Attached files

| file | filename |

|---|---|

| EX-31.2 - CHINA ELECTRIC MOTOR, INC. | v163553_ex31-2.htm |

| EX-31.1 - CHINA ELECTRIC MOTOR, INC. | v163553_ex31-1.htm |

| EX-32.1 - CHINA ELECTRIC MOTOR, INC. | v163553_ex32-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form 10-Q/A

Amendment

No. 1

|

x

|

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

|

For

the Quarterly Period Ended June 30, 2009

OR

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

|

For

the transition period

from to

Commission

File No.: 000-53017

CHINA

ELECTRIC MOTOR, INC.

(Exact

name of Registrant as specified in its charter)

|

Delaware

|

26-1357787

|

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer

Identification

Number)

|

Sunna

Motor Industry Park, Jian’an, Fuyong Hi-Tech Park, Baoan District, Shenzhen,

Guangdong,

People’s

Republic of China

(ADDRESS

OF PRINCIPAL EXECUTIVE OFFICES)(ZIP CODE)

86-0755-8149969

(COMPANY’S

TELEPHONE NUMBER, INCLUDING AREA CODE)

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes x No o

Indicate by check mark whether the

registrant has submitted electronically and posted on its corporate Web site, if

any, every Interactive Data File required to be submitted and posted pursuant to

Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12

months (or for such shorter period that the registrant was required to submit

and post such files). Yes o No o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting

company. See definitions of “large accelerated filer,” “accelerated

filer” and “smaller reporting company” as defined in Rule 12b-2 of the Exchange

Act.

|

Large

accelerated filer o

|

Accelerated

filer ¨

|

|

Non-accelerated

filer x

|

Smaller

reporting company ¨

|

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act). Yes o No x

The

registrant had 14,542,364 shares of common stock, par value $0.0001 per share,

outstanding as of October 22, 2009 (taking into account the reverse stock split,

as described below).

EXPLANATORY

NOTE

This

Amendment No. 1 (this “Amendment”) on Form 10-Q/A amends and in its entirety the

Quarterly Report on Form 10-Q filed by China Electric Motor, Inc. (“we” or the

“Company) with the Securities and Exchange Commission (the “SEC”) on August 21,

2009 (the “Original Filing). This Amendment reflects changes made in

response to comments we received from the Staff of the SEC in connection with

the Staff’s review of the Original Filing. As a result of this

Amendment, the certifications pursuant to Section 302 and Section 906 of the

Sarbanes-Oxley Act of 2002, filed as exhibits to our Original Filing have been

revised, re-executed and re-filed as of the date of this Amendment. Except as

stated in this Amendment, this Amendment continues to describe conditions as of

the date of the Original Filing, and the disclosures contained herein have not

been updated to reflect events, results or developments that have occurred after

the Original Filing, or to modify or update those disclosures affected by

subsequent events unless otherwise indicated in this report. This Amendment

should be read in conjunction with the Company’s filings made with the SEC

subsequent to the Original Filing, including any amendments to those

filings.

On

October 8, 2009, the Company’s Board of Directors and stockholders approved an

amendment to its Certificate of Incorporation to effect a 1-for-1.53846153846154

reverse stock split of all of its issued and outstanding shares of common stock

(the “Reverse Stock Split”). To effect the Reverse Stock Split, the Company will

file the amendment to the Certificate of Incorporation with the Secretary of the

State of Delaware, which will not be done sooner than 20 days after the Company

mails a definitive information statement on Schedule 14C to the Company’s

stockholders. The Reverse Stock Split will occur immediately prior to the

closing of the public offering that the Company proposes to complete in

accordance with the registration statement on Form S-1 as filed with the

SEC. The par value and number of authorized shares of the Company’s

common stock will remain unchanged. All references to number of shares and per

share amounts included in this Amendment No. 1 on Form 10-Q/A gives effect to

the Reverse Stock Split. The number of shares and per share amounts included in

the consolidated financial statements and the accompanying notes, included in

the F- section have been adjusted to reflect the Reverse Stock Split

retroactively. Unless otherwise indicated, all outstanding shares and earnings

per share information contained in this report gives effect to the Reverse Stock

Split.

CHINA

ELECTRIC MOTOR, INC.

FORM 10-Q

For

the Quarterly Period Ended June 30, 2009

INDEX

|

Page

|

||||

|

Part I

|

Financial

Information

|

|||

|

Item

1.

|

Financial

Statements

|

2

|

||

|

(a)

|

Consolidated

Balance Sheets as of June 30, 2009 (Unaudited) and December 31,

2008

|

2

|

||

|

(b)

|

Consolidated

Statements of Operations for the Three and Six Months Ended June 30, 2009

and 2008 (Unaudited)

|

3

|

||

|

(c)

|

Consolidated

Statements of Cash Flows for the Six Months Ended June 30, 2009 and 2008

(Unaudited)

|

4

|

||

|

(d)

|

Consolidated

Statements of Changes in Stockholders’ Equity and Comprehensive Income for

the Six Months Ended June 30, 2009 (Unaudited)

|

5

|

||

|

(e)

|

Notes

to Financial Statements (Unaudited)

|

6

|

||

|

Item

2.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

25

|

||

|

Item

3.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

33

|

||

|

Item

4.

|

Controls

and Procedures

|

33

|

||

|

Part II

|

Other

Information

|

|||

|

Item

1.

|

Legal

Proceedings

|

34

|

||

|

Item

1A.

|

Risk

Factors

|

34

|

||

|

Item

2.

|

Unregistered

Sale of Equity Securities and Use of Proceeds

|

48

|

||

|

Item

3.

|

Default

Upon Senior Securities

|

48

|

||

|

Item

4.

|

Submission

of Matters to a Vote of Security Holders

|

48

|

||

|

Item

5.

|

Other

Information

|

49

|

||

|

Item

6.

|

Exhibits

|

49

|

||

|

Signatures

|

50

|

|||

1

Part I.

Financial Information

Item

1. Financial Statements

China

Electric Motor, Inc. and Subsidiaries

Consolidated

Balance Sheets

(In US

Dollars)

|

June 30,

|

December 31,

|

|||||||

|

2009

|

2008

|

|||||||

|

|

(unaudited)

|

|||||||

|

ASSETS:

|

||||||||

|

Current

Assets:

|

||||||||

|

Cash

and cash equivalents

|

$ | 5,957,277 | $ | 2,655,808 | ||||

|

Trade

receivables, net (Note 3)

|

7,962,398 | 5,239,785 | ||||||

|

Inventories,

net (Note 4)

|

7,552,615 | 7,293,544 | ||||||

|

Other

receivables and prepaid expense

|

— | 15,103 | ||||||

|

Total

current assets

|

21,472,290 | 15,204,240 | ||||||

|

Property

and equipment, net (Note 5)

|

3,995,521 | 2,770,782 | ||||||

|

Total

Assets

|

$ | 25,467,811 | $ | 17,975,022 | ||||

|

LIABILITIES

& STOCKHOLDERS' EQUITY

|

||||||||

|

Current

Liabilities:

|

||||||||

|

Accounts

payable-trade

|

$ | 2,130,204 | $ | 2,309,026 | ||||

|

Accrued

merger costs

|

625,000 | — | ||||||

|

Short-term

note payable (Note 15)

|

500,000 | — | ||||||

|

Accrued

liabilities and other payable

|

237,439 | 240,130 | ||||||

|

Various

taxes payable

|

137,002 | 39,972 | ||||||

|

Wages

payable

|

373,260 | 295,367 | ||||||

|

Corporate

tax payable (Note 8)

|

774,194 | 469,435 | ||||||

|

Total

Current Liabilities

|

4,777,099 | 3,353,930 | ||||||

|

Due

to director (Note 6)

|

1,281,794 | 1,339,337 | ||||||

|

Total

Liabilities

|

6,058,893 | 4,693,267 | ||||||

|

Commitments

and Contingencies (Note 9)

|

— | — | ||||||

|

Stockholders'

Equity:

|

||||||||

|

Preferred

stock, $0.0001 par value, 10,000,000 shares authorized, none

issued

|

— | — | ||||||

|

Common

stock, $0.0001 par value, 100,000,000 shares authorized, 12,950,317 and

11,069,260 shares issued and

outstanding at June 30, 2009 and December 31, 2008, respectively.

(Note 1 and Note 13)

|

1,295 | 1,107 | ||||||

|

Additional

paid-in capital

|

1,137,203 | 158,232 | ||||||

|

Accumulated

other comprehensive income

|

1,093,444 | 1,089,032 | ||||||

|

Statutory

surplus reserve fund (Note 7)

|

1,177,075 | 1,177,075 | ||||||

|

Retained

earnings (unrestricted)

|

15,999,901 | 10,856,309 | ||||||

|

Total

Stockholders' Equity

|

19,408,918 | 13,281,755 | ||||||

|

Total

Liabilities and Stockholders' Equity

|

$ | 25,467,811 | $ | 17,975,022 | ||||

The

accompanying notes are an integral part of these financial

statements.

2

China

Electric Motor, Inc. and Subsidiaries

Consolidated

Statements of Operations

(In

US Dollars)

(unaudited)

|

For the Three Months Ended

|

For the Six Months Ended

|

|||||||||||||||

|

June 30,

|

June 30,

|

|||||||||||||||

|

2009

|

2008

|

2009

|

2008

|

|||||||||||||

|

Sales

|

$ | 22,319,384 | $ | 13,209,556 | $ | 41,212,530 | $ | 24,886,665 | ||||||||

|

Cost

of Goods Sold

|

16,323,353 | 9,570,934 | 29,862,858 | 17,897,558 | ||||||||||||

|

Gross

Profit

|

5,996,031 | 3,638,622 | 11,349,672 | 6,989,107 | ||||||||||||

|

Operating

Costs and Expenses:

|

||||||||||||||||

|

Selling

expenses

|

1,157,084 | 633,600 | 2,040,954 | 1,302,038 | ||||||||||||

|

Merger

cost

|

938,152 | — | 938,152 | — | ||||||||||||

|

General

and administrative expenses

|

559,626 | 263,731 | 874,889 | 539,703 | ||||||||||||

|

Research

and development

|

419,415 | 227,589 | 787,995 | 427,722 | ||||||||||||

|

Depreciation

|

5,383 | 5,718 | 10,804 | 11,632 | ||||||||||||

|

Total

operating costs and expenses

|

3,079,660 | 1,130,638 | 4,652,794 | 2,281,095 | ||||||||||||

|

Income

From Operations

|

2,916,371 | 2,507,984 | 6,696,878 | 4,708,012 | ||||||||||||

|

Other

income (expenses)

|

||||||||||||||||

|

Interest

income

|

6,844 | 736 | 12,880 | 1,707 | ||||||||||||

|

Imputed

interest (Note 6)

|

(17,016 | ) | (4,887 | ) | (34,032 | ) | (9,449 | ) | ||||||||

|

Sundry

income (expenses), net

|

(110 | ) | (2,837 | ) | (110 | ) | (2,837 | ) | ||||||||

|

Total

other income (expenses)

|

(10,282 | ) | (6,988 | ) | (21,262 | ) | (10,579 | ) | ||||||||

|

Income

before income taxes

|

2,906,089 | 2,500,996 | 6,675,616 | 4,697,433 | ||||||||||||

|

Income

taxes (Note 8)

|

(774,715 | ) | (451,381 | ) | (1,532,024 | ) | (847,561 | ) | ||||||||

|

Net

income

|

$ | 2,131,374 | $ | 2,049,615 | $ | 5,143,592 | $ | 3,849,872 | ||||||||

|

Basic

earnings per share

|

$ | 0.18 | $ | 0.19 | $ | 0.44 | $ | 0.35 | ||||||||

|

Weighted

average shares outstanding-basic

|

12,125,842 | 11,069,260 | 11,600,470 | 11,069,260 | ||||||||||||

|

Diluted

earnings per share

|

$ | 0.17 | $ | 0.19 | $ | 0.44 | $ | 0.35 | ||||||||

|

Weighted

average shares outstanding-diluted

|

12,511,623 | 11,069,260 | 11,794,426 | 11,069,260 | ||||||||||||

The

accompanying notes are an integral part of these financial

statements.

3

China

Electric Motor, Inc. and Subsidiaries

Consolidated

Statements of Cash Flows

(In

US Dollars)

(unaudited)

|

For the Six Months Ended

|

||||||||

|

June 30,

|

||||||||

|

2009

|

2008

|

|||||||

|

Cash

Flows From Operating Activities:

|

||||||||

|

Net

income

|

$ | 5,143,592 | $ | 3,849,872 | ||||

|

Adjustments

to reconcile net income to net cash provided

by operating activities:

|

||||||||

|

Depreciation

|

305,405 | 250,782 | ||||||

|

Imputed

interest

|

34,032 | 9,449 | ||||||

|

Changes

in operating assets and liabilities:

|

||||||||

|

Accounts

receivable-trade

|

(2,722,613 | ) | (1,620,239 | ) | ||||

|

Accrued

merger costs

|

625,000 | — | ||||||

|

Other

receivable and prepaid expenses

|

15,103 | 86,075 | ||||||

|

Inventories,

net

|

(259,071 | ) | (464,750 | ) | ||||

|

Accounts

payable and accrued liabilities

|

(181,513 | ) | 901,952 | |||||

|

Various

taxes payable

|

97,030 | 14,966 | ||||||

|

Wages

payable

|

77,893 | 88,021 | ||||||

|

Corporate

tax payable

|

304,759 | 345,428 | ||||||

|

Net

cash provided by operating activities

|

3,439,617 | 3,461,556 | ||||||

|

Cash

Flows From Investing Activities:

|

||||||||

|

Purchases

of property and equipment

|

(1,533,415 | ) | (299,338 | ) | ||||

|

Net

cash used by investing activities

|

(1,533,415 | ) | (299,338 | ) | ||||

|

Cash

Flows From Financing Activities:

|

||||||||

|

Proceeds

from (repayment of) short-term loans

|

500,000 | (164,520 | ) | |||||

|

Net

proceeds from sale of common shares

|

945,127 | — | ||||||

|

Dividends

paid

|

— | (2,088,600 | ) | |||||

|

Proceeds

from (repayment of) Due to related parties

|

(57,543 | ) | 268,040 | |||||

|

Net

cash provided (used) by financing activities

|

1,387,584 | (1,985,080 | ) | |||||

|

Effect

of exchange rate changes on cash and cash equivalents

|

7,683 | 365,292 | ||||||

|

Increase

in cash and cash equivalents

|

3,301,469 | 1,542,430 | ||||||

|

Cash

and cash equivalents, beginning of period

|

2,655,808 | 1,588,778 | ||||||

|

Cash

and cash equivalents, end of period

|

$ | 5,957,277 | $ | 3,131,208 | ||||

|

Supplemental

disclosure information:

|

||||||||

|

Income

taxes paid

|

$ | 1,226,684 | $ | 519,327 | ||||

The

accompanying notes are an integral part of these financial

statements.

4

China

Electric Motor, Inc. and Subsidiaries

Consolidated

Statements of Changes in Stockholders’ Equity and Comprehensive

Income

(In US

Dollars)

(unaudited)

|

Accumulated

|

||||||||||||||||||||||||||||||||

|

Additional

|

Other

|

Statutory

|

Retained

|

Total

|

||||||||||||||||||||||||||||

|

Common Stock

|

Paid-in

|

Comprehensive

|

Reserve

|

Earnings

|

Stockholders'

|

Comprehensive

|

||||||||||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Income

|

Fund

|

(Unrestricted)

|

Equity

|

Income

|

|||||||||||||||||||||||||

|

Balance

December 31, 2008

|

11,069,260 | $ | 1,107 | $ | 158,232 | $ | 1,089,032 | $ | 1,177,075 | $ | 10,856,309 | $ | 13,281,755 | |||||||||||||||||||

|

Reverse

merger adjustment

|

1,352,003 | 135 | (135 | ) | — | — | — | — | ||||||||||||||||||||||||

|

Sale

of common shares

|

529,054 | 53 | 945,074 | — | — | — | 945,127 | |||||||||||||||||||||||||

|

Imputed

interest

|

— | — | 34,032 | — | — | — | 34,032 | |||||||||||||||||||||||||

|

Net

income

|

— | — | — | — | — | 5,143,592 | 5,143,592 | $ | 5,143,592 | |||||||||||||||||||||||

|

Foreign

currency translation adjustments

|

— | — | — | 4,412 | — | — | 4,412 | 4,412 | ||||||||||||||||||||||||

|

Comprehensive

income

|

— | — | — | — | — | — | — | $ | 5,148,004 | |||||||||||||||||||||||

|

Balance

June 30, 2009 (unaudited)

|

12,950,317 | $ | 1,295 | $ | 1,137,203 | $ | 1,093,444 | $ | 1,177,075 | $ | 15,999,901 | $ | 19,408,918 | |||||||||||||||||||

The

accompanying notes are an integral part of these financial

statements.

5

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three and six months ended June 30, 2009 and 2008

are unaudited)

NOTE

1 – DESCRIPTION OF BUSINESS AND ORGANIZATION

China

Electric Motor, Inc. (“China Electric”, formerly SRKP 21, Inc.) was incorporated

in the State of Delaware on October 11, 2007. China Electric was originally

organized as a “blank check” shell company to investigate and acquire a target

company or business seeking the perceived advantages of being a publicly held

corporation. On May 6, 2009, China Electric (i) closed a share exchange

transaction pursuant to which SRKP 21 became the 100% parent of Attainment

Holdings Limited (“Attainment”), (ii) assumed the operations of Attainment and

its subsidiaries, including Luck Loyal International Investment Limited ("Luck

Loyal") and Shenzhen YuePengCheng Motor Co., Ltd (“YuePengCheng”), and (iii)

changed its name from SRKP 21, Inc. to China Electric Motor, Inc.

Attainment

is a holding company incorporated in the British Virgin Islands (“BVI”) on July

28, 2008. Attainment had 50,000 capital shares authorized with $1.00

par value and one share issued and outstanding. The sole shareholder

of Attainment was Excel Profit Global Group Limited (“Excel Profit”), which in

turn solely owned by Mr. To Chau Sum, a Hong Kong citizen.

Luck

Loyal is a holding company incorporated in Hong Kong (“HK”) on October 15,

2004. Luck Loyal had 10,000 shares authorized with one Hong Kong

Dollar (“HKD”) par value and one share issued and outstanding. The

sole shareholder of Luck Loyal is Attainment.

YuePengCheng

was incorporated in the City of Shenzhen of the People’s Republic of China

(“PRC”) on November 19, 1999. YuePengCheng mainly engages in

production, marketing, sales and research and development of specialized

micro-motor products for the domestic and international market.

Shenzhen

YuePengDa Development Enterprises (“YuePengDa”), a company owned by the son of

YuePengCheng and Luck Loyal’s Director, Ms. Jianrong Li (the “Director”); and

Taiwan Qiling Shashi Enterprises (“Qiling”), a company owned by a relative of

the director; were the original owners of YuePengCheng and held 75% and 25% of

the total interest of YuePengCheng, respectively.

In

November 2007, the Director caused Luck Loyal to enter into an ownership

transfer agreement with Qiling. Pursuant to the agreement, Qiling transferred

its 25% interest in YuePengCheng to Luck Loyal at a price of Chinese Renminbi

(“RMB”) 2.5 million. In September 2008, in order to implement a capital

restructuring program, the Director had Luck Loyal to acquire the remaining 75%

ownership of YuePengCheng from YuePengDa under an ownership transfer agreement.

Pursuant to the agreement, Luck Loyal paid YuePengDa RMB 7.5 million for the

ownership transfer. Thereafter, Luck Loyal became the sole owner of

YuePengCheng. Since these transactions were effected by parties under

common control, the Company accounted for them as similar to a pooling of

interest transaction, with a retroactive reduction in additional paid-in capital

for the payments to the former owner, and the recording of a corresponding

liability.

The

Director agreed to convert the debt owed to her of RMB 7.5 million and RMB 2.5

million (approximately $1.3 million) into shares of the Company’s common stock

on the effective date of the public offering, with the conversion price to be

equal to the per share price of the shares sold in the Company’s public

offering.

For

accounting purpose, this transaction is being accounted as business combination

of entities under common control and the historical financial statements include

the operations of YuePengCheng for all periods presented.

China

Electric and its subsidiaries – Attainment, Luck Loyal and YuePengCheng shall be

collectively referred throughout as the “Company.”

6

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three and six months ended June 30, 2009 and 2008

are unaudited)

NOTE

1 – DESCRIPTION OF BUSINESS AND ORGANIZATION (continued)

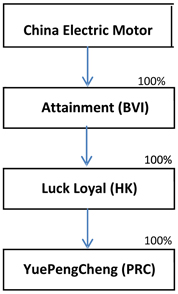

To

summarize the paragraphs above, the organization and ownership structure of the

Company is currently as follows:

Share

Exchange

On March

3, 2009, SRKP 21, Inc. (“SRKP, 21”) entered into a Share Exchange Agreement with

Attainment Holdings, Excel Profit as the sole shareholder of Attainment

Holdings, and as to certain portions of the agreement, certain designees.

Pursuant to the Share Exchange Agreement, as it was amended on May 6, 2009 (the

“Exchange Agreement”), SRKP 21 agreed to issue an aggregate of 11,069,260 shares

of its common stock in exchange for all of the issued and outstanding securities

of Attainment Holdings (the “Share Exchange”). The Share Exchange closed

on May 6, 2009. The 11,069,260 shares of common stock issued to the stock

holders of Attainment in conjunction with the share exchange transaction have

been presented as outstanding for all periods.

Upon the

closing of the Share Exchange, SRKP 21 issued an aggregate of 11,069,260 shares

of its common stock to the Excel Profit and the designees in exchange for all of

the issued and outstanding securities of Attainment Holdings. Prior to the

closing of the Share Exchange, the stockholders of SRKP 21 canceled an

aggregate of 3,260,659 shares held by them such that there were 1,352,003 shares

of common stock outstanding immediately prior to the Share Exchange. SRKP

21 stockholders also canceled an aggregate of 3,985,768 warrants to purchase

shares of common stock such that the stockholders held an aggregate of 626,894

warrants immediately after the Share Exchange. Immediately after the

closing of the Share Exchange, the Company had 12,421,263 outstanding shares of

common stock, no shares of Preferred Stock, no options, and warrants to purchase

626,894 shares of common stock.

For

accounting purposes, this transaction is being accounted for as a reverse

merger. The transaction has been treated as a recapitalization of Attainment

Holdings and its subsidiaries, with China Electric Motor (the legal

acquirer of Attainment and its subsidiaries including YuePengCheng) considered

the accounting acquiree and YuePengCheng , the only operating company, and whose

management took control of China Electric Motor (the legal acquiree of

YuePengCheng) is considered the accounting acquirer. The Company did

not recognize goodwill or any intangible assets in connection with the

transaction. The historical consolidated financial statements include the

operations of the accounting acquirer for all periods presented.

On

October 8, 2009, the Company’s Board of Directors authorized a 1-for-1.5384615

reverse stock split of the Company's outstanding shares of common stock (the

“Reverse Stock Split”). All references to shares in the consolidated financial

statements and the accompanying notes, including, but not limited to, the number

of shares and per share amounts, have been adjusted to reflect the Reverse Stock

Split on a retroactive basis.

7

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three and six months ended June 30, 2009 and 2008

are unaudited)

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

a. Basis of

Preparation

The

consolidated financial statements have been prepared in accordance with U.S.

GAAP for interim financial information and the instructions to Form 10-Q and

Article 10 of Regulation SX. Accordingly, they do not include all of the

information and footnotes required by generally accepted accounting principles

for complete financial statements. These consolidated financial statements

should be read in conjunction with the consolidated financial statements of the

Company for the year ended December 31, 2008 and notes thereto contained in the

Report on Form S-1 of the Company as filed with the United States Securities and

Exchange Commission (the “SEC”). Interim results are not necessarily indicative

of the results for the full year.

b. Basis of

Consolidation

The

consolidated financial statements include the accounts of the Company and its

subsidiaries. Intercompany transactions have been eliminated in

consolidation.

c. Use of

Estimates

The

preparation of financial statements in conformity with generally accepted

accounting principles requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities, disclosure of contingent

assets and liabilities at the date of the financial statements, and the reported

amounts of revenues and expenses during the reporting year. Because of the use

of estimates inherent in the financial reporting process, actual results could

differ from those estimates.

d. Fair

Values of Financial Instruments

The

Company’s financial instruments include cash and cash equivalents, accounts

receivable, other current assets, taxes payable, accounts payable, accrued

expenses and other payables. Management has estimated that the carrying amount

approximates their fair value due to their short-term nature.

e. Cash and

Cash Equivalents

Cash and

cash equivalents include cash on hand, demand deposits with banks and liquid

investments with an original maturity of three months or less.

f. Accounts

Receivable

Accounts

receivables are recognized and carried at original invoiced amount less an

allowance for uncollectible accounts, as needed.

The

Company uses the aging method to estimate the valuation allowance for

anticipated uncollectible receivable balances. Under the aging method, bad debts

percentages determined by management based on historical experience as well as

current economic climate are applied to customers’ balances categorized by the

number of months the underlying invoices have remained outstanding. The

valuation allowance balance is adjusted to the amount computed as a result of

the aging method. When facts subsequently become available to indicate that the

amount provided as the allowance was incorrect, an adjustment, classified as a

change in estimate, is made.

g. Inventories

Inventories

are stated at the lower of cost, as determined on a weighted average basis, or

market. Costs of inventories include purchase and related costs incurred in

bringing the products to their present location and condition. Market value is

determined by reference to selling prices after the balance sheet date or to

management’s estimates based on prevailing market conditions. The management

writes down the inventories to market value if it is below cost. The management

also regularly evaluates the composition of its inventories to identify

slow-moving and obsolete inventories to determine if valuation allowance is

required.

8

China

Electric Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three and six months ended June 30, 2009 and 2008

are unaudited)

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

h. Property and

Equipment

Property

and equipment are initially recognized and recorded at cost. Gains or losses on

disposals are reflected as gain or loss in the period of disposal. The cost of

improvements that extend the life of plant and equipment are capitalized. These

capitalized costs may include structural improvements, equipment and fixtures.

All ordinary repairs and maintenance costs are expensed as

incurred.

Depreciation

for financial reporting purposes is provided using the straight-line method over

the estimated useful lives of the assets at cost less 5% for salvage

value:

|

Machinery

and Equipment

|

5

~ 25 years

|

|

Office

and Other Equipment

|

5

~ 10 years

|

i. Impairment

of Long-Lived Assets

The

Company accounts for impairment of plant and equipment and amortizable

intangible assets in accordance with SFAS No. 144, “Accounting for Impairment of

Long-Lived Assets and Long-Lived Assets to be Disposed Of,” which requires the

Company to evaluate a long-lived asset for recoverability when there is event or

circumstance that indicate the carrying value of the asset may not be

recoverable. An impairment loss is recognized when the carrying amount of a

long-lived asset or asset group is not recoverable (when carrying amount exceeds

the gross, undiscounted cash flows from use and disposition) and is measured as

the excess of the carrying amount over the asset’s (or asset group’s) fair

value.

j. Comprehensive

Income

The

Company has adopted SFAS No. 130, Reporting Comprehensive

Income, which establishes standards for reporting and displaying comprehensive

income, its components, and accumulated balances in a full-set of

general-purpose financial statements. Accumulated other comprehensive income

represents the accumulated balance of foreign currency translation

adjustments.

k. Revenue

Recognition

The

Company generates revenues from the sales of micro-motor

products. The Company recognizes revenue net of value added tax (VAT)

when the earnings process is complete, as evidenced by an agreement with the

customer, transfer of title, acceptance of ownership and assumption of risk of

loss by the customer, as well as predetermined fixed pricing, persuasive

evidence of an arrangement exists, and collection of the relevant receivable is

probable. The Company includes shipping charges billed to customers in net

revenue, and includes the related shipping costs in cost of sales. No return

allowance is made as products returns are insignificant based on historical

experience.

The

Company does not provide different policies in terms warranties, credits,

discounts, rebates, price protection, or similar privileges among customers.

Orders are placed by both the distributors and OEMs and the products are

delivered to the customers within 30-45 days of order, the Company does not

provide price protection or right of return to the customers. The price of the

products are predetermined and fixed based on contractual agreements, therefore

the customers would be responsible for any loss if the customers are faced with

sales price reductions and rapid technology obsolescence in the industry. The

Company does not allow any discounts, credits, rebates or similar

privileges.

The

Company warrants the products sold to all customers for up to 1 year from the

date the products leave the Company’s factory, under which the Company will pay

for labor and parts, or offer a new or similar unit in exchange for a

non-performing unit due to defects in material or workmanship. The

customers may also return products for a variety of reasons, such as damage to

goods in transit, cosmetic imperfections and mechanical failures, if within the

warranty period. There is no allowance for warranty on the products sales as

historical costs incurred for warranty replacements and repairs have been

insignificant.

l. Research

and Development Costs

Research

and development costs are expensed to operations as incurred. The Company spent

$419,415, $227,589, $787,995 and $427,722, on direct research and development

(“R&D”) efforts in the three and six months ended June 30, 2009 and 2008,

respectively.

9

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three and six months ended June 30, 2009 and 2008

are unaudited)

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

m. Income

Taxes

The

Company accounts for income taxes in accordance with SFAS No. 109, "Accounting

for Income Taxes." SFAS No. 109 requires an asset and liability

approach for financial accounting and reporting for income taxes and allows

recognition and measurement of deferred tax assets based upon the likelihood of

realization of tax benefits in future years. Under the asset and liability

approach, deferred taxes are provided for the net tax effects of temporary

differences between the carrying amounts of assets and liabilities for financial

reporting purposes and the amounts used for income tax purposes. A valuation

allowance is provided for deferred tax assets if it is more likely than not

these items will either expire before the Company is able to realize their

benefits, or that future deductibility is uncertain.

The

Company adopted FASB Interpretation (“FIN”) No. 48, “Accounting for Uncertainty

in Income Taxes,” which prescribes a comprehensive model for how a

company should recognize, measure, present and disclose in its financial

statements uncertain tax positions that the company has taken or expects to take

on a tax return (including a decision whether to file or not file to file a

return in a particular jurisdiction).

n. Advertising

Costs

The

Company expenses advertising costs as incurred. The Company incurred

$135,051, $99,478, $283,510 and $179,303 on advertising expenses for the three

and six months ended June 30, 2009 and 2008, respectively.

o. Foreign

Currency Translation

The

functional currency of Attainment and Luck Loyal is the Hong Kong Dollar

(“HKD”). They maintain their financial statements using the functional currency.

Monetary assets and liabilities denominated in currencies other than the

functional currency are translated into the functional currency at rates of

exchange prevailing at the balance sheet dates. Transactions denominated in

currencies other than the functional currency are translated into the functional

currency at the exchange rates prevailing at the dates of the transaction.

Exchange gains or losses arising from foreign currency transactions are included

in the determination of net income (loss) for the respective

periods.

The

functional currency of YuePengCheng is the Renminbi (“RMB”), the PRC’s currency.

It maintains its financial statements using its own functional currency.

Monetary assets and liabilities denominated in currencies other than the

functional currency are translated into the functional currency at rates of

exchange prevailing at the balance sheet dates. Transactions denominated in

currencies other than the functional currency are translated into the functional

currency at the exchange rates prevailing at the dates of the transaction.

Exchange gains or losses arising from foreign currency transactions are included

in the determination of net income (loss) for the respective

periods.

For

financial reporting purposes, the financial statements of Attainment and Luck

Loyal, which are prepared in HKD, are translated into the Company’s reporting

currency, United States Dollars (“USD”); the financial statements of

YuePengCheng, which are prepared in RMB, are translated into the Company’s

reporting currency, USD. Balance sheet accounts are translated using the closing

exchange rate in effect at the balance sheet date and income and expense

accounts are translated using the average exchange rate prevailing during the

reporting period. Adjustments resulting from the translation, if any, are

included in accumulated other comprehensive income (loss) in stockholder’s

equity.

10

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three and six months ended June 30, 2009 and 2008

are unaudited)

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

o. Foreign

Currency Translation (continued)

The

exchange rates used for foreign currency translation were as follows (USD$1 =

RMB):

|

Period Covered

|

Balance Sheet Date Rates

|

Average Rates

|

||||||

|

Six

Months Ended June 30, 2009

|

6.82476

|

6.82270

|

||||||

|

Six

Months Ended June 30, 2008

|

6.85180

|

7.05020

|

||||||

The

exchange rates used for foreign currency translation were as follows (USD$1 =

HKD):

|

Period Covered

|

Balance Sheet Date Rates

|

Average Rates

|

||||||

|

Six

Months Ended June 30, 2009

|

7.74979

|

7.75250

|

||||||

|

Six

Months Ended June 30, 2008

|

7.80092

|

7.81678

|

||||||

p. Recently

Issued Accounting Pronouncements

In June

2009, the FASB issued SFAS No. 166, "Accounting for Transfers of Financial

Assets-an amendment of FASB Statement No. 140," amending the guidance on

transfers of financial assets to, among other things, eliminate the qualifying

special purpose entity concept, include a new unit of account definition that

must be met for transfers of portions of financial assets to be eligible for

sale accounting, clarify and change the derecognition criteria for a transfer to

be accounted for as a sale, and require significant additional disclosure. For

the Company, this standard is effective for new transfers of financial assets

beginning January 1, 2010. Because the Company historically does not have

significant transfers of financial assets, the adoption of this standard is not

expected to have a material impact on the Company's consolidated results of

operations or financial condition.

In June

2009, the FASB issued SFAS No. 167, "Amendments to FASB Interpretation No.

46(R)," which revised the consolidation guidance for variable-interest entities.

The modifications include the elimination of the exemption for qualifying

special purpose entities, a new approach for determining who should consolidate

a variable-interest entity, and changes to when it is necessary to reassess who

should consolidate a variable-interest entity. For the Company, this standard is

effective January 1, 2010. The Company is currently evaluating the impact of

this standard, but would not expect it to have a material impact on the

Company's consolidated results of operations or financial

condition.

In June

2009, the FASB issued SFAS No. 168, "The FASB Accounting Standards

CodificationTM and the

Hierarchy of Generally Accepted Accounting Principles a replacement of FASB

Statement No. 162," and approved—the FASB Accounting Standards CodificationTM

(Codification) as the single source of authoritative nongovernmental US GAAP.

The Codification does not change current US GAAP, but is intended to simplify

user access to all authoritative US GAAP by providing all the authoritative

literature related to a particular topic in one place. All existing accounting

standard documents will be superseded and all other accounting literature not

included in the Codification will be considered non-authoritative. For the

Company, the Codification is effective July 1, 2009 and will require future

references to authoritative US GAAP to coincide with the appropriate section of

the Codification. Accordingly, this standard will not have an impact on the

Company's consolidated results of operations or financial

condition.

11

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three and six months ended June 30, 2009 and 2008

are unaudited)

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

q. Recently

adopted accounting pronouncements

In

February 2006, FASB issued SFAS No. 155, “Accounting for Certain Hybrid

Financial Instruments”. SFAS No. 155 amends SFAS No 133, “Accounting for

Derivative Instruments and Hedging Activities”, and SFAS No. 140, “Accounting

for Transfers and Servicing of Financial Assets and Extinguishments of

Liabilities”. SFAS No. 155, permits fair value re-measurement for any hybrid

financial instrument that contains an embedded derivative that otherwise would

require bifurcation, clarifies which interest-only strips and principal-only

strips are not subject to the requirements of SFAS No. 133, establishes a

requirement to evaluate interest in securitized financial assets to identify

interests that are freestanding derivatives or that are hybrid financial

instruments that contain an embedded derivative requiring bifurcation, clarifies

that concentrations of credit risk in the form of subordination are not embedded

derivatives, and amends SFAS No. 140 to eliminate the prohibition on the

qualifying special-purpose entity from holding a derivative financial instrument

that pertains to a beneficial interest other than another derivative financial

instrument. This statement is effective for all financial instruments acquired

or issued after the beginning of the Company’s first fiscal year that begins

after September 15, 2006. The adoption of this statement did not have a material

impact on the Company’s consolidated financial position or results of

operations.

In June

2008, the Financial Accounting Standards Board (“FASB”) issued FSP No. EITF

03-6-1, Determining Whether Instruments Granted in Share-Based Payment

Transactions Are Participating Securities (“FSP EITF 03-6-1”). FSP EITF 03-6-1

concludes that unvested share-based payment awards that contain rights to

receive non-forfeitable dividends or dividend equivalents are participating

securities, and thus, should be included in the two-class method of computing

earnings per share (“EPS”). FSP EITF 03-6-1 is effective for fiscal years

beginning after December 15, 2008, and interim periods within those years. Early

application of EITF 03-6-1 is prohibited. It also requires that all prior-period

EPS data be adjusted retrospectively. The adoption of this

statement did not have a material impact on the Company’s consolidated financial

position or results of operations.

In April

2008, the FASB issued Staff Position FAS 142-3, Determination of the Useful Life

of Intangible Assets (“FSP FAS 142-3”) which amends the factors an entity should

consider in developing renewal or extension assumptions used to determine the

useful life of a recognized intangible asset under FAS No. 142, Goodwill and

Other Intangible Assets (“FAS No. 142”). FSP FAS 142-3 applies to intangible

assets that are acquired individually or with a group of assets and intangible

assets acquired in both business combinations and asset acquisitions. It removes

a provision under FAS No. 142, requiring an entity to consider whether a

contractual renewal or extension clause can be accomplished without substantial

cost or material modifications of the existing terms and conditions associated

with the asset. Instead, FSP FAS 142-3 requires that an entity consider its own

experience in renewing similar arrangements. An entity would consider market

participant assumptions regarding renewal if no such relevant experience exists.

FSP FAS 142-3 is effective for year ends beginning after December 15, 2008 with

early adoption prohibited. The adoption of this

statement did not have a material impact on the Company’s consolidated financial

position or results of operations.

In March

2008, the FASB issued SFAS 161, “Disclosures about Derivative Instruments and

Hedging Activities”. The new standard is intended to improve financial reporting

about derivative instruments and hedging activities by requiring enhanced

disclosures to enable investors to better understand their effects on an

entity’s financial position, financial performance, and cash flows. It is

effective for financial statements issued for fiscal years and interim periods

beginning after November 15, 2008, with early application encouraged. The

adoption of SPAS 161 did not have a material impact on the Company’s

consolidated financial position or results of operations.

On

December 4, 2007, the FASB issued SFAS No. 160, Noncontrolling interest in

Consolidated Financial Statements (SFAS No. 160). SFAS No. 160 requires all

entities to report noncontrolling (minority) interests in subsidiaries as equity

in the consolidated financial statements. The statement establishes a single

method of accounting for changes in a parent’s ownership interest in a

subsidiary that do not result in deconsolidation and expands disclosures in the

consolidated financial statements. SFAS No. 160 is effective for fiscal years

beginning after December 15, 2008 and interim periods within those fiscal years.

The adoption of this

statement did not have a material impact on the Company’s consolidated financial

position or results of operations.

On

December 4, 2007, the FASB issued SFAS No. 141R, Business Combinations (SFAS No.

141R). SFAS No. 141R requires the acquiring entity in a business combination to

recognize all the assets acquired and liabilities assumed, establishes the

acquisition date fair value as the measurement objective for all assets acquired

and liabilities assumed, and requires the acquirer to expand disclosures about

the nature and financial effect of the business combination. SFAS No. 141R is

effective for business combinations for which the acquisition date is on or

after the beginning of the first annual reporting period beginning on or after

December 15, 2008. The Company adopted SFAS

No. 141R for its business combination during the period ended June 30,

2009.

12

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three and six months ended June 30, 2009 and 2008

are unaudited)

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

q. Recently

adopted accounting pronouncements (continued)

In April

2009, the FASB issued FSP No. FAS 157-4, "Determining Fair Values When the

Volume and Level of Activity for the Asset or Liability Have Significantly

Decreased and Identifying Transactions That Are Not Orderly." This FSP provides

guidance on (1) estimating the fair value of an asset or liability when the

volume and level of activity for the asset or liability have significantly

declined and (2) identifying transactions that are not orderly. The FSP also

amends certain disclosure provisions of SFAS No. 157 to require, among other

things, disclosures in interim periods of the inputs and valuation techniques

used to measure fair value as well as disclosure of the hierarchy of the source

of underlying fair value information on a disaggregated basis by specific major

category of investment. For the Company, this FSP was effective prospectively

beginning April 1, 2009. The adoption of this standard did not have a material

impact on the Company's consolidated results of operations or financial

condition.

In April

2009, the FASB issued FSP No. FAS 115-2 and FAS 124-2, "Recognition and

Presentation of Other-Than-Temporary Impairments" (FSP 115-2). This FSP modifies

the requirements for recognizing other-than-temporarily impaired debt securities

and changes the existing impairment model for such securities. The FSP also

requires additional disclosures for both annual and interim periods with respect

to both debt and equity securities. Under the FSP, impairment of debt securities

will be considered other-than-temporary if an entity (1) intends to sell the

security, (2) more likely than not will be required to sell the security before

recovering its cost, or (3) does not expect to recover the security's entire

amortized cost basis (even if the entity does not intend to sell). The FSP

further indicates that, depending on which of the above factor(s) causes the

impairment to be considered other-than-temporary, (1) the entire shortfall of

the security's fair value versus its amortized cost basis or (2) only the credit

loss portion would be recognized in earnings while the remaining shortfall (if

any) would be recorded in other comprehensive income. FSP 115-2 requires

entities to initially apply the provisions of the standard to previously

other-than-temporarily impaired debt securities existing as of the date of

initial adoption by making a cumulative-effect adjustment to the opening balance

of retained earnings in the period of adoption. The cumulative-effect adjustment

potentially reclassifies the noncredit portion of a previously

other-than-temporarily impaired debt security held as of the date of initial

adoption from retained earnings to accumulated other comprehensive income. For

the Company, this FSP was effective beginning April 1, 2009. The adoption of

this standard did not have a material impact on the Company's consolidated

results of operations or financial condition.

In April

2009, the FASB issued FSP No. FAS 107-1 and APB 28-1, "Interim Disclosures about

Fair Value of Financial Instruments." This FSP essentially expands the

disclosure about fair value of financial instruments that were previously

required only annually to also be required for interim period reporting. In

addition, the FSP requires certain additional disclosures regarding the methods

and significant assumptions used to estimate the fair value of financial

instruments. This FSP was effective for the Company beginning April 1, 2009 on a

prospective basis. The adoption of this standard did not have a

material impact on the Company's consolidated results of operations or financial

condition.

In May

2009, the FASB issued SFAS No. 165, "Subsequent Events." This standard

incorporates into authoritative accounting literature certain guidance that

already existed within generally accepted auditing standards, with the

requirements concerning recognition and disclosure of subsequent events

remaining essentially unchanged. This guidance addresses events which occur

after the balance sheet date but before the issuance of financial statements.

Under SFAS No.165, as under previous practice, an entity must record the effects

of subsequent events that provide evidence about conditions that existed at the

balance sheet date and must disclose but not record the effects of subsequent

events which provide evidence about conditions that did not exist at the balance

sheet date. This standard added an additional required disclosure relative to

the date through which subsequent events have been evaluated and whether that is

the date on which the financial statements were issued. For the Company, this standard was effective

beginning April 1, 2009.

13

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three and six months ended June 30, 2009 and 2008

are unaudited)

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

|

|

q.

|

Recently

adopted accounting pronouncements

(continued)

|

In

September 2006, the FASB issued SFAS No. 157, "Fair Value Measurements" ("SFAS

157"). SFAS 157 defines fair value, establishes a framework and gives guidance

regarding the methods used for measuring fair value, and expands disclosures

about fair value measurements. In February 2008, the FASB issued FASB Staff

Position 157-1, "Application of FASB Statement No. 157 to FASB Statement No. 13

and Other Accounting Pronouncements That Address Fair Value Measurements for

Purposes of Lease Classification or Measurement under Statement 13" ("FSP

157-1") and FASB Staff Position 157-2, "Effective Date of FASB Statement No.

157" ("FSP 157-2"). FSP 157-1 amends SFAS 157 to remove certain leasing

transactions from its scope. FSP 157-2 delays the effective date of SFAS 157 for

all non-financial assets and non-financial liabilities, except for items that

are recognized or disclosed at fair value in the financial statements on a

recurring basis (at least annually), until fiscal years beginning after November

15, 2008. SFAS 157 is effective for financial statements issued for fiscal years

beginning after November 15, 2007, and interim periods within those fiscal

years. The Company adopted SFAS 157 effective January 1, 2008 for all financial

assets and liabilities as required. The adoption of SFAS No. 157 for

non-financial assets and non-financial liabilities that are not measured at fair

value on a recurring basis did not have a significant impact on the Company’s

consolidated financial statements.

In

February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for

Financial Assets and Financial Liabilities — Including an Amendment of FASB

Statement No. 115,” (“SFAS 159”) which is effective for fiscal years beginning

after November 15, 2007. SFAS 159 is an elective standard which permits an

entity to choose to measure many financial instruments and certain other items

at fair value at specified election dates. Subsequent unrealized gains and

losses on items for which the fair value option has been elected will be

reported in earnings. The Company has not elected the fair value

option for any assets or liabilities under SFAS 159.

NOTE

3 – ACCOUNTS RECEIVABLE

Accounts

receivable consists of the following:

|

June 30,

|

December 31,

|

|||||||

|

2009

|

2008

|

|||||||

|

Accounts

receivable-trade

|

$ | 7,965,642 | $ | 5,243,033 | ||||

|

Allowance

for doubtful accounts

|

(3,244 | ) | (3,248 | ) | ||||

|

Accounts

receivable-trade, net

|

$ | 7,962,398 | $ | 5,239,785 | ||||

The

change in the allowance for doubtful accounts between the reporting periods, as

of June 30, 2009, and December 31, 2008 is displayed as follows:

|

June 30,

|

December 31,

|

|||||||

|

2009

|

2008

|

|||||||

|

Beginning

|

$ | (3,248 | ) | $ | (3,036 | ) | ||

|

Effect

of exchange rate changes

|

4 | (212 | ) | |||||

|

Ending

|

$ | (3,244 | ) | $ | (3,248 | ) | ||

There

were no bad debts written off for the three and six months ended June 30, 2009

and 2008 as there were no accounts receivable outstanding in excess of 60 days

at June 30, 2009 and 2008. The aging of the accounts receivable (in thousands)

is as follows:

|

June 30,

|

||||||||

|

2009

|

2008

|

|||||||

|

1-30

days

|

$ | 7,966 | $ | 4,255 | ||||

|

31-60

days

|

— | 14 | ||||||

| $ | 7,966 | $ | 4,269 | |||||

14

China

Electric Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three and six months ended June 30, 2009 and 2008

are unaudited)

NOTE

4 – INVENTORY

Inventory

includes raw materials, work-in-process (“WIP”), and finished

goods. Finished goods contain direct material, direct labor and

manufacturing overhead and do not contain general and administrative

costs.

Inventory

consists of the following:

|

June 30,

|

December 31,

|

|||||||

|

2009

|

2008

|

|||||||

|

Raw

materials

|

$ | 2,487,343 | $ | 2,524,124 | ||||

|

Finished

goods

|

2,501,577 | 2,544,534 | ||||||

|

Work-in-process

|

2,563,695 | 2,224,886 | ||||||

|

Inventory,

net

|

$ | 7,552,615 | $ | 7,293,544 | ||||

NOTE

5 – PROPERTY AND EQUIPMENT

Property

and Equipment consist of the following:

|

June 30,

|

December 31,

|

|||||||

|

2009

|

2008

|

|||||||

|

Machinery

and equipment

|

$ | 5,842,854 | $ | 4,314,429 | ||||

|

Electronic,

office and other equipment

|

182,770 | 182,963 | ||||||

|

Accumulated

depreciation

|

(2,030,103 | ) | (1,726,610 | ) | ||||

|

Property

and equipment, net

|

$ | 3,995,521 | $ | 2,770,782 | ||||

The

depreciation expense for the three and six months ended June 30, 2009 and 2008

is as follows:

|

Three months ended June 30,

|

Six months ended June 30,

|

|||||||||||||||

|

2009

|

2008

|

2009

|

2008

|

|||||||||||||

|

Cost

of goods sold

|

$ | 151,196 | $ | 120,530 | $ | 294,601 | $ | 239,150 | ||||||||

|

Operating

expenses

|

5,383 | 5,718 | 10,804 | 11,632 | ||||||||||||

|

Total

|

$ | 156,579 | $ | 126,248 | $ | 305,405 | $ | 250,782 | ||||||||

NOTE

6 – DUE TO DIRECTOR

Due to

director consists of the following:

|

June 30,

|

December 31,

|

|||||||

|

2009

|

2008

|

|||||||

|

Due

to director - Li, Jianrong: Luck Loyal loans

|

$ | 1,281,794 | $ | 1,339,337 | ||||

In

November 2007, Luck Loyal acquired a 25% ownership interest in YuePengCheng from

Qiling; and in September 2008 acquired the remaining 75% ownership interest of

YuePengCheng from YuePengDa Investment. Pursuant to the agreements, Luck Loyal

paid Qiling and YuePengDa Investment RMB 2.5 million and RMB 7.5 million,

respectively. These amounts were paid out by a director of Luck Loyal, Ms. Li,

Jianrong, in 2007 and 2008.

15

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three and six months ended June 30, 2009 and 2008

are unaudited)

NOTE

6 – DUE TO DIRECTOR (continued)

On March

25, 2009, Ms. Li, Jianrong entered into an agreement to convert the debt above

into corresponding equity of China Electric Motor, Inc. at the time of China

Electric Motor, Inc.’s anticipated public offering of its common stock based on

the per share offering price.

The

imputed interest is as follows:

|

Three months ended June 30,

|

Six months ended June 30,

|

|||||||||||||||

|

2009

|

2008

|

2009

|

2008

|

|||||||||||||

|

Imputed

interest

|

$ | 17,016 | $ | 4,887 | $ | 34,032 | $ | 9,449 | ||||||||

NOTE

7 – STATUTORY RESERVES

As

stipulated by the relevant laws and regulations for enterprises operating in

PRC, the Company is required to make annual appropriations to a statutory

surplus reserve fund. Specifically, the Company is required to allocate 10% of

its profits after taxes, as determined in accordance with the PRC accounting

standards applicable to the Company, to a statutory surplus reserve until such

reserve reaches 50% of the registered capital of the Company.

NOTE

8 – INCOME TAX

The

Company is registered and entitled as a “Hi-Tech Corporation” in

PRC. The Company has tax advantages granted by the local government

for corporate income taxes and sales taxes. The Company is

entitled to have a 50% reduction on the normal tax rate of 15% commencing year

2005 for the following three consecutive years. The Company’s tax

advantages were abolished after the Enterprise Income Tax Law that took effect

on January 1, 2008. The Company’s prior tax rate of 15% was changed to a rate of

18% in 2008.

The tax

authority of the PRC Government conducts periodic and ad hoc tax filing reviews

on business enterprises operating in the PRC after those enterprises had

completed their relevant tax filings, hence the Company’s tax filings may not be

finalized. It is therefore uncertain as to whether the PRC tax

authority may take different views about the Company’s tax filings which may

lead to additional tax liabilities.

|

Three months ended June 30,

|

Six months ended June 30,

|

|||||||||||||||

|

Current

income tax expense:

|

2009

|

2008

|

2009

|

2008

|

||||||||||||

|

PRC

Enterprises Income Tax

|

$ | 774,715 | $ | 451,381 | $ | 1,532,024 | $ | 847,561 | ||||||||

A

reconciliation between the income tax computed at the PRC statutory rate and the

Group’s provision for income tax is as follows:

|

Three months ended June 30,

|

Six months ended June 30,

|

|||||||||||||||

|

2009

|

2008

|

2009

|

2008

|

|||||||||||||

|

Preferential

PRC income tax rate

|

$ | 20 | % | $ | 18 | % | $ | 20 | % | $ | 18 | % | ||||

Effective

January 1, 2008, the new "Law of the People's Republic of China on Enterprise

Income Tax" was implemented. The new law requires that:

|

|

(i)

|

For

all resident enterprises, domestic or foreign, the Enterprise Income Tax

rate is unified 25%.

|

|

|

(ii)

|

Enterprises

that are categorized as the "High Tech Enterprise" will have a reduced tax

rate of 15%.

|

|

|

(iii)

|

From

January 1, 2008 onwards, enterprises that enjoyed a preferential tax rate

before, will need to adopt the new law within the next five years.

Specifically; enterprises with a current preferential tax rate of 15% for

2007, the tax rate will be 18%, 20%, 22%, 24%, and 25% for the years ended

December 31 2008, 2009, 2010, 2011, and 2012,

respectively.

|

16

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three and six months ended June 30, 2009 and 2008

are unaudited)

NOTE

8 – INCOME TAX (continued)

Accounting for Uncertainty

in Income Taxes

The

Company adopted the provisions of FASB Interpretation No. 48, “Accounting for

Uncertainty in Income Taxes—an interpretation of FASB Statement No. 109” (“FIN

48”), on January 1, 2007. FIN 48 clarifies the accounting for uncertainty in

income taxes recognized in an enterprise’s financial statements in accordance

with SFAS No. 109, “Accounting for Income Taxes,” and prescribes a recognition

threshold and measurement process for financial statement recognition and

measurement of a tax position taken or expected to be taken in a tax return. FIN

48 also provides guidance on derecognition, classification, interest and

penalties, accounting in interim periods, disclosure and

transition.

Based on

the Company’s evaluation, the Company has concluded that there are no

significant uncertain tax positions requiring recognition in its financial

statements.

The

Company may from time to time be assessed interest or penalties by major tax

jurisdictions. In the event it receives an assessment for interest and/or

penalties, it will be classified in the financial statements as tax

expense.

NOTE

9 – COMMITMENTS AND CONTINGENCIES

The

Company leases its factory premises and staff quarters for approximately

$300,000 per year. These operating leases expire on December 31,

2010.

Rent

expense for these leases was $76,730, $73,716, $153,397 and $148,447 for the

three and six months ended June 30, 2009 and 2008, respectively.

NOTE

10 – OPERATING RISK

Country

Risk

The

Company has significant investments in the PRC. The operating results of the

Company may be adversely affected by changes in the political and social

conditions in the PRC and by changes in Chinese government policies with respect

to laws and regulations, anti-inflationary measures, currency conversion and

remittance abroad, and rates and methods of taxation, among other things. The

Company can give no assurance that those changes in political and other

conditions will not result in have a material adverse effect upon the Company’s

business and financial condition.

Concentration of Credit

Risk

A

significant portion of the Company’s cash is maintained at various financial

institutions in the PRC which do not provide insurance for amounts on

deposit. The Company has not experienced any losses in such accounts

and believes it is not exposed to significant credit risk in this

area.

The

Company operates principally in the PRC and grants credit to its customers in

this geographic region. Although the PRC is economically stable, it is always

possible that unanticipated events in foreign countries could disrupt the

Company’s operations.

For the

six months ended June 30, 2009, two customers accounted for 11% and 10% of total

sales, respectively. At June 30, 2009 those two customers accounted for

16%, and 11% of trade receivables, respectively.

For the

year ended December 31, 2008, three customers accounted for 11%, 10% and 10% of

total sales, respectively. At December 31, 2008 those three customers accounted

for 11%, 9%, and 10% of trade receivables, respectively.

17

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three and six months ended June 30, 2009 and 2008

are unaudited)

NOTE

11– SEGMENT INFORMATION AND GEOGRAPHIC INFORMATION

The

Company has not segregated business units for managing different products and

services that the Company has been carrying and selling on the

market. The assets and resources of the Company have been utilized,

on a corporate basis, for overall operations of the Company. The

Company has not segregated its operating assets by segments as it is

impracticable to do so since the same assets are used to produce products as one

segment.

The

Company uses the “management approach” in determining reportable operating

segments. The management approach considers the internal organization and

reporting used by the Company’s chief operating decision maker for making

operating decisions and assessing performance as the source for determining the

Company’s reportable segments. Management, including the chief operating

decision maker, reviews operating results solely by monthly revenue (but not by

sub-product type or geographic area) and operating results of the Company and,

as such, the Company has determined that the Company has one operating segment

as defined by SFAS No. 131, “Disclosures about Segments of an Enterprise and

Related Information.”

The

geographic information for revenue is as follows:

|

Three months ended June 30,

|

Six months ended June 30,

|

|||||||||||||||||||||||||||||||

|

2009

|

2008

|

2009

|

2008

|

|||||||||||||||||||||||||||||

|

China

Mainland

|

$ | 14,256,100 | 63.9 | % | $ | 7,520,934 | 56.9 | % | $ | 24,485,919 | 59.4 | % | $ | 14,084,442 | 56.6 | % | ||||||||||||||||

|

Korea

|

4,373,874 | 19.6 | % | 3,402,249 | 25.8 | % | 9,092,984 | 22.1 | % | 6,391,540 | 25.7 | % | ||||||||||||||||||||

|

Hong

Kong

|

3,689,410 | 16.5 | % | 2,286,373 | 17.3 | % | 7,633,627 | 18.5 | % | 4,410,683 | 17.7 | % | ||||||||||||||||||||

|

Total

|

$ | 22,319,384 | $ | 13,209,556 | $ | 41,212,530 | $ | 24,886,665 | ||||||||||||||||||||||||

The

geographic information for accounts receivables which are classified based on

the customers is as follows:

|

June 30,

|

||||||||

|

2009

|

2008

|

|||||||

|

China

Mainland

|

$ | 5,231,116 | $ | 2,266,477 | ||||

|

Korea

|

1,591,006 | 1,255,332 | ||||||

|

Hong

Kong

|

1,140,276 | 743,553 | ||||||

|

Total

|

$ | 7,962,398 | $ | 4,265,362 | ||||

NOTE

12 – SUBSIDIARY DIVIDENDS PAID PRIOR TO SHARE EXCHANGE

In

January 31, 2007, the Company declared dividends of $1,287,700. The

dividends were paid out in May 2007 to its current owners.

In

January 31, 2008, the Company declared dividends of $2,088,600. The

dividends were paid out in May 2008 to its current owners.

NOTE

13 – COMMON STOCK

On May 6,

2009, concurrently with the close of the Share Exchange, the

Company conducted an initial closing of a private placement transaction

(the “Private Placement”). Pursuant to subscription agreements entered

into with the investors, the Company sold an aggregate of 320,186 shares of

common stock at $2.08 per share, for gross proceeds of approximately

$665,000.

On June

19, 2009, the Company conducted a second closing of a private

placement. Pursuant to subscription agreements entered into with the

investors, the Company sold an aggregate of 208,868 shares of common stock,

$0.0001 par value per share, at $2.08 per share, for gross proceeds of

approximately $433,800.

18

China Electric

Motor, Inc. and Subsidiaries

Notes to

Consolidated Financial Statements

(Amounts

and disclosures at and for the three and six months ended June 30, 2009 and 2008

are unaudited)

NOTE

14 – WARRANTS

Warrants remaining from

Share Exchange

Prior to

the Share Exchange and Private Placement, the shareholders of SRKP 21 held an

aggregate of 4,612,662 warrants to purchase shares of the Company’s common

stock, and an aggregate of 3,985,768 warrants were cancelled in conjunction with

the closing of the Share Exchange. Immediately after the closing of

the Share Exchange and Private Placement, the shareholders held an aggregate of

626,894 warrants with an exercise price of $0.000154. The warrant has a 5 year