Attached files

| file | filename |

|---|---|

| EX-99.1 CHARTER - EXHIBIT 99.1 PRESS RELEASE RE EARNINGS - AutoWeb, Inc. | exhibit_99-1.htm |

| 8-K - FORM 8-K 3RD QTR EARNINGS RELEASE - AutoWeb, Inc. | form_8k.htm |

Exhibit 99.2

PRIME NEWS WIRE

Moderator: Lawrence

Brogan

10-22-09/4:00 p.m. CT

Confirmation # 35120681

Page 1

PRIME

NEWS WIRE

Moderator: Lawrence

Brogan

October

22, 2009

4:00

p.m. CT

|

Operator:

|

Good

morning. My name is (Christie) and I will be your conference

operator today. At this time, I would like to welcome everyone

to the Autobytel Third Quarter 2009 Financial Results. All

lines have been placed on mute to prevent any background

noise. After the speaker’s remarks, there will be a

question-and-answer session. If you would to ask a question

during this time simply press star then the number one on your telephone

keypad. If you would like to withdraw your question, press the

pound key.

|

Thank

you. Mr. Lawrence Brogan, Senior Vice President of Strategic and

Financial Planning, you may now begin.

|

Lawrence

Brogan:

|

Thank

you. Good afternoon and welcome to Autobytel’s 2009 Third

Quarter Conference Call. With me on the line today are Jeff

Coats, President and Chief Executive Officer and Curt DeWalt, Chief

Financial Officer.

|

Before we

begin, I need to remind you that during today’s call, including the Q&A

session, any projections and forward-looking statements made regarding future

events and the future financial performance of the company are covered by the

safe harbor statement contained in today’s press release and in the company’s

public filings with the Securities and Exchange Commission.

Please

note that actual events or results may differ materially from these

forward-looking statements. Specifically, please refer to our Form

10-K for the year ended December 31, 2008, our Form 10-Q for the quarter ended

June 30, 2009 and our Form 10-Q for the quarter ended September 30, 2009, which

we expect to file shortly.

These

filings identify the principal factors that could cause results to differ

materially from those forward-looking statements. Slides are included

with today’s presentation to help illustrate some of the points being made and

discussed during this call. You can access the slides in the investor

relations section of our Web site, www.Autobytel.com.

Now, I’ll

turn the call over to Jeff.

PRIME NEWS WIRE

Moderator: Lawrence

Brogan

10-22-09/4:00 p.m. CT

Confirmation # 35120681

Page 2

|

Jeff

Coats:

|

Thank

you, Larry. Good afternoon everyone. While the

Autobytel story the past few quarters was primarily one of cost reduction

and containment, our focus has also been on implementing a carefully

thought out reinvestment in our properties and products to enhance our

gross margins and drive revenue.

|

We’ve

improved our gross margin by approximately eight percent from the second quarter

of 2009 while at the same time reducing total operating expenses by a further

seven percent sequentially. But the last few quarters have also

included an extensive ground laying effort to upgrade, re-platform and

reconfigure our Web sites and integrate the data and content acquired from the

patent settlements completed in the second quarter of this year.

This

effort has improved page views to our Web site and increased the level of our

direct-to-site or “organic leads,” which carry better margins and are generally

of higher quality than leads acquired from third party sites. If you

will recall back in January we rehired two former Autobytel executives to take

charge of our Web site operations and search engine marketing. That

investment has already paid substantial dividends, and we are excited about our

current momentum in improving user experience, traffic acquisition and

monetization.

By most

measures the general economy seems to be stabilizing and there has been some

recent positive news coming out of the automotive industry. General

Motors and Chrysler have emerged from bankruptcy and the government’s

“Cash-for-Clunkers” program, albeit a one time event, stimulated the purchase of

nearly $700,000 cars through a rebate which returned close to $3 billion to

consumers.

Although

“Cash-for-Clunkers” was a real boon to auto manufacturers and dealers, it was

somewhat of a mixed blessing for Autobytel. Although we experienced

increased leads delivered per dealer as a result of the program during the third

quarter, overall dealer demand for our lead programs decrease, reflected in

fewer new dealer sign ups, as certain dealers felt they had sufficient volume of

customers through increased online and show room traffic. Our OEM and

advertising businesses benefited from heightened consumer demand in the short

term but we are now dealing with the after effects of dealer inventory sell outs

and a softening of consumer interest which typically means fewer requests for

auto lead referrals. We are hopeful that dealers buoyed by recent

increased sales related to “Cash-for-Clunkers” will increase their marketing

budgets over the coming months related to new products introduced for the 2010

model year.

While

working towards bolstering our top line and improving profitability we have

maintained a strong cash position, $25.2 million at the end of

September. Autobytel remains debt free and we are highly committed to

upholding and building our financial flexibility to take advantage of the

strategic opportunities that are available to us.

I’ll now

turn things over to Curt who will provide a review of our third quarter

results. Curt.

PRIME NEWS WIRE

Moderator: Lawrence

Brogan

10-22-09/4:00 p.m. CT

Confirmation # 35120681

Page 3

|

Curt

DeWalt:

|

Thank

you, Jeff. To keep things to the point, I’ll highlight a few

key metrics from the third quarter. You’ll find more detail in

the press release we just issued and our 10-Q for the quarter ended

September 30, 2009, which we expect to file

shortly.

|

As Larry

mentioned, you can also follow along with the slide presentation we posted

earlier today on our Web site.

As shown

on slide three, total revenues for the third quarter of $13.4 million were flat

with the second quarter of this year and down by approximately 23 percent

year-over-year. This is primarily due to the decline in the number of

participating dealers in our leads programs and the corresponding leads to those

dealers.

As the

automotive market has struggled, many of our dealers have gone out of business

or pulled back significantly in their marketing spend. While the

“Cash-for-Clunkers” program provided a short term boost for dealers it did not

boost demand for our lead programs as dealers were flooded with customers both

online and in their show rooms.

Finance

leads were off two percent from the second quarter of this year and declined 51

percent from the prior year third quarter due to the decline in the number of

participating dealers, which is primarily related to continued tightness in the

sub prime consumer credit environment, making it difficult for dealers to get

credit challenged customers financed.

Wholesale

OEM lead delivery improved throughout the quarter, showing continued stability,

and was up slightly from the second quarter. But this business is

still down year-over-year. We continue to see OEM leads as an area of

growth for Autobytel as more OEMs become active in the lead

marketplace.

Slide

five shows our quarterly revenue by product over the last two

years. In the third quarter of 2009, we delivered approximately

675,000 auto leads compared with 690,000 in the prior quarter and 772,000 in

last year’s third quarter reflecting a declining dealer base partially offset by

an increase in the number of leads delivered per dealer. Increasing

the leads delivered per dealer directly impacts our revenue per

dealer.

We

delivered 87,000 finance leads in 2009 third quarter, roughly equal to the

second quarter of 2009 and 145,000 in the third quarter of a year

ago. Again, declines primarily reflect the declining dealer base,

impacted by the lack of available sub prime consumer credit.

Our

dealer network continued to be impacted by challenges facing the automotive

industry. At the end of the third quarter 2009 we were serving 2021

new car franchises versus 2263 in the second quarter of 2009 and 3215 in the

prior year period. Our used car dealer franchises totaled 923 at the

end of the 2009 third quarter compared with 1,016 at the end of the second

quarter 2009 and down from 1,321 in the year ago quarter.

Finance

dealer franchises totaled 186 at the end of 2009 third quarter compared with 201

at the end of the second quarter and 298 in the 2008 third quarter.

It is

encouraging to note that we are currently seeing signs of a reversal in dealer

cancellations and loss.

PRIME NEWS WIRE

Moderator: Lawrence

Brogan

10-22-09/4:00 p.m. CT

Confirmation # 35120681

Page 4

Third

quarter advertising revenue was about equal to this year’s second quarter as

well as last year’s third quarter. Although “Cash-for-Clunkers”

resulted in higher traffic to our Web site properties during the quarter,

advertisers’ budgets did not increase significantly from prior

periods.

There

were approximately 48 million total Web page views across our Internet

properties in 2009 third quarter, up about 30 percent from the 37 million page

views in the second quarter. We had approximately 50 million in the

year ago period. The “Cash-for-Clunkers” program presented us with an

opportunity to spend SEM dollars effectively in July and August to generate

leads and page views. Our in-house SEM spending was approximately

three times higher in Q3 versus Q2 of 2009. This allowed us to

displace leads and traffic purchased from third party sources, leading to an

improvement in gross margin from Q2 to Q3. As Jeff mentioned at the

beginning of the call, carefully thought out reinvestment in programs and

properties has become a major focus for the Autobytel story.

Gross

margins were 35.5 percent in the 2009 third quarter, up from 32.9 percent in the

second quarter of this year as we worked to refine the retail auto

lead promotions which were initiated in response to the sliding

economy. In addition, the results of our decisions to carefully

reinvest in our properties and programs to enhance our gross margins is becoming

evident as we approach last year’s third quarter margins of 35.7

percent.

Both

slides three and six illustrate the reduce operating expenses by approximately

50 percent to $6.2 million and $12.2 million in the same period last year, which

included $1.8 million in severance costs. Without considering the

severance cost, year-over-year decline in operating expenses was 40

percent. On a sequential basis, expenses were lower by approximately

seven percent. Also on slide six you will see significant

improvements we’ve made in expense management over the last seven

quarters. Rest assured we are continually looking for increased

efficiency and decreased costs in line with our current and anticipated revenue

levels.

Non-cash

share based compensation in third quarter 2009 decreased to $266,000 down from

$561,000 in last year’s third quarter.

Net loss

for 2009 third quarter was $799,000 or two cents per share, which included

approximately $642,000 of other income and discontinued operations primarily

related to the release of funds from the escrow account which was established

when we sold our AVV business in January 2008, along with certain tax

adjustments.

These

results are a significant decline from the net loss of $5.6 million or 13 cents

a share in the 2008 third quarter. The company’s reported loss from

continuing operations was $1.4 million for 2009 third quarter. And in

2009 second quarter the loss from continuing operations was $1.5 million and in

the third quarter of last year the operating loss from continuing operations was

$5.8 million.

With

respect to the $1.9 million of AVV escrow, we expect to have this account fully

reconciled by the end of the year and that we will have captured approximately

95 percent of the funds escrowed at closing. The remaining amount

will be paid to the acquirer of the AVV business to obtain certain software

licenses per the original purchase agreement.

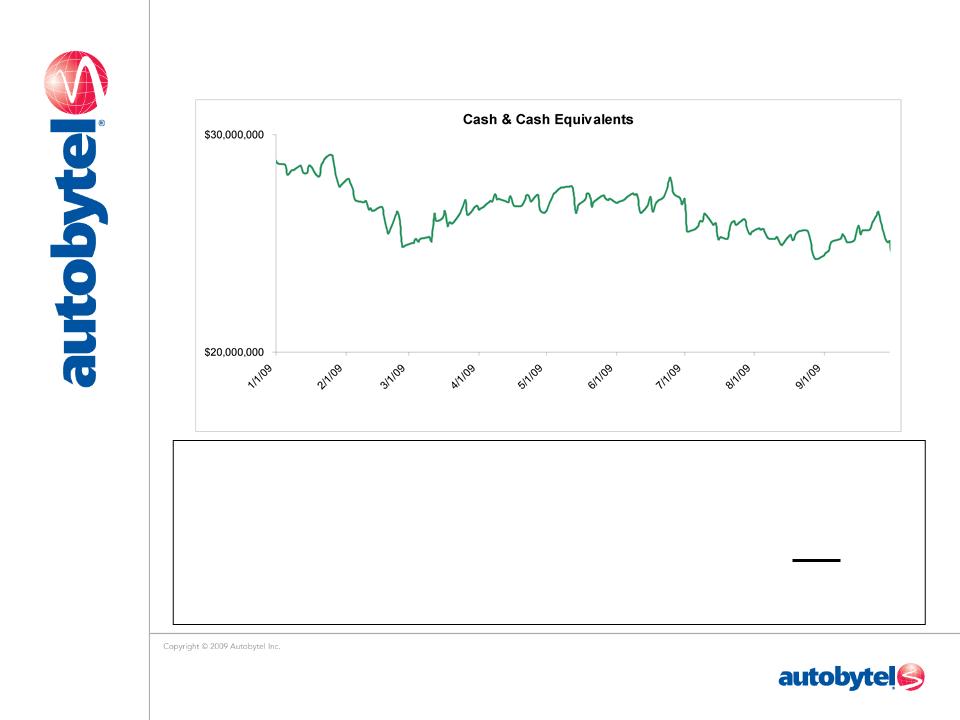

Slide

nine you can see how cash has trended since the beginning of the

year. At September 30, 2009 our cash balance was $25.2 million or 56

cents per share compared with $27.4 million or 61 cents per share at December

31, 2008 and $26.8 million or 59 cents per share at June 30, 2009. As

Jeff mentioned, our balance sheet remains debt free.

PRIME NEWS WIRE

Moderator: Lawrence

Brogan

10-22-09/4:00 p.m. CT

Confirmation # 35120681

Page 5

Some of

you had questions regarding the exposure to Chrysler and GM bankruptcy, both of

which emerged earlier this last quarter. We’ve received payment for

all outstanding pre-bankruptcy receivables and at this time our lead delivery

program with Chrysler is not active. We are continuing to provide

leads and advertising to General Motors, and Ford continues to be an important

and growing OEM customer.

Our

current ratio continues to improve and stood at 4.7 to one at the end of

September, compared with 4.4 to one at the end of June and 3.3 to one at the end

of December 2008.

As many

of you know from our recent Form 8-K filing with the SEC we received a

notification from NASDAQ on September 15 informing us that Autobytel was not in

compliance with NASDAQ’s $1 minimum closing price requirement for continued

listing of our stock on the NASDAQ global market. NASDAQ had

previously suspended the minimum bid requirement but lifted the suspension on

August 3. Per the terms of the notification, Autobytel has six months

from September 15 to regain compliance with the minimum bid requirement or face

de-listing. We are currently evaluating our options with respect to

this compliance deficiency and we’ll be communicating accordingly.

With that

I’ll now turn the call back to Jeff.

|

Jeff

Coats:

|

Thank

you, Curt. We are pleased with the progress we are making

although we remain constrained by a challenging external environments even

as our industry made some short term progress during the third

quarter. Throughout this period we’ve been working hard to

blend together efficiencies, decrease expenses and most importantly, we

are seeking new and better ways to provide increasing value to our

customer base.

|

Particularly

encouraging has been the significant progress we’ve made on our owned and

operated suite of Web sites, including Autobytel.com, AutoWeb, Autosite,

Car.com., CarSmart, CarTV and Myride.com.

In the

first quarter of this year we assembled a new leadership team to help us rebuild

our Web presence. We then focused on making improvements in site

reporting and infrastructure to lay the groundwork for this effort.

In the

second quarter, we relaunched Myride.com, improving the site speed, stability,

customer interaction and lead conversion. In the third quarter, we

began integrating the data, content, and tools we received as part of several

intellectual property settlements in the second quarter including those with

Edmund’s and Internet Brands. These assets include editorial content,

core vehicle data, car photos and other research tools. We are hoping

to achieve similar arrangements with other parties that would allow us to

further strengthen our Web site content.

PRIME NEWS

WIRE

Moderator:

Lawrence Brogan

10-22-09/4:00

p.m. CT

Confirmation #

35120681

Page 6

In the

fourth quarter, we expect to complete the remainder of the third party content

integration into our Web sites and relaunch Autobytel.com. As we do

this work we are already seeing improved results in customer acquisition and

conversion due to improvements in content, tools, and user

experience.

In the

first quarter of 2010 we expect to continue this work across our Web platform,

including relaunching Car.com, AutoWeb and Autosite. By continuing to

improve our Web sites we believe we can continue to decrease customer

acquisition costs, improve margins and raise product quality in both the leads

and the advertising businesses.

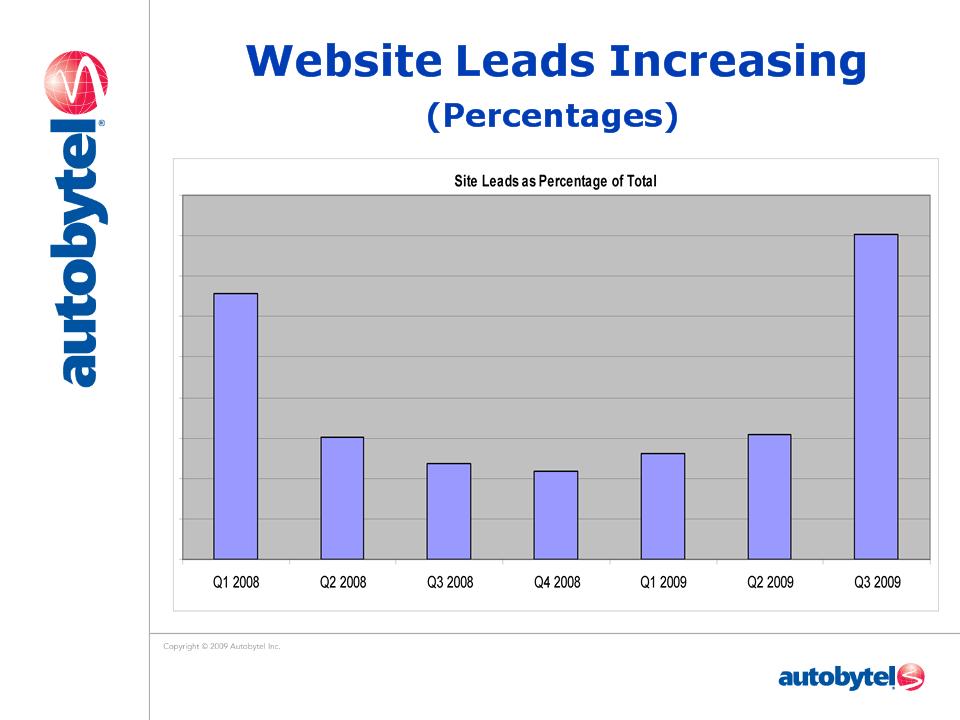

Slide

eight highlights our progress and provides a roadmap to further product

development. This progress has allowed us to bring our search engine

marketing or SEM activities in house at a positive and increasing

ROI. We’ve eliminated all negative SEM related ROI that previously

was outsourced. As seen on slide seven, further conversion of site

visits in the leads has increased by over 300 percent from the first quarter of

2009 and we expect to see this momentum continue. As we’ve mentioned

previously the creation of more organic leads is an important cornerstone of our

strategy going forward.

Our cash

position and prudent balance sheet management have allowed us the time to not

only weather the current storm but to position Autobytel for future growth by

providing our manufacturer and dealer customers with value added services that

allow them to maximize vehicle sales.

For

example as we discussed last quarter, we entered into an agreement with Kelley

Blue Book to extend our reach into the large used car market. This

will improve both the quality and quantity of leads from our used car

program. In July we launched a new lead verification technology

platform to increase the quality of and closing ratios on new and used car leads

for our dealer customers. We are very pleased thus far with the

results, especially in this type of environment, which has been one of the most

challenging times in our industry’s history. We must be sensitive and

responsive to our customer’s needs and help them quickly adapt to rapidly

changing business conditions.

Most

recently, we relaunched our e-mail manager program to help dealers better

respond to what has become a highly prolonged consumer purchase

cycle. In fact, today’s consumers spend about nine months from the

time they begin to research a car until they finalize a

purchase. This time frame is now about twice what it was in

2001. We completely revamped and enhanced the program’s capabilities

to provide dealers with a better method for keeping in front of potential

customers. Our e-mail campaigns result in earlier and more frequent

communications with consumers without taxing existing dealer

resources.

PRIME NEWS WIRE

Moderator: Lawrence

Brogan

10-22-09/4:00 p.m. CT

Confirmation # 35120681

Page 7

In our

continued efforts to provide innovation in September we began the roll out of a

new lead product program designed to better meet the needs of our large dealer

customers. It is services like these, coupled with our leading

automotive Web properties, that give dealers and manufacturers the tools they

need to effectively compete in a shrinking target market. We are

confident that, as well as these programs work in today’s environment, they will

become even more valuable as the economy continues to stabilize and returns to a

pattern of growth.

While

continually improving our consumer manufacturer and dealer experiences we are

also highly cognizant of our ongoing need to streamline our business and make

sure our costs are proportional to our current and expected revenue

levels. We remain focused on the further development of robust tools

that will assist our customers in selling cars in the most cost effective manner

possible. In parallel we remain committed to fine tuning our own

operations for maximum efficiency.

The

recovery in the general economy appears to be underway, and Detroit’s three

major automakers, as well as JD Power, seem to be painting better scenarios for

2010. We certainly hope they are right, but we are focused on

increasing productivity enhancement and further cost rationalization

regardless.

At

Autobytel I am confident that we are doing the right things to strengthen our

position in the marketplace while using our financial flexibility to the

utmost. Even in this economy, and perhaps because of it, strategic

opportunities abound. As I mentioned in prior calls the automotive

industry and its diverse segments are ripe for change and consolidation and

Autobytel is positioned very well to benefit from this.

We’ve

made considerable progress. We have the right team and strategy in

place to further strengthen and grow our company. We are strongly

positioned to benefit from a recovering economy and automotive

markets. I look forward to reporting back to you as we continue to

find new ways to not only survive but to thrive. Operator, we’ll now

take questions.

|

Operator:

|

Yes,

sir. If you’d like to ask a question at this time, simply press

star then the number one on your telephone keypad. We will

pause for just a moment to compile the Q&A roster. And your

first question comes from the line of (William

Martin).

|

|

(William

Martin):

|

Hey,

Jeff. How are you?

|

|

Jeff

Coats:

|

Good,

(Bill). How are you?

|

PRIME NEWS WIRE

Moderator: Lawrence

Brogan

10-22-09/4:00 p.m. CT

Confirmation # 35120681

Page 8

|

(William

Martin):

|

Very

good. Did I hear you correctly that you said that you’re seeing

a reversal in dealer losses this

quarter?

|

|

Jeff

Coats:

|

Things

are strengthening. They’re looking pretty good so far this

quarter.

|

|

(William

Martin):

|

Great. And

kind of along the same lines you know we’ve heard a number of major auto

retailers talking about significantly reallocating dollars on

line. I was curious just if you could talk about how you’re

attacking and going after that

opportunity.

|

|

Jeff

Coats:

|

Well,

as I mentioned we launched in late September and earlier this month a

couple of new products, one particularly focused on the large dealer

groups. We don’t really want to talk about it too much publicly

at this point for competitive reasons but we are very confident that it’s

going to pull more of those dollars in our direction. It’s

exactly what the big dealers have been asking for. The initial

feedback that we’re getting as we meet with them has really been

astounding. So we’re confident we’re going to see some big pick

ups from that.

|

|

(William

Martin):

|

Great. And

I – you obviously noted you continue to evaluate ways to strengthen your

market position from a strategic perspective. I was wondering

are you seeing, in this difficult auto environment, are you seeing smaller

competitors go out of business or come up for

sale?

|

|

Jeff

Coats:

|

I

haven’t really seen a lot of smaller competitors go out of business thus

far. Some of the smaller guys do seem to have, you know,

liquidity issues but you know it only takes two guys, and a dog in a

garage to start a search business and there are a lot of guys like that

out there. They can generate some amount of revenue, a million,

a couple million whatever. I think it’s hard for them to scale

much beyond that but you know there’s always people like that out

there.

|

We’re

looking for some interesting acquisition candidates. We’re talking to

quite a few. So you know we’re definitely – we’ve got our ear to the

ground and trying to see what we can do.

|

(William

Martin):

|

Great. And

just one more question. You know Autobytel obviously owns a

valuable patent portfolio, I was curious if you’re comfortable

articulating this publicly just how are you thinking about that asset

today?

|

|

Jeff

Coats:

|

We

are currently reviewing what our opportunities may be to pursue additional

licensing for our patient portfolio. And are, in fact, in some

discussions currently.

|

|

(William

Martin):

|

Great. Well,

thank you so much for your hard work. I really appreciate

it.

|

|

Jeff

Coats:

|

Thanks.

|

|

Operator:

|

And

your next question comes from the line of (Seth Setrakian) with First New

York.

|

|

(Seth

Setrakian):

|

Hi,

guys. How are you?

|

PRIME NEWS WIRE

Moderator: Lawrence

Brogan

10-22-09/4:00 p.m. CT

Confirmation # 35120681

Page 9

|

Jeff

Coats:

|

Hey,

(Seth).

|

|

(Seth

Setrakian):

|

I

guess I have a couple of questions, one regarding the balance

sheet. Is there one more payment that’s due from the settlement

a couple of years ago?

|

|

Jeff

Coats:

|

Yes. There’s

the payment of $2.67 million due in the middle of March

2010.

|

|

(Seth

Setrakian):

|

Got

it. So …

|

|

Jeff

Coats:

|

And

it’s not on the balance sheet,

(Seth).

|

|

(Seth

Setrakian):

|

Yes,

yes, no. It’s not on the balance sheet. I’m just

trying to think incremental like pro forma where assuming that burn isn’t

that dramatic for the fourth quarter, where we will be in the beginning of

next year. So essentially we’re still trading approximately net

cash.

|

It seems

like you guys have done a phenomenal job considering the state of where we were

operationally a year ago in the state of really automotive industry over the

past 12 to 18 months. And I guess from a fundamental point of view,

we’re doing very well in terms of the hand we were dealt with. I

guess now my question is considering we’re still only trading at net cash per

share and I’m looking at all of your peers if we can call them peers, all of the

dealers, all of the manufacturers, advertising companies, everyone that kind of

fell off the cliff from a business point of view a lot of their stocks have come

back to the spring 2008 levels. We’re clearly not even near

that. We were at $2 a share back then.

And you

know from a fundamental point of view all of these companies that I’m alluding

to probably had business drop off between 30 and 50 percent probably comparable

to us. But their stocks have come back, ours has not. Our

business is being valued at zero. So I guess going forward, I really

am curious to hear your thoughts on how we’re going to enhance shareholder value

in light of the fact that you’re not going to get any credit for the

business. But even more so I mean we do have this NASDAQ listing

issue also. And I mean from where I sit I see no reason why we’re not

above $1 a share. And I just kind of want to – I guess I want to hear

your thoughts on all of that.

|

Jeff

Coats:

|

Let’s

see. Those were a lot of points to

address.

|

|

(Seth

Setrakian):

|

I

know. Sorry.

|

PRIME NEWS WIRE

Moderator: Lawrence

Brogan

10-22-09/4:00 p.m. CT

Confirmation # 35120681

Page 10

|

Jeff

Coats:

|

No,

no. I think probably one of the reasons that our stock hasn’t

come back the way others has is because we had damaged our credibility

historically with our results. Our results had trended poorly

for a while even before the bottom fellow out of the economy in the

automotive market.

|

So I

think we are a little bit in a situation of show me. I think the

market is waiting to see us not just prove that we can cut costs, which we

definitely have done. But that we can actually rebuild a business and

improve the top line. We are absolutely in the process of

demonstrating that we can rebuild the business. Our margins are

improving. And you know and all of the things that we talked about

with regards to our lead conversion and our page views being up and the work

we’ve done on the sites this year all of that will set up very nicely as we move

forward into the fourth quarter and into 2010.

So as the

economy recovers, as the automotive economy recovers we really are very well

positioned to be able to improve the top line. I also think and you

know we haven’t really talked about this a whole lot on these calls but

historically the leads business was not getting a lot of investment capital

during the prior two or three years as other business efforts were being

pursued. And so you know we’ve spent this year rebuilding the leads

business. I think we’ve come a long way. I think we will

be able to demonstrate that we can and are rebuilding the business and will be

able to drive the top line.

I agree

with you with regards to stock price, but then of course, I would. We

certainly are reviewing all of our options with regards to the situation with

the NASDAQ and there certainly are various options available to us but the best

option is to, you know, put results – demonstrate results which result in

greater investor confidence and an improved stock price. We think

we’ve begun to do that. We think as we continue to move forward we’ll

be able to further demonstrate that our margins are strengthening

again.

You know

we’re not even close to historic margin levels. The benefits that

we’ve seen in, you know, lead conversion and page views have been pretty good so

far this year under almost anybody’s metrics. And yet, for the most

part it was done with the sites that had yet to be overhauled, with sites that

we had not yet integrated any of the new content or tools or photos or reviews

that we received as part of the litigation settlements.

So you

know I think there’s some – the best is yet to come as they say as we complete

the integration of all of these assets into the Web sites. And we can

really continue to turn up the flame under our search activities both SEM and

SEO and see the benefits from those.

|

(Seth

Setrakian):

|

You

know in addition you alluded to investor confidence, just one other point

to make. I think investor awareness is going to matter

also. I just feel we are below the radar screen. It

seems like there’s been a core list of holders that have been owning the

stock over the last couple of years and there are some new significant

shareholders also. However, I think in terms of getting the

story out and letting people know on how much improvement there’s been and

the value that’s here there’s probably a better effort we can make on

investor awareness.

|

And just

one thing I want to highlight even on the press release it’s only Webcast and I

know there’s a dial in number and that’s not even on the press

release. If that’s just something that we could do. I know

this is probably not the time to talk about stuff like this but it’s just too

good of a story out there. It’s tremendously undervalued and I think

little small things like that can increase our profile with a larger

audience. That can help us accomplish what we all want to do and

that’s you know see the stock be higher.

PRIME NEWS WIRE

Moderator: Lawrence

Brogan

10-22-09/4:00 p.m. CT

Confirmation # 35120681

Page 11

|

Jeff

Coats:

|

Sure. Well

you know we’re always – always want to get feedback and good ideas from

people. We certainly are working towards the goals that you’re

talking about. You know and I’ll be candid with you I have not

devoted much time to some of the activities thus far that you’re talking

about because you know I …

|

|

(Seth

Setrakian):

|

Your

plate’s been full. I mean there’s been a lot that you’ve had to

reverse.

|

|

Jeff

Coats:

|

No,

no, it’s not just that. It’s I decided that it didn’t make

sense for me to go out and say to the market this is what we’re going to

do because a lot of companies say that. This company has said

that historically and then didn’t deliver. So I decided to wait

until we had delivered some results and then go out and start saying OK

this is what we’ve now done. So we’ve got a little bit of

credibility. This is what we’re going to do and start telling

the story that way.

|

So I

think you know I agree with you. I think we’re pretty well positioned

at this point to start telling our story more broadly, more widely and you know

also this has been a difficult year in the automotive market and you know who

knew where the market was going to be and even if for sure we’re at the bottom

even though you know the conventional wisdom certainly hopes that we

are. Some of us were at the JD Power conference last week and there

certainly seems to be a positive outlook, not enthusiastic so it’s not over the

top, but a positive outlook as we roll into 2010, so you know.

|

(Seth

Setrakian):

|

Well,

look I just want to commend you guys. You guys are working

really hard. You’re doing a great job, and I think eventually

the market is going to notice. Keep it

up.

|

|

Jeff

Coats:

|

Thank

you very much. We appreciate your

support.

|

|

(Seth

Setrakian):

|

Thanks. Bye.

|

|

Operator:

|

And

your next question comes from the line of (Brian Horey) with

(Aurelian).

|

|

(Brian

Horey):

|

Hi. I

had two questions. I guess the first was in terms of the post

cash–for-clunkers period you know how does it all net out? I

understand you said that dealers were maybe more interested now in lead

generations since they don’t have so much showroom traffic. But

consumers on the other hand are you know are less

interested. So how does that net out for the business as we

enter Q4, I think?

|

And the

second question was I’m just kind of curious as to you know your sense of how

much of the organic traffic yield or potential we have realized with these

search engine optimization efforts that we’ve done to date and kind of how much

more opportunity is there to improve that going forward.

PRIME NEWS WIRE

Moderator: Lawrence

Brogan

10-22-09/4:00 p.m. CT

Confirmation # 35120681

Page 12

|

Jeff

Coats:

|

OK. With

regards to your first question I’d say it’s a mixed bag. You

know kind of what we’ve seen and you know there were some concerns during

“Cash-for-Clunkers” that what it would do would be – would pull forward a

lot of demand into July and August for people that would normally have

gone in and bought cars later in the year. And certainly there

seems to have been – there seems to be a significant element of

that.

|

But even

worse than that is the fact that a lot of dealerships don’t have any inventory

or haven’t had any inventory until this month because – for a variety of

reasons. You know cash–for-clunkers really sucked out a lot of

inventory out of the system. But even before then many dealers had

prudently and judiciously you know curtailed their inventory purchases earlier

in the year as you know they were seeing things not look great. So

there wasn’t a lot of, as they say in Detroit, metal on the lot before

cash–for-clunkers. “Cash-for-Clunkers” really siphoned off a lot of

what was left.

And so

we’ll see what happens as the 2010 products are delivered to

dealers. It will be interesting. You know we are hoping to

see some pick up in marketing dollars spent. So it remains to be

seen.

I’ve gone

blank on your second question.

|

Curt

DeWalt:

|

SEO

SEM.

|

|

Jeff

Coats:

|

Oh,

SEO SEM. The – it’s a good answer I’m happy to tell you in that

we’ve barely scratched the surface. We’ve made some good

inroads thus far, but again, what we’ve been able to do so far is even

with many of our sites still in need of overhaul without the new content,

the new tools, the new pictures, the new reviews that were coming into the

sites. We’re working on some other data acquisition

opportunities to even further enhance the quality of our Web

sites.

|

So you

know it never had made sense to bring a lot of people to our sites through paid

search if we couldn’t hold them on our sites. Now, that we’re

improving our sites and continuing to improve our sites and really you know even

if you go to the Autobytel.com today that site has not yet been

overhauled. You know Myride of all of the sites has gotten most of

the integration into. As we integrate the new tools, the new pictures

and everything is going into Myride first. And so that’s the place to

look. But as we complete the relaunch of Autobytel in November and

the other sites and integrate all of these wonderful things into them we will

really be able to see and expect to see some good benefits from our search

activities.

|

(Brian

Horey):

|

OK. And

is – at this point is there any way to kind of translate that potential

into you know let’s say a long term goal for gross margin you know just to

give us a sense as to what – a quantification of how big an opportunity

there is in front of us as far as all of that

goes?

|

|

Jeff

Coats:

|

We’re

working on that. You know it’s – because we’ve only scratched

the surface so far and because it’s a different world these days we’re not

prepared to say anything about that publicly. But you know stay

tuned for the earnings call that we’ll have in 2010 and perhaps we’ll be

able to talk a little bit more about that at that point with some more

results behind us.

|

PRIME NEWS WIRE

Moderator: Lawrence

Brogan

10-22-09/4:00 p.m. CT

Confirmation # 35120681

Page 13

|

(Brian

Horey):

|

OK. Thank

you.

|

|

Operator:

|

As

a reminder, if you’d like to ask a question, please press star then the

number one on your telephone keypad. Your next question comes

from the line of (Robert Setrakian) with

Helios.

|

|

(Robert

Setrakian):

|

Hi,

guys.

|

|

Jeff

Coats:

|

Hi,

(Robert). How are you?

|

|

(Robert

Setrakian):

|

Good. As

the couple of previous callers mentioned operationally investors should be

happy with what you have accomplished here in a difficult

environment. You know from a stock perspective we’re still

selling at net cash.

|

You know

if I remember correctly in the past two years a couple of times you know we had

hired bankers and we had gone through processes for strategic

alternatives. And I’m wondering whether you know with the environment

improving a little bit and you know having heard at that time from you know

industry sources, market players talking to some of your competitors before you

know there was a bit of interest do you guys as management and board you know

feel vulnerable at all with the stock trading at net cash? And you

know you have plans obviously for the next couple of years to take this to the

next level. And you know you feel it’s very undervalued but at net

cash environment improving, marketing on the Internet you know being interesting

area for people automotive industry improving. Don’t you feel a

little vulnerable?

|

Jeff

Coats:

|

Certainly,

(Robert), we’d like to see the stock price higher which would, of course,

moderate some of what you’re talking about. I don’t know that I

would say yes we do feel vulnerable. And I certainly would not

say that no we don’t feel

vulnerable.

|

I kind of

view us – I think we kind of view as – in a very interesting

position. We have the opportunity to be a catalyst for a lot of the

consolidation opportunities in this marketplace in a variety of

ways.

|

(Robert

Setrakian):

|

Yes.

|

|

Jeff

Coats:

|

So

you know we certainly are not putting our head in the

sand. We’re doing everything we can do to improve our

operations so that they are reflected in the company’s financial

results. You know I would remind you that we also have a pill

in place. That if anyone purchases in excess of 15 percent of

our stock it triggers the pill. And that you know generally is

a big negative if that were to

happen.

|

|

(Robert

Setrakian):

|

Yes.

|

|

Jeff

Coats:

|

So

that provides us with some amount of comfort but you know really we’re

pushing forward to both improve the company and as I’ve mentioned several

times position ourselves to take advantage of market consolidation

opportunities.

|

PRIME NEWS WIRE

Moderator: Lawrence

Brogan

10-22-09/4:00 p.m. CT

Confirmation # 35120681

Page 14

|

(Robert

Setrakian):

|

Yes. I

mean you know I do the math from where some of these comps are trading in

terms of three, four time sales. We’re trading at net

cash. Here we are talking about you know $1 stock price which

would probably value at us like 0.25 times sales. For a lot of

these guys you know simple math in terms of what they can do you know to

their own earnings or to their own sales. You know, I find it

incredible that you know they’re not – some of the people who were

interested at that time if they are still interested in the area are not

you know approaching you know for an interesting

deal.

|

On the

other hand, I wanted to ask at what point in time do you feel comfortable with,

you know, the business you know being stable – stabilized enough for you with

the incredibly strong balance sheet that you have relative to the size of the

business to put in a buyback for your stock to get to a certain level to show

confidence to the marketand then you know perhaps when people’s attention are on

your stock and you know we get the stock to a certain level be able to take

advantage of some of these opportunities in the market place you know with your

stock where you guys are happy, your investors are happy, you have a currency

now to be able to do you know things. You have a lot more

flexibility? And you know that’s something that is always on my mind

having been in this investment for a couple of years now. I think on

every single conference call I’ve mentioned the same thing like a broken

record.

|

Jeff

Coats:

|

As

I know very well from my numerous conversations with you, you definitely

are keen to see us do a buy back. I’d almost think from your

earlier comments you were trying to put us in play with regards to

pointing out that we might or might not be

vulnerable.

|

|

(Robert

Setrakian):

|

Yes

at you know two – if somebody comes in at $2 I don’t think we would be

unhappy at this point in time. At these prices you know like

you know the investor who tried to take advantage a few months back and

then you know went away.

|

|

Jeff

Coats:

|

Right.

|

|

(Robert

Setrakian):

|

Not

that kind of vulnerability.

|

|

Jeff

Coats:

|

No. No. Well

you know I guess as we sit today we still are in an uncertain

environment. I can’t see us doing anything to spend our cash on

something that doesn’t improve our operations at the

moment.

|

|

(Robert

Setrakian):

|

At

the moment.

|

|

Jeff

Coats:

|

But

you know as things evolve who knows. I’m sure that you and I

will have many more conversations about this. And you know

we’ll just have to see how things evolve. There really are some

very interesting opportunities out there for us. I agree with

you that you know a big plus for us would have – would be a strengthened

stock to use as a currency. I’m – you know perhaps I just kind

of look at it a slightly different way to get there for the time

being.

|

PRIME NEWS WIRE

Moderator: Lawrence

Brogan

10-22-09/4:00 p.m. CT

Confirmation # 35120681

Page 15

|

(Robert

Setrakian):

|

Yes. Well

congratulations on the quarter and look forward to you know many more

improving quarters.

|

|

Jeff

Coats:

|

Thank

you. Thank you very

much.

|

|

Operator:

|

And

there are no further questions at this time. I will now turn

the call back over to Mr. Coats.

|

|

Jeff

Coats:

|

Thanks

everybody. We appreciate you taking the time to speak with us

today. As I’ve said before stay tuned. I think we

have an ever improving story and I truly believe that we are about as well

positioned to benefit from the recovery in the automotive economy as we

could be. We look forward to talking to you in the

future. Thank you.

|

|

Operator:

|

And

this concludes today’s conference call. You may now

disconnect.

|

|

|

END

|

Autobytel

Q3 2009 Results

Q3 2009 Results

2

The

statements contained in this presentation that are not historical facts are

forward-

looking statements under the federal securities laws. These forward-looking statements

are not guarantees of future performance and involve certain risks, uncertainties and

assumptions that are difficult to predict. Actual outcomes and results may differ materially

from what is expressed in, or implied by, such forward-looking statements. Autobytel

undertakes no obligation to update publicly any forward-looking statements, whether as a

result of new information, future events or otherwise. Among the important factors that

could cause actual results to differ materially from those expressed in, or implied by, the

forward-looking statements are continuing adverse general economic conditions, the

economic impact of terrorist attacks or military actions, increased dealer attrition,

pressure on dealer fees, increased or unexpected competition, the failure to successfully

launch new products and services, failure to retain key employees or attract and integrate

new employees, that actual costs and expenses exceed the charges taken by Autobytel,

changes in laws and regulations, costs of defending lawsuits and undertaking

investigations and related matters and other matters disclosed in Autobytel's filings with

the Securities and Exchange Commission. Investors are strongly encouraged to review

our annual report on Form 10-K for the year ended December 31, 2008, and other filings

with the Securities and Exchange Commission for a discussion of risks and uncertainties

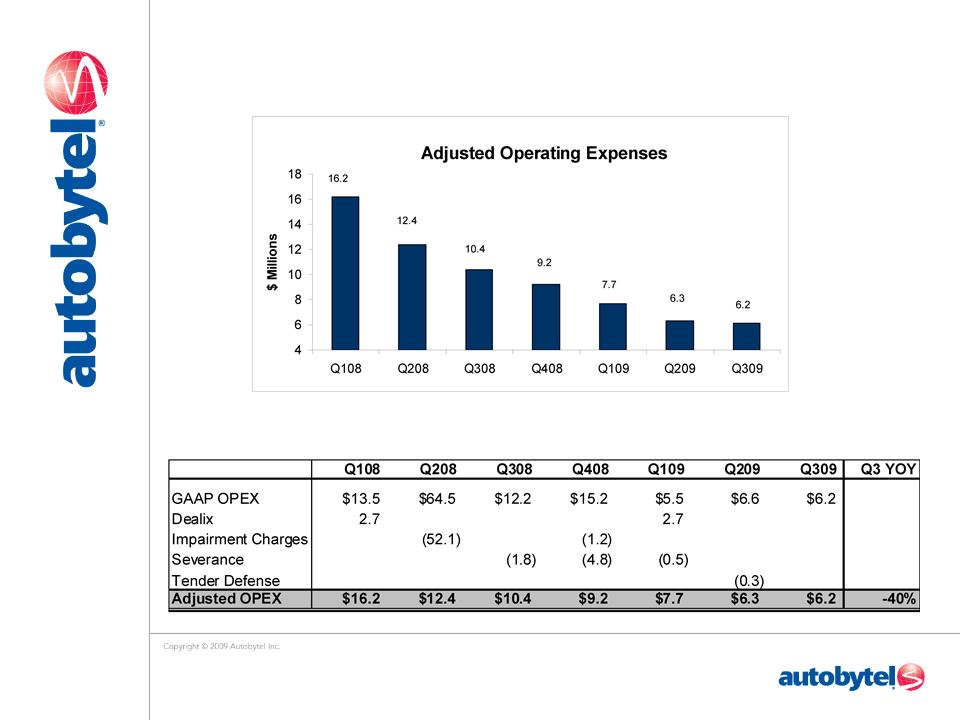

that could affect operating results and the market price of the company’s stock.

looking statements under the federal securities laws. These forward-looking statements

are not guarantees of future performance and involve certain risks, uncertainties and

assumptions that are difficult to predict. Actual outcomes and results may differ materially

from what is expressed in, or implied by, such forward-looking statements. Autobytel

undertakes no obligation to update publicly any forward-looking statements, whether as a

result of new information, future events or otherwise. Among the important factors that

could cause actual results to differ materially from those expressed in, or implied by, the

forward-looking statements are continuing adverse general economic conditions, the

economic impact of terrorist attacks or military actions, increased dealer attrition,

pressure on dealer fees, increased or unexpected competition, the failure to successfully

launch new products and services, failure to retain key employees or attract and integrate

new employees, that actual costs and expenses exceed the charges taken by Autobytel,

changes in laws and regulations, costs of defending lawsuits and undertaking

investigations and related matters and other matters disclosed in Autobytel's filings with

the Securities and Exchange Commission. Investors are strongly encouraged to review

our annual report on Form 10-K for the year ended December 31, 2008, and other filings

with the Securities and Exchange Commission for a discussion of risks and uncertainties

that could affect operating results and the market price of the company’s stock.

Safe Harbor

Statement

3

1

-

Excludes

MyRide.com impairment charges of $4.3M and severance of $300k in Q4

2008

2 - See

slide #6 in this set for GAAP to Adjusted OPEX reconciliation

3 - See

slide #11 for GAAP to Adjusted Loss from Continuing Ops

reconciliation

Financial

Overview

$ Millions, except gross margin

$ Millions, except gross margin

4

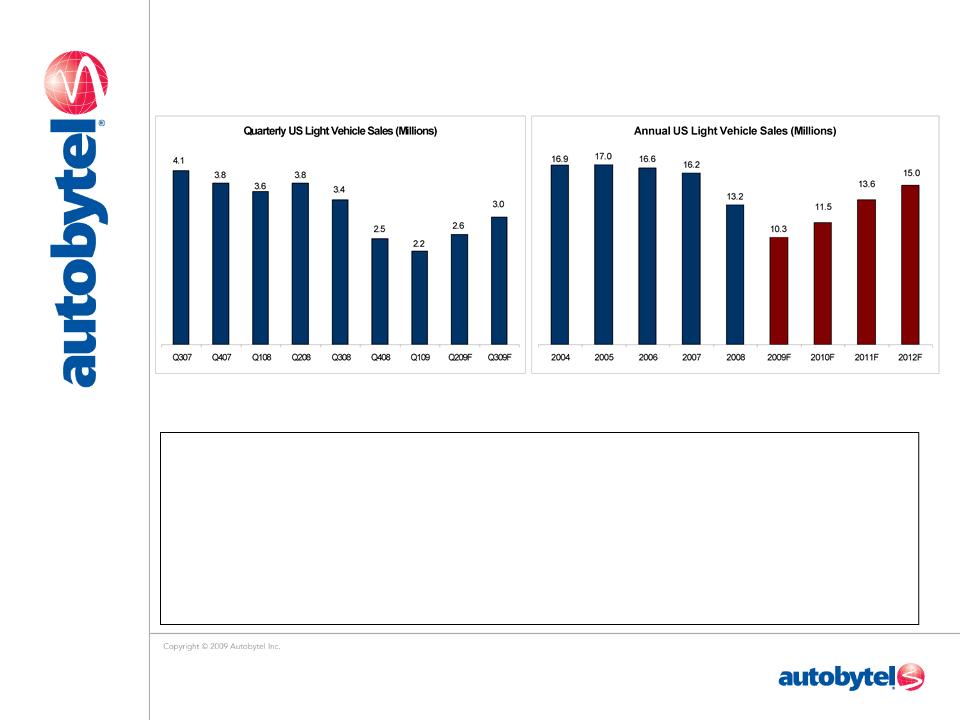

Comments

•

July / August vehicle sales boosted by “Cash for Clunkers”

•

Significant drop in September (Sales “pulled forward” / lack of dealer

inventory)

•

In September 2009, JD Power forecast 2009 and 2010 US light vehicle sales of

10.3M and

11.5M, respectively

11.5M, respectively

Source:

Automotive News, JD Power & Associates

Auto

Industry Sales

5

Comments

•

OEM revenue stable

•

Advertising revenue stable

Revenue

Results

Source:

Automotive News

6

GAAP

Reconciliation

Cost

Reductions

7

8

|

Q1

2009

|

Q2

2009

|

Q3

2009

|

Q4

2009

|

Q1

2010

|

|

•Rebuilt

website

leadership team to upgrade web presence •Improved

infrastructure and reporting |

•Moved MyRide

onto

Core platform (performance improvements, cost savings) •Brought paid

search

in-house (eliminate negative ROI Search spend) |

•Placed used

car

inventory on kbb.com (more used car leads) •Added more

ways to

search used car section (more used car leads) •Improved new

car

lead form (better conversion) •Leading

Cash-for-

Clunkers section (more leads & page views); highlighted on NBC News, USA Today, and CNN •News &

Articles

section (more content, better user experience) |

•Autodata

data

conversion (more comprehensive data set: car photos, car colorizations, regional incentives, etc.) •Re-launch

Autobytel.com (better user experience, better lead conversion, more page views, etc.) •Edmunds

content

integration (more content and page views) |

•Re-launch

Car.com,

Autosite.com, and Autoweb.com (site differentiations, better user experience) •New Car

Inventory

(improve volume and quantity of leads) •Certified

Pre-Owned

(CPO) section with inventory (more leads and advertising opportunities) •Launch

consumer

retention programs (email, etc.) |

Actual

Expected

Website

Roadmap

9

Comments Cash

Per Share

•

Cash balance at September 30, 2009 equaled $25.2M ......................................... $0.56

•

Additional sources of cash not carried on balance sheet

•Final

Dealix patent settlement payment of $2.7M due in Q1 2010 ……….. $0.06

$0.62

$25.2M

Cash

10

Q3

Summary

• Margin

improvement

• Increase page views

and lead

conversion

conversion

• Continued operating

expense

reductions

reductions

• Reinvesting and

positioned for

economic recovery

economic recovery

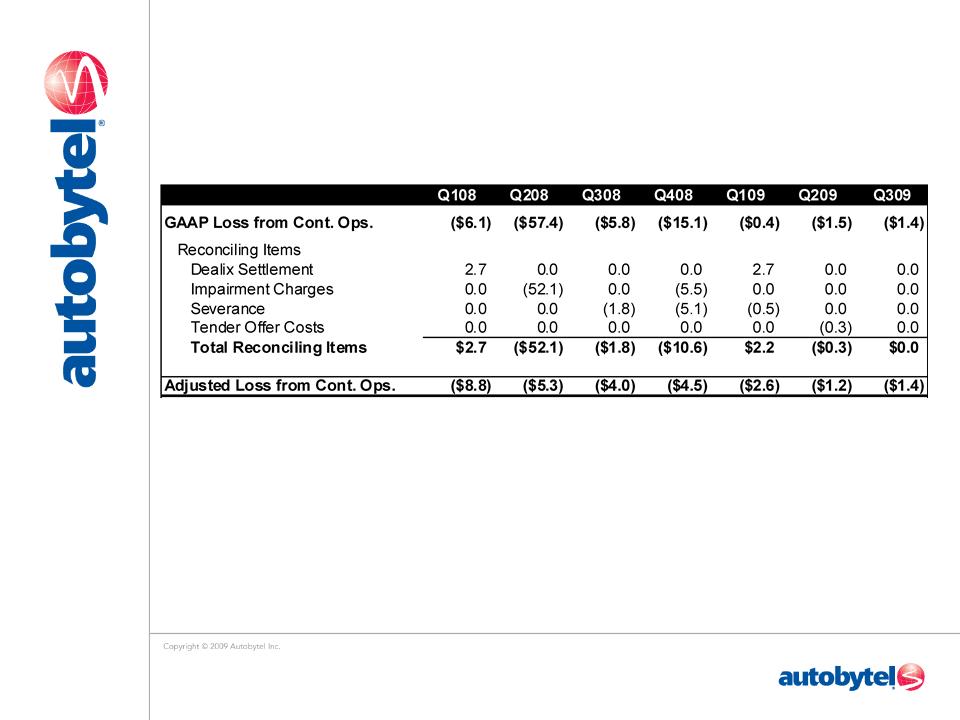

11

Appendix

Reconciliation of GAAP Loss from Continuing Operations

to Adjusted Loss from Continuing Operations

Reconciliation of GAAP Loss from Continuing Operations

to Adjusted Loss from Continuing Operations