Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended August 29, 2009

Or

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission file number 1-6807

FAMILY DOLLAR STORES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 56-0942963 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 10401 Monroe Road, Matthews, North Carolina | 28105 | |

| (Address of principal executive offices) | (Zip Code) |

P. O. Box 1017, Charlotte, North Carolina 28201-1017

(Mailing address)

Registrant’s telephone number, including area code: (704) 847-6961

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $.10 Par Value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer x |

Accelerated filer ¨ | ||||||||||||||

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company | ¨ | |||||||||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Table of Contents

The aggregate market value of voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, as of the last day of the registrant’s most recently completed second fiscal quarter, on February 28, 2009, was approximately $3.6 billion.

The number of shares of the registrant’s Common Stock outstanding as of October 2, 2009, was 138,797,782.

DOCUMENTS INCORPORATED BY REFERENCE

The information required in Part III of this Form 10-K is incorporated by reference to the registrant’s definitive proxy statement to be filed for the Annual Meeting of Stockholders to be held in January 2010.

Table of Contents

3

Table of Contents

We have provided information in this Annual Report on Form 10-K (this “Report”) regarding the operations of Family Dollar Stores, Inc., and its subsidiaries (“we,” “Family Dollar” or the “Company”) related to the fiscal years ended on August 29, 2009 (“fiscal 2009”); August 30, 2008 (“fiscal 2008”); September 1, 2007 (“fiscal 2007”); August 26, 2006 (“fiscal 2006”); and August 27, 2005 (“fiscal 2005”); and anticipated operations for the fiscal year ending on August 28, 2010 (“fiscal 2010”). You should review the discussion and analysis provided in this Report in conjunction with our Consolidated Financial Statements and the Notes to Consolidated Financial Statements, which are included elsewhere in this Report.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Report, or in other public filings, press releases, or other written or oral communications made by Family Dollar or our representatives, which are not historical facts, are forward-looking statements that are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements address our plans, activities or events which we expect will or may occur in the future and may include express or implied projections of revenue or expenditures; statements of plans and objectives for future operations, growth or initiatives; statements of future economic performance; or statements regarding the outcome or impact of pending or threatened litigation. These forward-looking statements may be identified by the use of the words “believe,” “plan,” “estimate,” “expect,” “anticipate,” “probably,” “should,” “project,” “intend,” “continue,” and other similar terms and expressions. Various risks, uncertainties and other factors may cause our actual results to differ materially from those expressed or implied in any forward-looking statements. Factors, uncertainties and risks that may result in actual results differing from such forward-looking information include, but are not limited to, those listed in Part I, Item 1A below, as well as other factors discussed throughout this Report, including, without limitation, the factors described under “Critical Accounting Policies” in Part II, Item 7 below, or in other filings or statements made by us. All of the forward-looking statements in this Report and other documents or statements are qualified by these and other factors, risks and uncertainties.

You should not place undue reliance on the forward-looking statements included in this Report. We assume no obligation to update any forward-looking statements, even if experience or future changes make it clear that projected results expressed or implied in such statements will not be realized, except as may be required by law. In evaluating forward-looking statements, you should consider these risks and uncertainties, together with the other risks described from time to time in our other reports and documents filed with the Securities and Exchange Commission (“SEC”).

4

Table of Contents

PART I

| ITEM 1. | BUSINESS |

General

We operate a chain of more than 6,600 general merchandise retail discount stores in 44 states, providing primarily low to middle income consumers with a selection of competitively-priced merchandise in convenient neighborhood stores. Our merchandise assortment includes consumables, home products, apparel and accessories, and seasonal and electronics. We sell merchandise at prices that generally range from less than $1 to $10.

We opened our first Family Dollar store in Charlotte, North Carolina, in 1959. In subsequent years, we opened additional stores and organized separate corporations to operate these stores. Family Dollar Stores, Inc., was incorporated in Delaware in 1969, and all then-existing corporate entities became its wholly-owned subsidiaries.

The mailing address of our executive offices is P.O. Box 1017, Charlotte, North Carolina 28201-1017, and our telephone number is (704) 847-6961. Our website address is www.familydollar.com. You can find our press releases for the past five years on our website. We also make available free of charge through our website all of our reports filed with or furnished to the SEC pursuant to the Securities Exchange Act of 1934, including our Annual reports on Form 10-K, Quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, as soon as reasonably practicable after they are electronically filed with or furnished to the SEC. These reports and amendments also are available on the SEC’s website at www.sec.gov.

Overview of Business Operations

Our Mission and Vision

Our mission is to provide customers with a compelling place to shop, our team members with a compelling place to work, and investors with a compelling place to invest. Our vision is to be the best small-format convenience and value retailer serving the needs of families in our neighborhoods.

Our Customers

We serve the basic needs of customers primarily in the low and middle income brackets. Typically, our customer is a female head-of-household. According to Nielsen’s 2009 Homescan® data, approximately 56% of our customers had annual gross income of less than $40,000 and approximately 26% had an annual gross income of less than $20,000. Approximately 33% of our customers were African American or Hispanic, and approximately 68% of our customers were age 45 or older.

Our Stores

A Family Dollar store is typically between 7,500 and 9,500 square feet and generally serves customers who live within five miles of the store. Our stores are located in urban, suburban, small town and rural markets. See Item 2 — “Properties” in this Report for more information. The relatively small size of a Family Dollar store allows us to select store locations that provide neighborhood convenience to our customers in each of these market areas. Family Dollar stores are open at least six days a week, with most open on Sundays. We currently accept cash, checks, PIN-based debit cards, and in most stores, credit cards and other electronic payment types, including food stamps.

Our Merchandise

We provide customers with quality merchandise at everyday low prices. We offer a focused assortment of merchandise in a number of core categories, such as health and beauty aids, packaged food and refrigerated products, home cleaning supplies, housewares, stationery, seasonal goods, apparel and home fashions. Our stores are operated on a self-service basis, and our low overhead enables us to sell merchandise at a relatively moderate markup. In the typical Family Dollar store, the majority of the products are priced at $10 or less, with many of the products priced at $1 or less. In fiscal 2009, the average customer purchase was $9.84.

Current Strategic Initiatives

We believe that balancing initiatives targeted to deliver short-term financial results with investments that may require longer-term development will help us weather difficult macro-environments and enable us to achieve our long-term financial goals. Our current investment agenda is concentrated around four key priorities: increase relevancy to the customer, drive increased profitability, manage risk and build great employee teams.

5

Table of Contents

Increase Relevancy to the Customer

As the economic environment changes, we remain focused on increasing our relevancy to the customer. We are re-aligning the space in our stores to better meet customer demand and improve the in-store shopping experience. During fiscal 2009, we re-aligned the space in approximately 48% of our stores, adding space for consumable merchandise and improving in-store signage and merchandise adjacencies. In addition, we continue to enhance our assortment of food to meet customers’ frequent fill-in food needs, and we are adapting our store operating hours to provide greater convenience to our customers. We are also expanding our customer research efforts and creating processes that enable us to apply our research more effectively in our merchandise and store layout decisions.

We are upgrading our register and point-of-sale technology to enable us to accept additional payment types, including credit cards and electronic benefit transfers such as food stamps. This upgraded technology also includes a number of computer-based tools to provide our store managers with better training, analytics and workflow management. At the end of fiscal 2009, approximately 74% of our stores operated with the technology. We expect to complete the rollout of this technology to all stores during fiscal 2010. In connection with the technology, we also plan to begin offering gift cards and merchandise return cards to our customers.

Drive Increased Profitability

In order to drive increased profitability, we continue to invest in initiatives that drive top-line growth, and we remain focused on cost management. In addition to the initiatives already discussed, we are enhancing our private label offering and global sourcing efforts and making additional investments to strengthen our pricing efforts. As customers become more budget-conscious, they value quality private label products at compelling prices more. We are enhancing our assortment of private label merchandise to reinforce our value perception and to enhance profitability.

As raw material and commodity prices fluctuate, having an appropriate pricing strategy is critical, both to reinforce value to the customer and to manage profitability. We have created a structured framework for pricing decisions that enables us to better balance the need for profitability with the customer’s perception of value. We plan to continue focusing in this area by refining and expanding our zone pricing initiative. We also plan to begin utilizing new software to strengthen our price optimization efforts, including promotional and clearance pricing.

To manage global pricing pressures and mitigate the pressure from increased sales of lower-margin consumable merchandise, we continue to enhance our global sourcing efforts. As a result of these investments, we have improved our product quality, offering greater value for our customers, while also improving merchandise markups.

Manage Risk

In the current economic environment, our customers face rising unemployment and a decline in average hours worked. As a result of these and other factors, our customers remain focused on basic consumable needs and continue to limit their discretionary spending. Reflecting the uncertainty in the current environment, we remain focused on managing our inventory risk. We are investing in key traffic-driving categories while constraining purchases in more discretionary categories.

We continue to make investments in our multi-year process improvement initiative called Project Accelerate. Focused on category management, price optimization, merchandise financial planning, assortment planning and space planning, this initiative is intended to help us improve and optimize our merchandising and supply chain processes. Our goal is to improve the shopping experience of our customers, the productivity of our inventory and the efficiency of our supply chain. The Project Accelerate initiative is helping us manage inventory risk and react quickly to the changing environment.

Build Great Teams

We believe that our long-term success is dependent on our ability to create strong employee teams that can adjust and respond quickly to ever-changing operating conditions. We continue to invest in this effort and in building a stronger Family Dollar culture. Utilizing an expanded library of computer-based training applications, we are creating career paths for talented, ambitious team members who want to make a larger contribution. We are strengthening our succession planning and leadership development programs, and, to support our focus on driving results and continuous improvement, we are improving our performance management programs.

We continue to make great strides in stabilizing our workforce, especially in our stores, where the benefit of experienced store teams has the greatest impact. Our current store manager, assistant manager and cashier retention are at historically high levels. A more experienced workforce allows us to offer stronger merchandise presentations, maintain better in-store standards, and improve the customer shopping experience. We believe our focus on employee retention also is having a positive impact on inventory shrinkage and workers’ compensation and general liability claims.

6

Table of Contents

Store Operations

We operate more than 6,600 stores in 44 states. All of our stores are managed and operated by us. A store manager manages each store and is responsible for hiring and training store employees, managing the financial performance of the store, and providing quality customer service. The store manager reports to a district manager or area operations manager. A district manager or area operations manager is typically responsible for 15 to 25 stores. During fiscal 2009, no single store accounted for more than one-quarter of one percent of sales.

Merchandise

Our stores offer a variety of general merchandise. The following table summarizes the percentage of net sales attributable to each product category over the last three fiscal years:

| Product Category |

2009 | 2008 | 2007 | ||||||

| Consumables |

64.4 | % | 61.0 | % | 58.8 | % | |||

| Home Products |

13.4 | % | 14.4 | % | 15.1 | % | |||

| Apparel and Accessories |

11.2 | % | 13.1 | % | 14.4 | % | |||

| Seasonal and Electronics |

11.0 | % | 11.5 | % | 11.7 | % |

The following table describes our product categories in more detail:

| Consumables | Household chemicals | |

| Paper products | ||

| Candy, snacks and other food | ||

| Health and beauty aids | ||

| Hardware and automotive supplies | ||

| Pet food and supplies | ||

| Home Products | Domestics, including blankets, sheets and towels | |

| Housewares | ||

| Giftware | ||

| Home décor | ||

| Apparel and Accessories | Men’s clothing | |

| Women’s clothing | ||

| Boys’ and girls’ clothing | ||

| Infants’ clothing | ||

| Shoes | ||

| Fashion accessories | ||

| Seasonal and Electronics | Toys | |

| Stationery and school supplies | ||

| Seasonal goods | ||

| Personal electronics, including pre-paid cellular phones and services | ||

During fiscal 2009, nationally advertised brand name merchandise accounted for approximately 52% of sales. Merchandise sold under our private label program, across all merchandise categories, accounted for approximately 19% of sales. Merchandise sold under other labels, or which was unlabeled, accounted for the balance of sales. During fiscal 2009, closeout merchandise accounted for approximately 2% of sales.

We purchase merchandise from a wide variety of suppliers and generally have not experienced difficulty in obtaining adequate quantities of merchandise. In fiscal 2009, no single supplier accounted for more than 8% of the merchandise sold by us. Approximately 54% of our merchandise was manufactured in the U.S., and substantially all such merchandise was purchased directly from the manufacturer. Approximately 46% of our merchandise was manufactured overseas and was purchased using domestic importers, agents or directly from the manufacturer. Our vendor arrangements provide for payment for such merchandise in U.S. Dollars.

7

Table of Contents

We maintain a substantial variety and depth of merchandise inventory in stock in our stores (and in our distribution centers for weekly store replenishment) to attract customers and meet their shopping needs. We negotiate vendors’ trade payment terms to help finance the cost of carrying this inventory. We balance the value of maintaining high inventory levels required to meet customer demand with the potential risk of having inventories at levels that exceed such demand and that may need to be marked down in price in order to sell.

Distribution and Logistics

During fiscal 2009, the manufacturer or distributor shipped approximately 7% of our merchandise purchases directly to stores. The balance of the merchandise was shipped to one of our nine distribution centers listed below. To provide consistent, cost-effective service, we enlist the services of several national transportation companies throughout the U.S. as well as our own private fleet of trucks to deliver merchandise to stores from our distribution centers. During fiscal 2009, approximately 90% of the merchandise delivered to our stores was delivered by common or contract carriers. At the end of fiscal 2009, the number of stores served by each of our distribution centers was as follows:

| Distribution Center |

Number of Stores Served | |

| Matthews, NC |

762 | |

| West Memphis, AR |

590 | |

| Front Royal, VA |

807 | |

| Duncan, OK |

767 | |

| Morehead, KY |

807 | |

| Maquoketa, IA |

806 | |

| Odessa, TX |

727 | |

| Marianna, FL |

731 | |

| Rome, NY |

658 | |

| Total |

6,655 | |

Technology

We utilize a variety of technological systems to manage our business, including point-of-sale technology, inventory management tools, supply chain systems, and financial and human resource applications.

We are upgrading our point-of-sale technology to provide better customer service and to improve the communications infrastructure in our stores. The upgraded technology facilitates the acceptance of additional payment types, including credit cards and food stamps, and includes a number of computer-based tools designed to provide our store managers with better training, analytics and work flow management. At the end of fiscal 2009, approximately 74% of our stores operated with the technology. We expect to complete the rollout of this technology to all stores during fiscal 2010.

We maintain by-item inventories for all stores and employ a demand forecasting system for replenishment of our distribution centers. We also utilize software applications for centralized store replenishment of basic merchandise and for allocation of non-basic merchandise. We have a centralized Merchandise Financial Planning application and process that is utilized to plan and forecast sales, cost of sales and inventory metrics by product category to position us to achieve our financial goals and to ensure proper flow of inventory. These systems allow us to optimize merchandise in-stock positions in stores, reduce markdowns and improve inventory turnover.

To minimize transportation costs and maximize our efficiency, we rely on a web-enabled transportation management system to track shipments, to maximize trailer loads and to secure low rates from our trucking partners. To maximize the productivity of our distribution centers, we utilize voice-recognition software, radio-frequency technology and high-speed sortation systems in each of our nine distribution centers.

To manage our extensive library of store leases, we utilize a lease management system that contains the key terms and conditions abstracted from our active store lease contracts. This electronic repository provides us with better visibility to key property management issues such as property taxes, common area maintenance and renewal options.

Our centralized procurement organization utilizes an on-line procurement system for many non-merchandise purchases. This system allows us to centralize these purchases, enabling us to leverage our buying power and control costs.

We utilize an online hiring system designed to provide consistent pre-employment assessments and interviews for prospective team members in approximately 81% of our stores.

8

Table of Contents

Competition

Our industry is highly competitive. The principal competitive factors include store locations, convenience, price and quality of merchandise, in-stock consistency, merchandise assortment and presentation, and customer service. We compete for sales and store locations in varying degrees with international, national, regional and local retailing establishments, including discount stores, department stores, variety stores, dollar stores, discount clothing stores, drug stores, grocery stores, convenience stores, outlet stores, warehouse stores and other stores. Many other large U.S. retailers have stores in areas in which we operate. We believe that the relatively small size of our stores permits us to operate new stores in most areas, including rural areas and large urban markets, in locations convenient to our target customer.

Seasonality

Our sales are slightly seasonal. Historically, sales have been highest in the second fiscal quarter (December, January, and February) in connection with the holiday season, representing approximately 27% of total annual sales over the last five fiscal years. Our quarterly results also can be impacted by the timing of certain holidays. We purchase significant amounts of seasonal inventory during the first quarter in anticipation of the holiday season.

Trademarks

We have registered with the U.S. Patent and Trademark Office the names “Family Dollar” and “Family Dollar Stores” as service marks, and also have registered other names and designs as trademarks for certain merchandise sold in our stores.

Employees

As of August 29, 2009, we had approximately 27,000 full-time employees and approximately 20,000 part-time employees. None of our employees are covered by collective bargaining agreements. We consider our employee relations generally to be good.

NYSE Certification

In accordance with New York Stock Exchange (the “NYSE”) rules, on February 11, 2009, we filed the annual certification by our Chief Executive Officer that, as of the date of the certification, Family Dollar was in compliance with the NYSE listing standards. For the fiscal year ended August 29, 2009, each of our Chief Executive Officer and Chief Financial Officer executed the certifications required by Section 302 of the Sarbanes-Oxley Act of 2002, which are filed as exhibits to this Report.

9

Table of Contents

Executive Officers

The following information is furnished with respect to each of the executive officers of Family Dollar as of October 2, 2009:

| Name |

Position and Office |

Age | ||

| Howard R. Levine | Chairman of the Board and |

50 | ||

| R. James Kelly | President and |

62 | ||

| Dorlisa K. Flur | Executive Vice President- |

44 | ||

| Charles S. Gibson, Jr. | Executive Vice President- |

48 | ||

| Barry Sullivan | Executive Vice President- |

45 | ||

| Kenneth T. Smith | Senior Vice President- |

47 | ||

| James C. Snyder, Jr. | Senior Vice President- |

45 | ||

| C. Martin Sowers | Senior Vice President- |

51 | ||

| Bryan E. Venberg | Senior Vice President- |

41 | ||

Mr. Howard R. Levine was employed by the Company in various capacities in the Merchandising Department from 1981 to 1987, including employment as Senior Vice President-Merchandising and Advertising. From 1988 to 1992, Mr. Levine was President of Best Price Clothing Stores, Inc., a chain of ladies’ apparel stores. From 1992 to April 1996, he was self-employed as an investment manager. He rejoined the Company in April 1996 and was elected Vice President-General Merchandise Manager: Softlines in April 1996; Senior Vice President-Merchandising and Advertising in September 1996; President and Chief Operating Officer in April 1997; Chief Executive Officer in August 1998; and Chairman of the Board in January 2003. He is the son of Leon Levine, the founder and Chairman Emeritus of the Company.

Mr. R. James Kelly was employed by the Company as Vice Chairman-Chief Financial and Administrative Officer in January 1997 and was promoted to President and Chief Operating Officer in August 2006.

Ms. Dorlisa K. Flur was employed by the Company as Senior Vice President-Strategy and Business Development in June 2004 and was promoted to Executive Vice President-Strategy and Marketing in October 2008 and to Executive Vice President-Chief Merchandising Officer in August 2009.

Mr. Charles S. Gibson, Jr., was employed by the Company as Vice President-Logistics in September 1997 and was promoted to Senior Vice President-Distribution and Logistics in October 1999 and to Executive Vice President-Supply Chain in September 2003.

Mr. Barry Sullivan was employed by the Company as Vice President-Store Operations in September 2002 and was promoted to Senior Vice President-Store Operations in May 2005 and to Executive Vice President-Store Operations in October 2007.

10

Table of Contents

Mr. Kenneth T. Smith was employed by the Company as a Financial Analyst in March 1990. He was promoted to Controller in October 1995; Vice President-Loss Prevention in April 1997; Vice President-IT in January 2001; Vice President-Internal Audit in February 2003; Vice President-Finance in September 2004; and Senior Vice President-Chief Financial Officer in April 2007.

Mr. James C. Snyder, Jr., was employed by the Company as Senior Vice President-General Counsel and Secretary in April 2009. Prior to his employment by the Company, he was employed by The Home Depot, Inc., a chain of home improvement stores, from July 2001 to March 2009, where his last position was Vice President and Associate General Counsel for Legal and Risk Management.

Mr. C. Martin Sowers was employed by the Company as an accountant in October 1984 and was promoted to Assistant Controller in January 1985. He was promoted to Controller in January 1986, Vice President-Controller in July 1989 and Senior Vice President-Finance in December 1991. Mr. Sowers is the Company’s principal accounting officer.

Mr. Bryan E. Venberg was employed by the Company as Senior Vice President-Human Resources in February 2008. Prior to his employment by the Company, he was employed by ShopNBC, a multi-media retailer, from May 2004 to November 2008, where his last position was Senior Vice President-Operations, Customer Service and Human Resources.

All executive officers of the Company are elected annually by and serve at the pleasure of the Board of Directors until their successors are duly elected.

| ITEM 1A. | RISK FACTORS |

The risks described below could materially and adversely affect our business, financial condition and results of operations. We also may be adversely affected by risks not currently known or risks that we do not currently consider to be material.

General economic conditions could impact our business adversely in various respects.

A further slowdown in the U.S. economy or other economic conditions affecting disposable consumer income, such as employment levels, inflation, business conditions, fuel and energy costs, consumer debt levels, lack of available credit, interest rates, and tax rates, may affect our business adversely by reducing overall consumer spending or by causing customers to shift their spending to products other than those sold by us or to products sold by us that are less profitable than other product choices, all of which could result in lower net sales, decreases in inventory turnover or a reduction in profitability due to lower margins. The current global economic uncertainty, the impact of recessions, and the potential for failures or realignments of financial institutions and the related impact on available credit may impact our suppliers, our landlords, our customers and our operations in an adverse manner including, but not limited to, our inability to readily access liquid funds or credit, increases in the cost of credit, bankruptcy of our suppliers or landlords, and other impacts, which we are currently unable to fully anticipate. At this time, we are unable to determine the impact on our customers and our business, if any, of programs adopted by the U.S. government to stabilize and support the economy.

Our profitability is vulnerable to cost increases, inflation, and energy prices.

Future increases in our costs such as the cost of merchandise, shipping rates, freight and fuel costs, and store occupancy costs may reduce our profitability. These cost changes may be the result of inflationary pressure that would further reduce our sales or profitability. Increases in other operating costs including changes in energy prices, wage rates and lease and utility costs may increase our costs of goods or operating expenses and reduce our profitability. For example, increases in the cost of diesel fuel will likely result in an increase in transportation costs, which will increase our overall operating costs and possibly lower profitability.

Our growth is dependent upon our ability to increase sales in existing stores and the success of our new store opening program.

Our growth is dependent on both increases in sales in existing stores and our ability to open profitable new stores. Increases in sales in existing stores are dependent on factors such as competition, merchandise selection, store operations and customer satisfaction. If we fail to realize our goals of successfully managing our store operations and increasing our customer retention and recruitment levels, our sales may not increase and our growth may be impacted adversely. Our ability to open profitable new stores depends on many factors including our ability to identify suitable markets and sites for new stores, negotiate leases with acceptable terms, gain name recognition in the new markets and successfully compete against local competition, while managing expenses and costs. Unavailability of attractive store locations, delays in the acquisition or opening of new stores, delays or costs associated with remodeling existing stores, delays or costs resulting from a decrease in commercial development due to capital constraints, difficulties in staffing and operating new store locations, and lack of customer acceptance of stores in new market areas all may impact our new store growth negatively and the costs or the profitability associated with new or remodeled stores.

11

Table of Contents

We operate in a highly competitive environment and, as a result, we may not be able to compete effectively or maintain or increase our sales, market share or margins, particularly if the prolonged global economic conditions intensify.

We operate in the highly competitive discount retail merchandise sector with numerous competitors, some of which may have greater resources than us. We compete for customers, merchandise, real estate locations and employees. This competitive environment subjects us to various risks, including the ability to continue our store and sales growth and to provide attractive merchandise to our customers at competitive prices that allow us to maintain our profitability. Price reductions by our competitors may result in the reduction of our prices and a corresponding reduction in our profitability. Consolidation in our retail sector, changes in pricing of merchandise, or offerings of other services by competitors could have a negative impact on the relative attractiveness of our stores to consumers. Our ability to provide convenience in a small box retail format while offering attractive, competitively-priced products could be impacted by various actions of our competitors that are beyond our control. See Item 1 — “Competition” for further discussion of our competitive position.

We depend heavily on technology systems that support all aspects of our operations; the failure of existing or new technology to provide anticipated benefits could affect our anticipated results of operations adversely.

Our merchandising, finance, human resources, distribution and logistics and store operations functions depend heavily upon the efficient operation of our technological resources. A failure in our information technology systems or controls could impact our operations negatively. In addition, we continuously upgrade our current technology or install new technology. Our inability to implement in a timely manner such upgrades or installations, to train our employees effectively in the use of our technology, or to obtain the anticipated benefits of our technology, including technology associated with our Project Accelerate initiative or our new store POS systems, could impact our operations or profitability adversely.

If we are unable to secure our customer’s confidential and credit card information, or other private data relating to our employees or the Company, we could be subject to bad publicity, costly government enforcement actions, or private litigation, which would hurt our business reputation and materially affect our profitability.

The protection of our customer, employee, and company data is critical to us. We have procedures and technology in place to safeguard our customer’s debit and credit card information, our employee’s private data, and the Company’s records and intellectual property. However, if we experience a data security breach of any kind, we could be exposed to negative publicity, government enforcement actions, private litigation and costly response measures. In addition, our reputation within the business community and with our customers may be affected, which could result in our customers discontinuing the use of debit or credit cards in our stores, or stop shopping our stores altogether. This could cause us to lose market share to our competitors and have a material adverse effect on our financial results.

New accounting guidance or changes in the interpretation or application of existing accounting guidance, or developments in legal or regulatory guidance could affect our financial performance adversely.

New accounting guidance may require systems and other changes that could increase our operating costs and/or change our financial statements. For example, implementing future lease accounting guidance or converting to International Financial Reporting Standards (“IFRS”) could force us to make significant changes to our lease management system or other accounting systems, and could result in changes to our financial statements.

Unanticipated changes in the interpretation or application of existing accounting guidance could result in material charges or restatements of our financial statements, which may further result in litigation or regulatory actions which could have a material adverse effect on our financial condition and results of operations. Changes or developments in legal or regulatory guidance may impact our position in related litigation matters negatively.

Changes in state or federal legislation or regulations, including the effects of legislation and regulations on product safety, wage levels, employee rights, social welfare and entitlement programs, and changes in currency exchange rates, trade restrictions, tariffs, quotas and freight rates could increase our cost of doing business.

We are exposed to the risk that new federal or state legislation, particularly in new product safety laws and regulations, may negatively impact our operations. For example, the Consumer Product Safety Improvement Act of 2008 was signed into law in August 2008. The new legislation addresses a number of consumer product safety issues, including the permissible levels of lead and phthalates in certain products. During fiscal 2009, we began removing certain products from our merchandise inventories in response to the new legislation. While we do not believe the new legislation will have a material impact on our future operating results, the scope and impact of the new legislation is still being determined in the retail marketplace generally and future adjustments to our merchandise inventories as a result of such legislation could impact our future operating results adversely.

Any additional changes in product safety legislation or regulations may lead to product recalls and the disposal or write off of merchandise inventories, as well as certain fines or penalties and reputational damage. Changes in federal or state wage requirements, employee rights (including changes in the process for our employees to join a union), social welfare or entitlement programs such as health insurance, paid leave programs, or other changes in workplace regulation or tax rates could adversely impact our ability to achieve our financial targets. Changes in trade restrictions, new tariffs and quotas, and higher shipping costs for goods also could impact our ability to achieve anticipated operating results adversely.

12

Table of Contents

Product safety concerns could affect our sales and results of operations adversely.

Various governmental authorities regulate the quality and safety of the products we sell in our stores. If our merchandise, including food and consumable products, do not meet applicable governmental safety standards or our customers’ expectations regarding quality or safety, we could experience lost sales, increased costs and be exposed to legal and reputational risk. Our inability to comply on a timely basis with regulatory requirements, or execute product recalls in a timely manner, could result in substantial fines or penalties, which could have a material adverse effect on our financial results. In addition, negative customer perceptions regarding the safety of the products we sell could cause us to lose market share to our competitors. If this occurs, it may be difficult for us to regain lost sales.

Any disruption in our ability to select, obtain and market merchandise attractive to customers at prices that allow us to profitably sell such merchandise could impact our business negatively.

We generally have been able to select and obtain sufficient quantities of attractive merchandise at prices that allow us to profitably sell such merchandise. If we are unable to continue to select products that are attractive to our customers, to obtain such products at costs that allow us to sell such products at a profit, or to market such products effectively to consumers, our sales or profitability could be affected adversely.

Any disruption in the supply or increase in pricing of such merchandise could further negatively impact our operations and results of operations. A significant amount of our merchandise is imported, and changes to the flow of these goods for any reason could have an adverse impact on our operations. For example, because a substantial amount of our imported merchandise comes from China, a change in the Chinese currency or other policies could negatively impact our merchandise costs. The United States and other countries have occasionally proposed and enacted protectionist trade legislation, which may result in changes in tariff structures and trade policies that could increase the cost of or reduce the availability of certain merchandise. Any of these or other measures relating to suppliers and the countries in which they are located, some or all of which are beyond our control, can negatively impact our operations, increase costs, and lower our margins. Such events or circumstances include, but are not limited to:

| • | political and economic instability; |

| • | the financial instability and labor problems of suppliers; |

| • | the availability of raw materials; |

| • | merchandise quality issues; |

| • | currency exchange rates; and |

| • | transportation availability and cost. |

In addition, we are currently implementing global sourcing programs and vendor and product quality requirements that could negatively impact our ability to find qualified suppliers or their ability to provide merchandise at attractive prices. These and other factors affecting our suppliers and our access to products could affect our financial performance adversely.

We are exposed to the risk of natural disasters, unusual weather, pandemic outbreaks, war and terrorism that could disrupt business and result in increased operating costs and capital expenditures.

Our headquarters, store locations and distribution centers, as well as certain of our vendors and customers, are located in areas which could be subject to natural disasters such as floods, hurricanes, tornadoes or earthquakes. Adverse weather conditions or other extreme changes in the weather, including resulting electrical and technological failures, may disrupt our business and may adversely affect our ability to sell and distribute products. In addition, we operate in markets that may be susceptible to pandemic outbreaks, war or terrorism. Our business may be harmed if our ability to sell and distribute products is impacted by any such events, any of which could influence customer trends and purchases and may negatively impact our net sales, properties or operations. Such events could result in: physical damage to one or more of our properties; the temporary closure of some or all of our stores or distribution centers; the temporary lack of an adequate work force in a market; temporary or long-term disruption in the transport of goods; delay in the delivery of goods to our distribution centers or stores; disruption of our technology support or information systems; or fuel shortages or dramatic increases in fuel prices which increase the cost of doing business. Any of these factors, or combination thereof, could affect our operations adversely.

13

Table of Contents

Operational difficulties, including those associated with our ability to develop and operate our stores and distribution facilities, could impact our business adversely.

Our stores are decentralized and are managed through a network of geographically dispersed management personnel. Our inability to operate our stores effectively and efficiently, including the ability to control losses resulting from inventory shrinkage, may negatively impact our sales or profitability.

In addition, we rely upon our distribution and logistics network to provide goods to stores in a timely and cost-effective manner. Any disruption, unanticipated expense or operational failure related to this process could impact our store operations negatively. We maintain a network of distribution facilities throughout our geographic territory and build new facilities to support our growth objectives. Delays in opening distribution facilities or stores could adversely affect our future operations by slowing the unit growth, which may in turn reduce revenue growth. Adverse changes in the cost to operate distribution facilities and stores, such as changes in labor, utility and other operating costs, could have an adverse impact on our financial performance. Adverse changes in our inventory shrinkage at the store level or in distribution facilities could also impact our results negatively.

We rely on third-party shippers and carriers whose operations are outside our control, and any failure by them to deliver products in a timely manner may damage our reputation and could cause us to lose customers.

We rely on arrangements with third-party shippers and carriers such as independent shipping companies for timely delivery of products to stores and distribution operations throughout the country. As a result, we are subject to carrier disruptions and increased costs due to factors that are beyond our control, including labor strikes, inclement weather and increased fuel costs. If the services of any of these third parties become unsatisfactory, we may experience delays in meeting our customers’ product demands and we may not be able to find a suitable replacement on a timely basis or on commercially reasonable terms. Any failure to deliver products in a timely manner may damage our reputation and could cause us to lose customers.

Adverse impacts associated with legal proceedings and claims could affect our business negatively.

We are a party to a variety of legal proceedings and claims incidental to our business, such as alleged personal and property damage, and labor claims. In particular several employees have alleged the company violated the Fair Labor Standards Act (FLSA) and other state laws by classifying Store Managers as “exempt” employees, not entitled to overtime compensation. We are subject to a series of lawsuits challenging that classification, and recently incurred a final judgment against us in federal court. There are currently additional lawsuits pending in the 4th Circuit Court of Appeals and in federal district court in North Carolina. We classified Store Managers as “exempt” employees in good faith and continue to believe that Store Managers are “exempt” employees under FLSA, that they should be paid as salaried employees, and that have been and are being properly compensated under both federal and state laws. We intend to defend ourselves vigorously against such claims. However, if at some point in the future the Company determines that a reclassification of some or all of its Store Managers as non-exempt employees under the FLSA is required, such action could have a material adverse effect on the Company’s financial position, liquidity or results of operation. At this time, we cannot quantify the impact of such a determination. The outcome of any litigation is uncertain and it may subject the Company to liability that could have a material adverse effect on its financial position, liquidity, or results of operations. See Note 9 to the Consolidated Financial Statements included in this Report for more information on our outstanding litigation.

Our ability to attract and retain employees could affect our business.

Our growth could be adversely impacted by our inability to attract and retain employees at the store operations level, in distribution facilities, and at the corporate level, including our senior management team, at costs which allow us to profitability conduct our operations. For example, we believe that the retention of managers at the store level is one factor in reducing inventory shrinkage resulting from employee theft. Various other factors, such as overall labor availability, wage rates, union organizing activity, regulatory or legislative impacts and various benefit costs could all impact our ability to attract and retain employees negatively and may affect our results of operations adversely.

Higher costs or any failure to achieve targeted results associated with the implementation of new programs or initiatives could affect our results of operations adversely.

We are undertaking a variety of operating initiatives and infrastructure initiatives related to, among other things, merchandising and supply chain systems, store technology, merchandise assortment and related schematic changes, and real estate remodeling and expansion goals. These changes may result in temporary disruptions to our business and negatively impact sales and the failure to properly execute any of these initiatives or the failure to obtain the anticipated results of such initiatives could have an adverse impact on our future operating results.

14

Table of Contents

Our business is slightly seasonal and adverse events during the holiday season could impact our operating results negatively.

Our business is slightly seasonal, with the highest percentage of sales (approximately 27% of total annual sales over the last five fiscal years) occurring during the second fiscal quarter (December, January, February). We purchase significant amounts of seasonal inventory in anticipation of the holiday season. Adverse events, such as deteriorating economic conditions, higher unemployment, higher gas prices, public transportation disruptions, or unusual weather can result in lower than planned sales during the holiday season. This could lead to lower sales or to unanticipated markdowns, impacting our financial condition and results of operations negatively.

Our failure to comply with our debt covenants could affect our capital resources, financial condition and liquidity adversely.

Our debt agreements contain certain restrictive covenants, which impose various operating and financial restrictions on us. Such restrictions include, but are not limited to, a consolidated debt to consolidated capitalization ratio, a fixed charge coverage ratio, and a priority debt ratio. Our failure to comply with the restrictive covenants in our debt agreements, as a result of one or more of the factors listed in this section, could result in an event of default, which, if not cured or waived, could result in us having to repay our borrowings before their due dates. If we are forced to refinance these borrowings on less favorable terms, our results of operations or financial condition could be harmed. In addition, if we are in default under any of our existing or future debt facilities, we will also not be able to borrow additional amounts under those facilities to the extent that they would otherwise be available. Our ability to obtain future financing may also be impacted negatively.

Funds associated with auction rate securities may not be liquid or readily available.

Our portfolio of investment securities currently consists of auction rate securities ($166.5 million at fair value as of August 29, 2009), which are not currently liquid or readily available to convert to cash. We do not believe that the current liquidity issues related to our auction rate securities will impact our ability to fund our ongoing business operations, but if the global credit crisis persists or intensifies, it is possible that we will be required to write down the fair value of our auction rate securities further. If we determine that the decline in the fair value of our auction rate securities is other than temporary, it would result in an impairment charge being recognized in our Consolidated Statements of Income, and this charge could be material and could adversely affect our financial results for the periods in which the charges occur. See Note 2 to the Consolidated Financial Statements included in this Report for more information on our auction rate securities.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

15

Table of Contents

| ITEM 2. | PROPERTIES |

We operate a chain of self-service retail discount stores. As of October 2, 2009, there were 6,664 stores in 44 states and the District of Columbia as follows:

| Texas |

841 | Arkansas | 101 | |||||

| Ohio |

413 | Missouri | 95 | |||||

| Florida |

391 | New Mexico | 94 | |||||

| North Carolina |

370 | Maryland | 91 | |||||

| Michigan |

349 | New Jersey | 78 | |||||

| Georgia |

313 | Minnesota | 70 | |||||

| New York |

291 | Utah | 59 | |||||

| Pennsylvania |

273 | Maine | 51 | |||||

| Louisiana |

228 | Connecticut | 49 | |||||

| Illinois |

223 | Kansas | 35 | |||||

| Virginia |

215 | Iowa | 32 | |||||

| Tennessee |

205 | Idaho | 31 | |||||

| South Carolina |

203 | Nebraska | 31 | |||||

| Indiana |

195 | Nevada | 26 | |||||

| Kentucky |

188 | South Dakota | 23 | |||||

| Alabama |

144 | New Hampshire | 22 | |||||

| Wisconsin |

136 | Rhode Island | 22 | |||||

| Arizona |

135 | Delaware | 21 | |||||

| Oklahoma |

128 | Wyoming | 20 | |||||

| Mississippi |

119 | North Dakota | 12 | |||||

| West Virginia |

117 | Vermont | 12 | |||||

| Colorado |

105 | District of Columbia | 3 | |||||

| Massachusetts |

104 |

As of October 2, 2009, we had, in the aggregate, approximately 56.7 million square feet of total store space (including receiving rooms and other non-selling areas) and approximately 47.2 million square feet of selling space.

The number of stores we operated at the end of each of our last five fiscal years was:

| Fiscal Year | Number of Stores at Year End | |

| 2005 |

5,898 | |

| 2006 |

6,173 | |

| 2007 |

6,430 | |

| 2008 |

6,571 | |

| 2009 |

6,655 |

During fiscal 2009, we opened 180 stores, closed 96 stores, relocated 10 stores within the same shopping center or market area, and expanded or renovated 41 stores. In addition, during fiscal 2009, we initiated efforts to re-align space in our stores to accommodate strong customer demand for consumable merchandise and improve the in-store shopping experience. Approximately 48% of the chain was impacted by these efforts during fiscal 2009. We plan to continue re-aligning the space in our stores during fiscal 2010. From August 30, 2009, through October 2, 2009, we opened 20 new stores, closed 11 stores, and relocated 4 stores within the same shopping center or market area.

Our stores are located in urban, suburban, small town and rural markets, and they are typically freestanding or located in shopping centers. At the end of fiscal 2009, approximately 20% of our stores were located in large urban markets (markets with populations above 200,000), and approximately 26% of our stores were located in small urban markets (markets with populations greater than 75,000 but less than 200,000) or suburban areas. During fiscal 2009, approximately 18% of our new store locations were opened in large urban markets, and 39% of our new locations were opened in small urban or suburban markets.

All of our stores are leased except for 487 stores which we own. Most of our leases have an initial term of five years and provide for fixed rentals, and most of our leases require additional payments based upon a percentage of sales, property taxes, insurance premiums, or common area maintenance charges.

16

Table of Contents

Of our 6,177 leased stores at October 2, 2009, all but 404 leases grant us options to renew for additional terms, in most cases for a number of successive five-year periods. The following table sets forth certain data concerning the expiration dates of all leases with renewal options as of October 2, 2009:

| Fiscal Years |

Approximate Number of Leases Expiring Assuming No Exercise of Renewal Options |

Approximate Number of Leases Expiring Assuming Full Exercise of Renewal Options | ||

| 2010 |

950 | 52 | ||

| 2011-2013 |

2,998 | 220 | ||

| 2014-2016 |

1,720 | 380 | ||

| 2017-2019 |

488 | 510 | ||

| 2020 and thereafter |

21 | 5,015 |

We own our corporate headquarters and a distribution center located on a 108-acre tract of land in Matthews, North Carolina, just outside of Charlotte, in two buildings containing approximately 1.24 million square feet. We use approximately 930,000 square feet for the distribution center, which includes receiving, warehousing, shipping and storage facilities, and we use approximately 310,000 square feet for the corporate headquarters.

We also own eight additional full-service distribution centers described in the table below:

| Facility Size | ||||||

| Distribution Center |

Land | Building | Date Operational | |||

| West Memphis, AR |

75 acres | 850,000 sq. ft. | April 1994 | |||

| Front Royal, VA |

108 acres | 907,000 sq. ft. | January 1998 | |||

| Duncan, OK |

85 acres | 907,000 sq. ft. | July 1999 | |||

| Morehead, KY |

94 acres | 907,000 sq. ft. | June 2000 | |||

| Maquoketa, IA |

74 acres | 907,000 sq. ft. | March 2002 | |||

| Odessa, TX |

89 acres | 907,000 sq. ft. | July 2003 | |||

| Marianna, FL |

76 acres | 907,000 sq. ft. | January 2005 | |||

| Rome, NY |

87 acres | 907,000 sq. ft. | April 2006 | |||

| ITEM 3. | LEGAL PROCEEDINGS |

Information for this item is included in Note 9 to the Consolidated Financial Statements included in this Report, and incorporated herein by reference.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

There were no matters submitted to a vote of security holders through the solicitation of proxies or otherwise during the fourth quarter of fiscal 2009.

17

Table of Contents

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock is traded on the New York Stock Exchange under the ticker symbol FDO. At October 2, 2009, there were approximately 2,690 holders of record of our common stock. The accompanying tables give the high and low sales prices of our common stock and the dividends declared per share for each quarter of fiscal 2009 and fiscal 2008. We expect that dividends will continue to be declared quarterly for the foreseeable future.

Market Prices and Dividends

| 2009 |

High | Low | Dividend | ||||||

| First Quarter |

$ | 32.50 | $ | 19.70 | $ | .12 1/2 | |||

| Second Quarter |

29.47 | 21.79 | .13 1/2 | ||||||

| Third Quarter |

35.00 | 26.06 | .13 1/2 | ||||||

| Fourth Quarter |

32.97 | 27.50 | .13 1/2 | ||||||

| 2008 |

High | Low | Dividend | ||||||

| First Quarter |

$ | 30.00 | $ | 21.03 | $ | .11 1/2 | |||

| Second Quarter |

23.86 | 14.62 | .12 1/2 | ||||||

| Third Quarter |

22.60 | 18.00 | .12 1/2 | ||||||

| Fourth Quarter |

26.62 | 18.43 | .12 1/2 | ||||||

Issuer Purchases of Equity Securities

The following table sets forth information with respect to purchases of shares of our common stock made during the quarter ended August 29, 2009, by us, on our behalf or by any “affiliated purchaser” as defined by Rule 10b-18(a)(3) of the Securities Exchange Act of 1934.

| Period |

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (1) |

Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs (1)(2) | |||||

| June (5/31/09-7/4/09) |

— | $ | — | — | 3,383,828 | ||||

| July (7/5/09-8/1/09) |

570,500 | 30.56 | 570,500 | 2,455,249 | |||||

| August (8/2/09-8/29/09) |

492,300 | 30.83 | 492,300 | 2,019,798 | |||||

| Total |

1,062,800 | $ | 30.68 | 1,062,800 | 2,019,798 | ||||

| (1) | On November 5, 2007, we announced that the Board of Directors authorized the purchase of up to $150 million of our outstanding common stock from time to time as market conditions warrant. As of August 29, 2009, there was $62.0 million remaining under this authorization. |

| (2) | Includes amounts converted to shares using the closing stock price as of the end of the fiscal month. |

Equity Compensation Plan Information

This information will be included in our proxy statement to be filed for the Annual Meeting of Stockholders to be held in January 2010, under the caption “Equity Compensation Plan Information” and is incorporated herein by reference.

18

Table of Contents

Stock Performance Graph

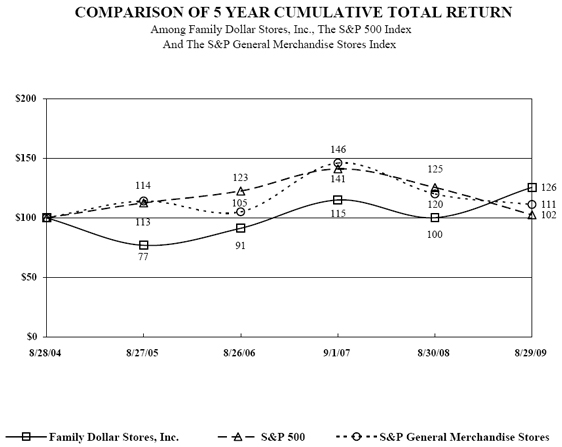

The following graph sets forth the yearly percentage change in the cumulative total shareholder return on our common stock during the five fiscal years ended August 29, 2009, compared with the cumulative total returns of the S&P 500 Index and the S&P General Merchandise Stores Index. The comparison assumes that $100 was invested in Family Dollar common stock on August 28, 2004, and, in each of the foregoing indices on August 28, 2004, and that dividends were reinvested.

19

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

SUMMARY OF SELECTED FINANCIAL DATA

| Years Ended | ||||||||||||||||

| (in thousands, except per share amounts and store data) |

August 29, 2009 |

August 30, 2008 |

September 1, 2007 |

August 26, 2006(1) |

August 27, 2005 |

|||||||||||

| Net sales |

$ | 7,400,606 | $ | 6,983,628 | $ | 6,834,305 | $ | 6,394,772 | $ | 5,824,808 | ||||||

| Cost of sales and operating expenses |

$ | 6,943,337 | $ | 6,618,322 | $ | 6,445,672 | $ | 6,077,467 | $ | 5,485,998 | (2) | |||||

| Income before income taxes |

$ | 450,925 | $ | 361,762 | $ | 381,896 | $ | 311,144 | $ | 342,795 | ||||||

| Income taxes |

$ | 159,659 | $ | 128,689 | $ | 139,042 | $ | 116,033 | $ | 125,286 | ||||||

| Net income |

$ | 291,266 | $ | 233,073 | $ | 242,854 | $ | 195,111 | $ | 217,509 | ||||||

| Diluted net income per common share |

$ | 2.07 | $ | 1.66 | $ | 1.62 | $ | 1.26 | $ | 1.30 | ||||||

| Dividends declared |

$ | 74,012 | $ | 68,537 | $ | 66,361 | $ | 62,757 | $ | 61,538 | ||||||

| Dividends declared per common share |

$ | 0.53 | $ | 0.49 | $ | 0.45 | $ | 0.41 | $ | 0.37 | ||||||

| Total assets |

$ | 2,842,722 | $ | 2,661,782 | $ | 2,624,156 | $ | 2,523,029 | $ | 2,409,501 | ||||||

| Working capital |

$ | 539,731 | $ | 275,106 | $ | 406,977 | $ | 432,737 | $ | 460,157 | ||||||

| Long-term investment securities |

$ | 163,545 | $ | 222,104 | $ | — | $ | — | $ | — | ||||||

| Long-term debt |

$ | 250,000 | $ | 250,000 | $ | 250,000 | $ | 250,000 | $ | — | ||||||

| Shareholders’ equity |

$ | 1,440,060 | $ | 1,254,083 | $ | 1,174,641 | $ | 1,208,393 | $ | 1,428,066 | ||||||

| Stores opened |

180 | 205 | 300 | 350 | 500 | |||||||||||

| Stores closed |

96 | 64 | 43 | 75 | 68 | |||||||||||

| Number of stores - end of year |

6,655 | 6,571 | 6,430 | 6,173 | 5,898 | |||||||||||

| (1) | Our results for fiscal 2006 include a $45.0 million (a net impact of approximately $0.18 per diluted share) litigation charge associated with an adverse litigation judgment and cumulative charges of $10.5 million (a net impact of approximately $0.04 per diluted share) to record non-cash stock-based compensation and income tax related interest expense. |

| (2) | We have reclassified this amount to conform to our current presentation. During fiscal 2006, we began presenting interest income and interest expense separately on the Consolidated Statements of Income. In prior years we included interest income and interest expense in selling, general and administrative expenses. |

20

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion summarizes the significant factors affecting our consolidated results of operations and financial condition for fiscal 2009, fiscal 2008 and fiscal 2007 and our expectations for fiscal 2010. You should read this discussion in conjunction with our Consolidated Financial Statements and the Notes to Consolidated Financial Statements, which are included in this Report. Our discussion contains forward-looking statements which are based upon our current expectations and which involve risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth in the “Cautionary Statement Regarding Forward Looking Statements” in the General Information section of this Report and the “Risk Factors” listed in Part I, Item 1A of this Report.

Our fiscal year generally ends on the Saturday closest to August 31 of each year, which generally results in an extra week every six years. Fiscal 2009 and fiscal 2008 were 52-week years compared with a 53-week year in fiscal 2007. The second quarter of fiscal 2009 and the second quarter of fiscal 2008 included 13 weeks compared with 14 weeks in the second quarter of fiscal 2007.

Executive Overview

We operate a chain of more than 6,600 general merchandise retail discount stores in 44 states, providing primarily low to middle income consumers with a selection of competitively priced merchandise in convenient neighborhood stores. Our merchandise assortment includes consumables, home products, apparel and accessories, and seasonal and electronics. We sell merchandise at prices that generally range from less than $1 to $10.

During fiscal 2009 as compared with fiscal 2008, our net sales increased 6.0% to $7.4 billion, our net income increased 25.0% to $291.3 million, and our diluted net income per common share increased 24.7% to $2.07. Comparable store sales (stores open more than 13 months) for fiscal 2009 increased 4.0% compared with fiscal 2008. Our strong results during fiscal 2009 were due primarily to strong sales of consumable merchandise and improvements in cost of sales, as a percentage of net sales.

Although the economic environment remained difficult for our customers during fiscal 2009, with rapidly rising unemployment and a decline in average hours worked, we believe our customers benefited from lower energy costs and certain government stimulus programs. We believe our strategy of providing both value and convenience continues to resonate well with budget-minded consumers. During fiscal 2009, we experienced an increase in customer traffic and the dollar value of the average transaction. Our customer research suggests that our core low-income customer is shopping us more frequently and spending more when they shop at our stores. In addition, we are seeing growth in the number of shopping trips and average transaction from more middle-income customers. The various components affecting our results for fiscal 2009 are discussed in more detail below.

During fiscal 2009, we focused on driving revenues, mitigating risk and managing costs through the following key initiatives:

| • | We continued the expansion of our assortment of traffic-driving consumables, providing customers with more of what they need in a challenging economic environment. During fiscal 2009, we initiated efforts to re-align space in our stores to accommodate strong customer demand for consumable merchandise and improve the in-store shopping experience. Approximately 48% of the chain was impacted by these efforts during fiscal 2009. |

| • | To strengthen the Family Dollar brand with customers and to reinforce the values we offer, we focused on increasing the productivity and returns of our advertising and customer communications and improving our in-store execution of promotional events. |

| • | We continued the roll-out of new register and point-of-sale technology in approximately 2,500 additional stores. As of August 29, 2009, approximately 4,900 stores were operating on the new technology platform. The new platform facilitates the acceptance of additional payment types, including credit cards and food stamps, and includes a number of computer-based tools designed to provide our store managers with better training, analytics and work flow management. |

| • | Through our price management work, the continued development of our private label offering, and our global sourcing efforts, we offset the impact of the shift in the merchandise mix to more lower-margin consumable merchandise. |

| • | We continued to focus on inventory productivity, and we lowered our inventory levels in more discretionary merchandise categories. During fiscal 2009, total inventory decreased 3.8% and inventory per store decreased 5.0%, both in comparison to fiscal 2008. Lower inventory levels are making our stores easier to shop and reducing our exposure to seasonal markdowns. We also believe that lower inventory levels are resulting in lower inventory shrinkage and a reduction in workers’ compensation and general liability claims. |

21

Table of Contents

| • | Reflecting the uncertainty in the current economic environment, we continued our measured pace of new store openings so that we can focus on improving our returns on existing assets. We opened 180 stores and closed 96 stores. |

Fiscal 2010 Outlook

During fiscal 2010, we plan to build on the improvements we made during fiscal 2009 and maintain our focus on four key priorities: increase relevancy to the customer, drive increased profitability, manage risk and build great employee teams.

To increase our relevancy to the customer we plan to continue re-aligning the space in our stores to better meet customer demand and improve the in-store shopping experience. In addition, we plan to complete the rollout of our new register and point-of-sale technology during fiscal 2010. We also plan to adjust our store operating hours to provide greater convenience for our customers and continue to expand our customer research efforts.

In order to drive increased profitability, we plan to continue investing in initiatives that drive top-line growth, and we remain focused on cost management. In addition to the initiatives already discussed, we plan to enhance our private label offering and global sourcing efforts and make additional investments to strengthen our pricing efforts.

We plan to continue managing our inventory risk by constraining purchases of discretionary merchandise. We also plan to leverage the investments we have made in our Project Accelerate initiative and global sourcing efforts to improve inventory productivity and quality.

We believe that our long-term success is dependent on our ability to create strong employee teams that can adjust and respond quickly to ever-changing conditions. We plan to continue to invest in building a stronger Family Dollar culture and great employee teams. We also plan to continue to focus on improving employee retention.

During fiscal 2010, we expect sales will continue to be strongest in the Consumables category, as customers continue to constrain their discretionary spending. We expect cost of sales, as a percentage of net sales, will continue to be pressured by the shift in the merchandise mix to more consumable merchandise. We plan to offset this pressure through lower markdowns, the enhancement of our private label program, improvements in price optimization, and lower inventory shrinkage. We expect selling, general and administrative (“SG&A”) expenses, as a percentage of net sales, will be pressured as we continue to make revenue driving investments, including the re-alignment of space in our stores, the roll-out of new register and point-of-sale technology and the expansion of store operating hours. See Part I, Item 1 of this Report for more information on our current strategic initiatives.

22

Table of Contents

Results of Operations

Our results of operations for fiscal 2009, fiscal 2008 and fiscal 2007 are highlighted in the table below and discussed in the following paragraphs:

| Years Ended | ||||||||||||

| (in thousands) |

August 29, 2009 | August 30, 2008 | September 1, 2007 | |||||||||

| Net sales |

$ | 7,400,606 | $ | 6,983,628 | $ | 6,834,305 | ||||||

| Cost and expenses: |

||||||||||||

| Cost of sales |

4,822,401 | 4,637,826 | 4,512,242 | |||||||||

| % of net sales |

65.2 | % | 66.4 | % | 66.0 | % | ||||||

| Selling, general and administrative |

2,120,936 | 1,980,496 | 1,933,430 | |||||||||

| % of net sales |

28.7 | % | 28.4 | % | 28.3 | % | ||||||

| Cost of sales and operating expenses |

6,943,337 | 6,618,322 | 6,445,672 | |||||||||

| % of net sales |

93.8 | % | 94.8 | % | 94.3 | % | ||||||

| Operating profit |

457,269 | 365,306 | 388,633 | |||||||||

| % of net sales |

6.2 | % | 5.2 | % | 5.7 | % | ||||||

| Interest income |

6,595 | 11,042 | 10,690 | |||||||||

| % of net sales |

0.1 | % | 0.2 | % | 0.2 | % | ||||||

| Interest expense |

12,939 | 14,586 | 17,427 | |||||||||

| % of net sales |

0.2 | % | 0.2 | % | 0.3 | % | ||||||

| Income before income taxes |

450,925 | 361,762 | 381,896 | |||||||||

| % of net sales |

6.1 | % | 5.2 | % | 5.6 | % | ||||||

| Income taxes |

159,659 | 128,689 | 139,042 | |||||||||

| % of net sales |

2.2 | % | 1.8 | % | 2.0 | % | ||||||

| Net Income |

291,266 | 233,073 | 242,854 | |||||||||

| % of net sales |

3.9 | % | 3.3 | % | 3.6 | % | ||||||

Net Sales

Net sales increased 6.0% in fiscal 2009 compared to fiscal 2008 and 2.2% in fiscal 2008 compared to fiscal 2007. The increases in fiscal 2009 and fiscal 2008 were attributable, in part, to increases in comparable store sales of 4.0% and 1.2%, respectively, with the balance of the increases primarily relating to sales from new stores opened as part of our store growth program. Comparable store sales includes stores that have been open more than 13 months. Stores that have been renovated, relocated, or expanded are included in the comparable store sales calculation to the extent that they had sales during comparable weeks in each year. The method of calculating comparable store sales varies across the retail industry. As a result, our comparable store sales calculation may not be comparable to similarly titled measures reported by other companies.

Net sales in fiscal 2008 as compared to fiscal 2007, were negatively impacted by the loss of one week during the reporting period. Fiscal 2008 was a 52-week year compared to a 53-week year in fiscal 2007. The additional week was approximately 2% of net sales in fiscal 2007.

The 4.0% increase in comparable store sales in fiscal 2009 resulted from an increase in customer traffic, as measured by the number of register transactions in comparable stores and an increase in the dollar value of the average customer transaction. During fiscal 2009, the customer count increased approximately 2.8% and the average customer transaction increased approximately 1.2% to $9.84 compared to fiscal 2008. Sales during fiscal 2009, on a comparable store basis, were strongest in Consumables, driven primarily by sales of food. Sales in more discretionary categories continued to be soft, reflecting the current economic environment.

The 1.2% increase in comparable store sales in fiscal 2008 resulted from an increase in the average customer transaction. During fiscal 2008, the customer count, as measured by the number of register transactions in comparable stores, was approximately flat (0.3% decrease), and the average customer transaction increased approximately 1.5% to $9.70 compared to fiscal 2007. Sales during fiscal 2008, on a comparable store basis, were strongest in Consumables. Sales in more discretionary categories were weaker.

23

Table of Contents