’ Equity (Deficit) |

(7,501 | ) | 32,796 | |||||

|

Total Liabilities and Stockholders’ Equity (Deficit) |

$ | 940 | $ | 32,921 | ||||

(The Accompanying Notes are an Integral Part of These Financial Statements)

F-2

-22-

Pepper Rock Resources Corp.

(An Exploration Stage Company)

Statements of Expenses

|

For the |

From |

From |

||||||||||

|

Year |

May 29, 2008 |

May 29, 2008 |

||||||||||

|

Ended |

(Date of Inception) |

(Date of Inception) |

||||||||||

|

July 31, |

to July 31, |

to July 31, |

||||||||||

|

2009 |

2008 |

2009 |

||||||||||

|

Expenses |

||||||||||||

|

General and administrative |

$ | 5,892 | $ | 1,304 | $ | 7,196 | ||||||

|

Management services |

4,800 | 800 | 5,600 | |||||||||

|

Professional fees |

34,110 | 15,000 | 49,110 | |||||||||

|

Impairment of mineral properties |

– | 5,000 | 5,000 | |||||||||

|

Exploration costs |

295 | 3,000 | 3,295 | |||||||||

|

Total Expenses |

$ | 45,097 | $ | 25,104 | $ | 70,201 | ||||||

|

Net Loss for the Period |

$ | (45,097 | ) | $ | (25,104 | ) | $ | (70,201 | ) | |||

|

Net Loss Per Share – Basic and Diluted |

$ | (0.00) | $ | (0.00) | n/a | |||||||

|

Weighted Average Common Shares Outstanding |

11,560,000 | 11,560,000 | n/a | |||||||||

(The Accompanying Notes are an Integral Part of These Financial Statements)

F-3

-23-

Pepper Rock Resources Corp.

(An Exploration Stage Company)

Statements of Cash Flows

|

For the

Year

Ended

July 31,

2009 |

From

May 29, 2008

(Date of Inception)

to July 31,

2008 |

From

May 29, 2008

(Date of Inception)

to July 31,

2009 |

||||||||||

|

Operating Activities |

||||||||||||

|

Net loss for the period |

$ | (45,097 | ) | $ | (25,104 | ) | $ | (70,201 | ) | |||

|

Adjustment to reconcile net loss to net cash used in operating activities: |

||||||||||||

|

Donated services |

4,800 | 800 | 5,600 | |||||||||

|

Impairment of mineral properties |

– | 5,000 | 5,000 | |||||||||

|

Changes in operating assets and liabilities: |

||||||||||||

|

Prepaid expenses |

(222 | ) | (128 | ) | (350 | ) | ||||||

|

Accounts payable and accrued liabilities |

8,257 | – | 8,257 | |||||||||

|

Net Cash Used in Operating Activities |

(32,262 | ) | (19,432 | ) | (51,694 | ) | ||||||

|

Investing Activities |

||||||||||||

|

Mineral property costs |

– | (5,000 | ) | (5,000 | ) | |||||||

|

Net Cash Used in Investing Activities |

– | (5,000 | ) | (5,000 | ) | |||||||

|

Financing Activities |

||||||||||||

|

Due to related parties |

59 | 125 | 184 | |||||||||

|

Proceeds from issuance of common stock |

– | 57,100 | 57,100 | |||||||||

|

Net Cash Provided by Financing Activities |

59 | 57,225 | 57,284 | |||||||||

|

Increase in Cash |

(32,203 | ) | 32,793 | 590 | ||||||||

|

Cash - Beginning of Period |

32,793 | – | – | |||||||||

|

Cash - End of Period |

$ | 590 | $ | 32,793 | $ | 590 | ||||||

|

Supplemental Disclosures |

||||||||||||

|

Interest paid |

$ | – | $ | – | $ | – | ||||||

|

Income taxes paid |

$ | – | $ | – | $ | – | ||||||

(The Accompanying Notes are an Integral Part of These Financial Statements)

F-4

-24-

Pepper Rock Resources Corp.

(An Exploration Stage Company)

Statement of Stockholders’ Equity (Deficit)

From May 29, 2008 (Date of Inception) to July 31, 2009

|

Deficit |

||||||||||||||||||||

|

Accumulated |

||||||||||||||||||||

|

Common Stock |

Additional |

During the |

||||||||||||||||||

|

Par |

Paid-in |

Exploration |

||||||||||||||||||

|

Shares |

Value |

Capital |

Stage |

Total |

||||||||||||||||

|

Issuance of common stock for cash at $0.00001 per share |

6,500,000 | $ | 65 | $ | 6,435 | $ | – | $ | 6,500 | |||||||||||

|

Issuance of common stock for cash at $0.00001 per share |

5,060,000 | 51 | 50,549 | – | 50,600 | |||||||||||||||

|

Donated services |

– | – | 800 | – | 800 | |||||||||||||||

|

Net loss for the period |

– | – | – | (25,104 | ) | (25,104 | ) | |||||||||||||

|

Balance – July 31, 2008 |

11,560,000 | $ | 116 | $ | 57,784 | $ | (25,104 | ) | $ | 32,796 | ||||||||||

|

Donated services |

– | – | 4,800 | – | 4,800 | |||||||||||||||

|

Net loss for the year |

– | – | – | (45,097 | ) | (45,097 | ) | |||||||||||||

|

Balance – July 31, 2009 |

11,560,000 | $ | 116 | $ | 62,584 | $ | (70,201 | ) | $ | (7,501 | ) | |||||||||

(The Accompanying Notes are an Integral Part of These Financial Statements)

F-5

-25-

Pepper Rock Resources Corp.

(An Exploration Stage Company)

Notes to the Financial Statements

July 31, 2009

1. Nature of Operations and Continuation of Business

Pepper Rock Resources Corp. (the “Company”) was incorporated in the State of Nevada on May 29, 2008. The Company is an Exploration Stage Company as defined by Statement of Financial Accounting Standard (“SFAS”) No. 7 “Accounting and Reporting for Development

Stage Enterprises”. The Company’s principal business is the acquisition and exploration of mineral resources.

2. Summary of Significant Accounting Policies

|

a) |

Basis of Presentation |

These financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States, and are expressed in US dollars. The Company’s fiscal year-end is July 31.

|

b) |

Use of Estimates |

The preparation of financial statements in conformity with generally accepted accounting principles in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the

reported amounts of revenues and expenses during the reporting period. The Company regularly evaluates estimates and assumptions related to the recoverability of mineral property costs, donated expenses and deferred income tax asset valuation allowances. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of

assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

|

c) |

Cash and Cash Equivalents |

The Company considers all highly liquid instruments with maturity of three months or less at the time of issuance to be cash equivalents.

|

d) |

Loss Per Share |

The Company computes net earnings (loss) per share in accordance with SFAS No. 128, "Earnings per Share". SFAS No. 128 requires presentation of both basic and diluted earnings per share (“EPS”) on the face of the income statement. Basic EPS is computed by dividing

net earnings (loss) available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants.

Diluted EPS excludes all dilutive potential shares if their effect is anti dilutive.

|

e) |

Asset Retirement Obligations |

The Company follows the provisions of SFAS No. 143, "Accounting for Asset Retirement Obligations," which establishes standards for the initial measurement and subsequent accounting for obligations associated with the sale, abandonment or other disposal of long-lived tangible assets arising from the acquisition, construction or development

and for normal operations of such assets.

|

f) |

Long-lived Assets |

In accordance with SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets”, the Company tests long-lived assets or asset groups for recoverability when events or changes in circumstances indicate that their carrying amount may not be recoverable.

Circumstances which could trigger a review include, but are not limited to: significant decreases in the market price of the asset; significant adverse changes in the business climate or legal factors; accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of the asset; current period cash flow or operating losses combined with a history of losses or a forecast of continuing losses associated with the use of the asset; and current expectation that the

asset will more likely than not be sold or disposed significantly before the end of its estimated useful life.

F-6

-26-

Pepper Rock Resources Corp.

(An Exploration Stage Company)

Notes to the Financial Statements

July 31, 2009

Recoverability is assessed based on the carrying amount of the asset and its fair value which is generally determined based on the sum of the undiscounted cash flows expected to result from the use and the eventual disposal of the asset, as well as specific appraisal in certain instances. An impairment loss is recognized when the carrying

amount is not recoverable and exceeds fair value.

|

g) |

Mineral Property Costs |

The Company is primarily engaged in the acquisition, exploration and development of mineral properties.

Mineral property acquisition costs are capitalized in accordance with EITF 04-2 “Whether Mineral Rights Are Tangible or Intangible Assets” when management has determined that probable future benefits consisting of a contribution to future cash inflows have been identified

and adequate financial resources are available or are expected to be available as required to meet the terms of property acquisition and budgeted exploration and development expenditures. Mineral property acquisition costs are expensed as incurred if the criteria for capitalization are not met. In the event that a mineral property is acquired through the issuance of the Company’s shares, the mineral property will be recorded at the fair value of the respective property or the fair

value of common shares, whichever is more readily determinable.

Mineral property exploration costs are expensed as incurred.

When mineral properties are acquired under option agreements with future acquisition payments to be made at the sole discretion of the Company, those future payments, whether in cash or shares, are recorded only when the Company has made or is obliged to make the payment or issue the shares. Because option payments do not meet

the definition of tangible property under EITF 04-2, all option payments are expensed as incurred.

When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves and pre feasibility, the costs incurred to develop such property are capitalized.

Estimated future removal and site restoration costs, when determinable are provided over the life of proven reserves on a units-of-production basis. Costs, which include production equipment removal and environmental remediation, are estimated each period by management based on current regulations, actual expenses incurred, and technology

and industry standards. Any charge is included in exploration expense or the provision for depletion and depreciation during the period and the actual restoration expenditures are charged to the accumulated provision amounts as incurred.

As of the date of these financial statements, the Company has incurred only acquisition and exploration costs which have been expensed.

|

h) |

Foreign Currency Transactions |

The Company’s functional and reporting currency is the United States dollar. Occasional transactions may occur in Canadian dollars and management has adopted SFAS No. 52 “Foreign Currency Translation”. Monetary assets and liabilities denominated in foreign currencies

are translated using the exchange rate prevailing at the balance sheet date. Non-monetary assets and liabilities denominated in foreign currencies are translated at rates of exchange in effect at the date of the transaction. Average monthly rates are used to translate revenues and expenses. Gains and losses arising on translation or settlement of foreign currency denominated transactions or balances are included in the determination of net income (loss). The Company has not, to the date of these financial statements,

entered into derivative instruments to offset the impact of foreign currency fluctuations.

|

i) |

Income Taxes |

Potential benefits of income tax losses are not recognized in the accounts until realization is more likely than not. The Company has adopted SFAS No. 109 “Accounting for Income Taxes” as of its inception. Pursuant to SFAS No. 109 the Company is required to compute tax

asset benefits for net operating losses carried forward. Potential benefit of net operating losses have not been recognized in these financial statements because the Company cannot be assured it is more likely than not it will utilize the net operating losses carried forward in future years.

|

j) |

Recent Accounting Pronouncements |

We do not expect the adoption of recently issued accounting pronouncements to have a significant impact on our results of operations, financial position or cash flow.

F-7

-27-

Pepper Rock Resources Corp.

(An Exploration Stage Company)

Notes to the Financial Statements

July 31, 2009

3. Going Concern

These financial statements have been prepared on a going concern basis, which implies that the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has not generated any revenue since inception and has never paid any dividends and is unlikely to pay dividends or generate

earnings in the immediate or foreseeable future. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations, and the attainment of profitable operations. As at July 31, 2009, the Company has accumulated losses since inception. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. These financial statements

do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

4. Related Party Transactions

|

a) |

For the fiscal period ended July 31, 2009 and 2008, the Company recognized $4,800 and $800 respectively for donated services at $400 per month provided by the President of the Company. |

|

b) |

As at July 31, 2009 and 2008 the Company is indebted to the President of the Company for $184 and 2008 $125 respectively for expenses paid on behalf of the Company. This amount is non-interest bearing, unsecured and due on demand. |

5. Mineral Property

On July 8, 2008, the Company paid $5,000 for a 100% interest in a mineral claim located in Nevada, and $3,000 for a geological report conducted on the respective mining claim. The cost of the mineral property was initially capitalized. At July 31, 2009, the Company recognized an impairment loss of $5,000, as it has not yet been determined

whether there are proven or probable reserves on the property.

6. Common Stock

|

a) |

On July 8, 2008, the Company issued 5,060,000 shares of common stock at $0.01 per share for cash proceeds of $50,600. |

|

b) |

On May 30, 2008, the Company issued 6,500,000 shares of common stock at $0.001 per share to the President of the Company for cash proceeds of $6,500. |

7. Income Taxes

The Company accounts for income taxes under SFAS No. 109, "Accounting for Income Taxes." Deferred income tax assets and liabilities are determined based upon differences between financial reporting and tax bases of assets and liabilities and are measured using the enacted tax rates

and laws that will be in effect when the differences are expected to reverse. Income tax expense differs from the amount that would result from applying the U.S federal and state income tax rates to earnings before income taxes. The Company has a net operating loss carryforward of $63,101 available to offset taxable income in future years which begins to expire in fiscal 2028. Pursuant to SFAS 109, the potential benefit of the net operating loss carryforward has not been recognized in the consolidated financial

statements since the Company cannot be assured that it is more likely than not that such benefit will be utilized in future years.

F-8

-28-

Pepper Rock Resources Corp.

(An Exploration Stage Company)

Notes to the Financial Statements

July 31, 2009

The Company is subject to United States federal and state income taxes at an approximate rate of 35%. The reconciliation of the provision for income taxes at the United States federal statutory rate compared to the Company’s income tax expense as reported is as follows:

|

July 31,

2009 |

July 31,

2008 |

|||||||

|

Net loss before income taxes per financial statements |

$ | 45,097 | $ | 25,104 | ||||

|

Income tax rate |

35% | 35% | ||||||

|

Income tax recovery |

(15,784 | ) | (8,786 | ) | ||||

|

Permanent differences |

1,680 | 280 | ||||||

|

Temporary differences |

(140 | ) | 665 | |||||

|

Valuation allowance change |

14,244 | 7,841 | ||||||

|

Provision for income taxes |

$ | – | $ | – | ||||

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Deferred income taxes arise from temporary differences in the recognition of income and expenses for financial reporting and tax

purposes. The significant components of deferred income tax assets and liabilities are as follows:

|

July 31,

2009 |

July 31,

2008 |

|||||||

|

Net operating loss carryforward |

$ | 22,610 | $ | 8,506 | ||||

|

Unamortized costs of incorporation |

$ | (525 | ) | $ | (665 | ) | ||

|

Valuation allowance |

(22,085 | ) | (7,841 | ) | ||||

|

Net deferred income tax asset |

$ | – | $ | – | ||||

The Company has recognized a valuation allowance for the deferred income tax asset since the Company cannot be assured that it is more likely than not that such benefit will be utilized in future years. The valuation allowance is reviewed annually. When circumstances change and which cause a change in management's judgment about the realizability

of deferred income tax assets, the impact of the change on the valuation allowance is generally reflected in current income.

8. Commitments

Beginning on August 1, 2009, the Company was obligated to make monthly payments of $175 for rent on a month to month basis.

9. Subsequent Events

In accordance with SFAS 165, we have evaluated subsequent events through October 29, 2009, the date of issuance of the audited financial statements. During this period we did not have any material recognizable subsequent events.

F-9

-29-

|

ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE. |

There have been no disagreements on accounting and financial disclosures from the inception of our company through the date of this Form 10-K. Our financial statements for the period from inception to July 31, 2009, included in this report have been audited by Malone & Bailey, PC, as set

forth in this annual report.

ITEM 9A. CONTROLS AND PROCEDURES.

Evaluation of Disclosure Controls and Procedures

We maintain “disclosure controls and procedures,” as such term is defined in Rule 13a-15(e) under the Securities Exchange Act of 1934 (the “Exchange Act”), that are designed to ensure that information required to be disclosed in our Exchange Act reports is recorded, processed,

summarized and reported within the time periods specified in the Securities and Exchange Commission rules and forms, and that such information is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure. We conducted an evaluation (the “Evaluation”), under the supervision and with the participation of our Chief Executive Officer (“CEO”) and Chief Financial Officer

(“CFO”), of the effectiveness of the design and operation of our disclosure controls and procedures (“Disclosure Controls”) as of the end of the period covered by this report pursuant to Rule 13a-15 of the Exchange Act. Based on this Evaluation, our CEO and CFO concluded that our Disclosure Controls were not effective as of the end of the period covered by this report due to a lack of segregation of controls and an overrelaince on consultants for accounting and reporting functions.

Limitations on the Effectiveness of Controls

Our management, including our CEO and CFO, does not expect that our Disclosure Controls and internal controls will prevent all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control

system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns

can occur because of a simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management or board override of the control.

The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions; over time, controls may become inadequate

because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

-30-

CEO and CFO Certifications

Appearing immediately following the Signatures section of this report there are Certifications of the CEO and the CFO. The Certifications are required in accordance with Section 302 of the Sarbanes-Oxley Act of 2002 (the Section 302 Certifications). This Item of this report, which you are currently

reading is the information concerning the Evaluation referred to in the Section 302 Certifications and this information should be read in conjunction with the Section 302 Certifications for a more complete understanding of the topics presented.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rule 13a-15(f). The Company’s internal control over financial reporting is a process designed to provide reasonable assurance to our

management and board of directors regarding the reliability of financial reporting and the preparation of the financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America.

Our internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company; (ii) provide reasonable assurance that

transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States of America, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Company’s assets that could have a material effect

on the financial statements.

Because of its inherent limitations, internal controls over financial reporting may not prevent or detect misstatements. All internal control systems, no matter how well designed, have inherent limitations, including the possibility of human error and the circumvention of overriding controls.

Accordingly, even effective internal control over financial reporting can provide only reasonable assurance with respect to financial statement preparation. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

-31-

Our management assessed the effectiveness of our internal control over financial reporting as of July 31, 2009. In making this assessment, it used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal

Control-Integrated Framework. Based on our assessment, we believe that, as of July 31, 2009, the Company’s internal control over financial reporting was not effective due to a lack of segregation of controls and an overreliance on consultants for accounting and reporting functions.

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of the Securities

and Exchange Commission that permit us to provide only management’s report in this annual report.

Changes in Internal Controls

We have also evaluated our internal controls for financial reporting, and there have been no significant changes in our internal controls or in other factors that could significantly affect those controls subsequent to the date of their last evaluation.

|

ITEM 9B. |

OTHER INFORMATION |

None.

PART III

|

ITEM 10. |

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS; COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT. |

Officers and Directors

Our sole director will serve until his successor is elected and qualified. Our sole officer is elected by the board of directors to a term of one (1) year and serves until his or her successor is duly elected and qualified, or until he or she is removed from office. The board of directors has

no nominating, auditing or compensation committees.

The name, address, age and position of our present officers and directors are set forth below:

|

Name and Address |

Age |

Position(s) |

|

Curtis C. Daye

Lot 118 Greenwich Acres

Mammee Bay

St. Ann, Jamaica |

37 |

president, principal executive officer, secretary, treasurer, principal financial officer, principal accounting officer and sole member of the board of directors. |

The person named above has held his offices/positions since inception of our company and is expected to hold his offices/positions until the next annual meeting of our stockholders.

-32-

Background of officers and directors

Since our inception on May 29, 2008, Curtis C. Daye has been our president, principal executive officer, secretary, treasurer, principal financial officer, principal accounting officer and sole member of the board of directors. Curtis C. Daye is an entrepreneur who experience is based

on the tourism industry in Jamaica. In Ocho Rios, Jamaica, Curtis Daye started a small taxi service business in March 31, 2003 called First Choice Taxi Services. Evolving from these services, Mr. Daye formed First Choice Tourism in March 31, 2003 in Ocho Rios, Jamaica. Where he built a fleet of tour vans which services the transport needs for tourists visiting the island of Jamaica and a taxi service which also services the transportation needs of the local population. Mr.

Daye is not an officer or director of any other corporations that files reports with the SEC pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934.

During the past five years, Mr. Daye has not been the subject of the following events:

1. Any bankruptcy petition filed by or against any business of which Mr. Daye was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time.

2. Any conviction in a criminal proceeding or being subject to a pending criminal proceeding.

3. An order, judgment, or decree, not subsequently reversed, suspended or vacated, or any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting Mr. Daye’s involvement in any type of business, securities or banking activities.

4. Found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission or the Commodity Future Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

Audit Committee Financial Expert

We do not have an audit committee financial expert. We do not have an audit committee financial expert because we believe the cost related to retaining a financial expert at this time is prohibitive. Further, because we have no operations, at the present time, we believe

the services of a financial expert are not warranted.

Conflicts of Interest

The only conflict that we foresee are that our sole officer and director will devote time to projects that do not involve us.

-33-

Involvement in Certain Legal Proceedings

Other than as described in this section, to our knowledge, during the past five years, no present or former director or executive officer of our company: (1) filed a petition under the federal bankruptcy laws or any state insolvency law, nor had a receiver, fiscal agent or similar officer appointed

by a court for the business or present of such a person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer within two years before the time of such filing; (2) was convicted in a criminal proceeding or named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses); (3) was the subject of any order, judgment or decree, not subsequently

reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from or otherwise limiting the following activities: (i) acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, associated person of any of the foregoing, or as an investment advisor, underwriter, broker or dealer in securities, or as an affiliated person, director of any investment company, or engaging

in or continuing any conduct or practice in connection with such activity; (ii) engaging in any type of business practice; (iii) engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of federal or state securities laws or federal commodity laws; (4) was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any federal or state authority barring, suspending or otherwise limiting for more than

60 days the right of such person to engage in any activity described above under this Item, or to be associated with persons engaged in any such activity; (5) was found by a court of competent jurisdiction in a civil action or by the Securities and Exchange Commission to have violated any federal or state securities law and the judgment in subsequently reversed, suspended or vacate; (6) was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated

any federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated.

Audit Committee and Charter

We have a separately-designated audit committee of the board. Audit committee functions are performed by our board of directors. None of our directors are deemed independent. All directors also hold positions as our officers. Our audit committee is responsible for: (1) selection and