Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K DATED OCTOBER 28, 2009 - HELIX ENERGY SOLUTIONS GROUP INC | form8k.htm |

| EX-99.1 - PRESS RELEASE DATED OCTOBER 28, 2009 - HELIX ENERGY SOLUTIONS GROUP INC | exh991.htm |

Third

Quarter 2009

Earnings Conference Call

Earnings Conference Call

October

29, 2009

2

This

presentation contains forward-looking statements within the meaning of Section

27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934. All such statements, other than statements of

historical fact, are statements that could be deemed “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, including, without limitation, any projections of revenue, gross margin,

expenses, earnings or losses from operations, or other financial items; future production volumes, results of

exploration, exploitation, development, acquisition and operations expenditures, and prospective reserve levels of

property or wells; any statements of the plans, strategies and objectives of management for future operations; any

statements concerning developments, performance or industry rankings; and any statements of assumptions

underlying any of the foregoing. Although we believe that the expectations set forth in these forward-looking

statements are reasonable, they do involve risks, uncertainties and assumptions that could cause our results to differ

materially from those expressed or implied by such forward-looking statements. The risks, uncertainties and

assumptions referred to above include the performance of contracts by suppliers, customers and partners; employee

management issues; complexities of global political and economic developments; geologic risks and other risks

described from time to time in our reports filed with the Securities and Exchange Commission (“SEC”), including the

Company’s Annual Report on Form 10-K for the year ended December 31, 2008 and subsequent quarterly reports

on Form 10-Q. You should not place undue reliance on these forward-looking statements which speak only as of the

date of this presentation and the associated press release. We assume no obligation or duty and do not intend to

update these forward-looking statements except as required by the securities laws.

1933 and Section 21E of the Securities Exchange Act of 1934. All such statements, other than statements of

historical fact, are statements that could be deemed “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, including, without limitation, any projections of revenue, gross margin,

expenses, earnings or losses from operations, or other financial items; future production volumes, results of

exploration, exploitation, development, acquisition and operations expenditures, and prospective reserve levels of

property or wells; any statements of the plans, strategies and objectives of management for future operations; any

statements concerning developments, performance or industry rankings; and any statements of assumptions

underlying any of the foregoing. Although we believe that the expectations set forth in these forward-looking

statements are reasonable, they do involve risks, uncertainties and assumptions that could cause our results to differ

materially from those expressed or implied by such forward-looking statements. The risks, uncertainties and

assumptions referred to above include the performance of contracts by suppliers, customers and partners; employee

management issues; complexities of global political and economic developments; geologic risks and other risks

described from time to time in our reports filed with the Securities and Exchange Commission (“SEC”), including the

Company’s Annual Report on Form 10-K for the year ended December 31, 2008 and subsequent quarterly reports

on Form 10-Q. You should not place undue reliance on these forward-looking statements which speak only as of the

date of this presentation and the associated press release. We assume no obligation or duty and do not intend to

update these forward-looking statements except as required by the securities laws.

The

United States Securities and Exchange Commission permits oil and gas companies,

in their filings with the SEC,

to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation

tests to be economically and legally producible under existing economic and operating conditions. Statements of

proved reserves are only estimates and may be imprecise. Any reserve estimates provided in this presentation that

are not specifically designated as being estimates of proved reserves may include not only proved reserves but also

other categories of reserves that the SEC’s guidelines strictly prohibit the Company from including in filings with the

SEC. Investors are urged to consider closely the disclosure in the Company’s 2008 Form 10-K.

to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation

tests to be economically and legally producible under existing economic and operating conditions. Statements of

proved reserves are only estimates and may be imprecise. Any reserve estimates provided in this presentation that

are not specifically designated as being estimates of proved reserves may include not only proved reserves but also

other categories of reserves that the SEC’s guidelines strictly prohibit the Company from including in filings with the

SEC. Investors are urged to consider closely the disclosure in the Company’s 2008 Form 10-K.

Forward-Looking

Statements

Summary of Q3 2009

Results (pg. 4)

2009 Outlook

(pg.

7)

Liquidity and

Capital Resources (pg.

10)

• Operational

Highlights by Segment

Contracting Services

(pg.

16)

Oil & Gas

(pg.

24)

• Non-GAAP

Reconciliations (pg.

27)

Well

Enhancer helideck

Presentation

Outline

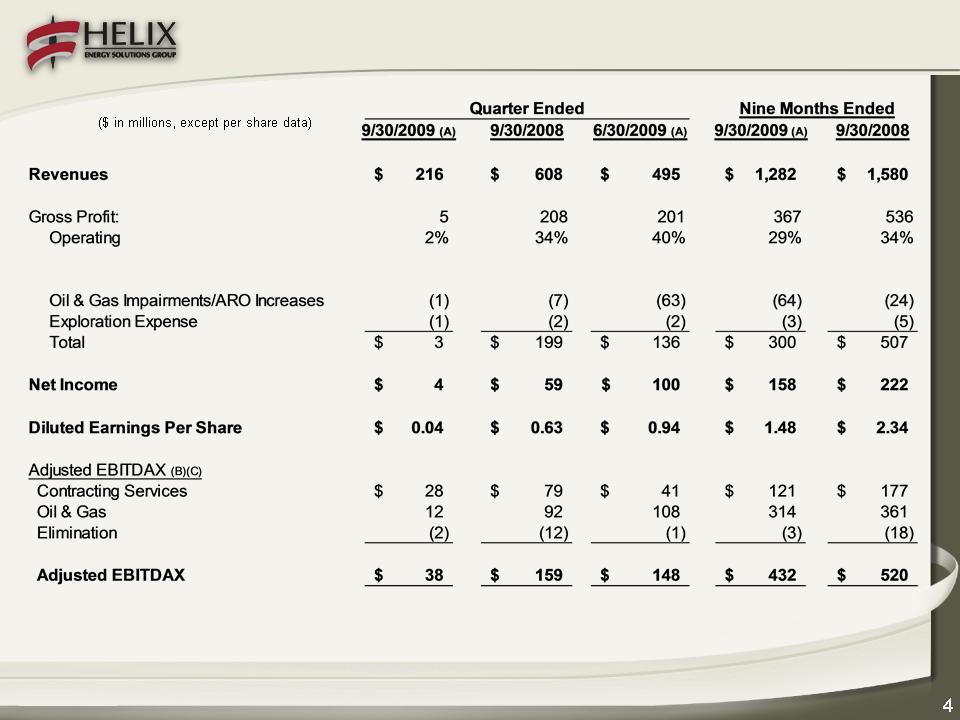

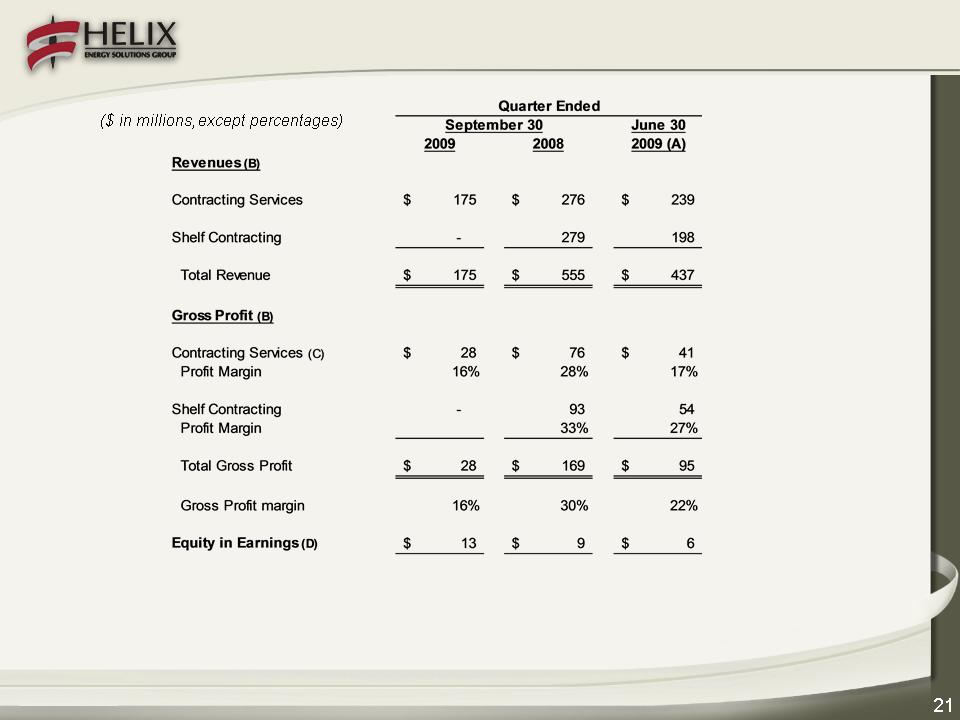

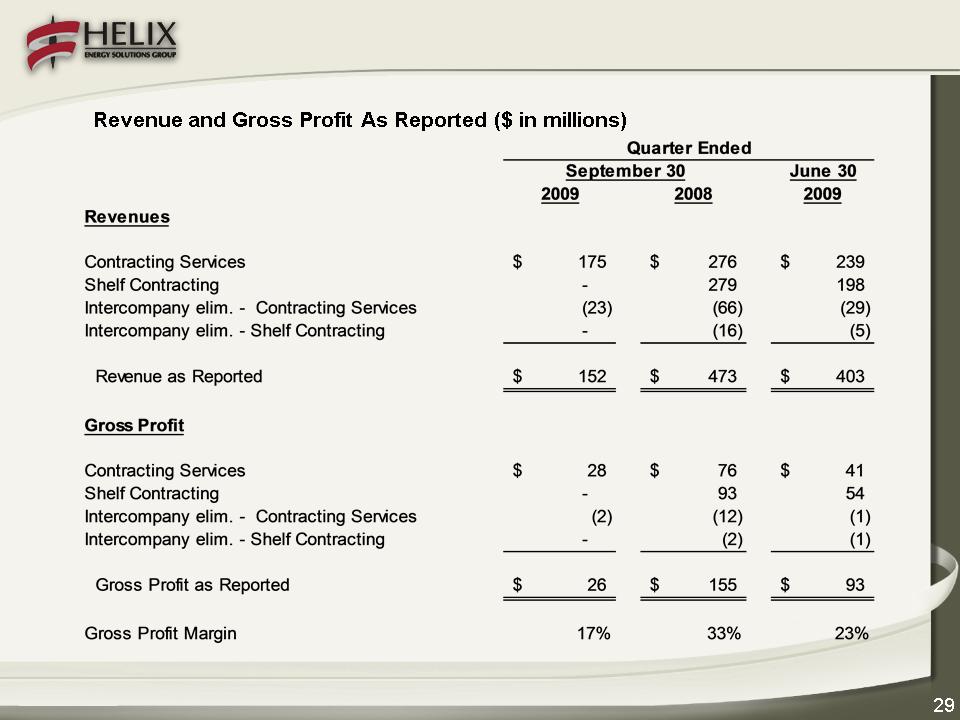

(A) Results of Cal Dive,

our former Shelf Contracting business, were consolidated through June 10, 2009,

at which time our ownership interest dropped below

50%; thereafter, our remaining interest was accounted for under the equity method of accounting until September 23, 2009, when we reduced our holdings with

the sale of the substantial majority of our remaining interest in Cal Dive. Second quarter revenues from our former Shelf Contracting business totaled $197.7

million.

50%; thereafter, our remaining interest was accounted for under the equity method of accounting until September 23, 2009, when we reduced our holdings with

the sale of the substantial majority of our remaining interest in Cal Dive. Second quarter revenues from our former Shelf Contracting business totaled $197.7

million.

(B) See non-GAAP

reconciliation on slides 28-29.

(C) Excludes Cal Dive

contribution in all periods presented.

Executive

Summary

• $17.9 million gain

on the sale of 23.2 million shares of Cal Dive stock

• $7.1 million of

incremental expense recorded as a result of the Company’s weather

derivative contract

derivative contract

•Expense concentrated

in Q3 2009 to coincide with hurricane season vs. straight

line expense

line expense

•Q3 results excluded

realized hedge gains of approximately $25 million for natural gas

hedge mark-to-market adjustments previously recognized as unrealized gains in Q1

and Q2 of 2009

hedge mark-to-market adjustments previously recognized as unrealized gains in Q1

and Q2 of 2009

The

after-tax effect of the above two items on EPS totaled $0.07 per

diluted

share.

share.

Executive

Summary

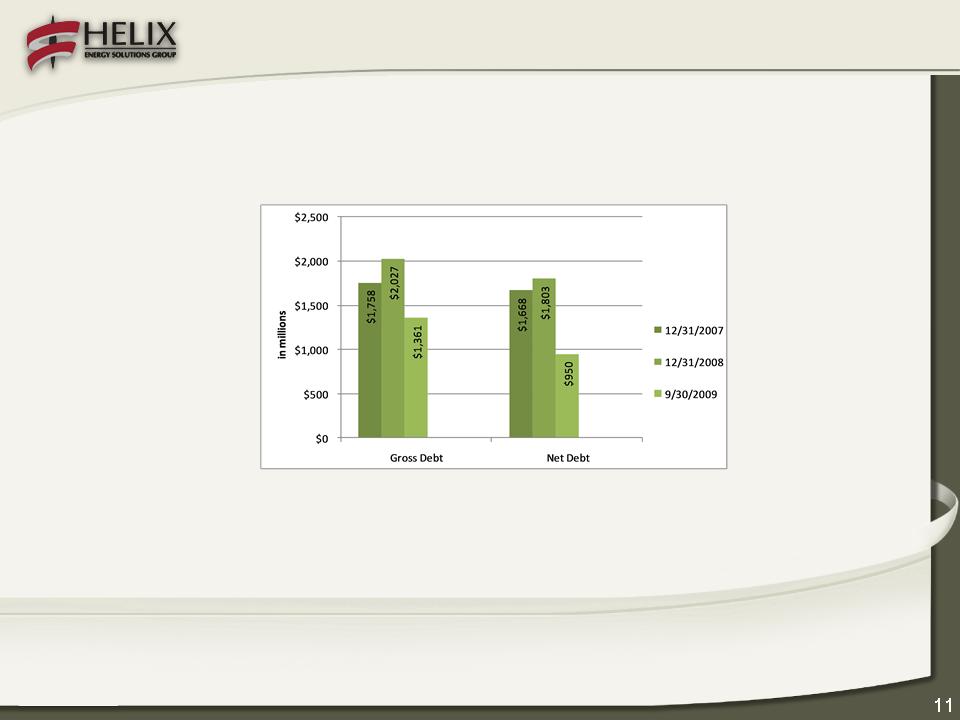

• Net debt balance

decreased by $853 million year-to-date

• Oil and gas

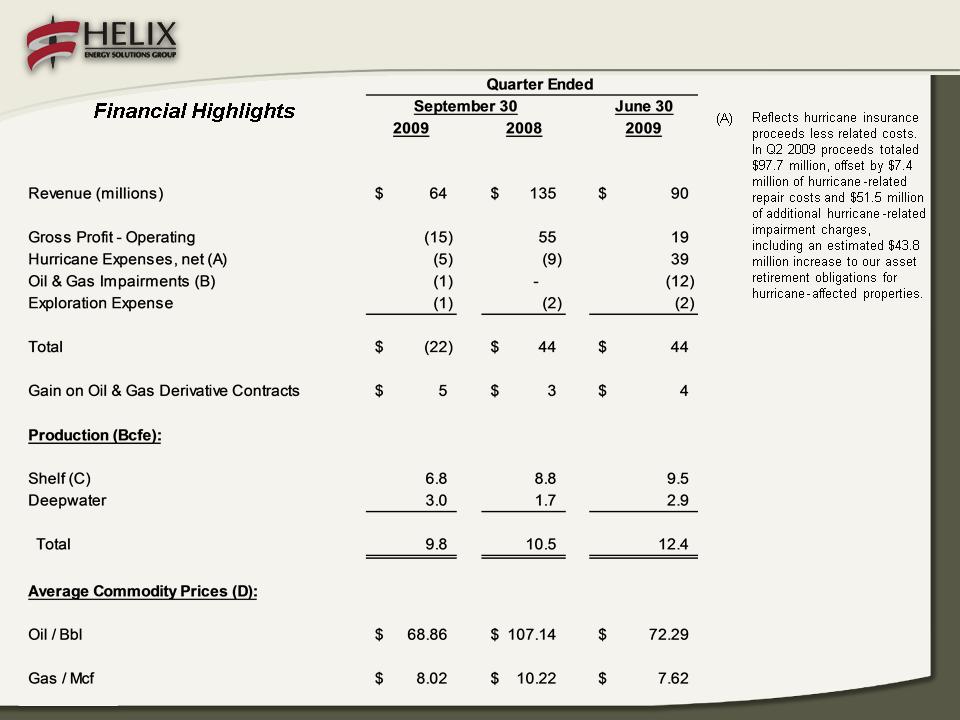

production totaled 9.8 Bcfe for Q3 2009 versus 12.4 Bcfe in Q2 2009

• Avg realized price

for oil $68.86 / bbl ($72.29 / bbl in Q2 2009), including effect of

settled hedges

settled hedges

• Avg realized price

for gas $8.02 / Mcf ($7.62 / Mcf in Q2 2009), including the effect of

settled hedges

settled hedges

Executive

Summary (continued)

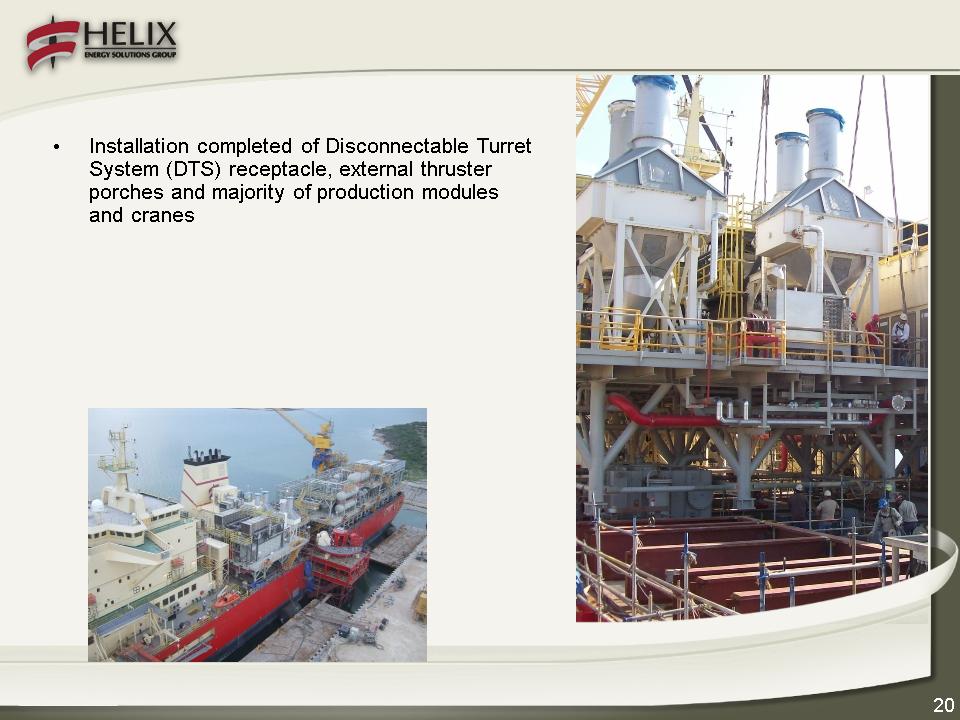

Helix

Producer I topside module installation progress at Kiewit Offshore Services

fabrication yard

• Express dry-dock, transit

and utilization on

Danny pipeline is impacting external revenues

Danny pipeline is impacting external revenues

• Capital expenditures

of approximately $340 to

$360 million for 2009, $209 million spent

year-to-date

$360 million for 2009, $209 million spent

year-to-date

• $205 million

relates to completion of three

major vessel projects (Well Enhancer, Caesar

and Helix Producer I)

major vessel projects (Well Enhancer, Caesar

and Helix Producer I)

• $55 million relates

to development of Danny

and Phoenix oil fields

and Phoenix oil fields

• Improved liquidity

and debt levels (see slide 11)

Express

spooling pipe for ERT Danny project

2009

Outlook

• Production range:

43 - 47 Bcfe

• Oil and gas

prices

• Without hedges:

$4.37 /mcfe;

$66.41 /bbl

$66.41 /bbl

• With realized

hedges and mark-to-

market adjustments (gas only):

$7.45 /mcfe; $70.91 /bbl

market adjustments (gas only):

$7.45 /mcfe; $70.91 /bbl

HPI

pipe racks connecting production modules

to buoy system

to buoy system

2009

Outlook (continued)

Liquidity

and

Capital

Resources

Capital

Resources

Well

Enhancer and Seawell in Aberdeen, Scotland

Debt

Liquidity*

of $781 million at 9/30/09

* Defined as available revolver capacity plus cash

Significant

Balance Sheet Improvements

• Completed (≈ $600

million pre-tax):

•Oil and gas

assets

• Bass Lite sale

December 08 & January 09 ($49 million)

• EC 316 sale in

February 09 ($18 million)

• Cal

Dive

• Sold a total of

15.2 million shares of Cal Dive common stock to Cal Dive

in January and June 2009 for aggregate proceeds of $100 million

in January and June 2009 for aggregate proceeds of $100 million

• Sold 45.8 million

Cal Dive shares in secondary offerings for proceeds of

≈ $405 million (net of offering costs) in June and September 2009

≈ $405 million (net of offering costs) in June and September 2009

• Sold

Helix RDS for $25 million in April 2009

Company

will continue to seek a sale of its shelf oil and gas properties

Liquidity

and Capital Resources

Company

is in compliance as of 9/30/2009, and based on current forecasts expects

compliance at December 31, 2009.

compliance at December 31, 2009.

|

Covenant

|

Test

|

Explanation

|

|

Collateral

Coverage Ratio

|

> 1.75 :

1

|

Basket of

collateral to Senior Secured Debt

|

|

Fixed Charge

Coverage Ratio

|

> 2.75 :

1

|

Consolidated

EBITDA to

consolidated

interest charges |

|

Consolidated

Leverage Ratio

|

< 3.5 :

1

|

Consolidated

EBITDA to

consolidated debt

|

Liquidity

and Capital Resources

Credit

Facilities, Commitments and Amortization

– $435

Million Revolving Credit Facility -

UNDRAWN.

• Facility extended to

November 2012.

• In July 2011,

commitments reduced to $407 million.

• $50 million of LCs

in place.

– $416

Million Term Loan B - Committed

facility through June 2013. $4.3

million

principal payments annually.

principal payments annually.

– $550

Million High Yield Notes - Interest only

until maturity (January 2016) or called

by Helix. First Helix call date is January 2012.

by Helix. First Helix call date is January 2012.

– $300

Million Convertible Notes - Interest only

until put by noteholders or called by

Helix. First put/call date is December 2012, although noteholders have the right to

convert prior to that date if certain stock price triggers are met ($38.56).

Helix. First put/call date is December 2012, although noteholders have the right to

convert prior to that date if certain stock price triggers are met ($38.56).

– $119

Million MARAD - Original 25 year

term; matures February 2027. $4.4

million

principal payments annually.

principal payments annually.

Liquidity

and Capital Resources

• Completed the

offshore work on the

Reliance KGD6 Project in the Bay of

Bengal

Reliance KGD6 Project in the Bay of

Bengal

• Express

returned from India

to the Gulf of

Mexico after her regulatory dry-dock in

Spain and began spooling the Helix ERT

Danny 12-inch pipe in 8-inch pipe (PIP)

pipeline at Helix’s new spoolbase in

Ingleside, Texas

Mexico after her regulatory dry-dock in

Spain and began spooling the Helix ERT

Danny 12-inch pipe in 8-inch pipe (PIP)

pipeline at Helix’s new spoolbase in

Ingleside, Texas

• Intrepid

Gulf of

Mexico activities included:

– Completed Newfield

Fastball project

– Installed jumpers

for BP to tie-in

Murphy’s Thunder Hawk and BHP

Shenzi export pipelines

Murphy’s Thunder Hawk and BHP

Shenzi export pipelines

– Worked for Helix ERT

on the

Phoenix Project

Phoenix Project

Caesar

pipelay stinger

Contracting

Services

• Olympic

Canyon working for

Reliance Industries offshore India

under long term inspection, repair

and maintenance contract

Reliance Industries offshore India

under long term inspection, repair

and maintenance contract

• Olympic

Triton supporting

Technip’s Deep Blue on GOM

Projects and will transit to West

Africa under contract with Technip

Technip’s Deep Blue on GOM

Projects and will transit to West

Africa under contract with Technip

• Island

Pioneer and Northern

Canyon enjoyed high utilization on

North Sea trenching projects

Canyon enjoyed high utilization on

North Sea trenching projects

Cable

trencher T200 being launched from the Seacor Canyon offshore

Indonesia

Contracting

Services

• Seawell worked the majority

of the quarter

for Shell under the long term firm contract

and also worked for BP, Apache and

Venture

for Shell under the long term firm contract

and also worked for BP, Apache and

Venture

• Q4000 worked for Chevron

and Walter Oil

& Gas in well intervention mode in July

and for ENI as an accommodation vessel

for the rest of the quarter. ENI work was

contracted at low rates because of delays

in prospective well intervention work.

& Gas in well intervention mode in July

and for ENI as an accommodation vessel

for the rest of the quarter. ENI work was

contracted at low rates because of delays

in prospective well intervention work.

• Well

Ops APAC operations

still

being

impacted by refurbishment of the Vessel

Deployment System and Subsea

Intervention Lubricator

impacted by refurbishment of the Vessel

Deployment System and Subsea

Intervention Lubricator

• Well

Enhancer construction

completed at

end of the third quarter and is now

generating revenue

end of the third quarter and is now

generating revenue

Subsea

Intervention Lubricator system

onboard Well Enhancer

onboard Well Enhancer

Contracting

Services

Well

Enhancer generating revenue

Caesar

completed sea trials offshore China

HPI

external thruster porches, DTS receptacle

and all production modules installed

and all production modules installed

Marine

Capital Projects

• DTS buoy loaded out

and to be installed by

Q4000 in November 2009

Q4000 in November 2009

• Installation of

2,500-ton production modules

underway and expected to be completed

November with hook-up to follow

underway and expected to be completed

November with hook-up to follow

• Expect deployment in

Phoenix field

in Q2 2010

in Q2 2010

HPI

production module installation

Disconnectable

Transfer System

Transfer System

Helix

Producer I

(A) Results of Cal Dive,

our former Shelf Contracting business, were consolidated through June 10, 2009,

at which time our ownership interest dropped below

50%; thereafter, our remaining interest was accounted for under the equity method of accounting until September 23, 2009, when we reduced our holdings

with the sale of the substantial majority of our remaining interest in Cal Dive.

50%; thereafter, our remaining interest was accounted for under the equity method of accounting until September 23, 2009, when we reduced our holdings

with the sale of the substantial majority of our remaining interest in Cal Dive.

(B) See non-GAAP

reconciliation on slides 28-29. Amounts

are prior to intercompany eliminations.

(C) Includes corporate

and operational support overheads.

(D) Amounts primarily

represent equity in earnings of Marco Polo and Independence Hub investments and

equity in earnings from Cal Dive from June 11

through September 23, 2009.

through September 23, 2009.

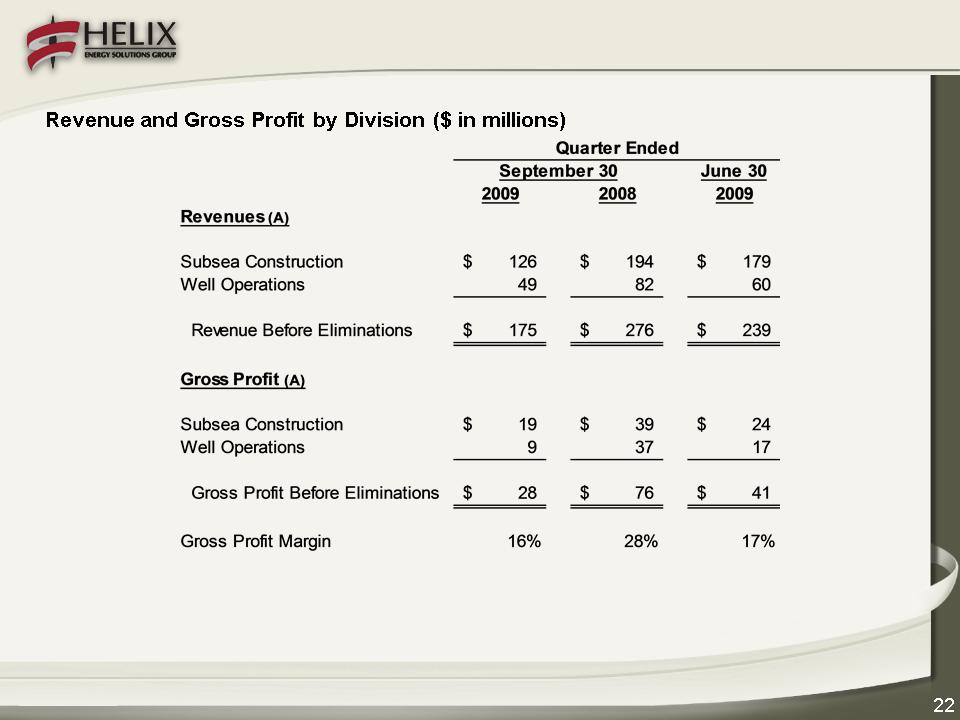

Contracting

Services

(A) Amounts are before

intercompany eliminations. See

non-GAAP reconciliation on slides 28-29.

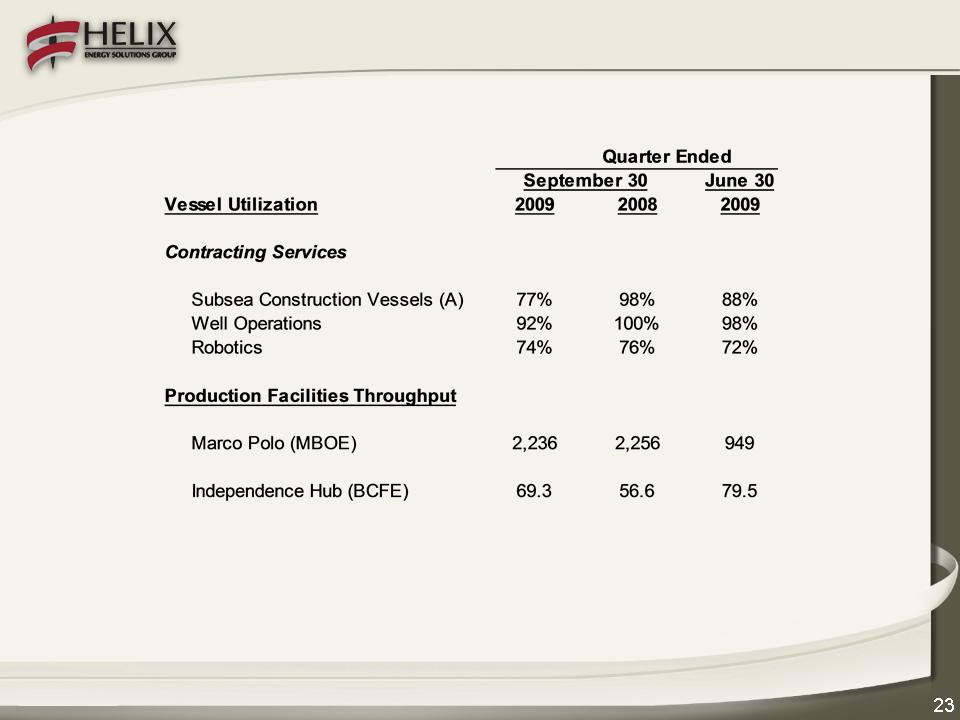

Contracting

Services

Contracting

Services

(A)

Includes REM

Forza on long-term

charter.

24

(B) Q2 amounts

reflect

$11.5 million of impairments

related to reduction in

carrying values of certain oil

and gas properties due to

reserve revisions.

$11.5 million of impairments

related to reduction in

carrying values of certain oil

and gas properties due to

reserve revisions.

(C) Includes UK

production of 0.1

Bcfe in Q3 2008 and 0.2 Bcfe

in Q2 2009.

Bcfe in Q3 2008 and 0.2 Bcfe

in Q2 2009.

(D) Including effect of

settled

hedges.

hedges.

Oil

& Gas

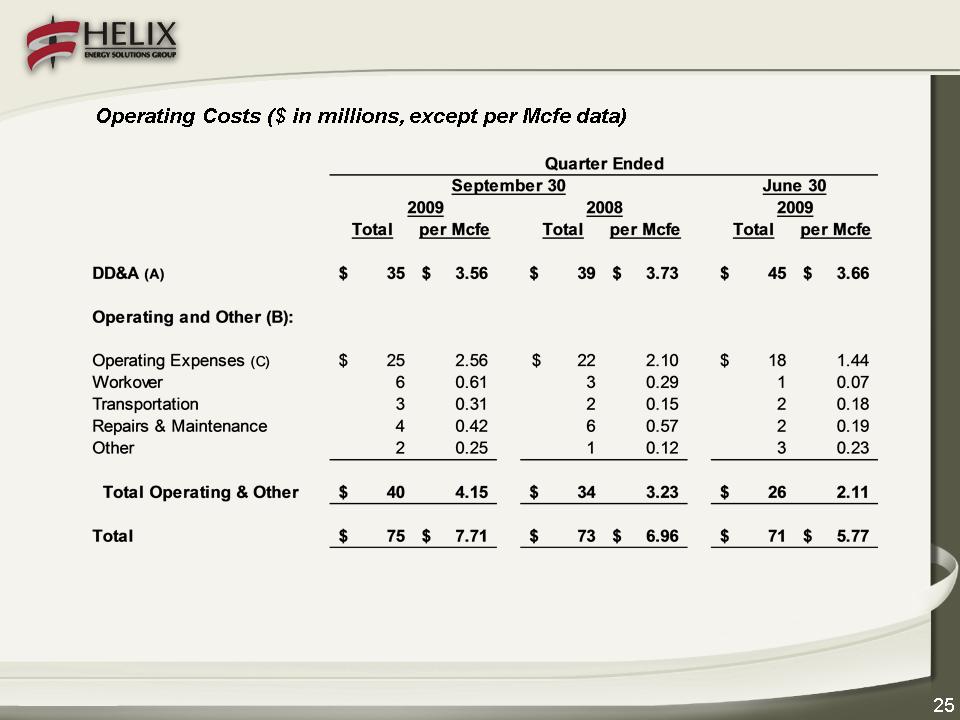

(A) Includes accretion

expense.

(B) Excludes

hurricane-related repairs of $5.1 , $2.3 and $7.4 million, net of insurance

recoveries of $0, $0, and

$97.7 million, for the

quarters ended September 30, 2009, September 30, 2008 and June 30, 2009, respectively.

quarters ended September 30, 2009, September 30, 2008 and June 30, 2009, respectively.

(C) Includes $10.4

million related to a weather derivative contract in the third quarter of

2009. Excludes

exploration expenses of $0.9,

$1.6 and $1.5 million, and abandonment of $2.9, $6.5 and $0.8 million for the quarters ended September 30, 2009, September 30,

2008 and June 30, 2009, respectively.

$1.6 and $1.5 million, and abandonment of $2.9, $6.5 and $0.8 million for the quarters ended September 30, 2009, September 30,

2008 and June 30, 2009, respectively.

Oil

& Gas

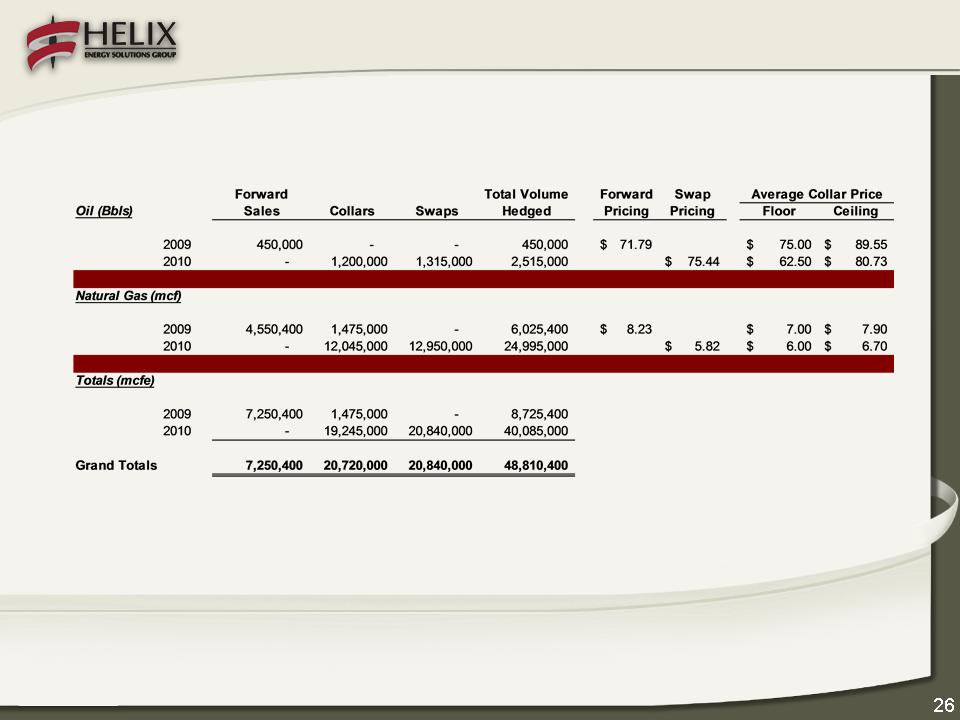

Summary

of Oct 2009-Dec 2010 Hedging Positions

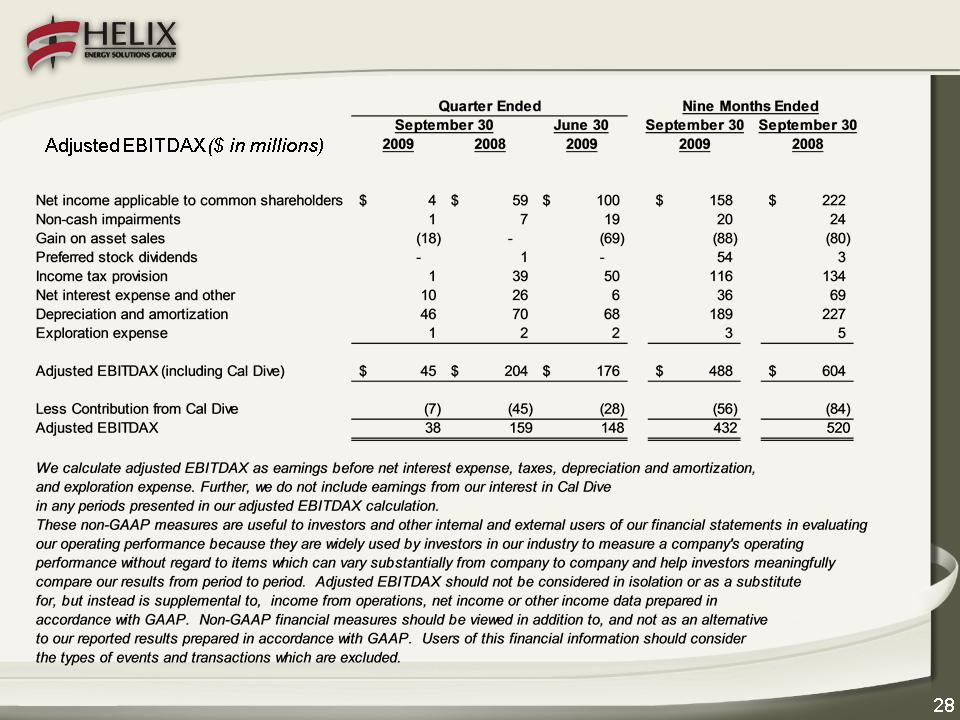

Non

GAAP Reconciliations

Non

GAAP Reconciliations