Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEWFIELD EXPLORATION CO /DE/ | nfx8k-10212009.htm |

| EX-99.1 - EARNINGS PRESS RELEASE - NEWFIELD EXPLORATION CO /DE/ | nfx8k-10212009ex991.htm |

Exhibit

99.2

@NFX is

periodically published to keep shareholders aware of current operating

activities at Newfield. It may include estimates of expected production volumes,

costs and expenses, recent changes to hedging positions and commodity

pricing.

October

21, 2009

This

edition of @NFX includes:

|

·

|

2009

THIRD QUARTER DRILLING ACTIVITY BY

AREA

|

|

·

|

RECENT

HIGHLIGHTS

|

|

·

|

OPERATIONAL

SUMMARIES BY FOCUS AREA

|

|

·

|

FOURTH

QUARTER ESTIMATES

|

|

·

|

UPDATED

TABLES DETAILING COMPLETE HEDGE

POSITIONS

|

Third Quarter 2009 Drilling

Activity*

|

NFX

Operated

|

Non-Operated

|

Gross

Wells

|

Dry

Holes

|

|||||||||||||

|

Mid-Continent

|

25 | 15 | 40 | 0 | ||||||||||||

|

Rocky

Mount.

|

47 | 4 | 51 | 0 | ||||||||||||

|

Onshore

GC

|

2 | 0 | 2 | 1 | ||||||||||||

|

Gulf

of Mexico

|

2 | 0 | 2 | 0 | ||||||||||||

|

International

|

1 | 5 | 6 | 0 | ||||||||||||

|

Total:

|

77 | 24 | 101 | 1 | ||||||||||||

*Represents

a 99% success rate

YTD Total

gross wells: 317; YTD dry wells: 6

RECENT

HIGHLIGHTS

|

-

|

Declining service costs,

reduced water handling fees related to deferred completions and efficiency

improvements throughout the Company have led to a significant decrease in

lease operating expense (LOE) throughout the year. Domestic

recurring LOE was $0.81 per Mcfe in the third

quarter.

|

|

-

|

We have invested approximately

$950 million year-to-date and paid down more than $100 million of debt on

our revolver during the year. Significant new projects have been

included throughout the year that will help build for the future, and were

funded within our $1.45 billion 2009 capital

budget.

|

|

-

|

Our production in the third

quarter of 2009 was 65.5 Bcfe, an increase of 7% over the third quarter of

2008. The volumes exclude approximately 2.6 Bcfe of voluntary

natural gas curtailments in the second quarter of 2009 in response to low

natural gas prices. Full year 2009 production is expected to be in the

upper half of original guidance – or greater than 255

Bcfe.

|

|

-

|

Oil liftings in the third

quarter were 3.8 MMBbls, or more than 40,500 BOPD net. This

represents a 40% increase over the same period in 2008. The increase is

attributable to a 4% increase in our domestic crude volumes and a

near-doubling of our international oil liftings. Throughout the second

half of 2009, we have shifted capital investments to “oily” projects. Our

diversified portfolio provides us with flexibility and multiple

options.

|

1

|

-

|

Strong 2010 hedge position.

We have hedged approximately 70% of estimated 2010 natural gas

production and approximately 30% of estimated 2011 natural gas production.

Approximately 40% of our estimated 2010 crude oil is hedged at more than

$100 per barrel.

|

ENTERING

THE MARCELLUS SHALE

On

October 14, we entered the Marcellus Shale through a joint exploration agreement

with Hess. The agreement covers up to 140,000 gross acres primarily in

Susquehanna and Wayne Counties, Pennsylvania. We will operate with a 50

percent interest. Initial drilling is not

expected to commence until 2010.

Our

proven expertise from large scale developments like the Woodford Shale, Granite

Wash and Monument Butte ranks us among a handful of companies that have

developed large-scale unconventional plays. We have drilled approximately 300

horizontal wells in the Woodford and over a four-year time span held

substantially all of 165,000 net-acre position by production. Our field

production today is 317 MMcfe/d gross and we have firm transportation agreements

in place to keep pace with our future growth. These activities have led to the

development of “core competencies” within our company that will guide our

success in the Marcellus.

The 2009

portion of our Marcellus Shale activities, estimated at approximately $20

million, will be funded within our existing $1.45 billion capital budget. We

expect to grow our business in the Marcellus play, just as we have created

businesses with scale in the Mid-Continent and Rocky Mountains.

MID-CONTINENT

Mid-Continent

gross operated production recently reached a new high and is currently 460

MMcfe/d, or 323 MMcfe/d net during the third quarter. The significant

increase is primarily attributable to curtailed wells that are being turned to

sales, as well as initial production from deferred completions. Newfield has a

remaining inventory of 30 wells (28 Woodford and 2 Granite Wash) that have been

drilled but not completed. Completions are commencing and will continue through

January 2010.

Woodford

Shale

Gross

operated production in the Woodford Shale set a recent new high, and today is

308 MMcfe/d, up nearly 30% from 240 MMcfe/d at the end of the second quarter. We

have drilled approximately 300 horizontal wells and continue to make

improvements in both drilling and completion operations. In 2008, we entered

development mode in the Woodford and continued efficiency gains have been

demonstrated through pad drilling, longer laterals and completion

optimization.

2

We are

operating 10 rigs under term contract, with three of the remaining rigs rolling

off of term in November and December 2009. Spot market rates on these rigs are

significantly lower than term rates.

Over the

last several years, we have increased our lateral lengths significantly. We

expect that our average completed lateral length will be more than 5,000’ in

2009. The following chart shows the significant increase in lateral length by

year:

Shown

another way in the chart below, the increasing lateral lengths are leading to

marked improvements in finding and development costs. Over the last 12 months,

our completed wells costs are down more than 25%.

We are

referring to our wells with laterals exceeding 8,000’ as “super extended

laterals” or SXLs. Regulatory rules in Oklahoma allow for drilling on stand-up

640 acre units… or units that are ½-mile wide by 2-miles long. This

configuration accommodates a 10,000’ lateral. We have drilled two 10,000’

laterals to date and expect to have eight SXLs drilled by year-end ‘09. These

wells have planned lateral lengths between 8,000’ and 9,000’. Initial production

data from the first SXLs are expected in late 2009.

3

We also

are fracture stimulating our wells with greater efficiency in 2009. The average

number of fracs per day has increased to more than five on recent pad

completions, compared to just three fracs per day in 2008. This eliminates

approximately six days off a standard completion; saving money and allowing us

to turn wells to production more quickly.

One of

the largest contributors to our Woodford cost reductions has been pad drilling

-- a common development technique in resource plays. Now that approximately 95%

of our acreage is held-by-production, our development drilling is dominated by

multi-well pads. Approximately 85% of our wells in 2009 will be drilled from

common pad locations.

Two

recent notable Woodford wells that typify increased cost efficiencies

include:

|

·

|

The

Cunningham 3H-22, located in Coal County, was drilled and cased in 26 days

for $3.3 million gross. The well was the first on a three-well pad and had

a 5,100’ lateral length. The completion was deferred until late

2009.

|

|

·

|

The

Tollett 7H-22, located in Hughes County, was drilled and cased in 17 days

for $2.7 million. The well had a 5,100’ lateral length. The completion was

deferred until late 2009.

|

The new

Mid-Continent Express Pipeline (MEP) links our Woodford production to

Perryville, La. For 2009, we have 310 MMcf/d of firm transportation on MEP and

an additional 50 MMcf/d on CEGT. We have staged additional firm transportation

on Boardwalk to coincide with our future growth needs. In total, we have

approximately 650 MMcf/d of firm transportation, helping to ensure we obtain the

best possible pricing for our Woodford gas.

The

Granite Wash

Based on

the success of our initial drilling program in the Granite Wash play, we added a

fourth operated rig in our Stiles Ranch field, located in Wheeler County, Texas.

In July, we announced that the first seven horizontal wells in our Stiles Ranch

field had an average initial production rate of 22 MMcfe/d. Recent well

completions have been deferred and the Company expects to have production

results from 6 – 8 additional completions in early 2010.

We have

increased lateral lengths on recent wells to approximately 4,000’, compared to

about 3,500’ on average for our initial seven wells.

(For

additional information on Granite Wash, please see @NFX July 22, 2009 and the

Granite Wash feature in Oil and Gas Investor magazine, October

2009.)

ROCKY

MOUNTAINS

Monument

Butte Field

Despite

dropping two operated rigs in Monument Butte in early 2009, production from our

Rocky Mountain division is expected to be up about 9% in 2009. Due to

higher oil prices and improved differentials, we recently added a fourth rig at

Monument Butte and expect to add a fifth rig in early 2010. Monument Butte

production is approximately 16,000 BOPD gross and a five-rig program is expected

to grow annual volumes by more than 10%.

4

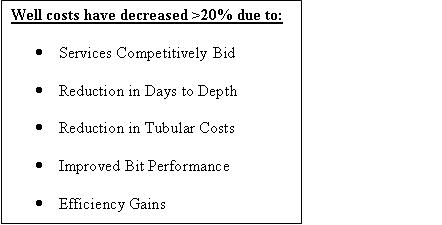

Monument

Butte Well Costs

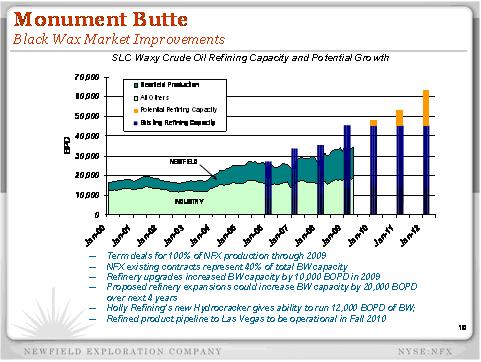

Differentials

for Black Wax crude have narrowed in 2009. The chart below shows our position in

the overall Black Wax market and in that area refining capacity has been

increasing. Monument Butte is a giant resource with more than 2 billion barrels

in place. Through the drilling of several thousand additional wells, we expect

to recover 18-20% of the original oil in place. We have more than a decade-long

inventory of drilling locations and significant growth through this large oil

asset.

Williston

Basin

We expect

to add up to two additional operated rigs in our Williston Basin development

areas. We have been running a one-rig program since early 2009. We have

approximately 200,000 net acres in prospective development areas, located

primarily on the Nesson Anticline and west of the Nesson. An additional 200,000

net acres are located in northern Montana where several exploration plays are

underway. We have drilled 12 successful oil wells in the North Dakota portion of

the Williston, focusing to date primarily on the Bakken Shale and Three

Forks/Sanish formations.

5

Two wells

were drilled since the last quarter’s update: Trigger is our first well in Big

Valley, an area covering more than 50,000 net acres in northern North Dakota.

The well was recently fracture stimulated and continues to clean-up. Early

results warrant additional drilling to asses this large area. Sergeant Major was

drilled in the Catwalk area, which covers 25,300 net acres. Completion

operations on the well are expected to commence next week.

GULF

OF MEXICO

We have

seven deepwater developments underway in the Gulf of Mexico which are expected

to provide significant future growth. Our most recent development is Fastball,

located at Viosca Knoll 1003. Fastball commenced production on October 19. Gross

production is expected to ramp up to 40 MMcf/d and 3,200 BOPD. We operate

Fastball with a 66% interest.

Pyrenees -- In the second quarter of

2009, we announced a significant operated discovery on its Pyrenees Prospect,

located at Garden Banks 293 in approximately 2,100 feet of water. A recent

sidetrack delineated the downdip limits in the three proven pay sands seen in

the discovery well and provided encouragement for the exploration potential of

both the shallow and deep sand sections on the feature. Additional drilling is

planned for 2010. We operate the development with a 40% working

interest.

Over the

last several years, we have assembled a substantial inventory of exploration

prospects in the deepwater Gulf of Mexico. We own interests in 88 deepwater

blocks (approximately 500,000 gross acres). We plan to drill 3-5 deepwater Gulf

of Mexico wells each year for the next several years.

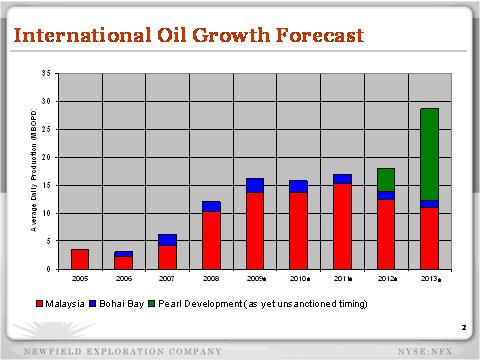

INTERNATIONAL

International

oil liftings in the third quarter of 2009 increased more than 90% over the same

period in 2008. We lifted 2.1 MMBbls in the third quarter, or an average of

23,380 BOPD net. The increased liftings reflects production recent developments

offshore Malaysia as well as timing of liftings in the quarter.

Malaysia

During

the third quarter, liftings from Malaysia average 21,270 BOPD net. Production

increases are attributable to higher rates from the East Belumut and Chermingat

oil fields. We recently accelerated the timing of our planned East Belumut

“Phase II” program, with plans to drill six development wells in late 2009 and

an additional six wells in 2010. We expect to invest approximately $18 million

in 2009 and $18 million in early 2010 associated with Phase II. Our developments

are located on two shallow water blocks – PM 318 and PM 323. We have a 50%

interest in PM 318 and a 60% operated interest in PM 323.

China

For the

third quarter of 2009, our offshore China liftings averaged 2,108 BOPD net. We

recently announced a significant operated oil discovery on our Pearl prospect,

located in the Pearl River Mouth Basin. The Pearl development is underway with

first production expected in 2012. The LF 7-1 well encountered more than 250’ of

high-quality oil pay in multiple sands and tested a single zone at 6,000 BOPD,

which was the maximum limit of the test equipment on location. The well was an

exploration offset to a downthrown anticline and was an offset to our 2008 oil

discovery – the LF 7-2. The two successes confirmed a commercial oil

development with first production expected in late 2012. There is significant

additional reserve potential in deeper objectives at Pearl, as well as with

prospects along a structural ridge located to the northeast. We call these our

Jade prospects.

6

Prior to

year-end 2009, we expect to spud an exploration well on our first Jade prospect.

We have a 100% working interest in the Pearl development; CNOOC has a 51%

back-in election to any commercial development.

7

FOURTH

QUARTER ESTIMATES

|

4Q09

Estimates

|

||||||||||||

|

Domestic

|

Int’l

|

Total

|

||||||||||

|

Production/Liftings

|

||||||||||||

|

Natural

gas – Bcf

|

44.7 – 45.5 | – | 44.7 – 45.5 | |||||||||

|

Oil

and condensate – MMBbls

|

1.7 – 1.8 | 1.4 – 1.5 | 3.1 – 3.3 | |||||||||

|

Total

Bcfe

|

54.9 – 56.3 | 8.4 – 9.0 | 63.3 – 65.3 | |||||||||

|

Average

Realized Prices

|

||||||||||||

|

Natural

gas – $/Mcf

|

Note

1

|

|||||||||||

|

Oil

and condensate – $/Bbl

|

Note

2

|

Note

3

|

||||||||||

|

Mcf

equivalent – $/Mcfe

|

||||||||||||

|

Operating

Expenses:

|

||||||||||||

|

Lease

operating

|

||||||||||||

|

Recurring

($MM)

|

$ | 34.2 - $37.8 | $ | 18.4 - $20.3 | $ | 52.6 - $58.1 | ||||||

|

per/Mcfe

|

$ | 0.62 - $0.67 | $ | 2.19 - $2.25 | $ | 0.83 - $0.89 | ||||||

|

Major

(workover, repairs, etc.) ($MM)

Note 4

|

$ | 13.1 - $14.5 | -- | $ | 13.1 - $14.5 | |||||||

|

per/Mcfe

|

$ | 0.24 - $0.26 | -- | $ | 0.21 - $0.22 | |||||||

|

Production and other taxes

($MM)Note

5

|

$ | 14.0 - $15.4 | $ | 13.3 - $14.7 | $ | 27.3 - $30.1 | ||||||

|

per/Mcfe

|

$ | 0.26 - $0.27 | $ | 1.58 - $1.63 | $ | 0.43 - $0.46 | ||||||

|

General and administrative

(G&A), net ($MM)

|

$ | 29.8 - $33.0 | $ | 1.4 - $1.5 | $ | 31.2 - $34.5 | ||||||

|

per/Mcfe

|

$ | 0.54 - $0.59 | $ | 0.16 - $0.17 | $ | 0.49 - $0.53 | ||||||

|

Capitalized

internal costs ($MM)

|

$ | (18.5 - $20.4 | ) | |||||||||

|

per/Mcfe

|

$ | (0.29 - $0.31 | ) | |||||||||

|

Interest

expense ($MM)

|

$ | 29.0 - $32.0 | ||||||||||

|

per/Mcfe

|

$ | 0.46 - $0.49 | ||||||||||

|

Capitalized

interest ($MM)

|

$ | (11.0 - $12.1 | ) | |||||||||

|

per/Mcfe

|

$ | (0.17 - $0.19 | ) | |||||||||

|

Tax

rate (%)Note

6

|

36 - 38 | % | ||||||||||

|

Income

taxes (%)

|

||||||||||||

|

Current

|

14% - 16 | % | ||||||||||

|

Deferred

|

84% - 86 | % | ||||||||||

|

Note

1: Gas prices in the Mid-Continent, after basis differentials,

transportation and handling charges, typically average 75–85% of the Henry

Hub Index. Gas prices in the Gulf of Mexico and onshore Gulf Coast, after

basis differentials, transportation and handling charges, typically

averages $0.25–$0.50 per MMBtu less than the Henry Hub Index.

Note

2: Oil prices in the Gulf Coast typically average 90–95% of NYMEX WTI

price. Rockies oil prices are currently averaging about $12–$14 per barrel

below WTI. Oil production from the Mid-Continent typically averages 85–90%

of WTI.

Note

3: Oil in Malaysia typically sells at a slight discount to Tapis, or about

90–95% of WTI. Oil production from China typically sells at $6–$8 per

barrel less than WTI.

Note

4: Domestic major expense includes approximately $6 million for well

workover expense and other projects initiated in response to higher

commodity prices and lower service costs.

Note

5: Guidance for production taxes determined using $75/Bbl oil and

$4.50/MMBtu gas.

Note

6: Tax rate applied to earnings excluding unrealized gains or losses

on commodity derivatives.

|

||||||||||||

8

NATURAL

GAS HEDGE POSITIONS

Please

see the tables below for our complete hedging positions.

The

following hedge positions for the fourth quarter of 2009 and beyond are as of

October 20, 2009:

Fourth Quarter

2009

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

26,120

MMMBtus

|

$ | 7.34 | — | — | — | — | ||||||||||||||

|

8,435

MMMBtus

|

— | — | $ | 8.23 — $11.20 | $ | 8.00 — $8.50 | $ | 8.97 — $14.37 | ||||||||||||

First Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

31,800

MMMBtus

|

$ | 6.79 | — | — | — | — | ||||||||||||||

|

5,700

MMMBtus

|

— | — | $ | 8.50 — $10.44 | $ | 8.50 | $ | 10.00 — $11.00 | ||||||||||||

Second Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

34,850

MMMBtus

|

$ | 6.41 | — | — | — | — | ||||||||||||||

Third Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

35,200

MMMBtus

|

$ | 6.41 | — | — | — | — | ||||||||||||||

Fourth Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

28,320

MMMBtus

|

$ | 6.49 | — | — | — | — | ||||||||||||||

First Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

18,900

MMMBtus

|

$ | 6.55 | — | — | — | — | ||||||||||||||

Second Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

19,110

MMMBtus

|

$ | 6.55 | — | — | — | — | ||||||||||||||

Third Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

19,320

MMMBtus

|

$ | 6.55 | — | — | — | — | ||||||||||||||

Fourth Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

6,510

MMMBtus

|

$ | 6.55 | — | — | — | — | ||||||||||||||

9

The

following table details the expected impact to pre-tax income from the

settlement of our derivative contracts, outlined above, at various NYMEX gas

prices, net of premiums paid for these contracts (in millions).

|

Gas

Prices

|

||||||||||||||||||||||||

| $ | 4.00 | $ | 5.00 | $ | 6.00 | $ | 7.00 | $ | 8.00 | $ | 9.00 | |||||||||||||

|

2009

|

||||||||||||||||||||||||

|

4th

Quarter

|

$ | 123 | $ | 88 | $ | 54 | $ | 19 | $ | (15 | ) | $ | (43 | ) | ||||||||||

|

Total

2009

|

$ | 123 | $ | 88 | $ | 54 | $ | 19 | $ | (15 | ) | $ | (43 | ) | ||||||||||

|

2010

|

||||||||||||||||||||||||

|

1st

Quarter

|

$ | 114 | $ | 77 | $ | 40 | $ | 2 | $ | (35 | ) | $ | (70 | ) | ||||||||||

|

2nd

Quarter

|

$ | 84 | $ | 49 | $ | 14 | $ | (21 | ) | $ | (56 | ) | $ | (91 | ) | |||||||||

|

3rd

Quarter

|

$ | 85 | $ | 49 | $ | 14 | $ | (21 | ) | $ | (56 | ) | $ | (91 | ) | |||||||||

|

4th

Quarter

|

$ | 70 | $ | 43 | $ | 14 | $ | (14 | ) | $ | (43 | ) | $ | (71 | ) | |||||||||

|

Total

2010

|

$ | 353 | $ | 218 | $ | 82 | $ | (54 | ) | $ | (190 | ) | $ | (323 | ) | |||||||||

|

2011

|

||||||||||||||||||||||||

|

1st

Quarter

|

$ | 48 | $ | 29 | $ | 10 | $ | (8 | ) | $ | (27 | ) | $ | (46 | ) | |||||||||

|

2nd

Quarter

|

$ | 49 | $ | 30 | $ | 10 | $ | (9 | ) | $ | (28 | ) | $ | (47 | ) | |||||||||

|

3rd

Quarter

|

$ | 49 | $ | 30 | $ | 11 | $ | (9 | ) | $ | (28 | ) | $ | (47 | ) | |||||||||

|

4th

Quarter

|

$ | 17 | $ | 10 | $ | 4 | $ | (3 | ) | $ | (9 | ) | $ | (16 | ) | |||||||||

|

Total

2011

|

$ | 163 | $ | 99 | $ | 35 | $ | (29 | ) | $ | (92 | ) | $ | (156 | ) | |||||||||

In the

Rocky Mountains, we hedged basis associated with approximately 17 Bcf of our

natural gas production from October 2009 through full-year 2012. This is in

addition to the 8,000 mmbtu/d sold on a fixed physical basis for the same term

for a total basis hedged for the period at an average of $(0.94) per

Mmbtu.

In the Mid-Continent, we

hedged basis associated with approximately 14 Bcf of our anticipated

Stiles/Britt Ranch production from October 2009 through August 2011. This is in

addition to the 30,000 mmbtu/d sold on a fixed physical basis for the same term

for a total basis hedged for the period at an average of $(0.52) per Mmbtu. In

addition, we hedged basis associated with approximately 23 Bcf of our natural

gas production from this area for the period September 2011 through December

2012 at an average of $(0.55) per Mmbtu.

Approximately

10% of our natural gas production correlates to Houston Ship Channel, 13% to

Columbia Gulf, 13% to Texas Gas Zone 1, 5% to Southern Natural Gas, 10% to Tenn

100, 6% to CenterPoint/East, 24% to Panhandle Eastern Pipeline, 6% to Waha, 7%

to Colorado Interstate, 6% to others.

CRUDE

OIL HEDGE POSITIONS

The

following hedge positions for the fourth quarter of 2009 and beyond are as of

October 20, 2009:

Fourth Quarter

2009

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

828,000

Bbls

|

$ | 128.93 | — | — | — | — | ||||||||||||||

|

828,000

Bbls

|

— | $ | 107.11 | — | $ | 104.50 — $109.75 | — | |||||||||||||

First Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

90,000

Bbls

|

$ | 93.40 | — | — | — | — | ||||||||||||||

|

810,000

Bbls

|

— | — | $ | 127.97— $170.00 | $ | 125.50 — $130.50 | $ | 170.00 | ||||||||||||

|

180,000

Bbls*

|

— | — | $ | 60.00— $112.05 | $ | 60 | $ | 112.00—$112.10 | ||||||||||||

10

Second Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

90,000

Bbls

|

$ | 93.40 | — | — | — | — | ||||||||||||||

|

819,000

Bbls

|

— | — | $ | 127.97— $170.00 | $ | 125.50 — $130.50 | $ | 170.00 | ||||||||||||

|

182,000

Bbls*

|

— | — | $ | 60.00— $112.05 | $ | 60 | $ | 112.00—$112.10 | ||||||||||||

Third Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

90,000

Bbls

|

$ | 93.40 | — | — | — | — | ||||||||||||||

|

828,000

Bbls

|

— | — | $ | 127.97— $170.00 | $ | 125.50 — $130.50 | $ | 170.00 | ||||||||||||

|

184,000

Bbls*

|

— | — | $ | 60.00— $112.05 | $ | 60 | $ | 112.00—$112.10 | ||||||||||||

Fourth Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

90,000

Bbls

|

$ | 93.40 | — | — | — | — | ||||||||||||||

|

828,000

Bbls

|

— | — | $ | 127.97— $170.00 | $ | 125.50 — $130.50 | $ | 170.00 | ||||||||||||

|

184,000

Bbls*

|

— | — | $ | 60.00— $112.05 | $ | 60 | $ | 112.00—$112.10 | ||||||||||||

*These 3-way collar contracts are

standard crude oil collar contracts with respect to the periods, volumes and

prices stated above. The contracts have floor and ceiling prices per Bbls as per

the table above until the price drops below a weighted average price of $50 per

Bbls. Below $50 per Bbls, these contracts effectively result in realized prices

that are on average $10 per Bbls higher than the cash price that otherwise would

have been realized.

The following table details the

expected impact to pre-tax income from the settlement of our derivative

contracts, outlined above, at various NYMEX oil prices, net of premiums paid for

these contracts (in millions).

|

Oil

Prices

|

||||||||||||||||||||||||||||

| $ | 40.00 | $ | 50.00 | $ | 60.00 | $ | 70.00 | $ | 80.00 | $ | 90.00 | $ | 100.00 | |||||||||||||||

|

2009

|

||||||||||||||||||||||||||||

|

4th

Quarter

|

$ | 129 | $ | 115 | $ | 99 | $ | 84 | $ | 70 | $ | 54 | $ | 39 | ||||||||||||||

|

Total

2009

|

$ | 129 | $ | 115 | $ | 99 | $ | 84 | $ | 70 | $ | 54 | $ | 39 | ||||||||||||||

|

2010

|

||||||||||||||||||||||||||||

|

1st

Quarter

|

$ | 70 | $ | 61 | $ | 50 | $ | 42 | $ | 33 | $ | 23 | $ | 14 | ||||||||||||||

|

2nd

Quarter

|

$ | 71 | $ | 62 | $ | 51 | $ | 42 | $ | 33 | $ | 24 | $ | 15 | ||||||||||||||

|

3rd

Quarter

|

$ | 72 | $ | 63 | $ | 52 | $ | 42 | $ | 33 | $ | 24 | $ | 15 | ||||||||||||||

|

4th

Quarter

|

$ | 72 | $ | 62 | $ | 52 | $ | 42 | $ | 33 | $ | 24 | $ | 15 | ||||||||||||||

|

Total

2010

|

$ | 285 | $ | 248 | $ | 205 | $ | 168 | $ | 132 | $ | 95 | $ | 59 | ||||||||||||||

We

provide information regarding our outstanding hedging positions in our annual

and quarterly reports filed with the SEC and in our electronic publication --

@NFX. This publication can be found on Newfield’s web page at http://www.newfield.com. Through the web page,

you may elect to receive @NFX through e-mail distributions.

Newfield

Exploration Company is an independent crude oil and natural gas exploration and

production company. The Company relies on a proven growth strategy of growing

reserves through the drilling of a balanced risk/reward portfolio and select

acquisitions. Newfield's domestic areas of operation include the U.S. onshore

Gulf Coast, the Anadarko and Arkoma Basins of the Mid-Continent, the Rocky

Mountains and the Gulf of Mexico. The Company has international operations in

Malaysia and China.

11

**This

publication contains forward-looking information. All information other than

historical facts included in this release, such as information regarding

estimated or anticipated fourth quarter 2009 results, estimated capital

expenditures, cash flow, production and cost reductions, drilling and

development plans and the timing of activities, is forward-looking information.

Although Newfield believes that these expectations are reasonable, this

information is based upon assumptions and anticipated results that are subject

to numerous uncertainties and risks. Actual results may vary significantly from

those anticipated due to many factors, including drilling results, oil and gas

prices, industry conditions, the prices of goods and services, the availability

of drilling rigs and other support services, the availability of refining

capacity for the crude oil Newfield produces from its Monument Butte field in

Utah, the availability and cost of capital resources, labor conditions and

severe weather conditions (such as hurricanes). In addition, the drilling of oil

and gas wells and the production of hydrocarbons are subject to governmental

regulations and operating risks.

12